Crypto World

Ripple’s XRP Dumps by 13% Daily, Bitcoin (BTC) Slipped Below $70K: Market Watch

XRP is today’s most substantial loser from the largest 100 alts, dumping below $1.40. ZEC and MORPHO follow suit.

Bitcoin’s poor price performance continues in full force as the asset erased all gains seen after Trump’s reelection by slipping below $70,000 earlier today.

Most altcoins have bled out heavily as well, and it’s not just XRP. ETH, BNB, SOL, DOGE, ADA, and many more have posted massive declines.

BTC Dipped Beneath $70K

It’s almost hard to believe that just over a week ago, last Wednesday, bitcoin traded at $90,000. The developments since then have been nothing short of pure bear domination. While the reasons are still debated, the fact is that BTC was violently rejected at that point and driven south hard.

At first, it fell to $81,000 last Thursday, rebounded to $84,000 on Friday, and plummeted again to under $75,000 on Saturday. After an unsuccessful relief rally to $79,000, the bears were back in control and drove it to $73,000 on Tuesday.

The dead-cat bounce pattern repeated and bitcoin continued to lose value in the past 12 hours or so. Moreover, it dumped below $70,000 earlier today for the first time since just after the US elections in 2024.

It has now bounced to slightly above $70,000, but it’s still 7% down daily and 20% in the red weekly. Its market cap has plummeted to $1.410 trillion on CG, while its dominance over the alts struggles at 57%.

Alts Keep Bleeding

The altcoins’ charts are just as painful, even more on some occasions. ETH is down by 6% as well as even Vitalik Buterin has started to dispose of his tokens. BNB has dumped below $700, while XRP has become today’s poorest performers with a double-digit drop to under $1.38. This is its lowest price tag in well over a year.

SOL, ADA< DOGE, XMR, LINK, and many others are deep in the red. HYPE continues to be among the few exceptions, gaining almost 5% to $34.

The total crypto market cap has erased another $170 billion and is below $2.5 trillion on CG now.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

How investors are generating income as XRP adoption expands

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The tokenization of real-world assets is rapidly advancing as attention turns to blockchain networks like the XRP Ledger for large-scale financial settlement.

Summary

- As institutions explore asset tokenization, the XRP Ledger is recognized for its fast settlement speeds and low costs, positioning it for potential widespread adoption.

- Increased on-chain asset volumes necessitate scalable network infrastructure, prompting interest in productive network participation beyond mere asset ownership.

- BI DeFi offers a cloud-based computational contract model that simplifies infrastructure participation, enhancing accessibility while providing operational safeguards for users.

The tokenization of real-world assets (RWA) is accelerating. Current estimates suggest that nearly $400 trillion in traditional financial assets, including equities, bonds, real estate, and private equity, remain off-chain. Only a small fraction has been tokenized so far.

As institutions increasingly explore asset tokenization, attention is shifting toward a critical question: Which blockchain networks are capable of supporting large-scale financial settlement?

The XRP Ledger (XRPL) is increasingly viewed as one of the infrastructures capable of handling this transition. Its fast settlement speed, low transaction costs, and built-in compliance features position it as a practical framework for institutional-grade activity.

If a meaningful portion of tokenized assets begins issuing, settling, or circulating on XRPL, network utilisation could rise significantly. In that scenario, value would be driven not only by market sentiment, but by actual usage.

This represents a structural shift, from price-driven speculation to adoption-driven demand.

Network expansion means growing infrastructure demand

As on-chain asset volumes expand, the underlying network must scale accordingly.

Greater transaction flow requires:

- More computational resources

- Stable validation capacity

- Efficient processing infrastructure

For this reason, some market participants are beginning to look beyond simple asset ownership. Instead, they are asking: How can we participate in the productive layer of the network itself?

BI DeFi: A gateway to infrastructure participation

BI DeFi, a UK-registered platform, offers a cloud-based computational contract model designed to simplify infrastructure participation.

Rather than purchasing and operating hardware, users can participate through structured computing contracts. The model removes the operational burdens typically associated with mining infrastructure, such as equipment management, cooling systems, and electricity contracts.

Key features include:

- Entry starting from $100

- $17 registration reward

- Support for major assets, including BTC, ETH, XRP, and SOL

- Automated 24-hour settlement cycles

- Cold storage custody structure

- Insurance-backed digital asset protection

The platform positions itself as a streamlined alternative to hardware-intensive models, aimed at improving accessibility while maintaining operational safeguards.

A structural transition underway

If even a fraction of global financial assets transitions on-chain, the implications extend beyond asset pricing.

The more fundamental question becomes:

- Which networks support settlement?

- Which infrastructures enable scalability?

- Who participates in the network’s productive capacity?

As digital asset ecosystems mature, infrastructure participation may become an increasingly important part of strategic positioning.

In that context, platforms such as BI DeFi are aligning with the broader shift toward network-level engagement rather than purely speculative exposure. To learn more, visit the BI DeFi.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

South Korea probes $4.8 million crypto theft after tax seizure photo blunder

South Korean tax authorities lost $4.8 million of seized crypto after displaying the relevant wallets’ seed phrases in a photograph covering the Feb. 26 event.

The crypto was taken immediately after the National Tax Service (NTS) shared a photo that included hardware wallets and their secret phrases. The service apologized for the incident, Asia Business Daily reported on Sunday.

“In an effort to provide more vivid information, we did not realize that sensitive information was included and carelessly provided the original photo,” the tax office said. “This is entirely the fault of the National Tax Service (NTS), with no excuse.”

This is at least the second time something like this has occurred in the country. South Korean authorities faced scrutiny over a separate failure in which Seoul’s Gangnam police allegedly lost 22 BTC (roughly $1.5 million) in a 2021 hacking case after leaving the funds and seed phrase with a third-party custodian. The authors of that theft were recently detained.

The new case involves a taxpayer who owed the NTS capital gains tax, which led to the individual’s home being raided. The authorities took control of at least four hardware wallets and cash. They then photographed the seized items, which included at least two seed phrases, and shared the unblurred photo publicly..

The NTS requested police intervention to recover the stolen cryptocurrency. The tax authority also revealed plans to conduct an external review of its overall security system and to overhaul the entire manual for the process from the seizure to the sale of virtual assets.

Koo Yun-cheol, South Korea’s deputy Prime Minister and Minister of Finance and Economy, confirmed the leak in an X post on Sunday.

Koo said several government agencies, including the Financial Services Commission and the Financial Supervisory Service would investigate the leak. He also said they would scrutinize how government agencies and public institutions seize and manage digital assets to prevent recurrence.

Crypto World

Tokenized gold PAXG, XAUT jump as missiles fly, BTC stalls near $66.2k

Tokenized gold PAXG and XAUT climb about 1–2% toward $5.4k as Middle East conflict sends BTC, ETH and SOL lower in 24h risk‑off trade.

Summary

- PAXG trades around $5.4k with a 24h range near $5.33k–$5.44k and a market cap close to $2.6b, while XAUT changes hands near $5.32k with roughly $932m in daily volume and a $3.0b market cap.

- Over the same window, BTC sits near $66.2k after a 3% daily drop inside a $64.35k–$68.24k band, ETH hovers around $1.97k after slipping about 2.5%, and SOL trades close to $83, down roughly 4% on almost $4.4b volume.

- CoinGecko data show PAXG and XAUT among the most‑viewed tokens during the US–Israeli conflict with Iran, as crypto X users describe a “gold panic bid” and note that “real gold wins when bombs fly” while BTC stagnates.

Tokenized gold is suddenly back in fashion as geopolitical risk flares, with on‑chain proxies for bullion emerging as the market’s preferred panic hedge.

Tokenized gold jumps on Middle East shock

In a post on X, CoinGecko noted that “tokenized commodities such as $PAXG and $XAUT are among the most viewed cryptocurrencies today amid the ongoing US–Israeli conflict with Iran.” The spike in attention tracks a sharp move higher in gold‑backed coins. As of Monday, PAX Gold (PAXG) changes hands near $5,409, after trading between roughly $5,326 and $5,439 over the past 24 hours, with a market cap around $2.6B. Tether Gold (XAUT) trades close to $5,318, up about 0.7% over the day, with 24‑hour volumes near $932M and a market cap of roughly $3.0B. Earlier coverage described PAXG “up 6.13% day on day at $5,513.28,” while XAUT was “up 4.62% to $5,403.82, with risk assets weakening and risk appetite strengthening for coins linked to safe‑haven assets.” A Reuters report similarly highlighted that “PAX Gold (PAXG) is currently leading the charge at $5,344/oz (+2.2% since Friday), while Tether Gold (XAUt) has climbed to $5,292/oz (+1.2%).”

On crypto X, the mood is blunt. “If there are crisis gold is mostly the favorite,” wrote MEXC’s Phil Herrmann. Another user observed that there is a “gold panic bid while crypto’s supposed inflation hedge sits frozen at 66k… Shows you who actually trusts btc when missiles fly vs who just talks about it on podcasts.” “Real gold wins when bombs fly,” added one Web3 commentator, while another summed up the moment as “safe havens szn. Gold always wins, WAGMI.”

Bitcoin, Ethereum and Solana lag

While tokenized gold rallies, major cryptocurrencies are softer to sideways. Bitcoin is trading around $66,200, down roughly 3% over the last 24 hours, with an intraday range near $64,350–$68,235. Ethereum hovers around $1,970, having slipped about 2.5% on the day, after swinging between roughly $1,940 and $1,980. Solana trades close to $83, down about 4% in 24 hours, with a session range between roughly $81.9 and $86.7 and a market cap near $47B.

Broader crypto market

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $66,200, with a 24‑hour range near $64,350–$68,235 and deep, exchange‑wide volumes. Ethereum (ETH) changes hands close to $1,970, on more than $21B in 24‑hour turnover and price action rotating inside the $1,940–$1,980 band. Solana (SOL) trades around $83, off roughly 4% on the day, with almost $4.4B in volume.

The renewed bid for tokenized bullion underlines a simple allocation truth: when missiles fly, markets still grab for gold—only this time, they are doing it on‑chain. For readers tracking these flows, live pricing is available via crypto.news pages for PAX Gold (PAXG) and Tether Gold (XAUT).

Crypto World

Mantle hits $1B market size milestone on Aave: will MNT price explode next?

- Mantle has crossed the $1 billion total market size threshold on Aave.

- If inflows persist, bulls could target resistance in the $0.85-$0.92 range.

- MNT can rally toward the bulls’ key target of $1.

Mantle, a layer-2 blockchain network connecting traditional finance and on-chain liquidity, has surpassed $1 billion in total lending and borrowing volume on the Aave protocol.

The milestone coincides with a sharp rise in Mantle’s total value locked (TVL) in decentralized finance, despite the crypto market’s bearish outlook.

Can the lending and TVL milestones bolster the price of the native token MNT?

Mantle hits $1B lending milestone on Aave

The Mantle-Aave lending market rocketed past the $1 billion mark following a blockbuster launch that injected $800 million in just one day last week.

According to details, the staggering jump in market size, achieved in under three weeks, saw a new uptick as a dynamic weekend brought more than $200 million in organic capital inflows.

Beyond these gains, the Aave integration has ignited broader ecosystem momentum.

Notably, Mantle’s DeFi TVL has jumped from around $455 million to over $755 million, a 66% increase in just one week.

Emily Bao, a key advisor for Mantle, emphasized the achievement:

“Crossing $1 billion in total market size in under three weeks is a clear signal and not just of what Mantle and Aave have built together, but of where institutional and retail DeFi is heading. Mantle was built to be the distribution layer where real-world finance flows, and these milestones are proof that the ecosystem is delivering on that vision. The MoMNTum is real, and we’ve barely even started.”

What could these network milestones mean for MNT? Market experts say the integration of Mantle on Aave is critical to users seeking opportunities and incentives across DeFi.

As such, the surge highlights Mantle’s growing appeal as a scalable and efficient platform for DeFi activities.

MNT price could eye gains as the ecosystem expands and attracts inflows.

Mantle price forecast: can bulls target $1?

MNT’s price has hovered around $0.65-$0.70 over the past month, with current prices well below the all-time high of $2.85 in October 2025.

While buyers have shown resilience, early signs of recovery have faded amid a broader market downturn.

However, the $1 billion milestone could act as a powerful catalyst for MNT, potentially drawing more liquidity and boosting token utility.

The TVL surge also highlights increased value bet on Mantle growth.

If bulls hold current levels, a fresh bounce could bring the supply zone around $0.85 and $0.92 into play.

The $1 level is a key bullish target.

However, technical indicators suggest sellers may continue to exert downside pressure in the coming days and weeks.

Mantle token trading below key moving averages and being neutral-to-sell leaning oscillators support this outlook.

RSI is at 42, and suggests seller conviction, while the price also hovers below the parabolic SAR.

If the downside proves to be the path of least resistance, the next support levels could be $0.57 and Feb. 6 lows at $0.52.

Crypto World

Is the Bottom In for XRP? The Critical Levels You Need to Watch

XRP is still trading in a broader downtrend, and the rebound attempts keep getting capped at lower highs. The asset is now trying to establish a bottom near the lower part of the range, so the next move likely comes down to whether buyers can defend the recent floor and reclaim the first resistance band.

Ripple Price Analysis: The USDT Pair

On the daily XRPUSDT chart, the trend remains bearish inside a descending channel, with the price holding below the 100-day moving average and the 200-day moving average. The most important overhead supply is the $1.80 zone, which has acted as a pivot area and now lines up with dynamic resistance from the moving averages and the channel structure.

Above that, the next heavier resistance level sits around $2.40 to $2.50, where sellers previously stepped in and where a larger trend shift would need to prove itself.

Support is concentrated around $1.20, which is the area that has been repeatedly defended after the recent flush. As long as XRP stays above this band, the market can keep forming a base and attempt a recovery leg. A clean daily breakdown below $1.20, however, would weaken the structure and increase the odds of a deeper drop toward the next support region near $1.00 or even lower.

The BTC Pair

On the daily XRPBTC chart, XRP is trading around 2,050 sats and still sits below key resistance levels and the key 100-day and 200-day moving averages, after failing to hold the prior recovery swings. The first resistance to watch is the 100-day moving average around 2,200, followed by the 200-day moving average around 2,400 sats.

These elements have repeatedly rejected the price and also overlap with the moving averages, acting as pressure from above. If XRP can reclaim that zone and hold it, the next upside target becomes the 2,500 to sats supply area.

The main support is also located near the 2,000 sats region, which has been tested multiple times and is clearly a line bulls are trying to defend. If the 2,000-sat level fails on a clean break and close, the next major demand pocket sits much lower around 1,400 to 1,500 sats. That is the type of move that usually happens when Bitcoin strength outpaces altcoins, so XRPBTC is still the key risk gauge for bulls here.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

CVX Shares Surge in Early Trading as Crude Oil Soars on Middle East Turmoil

Quick Summary

-

CVX shares gained approximately 4% before the market opening bell on rising crude prices

-

Brent crude surged up to 13% following strikes on Middle East energy infrastructure

-

The company’s Leviathan natural gas facility was shut down after regional attacks

-

Maritime traffic slowdowns near the Strait of Hormuz sparked supply worries

-

Market participants are monitoring petroleum stockpiles and regional tensions

Chevron (CVX) shares experienced upward momentum during Monday’s premarket session as crude oil prices rallied sharply following fresh military strikes across the Middle East.

The stock advanced around 4% in early morning trading as oil markets responded to renewed supply uncertainty and reduced maritime activity near the strategic Strait of Hormuz.

The rally came as both Brent crude and West Texas Intermediate futures posted significant gains.

Brent reached a peak increase of 13% during the opening moments before moderating somewhat as the session progressed.

Energy sector equities rallied swiftly as market participants factored in regional supply threats.

Chevron concluded Friday’s trading session at $186.76, posting a 1.41% increase.

Early Monday activity pushed the stock toward $194 as petroleum prices continued climbing.

Exxon Mobil alongside other prominent energy firms also experienced premarket gains.

The energy sector outperformed even as broader indices faced headwinds.

Supply Disruption Fears Fuel Oil Rally

Crude prices rocketed higher after recent strikes hit critical energy infrastructure and maritime passages throughout the Middle East.

Trading resumed with markets pricing in elevated risk premiums for potential supply interruptions.

Saudi Aramco suspended operations at its Ras Tanura refinery following a drone strike.

The installation has daily processing capacity of approximately 550,000 barrels, industry sources indicate.

Market observers characterized the attack as a significant escalation targeting crucial Gulf energy assets.

Maritime operations near the Strait of Hormuz experienced slowdowns in the wake of the strikes.

Approximately 20% of worldwide petroleum supply passes through the Strait of Hormuz.

Any impediment to transit through this waterway can rapidly influence global energy pricing.

Petroleum markets are currently responding to Gulf region events and shipping patterns.

Industry experts noted that price trajectories will depend significantly on disruption duration.

OPEC+ recently authorized a 206,000 barrel per day production boost beginning in April.

Traders emphasized that this supply addition remains modest when weighed against present geopolitical uncertainties.

Chevron’s Regional Exposure and Market Outlook

Chevron maintains significant exposure to regional events through its Middle East operations.

Israel’s Energy Ministry mandated temporary shutdowns of domestic natural gas production following the strikes.

Chevron’s operated Leviathan offshore gas field went offline in response to the attacks.

Industry sources attributed the closure to elevated security concerns.

The company’s financial performance correlates strongly with oil and gas pricing trends.

Elevated energy prices typically bolster upstream revenue for integrated producers.

Energy equities rallied broadly across the sector as petroleum prices advanced.

Occidental Petroleum and ConocoPhillips similarly registered substantial premarket increases.

Market participants are tracking whether Hormuz shipping volumes normalize in coming days.

Attention is also focused on potential resumption timelines for Israeli natural gas operations.

Domestic traders await Wednesday’s weekly petroleum inventory figures from regulators.

The Energy Information Administration is scheduled to publish the data at 10:30 a.m. Eastern Time.

CVX shares maintained premarket gains as oil markets continued processing supply concerns and operational interruptions stemming from Middle East developments.

Crypto World

Crypto ETPs Post $1B Inflows as Bitcoin Leads Gains

Crypto investment products recorded their first weekly inflows since January last week, snapping a five-week outflow streak of around $4 billion.

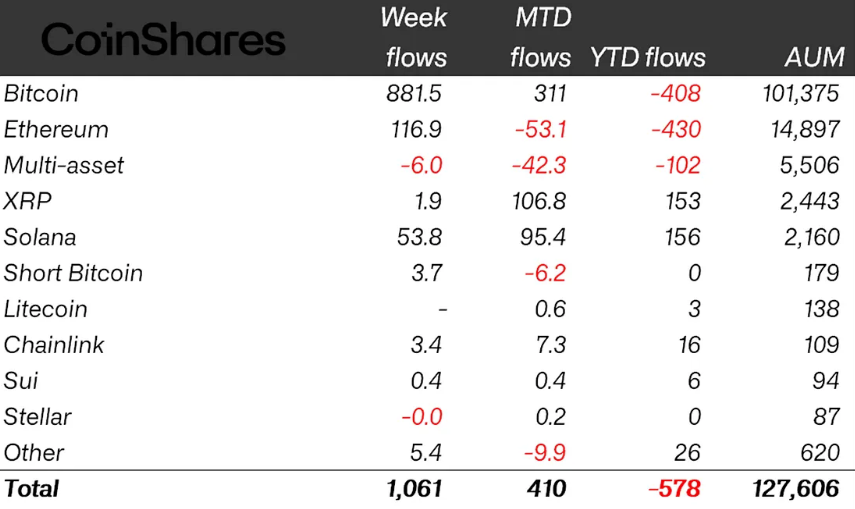

Crypto exchange-traded products (ETPs) attracted $1 billion in inflows last week, led by $882 million into Bitcoin (BTC) funds, according to a Monday report from CoinShares.

“From a macro standpoint, it is difficult to attribute the shift in sentiment to a single catalyst,” said James Butterfill, CoinShares’ head of research.

He said the reversal likely reflected prior price weakness, a break below key technical levels and renewed accumulation by large Bitcoin holders.

“At a more anecdotal level, recent client discussions have been almost entirely focused on identifying entry points rather than reducing exposure to the asset class,” he added.

Ether and Solana add $171 million in weekly crypto inflows

Ether (ETH) funds drew about $117 million, CoinShares said, marking their strongest week since January, while Solana (SOL) drew in about $54 million.

Chainlink (LINK) and XRP (XRP) followed with $3.4 million and $2 million in inflows, respectively.

Despite the renewed demand, Bitcoin and Ether ETPs remain in negative territory for the year, with net outflows of $408 million and $430 million, respectively.

Related: Bitcoin manipulation claims face pushback as ETFs snap 5-week outflow run: Finance Redefined

In contrast, Solana and XRP products have posted year-to-date inflows of $156 million and $153 million.

US spot Bitcoin ETFs lead with $787 million in inflows

Regionally, ETP flows were broadly aligned, with the United States accounting for the bulk of inflows at $957 million. Canada, Germany and Switzerland recorded inflows of $34 million, $32.7 million and $28 million, respectively.

Most of the gains came from US spot Bitcoin ETFs, which drew $787.3 million last week, snapping a five-week outflow streak that had totaled more than $3.8 billion, according to SoSoValue.

Despite the renewed inflows, total assets under management in crypto ETPs declined to $127.7 billion from $130.4 billion the previous week.

Net assets in Bitcoin ETFs also fell, slipping to $83.4 billion from $85.3 billion a week earlier.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Battered BTC price could find solace in ‘debasement’ trade: Crypto Daybook Americas

By Omkar Godbole (All times ET unless indicated otherwise)

The conflict between U.S., Israel and Iran remains the day’s biggest story as the attacks intensify and spread.

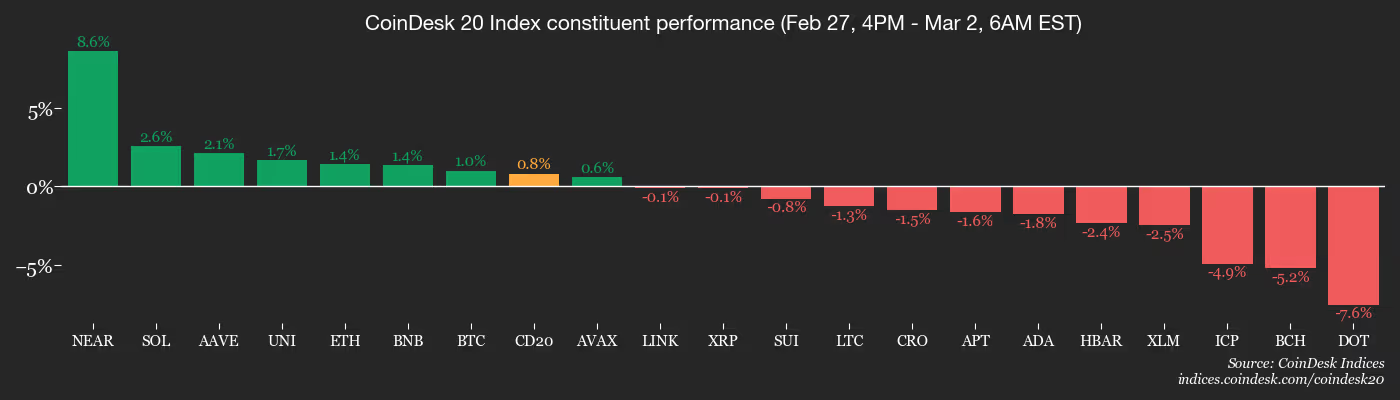

Markets reacted as they typically do: by de-risking and sending oil prices higher. Bitcoin dropped to $66,300, down 0.5% over 24 hours, having hit a high of $68,000 over the weekend. The CoinDesk 20 Index fell over 2%, signaling broader losses in the crypto market and futures tied to the S&P 500 index lost 1%.

Looking past the headlines and panic, the war could only strengthen the “debasement trade,” a strategy in which investors rotate into scarce-supply assets like gold and bitcoin in anticipation of a decline in the value of fiat (paper) currencies.

Governments in the U.S. and elsewhere already owe more than they generate in economic growth. Their finances will only worsen the longer the war drags on. In such situations, governments don’t collect enough in taxes. Instead, they force central banks to “print money” through bond purchases or quantitive easing (QE) to monetize debt. This floods fiat supply and dilutes purchasing power. Hello debasement.

Traders front-run that process by loading up on store-of-value assets like gold and BTC. The yellow metal has been on a tear for over a year mainly on debasement flows. BTC did not participate back then. But now, having nearly halved to under $67,000 since October, it looks oversold. The possibility of the debasement trade catalyzing a bounce in the largest cryptocurrency cannot be ruled out.

Besides, historically the Fed turns dovish with liquidity easing during geopolitical stress, supporting asset prices, as Maelstrom Fund’s CIO Arthur Hayes noted in his blog post.

Let’s see how things unfold. In the meantime traders need to watch headline risks and oil upswings. Stay alert!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Crypto

- March 2: SuperRare to release Delirium, a new collection by artist Xer0x

- March 2: Mantra’s OM to change to MANTRA with a 1:4 coin split as the MANTRA Chain upgrades from v6 to v7.

- Macro

- March 2, 10:00 a.m.: U.S. ISM manufacturing PMI for February est. 52.3 (Prev. 52.6)

- Earnings (Estimates based on FactSet data)

- March 2: Riot Platforms (RIOT), post-market, -$0.32

- March 2: Core Scientific (CORZ), post-market, -$0.18

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

- Governance votes & calls

- PoolTogether DAO is voting to manually resubmit and execute the remaining actions for the PTBR-35 Governance Shutdown after a previous execution error. Voting ends March 2.

- Angle DAO is voting to orderly wind down the EURA and USDA stablecoins, providing users a one-year 1:1 redemption period followed by a final settlement airdrop. Voting ends March 2.

- GMX DAO is voting to transition to a defined leadership model by hiring a CEO with performance-tied compensation and forming an interim leadership committee to guide the restructuring. Voting ends March 2.

- Unlocks

- Token Launches

- March 2: Dovu (DOVU) to be listed on Kraken.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead“.

Market Movements

- BTC is up 0.98% from 4 p.m. ET Friday at $66,194.78 (24hrs: -0.35%)

- ETH is up 1.48% at $1,950.67 (24hrs: -1.63%)

- CoinDesk 20 is up 0.78% at 1,916.46 (24hrs: -1.11%)

- Ether CESR Composite Staking Rate is up 1 bp at 2.85%

- BTC funding rate is at -0.0011% (-1.2147% annualized) on Binance

- DXY is up 0.64% at 98.23

- Gold futures are up 3.03% at $5,406.80

- Silver futures are up 2.64% at $95.75

- Nikkei 225 closed down 1.35% at 58,057.24

- Hang Seng closed down 2.14% at 26,059.85

- FTSE is down 0.78% at 10,825.36

- Euro Stoxx 50 is down 1.89% at 6,022.64

- DJIA closed on Friday down 1.05% at 48,977.92

- S&P 500 closed down 0.43% at 6,878.88

- Nasdaq Composite closed down 0.92% at 22,668.21

- S&P/TSX Composite closed down 0.47% at 34,339.99

- S&P 40 Latin America closed down 0.82% at 3,741.78

- U.S. 10-Year Treasury rate is up 0.4 bps at 3.966%

- E-mini S&P 500 futures are down 1.04% at 6,817.25

- E-mini Nasdaq-100 futures are down 1.42% at 24,650.00

- E-mini Dow Jones Industrial Average Index futures are down 1.11% at 48,458.00

Bitcoin Stats

- BTC Dominance: 58.63% (0.22%)

- Ether-bitcoin ratio: 0.02944 (-0.18%)

- Hashrate (seven-day moving average): 1,068 EH/s

- Hashprice (spot): $29.01

- Total fees: 2.55 BTC / $169,782

- CME Futures Open Interest: 109,280 BTC

- BTC priced in gold: 12.2 oz.

- BTC vs gold market cap: 4.42%

Technical Analysis

- The chart shows ether’s daily price swings with Bollinger bands, which are volatility bands placed two standard deviations above and below the 20-day simple moving average of the price.

- The gap between the bands has shrunk to $226, the narrowest since June 2025.

- Volatility typically booms when bands narrow, which means the token could soon see big price moves in either direction.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $175.85 (-2.88%), -2.42% at $171.60 in pre-market

- Circle Internet (CRCL): closed at $83.44 (-4.32%), -3.46% at $80.55

- Galaxy Digital (GLXY): closed at $20.59 (-6.15%), -2.19% at $20.14

- Bullish (BLSH): closed at $31.39 (-4.09%), -3.73% at $30.22

- MARA Holdings (MARA): closed at $8.94 (+5.80%), -1.23% at $8.83

- Riot Platforms (RIOT): closed at $16.29 (-4.68%), -2.70% at $15.85

- Core Scientific (CORZ): closed at $16.97 (-5.62%)

- CleanSpark (CLSK): closed at $9.95 (-4.69%), -2.01% at $9.75

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $39.88 (-5.43%), -3.61% at $38.44

- Exodus Movement (EXOD): closed at $10.20 (-2.39%), -2.25% at $9.97

Crypto Treasury Companies

- Strategy (MSTR): closed at $129.50 (-2.92%), -0.39% at $129.00

- Strive (ASST): closed at $7.94 (-3.05%), -2.39% at $7.75

- SharpLink Gaming (SBET): closed at $6.82 (-5.41%), +0.44% at $6.85

- Upexi (UPXI): closed at $0.66 (-12.88%)

- Lite Strategy (LITS): closed at $1.13 (-0.88%)

ETF Flows

Spot BTC ETFs

- Daily net flows: -$27.5 million

- Cumulative net flows: $54.78 billion

- Total BTC holdings ~1.27 million

Spot ETH ETFs

- Daily net flows: -$43 million

- Cumulative net flows: $11.63 billion

- Total ETH holdings ~5.7 million

Source: Farside Investors

While You Were Sleeping

- Trump says Iran war may last ‘four weeks or less’ as strikes escalate (Euronews): Trump says the Iran war could last four weeks or less as U.S. and Israeli forces continue their strikes in Iran, which is responding with hits on Gulf states, Israel and U.S. targets.

- New Iranian strikes reported across region, including in Saudi Arabia, as US planes crash in Kuwait (BBC): New Iranian strikes were reported across the Middle East, with explosions in Bahrain, Dubai and Saudi Arabia.

- U.S. equity futures fall in pre-market trading as oil, gold retreat from highs (CoinDesk): U.S. equities fell in pre-market trading. The Invesco QQQ ETF declined 1.5%. A Saudi Arabia oil refinery was hit by Iran, pushing WTI crude oil as high as $75 per barrel. Gold rallied more than 2% to $5,400 per ounce.

- Hedge funds, insurers rush to gauge exposure as Iran spirals (Bloomberg): Hedge funds, banks and insurers rushed to size up their exposure to the Middle East after weekend attacks on Iran fueled chaos across the region.

Crypto World

Composable Risk Oracles: The Missing Layer in DeFi Risk Management

In the current DeFi landscape, conversations almost always orbit around yield optimization, governance mechanics, or the scaling capabilities of layer-2 solutions. Yet one critical piece of infrastructure remains largely overlooked: risk oracles. While price oracles and data feeds have become standard tools, the notion of composable risk oracles—systems that dynamically quantify and communicate both systemic and protocol-specific risk across multiple platforms—is still in its infancy.

What Are Composable Risk Oracles?

A composable risk oracle is more than a price feed. It aggregates real-time data from across the DeFi ecosystem—borrowing/lending metrics, leverage exposure, liquidity depth, liquidation history, protocol governance signals, and even cross-chain activity—to produce standardized risk signals. These signals are then usable by any smart contract or protocol, enabling dynamic risk management instead of static, one-size-fits-all rules.

Imagine a lending protocol that no longer sets fixed collateralization ratios but instead adjusts them continuously based on the asset’s aggregated risk score. Or a yield aggregator that modifies reward rates according to the systemic risk of the pools it taps into. Risk oracles allow protocols to react proactively, not reactively, to volatility or emerging threats.

Why DeFi Needs Them

The current ecosystem assumes either that token price alone drives risk or that risk is manually managed by developers or governance processes. This has clear limitations:

-

Systemic Blind Spots: Individual protocols may look safe in isolation, but become fragile when interdependencies are ignored.

-

Slow Reaction: Manual updates or governance votes lag behind market realities, leaving funds exposed.

-

Inefficient Capital Allocation: Overly conservative or overly aggressive parameters reduce yield efficiency and user participation.

Composable risk oracles provide a single, unified “risk layer” that protocols can plug into, enabling smarter leverage, collateral, and incentive designs that respond to real-time ecosystem dynamics.

A Vision for DeFi with Risk-Aware Protocols

Picture this: a cross-chain DeFi ecosystem where protocols continuously query risk oracles to:

-

Adjust collateralization ratios based on the health of underlying assets.

-

Scale leverage limits according to current market volatility and systemic exposure.

-

Dynamically modulate reward rates to incentivize safer behavior during periods of high stress.

This would turn DeFi from a reactive landscape, where users and protocols chase yield at the risk of systemic failure, into a self-regulating, adaptive financial network. Essentially, risk moves from the shadows into the core protocol logic.

Challenges and Opportunities

Implementing composable risk oracles is non-trivial. Key challenges include:

-

Data aggregation across chains and platforms without introducing latency or oracle manipulation risks.

-

Standardizing risk metrics so diverse protocols can interpret and act upon them consistently.

-

Governance coordination is especially important in decentralized systems where incentive alignment is complex.

Yet the upside is enormous. Risk oracles could underpin capital-efficient DeFi, unlock higher-leverage yet safer markets, and even help regulators or insurance protocols quantify systemic exposure in real time.

Conclusion

The DeFi ecosystem has made leaps in tokenization, yield, and scaling—but risk remains the silent variable. Composable risk oracles have the potential to fundamentally transform how protocols manage risk, aligning incentives and protections in real-time, dynamically. They could become as indispensable to DeFi as price oracles are today—turning a collection of isolated protocols into a coherent, resilient financial network.

DeFi’s next frontier may not be more yield—it may be smarter, composable risk.

REQUEST AN ARTICLE

Crypto World

Hong Kong and Shanghai to Pilot Blockchain for Cargo-Trade Data

Hong Kong and Shanghai authorities unveiled a joint plan to deepen blockchain-enabled collaboration in trade finance and cargo documentation, signaling a practical shift toward digital infrastructures for cross-border commerce. The memorandum of understanding, signed on March 2, 2026, brings together the Hong Kong Monetary Authority (HKMA), the Shanghai Data Bureau (SDB), and the National Technology Innovation Center for Blockchain (NTICBC) to explore a blockchain-based cross-border platform that would interlink trade data, electronic bills of lading, and associated financial applications as part of HKMA’s Project Ensemble. Officials framed the move as a concrete step toward more efficient, transparent and regulatorily sound trade workflows, with pilots and research guiding the rollout.

Key takeaways

- HKMA, SDB, and NTICBC formalize cooperation to digitize cargo trade and finance via a blockchain-driven cross-border platform.

- The project aligns with HKMA’s Project Ensemble and aims to integrate trade data, electronic bills of lading, and financial services within a unified digital rails framework.

- The initiative leverages the Commercial Data Interchange (CDI), HKMA’s blockchain-based data infrastructure launched in 2022 to enable institutional access to corporate data for lending and financing.

- Project CargoX is expected to play a role in strengthening trade and cargo data capabilities for financing and related services.

- Separately, Hong Kong is pursuing tax concessions for digital assets, proposing to broaden qualifying investments for funds and family offices, with potential exemptions on profits if approved.

Tickers mentioned:

Market context: The MoU arrives amid a broader push to modernize financial infrastructure in Asia, with Hong Kong positioning itself as a hub for digital finance and cross-border tokenized services, and Shanghai advancing its fintech ambitions within the broader mainland regulatory framework.

Sentiment: Neutral

Price impact: Neutral. The announcement describes strategic cooperation and policy considerations rather than immediate market moves.

Trading idea (Not Financial Advice): Hold. The collaboration signals long-term structural changes in trade finance infrastructure rather than short-term price triggers.

Market context: The plan sits at the intersection of regulatory clarity, digitization of trade finance, and growing interest in tokenized and data-driven financial services, within a macro environment of ongoing digitization and cross-border coordination in the Asia-Pacific region.

Why it matters

The memorandum underscores a concerted effort by two of Asia’s largest financial centers to reimagine how trade and finance data move across borders. By pursuing a blockchain-enabled cross-border platform, the partners aim to reduce paperwork, shorten settlement times, and improve data integrity for cargo finance. The initiative is designed to harmonize digital records with traditional documents like bills of lading, marrying the reliability of paper-based processes with the efficiency of digital ledgers. In practice, a platform of this kind could lower the operational friction that has historically dogged freight finance, where misaligned documents and slow reconciliation can stall shipments and funding cycles.

On the technical side, the collaboration will leverage the HKMA’s CDI, a blockchain-based financial data infrastructure launched in 2022 to give institutional lenders access to a broader set of corporate data. CDI is already being used to streamline lending decisions by consolidating disparate data sources, and its extension into trade finance could yield faster underwriting and more accurate risk assessment for shipments and financing arrangements. The plan also references Project CargoX, an HKMA initiative intended to strengthen data capabilities across cargo and trade workflows to support financing and related services. Taken together, the effort signals a shift from standalone digital pilots toward interoperable, end-to-end digital rails that can support a wider ecosystem of trade-related financial products.

“We look forward to driving innovative application of digital technology in areas such as cargo trade and finance, promoting joint achievements in digital innovation, exploring a digital infrastructure that links Shanghai and Hong Kong, promoting digitalisation of trade finance.”

The officials framing the MoU emphasized that the collaboration is not merely a theoretical exercise but a milestone in building practical, data-powered digital infrastructure. In remarks from the Shanghai Data Bureau, the partnership was described as a meaningful step toward data-powered, innovation-driven development, with the ambition of creating a secure, efficient, and open digital ecosystem for cross-border trade. By aligning Shanghai’s data capabilities with Hong Kong’s financial services ecosystem, the parties hope to demonstrate how a regulated, standards-based, and transparent approach to data can improve outcomes for traders and financiers alike.

Beyond the cross-border platform itself, the policy dimension of the announcement signals a broader regulatory openness to digital assets as a legitimate investment category. In parallel to the MoU, Hong Kong’s government laid out a policy path to make its tax concessions more attractive to investment funds and family offices by expanding qualifying investments to include digital assets. If the proposal passes through the legislative process, profits from digital assets held within these investment structures could qualify for tax exemptions, subject to approval. This element complements the tech push by creating a more favorable fiscal environment for capital deployment into digital asset strategies, potentially drawing more global fund participants to Hong Kong as a gateway to the region’s digital economy.

Taken together, the announcements reflect a broader regional strategy: to blend cutting-edge digital infrastructure with a clear, asset-backed regulatory framework that can support both traditional finance and newer digital assets. The MoU’s emphasis on data interoperability and risk-aware automation—paired with a thoughtful tax policy—suggests policymakers are seeking a stable yet forward-looking path for the digitization of trade and finance in a way that can be scaled and exported to other markets in the region.

What to watch next

- Progress of pilot deployments or go-live plans for the cross-border platform under Project Ensemble, including milestones and timelines for the joint research program.

- Results and findings from CDI-enabled pilots in trade finance, and how cargo data integrates with eBLs and financing workflows.

- Further details on Project CargoX’s role, timelines for its adoption, and how it interfaces with existing trade-data standards.

- Regulatory and legislative updates on the digital assets tax concessions, including timing of any approvals from the Legislative Council Financial Affairs Committee.

Sources & verification

- Official MoU announcement from info.gov.hk describing the HKMA–SDB–NTICBC collaboration on cross-border trade data and Project Ensemble.

- HKMA – Commercial Data Interchange (CDI) documentation and its role in institutional access to corporate data since 2022.

- HKMA – Project CargoX description for enhancing cargo and trade data capabilities in financing.

- Remarks by Hui Ching-yu on digital asset concessions, including the Legislative Council Financial Affairs Committee meeting (P2026030200210).

Hong Kong–Shanghai cross-border blockchain initiative: what it means for markets and users

The collaboration represents a shift from isolated pilots toward integrated, governance-aligned digital rails that can support a broader set of trade-finance products. By weaving together trade data, electronic bills of lading, and financing tools within a blockchain framework, the partnership seeks to reduce friction in invoicing, risk assessment, and settlement—benefits that could resonate across supply chains and the banks that finance them. The emphasis on using CDI as the backbone for data access underscores a belief in regulated, auditable data flows as a bedrock for confidence in digital trade structures. If successful, the cross-border platform could serve as a model not only for Hong Kong and Shanghai but for other hubs looking to harmonize trade data standards with financial services in a standards-based, interoperable manner.

From a policy standpoint, the digital asset tax concessions reflect a recognition that financial technologies and crypto-adjacent assets are increasingly relevant to institutional investment. While the policy is still subject to legislative approval, the proposal indicates a willingness to create incentives for funds and family offices to allocate to digital assets, potentially accelerating institutional exposure to this broader asset class. The policy, paired with the MoU’s focus on infrastructure, positions Hong Kong as a testbed for regulated digital rails that can support both traditional financing and newer digital-asset strategies, all within a framework designed to promote transparency and governance.

In the broader market context, these developments occur amid growing interest in tokenization, data-centric finance, and cross-border fintech collaboration across Asia. While actual market prices for assets will reflect a multitude of macro and idiosyncratic variables, the signaling value of such coordinated public-private efforts is meaningful: they indicate a pathway toward more efficient trade finance channels, enhanced data privacy and security, and a regulatory posture that seeks to balance innovation with oversight.

-

Sports7 days ago

Sports7 days agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Politics7 days ago

Politics7 days agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Iris Top

-

Business6 days ago

Business6 days agoTrue Citrus debuts functional drink mix collection

-

Politics4 days ago

Politics4 days agoITV enters Gaza with IDF amid ongoing genocide

-

Tech1 day ago

Tech1 day agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports2 days ago

The Vikings Need a Duck

-

Crypto World6 days ago

Crypto World6 days agoXRP price enters “dead zone” as Binance leverage hits lows

-

NewsBeat2 days ago

NewsBeat2 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Tech6 days ago

Tech6 days agoUnsurprisingly, Apple's board gets what it wants in 2026 shareholder meeting

-

NewsBeat5 days ago

NewsBeat5 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

NewsBeat5 days ago

NewsBeat5 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat2 days ago

NewsBeat2 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat23 hours ago

NewsBeat23 hours ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat2 days ago

NewsBeat2 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoPolice latest as search for missing woman enters day nine

-

Entertainment5 hours ago

Entertainment5 hours agoBaby Gear Guide: Strollers, Car Seats

-

Business4 days ago

Business4 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Business4 days ago

Business4 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech3 days ago

Tech3 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS