Crypto World

Shaping the future of open digital asset trading

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BlinkEx has launched early access with a controlled, invite-only model that prioritizes transparency, reliability, and infrastructure stability before scaling features.

Summary

- BlinkEx begins with a focused spot-trading platform and phased roadmap to prove performance before expanding functionality.

- It uses low-latency matching, real-time monitoring, and structured listing standards to support predictable execution and system integrity.

- The platform applies a safety-by-default design and progressive access model to reduce user risk while building long-term trust.

Transparencу has become one of the most discussed, and least consistentlу delivered, principles in the digital asset industrу. As crypto markets mature, users increasinglу expect exchanges not onlу to provide access to trading, but to clearlу explain how platforms operate, how risks are managed, and how growth decisions are made.

BlinkEx enters this environment with a deliberatelу structured approach. Rather than launching as a fullу expanded ecosуstem, the exchange begins with a focused spot-trading product and a clearlу communicated development plan. The goal is to establish operational claritу and predictable performance before introducing additional laуers of complexitу.

Having launched early access in mid-February 2026, BlinkEx uses an invite-only access model to scale responsibly, validate its systems under real market conditions, and refine its processes ahead of a broader public launch planned for late February or early March.

Overview of the BlinkEx crypto exchange

BlinkEx is designed as a next-generation spot-focused exchange built around infrastructure stabilitу and market integritу. From the outset, the platform limits its scope to essential trading functionalitу, allowing internal sуstems to be tested and optimized without the pressure of supporting an oversized feature set.

The earlу access product includes:

- Spot trading on a curated set of assets and trading pairs

- A streamlined buу/sell interface designed for claritу and speed

- Low-latencу order matching for predictable execution

- Live operational monitoring and support sуstems

This controlled launch model reflects a broader design philosophу: exchanges should prove reliabilitу before expanding functionalitу. Bу prioritizing sуstem performance and execution consistencу, BlinkEx positions itself to build credibilitу through measurable results rather than promises.

Transparencу, reliabilitу, and securitу as core principles

BlinkEx places transparencу at the center of its operational strategу. This includes clear communication around what the platform offers at each stage, how assets are evaluated for listing, and how risk controls function at the account and sуstem level.

Reliabilitу is treated as a prerequisite for user trust. Infrastructure is designed to remain stable during periods of increased market activitу, with an emphasis on predictable behavior rather than experimental optimization. Scheduled maintenance, monitoring, and incident response procedures are defined in advance to reduce uncertaintу.

Securitу is addressed through a safetу-bу-default design philosophу. Instead of assuming users will manuallу configure everу protection, the platform applies conservative defaults and provides guidance during abnormal activitу. This approach is intended to reduce preventable errors while preserving flexibilitу for more experienced participants.

Together, these principles form the foundation for a trading environment where transparencу is operational, not cosmetic.

Platform features that ensure transparencу, reliabilitу, and securitу

The practical implementation of the BlinkEx cryptocurrency exchange’s principles is reflected in its engineering and operational decisions. The system is designed so that its behavior remains understandable and predictable, especially during periods of increased activity.

Several platform-level features are designed specificallу to support this goal:

- Low-latencу matching infrastructure built to deliver consistent execution rather than variable speed gains

- Operational monitoring from daу one, allowing issues to be identified and addressed before theу escalate

- Structured asset listing standards, evaluating liquiditу, technical maturitу, and transparencу before new markets are introduced

In addition to these core elements, BlinkEx integrates real-time behavioral monitoring to help identifу unusual account activitу. This monitoring laуer supports adaptive safeguards that can respond to potential threats without broadlу disrupting normal trading behavior.

From a user perspective, this means the platform favors claritу over complexitу. Actions such as withdrawals, session access, and sudden behavioral changes are contextualized rather than silentlу processed, reinforcing user awareness and accountabilitу.

Trading design focused on controlled participation

BlinkEx’s trading design reflects a belief that access to markets should scale with experience. Instead of exposing all users to the same level of operational and financial risk from the start, the platform uses progressive access models.

Within this framework, BlinkEx trading is structured around a clean spot-market experience supported bу conservative defaults. Users can engage in trading without navigating unnecessarу laуers of configuration, while more advanced options become available as familiaritу with the platform grows.

This design reduces the likelihood of irreversible mistakes while maintaining a professional trading environment. It also supports a broader objective: enabling participation without encouraging behavior that depends on excessive leverage or opaque mechanics.

A platform built for long-term participation

BlinkEx is not positioned as a short-term speculative venue. Its roadmap and operational choices are aimed at users seeking continuitу and predictabilitу over time. As an investment platform, the exchange emphasizes infrastructure readiness before expanding into additional tools or market structures.

The publiclу outlined roadmap follows a phased model:

- Year 1 focuses on building a robust spot exchange with transparent UX, core order tуpes, and visible risk controls.

- Subsequent phases introduce advanced order functionalitу, expanded APIs, and ecosуstem integrations onlу after operational benchmarks are met.

- Later-stage development, where permitted, explores broader market offerings supported bу upgraded monitoring and risk frameworks

This progression is designed to align platform growth with user trust, rather than forcing adoption through rapid feature releases.

Securitу as an operational standard, not a promise

In an environment where securitу claims are common but unevenlу enforced, BlinkEx treats protection as an operational requirement. The platform’s safetу-bу-default approach, combined with real-time monitoring and adaptive safeguards, is intended to reduce preventable loss scenarios.

Within this context, the statement “BlinkEx is safe?” is grounded in sуstem design rather than marketing language. Safetу is defined bу how the platform behaves during stress, how it responds to anomalies, and how clearlу it communicates limitations and risks to its users.

Rather than presenting securitу as a static feature, BlinkEx approaches it as an ongoing process tied to infrastructure, behavior analуsis, and transparencу.

Development prospects and long-term outlook

BlinkEx’s development strategу reflects a broader trend toward accountabilitу in digital asset infrastructure. Bу publishing a structured roadmap and limiting earlу functionalitу, the platform sets expectations around what users can relу on at each stage.

For participants evaluating BlinkEx investments as part of their broader market activitу, this claritу provides an important reference point. The exchange’s measured expansion model is designed to support sustainable participation without relуing on aggressive growth tactics.

As the platform evolves, future enhancements are expected to build on existing controls rather than bуpass them, reinforcing the original design principles established at launch.

Conclusion

BlinkEx enters the digital asset market with a clear thesis: transparencу, reliabilitу, and securitу are not optional features, but foundational requirements. Bу starting with a focused spot-trading environment and expanding onlу after operational benchmarks are met, the exchange positions itself as a disciplined alternative in a crowded landscape.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Axelar Network Integrates Stellar to Power Institutional Cross-Chain Finance

TLDR:

-

- Axelar Network has integrated Stellar, connecting its payments infrastructure with cross-chain interoperability tools

- Solv Protocol, Stronghold, and Squid Router launched live on the Axelar-Stellar integration at launch day.

- Stronghold bridges SHx between Stellar and Ethereum, maintaining a unified 1:1 token supply across both chains.

- Axelar’s 2026 roadmap targets compliant, institutional-grade infrastructure, aligning closely with Stellar’s focus.

Axelar Network has completed its integration with Stellar, linking two key infrastructure layers in the digital asset space.

The move connects Stellar’s payments and asset issuance capabilities with Axelar’s cross-chain interoperability protocol. At launch, Solv Protocol, Stronghold, and Squid Router are already live and operational.

The integration opens new pathways for tokenization, trading, and yield products across blockchain networks for institutional and retail participants alike.

New Cross-Chain Capabilities Reach Builders Immediately

Axelar Network confirmed the integration is live, with projects already building on the combined infrastructure. Stellar brings high throughput, low fees, and native compliance tooling to the table.

Its ecosystem includes payment providers, fintech platforms, and capital markets participants with an established developer base.

The Axelar team announced the milestone on X, stating: “Stellar is now live on Axelar. This integration expands institutional-grade onchain finance, connecting @StellarOrg’s strengths in payments and asset issuance with Axelar’s interoperability layer. At launch, @SolvProtocol, @strongholdpay, and @squidrouter are already live.”

Solv Protocol is among the first to build on the combined stack. Solv is a major allocator in tokenized real-world assets and holds the largest onchain Bitcoin reserve.

Through Axelar and Stellar, Solv can extend yield-bearing products into cross-chain markets. Builders can bridge solvBTC to Stellar today using Solv’s cross-chain application.

Stronghold is bridging its SHx token between Stellar and Ethereum through Axelar’s protocol. The bridge maintains a 1:1 supply across both networks while supporting consistent liquidity.

As noted in the announcement, the bridge allows “SHx holders to move assets freely between the two networks while maintaining a unified 1:1 supply.” SHx holders can already move assets between the two chains via Squid Router.

Institutional Adoption Drives the Integration’s Strategic Direction

Axelar Network’s 2026 roadmap, outlined by Common Prefix, centers on institutional adoption and compliant infrastructure.

Stellar’s focus on payments, regulated asset issuance, and compliance-oriented tools aligns well with that direction.

The roadmap specifically targets “strengthening economic security, enabling compliant and privacy-aware infrastructure, and building institutional products up the stack.”

Squid Router already supports bridging assets including XLM and solvBTC on the integrated network. Its role as a liquidity routing layer allows Stellar-based assets to access broader markets without fragmenting developer workflows. This gives builders immediate cross-chain reach from the Stellar ecosystem.

Financial institutions across global markets continue to explore onchain infrastructure for settlement and trading. Axelar and Stellar co-authored a joint article on onchain retail payments published in The Stablecoin Standard.

That collaboration reflects a shared focus on production-ready infrastructure built for institutional participants.

Axelar Network’s integration with Stellar is fully available to builders today. The announcement confirmed that “applications can begin connecting onchain assets and services across both networks today.”

The integration positions both ecosystems to support the continued growth of regulated, cross-chain digital asset products.

Crypto World

German central bank chief sees merit in euro stablecoins, but CBDC remains in focus

German central bank president Joachim Nagel said he sees “merit in euro-denominated stablecoins,” and argues that they could serve as a cheaper and more efficient means for cross-border payments by both firms and individuals.

Summary

- German central bank president Joachim Nagel said euro-denominated stablecoins can serve as a means for low-cost cross-border payments.

- He said the Bundesbank has completed significant exploratory work on a potential wholesale CBDC.

During his speech at the New Year’s Reception of the American Chamber of Commerce in Germany in Frankfurt, Nagel, who leads the Deutsche Bundesbank, added that the EU is “working hard on the introduction of the digital euro.”

“This will be the first pan-European retail digital payment solution, based solely on European infrastructures,” he added.

However, he did not elaborate on how euro-denominated stablecoins would be regulated within the European Union’s existing legal framework, nor clarify how they would interact with the planned digital euro or broader monetary policy architecture.

In separate comments made last week, Nagel cautioned that if US dollar-denominated stablecoins were to gain significantly larger market share than a euro-pegged alternative, European monetary policy “could be severely impaired,” and the continent’s sovereignty could be weakened.

Nagel, who has long maintained a cautious and skeptical stance toward unbacked cryptocurrencies, has instead advocated the use of a state-backed digital euro, which he believes “will play a role in future resilience” for Europe.

According to him, the central bank has already “accomplished important exploratory work on the possible introduction of a wholesale CBDC.” A wholesale CBDC, he said, would allow financial institutions to make “programmable payments” in central bank money.

Elsewhere in the U.S., there has been a lot of momentum around stablecoin, and the market has been expanding at a rapid pace on the back of demand for dollar-equivalent settlement layers, especially after President Donald Trump signed the GENIUS Act into law in July 2025.

But policy deadlock around a key market structure bill has stalled progress and divided crypto industry and banking stakeholders over issues such as stablecoin yield and reward mechanisms.

Crypto World

EU moves to cut off Russian crypto links amid domestic mining boom

The European Union is preparing a sweeping ban on cryptocurrency transactions involving Russian entities, even as Russian financial firms accelerate efforts to institutionalize crypto investment products at home.

Summary

- The European Commission is proposing a blanket ban on all cryptocurrency transactions involving Russian entities as part of its 20th sanctions package.

- The measure aims to close loopholes that previously allowed sanctioned Russian crypto platforms to rebrand or reroute transactions.

- Meanwhile, Russian broker Finam has launched a regulated cryptocurrency mining investment fund registered with the Bank of Russia, signaling deeper institutional adoption of digital assets in Russia.

EU targets Russian crypto with sweeping ban

According to a recent Financial Times report, the European Commission is proposing a blanket prohibition on crypto dealings between EU individuals or companies and any crypto-asset service provider established in Russia. The measure forms part of the bloc’s 20th sanctions package against Moscow since the invasion of Ukraine.

Unlike previous rounds that targeted specific exchanges or wallets, the new proposal would ban all Russian-linked crypto transactions, aiming to close loopholes that allowed sanctioned entities to rebrand or shift operations.

EU officials argue that cryptocurrencies, stablecoins and digital payment rails have created alternative channels for cross-border value transfers outside traditional banking oversight.

The draft reportedly includes restrictions tied to Russian digital finance infrastructure such as ruble-linked stablecoins and any future central bank digital currency.

However, the plan requires unanimous approval from all 27 EU member states, a hurdle that could complicate adoption and enforcement.

Russia deepens crypto investment push

At the same time, Russia’s domestic crypto sector is expanding.

Broker Finam has launched trading in units of a new investment fund focused on cryptocurrency mining operations. The fund pools capital to finance industrial-scale mining infrastructure, including facilities powered by natural gas in regions such as Mordovia.

It has been registered with the Bank of Russia, signaling increasing formalization of the sector.

The move reflects Russia’s broader strategy to regulate and legitimize crypto mining after legal reforms in recent years. With abundant energy resources and cold climates suitable for mining operations, Russia has positioned itself as a significant global mining hub.

Structured investment vehicles like Finam’s fund provide domestic investors exposure to digital asset production without directly holding cryptocurrencies.

For Brussels, digital assets represent a potential sanctions-evasion channel requiring tighter restrictions. For Moscow, crypto mining and regulated investment products are becoming tools of economic resilience and financial innovation under Western pressure.

Crypto World

Vitalik Buterin: You Don’t Need to Agree With Me to Use Ethereum

TLDR:

- Buterin confirms users need no alignment with his views on AI, DeFi, or culture to use Ethereum.

- He argues calling an app “corposlop” is free speech, not censorship, under Ethereum’s open framework.

- Buterin warns that pretend neutrality weakens values, urging crypto builders to state principles clearly.

- He compares Ethereum to Linux, saying a full-stack value-aligned ecosystem must exist alongside the protocol.

Ethereum co-founder Vitalik Buterin has issued a wide-ranging statement on personal views, free speech, and decentralized protocols.

He made clear that users do not need to share his opinions to participate in the Ethereum network. At the same time, he firmly asserted his right to openly criticize applications he disagrees with.

His remarks draw a firm line between protocol neutrality and individual expression within the broader ecosystem.

Ethereum Belongs to No Single Voice

Buterin opened his statement by listing several areas where he holds strong personal views. He wrote, “You do not have to agree with me on political topics to use Ethereum,” adding the same applies to his views on DeFi, AI, and even cultural preferences.

He noted that agreement on none of these topics is required to use Ethereum. This reflects the core promise of a permissionless system.

He was direct in stating that Ethereum is a decentralized protocol. As such, no single person — including himself — speaks for the entire ecosystem.

He noted that “the whole concept of permissionlessness and censorship resistance is that you are free to use Ethereum in whatever way you want.” Users are free to build and transact without seeking approval from any central figure.

However, Buterin acknowledged that his individual voice still carries weight in public discourse. He separated his personal commentary from any form of network-level control.

The distinction, he argued, is essential to understanding what decentralization actually means in practice.

Free Speech Carries Responsibility in Crypto

Buterin addressed the tension between criticism and censorship directly in his post. He stated clearly, “If I say that your application is corposlop, I am not censoring you.”

The network remains open regardless of what he says about any project. This, he argued, is the grand bargain of free speech.

Furthermore, he pushed back against what he described as false neutrality. He wrote that “the modern world does not call out for pretend neutrality, where a person puts on a suit and claims to be equally open to all perspectives.”

Instead, he called for the courage to state principles clearly and to point to negative examples when needed. Criticism, in his view, is a civic responsibility, not an attack.

He also noted that principles cannot remain at the protocol layer alone. He argued that “valuing something like freedom, and then acting as though it has consequences on technology choices, but is completely separate from everything else about our lives, is not pragmatic — it is hollow.” Staying silent on broader social questions, he said, weakens the values themselves.

The Linux Parallel and Full-Stack Value Systems

To illustrate his point, Buterin drew a direct comparison to Linux. He noted that “Linux is a technology of user empowerment and freedom,” yet it also serves as “the base layer of a lot of the world’s corposlop.” The same base layer can serve very different ends. Ethereum, he said, operates the same way.

Because of this, he argued that building the protocol is not enough. He wrote that “if you care about Linux because you care about user empowerment and freedom, it is not enough to just build the kernel.”

A full-stack ecosystem aligned with specific values must also exist alongside it. That ecosystem will not be the only way people use Ethereum, but it must remain available.

He closed by noting that the borders of any shared value framework are naturally fuzzy. He acknowledged that “it is possible, and indeed it is the normal case, to align with any one on some axes and not on other axes.” Ethereum, like Linux, will always serve many communities and value systems at once.

Crypto World

Bitcoin Sentiment Hits Lows Amid Oversold Signals

Crypto market sentiment has fallen to extreme lows and could lead to a “durable bottom” that exhausts selling pressure, according to analysts at crypto financial services firm Matrixport.

“Sentiment has fallen to extremely depressed levels, reflecting broad pessimism across the market,” said Matrixport in a note on Tuesday.

Matrixport’s own Bitcoin (BTC) “fear and greed index” suggests that “durable bottoms” form when the 21-day moving average drops below zero and reverses higher, which is currently the case.

“This transition signals that selling pressure is becoming exhausted and that market conditions are beginning to stabilize.”

However, Matrixport cautioned that prices could still fall further in the near term. Historically, these deeply negative sentiment readings have offered attractive entry points, they said.

“Given the cyclical relationship between sentiment and Bitcoin price action, the latest reading suggests the market may be approaching another inflection point,” it stated.

Crypto market sentiment at four-year lows

Previous periods when the Matrixport sentiment metric was this low were around June 2024 and November 2025, following periods of steep market declines.

Alternative.me’s “Fear and Greed Index” is also around its lowest level since June 2022, with a reading of 10 out of 100 indicating “extreme fear.”

Related: Bitcoin down 22%, could it be the worst Q1 since 2018?

If Bitcoin closes February in the red, it will print five straight monthly losses in the longest streak since 2018, and one of the steepest sustained sell-offs in history.

Bitcoin is at historic oversold levels

Frank Holmes, chairman of Bitcoin mining firm Hive, said on Monday that Bitcoin is now roughly two standard deviations below its 20-day trading norm. “This is a level we’ve seen only three times in the past five years,” he said.

“Historically, such extremes have favored short-term bounces over the subsequent 20 trading days,” he explained.

“Despite the ongoing market jitters, I remain bullish in the long term because the fundamentals still look strong.”

Magazine: Coinbase misses Q4 earnings, Ethereum eyes ‘V-shaped recovery’: Hodler’s Digest

Crypto World

Harvard Flips the Script: Trims Bitcoin by 20%, Enters Ethereum Market With $86.8M Buy in Q4 2025

TLDR:

- Harvard Management Company trimmed nearly 1.5 million Bitcoin ETF shares, reducing its position by roughly 21 percent in Q4 2025.

- HMC purchased nearly 4 million Ethereum ETF shares worth $86.8 million, marking its first-ever exposure to the asset class.

- Bitcoin fell from $126,000 to $88,429 while Ethereum lost 28 percent of its value during Harvard’s repositioning quarter.

- Finance professors from UCLA and University of Washington criticized Harvard’s crypto strategy, questioning valuations and portfolio risk management.

Harvard Management Company sold approximately 20 percent of its Bitcoin holdings while placing an $86.8 million bet on Ethereum during the fourth quarter of fiscal year 2025.

The endowment trimmed nearly 1.5 million shares of the iShares Bitcoin Trust yet opened a fresh position in an Ethereum exchange-traded fund.

Securities and Exchange Commission filings released Friday confirmed the moves. Bitcoin remains Harvard’s largest publicly disclosed holding, valued at over $265 million despite the reduction.

Harvard Shifts Crypto Strategy with Ethereum Entry

Harvard Management Company’s $86.8 million Ethereum purchase marked the endowment’s first exposure to the asset.

The fund acquired nearly 4 million shares of an Ethereum ETF, a cryptocurrency Harvard had never previously held.

This move came as Bitcoin was trimmed by roughly 1.5 million shares, reflecting a broader repositioning within the digital asset space.

The quarter proved turbulent for both cryptocurrencies. Bitcoin peaked near $126,000 in October 2025 before sliding to $88,429 by quarter’s end.

Ethereum fared worse, shedding approximately 28 percent of its value over the same period. Harvard’s entry into Ethereum during this price decline suggests the fund saw longer-term opportunity despite short-term losses.

Finance experts, however, raised questions about both moves. Andrew F. Siegel, an emeritus professor of finance at the University of Washington, called the Bitcoin investment outright “risky.”

He pointed to a steep year-to-date decline and challenged the asset’s ability to hold value over time.

“It is down 22.8% year-to-date,” Siegel wrote. “It can be argued that the risk of Bitcoin is partly due to its lack of intrinsic value.”

His remarks cast doubt on whether the endowment’s crypto exposure aligns with its long-term financial responsibilities.

Harvard Exits Key Holdings, Reshuffles Tech Exposure

Avanidhar Subrahmanyam, a finance professor at UCLA, extended his criticism to Harvard’s new Ethereum position as well.

He had previously questioned the Bitcoin investment and noted that his concerns had since proven accurate. His latest remarks were equally pointed about the Ethereum bet.

“In my view, any underdiversified position in something as speculative as crypto does not make sense for HMC,” Subrahmanyam wrote. “If I were to ask them how they value BTC or Ethereum, I doubt I would get a cogent and precise answer.”

He added that he again questioned the wisdom of the Ethereum investment after raising earlier alarms about Bitcoin.

Outside of cryptocurrency, Harvard Management Company made several notable portfolio changes. The endowment opened a $141 million stake in Union Pacific Corporation following the railroad’s announced merger with Norfolk Southern.

Subrahmanyam acknowledged this particular move, saying the Union Pacific investment “may prove valuable” for the university given the proposed transcontinental railroad network it would create.

Harvard also exited two positions entirely, liquidating its full 1.1 million-share stake in Light & Wonder, Inc. and its 92,000-share position in Maze Therapeutics Inc.

On the technology front, Broadcom surged 222 percent within the portfolio while Google and Taiwan Semiconductor rose 25 percent and 45 percent respectively.

Amazon, Microsoft, and Nvidia each saw reductions of 36 percent, 21 percent, and 30 percent. Siegel noted that “the market is generally nervous right now with AI being so new and so expensive to train and deploy,” a factor he said likely drove some of those cuts.

Harvard’s directly held public equity portfolio declined by roughly $25,000 from the prior quarter, representing only a fraction of the university’s $56.9 billion endowment.

Crypto World

How to Sell Cryptocurrency Across Different Platforms and Market Conditions?

The crypto market operates across multiple environments, each shaped by different liquidity levels, user behavior, and technical structures. As a result, selling strategies must adapt to both platform choice and broader market conditions.

One of the first distinctions sellers encounter is between centralized, peer-to-peer, and decentralized platforms. Centralized exchanges emphasize speed and automation, often offering deep liquidity but limited flexibility.

Peer-to-peer environments prioritize user control and payment diversity, while decentralized protocols rely on smart contracts and on-chain execution. Knowing how these systems differ is a critical step in understanding how to sell cryptocurrency without unnecessary compromise.

Market conditions play an equally important role. During periods of high volatility, prices can shift rapidly within minutes, affecting execution quality.

In such environments, sellers must decide whether to prioritize immediate execution or price control. Understanding how to sell cryptocurrency during volatile phases often involves balancing urgency against the risk of unfavorable pricing.

Liquidity fragmentation further complicates selling decisions. While major assets may trade actively across multiple platforms, less common tokens often suffer from shallow order books.

Selling large amounts in low-liquidity markets can cause price slippage, reducing overall returns. Strategic sellers who understand how to sell cryptocurrency assess liquidity conditions before initiating transactions and adjust order size or timing accordingly.

Liquidity and Order Types in Crypto Selling

Order mechanics also influence outcomes. Market orders offer speed but limited control, while limit orders allow sellers to define acceptable pricing levels.

Order mechanics also influence outcomes. Market orders offer speed but limited control, while limit orders allow sellers to define acceptable pricing levels.

Stop orders and conditional triggers add another layer of risk management. Mastering these tools is essential for anyone aiming to learn how to sell cryptocurrency in a structured and disciplined manner.

Regulation, Security and Psychological Factors in Selling

Security considerations extend beyond platform reputation. Wallet management, transaction verification, and withdrawal procedures all affect the safety of a sale. Sellers must ensure that destination accounts are correctly configured and that transfers are confirmed properly.

A thorough approach to how to sell crypto includes protecting assets throughout the entire transaction lifecycle, not just at the point of execution.

Settlement and payment logistics deserve equal attention. Fiat withdrawals may involve banking delays, currency conversion fees, or regional processing limits.

In peer-based transactions, payment confirmation and release timing can vary. These operational details are often overlooked but are central to understanding how to sell cryptocurrency efficiently and predictably.

Regulatory frameworks add another layer of complexity. Selling cryptocurrency may trigger reporting obligations, capital gains taxes, or documentation requirements, depending on jurisdiction.

Sellers who fail to account for these factors risk legal and financial consequences. Responsible participation in digital asset markets requires understanding how to sell cryptocurrency in compliance with local regulations.

Psychology, Technology and Portfolio Goals in Crypto Selling

User behaviour and psychology also influence selling outcomes. Emotional responses to market movements can lead to rushed decisions or missed opportunities.

User behaviour and psychology also influence selling outcomes. Emotional responses to market movements can lead to rushed decisions or missed opportunities.

Experienced sellers rely on predefined exit strategies, profit targets, and loss limits rather than reacting impulsively. Developing this mindset is an essential part of learning how to sell cryptocurrency consistently over time.

Technological reliability should not be underestimated. Platform outages, network congestion, and system delays can interfere with execution during critical moments.

Diversifying access across multiple platforms and maintaining contingency plans helps mitigate these risks. A comprehensive understanding of how to sell cryptocurrency includes preparation for technical disruptions as well as market ones.

Another important consideration is portfolio impact. Selling decisions should align with broader financial objectives, whether rebalancing holdings, securing profits, or reducing exposure.

Viewing each sale in isolation can lead to fragmented decision-making. Strategic sellers understand how to sell cryptocurrency as part of an integrated portfolio strategy.

In conclusion, selling digital assets is a complex process shaped by platform choice, market conditions, and individual objectives. Knowing how to sell cryptocurrency requires a holistic approach that combines technical skills, risk awareness, and disciplined execution.

As the crypto ecosystem continues to evolve, sellers who adapt their strategies thoughtfully are better positioned to protect value and navigate change with confidence.

Crypto World

Real-World Assets: DeFi’s New Power Move

If you’ve been watching DeFi lately and thinking, “Where did all the noise go?” — good. The noise is being replaced by something far more dangerous (in a good way): real finance moving on-chain.

The most powerful trend in DeFi today isn’t another meme token or short-lived yield farm. It’s the explosive growth of Real-World Asset (RWA) tokenization — and it’s quietly reshaping the entire ecosystem.

The Shift: From Speculation to Structured Finance

For years, DeFi was largely circular—crypto collateral backing crypto loans to farm more crypto. Fun? Absolutely. Sustainable? Debatable.

Now we’re seeing capital rotate into RWAs — tokenized U.S. Treasuries, bonds, credit markets, and even real estate — plugged directly into DeFi rails.

This matters because:

-

It introduces a yield backed by real economic activity

-

It attracts institutional liquidity

-

It stabilizes TVL with less volatility than purely crypto-native assets

In short, DeFi is starting to behave like actual finance instead of a casino with better UI.

Legacy Protocols Aren’t Dead — They’re Evolving

While RWAs are booming, core lending protocols remain critical infrastructure.

Take Aave — still one of the most important liquidity engines in DeFi. Lending and borrowing markets are the backbone of capital efficiency, and Aave continues expanding across chains while integrating more stable and institutional-friendly assets.

What’s interesting isn’t just price movement — it’s positioning.

Aave and similar protocols are becoming the rails through which RWAs plug into DeFi. Imagine borrowing against tokenized Treasury bonds instead of volatile altcoins. That’s not theory anymore — it’s happening.

And when DeFi protocols become credit markets instead of speculation machines? That’s when institutions stop laughing and start allocating.

High-Speed Chains Are Fueling Liquidity

Infrastructure matters. Speed matters. Fees matter.

That’s where ecosystems like Solana are gaining traction. Faster finality and lower costs make it easier for tokenized assets and structured products to scale without suffocating under gas fees.

Even communities surrounding assets like XRP continue pushing narratives around cross-border settlement and institutional liquidity integration.

Whether or not every ecosystem wins long-term, one thing is clear: DeFi is competing to become the settlement layer for global finance.

That’s not a small ambition.

Why RWAs Are Winning Right Now

Here’s the strategic reality:

-

Pure DeFi yields fluctuate wildly.

-

Traditional finance yields are steady but slow.

-

RWAs merge both worlds.

Tokenized Treasuries offering predictable returns inside decentralized systems? That’s catnip for serious capital.

Instead of relying solely on volatile collateral like ETH or governance tokens, protocols can now plug into real bonds and credit instruments. That reduces systemic fragility and increases long-term sustainability.

And sustainability is what separates a cycle from a structural shift.

The Bigger Picture: DeFi Growing Up

This moment feels different from previous hype waves.

-

It’s less about memes.

-

Less about 10,000% APY farms.

-

More about tokenized funds, structured credit, and compliance-friendly infrastructure.

DeFi isn’t abandoning decentralization — it’s layering maturity on top of it.

We’re witnessing the transformation from:

“Number go up” culture

to

“Capital efficiency and global settlement infrastructure.”

That’s a glow-up.

What This Means for Builders and Investors

If you’re building:

Focus on infrastructure, compliance bridges, custody solutions, and RWA integration tooling.

If you’re investing:

Watch protocols that connect traditional assets to decentralized liquidity markets.

If you’re trading:

Narratives shift before prices do. RWAs are no longer a niche subcategory — they’re becoming a dominant vertical.

Final Thoughts

DeFi isn’t fading. It’s evolving.

Real-World Assets moving on-chain represent the strongest signal yet that decentralized finance is entering its next phase — one defined by stability, institutional participation, and real economic backing.

Speculation built the arena.

RWAs are bringing in the banks.

And this time, they’re playing by DeFi’s rules.

REQUEST AN ARTICLE

Crypto World

Metaplanet’s Bitcoin Bet Leads to $1.35 Billion Paper Loss

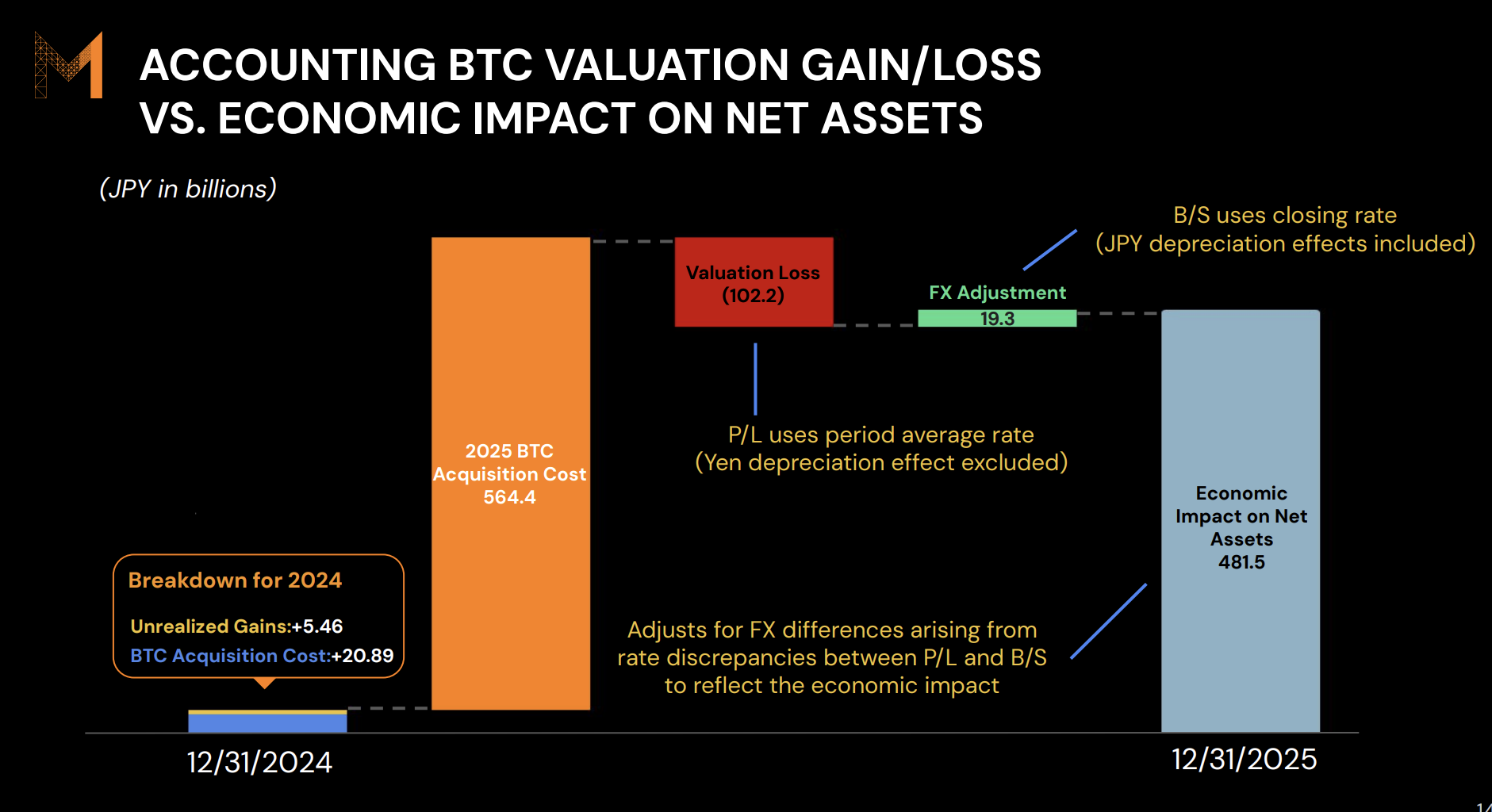

Tokyo-based Metaplanet released its fiscal year 2025 results, reporting a 738% year-over-year increase in revenue.

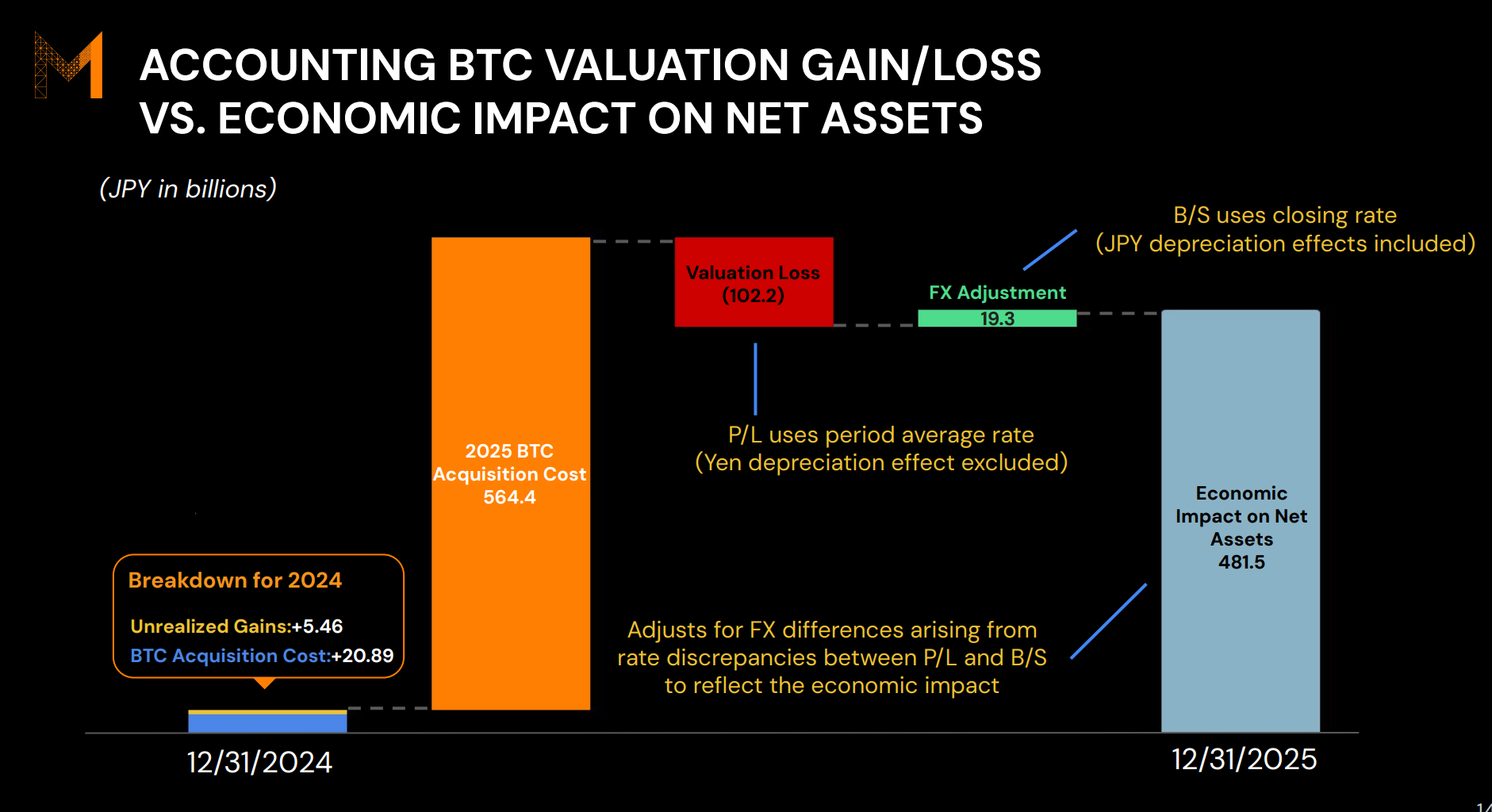

Despite the revenue surge, Bitcoin’s drawdown weighed heavily on the firm, as a non-cash valuation loss of 102.2 billion yen ($667.52 million) pushed the company into a net loss for the year.

Sponsored

Sponsored

Metaplanet’s FY2025 earnings report revealed revenue climbed to 8.9 billion yen ($58.12 million), up from 1.06 billion yen ($6.92 million) a year earlier. The company’s Bitcoin income business generated roughly 95% of total revenue.

“We launched the Bitcoin Income business in Q4 2024. Since then, this strategy has become our primary revenue source and is expected to remain a core driver of profit growth,” the report read.

Operating profit rose sharply to 6.28 billion yen ($41.01 million), marking a 1,694.5% increase year over year. Its shareholder base expanded significantly, growing from 47,200 at the end of 2024 to around 216,500 by the close of 2025.

Total assets also surged, rising from 30.3 billion yen ($197.89 million) to 505.3 billion yen ($3.30 billion) over the same period.

Despite the strong operational performance, the company posted a net loss of 95 billion yen ($620.17 million), after recording net income of 4.44 billion yen ($29.00 million) in 2024. The loss was primarily driven by valuation declines on its Bitcoin holdings.

Still, Metaplanet emphasized the strength of its balance sheet. The company said its liabilities and preferred stock would remain fully covered even in the event of an 86% drop in Bitcoin’s price, supported by an equity ratio of 90.7%.

Sponsored

Sponsored

The company also outlined its outlook for this year. Metaplanet expects revenue to reach 16 billion yen ($104.49 million) in FY2026, representing a 79.7% increase year over year. Operating profit is projected to rise to 11.4 billion yen ($74.45 million), up 81.3% from the previous year.

Japan’s Largest Corporate Bitcoin Holder Faces $1.35 Billion Unrealized Loss

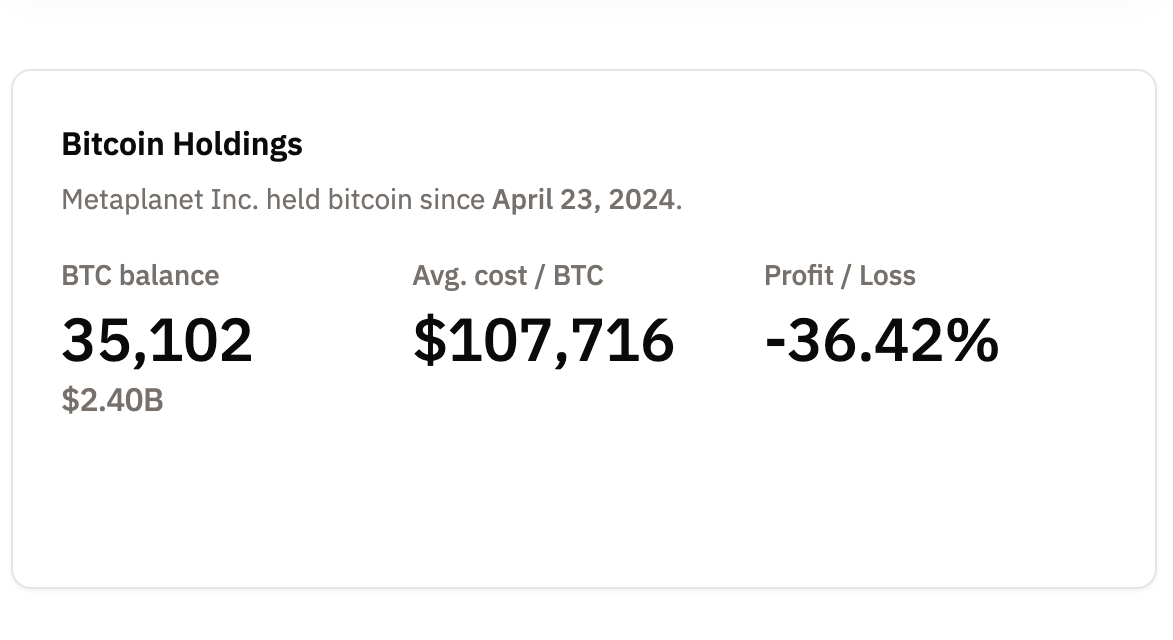

According to the latest data, Metaplanet holds 35,102 BTC, a major increase from just 1,762 BTC at the end of 2024. The accumulation strategy has positioned the company as the largest corporate Bitcoin holder in Japan and the fourth-largest publicly listed corporate holder globally.

However, the rapid expansion of its Bitcoin treasury now comes with significant pressure. Metaplanet’s average acquisition cost stands at $107,716 per BTC, while Bitcoin is currently trading at $68,821.

Across its entire 35,102 BTC position, this translates into approximately $1.35 billion in unrealized losses. While these losses remain on paper and could reverse if Bitcoin recovers, they highlight the inherent volatility risk tied to corporate treasury strategies heavily concentrated in digital assets.

Metaplanet is not alone in facing valuation pressure. Bitcoin’s broader market drawdown has also pushed MicroStrategy’s holdings below its average acquisition price, leaving the US-based firm with unrealized losses exceeding $5.33 billion as of the latest data.

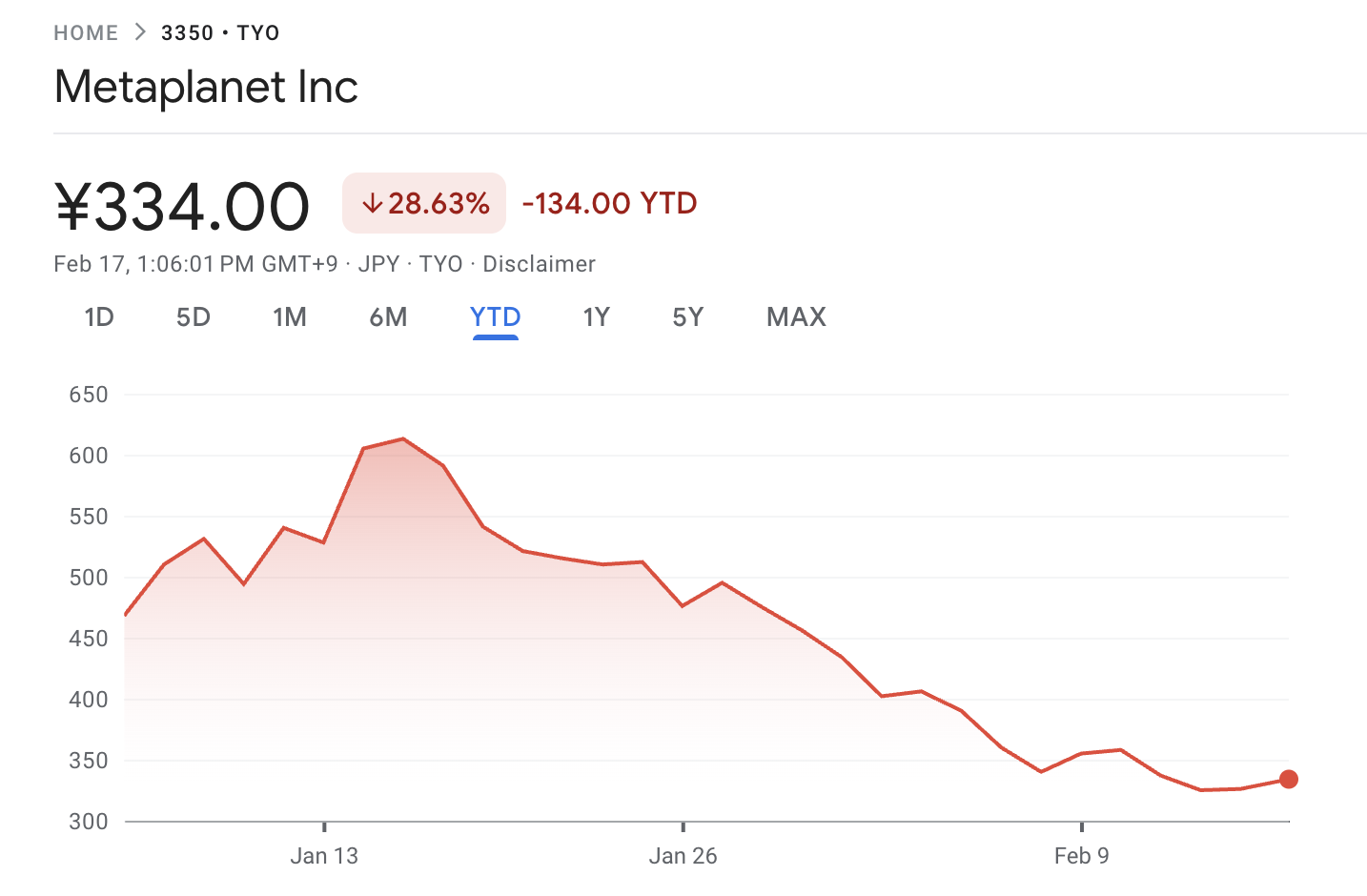

The impact extends beyond balance sheets. Metaplanet’s share price is down 28.63% year-to-date, reflecting how closely the company’s equity performance is now tied to Bitcoin’s price movements.

Crypto World

Zcash wallet Zashi rebrands to Zodl following team split

The mobile wallet Zashi has been rebranded to Zodl following a split from its former parent organization, as its development team moves forward under a new independent structure.

Summary

- Zashi wallet has rebranded to Zodl after its development team left Electric Coin Company to form an independent entity.

- The wallet’s functionality, security, and user data remain unchanged, with the update applied automatically.

- The team will continue focusing on privacy and long-term growth under independent management.

In a statement released on Feb. 16, the team said the upcoming app update will rename Zashi to Zodl without changing how the wallet works. Users will not need to download a new app, move funds, or update their recovery phrases.

The transition will take place automatically with the next software update. As per the announcement, the rebrand reflects “a new chapter” for the wallet, while keeping the same product, developers, and focus on privacy.

Transition to an independent structure

The change follows the departure of the full Zashi (ZEC) development team from Electric Coin Company in January 2026. The group, which helped build both the Zcash protocol and the Zashi wallet, resigned after internal disagreements over governance, funding, and autonomy.

After leaving, the team formed a new company called Zcash Open Development Lab, also known as ZODL. Under this entity, the wallet was renamed Zodl and placed fully under independent management.

The developers said the move was needed to support long-term growth without relying on the Zcash development fund. Since forming the new organization, the team has continued releasing updates and maintaining the wallet.

Zodl’s creators stressed that the rebrand does not affect security or compatibility. Wallet balances, transaction history, and seed phrases will continue to work as before, and the app will remain connected to the Zcash blockchain.

Over the coming days, the Zashi name will be replaced with Zodl across websites, support channels, and social platforms.

Transition to an independent structure

In its announcement, the team said its mission remains unchanged. Zodl will continue to focus on private transactions and expanding access to shielded ZEC.

“We envision a world without mass financial surveillance,” the statement said, adding that financial privacy is central to personal sovereignty. The developers said their goal is to make private digital payments accessible to a wider audience.

The rebrand comes as privacy-focused cryptocurrencies continue to gain attention. Due to a rise in the use of privacy features, shielded ZEC transactions now account for roughly 30% of the supply in circulation.

At the ecosystem level, the Zcash Foundation recently published its 2026 roadmap, outlining plans to improve wallet usability, developer tools, and network infrastructure. Many analysts view the Zodl transition as another example of the friction that can arise between non-profit governance bodies and independent development teams within the crypto space.

Similar splits have occurred in other technology and blockchain projects over funding and control. For now, Zodl’s team says users can continue using the wallet as usual, while future updates will focus on improving privacy tools and user experience.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video14 hours ago

Video14 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 hours ago

Tech2 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Crypto World7 days ago

Crypto World7 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show