Crypto World

Should Crypto Markets Worry About the SaaSpocalypse?

The term “SaaSpocalypse” is trending across financial markets, tech media, and investor circles. It refers to a sudden loss of confidence in software-as-a-service (SaaS) companies after the launch of advanced AI agents capable of automating tasks traditionally handled by enterprise software.

The term became popular after Anthropic released its Claude Cowork AI platform in late January. Following its launch, nearly $300 billion in global software market value was erased. Stocks of major SaaS firms—including Salesforce, Workday, Atlassian, and ServiceNow—fell sharply as investors questioned whether AI agents could replace large parts of their business.

Sponsored

Sponsored

AI Agents Trigger Market Panic

The core fear driving the SaaSpocalypse is simple: AI agents can now perform entire workflows autonomously.

Tools like Claude Cowork can review contracts, analyze sales data, generate reports, and execute multi-step tasks across multiple applications.

Instead of employees using five separate SaaS tools, a single AI agent can complete the same work.

This directly threatens the SaaS pricing model, which typically charges companies per user or “seat.” If AI reduces the need for human users, companies may need fewer licenses. Investors reacted quickly to this risk.

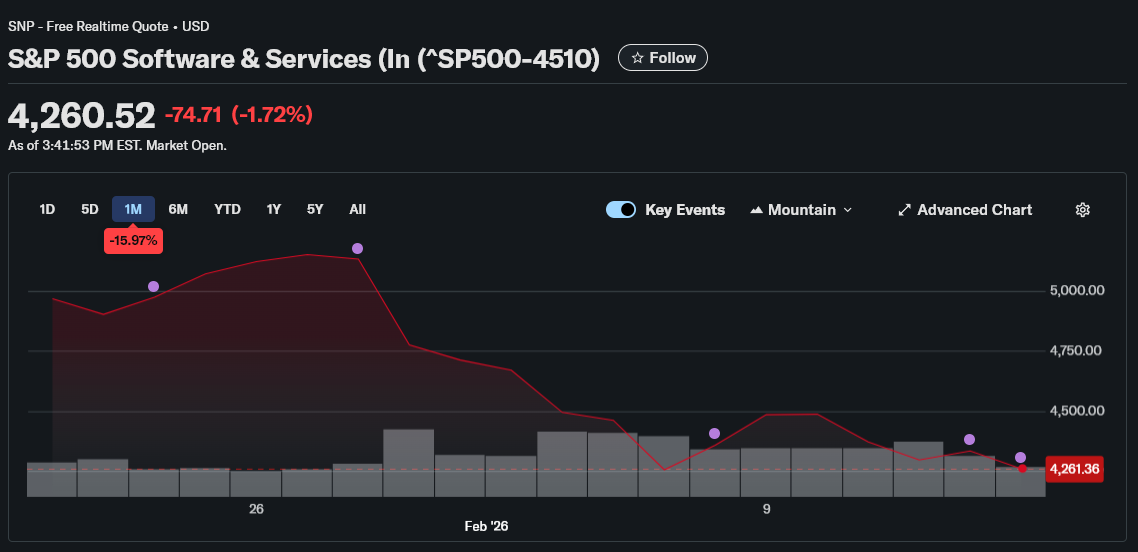

The S&P 500 Software and Services Index fell nearly 19% in early February, marking its worst losing streak in years.

Sponsored

Sponsored

At the same time, capital rotated toward AI infrastructure providers such as Nvidia, Microsoft, and Amazon, which supply the compute power behind AI agents.

Why the SaaSpocalypse Matters Beyond Software

The SaaSpocalypse reflects a deeper shift in how software creates value. Instead of selling tools that humans operate, companies are beginning to sell outcomes delivered by AI.

Analysts now describe this as a transition from software-as-a-service to “AI-as-a-service.” This shift challenges decades-old business models and forces software companies to rethink pricing, licensing, and product strategy.

Sponsored

Sponsored

However, this is not necessarily the end of SaaS. Many enterprises will still rely on established platforms for security, compliance, and data management.

Instead, the disruption will likely reshape the industry, forcing software companies to integrate AI deeply into their products.

How the SaaSpocalypse Could Impact Crypto Markets

The SaaSpocalypse is already affecting crypto markets indirectly. Both crypto and SaaS are considered high-growth, risk-sensitive sectors.

Sponsored

Sponsored

When investors sell software stocks, they often reduce exposure to crypto as well. In early February 2026, Bitcoin fell sharply as software stocks also posted heavy losses.

More importantly, capital is shifting toward AI. Venture capital invested over $200 billion into AI startups in 2025—far more than crypto received.

This means fewer resources may flow into new crypto projects, slowing innovation in some areas.

At the same time, crypto could benefit in specific niches such as decentralized computing and AI infrastructure.

But overall, the SaaSpocalypse signals a major capital rotation. AI is becoming the dominant investment theme, and crypto markets will need to compete for investor attention in this new environment.

Crypto World

Bitwise files for prediction market-backed ETFs

Bitwise Asset Management has filed with regulators to launch a new line of exchange-traded funds tied to political prediction markets, marking its latest push into alternative investment products.

Summary

- Bitwise has filed with regulators to launch a new line of ETFs focused on U.S. election outcomes.

- The proposed funds would give investors regulated access to political prediction contracts through traditional brokerage accounts.

- Approval is still pending, and regulators continue to review how these products fit within existing securities rules.

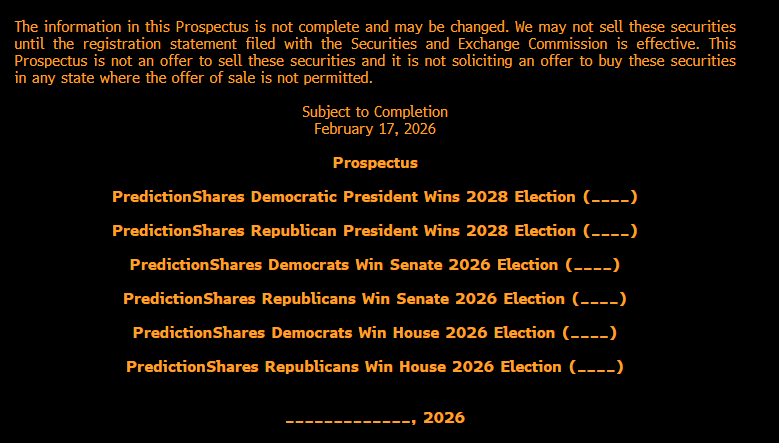

The filing was disclosed by Bloomberg ETF analyst James Seyffart, who shared details on social media. According to the preliminary prospectus dated Feb. 17, the proposed funds would operate under the “PredictionShares” brand and remain subject to regulatory approval.

The document states that the offering is incomplete and that the securities cannot be sold until the registration statement becomes effective.

Election-focused contracts at the core

The filings outline several proposed ETFs linked to U.S. political outcomes. These include separate funds tracking whether Democrats or Republicans win the 2028 presidential election, as well as products tied to control of the House and Senate in the 2026 mid-term elections.

Rather than investing in companies connected to prediction markets, the funds are designed to hold event-based contracts sourced from regulated trading venues. These contracts pay out based on specific real-world outcomes, such as election results.

Bitwise said PredictionShares will serve as a dedicated platform for clients seeking regulated exposure to prediction markets through traditional brokerage accounts. No launch date has been set, and approval from the U.S. Securities and Exchange Commission has not yet been granted.

Seyffart noted that similar filings have appeared in recent months and said more are likely to follow as interest in the sector grows.

Growing competition and market interest

Bitwise’s chief investment officer, Matt Hougan, said prediction markets are expanding in both size and relevance, making them difficult for asset managers to ignore. He added that client demand played a key role in the decision to pursue the products.

Other firms have also moved into the space. Roundhill Investments previously filed for similar election-based ETFs, while GraniteShares has submitted competing proposals. None has yet received regulatory clearance.

With platforms like Polymarket reporting heavy trading volume during significant political events, prediction markets have drawn increased attention in recent election cycles. Supporters say these markets often reflect public opinion more quickly than traditional polls.

Critics, like Vitalik Buterin, warn that they are extremely risky and can behave like speculative bets. Industry analysts caution that funds associated with particular outcomes could lose most of their value if forecasts prove to be wrong.

Additionally, regulators are examining how these products align with current derivatives and securities regulations.

Crypto World

Trading Platform eToro Q4 Earnings Sends Stock Surging

Trading platform eToro jumped more than 20% after reporting better-than-expected fourth-quarter earnings, with revenue coming mainly from its crypto services.

The company reported on Tuesday that its Q4 net income increased 16% from a year ago to $68.7 million, with earnings per share of 71 cents, compared with analyst expectations of 60 cents.

Fourth-quarter revenue came in at $3.87 billion, down 40% from the prior-year period, with crypto revenue accounting for the bulk of earnings at $3.59 billion.

The earnings beat bucked eToro’s main crypto rivals, Coinbase and Robinhood, whose Q4 earnings both missed expectations as their revenues took a hit amid a crypto market crash late last year.

Meanwhile, eToro’s full-year 2025 revenue rose more than 9% from 2024 to $13.84 billion, while its net income jumped 12% year-on-year to $215.7 million. Its full-year crypto revenue was $13 billion, up nearly 7% from 2024.

Shares climb on Q4 beat, CEO says it will catch crypto wave

Shares in eToro (ETOR) ended trading on Tuesday up 20.4% to $33.07 on the company’s earnings beat, making it one of the best-performing crypto stocks for the day. The stock fell slightly after-hours to $33.

EToro CEO Yoni Assia said it is “a pivotal moment for financial services” as artificial intelligence and the increasing use of blockchain infrastructure are “reshaping how people invest and interact with markets.”

“EToro is uniquely positioned to capture this opportunity,” he said. “We are positioning eToro for a financial system that is increasingly moving on-chain. With our long-standing leadership in crypto and tokenization, we are well placed to help shape this transition.”

Related: Gemini post-IPO shakeup sees exit of three top executives

Assia told investors on an earnings call that eToro was seeing some of its crypto-focused customers “suddenly trading commodities” for the first time.

“There’s somewhat of a convergence or a shift from crypto, which now has lower volatility, to now basically gold, silver, and other commodities that have higher volatility,” he said.

Meanwhile, the company said its crypto trading volume in January was down 50% from last year, with 4 million crypto trades over the month, and that the average investment per trade also dropped 34% to $182.

However, the total number of trades last month was up 55% year over year to 74 million, while the average investment per trade rose 8% to $252.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling — Joseph Chalom

Crypto World

Pumpfun Rolls Out ‘Cashback Coins’

The Solana memecoin launchpad’s new ‘Cashback Coins’ offer creators a choice between trader cashback and creator fees.

Solana-based token launchpad pumpfun has introduced a new feature called “Cashback Coins.”

Cashback Coins provide a choice for creators: they can decide to direct all creator fees towards traders or opt for traditional creator fees, but this choice must be made before launch and cannot be altered later. The introduction of these coins is part of pumpfun’s strategy to address ongoing concerns in the crypto space about the distribution of rewards and incentives.

“Creator Fees are undeniably a net positive for helping teams, creators & founders grow & succeed. However, many tokens achieve success without a team or project lead, thereby disproportionately rewarding token deployers who don’t deserve the fees,” the team wrote on X.

“Now, traders can choose to engage with tokens they feel the most aligned with, ultimately letting the market decide who gets rewarded and where the bar is set.”

The platform’s native PUMP token is up 11% over the past week.

This article was generated with the assistance of AI workflows.

Crypto World

Zora Launches Attention Markets on Solana

The activation enables users to trade “attention markets” that reflect real-life trends.

Zora launched a new token market on Solana today, dubbed “attention markets,” where users can tokenize and speculate on real-world trends.

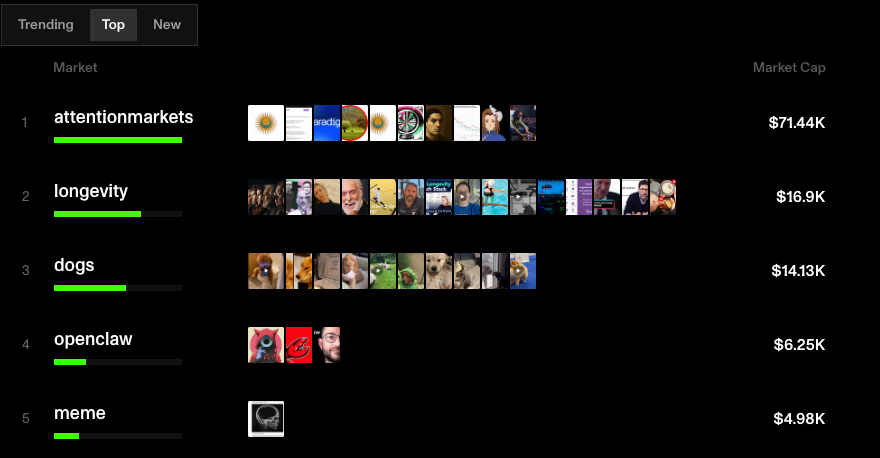

The platform is off to a slow start, with its flagship token, $attentionmarkets, trading at only a $70,000 market capitalization with just $170,000 in total trading volume 30 minutes after its launch. Meanwhile, only three of its tokens have market capitalizations above $10,000, indicating little immediate demand for the product.

Zora is likely aiming to be first to market with the launch, after it was reported just last week that Polymarket is partnering with Kaito to launch its own variation of attention markets.

The launch also comes less than two months after the crypto community tried to rally behind the idea of Zora’s tokenized content coins after viral political journalist Nick Shirley launched his own creator coin that quickly burned out.

After a brief 24-hour surge that saw the $thenickshirley token reach as high as a $16 million valuation, the token now changes hands at just a $470,000 market capitalization, leaving Zora bulls defeated yet again.

Jesse Pollak, the creator of Ethereum Layer 2 Base, which is closely integrated with Zora, took to X to share the launch, where he said, “Excited to see zora continue to experiment to grow the onchain pie. zora creator tools remain fully operational on zora.co and in the zora app, all running on base.”

Crypto World

Quantum Summit ETHDenver: Post-Quantum Cryptography for Web3

Tectonic announced the inaugural Quantum Summit, an ETHDenver 2026 event focused on practical preparation for post-quantum cryptography. The event will take place Feb. 19, 2026, at RISE Comedy in Denver.

Quantum computing is advancing, putting the cryptography used across much of the internet and many blockchain ecosystems under long-term pressure as the industry moves toward post-quantum cryptography. The transition is not a simple algorithm swap. It is a multidimensional migration effort that touches standards, protocol design, wallet security, identity systems, privacy tooling, operational readiness, and interoperability across ecosystems.

Quantum Summit is designed for developers, cryptographers, and institutional stakeholders seeking practical, implementation-focused discussions on post-quantum cryptography readiness. Programming focuses on post-quantum readiness, cryptographic migration planning, advanced privacy stacks, and decentralized identity in a quantum age. The event is structured to prioritize actionable takeaways and coordination across the systems and teams that must upgrade together.

“Post-quantum security is no longer theoretical. It is a planning problem,” said Michael Berman, Co-Founder and Co-CEO of Tectonic. He added:

“Quantum Summit is how we move from abstract risk to concrete readiness. We want builders and institutions aligned on what to do now, what decisions matter, and what migration paths are realistic.”

Ron Kahat, Co-Founder and Co-CEO of Tectonic, added: “Post-quantum migration is a multi-dimensional effort; it’s not just replacing algorithms, it’s an operational, strategic, and architectural overhaul. Unity across the industry is our strength; we must engineer the next line of defense that tomorrow demands before quantum threats materialize.”

Jay Jog, Co-founder of SEI and a confirmed speaker at the Quantum Summit, emphasized the operational challenge ahead:

“The hardest part of moving to PQC isn’t pure cryptography, it’s coordination. It’s making sure that libraries, signing flows, validator operations, and more all upgrade without breaking. As an industry, we need to start taking PQC much more seriously if we want to be prepared.”

“Security conversations stall when they stay theoretical,” stated Jake Salerno, VP of GTM at Zero Gravity Labs.

“The Quantum Summit is about aligning builders and stakeholders on the practical steps to PQC readiness, including how privacy and verifiable computation can be layered into real systems, and where we need redesign and standards to make it deployable.”

Other confirmed speakers include leaders from Tectonic, Espresso, Sei, RadPill, Hashlock, Algorand, Edge Capital, Zero Gravity Labs, Space and Time, OpenMatter, Amazon, Optimum, Canton, Hack VC, and Magenta Labs.

The Quantum Summit is supported by Hack VC, 0g, Halborn, Kite, Polymarket, Sushi, Hexaco, and W3JOE, alongside Tectonic Labs as host. For this edition, BeInCrypto is the main media partner.

Registration and updates are available at quantumsummit.net.

About Tectonic

Tectonic Labs is developing defense-grade blockchain infrastructure leveraging post-quantum security standards. Tectonic is building a post-quantum wallet and post-quantum audits designed to help teams assess quantum vulnerabilities and align with emerging NIST post-quantum cryptography standards. Tectonic is led by cryptography engineers and researchers with backgrounds across IBM, Google, MIT, Dartmouth, Coinbase, the Ethereum Foundation, Polygon, and Fireblocks.

Crypto World

Coin Center Urges Senate to Save Crypto Developer Protection Bill

A prominent US crypto-policy group is urging lawmakers to press ahead with a bill designed to protect developers from criminal exposure as the industry seeks a clearer regulatory path. Coin Center sent a letter to the Senate Banking Committee in support of the Blockchain Regulatory Certainty Act (BRCA). The measure, first introduced in September 2018 by Rep. Tom Emmer, would be refined in a new draft authored by Senators Cynthia Lummis and Ron Wyden to clarify that software developers and infrastructure providers who do not handle user funds are not money transmitters under federal law. The advocacy comes as several developers faced legal action last year, underscoring the tension between innovation and enforcement. The letter, circulated publicly last week, argues that a robust, predictable framework is essential for the next wave of crypto engineering to thrive in the United States.

Key takeaways

- The BRCA aims to shield non-custodial software developers and infrastructure providers from money-transmitter penalties, reducing chilling effects on innovation.

- The latest BRCA draft, authored by Senators Lummis and Wyden, seeks alignment with existing internet-era protections by treating non-custodial actors as outside the money transmitter regime.

- Coin Center argues that prosecutorial risk without clarity deters builders and pushes talent offshore, threatening domestic development of blockchain technologies.

- The Senate Banking Committee is reviewing the BRCA draft but has not yet marked it up or advanced it to a vote, keeping the proposal in a transitional stage.

- High-profile convictions of crypto developers last year—spanning Tornado Cash and Samourai Wallet-related cases—underscore the urgency of predictable, legislative safeguards.

Sentiment: Neutral

Price impact: Neutral. The policy discussion does not present an immediate price move, though clearer rules could influence risk sentiment and capital flows over time.

Market context: The BRCA debate sits within a broader regulatory framework taking shape in Washington, where lawmakers balance innovation incentives with consumer protection, enforcement precedence, and the evolving stance on decentralized technologies amid ongoing CLARITY Act discussions.

Why it matters

For the crypto ecosystem, the central question is whether the United States can provide a stable, predictable environment that encourages experimentation without inviting endless prosecutions against developers. The Coin Center letter frames BRCA as a legal shield for the “invisible engine” of blockchain innovation—the developers who build protocols, tooling, wallets, and infrastructure without directly controlling users’ funds. If enacted with clear limitations, BRCA could prevent well-intentioned creators from facing criminal exposure merely for building software that operates on open networks.

From a policy perspective, the tension is palpable. Proponents argue that clear exemptions are necessary to prevent a chilling effect on innovation and to maintain the United States as a hub for software development and crypto entrepreneurship. Opponents, and some lawmakers, worry that broad protections might erode consumer protections and create loopholes for illicit activity. The CLARITY Act framework referenced in the discourse adds another layer to the conversation, signaling that congressional interest in crypto regulation remains active and multi-faceted.

The heightened attention to BRCA also comes against the backdrop of a handful of courtroom outcomes tied to crypto activity. The conviction of Tornado Cash developer Roman Storm, along with Samourai Wallet founders Keonne Rodriguez and Will Lonergan Hill, illustrates how prosecutors are approaching unhosted or non-custodial ecosystems. Those cases—concerning conspiracy to operate an unlicensed money-transmitting business—have prompted industry voices to call for clearer, legislature-backed guardrails rather than relying solely on prosecutorial discretion. The outcomes to date, including prison sentences for Rodriguez (five years) and Lonergan Hill (four years), with Storm awaiting sentencing, have become reference points for lawmakers debating BRCA and related initiatives.

In practical terms, BRCA seeks to harmonize crypto development with mainstream internet policy norms, where service providers, cloud hosts, and developer ecosystems enjoy certain shielding protections as long as they do not exert direct control over user funds. As policymakers assess the BRCA draft, the central question remains: can non-custodial innovation be safeguarded without compromising accountability and legitimate enforcement? The discussions reflect a broader global trend toward regulatory clarity, with other jurisdictions pursuing similar guardrails for open networks and decentralized tooling, and the U.S. now weighing where to draw the line between risk and opportunity for builders.

Looking ahead, the dynamic between enforcement actions and legislative safeguards will likely continue shaping the posture of developers, exchanges, wallet providers, and infrastructure projects. The BRCA debate is not occurring in a vacuum; it sits at the intersection of evolving governance, enforcement clarity, and the practical needs of teams building on top of open networks that increasingly underpin real-world financial ecosystems.

As the narrative evolves, the crypto industry will monitor whether the BRCA language will be refined to balance innovation with risk controls, and whether the Senate will move from committee review toward a formal vote that could set a precedent for how future blockchain-led technologies are treated under federal law. In the meantime, the industry remains watchful of parallel legislative efforts, including ongoing discussions around the CLARITY Act framework and related regulatory initiatives, which could influence how developers and service providers plan and deploy new products in the months ahead.

What to watch next

- Keep an eye on whether the Senate Banking Committee marks up and votes on the BRCA draft in the near term.

- Monitor any amendments that define the scope of “non-custodial” roles and whether certain infrastructure providers receive wider exemptions.

- Watch for any official statements from lawmakers about the CLARITY Act framework and potential alignment with BRCA protections.

- Track outcomes of related enforcement actions and how they influence legislative tempo or sentiment among policymakers.

Sources & verification

- Coin Center’s letter to the Senate Banking Committee outlining the case for BRCA protections. View the letter

- The BRCA’s revised framework discussed by Senators Cynthia Lummis and Ron Wyden (new version of the bill).

- Convictions in 2025 related to Tornado Cash and Samourai Wallet founders, including sentencing details.

- Context on the CLARITY Act and ongoing crypto-law discussions in the United States.

Regulatory push for blockchain developer protections advances amid prosecutions

The Blockchain Regulatory Certainty Act (BRCA) is at the center of a renewed dialogue about how to safeguard the people who write the software and build the networks that power crypto ecosystems. The latest iteration, crafted by Senators Cynthia Lummis and Ron Wyden, seeks to codify a clear exemption for developers and infrastructure providers who do not control user funds, positioning them outside the federal money-transmitter framework. The argument is that such protections would not only align with the way other internet-era actors operate but also ensure that the United States remains a leading hub for blockchain innovation and engineering.

Coin Center’s policy director, Jason Somensatto, emphasized in the letter that the same logic used to shield everyday internet service providers—routers, browsers, hosting services—should apply to blockchain developers. He argued that granting these protections would foster a healthy environment for experimentation, enabling future builders to pursue ambitious projects without the constant shadow of criminal liability. The letter’s tone reflects a broader desire to avoid the “chilling effect” that a lack of regulatory clarity can produce, especially for small teams and startups that frequently operate with limited legal certainty.

The discussions occur as a pair of converging realities shape the regulatory landscape. On one hand, professional risk management and consumer protection remain priorities for lawmakers. On the other, a number of developers have already faced serious penalties in high-profile cases, underscoring the need for a stable policy framework that distinguishes core technology development from illicit misuse. The BRCA proposal, and the CLARITY Act framework that informs many conversations around this topic, aim to create a predictable baseline that reduces ambiguity for builders while preserving guardrails for behavior that breaches the law.

In markets terms, this is not a direct price catalyst but a policy stance with potential longer-term implications for liquidity and risk sentiment. If BRCA provides a credible shield for legitimate development, it could alleviate some regulatory risk concerns that have weighed on ambitious blockchain projects seeking to deploy on U.S. soil. Conversely, if lawmakers pare back protections or push for tighter controls, the calculus for new projects may shift toward offshore jurisdictions or alternative engineering partnerships, influencing where teams choose to locate their operations and how they allocate capital and talent.

As the Senate continues to vet the BRCA draft, industry observers will be watching for two key signals: (1) whether non-custodial definitions are sharpened to prevent circumvention, and (2) whether the bill coexists with, or diverges from, existing enforcement precedents. The outcomes will likely inform not only domestic innovation pipelines but also how international developers view the United States as a base of operations. With major debates ongoing and high-stakes enforcement cases fresh in the public narrative, the push for regulatory clarity remains a defining feature of the current crypto policy environment.

https://platform.twitter.com/widgets.js

Crypto World

Zora launches Solana-based “attention markets” platform

Zora has launched a new product called “attention markets” on the Solana blockchain, expanding its platform beyond its earlier focus on NFTs and Ethereum-based infrastructure.

Summary

- Zora launched attention markets on Solana, allowing users to trade tokens based on online trends.

- Users can create new markets for 1 SOL, trade positions in real time, and speculate on whether topics gain or lose social media attention.

- Early trading was modest, and analysts say the model is experimental and high risk.

The rollout took place on Feb. 17, publicly announced by both Zora and Solana. The new feature allows users to trade on trends, memes, and online topics by buying and selling tokens linked to how much attention those subjects receive across social media.

The launch marks Zora’s (ZORA) first major move onto Solana, a network known for fast transaction speeds and low fees.

Trading on trends and online culture

Attention markets let users create and trade markets tied to cultural moments, hashtags, and internet topics. Instead of betting on political or economic events, traders take positions on whether a subject will gain or lose online traction.

Anyone can create a new “trend” market by paying a 1 SOL fee, which the platform says is meant to reduce spam. Once launched, other users can buy or sell positions and track profits and losses in real time. Positions can be closed at any point.

Zora said the system was built natively on Solana (SOL) to support rapid trading and frequent price updates. The company does not currently offer direct rewards for users who create new markets, although some trading pairs may include incentives.

Early activity shows that topics such as “attentionmarkets,” “bitcoin,” “cats,” “dogs,” and “aigirlfriend” were among the first to attract traders. While some tokens posted sharp percentage gains, most saw limited volume in the first day.

Shortly after launch, the main attentionmarkets token reached a market value of about $70,000, with roughly $200,000 in trading volume. Few markets crossed the $10,000 mark during the initial period.

Market response and growing competition

The launch received mixed reactions across social platforms. Some users welcomed the move to Solana as a practical choice for high-frequency trading. Others viewed it as a shift away from Zora’s earlier Base and Ethereum roots.

Zora’s native token rose more than 5% following the announcement, trading near $0.022, according to market data.

The company is entering a growing field. Polymarket has recently worked with analytics firms on similar products focused on online sentiment. Meanwhile, Noise, a competing project on Base, raised $7.1 million from Paradigm to develop related tools.

Zora has also posted openings for an “Attention Economist,” a role focused on studying trends on platforms such as TikTok, Instagram, YouTube Shorts, and X. The position suggests a long-term effort to refine how attention is measured and priced.

Analysts say attention markets remain experimental and carry high risk, especially when liquidity is low. Still, supporters argue they offer a new way to measure public interest and turn cultural momentum into tradable data.

Crypto World

Ki Young Ju Says Bitcoin May Need to Hit $55K Before True Recovery Begins

Selling pressure overwhelms new capital inflows; institutional unwinding and the absence of buying interest define the current cycle.

CryptoQuant CEO Ki Young Ju has declared the current bitcoin market a definitive bear cycle, warning that a genuine recovery could take months and may require prices to fall further before a sustainable rebound materializes.

Sponsored

Sponsored

Capital Inflows Failing to Move the Needle

In an interview with a South Korean crypto outlet, Ju laid out a data-driven case for extended weakness. He pointed to a fundamental imbalance between capital inflows and selling pressure.

“Hundreds of billions of dollars have entered the market, yet the overall market capitalization has either stagnated or declined,” Ju said. “That means selling pressure is overwhelming new capital.”

He noted that past deep corrections have typically required at least three months of consolidation before investment sentiment recovered. Ju emphasized that any short-term bounces should not be mistaken for the start of a new bull cycle.

Two Paths to Recovery

Ju outlined two scenarios for Bitcoin’s eventual recovery. The first involves prices dropping toward the realized price of approximately $55,000. The price is the average cost basis of all bitcoin holders, calculated from on-chain transaction data, before rebounding. Historically, bitcoin has needed to revisit this level to generate fresh upward momentum.

The second scenario envisions a prolonged sideways consolidation in the $60,000 to $70,000 range. The prices would grind through months of range-bound trading before the next leg up.

Sponsored

Sponsored

In either case, Ki stressed that the preconditions for a sustained rally are not currently in place. ETF inflows have stalled, over-the-counter demand has dried up, and both realized and standard market capitalizations are either flat or declining.

Institutional Exodus Behind the Decline

Ju attributed much of the recent selling to institutional players unwinding positions. As bitcoin’s volatility contracted over the past year, institutions that had entered the market to capture volatility through beta-delta-neutral strategies found better opportunities in assets such as the Nasdaq and gold.

“When bitcoin stopped moving, there was no reason for institutions to keep those positions,” Ju explained. Data from the CME show that institutions have significantly reduced their short positions—not a bullish signal, but evidence of capital withdrawal.

Ju also flagged aggressive selling patterns where large volumes of bitcoin were dumped at market price within very short timeframes. He believes this suggests either forced liquidations or deliberate institutional selling to manipulate derivative positions.

Altcoin Outlook Even Bleaker

The picture for altcoins is grimmer still. Ju noted that while altcoin trading volume appeared robust throughout 2024, actual fresh capital inflows were limited to a handful of tokens with ETF listing prospects. The broader altcoin market cap never significantly surpassed its previous all-time high, indicating that funds were merely rotating among existing participants rather than expanding the market.

“The era of a single narrative lifting the entire altcoin market is over,” Ki said. He acknowledged that structural innovations such as AI agent economies could eventually create new value-driven models for altcoins, but dismissed the likelihood of simple narrative-driven rallies returning.

“Short-term altcoin upside is limited. The damage to investor sentiment from this downturn will take considerable time to heal,” he concluded.

Crypto World

XRP Ledger Introduces Permissioned DEX, Boosting Institutional Access

TLDR

- The Permissioned DEX amendment on the XRP Ledger will activate in 24 hours.

- This upgrade introduces controlled environments for trading within the decentralized exchange.

- The amendment allows regulated financial institutions to participate while adhering to compliance requirements.

- XRP’s demand remains strong, with nearly $4.5 million flowing into XRP-focused products in the last 24 hours.

- The Permissioned DEX amendment builds on the previous XLS-80, enhancing the platform’s functionality for permissioned domains.

The Permissioned DEX amendment is set to go live on the XRP Ledger within 24 hours, marking a key milestone for the platform. This upgrade will introduce controlled environments for trading within the XRP Ledger’s decentralized exchange (DEX). The development is expected to facilitate broader participation, especially from regulated financial institutions.

XRP Ledger’s Permissioned DEX Amendment Activation

The Permissioned DEX amendment, also known as XLS 81, is set to activate on the XRP Ledger tomorrow. This amendment will create controlled trading environments, allowing only authorized users to place and accept offers. By integrating permissioning directly into the DEX protocol, it is designed to offer a secure space for regulated entities to trade.

According to XRPScan, the countdown to activation stands at just 23 hours. This feature builds upon the previous XLS-80, which focuses on Permissioned Domains. As part of this upgrade, users within these domains will have the ability to trade freely but only within a pre-approved group.

XRP’s Continued Demand Despite Market Shifts

XRP remains in strong demand, even as the broader cryptocurrency market experiences fluctuations. Rayhaneh Sharif Askary, the head of product and research at Grayscale, spoke about the consistent interest in XRP at a recent community event. “Advisors are constantly asked by their clients about XRP,” said Sharif Askary, underlining its continued relevance.

In fact, XRP has become one of the most talked-about assets, trailing only behind Bitcoin in some circles. This increasing interest is reflected in the recent data compiled by SoSoValue, showing XRP funds receiving nearly $4.5 million in the last 24 hours. Despite a market drop, the demand for XRP shows no signs of slowing down.

At the time of writing, XRP had fallen by 1.78% in the last 24 hours to $1.45. However, it had gained 3.59% over the past week. This indicates that, while it may face short-term volatility, XRP continues to attract attention from investors.

The introduction of the Permissioned DEX amendment is seen as a crucial step in XRP’s journey toward broader institutional adoption. By offering a controlled environment for trading, the XRP Ledger aims to cater to the needs of regulated financial institutions.

The integration of permissioning features within the DEX protocol allows these institutions to participate without violating compliance requirements. In the long term, this move could play a pivotal role in attracting more institutional investors to the XRP ecosystem.

Crypto World

Bitwise And GraniteShares File Election Prediction ETFs

Exchange-traded fund issuers Bitwise and GraniteShares have filed with the US Securities and Exchange Commission to launch funds tied to event contracts on the outcome of US elections.

Bitwise filed a prospectus on Tuesday for a new lineup of ETFs branded as PredictionShares, with six prediction market-style ETFs on NYSE Arca.

The first two funds will pay out if either a Democrat or a Republican wins the U.S. presidential election in November 2028. The next two will pay out if either Democrats or Republicans win the Senate in November 2026, and the final two if either party wins the House.

“The fund’s investment objective is to provide capital appreciation to investors in the event that a member of the Democratic Party is the winner of the US Presidential election taking place on November 7, 2028,” read the prospectus.

Each fund invests at least 80% of its net assets in binary event contracts, or political prediction market derivatives traded on CFTC-regulated exchanges. These contracts settle at $1 if the referenced outcome occurs and $0 if it doesn’t.

“In the event that a member of the Democratic Party is not the winner of the 2028 Presidential election, the fund will lose substantially all of its value,” it explained.

Betting on a prediction market wrapped in an ETF

In essence, Bitwise is offering separate ETFs for each race — one for each party — and investors can choose which one to buy into.

The price of each fund’s shares on any given day reflects the market’s implied probability of that outcome, fluctuating between $0 and $1 based on polling, news, and sentiment.

Related: Prediction markets are the new open-source spycraft

ETF issuer GraniteShares also filed a prospectus on Tuesday offering six similar funds with the same structures based on US election outcomes.

“The financialization and ETF-ization of everything continues,” commented Bloomberg ETF analyst James Seyffart.

Not the first prediction market-style ETF filings

“This is not the first filing of this kind, and I think it’s extremely unlikely that these will be the last,” added Seyffart, in reference to the Roundhill filing for similar funds on Feb. 14.

The Roundhill prospectus also offers six prediction market-style ETFs based on the outcomes of the presidential, Senate, and House elections.

Magazine: Chinese New Year boosts interest, TradFi buying crypto exchanges: Asia Express

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business5 hours ago

Business5 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video20 hours ago

Video20 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World19 hours ago

Crypto World19 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery