Crypto World

Strategy buys 2,486 BTC as a rare pattern points to a Bitcoin price crash

Michael Saylor’s Strategy continued its Bitcoin buying spree last week, even as crypto winter persisted, and the coin formed a rare chart pattern pointing to more near-term downside.

Summary

- Strategy, formerly known as MicroStrategy, acquired 2,486 Bitcoin last week.

- The company now holds over 717,000 coins worth nearly $50 billion.

- Technical analysis suggests that the Bitcoin price is forming a bearish pennant pattern, pointing to a crash.

In an X post, Saylor noted that the company bought 2,496 Bitcoin (BTC) last week for $168 million. This purchase brought its total holdings to 717,131 coins, now valued at nearly $50 billion.

Strategy executed the purchase by selling shares, a move that has continued to dilute its shareholders. Data show that the company still has over $7.8 billion in common shares to sell and an additional $20 billion in preferred STRK.

The company now has over 312 million of outstanding shares, much higher than what it had a few years ago. This dilution will continue, as Michael Saylor has pledged to buy Bitcoin forever. He also revealed that he plans to swap its debt for shares in the future.

Bitcoin price technical analysis points to a crash

The ongoing Strategy acquisition is happening amid concerns that Bitcoin may continue falling in the near term. In a statement last week, Standard Chartered warned that Bitcoin may drop to $50,000 before recovering. The bank reduced its target for the coin from $150,000 to $100,000.

Bitcoin is facing other headwinds, including the tumbling futures open interest, which has moved to $43 billion, down from last year’s high of $95 billion.

At the same time, there are rising odds of a prolonged conflict in the Middle East despite the ongoing talks between Iran and the United States. Donald Trump has sent another carrier to the region, while Iran is conducting drills at the Strait of Hormuz.

A conflict in the Middle East would have a major impact on Bitcoin, which has proven that it is not a safe haven asset.

Technical analysis indicates that the Bitcoin price is slowly forming a bearish pennant pattern, consisting of a vertical line and a symmetrical triangle. The two lines of the triangle are nearing their confluence, meaning that the coin may soon drop to the year-to-date low of $60,000.

The bearish Bitcoin price outlook will become invalid if it moves above the key resistance level at $80,117, its lowest level in November last year.

Crypto World

Shiba Inu coin dies slowly as new rival Based Eggman reclaims memecoin momentum, GGs vs SHIB

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Based Eggman (GGs) challenges SHIB as investors shift toward utility-driven memecoins built on real ecosystem value.

Summary

- Shiba Inu’s momentum has slowed since 2021, while emerging utility memecoins like Based Eggman draw renewed investor attention.

- Analysts compare SHIB’s stalled growth with Based Eggman’s Base-linked utility, low fees, and governance-driven ecosystem model.

- Growing interest in scalable, utility-focused memecoins signals a shift from hype toward functional blockchain ecosystems in 2026.

The power structure of the memecoin world has changed a lot. Shiba Inu coin (SHIB), which used to be very popular as a “Dogecoin Killer,” is losing steam, which was a significant thing during the 2021 bull run. The prices have been hard to get back to where they were before, and the community’s joy has diminished because construction is going so slowly and in parts.

In this open arena, a new rival has arrived, not just to compete, but also to set a new standard for what a successful memecoin should be. Based Eggman (GGs) is swiftly capturing the attention — and money — of SHIB investors who are unhappy with their investments. This puts it in a good position to get back the explosive growth that used to define its opponent. This analysis looks at Based Eggman GGs and SHIB to figure out why one project is stuck, and the other is meant to explode out.

The stagnation of Shiba Inu coin: A record of broken promises

Shiba Inu made history with a huge surge, but its current route reveals how hard it is to keep a legacy memecoin running.

- The “Ghost Chain” Problem of Shibarium: Shibarium, SHIB’s Layer-2 solution, was expected to revolutionise the game by lowering fees and making new uses possible. But not many people have used it yet. The ecosystem hasn’t been able to get many significant, independent projects to join, which means that a lot of the use cases it promised haven’t happened. A lot of people are thinking of a “ghost chain,” which is infrastructure that doesn’t have a vibrant economy.

- Not being able to focus and being tired of the community: There are a lot of tokens (SHIB, BONE, LEASH, TREAT) and projects (ShibaSwap, Shiboshis) in the SHIB ecosystem. This dilution sometimes confuses new investors and makes it hard for the community to stay on track. Diversification can be wonderful, but it can also make people not care if there isn’t a clear, focused momentum. The SHIB price’s persistent attempts to break through crucial resistance levels reveal that it is exhausted.

- The Market Cap Anchor: SHIB’s high market cap is now its worst enemy, just like Dogecoin’s was before it. For new investors to obtain the same 100x or even 10x returns, they need to bring in a lot more money than a smaller, newer business does. The rule of decreasing returns is now firmly in force.

Because of this, a group of SHIB holders is trapped with their bags and is actively looking for the next project that can bring back the community-driven fun they had at the beginning. They are looking for Based Eggman.

The blueprint SHIB wanted Based Eggman to have a presale

Based Eggman (GGs) is not trying to kill SHIB. It is pursuing a better, more up-to-date plan that fixes the issues that have been holding SHIB back. It depicts what a memecoin for the next generation should be: useful first, lean, and focused.

1. The unbeatable launch strategy: The CEX listing catalyst

SHIB is slowly developing on DEXs and its own chain, but Based Eggman has made it easier for people to get into the market. The Based Eggman CEX Listing, which is coming up in the second quarter of 2026, is a scheduled event to add liquidity. This is the nicest thing that could happen to consumers who buy before the sale. Anyone can get in on the ground floor price of GGs tokens (CA: 0x7f23e5fc401bdfcdc9ad3970ff52f65de73ba8ed) now, before they go on sale on a big exchange. In the past, this has caused prices to go up a lot.

2. Lean, focused utility on superior infrastructure

Based Eggman doesn’t fall into the trap of dilution. The first thing it does is set a clear, singular goal: to be the gas and governance token for its ecosystem, which is based on Coinbase’s Layer-2, Base. This gives you perks right now that SHIB doesn’t have:

Low expenses and immediate scaling: Base offers institutional-level scalability and nearly no transaction costs right away. This is not like the slow and costly problems that early SHIB and even current Shibarium customers had to deal with.

The Based Eggman’s GGs dashboard is a great approach to get people involved because it interacts with the Shibarium blockchain. This makes it easier for SHIB holders to maintain track of their Shibarium assets in the Based Eggman ecosystem. It also makes it easier for new users to join and welcomes SHIB veterans.

Limited Supply: There are only 389 million GGs tokens available, therefore it’s a wonderful choice for people who desire something that’s hard to get. This is extremely different from SHIB’s approach, which has a quadrillion-supply and needs big burns all the time to keep prices up.

3. Bringing back the community spirit

Based Eggman’s Presale is bringing back the fierce, dedicated ethos that made early SHIB so great. The processes are clear: a presale, staking activation, a listing on a CEX, and expansion of the ecosystem. There is no confusion, and the tokenomics are not broken. This clarity is attracting SHIB holders who miss the days when everyone had the same goal, and it was easy to see how to attain it.

The memecoin decision: GGs vs. SHIB

It’s easy to tell the difference:

Shiba Inu (SHIB) is a well-known but old project that is having problems because it is too big, its ecology isn’t growing quickly enough, and there are too many things to do. It will grow slowly and be connected to the bigger market.

Based Eggman (GGs): A presale projectile with a timed ignition sequence (CEX listing), built on superior tech (Base), featuring smart integrations (Shibarium dashboard), and optimised for viral, focused growth.

The energy has shifted. SHIB isn’t “dead,” but the days of easy, large multiples are over. Capital and community energy are gravitating towards projects that show a clear, modern path to move forward.

In conclusion, the presale window is the new battlefield.

People who used to be in the SHIB army and want to know where the next 100x memecoin chance is should not wait for an old project to learn how to run again. It’s important to know what the planned benefit of a presale like Based Eggman is.

Based Eggman isn’t just a new memecoin; it’s a new way of doing things. It provides SHIB holders with what they’ve been asking for: a fresh start with professional execution, a large event that is sure to happen, and a community-focused vision based on better technology. The Based Eggman Presale is where the memecoin momentum that was lost is now centred. This is the best trade between GGs and SHIB for 2026.

For more information, visit the official website, blog, X, and Telegram.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Kraken Joins ICE Chat to Boost Institutional OTC Access

Kraken has expanded its institutional reach by linking its over-the-counter (OTC) desk to ICE Chat, Intercontinental Exchange’s real-time messaging platform used by banks and trading desks. Announced February 17, 2026, the arrangement makes Kraken the first cryptocurrency platform to be approved for ICE Chat, enabling quote requests and negotiations to flow directly within a system that aggregates more than 120,000 market participants. The move positions Kraken’s liquidity alongside traditional assets across a familiar workflow, signaling a broader push to incorporate digital assets into mainstream financial-market infrastructure. The OTC desk at Kraken handles large block trades in crypto spot and options, and the partnership with ICE is expected to evolve as institutions look for deeper, more integrated access to crypto liquidity.

Key takeaways

- Kraken’s OTC desk is now integrated with ICE Chat, enabling institutional traders to access Kraken’s crypto liquidity directly through a widely used messaging platform.

- ICE Chat connects more than 120,000 market participants, including banks, brokers, and trading desks, allowing real-time deal negotiation within established workflows.

- Kraken is the first crypto platform approved to connect to ICE Chat, situating digital asset liquidity alongside traditional asset classes.

- The integration is expected to expand over time, reflecting broader efforts to embed digital asset trading into traditional financial-market infrastructure.

- ICE’s broader crypto initiatives include on-chain data collaborations, large-scale investments in crypto markets, and potential partnerships with wallet and payments providers, signaling a more integrated financial ecosystem.

Market context: Link the story to broader crypto conditions (liquidity, risk sentiment, regulation, ETF flows, macro, or sector trends) WITHOUT inventing facts.

Why it matters

The Kraken-ICE Chat linkage marks a notable step toward deeper institutional access to crypto liquidity. By enabling quote requests and negotiations to occur within ICE’s established messaging network, hedge funds, asset managers, and banks can integrate crypto trading into their existing workflows without resorting to separate channels or processes. The arrangement reduces friction for large crypto block trades, a key consideration for participants handling significant volumes in both spot and options markets. In practical terms, traders can coordinate, price, and settle trades within a single, familiar interface, potentially improving execution efficiency and speed while preserving governance and compliance controls.

The move also highlights ICE’s broader strategy to bring digital assets into mainstream capital-markets infrastructure. ICE operates ICE Chat, the New York Stock Exchange, and a suite of data, clearing, and technology services. Its push into crypto markets aligns with the industry-wide trend of bridging traditional finance with digital assets, leveraging established market infrastructure to widen participation and liquidity. In recent months, ICE has pursued a series of crypto-related initiatives, including a collaboration with Chainlink to pull FX and precious metals data on-chain, substantial investments in crypto-native ventures, and explorations into crypto payments capabilities. These steps underscore a broader ambition to weave crypto more deeply into the fabric of conventional trading and risk management.

The partnership comes amid a wider set of tokenization and on-ramp developments across major exchanges. Nasdaq has signaled a willingness to explore tokenized equities through regulatory channels, while the NYSE has discussed plans to operate a 24/7 trading platform for tokenized stocks and ETFs, integrating traditional post-trade settlement with blockchain-based processes. These efforts reflect a synchronous push from traditional venues toward digitized asset classes, where liquidity, transparency, and execution efficiency are often cited as critical advantages. The ecosystem is evolving rapidly, with market participants watching how these initiatives will interact with evolving regulatory standards and the pace of adoption by institutional users.

The timing of Kraken’s announcement overlaps with other notable industry moves. Earlier in the year, Kraken pledged to support a government-backed initiative to create “Trump Accounts,” a savings program for Americans under 18—an effort that reflects the broader intersection of crypto policy and retail-facing programs. This backdrop illustrates how crypto firms are navigating public policy while expanding their institutional capabilities, seeking to demonstrate value beyond consumer-focused products and toward core market infrastructure.

Why it matters (continued)

The integration could help amplify liquidity for large crypto trades by tapping into ICE’s global network, potentially reducing spreads and improving price discovery for institutional participants. It also signals to regulators and incumbents that crypto liquidity can be treated as part of the same market ecosystem that handles equities, bonds, and other traditional asset classes. For Kraken, the collaboration with ICE Chat may expand its reach among asset managers who prefer operating within standardized, risk-managed environments—furthering the normalization of digital assets within regulated financial marketplaces.

What to watch next

- Expansion updates: Follow announcements about extending ICE Chat access to additional Kraken clients and other Kraken desks or counterparties.

- Broader ICE crypto initiatives: Monitor developments tied to ICE’s data services, on-chain integrations, and potential partnerships in payments or custody.

- Tokenization momentum: Track regulatory progress and product launches related to tokenized stocks and ETFs at Nasdaq and NYSE, which could influence liquidity and settlement paradigms.

- Data and settlement enhancements: Look for updates on ICE’s Consolidated Feed and how it interoperates with on-chain data streams and DeFi-native pricing mechanisms.

Sources & verification

- Kraken Integrates with ICE Chat to Expand Institutional OTC Access — Business Wire press release (official announcement of the integration).

- ICE Chat and Market Participation — ICE corporate communications outlining the platform’s reach beyond traditional markets.

- Chainlink and ICE Forge On-Chain Data Collaboration — Cointelegraph coverage detailing ICE’s data-on-chain initiative.

- ICE Invests in Polymarket — Cointelegraph reporting on ICE’s $2 billion investment and the valuation context.

- Nasdaq and NYSE tokenization efforts — Cointelegraph coverage of Nasdaq’s tokenized-stocks push and NYSE’s plans for 24/7 tokenized-trading platform.

What the announcement changes

The Kraken-ICE Chat integration represents a concrete step in the ongoing evolution of institutional crypto access. By embedding Kraken’s liquidity within ICE’s established communications platform, the move lowers barriers for large-scale crypto trading and aligns digital asset execution with the workflows many institutions already use for other asset classes. The collaboration reinforces the idea that cryptos are not merely retail instruments but elements of a broader, interconnected market infrastructure that includes data, clearing, risk management, and settlement. As the ecosystem expands, institutions may increasingly rely on a combination of on-chain data, centralized exchanges, and OTC desks to manage exposure, price risk, and execution efficiency across diverse crypto products.

What to watch next

- Monitoring quarterly updates from Kraken and ICE for new client onboarding and expanded platform access.

- Regulatory developments affecting crypto-asset trading infrastructure and tokenized securities, including any policy shifts impacting tokenization and cross-market liquidity.

- Progress on ICE’s partnerships with data providers and on-chain data feeds, and how these integrations affect price discovery and risk management.

Crypto World

Bitcoin Stalls at a Critical Stress Zone as On-Chain Data Warns the Bottom May Not Be In Yet

Bitcoin’s price action is hovering near a level where weaker holders exit and stronger hands begin accumulating historically.

Bitcoin has remained rangebound between $60,000 and $70,000, as choppy trading continued to reflect fears of a further downside move. Fresh data highlights risk building near Short-Term Holder Realized Price bands.

These areas have historically witnessed the start of accumulation and emerging opportunities for global market participants.

High-Risk, High-Opportunity Zone

According to Alphractal, Bitcoin is currently trading within a tight range defined by the Short-Term Holder Realized Price, and its price action is trapped between key support and resistance levels. In recent weeks, BTC has closely respected the -1σ and -1.5σ deviation bands.

Previous instances reveal that when the crypto asset breaks below the lower blue deviation band, the market typically sees one of two outcomes. Either the formation of a local bottom or a deeper capitulation phase, followed by accumulation. These deviation bands have consistently acted as natural support and resistance across multiple market cycles. To top that, the -1.5σ level has repeatedly represented periods of maximum stress, where selling pressure from short-term holders intensifies, and longer-term participants begin accumulating.

Against this backdrop of high short-term holder stress, Alphractal founder Joao Wedson pointed to a longer-term metric that may indicate the market is not yet at a historical turning point. The Net Unrealized Profit/Loss (NUPL) metric for long-term holders, which tracks whether the most resilient investors are sitting on unrealized gains or losses, currently stands at 0.36, which means that long-term holders remain in profit despite recent volatility.

Upon looking at past cycles, Wedson found that the clearest late bear-market signal tends to emerge only when this metric turns negative, a condition associated with extreme pessimism and seller exhaustion. Such phases have marked the end of bear markets, rather than the start of a new bull cycle.

Miners Reduce Exchange Exposure

As Bitcoin trades near crucial stress levels, further on-chain data shows miners adjusting their positioning amid ongoing market pressure. Data shared by CryptoQuant depicts a significant change in miner behavior as more than 36,000 Bitcoin were withdrawn from exchanges since the beginning of February.

You may also like:

The pace of withdrawals has accelerated compared to previous months, which points to changes in holding strategies or liquidity management. Of this total, over 12,000 BTC were withdrawn from Binance, while more than 24,000 BTC were spread across other exchanges, indicating that it’s not an isolated activity. Such movements are typically associated with transfers to long-term storage, as miners move assets off exchanges into cold wallets, and reduce immediate sell-side supply.

Daily withdrawals peaked above 6,000 BTC, the highest level since November, and significantly exceeded January levels. This means that miners may be repositioning against the backdrop of the current market uncertainty.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

$202 Million Solana Selling Sparks First Capitulation Since 2022

Solana remains under sustained pressure as broader market conditions deteriorate. SOL has extended its downtrend for several weeks, reflecting reduced investor confidence.

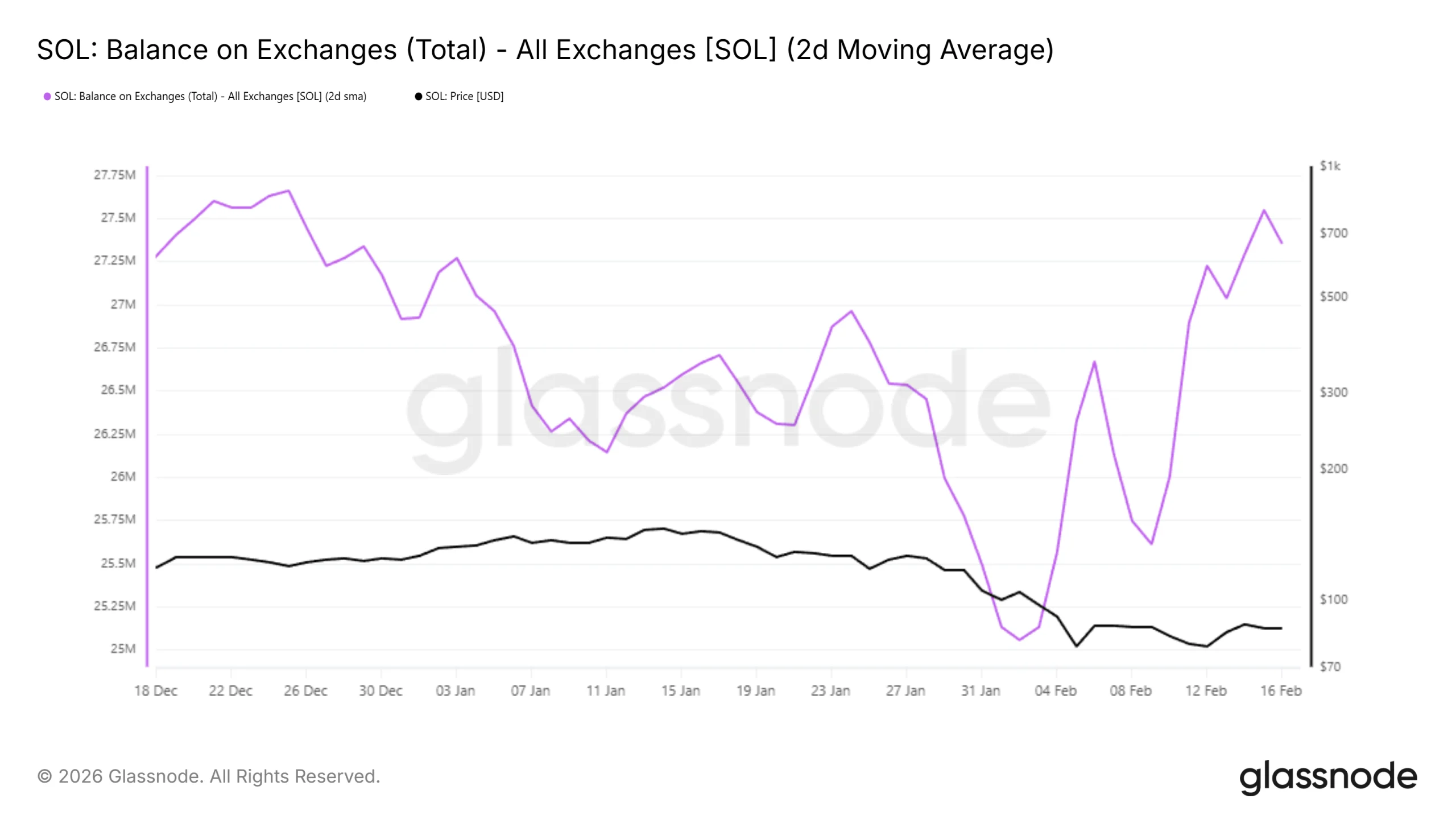

Recent on-chain data reveals a surge in exchange-directed supply. Roughly $202 million worth of SOL has moved to trading platforms since the beginning of the month. This wave of selling has intensified bearish momentum and revived capitulation signals not observed since 2022.

Sponsored

Sponsored

Solana Holders Are Selling

Active deposits on the Solana network have started declining after a sharp rise earlier this month. This metric tracks tokens transferred to exchanges, often signaling intent to sell.

Despite moderating deposit flows, exchange balances continue to reflect elevated supply. Over the past 17 days, exchange wallets have added 2.35 million SOL. At current prices, this increase equates to approximately $202 million in additional sell-side liquidity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Rising exchange reserves generally amplify downward pressure. Larger balances make it easier for traders to execute sell orders. However, this influx has also triggered a historical capitulation signal. Similar spikes in exchange supply previously aligned with late-stage bear market conditions.

Sponsored

Sponsored

The MVRV Pricing Bands provide critical valuation context. Solana’s price is currently trading below the Extreme Lows deviation band. For this classification, the Market Value to Realized Value ratio must stay below 0.8 for roughly 5% of trading days.

SOL has remained beneath that threshold for 26% of recent sessions. This confirms a prolonged undervaluation phase. The only comparable event occurred in May 2022. Following that period, Solana remained depressed for 17 months before staging a meaningful recovery.

SOL Price Downtrend Continues

Solana is trading at $86 at the time of writing. The token remains capped below the $90 resistance while holding above the $81 support zone. A move above $90 would intersect the prevailing downtrend line, signaling potential technical improvement.

However, current data suggests downside risk persists. Continued exchange inflows and weak macro momentum could pressure SOL further. A decisive break below $81 may expose the next support near $67, extending the drawdown.

Alternatively, reclaiming $90 would shift short-term sentiment. A breakout above the descending trendline could attract renewed capital inflows. If momentum strengthens, SOL may rally toward $105 and potentially higher, invalidating the prevailing bearish thesis.

Crypto World

Kraken Integrates OTC Desk with ICE Chat for Institutions

US-based crypto exchange Kraken has integrated its over-the-counter desk with Intercontinental Exchange’s ICE Chat, enabling institutional traders to access Kraken’s crypto liquidity directly through a messaging platform widely used across global financial markets.

ICE Chat connects more than 120,000 market participants, including banks, brokers and trading desks that use the system for real-time deal negotiation and execution. The integration allows those clients to communicate directly with Kraken’s OTC desk within their existing trading workflows.

Kraken said it is the first cryptocurrency platform approved to connect to ICE Chat, placing its crypto liquidity alongside traditional asset classes within established institutional communications infrastructure.

The companies added that they expect to expand the integration over time, reflecting broader efforts to embed digital asset trading into traditional financial market systems.

Kraken’s OTC desk facilitates large block trades in crypto spot and options markets. Intercontinental Exchange, which operates ICE Chat and owns the New York Stock Exchange, provides data, clearing and technology services to global financial markets.

The news follows Kraken’s pledge on Monday to support US President Donald Trump’s proposed “Trump Accounts,” a savings program for Americans under 18.

Related: Kraken parent Payward revenues jump 33% as crypto traders pile in

ICE expands deeper into crypto and tokenized markets

Intercontinental Exchange has stepped up its involvement in digital asset markets over the past year, expanding beyond traditional exchange infrastructure into blockchain data, prediction markets and crypto payments.

In August, ICE partnered with blockchain oracle provider Chainlink to bring foreign exchange and precious metals data onchain. The collaboration integrates ICE’s Consolidated Feed, which aggregates pricing data from more than 300 global exchanges and marketplaces, into Chainlink’s Data Streams.

In October, ICE invested $2 billion in crypto-based prediction market Polymarket, valuing the company at a reported $9 billion post-money. In December, ICE entered discussions to back crypto payments company MoonPay in its latest funding round, which is reportedly seeking a $5 billion valuation, though the size of ICE’s potential investment was not disclosed.

Both Nasdaq and the NYSE have also been making moves in crypto recently, particularly the tokenization of equities.

In September, Nasdaq filed a request with the US Securities and Exchange Commission seeking approval to list tokenized stocks through a proposed rule change.

In January, the NYSE announced plans to develop a 24/7 trading platform for tokenized stocks and ETFs, combining the exchange’s Pillar matching engine with blockchain-based post-trade settlement systems, subject to regulatory approval.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Gemini Space Station Shares Slide 14% Amid Executive Shake-Up

The shares dropped after the company reported large losses and announced leadership changes.

Shares of GEMI fell about 14% to around $6.50 on Tuesday after Gemini Space Station, a U.S.-based cryptocurrency exchange, said three top executives were leaving.

The company revealed in a new 8-K filing that Chief Operating Officer Marshall Beard, Chief Financial Officer Dan Chen and Chief Legal Officer Tyler Meade all stepped down effective immediately. Beard also resigned from the board, though his resignation “was not the result of any disagreement,” the filing reads.

Gemini currently ranks 19th among centralized exchanges (CEXs), with about $31.9 million in 24-hour trading volume, according to CoinGecko.

There are currently no plans to name a new COO as of now, and co-founder Cameron Winklevoss is expected to take on many of Beard’s duties alongside his current role. Meanwhile, Chief Accounting Officer Danijela Stojanovic will take over as interim CFO.

The leadership shake-up underscores how unexpected leadership changes can unsettle investors and sink stock prices. The filing also showed the company expects a net loss of roughly $587 million to $602 million for 2025, likely adding to investor concerns. Although, as of Dec. 31, 2025, the company recorded 600,000 monthly transacting users, up 17% from a year earlier.

Moreover, the leadership shake-ups come as the broader crypto markets remain weak, with Bitcoin trading at $67,000, down 25% over the past three months, per CoinGecko.

The changes follow Gemini’s announcement two weeks ago that it would cut up to 25% of its staff, as the Wall Street Journal reported.

The company, which went public in September 2025, has recorded a sharp downturn in recent months. Its total assets have also declined, falling to about $5.2 billion from $10.8 billion in October, according to DeFiLlama.

Gemini went public amid a broader rush of crypto firms seeking to IPO, driven by strong investor demand for industry stocks in 2025. The Defiant has reached out to Gemini for comment, but has not heard back at the time of publishing.

Crypto World

Pi Coin Price Completes Breakout, Now Eyes Another 60% Move?

Pi Coin price has gone through a sharp roller-coaster-like move over the past month. Between Jan. 14 and Feb. 11, Pi Coin fell nearly 38% as sentiment collapsed and sellers dominated. But the trend reversed quickly. Since Feb. 11, Pi Coin surged as much as 58% before correcting again.

Now, sentiment is improving once more for the Pi Network’s native token, and charts show this correction may not be a reversal. Instead, it could be preparation for the next breakout. Momentum, money flow, and price structure now explain why a much larger 60% move may still be possible.

Sponsored

Sponsored

Sentiment Collapse and Recovery Explain Pi Coin’s Roller-Coaster Move

Investor sentiment played a key role in Pi Coin’s recent volatility. Positive sentiment, which measures how optimistic investors feel based on social and market data, dropped sharply between December and early February. The sentiment score fell from 9.06 in early December to nearly zero by Feb. 4.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This collapse aligned with Pi Coin’s earlier range-bound move and the 38% price decline post Jan.14.

However, sentiment began improving again after Feb. 4. By Feb. 17, the score recovered to 3.82, aligning with the sharp price surge between Feb. 11 and Feb. 15 (over 58%). While still below earlier highs, this sentiment rebound, both before and after the rally, shows confidence is slowly returning.

This shift helps explain why Pi Coin quickly reversed its downtrend and began recovering. But the recovery itself was not random. It followed a precise technical breakout.

Sponsored

Sponsored

Breakout Pattern Completed, But Dip Buyers Still Active?

Pi Coin formed an inverse head-and-shoulders pattern, a bullish structure that signals a trend reversal after a decline. This pattern completed on Feb. 14 and pushed Pi Coin up roughly 26% toward its $0.206 level.

This level acted as the breakout target, and once reached, many traders took profits. This explains the large upper wick and the sharp pullback that followed. However, the Money Flow Index (MFI) tells a deeper story. The MFI measures buying and selling pressure by combining price and volume. When MFI forms higher lows, it possibly indicates that buyers continue to enter on dips.

Despite the correction, PI’s MFI stayed elevated, close enough to its recent local peak. This confirms dip buyers remained active and present even during the pullback.

This behavior often appears when investors position for another move higher. That raises the next question. Why are buyers still accumulating after the breakout target already completed? The answer appears in Pi Coin’s current price structure.

Sponsored

Sponsored

Bull Flag and EMA Crossover Show Next Breakout Structure Forming

After completing its first breakout, Pi Coin entered consolidation, a 19% dip from $0.206. This consolidation is forming a bull flag pattern. A bull flag is a continuation pattern where price pauses briefly before starting another rally.

At the same time, Pi Coin’s Exponential Moving Averages (EMAs) are signaling growing strength. The 20-period EMA is now approaching a crossover above the 50-period EMA, a potential bullish crossover. The EMA measures the average price over time, and when shorter-term averages cross above longer-term averages, it signals strengthening momentum.

This alignment explains why dip buyers continue entering.

Sponsored

Sponsored

However, timing is critical. If consolidation continues too long, the pattern could weaken. Bull flags require relatively quick breakouts to remain valid. This urgency also explains why buying pressure has remained steady. All of this now brings attention to Pi Coin’s key breakout levels.

Pi Coin Price Targets 60% Move if Key Breakout Level Clears

The immediate resistance level sits at $0.184. Pi Coin has tested this level multiple times but has not yet confirmed a breakout.

If Pi Coin closes above $0.184, the next targets are $0.204 and $0.242. The full bull flag projection points toward $0.290, representing a potential 60% rally from the breakout level. However, downside risk remains.

If Pi Coin falls below $0.158, the bull flag pattern would be invalidated. Extended sideways movement could also weaken the setup if consolidation becomes too large relative to the original breakout move. For now, the structure remains intact.

Pi Coin has already completed one breakout. Sentiment is improving. Money flow shows that dip buyers remain active, and the price structure is preparing for another potential breakout. The next confirmed move above resistance will determine whether Pi Coin can complete its larger 60% rally setup.

Crypto World

Gamma Prime’s Tokenized Capital Summit

On February 9 in Hong Kong, Gamma Prime held the Tokenized Capital Summit 2026, bringing together over 2,000 attendees from across the global investment landscape. The audience included family offices, institutional investors, and representatives of leading investment firms, reflecting the growing convergence between traditional capital and tokenized markets.

The stage welcomed prominent industry figures such as Yat Siu, Nenter Chow, Andrew Robinson, Head of Institutional Coverage at Coinbase, Adrian Tan, Head of Binance VIP & Institutional, and Akshat Vaidya, Co-Founder of Maelstrom, among other respected speakers. Together, they represented more than $20 billion in assets under management, reinforcing the summit’s status as one of the year’s most significant gatherings at the intersection of institutional finance and Web3.

Gamma Prime’s Product

Gamma Prime operates a compliant and secure marketplace for private investments, built to provide access to opportunities that are typically difficult to reach. The platform focuses on non-correlated yield, offering investors a practical way to diversify their portfolios beyond public markets.

By adhering to regulatory requirements across multiple jurisdictions, Gamma Prime is developing into a global marketplace for hedge funds, venture capital, private equity, and other illiquid private assets. This approach enables funds to reach new institutional partners, family offices, and accredited investors worldwide, while expanding the range of investment opportunities available on the platform.

The company’s leadership team includes DeFi builders, professionals from traditional finance, and Stanford PhDs, combining strong experience in blockchain innovation with institutional-grade governance and operational discipline.

Connecting Traditional Finance and Tokenization

The Tokenized Capital Summit represents an important step for the institutional Web3 sector. It brings together participants from traditional finance and companies active in tokenization, creating a platform for practical discussions on market developments and institutional adoption.

By organizing the summit, Gamma Prime advances its objective of expanding global access to private investments that have historically been fragmented and difficult to access. The event in Hong Kong demonstrates the growing cooperation between institutional investors, family offices, and Web3 companies, reflecting broader structural shifts within the financial industry.

About Gamma Prime

Gamma Prime is a tokenized marketplace of curated private investments specializing in hard-to-find uncorrelated returns – hedge funds, private credit, and other alternatives across both digital and real world asset classes. Fully regulatory compliant and built with institutional security standards, Gamma Prime is positioned to become the leading global platform for hedge funds, venture capital, private equity, and other illiquid private investment opportunities. The company was founded by a team of DeFi pioneers, traditional finance professionals, and Stanford PhDs.

Crypto World

Larry Lepard ragequits after Bloomberg analyst forecasts $10k BTC

A recent conversation between Bloomberg’s Mike McGlone and bitcoin (BTC) advocate Lawrence Lepard on Scott Melker’s show devolved into expletives and a ragequit. On one side, a BTC price forecast of $10k. On the other side, a BTC forecast of $140k to over $1 million.

The shouting match is a case study in how polarized beliefs about the value of BTC have become.

On one side of the argument, McGlone forecasted a BTC drop to $10,000 and laughed at Lepard’s buy-and-hold investment strategy. “You’re dollar cost averaging in an asset that has an unlimited supply, that’s done, that’s over,” McGlone stated.

That forecast earned immediate backlash. “Whoa, whoa, whoa. Unlimited supply? What the f*** are you talking about?” Lepard countered.

McGlone recast his claim about unlimited supply to the asset class of altcoins, even though he made the initial claim about bitcoin specifically.

“OK, maybe you should let me speak before you interrupt,” McGlone continued. “You’re at the start of a classic bear market. You’re denying it, you’re trying to buy every dip. You’ll sell out. You’ll stop out when – and I’ll say it now – it reads as a pretty low plateau around $10,000. That’s usually how markets work.”

Read more: CHART: BTC underperforms in Trump’s first year in office

McGlone called 2024 “as good as it gets” for crypto amid that initial euphoria about Donald Trump’s presidential election. Indeed, on November 18, 2024, the Fear & Greed rocketed to 83 on a scale from 0 to 100, its highest reading in 3.5 years.

McGlone concluded that the crypto industry is “done” and recommended everyone to immediately “get out.” “From the future, we will look back at the crypto mania as very comparable to tulips.”

Lawrence Lepard responds to a BTC $10k forecast

After McGlone’s rant, Lepard said he would clip that video of McGlone as the “dumbest fucking comments.” Within six minutes, Lepard ragequit the interview entirely.

After a brief moment of ambiguity over whether McGlone had said the acronym ETF or ETS, and after McGlone reiterated his view that inflows into ETFs as a bullish catalyst for BTC had failed to sustain prior rallies, Lepard claimed that McGlone was not letting him finish his bullish comments about BTC.

“Fuck you, I mean fuck you, seriously,” Lepard concluded. “Bye guys.”

Lepard is a professional money manager and a BTC permabull. McGlone is a senior commodity strategist at Bloomberg Intelligence.

After Lepard ended the exchange abruptly, his supporters celebrated. Soon, McGlone apologized on X for cutting-in. “I have apologized to Larry for interrupting him on Macro Mondays.”

Lepard has incorrectly predicted the price of BTC before, including a failed forecast for BTC to hit $140,000 last year.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Next Best Crypto 2026: Hong Kong SFC Licenses Victory Fintech, but DeepSnitch AI Is Likely the Next Best Crypto to Define Your Portfolio

Hong Kong’s Securities and Futures Commission (SFC) has formally added Victory Fintech Company Limited to its list of licensed cryptocurrency trading platforms. This marks the first approval since June 2025, showing the rigorous standards now required to operate in one of the world’s strictest financial hubs.

While legacy assets like Render ($RNDR) and Cosmos ($ATOM) struggle with bearish sentiment and stagnant price action, a new contender is rising. DeepSnitch AI ($DSNT) aligns perfectly with the market’s demand for transparency and security as the next best crypto.

With its presale already raising over $1.63 million, the chance for a 100x rally is high.

Hong Kong’s exclusive club

The addition of Victory Fintech to the SFC’s licensed list is a signal of survival of the fittest. The SFC now lists only 12 entities authorized to operate, a stark contrast to the hundreds of exchanges that once flooded the market.

Since June 2024, operating an unlicensed platform has been a criminal offense, forcing major players like OKX and Bybit to withdraw their applications and exit the region.

This creates a safer environment for institutional capital but raises the bar for retail traders. As Hong Kong sets the standard for compliance, DeepSnitch AI provides the global infrastructure for verification. Its SnitchScan tool allows users to audit smart contracts and track wallet associations, ensuring that they are not interacting with blacklisted entities.

Finding the next best crypto

DeepSnitch AI ($DSNT): Likely the next best crypto

The project has surged past $1.63 million in its presale, with the token price holding at $0.03985. This capital influx is a vote of confidence in the platform’s ability to solve the industry’s trust deficit.

DeepSnitch AI is likely the next best crypto because it offers an intelligence access that no other project can match. The team has created a closed ecosystem where presale buyers get exclusive access to live AI tools. This allows early investors to spot risks and opportunities before the broader market, effectively giving them insider status.

This utility drives demand, evidenced by the 36 million+ tokens already staked. The setup for DeepSnitch AI mirrors the early days of top utility tokens. A $15,000 investment at the current price secures roughly 369,094 DSNT tokens. As a top choice for the next best crypto, DeepSnitch AI has the potential to increase by 100x and turn this investment into $1.5 million.

Render market performance

Render ($RNDR) is facing a tough reality check. The token is currently underperforming, with technical analysis showing a bad outlook for the short-term. Based on data from mid-February, 21 technical indicators signal bearish signals, compared to only 9 bullish ones.

The sentiment is firmly bearish, and volatility remains very high. While the long-term forecast suggests Render could hit $1.65 by the end of 2026, this growth is average compared to the risks involved.

Render is trading below its 200-day SMA ($2.53), indicating a long-term downtrend. For investors seeking high-growth crypto picks, a 13% gain over a year is insufficient compensation for the volatility.

Cosmos price prediction

Cosmos ($ATOM) is struggling to find its footing in the current cycle. The Fear & Greed Index is at a terrifying 12 as of February 16th, which indicates Extreme Fear, and the sentiment remains neutral to bearish.

More alarmingly, long-term models predict that Cosmos could actually lose value by 2030, dropping to $1.06, a 53% decline from current levels. Despite a slight projected gain of 5% by the end of 2026, Cosmos is failing to offer massive profit potential. Hence, smart money is rotating out of these declining legacy chains and into emerging blockchain projects like DeepSnitch AI.

Final thoughts

Hong Kong is cleaning up the exchange market, and DeepSnitch AI is cleaning up the data market. One is a regulatory necessity, while the other is a profitable opportunity. DeepSnitch AI is likely the investment that will define your 2026 performance and could be the next best crypto to buy now. Use the DSNTVIP50 code to get an extra 50% bonus when you join the presale.

Visit the official DeepSnitch AI website, join Telegram, and follow on X for more updates.

FAQs

What is the next best crypto to buy now?

DeepSnitch AI ($DSNT) is likely the next best crypto to buy now due to its fast presale funding and high utility in a regulated market.

How does the Hong Kong SFC license affect the market?

The SFC licensing of Victory Fintech signals a maturing, stricter market. This benefits the next top cryptocurrency contenders like DeepSnitch AI, which provide the verification and compliance tools necessary for this new environment.

What are the best high-growth crypto picks for 2026?

While legacy coins struggle, DeepSnitch AI tops the list of high-growth crypto picks for 2026, offering potential exponential returns through its presale structure and AI utility.

Is Cosmos ($ATOM) a good long-term hold?

Cosmos is a risky long-term hold, with forecasts predicting a 53% price drop by 2030. Investors are shifting focus to emerging blockchain projects with better growth trajectories.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video4 days ago

Video4 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech16 hours ago

Tech16 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Video10 hours ago

Video10 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World10 hours ago

Crypto World10 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports16 hours ago

Sports16 hours agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business5 days ago

Business5 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat2 days ago

NewsBeat2 days agoMan dies after entering floodwater during police pursuit

-

Politics7 days ago

Politics7 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat3 days ago

NewsBeat3 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery