Crypto World

Strategy CEO Seeks More Preferred Stock to Fund Bitcoin Buys

Bitcoin (CRYPTO: BTC) treasury company Strategy will lean more heavily on its perpetual preferred stock program to finance additional Bitcoin purchases, moving away from a reliance on issuing common stock. CEO Phong Le outlined the pivot during Bloomberg’s The Close, explaining that the company intends to shift from equity capital to preferred capital as a core funding channel. The move centers on Stretch (STRC), Strategy’s perpetual preferred offering launched in July, which targets investors seeking steadier returns through an annual dividend north of 11%. The instrument has been positioned as an alternative to diluting the company’s stock while it continues to amass BTC holdings. The development comes as Strategy eyes a broader rollout of STRC later in the year, signaling a potential shift in how corporate treasuries wield equity-like instruments to grow crypto reserves.

Le emphasized that the preferred stock will “take some seasoning” and marketing before traders fully embrace the product, but he remained upbeat about STRC’s trajectory. He told The Close that, in the course of this year, Stretch could become a cornerstone offering for Strategy as it seeks to fund further Bitcoin acquisitions. The company’s financing strategy has repeatedly leaned on STRC to finance BTC purchases since its inception, providing a mechanism to accumulate digital assets without triggering immediate dilution of common equity. The approach is part of a broader class of crypto treasuries that use perpetual preferreds to balance income generation with asset accumulation.

STRC, which was introduced to market as Strategy’s fourth perpetual preferred instrument, was explicitly designed to appeal to buyers seeking long-term stability. It carries an annual dividend and is marketed as a capital-structure play rather than a plain equity raise. The instrument’s structure aims to deliver predictable income while enabling Strategy to keep building its Bitcoin stack. The narrative around STRC has fed into a wider discussion about how corporate treasuries are managing liquidity, risk, and exposure to crypto markets without immediately triggering shareholder dilution. Critics, however, have warned that the space has grown crowded and that some companies’ holdings now exceed their market capitalization, raising questions about concentration risk and governance.

Strategy could restart offerings as STRC hits $100

In late trading, STRC regained its par value of $100 for the first time since mid-January, a development Le described as the “story of the day.” The move back to par could unlock renewed appetite for STRC issuances, potentially enabling Strategy to fund additional Bitcoin purchases without issuing new common shares. Earlier this month, the stock traded under $94 when Bitcoin briefly slid below $60,000, underscoring how BTC price dynamics can influence the attractiveness of STRC as a funding mechanism. With Bitcoin trading roughly around $66,800, the market environment remains relatively constructive for asset accumulation through alternative financing vehicles, even as volatility lingers on near-term horizons.

Bitcoin’s price trajectory has been steady but not spectacular in the immediate term, hovering around the mid-$66,000s after peaking above $68,000 intraday. The price backdrop supports narratives that corporate treasuries can pursue more disciplined, income-generating avenues for finance, while still chasing the long-term upside of BTC exposure. The evolving dynamics around STRC and similar instruments come as crypto returns and risk sentiment influence decisions across corporate balance sheets, with issuers seeking to optimize cost of capital and dilution concerns in parallel.

Buying Bitcoin treasury rivals a “distraction”

Analysts have cautioned that the crypto treasury space is becoming crowded as several firms vie for a relatively small pool of traders and investors. In a crowded market, some observers warn that corporate treasuries could face diminishing marginal value as more players announce similar funding structures. The fragmentation raises questions about price discovery, liquidity, and the true strategic value of perpetual preferreds in maintaining BTC accumulation over the long run.

Related: Saylor’s Strategy buys $90M in Bitcoin as price trades below cost basis

Beyond pure competition concerns, Le dismissed the notion that Strategy would pursue aggressive consolidation through acquisitions of underperforming peers. He argued that focusing on the core STRC product is preferable to pursuing opportunistic takeovers, likening the approach to other technology or finance markets where companies emphasize product development over opportunistic acquisitions. “In any new market, whether it be electric cars or AI or SaaS software, you want to focus on your core product,” Le said. “It would be a distraction to go buy, at a discount to net asset value, another digital asset treasury company.”

As the wider market digests these developments, Strategy’s stock, traded as MSTR, closed down more than 5% at $126.14, reflecting a sentiment that remains cautious in the near term even as STRC gains traction. The price action underscores the delicate balance investors weigh between funded BTC accumulation and the potential dilution risk associated with new equity or preferred stock offerings. The discussion around STRC also feeds into broader debates about how corporate treasuries manage risk, yield, and the opportunity cost of capital when BTC becomes a strategic asset rather than a speculative instrument.

To contextualize the conversation, industry observers have pointed to a broader trend: as more companies adopt crypto treasuries, the market could see consolidation through mergers and acquisitions or more aggressive share-issuing strategies when faced with capital needs. Yet Strategy’s leadership seems intent on refining its preferred-stock route rather than chasing rapid expansion through bolder balance-sheet moves. The decision to prioritize a steady, dividend-bearing instrument aligns with a philosophy of measured growth and risk control, even as BTC remains a volatile, high-beta asset that can swing strategic outcomes in a single trading session.

In parallel, the crypto treasury sector has become a focal point for investors seeking visibility into how corporate treasuries navigate liquidity, risk, and regulatory constraints. Analysts suggest that while the category has matured in some respects, it remains a moving target shaped by Bitcoin’s price action, macroeconomic conditions, and evolving market structure. The emergence of streaming discussions around STRC and similar products indicates a willingness among issuers to experiment with bespoke capital-structure solutions as legitimate means of funding crypto purchases. The question remains: how durable will these instruments prove in different market regimes, and will investor demand stabilize as more issuers publish performance data and governance disclosures?

Why it matters

For investors, Strategy’s pivot toward preferred stock as a primary funding mechanism highlights a shift in how crypto treasuries can balance income with exposure to Bitcoin outright. The STRC instrument promises yield and stability, potentially reducing the pressure to issue more common stock and mitigate dilution. If STRC continues to perform and attract sufficient investor interest, Strategy could emerge as a case study for how treasuries combine traditional fixed-income features with crypto exposure to create a hybrid financing model.

From a market perspective, the development reinforces the idea that institutional players are increasingly treating BTC as a fundamental corporate asset rather than a speculative risk. The use of perpetual preferreds could provide a template for other issuers seeking to augment BTC reserves without triggering immediate equity dilution. Yet the crowded nature of the space also invites closer scrutiny of governance, risk management, and the alignment of incentives between a company’s treasury activities and shareholder interests. The balance between discipline in funding and the pursuit of BTC upside remains a central tension, one that Strategy appears intent on navigating with caution and clarity.

For builders and researchers, the case raises questions about the transparency of crypto-treasury deals, the long-term performance of perpetual preferreds in crypto contexts, and how such instruments should be regulated as they gain traction in mainstream finance. The evolving narrative around STRC and related products could influence product design, disclosure standards, and investor education as more firms explore innovative capital-structure solutions to support digital-asset accumulation.

What to watch next

- Progress in STRC marketing and adoption, including any new issuances or marketing milestones (dates to watch).

- Bitcoin price movements and any corresponding shifts in Strategy’s BTC purchase cadence or balance-sheet disclosures.

- Regulatory developments affecting corporate crypto treasuries and preferred-stock financings.

- Q3 and Q4 earnings context for Strategy (or related entities) that could reflect changes in capital-raising strategies.

- Market sentiment indicators for crypto treasuries, including liquidity and trading volumes for perpetual-preferred products.

Sources & verification

- Bloomberg – Phong Le interview on The Close discussing Strategy’s move from equity capital to preferred capital and STRC’s role (YouTube link provided in original coverage).

- Cointelegraph – Strategy raises $2B in preferred stock to back Bitcoin purchases (article detailing STRC launch and purpose).

- Cointelegraph – Why Saylor’s Strategy keeps buying Bitcoin: Long-term investment rationale and treasury approach.

- Cointelegraph – Saylor/Strategy buys $90M in Bitcoin as price trades below cost basis (context on BTC purchases and treasury activity).

- Cointelegraph – Crypto treasury more merger/acquisition cycle mature (analysis of competitive dynamics in the treasury space).

What to watch next

Market development and official disclosures in the coming quarters will be critical to assess STRC’s effectiveness as a funding tool and Strategy’s broader strategy for growing its BTC holdings through preferred-stock issuances.

Crypto World

UNI price jumps as BlackRock’s BUIDL token lists on Uniswap, but risks remain

- Uniswap (UNI) price surged on BUIDL news but quickly pulled back as momentum faded.

- Institutional access boosts Uniswap’s profile but remains tightly restricted.

- Whale activity before the news raised insider trading concerns.

Uniswap’s UNI token experienced a sharp price surge after the announcement of the listing of BlackRock’s BUIDL token on the protocol.

UNI briefly rallied toward the $4.50 region before losing momentum and pulling back, reflecting a mix of excitement and caution among traders.

Alongside the optimism, concerns have emerged that could limit sustained upside for the UNI price.

BlackRock’s BUIDL listing on Uniswap brings institutional credibility

BlackRock’s BUIDL token is a treasury-backed, tokenised money market fund designed for institutional investors.

By enabling BUIDL to be traded through Uniswap’s infrastructure, the protocol has taken a significant step toward hosting real-world assets on-chain.

This integration relies on a request-for-quote model rather than open liquidity pools, reflecting the compliance needs of large financial institutions.

Only whitelisted market makers and qualified investors are allowed to participate in these trades.

As a result, the integration showcases Uniswap as an execution and settlement layer rather than a fully permissionless marketplace in this case.

For UNI holders, the announcement strengthened the narrative that Uniswap can benefit from institutional adoption without changing its core architecture.

The market responded quickly, pushing UNI higher as traders priced in potential long-term fee growth and relevance.

UNI price surge followed by a pullback

UNI’s rapid surge was followed by an equally notable pullback, suggesting many traders treated the rally as a short-term opportunity rather than a structural shift in valuation.

Volume spiked sharply during the surge, indicating aggressive positioning from both buyers and sellers.

Then, soon after, selling pressure increased as the price failed to hold above key resistance levels.

The pullback has returned UNI closer to its recent trading range, despite the significance of the announcement.

This behaviour reflects a market that is still cautious about translating institutional experiments into lasting token value.

It also highlights that Uniswap’s fundamentals, while improving, remain exposed to broader crypto market sentiment.

Insider trading concerns

Adding complexity to the situation were reports of large UNI movements shortly before the BlackRock-related news became public.

A long-dormant whale wallet reportedly moved millions of UNI tokens after years of inactivity.

Shortly before #BlackRock announced plans to buy an undisclosed amount of #Uniswap‘s $UNI token, we noticed something interesting.

A $UNI whale wallet (0x9c98) that had been inactive for 4 years moved 4.39M $UNI($14.75M) to a new wallet (0xf129).https://t.co/fZabEVYlcn… pic.twitter.com/JfFbPP67Da

— Lookonchain (@lookonchain) February 11, 2026

The timing of this transfer raised speculation that some market participants may have had early knowledge of the announcement.

While no evidence confirms wrongdoing, the optics alone were enough to spark debate.

Insider trading concerns can undermine confidence, especially when institutional names are involved.

For regulators and institutional investors, perception matters almost as much as facts.

Any lingering doubts about fairness or information asymmetry could limit follow-through buying.

This risk sits alongside the structural limitation that BUIDL access remains restricted to institutions.

Retail traders may benefit indirectly, but they are not participants in the actual BUIDL market.

Uniswap price forecast

UNI is now trading well below its recent peak, placing technical levels back at the centre of attention.

The first key support zone lies around the $3.20 to $3.30 area, where buyers previously stepped in.

A sustained break below this range could expose UNI to deeper downside toward the psychological $3.00 level.

Below that, the $2.80 to $2.90 region stands out as a major support that aligns with prior consolidation.

On the upside, traders will watch the $3.80 to $4.00 zone as near-term resistance.

A clean move above $4.00 would signal renewed bullish momentum and open the door for a retest of $4.50.

Failure to reclaim these levels would suggest the BlackRock-driven rally has fully cooled.

For now, UNI sits at a crossroads where strong narratives compete with technical weakness.

Crypto World

Vitalik Buterin Explains How Crypto Can Save Russia

Ethereum co-founder Vitalik Buterin has condemned Russia’s invasion of Ukraine as “criminal aggression.” He advocates applying crypto-inspired governance principles to transform Russia’s political system.

His remarks, published ahead of the fourth anniversary of the invasion on February 24, 2026, link blockchain concepts to the long-term security of Europe and Ukraine.

Sponsored

Sponsored

Vitalik Buterin Condemns Aggression Amid Support for Ukraine

The Russo-Canadian innovator directly rejected narratives that frame the conflict as morally ambiguous. He emphasized that Russia’s invasion of Ukraine cannot be justified.

Drawing on his Russian heritage and Canadian upbringing, he highlighted the dramatic contrast between:

- Ukraine’s institutional improvements over the past decade and

- Russia’s escalating repression, imperial ambitions, and military aggression.

“Ukraine needs a lot of help — to continue defending itself and to minimize human suffering from attacks on residential buildings, the energy system, etc.,” Buterin wrote, urging sustained international support to protect civilians and maintain Ukraine’s defense capabilities.

Buterin also criticized Western narratives that downplay Russian responsibility, asserting that Moscow’s leadership currently lacks incentive to pursue peace.

Based on this, he suggests that only continued military and economic pressure could compel meaningful negotiations.

Sponsored

Sponsored

Applying Crypto Principles to Political Reform

Drawing parallels from his experience in Ethereum and blockchain governance, Buterin proposed that long-term reform in Russia could benefit from:

- Decentralized governance

- Quadratic voting, and

- Digital democracy

These mechanisms, already explored in crypto ecosystems, are designed to spread power, prevent authoritarian consolidation, and allow citizens to influence decisions proportionally.

“The goal is to build a country that, when the objective is improving people’s lives, will be maximally strong, but when the goal is oppressing minorities or aggression against neighbors, will be maximally uncoordinated and weak,” he explained.

Buterin emphasized that decentralization is not merely a conceptual exercise; it could guide real-world political transitions.

Systems like https://pol.is, which enable large-scale consensus-building and public deliberation, could help identify shared priorities among citizens and inform policy without relying solely on traditional hierarchical structures.

Sponsored

Sponsored

The remarks come only weeks after internet providers began blocking access at the network level, barring several crypto news sites on Russian home internet connections.

Vision for a “Beautiful Russia of the Future”

Nonetheless, beyond immediate conflict resolution, Buterin argued that European and Ukrainian security depends on fundamentally transforming Russia.

He envisioned a state in which internal governance structures prioritize public welfare and economic prosperity over military aggression, thereby reducing the likelihood of future conflicts.

Buterin stressed that this transformation requires new leadership and novel ideas within Russia’s political opposition.

Sponsored

Sponsored

Drawing lessons from crypto, he noted that entrenched systems rarely yield progress without fresh strategies, experimentation, and inclusive participation. He framed this approach as a two-step process:

- First, Ukraine must receive every possible form of support to weaken the Russian military and compel a ceasefire.

- Second, after Putin, the focus should shift to empowering moderate factions in Russia willing to adopt reform, peace, and decentralized governance principles.

Buterin’s proposal reflects a growing intersection between technological governance models and international politics.

While blockchain-inspired methods have been tested primarily in digital networks, applying these concepts to national governance represents a radical, untested approach.

Nonetheless, the Ethereum co-founder’s perspective offers a novel lens on conflict resolution and state-building. It suggests that beyond diplomacy or military pressure, systemic innovation may be essential for lasting peace.

Crypto World

Crypto industry experts at Consensus see Asian institutions pivot toward stablecoins

Hong Kong — Institutional crypto participation across Asia is moving into a more mature phase as regulators establish clear frameworks for stablecoins and exchange-traded funds. Large players now favor market-neutral strategies and regulated vehicles over direct, directional exposure to digital assets.

Vicky Wang, president of Amber Premium, highlighted this shift during a panel discussion at Consensus Hong Kong. She noted that while transaction volumes reached $2.3 trillion by mid-2025, capital allocation remains cautious. “The institutional participation in Asia, I would say it’s real, but at the same time it’s very cautious,” Wang said. She observed that institutions prefer “market neutral and yield strategy” over aggressive directional bets.

Fakhul Miah, managing director of GoMining Institutional, pointed to the recent approval of ETFs and perpetuals in Hong Kong as a major driver for liquidity. He noted that even traditional “mega banks” in Japan are now working on stablecoin solutions. These developments allow traditional capital to enter the space through familiar structures. Miah explained that institutions must pass through “risk committees and operational governance structures,” which historically did not exist for onchain products.

The focus for many Asian institutions has shifted toward real-world asset tokenization and stablecoin settlement. Wendy Sun, chief brand officer at Matrixport, noted that while these topics are popular, there remains a gap in internal treasury adoption. “For the internal treasury-based stablecoin, we are still waiting for the standard to come out,” Sun said. She argued that the behavior of these institutions is becoming more “rule-based and scheduled” rather than pursuing short-term gains.

Wang concluded that the industry’s future rests on the convergence of artificial intelligence and digital assets. “In the future, digital assets would not be a just alternative asset class or an alternative financial system,” Wang said. “It will be the financial layer of the AI.”

Crypto World

Russia Weighs Support for Cuba Amid Fuel Crisis and U.S. Tariff Threats

TLDR

- Russia is exploring ways to aid Cuba, which is facing a severe fuel shortage.

- Russia emphasizes “constructive dialogue” with the U.S. over the situation in Cuba.

- The U.S. threatens sanctions on countries supplying oil to Cuba, escalating tensions.

- U.S. tariff revenue has surged by over 300%, reaching $124 billion for the year.

- The U.S. Supreme Court’s upcoming ruling on tariffs could impact the country’s fiscal health.

On Thursday, the Kremlin expressed its willingness to provide assistance to Cuba, which is grappling with a severe fuel shortage. In response to the growing crisis, Kremlin spokesperson Dmitry Peskov dismissed U.S. President Donald Trump’s tariff threats, stating that Moscow had limited trade with Cuba. Tensions continue to rise, as the U.S. threatens sanctions on any country supplying oil to the Caribbean island.

Kremlin Addresses Oil Supply for Cuba

The Kremlin confirmed that it was exploring options to aid Cuba with its escalating energy crisis. According to a local media report, Peskov acknowledged the strained relationship but assured that the Kremlin would not seek to escalate tensions.

Peskov emphasized the need for constructive dialogue between Russia and the U.S. regarding the situation. Cuba, already struggling under a 60-year U.S. trade embargo, is facing a deepening economic crisis exacerbated by a fuel shortage. Moscow’s support could play a pivotal role in alleviating some of Cuba’s immediate challenges.

Despite this, Russia has refrained from making any public commitments, citing the sensitivity of the matter. Peskov further added that such issues must be discussed discreetly due to their delicate nature. As Cuba’s energy crisis worsens, international airlines, including Air Canada, have already canceled flights to the island, underscoring the extent of the fuel shortage.

U.S. Tariff Revenue Surges Amid Ongoing Disputes

Meanwhile, U.S. tariff revenue has surged by over 300% in recent months, bringing in $30 billion in January alone. This sharp increase follows President Trump’s decision to impose tariffs on a wide range of goods. The tariff revenue for the year has already reached $124 billion, reflecting the aggressive trade policies pursued by the White House.

However, this rise in revenue comes as the U.S. waits for a crucial Supreme Court ruling on the legality of these tariffs. The Supreme Court has yet to issue its decision on the justification for the tariffs, with oral arguments held last November.

A ruling is expected soon, and a negative verdict could have implications for the U.S. economy. If the court finds the tariffs unjustified, the U.S. could be required to reimburse the duties collected, which would affect the country’s fiscal health.

As the U.S. faces this legal uncertainty, the tariff policy remains a key factor in shaping the nation’s economic outlook. Although tariff revenue has helped reduce the budget deficit by 26% compared to last year, the U.S. continues to struggle with its national debt. In January alone, interest payments on the debt totaled $76 billion, highlighting the ongoing financial strain.

Crypto World

US Credit Union Regulator Proposes Stablecoin Licensing Path

The United States National Credit Union Administration (NCUA) has laid out its first proposed rules under the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, detailing how subsidiaries of federally insured credit unions could apply to become federally supervised payment stablecoin issuers. This marks a tangible step toward setting a licensing and oversight framework for a niche of digital assets that regulators view as both a payments solution and a potential systemic risk. The proposal aligns with the NCUA’s broader mandate to supervise credit unions that collectively serve roughly 144 million members and manage about $2.38 trillion in assets as of mid-2025. If the rulemaking proceeds, issuers would need an NCUA-permitted payment stablecoin issuer (PPSI) license before issuing coins, and federally insured credit unions would face investment and lending restrictions related to PPSIs. The agency has also signaled that a forthcoming rule will implement GENIUS Act standards for PPSIs, addressing reserves, capital, liquidity, illicit finance controls, and information technology risk management.

The agency’s stance reflects a cautious yet orderly approach to stabilizing the regulatory ground for stablecoins issued through bank-like affiliates. The NPRM focuses on licensing architecture and investment limits, laying the groundwork for a regulated path to potential stablecoin services for credit union members. The policy landscape around stablecoins in the U.S. has evolved alongside ongoing discussions about the GENIUS Act’s broader technical standards, including soundness provisions and risk controls that would govern PPSIs. Notably, the draft emphasizes that any licensing framework would be built around separate supervised subsidiaries rather than direct issuance by insured depository institutions themselves. This structural choice mirrors a recurring policy design across U.S. banking and payments regulation, seeking to isolate stablecoin activities within regulated, auditable entities while preserving the safety and soundness of the parent institutions.

The draft is notable for its clock and openness provisions. A key feature is a 120‑day deadline to approve or deny an application once it has been deemed substantially complete. If the agency does not act within that period, the application would be deemed approved by default. The rule also ensures a level playing field by stating that an issuer’s choice to operate on an open, public, or decentralized network cannot be used as the sole reason to deny a PPSI application. In addition, the NPRM reiterates a core GENIUS Act design principle: insured depository institutions, including credit unions, would not issue payment stablecoins directly; rather, they would channel activities through separately supervised subsidiaries that meet uniform federal standards.

Stakeholders now have a 60‑day window from the Federal Register publication to comment on the proposed rule before the NCUA moves to finalize or revise the licensing framework. The proposal, in its current form, serves as a narrow but important first step in shaping licensing, oversight, and investment parameters for PPSIs. A second wave of rulemaking is anticipated to implement the GENIUS Act’s broader standards for PPSIs, including risk management and anti‑money‑laundering controls.

Public chain neutral and 120‑day clock

Two features stand out for the broader crypto market. First, the NCUA would be barred from denying a substantially complete application solely because a stablecoin is issued “on an open, public, or decentralized network,” language that explicitly prevents public blockchain issuance from being rejected on that basis alone. Second, once an application is deemed “substantially complete,” the agency would have 120 days to approve or deny it, and if the NCUA fails to act within that window, the application would be “deemed approved” by default.

The draft also implements a central GENIUS Act design choice: insured depository institutions, including credit unions, cannot issue payment stablecoins directly and must instead use separately supervised subsidiaries that meet uniform federal standards. For credit unions, that generally means routing activity through credit union service organizations and other qualifying entities that fall under NCUA’s jurisdiction as “subsidiaries of an insured credit union.” The document, however, is only a notice of proposed rulemaking. Stakeholders have 60 days from Federal Register publication to comment before the NCUA can finalize or revise the licensing regime.

The NPRM signals a cautious but deliberate approach to how traditional financial institutions might intersect with digital assets through regulated vehicles. While the GENIUS Act has been a focal point of debate among policymakers, this initial draft concentrates on licensing mechanics and investment boundaries, deliberately deferring the detailed standards to a forthcoming proposal. The NCUA’s posture suggests an intent to create a controlled pathway for any PPSI that seeks to serve members, rather than open the door to a broad, unregulated stablecoin issuance environment.

As the public comment period opens, market participants and industry observers will be watching for how the agency delineates eligibility criteria for PPSIs, how it defines “substantial completeness,” and how the licensing process interacts with other federal regulators. The regulatory cadence around stablecoins remains a dynamic frontier in U.S. financial policy, particularly as other jurisdictions pursue their own approaches to stablecoin governance and payments infrastructure.

For now, the rulemaking is narrowly scoped to licensing and investment limits. A forthcoming proposal will implement GENIUS Act standards and restrictions for PPSIs, including reserves, capital, liquidity, illicit finance safeguards, and IT risk management. The NCUA indicated in the notice that the GENIUS Act’s standards would provide a cohesive framework for the prudential oversight of PPSIs operating via insured credit unions’ subsidiaries.

What to watch next

- 60‑day comment period following Federal Register publication to shape the final rule.

- Release of the final PPSI licensing framework, including application procedures and eligibility criteria.

- Publication of the GENIUS Act–driven standards for PPSIs, covering reserves, capital, liquidity, and IT risk management.

- Any regulatory guidance on investments by credit unions in PPSIs and related vehicle structures through subsidiaries.

- Potential pilot programs or demonstrations of PPSI services within insured credit unions, subject to approvals.

Sources & verification

- NCUA press release: NC UA proposes rule permitting payment stablecoin issuer applications — https://ncua.gov/newsroom/press-release/2026/ncua-proposes-rule-permitted-payment-stablecoin-issuer-applications

- NCUA press release: NC UA releases second quarter 2025 credit union system performance data — https://ncua.gov/newsroom/press-release/2025/ncua-releases-second-quarter-2025-credit-union-system-performance-data

- GENIUS Act overview and implications — https://cointelegraph.com/learn/articles/genius-act-how-it-could-reshape-us-stablecoin-regulation

- Magazine coverage: Bitcoin stablecoins showdown looms as GENIUS Act nears — https://cointelegraph.com/magazine/bitcoin-stablecoins-showdown-looms-genius-act-nears/

Crypto World

Another 80% Crash Comes Next?

Are SHIB bulls about to face another massive setback?

Shiba Inu (SHIB) has lately been a pale shadow of its former self, with its valuation tumbling by double digits in a matter of weeks.

According to some analysts, the bad days for the bulls might be just starting.

Devastating Crash Ahead?

As of press time, SHIB trades at around $0.000006127, representing a 20% decline on a 14-day scale. Its market cap slipped to around $3.6 billion, making it the 30th-biggest cryptocurrency. Recall that it ranked much higher in the spring of last year when the capitalization neared $10 billion.

One popular analyst who touched upon the meme coin’s downfall is Ali Martinez. He claimed that the recent drop below $0.00000667 could have opened the door to a much deeper collapse to as low as $0.00000138. Such a move south would represent a whopping 77% crash from current levels.

Several key indicators also suggest that SHIB’s price could be headed for a further plunge. Over the past 24 hours, the Shiba Inu team and community have burned a negligible 483 coins, representing a 99% decline from yesterday’s figure.

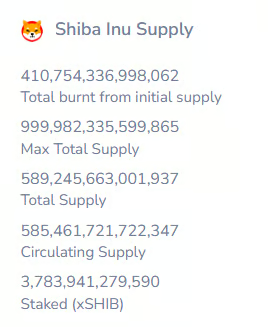

The ultimate goal of the mechanism, adopted in 2022, is to reduce the meme coin’s overall supply, potentially making it more valuable in time (assuming demand remains constant or heads north). Data shows that the current circulating supply is roughly 585.46 trillion tokens after more than 410.7 trillion SHIB have been scorched over the years.

Meanwhile, Shibburn – the X account spreading information about the recent token burns – has been inactive lately. The last update on the matter, from January 9, showed that the daily and weekly burn rates have been unimpressive.

You may also like:

Shiba Inu’s Relative Strength Index (RSI) supports the bearish scenario. Over the past few hours, the metric’s ratio exceeded 70, indicating the asset is overbought and could be gearing up for a pullback. The technical analysis tool ranges from 0 to 100, where readings between 30 and 70 are considered neutral, whereas anything below 30 may be viewed as a buying opportunity.

Can the Bulls Return?

Contrary to Martinez’s grim prediction, the analyst who goes by the X moniker Vuori Trading argued that SHIB may explode in the foreseeable future.

They claimed that the asset remains in the “bear trap” stage, characterizing the setup as “pure manipulation before shooting higher.” The analyst set a target of “at least” $0.00014, which would be an all-time high and represent a staggering 2,200% increase from the ongoing valuation.

Despite the recent price plunge, SHIB investors don’t appear to be rushing to sell. In fact, CryptoQuant’s data shows that the number of coins stored on exchanges has declined over the past month. This trend signals a shift toward self-custody and reduces immediate selling pressure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Hong Kong Crypto Sentiment Stays Bullish as $2 Trillion Market Crash Tests Asia

The rest of the world is panic-selling into a $2 trillion wipeout, but Hong Kong isn’t blinking.

While Bitcoin hovers precariously around $67,000, down nearly 50% from its October highs, institutional players in Asia’s financial capital are doubling down on infrastructure rather than fleeing the liquidity crisis.

It sounds counterintuitive, given the carnage, seeing altcoins decimated and liquidity described as “perilously patchy” by Bloomberg, but the smart money in Hong Kong is playing a different game entirely.

Key Takeaways

- Bitcoin trades near $67,000, down 47% from peaks, while wider crypto markets suffer a $2 trillion rout.

- Hong Kong officials reaffirmed support at Consensus 2026, citing $3.71 billion in tokenized deposits.

- Institutional focus in HK contrasts sharply with South Korean retail traders currently fleeing the market.

Is Asia, Especially Hong Kong, Decoupling from the Crash?

To understand the disconnect between price action and sentiment, look at who is actually buying.

While retail traders globally are capitulating, Hong Kong is leveraging a regulatory framework years in the making.

The city has spent the last three years positioning itself as a hub for regulated digital assets, and that investment is creating a buffer against current volatility.

While U.S. markets flounder under uncertainty, we are seeing similar patterns of institutional positioning from major players on Wall Street who remain invested despite the drawdown. In Hong Kong, this resolve is policy-backed.

Hong Kong Chief Executive John KC Lee, yesterday, reaffirmed the city’s commitment to a “sustainable digital asset ecosystem” during Consensus Hong Kong 2026.

This isn’t just talk: the city’s Securities and Futures Commission (SFC) is pushing ahead with licensing regimes that institutionalize the sector, regardless of the spot price of Bitcoin.

The $3.71 Billion Safety Net

The numbers coming out of the region paint a starkly different picture than the red candles on your charts.

While retail sentiment is crushed, Financial Secretary Paul Chan Mo-po revealed that Hong Kong banks are on track to offer tokenized deposit services worth US$3.71 billion by the end of 2025.

Compare this to the situation in South Korea. There, retail traders are bailing on crypto’s riskiest trades as alts collapse.

This mirrors the accumulation behavior we are tracking elsewhere, where large entities are controlling supply during price crashes to strengthen positions.

Even amid this crash, analysts are identifying the best crypto to buy, betting that Hong Kong’s regulatory clarity will draw serious volume once the dust settles.

Discover: The best crypto to diversify your portfolio

What the Hong Kong Situation Means for Global Regulation

Hong Kong is effectively calling the bottom by refusing to halt progress. The SFC is advancing legislative proposals for custodian licensing in early 2026, focusing on safeguarding private keys. This is the kind of clarity institutions need to deploy capital.

It’s a sharp contrast to the West, where stablecoin talks have stalled amid banking yield restrictions. Hong Kong’s approach of integrating tokenized assets directly into banking could force other jurisdictions to speed up or risk losing the center of gravity for crypto finance to Asia.

Solana Foundation President Lily Liu summed it up best at Consensus, noting that “Asia underpinned Bitcoin in any aspect.”

If Hong Kong holds firm while the $2 trillion crash plays out, it may emerge as the de facto capital for the recovery.

Discover: What is the next crypto to explode?

The post Hong Kong Crypto Sentiment Stays Bullish as $2 Trillion Market Crash Tests Asia appeared first on Cryptonews.

Crypto World

Is the Bottom In for ETH? $1.8K Support Holds Key to Recovery

Following the aggressive sell-off toward the $1.8K demand region, Ethereum stabilised and produced a corrective rebound. However, this recovery lacks strong momentum and is unfolding within a broader bearish structure. The current price behaviour indicates a potential consolidation between a well-defined demand zone below and an overhead supply area that continues to cap upside attempts.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH remains within a descending channel, with the price trading below both the 100-day and 200-day moving averages, which are now sloping downward and serving as dynamic resistance. The recent breakdown below the prior major swing low around $2.4K accelerated the sell-off, confirming bearish continuation and triggering a move toward the $1.8K demand zone.

The rebound from this crucial zone shows that buyers are defending this key historical support, which previously acted as an accumulation area. However, the price is currently trading at approximately $2K and remains below the internal resistance near $2.2K.

As long as Ethereum remains between $1.8K and $2.2K, the market is likely to consolidate within this range. A daily close below $1.8K would expose the next lower liquidity pocket toward $1.6K, while a reclaim of $2.2K could open the path toward the $2.6K supply region.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the price action reveals a compression structure following the sharp decline. Ethereum formed a local bottom near $1.8K and then produced a higher low, creating a short-term ascending trendline against the broader downtrend. At the same time, a descending resistance line from the recent swing high continues to cap price, forming a tightening range.

The immediate supply lies around $2.2K, where the previous breakdown occurred, while the nearest demand remains at $1.8K. With price hovering near $1,960, Ethereum appears to be consolidating between these two zones. A breakout above $2.2K on the 4-hour chart would signal short-term bullish continuation toward $2.4K, whereas a breakdown below $1.8K would likely invalidate the consolidation scenario and resume the dominant bearish trend.

Overall, the structure remains bearish on higher timeframes, but in the short term, Ethereum is compressing between $1.8K demand and $2.8K supply, and the next impulsive move will likely emerge from a decisive break of this range.

Sentiment Analysis

The ETH liquidation heatmap over the last 6 months provides critical confirmation of the bearish technical structure. A significant concentration of liquidity has been built around and just below the $2K level, which has recently acted as a strong magnet for price. The sharp sell-off into this area confirms that downside liquidity was actively targeted, resulting in a large flush of leveraged long positions.

Despite this liquidation event, the heatmap still reveals residual liquidity pockets extending slightly below current price levels, indicating that the market may not have fully exhausted its downside objectives yet. These remaining clusters continue to exert gravitational pull on price, especially if spot demand remains weak and derivatives positioning rebuilds on the long side too quickly.

That said, the intensity of liquidations around the $2K zone suggests that a meaningful portion of forced selling has already occurred. This reduces immediate liquidation pressure and explains the short-term stabilization seen after the drop. However, from an on-chain perspective, this behavior supports consolidation or corrective rebounds, not a confirmed trend reversal, unless liquidity interest decisively shifts back above current levels.

In summary, on-chain data aligns closely with the technical picture: Ethereum is still operating in a bearish liquidity-driven environment, with downside risks remaining active as long as price fails to reclaim key supply zones and attract sustained spot demand.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Bitcoin layer-2 builders pitch BTCFi as the next institutional unlock

Leaders from Citrea, Rootstock Labs and BlockSpaceForce argued that bitcoin’s scaling layers are less about throughput and more about turning the asset into a programmable financial base layer.

Crypto World

YZi Labs is backing AI, biotech and Web3

In a market where crypto cycles rise and fall while AI feels inevitable and biotech plays out over decades, YZi Labs is deliberately positioning itself across multiple technological frontiers.

The unifying thesis is “to focus on the things haven’t happened yet, and to focus on the people who are there to dream them up and to make it happen,” head of YZi Labs Ella Zhang said at Consensus Hong Kong 2026 on Thursday.

YZi, formerly Binance Labs, invests across AI, biotech and Web3, balancing time horizons, particularly as crypto “feels very cyclical at the moment,” while AI adoption accelerates, Zhang said.

“Focus on user demand. Is there real demand happen or the demand is imagined?” she said. Instead of chasing narratives, the firm pressures founders on product fundamentals: what pain point is being solved, how distribution works, and whether there are early signals that the problem truly matters.

That philosophy also shapes capital deployment. “We’re not obligated to deploy all the capital we have,” Zhang said, emphasizing that checks follow conviction, not the other way around. YZi aims to be an early backer but continues supporting companies across multiple rounds, offering mentorship and strategic resources alongside funding.

On infrastructure, Zhang pointed to BNB Chain’s scale as a natural distribution layer, with “thousands of protocols” and “hundreds of millions of users” forming a ready ecosystem for new applications. At the same time, YZi is “very, very open for the founders to fail and welcome them to come back,” she said, framing failure as part of long-term founder development.

As for product trends, Zhang called stablecoins the first true mass-market application beyond trading. “Stablecoins are currently a very good application for crypto to go to mass adoption,” she said, citing improving compliance frameworks globally. Still, she sees further work ahead in custody, exchange infrastructure and on-chain FX before stablecoins fully mature.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports14 hours ago

Sports14 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World15 hours ago

Crypto World15 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video11 hours ago

Video11 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month