Crypto World

The Protocol: Zora moves to Solana

Network News

ZORA MOVES FROM BASE TO SOLANA: On-chain social platform and decentralized protocol Zora is making a decisive shift beyond its non-fungible tokens (NFT) and creator roots with the launch of “attention markets” on Solana, a product that allows users to trade tokens tied to internet trends, memes and cultural moments. The feature, unveiled Feb. 17, lets anyone create a new market for 1 SOL. Once live, users can buy and sell positions on whether a topic will gain or lose traction across social media. Instead of wagering on elections or macro data, traders speculate on buzz itself — such as hashtags, viral narratives, even broad themes like “AI girlfriend” or “bitcoin.” The design leans heavily into Solana’s strengths. Fast block times and low transaction costs make it easier to support rapid price updates and frequent trading, which are essential for markets built around fleeting online momentum. Initial activity was limited, however. The primary “attentionmarkets” token briefly touched roughly $70,000 in market capitalization, with around $200,000 in trading volume. Most other trend markets struggled to attract meaningful liquidity, with few crossing the $10,000 mark on their first day. Percentage swings were sharp, though largely driven by thin order books rather than sustained demand. Zora was among the breakout applications on Coinbase’s Layer 2 Base network in the past few years. It launched its ZORA token there in April and helped roll out Creator Coins tied to Base profiles in July, a push that briefly helped Base overtake Solana in daily token creation. Creator coins are tokens tied to an individual creator’s online profile, brand or community. Think of them as tradable “shares” in a person’s internet presence. On platforms like Zora and Base, a creator coin could be automatically generated from a user’s profile. Fans could buy the coin to signal support, gain social clout, or speculate that the creator’s popularity would grow. As more people bought in, the price could rise, and interest faded, it could fall. As such, some in the Base community saw the new “attention markets” product as a pivot away from that momentum. — Shaurya Malwa Read more.

EF EXECUTIVE-DIRECTOR TO LEAVE: Tomasz Stańczak, co-executive director of the Ethereum Foundation (EF), announced he will step down from his leadership role at the end of February 2026, marking a notable shift in the organization’s executive team. Stańczak, who has co-led the foundation alongside Hsiao-Wei Wang since early 2025, said in a blog post that he believes the foundation and the broader Ethereum ecosystem are “in a healthy state” as he prepares to hand over the reins to Bastian Aue, who will take the co-executive director role alongside Wang. Stańczak’s tenure began at a turbulent time for the EF. He was brought aboard following the transition of long-time executive director Aya Miyaguchi into a new leadership position amid mounting community criticism that the foundation wasn’t doing enough to aggressively push the Ethereum ecosystem forward. At the time, detractors pointed to a perceived disconnect between the EF and developers, including conflicts of interest, clashes over strategic direction and frustrations about ETH’s price performance. Such criticisms helped spur a broader leadership restructuring. While Stańczak stressed his confidence in the team’s ability to carry forward the EF’s mission, he also signaled his intention to remain involved in the ecosystem. — Margaux Nijkerk Read more.

XRP LEDGER RELEASES MEMBER-ONLY DEX: The XRP Ledger has activated a new “Permissioned DEX” amendment, a technical upgrade designed to let regulated institutions trade on XRPL without opening markets to everyone. The change, known as XLS-81, allows the creation of permissioned decentralized exchanges that work like XRPL’s existing built-in DEX, but with a key difference. A permissioned domain can restrict who can place offers and who can accept them, creating a gated trading venue where participation is tied to compliance requirements such as KYC and AML checks. Think of it as a ‘members only’ marketplace, while still keeping the trading mechanics native to the ledger. The feature is aimed at banks, brokers and other firms that may want onchain settlement and liquidity but cannot interact with fully open DeFi markets. For these players, the ability to control access is not optional; it is a minimum requirement. The activation also adds to a growing set of “institutional DeFi” primitives XRPL has been rolling out this month. Token Escrow, or XLS-85, went live last week, extending XRPL’s native escrow system beyond XRP to all trustline-based tokens and Multi-Purpose Tokens, including stablecoins such as RLUSD and tokenized real-world assets. — Shaurya Malwa Read more.

ETHEREUM MEMBERS REVIVE NEW VERSION OF THE DAO: In the summer of 2016, the Decentralized Autonomous Organization, known as the DAO, became the defining crisis of Ethereum’s early years. A smart contract exploit siphoned millions of dollars’ worth of ether (ETH) from that initial project, and the community’s response — a contentious hard fork to recover those funds, splintered the original chain from the current one, leaving the old chain behind, known as Ethereum Classic. The DAO was once the greatest crowdfunding effort in crypto’s history, but faded into a cautionary tale of governance, security, and the limits of “code is law.” Now, nearly a decade later, that story has taken an unexpected turn. What was lost, or rather, left untouched, is being repurposed as a ~$150 million (at today’s prices) security endowment for the Ethereum ecosystem. The endowment, now known as TheDAO Security Fund, will stake some of the 75,000 dormant ether (ETH) and deploy the yield through community-driven funding rounds to support Ethereum security research, tooling and rapid-response efforts, while keeping claims open for any remaining eligible token holders. At the center of this story is Griff Green, one of the original DAO curators and a veteran of Ethereum decentralized governance. “When the DAO hack happened [in 2016], obviously, I jumped into action and basically led everything but the hard fork,” Green said of assembling the white hat group that rescued funds on the original Ethereum chain. “We hacked all these hackers. It was straight up DAO wars”. That effort, alongside others, helped salvage funds that might otherwise have been lost forever. At the time, the hard fork restored roughly 97% of the DAO’s funds to token holders, but left a small fraction, roughly 3%, in limbo. These “edge case” funds came from quirks of the original smart contracts: people who paid more than expected, those who burned tokens to form sub-DAOs, and other anomalies that didn’t cleanly map back. Over time, that leftover balance, once only worth a few million, ballooned into something far more significant due to ether’s appreciation. “The value of the funds we control has grown dramatically… well over 75,000 ETH,” a blog post for the new DAO fund states. — Margaux Nijkerk Read more.

In Other News

- A recent poll of 1,000 American investors in digital assets found that over half are scared they’ll face an IRS tax penalty this year as new transparency rules governing crypto exchanges take effect. The data collected at the end of January by crypto tax platform Awaken Tax canvassed U.S. holders’ concerns about a radical shift from self-disclosure to automatic reporting of transactions. This has been enacted through the introduction of the “Digital Asset Proceeds From Broker Transactions,” or Form 1099-DA, which tens of millions of Americans will be made aware of over the next month or so. The new rules are designed to clamp down on crypto tax evasion and compel brokers, such as crypto exchange Coinbase (COIN), to report all sales and exchanges of digital assets that occurred in 2025 to the tax agency. The aim is to give tax authorities a clear view of investor gains and losses by opening up customer data inside exchanges for the first time, allowing the IRS to compare what crypto brokers report with what taxpayers file. While the goal is to remove any margin of error, the rules are a “blunt instrument,” created by legislators who know nothing about crypto, according to Awaken Tax founder Andrew Duca. “It means crypto is being treated like stocks, but it doesn’t behave in that way. Real crypto users will move assets between multiple wallets and interact with decentralized finance (DeFi) protocols, using pretty complex trading strategies,” Duca said. — Ian Allison Read more.

- Crypto venture firm Dragonfly Capital completed a $650 million fourth fund, marking one of the largest raises in the sector at a time when many blockchain-focused VCs are struggling, Managing Partner Haseeb Qureshi said. “It’s a weird time to celebrate,” Qureshi wrote on a social media post, describing low spirits and “the gloom of a bear market” for crypto. However, he noted that Dragonfly has historically raised capital during downturns, including the 2018 ICO crash and just before the 2022 Terra collapse, ‘vintages,’ he said, ultimately became the firm’s best performers. In September, the firm said it aimed to raise $500 million for its fourth fund, targeting early-stage projects. It has not yet identified any of them. In May 2023, Dragonfly Capital raised $650 million for its third crypto fund for later-stage companies. — Olivier Acuna Read more.

Regulatory and Policy

- Hyperliquid (HYPE), a blockchain-based exchange that processed more than $250 billion in perpetual futures trading last month, has launched a U.S. lobbying and research arm to shape how lawmakers regulate decentralized finance (DeFi). The Hyperliquid Policy Center, a Washington, D.C.-based nonprofit, will focus on regulatory frameworks for decentralized exchanges, perpetual futures and blockchain-based market infrastructure, according to a press release. Jake Chervinsky, a prominent crypto lawyer and former policy head at the Blockchain Association, will serve as founder and CEO. The launch comes as Congress and federal agencies debate how to oversee crypto trading platforms and derivatives markets. Perpetual futures, which allow traders to hold leveraged positions without an expiration date, are widely used on offshore venues but remain a gray area under U.S. law. The arrival of a new group also represents just the latest entrant into a Washington crypto-policy scene that’s jammed with similar organizations, including the DeFi Education Fund and Solana Policy Institute, in addition to the broader groups such as the Digital Chamber, Blockchain Association and Crypto Council for Innovation. And the new organization lands as negotiation is well underway on Senate legislation that may set U.S. DeFi policy. — Kristzian Sandor Read more.

- The legal challenges from state governments against certain aspects of prediction markets such as Polymarket and Kalshi received a sharp rebuke from U.S. Commodity Futures Trading Commission Chairman Mike Selig, who is arguing that his federal agency has jurisdiction, not the states. “To those who seek to challenge our authority in this space, let me be clear: we will see you in court,” Selig said in a video statement posted on social media site X. He said his agency filed a legal brief in court to back up the federal role as the leading regulator over this corner of the derivatives markets. “The CFTC has regulated these markets for over two decades,” he said. “They provide useful functions for society by allowing everyday Americans to hedge commercial risks like increases in temperature and energy price spikes; they also serve as an important check on our news media and our information streams.” — Jesse Hamilton Read more.

Calendar

- Feb. 18-21, 2026: EthDenver, Denver

- Feb. 23-24, 2026: NearCon, San Francisco

- Mar. 24-26, 2026: Digital Asset Summit, New York City

- Mar. 30-Apr. 2, 2026: EthCC, Cannes

- Apr.15-16, 2026: Paris Blockchain Week, Paris

- Apr. 29-30, 2026: Token2049, Dubai

- May 5-7, 2026: Consensus, Miami

- Sept. 29-Oct.1, 2026: Korea Blockchain Week, Seoul

- Oct. 7-8, 2026: Token2049, Singapore

- Nov. 3-6, 2026: Devcon, Mumbai

- Nov. 15-17, 2026: Solana Breakpoint, London

Crypto World

Bitcoin Still Being Bought, Just Much More Cautiously: Report

Short-term Bitcoin buyers are becoming cautious, and accumulation is slowing even as net positions stay positive.

Bitcoin climbed above $126,000 in early October and recently crashed to $60,000 before a modest recovery near $68,000. Despite the brutal swing, many entities are still buying the asset, betting on a much-anticipated price appreciation.

But a certain cohort of BTC holders has reduced this pace.

Demand Deceleration

Data shared by Alphractal revealed that the Short-Term Holder Net Position Change over 90 days is declining, despite remaining in positive territory. This means that while short-term holders are still accumulating Bitcoin, the pace of accumulation has slowed sharply in recent days.

According to the analytics platform, this deceleration points to weakening short-term demand momentum and has historically preceded periods of market consolidation, increased volatility, or broader regime transitions.

Against this backdrop, Alphractal founder Joao Wedson said that recent institutional buying has not translated into stronger short-term holder demand.

“Even with the news of Strategy accumulating and other institutional entities increasing their positions, Short-Term Holders are not accumulating at the same pace as they were 90 days ago. Analyzing a few isolated entities is not enough. The correct approach is to evaluate the entire Bitcoin blockchain to understand the true underlying demand”

Whale Holdings Differ

Separate analysis from CryptoQuant points to a contrasting trend among large Bitcoin holders. It found that whale accumulation has increased by more than 200,000 BTC.

Although whale inflows to exchanges have risen recently, which is often associated with short-term selling activity, their overall holdings have continued to grow. To capture a more medium-term perspective, the analysis tracks whale-held supply using monthly averages rather than short-term flows. After this metric fell sharply to nearly -7% on December 15, whale behavior appears to have changed over the past month, as evidenced by holdings increasing by 3.4%.

You may also like:

During this period, the amount of Bitcoin held by whales rose from around 2.9 million BTC to over 3.1 million BTC. The last time an accumulation of this scale occurred was during the April 2025 market correction, when whale buying helped absorb selling pressure and Bitcoin’s advance from $76,000 to $126,000. CryptoQuant explained that the crypto asset is currently consolidating almost 46% below its most recent all-time high. Hence, some whales may be taking advantage of this opportunity.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

HBAR Bears Face $4.9 Million Squeeze as Price Direction Shifts

Hedera has posted a muted recovery in recent sessions. HBAR price remains constrained by cautious sentiment across the broader cryptocurrency market. Uncertainty in Bitcoin and macro conditions continues to cap upside attempts.

However, bearish traders may need to monitor changing signals. Derivatives positioning and capital flow indicators suggest the current balance could shift.

Sponsored

Hedera Traders Could Be In Trouble

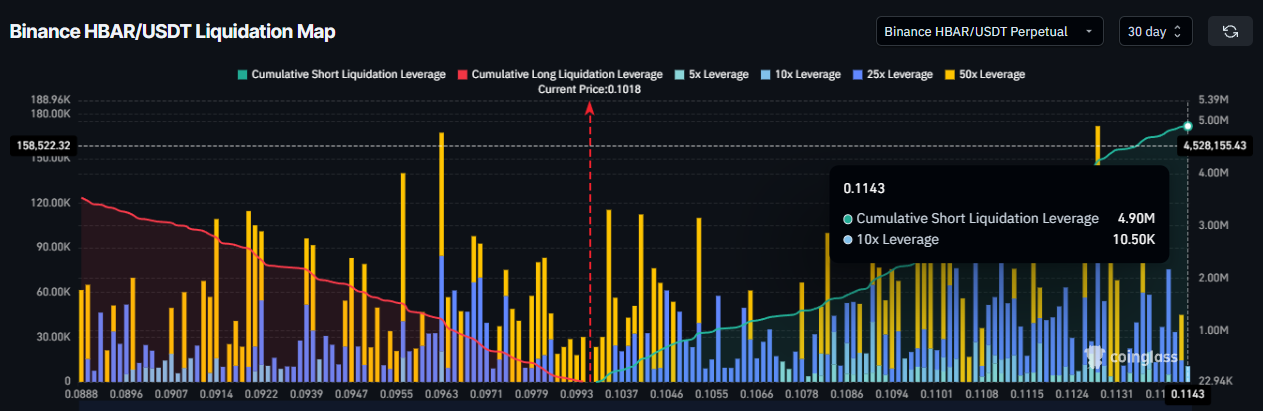

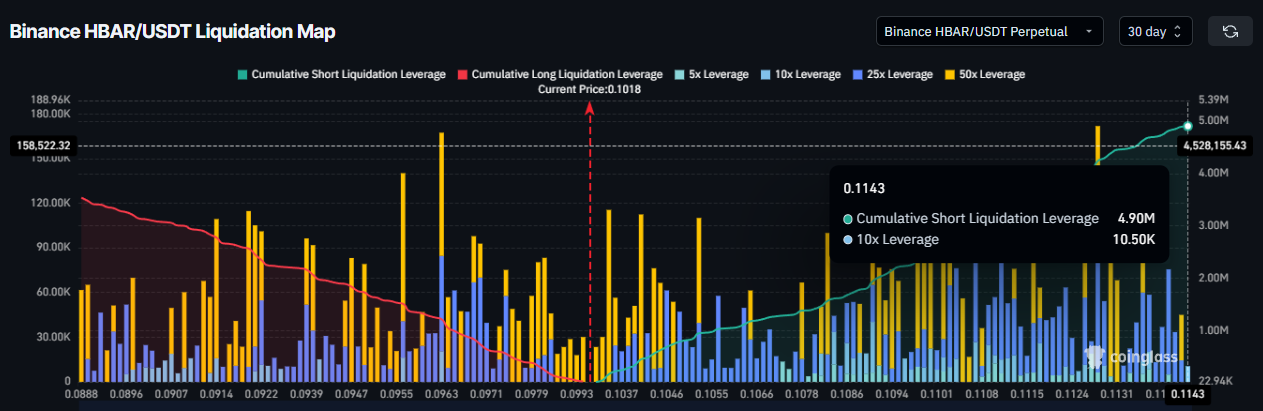

HBAR is currently experiencing strong bearish positioning in the futures market. Traders have opened a notable number of short contracts, reflecting expectations of further downside. The liquidation map highlights that positions are skewed toward bears at current levels.

Data shows that HBAR bears could face approximately $4.9 million in liquidations if the price crosses the $0.1143 mark. Such forced liquidations can trigger rapid upside volatility. When short positions unwind, buying pressure increases as traders close contracts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

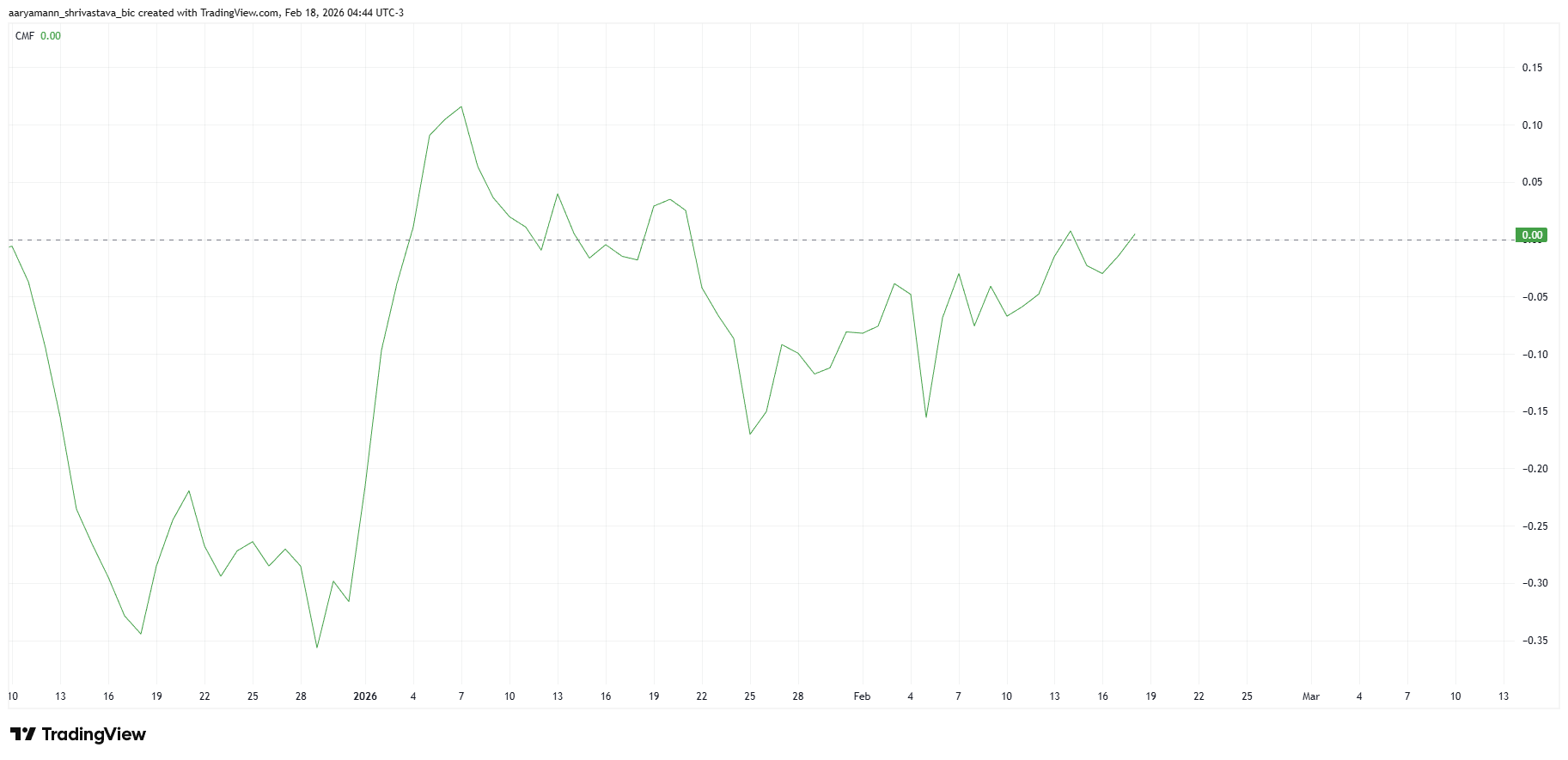

The Chaikin Money Flow indicator offers additional insight into capital movement. CMF measures inflows and outflows to assess whether buyers or sellers dominate. The indicator is currently rising, although it remains at the zero line.

Sponsored

An upward slope at zero suggests that outflows are at par with the inflows. However, the gap will likely diminish as inflows rise. Declining outflows often precede a shift toward net inflows. If this transition occurs, HBAR could gain the support needed for a short-term recovery.

Bitcoin Is Unhelpful

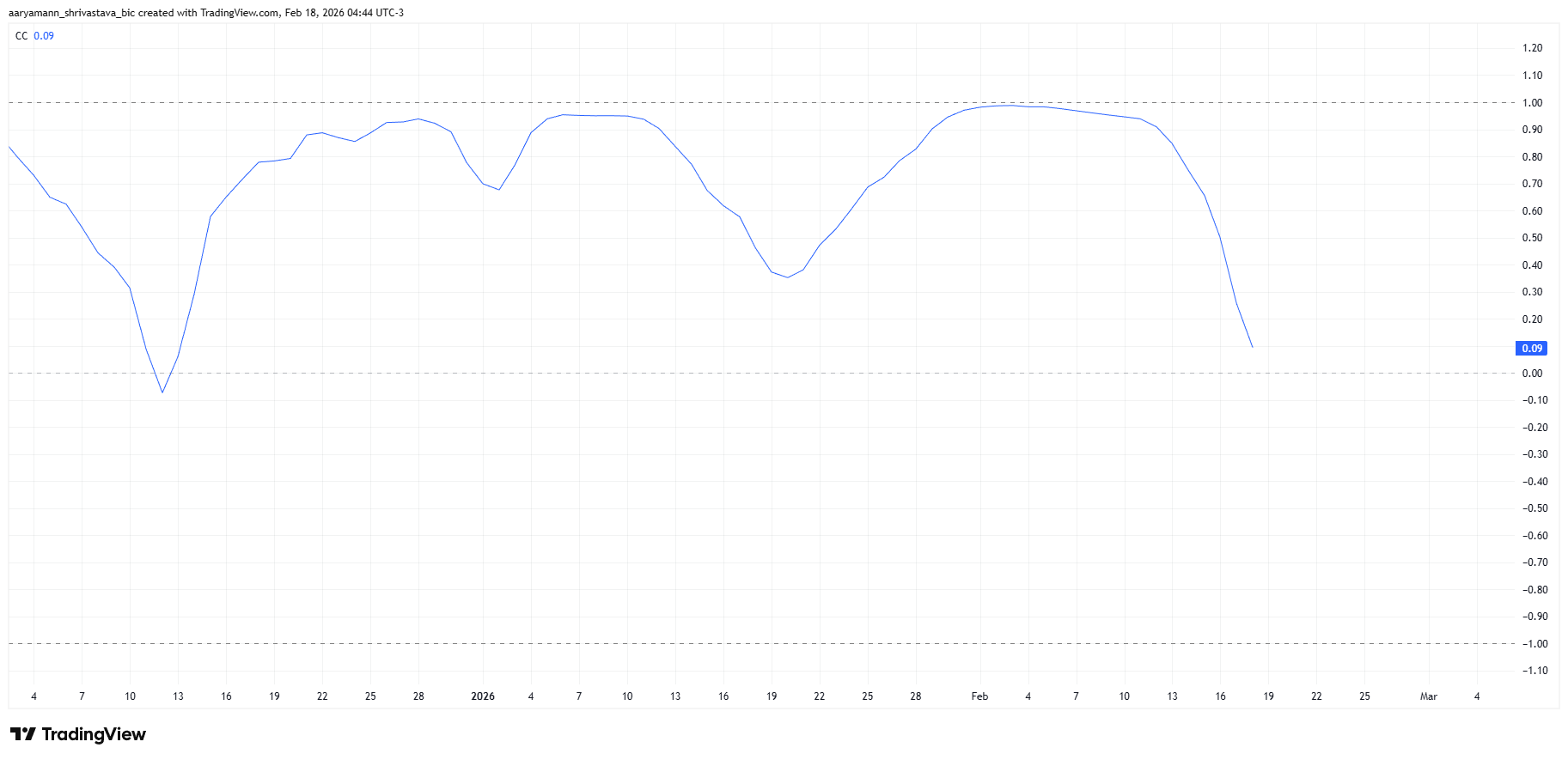

Correlation trends also support a potential shift. HBAR’s correlation with Bitcoin has declined in recent weeks. The current coefficient has dropped to 0.09, signaling weaker alignment with the crypto market leader, inching closer to completely dissociating with Bitcoin.

Sponsored

Reduced correlation can benefit altcoins during periods of Bitcoin uncertainty. If HBAR decouples further, price action may reflect investor-specific demand rather than broader market weakness. This flexibility could allow HBAR to chart an independent recovery path.

HBAR Price Has a Few Barriers To Breach

HBAR is trading at $0.1019 at the time of writing. The altcoin remains above the key $0.0961 support level at the 38.2% Fib line. However, it faces resistance at $0.1035, which aligns with the 50% Fibonacci retracement. This level currently caps upward momentum.

Sponsored

Flipping $0.1035 into support would mark a short-term breakthrough. Combined with declining outflows, this shift could fuel a recovery rally. HBAR would then target $0.1109 at the 61.8% Fibonacci.

This level is considered a critical support for an asset, and flipping it would likely trigger stronger buying among the investors, pushing the HBAR price higher.

This would bring HBAR past $0.1143, a level that threatens $4.9 million in shorts liquidations. Sustained strength could extend gains toward $0.1215 and $0.1349 eventually, helping recover year-to-date losses.

If bullish signals fail to materialize, consolidation may continue. Persistent outflows would limit breakout attempts. A breakdown below $0.0961support could expose HBAR to further downside near $0.0870. Such a move would invalidate the near-term bullish outlook and reinforce bearish control.

Crypto World

Kraken Acquires Tokenization Platform Magna Ahead of Potential IPO

Payward, the parent company of cryptocurrency exchange Kraken, has acquired tokenization platform Magna, expanding the company’s infrastructure.

Kraken said Wednesday the acquisition would allow Magna to operate “as a standalone platform, powered by” the crypto exchange. The company’s announcement said Kraken would use the platform for “onchain and offchain vesting, white-label token claims, custody and escrow workflows, specialized staking functionality” and other functions.

“Joining Kraken gives us the resources to support existing and new clients with institutional-grade infrastructure, deeper liquidity, and global distribution,” said Magna CEO Bruno Faviero.

According to Kraken, Magna serves more than 160 clients with a peak total value locked of $60 billion in 2025. The acquisition is the latest move by the exchange this month, following an integration with ICE Chat, and its move to sponsor “Trump Accounts” under an initiative pushed by US President Donald Trump.

Related: Kraken parent Payward revenues jump 33% as crypto traders pile in

Kraken submitted a confidential initial public offering filing with the US Securities and Exchange Commission in November, signaling a potential IPO in the future. The company reported $2.2 billion in adjusted revenue for 2025.

In 2025, Payward acquired crypto native prop company Breakout, futures trading platform NinjaTrader, derivatives trading platform Small Exchange and software company Capitalise.

Other crypto companies mulling US IPOs in 2026

Crypto hardware wallet provider Ledger, headquartered in France, was reportedly discussing a potential public offering in the United States, with a valuation of $4 billion. Digital asset custodian Copper, based in London, was also reportedly considering a similar move into the US markets, while Securitize, a tokenization platform, reported in January that the company’s revenues were up over 840%, in an SEC filing ahead of plans to go public.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

What’s Next for SUI? $0.95 Weekly Oversold RSI Triggers Setup Phase

TLDR:

- SUI is trading near $0.95, sitting just below Weekly Hypertrend resistance positioned around the $1.00 level.

- The weekly RSI has entered oversold territory, with approximately 50% of the October 10 liquidation wick now filled.

- Past weekly oversold signals for SUI led to expansions of 503% in October 2023 and 837% in August 2024 respectively.

- The Genesis AVWAP near $2.00 defines long-term macro positioning, while reclaim and volume confirmation remain the key requirements.

SUI is drawing renewed attention from analysts as the asset trades near $0.95. The token sits just below a key Weekly Hypertrend level around $1.00.

Market observers note that the RSI has entered oversold territory on the weekly chart. Early momentum divergence signals are beginning to appear.

The broader macro structure remains upward sloping since genesis. Traders are now watching for confirmation before positioning.

Technical Levels Point to a Compressed Setup

SUI is currently trading just below the Weekly Hypertrend resistance near $1.00. This level has acted as a structural ceiling in recent price action.

The RSI entering oversold territory on the weekly timeframe adds weight to the current setup. Analysts are watching whether momentum divergence will develop into a confirmed reversal signal.

According to market commentary from eye zen hour, approximately 50% of the October 10 liquidation wick has now been filled. This kind of wick fill often reflects a controlled recovery in price structure.

On-balance volume, or OBV, remains a key indicator to monitor at this stage. A curl back above its moving average could support the case for trend continuation.

The Genesis AVWAP sits near the $2.00 level and continues to define long-term positioning for SUI. This anchored volume-weighted average price from genesis serves as a macro reference point.

Price remains well below that level, meaning there is room for expansion if structure confirms. Traders are treating the $2.00 area as a longer-term target, not an immediate one.

Eye zen hour noted in a recent post that the current phase is “setup phase, not breakout phase.” That framing keeps expectations grounded without dismissing the structure building beneath price.

Until a Weekly Hypertrend reclaim occurs with participation, the setup remains unconfirmed. This distinction is important for risk management at current levels.

Historical Oversold Signals Offer Raw Data for Context

SUI has produced weekly oversold readings before, and the outcomes were notable both times. The October 2023 oversold signal was followed by a price expansion of 503%.

The August 2024 signal led to an 837% move higher from the oversold condition. These figures are cited as raw historical data, not as forward projections.

Eye zen hour was clear in stating these are “not predictions, just raw data.” That framing separates observation from speculation, which matters in volatile markets.

Still, the historical context gives traders a framework for understanding how the asset has behaved. Pattern recognition remains one tool among many in technical analysis.

The macro structure for SUI since genesis continues to slope upward, according to the analysis. Momentum is currently stretched to the downside, and structure appears compressed.

These two conditions together often precede volatility expansion in either direction. Confirmation through reclaim and volume participation remains the key requirement before any directional bias is established.

Crypto World

Dogecoin price tests $0.1 as this chart pattern hints at possible rebound

- Dogecoin struggles below key moving averages, signaling weak short-term trend.

- A cup and handle pattern is forming, hinting at a potential breakout if the resistance breaks.

- Support lies near $0.08, with higher volume needed for a sustained upward move.

Dogecoin is hovering around the $0.10 mark after a shaky month that saw the price dip over 20%.

The popular meme coin has struggled to hold momentum, with trading volumes showing signs of weakness.

Even so, there are hints in the charts that a rebound could be forming.

Technical analysis

Looking at the moving averages, DOGE is currently below the 5-day, 10 and 20-day averages.

This typically signals that the short-term trend is weak.

Traders often watch for the price to climb above these averages as an early sign of bullish momentum.

Right now, resistance is in the $0.105–$0.107 range.

A break above this level would be an important signal for those hoping for a recovery. The MACD indicator is also showing mixed signals.

The MACD line has moved above the signal line despite both being in the negative, and the histogram has turned positive, suggesting that buyers are beginning to step in after a period of inactivity.

However, volume is still modest. A strong breakout would require significantly more trading activity than the roughly $33 million seen recently.

Support remains solid at around $0.08, which has already acted as a bounce point.

This level has prevented further sharp declines and could continue to anchor the price if bearish pressure returns.

Cup and handle pattern points to possible upside

On the daily chart, Dogecoin is forming a classic Cup and Handle pattern.

The Cup bottomed near $0.08 and then rallied toward $0.11.

The Handle is now forming near the top of the Cup, consolidating just below resistance.

This formation often precedes a breakout when the price moves above the Handle.

If Dogecoin can clear this resistance, it could push toward higher levels, reigniting optimism among traders.

Chart patterns like this are watched closely because they combine both support and momentum signals.

They show where traders are willing to buy and where sellers may step in.

In Dogecoin’s case, the pattern suggests that there is still potential for upside, but it won’t happen without stronger buying interest.

Volume and momentum will be key to confirming the breakout. Traders are likely waiting for both to pick up before committing heavily.

Even with these early bullish signs, caution is warranted.

The market has been volatile, and DOGE has lost significant value over the past year. Short-term gains are possible, but the overall trend remains fragile.

Crypto World

Crypto Markets Fall as Bitcoin Drops 2.5% and Liquidations Near $200 Million

The selloff continues as tensions in the Middle East rise and the Department of Homeland Security remains partially shut down.

Crypto markets slipped further on Wednesday, Feb. 18, as political and macroeconomic uncertainty continued to weigh on sentiment.

Bitcoin (BTC) is trading at $66,344, down 2.5% over the past 24 hours, while Ethereum (ETH) is at $1,953, down 2.3%. Separately, Founders Fund, a venture firm tied to billionaire Peter Thiel, disclosed it had exited its entire 7.5% stake in Ethereum treasury company ETHZilla Corp. last year, according to a recent SEC filing.

Other large-cap tokens were also lower, with BNB down 2% near $610, XRP down 3% to $1.44, and Solana (SOL) down 4.5% to $81.

Meanwhile, the total cryptocurrency market capitalization stood near $2.37 trillion, down 2% over the past 24 hours. Daily trading volume was around $88.5 billion, according to CoinGecko.

Among top gainers, World Liberty Financial (WLFI) rose 15.7%, following news of top Wall Street CEOs preparing to headline at the World Liberty Forum.

Cosmos Hub (ATOM) also climbed 6.2%, while Provenance Blockchain (HASH) rose about 5%. HASH’s rally comes shortly after Figure announced that pricing has officially closed for FGRD, the first public equity trading natively on the Provenance blockchain.

On the downside, pumpfun (PUMP) fell around 11%, MemeCore (M) dropped roughly 7%, and Bittensor (TAO) slipped about 6.3%.

Liquidations and ETF Flows

Around $192 million in leveraged crypto positions were liquidated over the past 24 hours, according to CoinGlass. Long liquidations accounted for about $134.6 million, while shorts made up $57.4 million.

Bitcoin led liquidations at about $66.7 million, followed by Ethereum at roughly $53.7 million. More than 84,000 traders were liquidated during the period.

In the ETF market, Bitcoin spot ETFs recorded $104.87 million in net outflows, while Ethereum spot ETFs recorded $48.63 million in inflows. XRP spot ETF flows were flat on the day, while Solana spot ETFs recorded $2.19 million in inflows.

Elsewhere

In other markets, precious metals moved higher on the day, with gold trading around $5,000, up 2% and silver rising 4.3% to $77.49. Platinum gained 3.3% to $2,098, while palladium added nearly 2% to $1,742.

Political uncertainty also remained in focus as the White House did not give a clear timeline for talks with Iran amid rising tensions in the Middle East.

Meanwhile, negotiations between Ukraine and Russia concluded, with further discussions expected. In Washington, conflict over reopening the Department of Homeland Security, which is partially shut down, persists, CNN reported.

Crypto World

Peter Thiel lost tens of millions in ETHZilla

Peter Thiel, as of December 31, has fully divested from ETHZilla, his ether (ETH) gobbling company that’s currently down 98% from its 52-week high.

Those sales finalize losses for Thiel’s investment that exceeded $200 million at the company’s brief, exuberant peak in August.

On August 4 last year, ETHZilla (under its prior Nasdaq-listed name, 180 Life Sciences) closed a $425 million private investment in public equity (PIPE).

Separately, Thiel’s funds had also invested by August 4, 2025, disclosing aggregate beneficial ownership of 11,592,241 shares. Thiel’s quantity was then worth about $40 million or 7.52% of 180 Life Sciences’ 154,032,084 shares outstanding.

Although charts show an ETHZ trading range of $27.22-$35.70 on the day before Thiel’s investment, that price reflects a one-for-10 reverse share split that occurred in October.

In actual fact, Thiel’s 11.5 million beneficially-owned shares were trading at $2.72-$3.57 the day prior to his investment, imputing an investment of approximately $40 million based on their $3.54 closing print on August 1, 2025.

He disclosed his ownership the following trading day, as required by SEC regulations.

Within two weeks of his investment, his pre-split shares rocketed from $3.54 to $17.46 on August 13 after the former biotech company announced a host of crypto investors and an ETH acquisition strategy that was enjoying a brief mania in digital asset treasury (DAT) stocks.

Read more: Even Ethereum treasury companies are selling ETH to pay off debt

ETHZilla is down 98% from its August peak

Marked-to-market at the company’s August peak, Thiel and his funds owned over $200 million worth of stock.

Unfortunately, he hung on for months of losses.

Although Thiel trimmed his exposure from 7.5% to 5.6% by September 30, he continued to hold the vast majority of his shares — and their dwindling value.

He wouldn’t sell the entire position until the fourth quarter — after shares had lost over 85% of their August peak value.

By the time he’d sold everything, shares were down 86% from Thiel’s August 1 closing price and 97% from their August 13 peak.

As of today, shares are down 98% from their high.

Although Thiel isn’t required to disclose his average sale prices on SEC 13G schedules, approximating his losses is elementary math.

If Thiel beneficially owned approximately $40 million as of his opening investment, he certainly lost tens of millions of dollars by the time he sold.

From their fleeting value above $200 million, he let well over $100 million — probably more than $150 million — in paper value evaporate.

Losses from his starting investment size likely exceed $30 million from August 1 to the average trading range during the periods in which he was selling.

Note: Above figures about Thiel’s investments include all of the funds through which he invested in ETHZilla (formerly 180 Life Sciences):

- FF Consumer Growth, LLC

- FF Consumer Growth II, LP

- The Founders Fund Growth Management, LLC

- The Founders Fund Growth II Management, LP

- Peter Thiel

- FF Upper Tier GP, LLC

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Altcoin Sell Pressure Hits $209B As BTC Volumes Lead The Market

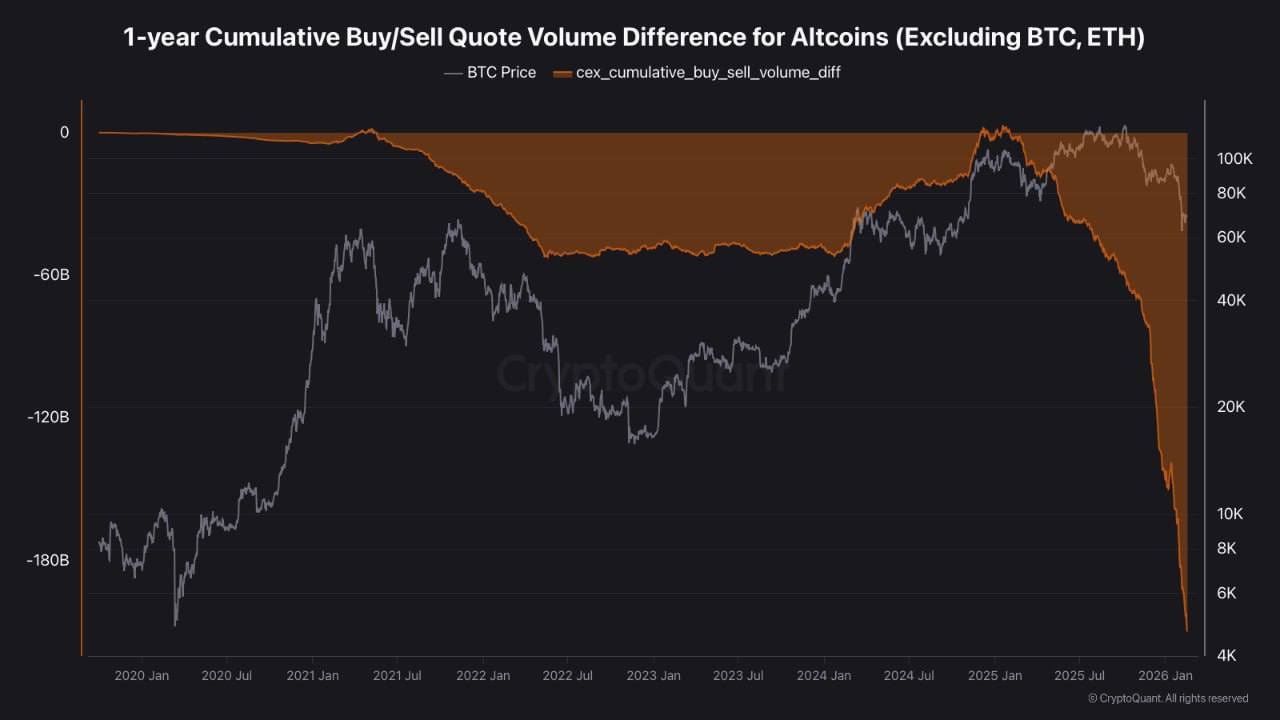

Altcoins, excluding Ether (ETH), have recorded $209 billion in net selling volume since January 2025, marking one of the steepest declines in speculative demand for crypto assets this cycle.

On Binance, altcoin trading volumes dropped roughly 50% since November 2025, reflecting a steady dip in activity. The decrease also coincides with an increase in Bitcoin’s volume share on the exchange.

Analysts said that the contraction in altcoin demand, alongside elevated stablecoin dominance, signals that the broader market is shifting its capital toward BTC during the current downtrend.

Altcoin spot volume imbalance deepens against Bitcoin

Crypto analyst IT Tech noted that the cumulative buy and sell difference for altcoins, excluding BTC and Ether (ETH), reached -$209 billion. The metric measures net spot demand across centralized exchanges for altcoin trading pairs. A positive reading indicates rising spot demand, which was briefly observed back in January 2025.

A negative cumulative delta at this scale signals the absence of consistent spot buyers. The analyst noted that the metric tracks net flow imbalance rather than price valuation, so it does not indicate a market bottom. Over the past 13 months, capital has exited the altcoin markets without significant counterflows.

Volume data from Binance reinforces the shift. As BTC tested the $60,000 level in early February, the total trading volume was redistributed. On Feb. 7, Bitcoin volumes rose to 36.8% of total activity. Altcoin volumes dropped to 33.6% by mid-February, from a high of 59.2% in November.

According to crypto analyst Darkfost, similar rotations appeared in April 2025, August 2024, and October 2022. During these corrective phases, capital consolidated into Bitcoin while altcoin volumes contracted.

Related: New Bitcoin whales are trapped underwater, but for how long?

Tether dominance rises to its all-time high level

Tether’s USDt (USDT) market cap dominance reached the 8% level on the one-week chart, aligning with prior highs which lasted between June 2022 and October 2023. The rising stablecoin dominance typically coincides with capital moving into dollar-pegged assets rather than deploying into tokens like BTC (BTC) and Ether (ETH).

As observed, the elevated USDT dominance coincided with Bitcoin consolidating near bear market lows, as observed in 2022 and 2023. A decline in dominance has often marked one of the earliest signals of a renewed bullish trend.

Previously, the USDT dominance chart formed lows around 3.80-4% in March 2024, December 2024, and October 2025. These periods coincided with Bitcoin setting new all-time highs near $72,000, $104,000, and $126,000, respectively.

Related: Wells Fargo sees ‘YOLO’ trade driving $150B into Bitcoin and risk assets

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

BTC’s bounce from this month’s crash evaporates

After chopping around early Wednesday, bitcoin rolled over during the U.S. afternoon and slid to session lows under $66,000, putting pressure back on the lower end of its recent range.

Having traded $68,500 overnight, BTC was down 2.5% over the past 24 hours and last trading at $66,200.

Crypto stocks, which started the day on a stronger foot, followed suit, paring back their gains or snapping into declines across the board. Most notable was Coinbase (COIN), which turned its 3% morning advance into a 2% decline by the afternoon. Strategy (MSTR), he largest corporate holder of bitcoin, was down roughly 3% as the underlying asset weakened.

After a fast start to the session, U.S. stocks had given back much of their gains shortly before the close of trading. Not helping were surprisingly hawkish minutes from the January meeting of the Federal Reserve’s Federal Open Market Committee (FOMC). As expected, most at the central bank agreed with the decision to pause rate cuts, but — in a twist — several suggested the Fed favor “two-sided” guidance at which the bank might opt to hike rates if inflation continues to remain sticky.

Already higher for the day, the U.S. dollar gathered even more strength, with the dollar index (DXY) — which measures the greenback against a basket of major foreign currencies — climbing to its strongest level in nearly two weeks. A firmer dollar often weighs on risk assets, and Wednesday’s crypto fade appeared to fit that pattern.

With today’s slide, bitcoin is now staring at a fifth straight week of losses, its worst streak since the long 2022 bear market.

It also faces a key test at current levels. The $66,000 area held as support last week and helped fuel a bounce above $70,000. If that floor gives way decisively, traders will likely start eyeing the early February lows at $60,000 or a fresh leg lower.

Crypto World

Coin Center Pushes Senate to Preserve Crypto Developer Liability Protections

Crypto advocacy group Coin Center is lobbying the U.S. Senate to maintain a crucial clause in the upcoming market structure bill, according to a new blog post.

This provision protects software developers from liability if third parties misuse their open-source code for illicit activities.

The stakes are incredibly high for the industry. Removing these protections could freeze innovation by making coders legally responsible for how strangers use their tools. That is a risk few developers are willing to take.

Key Takeaways

- Liability Shield: Coin Center argues that developers who do not control assets should not be treated as money transmitters.

- Senate Standoff: The Senate Judiciary Committee is blocking the clause, citing enforcement concerns over platforms like Tornado Cash.

- Procedural Roadblock: The dispute has stalled the broader market structure bill, delaying regulatory clarity.

Why Is Coin Center Lobbying so Hard?

The Senate Banking Committee is currently deliberating a comprehensive digital asset market structure bill.

This legislation aims to define how the CFTC and SEC regulate the industry. Recently, Trump suggested a crypto market structure bill could arrive soon, ramping up the urgency.

However, a specific clause protecting non-custodial developers has hit a wall. Leaders of the Senate Judiciary Committee, including Senators Dick Durbin and Chuck Grassley, have intervened. They argue that shielding developers weakens laws against unlicensed money transmitters.

This political friction has created a significant procedural hurdle for the bill. Without a compromise, the entire legislative package risks indefinite delay.

The Battle Over Code Liability

For Coin Center, preserving this liability shield is a top priority. The advocacy group contends that punishing developers for the actions of users creates “chilling uncertainty” for open-source innovation.

The core issue revolves around control. Coin Center argues that if you merely publish code, like the developers of a decentralized exchange, you do not control user funds. Therefore, you cannot comply with Bank Secrecy Act requirements designed for custodial intermediaries.

This distinction is vital for the DeFi sector. Protocols where rely on developers building open systems without fear of prosecution.

If the Senate removes these protections, writing smart contracts could become a criminal liability in the U.S.

This debate refers back to earlier legislative attempts, such as the Blockchain Regulatory Certainty Act, which sought similar clarifications regarding non-controlling blockchain services.

Discover: The best crypto to diversify your portfolio with.

What Happens Next?

The industry is now watching the Senate Banking Committee. They must decide whether to strip the clause to appease the Judiciary Committee or fight to keep it. Stripping it might pass the bill, but it leaves developers exposed.

Looking globally, the U.S. risks falling behind jurisdictions with clearer frameworks. For instance, Germany’s central bank endorsed stablecoins under the MiCA regulation, providing the kind of legal certainty U.S. builders are desperate for.

If the Senate fails to resolve this standoff, major market structure legislation could be pushed into late 2026. Until then, American developers operate in a dangerous gray zone.

Discover: Here’s the best pre-launch token sales in crypto now.

The post Coin Center Pushes Senate to Preserve Crypto Developer Liability Protections appeared first on Cryptonews.

-

Sports7 days ago

Sports7 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business22 hours ago

Business22 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment9 hours ago

Entertainment9 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World7 days ago

Crypto World7 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech13 hours ago

Tech13 hours agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Video7 days ago

Video7 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Business15 hours ago

Business15 hours agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World3 hours ago

Crypto World3 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit