Crypto World

The record breaking stats from BTC’s capitulation on Thursday signal a bottom is near

Bitcoin’s Feb. 5 collapse will go down as one of the most historic selloffs on record. Below are the key statistics that help define the event and indicate how much further there may be to fall.

The bitcoin price started the day near $73,000 and fell to a low around $62,000, a drop — or, as some market participants call it, a candle — of more than $10,000. The day’s 14% decline was the largest single-day drop since November 2022, during the implosion of crypto exchange FTX.

The Fear and Greed Index dropped into single digits, a level seen only a handful of times in bitcoin’s 17-year history. At the same time, bitcoin was the third most oversold it has ever been on the RSI, an indicator that measures the speed and change of price movements.

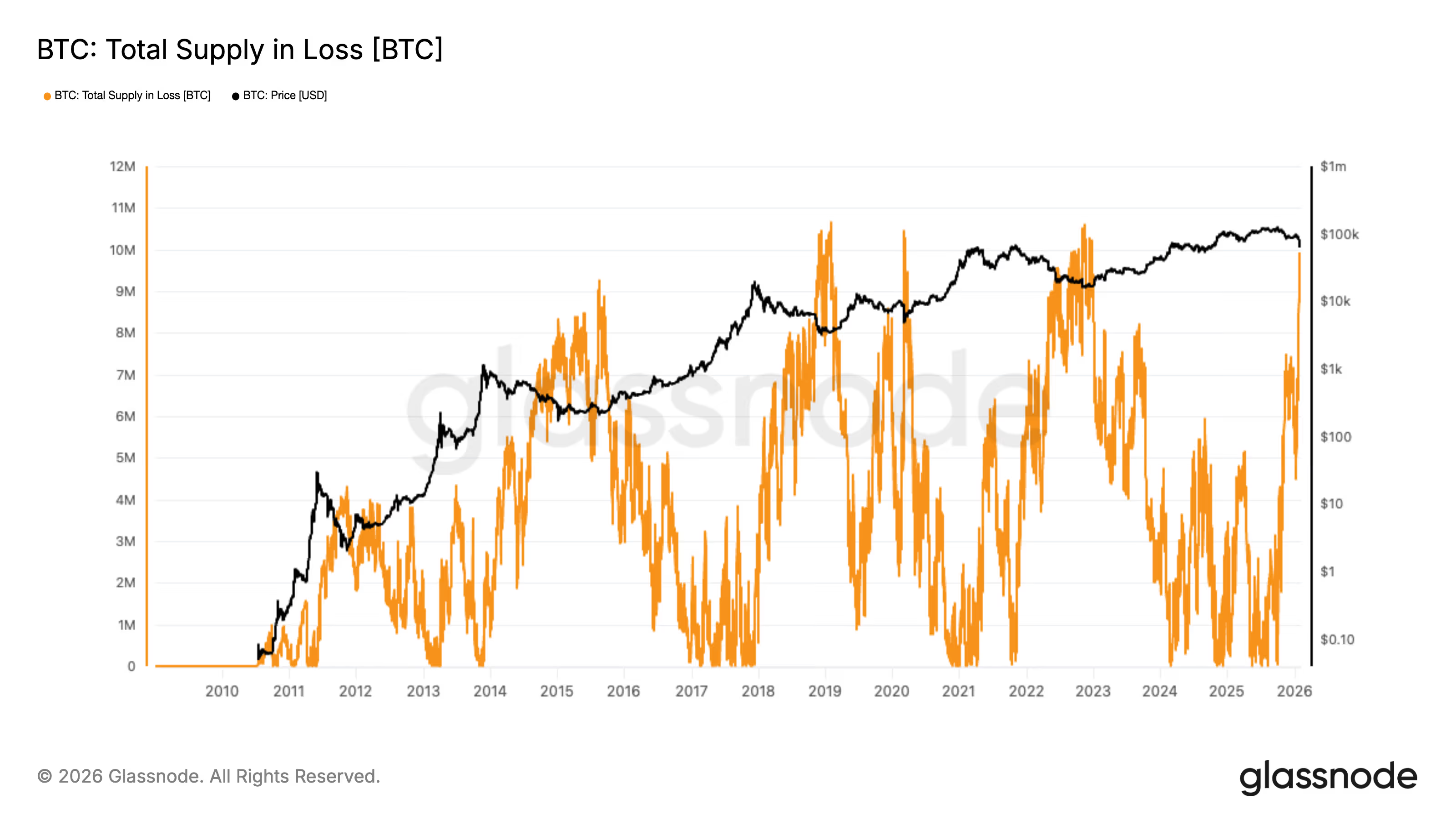

Supply in profit and loss

The circulating supply in loss, meaning the number of coins that last moved at prices higher than the market price, surged to almost 10 million BTC. That is the fourth-highest level ever, comparable with the 2015, 2019 and 2022 bear-market bottoms.

Another measure, the amount of long-term holders’ circulating supply that is at a loss, reached 4.6 million BTC. At the lows of previous bear markets, the figure exceeded 5 million BTC, suggesting this metric is approaching, but has not yet fully matched, prior extremes.

Supply in profit and supply in loss have nearly converged, a condition that has historically aligned with the bottom of major market declines. At present, roughly 10 million BTC sit in profit and 10 million BTC sit in loss.

While nobody knows for certain whether the bottom is in for bitcoin, history suggests it is likely close, especially with bitcoin already recovering toward $68,000.

Still, market participants may be waiting for bitcoin to test its 200-week moving average, currently near $58,011.

Crypto World

Marathon Digital Moves 1,318 BTC to Institutional Wallets Amid Bitcoin Dip

TLDR:

- MARA moved 1,318 BTC (~$86.9M) to Two Prime, BitGo, and Galaxy Digital in a 10‑hour window.

- The largest transfer of 653.773 BTC went to Two Prime, indicating structured institutional flows.

- Transfer occurred as Bitcoin traded in the mid‑$60K range during recent market weakness.

- Marathon still holds ~52,850 BTC, keeping it among the top reported public holders.

Marathon Digital Holdings recently transferred 1,318 BTC (~$87 million) to institutional platforms, including Two Prime, BitGo, and Galaxy Digital, within about 10 hours.

Bitcoin traded near mid‑$64,000 during the transfers. Despite the outflow, MARA still holds roughly 52,850 BTC, ranking among the largest corporate holders of Bitcoin globally.

MARA’s Institutional Transfers and Strategic Management

Marathon Digital Holdings transferred 1,318 BTC, valued at approximately $86.89 million, to institutional wallets over a short period.

The recipients included Two Prime, BitGo, and Galaxy Digital, demonstrating intentional allocation rather than reactive selling.

Two Prime received the largest portion, including 653.773 BTC worth around $42 million, along with smaller tranches. This wallet suggests the coins may support collateralized yield, hedging, or other structured financing strategies.

This indicates operational planning rather than market panic. BitGo handled nearly 300 BTC, consistent with its custody-first service for secure storage, settlement, or pre-OTC positioning.

Galaxy Digital, linked via Anchorage wallets, received the remaining coins, reinforcing the institutional nature of these transfers and highlighting coordinated treasury management.

Even after moving 1,318 BTC, MARA still holds 52,850 BTC, ranking as the second-largest publicly reported holder. The transfers represent roughly 2.5% of total holdings, suggesting measured liquidity management.

These moves likely fund operations, manage debt, or prepare for market volatility without requiring large-scale liquidation. The timing of transfers coincided with Bitcoin trading around $64,840, down almost 10% in 24 hours.

While such a decline might appear bearish, the involvement of institutional wallets indicates that these moves were planned and strategic. MARA’s approach reflects controlled, professional treasury operations rather than panic-driven exits.

Bitcoin Price Movements and Market Absorption

During the same period, Bitcoin opened near $68K, but sellers quickly drove the price below $60K. This sharp drop reflects forced deleveraging and cascading long liquidations rather than organic market behavior.

Buyers entered aggressively near $62K, driving the price back above $64K and through $65K. The pattern formed higher lows, showing absorption of selling pressure and resilience among stronger market participants.

The market did not continue lower, reflecting controlled capital deployment despite volatility. By the end of the trading window, Bitcoin nearly retraced the full drawdown, stabilizing near $68K.

Combined with MARA’s structured BTC transfers, this indicates deliberate repositioning under stress rather than distressed selling. Large holders can move significant amounts while maintaining balance in the market.

These coordinated transfers, paired with price absorption, illustrate operational management and strategic liquidity positioning.

MARA’s actions show careful deployment of its Bitcoin holdings, emphasizing treasury oversight and market awareness.

Crypto World

Tether mints $1B USDT as stablecoin issuance tops $4.7B in a week

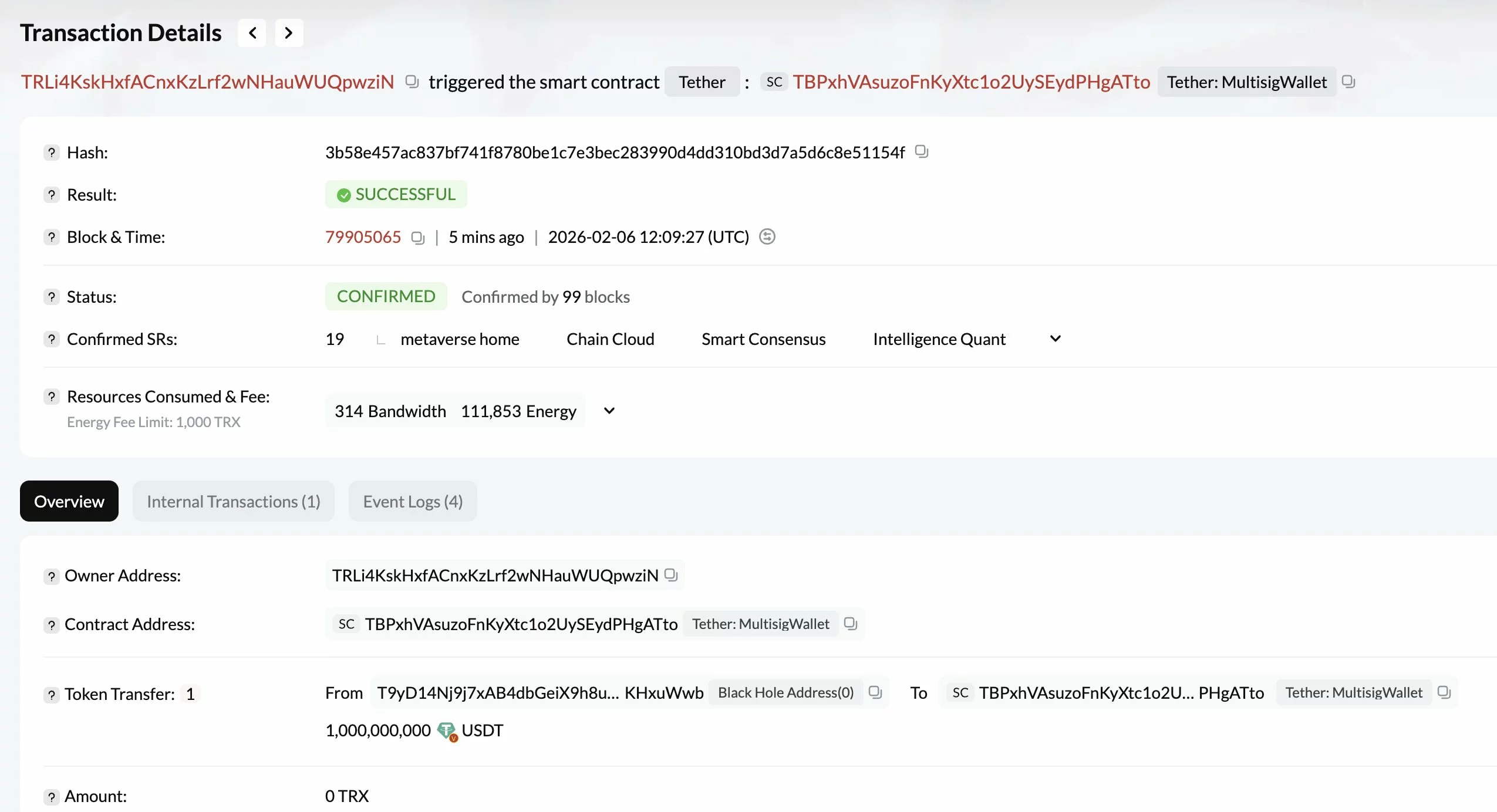

Stablecoin issuer Tether has minted another $1 billion worth of USDT, adding to a sharp rise in stablecoin issuance over the past week, according to on-chain analytics firm Lookonchain.

Summary

- Tether minted $1B USDT, adding to roughly $4.75B in stablecoins issued by Tether and Circle over the past week, according to Lookonchain.

- Analysts caution the surge is a liquidity signal, not a buy signal, noting that rising stablecoin supply has also coincided with choppy or falling Bitcoin prices.

- Markets are watching deployment, redemptions, and velocity, alongside macro factors like ETF flows and derivatives funding, for confirmation of bullish momentum.

The latest mint brings total stablecoin issuance by Tether and Circle to roughly $4.75 billion in the past seven days, highlighting a rapid expansion in crypto market liquidity even as broader markets remain under pressure.

Lookonchain noted that the most recent USDT mint occurred on the Tron network, as Bitcoin (BTC) continued to trade around the $66,000 level.

Liquidity signal, not a buy signal

Crypto analyst Milk Road cautioned that while large stablecoin mints are often framed as “dry powder” for a market rebound, the signal is more nuanced.

According to Milk Road, roughly $3 billion in stablecoin issuance over just three days points to liquidity building within the market’s infrastructure rather than an immediate directional bet on prices.

Historically, rising stablecoin supply has preceded bull runs, but similar conditions have also occurred during choppy or declining Bitcoin markets.

“Stablecoin supply growth alone isn’t a directional indicator,” Milk Road said, describing it instead as a liquidity and readiness signal.

What markets are watching

Analysts say the key indicators to monitor are whether stablecoin issuance is accompanied by low redemptions, improving velocity, and deployment onto exchanges, alongside supportive macro conditions such as ETF inflows and favorable derivatives funding rates.

Absent those signals, rising stablecoin supply may simply reflect market participants positioning capital, rather than actively deploying it.

As Milk Road put it, the market may be “loading ammunition, not pulling the trigger.”

Crypto World

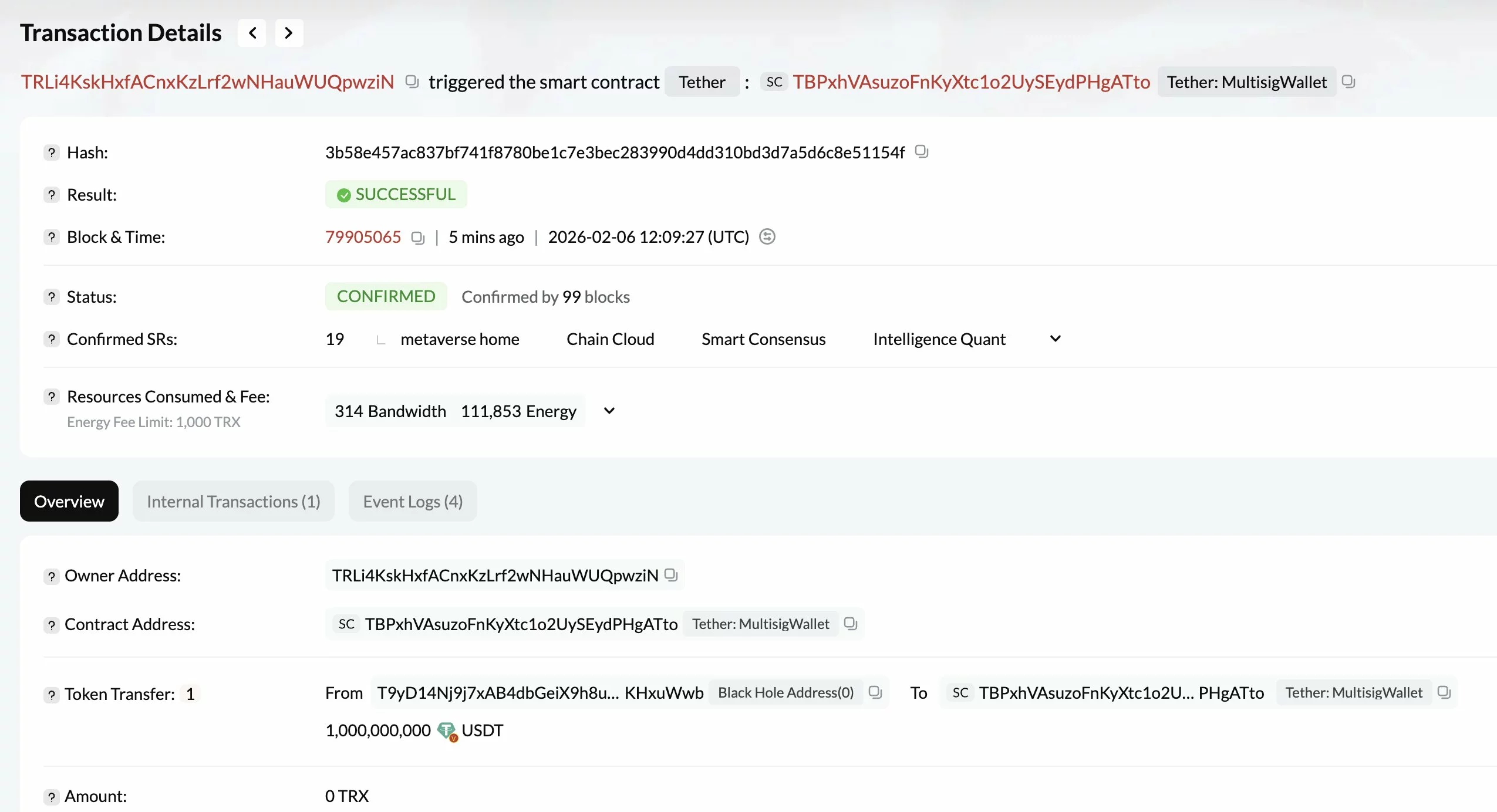

Ripple (XRP) Surges 20.1% as All Assets Trade Higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1944.26, up 6.7% (+121.31) since 4 p.m. ET on Thursday.

All 20 assets are trading higher.

Leaders: XRP (+20.1%) and HBAR (+13.1%).

Laggards: AAVE (+1.9%) and BNB (+3.0%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

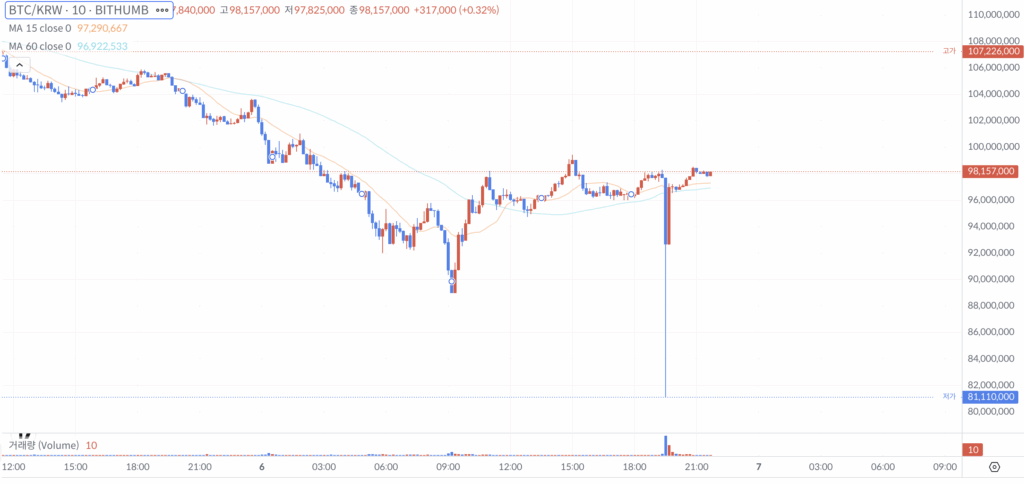

Bithumb Fixes Payout Error After Abnormal Bitcoin Trades

In South Korea, Bithumb disclosed it detected and corrected an internal payout error that briefly sent an abnormal amount of Bitcoin (CRYPTO: BTC) to a subset of users during a promotional event, triggering swift volatility on the exchange. In an official Friday notice, the operator explained that some recipients liquidated part of the mistakenly credited BTC, prompting a price dislocation that was halted within minutes as internal controls restricted affected accounts and prevented cascading liquidations. The exchange stressed this was not linked to any hack or security breach and that customer assets remained secure as trading, deposits and withdrawals continued normally. The incident underscores the operational risks embedded in real-time promotional activity at centralized venues, even as systems respond to anomalies in near real-time.

The firm also signaled that it had tightened its internal safeguards to avoid a repeat of the episode, while promising transparent follow-ups on steps taken to bolster payout accuracy and account-level safeguards. While the company did not disclose the exact amount involved, users on social media posited that several accounts may have been credited with as much as roughly 2,000 BTC, a figure that could not be independently verified at this stage.

In a broader context, the episode arrives amid ongoing scrutiny of how centralized exchanges handle rapid price moves and user activity during promotions. Bithumb’s January disclosure about dormant assets—roughly $200 million held across 2.6 million inactive accounts as part of a recovery effort—illustrates a continued effort to reconcile long-tail liabilities and improve asset management under regulatory expectations. The exchange’s public scrutiny comes as market data show Bithumb’s trading activity remains material, with CoinGecko reporting substantial 24-hour volume and a trust score reflecting observed risk elements in the platform’s operations.

As the sector contends with periodic operational frictions, the push to demonstrate robust risk controls has grown louder. Earlier in the year, Coinbase acknowledged that account restrictions could hamper user activity during stress periods, reporting improvements after deploying enhanced machine-learning models and upgraded infrastructure to reduce unnecessary account freezes by a meaningful margin. The lessons from these experiences feed into a wider narrative about how exchanges balance user experience, security, and liquidity during unpredictable market conditions.

During a separate episode last fall, a major crypto venue faced widespread user concerns that some traders could not exit positions during a sharp sell-off. While the exchange argued that its core infrastructure remained intact and that liquidity conditions in the market were the primary drivers of liquidations, it ultimately distributed a substantial compensation package to affected users. The episode underscored how a combination of market dynamics and technical hiccups can amplify user frustrations even when the underlying systems remain capable of handling the broader trading flow.

Taken together, the incidents spotlight a recurring theme in the crypto ecosystem: the fragility of operations under stress, even when asset custody remains sound. Bithumb’s public acknowledgement of the error, combined with the quick containment measures and commitment to future preventive steps, reinforces the industry’s emphasis on transparency and continuous improvement. For investors and users, the key takeaway is that while asset security is guarded, execution risk—whether from payout misfires, liquidity gaps, or automated processes—continues to test the resilience of centralized platforms.

Market reaction and key details

Beyond the immediate price movement, observers are watching how exchanges sanitize anomalies that arise from promotional events or internal misconfigurations. The incident at Bithumb shows that even minor missteps can ripple through intraday prices, prompting a swift response from risk teams to halt affected accounts and restore orderly trading. The episode also highlights the role of governance and internal controls as central levers for mitigating systemic risk within single venues, particularly when millions of dollars of daily volume can hinge on a handful of credited accounts.

For context, the broader market has navigated a string of operational challenges across major platforms. The Coinbase episode in mid-year highlighted the tension between security measures and user access, with the exchange reporting improvements in preventing unnecessary account freezes. Binance, on the other hand, faced widespread complaints when volatility surged, and while the firm maintained that core trading engines held up, it nonetheless issued compensation to users impacted by the disruption. These instances collectively emphasize that operational uptime, real-time risk controls, and transparent communications are becoming core differentiators for centralized exchanges in a crowded landscape.

Looking at liquidity and market sentiment, trackers show continued appetite for exchange participation, even as demand peaks temporarily during promotional campaigns. Bithumb’s reported metrics—coupled with its commitment to disclose corrective actions—signal a path toward restoring trust through accountability. The exchange also remains under the watchful eye of analysts tracking the health of liquidity providers and the ability of platforms to gracefully unwind unintended or erroneous credits without triggering cascading liquidations or systemic stress.

The episode’s significance extends beyond a single incident. It reinforces a broader narrative about how crypto markets are maturing: incidents are increasingly identified, contained, and followed by concrete governance steps. Investors now expect rapid disclosures, independent follow-ups, and demonstrable improvements in both on-chain and off-chain processes. While the immediate fallout may be contained, the long-term impact rests on whether exchanges translate lessons learned into durable practice that can withstand future shocks.

Why it matters

For users, the incident underscores the importance of robust account protections and the value of clear, timely communications from exchanges following any anomaly. For operators, it highlights the necessity of automated safeguards that can quickly detect unusual credit patterns and isolate affected accounts before they ripple outward to price and liquidity. The emphasis on transparent post-event action—detailing what went wrong, how it was fixed, and what changes will be implemented—helps restore confidence in a space where trust and reliability are paramount.

From a market perspective, the episode contributes to a growing realization that operational risk is an intrinsic component of centralized platforms. While custody and asset safety are critical, execution risk—particularly during promos and periods of high volatility—can shape user behavior and liquidity provisioning. The industry’s response, including better incident reporting, tighter internal controls, and proactive communication, is likely to influence how funds flow across exchanges and how investors price resilience into their risk models.

For builders and regulators, the event offers a case study in the balance between innovation and oversight. As platforms explore new products, incentives, and cross-border activities, the need for clear governance frameworks and standardized incident reporting becomes more acute. The ongoing dialogue between exchanges, users, and policymakers could set the groundwork for more robust operational standards across the crypto ecosystem.

What to watch next

- Follow-up disclosures from Bithumb detailing corrective actions and any independent reviews of the payout process.

- Any updates to internal controls and the redeployment of automated checks to prevent similar miscredits.

- Regulatory or industry-led audits assessing operational risk management on centralized exchanges in Korea and beyond.

- Monitoring by liquidity providers and market makers for signs of lingering price effects or liquidity gaps around the incident timeframe.

Sources & verification

- Bithumb official announcement: https://feed.bithumb.com/notice/1651924

- Dormant assets report referenced by Bithumb: https://cointelegraph.com/news/bithumb-dormant-crypto-assets-200m-inactive-accounts

- CoinGecko exchange page for Bithumb (trust score and volume): https://www.coingecko.com/en/exchanges#:~:text=As%20of%20today%2C%20we%20track,%2C%20Coinbase%20Exchange%2C%20and%20OKX.

- Binance support article cited for liquidity disruptions: https://www.binance.com/en/support/announcement/detail/3d45a1ab541f463982d59c8de85e36b8

- Scott Melker commentary referenced in discussion of the incident: https://x.com/scottmelker/status/2019812751150088197

Crypto World

Bithumb accidentally gave away 2,000 BTC and crashed its market

Bitcoin (BTC) has flash crashed 10% on the South Korean exchange Bithumb after a user sold 2,000 BTC that they received by mistake from a promotional airdrop.

Earlier today, X users noted that Bithumb’s listed BTC/South Korean Won (KRW) trading pair plummeted by 10% in the space of a minute before returning to its original price.

The account “Definalist,” which claims to be made up of five crypto traders based in China, noted the price drop and a “rumor” that someone dumped 2,000 BTC.

They also appeared to show a screenshot taken from the seller’s account while they were dumping the BTC, which in today’s less-than-stellar crypto markets would fetch $134 million.

Read more: Bithumb boosts security in wake of SK Telecom malware hack

Definalist later claimed that hundreds of users may have received 2,000 BTC accidentally after an employee typed BTC, instead of KRW, when sending out 2,000 KRW ($1.4) as part of a “random box prize” promotional giveaway.

Bithumb confirms it sent ‘abnormal’ sums of BTC to users

Bithumb has since confirmed some details of the incident, although it didn’t confirm the quantity of BTC nor the number of customers who received mistaken disbursements.

It admitted that an “abnormal” sum of BTC was paid to various users, and that BTC’s price “temporarily fluctuated sharply as some accounts that received the BTC sold it.”

It notes that it was able to restrict the accounts selling the BTC and added that “the market price returned to normal levels within five minutes, and the domino liquidation prevention system functioned normally, preventing chain liquidations due to the abnormal BTC price.”

“We want to make it clear that this incident is unrelated to any external hacking or security breach, and does not pose any issues with system security or customer asset management,” the exchange said.

If Bithumb did in fact send 2,000 BTC to at least 100 users, thats a minimum distribution of $13 billion.

BTC crashed almost 47% from its all-time high of $126,000 last October but has, for the time being, gradually begun to increase in price again.

The flash crash is another problem for Bithumb after South Korea’s financial competition watchdog raided its office last week over various promotions it advertised last year.

Protos has reached out to Bithumb for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Wall Street remains split after earnings miss

IREN’s (IREN) latest earnings offered a snapshot of a company mid-transition, with shares currently paying the price for that transition. The firm reported weaker-than-expected revenue and earnings as bitcoin mining took a back seat to its rapidly expanding AI cloud ambitions.

Crushed by record-low margins after the 2024 halving, bitcoin miners are recasting themselves as digital infrastructure players, converting power-hungry mining sites into AI-ready data centers in a bid for more stable, long-term revenue.

One of last year’s best-performing stocks, not just in crypto, but for the whole market, IREN has come back to earth a bit since hitting a record high near $77 in November. Down about 20% amid Thursday’s market crash, shares are flat on Friday at $39.77.

IREN has secured $3.6 billion in GPU financing tied to its Microsoft contract, alongside a $1.9 billion customer prepayment, funding that management says will cover roughly 95% of GPU-related capital expenditures as it scales its AI business, a development JPMorgan analysts Reginald Smith and Charles Pearce described as encouraging.

IREN’s fiscal second-quarter revenue fell sequentially as lower average hashrate, fewer coins mined and a quarter-over-quarter drop in bitcoin prices weighed on results, according to the Wall Street bank.

The drag from mining was partly offset by rapid growth in cloud services, where revenue more than doubled from the prior quarter to $17 million. That figure came in above JPMorgan’s $14 million estimate but well short of the Street’s $28 million forecast. Management said all GPUs currently energized are fully contracted, a signal the bank described as encouraging as the company pivots toward AI infrastructure.

Cost controls also helped cushion the quarter. Cash SG&A dropped sharply to $43 million, while power costs declined on lower average hashrate. As a result, adjusted EBITDA reached $75 million, beating the bank’s estimate, driven by lower operating and energy expenses. The bank has an underweight rating on the stock.

Investment bank B. Riley raised its price target on IREN to $83 from $74 while reiterating its buy rating, arguing that the recent pullback has created an attractive entry point.

The upgrade comes despite a softer fiscal second quarter, during which adjusted EBITDA of $75.3 million missed expectations. B. Riley said the earnings miss is overshadowed by IREN’s progress on its AI pivot, including $3.6 billion in low-cost GPU financing tied to its Microsoft deal, a $1.9 billion prepayment that covers about 95% of GPU capex, and an expanded power portfolio now exceeding 4.5 gigawatts (GW).

Compass Point analyst Michael Donovan reiterated a buy rating and a $105 price target on IREN, saying the latest earnings show a company better positioned for growth, even though recent results were weaker. He said IREN now has more secure power and a clearer plan to fund its expansion, which matters more than one soft quarter.

Donovan described the fourth quarter as a period of change. Revenue fell to $184.7 million as the company mined less bitcoin while shifting its facilities from older bitcoin-focused machines to newer chips used for artificial intelligence. Even so, the mix of revenue improved as AI-related services began to make up a larger share of the business.

He pointed to the $3.6 billion financing package linked to IREN’s Microsoft project as an important milestone. The funding is larger than originally planned and is structured so that money is drawn as construction moves forward and revenue contracts kick in.

Donovan expects IREN to begin recognizing revenue from Microsoft toward the end of the second quarter of 2026, with revenue increasing in stages after that. By the end of 2026, he sees a path for the business to generate about $3.4 billion in annualized revenue.

Read more: Weak earnings drag IREN, Amazon; bitcoin stocks rebound in pre-market

Crypto World

100% of Strategy’s convertible debt is now out-of-the-money

As if the week for Strategy investors wasn’t already bad enough, their capital stack has hit another, new low. Unfortunately, 100% of the company’s convertible debt is now “out-of-the-money.”

With the firm’s 2030A convertible bond notes, the final holdout from last week, joining the other five series in reaching out-of-the-money territory, all six series now have a conversion price above the price of MSTR, Strategy’s common stock.

In plain English, it’s now worse for bondholders to convert into common stock rather than just keeping their bonds as bonds.

As a result, Strategy will need to continue servicing their coupons, and principal cash repayments.

While all bondholders are out-of-the-money, in other words, these convertibles will not convert into MSTR and will, instead, continue to drag on the cash obligations of the company going forward.

These creditors will demand on-time interest payouts and principal repayment through June 2032, unless the price of MSTR starts to rally and sufficiently motivate them to exercise their convertible options.

Strategy’s bonds pay interest coupons of 2.25%, 0.625%, and 0%, depending on their upcoming maturities. The company has $8.2 billion worth of notional debt outstanding.

Read more: Michael Saylor missed out on a $33 billion profit at Strategy

Strategy must service its out-of-the-money debts

Bonds, in capital stack seniority, rank even higher than preferred shares in terms of the company’s cash obligations.

Unlike common stock at the bottom of the stack or preferred dividends which the company’s board of directors may suspend at any time, Strategy must service its debts unless it wants to default.

Defaulting is normally a catastrophic decision from a financial perspective, risking downgrades by credit analysts, uncertainty in pricing listed securities, and possible legal action by the bondholders.

Whereas an in-the-money cushion above the company’s convertibles is widely viewed as a sign of financial strength, all convertibles issued by Strategy have punctured through that safety net.

Sure, they helped the company raise money to buy bitcoin in the past, but now they have long-lasting consequences.

No longer able to convert them into MSTR — unless MSTR rallies substantially — founder Michael Saylor must continue to repay bonds with cash or drum up more demand for MSTR so that its price rallies above bondholders’ conversion price.

Conversion prices for Strategy bonds range from a low of $149.77 to a high of $672.40.

Options traders coined the term out-of-the-money when “the money” simply meant the actual, realizable, current cash value of a position.

Traders used out-of-the-money as a shorthand reference to having no immediate cash worth by exercising a right like an option or warrant.

An option whose strike, or conversion, price was already favorable relative to prevailing prices of the underlying was “in the money” because there was real money on the table.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Labor Market and Housing Data Raise New Fears of a U.S. Economic Slowdown

TLDR:

- Layoffs and declining job openings show employers preparing for slower growth and tighter financial conditions

- Housing demand is weakening as sellers outnumber buyers, creating a record imbalance and reduced market liquidity

- Bond and credit markets reflect rising stress tied to debt levels and long-term growth uncertainty

- Rapid disinflation and firm monetary policy increase the risks of tightening into an already fragile economy

U.S. economic indicators are showing coordinated signs of strain across labor, housing, and credit markets. Layoffs are rising while hiring slows, reducing job security for many workers.

Housing demand is weakening as sellers outnumber buyers. Bond and credit markets also reflect growing caution. Together, these trends suggest the economy is entering a fragile late-cycle phase.

Labor and Housing Data Point to Late-Cycle Fragility

Labor and housing data are moving together in a pattern associated with late-cycle slowdowns. January layoff announcements exceeded one hundred thousand, the highest level for that month since the global financial crisis.

Weekly jobless claims have trended higher, while job openings have fallen to levels last seen in 2020. This combination reduces worker mobility and weakens income security across sectors.

Companies are not only cutting staff but also limiting recruitment, with hiring plans reaching record lows for the month. Consumer confidence surveys now reflect growing caution toward discretionary spending and long-term purchases.

Housing markets mirror this shift in behavior. Sellers outnumber buyers by a wide margin, creating the largest recorded gap between supply and demand participants.

Elevated mortgage rates continue to restrict affordability, while existing owners hesitate to reduce prices because of low-rate loans locked in earlier years. Listings remain visible, yet transactions slow as liquidity dries up.

This imbalance delays price discovery and increases carrying costs for households and developers.

Employment weakness directly affects housing demand. Fewer stable incomes mean fewer qualified buyers, placing additional pressure on inventories struggling to clear.

Together, labor deterioration and housing imbalance suggest that economic momentum is being supported by inertia rather than expanding demand, a condition that historically precedes slowdowns across consumption-driven industries.

Bond, Credit, and Inflation Signals Reinforce Economic Stress

Financial markets are reflecting stress through bond and credit indicators. The Treasury yield curve has entered bear steepening, where long-term yields rise faster than short-term rates.

Investors demand higher compensation to hold extended maturity debt, signaling concern over fiscal deficits and long-term growth expectations. Similar curve movements have preceded economic contractions in previous cycles.

Corporate credit conditions show parallel weakness. A rising share of lower-quality bonds now trades at distressed levels or faces elevated default risk.

When financing tightens, firms cut costs, postpone investment, and reduce payroll. These actions feed back into employment and consumer demand, reinforcing pressure already visible in labor data.

Business bankruptcy filings continue to trend upward, reducing liquidity within supply chains and tightening lending standards across financial institutions. Inflation readings have shifted quickly, with real-time measures pointing toward levels near one percent.

Rapid disinflation increases the risk that consumers delay spending in anticipation of lower prices, slowing transaction activity across goods and services markets.

Monetary policy remains focused on inflation control despite weakening forward indicators in labor and housing. A restrictive stance during slowing growth raises the probability of misalignment between financial conditions and economic capacity.

Combined with credit strain and yield curve signals, the environment reflects fragility rather than expansion.

Crypto World

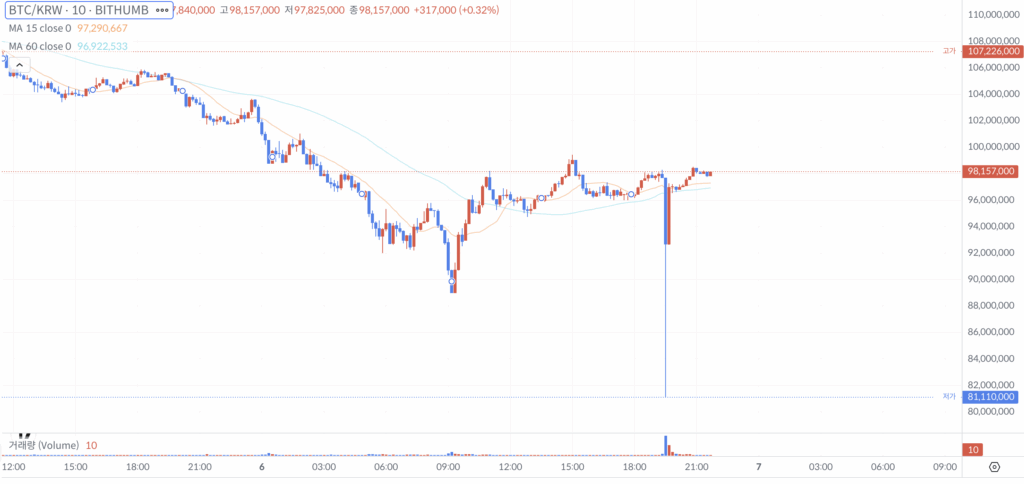

Why Privacy Coins Often Appear in Post-Hack Fund Flows

Key takeaways

-

Privacy coins are just a step in a broader laundering pipeline after hacks. They serve as a temporary black box to disrupt traceability.

-

Hackers typically move funds through consolidation, obfuscation and chain hopping and only then introduce privacy layers before attempting to cash out.

-

Privacy coins are most useful immediately after a hack because they reduce onchain visibility, delay blacklisting and help break attribution links.

-

Enforcement actions against mixers and other laundering tools often shift illicit flows toward alternative routes, including privacy coins.

After crypto hacks occur, scammers often move stolen funds through privacy-focused cryptocurrencies. While this has created a perception of hackers preferring privacy coins, these assets function as a specialized “black box” within a larger laundering pipeline. To understand why privacy coins show up after hacks, you need to take into account the process of crypto laundering.

This article explores how funds move post-hack and what makes privacy coins so useful for scammers. It examines emerging laundering methods, limitations of privacy coins like Monero (XMR) and Zcash (ZEC) as laundering tools, legitimate uses of privacy technologies and why regulators need to balance innovation with the need to curb laundering.

How funds flow after a hack

Following a hack, scammers don’t usually send stolen assets directly to an exchange for immediate liquidation; instead, they follow a deliberate, multi-stage process to obscure the trail and slow down the inquiry:

-

Consolidation: Funds from multiple victim addresses are transferred to a smaller number of wallets.

-

Obfuscation: Assets are shuffled through chains of intermediary crypto wallets, often with the help of crypto mixers.

-

Chain-hopping: Funds are bridged or swapped to different blockchains, breaking continuity within any single network’s tracking tools.

-

Privacy layer: A portion of funds is converted into privacy-focused assets or routed through privacy-preserving protocols.

-

Cash-out: Assets are eventually exchanged for more liquid cryptocurrencies or fiat through centralized exchanges, over-the-counter (OTC) desks or peer-to-peer (P2P) channels.

Privacy coins usually enter the stage in steps four or five, blurring the traceability of lost funds even more after earlier steps have already complicated the onchain history.

Why privacy coins are attractive for scammers right after a hack

Privacy coins offer specific advantages right at the time when scammers are most vulnerable, immediately after the theft.

Reduced onchain visibility

Unlike transparent blockchains, where the sender and receiver and transaction amounts remain fully auditable, privacy-focused systems deliberately hide these details. Once funds move into such networks, standard blockchain analytics lose much of their efficacy.

In the aftermath of the theft, scammers try to delay identification or evade automated address blacklisting by exchanges and services. The sudden drop in visibility is particularly valuable in the critical days after theft when monitoring is most intense.

Breaking attribution chains

Scammers tend not to move directly from hacked assets into privacy coins. They typically use multiple techniques, swaps, cross-chain bridges and intermediary wallets before introducing a privacy layer.

This multi-step approach makes it significantly harder to connect the final output back to the original hack. Privacy coins act more as a strategic firebreak in the attribution process than as a standalone laundering tool.

Negotiating power in OTC and P2P markets

Many laundering paths involve informal OTC brokers or P2P traders who operate outside extensively regulated exchanges.

Using privacy-enhanced assets reduces the information counterparties have about the funds’ origin. This can simplify negotiations, lower the perceived risk of mid-transaction freezes and improve the attacker’s leverage in less transparent markets.

Did you know? Several early ransomware groups originally demanded payment in Bitcoin (BTC) but later switched to privacy coins only after exchanges began cooperating more closely with law enforcement on address blacklisting.

The mixer squeeze and evolving methods of laundering

One reason privacy coins appear more frequently in specific time frames is enforcement pressure on other laundering tools. When law enforcement targets particular mixers, bridges or high-risk exchanges, illicit funds simply move to other channels. This shift results in the diversification of laundering routes across various blockchains, swapping platforms and privacy-focused networks.

When scammers perceive one laundering route as risky, alternative routes experience higher volumes. Privacy coins gain from this dynamic, as they offer inherent transaction obfuscation, independent of third-party services.

Limitations of privacy coins as a laundering tool

Privacy features notwithstanding, most large-scale hacks still involve extensive use of BTC, Ether (ETH) and stablecoins at later stages. The reason is straightforward: Liquidity and exit options are important.

Privacy coins generally exhibit:

These factors complicate the conversion of substantial amounts of crypto to fiat currency without drawing scrutiny. Therefore, scammers use privacy coins briefly before reverting to more liquid assets prior to final withdrawal.

Successful laundering involves integration of privacy-enhancing tools with high-liquidity assets, tailored to each phase of the process.

Did you know? Some darknet marketplaces now list prices in Monero by default, even if they still accept Bitcoin, because vendors prefer not to reveal their income patterns or customer volume.

Behavioral trends in asset laundering

While tactical specifics vary, blockchain analysts generally identify several high-level “red flags” in illicit fund flows:

-

Layering and consolidation: Rapid dispersal of assets across a vast network of wallets, followed by strategic reaggregation to simplify the final exit.

-

Chain hopping: Moving assets across multiple blockchains to break the deterministic link of a single ledger, often sandwiching privacy-enhancing protocols.

-

Strategic latency: Allowing funds to remain dormant for extended periods to bypass the window of heightened public and regulatory scrutiny.

-

Direct-to-fiat workarounds: Preferring OTC brokers for the final liquidation to avoid the robust monitoring systems of major exchanges.

-

Hybrid privacy: Using privacy-centric coins as a specialized tool within a broader laundering strategy, rather than as a total replacement for mainstream assets.

Contours of anonymity: Why traceability persists

Despite the hurdles created by privacy-preserving technologies, investigators continue to secure wins by targeting the edges of the ecosystem. Progress is typically made through:

-

Regulated gateways: Forcing interactions with exchanges that mandate rigorous identity verification

-

Human networks: Targeting the physical infrastructure of money-mule syndicates and OTC desks

-

Off-chain intelligence: Leveraging traditional surveillance, confidential informants and Suspicious Activity Reports (SARs)

-

Operational friction: Exploiting mistakes made by the perpetrator that link their digital footprint to a real-world identity.

Privacy coins increase the complexity and cost of an investigation, but they cannot fully insulate scammers from the combined pressure of forensic analysis and traditional law enforcement.

Did you know? Blockchain analytics firms often focus less on privacy coins themselves and more on tracing how funds enter and exit them since those boundary points offer the most reliable investigative signals.

Reality of legitimate use for privacy-enhancing technologies

It is essential to distinguish between the technology itself and its potential criminal applications. Privacy-focused financial tools, such as certain cryptocurrencies or mixers, serve valid purposes, including:

-

Safeguarding the confidentiality of commercial transactions, which includes protecting trade secrets or competitive business dealings

-

Shielding individuals from surveillance or monitoring in hostile environments

-

Reducing the risk of targeted theft by limiting public visibility of personal wealth.

Regulatory scrutiny isn’t triggered by the mere existence of privacy features, but when they are used for illicit activity, such as ransomware payments, hacking proceeds, sanctions evasion or darknet marketplaces.

This key distinction makes effective policymaking difficult. Broad prohibitions risk curtailing lawful financial privacy for ordinary users and businesses while often failing to halt criminal networks that shift to alternative methods.

Balancing act of regulators

For cryptocurrency exchanges, the recurring appearance of privacy coins in post-hack laundering flows intensifies the need to:

-

Enhance transaction monitoring and risk assessment

-

Reduce exposure to high-risk inflows

-

Strengthen compliance with cross-border Travel Rule requirements and other jurisdictional standards.

For policymakers, it underscores a persistent challenge: Criminal actors adapt more quickly than rigid regulations can evolve. Efforts to crack down on one tool often displace activity to others, turning money laundering into a dynamic, moving target rather than a problem that can be fully eradicated.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

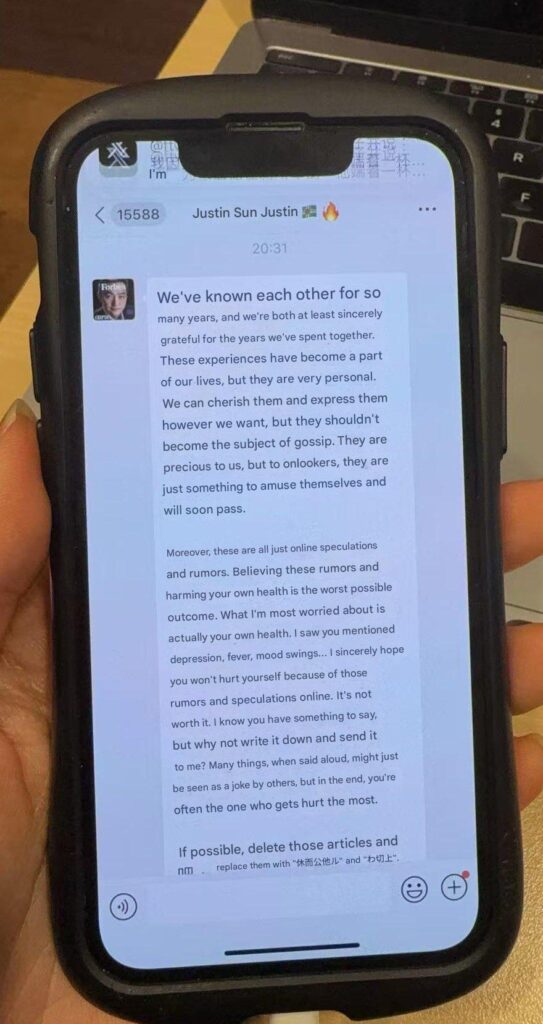

Justin Sun’s ‘ex’ claims he slid into her DMs to get articles deleted

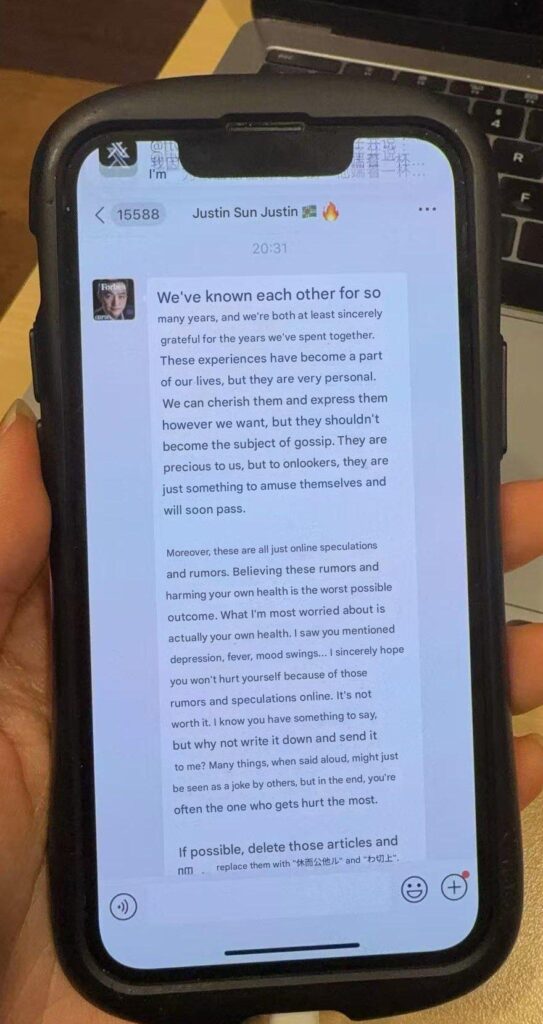

A crypto blogger claiming to be Justin Sun’s ex-girlfriend has shared what appears to be a message from the Tron founder asking her to delete numerous articles while admitting that he “cherishes” their personal time together.

Zeng Ying, otherwise known as Ten Ten, started making accusations against Sun last weekend, accusing him of manipulating the price of TRX with Binance accounts wash trading on his behalf, and also directing crypto accounts to spread misinformation about her.

Her latest post appears to reveal a message she received from Sun, in which he admits that he’s known her for many years and shared “very personal” experiences with her.

In the alleged message, translated using Google, he tells Ten Ten that the two can “cherish” and “express” these experiences, but that they “shouldn’t become the subject of gossip.”

Read more:Justin Sun’s alleged ex accuses him of market manipulation, insider trading

“They are precious to us, but to onlookers, they are just something to amuse themselves and will soon pass.”

He additionally downplays her accusations as “online speculations and rumors,” and tells her that “Believing these rumors and harming your own health is the worst possible outcome.”

“I know you have something to say, but why not write it down and send it to me?” he asks. “Many things, when said aloud, might just be seen as a joke by others, but in the end, you’re often the one who gets hurt the most.”

In the message, Sun apparently also asks Ten Ten to delete some articles and replace them with different text. However, the screenshot shared online doesn’t reveal what specific text this would be.

When sharing the message, Ten Ten said, “So you bought all those water army accounts to smear me, all to help me strengthen my body and build fitness, huh?”

Justin Sun denies all of Ten Ten’s claims

Sun claimed yesterday that “rumors regarding an ‘ex-girlfriend’ and our compliance status are unequivocally false.”

He claims that his firm “cooperates fully with global judicial and law enforcement agencies to crack down on embezzlement, fraud, hacking, other forms of cybercrime, to protect our users’ lawful assets.”

Ten Ten posted minutes later that, “Sun finally got hard for once — he never really got hard when we were together before. I’ll send the full verdict later.” This post was later deleted.

Read more: Justin Sun directed wash trading scheme from his US apartment, SEC claims

The crypto blogger claims to have started publicly attacking Sun after she says she witnessed him become “an insurmountable gate of corruption and wrongdoing.”

She also claims that he offered to marry her later in life, only for him to then announce that he was in a relationship with the skier Eileen Gu.

Protos has reached out to Ten Ten for comment on her allegations and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech8 hours ago

Tech8 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports18 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat14 hours ago

NewsBeat14 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 hours ago

NewsBeat2 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation