Crypto World

U.S. layoffs spike to 17-year high on UPS, Amazon cuts

The U.S. jobs market is cooling fast, a timely blow that could force the Federal Reserve to loosen its purse strings and potentially put a floor under the price of bitcoin .

Planned layoffs, the job cuts that companies have announced but not yet executed, surged by 205% to 108,435 in January, according to data tracked by global outplacement firm Challenger, Gray & Christmas. That’s the highest reading since January 2009, months after Lehman Brothers collapsed and pushed the global economy into recession.

Year-on-year, the announced cuts rose 118%, indicating a sharp weakening in the labor market in the first year of Donald Trump’s second stint as president. The technology industry announced 22,291 reductions, with Amazon (AMZN) accounting for most, while United Parcel Service (UPS) announced 31,243 planned cuts.

Andy Challenger, workplace expert at Challenger, Grey & Christmas, called it a high figure for January, in any case a seasonally weak month for hiring.

“It means most of these plans were set at the end of 2025, signaling employers are less-than-optimistic about the outlook for 2026,” Challenger said.

This data clashes with the Bureau of Labor Statistics’ monthly payrolls report, which still paints a resilient labor market picture.

Private reports are increasingly becoming early warning flags, signaling cracks forming before the official figures. Earlier this month, the blockchain-based Truflation showed a precipitous drop in real-time inflation, to under 1%, even as the official CPI lingers well above the Fed’s 2% target.

Together, these unofficial indicators suggest the Fed may soon need to relax policy by lowering borrowing costs to support the economy. The potential easing could bode well for assets like bitcoin, which is now down nearly 50% from its record high of over $126,000.

The Fed this month left the benchmark borrowing rate unchanged in the 3.5%-3.75% range, while flagging concerns about inflation. Analysts’ projections on what it will do next are all over the place.

JPMorgan expects the Fed to keep rates unchanged throughout this year and then increase sometime in 2027, while other banks expect at least two 25-basis-point rate cuts this year.

An economist who correctly predicted Japan’s fiscal issues expects Trump’s nominee for Fed chairman, Kevin Warsh, to cut rates by 100 basis points before the mid-term elections in November.

Crypto World

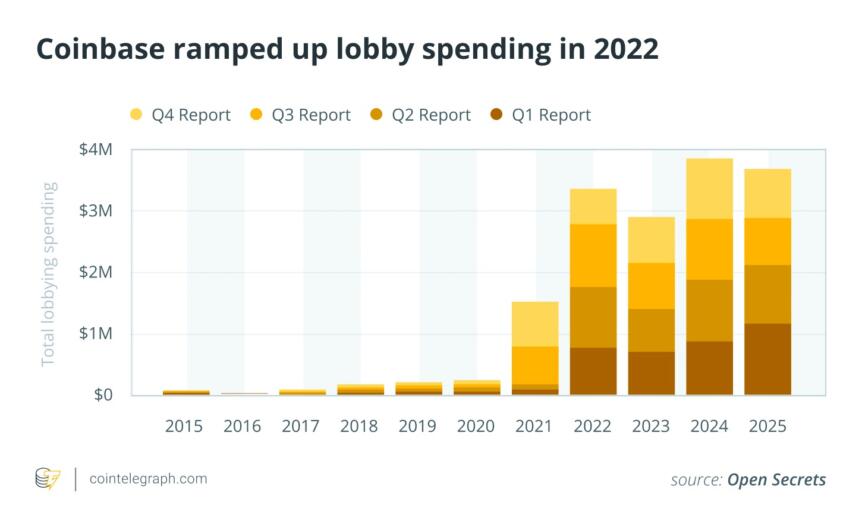

Crypto PACs Amass Millions Ahead of Midterms

As the United States moves toward the 2026 midterm elections, crypto industry lobbying and fundraising activity has accelerated, highlighting a strategic shift in how the sector seeks to shape policy. Super PACs linked to crypto interests have begun pooling funds, with a notable fundraising push that includes a main industry vehicle and prominent tech donors. The landscape features a blend of bipartisan engagement and party-aligned advocacy, underscored by legislative efforts such as the CLARITY Act, which has stalled in the Senate even as committees in the House advance. This push comes amid a broader backdrop of regulatory scrutiny, market volatility, and debates over how best to foster innovation while protecting consumers.

Key takeaways

- The crypto sector’s political spending surged last cycle, with total contributions reaching at least $245 million in 2024, signaling a robust, well-funded lobbying posture ahead of midterm elections.

- Fairshake, the industry’s leading super PAC, raised about $133 million in 2025 and now holds more than $190 million in cash on hand, reflecting significant donor commitments from major players including a16z, Coinbase, and Ripple.

- Discontent about influence in Washington is real among reform groups, who warn that large, industry-aligned money can marginalize ordinary voters and complicate democratic processes.

- Crypto donors are pursuing a bipartisan strategy, supporting both parties or pivoting to align with policymakers who promise a friendlier regulatory environment, while some in Congress push for a unified framework like the CLARITY Act.

- Historical context matters: the sector’s political clout has grown since the 2020–2021 lobbying surge and the FTX collapse, which did not halt the industry’s push to engage lawmakers and shape policy on market structure and consumer protection.

Tickers mentioned: $BTC, $ETH, $COIN

Market context: As the midterm cycle sharpens, the crypto lobby’s visibility in Washington mirrors broader regulatory debates and a shifting investment climate. The policy trajectory—particularly around market structure and stablecoins—remains uncertain, even as lobby groups deploy sizable resources to influence committees and votes.

Why it matters

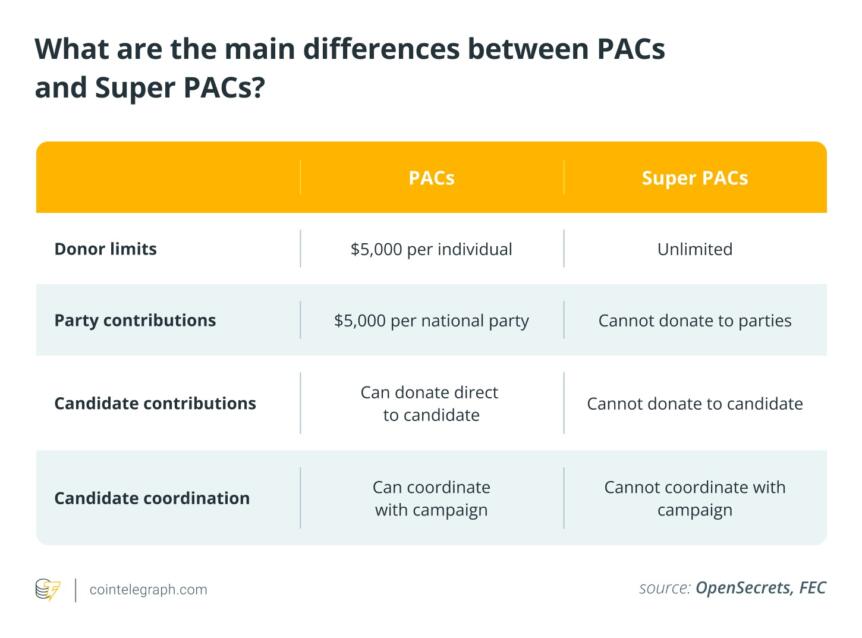

The scale of money funneled into crypto lobbying marks a meaningful departure from earlier eras of campaign finance. Industry-aligned super PACs have become major players, capable of marshaling independent expenditures and transfers to allied committees in a way that can outpace more traditional advocacy channels. This dynamic matters for users, investors, and builders because policy decisions—ranging from regulatory clarity to enforcement actions—directly affect product innovation, market access, and consumer protections.

Observers say the growing influence of well-funded crypto PACs is changing the calculus inside Congress. While some lawmakers welcome clearer rules and a predictable regulatory environment, critics argue that high-dollar donations risk sidelining everyday constituents and distorting legislative priorities. The tension between fostering innovation and imposing guardrails is at the core of ongoing debates about market structure, stablecoins, and the broader crypto economy. The argument is not merely about dollars and elections; it touches the core question of how the American political system can balance rapid technological change with responsible oversight.

Within this landscape, the industry’s messaging is increasingly tailored to bipartisan themes, while some prominent figures invest in politically aligned avenues that promise favorable outcomes. The Winklevoss twins’ support for a conservative pro-crypto fund, for example, underscores a strategic tilt toward candidates perceived as crypto-friendly, even as others push for more centrist or Democratic support to maintain broad accessibility to policymakers. The result is a more nuanced, multi-faceted lobbying approach that seeks to hedge policy risk across party lines and ideological spectrums.

Looking back, the sector’s political activity has evolved alongside its own evolution as a market sector. During the 2020–2021 bull run, crypto firms ramped up advertising and public-relations campaigns, while high-profile names in the industry entered politics or attempted to influence policy through visible campaigns. The FTX saga and related enforcement actions accelerated a broader embrace of Washington engagement, as industry participants sought to define a path toward functioning product rails under a potential regulatory framework.

In Congress, the debate often centers on balance. Proponents argue that a comprehensive framework could unlock innovation and reduce uncertainty, while opponents warn against overreach that could stifle the development of new financial products. The debate around a major piece of legislation, commonly referred to as the CLARITY Act, illustrates this tug-of-war: supporters contend that clear rules would legitimize the sector and invite responsible participants to operate within a defined system, whereas critics warn that the bill may still fall short of satisfying industry stakeholders and ethics officials in the Senate.

One notable donor in the crypto space—Bankman-Fried—made headlines years earlier with immense campaign contributions, a fact cited by prosecutors as part of a broader indictment about how influence was used to push for policies favorable to his business interests. His case serves as a cautionary backdrop to current financing strategies, illustrating how the line between political advocacy and business priorities can blur in high-velocity markets. While Bankman-Fried has faced severe legal scrutiny, the broader ecosystem continues to pursue access to policymakers, albeit with increased attention on governance, compliance, and transparency.

As the 2024 cycle demonstrated, crypto funding did not merely surge; it also diversified. The Fairshake network, originally built as a single-issue pro-crypto fund, grew into a hub for multiple committees and independent expenditures. Its disclosed activity included substantial support for Democrats during the 2023–2024 period, alongside other, more conservative-aligned committees. This diversification is indicative of a broader strategy: deploying resources to achieve leverage across the political spectrum, while maintaining an emphasis on lawmakers perceived as aligned with crypto-friendly regulatory approaches.

“Super PACs are increasingly becoming in vogue for special interests who want to make their presence known in Washington,” said Michael Beckel, research director of Issue One, noting that large, industry-backed reservoirs of cash have become a significant force in shaping policy outcomes. As a result, the cadence and flow of money—both donations and independent expenditures—have become a persistent feature of the policy landscape, with significant implications for how regulations are written and how quickly they move through Congress.

“Industry-aligned super PACs with huge bank accounts have made a huge splash and helped thwart new regulations on their business interests.”

Beyond the halls of Congress, attention has turned to broader governance questions, including the ongoing debate around market structure, consumer protections, and the role of stablecoins in a broad financial ecosystem. The White House has hosted closed-door discussions among crypto and banking leaders in a bid to bridge gaps, but public progress remains cautious, with officials signaling that meaningful consensus may require additional time and negotiation. The dynamic between White House oversight, Senate deliberations, and industry lobbying will likely shape the regulatory timetable for years to come.

As election season resumes, the crypto lobby’s influence remains a core variable in policy outcomes. The sector’s strategy—balancing donor networks, bipartisan outreach, and legislative pressure—highlights how political influence now intersects with technology policy in a way that goes beyond traditional lobbying. If lawmakers can craft a coherent, forward-looking framework that protects consumers while enabling innovation, it could mark a watershed moment for both the crypto industry and the broader financial ecosystem. If not, the divergence between policy ambitions and practical implementation could prolong regulatory uncertainty for years ahead.

What to watch next

- Tracking the CLARITY Act’s status in the Senate and any new consensus on market structure legislation (dates and committee votes).

- Updates on major crypto donors’ disclosures and whether new transparency rules affect PACs and independent expenditures.

- White House-industry talks outcomes and potential regulatory proposals touching stablecoins and consumer protections.

- Upcoming midterm dynamics and how shifts in party control may influence crypto-friendly policy initiatives.

- Monitoring any shifts in the funding strategy of Fairshake and its affiliated committees as the 2026 cycle approaches.

Sources & verification

- FEC committee records for Fairshake (C00835959) and its 2024–2025 activity.

- Open Secrets data on Fairshake expenditures and donor contributions from 2023–2024.

- Reuters reporting on Bankman-Fried’s political donations and related investigations.

- Politico commentary on the blockchain network and party strategy in 2025.

- Senate roll-call votes related to the GENIUS Act and related crypto policy debates.

Crypto money and the midterm race: donors, policy, and power

Political action committees representing the crypto industry have already mobilized substantial funding as the United States heads toward its 2026 midterm elections. The focal point is a blend of large, unrestricted sums and more targeted campaigns designed to influence key policymakers and committees. The industry’s flagship super PAC, Fairshake, has emerged as a central vehicle for fundraising and political spending, with documented contributions and independent expenditures that exceed a century-and-a-half in collective capacity when combined with allied groups.

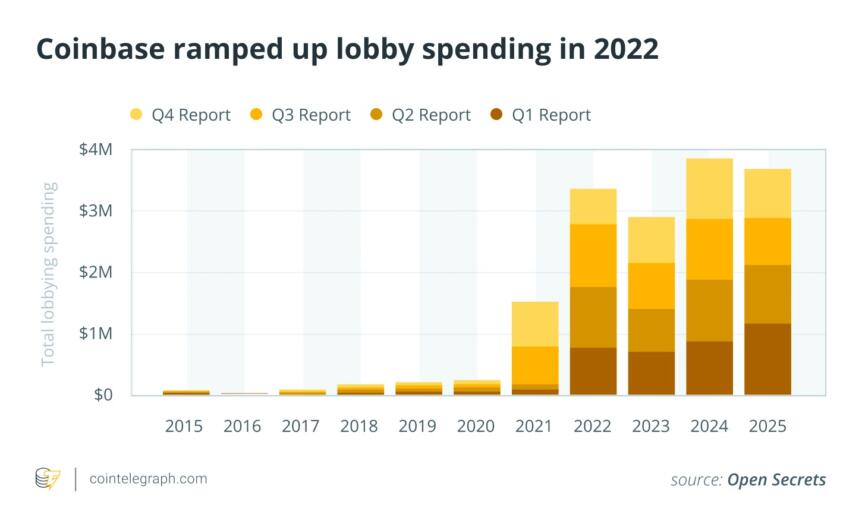

Last year, the crypto industry spent at least $245 million on campaign contributions, a figure that underscored the sector’s appetite for influence. The main super PAC funded by the industry, Fairshake, raised about $133 million in 2025, and its cash on hand now exceeds $190 million. Notable backers include venture-capital powerhouse a16z which contributed an initial $24 million, with Coinbase and Ripple each donating $25 million. The scale here is not merely academic: it represents a deliberate attempt to tilt regulatory and legislative outcomes in ways that supporters argue will create a more predictable environment for innovation and growth, while critics warn of the democratic perils of concentrated influence.

Activist groups have pressed back, arguing that large, industry-backed money undermines the voice of everyday Americans. “This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry’s deregulatory desires,” said Saurav Ghosh, director of the Campaign Legal Center. The concern is not limited to the abstract; it centers on the real-world risk that policy outcomes could skew toward a narrow set of corporate interests rather than broad public goals, particularly as midterm dynamics favor the party controlling the House, Senate, or White House.

The broader political calculus shows crypto lobbying pursuing a degree of bipartisanship, even as the industry remains most comfortable with a regulatory posture that favors innovation. The Senate’s posture toward the CLARITY Act remains a barometer of how far policymakers are willing to go in crafting a comprehensive framework. The act advanced in the House this summer, but in the Senate it has yet to reach a conclusion that satisfies the governance and ethics concerns raised by many Democrats. In the interim, crypto advocates have sought to demonstrate broad-based appeal, balancing support within both major parties and pushing a long-term vision of a policy regime that accommodates new financial technologies without compromising consumer protections.

Publicly, some in the industry emphasize the necessity of nonpartisan engagement. Representative Sam Liccardo, a crypto-friendly Democrat, suggested that no industry should “put eggs in one basket,” signaling a preference for diversified political support. Yet others warn that aligning too closely with one party could backfire as political winds shift. The Winklevoss twins’ strategic donations to Digital Freedom Fund illustrate how industry actors are attempting to influence the policy conversation from multiple angles, covering both conservative and liberal lanes in pursuit of favorable regulatory outcomes.

The policy dialogue has also intersected with discussions about market structure and consumer protections, with Coinbase’s leadership engaging in public debates about proposed restrictions on stablecoin yields. Coinbase argued that a blanket ban could stifle innovation and impede legitimate financial services, while supporters of tighter controls contend that consumer safety cannot be compromised in the name of rapid innovation. The White House has attempted to broker a dialogue on these issues, hosting a closed-door summit with leaders from both crypto and banking sectors; however, Reuters reports that the gathering did not yield a definitive breakthrough on policy alignment.

The broader context is a political environment in which the crypto industry’s influence is increasingly visible and, for some observers, troubling. Critics warn that a system in which wealthier donors shape policy can cast doubt on the electorate’s ability to influence outcomes. Election-oversight advocates argue that this trend could erode trust in democratic institutions if policy results appear engineered to accommodate corporate interests rather than public benefit. In this light, the ongoing lobbying activity surrounding the CLARITY Act, the market structure debate, and related regulatory proposals will be essential to watch as the 2026 midterms approach.

As with any sector undergoing rapid evolution, the stakes are high for users, investors, and builders who rely on a stable, transparent policy framework. The current cycle demonstrates that money, messaging, and momentum can affect the speed and direction of regulatory developments, even in a landscape as complex and dynamic as crypto. The coming months will reveal whether policymakers can translate high-level objectives into clear, workable rules that support innovation while safeguarding the integrity of financial markets.

Crypto World

Is This the Ultimate Rebound Signal?

Is XRP’s recovery sustainable or is this just a dead cat bounce?

Ripple’s cross-border token nosedived to a 14-month low amid the recent crash of the broader cryptocurrency market.

Despite the brutal collapse and the bearish conditions, one important indicator suggests that a short-term resurgence could be on the horizon.

The Light at the End of the Tunnel

The past 24 hours have been ruthless for the digital asset sector, and XRP undoubtedly felt the impact. Its valuation plummeted to $1.11 (per CoinGecko’s data), the lowest level since November 2024, while its market capitalization briefly shrank to nearly $70 billion.

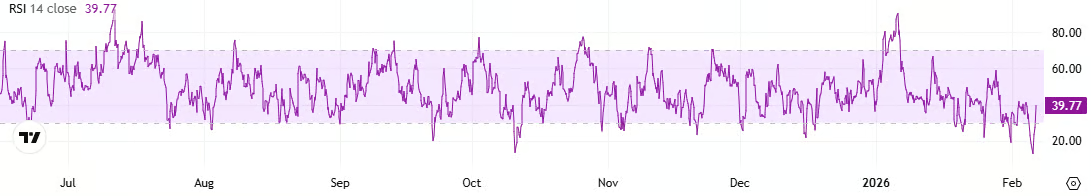

The violent move south has caused the asset’s Relative Strength Index (RSI) to reenter territory last seen during the October 2025 collapse. The technical analysis tool measures the speed and magnitude of recent price changes and ranges from 0 to 100.

Ratios below 30 suggest that the valuation has declined too much in a short period of time, meaning the token is oversold and ready for a potential rebound. On the contrary, anything above 70 is considered a bearish zone. Hours ago, XRP’s RSI fell to 13, but later rose to the current 40.

Meanwhile, the asset’s price has regained some lost ground to nearly $1.40, raising the question of whether this marks the beginning of a genuine recovery or simply represents a dead-cat bounce.

It is important to note that over the past few days, the spot XRP ETF netflows have been positive, suggesting that institutional investors remain interested in the asset. To put this into perspective, the same investment vehicles focused on Bitcoin (BTC) and Ethereum (ETH) have experienced massive red daily candles.

You may also like:

Not so Fast

Despite the optimistic signals mentioned above, some industry participants believe that a further crash is imminent. X user FEXIR | CRYPTO predicted that XRP may tumble below $0.50, while Charting Guy warned that the price could fall to $1.

The increasing number of tokens stored on Binance reinforces fears of an additional crash. Data provided by CryptoQuant shows that investors have been transferring coins from self-custody to the biggest exchange in the past week, and now the reserves stand at almost 2.73 billion XRP. Such a development is often interpreted as a pre-sale step.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Coinbase (COIN) Shares Plunged Alongside Bitcoin

While the leading cryptocurrency was trading above $125k in October 2025, it fell to around $60k yesterday. The decline accelerated sharply — a pattern typical of panic-driven markets where excessive leverage is widely used. According to Coinglass, roughly $2bn worth of long positions were liquidated across crypto exchanges over the past 24 hours.

Bitcoin’s drop of more than 50% over five months has had a direct impact on Coinbase (COIN) shares, which slid below $150 for the first time since April 2025.

Technical analysis of COIN shares

Recall that on 16 January, when analysing the Coinbase (COIN) chart, we:

→ highlighted bearish signals, including a bull trap at peak B;

→ outlined a descending red price channel;

→ suggested that despite COIN trading near a key support area (marked in blue), a strong bullish reversal was unlikely.

Since then:

→ the narrow candle bodies between 20 and 28 January showed that buyers attempted to defend the highlighted support zone, but without success;

→ on 29 January, price broke bearishly below the long-term ascending channel (shown in black), after which COIN continued to fall without finding support. As a result, 13 consecutive bearish daily candles formed.

That said, the extreme fear currently dominating the market is creating conditions for a technical rebound:

→ the RSI indicator has fallen to its lowest level since COIN began trading on the Nasdaq, encouraging profit-taking on short positions;

→ price is hovering near the lower boundary of the descending channel, which has now doubled in width;

→ price is also close to the $145 level, which acted as support in 2024–2025. A false bearish break below this area cannot be ruled out, potentially triggering a psychological shift and altering the balance between supply and demand.

It is reasonable to assume that the sharp collapse in COIN’s share price could attract large-scale investors who may view it as undervalued from a long-term perspective.

Sentiment could also improve following the release of the quarterly earnings report, scheduled for 12 February, as well as the exchange’s strategic plans for 2026.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

What Is a Change of Character (CHoCH) in Trading? Definition, Signals, and Examples

In Smart Money Concept (SMC) trading, recognising when market momentum shifts can mean the difference between catching a trend reversal and holding a losing position. The Change of Character (CHoCH) is a price action pattern that can signal these pivotal moments when the balance between buyers and sellers tips. Unlike continuation patterns that confirm ongoing momentum, a CHoCH alerts traders to prepare for directional changes.

This article explores how to identify CHoCH patterns on a chart, explains how they differ from similar concepts like Break of Structure and Market Structure Shift, and demonstrates their practical application through real trading examples.

Takeaways

- CHoCH is a concept that signals potential trend reversals in Smart Money Concept trading. This pattern has two forms: bullish CHoCH and bearish CHoCH. A bullish CHoCH occurs when price breaks above a recent lower high in a downtrend, while a bearish CHoCH happens when price falls below a recent higher low in an uptrend, indicating possible momentum shifts.

- A CHoCH is usually compared to a Break of Structure (BOS). However, these concepts are opposite. BOS confirms trend continuation by breaking in the direction of the existing trend, whereas CHoCH signals a potential reversal by breaking against the prevailing trend.

- Another common pattern the CHoCH is compared to is a Market Structure Shift (MSS). However, MSS is a higher-confluence CHoCH that includes additional confirmation signals like a lower high (bearish) or higher low (bullish) before the break, plus strong displacement.

- Change of Character patterns can be found across all timeframes, from intraday to weekly charts, with higher-timeframe signals generally carrying more significance.

Understanding Breaks of Structure

Before delving into concepts like Change of Character (CHoCH) traders should understand the Breaks of Structure (BOS) pattern. A BOS in trading signifies a continuation within the current trend and is marked by a clear deviation from established swing points that indicate previous highs and lows.

In the context of an uptrend, a BOS is identified when the price exceeds a previous high without moving below the most recent higher low. This action confirms that the upward momentum is still strong and likely to continue as buyers push the market to new heights.

Similarly, in a downtrend, a BOS occurs when prices drop below a previous low without breaking the prior lower high, suggesting that sellers remain in control and the downward trend is set to persist.

By recognising these points where the market extends beyond its former bounds, traders can confirm that the current trend is robust and act accordingly. This foundational concept of BOS may not only help in assessing trend strength but also sets the stage for understanding more complex patterns like CHoCH, where the focus shifts from trend continuation to potential trend reversals.

CHoCH Trading Meaning

In trading, a Change of Character (CHoCH) is a concept that reflects a potential shift in market dynamics, often indicating a reversal from the prevailing trend. It may help traders discern when the momentum is shifting, offering a strategic point to consider adjusting their positions.

A CHoCH occurs when there’s a noticeable deviation in the market’s price trend. For example, in a bullish trend characterised by a series of higher highs and higher lows, a CHoCH is indicated by the price failing to set a new high and subsequently falling below a recent higher low. This suggests that buyers are losing control, and a bearish trend could be emerging.

Similarly, during a bearish trend marked by lower highs and lower lows, a bullish CHoCH would occur if the price unexpectedly breaks above a recent lower high. This break indicates that sellers are losing their grip, and a bullish trend may be starting.

The Significance of CHoCHs Across Timeframes

The fractal nature of financial markets means that patterns and behaviours recur across various timeframes, each providing unique insights and implications for trading. Understanding CHoCHs in different timeframes may help traders align their strategies with both short- and long-term trend shifts. This is known as multi-timeframe analysis.

In intraday trading, where decisions are made on lower timeframes (like minutes or hours), a CHoCH can signal a possible short-term trend reversal. For example, if a currency pair in a downtrend on a 15-minute chart suddenly posts a higher high, this could indicate a weakening of the bearish momentum, suggesting a potential bullish reversal.

Traders might use this information to close short positions or to consider a long position, capitalising on the emerging upward trend. These short-term CHoCHs allow traders to respond quickly to market changes, potentially securing returns before larger market shifts occur.

Conversely, CHoCHs observed on higher timeframes, such as daily or weekly charts, are particularly significant because they can indicate a shift in the broader market trend that might last days, weeks, or even months. Such changes can then be used by both long and short-term traders to adjust their positioning and directional bias.

How Is Change of Character Identified?

The initial step to identify a CHoCH in trading involves clearly defining the existing trend on a specific timeframe. This is done by marking the significant swing highs and lows that delineate the trend’s progress. These points should represent somewhat meaningful retracements in the price, providing clear markers of trend continuity or potential reversal points.

According to the Smart Money Concept (SMC) theory, the integrity of an uptrend is maintained as long as the price does not trade through the most recent significant higher low. Conversely, a downtrend is considered intact if the price does not surpass the most recent significant lower high. Therefore, traders focus their attention on these critical points.

To identify a CHoCH, traders watch for a break in these crucial high or low points. For instance, in an uptrend, a bearish CHoCH is indicated when the price achieves a higher high but then reverses to descend below the previous significant higher low.

Similarly, in a downtrend, a bullish CHoCH occurs when the price drops to a lower low before reversing to break above the previous significant lower high, setting a new high. Both types of breaks signal a potential reversal in the trend direction.

To try and spot your own CHoCHs, you can head over to FXOpen’s TickTrader platform to access real-time charts and numerous market analysis tools.

Application of CHoCH

CHoCHs should be integrated with other aspects of the SMC framework. This includes the use of order blocks and imbalances, which are important components in identifying potential reversals.

Order Blocks and Imbalances

An order block is essentially a substantial consolidation area where significant buying or selling has occurred, and prices often revisit these zones before reversing. These blocks can be seen as levels where institutional orders were previously concentrated.

An imbalance, also known as a fair value gap, occurs when the price moves sharply up or down, leaving a zone that has not been traded extensively. Price often returns to these gaps to ‘fill’ them, establishing equilibrium before a potential reversal happens.

In practice, traders can look for a sequence where the price first approaches an order block and begins to fill any existing imbalances. This setup increases confidence in a potential reversal. As the price meets these criteria and a CHoCH occurs, this indicates that the influence of the order block is likely to initiate a price reversal.

Practical Example on GBP/USD

Consider the 4-hour chart of the GBP/USD pair above. We see the pair encounter an order block on the left, one that’s visible on the daily chart. As the price interacts with this block, it begins to retrace, attempting to fill the imbalance but moves away. Eventually, the price completes the fill of the imbalance and meets the previously established order block.

Switching to a 1-hour timeframe, this scenario unfolds similarly. After reaching the order block on the 4-hour chart, another CHoCH occurs, signalling the start of a new uptrend. This lower timeframe CHoCH, following the meeting of the order block, corroborates the potential for a reversal initiated by the higher timeframe dynamics.

This example illustrates how CHoCHs can be utilised across different timeframes, tying back to the fractal nature of markets discussed earlier. By recognising these patterns and understanding their interaction with order blocks and imbalances, traders can strategically position themselves to capitalise on potential market reversals, aligning their trades with deeper market forces at play.

Change of Character vs Market Structure Shift

A Market Structure Shift (MSS) is a specific type of Change of Character that includes additional signals suggesting a potential trend reversal. Unlike a straightforward CHoCH that typically indicates a trend is shifting but may also be a false break, an MSS can be seen as a higher confluence CHoCH. An MSS occurs after the market first makes a key movement contrary to the established trend—forming a lower high in an uptrend or a higher low in a downtrend—without plotting a higher high or lower low.

Following these preliminary signals, an MSS is confirmed when there is a decisive break through a significant swing point accompanied by a strong displacement (i.e. impulse) move, creating a CHoCH in the process. This sequence not only reflects that the prevailing trend has paused but also that a new trend in the opposite direction is establishing itself.

Due to these additional confirmations, an MSS can offer added confirmation for traders, indicating a stronger likelihood that a new, sustainable trend has begun. This makes the MSS particularly valuable for traders looking for more substantiated signals in their trading strategy.

The Bottom Line

The Change of Character (CHoCH) is one of the popular Smart Money concepts, offering traders valuable insight into potential market reversals. By learning to identify CHoCH patterns, traders can align their strategies with institutional order flow. However, as with any trading tool, CHoCH isn’t used in isolation but combined with other market analysis techniques.

To test different trading approaches, you can consider opening an FXOpen account and access a wide range of financial assets, low commissions*, and tight spreads* (*additional fees may apply).

FAQ

What Is CHoCH in Trading?

In trading, CHoCH is a technical observation that signifies a change in the trend’s character, where the price movement breaks from its established pattern of highs and lows, suggesting a potential reversal or substantial shift in the market’s direction.

What Is CHoCH in SMC Trading?

In Smart Money Concept (SMC) trading, a Change of Character (CHoCH) refers to a clear shift in market behaviour that indicates a potential reversal of the prevailing trend. This concept is used by traders to detect early signs of a momentum shift that might lead to significant changes in price direction, enabling strategic adjustments to their trading positions.

What Is a CHoCH in the Market Structure?

A CHoCH in market structure is identified when there is an observable deviation from established price patterns — specifically when new highs or lows contradict the current trend. It signifies that the previous market sentiment is weakening, and a new opposite trend may be starting, prompting traders to reassess their strategies.

How Is CHoCH Identified on a Price Chart?

Identifying a CHoCH involves monitoring significant swing highs and lows for breaks that are contrary to the existing trend. For instance, in an uptrend, a CHoCH would be indicated by a failure to reach a new high followed by a drop below the recent higher low, suggesting a shift to a bearish outlook.

What Is ChoCH vs BOS in Trading?

While both CHoCH and Break of Structure (BOS) are critical in assessing market dynamics, they serve different purposes. CHoCH indicates a potential trend reversal by highlighting a significant change in the price pattern. In contrast, a BOS indicates a continuation of the current trend by showing the price surpassing previous significant highs or lows, reinforcing the ongoing direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Mitigation Blocks: How May Traders Identify and Trade Them?

Understanding where institutional traders have left unfilled orders can provide insights into potential price reversals. Mitigation blocks represent specific zones on price charts where price movements stopped and reversed, offering traders a framework for anticipating future market behaviour.

Within the Smart Money Concept framework, these areas serve as possible reference points for entry and exit strategies. This article examines mitigation in trading, their distinguishing characteristics compared to breaker blocks, and practical applications in trading strategy development.

Takeaways

- A mitigation block is a price action concept identifying specific price zones where previous price movements halted and reversed. They mark potential areas for future market turns within Smart Money trading frameworks.

- A bullish mitigation block forms during downtrends when price creates a higher low without breaking the previous low, often showing increased buying volume. Conversely, a bearish mitigation block develops in uptrends with a lower high formation and heightened selling pressure at resistance.

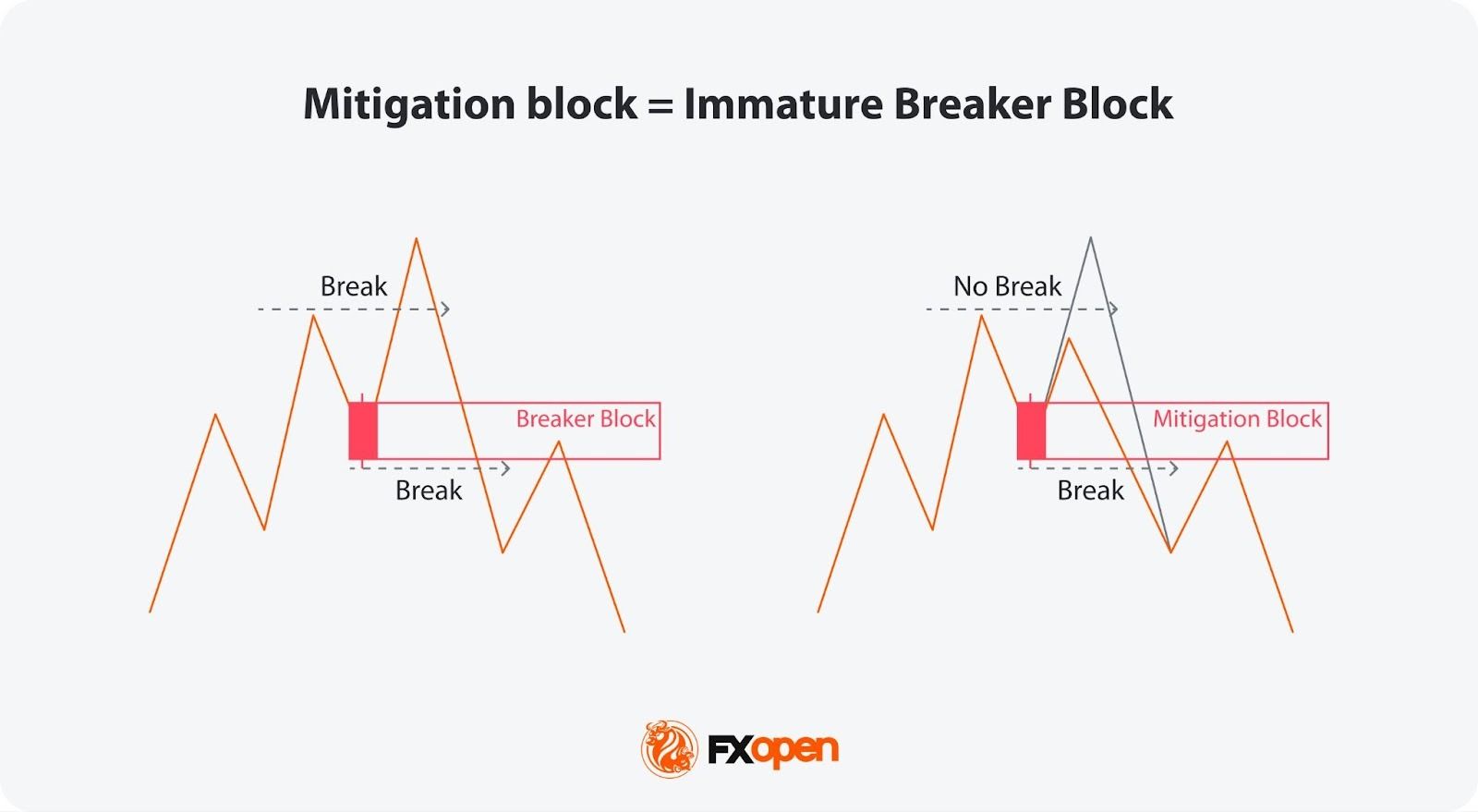

- Mitigation blocks are often compared to breaker blocks, but there are significant differences between the two. Mitigation blocks form after failure swings where price doesn’t surpass the previous extreme, while breaker blocks occur when price creates a new high/low before reversing and breaking structure—indicating liquidity may have been taken.

- Traders use mitigation blocks in trading by placing limit orders within validated zones, often after a new peak or trough confirms the block, while combining analysis with higher timeframe context for refined entries.

Definition and Function of a Mitigation Block

A mitigation block refers to a specific zone on a chart that indicates where previous movements have stalled and reversed, marking it as a potential area for future market turns. This concept within the Smart Money framework is popular among traders looking for strategic entry and exit points.

The idea behind these areas is rooted in the dynamics of supply and demand. When a currency pair reaches a level where buyers or sellers have previously entered the market in force, causing a reversal, it suggests a potential repeat of such actions when the price returns to the area.

Characteristics and How Traders Identify a Mitigation Block

Mitigation blocks can be bullish or bearish, each with distinct characteristics:

- Bearish Mitigation Block: This type forms during an uptrend and is identified by a significant peak followed by a decline and a failed attempt to reach or surpass the previous high, creating a lower high. When prices drop below the previous low, the price zone above the low becomes mitigation. It may be characterised by an increase in selling volume as the price approaches the level, signalling resistance and a potential downward reversal.

- Bullish Mitigation Block: Conversely, a bullish type is established during a downtrend. It is characterised by a significant trough, followed by a rise to form a higher low, and a failure to drop below the previous low. As the price moves up, the zone below the high marks mitigation one. This area often shows an increase in buying volume as the price approaches, indicating support and a potential upward reversal.

To have a go at identifying your own blocks, you can head over to FXOpen’s TickTrader platform to access a world of currency pairs and over 1,200 charting tools.

Mitigation Block vs Breaker Block

Mitigation and breaker blocks are both significant in identifying potential trend reversals in trading, but they have distinct characteristics that set them apart. A mitigation block forms after a failure swing, which occurs when the market attempts but fails to surpass a previous peak in an uptrend or a previous trough in a downtrend. The pattern indicates a loss of momentum and a potential reversal as the price fails to sustain its previous direction.

On the other hand, a breaker block is characterised by the formation of a new high or low before the market structure is broken, indicating that liquidity has been taken. This means that although the trend initially looked set to continue, it quickly reverses and breaks structure.

In effect, a breaker appears when the market takes liquidity beyond a swing point before reversing the trend. A mitigation appears when the price doesn’t move beyond the trend’s most recent high or low, instead plotting a lower high or higher low before reversing the trend.

Application of Mitigation Blocks in Trading

Areas of mitigation in trading can be important tools for identifying potential trend reversals and entry points. When they align with a trader’s analysis that anticipates a reversal at a certain level, it can serve as a robust confirmation for entry.

Traders can utilise these zones by placing a limit order within the area once it is considered valid. Validation occurs after a new peak or trough is established following the initial failure swing that forms the mitigation area.

If a liquidity void or fair-value gap is present, the trader may look for such a gap to be filled before their limit order is triggered, potentially offering a tighter entry. Stop losses might be placed beyond the failure swing or the most extreme point.

Furthermore, if a mitigation block is identified on a higher timeframe, traders can refine their entry by switching to a lower timeframe. This approach is supposed to allow for a tighter entry point and potentially more effective risk management, as it offers more granular insight into the momentum around the area.

Common Mistakes and Limitations in Mitigation Blocks

While these blocks are valuable for trading, they come with potential pitfalls and limitations that traders should know.

- Overreliance: Relying solely on mitigation blocks without corroborating with other trading indicators can lead to misjudged entries and exits.

- Ignoring Context: Using these zones without considering the broader market conditions may result in trading against a prevailing strong trend.

- Misinterpretation: Incorrect identification can lead to erroneous trading decisions, especially for less experienced traders.

- False Signals: Mitigation blocks can sometimes appear to signal a reversal but instead lead to a continuation of the trend, trapping traders in unfavourable positions.

The Bottom Line

Mitigation blocks remain a valuable tool for traders seeking to understand institutional behaviour. By highlighting areas where unfilled orders may influence future price action, they can support traders in decision-making. However, like any market concept, mitigation blocks should not be viewed in isolation. Traders combine them with broader market structure analysis, liquidity concepts, and strict risk-control practices.

If you are looking to apply these concepts in a practical trading environment, you can consider opening an FXOpen account to put theory into practice across dozens of currency pairs complemented by robust tools and insights.

FAQs

What Is a Mitigation Block?

A mitigation block is a price zone that identifies potential reversal points. It signals where a currency pair has previously stalled, indicating strong buying or selling pressure, suggesting similar reactions in future encounters with these levels.

How Do Traders Identify a Mitigation Block?

Mitigation blocks are identified by analysing charts for areas where previous highs or lows were not surpassed, leading to a reversal. Traders look for a sequence of movements, including a swing high or low followed by a retracement that fails to exceed the previous swing.

What Is the Difference Between a Breaker Block and a Mitigation Block?

While both indicate potential reversals, a breaker block forms when the price makes a new high or low before reversing, suggesting a temporary continuation of the trend. In contrast, a mitigation block forms without creating a new extreme, indicating a direct loss of momentum and an immediate potential for reversal.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Gurhan Kiziloz confirms he has $100b in sight for Nexus International

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Nexus International hits $1.2 billion revenue as billionaire Gurhan Kiziloz sets sights on $100 billon long-term growth.

Summary

- Nexus International hits $1.2b revenue as founder Gurhan Kiziloz targets $100b without outside investors.

- After five bankruptcies, Gurhan Kiziloz has built a $1.2b revenue empire while retaining full ownership.

- Spartans.com’s casino-only strategy powers Nexus growth, avoiding dilution while competing with Stake and bet365.

Gurhan Kiziloz, the self-made billionaire behind Nexus International, is not one to celebrate mid-journey. His company just crossed $1.2 billion in annual revenue for 2025, triple its 2024 performance, and yet he’s already thinking ten steps ahead. “We’re not calling $1.2 billion a milestone,” Kiziloz said in a recent interview. “There’s much more scale to build. I’d call $100 billion a turning point. That’s where we’re going.”

For most founders, that kind of revenue would signal a peak. For Kiziloz, it barely registers as a checkpoint. The entrepreneur who once faced five bankruptcies is now the sole owner of a company that competes with billion-dollar operators, without raising a single dollar in venture capital. And he’s openly stating that $100 billion is the number that will define his long-term ambition.

The numbers are clear. In 2024, Nexus International reported $400 million in revenue. By the end of 2025, that number hit $1.2 billion. The 200% year-on-year increase marks the largest single-period growth in the company’s history and puts it firmly in the league of mid-sized global operators.

But what makes Nexus different isn’t just the scale, it’s the structure. The company has no external investors. Every dollar used for growth comes from retained earnings. Kiziloz has maintained full ownership of the parent company throughout this expansion, bypassing the equity dilution that usually follows hypergrowth.

The biggest contributor to Nexus’s revenue explosion is Spartans.com, a casino-only gaming platform that goes head-to-head with names like Stake and bet365. Unlike most competitors, Spartans.com doesn’t combine casino and sportsbook offerings. It’s intentionally focused, designed to dominate the casino niche rather than spread thin across multiple verticals.

In 2025 alone, Spartans.com absorbed $200 million in platform reinvestment, every cent funded internally. This operational discipline has become a hallmark of the Nexus playbook: scale only when the existing product is cash-generative, and never dilute ownership to fuel expansion.

The remaining portfolio includes Megaposta, a licensed Latin American brand, and Lanistar, a platform tailored for Europe. While both contribute to the overall structure, Spartans remains the driving force behind the company’s financial ascent.

What makes Kiziloz’s model unique isn’t just that he avoided venture funding. It’s how he used that constraint as a structural advantage. Without external capital, there’s no boardroom politics, no investor timelines, and no incentive to inflate short-term metrics for the sake of fundraising optics. Decisions are made fast, costs are tightly controlled, and accountability rests entirely with Kiziloz and his internal team.

The numbers reflect that clarity. The company reinvested $200 million in 2025 into tech, compliance, and platform architecture, without tapping into credit lines or private equity. That’s rare in a sector where expansion is almost always debt- or dilution-fueled.

It’s easy to misread Kiziloz’s $100 billion target as bravado. But for him, it’s about building a durable model that doesn’t depend on narrative cycles or temporary hype. The $1.2 billion revenue mark is a milestone, yes, but it’s not the story. The story is that he got there without giving up ownership, without artificial growth, and without compromising execution standards.

“I think the future of high-scale businesses will look more like this,” he said. “You don’t need to raise to grow. You need to build things that work and keep control while doing it.”

That approach stands in contrast to most of today’s unicorns, many of which are propped up by billions in funding with no clear path to profitability. Nexus has already crossed the profitability line. And it’s doing so with a product-first, capital-efficient mindset that remains rare, especially in online gaming.

Nexus has not issued public guidance for 2026, nor has it broken down revenue by platform or geography. Kiziloz’s philosophy is not to speculate forward but to let operational output speak for itself.

But if past performance is any indication, Nexus International is not slowing down. With Spartans.com driving volume, and Megaposta continuing to benefit from early market entry in Brazil, the company’s momentum is clear. And unlike its competitors, Nexus doesn’t have to wait for board approvals or capital calls to deploy that momentum.

The result is a structure that moves faster, adapts more precisely, and scales without compromise.

Gurhan Kiziloz’s story isn’t clean or conventional. He went bankrupt five times before finding the formula that stuck. That formula was simple: eliminate what doesn’t work, double down on what does, and keep ownership at all costs.

Today, with a $1.7 billion personal net worth and a business generating $1.2 billion annually, the math proves that approach works. But for Kiziloz, it’s still early.

Because the goal was never just survival. The goal, as he says, is to reach the turning point. And that number is $100 billion.

This article was prepared in collaboration with BlockDAG. It does not constitute investment advice.

Crypto World

Solana Price Bounces After 30% Crash, Yet Recovery Looks Weak

Solana’s price has staged a sharp rebound after one of its steepest declines. After breaking down from its descending channel on February 4, SOL plunged nearly 30% to around $67. Since then, the token has recovered more than 15%, climbing back toward the $78 region.

At first glance, the bounce looks encouraging. However, on-chain data suggests that the rebound may be driven by short-term speculation rather than strong long-term demand. Historical patterns show that similar recoveries often fade quickly when speculative money comes in strongly. Current metrics indicate that Solana may still be vulnerable to another leg lower if one key level isn’t reclaimed.

Sponsored

Sponsored

Descending Channel Breakdown Triggered the 30% Drop

Solana’s sell-off accelerated after the price decisively broke the lower trendline of its descending channel on February 4, in line with an earlier SOL price analysis.

Once the lower trendline support failed, SOL quickly moved toward its projected downside target near $67, completing a decline of nearly 30% from recent highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

After reaching the $67 zone, buyers stepped in and triggered a rebound toward $78. While this move represents a recovery of more than 15%, the broader technical structure has not improved.

Similar rebounds in past cycles have often occurred after major dips, but they rarely marked durable reversals unless supported by strong accumulation. So far, the current bounce lacks that confirmation as the buyer persona is now under the scanner.

Short-Term Buyers Lead the Rebound as Long-Term Holders Reduce Exposure

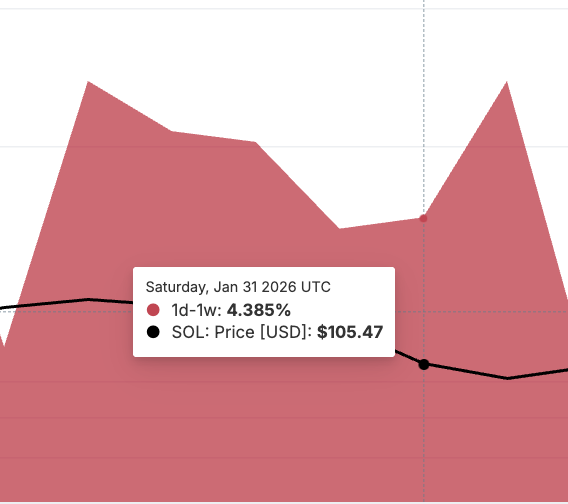

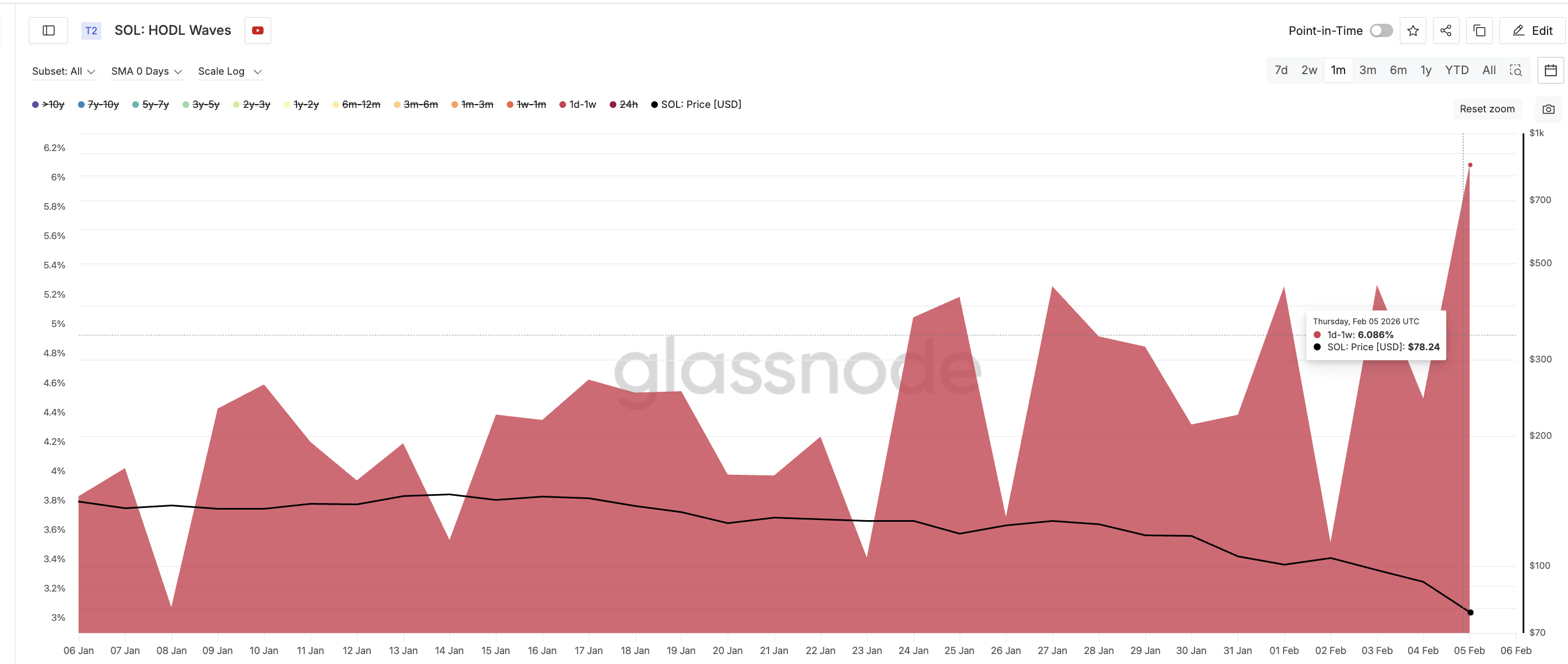

On-chain data shows that Solana’s rebound is being driven mainly by short-term holders rather than long-term investors. According to the HODL waves metric, which separates wallets by time held, the one-day to one-week cohort increased its share of supply from 4.49% to 6.08% between February 4 and February 6.

Sponsored

Sponsored

This represents a sharp rise in speculative participation over a short period. Historically, this group tends to sell quickly during periods of weakness, making their buying activity unreliable as a foundation for sustained rallies.

A similar pattern appeared in late January. On January 27, short-term holders controlled around 5.26% of the supply. By January 31, their share had dropped to 4.38% as they sold into weakness. During that period, Solana’s price fell from around $127 to $105, a roughly 17% decline.

This behavior highlights how quickly short-term buyers can exit when momentum fades. With their current share rising again, the recent rebound risks unraveling if selling pressure returns.

Sponsored

Sponsored

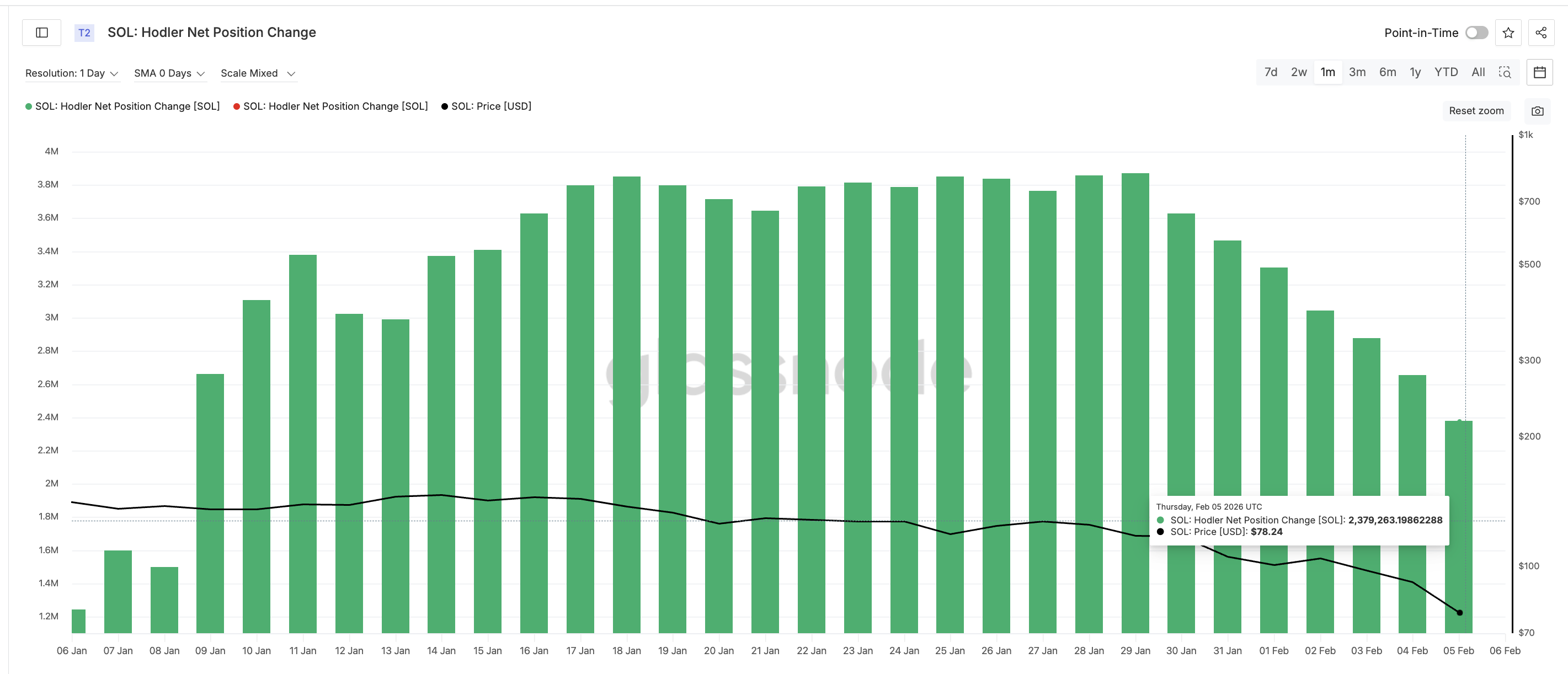

At the same time, long-term holders continue to reduce exposure. The Hodler net position change metric, which tracks long-term investor holdings, has declined from approximately 2.87 million SOL on February 3 to around 2.37 million SOL by February 5. A 17% dip in two days, amid the dip.

This shows that investors holding for more than 155 days are still distributing rather than accumulating.

When short-term buyers are increasing exposure while long-term holders are exiting, it usually signals weak market conditions. This imbalance suggests that conviction remains weak and that the rebound is not being supported by strong capital inflows.

Solana Price Levels Show Why the Recovery Remains Unproven

Solana’s price structure reflects the weakness seen in on-chain data.

Sponsored

Sponsored

The first key level to watch is $93. Reclaiming this zone would require another move of nearly 19% from current levels and would signal a meaningful improvement in market structure and even Hodler confidence. Without a sustained break above this level, upside attempts are likely to face selling pressure.

Above $93, stronger resistance sits near $105 and $121, where previous breakdowns occurred. These zones would need to be reclaimed before a medium-term recovery could be confirmed.

On the downside, the $67 region remains critical support. This level marked the recent cycle low. A sustained break below $67 would expose the next downside target near $59.

If $59 fails, Solana could enter a deeper corrective phase, bringing lower support zones into play. Such a move would likely be accompanied by further selling from short-term holders and continued distribution from long-term investors.

Until Solana reclaims $93 while long-term accumulation returns and speculative activity cools, the rebound remains technically and structurally weak. Under current conditions, price bounces are still vulnerable to rapid reversals.

Crypto World

Toyota Stock Rises 2% as Earnings Beat Estimates Despite Tariff Headwinds

TLDR

- Toyota reported Q3 operating profit of $7.6 billion, beating Wall Street estimates of $6.7 billion as higher prices and a weaker yen offset U.S. tariff impacts.

- The automaker raised its full-year profit forecast by $2.6 billion to $24.2 billion, citing strong sales and cost-cutting measures.

- Toyota stock rose 2% in overseas trading following the earnings beat despite implied Q4 guidance falling below analyst projections.

- CEO Koji Sato will step down and be replaced by CFO Kenta Kon, with Sato moving to vice chairman and chief industry officer roles.

- The company trimmed annual vehicle sales forecast to 9.75 million units from 9.8 million due to production disruptions in Brazil and continued U.S. tariff pressure.

Toyota stock climbed 2% in Friday trading after the Japanese automaker reported fiscal third-quarter earnings that crushed Wall Street expectations. The strong results came despite ongoing pressure from U.S. tariffs.

The company posted operating profit of ¥1.2 trillion ($7.6 billion) for the quarter ending December 31. Analysts had projected just $6.7 billion.

Higher vehicle prices helped the automaker maintain profitability. A weaker yen also provided a boost to the bottom line.

Toyota’s U.S.-listed American depositary receipts gained 1.8% in premarket trading. The stock has climbed 25% over the past 12 months.

Tariff Impact Less Severe Than Expected

U.S. import duties on Japanese vehicles remain at 15% after President Donald Trump reduced them from an initial 25% following a trade deal with Tokyo. Many analysts feared these tariffs would severely damage Toyota’s profit margins.

The third-quarter results showed those fears were overblown. Toyota managed to offset the tariff costs through pricing power and currency benefits.

Revenue grew nearly 8% year-over-year to ¥13.5 trillion. Net income fell 40% to ¥1.3 trillion, reflecting increased costs and investment spending.

The automaker increased its full-year profit forecast by ¥400 billion ($2.6 billion) to ¥3.8 trillion ($24.2 billion). The raised guidance reflects better-than-expected performance in the first three quarters.

Mixed Outlook for Fourth Quarter

Toyota’s implied fourth-quarter operating profit guidance sits at approximately $3.8 billion. Wall Street analysts currently project $5.6 billion for the period.

Last year, Toyota reported $7.7 billion in operating profit during the fiscal fourth quarter. The company’s fiscal year runs through March 31.

Toyota trimmed its annual vehicle sales forecast to 9.75 million units from 9.8 million. Production disruptions in Brazil contributed to the reduced outlook.

Chinese sales continue to face pressure as diplomatic tensions between Tokyo and Beijing persist. U.S. tariffs remain a headwind despite the recent reduction.

Leadership Transition Announced

Toyota announced a major leadership change alongside its earnings report. CEO Koji Sato will step down from his position.

CFO Kenta Kon will take over as chief executive. Sato will remain with Toyota as vice chairman and chief industry officer.

The leadership transition comes as Toyota navigates a challenging global trade environment. The company continues implementing cost-cutting measures to maintain profitability.

Foreign exchange movements provided tailwinds during the quarter. The yen’s weakness against the dollar helped offset some cost pressures.

Car stocks have performed well recently despite tariff concerns. Ford Motor stock is up 48% over the past year, while General Motors has gained 74%.

Toyota’s strong quarterly results and raised full-year guidance were enough to satisfy investors on Friday. The company’s ability to beat estimates while managing tariff headwinds demonstrates pricing power in a difficult environment.

Crypto World

Bithumb Error Sends Bitcoin Crashing 10% After 2,000 BTC Airdrop

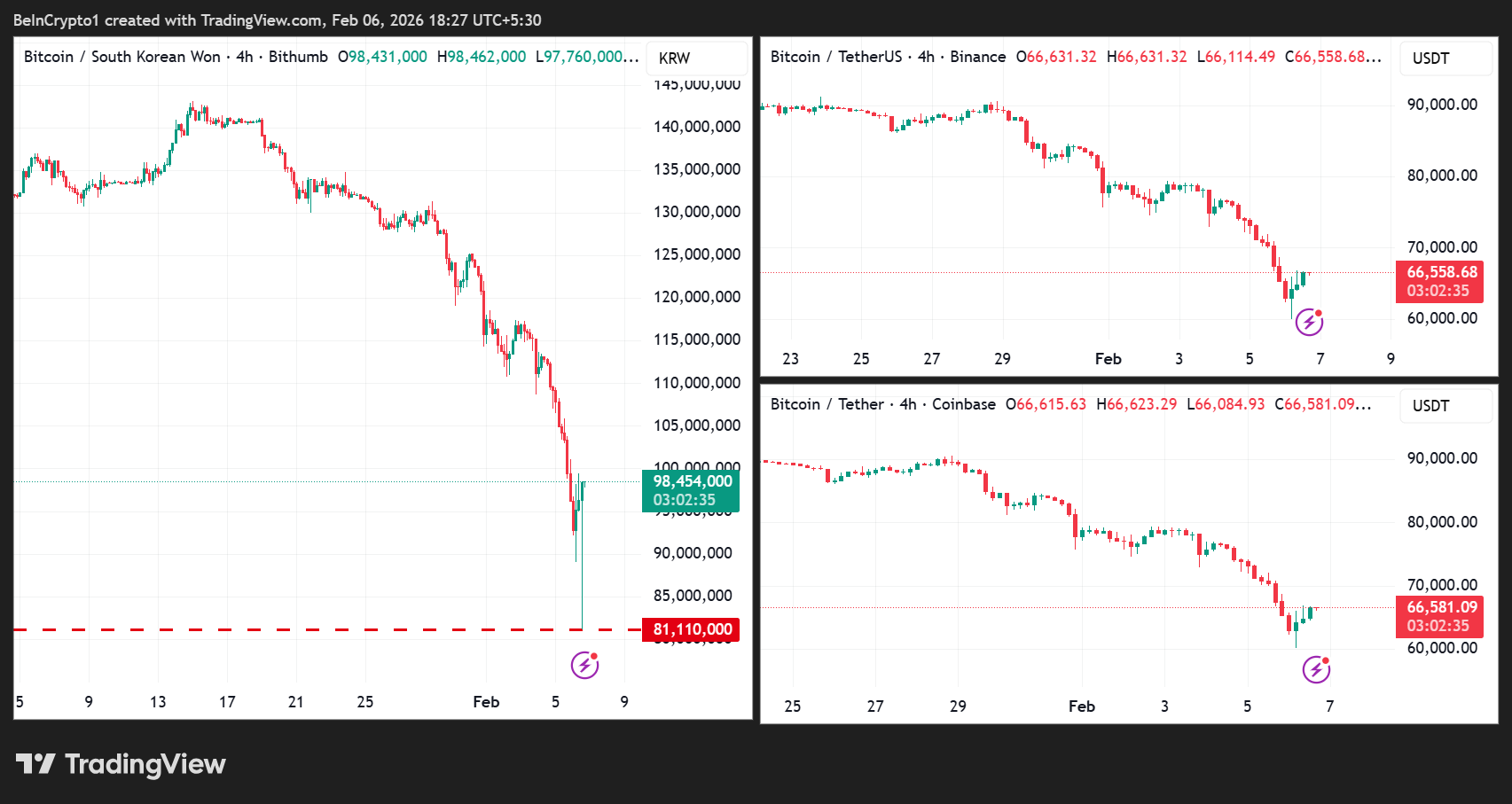

South Korea’s cryptocurrency exchange Bithumb faced a major operational mishap on February 6, 2026, which quickly sent the BTC/KRW trading pair down by double digits.

It brings to mind past controversies about the exchange, including incidents of partial liability in data leaks.

Sponsored

Sponsored

Bithumb’s Accidental 2,000 BTC Airdrop Sparks 10% Bitcoin Crash on Exchange

Reportedly, a staff member accidentally sent 2,000 Bitcoin (BTC) to hundreds of users instead of the intended 2,000 Korean Won (KRW) reward.

The error triggered an immediate wave of sell-offs, sending Bitcoin’s price on the exchange more than 10% below global market rates.

Dumpster DAO core member Definalist first reported the incident, citing a routine airdrop meant as a small incentive for platform users.

Amidst the chaos, some users reportedly benefited significantly from the mistake, selling their unexpected Bitcoin windfall at market prices.

The accidental BTC distribution has raised questions about internal controls and risk management at crypto exchanges, particularly those handling high-value digital assets.

Sponsored

Sponsored

“Crazy to think that exchanges can still do paper trading like this, even in 2026 lmao,” remarked Definalist.

Notably, however, the Bitcoin price crash was largely confined to Bithumb due to the exchange’s isolated order book. Users sold massive amounts of BTC directly on Bithumb, overwhelming its liquidity and causing a 10% local drop.

Other exchanges remained unaffected because the selling pressure didn’t enter their markets, and global arbitrage mechanisms hadn’t yet adjusted the discrepancy, keeping the impact largely contained.

Notwithstanding, the incident highlights the operational risks that can persist even in major exchanges, despite years of industry maturation. It also shows how a simple input error can cascade into substantial market disruption.

Sponsored

Sponsored

Bithumb did not immediately respond to BeInCrypto’s request for comment and has not yet released an official public statement on corrective measures.

Still, the event could influence market confidence in the short term, particularly on exchanges where operational errors have immediate price consequences.

Bithumb’s Operational History and Corporate Changes Highlight Ongoing Risks

Bithumb itself has a checkered history with security and operational issues. In 2017, a data breach exposed customer information, and in a 2020 ruling, local media reported that the exchange was found partially liable in one case in which a user lost $27,200.

The court ruled that, although Bithumb’s database had been accessed, the claimants should have recognized the scam attempts and awarded only $5,000 in damages.

Sponsored

Sponsored

Other claims were dismissed because the court found the private information could have been obtained elsewhere.

Bithumb has also undergone significant corporate changes in recent years. In 2018, the exchange sold a 50% stake to BK Global Consortium, a group led by startup investor Kim Byung-gun, who was already the company’s fifth-largest shareholder.

This acquisition came amid a broader contraction in the crypto sector investment. According to FinTech Global research, global crypto investments peaked at $7.62 billion in 2018 before falling to $3.11 billion in 2019. In the first half of 2020 alone, the sector raised just $578.2 million.

This latest mishap adds to Bithumb’s long history of operational challenges, reinforcing the view that while crypto adoption is growing, the sector remains vulnerable to human and technical errors, even in leading exchanges.

Crypto World

Citi trims price target after big decline

Wall Street bank Citigroup is dialing back expectations for Coinbase (COIN) amid a risk-off mood gripping markets.

In a Friday note to clients, the bank’s analysts lowered their price target on the crypto exchange to $400 from $505, citing weaker trading volumes, softer institutional activity and ongoing uncertainty around the timing of U.S. crypto legislation.

The new $400 price target still represents more than a doubling in price from COIN’s close last night of $146. The same analyst team lifted its price target on COIN to $505 in July 2025 as the stock was hitting a record high near $450.

Shares are up 6% in pre-market action on Friday as crypto markets recover a bit from Thursday’s crash that saw bitcoin plunge all the way to $60,000.

Despite the near-term reset, the firm reiterated its buy/high risk rating, calling Coinbase the category leader and a prime beneficiary of eventual crypto reform. Progress on CLARITY, Citi said, remains the key catalyst for reviving the stock’s momentum.

The bank now expects Senate negotiations over the market structure bill to stretch beyond 2026, even as groundwork continues.

Coinbase CEO Brian Armstrong said his firm had pulled support for a sweeping digital assets bill after finding provisions that could have harmed consumers and stifled competition.

The bill has repeatedly lost steam as crypto and banking lobbyists clash over stablecoin yield, while lawmakers from both parties remain deadlocked on several other provisions.

Marking current crypto prices to market, analysts led by Peter Christiansen cut their near-term forecasts, trimming Coinbase fourth-quarter 2025 net revenue by roughly 10% to $1.69 billion, about 4% below consensus.

After factoring in a $2.3 billion mark-to-market decline on crypto holdings and Coinbase’s equity stake in Circle (CRCL), the analysts now forecast a fourth-quarter GAAP EPS loss of $2.64.

Coinbase will release fourth quarter and full year 2025 financial results after the close on February 12.

Read more: Citi says CLARITY Act momentum builds, but DeFi fight could stall crypto bill

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports5 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business22 hours ago

Business22 hours agoQuiz enters administration for third time

-

NewsBeat57 minutes ago

NewsBeat57 minutes agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World22 hours ago

Crypto World22 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World21 hours ago

Crypto World21 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation