Crypto World

UAE-Approved DDSC Stablecoin Goes Live on ADI Chain

IHC and First Abu Dhabi Bank-initiated DDSС stablecoin goes live with the UAE Central Bank approval and license, proving ADI Chain’s readiness to support regulated global financial and capital markets infrastructure at scale.

The Dirham-Backed Stablecoin DDSC is now live on ADI Chain. Backed 1:1 by UAE Dirham reserves, it was initiated by International Holding Company (IHC), one of the largest investment companies in the world, with $240 billion in capitalization, and First Abu Dhabi Bank (FAB) – the UAE’s largest bank with over $330 billion in assets and 33% of the UAE banking market share.

DDSC is approved and licensed by the UAE Central Bank and operates exclusively on ADI Chain, an institutional-grade Layer 2 blockchain infrastructure built for national-scale deployment. FAB serves as the banking partner, providing custody of fiat reserves and bringing 4 million customers across 20 markets and decades of banking infrastructure onto programmable blockchain rails.

The model is designed with clear separation. IHC and FAB initiated the stablecoin project, with Sirius International Holding supporting deployment and institutional adoption. DDSC, a registered entity, serves as the distributor and issuer. The UAE Central Bank approved and licensed it. ADI Chain hosts it on compliance-ready infrastructure.

Proving the Compliance-Ready Blockchain Model

Stablecoins have reached a global scale. According to a16z crypto’s State of Crypto report, stablecoin transactions exceeded $46 trillion in 2024. Usage now resembles traditional payment rails rather than speculative trading. Digital cash is moving from a crypto-native tool to a strategic national infrastructure.

DDSC demonstrates that compliance requirements don’t conflict with public blockchain benefits. The infrastructure delivers instant settlement, 24/7 availability, and transparent transaction rails. Industry data shows the UAE processes over $70 billion in digital payment transaction value annually, alongside nearly $50 billion in cross-border remittances and significant trade flows across MENA-Asia-Africa corridors. DDSC stablecoin provides compliant settlement rails for these existing flows.

When a Central Bank trusts blockchain infrastructure for monetary settlement, governments and institutions worldwide take notice. Post-mainnet, ADI secured MOUs with BlackRock, Mastercard, and Franklin Templeton for tokenized asset settlement, blockchain payment rails, and digital product infrastructure, alongside M-Pesa Africa for cross-border remittance rails across eight African markets. These collaborations validate the compliance-first approach.

The Infrastructure Behind Sovereign Settlement

ADI Chain is the first institutional Layer 2 blockchain for stablecoins and real-world assets in MENA. The ADI Foundation was founded by Sirius International Holding, the digital arm of IHC, which is one of the world’s largest investment holding companies.

The foundation developed ADI Chain as a purpose-built infrastructure for emerging markets where compliance, security, and regulatory alignment cannot be compromised.

The architecture rests on three pillars:

- Compliance-ready infrastructure begins with the ADI Foundation, which operates under the ADGM regulatory framework.

- Efficient execution leverages ZKsync’s Airbender technology, making ADI the first blockchain to implement the latest generation of zero-knowledge proof systems.

- Secure architecture is validated through OpenZeppelin’s comprehensive audit covering core contracts, infrastructure, token standards, and critical systems.

This combination creates infrastructure that addresses institutional needs without compromising the benefits of public blockchain technology.

ADI: The Utility Token

Every blockchain requires a gas token to function. For governments and institutions building compliant infrastructure, that token needs to deliver functions beyond processing transactions.

ADI serves as the core utility token for MENA’s first institutional Layer 2 ecosystem. The token processes all smart contract executions, dApp interactions, and value transfers across ADI Chain and its L3 sovereign networks. It functions as the medium of exchange across the ecosystem, facilitating settlement between enterprises, developers, validators, and users, creating a unified settlement layer for network operations.

DDSC stablecoin operates on ADI Chain’s infrastructure, where ADI functions as the utility token powering on-chain transactions. When users transfer DDSC for payments, settlements, or cross-border remittances, ADI processes the underlying blockchain operations.

The Path Forward

DDSC represents the first step in a larger infrastructure play. The roadmap moves through clear stages: prove the model with the UAE’s dirham, extend to other GCC currencies, connect to Africa via M-Pesa infrastructure, and enable interoperable settlement across MENA-Africa-Asia.

The goal is a network of institution-backed regional stablecoins, all interoperable on ADI Chain, creating a compliant settlement infrastructure for emerging markets. ADI Foundation is building infrastructure to support multiple governments launching regional stablecoins on the same compliance-ready settlement layer.

A year ago, the ADI Foundation announced its formation at Abu Dhabi Finance Week. Twelve months later, it returned to the same stage to announce the mainnet launch. Today, Dirham-Backed stablecoin DDSC goes live on ADI Chain, proving that regulated national stablecoins can operate on public blockchain infrastructure.

About ADI Foundation & ADI Chain

ADI Foundation is an Abu Dhabi-based non-profit founded by Sirius International Holding, a subsidiary of IHC, dedicated to empowering governments and institutions in emerging markets through blockchain infrastructure. The foundation’s mission is to bring one billion people into the digital economy by 2030, building on a foundation of 500+ million people already within its ecosystem reach.

ADI Chain is the first institutional Layer 2 blockchain for stablecoins and real-world assets in the MENA region, providing settlement infrastructure for a dirham-backed stablecoin initiated by IHC and FAB, licensed by the UAE Central Bank. The network operates on three pillars – Compliance, Efficiency, Security – serving governments implementing blockchain infrastructure across the Middle East, Asia, and Africa.

For more information, visit the Official Website, LinkedIn, and X.

DISCLAIMER: ADI Foundation is an Abu Dhabi-based not-for-profit DLT Foundation (“ADI”) and registered with Abu Dhabi Global Market (“ADGM”) under commercial license number (20599) and governed by ADGM’s DLT Foundation Regulation of 2023. ADI Chain and tokens developed by ADI are not subject to registration with ADGM’s financial regulator, the Financial Services Regulatory Authority (“FSRA”). ADI’s Chain is used by regulated and non-regulated third parties for the deployment of digital assets.

ADI Chain and the ADI token are developed by ADI. ADI issues only utility tokens which are not regulated digital assets under the regulatory framework of ADGM’s Financial Services Regulatory Authority (“FSRA”) and therefore, ADI’s tokens are not subject to registration with the FSRA or other financial regulators.

All features, token utilities, timelines, and launch details are subject to change without notice. No guarantees are made regarding future performance or token value. This content is for informational purposes only and does not constitute investment, legal or tax advice, nor an offer to buy or sell any digital assets. Investment capital is a risk.

Crypto World

Hundreds of developers competed in the Consensus Hong Kong 2026 hackathon

As the curtain falls on Consensus Hong Kong 2026, the focus has shifted from the corporate boardrooms to the show floor. While institutional talk dominated the main stages, nearly 1,000 developers spent the week in the trenches of the EasyA x Consensus Hackathon, signaling a definitive pivot in the industry: the “Year of the Application Layer.”

The competition, which has become a staple of Consensus by CoinDesk’s flagship events, saw over 30 projects pitch on demo day. The quality of builds, aided significantly by generative AI, clearly demonstrated that the barrier between a “proof of concept” and a “market-ready product” has effectively been removed.

A rising bar: From infrastructure to intent

The evolution of the developer talent at Consensus has grown gradually. In previous years, hackathon submissions were often deeply technical, building faster consensus mechanisms or niche scaling solutions that remained out of reach for the average user.

This year, however, the bar has been set to a new level. Developers have evolved into product builders, shifting their focus from the backend to the user.

“The big thing that we’ve seen right now is that developers are actually building things that real people can actually use,” said Phil Kwok, co-founder of EasyA. “We’ve seen a big increase in the application layer. This is the year of the horse in Asia, but it’s the year of the application layer in blockchain.”

This shift toward User Experience (UX) was evident in the sophisticated use of “passkeys”, technologies from iOS and Android that allow users to log into Web3 apps without the friction of 24-word seed phrases, Kwok said. By removing these traditional “clicks” and barriers, developers are finally making products that feel like the apps people use every day.

The Winners’ Circle

The judges awarded top honors to projects that prioritized automation, security, and risk management, three pillars essential for the next wave of retail adoption, Kwok explained.

First place: FoundrAI ($2,500)

Taking the top spot was FoundrAI, an autonomous AI agent designed to act as a “startup in a box.” The platform doesn’t just launch tokens; it manages the entire lifecycle of a project, including hiring human developers to build out the product. It represents a provocative look at the future of decentralized labor.

Second place: SentinelFi ($1,750)

Addressing the industry’s persistent “rug-pull” problem, SentinelFi provides real-time safety scores for crypto traders. By performing six-category on-chain analysis, the tool helps users sniff out scam tokens before they commit capital—a critical utility as token launch volumes explode.

Third Place: PumpStop ($1,000)

PumpStop rounded out the top three with a non-custodial trading layer focused on risk mitigation. Using state-channel instant execution, it allows traders to set stop-loss orders with on-chain proofs, bringing professional-grade trading tools to a decentralized environment without sacrificing custody.

The ‘show floor’ evolution

The growth of the hackathon reflects a broader shift in the Consensus ethos. Once a strictly corporate affair, the event has increasingly integrated the “builder” culture into its DNA. Dom Kwok, co-founder of EasyA, noted that the hackathon has moved from side rooms to the center of the show floor.

“Typically every hackathon that we host gets bigger and bigger,” Dom said. “It’s taking up more and more of the conference floor every year. We had someone flying in from San Diego just to see what was getting built.”

Despite the “depressing” macro environment often reflected in token prices, the sentiment on the ground in Hong Kong remained stubbornly bullish. Organizers pointed out that while interest rates and Fed policy drive the charts, the builders are focused on the 93% of the world that doesn’t yet own crypto. The path to that next billion users, it seems, is being paved by developers who finally realize that usability is the ultimate feature, Dom said.

Phil and Dom said they can’t wait for Consensus Miami 2026 to see how much more the bar is raised and how many more developers participate with surprisingly great new ideas.

Crypto World

Alameda moves another $15M in Solana as traders watch for market impact

Alameda Research’s bankruptcy estate has distributed another $15 million worth of Solana to creditors, extending a repayment process that has now been running for nearly two years.

Summary

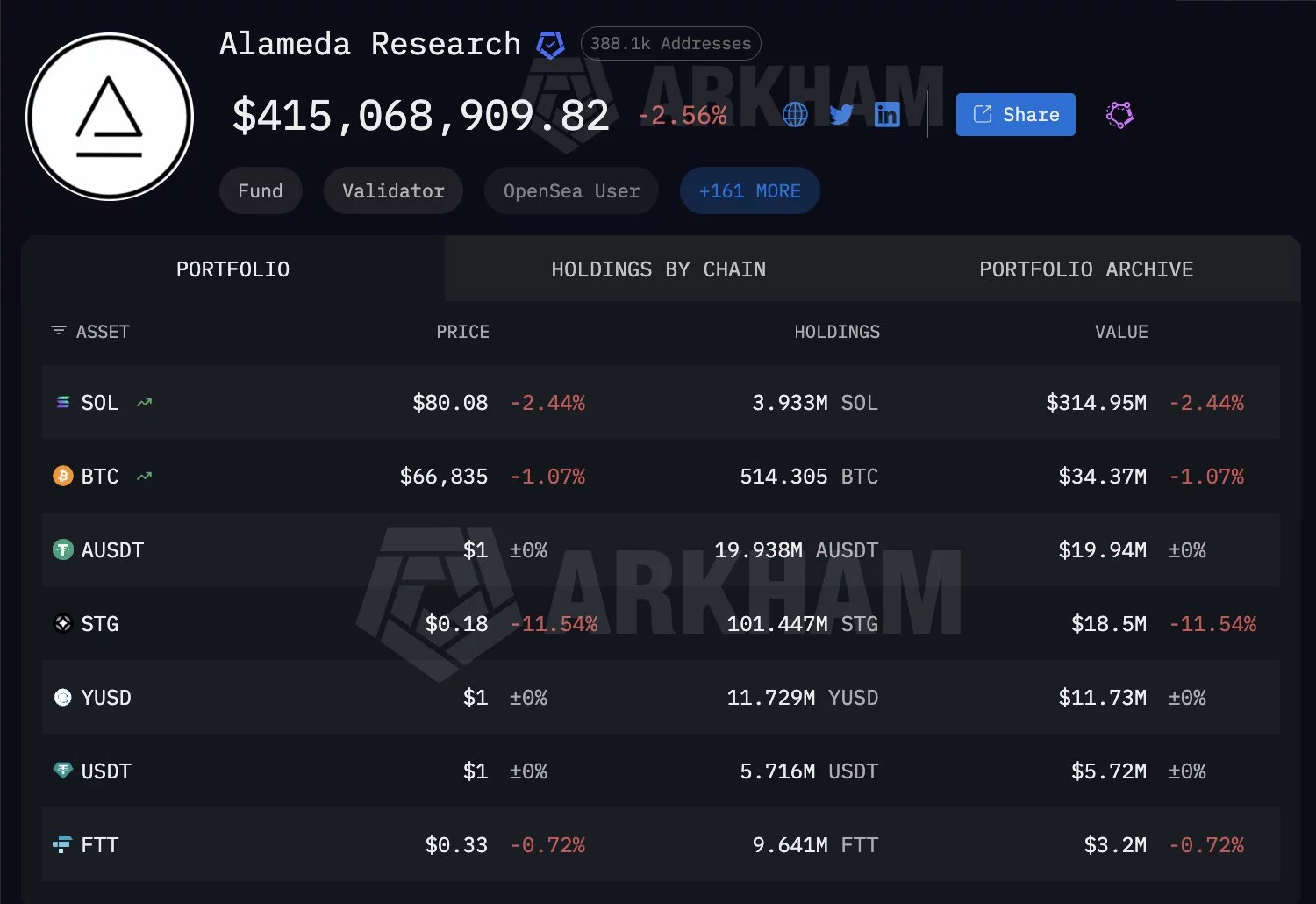

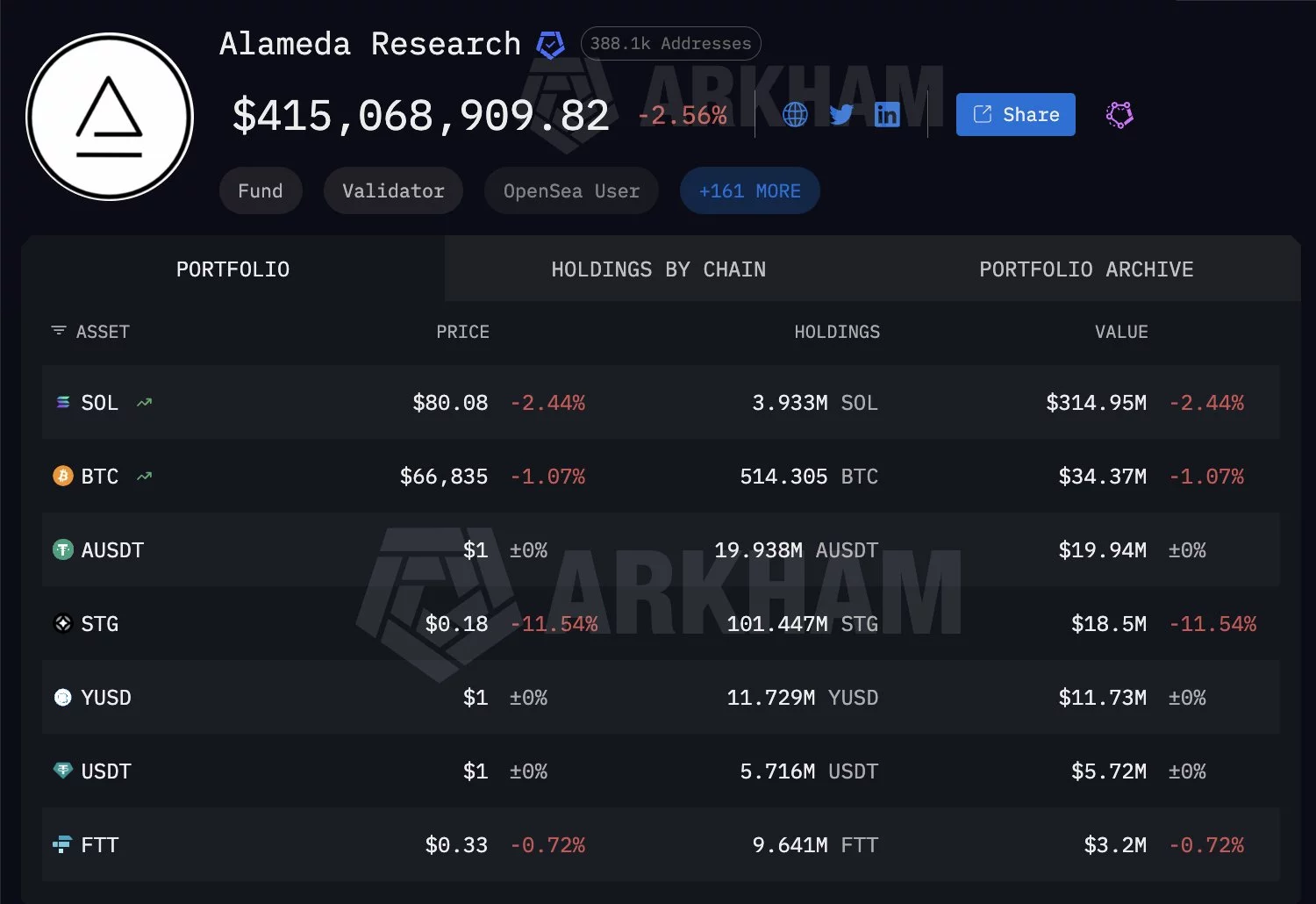

- Alameda Research’s bankruptcy estate distributed roughly $15.6 million in Solana to creditors in its latest monthly payout, extending a repayment process that has run for 21 months.

- Despite ongoing distributions, Alameda still holds nearly $315 million worth of SOL on-chain, keeping traders alert to potential supply overhang risks.

- Most of Alameda and FTX’s SOL was previously sold through OTC deals in 2024, with remaining distributions being handled gradually to limit market impact.

According to blockchain data highlighted by Arkham, the latest monthly tranche involved the transfer of roughly $15.60 million in Solana (SOL) to 25 separate addresses.

The movement forms part of a structured distribution program that has been ongoing for 21 months following the collapse of FTX and its trading arm, Alameda Research.

Despite the steady outflows, Alameda’s on-chain wallets still hold approximately $314.95 million worth of SOL, keeping the estate among the largest known holders of the token tied to the defunct exchange empire.

Market impact questions resurface

The renewed transfers have reignited debate over whether these distributions ultimately translate into sell pressure on the open market.

Arkham raised the question directly, asking whether the newly distributed SOL would be “SOLd straight into the market,” a concern that has repeatedly surfaced during prior repayment rounds.

While the latest tranche is relatively modest compared to Alameda’s historical holdings, traders remain sensitive to any supply overhang tied to creditor payouts, particularly during periods of broader market volatility.

Solana’s native token has been volatile in recent months, trading near the low-to-mid $80s to low $90s range after pulling back from higher levels seen in 2025.

Where Alameda’s SOL went

Additional context was provided by analyst Emmet Gallic, who traced the fate of the bulk of Alameda and FTX’s Solana holdings.

According to the analysis, roughly 43 million SOL was largely sold through over-the-counter deals across three major tranches in 2024, limiting direct market disruption.

Those sales included 26 million SOL at $64 to buyers such as Galaxy, Pantera, Jump, and Multicoin; 14 million SOL at $95 through a Pantera-led consortium; and a further 2 million SOL at $102 involving Figure Markets and Pantera.

Since those OTC sales, remaining SOL distributions have been handled gradually, suggesting a continued effort to balance creditor repayments with market stability. Still, with more than $300 million in SOL left on-chain, Alameda-linked movements are likely to remain a point of close scrutiny for Solana traders in the months ahead.

Crypto World

Why DOGE and XRP Holders Are Excited

As part of the strategy to turn X (formerly Twitter) into a “super app” or Everything App, a key missing piece, X Money, is beginning to take shape.

X aims to be more than a social media platform. Elon Musk wants to transform it into a personal finance game-changer. Users could handle messaging, shopping, and full personal asset management in one place.

Why Are Crypto Investors Excited About X Money?

During an xAI “All Hands” presentation in February 2026, Elon Musk revealed that X Money is already running in internal testing among X employees. A limited rollout to users is expected within the next one to two months.

Sponsored

Sponsored

X Money has secured money transmitter licenses in more than 40 US states. It also established strategic partnerships with major payment giants such as Visa last year.

“For X Money, we actually had X Money live in closed beta within the company, and we expect in the next month or two to go to a limited external beta and then to go worldwide to all X users. And this is really intended to be the place where all the money is, the central source of all monetary transactions. So it’s really going to be a game-changer,” Elon Musk said.

Musk aims to push monthly active users past 600 million and ultimately reach 1 billion. Analysts compare this ambition to building an everything app similar to China’s WeChat.

As a result, X Money represents a major opportunity for any crypto project that accepts it as a payment method or is indirectly connected to the platform.

However, X Money has never confirmed that crypto will be used as a payment option. Investors, meanwhile, continue to build their own narratives.

The first speculation centers on Dogecoin (DOGE). This meme coin closely aligns with Elon Musk’s personal brand. The theory stems from Musk’s past comments suggesting DOGE could be suitable for micropayments.

The second speculation involves XRP. This hypothesis is linked to Cross River Bank, a financial partner working with X to process payment flows. Since 2014, Cross River Bank has integrated Ripple’s protocol to enable real-time cross-border payments between the US and Western Europe.

Despite these narratives, DOGE and XRP prices showed no significant reaction to news of X Money’s upcoming launch.

In the coming months, once X Money officially goes live as planned, its impact on crypto markets and the global financial system may become clearer.

Crypto World

UK Launches Blockchain Digital Bond Pilot With HSBC Orion

The United Kingdom’s government has appointed HSBC’s tokenization platform to power a pilot issuance of digital government bonds, known as “gilts,” marking the latest step in its push to modernize sovereign debt markets using blockchain technology.

His Majesty’s Treasury has appointed HSBC Orion to facilitate the Digital Gilt Instrument (DIGIT) pilot issuance, according to a Thursday announcement.

The Treasury published a DIGIT pilot update in July 2025, outlining plans to explore blockchain applications in UK sovereign debt issuance and to support the development of domestic tokenization infrastructure.

“We want to attract investment and make the UK the best place to do business,” said Lucy Rigby, UK economic secretary to the Treasury, commenting on HSBC Orion’s DIGIT appointment. She added that the pilot will help the UK explore how to capitalize on the distributed ledger technology (DLT), enhance efficiency and reduce costs for businesses.

Key objectives and features of the DIGIT pilot

The DIGIT pilot aims to enable digitally native, short-dated government bonds operating within the Digital Securities Sandbox (DSS).

The pilot is designed to support secondary market development and broader accessibility, with onchain settlement, while operating independently of the UK government’s main debt management program.

“This is exactly the kind of financial innovation we need to keep the UK at the forefront of global capital markets and I’m looking forward to working with HSBC and other parties to deliver DIGIT,” Rigby said.

HSBC has issued $3.5 billion in digital bonds globally

Since its launch in 2023, HSBC Orion has enabled the issuance of at least $3.5 billion in digitally native bonds globally, including the European Investment Bank’s first digital sterling bond and a multi-currency $1.3 billion-equivalent bond issued by the Hong Kong government.

“The UK is a home market for us and the sixth largest economy in the world,” said Patrick George, HSBC’s global head of markets and securities services. “HSBC is delighted to be supporting the continued development of the gilt market, market innovation, and the growth of the broader UK economy,” he added.

Related: Malaysia’s central bank announces stablecoin, tokenization sandbox

Alongside appointing HSBC Orion as the platform provider for DIGIT, the UK government also appointed global law firm Ashurst to provide legal services for the pilot.

“Our team brings deep expertise in digital assets transactions, and we look forward to working with HSBC and supporting the government as it takes this transformative step for UK capital markets,” Ashurst’s head of digital assets, Etay Katz, said.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

New Crypto Casino With 275% Welcome & 75 Free Spins!

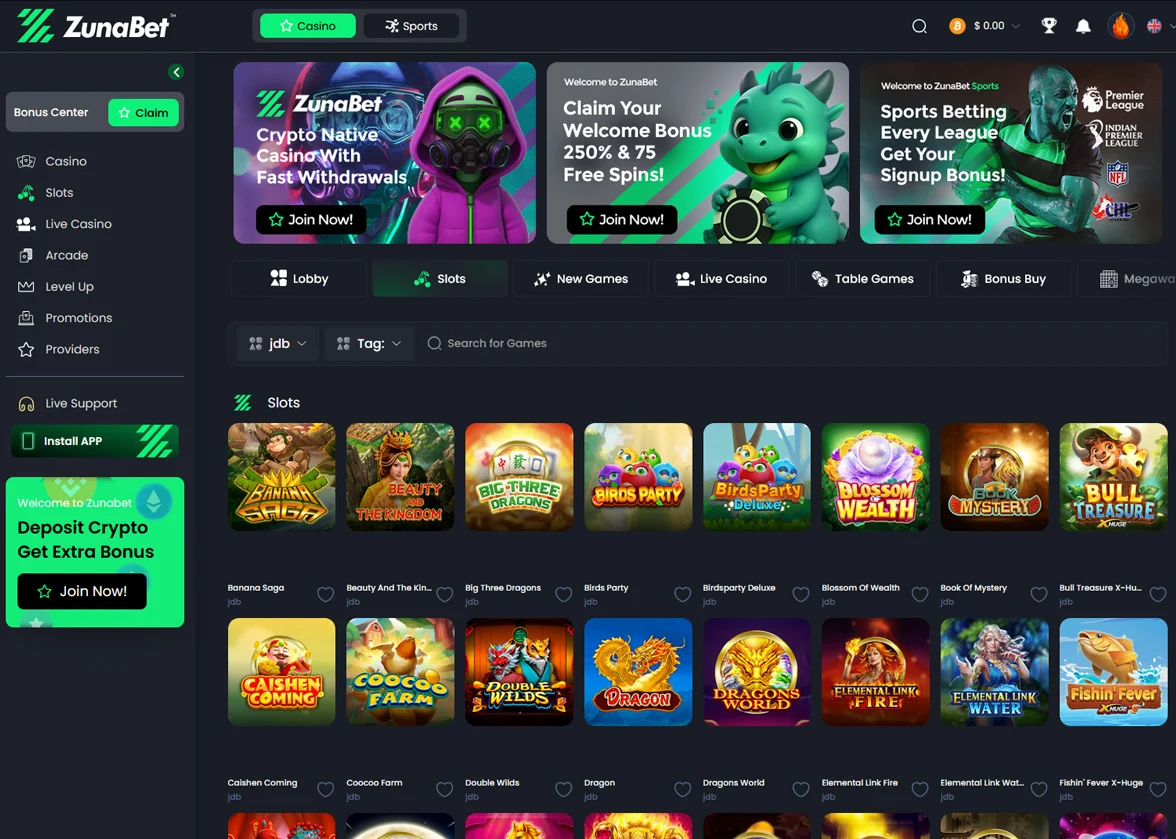

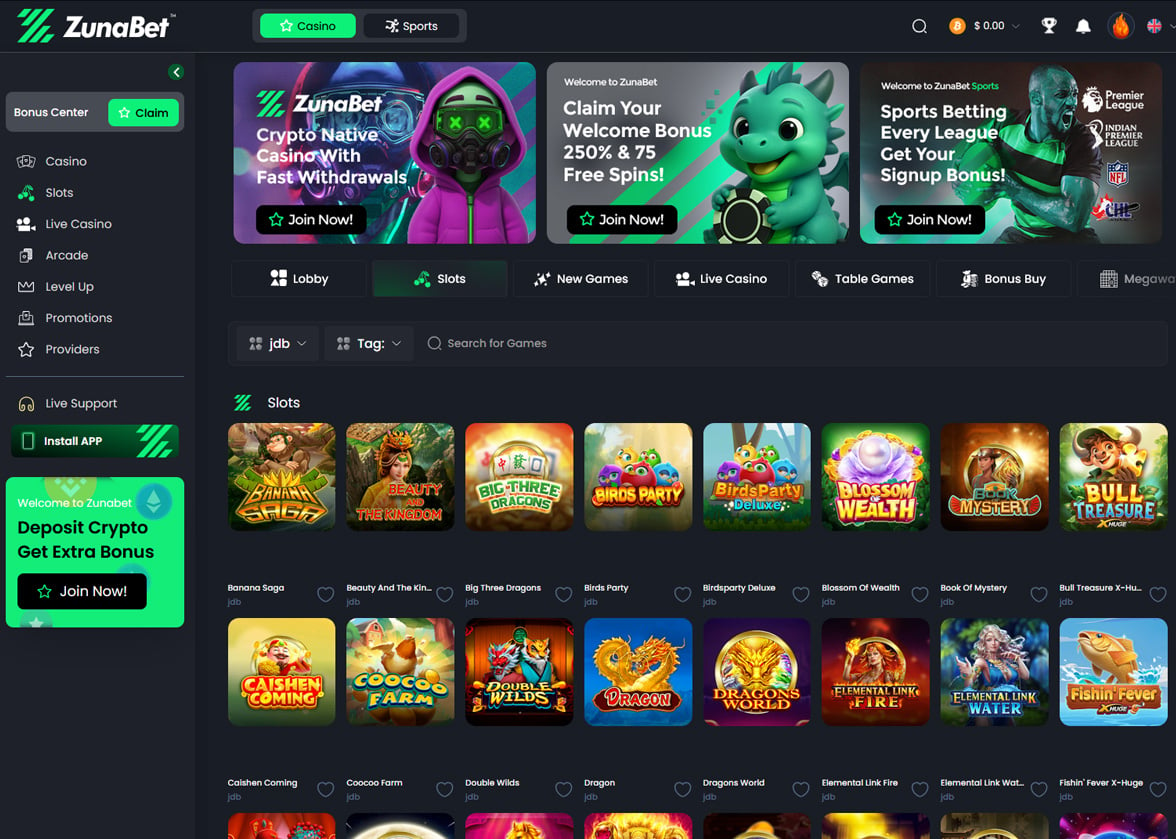

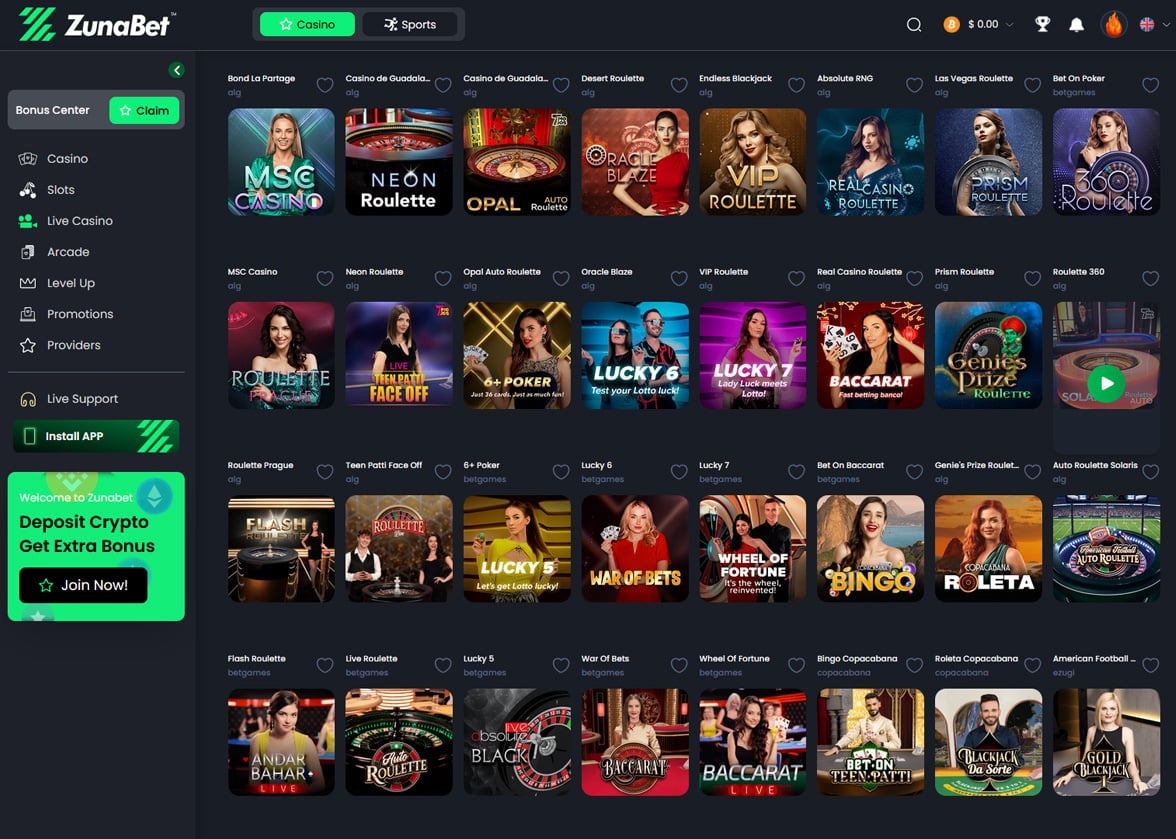

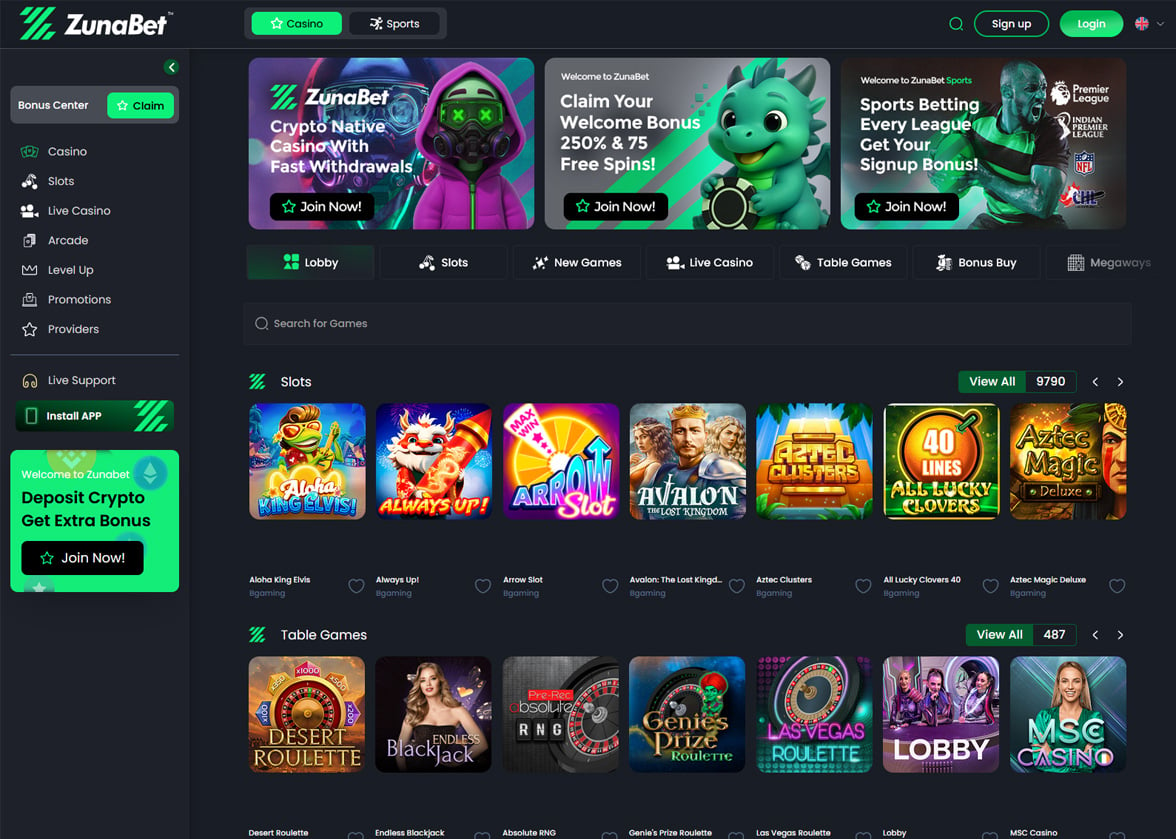

ZunaBet is a new crypto casino and sportsbook that launched in 2026. The platform combines traditional casino gaming with cryptocurrency payments and modern features. With over 11,000 games and a full sports betting section, it aims to serve players looking for a crypto-friendly gambling destination.

Here’s our full review!

Quick Verdict: ZunaBet is a crypto casino offering over 11,000 games from 63 providers, extensive sports betting options across traditional and eSports, and a generous welcome package of 250% up to $5000 with 75 free spins,

Quick Facts

| Category | Information |

|---|---|

| Launch Year | 2026 |

| License | Government of Anjouan, License No. ALSI-202510047-FI2 |

| Operator | Strathvale Group Ltd., Belize |

| Number of Games | 11,294+ |

| Game Providers | 63 providers |

| Cryptocurrencies | 20+ including BTC, ETH, USDT, SOL |

| Sports Betting | Traditional sports and eSports |

| Welcome Bonus | 250% up to $5000 + 75 Free Spins |

| Loyalty Program | Dragon Evolution System with 6 tiers |

| Mobile Access | Responsive design plus downloadable apps |

| Customer Support | Email at support@zunabet.com |

| Supported Languages | English, Italian, Spanish, French, German, Indian |

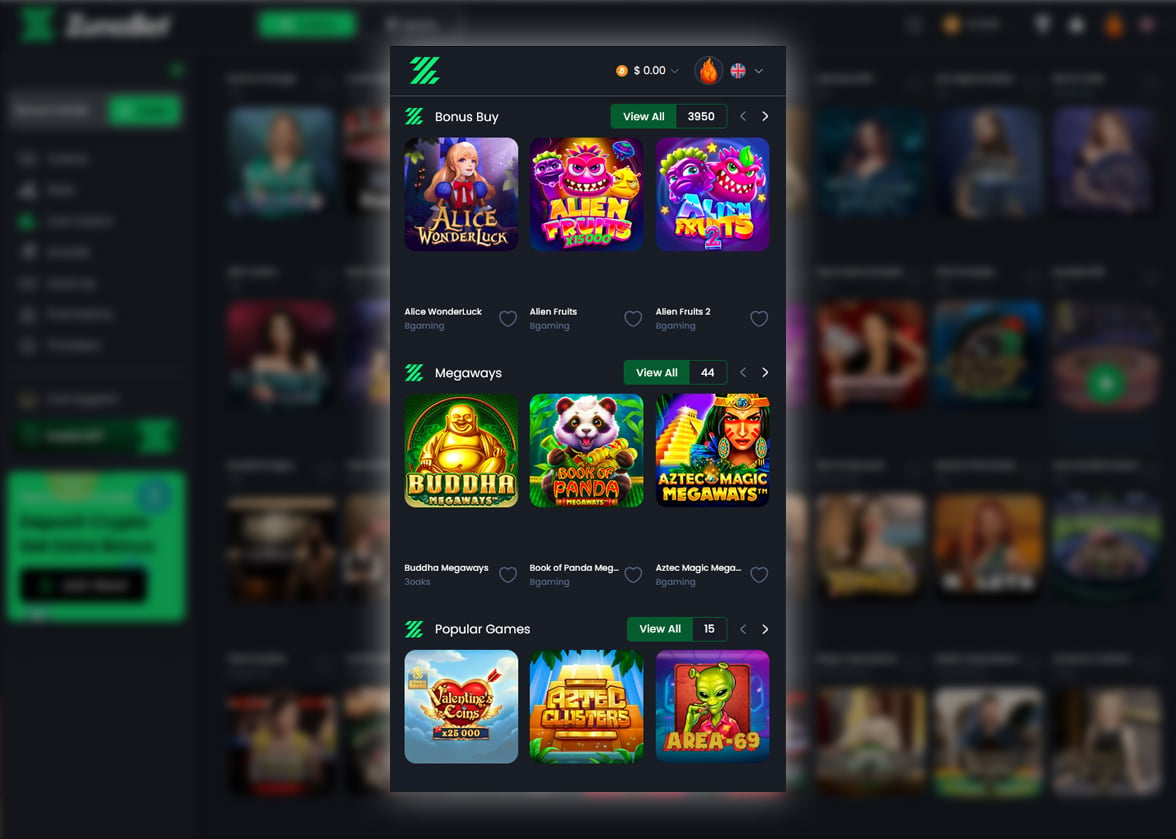

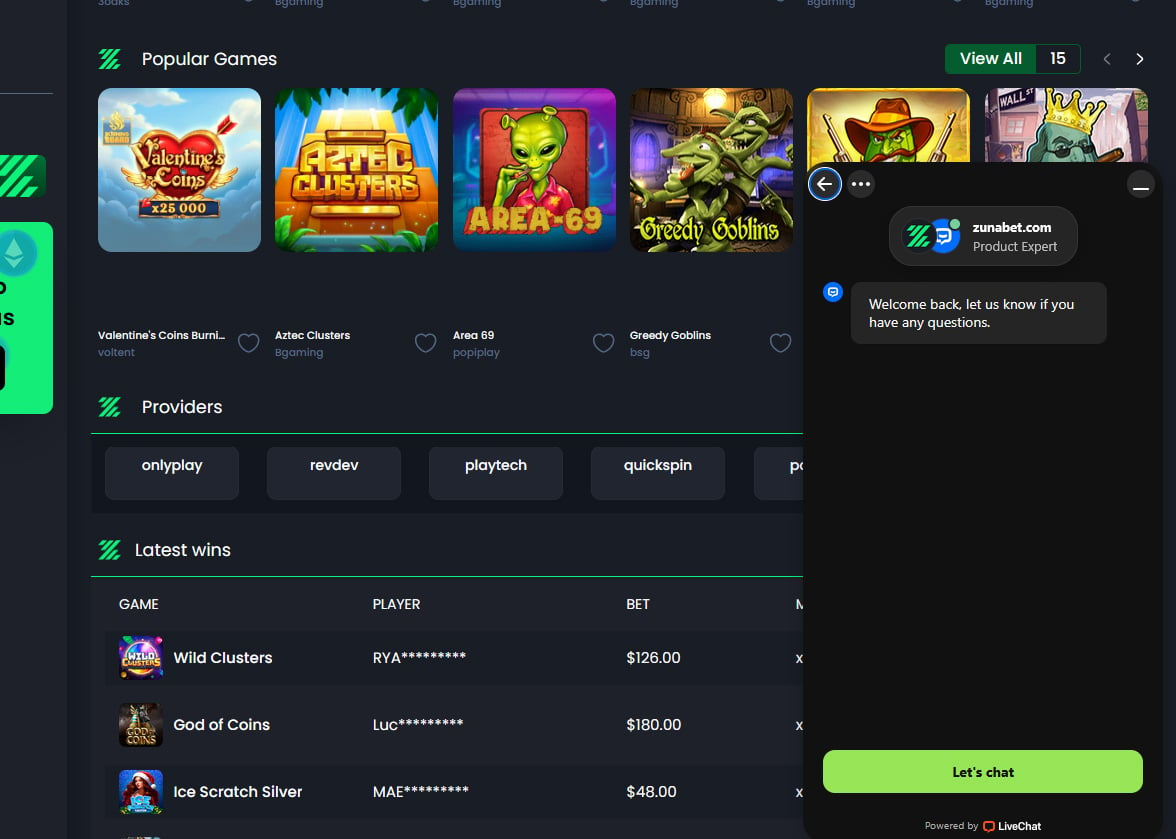

Casino Games

ZunaBet hosts an impressive collection of 11,294 casino games. This extensive library comes from 63 different software providers, giving players access to a wide variety of gaming styles and themes. The selection covers all major casino game categories that players expect from a modern online casino.

The slot game section makes up the majority of the casino’s offerings. Players can find everything from classic three-reel slots to modern video slots with complex bonus features. The games come with different volatility levels and return-to-player percentages to suit different playing styles.

Table game fans have access to multiple versions of blackjack, roulette, baccarat, and poker. These games range from standard versions to variants with special rules or side bets. The variety ensures that both casual players and experienced table game enthusiasts can find options that match their preferences.

Live dealer games bring the casino floor experience to your screen. The platform includes live versions of popular table games where real dealers run the games in real-time. Players can interact with dealers and other players through chat functions while placing their bets.

The game providers list reads like a who’s who of the online casino industry. Pragmatic Play and Hacksaw Gaming feature prominently, offering their popular slot titles. Playtech contributes both slots and table games to the collection. Evolution Gaming powers the live dealer section with their industry-leading live casino products.

Other major providers include BGaming, Booming Games, Endorphina, Evoplay, Ezugi, Habanero, and Yggdrasil. Each provider brings their own unique style and game mechanics to the platform. This diversity means players can explore different themes, features, and gameplay styles without leaving the site.

The casino doesn’t require downloads to play games. All titles run directly in web browsers using HTML5 technology. This means players can access games from any device with an internet connection and a modern browser.

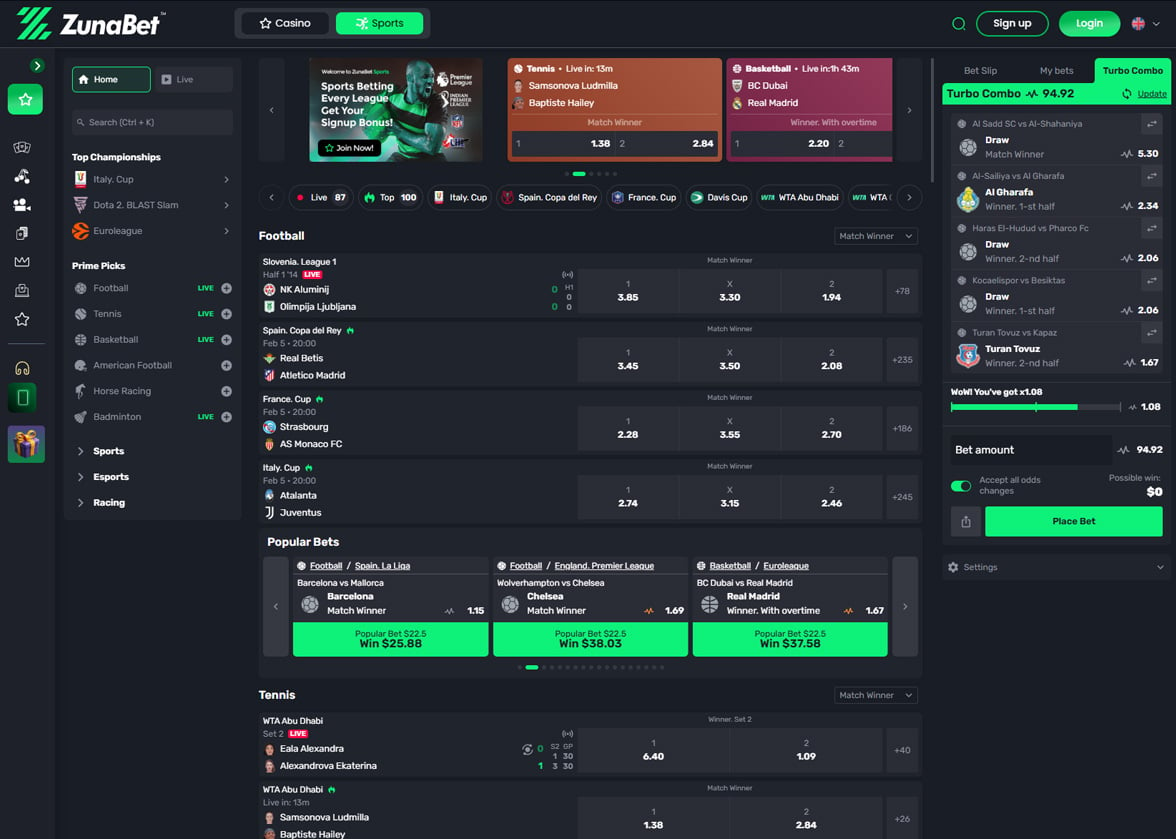

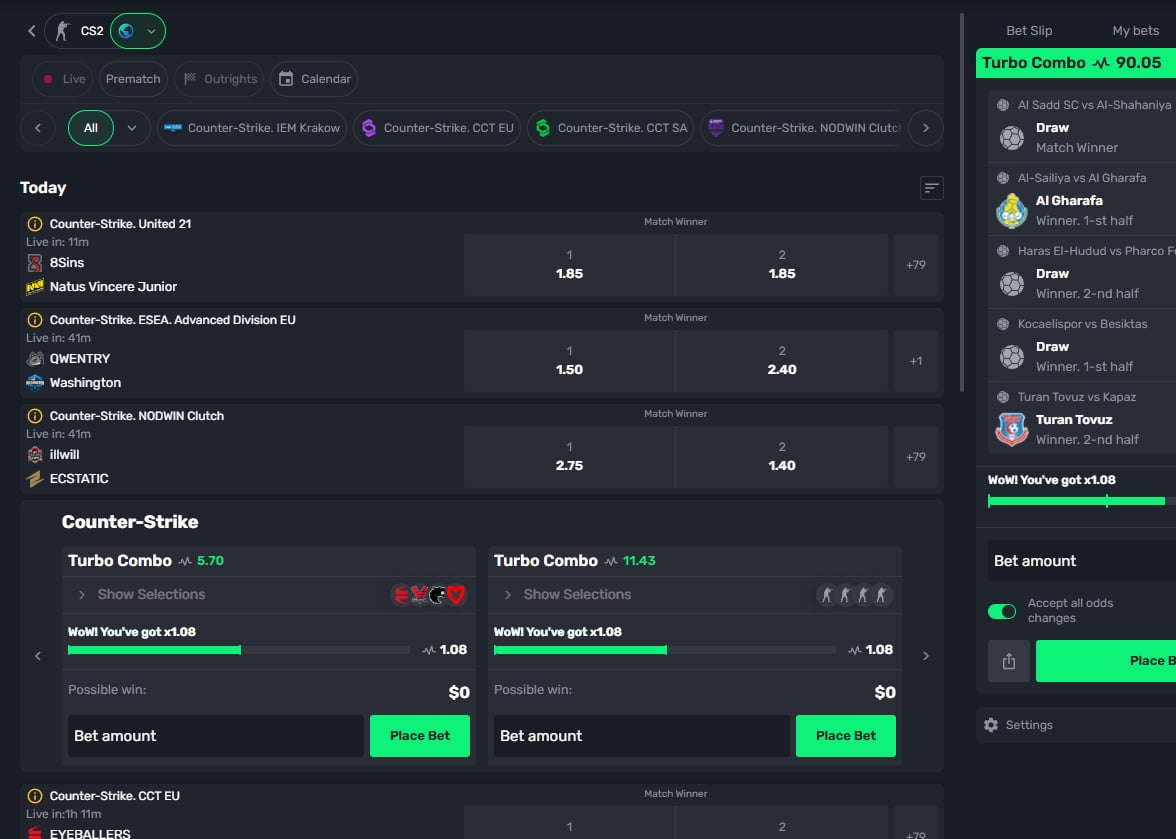

Sports Betting

The sportsbook at ZunaBet covers a comprehensive range of sporting events. Traditional sports betting includes football, which features leagues and matches from around the world. Bettors can place wagers on major European leagues, international tournaments, and regional competitions.

Tennis betting includes ATP, WTA, and Grand Slam events. The platform offers markets on match winners, set betting, and game handicaps. Basketball coverage includes both NBA action and international leagues, with 3×3 basketball also available for betting.

Ice hockey fans can bet on NHL games and international competitions. Baseball betting focuses primarily on MLB, with markets on game winners, run lines, and totals. Volleyball and beach volleyball provide options for fans of court sports.

Rugby betting covers both rugby union and rugby league competitions. The platform includes markets on Six Nations, Rugby Championship, and club competitions. Other traditional sports include badminton, table tennis, handball, Australian football, and futsal.

Water polo, snooker, and darts provide options for fans of these sports. Combat sports coverage includes boxing and MMA, with betting available on major promotions. The platform also added Power Slap, reflecting its commitment to covering emerging combat sports.

Cricket betting serves fans in countries where the sport is popular. Chess betting offers a unique option for those interested in wagering on intellectual competitions. Bowls, cycling, Formula 1, lacrosse, and golf round out the traditional sports offerings.

eSports coverage includes all major competitive gaming titles. Counter-Strike betting covers tournaments from around the world. Dota 2 and League of Legends, two of the biggest eSports titles, have dedicated betting markets. The platform includes major tournaments like The International and the League of Legends World Championship.

Other Products

The loyalty program stands out as a unique product. Built around a dragon theme, it gamifies the player experience. New members choose an elemental egg when joining. This egg evolves as players wager, eventually hatching into a personalized Zuna Dragon.

The dragon mascot, named Zuno, serves as the casino’s brand ambassador. According to the casino’s lore, Zuno is a dragon who grew up in the ZunaBet vaults surrounded by casino games. The character adds personality to the platform and features in promotional materials.

Players can install dedicated apps for iOS, Android, Windows, and MacOS. These apps provide quick access to the casino without opening a web browser. The apps mirror the functionality of the website, giving players a seamless experience across devices.

The platform includes social elements through its community features. Players can interact through the VIP club, which becomes available at higher loyalty tiers. Random promotions add an element of surprise to the player experience.

A wheel spin feature gives players additional chances to win prizes. This becomes a double wheel spin at certain loyalty levels. These extra features create more engagement opportunities beyond standard casino games and sports betting.

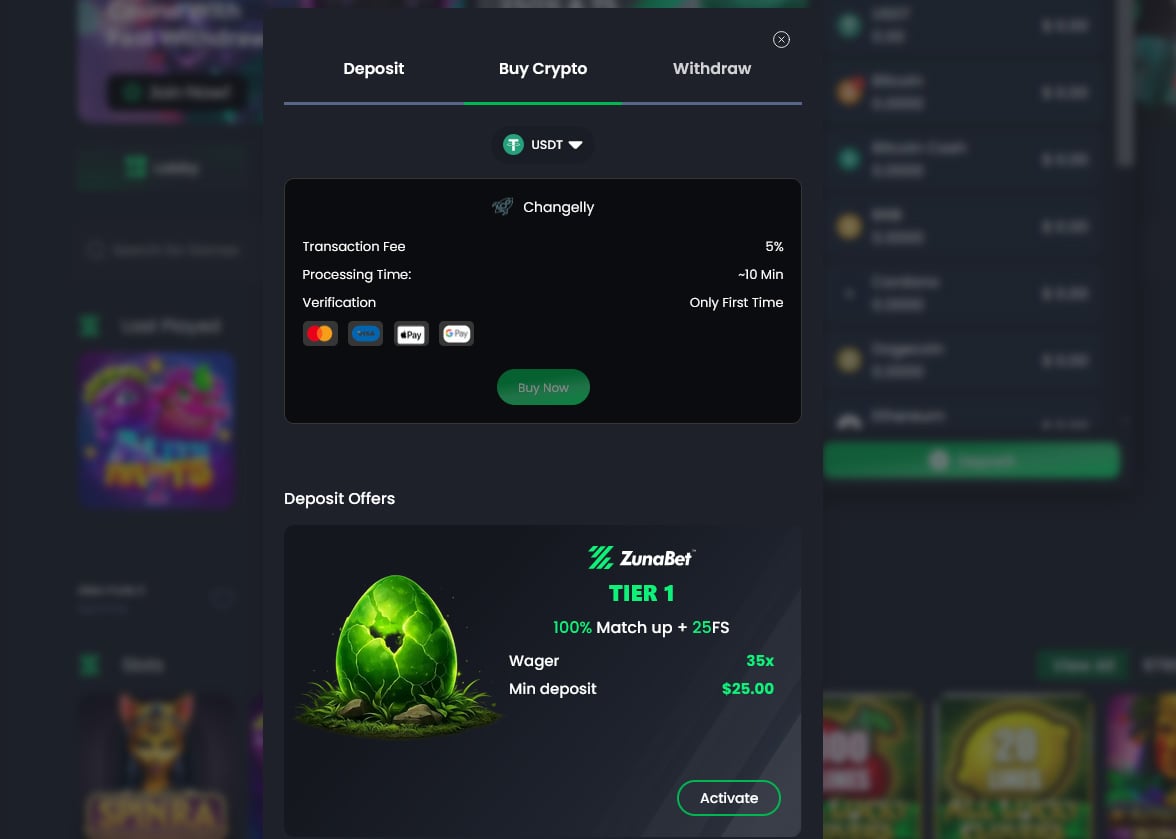

Welcome Bonuses

ZunaBet offers a substantial welcome package for new players. The promotion is structured across three deposits, giving new members multiple opportunities to claim bonus funds and free spins. The total potential value reaches $5000 in bonus money plus 75 free spins.

- The first deposit triggers a 100% match bonus up to $2000. This means if a player deposits $2000, they receive an additional $2000 in bonus funds. The first deposit also includes 25 free spins that can be used on selected slot games.

- The second deposit comes with a 50% match bonus up to $1500. A player depositing $1500 would receive $750 in bonus funds. This deposit also awards 25 free spins, bringing the total to 50 free spins across the first two deposits.

- The third deposit provides a 100% match bonus up to $1500. Combined with another 25 free spins, this completes the welcome package. When fully claimed across all three deposits, players receive the maximum $5000 in bonuses plus 75 free spins total.

The casino markets this as a “250% Match bonus up to $5000 + 75 FS” for new players. This calculation adds together the percentages from all three deposit bonuses. The structure encourages players to make multiple deposits to unlock the full value.

Free spins awarded as part of the welcome package apply to specific slot games. The casino determines which games are eligible for free spin use. Players should check the promotion terms to see which slots are included.

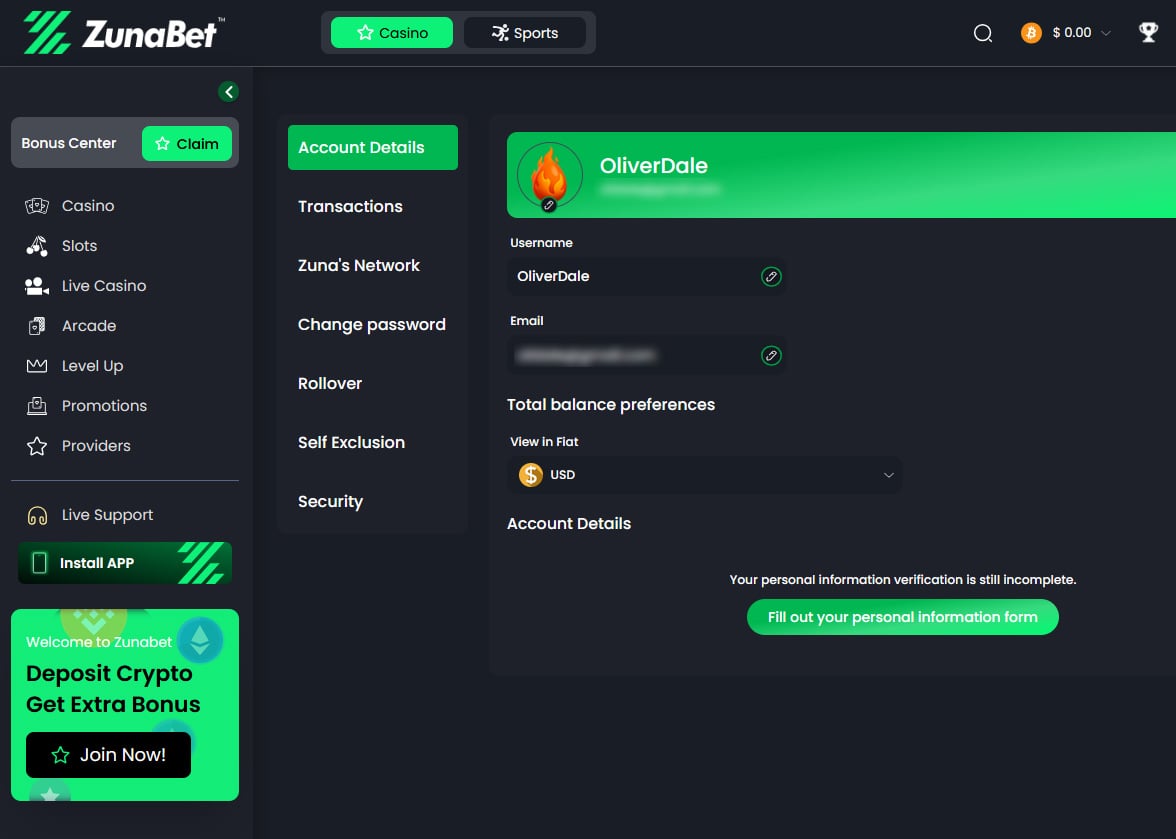

How to Signup

Creating an account at ZunaBet follows a straightforward process:

- Visit the ZunaBet website at zunabet.com

- Click the registration or sign-up button, typically located in the top right corner of the homepage

- Enter your email address and create a secure password for your account

- Choose your preferred cryptocurrency for deposits and withdrawals

- Select your elemental egg, which starts your journey in the dragon loyalty program

- Agree to the casino’s terms and conditions and confirm you meet the minimum age requirements

- Complete any verification steps required, which may include email confirmation

- Make your first deposit using one of the supported cryptocurrencies

- Claim your welcome bonus if you want to participate in the promotion

- Start playing games or placing sports bets

The registration process takes only a few minutes. The casino uses email verification to confirm account ownership. Once your email is verified and your first deposit is made, you can access the full range of games and betting options.

Regular Promotions and Loyalty Program

The loyalty program at ZunaBet uses a tiered system with six levels. Each level offers increasing rewards and benefits. Players progress through levels based on their total wagering volume. The system tracks all bets placed on casino games and sports betting to calculate advancement.

- The first tier is Squire, which is the starting level for all new players. Squire members receive 1% rakeback on their bets. This level requires no minimum wagering and provides no free spins. However, it grants access to random promotions and the double wheel spin feature.

- Warden is the second tier, requiring $1,000 in total wagers. The rakeback increases to 2% at this level. Warden members receive 20 free spins as a tier reward. All the benefits from Squire continue, including random promotions and wheel spin access.

- Champion tier requires $5,000 in total wagering. Rakeback jumps to 4% for Champion members. The tier awards 50 free spins. Players maintain access to all previous benefits while enjoying the improved rakeback rate.

- Divine tier becomes available at $20,000 in total wagers. Members receive 5% rakeback and 150 free spins. The increased rakeback means players get more value returned on every bet they place, whether in the casino or on sports.

- Knight tier is for serious players with $200,000 in total wagering. The rakeback rate reaches 10%, providing substantial returns on play volume. Knight members receive 400 free spins. Access to VIP club benefits becomes more valuable at this level.

- Ultimate tier represents the highest achievement in the loyalty program. It requires $1,000,000 in total wagering. Ultimate members enjoy 20% rakeback, the maximum rate available. The tier awards 1,000 free spins. These players receive the best treatment available at the casino.

Rakeback is a valuable benefit that returns a percentage of all wagers to players. Unlike traditional bonuses, rakeback typically has fewer restrictions. Players receive rakeback regularly based on their betting activity, providing a steady stream of value.

The free spins awarded at each tier can be used on selected slot games. These spins provide opportunities to try new games or play favorites without risking additional funds. Free spins from tier advancement are separate from promotional free spins.

Random promotions add an element of surprise to the loyalty program. The casino runs special offers that vary based on seasons, events, or promotional calendars. These might include deposit bonuses, free spin packages, or tournament entries.

The double wheel spin feature gives players two chances instead of one when using the wheel feature. This doubles the potential for winning prizes from the wheel, which may include bonus funds, free spins, or other rewards.

VIP club access becomes more meaningful at higher tiers. VIP members may receive personalized customer service, faster withdrawal processing, and exclusive bonus offers. The casino tailors VIP benefits to reward its most loyal players.

The dragon evolution theme ties the loyalty program together. Your chosen egg evolves as you progress through tiers. The visual representation of your dragon growing provides a fun way to track loyalty progress. Each tier brings your dragon closer to its ultimate form.

Payment Methods

ZunaBet operates as a cryptocurrency casino, accepting 20 different digital currencies for deposits and withdrawals. The platform’s crypto-first approach means all transactions use blockchain technology. This provides fast processing times and lower fees compared to traditional banking methods.

The supported cryptocurrencies include:

- Bitcoin (BTC) – The original cryptocurrency remains the most popular option

- Ethereum (ETH) – The second-largest cryptocurrency by market cap

- Binance Coin (BNB) using the BSC network

- Ripple (XRP) – Known for fast transaction speeds

- Tron (TRX) – Popular for low transaction fees

- Bitcoin Cash (BCH) – A Bitcoin fork with larger block sizes

- Litecoin (LTC) – Often called the silver to Bitcoin’s gold

- Dogecoin (DOGE) – Originally a meme coin, now widely accepted

- Cardano (ADA) using the Cardano network

- Solana (SOL) – Known for high-speed transactions

- Toncoin (TON) – The blockchain associated with Telegram

- Polygon (POL) – A scaling solution for Ethereum

The casino also accepts multiple stablecoins pegged to the US dollar. These include USDC on Ethereum, Polygon, and Solana networks. USDT (Tether) is available on Ethereum, Polygon, TON, Tron (TRC20), and Solana networks. Stablecoins provide price stability while maintaining the benefits of cryptocurrency transactions.

Players select their preferred cryptocurrency during account registration. Deposits require sending the chosen cryptocurrency to the wallet address provided by the casino. The platform generates unique deposit addresses for each player to ensure funds reach the correct account.

Cryptocurrency deposits typically process within minutes, depending on blockchain confirmation times. Bitcoin transactions may take longer during periods of network congestion. Faster blockchains like Solana and Tron often complete deposits in seconds.

Withdrawals follow a similar process. Players request a withdrawal to their personal cryptocurrency wallet. The casino processes the request and sends funds to the provided wallet address. Blockchain transactions provide transparency, allowing players to track their transfers.

The casino plans to introduce fiat currency payment options during 2026. This expansion will allow players to deposit using traditional currencies through methods like credit cards, bank transfers, or e-wallets. The addition of fiat options will make the casino accessible to a broader audience.

Is it Legit?

ZunaBet operates under a gambling license from the Government of the Autonomous Island of Anjouan, Union of Comoros. The license number is ALSI-202510047-FI2. This license authorizes the casino to offer games of chance and wagering to players in permitted jurisdictions.

The casino is owned and operated by Strathvale Group Ltd., a company registered in Belize. The registration number is 000050881, and the registered address is San Victor Street, Orange Walk Town, Belize. This information is publicly available and can be verified.

The Anjouan license allows the casino to operate legally within its regulatory framework. The Government of Anjouan regulates online gambling operators under its jurisdiction. Licensed casinos must meet certain standards to maintain their authorization.

The casino states it has passed all regulatory compliance requirements. This includes verification of gaming systems, fairness of games, and proper business practices. Licensed operators undergo review processes to ensure they meet licensing standards.

The team behind ZunaBet brings over 20 years of combined experience in online casino operations. This experience suggests the operators understand the industry and how to run a gambling platform. Experienced operators are more likely to maintain professional standards.

Design & Usability

ZunaBet features a modern design with a dark color scheme. The black background creates a sleek appearance that reduces eye strain during extended gaming sessions. Green accents throughout the interface tie into the casino’s brand colors and logo design.

The dark theme has become popular among online casinos and gaming platforms. It provides a contemporary look that appeals to modern players. The green highlights stand out against the dark background, making important buttons and features easy to locate.

The layout follows current web design principles with clear navigation menus. The homepage showcases featured games, popular slots, and current promotions. Players can quickly access different sections without searching through complicated menus.

The casino organizes games into categories for easy browsing. Players can filter by game type, provider, or popularity. A search function allows finding specific titles quickly. This organization helps players navigate the large game library of over 11,000 titles.

The sports betting section maintains the same design aesthetic. The sportsbook interface shows available events and markets clearly. Live betting features are accessible, with real-time odds updates displayed prominently.

Visual elements throughout the site reflect the dragon theme. The Zuno mascot appears in various places, adding personality to the platform. The dragon imagery creates a cohesive brand experience that makes ZunaBet memorable.

Members Area

The members area serves as the hub for account management. After logging in, players access their dashboard showing account balance, recent activity, and available bonuses. The dashboard provides an overview of account status at a glance.

Account settings allow players to update personal information and preferences. This includes email address, password changes, and communication preferences. Players can manage how they receive notifications from the casino.

The loyalty program status displays prominently in the members area. Players can see their current tier, progress toward the next level, and available rewards. The dragon evolution visual shows how close the dragon is to its next stage.

Transaction history is accessible through the members area. Players can review all deposits and withdrawals with dates, amounts, and transaction IDs. This transparency helps players track their gambling activity and verify transactions on blockchains.

Mobile Offering

ZunaBet provides full mobile access through multiple channels. The website uses responsive design that adapts to different screen sizes. Players can access the casino through mobile web browsers on smartphones and tablets without any loss of functionality.

The responsive design ensures games display properly on smaller screens. Touch controls work smoothly for navigation and gameplay. The mobile web version includes all features available on desktop, from casino games to sports betting.

Dedicated mobile apps are available for multiple operating systems. iOS users can install the app on iPhones and iPads. Android users have an app optimized for Android devices. The availability of native apps improves performance and convenience.

Windows and MacOS apps extend mobile access to laptops and desktop computers. These apps provide quick access without opening a web browser. Installing the app creates a shortcut that launches directly to the casino.

The apps mirror the website’s functionality completely. Players have access to the full game library, sportsbook, and account features. There’s no compromise in available features between web and app access.

Mobile gameplay performs well across games. Slots are optimized for touch controls with easy tap-to-spin functions. Table games work smoothly with touch-based betting interfaces. Live dealer games stream in good quality on mobile devices.

Customer Support

ZunaBet provides customer support through email at support@zunabet.com and also the live chat area of the website. Players can contact the support team with questions, issues, or feedback. Email support allows for detailed explanations of problems and provides a written record of communications.

The support team assists with account issues including login problems, password resets, and verification questions. They can help troubleshoot technical issues if players experience problems with games or the website.

Deposit and withdrawal inquiries are handled through customer support. If transactions are delayed or players have questions about cryptocurrency transfers, the support team can investigate. They can provide updates on pending withdrawals or verify deposit confirmations.

Bonus-related questions are common support inquiries. The team can explain wagering requirements, bonus terms, and eligibility for promotions. They can verify bonus crediting and help resolve issues if bonuses don’t appear correctly.

Game-specific issues can be reported to customer support. If a game malfunctions or a round doesn’t complete properly, the team can investigate. They can review game logs to determine what happened during a disputed session.

Conclusion

ZunaBet enters the online casino market with a strong offering. The platform combines over 11,000 games from 63 providers with comprehensive sports betting coverage. The cryptocurrency focus provides fast transactions and lower fees for players comfortable with digital currencies.

The welcome bonus package offers good value with up to $5000 in bonuses plus 75 free spins across three deposits. The structure encourages new players to make multiple deposits to unlock the full value. This compares favorably with welcome offers at other crypto casinos.

The dragon-themed loyalty program adds a unique element to the player experience. The six-tier system with increasing rakeback rates rewards regular players. The gamification aspect makes progress feel more engaging than standard VIP programs.

The game selection is impressive in both quantity and variety. Having 63 providers ensures diverse gaming options from established names and innovative newcomers. Players will find popular titles alongside games they might not encounter at other casinos.

Sports betting coverage is thorough across traditional sports and eSports. The inclusion of lesser-known sports and extensive eSports options broadens the appeal. Live betting functionality allows action on events as they happen.

The modern design with dark theme and green accents creates a contemporary feel. The platform performs well with responsive design across devices. Mobile apps for multiple operating systems provide convenient access for players on the go.

For players seeking a crypto casino with extensive games, solid sports betting, and rewarding loyalty benefits, ZunaBet delivers. The platform provides entertainment value with enough variety to keep regular players engaged. The combination of features positions it well in the competitive crypto casino space.

FAQs

What cryptocurrencies does ZunaBet accept?

ZunaBet accepts over 20 cryptocurrencies including Bitcoin, Ethereum, Litecoin, Dogecoin, Solana, Cardano, and multiple stablecoins like USDT and USDC on various networks. The platform also accepts BNB, XRP, TRX, BCH, ADA, TON, and POL.

How does the loyalty program work?

The loyalty program has six tiers from Squire to Ultimate. Players progress through tiers based on total wagering volume. Each tier offers increased rakeback percentages from 1% to 20%, free spins, and access to random promotions and VIP benefits. Your dragon evolves as you advance through tiers.

What is the welcome bonus at ZunaBet?

New players receive a welcome package worth up to $5000 plus 75 free spins across three deposits. The first deposit gets 100% up to $2000 plus 25 free spins, the second deposit gets 50% up to $1500 plus 25 free spins, and the third deposit gets 100% up to $1500 plus 25 free spins.

Can I play on my mobile device?

Yes, ZunaBet is fully mobile-compatible with responsive web design that works on any mobile browser. The casino also offers downloadable apps for iOS, Android, Windows, and MacOS devices for convenient access.

How many games are available at ZunaBet?

ZunaBet offers over 11,294 games from 63 different software providers. The library includes slots, table games, live dealer games, and various specialty games. Major providers include Pragmatic Play, Hacksaw Gaming, Evolution Gaming, and many others.

Zunabet

Pros

- Massive game library with over 11,000 titles from 63 providers

- Generous welcome bonus package

- Unique dragon-themed loyalty program

- Extensive cryptocurrency support

- Comprehensive sports betting

Cons

- Currently crypto-only payments

- New casino without established track

Crypto World

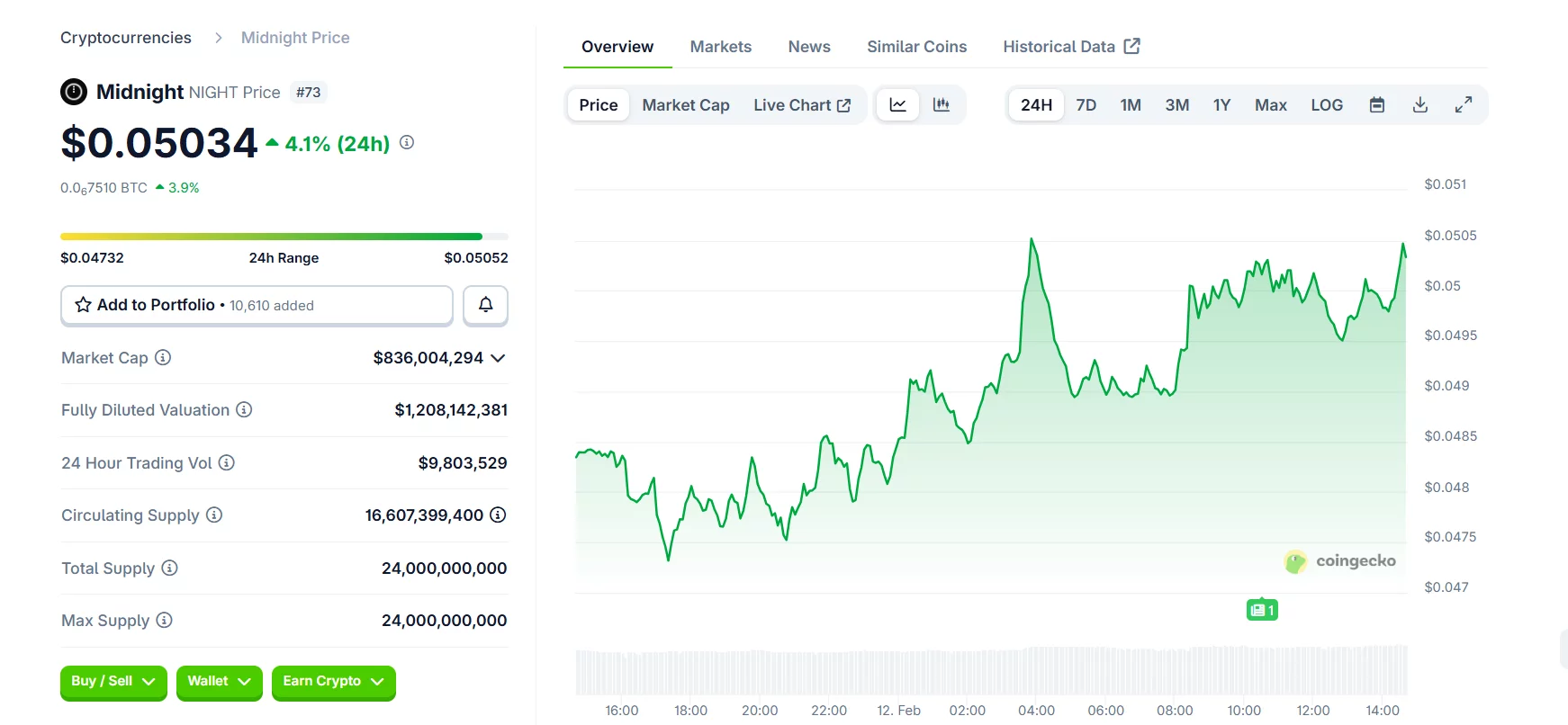

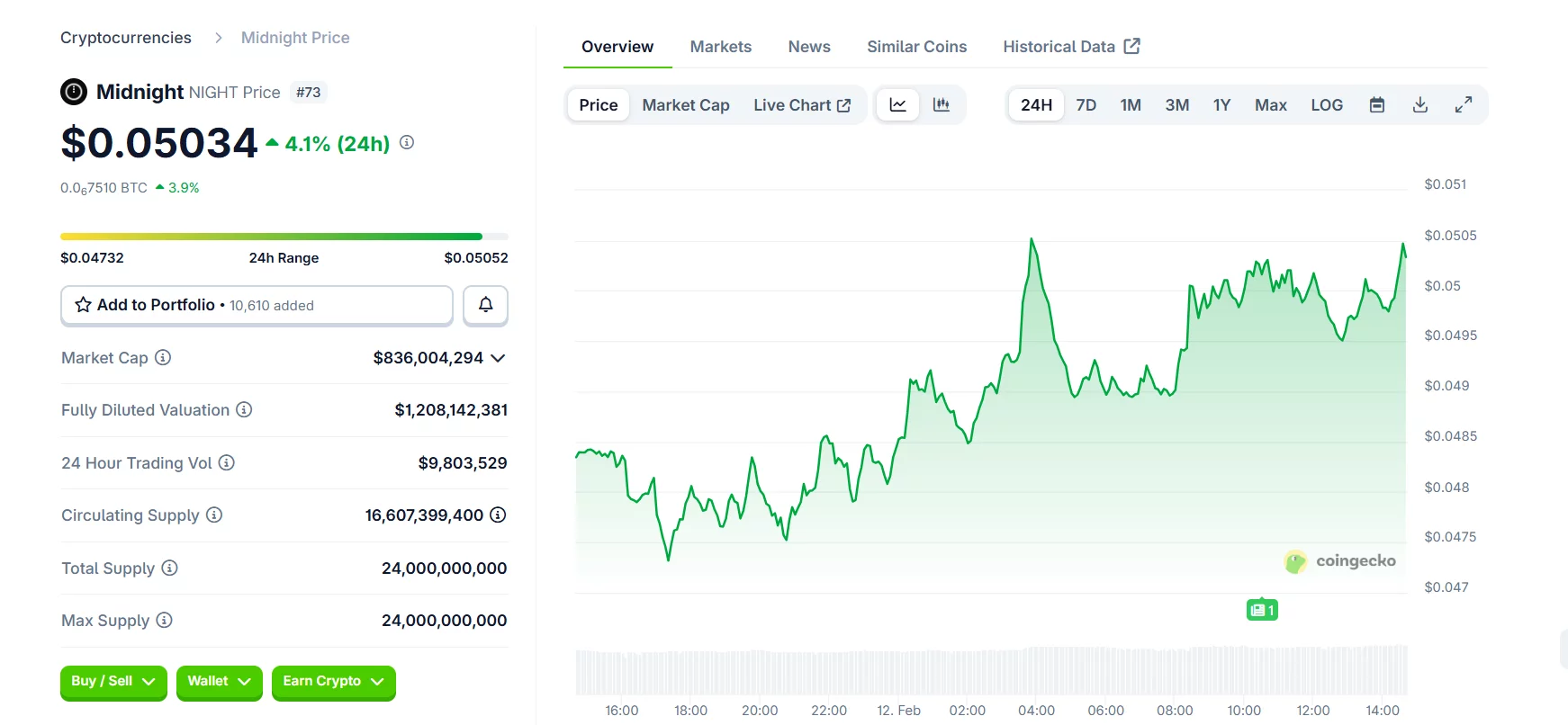

Midnight token price jumps after Google and Telegram partnership news

The privacy-focused blockchain Midnight saw renewed market interest this week after Cardano founder Charles Hoskinson announced key developments at the Consensus Hong Kong conference.

Summary

- Midnight gained attention after Charles Hoskinson confirmed a late-March mainnet launch and cited collaborations with Google and Telegram at Consensus Hong Kong.

- The project is positioned as a selective-disclosure privacy layer, with the new Midnight City Simulation introduced to test the network ahead of launch.

- The NIGHT token rose to around $0.048–$0.051, up roughly 3–4% in 24 hours.

This includes the project’s scheduled mainnet launch in late March and collaborations involving Google and Telegram.

Hoskinson’s remarks highlight Midnight’s evolution toward a “selective disclosure” privacy layer for blockchain applications, balancing confidentiality with real-world compliance.

While neither Google nor Telegram have independently confirmed the arrangement, Hoskinson said they are among partners helping support Midnight’s rollout and infrastructure.

“We have some great collaborations to help us run it,” he said. “Google is one of them. Telegram is another. We’re really excited, there’s more that will come.”

The announcement also introduced the Midnight City Simulation, a testing platform intended to stress-test network proof generation with AI agents well ahead of mainnet.

Midnight price uptick reflects renewed interest

Midnight’s native token NIGHT has responded positively to the news, trading at around $0.048–$0.051 at press time with modest short-term gains.

According to live price data, the token is up roughly 3–4 % in the past 24 hours, indicating renewed investor appetite following the partnership and mainnet timeline disclosure.

Midnight’s full mainnet debut, expected in March as a Cardano (ADA) partner chain with zero-knowledge proofs and “rational privacy” features, is now the next major catalyst for global markets.

Hoskinson has also made it clear that Midnight will not pursue direct onboarding of legacy privacy coin communities, such as Monero and ZCash, instead focusing on broader user adoption.

“You don’t try to get anybody from Monero or ZCash over,” he said during a Q&A session at Consensus Hong Kong on Thursday.

Crypto World

Solana leans into tokenization and payments at Hong Kong’s Accelerate APAC event

Solana wants to position itself as the execution layer for “internet capital markets” in Asia, or venues where users can issue, trade, borrow, lend, and settle assets online, 24/7, without needing a traditional exchange, bank or clearing house.

At least, that was the position attendees and panelists at Solana’s Accelerate APAC event in Hong Kong on Wednesday. Speakers struck a noticeably institutional tone, with panels and keynotes focused less on hype cycles and more on payments, tokenization and the plumbing needed to onboard traditional finance at the conference, held alongside CoinDesk’s Consensus Hong Kong

The day’s agenda reflected that shift. Discussions ranged from SOL staking exchange-traded funds (ETFs) and digital asset trusts to stablecoin rails, tokenized securities and regulated exchange-traded products.

Asset managers including Mirae Asset and ChinaAMC shared the stage with infrastructure players such as CME Group, Fireblocks and Cumberland, showing how closely the ecosystem is courting traditional financial firms.

Payments also featured heavily. Multiple sessions centered on payment rails, compliant stablecoin infrastructure and cross-border use cases, with a clear emphasis on real-world adoption rather than speculative trading.

Infrastructure and AI were another pillar. Talks from Alibaba Cloud and several crypto-native builders highlighted the growing overlap between blockchain settlement layers and AI-driven applications, reinforcing Solana’s long-standing pitch around speed and scalability.

The overall mood in Hong Kong was simple and almost stubbornly consistent. Build.

Not the “buidl” that shows up in bull markets as a vibe check, but the kind that shows up when prices are down 70% over a year, attention is scant and nobody’s pretending the last few months have been fun. But that wasn’t the frame the event operated in.

Panels kept circling back to the same practical questions: How do stablecoins work at scale, how do you onboard institutions without breaking compliance and what metrics actually matter when you’re selling onchain rails to asset managers and banks. How do you make wallets feel less like science projects and how do you build tokenization infrastructure that survives a regulator’s first serious audit also took center stage

If anything, the downturn seemed to sharpen the messaging, with less talk about narratives and more about settlement, custody, payments, identity and the boring operational details that decide whether “real adoption” is real or just a meme.

A key vibe takeaway was not that Solana is immune to market cycles, but that the people building on it are trying to act like the cycle doesn’t get to decide what matters.

Crypto World

Banks push OCC to curb crypto trust charters until GENIUS rules clear

The American Bankers Association is pressing the Office of the Comptroller of the Currency to slow the wheel on national trust bank charters for crypto and stablecoin firms until key questions around the GENIUS Act, which would reshape U.S. stablecoin regulation, are settled. In a recent comment letter responding to the OCC’s notice of proposed rulemaking on national bank charters, the ABA warned that the sector’s regulatory picture remains fragmented across federal and state authorities. The trade group argued that advancing applications now could leave uninsured, digital-asset‑focused trusts exposed to unresolved safety, operational, and resolution issues, even as the industry connects customer assets to federally chartered platforms.

The ABA’s critique centers on the risk that a patchwork of oversight can create gaps for entities that manage crypto and stablecoins. The letter contends that until forthcoming GENIUS Act rulemakings lay out clear regulatory obligations, it would be prudent for the OCC to pause or slow down approvals. The GENIUS Act, which aims to streamline or redefine how digital assets fit into the U.S. banking framework, has not yet produced a settled regulatory map. Without that clarity, the ABA argues, banks seeking charters could face obligations that are not yet defined, complicating risk management and supervisory expectations for these new structures.

Beyond governance, the association underscored distinct safety and soundness concerns tied to uninsured, digital-asset‑focused national trusts. Chief among them are questions about how customer assets are segregated and protected, potential conflicts of interest, and the cyber safeguards necessary to withstand sophisticated threats. The letter points to the possibility that uninsured digital-asset trusts could be used to sidestep traditional registration and scrutiny by agencies such as the SEC or CFTC when activities would ordinarily trigger securities or derivatives regulation. The overarching worry is that these charters could become a back door to bypass comprehensive, integrated oversight.

The ABA’s stance comes as the OCC has recently moved to greenlight a path for several crypto firms to hold and manage customer digital assets under a federal charter while staying outside the deposit-taking and lending business. In December 2025, the OCC granted conditional national trust bank approvals to five notable players: Bitgo Bank & Trust, Fidelity Digital Assets, Ripple National Trust Bank, First National Digital Currency Bank, and Paxos Trust Company. This sequence—clear progress followed by calls for prudence—has amplified calls from industry observers and policymakers to align new models with robust regulatory guardrails.

As the regulatory dialogue intensifies, the broader banking lobby has amplified its push for Congress to act. Proposals such as the Digital Asset Market Clarity (CLARITY) Act have gained attention for attempting to curb the appeal of stablecoin rewards and other yield-bearing programs that could blur the line between traditional banking products and crypto offerings. At the same time, coverage of GENIUS Act proposals has underscored the tension between innovation and prudential supervision. The industry’s worry is that without a unified framework, chartered entities could be forced into a regulatory limbo where consumer protection and financial stability are not fully safeguarded.

While the ABA’s letter emphasizes caution, the OCC’s recent actions reflect a different facet of the ongoing balancing act: enabling regulated access to digital assets under a federal charter while attempting to avoid the full deposit-taking framework. The OCC’s stance has drawn support from some voices within the crypto sector who argue for clear, uniform standards that would prevent a fragmented patchwork of state-by-state approaches. The debate also intersects with ongoing discussions about how to treat banks and crypto similarly or differently, a point highlighted by industry and regulatory leaders alike. A separate OCC statement and related commentary have argued that there is no justification to treat banks and crypto differently; the underlying question remains how to translate those principles into enforceable, uniform rules across multiple agencies.

Warning after new crypto trust charters

The timing of the ABA’s intervention is notable: it follows the OCC’s conditional approvals announced earlier in December 2025 that would allow these firms to hold and manage customer digital assets under a federal umbrella while remaining out of the deposit-taking and lending business. The OCC described these structures as national trusts designed to segregate digital assets and provide custody capabilities without converting to traditional banking operations. The five charter recipients—Bitgo Bank & Trust, Fidelity Digital Assets, Ripple National Trust Bank, First National Digital Currency Bank, and Paxos Trust Company—represent a cross-section of the market and reflect a broader appetite to experiment with federal oversight in the crypto custody space. The OCC’s action signals a potential pathway for regulated custody of digital assets, even as lawmakers and industry groups push for clarifying legislation and more precise supervisory expectations.

The push for governance clarity is not happening in a vacuum. Industry participants and lawmakers alike have been weighing proposals like GENIUS Act and CLARITY Act, which seek to define the boundaries of crypto activities within the traditional banking regime and curb practices that could be mischaracterized as bank-like products without full bank regulation. The evolving regulatory mosaic poses a dilemma for firms seeking charters: how to align innovative custody models with a robust, predictable framework that ensures customer protection and systemic stability—without dampening the competitiveness and speed of financial-technology innovation.

As regulatory scoping continues to evolve, observers note that the OCC’s framework for conditional approvals to national trust charters could have meaningful implications for market structure, consumer safeguards, and the scope of permissible activities for non-deposit-taking digital asset custodians. The tension between fostering innovation and ensuring a resilient financial system remains at the heart of the debate. Several pieces of legislation and policy proposals that would influence this trajectory are already in circulation, reinforcing the sense that 2026 could be a critical year for how crypto custody and stablecoins are governed at the federal level.

Why it matters

For investors, the ongoing regulatory clarifications affect risk assessment and the perceived legitimacy of crypto custody solutions. A formal, well-defined regulatory framework could reduce ambiguity around the protections afforded to customer assets held by uninsured digital-asset trusts and influence risk pricing for associated products. For builders and operators, clear rules can help map out feasible business models that align with capital, governance, and risk-management expectations. And for policymakers, the interplay between GENIUS Act provisions, banking supervision, and securities/derivatives regulation underscores a key objective: ensuring that innovation remains aligned with financial stability and consumer protection.

From a market structure perspective, the debate highlights how custody and settlement infrastructures could evolve under federal oversight. If the OCC’s conditional trust charters become a common feature, watchers will be looking for transparency around capital requirements, resilience standards, and the safeguards that would prevent consumer confusion—especially around institutions that use “bank” in their names for branding purposes despite not engaging in traditional banking activities. The industry’s insistence on naming rules reflects a broader concern about trust and clarity in a landscape where digital assets can be held by entities operating under a federal umbrella but without full deposit-taking powers.

Meanwhile, the GENIUS Act and related proposals continue to shape the policy dialogue on stablecoins and digital assets within the U.S. financial system. As the regulatory math evolves, the market will be watching how agencies interpret and implement these concepts in real-world chartering decisions. The balancing act remains: enable responsible innovation in custody and settlement while preserving a robust, transparent, and enforceable supervisory regime that protects consumers and maintains market integrity.

What to watch next

- OCC’s formal response to the ABA comment letter and any adjustments to the proposed rulemaking timeline.

- Developments in GENIUS Act rulemaking and any accompanying guidance that clarifies obligations for crypto custody under national bank charters.

- Details on the five crypto firms granted conditional national trust charters, including milestones for capital, risk controls, and asset segregation.

- Legislative progress on the CLARITY Act and related measures that would influence stablecoin governance and disclosure requirements.

Sources & verification

- The ABA letter to the OCC regarding national bank chartering (PDF).

- OCC press release: conditional national trust bank approvals for Bitgo Bank & Trust, Fidelity Digital Assets, Ripple National Trust Bank, First National Digital Currency Bank, and Paxos Trust Company (nr-occ-2025-125.html).

- OCC updates on GENIUS Act-related rulemaking and related policy discussions cited in industry coverage.

- Cointelegraph reporting on the OCC’s stance toward treating banks and crypto equally and the broader lobbying around the GENIUS Act and related reforms.

What the ABA letter says, in context

The ABA’s position centers on prudence and transparency. The association argues that the OCC should resist rushing charter approvals for entities handling uninsured customer funds in crypto and stablecoin operations until the GENIUS Act rulemakings are fully defined and integrated into a coherent supervisory framework. It emphasizes that without a clear, comprehensive set of obligations, chartered entities could encounter undefined capital, operational resilience, and customer-protection standards. The letter calls for greater clarity on how capital and resilience benchmarks will be calibrated in conditional approvals and presses for tighter naming rules to prevent consumer confusion when entities use “bank” in their branding, despite not engaging in traditional banking activities. The overarching theme is to align innovation with robust safeguards and to keep deposit-empowered banks as the reference point for consumer protections and risk management.

Key figures and next steps

As the regulatory conversation continues, observers will be watching a trio of developments: the OCC’s formal responses to stakeholder comments, the progression of GENIUS Act rulemaking, and the practical implications of the five conditional charter approvals already granted. The dialogue around whether banks and crypto should be treated differently is likely to persist, but the current emphasis appears to be on ensuring that any new chartering framework provides explicit obligations and strong oversight. With policy and industry stakeholders navigating these questions, the coming months could define how crypto custody, stablecoin issuance, and related digital-asset activities are integrated into the U.S. banking system on a long-term, predictable basis.

Crypto World

Strategy to Push Preferred Stock to Boost Bitcoin Buys: CEO

Bitcoin treasury company Strategy will further lean on its preferred stock sales to acquire Bitcoin, shifting from its strategy of selling common stock, says CEO Phong Le.

“We will start to transition from equity capital to preferred capital,” Le told Bloomberg’s “The Close” on Wednesday.

Stretch (STRC) is Strategy’s perpetual preferred stock, launched in July, and is aimed at buyers looking for stability by offering an annual dividend of over 11%.

STRC is the company’s fourth perpetual preferred offering, launched to finance its Bitcoin (BTC) purchases. It’s an alternative to issuing new shares that dilute its stock price.

Le admitted that its preferred stock will “take some seasoning” and marketing to pitch traders on the offering, but added that “throughout the course of this year, we expect Stretch to be a big product for us.”

Strategy could restart offerings as STRC hits $100

STRC reclaimed its par value of $100 at the close of trading on Wednesday for the first time since mid-January, which Le said was the “story of the day.”

The stock had dipped below $94 earlier this month as Bitcoin crashed under $60,000, but with it now trading at par — the price Strategy has designated as its minimum — the company could again offer shares to fund more Bitcoin purchases.

Bitcoin has traded mostly flat over the last 24 hours at around $66,800, down from an intraday high of over $68,000.

Buying Bitcoin treasury rivals a “distraction”

Analysts have warned that the crypto treasury space is becoming crowded as companies compete for a small segment of traders, leading to some companies’ crypto holdings being worth more than the companies themselves.

Related: Saylor’s Strategy buys $90M in Bitcoin as price trades below cost basis

In that case, some analysts said that rival treasury firms could move to acquire underperforming companies to scoop up Bitcoin on the cheap, but Le said Strategy isn’t interested in making such a move.

“I think in any new market, whether it be electric cars or AI or SaaS software, you want to focus on your core product,” Le said. “I think it would be a distraction to go buy, at a discount to net asset value, another digital asset treasury company.”

Shares in Strategy (MSTR) ended trading on Wednesday down over 5% at $126.14.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

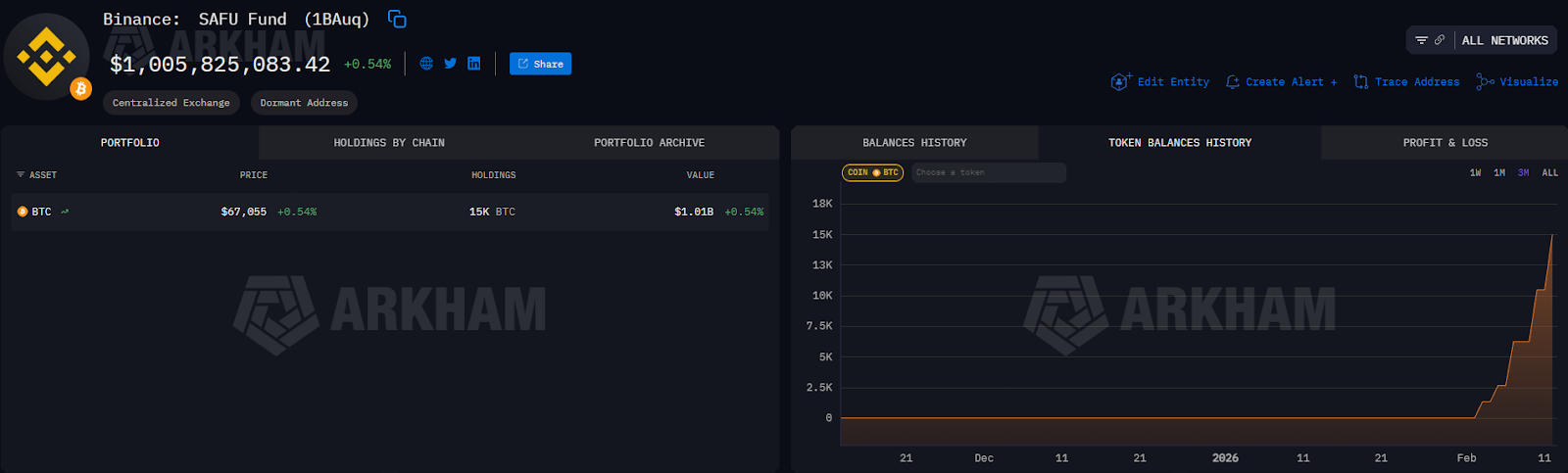

Binance Completes $1B Bitcoin Conversion for SAFU Fund

Binance completed the $1 billion Bitcoin conversion for its emergency fund, committing to holding Bitcoin as its core reserve asset.

Binance purchased another $304 million worth of Bitcoin (BTC) on Thursday, completing the conversion of $1 billion in Bitcoin for its Secure Asset Fund for Users (SAFU) wallet, according to Arkham data.

The fund now holds 15,000 Bitcoin, worth over $1 billion, acquired at an average aggregate cost basis of $67,000 per coin, Binance said in a Thursday X post.

“With SAFU Fund now fully in Bitcoin, we reinforce our belief in BTC as the premier long-term reserve asset.”

The last tranche of BTC came three days after Binance’s previous $300 million acquisition on Monday.

Related: Bitcoin’s $60K crash may mark halfway point of bear market: Kaiko

The exchange first announced it would convert its $1 billion user protection fund into Bitcoin on Jan. 30, initially pledging a 30-day window for the acquisitions, which were completed in less than two weeks.

The exchange said it would rebalance the fund if volatility pushes its value below $800 million.

Related: Bitcoin dips to $60K, TRM Labs becomes crypto unicorn: Finance Redefined

Crypto investor sentiment plunges to lowest levels on record

The conversion comes as broader market sentiment remains deeply negative.

Sentiment took another hit following Bitcoin’s brief correction below $60,000 on Feb. 5, plunging to five on Thursday — the lowest reading on record — signaling extreme fear among investors, according to data from alternative.me.

The index is a multifactorial measure of crypto market sentiment.

The industry’s leading traders by returns, tracked as “smart money,” are also hedging for more crypto market downside.

According to crypto intelligence platform Nansen, smart-money traders held a cumulative $105 million net short position in Bitcoin and were net short across most major cryptocurrencies, with Avalanche (AVAX) the only notable exception, recording $10.5 million in net long exposure.

Bitcoin’s correction also took a significant supply of tokens at a loss equaling to 16% of Bitcoin’s market cap, marking the highest pain point seen in markets since the implosion of algorithmic stablecoin issuer Terra in May 2022, wrote Glassnode in a Monday X post.

Yet in a silver lining to the correction, the market structure is showing early signs of stabilization, according to Dessislava Ianeva, dispatch analyst at digital asset platform Nexo.

“Derivative positioning remains cautious. Funding rates are neutral to slightly negative, reflecting subdued leverage demand, while open interest in native BTC terms has returned to early-February levels, suggesting stabilization rather than a renewed expansion phase,” the analyst told Cointelegraph.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports10 hours ago

Sports10 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World12 hours ago

Crypto World12 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video7 hours ago

Video7 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

![[KPOP IN PUBLIC] LISA - 'MONEY' | Cover by BN DANCE TEAM FROM VIETNAM](https://wordupnews.com/wp-content/uploads/2026/02/1770893501_maxresdefault-80x80.jpg)