Crypto World

UAE-Backed Investor Took 49% Stake in Trump-Linked Crypto Firm for $500M

A UAE-backed investment vehicle quietly agreed to buy nearly half of World Liberty Financial, a cryptocurrency startup linked to President Donald Trump, just days before he returned to the White House, according to a report by The Wall Street Journal.

Aryam Investment 1, an Abu Dhabi entity backed by Sheikh Tahnoon bin Zayed Al Nahyan, signed a deal in January 2025 to purchase a 49% stake in World Liberty Financial for $500 million, the Journal said, citing documents and people familiar with the matter.

Half of that amount was paid upfront, sending $187 million to Trump family-controlled entities, with additional tens of millions flowing to entities tied to co-founders, including relatives of US Middle East envoy Steve Witkoff, per the report.

The agreement was reportedly signed by Eric Trump. The Journal reported that the deal had not been publicly disclosed, despite World Liberty later revealing that the Trump family’s stake had fallen sharply.

Related: Sam Bankman-Fried turns up Trump support following Ellison’s release

Tahnoon’s ambitions grow after Trump election

Tahnoon, the brother of the United Arab Emirates president and the country’s national security adviser, has been central to Abu Dhabi’s push to become a global leader in artificial intelligence. Under the Biden administration, his efforts to secure advanced US-made AI chips were limited amid concerns that sensitive technology could reach China, particularly through companies such as G42.

Following Trump’s election, those efforts gained momentum. Tahnoon met multiple times with Trump and senior US officials, and within months the administration committed to granting the UAE access to hundreds of thousands of advanced AI chips annually.

The Journal reported that executives from G42 helped manage Aryam Investment 1 and took board seats at World Liberty as part of the deal, making Aryam the startup’s largest outside shareholder. Weeks before the US-UAE chip framework was announced, another Tahnoon-led firm, MGX, used World Liberty’s stablecoin to complete a $2 billion investment into Binance.

World Liberty and the White House have reportedly denied any wrongdoing. Spokespeople told the Journal that President Trump was not involved in the deal and that it did not provide any influence over US policy.

Related: Trump picks crypto-friendly Kevin Warsh as new Fed chair

World Liberty faces US probe calls

Last year, Democratic senators called on US authorities to investigate alleged links between World Liberty Financial’s token sales and sanctioned foreign actors. In a Nov. letter to the Justice Department and Treasury, Senators Elizabeth Warren and Jack Reed cited claims that WLFI governance tokens were bought by blockchain addresses tied to North Korea’s Lazarus Group, as well as Russian- and Iranian-linked entities.

The controversy is heightened by WLFI’s ownership structure, which gives Trump family-linked entities control over the majority of token revenue. Lawmakers argue this creates a direct conflict of interest, as most proceeds from token sales flow to the president’s family.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

58% of Ethereum’s wealth is hiding in plain sight, and half of DeFi is built on thin air

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Ethereum’s top holders double in size when tokens and stablecoins are included in on-chain valuations.

Summary

- Aggregating ETH with tokens shows top holders control $426 billion, over 2x higher than ETH-only rankings reveal.

- Including ERC-20s shifts power view, with smart contracts holding nearly 40% of top Ethereum balances.

- New PPI metric flags self-minted DeFi exposure, warning of fragility if selling pressure triggers unwind risks.

Ethereum’s balance sheet looks nothing like what it looked like a couple of years ago.

A new on-chain analysis has found that 58% of capital held by Ethereum’s largest addresses exists outside of Ethereum (ETH) entirely — sitting in ERC-20 tokens and stablecoins that traditional rankings simply don’t capture.

When Ethereum addresses are ranked by ETH balance alone, the top 10,000 hold a combined $189 billion. Rank those same addresses by total assets — ETH plus ERC-20 tokens and stablecoins — and that figure climbs to $426 billion. The capital sitting at the top of Ethereum’s economy is more than twice as large as conventional rankings suggest.

The gap is not just a numbers story. It reveals an entirely different cast of major holders. Among the top 1,000 addresses, only 537 appear in both the ETH-only and the aggregated rankings, meaning nearly half of Ethereum’s largest holders are effectively invisible when the market looks at ETH balances alone.

The composition of those holdings tells its own story. ETH now represents just 42% of what the largest addresses hold. Stablecoins account for roughly 26%, with the remaining share spread across ERC-20 tokens. A form of dominance shift has already taken place through quiet balance-sheet accumulation across protocols and tokens while prices remained largely range-bound.

Smart contracts are a central part of this new picture. Through an ETH-only lens, they appeared as minor participants in Ethereum’s wealth distribution. In the aggregated ranking, they control nearly 40% of top-holder capital. This roughly three times their previous share. Risk, the report argues, has migrated from individual holders making decisions to automated mechanisms governed by code, collateral design and token economics.

That shift in who holds capital leads directly to a harder question: what is that capital actually made of?

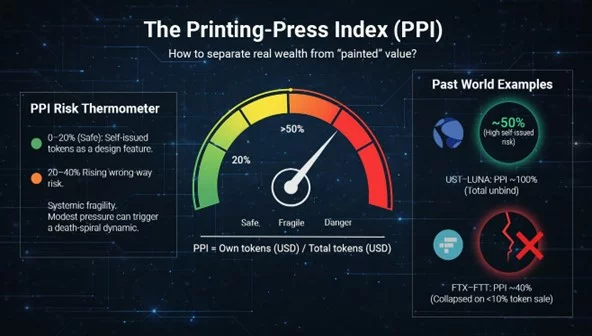

To answer it, the report introduces the Printing-Press Index, which is a measure of how much of a protocol’s token holdings are made up of its own self-issued tokens. Among DeFi protocols, that figure clusters around 50%, with names like Uniswap, Aave and Mantle among the examples cited.

The report identifies roughly 20% as the point where self-issued tokens begin to introduce meaningful risk, and 40-50% as the threshold where a protocol enters fragile territory. At those levels, a balance sheet is no longer primarily backed by external capital — it is partially backed by confidence in itself.

Modest selling pressure can impair that confidence, compress liquidity, and trigger the kind of reflexive unwind seen in the LUNA-UST collapse, where a Printing-Press Index near 100% contributed to a full death spiral within days.

The implication for how Ethereum’s economy is analyzed is significant. Once tokens represent the majority of large-address holdings and smart contracts control nearly 40% of that capital, balance size alone becomes a poor indicator of resilience. The Printing-Press Index offers a practical way to look past headline figures and assess what is actually backing the wealth that aggregated rankings are now beginning to reveal.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin Cash extends losses, dumps 10% amid BTC sell-off

- Bitcoin Cash price dropped more than 10% as bears hit the crypto market on Tuesday.

- The altcoin fell to lows of $481 and risked further losses amid Bitcoin weakness.

- Analysts say demand recovery could help bulls bounce.

Bitcoin Cash price has extended its downward trajectory, shedding more than 10% in value over the past 24 hours to touch lows of $481 in early trading on February 24, 2025.

The declines come as bearish sentiment grips the broader cryptocurrency market, with top coins plunging alongside Bitcoin’s fall below $63,000.

While some analysts note that the market could see a potential for a short-term recovery, prevailing headwinds favour sellers.

Other altcoins, including Ethereum, XRP, and BNB, have also marked steep declines as negative sentiment dominates.

BCH drops amid macro and geopolitical headwinds

Fresh tariff threats from US President Donald Trump, following a recent Supreme Court ruling on Trump’s 2025 tariffs, have triggered risk-off sentiment.

This has been compounded by other factors, including geopolitical uncertainty, which has prompted investors to seek safer assets and steer clear of volatile cryptocurrencies.

Weak sentiment has, in turn, suppressed crypto bids and contributed to huge outflows from digital asset investment products.

Tightening liquidity and elevated liquidations have further weighed on risk appetite, capping Bitcoin’s rebound.

The dump to lows of $62,700 for BTC accelerated losses for Bitcoin Cash amid this outlook, with bears showing greater appetite as daily volume jumped 46% to over $545 million.

Analysts say the macroeconomic picture and potential escalation in US-Iran tensions could cue further losses.

However, resolutions in favour of bulls will help cut the impact of the correction.

Bitcoin Cash price analysis

As noted, Bitcoin Cash traded as low as $481 on February 24, slipping by double digits in 24 hours as sellers pulled prices from highs of $570.

The fresh selling that has driven BCH below $500 aligns with technical indicators that paint a mostly bearish picture.

Bitcoin Cash’s recent declines have pushed the 50-day moving average toward the 200-day moving average, outlining a possible death cross pattern.

Increased losses and confirmation will come with intensified bearish momentum.

Meanwhile, the RSI and MACD indicators are also slipping lower, signaling bearish control.

According to CryptoQuant, Bitcoin’s slide from near $68k to under $63k coincides with the Coinbase Premium Index (SMA 30) rejecting downward.

The index gauges price premium on Coinbase versus global exchanges, and its downtrend for over a month suggests US selling pressure remains.

Failure to recover in the latest sessions highlights continued institutional hesitation.

Analysts at Bitfinex also share a similar outlook.

$BTC can bounce on positioning, but it rallies on spot demand.

CVD implies roughly $2.5B of net market sells since Feb 20 across centralised exchanges. That is not “one bad actor”, it is broad distribution.

Until that slows, breakouts often fade. pic.twitter.com/sR3vfvaZVi

— Bitfinex (@bitfinex) February 24, 2026

If Bitcoin drops to $50k or lower, a cascade of sell-off pressure will exacerbate BCH’s losses.

In the short term, BCH faces continued selling toward $425 and possibly $378.

On the upside, initial resistance is at the $500 mark, and then the moving average levels.

Currently, the 50-day and 200-day MA are converging near $560-$566.

Crypto World

Empery Digital shareholder demands sale of 4,000+ BTC, resignations

A major shareholder in Empery Digital has urged the company to abandon its Bitcoin-focused strategy, sell its digital asset holdings, and return the proceeds to investors, while calling for the resignation of the CEO and the entire board. In a letter dated February 23, 2026, Tice P. Brown, who owns about 9.8% of Empery Digital’s outstanding shares, argued that management has insulated itself at holders’ expense and pushed for a governance reset to unlock shareholder value. Brown’s appeal arrives as the company faces questions about whether its Bitcoin-centric approach remains viable amid a tighter funding environment and shifting volatility in crypto markets.

Brown’s leverage escalated just days after he disclosed that Empery Digital privately approached him on February 18 with an offer to repurchase all of his shares at a price equal to 100% of their market net asset value (mNAV), a premium he described as sizable relative to prevailing valuations. He rejected the proposal, saying it appeared designed to preserve management’s positions rather than to return capital to shareholders. The disclosure underscores a broader tension between insiders who favor propping up the company’s strategy and dissident investors seeking a more liquid, investor-friendly outcome.

Brown has been vocally critical of Empery Digital’s capital allocation decisions, governance posture, and its buyback strategy, arguing for a pivot away from a Bitcoin-centric model. In his view, the company should reposition toward liquidity, diversification, and a clearer path to capital returns for holders. Empery Digital has publicly pushed back, asserting that Brown’s characterization of events is distorted and that management remains open to arrangements that align with the long-term interests of the company and its shareholders.

The tensions come as Empery Digital, formerly known as Volcon, restructures its identity around a Bitcoin-focused corporate treasury. The company began its pivot in mid-2025 with the aim of becoming a Bitcoin aggregator, amassing a sizable position in the cryptocurrency. As of the latest disclosures, Empery Digital holds 4,081 BTC, placing it among the top 25 publicly traded Bitcoin holders globally. That concentration has become a focal point for critics who question whether a treasury strategy anchored to a volatile asset class can sustain long-term shareholder value, especially when market conditions compress valuations across the sector.

Analysts and observers have noted that digital asset treasuries have faced renewed pressure as crypto prices retrace and equity valuations across the sector compress. Standard Chartered recently warned that the sustainability of many crypto-treasury models depends on maintaining a premium valuation relative to the underlying Bitcoin holdings, a premium that has proved increasingly difficult to defend in current markets. The dynamic raises questions about whether Empery Digital’s current structure can weather declines in Bitcoin’s price, while still delivering meaningful upside to investors if market sentiment improves.

Meanwhile, the market context for crypto treasuries remains nuanced. On one hand, Bitcoin remains a focal point for investors seeking on-chain exposure within corporate balance sheets. On the other, the performance and governance of firms with large digital-asset holdings are scrutinized more closely, given concerns about liquidity, transparency, and the ability to liquidate assets without triggering adverse price moves. The public discourse around Empery Digital’s strategy reflects a broader debate about the role of crypto-treasury functions within traditional corporate structures and the potential need for governance safeguards to protect minority holders during periods of volatility.

Empery Digital’s Bitcoin gambit could be upended

The dispute highlights growing tensions around Empery Digital’s business model, which now centers on holding Bitcoin as its principal asset rather than pursuing a diversified corporate portfolio. The company’s strategic direction—pursuing a Bitcoin-centered treasury that aspires to function as a Bitcoin aggregator—has drawn both curiosity and criticism. If Brown’s push gains traction and the board yields to investor demands, a liquidation or partial divestment of the BTC holding could dramatically reframe the company’s value proposition and alter investor expectations about future returns.

Empery Digital’s origin story adds another layer to the narrative. It began life as Volcon, a maker of electric off-road vehicles and related equipment, before pivoting to a crypto-centric treasury strategy in 2025. The shift represents a broader trend in which corporate treasuries allocate to digital assets as a hedge or growth engine, a move that has attracted both interest and regulatory scrutiny. The transformation also places Empery Digital at the center of conversations about governance, capital allocation, and the sustainability of asset-backed valuations in the crypto era.

Brown’s stance, backed by his 9.8% stake, has already prompted public statements from Empery Digital. The company contends that Brown “continues to misrepresent and distort the facts,” arguing that any repurchase discussions were solely driven by a desire to act in the best interests of all shareholders. The public exchange signals a potential turning point for Empery Digital, as management seeks to defend a strategy that has become highly scrutinized in a market where liquidity and asset valuations can swing rapidly. This back-and-forth underscores the challenges faced by crypto-treasury businesses when governance decisions intersect with market cycles and investor sentiment.

Beyond Empery Digital’s shores, the broader crypto market has watched closely. Bitcoin’s price dynamics have influenced how investors evaluate crypto treasuries, with some market participants arguing that pure BTC accumulation strategies may need to be complemented by liquidity options, hedging mechanisms, or revenue-generating activities to weather downturns. As the sector collectively reassesses the economics of digital-asset holdings in corporate portfolios, Empery Digital’s situation could serve as a barometer for how governance disputes, minority shareholder rights, and strategic pivots are resolved in real time.

The discord also touches on the question of whether a company can sustain a premium to its net asset value (NAV) when its core asset—the cryptocurrency—suffers price fluctuations. If the market reassesses the premium to NAV or doubts the ability to liquidate Bitcoin holdings efficiently without impacting prices, investors may demand more transparent pathways to value realization. In that context, Empery Digital’s leadership transition discussions and potential strategic recalibration become critical signals for the market around risk, governance, and the alignment of incentives between management and shareholders.

As the story unfolds, market observers will be watching for three key developments: the board’s response to Brown’s letter and any concrete governance changes, the outcome of any discussions about liquidating or reallocating the BTC holdings, and how Empery Digital communicates its strategic considerations to investors going forward. The stakes extend beyond a single shareholder dispute; they touch on how crypto-treasury strategies are evaluated, priced, and regulated within traditional capital markets. The unfolding narrative will likely influence how other publicly traded entities with cryptocurrency holdings approach governance, disclosures, and capital-allocation decisions in an environment characterized by ongoing scrutiny and evolving market dynamics.

What to watch next

- Public response from Empery Digital’s board and any formal governance votes or resolutions related to Brown’s requests.

- Updates on the company’s BTC holdings, including any implications for liquidity, NAV, and potential sale or diversification plans.

- forthcoming statements or filings detailing the timeline of any share repurchase discussions or revised capital-allocation strategies.

- Market reaction to governance developments and any subsequent price or volatility shifts in the company’s shares or BTC exposure.

Sources & verification

- Shareholder letter from Tice P. Brown to Empery Digital’s board (Feb 23, 2026) as published in GlobeNewswire.

- Empery Digital’s statement addressing Brown’s characterization (as referenced in FT Markets reporting on Feb 24, 2026).

- StreetInsider coverage of the shareholder push for CEO and board resignations.

- BitcoinTreasuries.NET page documenting Empery Digital’s BTC holdings (Volcon Inc) and its ranking among public holders.

Empery Digital’s Bitcoin strategy under pressure as investor calls for governance shakeup

Empery Digital has built a Bitcoin (CRYPTO: BTC)-centric treasury, accumulating 4,081 BTC to date and positioning itself among the world’s more prominent public holders. The approach, intended to create value through crypto asset appreciation, has become a focal point for governance scrutiny after a major shareholder demanded a major strategic pivot. The confrontation began with a February 23 letter from Tice P. Brown, who holds roughly 9.8% of the company’s outstanding shares, urging the removal of CEO Ryan Lane and the entire board, and calling for a sale of the company’s Bitcoin stash with proceeds redistributed to shareholders. Brown contends that the current management team has entrenched itself in a way that undermines shareholder interests and capital efficiency.

The letter revealed a concrete counterproposal: a prior private offer to repurchase Brown’s shares at 100% of market net asset value (mNAV), framed as a premium to current market valuations. Brown rejected the deal, arguing that such a transaction would simply preserve existing control structures rather than deliver meaningful capital returns to investors. The exchange underscores a broader debate about whether a Bitcoin-centered strategy can deliver durable value in a market characterized by price swings, regulatory shifts, and evolving liquidity dynamics. While Brown framed the buyback as an opportunity to unlock value, Empery Digital characterizes the proposal as misaligned with the company’s long-term interests and governance standards.

Empery Digital’s response emphasizes that its leadership sought to engage Brown in a manner consistent with shareholder value creation, while maintaining a careful stance on the timing and method of any liquidity actions. The company’s board contends that Brown’s public portrayal of events does not accurately reflect the negotiation process, and insists that discussions were conducted with the aim of safeguarding the equity base. This exchange highlights the delicate balance between a treasury strategy anchored in a volatile asset and the expectations of public investors who seek predictable returns and governance accountability.

Looking ahead, the market will assess whether Empery Digital’s Bitcoin holdings—built over the course of 2025 and sustained into 2026—can withstand a shifting macro backdrop. Standard Chartered’s warnings about the sustainability of a premium to NAV in crypto-treasuries add a layer of caution to the conversation. If the market shifts away from valuing Bitcoin-heavy treasuries at a premium, companies like Empery Digital may need to demonstrate enhanced liquidity options, transparent capital-allocation policies, and credible pathways to returning capital to shareholders. The ongoing debate is not merely about whether to hold or sell; it is about how a crypto-native strategy integrates with corporate governance norms, investor expectations, and the regulatory environment that shapes disclosures and financial performance.

In the near term, investors will look for clarity on governance and strategy. Brown’s letter has already sparked a public debate about whether a Bitcoin-focused corporate treasury can deliver consistent shareholder value without sacrificing governance and liquidity. Empery Digital’s next moves—whether they entail partial divestitures, strategic diversification, or a recalibration of its capital-allocation framework—will be closely watched by a spectrum of investors, from crypto-focused funds to traditional equity holders seeking risk-adjusted exposure to digital assets. The outcome could influence how other companies with crypto holdings articulate their governance structures and communicate with shareholders in a market that remains sensitive to both asset volatility and governance signals.

Crypto World

Pi Network (PI) Founders Answer Hot Questions: Are Pioneers Happy?

Pi Network’s co-founder Nicolas Kokkalis asserted that KYC and migration remain a top priority.

Earlier this month, Pi Network celebrated the first anniversary of its Open Network launch.

To mark the milestone, the co-founders of the controversial crypto project answered a series of questions to offer users more insight into Pi’s future strategy, approach, and current work.

KYC And More

The co-founders, Chengdiao Fan and Nicolas Kokkalis, started by praising the “incredible advances” in Pi Network’s activity, app development initiatives, and platform-level utility releases over the past year. Fan asserted that in the next 12 months, the team will focus on expanding its ecosystem by creating additional opportunities for users.

Then they moved to the first question: what makes Pi Network different from other blockchains, and why does utility matter? Fan described Pi as “nonconformist,” emphasizing that it sets itself apart in several fundamental ways. She highlighted that the project has never conducted an ICO, is built on a mobile-first approach, is free to mine, and has already amassed tens of millions of verified users worldwide.

From there, the discussion shifted toward Pi Network’s emphasis on real-world utility. Fan explained that Pi’s vision has always centered on enabling tokens to participate in genuine economic activity rather than relying solely on abstract financial mechanisms. In her view, this approach is reinforced by Pi’s fully KYC-verified user base, which the team considers essential for supporting real-world assets and meaningful value creation across the ecosystem.

The next question, “What is the network working on now?” was answered by Kokkalis. He asserted that KYC and migration remain a top priority, adding that the team has started increasing KYC throughput, unblocking more users, boosting speed, and allowing second migrations.

“We are also on track to roll out KYC validator rewards this quarter in a secure and scalable way. In terms of Developer tools and support, we’re supporting developers, lowering the barrier to building on Pi through improved tooling and simpler integrations, including new tools like much faster Pi payment setups, along with ongoing support to help developers launch and scale real utilities,” he added.

Moreover, Kokkalis said the team will continue working on Nodes, protocol upgrades, and components like DEX functionality and liqduity pools.

You may also like:

Perhaps the most important question intriguing a large part of the community is the significance of the Know-Your-Customer process and what comes next. Kokkalis said the team has spent years building its KYC solution, explaining that because Pioneers are spread across the globe, the system needed to achieve broad geographic coverage and scalability.

The co-founder added that the heavy investment in the function was intentional, as identity verification is important to the integrity and authenticity of the entire network. Looking ahead, he noted that the team intends to offer its KYC technology as a service to external projects, thus turning it into a capability that could support Web3 and traditional businesses.

PI Tokens and AI

Another question for the founders focused on clarifying what Pi ecosystem tokens actually are. Fan explained that those are coins created by the community and issued on Pi.

“As many of you know, ecosystem tokens have already been released on Testnet, and we are finalizing their implementation on Mainnet. While technology and product are obviously important, we believe the most critical factor on Mainnet will be their design,” she added.

Fan believes that the ability to issue tokens is an “important superpower” of Web3, yet she thinks many coins in the crypto space are designed with no real-world use.

The last question focused on the fast-evolving Artificial Intelligence sector and how Pi Network plans to integrate that technology. Fan explained that AI is reshaping how value is created, making it essential for blockchain networks to support real-world production rather than rely on speculation. She stated that Pi’s strategy is to build AI-powered apps using tools such as Pi App Studio.

Are Pioneers Satisfied?

Judging by the comments under Pi Network’s anniversary announcement, plenty of users continue to struggle with major issues and urged the team to act more urgently.

Some Pioneers claimed they’ve been waiting for five-six years to complete the necessary verification steps and migrate to the mainnet, yet still haven’t been able to do so. Others went even further, calling Pi Network “a dirty scam project.”

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Ethereum Foundation Pledges to Support Privacy-First, Permissionless DeFi

The EF has created a team to support DeFi builders, focusing on privacy, security, and open-source principles.

The Ethereum Foundation is doubling down on decentralized finance this year, forming a dedicated internal unit to support builders and to scale what it calls “cypherpunk values alongside market growth.”

In a blog post published on Monday, Feb. 23, the organization framed DeFi as the “inevitable evolution of finance,” adding that “it’s been a critical driver of Ethereum’s growth and adoption.”

The foundation is explicit about the kind of DeFi it supports: “permissionless, censorship-resistant, privacy-first, self-custodial, and open source.”

The focus of the new DeFi unit, which sits within the organization’s App Relations team, is to guide DeFi development on Ethereum, support teams building in the space, and make sure projects stick to those principles. According to the blog post, the unit is led by Charles St. Louis and IvanGBI, both veterans from projects like DELV, MakerDAO, and Gearbox Protocol.

“The Ethereum Foundation believes in Defipunk: not finance that’s marginally better than TradFi, but finance that couldn’t exist without Ethereum,” the blog post reads.

First announced last year, “Defipunk” is the EF’s new framework that supports privacy- focused DeFi projects, as The Defiant reported earlier.

Ethereum remains the largest blockchain network by total value locked in DeFi, with $53.8 billion.

Priorities for 2026

To support the outlined plan, the foundation plans to set up “clear channels for DeFi teams to connect with the EF and each other,” though it didn’t provide specifics.

For 2026, the foundation is zeroing in on a set of priorities such as building stronger relationships with teams, improving security, supporting decentralization, advancing privacy, and conducting research.

Looking ahead, the Ethereum Foundation is also watching emerging intersections with AI, institutional adoption, stablecoins and new financial primitives, promising content and support in these areas.

To keep up with the trends, the organization has already set up a new unit dubbed the “dAI Team,” which aims to make Ethereum the “preferred settlement and coordination layer” for AI agents and the machine economy, The Defiant reported back in September.

The pledge to double down on DeFi comes just weeks after Tomasz Stańczak — who led the EF’s platform and EcoDev teams and founded execution-client project Nethermind — announced in mid-February that he would step down as co-executive director of the Ethereum Foundation.

Stańczak, who has served in the role for just under a year, said in a post on X that Bastian Aue will take over as interim co-ED alongside current co-ED Hsiao-Wei.

Crypto World

Empery Digital Shareholder Urges BTC Sale, CEO Exit

A major shareholder in Empery Digital has called on the company to abandon its Bitcoin-centric strategy, sell its digital asset holdings and return the proceeds to investors, along with demanding the resignation of the CEO and the entire board of directors.

In a letter to the company’s board on Monday, Tice P. Brown, who is the beneficial owner of roughly 9.8% of Empery Digital’s outstanding shares, accused management of entrenching themselves at shareholders’ expense.

Brown said that Empery Digital’s leadership privately approached him on Feb. 18 with an offer to repurchase all of his shares at a price equal to 100% of their market net asset value (mNAV), which he called “a large premium to prevailing market valuations.” He declined the proposal, saying it was designed to preserve management’s positions rather than return capital to shareholders.

Brown previously criticized the company’s capital allocation decisions, particularly its governance and buyback strategy, and urged a complete pivot away from its Bitcoin (BTC) strategy.

In response to Brown’s recent letter demanding both the Bitcoin sale and the immediate resignation of CEO Ryan Lane and the entire board, Empery Digital said the dissident investor “continues to misrepresent and distort the facts to further his self-serving campaign.”

In its statement, the company pushed back on Brown’s characterization of events, saying: “Mr. Brown intimated his interest in having his shares repurchased by the company but initially demanded a significant premium to NAV. Management attempted to reach an agreement with Mr. Brown as it believed such an agreement would be in the best interests of the Company and all its shareholders.”

Related: Bitcoin ETFs still sit on $53B in net inflows despite recent outflows: Bloomberg

Empery Digital’s Bitcoin gambit could be upended

The revolt by a major shareholder highlights mounting tensions around Empery Digital’s business model, which is built on accumulating and holding Bitcoin as its principal asset. A push to liquidate that stash could upend the strategy and reshape investor expectations of the company’s value.

Empery Digital, formerly known as Volcon, began as an electric power sporting goods company producing electric off-road vehicles and related products. It pivoted to a Bitcoin-centric corporate treasury strategy in mid-2025, adopting the new focus with the stated goal of becoming a Bitcoin aggregator.

Since then, Empery has accumulated 4,081 BTC, making it one of the top 25 publicly traded Bitcoin holders globally.

Digital asset treasuries have come under pressure as crypto prices have retraced and equity valuations across the sector have compressed.

Analysts at Standard Chartered recently warned that the sustainability of many crypto treasury companies hinges on their ability to maintain a premium valuation relative to their underlying Bitcoin holdings, commonly measured by market net asset value. That premium has become increasingly difficult to sustain amid current market conditions.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

Crypto World

SOL price outlook as three Solana platform announce shut down after Step Finance hack

- Step Finance, SolanaFloor, and Remora Markets halt operations after hack.

- STEP token collapses, while Remora tokens remain redeemable.

- SOL breaks key $77 support as bearish trend dominates amid high volatility.

Step Finance, a leading DeFi aggregator and portfolio dashboard on Solana, has announced an immediate shutdown following a major security breach.

The Step Finance hack reportedly drained over 260,000 SOL from the platform’s treasury, leaving the project unable to recover financially.

Alongside Step Finance, two affiliated platforms, SolanaFloor and Remora Markets, are also winding down operations.

Today we are announcing that Step Finance, SolanaFloor, and Remora Markets will be winding down all operations.

Following the hack at the end of January we explored every possible path forward, including financing and acquisition opportunities.

Unfortunately, we were unable to…

— Step☀️ (@StepFinance_) February 23, 2026

Market reaction

The news has sent shockwaves through the Solana community.

Token holders are reeling from the impact, particularly STEP token investors, whose asset has collapsed nearly 100% since the breach.

Remora Markets’ token holders, however, may be able to redeem their rTokens for USDC, as these assets remain fully backed.

Step Finance has also announced plans for a buyback program for eligible STEP holders based on a pre-hack snapshot.

The shutdown highlights the fragility of some projects in the Solana DeFi ecosystem.

It also underscores the broader risk of centralised treasury management, even within decentralised finance platforms.

Solana price reaction

The price of Solana (SOL) has shown noticeable weakness in the wake of these developments.

Over the past 24 hours, SOL has dropped below $77, a level that had previously served as key support.

Despite this, Solana’s trading volumes remain robust, reflecting heightened activity as investors reassess positions.

Derivatives data indicate growing bearish sentiment with rising long liquidations and a long-to-short ratio falling below 1, suggesting that shorts currently dominate the market.

Funding rates in futures markets have also turned negative, reinforcing the downward pressure on SOL.

In addition, institutional players appear to be taking a measured approach, as US spot SOL ETFs see modest inflows.

This accumulation hints that some investors see the recent dip as a potential buying opportunity, even amid broader uncertainty.

SOL price forecast

While some institutional support exists, SOL faces immediate technical hurdles and key levels that could determine its next direction.

SOL’s technical indicators signal a cautious outlook.

Notably, the cryptocurrency is trading below both its 50-day and 200-day EMAs, signalling a bearish trend, and the Relative Strength Index (RSI) is near oversold levels, suggesting momentum is heavily skewed toward sellers.

As a result, traders should watch the $75 mark closely as it represents a critical support level.

If this level fails to hold, SOL could see further downside toward the $63-51 range, according to Coinlore’s analysis.

On the upside, a rebound would need to overcome resistance near $91, with a more significant recovery targeting $102.

Short-term volatility is, however, likely to remain high given the recent ecosystem shocks, and investors should pay attention to both price action and on-chain metrics to gauge the resilience of SOL amid these challenges.

Crypto World

21Shares Launches TSUI ETF on Nasdaq

21Shares has launched the TSUI ETF on Nasdaq, offering U.S. investors regulated exposure to Sui.

21Shares, a financial services company known for its cryptocurrency exchange-traded products (ETPs), has introduced the TSUI ETF on Nasdaq, offering U.S. investors regulated access to Sui (SUI), according to the Sui Blog.

The spot TSUI ETF provides U.S. investors with a streamlined, regulated avenue to gain direct exposure to Sui. Trading on Nasdaq allows market participants to engage with Sui through established brokerage accounts. The SUI token is currently trading at $0.86, down 1% on the day, according to CoinGecko.

This debut of the ETF underscores the growing momentum behind institutional interest in regulated crypto investment products.

It also highlights the growing institutional focus on Sui. For example, financial entity Canary Capital recently launched the first-ever staked SUI ETF, The Defiant recently reported.

“TSUI marks yet another widely available access point to Sui, leveraging the industry’s preeminent tech stack to support global payments use cases and financial applications at scale,” said Evan Cheng, co-founder and CEO of Mysten Labs, the original contributor to Sui.

Elsewhere, financial institutions like Bitwise, Franklin Templeton, Grayscale, and VanEck have also shown interest in Sui-related initiatives.

This article was generated with the assistance of AI workflows.

Crypto World

BTC narrows big early losses, rallying back above $64,000

Bitcoin pushed back above $64,000 in early U.S. trading Tuesday, tracking a broader rebound in risk assets after several sessions of turbulence.

Trading recently at $64,200, bitcoin was still lower by 0.75% over the past 24 hours, but nicely above the morning’s low of $62,500. Ether (ETH) and solana (SOL) also narrowed big early losses.

Crypto’s tight correlation with technology stocks remained evident, with software shares — as represented by the iShares Software Sector ETF (IGV) — bouncing 1.7% after recent heavy losses on concerns that artificial intelligence (AI) tools will destroy their business models.

The gains came as some companies, including Intuit and DocuSign, announced partnerships with AI firm Anthropic, signaling that incumbents might be able to adapt rather than being displaced.

Meanwhile, traditional safe havens lost ground. Gold fell 1.5% on the session, while crude oil slipped 0.5% as geopolitical tensions eased. Reports cited Iran’s deputy foreign minister Majid Takht-Ravanchi saying the country “is ready to take any necessary step to reach a deal with the U.S.,” tempering fears of an imminent military strike.

The tech-heavy Nasdaq 100 traded 1.1% higher, while the broad-market S&P 500 was up 0.8%.

High-performance computing firms and bitcoin miners — increasingly tied to AI data center infrastructure — joined the move higher. Bitdeer (BTDR), Cipher Mining (CIFR), Hut 8 (HUT) and TeraWulf (WULF) led gains, rallying 6%-10%.

Much of the rest of the crypto-related sector was modestly lower, with Coinbase (COIN), MARA Holdings (MARA) and Strategy (MSTR) among those showing losses of 0.5%-1%.

Crypto World

prediction markets eye $10 billion future, Citizens says

Growth in prediction markets is surging as traders seek more precise ways to price and hedge discrete events, from elections to rate decisions, without relying on blunt proxy trades.

Prediction markets are running at an annualized revenue rate above $3 billion, up from about $2 billion in December, and could reach $10 billion by 2030, according to a Monday report by U.S. bank Citizens.

The bank cited accelerating volumes, stronger market structure and early institutional engagement, saying the trajectory mirrors the early evolution of listed derivatives and digital assets.

“We continue to view ~$10 billion of annual industry revenue by 2030 as a reasonable medium-term waypoint rather than an end state,” wrote analysts led by Devin Ryan.

Prediction markets have rapidly moved beyond niche betting to a growing ecosystem of sophisticated trading platforms that aggregate real-world event probabilities. Leading players include Kalshi, a CFTC-regulated U.S. exchange for event contracts, and Polymarket, one of the largest decentralized markets covering politics, sports and economics. These platforms are drawing significant volume and attention from mainstream finance and regulatory bodies alike, reflecting broader growth and the shift toward institutional relevance.

Asset classes typically scale from retail-led liquidity to professional market makers and, eventually, institutional capital, driving a step-change in depth and sophistication, the analysts said, arguing prediction markets are following that path.

January volumes rose more than 40% from December, with February tracking at a similar pace despite expectations of a post-football slowdown. While sports remain a key liquidity driver, activity is broadening into macroeconomic, political and regulatory events, areas more aligned with institutional demand.

Prediction markets allow investors to hedge discrete event risk, from inflation surprises to M&A approvals, without relying on proxy instruments such as index futures or options, reducing basis risk. By isolating specific outcomes, they provide targeted risk transfer and real-time, capital-weighted probability signals, Citizens said.

Institutional participation is emerging first through data integration, liquidity provision, settlement standards and regulatory clarity, with direct trading expected to scale as infrastructure matures. While revenues today are largely transaction-driven, the bank’s analysts see growth in data, research and financing services as the ecosystem develops.

Read more: How AI is helping retail traders exploit prediction market ‘glitches’ to make easy money

-

Video5 days ago

Video5 days agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread: Boden – Corporette.com

-

Politics3 days ago

Politics3 days agoBaftas 2026: Awards Nominations, Presenters And Performers

-

Sports1 day ago

Sports1 day agoWomen’s college basketball rankings: Iowa reenters top 10, Auriemma makes history

-

Business7 days ago

Business7 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment6 days ago

Entertainment6 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Politics1 day ago

Politics1 day agoNick Reiner Enters Plea In Deaths Of Parents Rob And Michele

-

Tech6 days ago

Tech6 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 days ago

Sports6 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Business2 days ago

Business2 days agoMattel’s American Girl brand turns 40, dolls enter a new era

-

Crypto World12 hours ago

Crypto World12 hours agoXRP price enters “dead zone” as Binance leverage hits lows

-

Business2 days ago

Business2 days agoLaw enforcement kills armed man seeking to enter Trump’s Mar-a-Lago resort, officials say

-

Entertainment6 days ago

Entertainment6 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business6 days ago

Business6 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Tech2 days ago

Tech2 days agoAnthropic-Backed Group Enters NY-12 AI PAC Fight

-

NewsBeat1 day ago

NewsBeat1 day ago‘Hourly’ method from gastroenterologist ‘helps reduce air travel bloating’

-

NewsBeat2 days ago

NewsBeat2 days agoArmed man killed after entering secure perimeter of Mar-a-Lago, Secret Service says

-

Politics2 days ago

Politics2 days agoMaine has a long track record of electing moderates. Enter Graham Platner.

-

Crypto World6 days ago

Crypto World6 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World5 days ago

Crypto World5 days ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market