Crypto World

UNI Token Tests Critical $2.80 Support After 93% Crash: Analyst Eyes 1,500% Rally Potential

TLDR:

- UNI has declined 93% from all-time highs and currently tests multi-year channel support at $2.80 level.

- Historical patterns show UNI delivered 2,400% gains in 2020 and 400% rally in 2023 from similar support zones.

- Analyst targets range from $14 to $45, representing potential 3x to 8x returns if current support holds firm.

- Uniswap V4 development and DeFi narrative momentum provide fundamental catalysts for projected 1,500% rally.

UNI, the native token of decentralized exchange Uniswap, currently trades at $3.63 after dropping 93% from its all-time high.

The token is testing a multi-year descending channel support that has remained intact since 2022. This high-timeframe structure represents a potential cycle-level accumulation zone.

Market analysts are monitoring whether this support holds as the token approaches critical demand levels.

Multi-Year Channel Support Shows Historical Significance

The descending channel support has proven reliable during previous market cycles. UNI delivered a 2,400% rally in 2020 from October lows when similar support structures formed. The token repeated this pattern in 2023 with a 400% increase from support levels.

Technical indicators show the token trading below the $6 support zone. However, the $2.80 demand zone continues to attract buying interest. This level represents a major macro support that would invalidate below this threshold.

Crypto analyst Patel shared his technical outlook on the token’s structure. According to his analysis, the current positioning suggests smart money accumulation at high-timeframe support levels. The extended base formation historically precedes substantial upward movements in cryptocurrency markets.

The token’s correction from all-time highs places it in what traders call a maximum pain zone. This region often marks periods where retail investors capitulate while institutional participants accumulate positions. The 93.68% decline matches the severity of previous bear market bottoms for major DeFi tokens.

Price Targets Align With DeFi Sector Recovery

Patel’s analysis projects three potential targets if the support structure holds: $14, $26, and $45. These levels represent 3x to 8x returns from current prices. The projections assume the multi-year channel support remains valid through 2026.

The potential for a 1,500% rally stems from historical precedent and cycle analysis. Previous instances where UNI tested similar structures resulted in exponential gains. The asymmetric risk-reward profile becomes attractive when the token trades near established support zones.

Uniswap V4 development adds a fundamental catalyst to the technical setup. The protocol upgrade introduces new features that could drive increased trading volume and fee generation.

DeFi narratives are gaining momentum as the broader cryptocurrency market recovers from the bear cycle.

Market participants watch whether the $2.80 level holds during potential retests. A breakdown below this zone would challenge the bullish thesis and require reassessment of accumulation strategies. Conversely, a successful defense of support could trigger the next leg higher.

The longer consolidation period at these levels typically builds energy for eventual breakouts. Time spent building a base correlates with the magnitude of subsequent rallies in cryptocurrency markets. The current structure mirrors formations that preceded major bull runs in previous cycles.

Crypto World

Solo Operators Generate Millions as Automation Drives $1 Trillion Wealth Transfer

TLDR:

- Solo developer earned $1.87M in four months using Polymarket bot without hiring single employee or team

- One trader with Clawdbot monitors 1,000+ wallets continuously matching 50-person trading desk for $20 daily

- Automated DeFi farmers create 50%+ annual yield gap over manual traders through continuous auto-compounding

- Output equation shifted from time multiplied by team size to skill times automation raised to exponential scale

A wealth transfer of unprecedented scale is currently underway as individual operators leverage automation tools to compete with traditional teams.

Crypto trader Axel Bitblaze highlighted this shift in a detailed thread, noting that solo developers and traders are now generating million-dollar revenues without employees.

The transformation represents a fundamental change in how value is created and captured in digital markets. Traditional labor-based models are losing ground to system-driven approaches.

The New Automation Economy

Individual operators are achieving results previously reserved for large organizations through automated systems. One developer built a Polymarket prediction bot that generated $1.87 million in profit over four months without any employees.

Another solo creator launched a token through Pump.fun that reached $100 million market cap within 24 hours of trading.

A single trader using Clawdbot monitors over 1,000 wallets continuously and executes trades faster than traditional trading desks.

These examples demonstrate how the leverage equation has fundamentally changed in recent years. The old model calculated output as time multiplied by skill and team size.

Modern operations follow a different formula where output equals skill times automation raised to scale. This exponential factor allows individuals to compete with teams of 100 or more people.

The shift became possible only within the past three years as AI and automation tools reached practical deployment stages.

Axel Bitblaze emphasized in his January 17 post that this is not theoretical economics but observable reality. Solo operators are running operations that would have required dozens of employees under previous paradigms.

The gap between automated and manual approaches compounds rapidly across different sectors. Polymarket bot operators earned $100,000 daily while manual traders competing in the same markets generated zero returns.

DeFi farming bots track 40 protocols simultaneously and auto-compound four times daily, creating annual percentage yield gaps exceeding 50 percent compared to manual farmers.

Silent Transfer of Economic Power

Most market participants fail to recognize this transfer because it appears gradual rather than disruptive. People attribute automated success to luck or insider advantages rather than systematic approaches.

Many believe they will catch up when time permits, but the performance gap doubles every six months according to current trends.

Historical precedents show similar leverage shifts during previous technological transitions. Factory owners captured wealth from craftsmen in the 1800s when one person with machinery could produce 100 times more output.

Digital platforms transferred value from local businesses in the 1990s as the internet’s reach expanded exponentially. The current AI and automation wave represents another magnitude shift in individual capability.

The trajectory points toward solo operators managing multi-million dollar operations within months. Traditional teams cannot match the speed and efficiency of well-designed automated systems.

Bitblaze projects that billion-dollar companies run by five people will emerge within two years as automation becomes a baseline rather than an advantage.

Positioning determines whether individuals extract value or become part of systems extracting value from their labor.

Manual checking of data that automation could track, competing on time rather than systems, and postponing automation efforts place operators on the losing side.

Building scalable systems, amplifying output through code, and seeking 10x improvements through automation indicate the correct positioning for this economic shift.

Crypto World

Trump-Linked Truth Social Files for Bitcoin, Ethereum and CRO Staking ETFs

Trump Media and Technology Group is expanding its push into digital assets, filing for two new cryptocurrency exchange-traded funds tied to Bitcoin, Ether and the Cronos ecosystem.

Key Takeaways:

- Trump Media filed for two crypto ETFs tracking Bitcoin, Ether and the Cronos token.

- The Cronos fund would include staking rewards with Crypto.com providing custody and services.

- The move deepens ties between US politics and the growing crypto investment sector.

Truth Social Funds, the ETF arm of the company behind the Truth Social platform, submitted applications Friday for the “Truth Social Bitcoin and Ether ETF” and the “Truth Social Cronos Yield Maximizer ETF.”

The filings mark another step in the growing overlap between US politics and the crypto investment industry.

Truth Social ETFs Target Bitcoin, Ether and CRO With Staking Rewards

The proposed Bitcoin and Ether ETF would track the performance of the two largest cryptocurrencies, reportedly using an allocation weighted toward Bitcoin.

The Cronos product, meanwhile, would provide exposure to CRO, the native token of the Crypto.com-linked Cronos blockchain, while also offering staking rewards to investors.

Crypto.com is partnering with Trump Media on the products and is expected to provide custody, liquidity and staking services.

CEO Kris Marszalek said the company supports the funds and plans to enable trading access once they launch.

The new filings follow a previous agreement between the firms to introduce crypto investment products and continue a broader strategy by Trump Media to establish a presence in digital finance.

The company had already sought approval for a standalone Bitcoin ETF and a multi-asset crypto fund that included several major tokens.

The ETF market is increasingly competitive. Asset managers such as BlackRock, Fidelity and Grayscale already operate widely traded Bitcoin investment vehicles, giving investors indirect exposure to crypto without holding tokens directly.

Trump Media has also signaled interest in integrating blockchain beyond ETFs.

The company recently said it intends to distribute a new digital token to shareholders on the Cronos network and previously disclosed plans for a corporate crypto treasury involving CRO.

The expansion has drawn political scrutiny, with critics arguing the president’s business ventures could create conflicts of interest, particularly as regulatory decisions affecting digital assets are debated in Washington.

Last year, Trump Media also announced a partnership with Crypto.com to bring prediction markets to the social media platform, positioning it as the first publicly traded social media company to integrate such technology.

Bitcoin Loses 25,000 Millionaire Addresses Under Trump

As reported, Bitcoin has shed roughly 25,000 millionaire addresses in the year since Donald Trump returned to the White House, even as US policy shifted toward a more crypto-friendly stance.

Blockchain data shows the number of addresses holding at least $1 million in BTC fell about 16% year over year, suggesting regulatory optimism has not translated into sustained on-chain wealth growth.

The pullback was less severe among the largest holders. Addresses with more than $10 million in Bitcoin declined by about 12.5%, indicating that top-tier investors were better able to withstand price volatility, while wallets near the millionaire threshold were more exposed to market swings.

Much of the increase in Bitcoin millionaire addresses occurred before Trump took office, driven by a late-2024 rally fueled by election-related optimism and expectations of deregulation.

The post Trump-Linked Truth Social Files for Bitcoin, Ethereum and CRO Staking ETFs appeared first on Cryptonews.

Crypto World

Mirae Asset to Buy 92% Stake in Korbit for $93M

Mirae Asset Consulting, an affiliate of South Korea’s Mirae Asset Group, is moving to take control of local crypto exchange Korbit. In a regulatory filing, the company agreed to acquire 26.9 million Korbit shares for 133.48 billion won, roughly $93 million, securing a 92.06% ownership stake in the exchange. The purchase will be paid entirely in cash, and the deal has the board’s approval as of February 5. Completion is expected within seven business days after all contractual closing conditions are satisfied, underscoring a rapid move to consolidate a regulated digital-asset business within Korea’s evolving crypto infrastructure. The filing notes Mirae Asset intends to secure future growth drivers through digital-asset (virtual-asset) businesses.

Key takeaways

- Mirae Asset Consulting agrees to buy 26.9 million Korbit shares for 133.48 billion won, gaining about 92.06% ownership in the exchange, with cash as the payment method.

- The acquisition received board approval on February 5, and is slated to close within seven business days after contractual closing conditions are satisfied.

- Korbit’s current ownership structure includes about 60.5% held by NXC and Simple Capital Futures, with SK Square owning roughly 31.5%.

- Korbit reported 8.7 billion won in revenue and 9.8 billion won in net profit in its latest fiscal year, reversing prior losses.

- The exchange operates with a full license and established compliance infrastructure, potentially making it an attractive vehicle for a financial group seeking regulated exposure to digital assets.

Tickers mentioned:

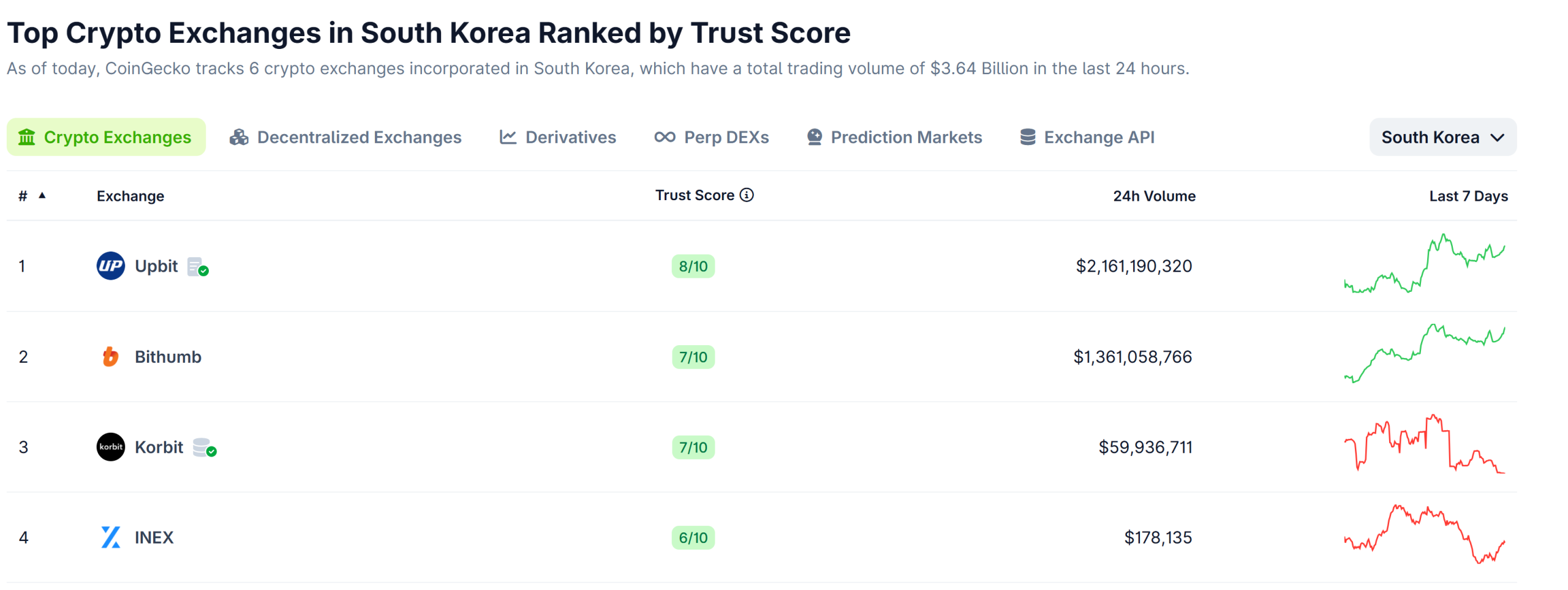

Market context: The deal unfolds within Korea’s tightly regulated crypto landscape, where Upbit and Bithumb dominate daily trading volumes, and Korbit remains a smaller player by comparison. Data cited by CoinGecko shows Korbit’s roughly $59.9 million in 24-hour trading activity versus Upbit’s about $2.16 billion and Bithumb’s around $1.36 billion. The transaction signals ongoing consolidation among domestic exchanges as traditional financial groups pursue regulated access to digital-asset markets.

Market context: The broader environment in Korea has long featured a push toward licensed operations and stronger compliance frameworks, with regulators scrutinizing promotions and business practices in the sector. The move by a major asset manager to take control of a licensed exchange aligns with a broader trend of institutional players seeking regulated exposure to crypto markets rather than unregistered platforms.

Why it matters

The planned acquisition marks a notable shift in Korea’s crypto ecosystem, illustrating how conventional financial groups are intensifying their strategic bets on digital-asset infrastructure. Mirae Asset’s intention to leverage Korbit’s established license and compliance capabilities could accelerate the exchange’s product, risk controls, and customer onboarding processes, potentially translating into stronger operating leverage for the platform as part of a larger asset-management and fintech ecosystem.

For Korbit, the deal provides a clear path to liquidity and alignment with a major financial conglomerate, potentially enabling enhanced interoperability with traditional banking channels and institutional-grade custody solutions. The company’s reported 8.7 billion won in revenue and 9.8 billion won in net profit in its most recent fiscal year reflect a profitability trajectory that may have attracted Mirae Asset’s interest in expanding regulated, scalable digital-asset services. Korbit’s ownership structure—where NXC and Simple Capital Futures hold a majority stake alongside SK Square—suggests a transition moment that could reshape the exchange’s governance and strategic direction under new majority ownership.

From a market perspective, the deal emphasizes the continuing maturation of Korea’s crypto market, where licensed venues like Korbit coexist with larger platforms and regulatory scrutiny. The emphasis on a cash deal and rapid closing also signals a preference for definitive, trustee-like control structures to manage risk and ensure a swift integration path for regulatory-compliant digital-asset activities. As regulatory expectations evolve, the success of Mirae Asset’s investment could hinge on how smoothly Korbit can integrate into a broader digital-asset strategy and how it adapts to evolving compliance standards and product requirements.

What to watch next

- The contractual closing conditions must be satisfied, with settlement anticipated within seven business days after those requirements are met.

- The integration of Korbit into Mirae Asset’s digital-asset framework and any organizational changes at the exchange.

- Regulatory confirmations or conditions that may accompany the closing process and any post-merger compliance reviews.

Sources & verification

- DART filing: rcpNo=20260213002679, detailing the cash acquisition and ownership thesis.

- Korbit’s financials: revenue of 8.7 billion won and net profit of 9.8 billion won in the latest fiscal year.

- Korbit ownership: NXC and Simple Capital Futures ~60.5%, SK Square ~31.5%.

- Trading volume context: Upbit (~$2.16 billion) and Bithumb (~$1.36 billion) in 24-hour activity; Korbit ~ $59.9 million, per CoinGecko data.

What the move means for Korea’s crypto landscape

Mirae Asset’s Korbit bet signals a broader push into regulated crypto markets

The transaction represents a decisive step in the ongoing consolidation of Korea’s digital-asset infrastructure, where license and compliance play a critical role in determining strategic value. Mirae Asset’s cash offer and rapid cadence may set a precedent for other traditional financial groups evaluating similar moves, especially those seeking to bolster exposure to regulated crypto ecosystems without bearing the full operational burden of building a compliant platform from scratch. As the ecosystem evolves, Korbit’s improved access to Mirae Asset’s capital and infrastructure could translate into more robust risk controls, enhanced product offerings, and greater interoperability with mainstream financial services.

In the near term, stakeholders will be watching how Korbit navigates post-acquisition governance, how the integration aligns with Mirae Asset’s broader digital-asset strategy, and whether the deal serves as a catalyst for other exchanges to pursue strategic partnerships or consolidations. For investors and users, the development underscores the ongoing transition of crypto services from scrappy startups to regulated, institution-friendly platforms—an arc that could influence liquidity, product quality, and regulatory clarity across Korea’s crypto market.

Crypto World

Mirae Asset to Buy Controlling Stake at Korea’s Korbit Exchange for $93M

Mirae Asset Consulting, an affiliate of South Korean multinational financial services company Mirae Asset Group, has agreed to acquire a controlling stake in local crypto exchange Korbit.

The company plans to purchase 26.9 million shares of Korbit for 133.48 billion won (about $93 million), a transaction that would give it a 92.06% ownership interest in the exchange, according to a Friday regulatory filing. The payment will be made entirely in cash

Mirae Asset said the purpose of the acquisition is “to secure future growth drivers through digital-asset (virtual-asset) businesses,” per the filing. The company’s board approved the decision on Feb. 5, while reports on the planned deal initially surfaced last year.

The transaction has not yet closed. The settlement will occur once contractual closing conditions are satisfied, with completion expected within seven business days after those requirements are met.

Related: How a Bitcoin promotion error triggered a regulatory reckoning in South Korea

Korbit returns to profit after sale talks

Korbit reported 8.7 billion won in revenue and 9.8 billion won in net profit in its most recent fiscal year, reversing losses recorded in prior years.

Korbit is primarily owned by NXC and its subsidiary Simple Capital Futures, which together hold about 60.5% of the exchange. SK Square owns an additional 31.5% stake.

Korbit holds a full operating license and compliance infrastructure, which could make it an attractive entry point for a major financial group seeking regulated exposure to digital assets.

As Cointelegraph reported, local exchange Coinone also is exploring a potential sale, as chairman Cha Myung-hoon seeks to divest his 53.4% controlling stake.

Related: South Korea probes Bithumb after $43B ‘phantom’ Bitcoin payout

Korbit trails major Korean exchanges in trading volume

According to CoinGecko data, Korbit remains a relatively small player in South Korea’s crypto trading market compared with larger domestic exchanges. Of roughly $3.64 billion in combined 24-hour trading volume tracked across Korea-based platforms, Korbit recorded about $59.9 million in daily activity.

Upbit accounted for the vast majority of trading with approximately $2.16 billion in 24-hour volume, followed by Bithumb at around $1.36 billion. Smaller venues trailed far behind, with exchanges such as INEX reporting volumes in the hundreds of thousands of dollars.

Magazine: Bitget’s Gracy Chen is looking for ‘entrepreneurs, not wantrepreneurs’

Crypto World

Bankman-Fried follows 2023 media strategy from prison, SafeMoon CEO gets 100-month sentence, Strategy expands Bitcoin holdings | Weekly recap

In this week’s edition of the weekly recap, Sam Bankman-Fried appeared to implement a documented media playbook from prison, former SafeMoon CEO Braden Karony received a 100-month sentence, and Strategy introduced perpetual preferred shares to fund Bitcoin purchases. Bankman-Fried executes…

Crypto World

Best Crypto Presales Include MAXI and SHPRO, but the Upcoming Crypto That Seems a Rocket Launch Is DeepSnitch AI

Something that makes the search for the best crypto presales an exciting endeavor is that it is an opportunity to find innovative use cases one hadn’t thought about. Innovation in the crypto space is continuous and fast, and upcoming cryptos are its main catalyst.

Among ongoing presales, DeepSnitch AI is at the leading spot, not so much due to its fast pace (though that’s impressive enough) but because of its disruptive nature. The upcoming AI tool will change crypto investing for the better, and take a trip into a 100x returns orbit in the process.

New crypto use cases take the spotlight at Consensus

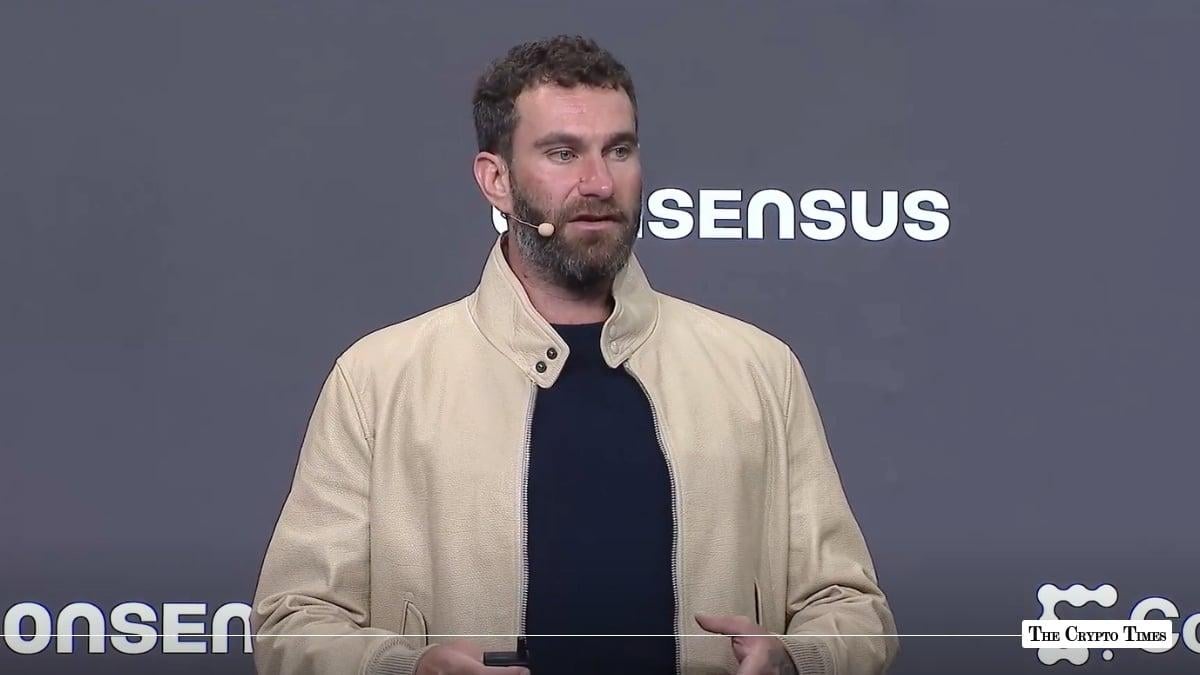

That spirit of innovation that characterizes the best crypto presales was very much present at Consensus 2026 on the final day, in Hong Kong. There were plenty of interesting pitches, but one that stood out was that of Zak Folkman, from World Liberty Financial.

The Trump-associated firm is developing a foreign-exchange platform called World Swap, co-founded by Folkman, which will target cross-border transfers using the stablecoin USD1.

Zak Folkman from World Liberty Financial pitches cross-border solution World Swap at Consensus, in Hong Kong, on Feb. 12. (© Consensus).

Zak Folkman from World Liberty Financial pitches cross-border solution World Swap at Consensus, in Hong Kong, on Feb. 12. (© Consensus).

While financial use cases are increasingly common for upcoming projects, and they certainly are frequent among the best crypto presales, there are many other fields to explore. This is reflected in the current presale crypto calendar, from which the next section reviews a few of the most interesting options.

Presales worth considering in February

1. DeepSnitch AI (DSNT)

The best crypto presales are the catalysts of crypto innovation, and DeepSnitch AI is the ultimate example of that. The project is the most sophisticated and market-aligned AI use case in the crypto space: an AI-powered investment guidance tool that will help hundreds of millions of crypto holders with their investment decision-making.

In a nutshell, the system is a suite of AI agents that transform crypto data into market intelligence by performing a set of tasks. These tasks, taken in unison, amount to an “investing brain” that generates concrete and actionable insights. For instance, SnitchFeed might suggest a list of trending coins, and AuditSnitch can check whether those coins are legitimate or dubious.

Given the sophistication and market alignment of this powerful tool, it’s no wonder that the presale numbers are so impressive. In just the 5th stage, almost $1.6 million has been raised. Moreover, the entry price is still only $0.03985, making DeepSnitch AI one of the best early investor opportunities in February.

On top of that, the team is giving bonuses, beginning with a 30% bonus for an investment of at least $2,000, which would turn a 7x price increase into a 10x return. But if you want to see your wallet explode this year, it is crucial for you to take part in the presale now.

2. Maxi Doge (MAXI)

As of Feb. 14, Maxi Doge is close to reaching the $4.6 million raising milestone, which is an impressive number for a pure meme token. Indeed, something that has been welcomed by meme investors is that MAXI is straightforwardly marketed as a cool alternative to other dog-themed memes like DOGE and SHIB, making it the best crypto presale for those who love dog memes.

The entry price is $0.0002803, which is less than DeepSnitch AI, though the comparison isn’t a good one, given their radically different nature. A better comparison would be with another dog meme like DOG, whose current market price is $0.0009472.

3. ShieldGuard Protocol (SHPRO)

ShieldGuard Protocol is among the trending new ICOs focused on cybersecurity. The SHPRO coin, built over the BNB chain, has just started to be pre-sold, and so far, over $7,000 has been raised in its first stage.

Clearly, these are the early days for SHPRO and it is still to be seen whether the fundraising gains traction and speed. But judging by the thorough way that the project has been technically documented, it wouldn’t come as a surprise if it turns out to be one of the best crypto presales this year.

Conclusion

The best crypto presales are those that catalyse innovation, and DeepSnitch AI is at the top spot, like a rocket ready to be launched into a 100x return orbit.

But only those who invest now in the presale and take advantage of the bonuses (30% code: DSNTVIP30, 50% code: DSNTVIP50, 150% code: DSNTVIP150, 300% code: DSNTVIP300) will enjoy that trip into space.

Visit the official website to buy into the DeepSnitch AI presale now, and visit X and Telegram for the latest community updates.

FAQs

What’s the point of holding Maxi Doge, Shiba Inu, or another meme?

Memes are clean and easy-to-understand investment instruments, and they carry a cultural appeal that coins like BTC or ETH lack. DeepSnitch AI, while not a pure meme, also benefits from that cultural appeal.

How advanced is DeepSnitch AI’s product development?

This is one of the factors that make DeepSnitch AI the best crypto presale right now. The system is almost ready, which is something really unusual for a presale.

So, will the DeepSnitch AI tool be ready to use after launch?

Absolutely. DeepSnitch AI will be ready for more than half a billion crypto holders around the world, who will radically improve their investing.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Vitalik Buterin Warns Prediction Markets Are Becoming Overly Speculative

Ethereum co-founder Vitalik Buterin is voicing concern about the current direction of prediction markets, arguing that the sector is drifting away from useful economic tools and toward short-term betting.

Key Takeaways:

- Vitalik Buterin warns prediction markets are drifting toward short-term speculation and betting.

- He proposes using onchain markets and AI to hedge everyday expenses and inflation risk.

- Supporters say platforms like Polymarket and Kalshi can also serve as decentralized market intelligence.

In a recent post on X, Buterin said many platforms are “over-converging” into products centered on rapid price wagers and speculative trading rather than practical applications.

He warned that the trend risks turning prediction markets into little more than gambling venues instead of systems that support real-world economic planning.

Buterin Says Prediction Markets Should Shift From Betting To Hedging

Rather than focusing on event betting or short-term financial outcomes, Buterin suggested prediction markets should evolve into hedging mechanisms designed to protect consumers and businesses from price volatility.

He outlined a model in which onchain prediction markets work alongside large language models (LLMs).

The system would track price indices across categories of goods and services, such as food, housing or transportation, separated by region.

A user’s personal AI assistant would analyze spending patterns and construct a tailored portfolio of prediction-market positions representing expected future expenses.

The idea is to help households and companies offset rising costs. Individuals could hold traditional investments for growth while maintaining a basket of prediction-market shares tied to living expenses, creating a buffer against inflation in fiat currencies.

Supporters of prediction markets say the technology already has broader value beyond speculation.

These platforms crowdsource expectations about events, financial trends and economic conditions, producing signals some researchers argue can rival polling data.

Markets such as Polymarket and Kalshi have gained traction by offering alternative views on political and economic developments.

Advocates say they provide a decentralized source of intelligence that is harder to shape by centralized narratives.

State Opposition to Prediction Markets Builds Over Consumer Concerns

State opposition to prediction markets has been building for months.

In 2025, the SWC urged the CFTC to prohibit sports event contracts, arguing that such products bypass state safeguards such as age verification, responsible gaming rules and anti-money laundering requirements.

As reported, a new legislation to limit the interactions between government officials and the prediction markets is being supported by more than 30 Democrats in the US House of Representatives, including former Speaker Nancy Pelosi.

The lure behind new restrictions is a controversial Polymarket bet, which started as a bet of $32,000 but eventually became more than $400,000 shortly before the unexpected detention of Venezuelan President Nicolás Maduro.

The bill proposed by the New York Representative Ritchie Torres is the Public Integrity in Financial Prediction Markets Act of 2026.

Last month, Kalshi opened a new office in Washington, D.C., as it ramps up efforts to shape federal and state policy amid growing scrutiny of its products across the United States.

The company also hired veteran political strategist John Bivona as its first head of federal government relations.

The post Vitalik Buterin Warns Prediction Markets Are Becoming Overly Speculative appeared first on Cryptonews.

Crypto World

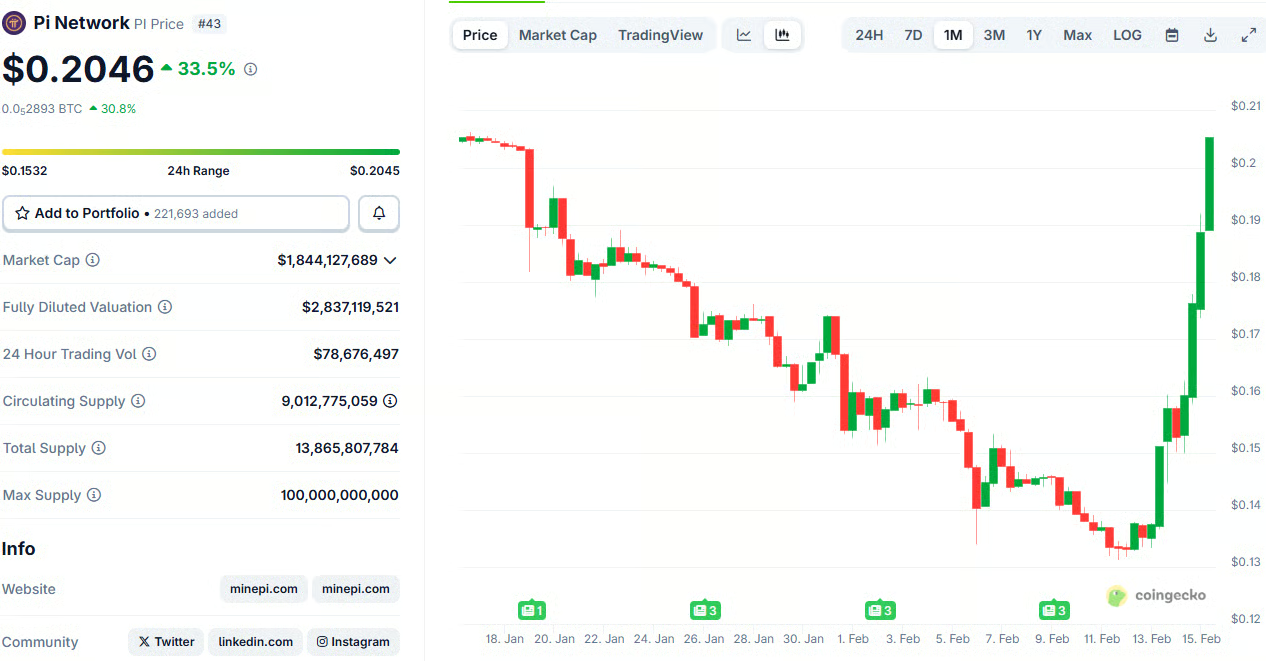

Pi Network’s PI Steals the Show as Bitcoin (BTC) Reclaims $70K: Weekend Watch

PI’s recent rally has only intensified as the asset flew past $0.20 earlier today.

Bitcoin’s rather impressive and unexpected weekend recovery run has continued as the asset exceeded $70,000 earlier today and hasn’t looked back since.

Many altcoins have produced even more notable gains, including XRP and DOGE, both of which have skyrocketed by double digits. PEPE and PI joined that club.

BTC Taps $70K

It was just over a week ago – February 6, when the primary cryptocurrency’s crash culminated in a nosedive to $60,000. This became its lowest price tag in well over a year after a $30,000 drop in the span of approximately 10 days.

The bulls finally woke up at this point and didn’t allow another decline to the sub-$60,000 levels. Just the opposite, BTC exploded by $12,000 within a day and surged to $72,000, which turned out to be too strong a resistance.

The following few days were sluggish, with bitcoin trading between $68,000 and $72,000. The mid-week rejection at the upper boundary resulted in more pain, as the asset fell to $66,000 on Friday. However, it rebounded strongly in the following days, climbed to $69,000 on Saturday and to $70,800 on Sunday. It faced some resistance there, but still trades above $70,000 as of press time.

Its market capitalization has risen to $1.410 trillion on CG, while its dominance over the alts has decreased slightly to 56.5%.

PI, XRP, DOGE on the Run

While some larger-cap altcoins, such as ETH, BNB, and TRX, have remained sluggish on a daily scale, others, such as XRP and DOGE, have gone on a tear. The OG meme coin has gained 18% daily, perhaps driven by an announcement by Elon Musk, and now sits around $0.115. XRP has reclaimed the $1.60 resistance after an 11% pump.

ADA, ZEC, and XLM are also in the green from the larger caps, while PEPE has soared by 25%. Pi Network’s native token became the top performer in the crypto markets today, surging by over 35% at one point to over $0.20. Although it has lost some traction since then, it’s still up by 20%.

The total crypto market cap has added another $40 billion daily and is close to $2.5 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Pi Network Pioneers Celebrate PI’s 35% Daily Surge as Important Deadline Approaches

The PI token has become the most substantial gainer over the past 24 hours.

What a volatile ride it has been for Pi Network’s native token after the calmness experienced during the December holidays. The asset was charting severe losses for several consecutive weeks, but the past few days have been a lot more positive.

This resurgance comes after the team issued an important reminder about a deadline for today.

PI Rockets

As mentioned above, PI was consistently one of the worst performers in the cryptocurrency markets ever since the last correction began in mid-January. The asset marked consecutive all-time lows, with the latest being at $0.1312 on February 11. As the community was lashing out against the project behind it and there were calls for further decline, the trend reversed in the past few days.

PI’s price went on a wild run, gaining more than 30% in the past day alone, and over 55% since its all-time low seen just a few days ago. As such, it now trades above $0.20, which has prompted many Pioneers to celebrate the move and call for further gains.

“Huge congratulations to all Pioneers who recently DCA’d at the bottom around $0.13 – that decision is paying off nicely right now. A special shoutout and big thanks to PiBridge – a project that truly listens to the community and delivered one of the most useful features yet: USDT loans collateralized by PI. Thanks to this, anyone who urgently needed cash but didn’t want to sell their PI at the painful $0.13-$0.14 levels can now avoid massive regret,” commented Cryptoleakvn.

It’s worth noting that today’s surge comes just a day after a popular crypto analyst, Captain Faibik, said they added PI to their portfolio and predicted a massive 500% surge.

Deadline Approaches

Separately, but perhaps somehow related to the recent pump, is the deadline ending today that concerns Pi Network’s “4th role” – Pi Nodes. As reported earlier this week, the Pi Mainnet blockchain protocol is undergoing a series of upgrades, and the deadline for the first one is February 15.

It requires all Mainnet nodes to complete this important step to remain connected to the network. In this article, we reiterated the Core Team’s explanation that nodes must run on laptops or desktop computers, which would allow them to help power PI decentralization by validating transactions, strengthening network security, and supporting global consensus and trust.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Senators urge Bessent to probe $500M UAE stake in Trump-linked WLFI

Two US senators pressed the Treasury Department to examine a UAE-backed investment into World Liberty Financial (WLFI), citing potential national security and data privacy concerns. In a Friday letter to Treasury Secretary Scott Bessent, Elizabeth Warren and Andy Kim urged the Committee on Foreign Investment in the United States (CFIUS) to determine whether a formal review is warranted into a deal in which a UAE-backed investment vehicle would acquire about 49% of WLFI for roughly $500 million. The arrangement, disclosed days before Donald Trump’s inauguration, would make the foreign investor WLFI’s largest shareholder and its lone publicly known outside investor. The disclosures tie the funding to Sheikh Tahnoon bin Zayed Al Nahyan and include governance seats for executives linked to the technology firm G42, which has previously drawn scrutiny from U.S. intelligence agencies over potential ties to China.

Key takeaways

- The senators have asked Treasury Secretary Scott Bessent, who chairs CFIUS, to assess whether the foreign stake should trigger a formal CFIUS investigation, with a response deadline tied to March 5.

- The deal would grant a UAE-backed fund a 49% stake in WLFI for about $500 million, positioning the investor as WLFI’s largest shareholder and its only publicly disclosed non-U.S. investor, and it would involve two WLFI board seats held by executives connected to G42.

- Officials tied the investment to Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security adviser, raising concerns about foreign influence over a U.S. company handling financial and personal data.

- WLFI’s disclosed data practices include wallet addresses, IP addresses, device identifiers, approximate location data, and certain identity records through service providers—factors that intensify national-security considerations if a foreign government gains access or influence.

- Previous inquiries linked WLFI’s token sales to sanctioned or otherwise problematic actors, underscoring ongoing scrutiny of the firm’s governance and funding channels.

Tickers mentioned: $WLFI

Sentiment: Neutral

Market context: The episode sits within a broader regulatory backdrop in which U.S. authorities are closely examining foreign involvement in fintech, crypto, and data-centric companies, with CFIUS and other agencies increasingly scrutinizing deals that could expose Americans’ sensitive information to non-U.S. entities.

Why it matters

The inquiry highlights a growing tension between ambitious cross-border fintech investments and national-security safeguards. WLFI’s stake sale to a foreign investor—reportedly tied to a figure who serves as the UAE’s national security adviser—touches on questions about how foreign influence could translate into practical control over a U.S. company handling financial data and personal identifiers. The senators’ letter emphasizes that WLFI’s privacy disclosures include data types that could be valuable for both commercial and security purposes, including wallet addresses, IP addresses, device identifiers and location signals collected via service providers. If CFIUS were to determine that foreign access to this information poses a risk, it could lead to remedies ranging from structural changes to divestment or blocking the transaction.

The timing is notable. The deal’s trajectory reportedly unfolded in the period surrounding the transition into the early days of the Trump administration, a moment that further complicates oversight of foreign involvement in U.S. tech and financial platforms. The letter asks for a comprehensive, unbiased assessment, signaling that the matter could become a touchpoint in ongoing debates about foreign capital, data sovereignty, and the boundaries of U.S. national-security review in the digital era.

Meanwhile, WLFI’s governance and fundraising activity have drawn attention from lawmakers who previously raised concerns about the company’s token sales. In a separate thread, senators highlighted alleged connections between WLFI token economics and actors under sanctions or other sensitive watchlists, underscoring the potential for governance risks in a project that straddles traditional finance and blockchain-enabled remittance or exchange services. The convergence of crypto-oriented fundraising with established corporate governance raises practical questions about how future regulatory reviews will treat blended business models and cross-border capital flows.

What to watch next

- CFIUS response: Look for a formal reply from Bessent by the March 5 deadline and any indication of whether a full or targeted review will be initiated.

- Notifications and disclosures: Monitor whether WLFI or the UAE investor issues additional disclosures or amendments related to the stake, governance seats, or data handling practices.

- Governance dynamics: Track updates on WLFI’s board composition and whether the involvement of G42-linked executives persists or evolves in response to regulatory scrutiny.

- Regulatory actions: Observe any further actions from U.S. authorities regarding WLFI’s token sales or related governance tokens, and any comparable reviews of foreign investments in fintech platforms.

Sources & verification

- Letter to Bessent requesting CFIUS review (PDF): https://www.banking.senate.gov/imo/media/doc/letter_to_bessent_re_cfius_wlf.pdf

- Report on UAE-backed investment in WLFI and Trump-linked connections: https://cointelegraph.com/news/uae-backed-firm-buys-49-percent-trump-linked-world-liberty-wsj

- November 2023 inquiry into WLFI token sales and potential sanctions connections: https://cointelegraph.com/news/senators-trump-linked-wlfi-national-security-threat

- Trump denial of involvement in WLFI stake: https://cointelegraph.com/news/trump-denies-involvement-500m-uae-wlfi-stake

UAE-backed WLFI stake triggers CFIUS review over data access and security

A federal inquiry into a United Arab Emirates–backed investment in World Liberty Financial (WLFI) has surged into focus for U.S. national-security authorities. In a Friday letter to Treasury Secretary Scott Bessent, Senators Elizabeth Warren and Andy Kim request a formal assessment by the Committee on Foreign Investment in the United States (CFIUS) to determine whether the arrangement warrants a comprehensive review. The deal contemplates a UAE-backed investment vehicle acquiring roughly 49% of WLFI for about $500 million, a stake that would position the foreign fund as WLFI’s largest shareholder and sole outside investor currently disclosed. The outside investor’s ties to Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security adviser, and the allocation of two WLFI board seats to executives linked to the tech company G42, have attracted scrutiny from lawmakers who emphasize potential foreign influence over sensitive data streams and corporate governance.

The core concern centers on data control and access. WLFI’s disclosed privacy practices indicate that the company collects a spectrum of user data, including wallet addresses, IP addresses, device identifiers and approximate location data, as well as certain identity records obtained through service providers. Warren and Kim argue that such data, if controlled by a foreign government, could be leveraged to influence business decisions or gain strategic insight into American consumers’ financial behaviors. For CFIUS, this represents a classic national-security calculus: do the benefits of foreign investment outweigh the risk of sensitive information flowing beyond U.S. borders or under foreign influence?

The lawmakers’ letter notes that CFIUS’s remit includes evaluating foreign investments that could provide access to sensitive technologies or personal data belonging to U.S. citizens. They request a response by March 5 and advocate for a “comprehensive, thorough, and unbiased” review if warranted. The request follows a pattern of heightened scrutiny of foreign involvement in crypto and fintech ventures—a trend that has intensified as policymakers balance economic openness with the imperative to protect personal data and national security. The situation intertwines elements of geopolitical risk, data privacy, and the evolving regulatory framework governing digital assets and fintech platforms.

Earlier in the year, Warren and Reed also pressed authorities to investigate WLFI’s token sales amid allegations of connections to sanctioned actors, including claims that governance tokens were acquired by addresses associated with the Lazarus Group and other entities linked to Russia and Iran. While those claims remain contested and subject to ongoing debate, they underscore the broader context in which WLFI operates—where tokenization, remittance services, and crypto governance intersect with complex international exposure.

As WLFI and its backers navigate this regulatory landscape, the public record continues to evolve. President Trump, in separate remarks, has indicated that his family is handling the matter and that he does not have direct involvement in the investment. “My sons are handling that — my family is handling it,” he stated, adding that investments come from various individuals. The evolving narrative highlights how political dynamics can intersect with fintech ventures that straddle traditional financial services and blockchain-based offerings, raising questions about transparency, governance, and the safeguards that shield U.S. data from foreign influence.

-

Politics7 days ago

Politics7 days agoWhy Israel is blocking foreign journalists from entering

-

Business7 days ago

Business7 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat6 days ago

NewsBeat6 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech9 hours ago

Tech9 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics7 days ago

Politics7 days agoThe Health Dangers Of Browning Your Food

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World1 day ago

Crypto World1 day agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports6 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?