Crypto World

US Fines Paxful $4M for Funds Linked to Trafficking and Fraud

In a high‑profile enforcement action, Paxful, the peer‑to‑peer crypto exchange, was ordered to pay $4 million after admitting it knowingly profited from criminals who used its platform due to lax anti‑money laundering controls. The Department of Justice outlined that Paxful pleaded guilty in December to conspiring to promote illegal prostitution and knowingly transmitting funds derived from crime, in violation of federal AML requirements. The government also detailed that, between January 2017 and September 2019, Paxful facilitated more than 26 million trades valued at nearly $3 billion, earning about $29.7 million in revenue while turning a blind eye to illicit activity. The case centers on how a platform marketed itself as a lenient, low‑information exchange while neglecting core safeguards. The DOJ’s filing underscores that Paxful’s business model depended on attracting criminal users by downplaying compliance obligations.

The Justice Department highlighted that Paxful had agreed the appropriate criminal penalty would be $112.5 million, but prosecutors determined the company could not pay more than $4 million. The settlement reflects a broader push by federal authorities to curb crypto platforms that fail to implement or enforce anti‑money laundering measures, particularly when they facilitate illegal activities such as fraud, extortion, prostitution, and trafficking. The department said Paxful profited from moving money for criminals it attracted with the promise of minimal compliance, a dynamic prosecutors described as corrosive to legitimate finance and to users seeking lawful services.

The case traces to Paxful’s ambitious growth period from 2017 through 2019, when the platform reportedly handled tens of millions of trades and generated substantial revenue despite warnings from investigators about AML gaps. Prosecutors maintained that Paxful’s marketing messaging, which emphasized a lack of required customer information, paired with policies it knew were not implemented or enforced, created a permissive environment for illicit actors. The backers of the case say this approach allowed criminal actors to route funds through Paxful more readily than through regulated channels.

The Justice Department’s description of Paxful’s operational ethos is complemented by a notable cross‑industry connection: the crypto platform had ties to Backpage and a similar site during a period spanning 2015 to 2022, a relationship the government says contributed to Paxful’s profits, estimated at about $2.7 million. While Backpage’s platform was shut down due to illegal activities, the Paxful alliance is cited as a concrete example of how illicit networks exploited crypto rails to monetize wrongdoing. The department noted that Paxful’s founders publicly boasted about the “Backpage Effect,” portraying the collaboration as a catalyst for growth, a claim the government used to illustrate a deliberate strategy of enabling criminal transactions.

The case also sheds light on Paxful’s eventual exit from the market. The exchange halted operations in November, and its October closure‑announcement post—later archived—depicted the decision as a response to “the lasting impact of historic misconduct by former co‑founders Ray Youssef and Artur Schaback prior to 2023, combined with unsustainable operational costs from extensive compliance remediation efforts.” Youssef publicly countered the timing of the closure, suggesting the firm should have closed when he left the company. Meanwhile, Schaback, Paxful’s former chief technology officer, pleaded guilty in July 2024 to conspiring to fail to maintain an effective AML program and awaits sentencing, with a California judge moving his hearing from January to May to accommodate ongoing cooperation with authorities. The DOJ’s account makes clear that a broader reckoning—beyond Paxful’s leadership—extends into the company’s users, employees, and the broader crypto ecosystem.

As authorities pursued the case, officials emphasized that the Paxful matter is not an isolated incident but part of a wider effort to tighten regulatory expectations on crypto marketplaces. The department pointed to the need for robust know‑your‑customer checks, comprehensive AML compliance programs, and proactive monitoring of suspicious activity to deter illicit uses of digital assets. The implications extend to other platforms that operate in the same space, signaling that permissive, low‑oversight models will attract intensified scrutiny from federal law enforcement and regulators.

Key takeaways

- Paxful received a $4 million criminal penalty after pleading guilty to conspiracy related to illegal activities and AML violations, with prosecutors noting a potential maximum penalty of $112.5 million.

- From 2017 through 2019, Paxful facilitated more than 26 million trades valued at nearly $3 billion and amassed around $29.7 million in revenue, according to DOJ filings.

- The DOJ characterizes Paxful as profiting from enabling criminals by downplaying AML controls and failing to comply with applicable money‑laundering laws.

- Prosecutors linked Paxful to illicit revenue streams via partnerships with Backpage and similar platforms, describing profits of about $2.7 million tied to those connections.

- The company shut down operations in November, citing historic misconduct by former co‑founders and the costs of compliance remediation, with ongoing legal actions surrounding Schaback’s case and the broader investigation.

- The case illustrates how enforcement agencies are escalating scrutiny of crypto marketplaces that permit lax due‑diligence and high‑risk activity, reinforcing expectations for AML programs across the sector.

Sentiment: Bearish

Market context: The Paxful action aligns with a broader tightening of crypto‑AML standards as regulators seek to normalize compliance expectations across peer‑to‑peer platforms, exchanges, and other digital asset services, influencing liquidity, risk sentiment, and enforcement tempo across the industry.

Why it matters

The DOJ’s settlement with Paxful underscores a pivotal moment for the crypto‑platform landscape. For users, it signals that providers must demonstrate verifiable diligence in their AML programs or face tangible penalties and reputational damage. For operators, the case reinforces the need to align platform design, user onboarding, and transaction monitoring with established legal requirements rather than relying on marketing narratives about anonymity or minimal information. The development also matters for builders and policymakers. It highlights the costs of lax controls and the potential for illicit activity to undermine trust in decentralized finance ecosystems, prompting crypto firms to invest more heavily in compliance technology, real‑time surveillance, and robust governance frameworks.

From an investor perspective, enforcement actions like this can influence risk pricing and funding cycles for crypto platforms, particularly those with international user bases or complex payment rails. The Paxful narrative—centered on public statements by founders, internal policy gaps, and late‑stage remediation—serves as a cautionary tale about the fragility of business models that rely on permissive compliance postures. In a market where users increasingly demand transparency and regulatory alignment, the case emphasizes why credible AML programs are not merely a legal checkbox but a core driver of platform reliability and long‑term viability.

What to watch next

- Schaback’s sentencing timing remains fluid, with a May hearing continuing to unfold as prosecutors incorporate ongoing cooperation into the government’s recommendation.

- Any additional actions or disclosures related to Paxful’s former leadership could emerge as part of related investigations and settlements.

- Regulators may intensify scrutiny of other P2P exchanges and non‑custodial marketplaces to assess AML controls, monitoring capabilities, and enforcement readiness.

- Broader market reactions might reflect shifting risk sentiment as platforms adjust compliance investments and governance standards in response to high‑profile enforcement cases.

Sources & verification

- U.S. Department of Justice press release: Virtual Asset Trading Platform sentenced for violating Travel Act and other federal crimes (link provided in the DOJ filing).

- DOJ Criminal Division official X/Twitter post confirming the case details and sentencing status.

- Paxful closure announcement (archived): Paxful closure announcement, noting misconduct and remediation costs.

- Statements and coverage surrounding Ray Youssef’s response to Paxful’s closure and Artur Schaback’s guilty plea.

- Related reporting on Paxful’s alleged “Backpage Effect” and the platform’s historical collaborations cited by prosecutors.

What the story changes

The Paxful case illustrates how enforcement actions tied to AML controls can reshape the operations and viability of crypto platforms that rely on rapid growth and minimal compliance. By tying significant penalties to proven misconduct and highlighting explicit links to illicit activities, authorities are sending a clear signal: robust, transparent AML programs are foundational, not optional. As the industry evolves, platforms may need to reassess their onboarding, transaction screening, and governance practices to withstand heightened regulatory scrutiny and to restore or preserve user trust in a landscape that continues to balance innovation with accountability.

Crypto World

Will XRP Community Day trigger a rally?

XRP Community Day has put Ripple’s token back in focus as traders look for catalysts amid a fragile market structure.

Summary

- XRP Community Day has refocused attention on the XRP Ledger’s ecosystem, highlighting developer activity and community engagement rather than delivering a single market-moving announcement.

- XRP is consolidating near the $1.37–$1.38 support zone, with narrowing Bollinger Bands and a recovering CMF suggesting selling pressure is easing, though upside remains capped below $1.45–$1.50.

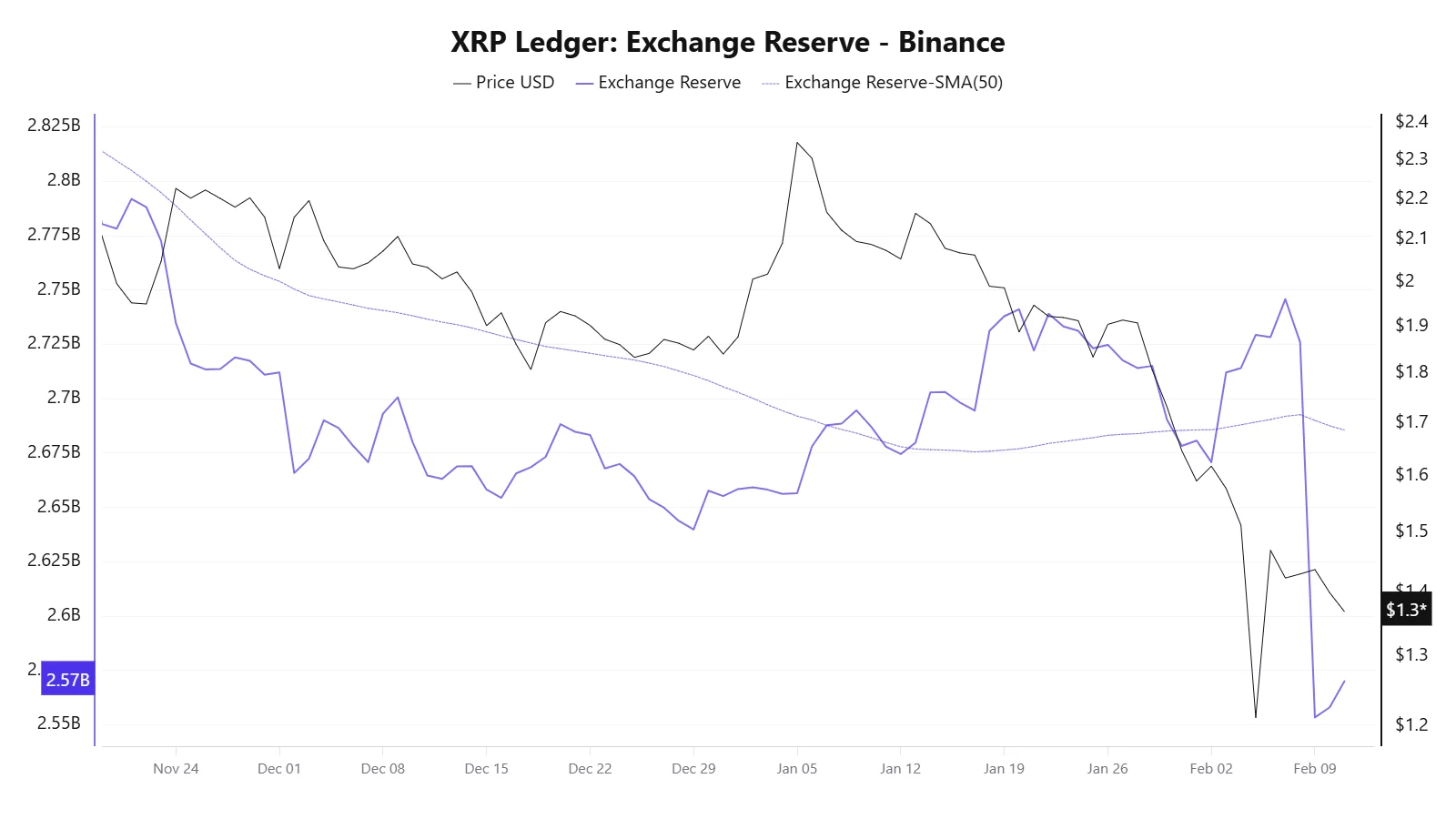

- Declining XRP exchange reserves on Binance point to reduced immediate sell-side supply, offering a supportive backdrop if renewed community-driven interest translates into demand.

The community-led event highlights ecosystem updates, developer activity, and ongoing engagement around the XRP (XRP) Ledger. This could help refocus attention on fundamentals after weeks of price weakness.

While XRP Community Day is not tied to a single market-moving announcement, it often serves as a sentiment booster, particularly during consolidation phases.

Increased visibility, renewed social engagement, and discussion around XRPL use cases can act as short-term momentum drivers if broader market conditions cooperate.

XRP price action steadies near key support

XRP is trading near the $1.37–$1.38 zone at press time, attempting to stabilize after a steady pullback from highs above $1.60 earlier this month.

The price is holding near the middle-to-lower portion of the Bollinger Bands on the daily chart. The bands have started to narrow, signaling reduced volatility following the recent sell-off.

While XRP is no longer hugging the lower Bollinger Band, indicating that downside momentum has eased, price has struggled to reclaim the mid-band (20-day moving average). As long as XRP remains below this level, upside attempts are likely to face resistance.

A sustained move above the mid-band would open the door toward the upper band near the $1.45–$1.50 zone.

The Chaikin Money Flow (CMF) remains slightly below the zero line but has turned higher from recent lows, suggesting selling pressure is fading. A move back into positive territory would signal improving capital inflows.

A failure to do so could leave XRP vulnerable to a retest of support around $1.35, followed by $1.28 on a deeper pullback.

Exchange reserve data hints at supply dynamics

Moreover, CryptoQuant data shows XRP exchange reserves on Binance have declined recently, suggesting fewer tokens are being held on exchanges.

This trend typically points to reduced immediate sell-side pressure, as more XRP moves into private wallets rather than remaining available for spot selling.

While falling exchange reserves alone do not guarantee a rally, they can provide a supportive backdrop if demand picks up. Combined with community-driven attention from XRP Community Day, the supply-side dynamics could help limit downside risk in the near term.

Overall, XRP remains in a consolidation phase, with Community Day acting as a sentiment catalyst rather than a guaranteed breakout trigger. Traders will be watching whether XRP can defend the $1.35 support zone and reclaim resistance near $1.45 to signal a shift toward recovery.

Crypto World

WTI Oil Price Climbs to a Monthly High

As the XTI/USD chart shows, the price per barrel moved above the 4 February peak yesterday, marking its highest level since the start of the month. The bullish sentiment has been driven by geopolitical uncertainty. According to media reports:

→ The Trump–Netanyahu meeting in Washington on 10–11 February failed to ease tensions. Despite Omani mediation and statements suggesting a “near compromise”, no formal agreement has yet been reached.

→ Reports of a possible deployment of additional US carrier strike groups to the Middle East have added to market nerves. Any escalation could threaten supplies through the Strait of Hormuz, which accounts for around 20% of global oil consumption.

While the fundamental backdrop remains tense and continues to support higher oil prices, the chart simultaneously points to vulnerability to a pullback.

Technical Analysis of the XTI/USD Chart

When analysing the WTI oil chart on 5 February, we:

→ used recent price swings to construct a broad ascending channel (shown in purple), noting that its lower boundary was acting as support;

→ suggested that the $65 level would become a key obstacle for bulls attempting to maintain upward momentum.

Recent price action supports this view, as:

→ if yesterday’s move above the 4 February high is treated as a bullish breakout, it appears to have failed — a potential bull trap;

→ a bearish engulfing reversal pattern has formed on the chart (indicated by the arrow).

It is noteworthy that many investment bank analysts consider current WTI prices to be overstretched, forecasting a decline towards the $57–59 range due to oversupply. However, such a scenario would likely require a reduction in geopolitical risk.

In light of the above, it is reasonable to assume that the initiative may now be shifting to the bears, who could attempt to push prices towards the lower boundary of the channel. The $64.40 level — which acted as resistance last week — now appears to offer local support.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Binance CEO Richard Teng breaks down the ‘10/10’ nightmare that rocked crypto

Binance did not cause the crypto market liquidation event on Oct. 10, but every exchange — centralized or decentralized — saw massive liquidations that day after China imposed rare earth metal controls and the U.S. announced fresh tariffs, said Binance Co-CEO Richard Teng.

About 75% of the liquidations took place around 9:00 p.m. ET, alongside two unrelated, isolated issues: a stablecoin depegging and “some slowness in terms of asset transfer,” Teng said Thursday at CoinDesk’s Consensus Hong Kong conference.

“The U.S. equity market plunged $1.5 trillion in value that day,” he said. “The U.S. equity market alone saw $150 billion of liquidation. The crypto market is much smaller. It was about $19 billion. And the liquidation on crypto happened across all the exchanges.”

Some users were affected by this, which Binance helped support, he said, an action other exchanges did not take.

Binance facilitated $34 trillion in trading volume last year, he said, with 300 million users. Trading data does not indicate any massive withdrawals from the platform.

“The data speaks for itself,” he said.

Speaking more broadly, Teng said the crypto market was tracking broader geopolitical tensions but that institutions are still pouring into the sector.

“At the macro level, I think people are still uncertain about interest rate movements going forward,” he said. “And there’s always the trend of geopolitics, tension, etc. Those weigh on these assets, such as crypto.”

However, pointing to how the sector has changed over the past four to six years, Teng said long-term industry participants will have noticed that crypto prices move cyclically.

“I think what we have to look at is the underlying development,” he said. “At this point in time, retail demand is somewhat more muted compared to the past year, but the institutional deployment, the corporate deployment is still strong.”

Institutions are still entering the sector, even despite the market, he said, “meaning the smart money is deploying.”

Crypto World

Nikkei 225 Retreats From Record High

As the chart shows, the Nikkei 225 index (Japan 225 on FXOpen) reached a historic high near 58,500 points on Monday. Bullish sentiment was driven primarily by political developments.

According to media reports, the rally followed the decisive victory of the Liberal Democratic Party (LDP) under Sanae Takaichi, who has signalled aggressive fiscal stimulus measures (a package exceeding $135 bn), food tax cuts, and the continuation of an accommodative monetary policy stance.

However, today the Nikkei 225 is showing signs of a pullback. It is possible that major market participants have begun taking profits amid the wave of optimism, as Takaichi’s victory had already been largely priced in, and official confirmation of a parliamentary supermajority may have acted as a trigger to close long positions.

From a technical perspective, a retracement also appears justified.

Technical Analysis of the Nikkei 225 Chart

It is worth noting that:

→ after the RSI moved into extreme overbought territory, it formed a bearish divergence with price;

→ price action itself produced a bearish triple top pattern.

As the decline unfolds, a local trendline (shown in purple) has shifted from acting as support to functioning as resistance.

In light of the above, it is reasonable to assume that an extended pullback could drive the Nikkei 225 towards the median of the long-term ascending channel.

In the event of a deeper correction, the support zone below the 56,000 level may come into play, where a previous bullish imbalance formed characteristics of a Fair Value Gap pattern.

Trade global index CFDs with zero commission and tight spreads (additional fees may apply). Open your FXOpen account now or learn more about trading index CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

ARK Invest Snaps Up $33M in Robinhood Shares Amid Bitcoin Dip

ARK Invest, the investment firm led by Bitcoin bull Cathie Wood, snapped up a significant batch of crypto-linked stocks on Wednesday as BTC briefly dipped below $66,000.

ARK purchased 433,806 shares of Robinhood (HOOD) for approximately $33.8 million, according to a trade notification reviewed by Cointelegraph.

The asset manager also boosted its exposure to crypto exchange Bullish (BLSH) and USDC (USDC) issuer Circle (CRCL), acquiring 364,134 shares valued at $11.6 million and 75,559 shares worth $4.4 million, respectively.

The purchases came as all three stocks traded lower on the day, with Robinhood shares sliding nearly 9%, according to TradingView data.

ARK withheld from buying more Coinbase (COIN) shares after dumping $17 million of the stock last week.

Robinhood becomes top crypto holding in ARK’s flagship fund

ARK’s latest Robinhood acquisition coincided with the company’s official testnet launch of the Robinhood Chain, a permissionless layer 2 (L2) blockchain built for financial services and tokenized real-world assets (RWAs).

Earlier this week, Robinhood reported record net revenue of nearly $1.28 billion for the fourth quarter of 2025. While revenue surged 27% year over year, it fell short of Wall Street expectations of $1.34 billion, sending the stock down about 8%.

As of Feb. 11, Robinhood stands as the largest crypto-linked position in ARK’s flagship ARK Innovation ETF (ARKK), accounting for roughly 4.1% of the portfolio, or about $248 million, according to the fund’s data.

Spot Bitcoin ETFs mirror BTC weakness as inflows stall

Broader market weakness has spilled over into US spot Bitcoin (BTC) exchange-traded funds (ETFs), which failed to sustain momentum after a three-day inflow streak.

According to SoSoValue data, Bitcoin ETFs recorded $276.3 million in net outflows on Wednesday, nearly wiping out weekly gains, which now stand at just $35.3 million. Total assets under management declined to $85.7 billion, the lowest level since early November 2024.

Ether (ETH) ETFs also posted losses, with daily outflows totaling $129.2 million. XRP (XRP) funds saw no inflows, while Solana (SOL) ETFs recorded modest inflows of roughly $0.5 million.

Related: Strategy CEO eyes more preferred stock to fund Bitcoin buys

At the time of publication, Bitcoin was trading at $67,227, up 0.4% over the past 24 hours, according to CoinGecko.

The latest pullback comes after analysts had pointed to a potential inflection point in crypto investment products following three consecutive weeks of outflows totaling more than $3 billion.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

BNB Chain real-world assets soar 555% on institutional demand

BNB Chain’s real-world assets surged 555% in Q4 2024 as institutions tokenized funds and stocks, even as BNB’s market cap and DeFi TVL faced volatility.

Summary

- Real-world asset value on BNB Chain climbed 555% year over year in Q4 2024, making it the second-largest RWA network behind Ethereum.

- Institutional players tokenized money market funds, U.S. stocks, and ETFs via partners like CMB International, Ondo Global Markets, and Securitize.

- Despite a Q4 BNB market-cap drop and softer DeFi TVL, network activity, stablecoin supply, and infrastructure upgrades continued to strengthen.

Real-world assets on BNB Chain (BNB) expanded 555% year over year in the fourth quarter of 2024, driven by institutional capital inflows and stablecoin growth, according to a report by research firm Messari.

The blockchain network ranked second among all blockchains by real-world asset value at quarter-end, surpassing Solana and trailing only Ethereum, the report stated. The growth occurred despite a decline in the network’s native token price during the period.

BNB Chain’s native token market capitalization fell quarter over quarter following an industry-wide liquidation event on Oct. 11 that pressured cryptocurrency markets, according to Messari. The token had reached a record high in mid-October before declining through year-end. The token remained the third-largest cryptocurrency by market capitalization at quarter-end, behind Bitcoin and Ethereum.

Network activity strengthened during the quarter, with average daily transactions rising substantially from third-quarter levels, the report said. Daily active addresses also increased, with early October volatility causing a brief spike in activity. Excluding that surge, usage remained above third-quarter levels, indicating steady user growth, according to Messari.

Total real-world asset value on BNB Chain rose sharply from the third quarter and increased 555% from the prior year, the research firm reported.

Institutional partnerships drove the expansion. In October, BNB Chain partnered with CMB International to launch a tokenized money market fund. Ondo Global Markets subsequently added more than 100 tokenized U.S. stocks and exchange-traded funds to BNB Chain, expanding offerings beyond money market funds into equities. In November, a major institutional fund issued through Securitize expanded to BNB Chain, according to the report.

Real-world asset value remained concentrated in a small number of products. A single product accounted for the majority of total value, followed by another representing approximately one quarter, Messari stated. Other assets, including Matrixdock Gold and VanEck’s Treasury Fund, held smaller amounts. Tokenized shares of major companies represented a small portion of overall value.

BNB pivoting towards real-world assets

Decentralized finance activity slowed during the fourth quarter, with total value locked declining from third-quarter levels, the report said. Total value locked remained above year-earlier levels, and BNB Chain ranked as the third-largest network by that metric.

PancakeSwap remained the largest decentralized finance platform on the network, holding a significant portion of total value locked and controlling approximately one-third of the market, according to Messari. Its total value locked declined by a small amount, indicating user and fund retention. Other protocols experienced declines following liquidity withdrawals and reduced borrowing demand, with smaller projects affected most significantly as traders reduced risk exposure.

Stablecoin supply on BNB Chain increased during the quarter, with total stablecoin value rising, the report stated. One major stablecoin remained the largest after posting gains. Another prominent stablecoin grew substantially, aided by payment use cases and gas-fee discounts.

New partnerships expanded payment applications on BNB Chain. A payments network added support for multiple stablecoins to settle cross-border transfers on-chain and later enabled cloud-service customers to pay for services using BNB through the system, according to Messari. A new stablecoin launched in December allowing users to mint tokens using major stablecoins as collateral.

BNB Chain deployed several upgrades in 2024, including Pascal, Lorentz, Maxwell, and the ongoing Fermi hardfork, the report said. Block times decreased and transaction finality improved. Network capacity more than doubled, and gas fees fell sharply.

The protocol’s 2025 plans target approximately 20,000 transactions per second with sub-second finality, according to the report. The development team plans to integrate off-chain computing with on-chain verification to process additional transactions without performance degradation. Long-term development includes a trading-focused chain designed for near-instant confirmation, Messari stated.

Crypto World

Bitcoin price prediction as BTC ETFs break three-day inflow streak

Bitcoin prices traded cautiously after US-listed spot Bitcoin ETFs snapped a three-day inflow streak, adding pressure to an already fragile market structure.

Summary

- Bitcoin traded cautiously near $67,000 after US-listed spot Bitcoin ETFs ended a three-day inflow streak, flipping back to net outflows.

- ETF flow data points to waning institutional demand, reinforcing fragile market structure amid ongoing price consolidation.

- Technically, BTC remains well below its 50-day moving average, with RSI in the low-30s, keeping near-term momentum tilted to the downside.

Bitcoin price struggles as ETF momentum stalls

Bitcoin (BTC) was trading around $67,000 at press time, struggling to attract strong upside follow-through after recent attempts to stabilize.

ETF flow data shows Bitcoin spot ETFs recorded steady inflows over the previous three sessions, signaling a brief return of institutional demand as BTC attempted to stabilize near $67,000.

However, that trend reversed in the latest session, with net outflows replacing inflows, suggesting renewed caution among investors amid ongoing price consolidation.

The halt in ETF inflows comes as broader risk sentiment remains mixed, with traders closely watching whether institutional demand can reassert itself after weeks of volatility.

Bitcoin price action weak below key moving average

The daily chart shows Bitcoin remains well below its 50-day simple moving average, which is currently hovering near $85,000. This large gap highlights the depth of the recent correction and signals that the broader trend remains under bearish control.

Meanwhile, the Relative Strength Index (RSI) is holding below the neutral 50 level. It sits in the low-30s, suggesting bearish momentum is still dominant, even as selling pressure has eased compared with January’s sharp breakdown.

On the downside, immediate support sits near $66,500–$66,000, a level that has repeatedly attracted buyers in recent sessions. A decisive break below this zone could expose Bitcoin to deeper losses toward $64,000, followed by a broader psychological support area near $60,000.

On the upside, initial resistance is located around $70,000, where prior rebound attempts have stalled. Beyond that, stronger resistance emerges near $74,000–$75,000, a former support zone that now acts as a selling area.

A sustained move above these levels would be required to signal a shift in near-term momentum.

Overall, Bitcoin remains in a consolidation phase following a sharp correction, with ETF flow data and broader market sentiment likely to determine whether BTC breaks higher or resumes its downward trend in the days ahead.

Crypto World

Thailand recognizes cryptocurrencies under the Derivatives Trading Act

Thailand has officially recognized cryptocurrencies as an underlying asset under the Derivatives Trading Act.

Summary

- Thailand has formally recognized cryptocurrencies like Bitcoin as underlying assets under the Derivatives Trading Act.

- The SEC will draft rules to support crypto-linked derivatives and review licenses for exchanges and brokers.

According to a Bangkok Post report, the Thai government approved the Finance Ministry’s proposal to allow cryptocurrencies to be used as the foundation for regulated futures and options contracts within the country’s derivatives on Feb. 10.

Under the new guidelines, cryptocurrencies like Bitcoin will be classified as “permissible goods and variables,” according to SEC secretary-general Pornanong Budsaratragoon, whose department put forward the proposal in early 2026.

The SEC will now draft the specific regulatory requirements for market participants, which include amending derivatives business licenses to allow existing digital asset operators to offer these new contracts and establishing strict contract specifications to mitigate the unique volatility risks associated with crypto assets.

Budsaratragoon said the amendments will help promote market inclusiveness and allow investors to diversify their portfolios, while also improving risk management.

Further, the SEC will collaborate with the Thailand Futures Exchange to make way for the launch of its first suite of crypto-linked derivatives, including Bitcoin futures. It is currently reviewing the existing licensing framework to ensure that broker and clearing houses are aligned to offer these new products, the report said.

As part of the amendment, carbon credits are also being classified as variables instead of goods, which means Thai investors will soon be able to access physically delivered carbon credit futures.

The SEC’s 2026 roadmap also includes plans to roll out crypto exchange-traded funds as it looks to position itself as a regional crypto trading powerhouse.

Last month, the SEC’s deputy secretary-general, Jomkwan Kongsakul, said that the commission plans to launch crypto ETFs in Thailand “early this year.”

Thailand is also eyeing crypto use in the tourism sector. Thailand’s Deputy Prime Minister Pichai Chunhavajira introduced the TouristDigiPay initiative last year to bolster the country’s tourism sector by allowing travelers to convert their digital assets into the local fiat currency.

Crypto World

OKX Ventures backs STBL in partnership with Hamilton Lane and Securitize

OKX Ventures, the venture capital arm of the global cryptocurrency exchange, has made a strategic investment in STBL, a next-generation stablecoin and yield infrastructure provider.

STBL, co-founded by Reeve Collins, who also co-founded Tether, and tokenization pioneer Avtar Sehra, also announced a partnership with Hamilton Lane (HLNE), an alternative-investment management firm, and Securitize, a regulated digital securities issuance firm whose clients include BlackRock (BLK).

The plan is to develop a stablecoin backed by real-world assets (RWA) on OKX’s Ethereum-compatible layer-2 blockchain X Layer, the companies said on Thursday.

The endeavor features a feeder fund to Hamilton Lane’s Senior Credit Opportunities Fund (SCOPE), issued and tokenized via Securitize, according to a press release.

“RWA markets are entering a new phase, where tokenization must deliver real utility, not just representation,” said Sehra, who is also CEO of the company. “STBL provides a purpose-built architecture for RWA-backed stablecoins combined with compliant yield management.”

The collaboration shows how tokenization brings utility to assets when it’s paired with regulated issuance and programmable settlement, said Securitize CEO Carlos Domingo.

“By embedding institutional private credit directly into onchain money flows, we’re turning tokenized assets into functional building blocks: assets that can be settled, composed and used across financial applications, not just held,” Domingo said.

Crypto World

Berachain (BERA) is up 75%: here’s why the altcoin is rising

- Berachain’s strategic shift toward revenue-driven apps boosted long-term confidence.

- The successful mainnet launch and smooth token unlock have helped ease BERA’s selling pressure.

- Berachain’s token price needs to stay above $0.8318 for the bullish momentum to hold.

Berachain’s native token, BERA, posted a sharp 75% rally in 24 hours, drawing renewed attention from traders and long-term crypto investors alike.

The move comes after a prolonged period of weakness that pushed the token close to its all-time lows earlier this year, coinciding with the broader crypto market’s plunge.

This sudden reversal has not been driven solely by hype, but by a combination of structural, strategic, and market-specific developments that have shifted sentiment around the project.

Below is a breakdown of the key reasons behind BERA’s strong rebound and what it could mean going forward.

Strategic shift toward revenue-generating applications

One of the most important catalysts behind BERA’s rally is Berachain’s strategic pivot toward supporting applications that generate real, sustainable revenue.

In its end-of-year report, Berachain stated that it has moved away from heavy reliance on token incentives and emissions that often attract short-term liquidity but create long-term sell pressure.

Instead, the focus is now on encouraging builders to create businesses that generate fees, activity, and organic demand for the token.

This shift has resonated with the market because it addresses one of the biggest criticisms of many layer-1 projects, which is the lack of durable economic value.

By prioritising sustainable use cases, Berachain has improved investor confidence in the long-term utility of BERA.

This narrative change has helped reframe BERA from a speculative asset into a token with a clearer economic role within its ecosystem.

Token unlock passed without heavy selling pressure

BERA also benefited from a token unlock event that did not result in the aggressive selling many had anticipated.

According to data from Tokenomist, Berachain, on February 6, unlocked tokens worth around $24 million.

Token unlocks often lead to sharp declines as early holders rush to realise profits.

In this case, the market absorbed the additional supply relatively smoothly.

The lack of panic selling surprised traders and reinforced the idea that weaker hands had already exited during the long downtrend.

This dynamic contributed to a relief rally, as short sellers were forced to reconsider their positions.

As selling pressure failed to materialise, upward momentum accelerated.

Berachain mainnet launch

Berachain’s mainnet launch on February 6 marked a critical milestone for the project and laid the foundation for long-term ecosystem growth.

The launch was accompanied by a large airdrop that distributed a meaningful portion of the token supply to early users and contributors.

This helped decentralise token ownership and encouraged active participation across the network.

By rewarding testnet users and liquidity providers, Berachain strengthened its community and increased on-chain engagement.

The mainnet launch also made it easier for users to interact with the network through familiar wallet infrastructure.

Together, these developments increased visibility and usage, supporting the recent recovery in price.

BERA price forecast

From a technical perspective, the most important support level sits at $0.8318, which needs to hold to maintain the current bullish structure.

As long as BERA remains above this zone, buyers are likely to stay in control.

On the upside, the first major resistance level is located at $1.51, where profit-taking pressure could emerge.

A clean break and sustained move above $1.51 would open the door for a rally toward the next resistance at $1.86.

If bullish momentum continues and market conditions remain favourable, analysts say that the third resistance level to watch is around $2.19.

Failure to hold above the key support, however, could invalidate the bullish outlook and return BERA to consolidation.

But for now, the combination of improved fundamentals and constructive technical levels suggests that traders will remain closely focused on how price behaves around these zones.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports8 hours ago

Sports8 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World10 hours ago

Crypto World10 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video5 hours ago

Video5 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month