Crypto World

Vitalik Buterin’s stark warning on layer-2 roadmap

Network News

VITALIK BUTERIN SAYS LAYER-2 ROADMAP ‘NO LONGER MAKES SENSE’: Ethereum co-founder Vitalik Buterin said the role of layer-2 networks needs to be reconsidered as the blockchain’s main network continues to scale and transaction costs remain low. In a post on X, Buterin said the original rollup-centric roadmap, which positioned layer-2s as the primary way Ethereum would scale, “no longer makes sense.” That roadmap envisioned layer-2s as secure extensions of Ethereum that would handle most transactions while inheriting Ethereum’s security guarantees, often described as “branded shards” of the network. According to Buterin, two developments have challenged that original vision for layer-2 networks. First, progress among layer 2s toward later stages of decentralization has been slower and more difficult than expected. Second, Ethereum is now scaling directly on layer 1, with fees remaining low and gas limits expected to increase significantly. In his view, because Ethereum itself is scaling, layer-2 networks are no longer required to function as official extensions of Ethereum. He also noted that many layer-2s are “not able or willing” to meet the decentralization and security standards required by the model and that some layer 2s may intentionally choose not to move beyond “stage 1,” including for regulatory reasons. — Margaux Nijkerk Read more.

BITCOIN OPEN-SOURCE ALTERNATIVE: Tether released an open-source operating system for bitcoin mining, pitching it as a way to make running mining infrastructure simpler while reducing reliance on closed, vendor-controlled software. The stablecoin issuer said it rolled out MiningOS (MOS), describing it as a modular, scalable mining operating system designed for anyone from hobbyist miners to large institutions. The stack is intended to remove the “black box” nature of many mining setups, where hardware and monitoring tools are tightly tied to proprietary platforms. “MiningOS changes that — introducing transparency, openness, and collaboration into the core of Bitcoin infrastructure,” Tether said on the project’s website, adding that the system is built with “no lock-in.” According to Tether, MOS uses a self-hosted architecture and communicates with connected devices through an integrated peer-to-peer network, allowing operators to manage mining activity without relying on centralized services. The company said miners can adjust settings through a companion platform depending on the scale of their operation and output requirements. CEO Paolo Ardoino called MOS a “complete operational platform” that can scale from a home setup to an “industrial grade” site spread across multiple geographies. Tether first previewed plans for an open-source mining OS in June, arguing that new miners should be able to compete without having to depend on expensive third-party vendors for software and management tools. — Shaurya Malwa Read more.

ETHEREUM FOUNDATION POST-QUANTUM TEAM: Quantum computing has long been a distant, theoretical threat to blockchain cryptography. But over the past few months, that calculus has shifted. While the Bitcoin community has been debating threats to its protocol for the past year, the Ethereum community seems to be only now taking its first steps. “Quantum computing is moving from theory into engineering,” said Thomas Coratger, who leads the Ethereum Foundation’s (EF) post-quantum (PQ) team. “That changes the timeline, and it means we need to prepare.” Earlier in January, the foundation formally elevated post-quantum security to a strategic priority, creating that dedicated team to drive research, tooling and real-world upgrades to protect the network’s cryptographic foundations. At the same time, major industry participants are building their own defenses: Coinbase announced an independent quantum advisory board staffed with leading cryptographers to guide long-term blockchain security planning, signaling that even custodial infrastructure must prepare for quantum-era risks. And across the ecosystem, Optimism, is one of Ethereum’s largest layer-2 networks, laid out a formal 10-year roadmap to transition its Superchain stack, from wallets to sequencers, toward post-quantum cryptography, committing to phase out vulnerable signatures and ensure continuity across layer-2 networks. Together, these moves mark a noticeable shift: post-quantum security is no longer a fringe topic for the far future, but a live concern shaping development roadmaps, governance discussions and ecosystem coordination across Ethereum and beyond. For the EF, the move toward post-quantum security isn’t about sounding an alarm, it’s about not being caught flat-footed. — Margaux Nijkerk Read more.

NEW LENDING PROTOCOL FOR XRP ASSETS: The Flare blockchain introduced lending and borrowing for XRP-linked assets through an integration with Morpho, a crypto lending protocol that runs across multiple Ethereum compatible chains. The update lets users lend and borrow with FXRP, a version of XRP designed for use on Flare, the team behind the blockchain said. Flare pitched the move as a step toward giving XRP owners more ways to earn yield and use their tokens beyond holding or trading. For years, XRP has had fewer decentralized finance (DeFi) options than tokens built on smart contract networks. Flare has been trying to change that by building tools that let XRP be used in onchain apps while keeping the original XRP on the XRP Ledger. FXRP holders can now deposit their tokens to earn interest, or use FXRP as collateral to borrow other assets such as stablecoins. Flare said these positions can also be combined with other features on the network, including staking and yield products, for users who want more active strategies. Morpho differs from older lending apps that mix many assets into one shared pool. Each lending market is set up with one collateral asset and one borrowed asset, and the rules for that market are set when it is created. This structure is meant to keep problems in one market from spilling into others. — Shaurya Malwa Read more.

In Other News

- The next evolution of asset management will be “wallet-native,” not just digital, according to Franklin Templeton’s head of innovation, Sandy Kaul. Speaking at the Ondo Summit in New York on Tuesday, Kaul said she envisions a future where all financial assets — stocks, bonds, funds, and more — are held and managed through tokenized digital wallets. “The totality of people’s assets is going to be represented in these wallets,” she said. The panel, which included Cynthia Lo Bessette of Fidelity, Kim Hochfeld of State Street and Will Peck of WisdomTree, agreed that tokenization is no longer a theoretical concept. After years of slow progress, infrastructure is now in place, and use cases are expanding beyond early experiments. The panelists cautioned that building utility and trust is now the industry’s biggest challenge. “The idea of bringing an asset and representing it onchain with a token is the easiest part,” said Lo Bessette, head of digital asset management at Fidelity. “The hardest part is building the ecosystem for utility.” Despite recent growth, adoption remains early. Hochfeld, State Street’s global head of digital and cash, said much of the current work is focused on internal and client education. “We’re not yet seeing a rush to the door,” Hochfeld said. “We’ve got to experiment … and see what works.” — Helene Braun Read more.

- TRM Labs, a blockchain analytics startup used by global law enforcement and financial firms, raised $70 million in a new funding round that pushed its valuation to $1 billion. The Series C round, Fortune reports, was led by Blockchain Capital with participation from Goldman Sachs, Citi Ventures, Bessemer, Thoma Bravo and Brevan Howard. The firm, according to data from TheTie, has raised nearly $150 million to date, having seen another $70 million fundraise back in 2023, along with other smaller fundraising rounds That bring the total to $220 million. The firm’s software helps trace cryptocurrency transactions across multiple blockchains, a service increasingly in demand as crypto crime grows more complex.TRM counts several major government agencies, including the IRS and FBI, among its clients, as well as major banks. It was an early mover in tracking not just bitcoin but various other cryptocurrencies, a decision that set it apart from competitors. That edge has become more valuable as criminal networks diversify their use of tokens and platforms. — Francisco Rodrigues Read more.

Regulatory and Policy

- At a White House meeting called to thaw the ice between crypto firms and Wall Street bankers, the crypto insiders — who outnumbered the bankers by a wide margin — came away feeling the banks were dragging their heels on making a deal on crypto market structure legislation. The White House gave them all new marching orders, according to people familiar with the talks: Get to a compromise on new language on stablecoin yields before the month is out. The crypto industry’s top policy priority is still struggling to make headway in the U.S. Senate, and the longer it’s delayed from getting a floor vote in the overall Senate, the less likely it is to happen this year. The gathering — led by President Donald Trump’s crypto adviser Patrick Witt — was largely focused on whether stablecoins should be associated with yield and rewards. Policy experts from the crypto industry and Wall Street banks gathered in the White House’s Diplomatic Reception Room for more than two hours to discuss how to overhaul the stickiest provisions of the bill, the people said. The talks will continue with a narrower group, the people said, and the White House has asked them to come to the table ready to agree on actual changes to the bill’s language. One of the people said that the banking representatives were members of trade associations and may need to get buy-in from their members before they can make a move in the negotiation. — Jesse Hamilton Read more.

- Rui-Siang Lin, the alleged operator of the dark web narcotics marketplace “Incognito Market,” was sentenced to 30 years in U.S. federal prison, according to a statement from the U.S. Attorney’s Office for the Southern District of New York, bringing to a close one of the largest online drug market prosecutions since Silk Road. Lin, a 24-year-old Taiwanese national who used the online alias “Pharaoh,” pleaded guilty in December 2024 to narcotics conspiracy, money laundering and conspiring to sell adulterated and misbranded medication. Prosecutors said the platform processed more than $105 million in illegal drug sales between October 2020 and March 2024, facilitating more than 640,000 transactions and serving hundreds of thousands of buyers worldwide. “Rui-Siang Lin was one of the world’s most prolific drug traffickers, using the internet to sell more than $105 million of illegal drugs throughout this country and across the globe,” U.S. Attorney Jay Clayton said in a statement. “While Lin made millions, his offenses had devastating consequences. He is responsible for at least one tragic death, and he exacerbated the opioid crisis and caused misery for more than 470,000 narcotics users and their families.” — Sam Reynolds Read more.

Calendar

- Feb. 10-12, 2026: Consensus, Hong Kong

- Feb. 17-21, 2026: EthDenver, Denver

- Feb. 23-24, 2026: NearCon, San Francisco

- Mar. 30-Apr. 2, 2026: EthCC, Cannes

- Apr.15-16, 2026: Paris Blockchain Week, Paris

- May 5-7, 2026: Consensus, Miami

- Nov. 3-6, 2026: Devcon, Mumbai

- Nov. 15-17, 2026: Solana Breakpoint, London

Crypto World

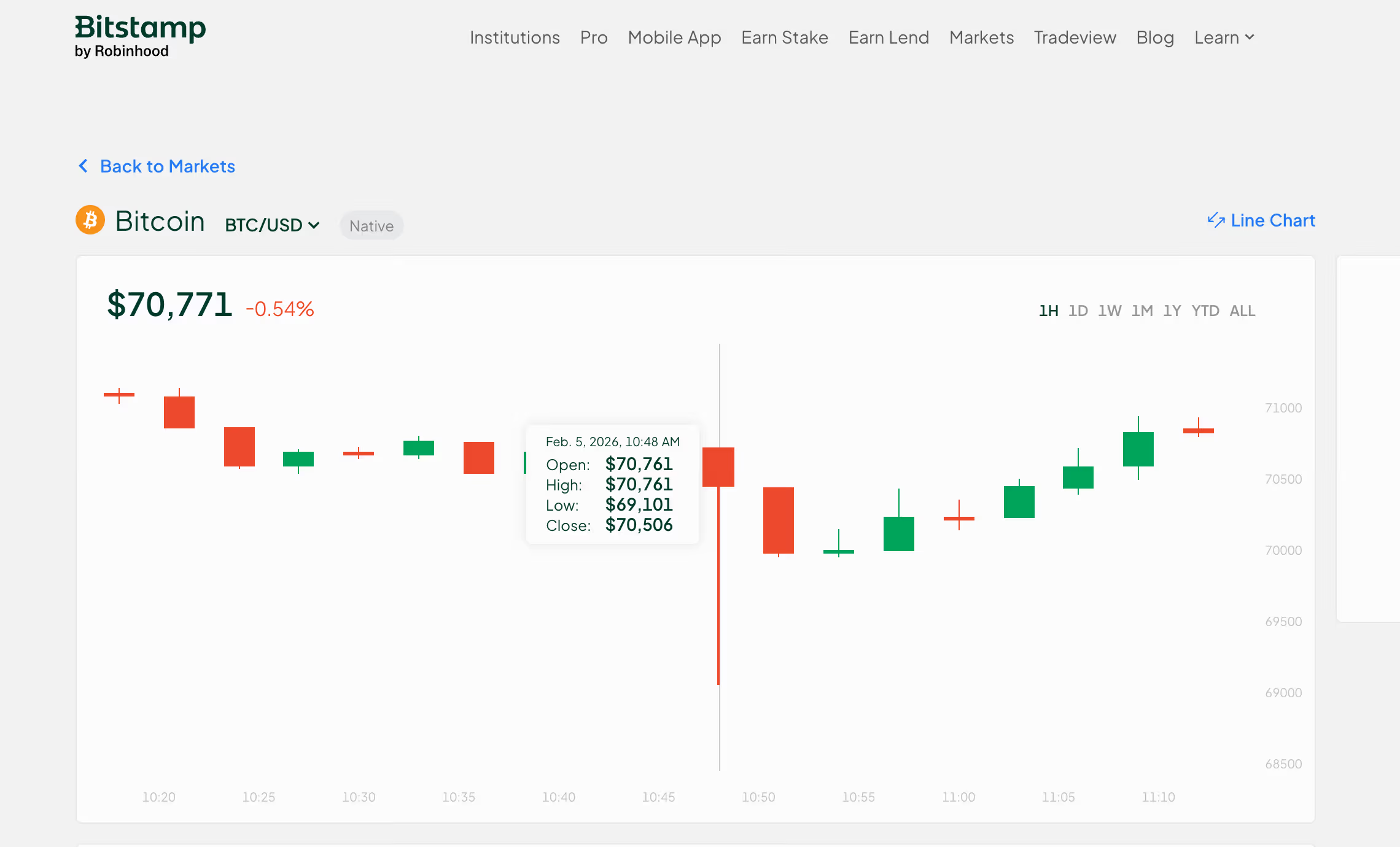

BTC tanks to $69,101 on Bitstamp

Bitcoin’s price sell-off continued Thursday, with prices breaking below the widely-tracked $70,000 level on the OG crypto exchange Bitstamp.

BTC’s dollar-denominated price slipped to $69,101 during the Asian trading hours, trading a discount to prices on other exchanges, including Coinbase, where BTC hit a low of $70,002.

The discount on Bitstamp likely stemmed from stronger selling pressure on the Robinhood-owned platform.

The global average price, tracked by CoinDesk, peaked above $126,000 in early October and has been in a downtrend since then. Some analysts expect further sell-off at least to $60,000, where prices may eventually bottom out.

Crypto World

Tether Tops 500 Million Users But USDT Peg Concerns Abound

Tether’s USDT has crossed a major milestone, surpassing 534 million users, even as the broader crypto market remains under pressure following a sharp contraction that began in October 2025.

According to the company’s Q4 2025 USD₮ Market Report, the stablecoin added more than 35 million users in the quarter, marking the eighth consecutive quarter of adding over 30 million users.

Sponsored

Sponsored

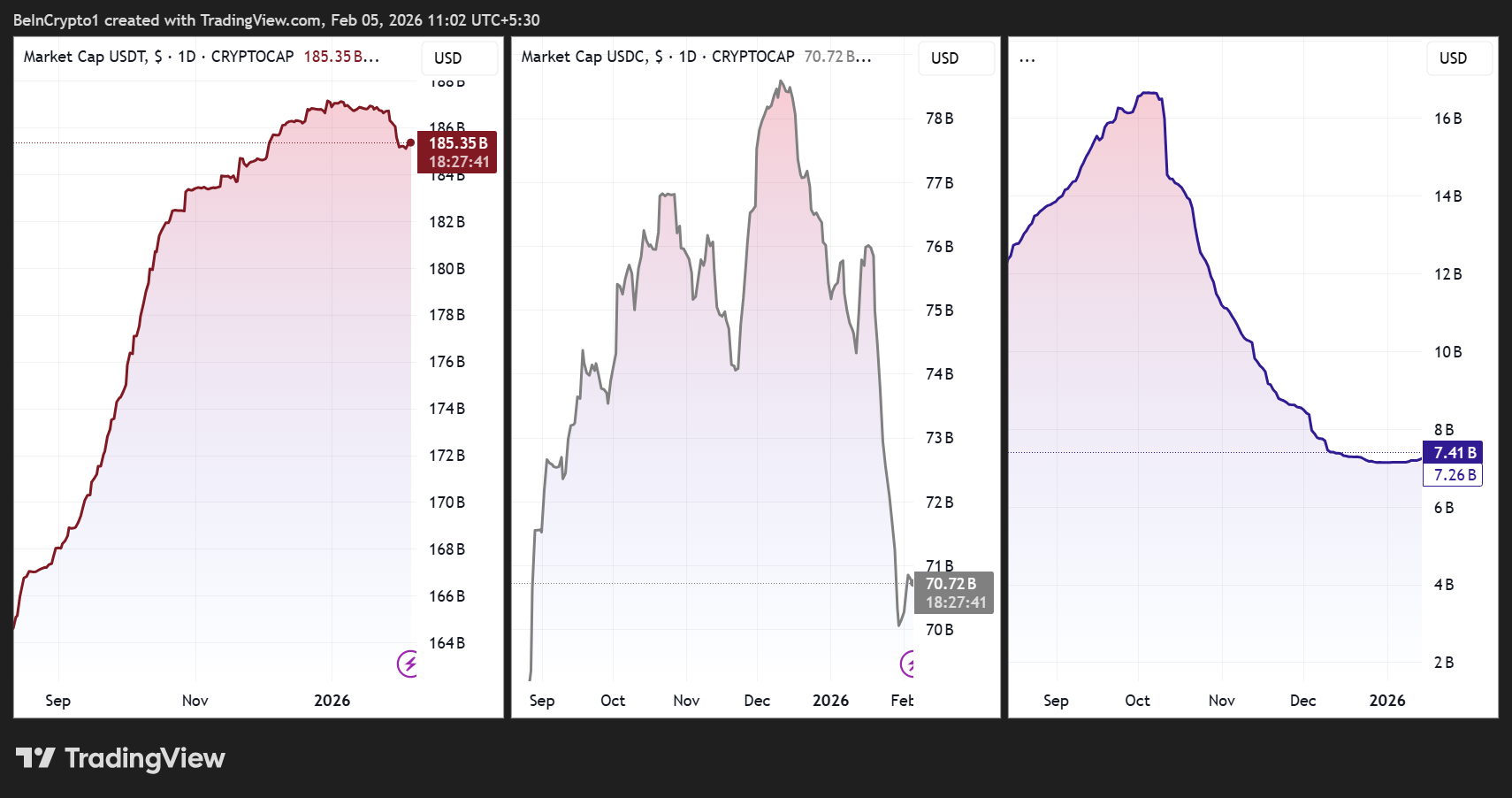

USDT Expands as a Global Store of Value Even as Crypto Market Cap Contracts

The growth comes during a period of declining risk appetite. Since the October 10 liquidation cascade, the total crypto market capitalization has fallen by more than one-third (30%). Meanwhile, USDT’s supply has continued to expand modestly.

Tether reported that its market capitalization rose to $187.3 billion, up $12.4 billion in Q4, even as some competing stablecoins shrank.

Tether attributes the resilience to demand for savings, payments, and cross-border transfers rather than purely speculative trading.

On-chain metrics cited in the report show rising wallet balances among long-term holders and record transaction volumes.

However, the estimates of total users include both on-chain wallets and approximations of exchange users, making independent verification difficult.

Reserve disclosures also show continued expansion. Total reserves reached $192.9 billion, including $141.6 billion in US Treasuries, a level that would place Tether among the largest Treasury holders globally if it were a country.

Sponsored

Sponsored

The company also increased its Bitcoin holdings to 96,184 BTC and its gold reserves to 127.5 metric tons, reflecting a strategy to diversify collateral beyond cash-equivalent assets.

On-chain activity continued to grow rapidly. The number of USDT holders rose to 139.1 million, while monthly active users reached 24.8 million, both record highs.

The value transferred on-chain reached $4.4 trillion in Q4, and USDT’s share of spot trading volumes on centralized exchanges climbed to 61.5%. This highlights its role as the dominant settlement asset in crypto markets.

Sponsored

Sponsored

Minting Surge, Peg Wobbles, and Flippening Talk Highlight USDT’s Growing Systemic Role

Recent issuance activity suggests demand has carried into early 2026. On February 4, blockchain analytics account Lookonchain reported that Tether minted $1 billion in USDT, part of roughly $3 billion in stablecoins issued by Tether and Circle over three days.

Large issuances are often interpreted by traders as a signal of incoming liquidity, although newly minted tokens are not always immediately circulated.

At the same time, Tether’s growing dominance has intensified scrutiny. Market attention briefly turned to USDT’s stability after the token slipped to around $0.9980, its weakest level in more than 5 years.

While the deviation was small and short-lived, any sustained loss of confidence in the peg could have outsized consequences, given the stablecoin’s central role in trading infrastructure.

Sponsored

Sponsored

Market estimates often suggest that most crypto trading volume flows through USDT pairs, making it a critical pillar of liquidity.

The scale of Tether’s expansion has also fueled debate over its place in the crypto hierarchy. Some market observers have speculated that, if current trends continue, USDT could eventually challenge Ethereum’s position as the second-largest cryptocurrency by market capitalization, particularly during prolonged periods of risk aversion when capital rotates into stable assets.

Meanwhile, the latest data shows that USDT is expanding in terms of users, reserves, and transaction volume, even as the broader market contracts.

Yet that same growth is concentrating liquidity and systemic importance in a single instrument. The stability of Tether’s peg is increasingly tied not just to one company, but to the resilience of the crypto market itself.

Crypto World

Why Vitalik Buterin Says L2s Aren’t Scaling Ethereum Anymore

Buterin argued that many Layer 2s no longer meaningfully inherit Ethereum security.

Ethereum co-founder Vitalik Buterin said recent developments mean the original conception of Layer 2 scaling within the ETH ecosystem is no longer viable.

He said that the progress among many L2 networks has fallen short of earlier expectations, while the mainnet continues to scale directly.

Slow Progress, Low Fees

In a recent post on X, Buterin pointed to two important realities reshaping the debate. First, there is the slow and difficult progress of L2s toward “stage 2” decentralization and interoperability, and the fact that Ethereum’s mainnet has already achieved very low fees, with gas limits expected to rise significantly through 2026.

Buterin reiterated that Ethereum scaling was originally defined as expanding block space that fully inherits Ethereum’s security. This means that all activity remains valid and censorship-resistant as long as the network operates. As such, systems that rely on multisig bridges or other forms of discretionary control cannot be considered extensions of Ethereum in this sense, even if they offer high throughput.

The co-founder explained that this framing no longer holds because the blockchain no longer needs L2s to function as “branded shards,” while many L2s are either unable or unwilling to meet the security and governance requirements that such a role would imply.

Buterin observed that some projects have explicitly stated they may never move beyond stage 1, not only due to technical concerns around zero-knowledge EVM safety, but also because regulatory or customer requirements necessitate ultimate control. While he said this may be appropriate for those projects’ use cases, it means they should not be described as scaling Ethereum under the original definition.

Instead, Buterin suggested abandoning the idea that all Layer 2s should occupy the same category and be judged by the same criteria. He proposed that they be viewed as a broad spectrum of systems with varying degrees of connection to Ethereum. In this framing, some L2s may be fully backed by Ethereum’s security while others operate with more limited guarantees. This would allow users and applications to choose based on their needs.

You may also like:

He added that L2s should focus on providing distinct value beyond generic scaling, such as specialized virtual machines, application-specific efficiency, extreme throughput, non-financial use cases, low-latency sequencing, or integrated services like oracles or dispute resolution. For networks handling ETH or Ethereum-issued assets, he said reaching at least stage 1 should be a minimum standard.

ZK-EVM Precompile

From Ethereum’s perspective, Buterin said he has become increasingly convinced of the importance of a native rollup precompile that would verify ZK-EVM proofs as part of Ethereum itself. Such a system in place enables trustless interoperability and composability while allowing L2s flexibility in extending functionality.

He said that while a permissionless ecosystem will inevitably include systems with weaker or trust-dependent guarantees, Ethereum’s responsibility is to make those guarantees clear and continue strengthening the base protocol.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

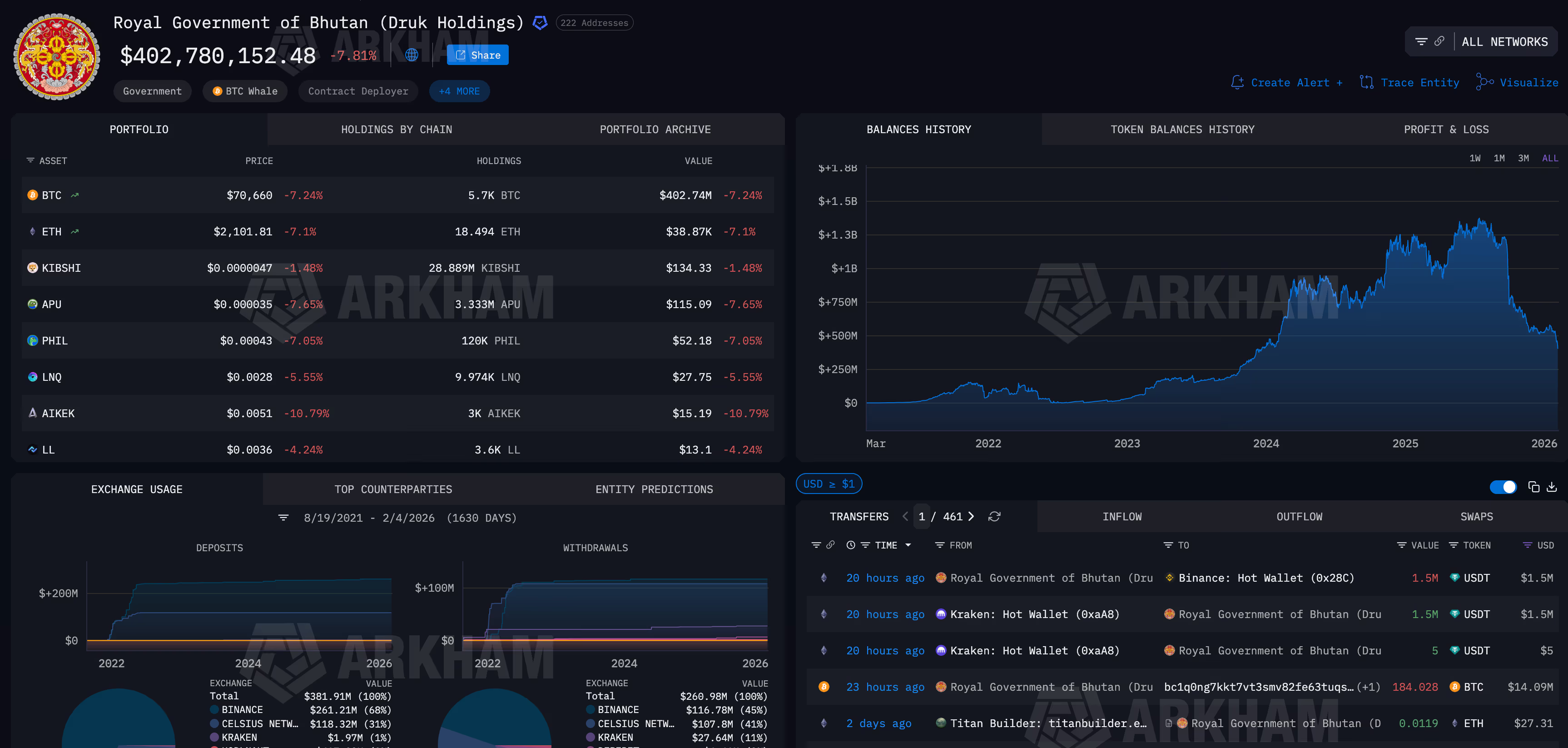

Bhutan shifts holdings after months of silence as BTC moves to $70,000

The Royal Government of Bhutan has begun moving bitcoin after months of wallet inactivity, shifting funds to trading firms, exchanges and fresh addresses as bitcoin slid below $71,000 and broader markets convulsed.

Onchain data tracked by Arkham shows Bhutan-linked wallets transferring more than 184 BTC, worth roughly $14 million, over the past 24 hours.

Some of the bitcoin was sent to new addresses, while other transfers flowed to known counterparties including QCP Capital and a Binance hot wallet, according to Arkham.

These destinations typically associated with trading, liquidity management or potential sales. CoinDesk reached out to QCP Capital via Telegram for comment.

The activity marks Bhutan’s first notable wallet movement in roughly three months and comes at a volatile moment for crypto markets. Bitcoin has fallen more than 7% in 24 hours, while silver plunged as much as 17% and global equities slid amid fears that artificial intelligence spending is undermining traditional software business models.

Bhutan has emerged over the past two years as one of the more unusual sovereign bitcoin holders, quietly building a stash through state-backed mining tied to hydropower.

Unlike corporate treasuries that trumpet accumulation strategies, Bhutan’s holdings have largely been managed out of the spotlight, making changes in wallet behavior closely watched by traders.

The latest transfers do not confirm outright selling. Coins were split across multiple destinations, including new wallets that could indicate internal reshuffling or collateral management rather than immediate liquidation.

Still, sending bitcoin to exchanges and trading firms during a sharp drawdown contrasts with the country’s otherwise long periods of inactivity.

The moves also echo a broader theme emerging in this selloff: large holders treating bitcoin less as a static reserve asset and more as a balance-sheet tool during stress.

Corporate treasuries, miners and now sovereign-linked entities are adjusting positions as liquidity tightens and price swings accelerate.

Crypto World

Bitcoin ETFs Hold On Amid Price Plunge, Analyst Says

US-based spot Bitcoin ETF holders are showing resilience despite a four-month downtrend in Bitcoin (CRYPTO: BTC), according to ETF analyst James Seyffart. In a recent post on X, he noted that the ETFs are “hanging in there pretty good,” even as the underlying asset has endured a prolonged slide. While acknowledging the pain of the current stretch—Bitcoin trading below $73,000 has left ETF holders with what he described as their largest paper losses since the January 2024 launch—the way flows have behaved contrasts with the height of the market cycle. The narrative is nuanced: inflows have cooled from peak levels, but the existing positions remain broadly intact as investors weather the drift in price.

Key takeaways

- Spot Bitcoin ETF holders are currently underwater but continuing to hold positions, signaling a degree of conviction despite the drawdown.

- Net ETF inflows had reached roughly $62.11 billion before the October downturn, and have since cooled to around $55 billion, according to preliminary data from Farside Investors.

- Bitcoin’s price trajectory has contributed to paper losses for ETF holders, with the broader market down about 24% over a 30-day window and the spot price near $70,537 at the time of reporting.

- Industry observers highlight a pattern of extended outflows, noting that three consecutive months of withdrawals marked a first in the history of higher-frequency ETF data monitoring.

- Industry voices emphasize a longer-term perspective, arguing that Bitcoin’s performance since 2022 has outpaced traditional assets in several periods, challenging the sentiment of a uniformly bearish cycle among analysts.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. ETF holders remain underwater as Bitcoin’s price decline drags on, though the net inflow dynamics offer a counterpoint to pure price Action.

Trading idea (Not Financial Advice): Hold. The combination of persistent holdings by ETF investors and improving inflows relative to peak levels suggests patience may be warranted amid ongoing price volatility.

Market context: The ETF landscape sits at the intersection of liquidity, risk appetite, and macro flows. Inflows into BTC-linked vehicles have cooled after a major cycle, while on-chain and market indicators show divergent signals about near-term momentum. The mix of price pressure and ongoing institutional participation shapes a cautious but not collapsing narrative for Bitcoin-focused ETFs.

Why it matters

The behavior of spot BTC ETFs helps illuminate a broader dynamic in crypto markets: institutional vehicles can provide a stabilizing, if not yet growth-driven, channel for price discovery. Even as price declines stretch across several weeks, the fact that ETF inflows remain sizable—albeit down from the peak—suggests that investors are maintaining exposure rather than exiting en masse. This matters for market liquidity, as ETF flows can dampen sharp price moves when buying or selling pressure intensifies, particularly in a sector as sensitive to macro headlines as crypto.

The discourse around investor sentiment is nuanced. On one hand, there is acknowledgment of substantial paper losses among ETF holders during the recent downturn, with Bitcoin navigating lower levels and volatility elevated. On the other hand, observers highlight that Bitcoin’s recovery potential remains tethered to macro risk appetite and the pace of flows into crypto vehicles. The conversation is further complicated by longer-term performance comparisons: Bitcoin has, in multiple cycles, outperformed traditional assets over extended horizons, which some argue justifies a longer view despite the near-term pain.

Analysts and researchers stress that focusing solely on near-term drawdowns can obscure the more complex picture of investor behavior and market structure. For instance, a well-known market observer suggested that Bitcoin’s strength in previous years—particularly its outsized gains through 2023 and 2024—remains a reference point for evaluating current demand. While the market may appear to be in a risk-off phase, the longer arc of Bitcoin’s price action has historically included substantial rallies following consolidation periods, underscoring the difficulty in drawing conclusions from a single quarter’s results.

Another thread in the discussion centers on the prudence of staying invested when ETF holders are effectively “underwater and collectively holding,” as some observers phrase it. This stance mirrors a broader crypto investing paradigm where conviction and time horizons matter as much as timing. In a space where episodic headlines can swing prices, the behavior of ETF holders offers a degree of reflexivity: ongoing participation from established vehicles can support price resilience, even when volatility remains elevated.

The discourse also touches on narrative risk—whether market participants are overly pessimistic about BTC’s near-term prospects. Some voices argue that evaluating Bitcoin’s performance in a post-2022 context should consider its outsized gains relative to gold and traditional assets, suggesting that the market’s recovery potential remains intact even after a difficult stretch. While sentiment among analysts fluctuates, the fact that a broad spectrum of commentators continues to discuss Bitcoin’s long-term trajectory hints at a market that is more nuanced than a straightforward bullish or bearish verdict.

The price action is clear: Bitcoin has shed nearly a quarter of its value in the last 30 days, with BTC trading around $70,537, according to CoinMarketCap. The linkage between ETF flows and price remains an evolving interplay, and investors are watching for how upcoming data and regulatory signals might shape the next leg of the cycle.

In the broader ecosystem, crypto analytics firms and market researchers have highlighted a pattern that may be drawing attention beyond immediate price moves. A widely cited analyst pointed out that the current period marks a historic phase in which consecutive outflows have occurred, raising questions about the implications for liquidity, volatility, and the resilience of BTC-linked products. Yet, this is not the first time the market has faced a testing environment, and some observers emphasize that Bitcoin’s fundamental narratives—scalability, network activity, and institutional adoption—remain central to the longer-term thesis.

Meanwhile, voices from the analytics community caution against a purely short-term lens. The market’s reaction to liquidity shifts, regulatory signals, and ETF flows can diverge from what is visible in day-to-day price movements. By examining the total inflows and outflows relative to the size of the market, investors can form a more balanced view of risk and opportunity in the BTC ETF space, rather than focusing solely on immediate losses or gains.

Eric Balchunas, a veteran ETF analyst, has emphasized that Bitcoin’s performance since 2022 has delivered outsized gains compared with gold and silver, arguing that those who judge BTC on a single year’s performance may be missing the broader arc. His comment underscores the importance of framing BTC’s story within a multiyear horizon, especially for investors considering exposure through spot BTC ETFs rather than direct spot markets. The ongoing debate about risk and return continues to shape how market participants approach BTC-focused ETFs and related products.

Ki Young Ju, CEO of CryptoQuant, summed up a meta-view that reflects a cautious mood among market participants: “every Bitcoin analyst is now bearish,” a remark that underscores the prevailing mood while leaving room for a counterpoint in a market that has historically proven contrarian at pivotal moments. The tension between bearish sentiment and the potential for a longer-term rebound remains a defining feature of BTC discourse as traders weigh the odds of a renewed upshift in price against continued macro uncertainty.

What to watch next

- Next wave of ETF flow data from Farside Investors and other researchers, which could show whether the contraction in inflows accelerates or stabilizes.

- Bitcoin price behavior over the next several weeks, particularly in response to macro cues and any regulatory developments impacting crypto markets.

- Further commentary from major ETF analysts and researchers on whether the current drawdown is a pause or the onset of a deeper correction.

- Updates on institutional participation in BTC-linked products, including any changes in flows into other crypto ETFs or related vehicles.

Sources & verification

- Preliminary net inflows data for spot BTC ETFs from Farside Investors (as cited in the article).

- Public X posts by James Seyffart discussing ETF holders’ performance and sentiment.

- Public X posts by Jim Bianco and Rand analyzing ETF holder underwater percentages and historical comparisons.

- Price data for Bitcoin from CoinMarketCap at the time of publication (BTC price around $70,537).

- Comments from Eric Balchunas regarding BTC’s performance since 2022 relative to other assets.

- Ki Young Ju’s remarks from CryptoQuant on market sentiment.

Bitcoin ETF flows and price action amid a four-month decline

US-based spot BTC ETFs are navigating a difficult phase that has stretched over several months, marked by a meaningful rally-to-correction cycle that has dragged prices lower while inflows have not collapsed as some bears expected. The conversation among analysts centers on a paradox: even as many investors sit underwater, the aggregate posture remains constructive enough to sustain a broad layer of market liquidity and investor confidence. From the vantage point of ETF market structure, the persistence of holdings and the scale of inflows before October point to a durable base of participants who view BTC exposure as a core, long-term component of a diversified portfolio rather than a speculative, short-term bet.

As price action remains volatile, the ETF community continues to balance risk and opportunity. The data show that, despite the downturn, the community of ETF holders has not rushed to exit en masse. This behavior aligns with a longer-run thesis that Bitcoin, despite reputational cycles, has established a persistent presence in institutional portfolios. The tension between near-term losses and longer-term potential remains a central theme in assessing BTC’s role within the ETF ecosystem, with analysts urging caution not to conflate short-term price dynamics with the asset’s ultimate trajectory.

In practical terms, the ongoing observation is that ETF inflows, while reduced from peak levels, still reflect a non-negligible demand for BTC exposure. The numbers suggest a market that is not capitulating, even as the price declines continue. For traders and investors, the key takeaway is that the ETF framework provides a stable, regulated channel for exposure that can influence liquidity dynamics in ways that are distinct from the spot market alone. The evolving narrative around ETF flows—alongside Bitcoin’s price path and macro signals—will continue to shape market psychology and the pace of the next leg in BTC’s cycle.

For readers who want to verify the underlying data and quotes, the linked posts and price data points in this report provide direct sources. The discussion around ETF flows, price levels, and analyst commentary reflects a broad cross-section of market voices, each contributing to a composite view of a market that remains highly reactive to both micro and macro catalysts. As regulation, classification of crypto assets, and ETF product design continue to mature, observers anticipate that flows into BTC-linked vehicles will adjust in response to evolving expectations for risk, return, and liquidity in the crypto space.

The subscription template at the end of the article is included to reflect ongoing engagement opportunities for readers seeking deeper insights into crypto market dynamics.

Notes: The coverage above preserves the factual statements and linked references as presented, while restructuring them into a professional, journalistic narrative. No promotional boilerplate from the publisher is included in this rewritten article.

Crypto World

BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100

BitMine Immersion Technologies, the Ethereum-treasury company led by Fundstrat’s Tom Lee, is facing intensifying pressure after a sharp drop in ether prices pushed the firm deep into unrealized losses. As of Feb. 5, Ethereum fell to a local low of $2,092, leaving BitMine’s holdings of roughly 4.285 million ETH with a paper loss exceeding $7 billion, -45% on its holdings.

The company pivoted from Bitcoin mining to an aggressive “Ethereum-first” treasury strategy last summer, accumulating ETH at an estimated average cost between $3,800 and $3,900. With ETH now trading more than 50% below its August 2025 all-time high of $4,946, BitMine’s once $8.4 billion portfolio is significantly underwater, placing it at the center of one of crypto’s largest single-asset corporate bets.

BitMine and Strategy Both Under Water as Bear Market Deepens

The market reaction has been swift. BMNR shares have fallen alongside ETH, reviving comparisons with Michael Saylor’s Bitcoin-focused firm, Strategy (MSTR). However, both companies are now under pressure. Strategy is currently sitting on an unrealized loss of roughly $2.70 billion on its Bitcoin holdings, based on an average purchase price of $76,052 and a current BTC price near $70,500. MSTR shares are down about 9% in the past eight hours, erasing roughly $3.7 billion in market value.

While BitMine’s losses are larger in absolute terms, analysts note that both firms highlight the risks of concentrated treasury strategies tied to volatile crypto assets.

Tom Lee Stays Bullish Despite Drawdown

Despite the “eye-watering” figures, Tom Lee remains publicly undeterred. Earlier this week, Lee described the drawdown as “a feature, not a bug,” arguing that Ethereum’s long-term fundamentals remain intact. He pointed to record daily transactions of around 2.5 million and rising active addresses as evidence that network usage is diverging from price action.

Lee attributed recent weakness to a post-October deleveraging cycle and capital rotation into precious metals. BitMine has continued to double down, recently adding another 41,000 ETH to its balance sheet, even as the Ethereum-treasury narrative faces its most severe stress test to date.

The post BitMine Faces $7B Unrealized Loss as Ethereum Slides Below $2,100 appeared first on Cryptonews.

Crypto World

Why is Hyperliquid price up despite crypto market bloodbath?

Hyperliquid price is rallying against the market tide as institutional adoption and improving chart structure attract fresh buyers.

Summary

- HYPE gained 6% even as Bitcoin dipped below $72,000 and most majors fell.

- Institutional integrations and token utility developments lifted sentiment.

- Technical structure shows a confirmed trend shift with momentum favoring buyers.

Hyperliquid was trading around $34.96 at press time, up 6% in the past 24 hours, even as the crypto market sold off sharply. Bitcoin briefly slipped below $72,000, and most large-cap tokens traded lower.

Hyperliquid (HYPE), however, has moved in the opposite direction. The token is up 1.5% over the past seven days and has gained 29% over the last month, standing out during a period of heavy market pressure.

Derivatives data points to cooling leverage rather than panic buying. Open interest fell 2.42% to $1.55 billion, while trading volume decreased 31% to $4.06 billion, according to CoinGlass data.

This often indicates that traders are lowering their exposure rather than chasing gains, which can keep the price stable during volatile sessions.

Why is Hyperliquid price rising?

Several developments have raised short-term demand. On Feb. 4, Ripple announced that Ripple Prime, its institutional brokerage platform, had added support for Hyperliquid.

The integration allows institutions to access on-chain perpetuals and derivatives on Hyperliquid while managing risk alongside traditional assets such as FX and fixed income.

The news was met with a positive market response, lifting HYPE even as selling pressure persisted across the crypto market. While the integration does not directly benefit XRP or rely on the XRP Ledger, it will boost HYPE which is at the centre of perps trading activity.

Another development followed the same day. Hyperion DeFi Inc. (NASDAQ: HYPD), a publicly traded digital asset treasury focused on Hyperliquid, said it plans to use its HYPE holdings as options collateral.

The company said it isn’t engaging in directional bets. Instead, the strategy focuses on earning income from options premiums and fees, together with staking rewards. Hyperion is working with Rysk protocol to launch an on-chain options vault directly on Hyperliquid.

Over time, the vault could be opened to other institutional HYPE holders. By putting more tokens into structured products and reducing the liquid supply, this strategy might support the token’s price.

Another protocol update that has garnered attention is HIP-4. The plan introduces fully collateralized “outcomes” trading for products that resemble options and prediction markets. The feature is designed to appeal to traders who prefer defined risk during volatile periods.

HIP-4 comes after previous improvements that enabled permissionless markets for crypto, equities, and commodities. With over $1 billion in open interest, nearly $5 billion in daily volume, and a massive rise in weekly transactions since those updates, Hyperliquid has seen strong network growth.

An upcoming token unlock on Feb. 6, releasing about 9.92 million HYPE worth roughly $300 million, has so far failed to unsettle buyers. Previous unlocks were absorbed without sharp pullbacks, which has helped calm concerns.

Hyperliquid price technical analysis

After months of steady decline, HYPE has shifted structure. A distinct shift in trend behavior is visible as the price recovered the mid-Bollinger Band and remained above it. The recent pullback formed the first higher low since November, flipping the structure from bearish to neutral-bullish.

Price has pushed above the upper Bollinger Band with strong closes rather than thin wicks. Volatility bands have turned upward, and the 20-day moving average now acts as support instead of resistance. The relative strength index has moved into the 60–70 range, holding above its signal line.

HYPE also cleared the $32–$33 resistance zone and has stayed above it, suggesting acceptance at higher levels. Overhead supply looks limited until the $40 area.

Holding above $32 keeps momentum intact and allows a move toward $38–$42 if market conditions stabilize. A drop back below $32 could pull the price toward $27–$28, where trend support would be tested.

Crypto World

Cardano Whales Stack 210M ADA, Igniting $1 Recovery Hopes

Join Our Telegram channel to stay up to date on breaking news coverage

Cardano continues to trade in a massive drawdown even after rebounding from the $0.30 lows. However, fresh on-chain data shows whales are back to aggressively buying ADA alongside other altcoins.

Large holders have stacked another significant volume in recent weeks, signaling renewed conviction despite broader market pressure.

This accumulation, combined with tightening supply and improving technical setups, is once again fueling speculation of a stronger recovery push toward higher levels.

With interest creeping in, can it sustain a bullish sentiment for Cardano’s price?

According to data from Ali Martinez, a popular analyst on X, whales have bought 210 million Cardano tokens over the past three weeks. This level of accumulation signals strong interest from large holders.

210 million Cardano $ADA bought by whales in the past three weeks! pic.twitter.com/Mqq4xdQGSK

— Ali Charts (@alicharts) January 17, 2026

In one of the latest buys, a whale deposited $7.9 million USDC into the Hyperliquid exchange, buying 6.46 million ADA for a position worth about $2.50 million.

Whale activity is an indicator of informed money, suggesting the Cardano token price could be gearing up for a rally.

ADA Volumes Increase In The Derivatives Market

Cardano is seeing increased volume in the derivatives market, with traders now watching what comes next for its price.

Data from Coinglass shows that Cardano has increased 10,654% in futures volume on the Bitmex exchange, reaching $40.04 million.

Cardano’s derivatives have benefited from a surprisingly high boost.

The BitMEX futures have expanded by an extraordinary 10,654% to a whopping $40 million, in conjunction with a looming listing of $ADA futures by @CMEGroup. The institutional appetite is evidently waking up. A… pic.twitter.com/QmNDacBvpQ

— Mentor (@CardanoMentor) January 17, 2026

This indicates a surge in activity in the derivatives market, given that Bitmex is a major derivatives exchange.

Can ADA Rally To $1?

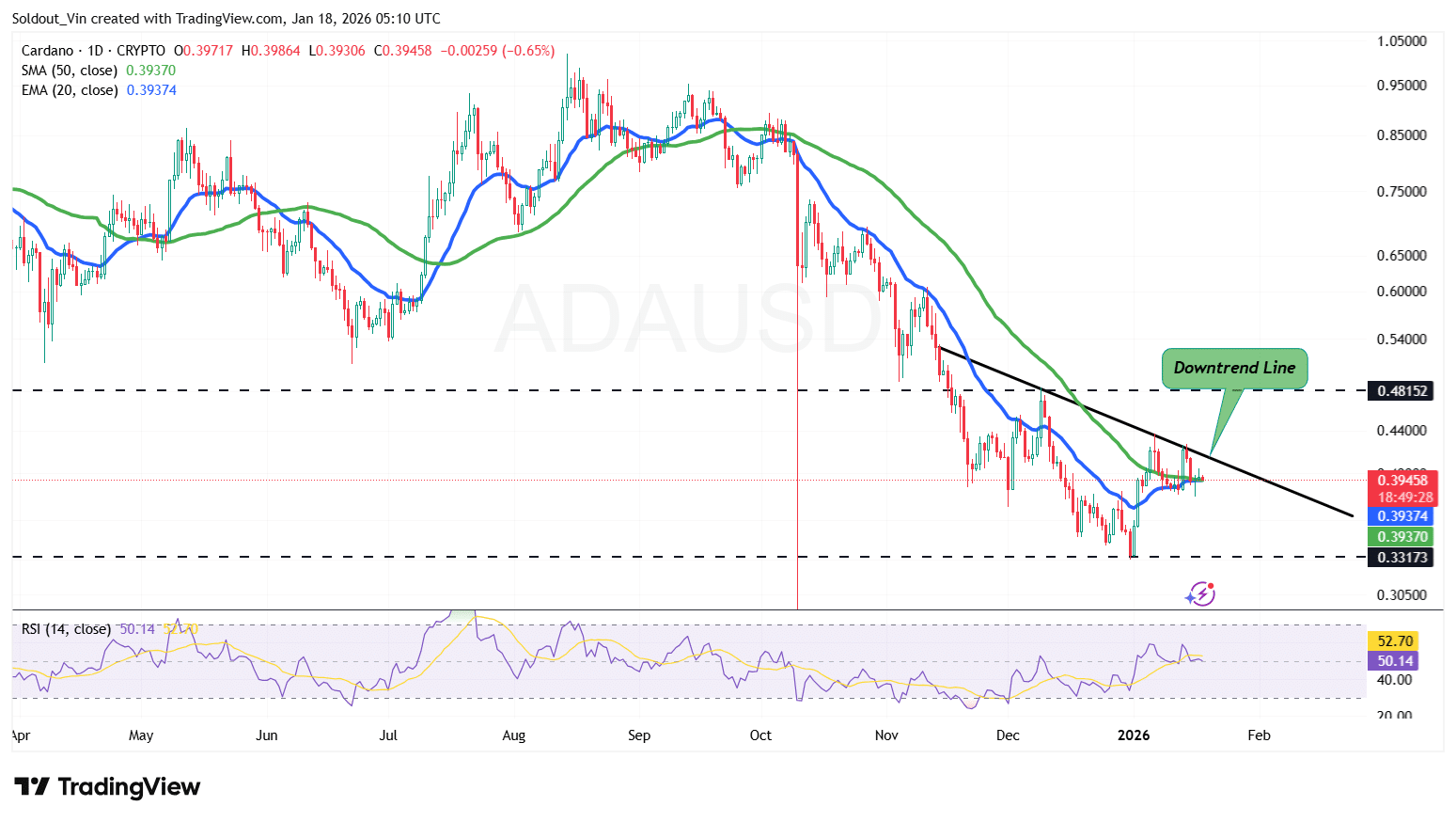

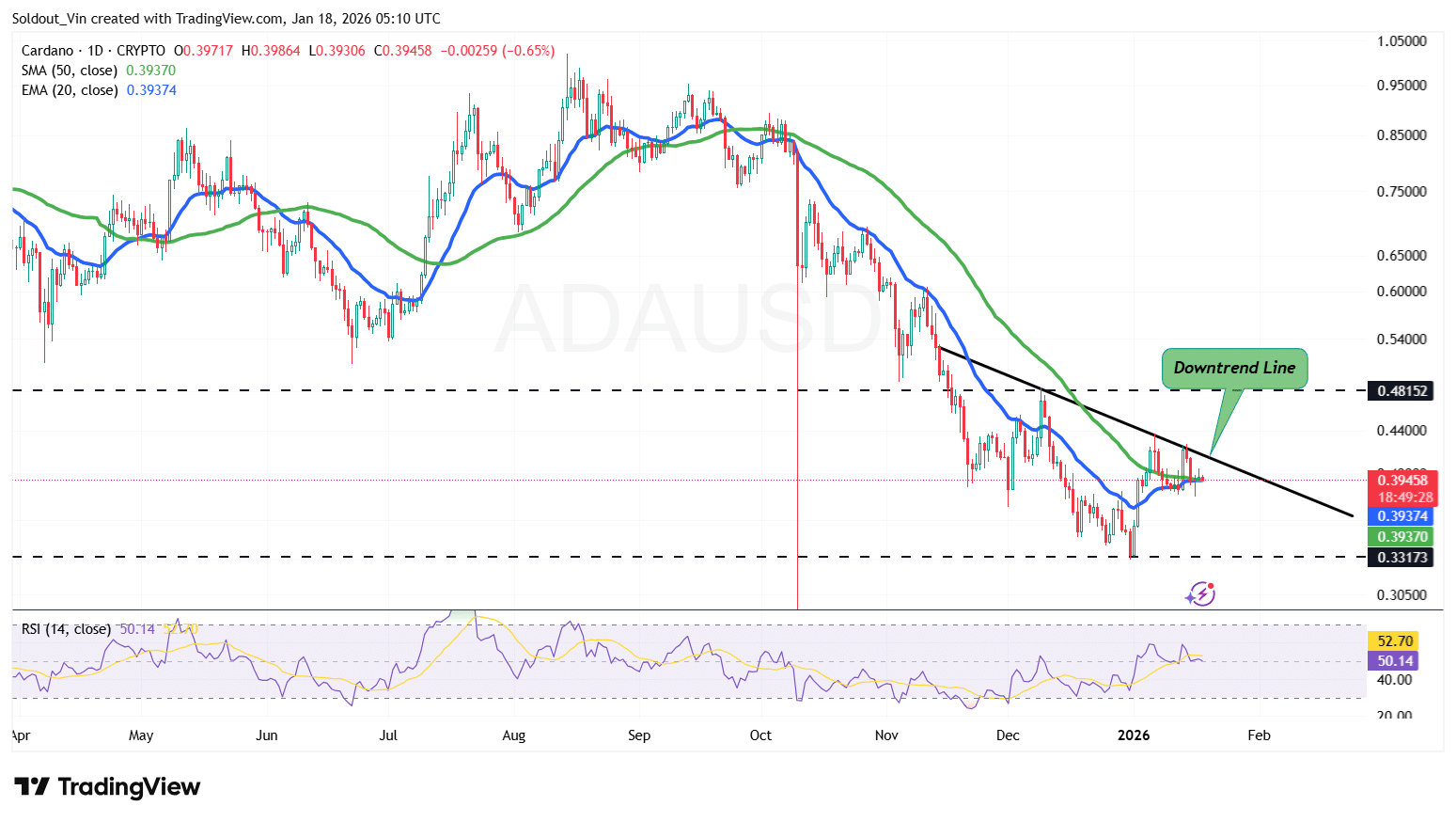

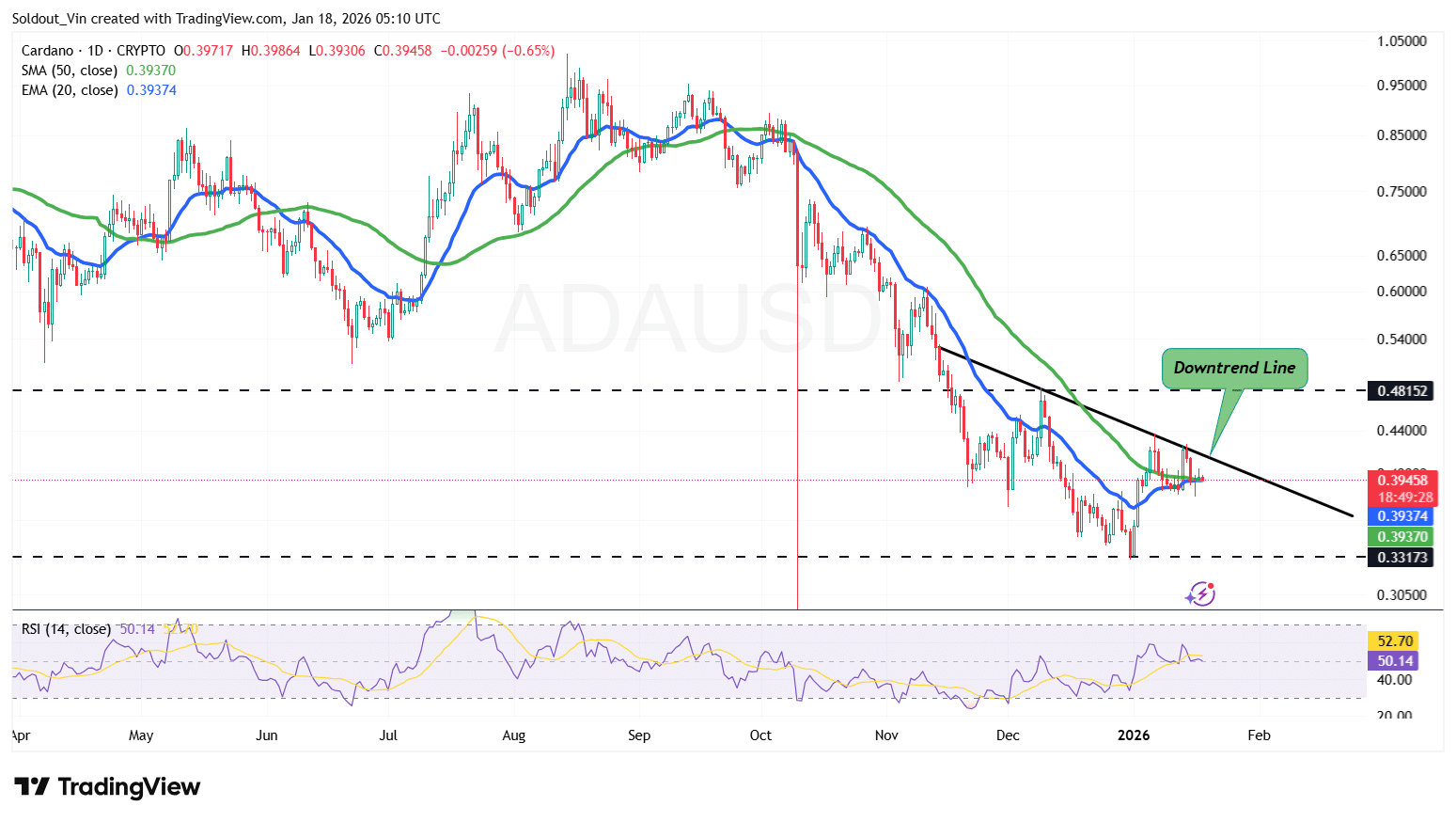

Cardano’s price is currently consolidating near the $0.39–$0.40 region, holding above the short-term support zone at $0.33–$0.35, which buyers have defended following the recent sell-off.

This stabilization followed a sharp decline from the October highs, with demand stepping in near $0.33, a historically significant support level. The bounce from this area suggests selling pressure is easing, although bullish conviction remains cautious.

ADA is trading around the 20-day EMA (~$0.39) but remains below the 50-day Simple Moving Average (SMA) near $0.48, which continues to act as a key overhead resistance. The downward slope of the 50-day SMA suggests the broader trend remains bearish unless ADA can reclaim and hold above this level.

Cardano’s Relative Strength Index (RSI) is hovering around 52, sitting near the neutral zone. This reflects modest momentum recovery without signs of overbought conditions, meaning price has room to move higher if buying strength increases.

From the 1-day ADA/USD chart perspective, Cardano could attempt a move toward the $0.45–$0.48 resistance zone, where the downtrend line and the 50-day SMA converge. A clean breakout above this area would be the first meaningful signal of a trend shift and could open the door for a move toward $0.60 in the medium term.

For ADA to realistically target $1, the price would need a sustained trend reversal, including a break above its resistance around $0.54.

Conversely, failure to break above the downtrend resistance could trigger another pullback, with $0.35 as initial support, followed by the $0.33 demand zone if selling pressure returns.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

BTC, SOL, UNI, PUMP slide

Crypto prices today are in the red as forced liquidations and weak demand pushed major tokens lower.

Summary

- Extreme fear dominated sentiment, with the Fear & Greed Index at 12.

- Analysts see $70,000 as the next key level for Bitcoin.

- Short-term recovery possible if BTC holds $72,000–$74,000 and spot inflows resume.

At press time, total crypto market capitalization was down 4.4% to $2.35 trillion. Bitcoin fell 5.5% in the past 24 hours to $73,103. Almost all top 100 altcoins were in the red.

Solana briefly slipped below $90, a level last seen in 2024, and was trading at $91, down 7.6%. Uniswap declined 3% to $3.78, while Pump.fun dropped 6% to $0.002271.

Alternative’s Fear and Greed Index fell two points to 12, remaining in the extreme fear range. The average relative strength index across the market was at 40, showing weak short-term momentum.

In addition, total open interest fell 4% to $106 billion, indicating continued deleveraging.

Liquidations put pressure on crypto prices

Much of the selling pressure came from forced liquidations in leveraged futures and perpetual contracts. Traders holding highly leveraged long positions faced margin calls, leading exchanges to automatically close those positions. This added to the selling and contributed to cascading losses.

According to CoinGlass data, long positions accounted for $520 million of the $650 million in total liquidations, which rose by 22% over the previous day. Since late January 2026, cumulative liquidations have now reached about $7 billion, contributing to a market capitalization drop of roughly $500 billion in the same period.

Open interest is now at multi-month lows in several markets, indicating that over-leveraged positions are being cleared.

Other pressures are coming from risk-averse behavior across financial markets. Crypto has moved alongside declines in technology stocks, mostly AI-related shares. Hawkish signals from the Federal Reserve, including expectations for higher interest rates for longer, have reduced liquidity and made speculative assets less attractive.

Institutional flows have weakened as well. Spot Bitcoin exchange-traded funds have seen outflows in recent weeks, while a negative Coinbase premiums and selling by large holders has added steady pressure.

Short-term outlook and analyst views

The short-term outlook for crypto is cautious. Bitcoin has broken support in the $75,000–$78,000 range, and many analysts are watching $70,000 as the next test level. If the price falls below that, it could move toward $65,000–$68,000 if selling intensifies.

On the upside, a hold above $72,000–$74,000 could allow a relief rally toward $82,000–$88,000 by late February. Liquidity is thin, and market swings could be sharp if macroeconomic news or Fed updates influence sentiment.

Polymarket odds now show an 82% probability of Bitcoin falling below $70,000. Analysts at Citi noted that slowing spot ETF inflows and regulatory uncertainty could push Bitcoin toward that level. In a February 4 report, Citi highlighted that the average entry price for spot ETF investors is $81,600.

Compared with gold, which has gained amid geopolitical concerns, Bitcoin is more sensitive to liquidity and risk appetite. According to Citi, delays in the U.S. CLARITY crypto bill and shrinking liquidity from the Federal Reserve are also adding pressure.

As of now, traders are watching closely to see whether oversold conditions and historical February trends will create opportunities for short-term relief.

Crypto World

Zama Token Debuts at $400 Milion Valuation

ZAMA is currently trading 30% below its ICO price.

Zama’s highly anticipated $ZAMA token has made headlines as the first production-scale use of Fully Homomorphic Encryption (FHE) on the Ethereum mainnet.

However, the token is currently trading at $0.035, marking a 30% decrease from its initial coin offering (ICO) price).

Zama’s auction format was notable for its confidentiality features. The token sale raised $118.5 million through a sealed-bid Dutch auction, using Zama’s technology to protect the privacy of participants’ bids.

Zama’s focus on FHE is part of a broader strategy to enable confidential smart contracts on Ethereum. This technology enables computation on encrypted data without first decrypting it, enhancing privacy for blockchain applications.

This article was generated with the assistance of AI workflows.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech23 hours ago

Tech23 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards