Crypto World

Walmart Stock Surges 20% in 2026: Should Investors Buy Ahead of Earnings?

TLDR

- Walmart stock has gained 20.18% in 2026, outperforming the S&P 500 and Dow Jones indices.

- Walmart became the first retailer to reach a $1 trillion market capitalization.

- Analysts have a ‘Strong Buy’ rating for Walmart stock, but price targets suggest limited growth.

- Walmart stock is expected to retrace slightly, with a 12-month target price of $133.04.

- The company has exceeded earnings per share forecasts in three of the last four quarters.

Walmart (NYSE: WMT), one of the top-performing blue-chip stocks of 2026, is set to release its next quarterly earnings report on February 19. Investors are closely monitoring whether Walmart stock remains a solid buy ahead of the event. The retail giant has recently achieved impressive growth, making it a standout in a challenging market.

Walmart Stock Recent Performance

Walmart stock has surged 20.18% in 2026, outpacing both the S&P 500 and Dow Jones indices. In contrast, the broader market has struggled, with the S&P 500 declining by 0.33% and the Dow Jones rising by just 2.31%. This strong performance is raising questions about whether the stock can continue to climb or if a pullback is imminent.

The retailer’s market capitalization recently crossed $1 trillion, making it the first retailer to reach this milestone. Despite its success, there are concerns about the stock’s high valuation, especially ahead of its upcoming earnings report. A slight miss in earnings could trigger a correction, similar to what occurred with Microsoft’s stock after its latest report.

Wall Street remains largely positive on Walmart stock, with an average rating of ‘Strong Buy.’ However, analysts’ 12-month price targets suggest that the stock may see only modest growth. Walmart stock is expected to retrace 0.63%, with a target price of $133.04 in the next year.

Several analysts have raised concerns about potential pullbacks despite the positive outlook. Bernstein’s Zhihan Ma recently maintained a ‘Buy’ rating but forecasted a drop to $129. Similarly, Citi’s most bullish forecast of $147 suggests just a 9.79% increase from current levels. These predictions indicate that even optimistic estimates expect limited upside for the stock in the near term.

The Outlook for Walmart’s Earnings Report

Ahead of its earnings report, Walmart’s strong performance in recent quarters offers some reassurance. The company has exceeded earnings per share (EPS) forecasts in three of the last four quarters, increasing the likelihood of another beat. Walmart’s diversified business model, which includes e-commerce and technology, positions it well in both favorable and unfavorable economic conditions.

Even if the economy faces a downturn, Walmart’s reputation for offering ‘great value’ prices could drive continued consumer demand. This defensive nature of Walmart’s business model has contributed to its strong performance, making it a relatively safe investment in uncertain times.

Crypto World

Dogecoin price eyes a steeper dive as headwinds rise

Dogecoin price dropped for two consecutive days after hitting the 50-day Exponential Moving Average as demand dropped and key headwinds rose.

Summary

- Dogecoin price has slumped in the past few months.

- Spot DOGE ETFs inflows have stalled this year.

- The futures open interest has continued falling, while the funding rate has turned negative.

Dogecoin (DOGE) token dropped to the important support level at $0.100, much lower than this month’s high of $0.1176. It remains ~67% from its highest level in 2025.

The coin faces major headwinds, which may drag its price in the near term. For example, it faces a major challenge on the ongoing crypto market crash, which has affected Bitcoin and most altcoins.

Additionally, the futures open interest has continued falling in the past few months, moving from a high of $5.20 billion in September to the current $1.16 billion. Falling open interest is a sign that demand has continued falling in the past few months.

More data shows that the weighted funding rate has remained in the red in the past few days. It dropped to the lowest level since February 10. A falling funding rate is a sign that investors believe that the coin will continue falling in the near term.

The same is happening in the exchange-traded fund market this year. Data compiled by SoSoValue shows that spot three spot DOGE ETFs by companies like Grayscale, 21Shares, and Bitwise have not had any inflows or outflows since February 3 this year. These funds now have had over $6.67 million in cumulative inflows, bringing the net inflows to $8.69 million.

Dogecoin price technical analysis

The daily timeframe chart shows that the DOGE price has been in a strong downward trend in the past few months, moving from a high of $0.3073 in September last year.

Dogecoin price has dropped below the key support level at $0.1295, its lowest level on April 7 last year. It has fallen below all moving averages, while the Percentage Price Oscillator remains below the zero line.

Therefore, the most likely scenario is where the coin continues falling, potentially to the year-to-date low of $0.0790, its lowest level this month. A drop below that support level will signal more downside.

Crypto World

Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026

Feeding Google’s Gemini AI careful prompts unlocks explosive 2026 price predictions for XRP, Solana, and Bitcoin.

Given the fact that Gemini leverages Google’s expansive data set, these compelling predictions are grounded in hard analysis of the projects’ fundamental strengths, overall roadmap and ongoing macro and industry developments.

Below we unpack why Gemini is bullish on these specific coins.

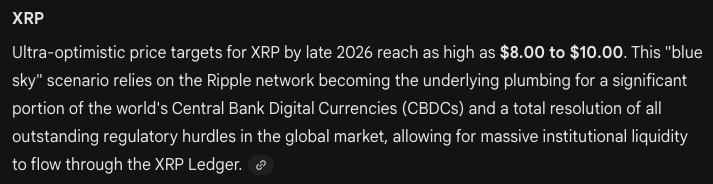

XRP ($XRP): Gemini Suggests Ripple’s Payments Solution Could Drive XRP to $10

In a recent update, Ripple reiterated that XRP ($XRP) remains central to its roadmap of establishing the XRP Ledger as a global, institution-ready payments layer.

With near-instant settlement speeds and minimal transaction costs, XRPL is in a position to benefit from growth in two rapidly expanding sectors: stablecoins, (via Ripple’s in-house RLUSD), and real-world asset tokenization.

The XRP token is currently trading around $1.49. Gemini’s outlook points to a potential move toward $10 by late 2026, implying a near-sevenfold gain, or roughly 600%, from current prices.

XRP’s Relative Strength Index (RSI) is at 42 and climbing quickly, a hint that investors are quietly stacking it at its current discounted price.

Possible momentum drivers include institutional capital flows following the approval of U.S.-listed spot XRP exchange-traded funds, Ripple’s expanding list of strategic partnerships, and the possibility of U.S. lawmakers finalizing the CLARITY bill later this year.

Solana (SOL): Gemini Projects a Climb Toward $600

The Solana ($SOL) network currently secures approximately $6.6 billion in total value locked (TVL) and carries a market capitalization near $50 billion. Increased on-chain activity, developer engagement, and daily user growth have supported its expansion.

The rollout of Solana-linked exchange-traded funds by firms such as Bitwise and Grayscale has further boosted institutional interest.

That said, following an extended correction in late 2025, SOL has spent much of February trading below the $100 level.

Under Gemini’s most optimistic scenario, Solana could rally toward $600 by 2027. Such a move would represent 7x upside from current levels around $84, comfortably exceeding SOL’s January 2025 ATH of $293.

Asset managers including Franklin Templeton and BlackRock are issuing tokenized real-world assets on the network, strengthening its real-world utility and long-term growth potential.

Bitcoin (BTC): Gemini Sees $250,000 Bitcoin on the Horizon

Bitcoin ($BTC), the original cryptocurrency and largest by market cap, reached a new all-time high of $126,080 on October 6 before entering a prolonged downturn.

Despite recent volatility, Gemini’s analysis indicates that Bitcoin can sustain its year-on-year growth and hit a new high watermark of $250,000.

Often referred to as digital gold, Bitcoin continues to attract institutional and retail investors seeking a hedge against inflation and macroeconomic uncertainty.

Bitcoin currently represents roughly $1.4 trillion of the $2.4 trillion total crypto market. Since setting its most recent ATH, BTC has fallen by around 46% and now trades below $70,000, following two sharp selloffs as potential U.S. military actions involving Iran and Greenland scared risk averse investors.

Gemini’s outlook highlights accelerating institutional adoption and post-halving supply constraints as key forces that could drive Bitcoin to multiple new highs this year.

Additionally, if U.S. lawmakers move forward with proposals to establish a Strategic Bitcoin Reserve, Bitcoin’s long-term upside could extend even beyond Gemini’s already bullish forecasts.

Maxi Doge: A New Meme Coin Enters the Frame

Finally, while Gemini’s analysis centers on the steady advance of established market leaders, high-risk-high-reward seekers are diversifying their portfolios with Maxi Doge ($MAXI), a sensational new pre-launch token sale that has already pulled $4.6 million from investors.

The project revolves around Maxi Doge, a gym-obsessed, Dogecoin challenger who channels the fun and outrageous spirit of the 2021 bull run, aka the meme coin heyday.

Additionally, presale buyers can stake MAXI for yields of up to 68% APY, with returns gradually declining as the staking pool grows.

MAXI is priced at $0.0002804 in the current presale round, with planned price increases at each funding milestone. Interested participants can purchase using wallets such as MetaMask and Best Wallet, or via bank card.

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post Google’s Gemini AI Predicts the Price of XRP, Solana and Bitcoin By the End of 2026 appeared first on Cryptonews.

Crypto World

Germany‘s Central Bank President Touts Stablecoin Benefits for EU

Joachim Nagel said euro-pegged stablecoins would offer the bloc more independence from US dollar-pegged coins soon to be allowed under the GENIUS Act.

Joachim Nagel, president of Germany’s central bank, the Deutsche Bundesbank, supported the introduction of a euro-pegged central bank digital currency (CBDC) and euro-denominated stablecoins for payments.

In remarks prepared for a speech at the New Year’s Reception of the American Chamber of Commerce in Frankfurt on Monday, Nagel said EU officials were “working hard” toward the introduction of a retail CBDC. Euro-denominated stablecoins, according to the central bank president, could also contribute to “making Europe more independent in terms of payment systems and solutions.”

“Notably, a wholesale CBDC would allow financial institutions to make programmable payments in central bank money,” said Nagel. “I also see merit in euro-denominated stablecoins, as they can be used for cross-border payments by individuals and firms at low cost.”

Nagel’s remarks come months after US President Donald Trump signed a bill into law establishing a framework for payment stablecoins in the country, potentially setting US dollar-pegged stablecoins on a path to challenge any possible rollout of a euro-pegged peer. The law is expected to be fully implemented 18 months after it was signed or 120 days after related regulations are finalized.

Related: ING Germany expands crypto ETP and ETN offerings with Bitwise, VanEck

The German central bank president’s comment on stablecoins did not include risks he mentioned last week at the Euro50 Group meeting. Nagel warned domestic monetary policy “could be severely impaired, not to mention that European sovereignty could be weakened” if US dollar-denominated stablecoins were to have significantly larger market share than a euro-pegged coin.

Stablecoin yield at issue in US bill under consideration

Washington lawmakers and White House officials have been meeting with representatives from the banking and crypto industries ahead of a potential vote on the CLARITY Act in the US Senate. The bill, expected to provide a comprehensive regulatory framework for digital assets, has been dividing many crypto industry and banking leaders due to its approach to stablecoin rewards, which has yet to be finalized in the legislation.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

Vanguard Group Increases Netflix Stake by 0.4%, Boosting Holdings

TLDR

- Vanguard Group increased its stake in Netflix by 0.4% in the third quarter, acquiring an additional 142,238 shares.

- The firm now owns 38,521,322 shares of Netflix, valued at $46.18 billion, representing 9.09% of the company.

- Several institutional investors, including Retirement Wealth Solutions LLC and Steph & Co., also made moves in Netflix stock.

- Analysts have adjusted their price targets for Netflix, with some lowering their projections for the stock.

- Insiders, including Cletus R. Willems and David A. Hyman, recently sold shares of Netflix, totaling over $700,000 in sales.

Vanguard Group Inc. has increased its stake in Netflix, Inc. ($NFLX) by 0.4% in the third quarter, as per the latest 13F filing with the Securities & Exchange Commission (SEC). The firm now holds 38,521,322 shares of Netflix, reflecting an additional 142,238 shares acquired during the quarter. This move positions Netflix as the 16th largest holding in Vanguard’s portfolio, making up 0.7% of the total value.

Vanguard’s Stake in Netflix Grows

In the third quarter, Vanguard’s increase in Netflix shares signals confidence in the company’s performance. As of the most recent SEC filing, Vanguard’s stake in Netflix is valued at $46.18 billion. The firm now owns 9.09% of Netflix, a sign of its growing importance in Vanguard’s portfolio.

Other institutional investors also made moves during this period. Retirement Wealth Solutions LLC purchased a new stake in Netflix worth $28,000, while Steph & Co. increased its position by 188.9%. The combined actions of these firms suggest that many see potential in Netflix’s stock despite market fluctuations.

NFLX Stock: Analysts’ Take

Several analysts have updated their price targets and ratings for Netflix’s stock. Robert W. Baird reduced their target price from $150 to $120, while Wells Fargo & Company lowered its from $156 to $151. These adjustments reflect mixed sentiments about Netflix’s near-term outlook, but the stock continues to receive “buy” ratings from many experts.

Despite some analysts lowering their price targets, NFLX stock maintains a consensus “Moderate Buy” rating. With a 50-day moving average of $88.67 and a 200-day moving average of $106.99, the stock has experienced significant volatility in the past year. Investors remain divided on the stock’s potential, as reflected in its price swings between a 1-year low of $75.23 and a high of $134.12.

Insider Activity in Netflix

In addition to institutional movements, insiders at Netflix have also been active. On February 10th, Cletus R. Willems, a company insider, sold 3,136 shares at an average price of $82.67. Similarly, David A. Hyman sold 5,727 shares on February 9th at $81.06 each, totaling over $464,000.

These insider sales are part of regular transactions within the company, but do raise questions about internal confidence. The continued insider activity might suggest a desire to capitalize on the current market conditions. However, insiders still hold a combined 1.37% of the company’s stock.

Crypto World

Bitcoin’s 50% Drop Tests Markets as Retail Investors Continue Dip Buying

Retail investors on Coinbase continued buying dips through market volatility, even as warnings of a severe crypto winter emerged.

Since reaching a record high last October, Bitcoin has shed nearly half its value. As it continues to struggle below $70,000, the weakness is fueling fears of another crypto winter.

But despite the ongoing volatility in the market, retail activity on Coinbase has remained steady, according to Brian Armstrong.

Post-October Slump

In a recent tweet, the Coinbase chief executive said that the platform data shows retail users have continued buying despite price dips as native unit holdings across Bitcoin and Ethereum increased. Armstrong added that a majority of retail customers held balances in February that were equal to or higher than their December levels, as participation from smaller investors on Coinbase remained steady.

While retail activity appears resilient, market commentator Mippo warned that the broader market outlook remains fragile. Mippo said current conditions point to the onset of a “full-on crypto winter,” which has the potential to match the severity of the 2022 bear market or even the downturn seen in 2019. He attributed the near-term pressure to the “air gap” created by previously unsustainable valuations alongside an evolving regulatory environment.

He stated that historical crypto valuations were largely driven by speculative capital flows rather than business fundamentals, as regulatory uncertainty made it difficult for projects to generate compliant revenue or cash flows. Prices were often set by how much capital chased a limited supply of tokens tied to the most popular narratives at the time, and higher-risk themes commanded higher valuations.

According to Mippo, this framework is now breaking down as regulatory pathways for crypto projects become clearer, beginning with stablecoins and expected to extend to a broader range of tokens.

While he characterized this regulatory change as positive over the long term, Mippo said it creates challenges for projects whose valuations were built primarily on speculation. As compliant revenue generation becomes possible, he explained that market participants are increasingly focused on cash flows, which has led to a reassessment of token prices that were set too high under earlier assumptions. This helps explain why on-chain activity and fundamental usage may be growing even as token prices continue to decline, he added.

You may also like:

AI Dominance Pressures Crypto

Mippo also said crypto is being “absolutely mogged by AI,” while adding that the frenzy around meme coin speculation is catching up with the industry, and that crypto failed to build useful products during that period.

As such, he estimated the reset in valuations could continue for another nine to eighteen months before broader market conditions begin to improve.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Animoca Brands Wins Dubai Crypto License Expands Middle East Services

Animoca Brands has secured a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA), enabling a broader, regulated footprint for crypto activities within the emirate. The license authorizes broker-dealer services and investment management related to virtual assets in Dubai, excluding the Dubai International Financial Centre, and targets institutional and qualified investors. The public record shows the license was issued on Feb. 5, reinforcing Dubai’s ongoing push to formalize digital-asset operations under a clear governance framework. Animoca says the license strengthens its ability to engage with Web3 foundations and global institutions within a well-defined regulatory environment. The move comes as Dubai continues to position itself as a regional hub for regulated crypto activity.

Key takeaways

- Animoca Brands obtains a VARA VASP license to offer broker-dealer services and asset-management activities related to virtual assets in Dubai, focused on institutional and qualified investors.

- The license excludes the Dubai International Financial Centre, signaling a mainland-and-free-zone approach to oversight under VARA.

- The development aligns with Animoca’s broader strategy in Web3, including support for projects such as The Sandbox, Open Campus, and Moca Network, while expanding its investor access in the region.

- Dubai has a growing roster of licensed crypto operators, underscoring a deliberate shift toward a regulated, institution-friendly crypto ecosystem in the emirate.

- Animoca’s recent activity includes the January acquisition of Somo, integrating playable and tradable digital collectibles into its portfolio.

Market context: Dubai’s VARA framework is part of a broader regional trend toward regulated digital-asset markets within the UAE, with enforcement actions signaling a clear stance against unlicensed activity and marketing breaches. The emirate’s approach contrasts with looser regimes elsewhere, drawing institutional participants seeking compliant environments and predictable governance.

Why it matters

The VARA license marks a meaningful expansion point for Animoca Brands in a market that has openly courted Web3 and blockchain-driven enterprise. By enabling broker-dealer functions and asset-management capabilities under VARA’s oversight, Animoca gains a regulated on-ramp for institutional and qualified investors, potentially accelerating large-scale partnerships and liquidity channels for its portfolio companies. This is particularly relevant as the company maintains a diversified portfolio—encompassing The Sandbox, Open Campus, and Moca Network—while continuing to back early-stage projects that align with its long-term strategy in decentralized ecosystems.

For Dubai, the approval reinforces a deliberate effort to attract structured capital and sophisticated investment strategies into digital-asset ventures. The license depiction in VARA’s public register confirms a formal recognition of Animoca’s operations within the emirate and suggests a framework under which the company can collaborate with Web3 foundations and other international players—an important signal for both developers and financiers looking for regulated access to Dubai’s growing crypto infrastructure.

On the corporate side, the move dovetails with Animoca’s ongoing efforts to broaden its influence in the blockchain space. The company has been expanding its reach through portfolio expansion, strategic acquisitions, and partnerships that blend gaming, digital collectibles, and interoperable ecosystems. The Somo acquisition in January, which added playable and tradable digital collectibles to Animoca’s repertoire, underscores a strategy to combine asset-backed experiences with a regulated, institution-facing platform. This combination could help the firm monetize digital assets through more formalized channels while maintaining its emphasis on creator economies and user-owned ecosystems.

Altogether, the Dubai license positions Animoca at the intersection of regulated finance and Web3 innovation—a space that investors and builders have increasingly prioritized as crypto markets mature. The licensing choice also aligns with a broader UAE narrative of modernization and regulatory clarity, where oversight is paired with a deliberate openness to institutional participation in digital-asset markets.

What to watch next

- VARA’s ongoing oversight of licensed entities: continued monitoring of market conduct and compliance expectations for broker-dealer activities in the emirate.

- Expansion of Animoca’s regional activities: potential collaborations with Dubai-based institutions and Web3 foundations, and integration of Somo and other assets into regulated product offerings.

- Further licensing activity in Dubai: follow-on approvals for additional asset classes or service models, signaling the pace of institutional crypto adoption in the region.

- Regulatory alignment within the UAE: broader moves to harmonize crypto frameworks across Dubai and Abu Dhabi, and among allied Gulf markets.

Sources & verification

- VARA public register entry for Animoca Brands Middle East Advisory FZCO (license issued Feb. 5)

- Animoca Brands announcement: Animoca Brands secures VASP licence from Dubai’s VARA

- Animoca Brands expands portfolio with Somo acquisition

- BitGo awarded VARA broker-dealer license for its Middle East and North Africa unit

Dubai license expands Animoca’s Web3 footprint

Dubai’s VARA granted Animoca Brands a virtual-asset service provider license that unlocks broker-dealer and investment-management capabilities for virtual assets within the emirate, excluding the Dubai International Financial Centre. The license, officially issued on Feb. 5 and logged in VARA’s public register, opens the door for Animoca to serve institutional and qualified investors under VARA’s supervision. The registry entry confirms the formal scope of permitted activities and marks a notable milestone for a company whose portfolio spans The Sandbox, Open Campus, and Moca Network, along with a broad set of early-stage projects in the blockchain and gaming landscape. In comments accompanying the license, Omar Elassar, Animoca’s managing director for the Middle East and head of global strategic partnerships, described the move as a way to deepen partnerships with Web3 foundations and global institutions within a well-regulated framework.

The Dubai license is part of a broader pattern in which the emirate has actively cultivated regulated pathways for digital assets to foster institutional participation while maintaining oversight. VARA, established in 2022 to regulate asset issuance, trading, and related services across Dubai’s mainland and its free zones, has signaled a firm stance against unregistered activity. The regulator has also been active in enforcement, including financial penalties assessed against entities for unlicensed operations and marketing violations, underscoring the balance Dubai seeks between encouraging innovation and ensuring consumer protection and market integrity.

Animoca Brands’ footprint in the region extends beyond licenses. The company has built a diversified Web3 platform ecosystem that includes The Sandbox, a leading virtual world, along with Open Campus and the Moca Network. These projects are designed to integrate user-generated content, creator economies, and interoperable assets across multiple experiences. The company has also been expanding its investment thesis in digital collectibles and blockchain-based entertainment, backing a wide array of initiatives across the ecosystem.

In January, Animoca expanded its strategic capabilities by acquiring Somo, a gaming and digital-collectibles company, which brought playable and tradable collectibles into Animoca’s asset mix. The acquisition aligns with Animoca’s broader strategy of combining interactive experiences with a regulated, institution-facing platform, potentially enabling new revenue models and liquidity channels for Web3 projects within Dubai’s regulatory framework. While Somo’s integration is ongoing, the deal illustrates how Animoca intends to leverage regulatory access in Dubai to accelerate growth and broaden its reach in the Middle East’s burgeoning crypto market.

As Dubai continues to refine its regulatory approach and attract more institutional players, Animoca’s VARA license stands as a tangible signal of the emirate’s commitment to structured, compliant innovation in digital assets. For industry observers, the development highlights how major Web3 builders are moving toward regulated environments that can support scalable, investor-grade activity while preserving the decentralized and creator-centric ethos at the core of the sector.

Crypto World

Metaplanet Reports $605 Million Loss After Billions Spent on Bitcoin

TLDR

- Metaplanet posted a $605 million loss due to the decline in Bitcoin’s value.

- The company spent $3.8 billion on Bitcoin, purchasing the asset at an average price of $107,000 per coin.

- Metaplanet’s Bitcoin holdings are currently down by 37%, reflecting an unrealized loss of $1.4 billion.

- Despite the losses, the company saw an 81% increase in operating profit from its options business.

- Metaplanet continued purchasing Bitcoin even when the price exceeded $100,000, making its largest purchases in September and October.

Metaplanet, a Japanese firm that heavily invested in Bitcoin, has revealed a significant financial setback. The company announced a loss of ¥95 billion, or $605 million, for the past year. This decline follows the cryptocurrency’s steep drop in price from its all-time highs in October.

Metaplanet’s Losses Stem from Falling Bitcoin Value

The primary reason behind Metaplanet’s financial struggles lies in the falling value of its Bitcoin holdings. The firm’s 35,100 Bitcoin, which was worth $2.4 billion, has seen a dramatic decline in value. Since the company began accumulating Bitcoin 21 months ago, it has spent approximately $3.8 billion, acquiring the digital asset at an average price of $107,000 per Bitcoin.

At the current market value, Metaplanet’s Bitcoin holdings are down by about 37%, reflecting an unrealized loss of $1.4 billion. In the last quarter, ending December 31, the company’s Bitcoin stash lost ¥102 billion, or $664 million, in value. Despite these losses, Metaplanet’s stock price saw a minor increase to ¥326 on Monday.

Revenue from Premiums Amid the Losses

Metaplanet’s revenue model remains largely dependent on premiums from writing options. Over the course of the year, the company’s option premiums increased substantially, rising to ¥7.9 billion, or $51 million. This marks a sharp contrast to the previous ¥691 million, or $4.5 million, recorded in the prior year.

The firm has projected an 81% increase in operating profit, which it expects to come from its options business. While Metaplanet’s Bitcoin holdings have significantly decreased in value, this shift in focus toward its options business aims to provide some financial stability.

Bitcoin Purchases Amid the Decline

Metaplanet has continued to invest in Bitcoin even as its value fluctuated. The company made some of its largest purchases when Bitcoin was trading above $100,000. In September, Metaplanet acquired $630 million worth of Bitcoin when the price was around $106,000, followed by another purchase of $615 million in October.

In total, Metaplanet has been purchasing Bitcoin through a combination of common stock issuance and preferred shares. The company’s strategy mirrors that of Michael Saylor’s firm, Strategy, which has also invested heavily in Bitcoin. However, unlike Strategy, Metaplanet has introduced products like MERCURY and MARS to help mitigate market risks.

Crypto World

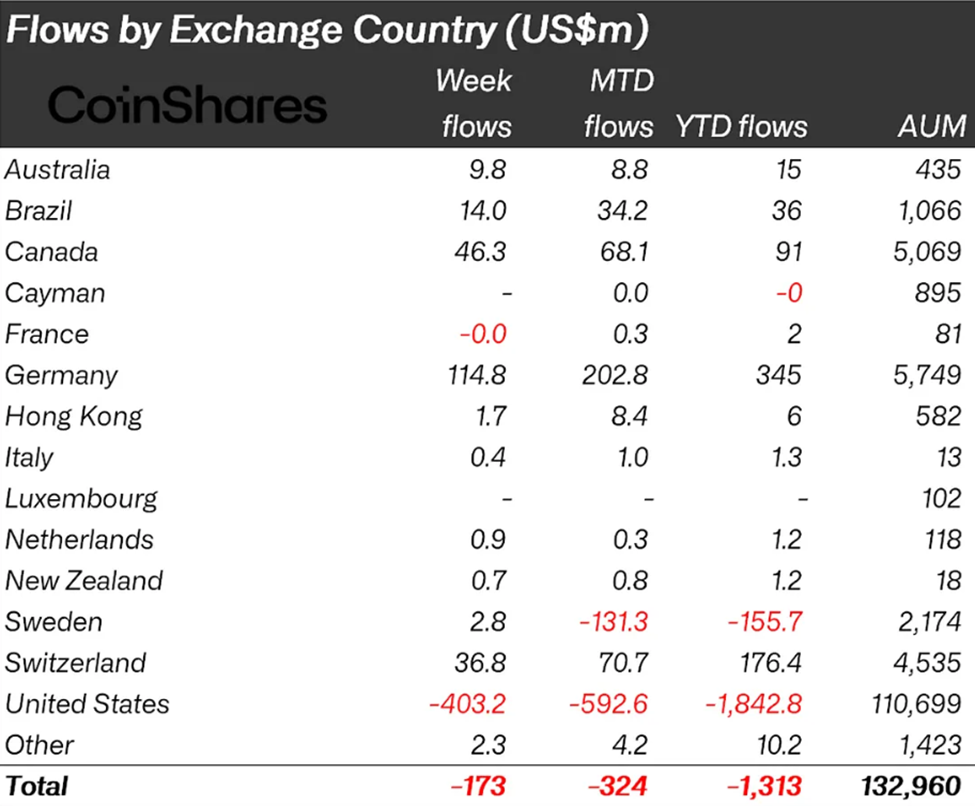

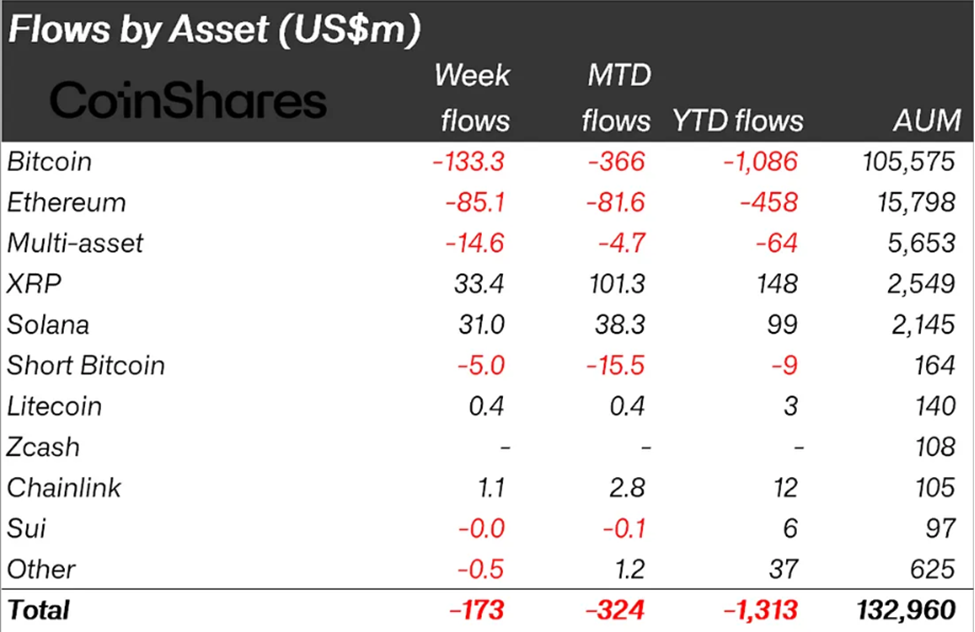

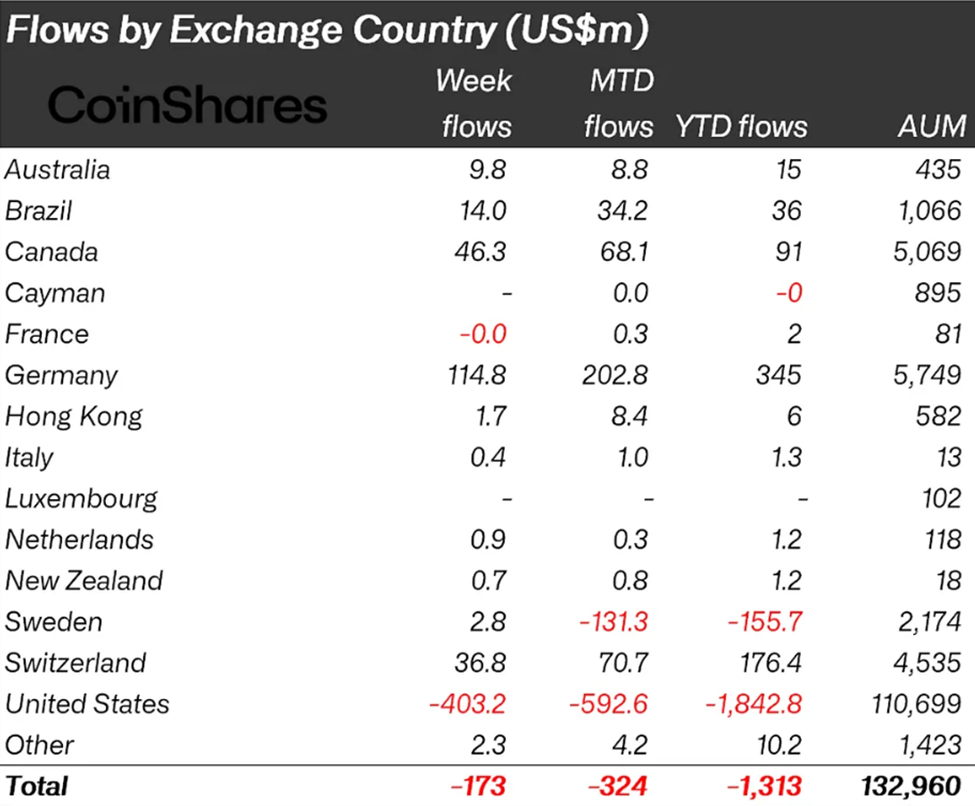

Altcoins See Selective Strength Amid $173 Million Crypto Outflows

Crypto funds recorded a fourth consecutive week of net outflows, shedding $173 million, as investor caution persisted across major digital assets.

However, the pace of withdrawals has slowed markedly from the heavy selling seen in late January and early February, while select altcoins have continued to attract fresh capital.

Sponsored

Sponsored

Crypto Outflows Persist but Slow from January Peaks

According to the latest weekly fund flows report from CoinShares, cumulative outflows over the past four weeks have reached $3.74 billion, reflecting sustained weak sentiment following earlier market volatility.

While outflows continued, last week’s figure was broadly in line with the previous week’s $187 million decline, suggesting the sharp liquidation phase may be easing.

Earlier in the cycle, digital asset funds experienced much steeper withdrawals, including roughly $1.7 billion in each of the final weeks of January.

Market activity also cooled significantly, with ETF trading volumes dropping to $27 billion, down sharply from the record $63 billion reported the week before.

The decline in turnover suggests investors may be stepping back from aggressive repositioning, even as broader uncertainty persists.

Despite the overall negative flows, sentiment improved slightly toward the end of the week. Softer-than-expected US inflation data helped spark $105 million in inflows on Friday.

“Sentiment improved slightly on Friday following weaker-than-expected CPI data,” wrote James Butterfill, head of research at CoinShares.

This suggests macroeconomic signals continue to play a decisive role in shaping short-term crypto demand.

Sponsored

Sponsored

Regional Divergence Becomes More Pronounced as Bitcoin and Ethereum Lead Withdrawals

One of the most notable trends in the latest data was a widening regional divide. The US accounted for $403 million in outflows. This made it the primary driver of the global decline.

While US investors remain cautious, potentially reflecting macro uncertainty and positioning shifts, institutions in other markets may be viewing the recent price weakness as an opportunity to accumulate.

Meanwhile, the largest digital assets continued to bear the brunt of negative sentiment. Bitcoin investment products saw $133 million in outflows, the weakest performance among major assets.

Sponsored

Sponsored

Interestingly, short Bitcoin products also recorded outflows totaling $15.4 million over the past two weeks.

Historically, declines in demand for bearish positions have sometimes coincided with periods of market capitulation. Therefore, it may signal that the worst of the selling pressure could be nearing exhaustion.

Ethereum funds also struggled, posting $85.1 million in outflows as investors reduced exposure to the second-largest crypto. Smaller products were not immune either, with Hyperliquid seeing modest withdrawals of around $1 million.

Altcoins Show Signs of Rotation

In contrast to the broader trend, several altcoins continued to attract capital. XRP led inflows at $33.4 million, followed closely by Solana at $31 million, while Chainlink added $1.1 million.

Sponsored

Sponsored

These inflows point to a selective rotation rather than a wholesale exit from the crypto sector. Investors appear to be reallocating toward assets perceived to have stronger narratives or relative momentum, even as exposure to larger-cap tokens declines.

Taken together, the latest data paints a picture of a market still under pressure but stabilizing compared with the intense selling seen earlier in the year.

Crypto outflows remain persistent, yet their reduced scale, coupled with regional inflows and continued interest in certain altcoins, suggests investors are adjusting portfolios rather than abandoning the asset class outright.

Crypto World

YZi Labs Files for Board Expansion at CEA Industries Amid BNB Treasury Dispute

TLDR

- YZi Labs has filed a revised preliminary consent statement with the SEC to expand the board at CEA Industries.

- The expansion aims to place nominees who align with YZi Labs’ vision for the company’s future.

- YZi Labs raised $500 million in a private placement to build the world’s largest corporate BNB treasury.

- The company accused CEA Industries’ asset managers of attempting to shift from a BNB-only strategy to include other cryptocurrencies.

- The fallout from the treasury dispute caused CEA Industries’ stock to drop by 87%.

YZi Labs has formally filed a revised preliminary consent statement with the SEC, aiming to expand the Board of Directors at CEA Industries Inc. The expansion seeks to add new members who align with YZi Labs’ vision for the company. This move follows mounting tensions over the company’s digital asset strategy, particularly its management of the BNB treasury.

YZi Labs Pushes for Board Expansion

YZi Labs is looking to place nominees in new positions on the CEA Industries board. This move comes after a series of disagreements regarding the company’s asset management. The group has made it clear that its goal is to influence the direction of CEA Industries by installing directors who support their vision.

The push for expansion comes after a private placement raised $500 million for the company in July 2025. The capital was initially intended to build the world’s largest corporate BNB treasury. However, by the end of 2025, YZi Labs accused CEA Industries’ asset managers of trying to diversify away from a BNB-only strategy, which led to disputes within the company.

BNB Treasury Controversy Prompts Action

YZi Labs’ dispute with CEA Industries revolves around its BNB treasury management. The company had amassed over 515,000 BNB, worth $465 million in August 2025, to serve as its main reserve. However, tensions escalated in December 2025 when YZi Labs accused 10X Capital and BNC management of secretly adding other cryptocurrencies, such as Solana, into the strategy.

This shift away from a strict BNB-focused approach led to an 87% drop in CEA Industries’ stock from its post-announcement highs. The rift over the treasury strategy has now evolved into a power struggle, with YZi Labs pushing to control the company’s future by expanding the board.

SEC Review Delays Shareholder Vote

YZi Labs filed its revised preliminary consent statement with the SEC to initiate the board expansion. The filing is currently under review to ensure compliance with legal requirements for soliciting shareholder consents. Shareholders are unable to vote or submit consent forms until the SEC finishes its review process.

Once the SEC approves the filing, YZi Labs will distribute a white consent card to shareholders. This will allow shareholders to officially vote for or against the expansion of the board and the proposed new nominees.

Crypto World

Bitcoin Capitulation Deepens with $2B Daily Losses as Markets Flash Crash Warnings

TLDR:

- Bitcoin realized losses surpassed $2 billion daily from February 5-11, marking the highest levels in 2025

- Seven-day loss averages indicate sustained capitulation among weak hands rather than temporary selling

- S&P 500 put-call ratio reached 1.38, the highest reading since Liberation Day, signaling elevated crash risk

- Historical data shows P/C ratios above 1.1 consistently preceded major equity market declines in 2024-2025

Bitcoin investors recorded over $2 billion in daily realized losses throughout the week of February 5-11, signaling potential capitulation among market participants.

The figures represent the highest loss levels observed in 2025 as selling pressure intensifies. Analysts interpret the sustained outflows as evidence that weaker investors are exiting positions after weeks of correction.

Broader market indicators simultaneously point to elevated crash risks, creating a challenging environment for digital assets.

Capitulation Metrics Reach Critical Thresholds

Data from market analyst Darkfost reveals that realized losses have exceeded $2 billion daily since early February. The seven-day moving average maintains this elevated level, indicating persistent rather than sporadic selling. This pattern emerged after January 20, when the market shifted from accumulation to distribution mode.

The magnitude of these losses suggests genuine capitulation is underway. Investors who purchased Bitcoin at higher prices are crystallizing substantial losses rather than waiting for recovery. This behavior typically occurs when market participants lose confidence in near-term price appreciation.

However, the data requires careful interpretation due to several complicating factors. UTXO consolidation transactions can inflate realized loss figures without representing true capitulation.

Additionally, institutional movements such as recent Fidelity Investments transfers contribute to the headline numbers.

Despite record loss levels, Bitcoin prices have demonstrated unexpected resilience in recent sessions. The cryptocurrency has avoided sharp declines even as selling pressure mounts.

This divergence between realized losses and price action indicates strong support from long-term holders who refuse to sell at current levels.

Crash Warnings Compound Downside Risks

Market trader Leshka_eth has documented a troubling pattern in equity market indicators. The put-call ratio currently stands at 1.38, matching the highest reading since the Liberation Day market event. Historical precedent shows S&P 500 declines consistently follow P/C spikes above 1.1-1.2.

This ratio reflects intense hedging activity as investors purchase protective puts. Dealers who sell these options must hedge by selling index exposure through futures and exchange-traded funds.

The resulting selling pressure removes natural market support, potentially triggering self-reinforcing downward spirals.

Multiple headwinds are converging to pressure risk assets. Kevin Warsh’s Federal Reserve Chair nomination signals potential monetary tightening and balance sheet reduction.

The central bank’s $6.6 trillion balance sheet could face systematic unwinding, removing liquidity from financial markets.

Global markets have already contracted sharply, with $12 trillion in losses recorded during January alone. Commodities experienced severe declines, including gold down 13% and silver plunging 37%.

Corporate earnings reports reveal deteriorating fundamentals even as valuations remain historically elevated. These conditions create an unfavorable backdrop for speculative assets like Bitcoin, where capitulation may accelerate if equity markets destabilize further.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video7 hours ago

Video7 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show

-

Sports6 days ago

Sports6 days agoWinter Olympics 2026: Australian snowboarder Cam Bolton breaks neck in Winter Olympics training crash