Crypto World

What Happened to Compound’s Crypto Lending Empire?

Compound was an OG of DeFi lending, but missteps have knocked it off its perch.

Compound was once the default answer for crypto lending in decentralized finance. Launched in 2018 by Robert Leshner and Geoffrey Hayes, the protocol lets users earn interest or borrow assets directly on Ethereum, in a fully decentralized manner, without banks or brokers.

For early DeFi users, it felt obvious. The project raised millions in backing from Andreessen Horowitz, Bain Capital Crypto, Paradigm, and Coinbase Ventures.

Compound also helped popularize yield farming, especially after launching its governance token, COMP, in 2020, which turned passive users into active participants.

By 2021, Compound was the core infrastructure for crypto lending. Billions of dollars sat in its smart contracts. Other protocols like Yearn Finance and exchanges like Coinbase also integrated it, cementing the protocol’s dominance in the space.

That changed in October 2021, when the protocol’s liquidity began to thin quickly.

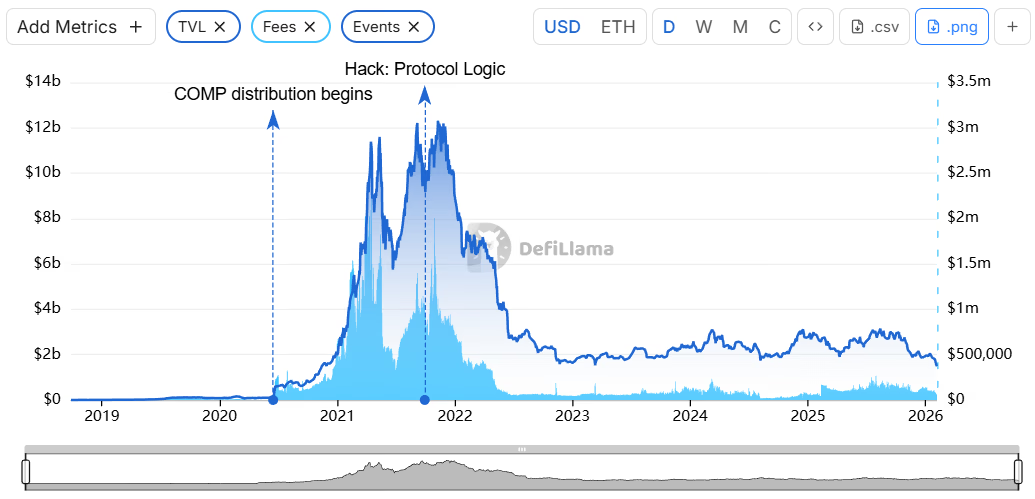

The decline is evident in Compound’s total value locked (TVL), which fell sharply from a November 2021 peak of $12 billion to just $2.2 billion by November 2022, per data from DefiLlama.

Value Leak

The problems began when a protocol update called “Proposal 62,” intended to adjust COMP rewards, went live with a bug. As a result, the protocol began overpaying rewards, leaking tens of millions of dollars’ worth of COMP to users.

Because of how Compound governance worked, the team couldn’t immediately stop it. The fix had to wait through a mandatory timelock. In the meantime, tokens kept flowing out, and confidence in the protocol’s stability went with them.

In an X post on Sept. 30, 2021 Leshner asked recipients who received excess COMP to return it and offered a 10% reward for whitehat returns.

He added that “otherwise, it’s being reported as income to the IRS, and most of you are doxxed.” The threat sparked swift backlash from the crypto community, and Leshner later called it a bone-headed post and walked it back.

But funds continued to leave, and tens of millions of dollars flowed out of the protocol in the weeks after the bug was discovered. Even though the issue was fixed, the incident was enough to shake confidence.

Bad Timing

It’s hard to say if the October 2021 bug alone ended Compound’s dominance, but it clearly left the protocol vulnerable at a bad time. By December 2021, Bitcoin had started falling from its $69,000 all-time high, signaling the start of a multi‑year crypto bear market.

As crypto prices fell, lending activity slowed across DeFi as borrowers began pulling funds. For Compound, which relied heavily on pooled liquidity markets, those outflows hit harder than rivals like Aave and Maker, which were built around isolated or more flexible risk models.

The contrast became clearer as the 2022 crypto winter came in. After Terra’s multi-billion dollar collapse, the implosion of FTX, and a string of centralized lender failures, the crypto community grew more sensitive to systemic risk.

Behind the scenes, leadership was changing too. Leshner stepped back from day-to-day involvement, and by June 2023, he left Compound and founded Superstate, a tokenization platform that allows companies to issue and trade their public shares on blockchain.

As a result, today Compound looks markedly different from its peak, when crypto lending was still taking off. Today, Compound’s once double-digit TVL sits at just below $1.4 billion. That makes it the 7th largest lending protocol in DeFi by TVL, where Aave dominates with a TVL of nearly $27 billion.

Monthly fees have dropped from a 2021 peak of nearly $47 million to about $3.5 million, while the protocol’s highest monthly revenue since the start of 2025 was $888,666, down from an all-time high of $5.14 million in April 2021.

Compound declined The Defiant’s request for comment for this story.

Crypto World

China’s U.S. Treasury Holdings Fall to Lowest Share Since 2001 Amid Gold Accumulation

TLDR:

- China’s U.S. Treasury holdings fell to $682.6B, down from a $1.3T peak in 2013.

- China’s share of foreign Treasury holdings dropped to 7.3%, the lowest since 2001.

- Gold reserves reached 2,308 tonnes after 15 straight months of central bank buying.

- Total foreign U.S. Treasury holdings hit a record $9.36T despite China’s reduction.

China’s holdings of U.S. Treasuries declined to their lowest share in foreign reserves since 2001. As of November 2025, Beijing held $682.6 billion in U.S. government debt, while its gold reserves climbed to record levels.

Treasury Holdings Decline to Multi-Decade Low Share

Data shows China’s Treasury holdings dropped to $682.6 billion in November 2025. This marks a sharp fall from its 2013 peak of over $1.3 trillion.

China now accounts for 7.3% of total foreign-held U.S. Treasuries. That share is the lowest recorded since 2001. Despite the decline, overall foreign holdings reached a record $9.36 trillion. Japan and the United Kingdom remain the largest foreign holders.

The reduction has drawn attention across financial markets. However, bond markets have remained stable during the adjustment period. The figures indicate a gradual rebalancing rather than an abrupt market disruption.

On X, user Wimar X claimed that China “dumped $638 billion” in U.S. Treasuries. The post also stated that current holdings are the lowest since 2008. The tweet further suggested China is “exiting the system.”

Official data confirms the decline in holdings. However, total foreign demand for Treasuries remains strong, led by other major economies.

Gold Reserves Rise for 15 Consecutive Months

At the same time, the People’s Bank of China continued adding gold to its reserves. January 2026 marked the fifteenth straight month of gold purchases.

China’s gold holdings reached 2,308 tonnes, valued at about $370 billion. Gold now represents roughly 5% of the country’s $3.3 trillion in total reserves. This is the highest recorded level for China’s gold stockpile.

Some market observers view the shift as a move toward hard assets. Others describe it as standard reserve diversification. The increase in gold has occurred alongside the steady reduction in Treasury exposure.

Even so, China remains one of the largest holders of U.S. government debt globally. The adjustment appears gradual rather than sudden.

The combination of lower Treasury holdings and higher gold reserves reflects changing reserve allocations. Meanwhile, global Treasury markets continue to operate without major volatility.

Crypto World

BTC, ETH, BNB, DOGE Build Liquidation Pressure After $60K BTC Test

TLDR:

- Aggregated liquidation data shows rising long and short exposure across major crypto assets.

- Bitcoin’s move to $60K triggered a new phase of positioning in derivatives markets.

- Traders expect consolidation for up to 30 days before a clear trend emerges.

- Expanding liquidation clusters increase the chance of a sharp price swing.

Recent liquidation data across major cryptocurrencies shows mounting pressure in derivatives markets. Aggregated levels for Bitcoin, Ether, BNB, and Dogecoin point to growing long and short exposure. Market participants now watch for a decisive move after Bitcoin’s return to $60,000.

Liquidation Levels Expand Across Major Crypto Assets

Crypto analyst Joao Wedson shared aggregated liquidation levels for Bitcoin, Ethereum, BNB, and Dogecoin over the past seven days. The data shows consistent growth in both long and short positions across these assets.

According to Wedson’s tweet, traders continue building exposure on both sides of the market. As leverage accumulates, liquidation clusters expand above and below current price levels. This structure often sets the stage for sharp price swings once liquidity is triggered.

He noted that the current setup increases the probability of a strong move in the coming days. When long and short positions rise together, the market often seeks liquidity in one direction. As a result, volatility tends to increase after periods of compression.

However, the data does not confirm the direction of the next breakout. Instead, it shows a market preparing for expansion. Traders remain positioned for both downside continuation and recovery.

30-Day Consolidation Expected Before Clear Direction

Wedson also stated that the market may require around 30 days of consolidation after Bitcoin reached $60,000. This cooling period could allow excessive leverage to reset. Until then, price action may remain range-bound.

Many traders continue to expect further capitulation. Others anticipate a steady recovery from recent lows. Even so, Wedson suggested that neither scenario is likely to fully develop without extended consolidation.

The return of Bitcoin to the $60,000 level marked a psychological shift. Yet sustained direction often follows structural balance. Therefore, time may be required before momentum builds decisively.

As positions accumulate, liquidation levels act as reference zones for traders. A breakout above or below these clusters could trigger cascading liquidations. That sequence may define the next major move.

For now, derivatives data reflects tension rather than clarity. Both bullish and bearish participants remain active. Consequently, the market appears positioned for volatility, though timing remains uncertain.

Crypto World

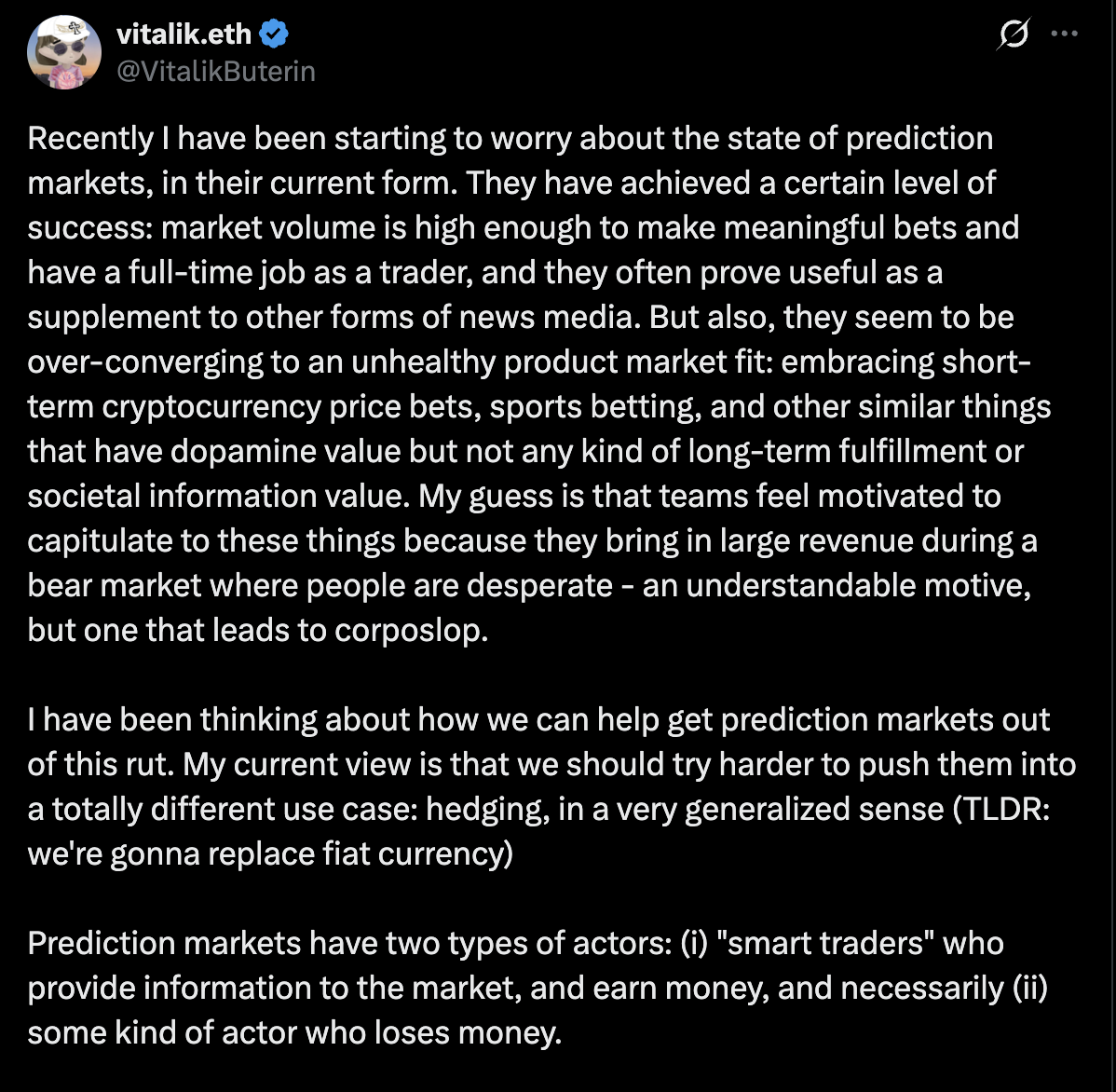

Prediction Markets Must Evolve Into Hedging Platforms

Ethereum co-founder Vitalik Buterin has grown wary of how prediction markets are evolving, warning they risk becoming short-term price betting engines rather than tools that support long-term infrastructure. In a post on X, he argued that the current trajectory shows “over-converging” focus on immediate price moves and speculative behavior. He called for a shift toward onchain prediction markets that serve as hedges against price exposure for consumers, rather than betting mechanisms that amplify fiat-driven volatility. The thrust of his critique centers on moving from pure price bets to broader markets that can stabilize expenditures over time. He suggested a framework that blends prediction markets with AI-driven tools to counter inflationary pressures faced by households and businesses alike. In essence, his stance positions prediction markets as potential risk-management primitives if redesigned with real-world spending in mind.

Key takeaways

- Buterin argues prediction markets are tilting toward short-horizon price betting, which he views as unhealthy for long-term building in crypto and beyond.

- He envisions a model where onchain prediction markets are paired with AI large-language models to hedge consumer price exposure across goods and services.

- The proposed system would create price indices by major spending categories and regional differences, with prediction markets for each category.

- Each user could have a local LLM that maps their expenses and generates a personalized basket of prediction-market shares representing several days of future outlays.

- Supporters say such markets can offer valuable market intelligence and hedging capabilities, potentially improving price stability in a fiat-dominated environment.

- Existing prediction-market platforms like Polymarket and Kalshi are cited as part of the broader ecosystem that could be reoriented toward hedging and risk management rather than speculative bets.

Tickers mentioned: $ETH

Sentiment: Neutral

Market context: The discussion sits at the intersection of onchain finance, risk management, and regulatory scrutiny, as investors and developers weigh how to apply AI tools to price hedging while navigating evolving policy debates around prediction markets.

Why it matters

The idea of coupling onchain prediction markets with AI-assisted personal finance tools signals a broader attempt to retrofit crypto-native mechanisms for real-world stability. If successful, the approach could reframe how individuals and businesses manage price risk—shifting from a speculative posture to a practical hedging framework that protects purchasing power in an inflationary fiat environment. Buterin’s proposal emphasizes a user-centric model in which private data about expenses informs a custom set of market instruments. That alignment between individual spending patterns and market-based hedges could, in theory, yield more predictable budgeting for everyday goods and services.

Critics of prediction markets often point to concerns about manipulation, liquidity distribution, and regulatory risk. But proponents argue that when linked to digital, onchain ledgers and AI-driven personalization, these markets can deliver more resilient price signals and a public-good function by aggregating diverse information. The debate touches broader questions about how decentralized finance should interact with traditional market dynamics and consumer protection standards. In this framing, the role of prediction markets extends beyond forecasting political events or commodity prices to becoming a probabilistic toolkit for household and business planning.

As the ecosystem evolves, the boundary between information services and financial instruments remains a focal point for policymakers and practitioners alike. The discussion around onchain prediction markets is part of a wider push to explore how AI can augment human decision-making in finance, risk assessment, and purchasing power. The outcome will hinge on how convincingly the model demonstrates real-world utility, addresses liquidity and governance challenges, and remains compliant with applicable rules in various jurisdictions.

What to watch next

- The publication of any whitepapers or technical notes detailing the proposed onchain prediction-market architecture and the role of local LLMs in personal expense modeling.

- Emerging experiments or pilot programs that test category-based price indices and category-specific prediction markets in real-world settings.

- Regulatory responses or clarifications around prediction markets and onchain hedging tools, particularly in jurisdictions weighing consumer protection and market integrity.

- Public discussions and research from academics and practitioners about the feasibility and governance of personalized prediction-market portfolios.

- Follow-up statements or interviews from Vitalik Buterin or affiliated teams that expand or refine the proposed framework.

Sources & verification

- Vitalik Buterin’s X post outlining concerns about prediction markets and the proposed shift to hedging mechanisms. Link: https://x.com/VitalikButerin/status/2022669570788487542

- Cointelegraph op-ed discussing onchain prediction markets and the integration of AI LLMs. Link: https://cointelegraph.com/opinion/blockchain-prediction-markets

- Cointelegraph coverage on prediction markets and information markets, including perspectives on market intelligence. Link: https://cointelegraph.com/news/prediction-markets-information-finance

- Cointelegraph coverage of academic perspectives on prediction markets, including comments from Harry Crane of Rutgers University. Link: https://cointelegraph.com/news/prediction-markets-polymarket-polls

- CFTC-related developments regarding proposals on prediction markets, cited in Cointelegraph coverage. Link: https://cointelegraph.com/news/cftc-withdraws-proposal-ban-sports-political-prediction-markets

Rethinking prediction markets as hedging tools with AI

Ethereum co-founder Vitalik Buterin has grown wary of how prediction markets are developing, warning they risk becoming short-term price betting engines rather than tools that support long-term infrastructure. In a post on X, he argued that the current trajectory shows “over-converging” focus on immediate price moves and speculative behavior. He called for a shift toward onchain prediction markets that serve as hedges against price exposure for consumers, rather than betting mechanisms that amplify fiat-driven volatility. The thrust of his critique centers on moving from pure price bets to broader markets that can stabilize expenditures over time. He suggested a framework that blends prediction markets with AI-driven tools to counter inflationary pressures faced by households and businesses alike. In essence, his stance positions prediction markets as potential risk-management primitives if redesigned with real-world spending in mind. He proposed a system in which price indices are constructed across major spending categories, with regional variations treated as distinct categories, and a dedicated prediction market for each.

Buterin elaborates a mechanism where each user—whether an individual or a business—operates a local AI model that understands that user’s expenses. This AI would curate a personalized basket of market shares, effectively representing “N” days of predicted future outlays. The intent is to offer a dynamic hedge against rising costs, allowing participants to hold a mix of assets to grow wealth while maintaining a safety net against inflation via tailored prediction-market positions.

Supporters of prediction markets argue they provide valuable information about global events and financial trajectories, potentially serving as a hedge against a variety of risks. They point to platforms such as Polymarket and Kalshi as examples of how publicly sourced probabilities can supplement traditional data sources. Academic voices, including Rutgers professor Harry Crane, contend that well-structured prediction markets can outpace conventional polls in forecasting accuracy and should be treated as a public good in principle, assuming robust governance and safeguards. Critics, however, worry about misuse, regulatory constraints, and the potential for manipulation if markets are driven by centralized or biased actors. The debate straddles both the philosophy of information markets and the practical design challenges of turning them into reliable hedges for everyday life.

Ultimately, the question is whether a hybrid system—combining onchain markets with AI personalization—can deliver tangible price stability without sacrificing liquidity or inviting abuse. If such a model proves viable, it could redefine how crypto-native financial instruments interact with the real economy, offering tools that help households and firms weather price fluctuations while contributing to a broader ecosystem that values data-driven risk management.

Crypto World

Lightning Labs Unveils Open-Source Toolkit Enabling AI Agents to Transact with Bitcoin

TLDR:

- Lightning Labs released open-source toolkit enabling AI agents to transact with bitcoin independently.

- The L402 protocol allows AI systems to pay for services without requiring accounts or authentication.

- Remote signer architecture separates private keys from agent operations to prevent security breaches.

- Agents can now purchase data feeds and sell services autonomously using bitcoin through micropayments.

Lightning Labs has released an open-source toolkit that enables artificial intelligence agents to send and receive bitcoin payments independently through the Lightning Network.

The technology eliminates the need for human intervention, traditional accounts, or API authentication systems. This development represents a major advance toward autonomous machine commerce, where AI systems can directly purchase data, services, and computational resources without human oversight.

Automated Payment Infrastructure for AI Systems

The new toolkit addresses a critical limitation in current AI agent capabilities. While modern AI systems can write code, analyze information, and execute complex tasks, they cannot easily conduct financial transactions.

Traditional payment methods require human identity verification through credit cards, bank accounts, and regulated payment platforms.

These systems depend on personal documentation and manual approval processes that AI agents cannot navigate.

Lightning Labs explained that agents face a fundamental barrier despite their technical sophistication. The company stated that AI systems still struggle with payments despite being able to read documentation and call APIs effectively.

This gap exists because agents need to transact instantly and programmatically at massive scale, requirements incompatible with conventional financial infrastructure.

The solution centers on L402, a protocol built upon the HTTP 402 “Payment Required” status code. When an AI agent attempts to access paid content or services, the server responds with a Lightning invoice.

The agent pays this invoice and receives cryptographic proof of payment. This proof functions as an access credential, allowing the agent to retrieve the requested resource.

Lightning Labs introduced “lnget,” a command-line tool that automates the entire payment process. When an agent encounters paid content, lnget handles invoice payment in the background without requiring manual steps.

The tool supports multiple Lightning backend configurations, including direct connections to local nodes and encrypted tunnel access through Lightning Node Connect.

Michael Levin, head of product development at Lightning Labs, emphasized the toolkit allows agents to use bitcoin payments without mandatory identification or registration requirements.

Security Architecture and Commercial Applications

Security measures form a core component of the toolkit’s design. The recommended configuration uses a remote signer architecture that separates private key storage from payment operations.

The signing machine holds private keys offline while the agent machine executes transactions. This separation ensures that compromised agent systems cannot expose private keys.

The macaroon-based credential system enables fine-grained permission control. Developers can create credentials limited to specific functions such as payment-only or read-only access.

These bearer tokens can be further restricted without issuing new credentials. The system supports five preset security roles tailored to different agent functions.

On the server side, Aperture enables developers to convert standard APIs into pay-per-use services. This reverse proxy handles L402 protocol negotiation and supports dynamic pricing based on resource consumption.

Backend systems require no Lightning-specific modifications. The combination creates a complete commerce loop where one agent can host paid services while another consumes them.

The toolkit enables direct agent-to-agent transactions at scale. AI systems can now purchase premium data feeds, acquire computational resources, and sell services for bitcoin.

This infrastructure supports micropayments that would be economically unfeasible with traditional payment rails. Lightning Labs positions the technology as foundational infrastructure for an emerging machine economy where autonomous agents conduct billions of programmatic transactions.

Crypto World

Prediction Markets Should Become Hedges for Consumers

Ethereum co-founder Vitalik Buterin said he is starting to “worry” about the direction of prediction markets and suggested that they shift to become marketplaces to hedge against price exposure risk for consumers.

Prediction markets are “over-converging” to “unhealthy” products that are focused on short-term price betting and speculative behavior as opposed to long-term building, Buterin said in an X post.

Instead, onchain prediction markets coupled with AI large-language models (LLMs) should become general hedging mechanisms to provide consumers with price stability for goods and services, Buterin said. He explained how this system would work:

“You have price indices on all major categories of goods and services that people buy, treating physical goods and services in different regions as different categories, and prediction markets on each category.

Each user, individual or business, has a local LLM that understands that user’s expenses and offers the user a personalized basket of prediction market shares, representing ‘N’ days of that user’s expected future expenses,” he continued.

Individuals and businesses can hold a combination of assets to grow wealth and “personalized prediction market shares” to offset the rising cost of living created by fiat currency inflation, Buterin concluded.

Related: CFTC pulls Biden-era proposal to ban sports, political prediction markets

Prediction markets are useful market intelligence tools, supporters say

Prediction markets are crowdsourced intelligence platforms that can provide insight into global events and financial markets, while allowing individuals and businesses to hedge against a wide variety of risks, proponents of prediction markets say.

Prediction markets are more accurate than polls and should be treated as a public good, according to Harry Crane, a statistics professor at Rutgers University.

Crane told Cointelegraph that opponents of prediction markets in the US government want to restrict these platforms because they offer insights that cannot be easily ignored or manipulated by centralized entities.

Prediction markets like Polymarket or Kalshi provide an alternative to information presented in official sources or media reports that can be controlled or manipulated to feed certain narratives by distorting public opinion, Crane said.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

BlackRock Says Bitcoin ETF Holders Stayed Calm Amid Volatility

TLDR:

- Only 0.2% of IBIT assets were redeemed during recent Bitcoin volatility

- BlackRock says ETF investors are long-term and buy-and-hold focused

- Major liquidations occurred on leveraged perpetual platforms

- IBIT has grown to nearly $100B despite short-term market swings

Bitcoin exchange-traded fund investors remained steady during last week’s market turbulence, according to BlackRock.

The asset manager reported minimal redemptions from its iShares Bitcoin Trust, even as leveraged traders faced sharp liquidations across perpetual futures platforms.

BlackRock Reports Limited IBIT Redemptions

A recent post by CryptosRus on X cited comments from BlackRock executive Robert Mitchnick. He stated that only about 0.2% of the $IBIT was redeemed during the recent Bitcoin volatility.

The iShares Bitcoin Trust, known as iShares Bitcoin Trust, has grown to roughly $100 billion in assets in record time. Despite the rapid growth, redemptions during the market swing remained nearly flat.

Mitchnick explained that if hedge funds had aggressively reduced ETF exposure, billions in outflows would have appeared. However, that scenario did not occur. Instead, the bulk of liquidations took place on leveraged perpetual trading platforms.

These remarks came from BlackRock, the world’s largest asset manager with over $14 trillion in assets under management. The firm described its Bitcoin ETF investor base as largely long-term and buy-and-hold oriented.

That characterization suggests the presence of institutional capital rather than short-term trading desks. As a result, ETF flows remained stable even while Bitcoin prices moved sharply.

Leverage Drives Volatility as ETF Base Holds Firm

The contrast between ETF stability and leveraged liquidations stands out. According to the statements referenced in the tweet, leverage created most of the volatility seen during the period.

Perpetual futures platforms often amplify price swings when traders use high leverage. When markets move against those positions, forced liquidations can accelerate declines or rallies.

In this case, the turbulence occurred largely within those leveraged venues. Meanwhile, spot ETF investors did not rush to exit positions. That dynamic marks a shift from earlier crypto cycles dominated by retail speculation.

The steady ETF base points to deeper capital participation in the Bitcoin market. With a growing pool of long-term holders, market shocks may be absorbed differently compared to prior periods.

Moreover, the presence of large asset managers changes the structure of Bitcoin ownership. Institutional allocation through regulated vehicles offers a different capital profile than margin-based trading.

As noted in the tweet, the takeaway centers on the source of volatility. Leverage drove price action, while ETF holders remained composed. For market observers, this separation between trading platforms and fund flows offers a clearer view of where pressure originated.

Crypto World

Paxful Fined $4M After Admitting It Profited From Criminal Activity on Its Crypto Platform

Despite pleading guilty to serious AML violations, Paxful received a reduced $4 million penalty instead of the $112.5 million figure agreed by the parties.

Peer-to-peer virtual asset trading platform Paxful has been sentenced to pay a $4 million criminal penalty after pleading guilty to multiple federal offenses, according to an official press release from the US Department of Justice.

The sentence follows Paxful’s admission that it conspired to promote illegal prostitution, violated the Bank Secrecy Act, and knowingly transmitted funds derived from criminal activity.

Illicit Crypto Flows

The penalty was determined based on the company’s ability to pay. Federal authorities said Paxful profited from facilitating transactions for criminals while promoting its lack of anti-money laundering (AML) controls and failing to comply with applicable money laundering laws, despite knowing that users on its platform were engaged in crimes including fraud, extortion, prostitution, commercial sex trafficking, romance scams, and human trafficking.

Court documents revealed that Paxful operated an online virtual currency platform and money transmitting business where users traded cryptocurrency for cash, prepaid cards, gift cards, and other items. From January 1, 2017, to September 2, 2019, Paxful facilitated more than 26.7 million trades worth nearly $3 billion in total value and generated more than $29.7 million in revenue.

Authorities said Paxful knew that a portion of these transactions involved funds derived from criminal offenses, including fraud schemes and illegal prostitution. The company also deliberately transferred virtual currency on behalf of Backpage, an online advertising platform that later admitted in criminal proceedings that it advertised and profited from illegal prostitution, including content involving minors.

According to the Justice Department, Paxful’s founders referred internally to the “Backpage Effect,” which they credited with helping the platform grow. Between December 2015 and December 2022, Paxful’s dealings with Backpage and a similar website resulted in nearly $17 million worth of Bitcoin being transferred from Paxful wallets to those sites. From this, Paxful earned at least $2.7 million in profits.

The plea agreement states that from July 2015 to June 2019, Paxful marketed itself as a platform that did not require know-your-customer (KYC) information. It not only allowed users to trade without collecting sufficient KYC data but also provided third parties with AML policies that were not implemented or enforced, and failed to file suspicious activity reports despite clear indicators of criminal conduct.

You may also like:

DOJ Cuts Penalty

Paxful pleaded guilty to conspiring to violate the Travel Act by promoting illegal prostitution through interstate commerce, conspiring to operate an unlicensed money transmitting business, and conspiring to violate the Bank Secrecy Act’s AML requirements.

Although the parties agreed that the appropriate criminal penalty was $112.5 million, the department concluded Paxful could only pay $4 million as part of the resolution.

Paxful’s guilty plea was part of a coordinated resolution with the Financial Crimes Enforcement Network (FinCEN), and in July 2024, the company’s co-founder and former CTO, Artur Schaback, also pleaded guilty to related AML violations.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Does Bitcoin $1.4 Trillion Valuation Compare to the Global Asset Landscape?

TLDR:

- Bitcoin’s $1.4 trillion market cap represents just 4% of gold’s $35 trillion global valuation share

- Cryptocurrency comprises 0.4% of bond markets and 1.2% of equities in proportional asset analysis

- Top 100 institutions control 1.13 million BTC while daily mining produces only 450 new coins total

- One percent reallocation from gold holdings would generate $350 billion in new Bitcoin demand flow

Bitcoin’s position within the $100 trillion global financial system reveals stark proportional disparities compared to traditional asset classes.

The cryptocurrency’s $1.4 trillion market capitalization represents 0.4% of worldwide bond markets and 1.2% of global equities as of February 2026.

Crypto analyst Crypto Patel published detailed comparative analysis examining Bitcoin against every major asset category.

The study maps Bitcoin’s current footprint across bonds, stocks, real estate, commodities, and gold holdings. Mathematical projections demonstrate how minor capital shifts from legacy assets could reshape Bitcoin’s valuation significantly.

Bitcoin Ranks as Rounding Error in $100 Trillion Asset Hierarchy

The global asset landscape totals over $100 trillion when combining all major investment categories. Bond markets alone exceed $130 trillion in aggregate value worldwide.

Global equity markets represent approximately $115 trillion in total capitalization. Real estate holdings comprise roughly $380 trillion across residential and commercial properties.

Against this backdrop, Bitcoin’s $1.4 trillion footprint appears mathematically insignificant in proportional terms.

Gold maintains a $35 trillion market capitalization, creating a 25-fold size advantage over Bitcoin. The precious metal’s dominance in store-of-value allocation reflects centuries of institutional acceptance.

Bitcoin currently captures just 4% of gold’s total market share. This comparison highlights the vast distance between digital and physical reserve assets.

Traditional investors continue allocating overwhelmingly toward established safe-haven holdings rather than emerging alternatives.

Crypto Patel’s analysis positions Bitcoin as the smallest component among major global asset classes. The cryptocurrency represents 0.37% of the $380 trillion real estate market.

Corporate and government bonds dwarf Bitcoin by factors exceeding 90 times current valuation. Even within the narrower commodities category, Bitcoin trails far behind aggregate precious metals holdings.

The proportional analysis reveals Bitcoin occupies marginal space in global wealth distribution patterns.

Small Allocation Shifts Generate Outsized Bitcoin Price Impacts

Mathematical modeling demonstrates how percentage-based reallocations dramatically affect Bitcoin prices due to current small market cap.

A 1% shift from gold holdings into Bitcoin would generate approximately $350 billion in new demand. This capital influx would push Bitcoin’s market cap toward $1.75 trillion at current supply levels.

The price per coin would rise substantially given the fixed 21 million maximum supply. Simple proportional calculations reveal asymmetric upside potential from modest allocation changes.

Scenario analysis projects Bitcoin prices under various global asset reallocation assumptions. Capturing 10% of gold’s market share would establish a $5.4 trillion Bitcoin market cap.

This translates to approximately $257,000 per coin based on current circulating supply. A 25% share of gold markets would push valuations toward $10.15 trillion total.

The corresponding per-coin price would approach $483,000 under this allocation model. These projections assume linear market cap relationships without considering supply constraints.

Bond and equity market reallocations produce even more dramatic mathematical outcomes given their larger base sizes. Just 2% of global bond markets flowing into Bitcoin equals $2.6 trillion in new demand.

This exceeds Bitcoin’s entire current market capitalization by 85%. The supply-constrained nature of Bitcoin amplifies price impacts from institutional reallocation decisions. Traditional assets lack comparable scarcity mechanisms that magnify demand pressure effects.

Institutional Infrastructure Enables Cross-Asset Capital Flows

Bitcoin exchange-traded funds launched in January 2024 created regulated pathways for traditional capital allocation. Wealth management platforms now offer Bitcoin alongside conventional bond and equity products.

Major wirehouses including Bank of America and Wells Fargo distribute Bitcoin ETFs to advisory clients. This infrastructure removes previous barriers preventing institutional cross-asset reallocation. Financial advisors increasingly recommend 1% to 5% Bitcoin allocations within diversified portfolios.

Regulatory developments could unlock retirement account allocations currently restricted from Bitcoin exposure. Defined-contribution plans hold trillions in assets presently allocated entirely to traditional investments.

Potential rule changes would permit 401(k) administrators to include Bitcoin as an investment option. Even 1% reallocation from these plans would generate $87 billion in new Bitcoin demand. This represents four times the total spot ETF inflows since product launches.

Sovereign adoption patterns suggest governments may begin treating Bitcoin as a reserve asset category. The United States government maintains 328,372 BTC as a strategic holding.

This positions Bitcoin alongside gold and foreign currency reserves in official asset classifications. Other nations face game-theory incentives to establish similar positions.

Cross-border capital flows into Bitcoin could accelerate if sovereign wealth funds initiate allocation programs.

Crypto World

Pi Network Rallies 25%, Tops Daily Charts, and Outpaces Bitcoin

Pi Coin price surged 25% in the past 24 hours, marking its strongest single-day gain since November 2025. The move also represents the first consecutive advance in nearly six weeks.

The rally comes as broader crypto market sentiment stabilizes. Unlike previous brief spikes, this uptick reflects improving technical and derivatives signals.

Sponsored

Sponsored

Pi Coin Holders And Traders Change Stance

The Relative Strength Index, or RSI, shows Pi Coin rebounded after spending nearly a month in oversold territory. RSI readings below 30.0 typically indicate heavy selling pressure. In this case, extended bearishness followed the broader market downturn.

Oversold conditions did not signal an immediate reversal. Instead, they reflected prolonged weakness. Historically, Pi Coin has staged rallies after exiting oversold zones. The recent move above the neutral threshold suggests strengthening bullish momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

As RSI climbs higher, buying pressure appears more consistent. Improved momentum signals that sellers may be losing control. If sustained, this shift could support additional upside in Pi Coin price action.

Sponsored

Sponsored

Derivatives data reinforces the improving outlook. Pi Coin’s funding rate has shifted from negative to positive. A positive funding rate indicates long positions now dominate the futures market.

Previously, negative funding reflected heavy short positioning. The reversal suggests traders are rotating from bearish to bullish exposure. Reduced short dominance lowers the probability of aggressive downside volatility in the near term.

Pi Coin Price Is Finding Support

Pi Coin price is trading at $0.171 at publication, remaining just below the $0.173 resistance level. This barrier represents the immediate hurdle for continued recovery. A decisive breakout requires sustained buying pressure.

If bullish momentum persists, Pi Coin could climb above $0.180 and target $0.197. A move toward $0.212 would confirm a stronger structural recovery. Reclaiming that level would signal broader investor confidence returning.

However, risk remains from underwater long-term holders. If profit-taking accelerates, Pi Coin’s rally may stall. A pullback toward $0.150 or closer to the all-time low of $0.130 would invalidate the bullish thesis and reintroduce downside pressure.

Crypto World

XRP Faces Potential Downside Targets as Exchange Liquidity Levels Remain Unswept

TLDR:

- Three major exchanges show unswept XRP lows: KuCoin at $1.08, Bitfinex at $1.00, and Binance perp at $0.77.

- Historical mean-reversion data suggests 45% average pullback could target the $0.75 to $0.65 support zone.

- Seven exchange lows already swept including Poloniex, Gemini, Coinbase, Bitstamp, and Binance spot pairs.

- Two scenario paths emerge: rapid liquidity sweep with violent reversal or slow bleed to targets before bounce.

XRP price action has captured attention from technical analysts who point to specific exchange liquidity levels yet to be tested.

Crypto analyst EGRAG CRYPTO highlighted several key price points across major trading platforms that could serve as downside targets.

The analysis combines historical mean-reversion patterns with unfilled liquidity zones on exchange charts. Market participants now watch whether these levels will be reached before any reversal occurs.

Untapped Exchange Lows and Mean-Reversion Data

Three major exchange price levels remain unswept according to EGRAG CRYPTO’s recent analysis. KuCoin’s XRP/USDT pair shows a low of $1.08 that has not been taken yet.

Bitfinex recorded an XRP/USD low at $1.00 that also remains untouched. Binance perpetual futures for XRP/USD marked a wick down to $0.77 without a subsequent test.

The analyst contrasted these with already-swept levels across multiple platforms. Poloniex, Gemini, Coinbase, Bitstamp, TradingView, and Binance spot all saw their respective lows tested in recent price action.

Poloniex XRP/USDT touched $2.26 while the USD pair hit $2.17 during previous drawdowns. Gemini reached $2.10, Coinbase dropped to $1.77, and Bitstamp found support at $1.58 before bouncing.

Historical mean-reversion patterns from the Super Guppy indicator add context to potential downside projections. Cycle 1 showed approximately 50% retracement from local highs during previous corrections.

Cycle 2 demonstrated around 40% pullback before finding support and reversing. The average of these two cycles suggests roughly 45% mean reversion could occur.

Based on this historical data, the analyst projects a potential final sweep into the $0.75 to $0.65 range. This zone aligns with macro green uptrend support visible on longer-term charts.

The level also represents where remaining liquidity completion would occur across exchanges. An ascending triangle pattern on higher timeframes would remain structurally valid even with a move to this area.

Two Scenario Paths and Technical Structure

The analysis presents two distinct paths forward for XRP price development. The first scenario involves a rapid liquidity sweep followed by an immediate violent reclaim of higher levels.

This pattern typically generates the fastest reversals when market sentiment reaches maximum pain. Such moves often catch traders off guard after capitulation moments.

The alternative path involves a slower price bleed toward the $0.75 to $0.65 zone over an extended period. After tagging these levels and completing the liquidity sweep, a reversal would then commence.

Both scenarios ultimately lead to the same technical outcome despite different timeframes and volatility profiles.

EGRAG CRYPTO emphasized viewing this as structural price action rather than emotional market behavior. The analyst noted that Binance printed the most aggressive downward wick visible on current charts.

The commentary stressed that tolerance for potential moves to $0.75 to $0.65 separates long-term holders from short-term participants.

The analyst disclosed maintaining a long-term position untouched while actively trading the macro range. Dollar-cost averaging continues for core holdings alongside cash reserves held for optimal entry timing.

This approach separates strategic accumulation from tactical trading within the broader price structure.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business7 days ago

Business7 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World21 hours ago

Crypto World21 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World5 days ago

Crypto World5 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?