Crypto World

What’s Been Behind the Bitcoin Crash as BTC Falls to $60K

Key Insights

- Bitcoin whales sold over 81,000 BTC in eight days, adding strong supply pressure to the market.

- Large wallets now hold their lowest share of Bitcoin supply recorded in the past nine months.

- Retail wallets increased accumulation, reaching their highest Bitcoin supply share in 20 months.

Bitcoin continued its downward move as the broader cryptocurrency market faced renewed selling pressure. Total market capitalization declined by about 7.9% to $2.23 trillion, reflecting reduced risk appetite across digital assets. Bitcoin traded near $65,100 after briefly falling to $60,074, its lowest price level since October 2024.

Ethereum followed the same trend, falling close to 9% to around $1,913. The leading altcoins such as BNB, XRP, Solana, and Dogecoin also recorded losses of between 9 per cent to 14 per cent. The market evidence indicates internal supply forces but not one macroeconomic precipitator triggered the decline.

Large Holders Reduce Bitcoin Exposure

On-chain data from Santiment shows sustained selling by large Bitcoin holders. Wallets holding between 10 and 10,000 BTC reduced their holdings over recent weeks. These wallets now control about 68.04% of total Bitcoin supply, marking a nine-month low.

Over the last eight days, big holders sold about 81,000 BTC. This selling increased available supply during weaker demand sessions. As supply pressure grew, Bitcoin prices moved lower, testing levels not experienced in several months.

Large holders often adjust exposure during periods of uncertainty. Their actions tend to influence short-term price movements due to the volume involved.

Small Investors Increase Accumulation Despite Price Decline

Large wallets decreased holdings, but smaller investors kept on accumulating Bitcoin. The proportion of wallets that contained less than 0.01 BTC expanded their total supply to approximately 0.249.This value represents the highest level recorded in roughly 20 months.

The retail wallets dominate such a small part of the total supply, but their constant accumulation indicates that they are still involved at lower levels of prices. This trend shows that smaller investors were able to absorb some of the selling pressure that was generated by larger holders.

Supply Shifts Drive Market Volatility

The contrasting behavior between large and small holders continues to shape Bitcoin’s market structure. Similar patterns have appeared during extended corrective phases in past market cycles. Big sellers allocate supply and retail players slowly escalate exposure.

Until selling activity from large wallets declines and demand improves, Bitcoin may remain volatile. The trend in prices is expected to portray a continuing shift in supply allocation and not news flash.

Crypto World

Galaxy Authorizes $200M Share Buyback Amid Crypto Market Downturn

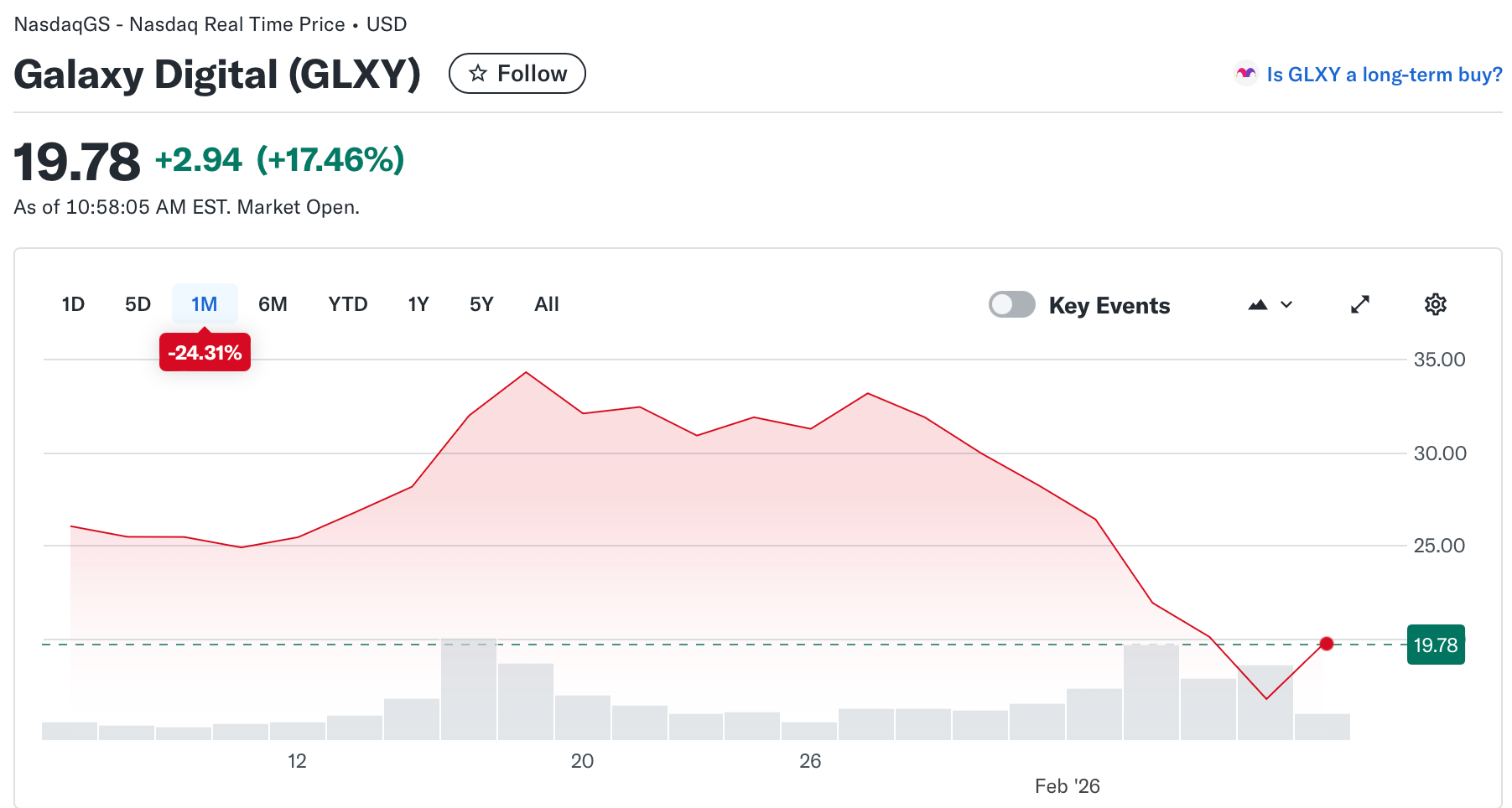

Galaxy Digital Inc. (Nasdaq: GLXY) has authorized a share repurchase program of up to $200 million, allowing the company to buy back its Class A common stock over the next 12 months.

According to a company announcement, the repurchases may be conducted on the open market or through privately negotiated transactions, including under Rule 10b5-1 trading plans, and remain subject to applicable securities laws and exchange rules. The program does not obligate Galaxy to repurchase any shares and may be suspended or discontinued at any time.

The buyback program has a term of 12 months and, if conducted on the Toronto Stock Exchange, remains subject to regulatory approval under a normal course issuer bid. Purchases made on Nasdaq would be capped at 5% of Galaxy’s outstanding shares at the start of the program, according to the announcement.

Galaxy is listed on the Nasdaq and the Toronto Stock Exchange and operates across digital asset trading, asset management, staking, custody and data center infrastructure. The company did not disclose how much of the $200 million authorization it expects to use, or when repurchases might begin.

Mike Novogratz, founder and CEO of Galaxy, said the company is “entering 2026 from a position of strength,” adding that its balance sheet and ongoing investments give it flexibility to return capital when management believes the stock is undervalued.

The news comes three days after Galaxy reported a net loss of $482 million for the fourth quarter of 2025 and a $241 million loss for the full year, citing lower digital asset prices and about $160 million in one-time costs.

At the time of writing, shares of Galaxy were up about 17% over 24 hours, but remained down about 25% for the month, according to Yahoo Finance.

Related: Optimism passes buyback proposal to bolster OP token

Market downturn impacts crypto stocks

Galaxy’s recent share-price decline reflects a broader pullback across crypto-related equities, as Bitcoin has fallen over the past month from January highs above $97,000 to to a low of about $60,300 on Thursday.

Shares of Coinbase Global (COIN) were down about 36% over the past month, while Circle Internet Group (CRCL) fell about 34% over the same period and about 65% over six months.

Strategy (MSTR), the largest public holder of Bitcoin with 713,502 BTC on its balance sheet, has fallen about 20% over the past month and nearly 68% over six months. Cointelegraph reported Thursday that the company posted a $12.4 billion net loss in the fourth quarter of 2025.

Bitcoin mining stocks have also declined, with MARA Holdings (MARA) down about 27% over the past month and about 52% over the past six months, while IREN Limited (IREN) is down about 8% on the month.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Samson Mow Breaks Down Bitcoin Market Crash

In a video interview, Samson Mow shares his views on Bitcoin’s latest bloodbath, quantum fears and the catalysts that could drive Bitcoin’s next recovery.

In an exclusive Cointelegraph interview, Bitcoin OG Samson Mow shares his perspective on Bitcoin’s latest massive crash, what’s driving the sell-offs and why a rebound could be closer than most expect.

We discuss gold and silver’s rally, forced liquidations, the “quantum threat” to crypto, and examine the long-term Bitcoin thesis: Is Bitcoin truly designed to rise in price due to fiat devaluation, or is that a flawed narrative?

After months of relentless selling pressure, sharp liquidations and growing bearish sentiment, many investors are asking the same question: Why does Bitcoin keep falling despite strong fundamentals, and when could it finally recover?

According to Mow, Bitcoin’s unique role as the most liquid asset in global markets, combined with its 24/7 tradability, makes it particularly sensitive to downside shocks that more traditional assets often avoid, at least in the short term.

The discussion also explores one of the most important dynamics in today’s market: the relationship between gold, silver and Bitcoin. After a powerful rally in precious metals, Mow lays out the case for why capital rotation from other hard assets may be setting the stage for Bitcoin’s next move.

If you’re trying to understand the nature of Bitcoin’s recent decline and what may come next, watch the full interview on our YouTube channel.

This interview has been edited and condensed for clarity.

Crypto World

Bitcoin’s Rollercoaster Ride Continues as BTC Price Recovers $10K in a Day

Bitcoin’s price jumped past $71,000 minutes ago, while XRP and other altcoins have produced massive double-digit daily gains.

What a ride it has been in the cryptocurrency space lately. The quick and sharp moves continue as of press time, as BTC has skyrocketed to over $71,000 just less than a day after it dipped to $60,000.

The altcoins are well in the green now on a daily scale, and the total crypto market cap has increased by roughly $200 billion since its low from earlier this morning.

Bitcoin’s price chart from above paints a very clear and volatile picture. It shows that the cryptocurrency plummeted by roughly $30,000 in the span of just over a week – from last Wednesday to Friday morning.

As reported earlier today, popular analysts blamed this latest crash, in which bitcoin dropped from $77,000 to $60,000 in about 24 hours, to emotional selling and structural change rather than broken fundamentals within BTC and the crypto market.

Since then, BTC has gone on a tear. It added over $10,000 since this morning’s multi-year low, and briefly surpassed $71,000 minutes ago before it was stopped and now trades inches below it.

The altcoins have produced even more impressive gains, with XRP leading the pack. Ripple’s cross-border token has soared by 19% daily to over $1.50 as of press time, while ETH has reclaimed the psychological $2,000 level.

The total value of wrecked positions daily is still over $2 billion, but most of it is from longs, which happened before today’s recovery. Nevertheless, over $350 million worth of shorts have been wrecked in the past 12 hours, with BTC responsible for the lion’s share ($261 million).

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin gets slashed in half. What’s behind the crypto’s existential crisis

Bitcoin tumbled toward $60,000 this week as investors reassessed its utility. And while there isn’t one clear catalyst driving the bloodbath, one thing is clear: the crypto market is in crisis.

“There’s nothing going on in the marketplace that should have necessitated this type of a crash,” Anthony Scaramucci, founder and managing partner of alternative investment firm SkyBridge, told CNBC. “And so I think that’s made people, frankly, more fearful. … You have to ask yourself, ‘is it over for bitcoin?’”

Bitcoin fell as low as $60,062 on Thursday, bringing it to its lowest level since Oct. 11, 2024. That’s more than 52% off from its record high of $126,000 hit in early October 2025.

The previous session marked one of bitcoin’s bloodiest ever, with the token shedding more than 15% on the day. Its daily relative strength index fell to 18, putting the asset in extremely oversold territory. As of Thursday, other digital assets like ether and solana were also down 24% and 26% for the week to date, respectively — a sign investors’ confidence in the entire crypto market is faltering.

Bitcoin bounces, but losses loom large

Bitcoin was rebounding on Friday, with the token last trading at $69,631.97, up more than 9% on the day.

But, its recent drawdown has prompted investors to re-evaluate its utility, including its role as a digital currency or as a store of value. Simultaneously, institutional appetite for the flagship crypto appears to be waning as spot bitcoin exchange-traded funds record outsized outflows, threatening to drive bitcoin deeper into the red.

“This time is markedly different from other bear markets, however, in that it’s not in response to a structural blowup,” Jasper De Maere, desk strategist at crypto market-making firm Wintermute, said in a statement shared with CNBC. “It’s a fundamentally macro-driven deleveraging tied to positioning, risk appetite and narratives rather than systemic failures within crypto itself.”

Bitcoin prices over the past year

Over the past few months, investors have grown increasingly skeptical of efforts to recast bitcoin as “digital gold,” or an alternative to traditional safe havens such as gold. Bitcoin is down 28% over the past 12 months, while gold is up 72% during the same period — a testament to the latter’s utility as a hedge against macro risks.

Conversely, bitcoin has often traded down alongside other risk-on assets such as equities amid periods of high macroeconomic and geopolitical uncertainty, raising doubts about its utility as a safe haven. Nearly a week after Trump’s “liberation day” tariff announcement on April 2, 2025, bitcoin had fallen about 10% to below $80,000, while the S&P 500 had declined roughly 4%.

Separately, investors are also reassessing the extent to which financial institutions, treasury firms and governments are willing to adopt bitcoin — a major catalyst for the token in recent years.

Large institutional outflows are mounting as investors brace for bitcoin to go lower, thinning liquidity for the token, according to a recent analyst note from Deutsche Bank.

Those outflows are also noticeable among spot bitcoin ETFs in recent months, according to the investment firm. The funds have seen outflows of more than $3 billion in January, in addition to roughly $2 billion last December and about $7 billion last November.

Additionally, a swath of Strategy copy-cats that emerged over the past year or so have slowed or paused their bitcoin purchases amid the digital asset’s correction.

Finally, traders have acknowledged that long-time efforts to market bitcoin as an alternative to fiat currencies have largely faded. While Steak ‘n Shake and Compass Coffee have rolled out support for bitcoin payments in recent years, initiatives to make the asset a form of payment have largely died, particularly as interest in dollar-pegged stablecoins grows, according to Bitwise’s Ryan Rasmussen.

“We’re seeing Wall Street adopt stablecoins because it is a fundamental transformation of the way payments work, and bitcoin is just a different asset. It’s not meant for that today,” Rasmussen said, arguing that the token’s purpose has evolved from that of a currency to a decentralized, non-governable store of value. “I’ve never paid for coffee or a sandwich with Bitcoin, and I never will.”

And beyond those more immediate concerns, investors are also increasingly worried that bitcoin’s underlying network could be hacked, driving the token to zero.

“It certainly is a risk that is seeing more attention from investors as they’re getting more worried about [it], and I think you’re seeing a little bit of that risk priced into bitcoin,” Rasmussen said.

He noted that Bitwise has allocated funds toward efforts to mitigate the threat from quantum computing.

Nevertheless, traders’ appetite for bitcoin has largely dwindled, denting its price. That’s true even as long-time believers are still proudly betting on bitcoin, despite of the charts and the naysayers.

“I believe that the story is intact,” said Scaramucci, adding that he bought bitcoin for his fund on Thursday. “But, I don’t have a crystal ball. … Who the hell knows.”

Crypto World

PBOC Officially Bans ‘Unapproved’ Yuan-Pegged Stablecoins

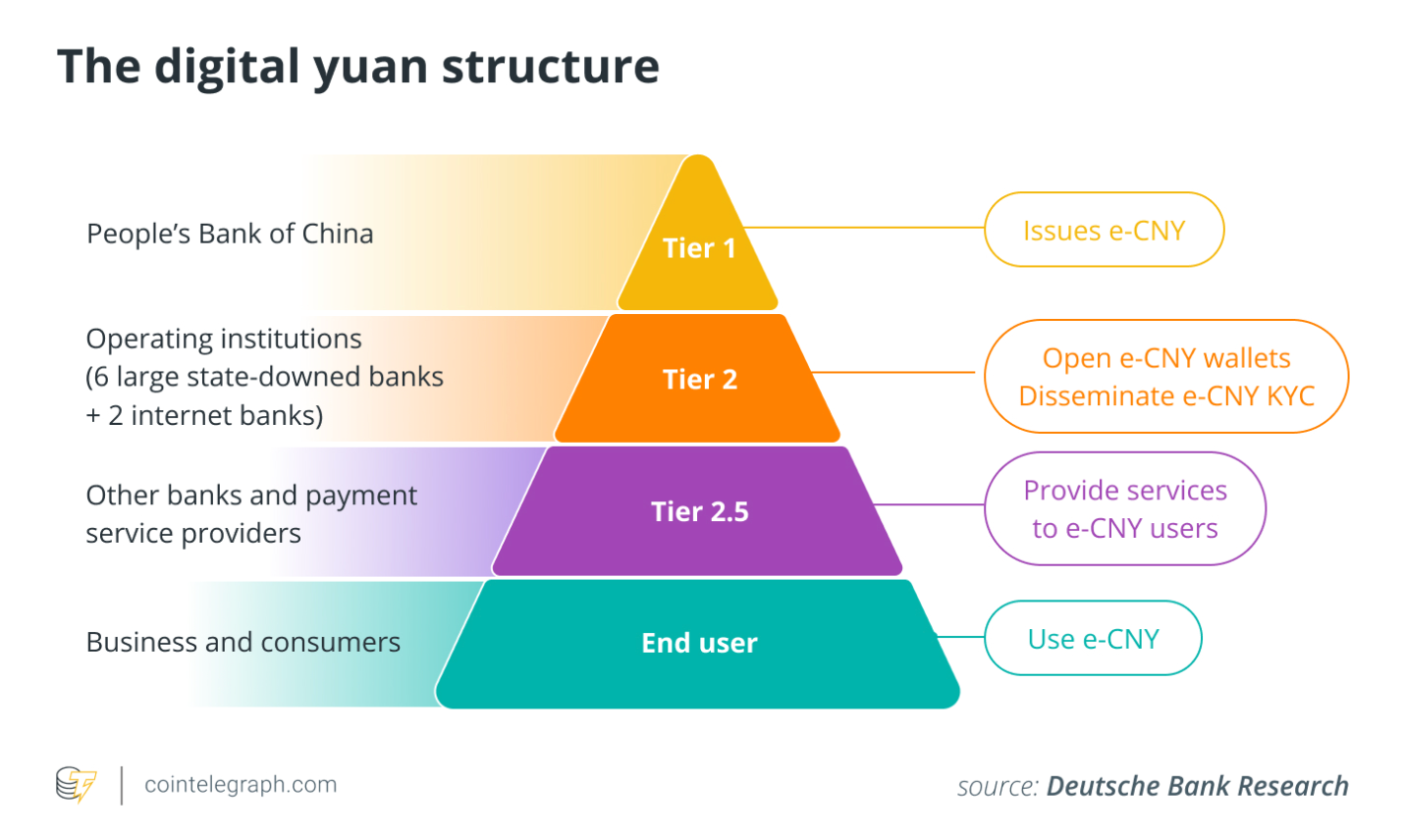

The People’s Bank of China (PBOC), the country’s central bank, and seven Chinese regulatory agencies published a joint statement on Friday banning the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs).

The ban applies to both domestic and foreign stablecoin and tokenized RWA issuers, according to the statement, which was also signed by the Ministry of Industry and Information Technology and China’s Securities Regulatory Commission. A translation of the announcement said:

“Stablecoins pegged to fiat currencies perform some of the functions of fiat currencies in disguise during circulation and use. No unit or individual at home or abroad may issue RMB-linked stablecoins without the consent of relevant departments.”

Winston Ma, an adjunct professor at New York University (NYU) Law School and former Managing Director of CIC, China’s sovereign wealth fund, told Cointelegraph that the ban extends to the onshore and offshore versions of China’s Renminbi, also called the yuan.

“The Beijing crypto ban rule applies across all RMB-related markets, whether CNH or CNY,” he said. CNH is the offshore version of the Renminbi, designed to give the currency flexibility in foreign exchange markets, without sacrificing currency controls, Ma said.

“This is the latest step in a multi‑year project: Keep speculative crypto outside the formal financial system, while actively promoting the usage of e-CNY, the sovereign CBDC issued by China’s central bank,” he said.

The announcement follows the Chinese government approving commercial banks to share interest with clients holding the country’s digital yuan, a central bank digital currency (CBDC) managed by state authorities.

Related: China’s interest-bearing digital yuan piles pressure on US stablecoin rules

Chinese government briefly considered yuan-pegged stables, but focused on CBDC instead

In August 2025, reports began circulating that China’s government was considering allowing private companies to issue yuan-pegged stablecoins, a major reversal of long-standing policy.

However, the Chinese government restricted stablecoin and digital asset issuance in September of that same year, instructing stablecoin issuers to pause or halt their stablecoin trials until further notice.

In January 2026, the PBOC approved commercial banks paying interest to digital yuan wallets in a push to make the CBDC more attractive to investors.

Magazine: China officially hates stablecoins, DBS trades Bitcoin options: Asia Express

Crypto World

Ending In 24 Hours, Be Fast! Remittix Secures Top Altcoin Spot After 300% Crypto Bonus Offer

Crypto markets have this funny habit of rewarding urgency right when most people are feeling hesitant. When Bitcoin chops sideways, Ethereum news turns into ETF chatter and big-cap altcoins start moving like slow trucks instead of sports cars, traders don’t stop hunting, They just switch lanes. That’s exactly the backdrop Remittix (RTX) is taking advantage of right now.

Because while the broader market is busy arguing about “what’s next,” Remittix has been stacking the kind of signals that usually show up right before a presale breaks into the mainstream conversation: a live product, a fixed launch date, major listings lined up and a 300% bonus window that’s now in its final stretch.

Why the Market Suddenly Cares About “PayFi” Again

A few years ago, payment tokens were mostly “promises.” Now they’re turning into one of the most practical categories in crypto, because real money movement is still weirdly hard in a world full of blockchains.

Even with stablecoins everywhere, the last mile is still messy:

- cashing out without getting clipped by FX spreads

- sending money cross-border without delays

- getting paid as a freelancer without jumping through hoops

That’s the niche Remittix is leaning into with its PayFi model: Send crypto, recipient gets fiat in their bank account, with pricing shown upfront. It’s not just a whitepaper story anymore.

The Credibility Jump: Wallet Live + Launch Date Locked

This is a big reason Remittix is being treated differently from the average presale. The Remittix Wallet is already live on Apple’s App Store not “coming soon”. The PayFi platform launch is confirmed for February 9th, 2026

That mix of a working consumer product and a fixed platform rollout date is exactly what investors look for when separating substance from pure marketing.

Then there’s the element driving the most conversation: the 300% bonus. In real terms, incentives of this scale don’t merely boost interest, they accelerate decision-making. Investors who might typically wait for exchange listings are stepping in earlier, recognizing the clear entry advantage. Several outlets have already framed the bonus as a narrow window, one that’s fueling a noticeable surge in participation.

“Top Altcoin Spot”: What That Actually Means

Whenever you see phrases like “top altcoin spot,” it’s usually shorthand for a mix of:

- trending attention (search + social + media pickup)

- unusual presale velocity

- a narrative that’s easy for non-crypto people to understand

Remittix is getting that kind of lift right now partly because “crypto-to-fiat bank transfers” is a story even skeptics can grasp. The bonus has pushed it into broader discussion across crypto news coverage as a top-of-mind presale topic.

The Exchange Question Everyone Is Asking Next

Whenever a presale starts accelerating like this, the market inevitably jumps to the same follow-up question: where will it trade first? In Remittix’s case, that part of the story is already taking shape.

The project has confirmed upcoming centralized exchange listings on BitMart and LBank, two platforms known for onboarding high-momentum presale tokens and giving early communities immediate access to liquidity. That confirmation alone separates Remittix from the majority of presales that are still hoping for listings rather than securing them in advance.

For investors, locked-in exchanges matter. They signal:

- A defined path from presale to open market

- Basic due diligence clearance by established platforms

- Reduced uncertainty around post-presale access

Now that these exchanges are in place, the conversation naturally shifts from whether Remittix will list to which exchange will be next, especially as the 300% bonus continues to attract new users and compress the presale timeline. In past cycles, this is often the stage where additional exchanges begin circling quietly, not wanting to be late to a token that’s already generating demand elsewhere.

The Real Reason This Setup Is Working

Strip away the hype and Remittix is benefiting from a simple recipe that tends to perform in crypto:

- A clear use case people actually need (payments, cross-border transfers)

- A visible product (App Store wallet)

- A fixed catalyst date (February 9th, 2026, platform launch)

- A short-term incentive that accelerates early participation (300% bonus)

When those four align, presales don’t usually “slowly trend.” They tend to move in bursts, especially as the bonus window tightens and late buyers realize the math is changing.

Discover the future of PayFi with Remittix by checking out the project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Rebuilding Global Payments with Stablecoins | Circle & USDC with Nikhil Chandhok

Stablecoins have quietly become the most successful use case in crypto.

Crypto World

Remittix Presale Holders Set To See A 5x This Week As Mega 300% Bonus Event Goes Live

Remittix (RTX) holders are positioning for gains this week as a mega 300% bonus event has gone live and early data shows strong participation momentum. Investors in the crypto market are analysing potential returns as Remittix’s recent adoption signals accelerate with downloads and wallet engagement.

The activated bonus means new buyers receive 300% extra tokens via email activation, which is driving demand and giving holders reasons to expect a 5x move in the short term.

With over 703 million tokens sold and the platform launch scheduled for 9th February 2026, Remittix is standing out as a top crypto under $1 project that blends incentives with early product engagement.

Remittix Sales And Bonus Event Fuel Short-Term Upside

Remittix has sold more than 703 million tokens from its total 750 million allocation, with tokens priced at $0.123 and funds raised exceeding $29 million, moving quickly toward the $30 million milestone.

This strong uptake shows that demand remains high, driven in part by the newly activated 300% bonus available via email signup. The bonus gives every new buyer a larger token allocation for the same contribution, which in turn boosts market activity.

Downloads of the Remittix wallet have increased as users prepare to engage with upcoming features. The wallet is currently live on the Apple App Store with a Google Play release underway, allowing holders to store, send and manage assets ahead of the full platform launch on 9 February 2026.

This product engagement supports the thesis that Remittix is gaining real user participation rather than passive speculation.

Market observers also note that incentives, when paired with growing usage, often correlate with increased interest and volume. The activated bonus, combined with a limited remaining supply, is creating conditions where holders see the potential for strong upside this week.

Why Remittix’s Fundamentals Support Continued Growth

Remittix’s appeal goes beyond short-term incentives. The project is positioned at the intersection of crypto, payments and global remittance, a market worth $19 trillion. The goal is to make Remittix the go-to crypto-to-fiat payment hub for merchants, users, and businesses worldwide.

This Remittix DeFi project roadmap includes a wallet, web app, fiat rails and API integrations for developers and payment providers, practical tools that give the token real utility.

Security and credibility are strong points for Remittix. The team is fully verified by CertiK, the gold standard in blockchain security and Remittix is ranked #1 on CertiK Skynet with an 80.09 Grade A score from over 24,000 community ratings. These metrics help build investor trust and reinforce confidence among holders and new entrants alike.

Remittix also offers a 15% USDT referral program, boosting participation beyond basic buying incentives. The project has already secured two CEX listings on BitMart and LBANK, with preparations in motion for a third major exchange listing once the $30 million raise is reached.

The upcoming full platform release on the 9th February 2026 marks a transition from early engagement to real utility as PayFi infrastructure begins rolling out. This scheduled launch, combined with the mega bonus event and rising wallet activity, gives holders multiple reasons to believe that strong moves could unfold this week and beyond.

Reasons Why Remittix Is Drawing Attention:

- Solving a real-world $19 trillion cross-border payments problem

- Utility first token model built around real transaction volume

- Deflationary tokenomics with growth potential

- Global payout rails are expanding with a focus on key remittance corridors

- Built for adoption rather than short-term speculation

Why This Week Could Mark A Turning Point For Remittix

Remittix’s activated 300% bonus, strong sales data, expanding product footprint and scheduled platform launch align in a way that supports both short-term interest and longer-term utility adoption. Early participants now see a potential path to meaningful gains, while the project’s growth signals continue to attract attention in the broader crypto market.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Griffin AI announces partnership with OpenAI and receives usage milestone trophy recognizing 20+ billion tokens processed

- Griffin AI received a second OpenAI milestone trophy after surpassing 20 billion tokens processed.

- Growth reflects rising reliance on AI agents for crypto research, workflows, and decision support.

- Company aims to convert high usage into durable, utility-driven value across Web3 ecosystems.

User engagement with GriffinAI agents accelerates with 57% month-over-month growth in prompt-driven activity, reinforcing Griffin AI’s position among the most active OpenAI model users in the crypto sector.

6 February 2026— Griffin AI, the AI agent builder for DeFi, today announced its partnership with OpenAI and confirmed it has received a milestone trophy from OpenAI recognizing Griffin AI’s continued high-volume usage of OpenAI models.

Founder Oliver Feldmeier shared the milestone publicly during a recent AMA on X, noting that Griffin AI first received recognition after surpassing 10 billion tokens consumed via OpenAI’s platform, and has now received a second trophy after passing another 10 billion tokens—a sign of accelerating adoption and platform engagement.

Oliver Feldmeier, Founder of Griffin AI said:

In times like these, during the extreme market turmoil in the bear market phase, what counts is that users keep using our agents — and premium usage is paid in our native GAIN token. That organic demand, driven by real utility of our agents, is what matters beyond short-term market movements. This isn’t just a vanity metric. It’s evidence that real users are actively engaging with our agents—triggering prompts, running workflows, and using the platform at meaningful scale.

Customer growth and engagement momentum

Griffin AI has seen steady growth in user adoption and a material increase in usage intensity on the platform.

In recent months, prompt-driven activity triggering Griffin AI agents grew by 57% month-over-month, reflecting a sharp rise in engagement as users increasingly rely on AI agents to support crypto research, decision support, and workflow automation.

While much of today’s activity occurs within the platform—prior to being fully observable on-chain—Griffin AI views these engagement metrics as an early indicator of product-market fit for agent-led experiences in crypto.

Why this matters

This recognition from OpenAI reinforces Griffin AI’s focus on scaling reliable, production-grade AI agent experiences for crypto users.

The token milestone trophies serve as external validation that Griffin AI is operating at top-tier usage levels—positioning the company among the most active OpenAI model consumers in the crypto space.

Key milestones highlighted:

- 20+ billion OpenAI model tokens processed across two recognized usage thresholds

- Second OpenAI milestone trophy received, signaling accelerating platform demand

- 57% month-over-month growth in prompt-generated agent activity in recent months

What’s next: converting demand into durable utility

Griffin AI’s next phase is centred on converting rising usage into measurable end-user value—through commercial-grade agents that can operate across the web, social platforms, and crypto workflows, with a roadmap that ties platform usage to broader ecosystem utility.

Griffin AI also continues to operate a multi-model stack—leveraging OpenAI alongside additional leading models and self-hosted deployments—ensuring performance, resilience, and flexibility as the product scales.

About Griffin AI

#1 AI Agent Builder for Web3

IGriffin AI is the leading AI agent builder for decentralized finance, enabling anyone to create, deploy, and scale autonomous crypto-native agents. Its flagship agents “Transaction Execution Agent” executes swaps, yields, and cross-chain operations through natural language, while multiple research agents help investors find Alpha.

PR Contact:

[email protected]

Note: “Tokens” refer to AI model tokens processed through OpenAI model usage (not blockchain tokens). Forward-looking statements in this release are subject to risks and uncertainties.

Crypto World

Bitcoin Plunges in One of Its Fastest Crashes Ever

Bitcoin (CRYPTO: BTC) trading action suggests a rebound is becoming increasingly likely, even as the asset tests downside extremes. Data show BTC is about 2.88 standard deviations below its 200-day moving average—the kind of deviation that has not occurred in a decade of data, according to Martin Leinweber of MarketVector Indexes. A dip below $60,000 intensified the narrative that this is macro-driven rather than a breakdown of the technology or the network’s fundamentals, with analysts framing the move as a potential prelude to mean reversion. While official bottoms remain uncertain, the long-term thesis for Bitcoin’s role in diversified portfolios remains intact, keeping attention on what happens next as liquidity and risk sentiment evolve.

Key takeaways

- Bitcoin (BTC) sits about 2.88σ below its 200-day moving average, an extreme not seen in roughly ten years of data.

- BTC plunged more than 22% in a single week, placing the move among the fastest drawn‑down episodes in its history.

- Analysts describe the current bear market as macro-driven rather than a tech failure, with the long‑term thesis for BTC still intact.

- Ethereum (ETH) and Solana (SOL) have underperformed BTC during this episode, underscoring broad risk-off conditions across major crypto assets.

- Despite the drawdown, some observers see signs of mean reversion ahead, though a definitive bottom remains elusive.

Tickers mentioned: $BTC, $ETH, $SOL

Sentiment: Bearish

Price impact: Negative. A steep weekly loss reinforces risk-off sentiment and pressures near-term liquidity dynamics.

Market context: The move aligns with broader risk-off environments where macro factors drive volatility in crypto markets, shaping trading ranges and participant behavior rather than signaling a systemic breakdown of the asset class.

Why it matters

Bitcoin’s recent performance has spotlighted the fragility and resilience of crypto markets at the intersection of macro stress and digital asset hedging. On one hand, the unprecedented distance from the 200-day SMA underscores how stretched sentiment and liquidity can become during risk-off phases. On the other hand, the fact that the long-term investment narrative remains intact—often cited by researchers and institutions—suggests that the drawdown may eventually be absorbed as traders reprice risk rather than reallocate away from the asset class entirely.

Analysts point to the speed and magnitude of the move as a catalyst for renewed interest among long-term holders and “cash-heavy” buyers prepared to accumulate during volatility. In the near term, the market is watching whether the price reverts toward trend lines and whether any technical floor emerges around historically meaningful levels. The divergence between BTC and altcoins like Ethereum (CRYPTO: ETH) and Solana (CRYPTO: SOL) during this period also matters: a widening dispersion could indicate selective risk appetite among institutional players or hedged traders recalibrating exposure across chains.

Macro factors continue to loom large. When bear markets crest on macro-driven dynamics, the consensus often shifts between “this is a pause before a recovery” and “this is the start of a longer review of risk premia across digital assets.” The sentiment readings have been grim at moments, such as the episode’s rapid liquidation cycles and the perception of liquidity shortages in stressed markets. Yet within this volatility, the potential for mean reversion persists because the observed distances from trend lines are statistically extreme. In the view of Leinweber and others, the dataset suggests that outsized deviations can produce sharp, corrective rebounds when liquidity and risk tolerance normalize.

Historical context remains a persistent theme. The drawdown scenario recalls prior stress events but stokes caution against assuming a bottom has formed. While the macro narrative dominates near-term moves, participants continue to scrutinize on-chain signals, exchange flows, and the behavior of large holders to gauge whether capacity is forming for a technical bounce or if further declines could unfold before any stabilization.

What to watch next

- Monitor Bitcoin’s proximity to the 200-day SMA and any early signs of mean reversion, including turnover in liquidity metrics and order-book dynamics.

- Track hedging and accumulation patterns among large traders and institutions, particularly any shifts in funding rates and open interest on BTC-denominated derivatives.

- Assess sentiment indicators, such as the Crypto Fear & Greed Index, for any uptick from extreme readings as prices stabilize or bounce.

- Compare performance across BTC, ETH, and SOL to determine whether the macro backdrop is driving broad risk-off or if assets begin to decouple in a stabilization phase.

Sources & verification

- Martin Leinweber’s X thread detailing BTC’s distance from the 200-day SMA and the sub-$60,000 dip (via New analysis).

- BTC’s weekly drawdown exceeding 22% and its ranking among the fastest declines in history.

- Crypto Fear & Greed Index reading at 9/100, signaling extreme market pessimism (via Alternative.me).

- Reported dip-buying activity and commentary from traders discussing potential opportunities for cash-rich buyers (via buying the dip).

- On-chain and market observations cited in discussions around BTC’s move and altcoin relative performance (via linked analyses and price pages for ETH and SOL).

Market reaction and key details

Bitcoin (CRYPTO: BTC) has moved into a territory that market technicians label as extraordinarily rare: a sustained deviation from the 200-day moving average that has not appeared in roughly ten years of data. The data show BTC trading below the 200-day SMA by about 2.88 standard deviations, a statistic that Leinweber describes as a once-in-a-decade event. The price fragment below the $60,000 level has arrived amid a weekly slide of more than 22%, a pace that places the move among the most rapid drawdowns in the currency’s history. In practical terms, the slide has undertaken both the breadth of a market-wide risk-off mood and the depth associated with cascading liquidations across leveraged positions.

Despite the severity of the move, the analyst notes that Bitcoin’s long-term investment thesis remains intact. He stresses that the bear market at hand appears macro-driven rather than a sign of systemic weakness in the protocol or in its underlying economic model. In his perspective, the combined signals—distance from the 200-day SMA, an outsized daily drawdown, and the persistence of macro headwinds—point toward a high probability of mean reversion as liquidity conditions normalize and market participants recalibrate risk appetites. This framing resonates with the broader interpretation that the current episode is more about macro dynamics than a fundamental failure of Bitcoin’s supply-demand mechanics.

The broader market also reveals differentiated performance among major crypto assets. Ethereum (CRYPTO: ETH) and Solana (CRYPTO: SOL) have not kept pace with Bitcoin’s decline, reinforcing the narrative that capital follows risk-off trends with selective dispersions across chains. The distances from trend lines for these assets underscore how volatility has affected the sector as a whole, even as some observers argue that BTC’s unique status as a market anchor can drive sharper moves in its wake. The juxtaposition between BTC’s outsized deviation and altcoins’ responses provides a window into how market participants are weighing potential rebounds versus the risk of renewed downside momentum.

Market participants have also been watching the buy-and-dump cycles that have characterized recent weeks. Several commentators described how large‑volume liquidations have created pockets of opportunity for those with dry powder, especially among hedge funds and major exchange ecosystems. One trader emphasized that the “middle” of 2024’s range could offer attractive entry points for those prepared to accumulate while volatility remains elevated. Yet even as accumulation narratives gain traction, the scale of the current decline and the magnitude of the deviation suggest that any reprieve could be inherited with caution rather than enthusiasm, as investors assess where the next catalyst might come from and whether a longer-term stabilizing phase can emerge from the micro- and macro- forces at play.

As observers parse the data, the emphasis remains on risk management and disciplined positioning. While the macro backdrop remains unsettled—characterized by inflation dynamics, central bank policy expectations, and liquidity considerations—the consensus among several researchers is that Bitcoin’s core narrative persists. The asset’s scarcity, its history of resilience, and the belief that it still acts as a portfolio hedge for some traders anchor a case for eventual recovery, even if the near term remains volatile and uncertain. In short, the market is braced for a potential rebound, but the path there will be shaped by evolving macro signals and the behavior of market participants navigating a complex risk environment.

https://platform.twitter.com/widgets.js

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports8 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat4 hours ago

NewsBeat4 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World23 hours ago

Crypto World23 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation