Crypto World

XRP Ledger Introduces Permissioned DEX, Boosting Institutional Access

TLDR

- The Permissioned DEX amendment on the XRP Ledger will activate in 24 hours.

- This upgrade introduces controlled environments for trading within the decentralized exchange.

- The amendment allows regulated financial institutions to participate while adhering to compliance requirements.

- XRP’s demand remains strong, with nearly $4.5 million flowing into XRP-focused products in the last 24 hours.

- The Permissioned DEX amendment builds on the previous XLS-80, enhancing the platform’s functionality for permissioned domains.

The Permissioned DEX amendment is set to go live on the XRP Ledger within 24 hours, marking a key milestone for the platform. This upgrade will introduce controlled environments for trading within the XRP Ledger’s decentralized exchange (DEX). The development is expected to facilitate broader participation, especially from regulated financial institutions.

XRP Ledger’s Permissioned DEX Amendment Activation

The Permissioned DEX amendment, also known as XLS 81, is set to activate on the XRP Ledger tomorrow. This amendment will create controlled trading environments, allowing only authorized users to place and accept offers. By integrating permissioning directly into the DEX protocol, it is designed to offer a secure space for regulated entities to trade.

According to XRPScan, the countdown to activation stands at just 23 hours. This feature builds upon the previous XLS-80, which focuses on Permissioned Domains. As part of this upgrade, users within these domains will have the ability to trade freely but only within a pre-approved group.

XRP’s Continued Demand Despite Market Shifts

XRP remains in strong demand, even as the broader cryptocurrency market experiences fluctuations. Rayhaneh Sharif Askary, the head of product and research at Grayscale, spoke about the consistent interest in XRP at a recent community event. “Advisors are constantly asked by their clients about XRP,” said Sharif Askary, underlining its continued relevance.

In fact, XRP has become one of the most talked-about assets, trailing only behind Bitcoin in some circles. This increasing interest is reflected in the recent data compiled by SoSoValue, showing XRP funds receiving nearly $4.5 million in the last 24 hours. Despite a market drop, the demand for XRP shows no signs of slowing down.

At the time of writing, XRP had fallen by 1.78% in the last 24 hours to $1.45. However, it had gained 3.59% over the past week. This indicates that, while it may face short-term volatility, XRP continues to attract attention from investors.

The introduction of the Permissioned DEX amendment is seen as a crucial step in XRP’s journey toward broader institutional adoption. By offering a controlled environment for trading, the XRP Ledger aims to cater to the needs of regulated financial institutions.

The integration of permissioning features within the DEX protocol allows these institutions to participate without violating compliance requirements. In the long term, this move could play a pivotal role in attracting more institutional investors to the XRP ecosystem.

Crypto World

Markets – Bitcoin Tests Critical Support

Our chart of the week is HYPE.

Crypto World

Abu Dhabi sovereign funds top $1B in Bitcoin ETFs despite fresh outflows

Abu Dhabi-linked sovereign investors held more than $1 billion in U.S. spot Bitcoin ETF exposure at the end of 2025, a milestone that comes as the broader market faces renewed outflows this week.

Summary

- Abu Dhabi-linked sovereign investors held over $1.04 billion in U.S. spot Bitcoin ETFs at the end of 2025, according to SEC filings.

- Mubadala Investment Company and Al Warda Investments disclosed a combined 20.9 million shares in BlackRock’s Bitcoin ETF.

- The milestone comes as Bitcoin ETFs recorded $104.87 million in daily net outflows, signaling short-term selling pressure despite long-term institutional positioning.

The disclosure adds to a broader wave of institutional adoption, after Italian banking giant Intesa Sanpaolo revealed nearly $100 million in Bitcoin ETF holdings in a recent U.S. regulatory filing.

Abu Dhabi’s billion-dollar Bitcoin ETF play

According to fourth-quarter Form 13F filings submitted to the U.S. Securities and Exchange Commission, Mubadala Investment Company reported holding 12,702,323 shares of BlackRock’s spot Bitcoin ETF, valued at approximately $630.7 million as of Dec. 31, 2025.

A separate filing shows Al Warda Investments owned 8,218,712 shares in the same fund, worth roughly $408.1 million at year-end.

Combined, the two Abu Dhabi entities held about 20.9 million shares valued at just over $1.04 billion, underscoring continued sovereign exposure to regulated Bitcoin products offered by BlackRock.

Bitcoin ETF outflows resume

The milestone comes as Bitcoin ETFs recorded renewed selling pressure. Data from SoSoValue shows total daily net outflows of $104.87 million in the latest session. Total net assets across U.S. spot Bitcoin ETFs stood at $85.52 billion, while Bitcoin traded around $67,753 at the time of the writing.

Recent flow data shows volatility across late January and February, with several large redemptions interspersed with brief inflow spikes. Despite the short-term outflows, Abu Dhabi’s year-end filings suggest a longer-term allocation strategy rather than tactical trading.

The 13F disclosures reflect positions as of Dec. 31 and do not capture activity in early 2026. However, the scale of the holdings highlights how major state-backed investors remain positioned in U.S.-listed Bitcoin ETFs even as market sentiment fluctuates.

Crypto World

Peter Thiel’s Founders Fund dumps every ETHZilla share

Digital asset treasury firms with a sole business of investing in tokens have fallen out of investor favor and how.

Billionaire entrepreneur and co-founder of PayPal and Palantir Technologies Peter Thiel’s venture arm has wiped its slate clean of ETHZilla, selling every last share of the ether-hoarding digital asset treasury firm by the end of the last year, fresh paperwork filed with the Securities and Exchange Commission shows.

Thiel’s Founders Fund now shows a big fat zero in ownership, down from a 7.5% stake in August last year.

ETHZilla, a crypto investment firm based in Palm Beach, mimics Michael Saylor’s bitcoin hoarding firm Strategy (MSTR). ETHZilla started as a failed biotech stock called 180 Life Sciences, before pivoting hard to Ethereum (ETH) treasury, amassing over 100,000 ETH tokens at its peak.

The fund, however, panicked as markets peaked in early October and $40 million in ether for buybacks, then $74.5 million more in December to reduce debt from convertible notes. According to Bloomberg, the firm is pivoting hard again, spinning out ETHZilla Aerospace to offer investors tokenized slices of leased jet engines.

Crypto World

Here’s What Triggered a 50% Rally in ORCA Price in 24 Hours

Orca stunned the market with a sharp 50% surge in the past 24 hours. The price climbed quickly without any major development announcement. The rally appears driven by renewed investor interest rather than protocol upgrades.

However, strong upside moves often carry elevated risk. Sudden spikes can attract speculative capital and trigger volatility.

Sponsored

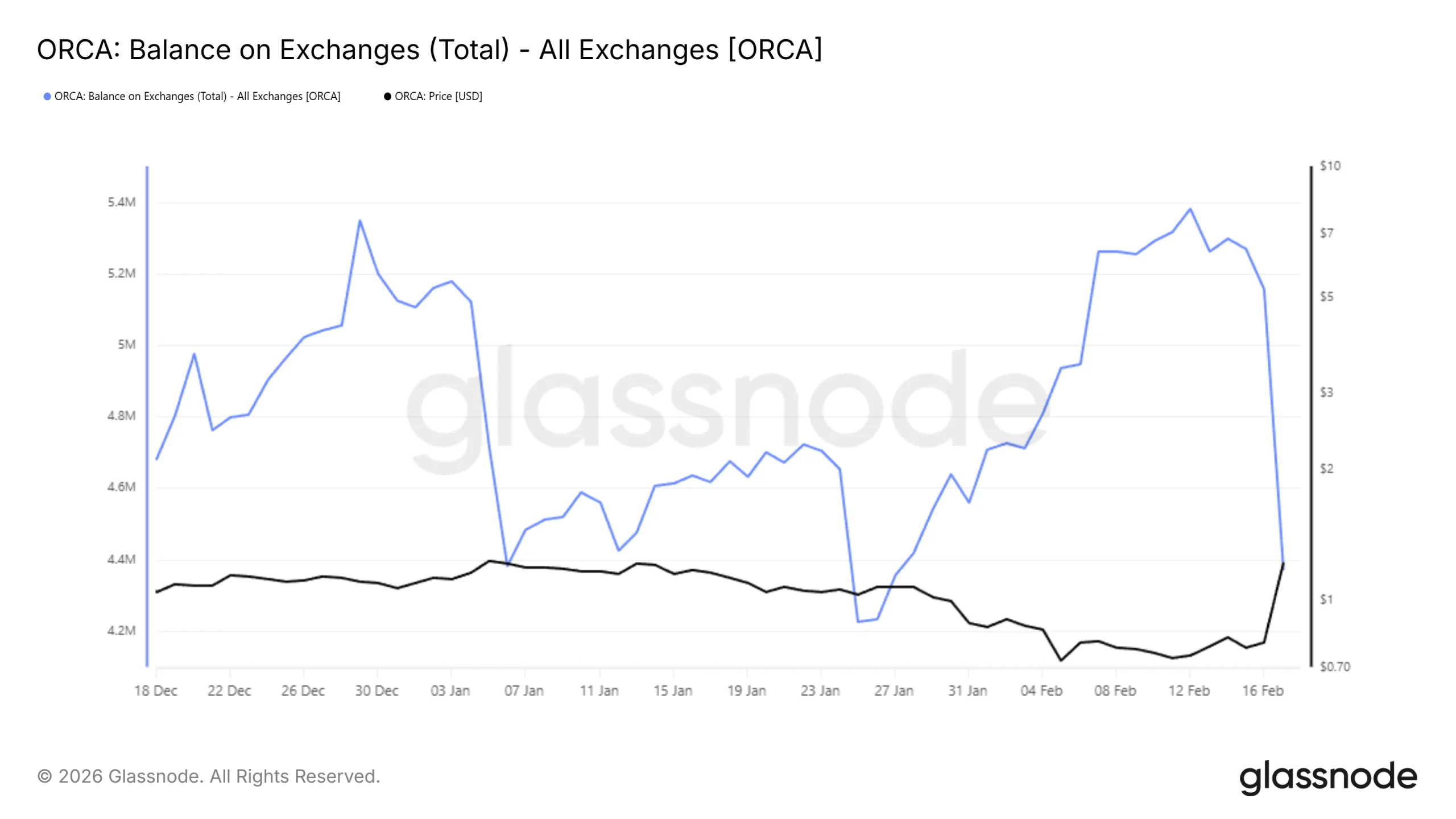

Orca Buying Spree Contributed To The Rally

ORCA balances on exchanges declined significantly over the past day. Nearly 1 million ORCA tokens were bought off exchanges within 24 hours. At the current price of $1.23, that supply is worth approximately $1.23 million.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This marks the largest single-day accumulation of ORCA this year. Reduced exchange supply typically reflects rising investor conviction. Organic demand appears to have fueled the rally. Utility metrics support this view.

USDC total value locked on Orca increased 100% year over year, reaching nearly $90 million.

Sponsored

The Net Unrealized Profit and Loss, or NUPL, indicator provides additional context. Recent readings show that prior losses had saturated. High unrealized losses often reduce selling pressure as holders stop capitulating.

A similar pattern appeared in March 2025. At that time, ORCA rallied nearly 119% after a prolonged downside. Loss saturation can trigger accumulation at perceived value zones. Current data suggests investors stepped in aggressively at discounted levels.

Sponsored

ORCA Price Finds Support

ORCA trades at $1.214 after posting a 51.7% gain in 24 hours. The token reached an intraday high of $1.421 before retreating below $1.256. This pullback suggests early profit-taking.

The altcoin remains above the 61.8% Fibonacci retracement level. This zone acts as a bullish support floor. Holding above it could encourage renewed buying. Sustained demand may push ORCA back toward $1.421. A confirmed breakout could extend gains to $1.603.

However, sharp rallies can reverse quickly. If investors prioritize short-term profits, selling pressure may intensify. A drop below $1.126 would signal weakening structure. Further downside toward $1.025 becomes likely in that case. Losing this support could send ORCA below $1.000 to $0.945, invalidating the bullish thesis.

Sponsored

ORCA Warning Signs

Risk analysis data introduces another factor. Rugcheck Risk Analysis flagged that Mint Authority remains enabled for the owner’s wallet. This setting can allow token issuance beyond the current supply.

In many cases, mint authority exists for technical reasons. Some projects use lock-and-mint or burn-and-mint mechanisms for cross-chain transfers. However, governance clarity is essential. Orca operates with a decentralized autonomous organization structure.

Typically, a DAO should control token issuance. If a single wallet retains mint authority, concerns may arise. Transparency remains critical for investor trust. BeInCrypto has provided Orca’s team with a Right of Reply. An update will follow upon receiving formal clarification. Until then, investors should monitor this risk factor carefully.

Crypto World

Bitcoin Long-Term Holders Realize Losses as Binance Inflows Hit Alarming Levels

TLDR:

- Bitcoin’s LTH SOPR has dropped to 0.88, a level not seen since the close of the 2023 bear market cycle.

- Long-term holders are now realizing losses on average, marking a sharp shift from historically resilient behavior.

- Daily BTC inflows to Binance have reached twice the annual average across several consecutive days recently.

- Rising exchange inflows from long-term holders signal sustained selling pressure that may weigh on Bitcoin’s short-term recovery.

Bitcoin long-term holders are beginning to feel the weight of a prolonged market correction. The asset remains more than 45% below its previous all-time high.

This sustained decline is creating financial pressure across a wide range of investors. Even the most resilient market participants are now adjusting their behavior in response. The shift marks a notable change for a group known for holding up under difficult conditions.

LTH SOPR Drops Below Key Threshold

The LTH Spent Output Profit Ratio (SOPR) has recently crossed below the critical level of 1. It currently sits at 0.88, a level not recorded since the close of the 2023 bear market.

This reading means long-term holders are, on average, selling at a loss. That alone represents a meaningful change in market behavior.

Analyst Darkfost noted in a post on X that the annual average LTH SOPR remains at 1.87. However, the short-term reading has moved well below that average.

The gap between the two figures reflects how quickly conditions have shifted. It points to growing financial strain within a historically patient group of investors.

When long-term holders begin realizing losses, it often signals a deeper phase of market stress. These participants typically sell only when they see value or face genuine pressure.

A move into negative SOPR territory suggests the latter is increasingly the case. The trend warrants close attention from market observers.

The drop below 1.0 also carries weight because of the size of this investor group. Long-term holders control a substantial portion of Bitcoin’s circulating supply.

Their decisions carry more influence over price than those of short-term traders. A sustained pattern of loss realization could weigh on recovery efforts.

Rising Binance Inflows Point to Increased Activity

At the same time, long-term holder inflows to Binance have increased sharply in recent weeks. Daily inflows have reached roughly twice the annual average on several consecutive days.

This level of activity is considered exceptionally elevated by historical standards. It points to a clear and deliberate shift in behavior among this group.

Darkfost also noted that this pattern has been building since the last all-time high. The acceleration in recent weeks adds further context to the SOPR data.

Together, the two indicators tell a consistent story about how long-term holders are responding. They are actively managing their exposure rather than simply waiting out the correction.

Binance remains the platform of choice for this activity due to its liquidity. Large holders need deep markets to move significant volumes without major price disruption.

The exchange’s market depth makes it practical for participants managing large positions. Their preference for Binance is therefore a logical outcome of their size.

Rising inflows from long-term holders to exchanges are generally viewed as a bearish signal. More Bitcoin moving onto platforms increases the available supply for sale.

This dynamic could continue to apply downward pressure in the short to medium term. The market may need time before this adjustment phase runs its course.

Crypto World

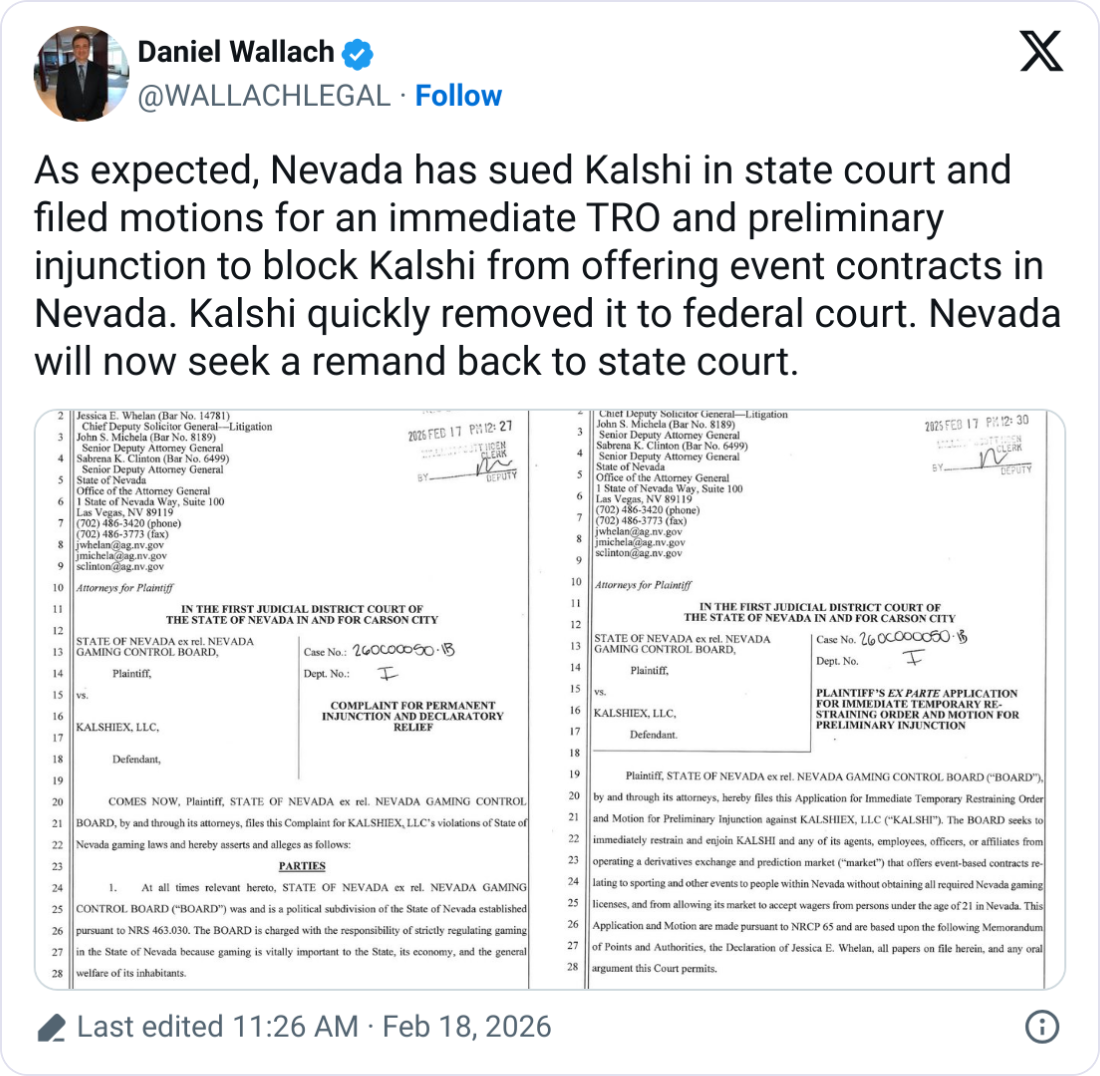

Nevada Sues Kalshi After Appeals Court Greenlights Action

The US state of Nevada has sued Kalshi after the prediction market company lost its court challenge to stop the state’s regulator from taking action over its sports prediction markets.

The US Court of Appeals for the Ninth Circuit on Tuesday denied Kalshi’s bid to stop Nevada’s gaming regulator from taking action on its sports event contracts, removing a block on the regulator launching a civil suit against the company.

After the decision, the Nevada Gaming Control Board promptly filed a civil enforcement action in state court against Kalshi, which it said sought to block the company “from offering unlicensed wagering in violation of Nevada law.”

Kalshi swiftly filed a motion to have the suit heard in a federal court, repeating its long-held argument that it is “subject to exclusive federal jurisdiction” under the Commodity Futures Trading Commission.

The appeals court order and subsequent lawsuit are a blow to Kalshi in its nearly year-long battle against Nevada to keep its sports contracts active in the state. The company and other prediction markets are facing multiple similar lawsuits from other states.

The company sued the state last year in March after receiving a cease-and-desist order to halt all sports-related markets within the state. In April, a federal court backed Kalshi’s bid to temporarily block Nevada from taking action amid court proceedings.

Kalshi did not immediately respond to a request for comment.

Nevada says Kalshi is flouting state law

In its latest lawsuit, the Nevada Gaming Control Board repeated its past claim that Kalshi’s sports event contracts meet the requirements to be licensed under state law, as they allow “users to wager on the outcomes of sporting events.”

Despite making wagers, sports betting and other gaming activities accessible in the State of Nevada, Kalshi is not licensed in Nevada and does not comply with Nevada gaming law, the regulator argued.

In its federal court motion, Kalshi argued that such a claim means the court “must adopt a narrow interpretation” of federal commodity exchange laws, which it asserts it is regulated under by the CFTC.

CFTC chair asserts jurisdiction over prediction markets

Earlier on Tuesday, CFTC chair Mike Selig said his agency filed an amicus brief backing Crypto.com in a similar lawsuit the crypto exchange had brought against Nevada.

Crypto.com had sued Nevada’s regulators in June after similarly receiving a cease-and-desist letter. It also appealed to the Ninth Circuit in November after losing a federal court motion to block the state from taking action.

Related: Crypto lobby forms working group seeking prediction market clarity

The CFTC argued in its brief to the Ninth Circuit that “states cannot invade the CFTC’s exclusive jurisdiction over CFTC-regulated designated contract markets by re-characterizing swaps trading on DCMs as illegal gambling.”

Selig said that event contracts “are commodity derivatives and squarely within the CFTC’s regulatory remit,” and the agency would “defend its exclusive jurisdiction over commodity derivatives.”

The CFTC’s push comes after Trump Media and Technology Group said in October that it was looking to bring prediction markets to its flagship social media platform, Truth Social, via a partnership with Crypto.com.

Donald Trump Jr., the US president’s son, has also been an advisor to Kalshi since January 2025. He has also served as an advisor to rival Polymarket after investing in the company in August.

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

Crypto World

Token Launch Timing Doesn’t Matter, Says Dragonfly’s Qureshi

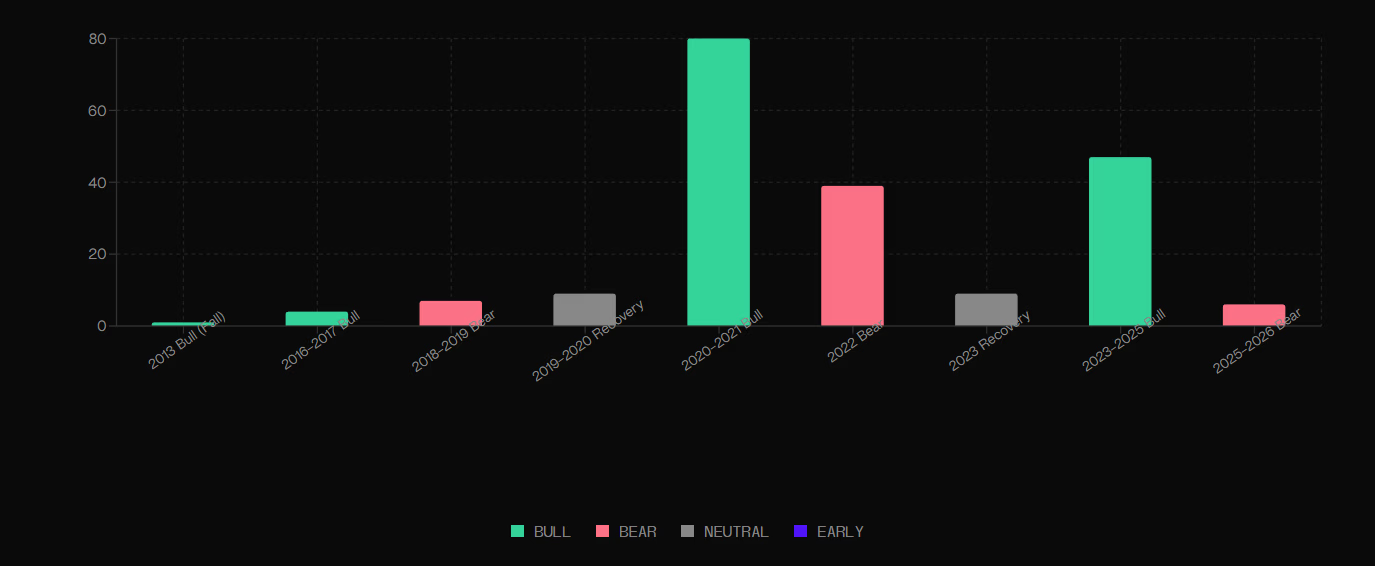

New research by Dragonfly managing partner Haseeb Qureshi looked at long-term performance of Binance-listed tokens in bull and bear markets.

A new study suggests that token launch timing barely changes how the asset performs in the long run. The report by Haseeb Qureshi, a managing partner at crypto VC firm Dragonfly Capital, analyzed every token that had its listing announced by Binance, filtering out stablecoins, wrapped assets and other non-independent tokens.

The sample covers 202 tokens in total. When the tokens were split by launch environment — 101 tokens went to market in bull markets and 33 in bear markets — the performance gap all but disappeared.

Also, Qureshi noted, regardless of the timing, most tokens don’t perform well over time. Bull-market launches recorded a median annualized return of about 1.3%, while bear-market launches came in at -1.3%.

Even when the data was sliced in different ways, the results stayed broadly the same. Qureshi emphasized that timing does not appear to matter, and shouldn’t be a primary consideration for founders:

“There is no statistically significant difference in performance between tokens launched in bull markets vs bear markets. There may be other considerations in when you choose to launch your token: cost, exchange fees, marketing expenses, etc. But if anything, those likely cut against launching in a bull market, as they tend to be higher in bulls vs bears.”

Less Competition in Bear Markets

Qureshi noted in an X post on Sunday, Feb. 15, presenting the research that this doesn’t settle every key question founders face. Bear markets may still offer cheaper talent and less competition for listings, while bull markets tend to boost demand for token sales.

Also, the data only captures tokens that made it to Binance — by far the largest centralized exchange by trading volume — meaning projects that died quietly elsewhere aren’t reflected in the report. Additionally, some market cycles include fewer tokens than others, and defining where one cycle ends and another begins is never exact, the study notes.

Nonetheless, Qureshi says it “it doesn’t matter that much when you launch,” pointing to Solana’s debut just days after the March 2020 market crash as a reminder that execution, not timing, tends to do the heavy lifting.

That said, survival itself appears to be the real hurdle. Of the roughly 24,000 tokens created since 2014, more than 14,000 are now defunct, according to a 2024 report from CoinGecko.

Even among those that do survive, meaningful revenue is rare. As The Defiant reported previously, a study by 5Money and Storible found that about 95% of nearly 5,000 crypto projects generate less than $1,000 a month, including the majority of projects valued at over $1 billion.

Crypto World

Spot Trading Volume Climbs 10% in January 2026 While Derivatives Market Holds Steady

TLDR:

- Spot trading volume on major crypto exchanges rose approximately 10% in January 2026 versus December 2025.

- Bitfinex led all exchanges with a 67% spot trading surge, followed by Uniswap at 62% and Upbit at 44%.

- Derivatives trading volume grew just 0.5% month-on-month, with Hyperliquid posting the top gain at 46%.

- Website traffic across major exchanges fell 0.3%, with HTX recording the steepest drop at 22% in January.

January crypto exchange volumes painted a mixed picture across major trading platforms in early 2026. Spot trading jumped 10% month-on-month, derivatives remained nearly flat at 0.5%, and website traffic across major exchanges dipped 0.3%, per Wu Blockchain data.

Spot Trading Jumps 10% With Notable Gains Across Select Exchanges

January crypto exchange volumes reflected a recovery in spot market activity compared to December 2025. The 10% overall increase came as several exchanges posted sharp month-on-month gains.

Others, however, recorded notable declines that offset some of the broader market growth. The data, sourced from CoinGecko, was processed to account for wash trading and bot-related activity.

Bitfinex recorded the strongest spot trading growth among all exchanges in January 2026, rising 67%. Uniswap followed with a 62% month-on-month gain, while Upbit posted a 44% increase over the same period.

These three exchanges drove much of the overall 10% rise seen across the broader spot market.

Wu Blockchain published the monthly exchange report on X, noting that preprocessing was applied to the dataset. The adjustments included outlier removal, metric normalization, and methodological changes.

These steps were taken to reduce the effect of artificial trading activity on the final figures. The firm cited CoinGecko for both spot and derivatives data in the report.

Not all exchanges benefited from the January surge in spot trading activity. HTX posted the steepest decline among tracked platforms, falling 17% month-on-month.

Bybit dropped 16%, and KuCoin recorded a 14% decrease in spot trading volume over the same period.

Derivatives Trading Stays Flat While Traffic Data Shows Modest Shifts

January crypto exchange volumes in the derivatives segment showed little movement, gaining just 0.5% over December 2025. The near-flat result came despite strong performances from a few individual platforms.

Wide variation across exchanges kept the overall figure from moving in either direction meaningfully. The derivatives market showed more stability than the spot segment throughout the month.

Hyperliquid led derivatives trading growth in January 2026 with a 46% month-on-month increase in volume. Crypto.com followed with an 18% gain, and Gate posted an 11% rise during the same period.

Their performances helped counterbalance the sharp declines recorded at other exchanges in the derivatives segment.

MEXC saw the largest drop in derivatives trading volume among tracked exchanges, falling 27% in January 2026. KuCoin declined 17% month-on-month, while Deribit posted an 8% decrease over the same period.

These three exchanges ranked at the bottom for derivatives volume changes in the January report.

Website traffic across major exchanges fell 0.3% in January 2026 compared to December 2025. Upbit led traffic growth with a 9% increase, while KuCoin and Bitfinex each gained 7%.

HTX recorded the sharpest traffic drop at 22%, followed by Bitget at 9% and MEXC at 8%. Traffic figures in the report were sourced from Similarweb.

Crypto World

Bitcoin losing $70,000 is a warning sign for further downside

Bitcoin is back below $68,000, making the earlier bounce to above $70,000 look weaker.

The largest cryptocurrency briefly tried to reclaim the level on Monday, only to be pushed down toward $67,000 as sellers emerged around the breakout zone. It was trading near $68,000 early Wednesday, roughly flat on the day but now sitting under what had been short-term support.

That shift matters. The $68,000–$70,000 range had acted as a floor through the first half of February. Losing it increases the risk that rallies are sold rather than bought, and a clean break under $67,000 would put $65,000 and possibly $60,000 back in focus.

Bitcoin, Ethereum and BNB are all down as much as 3% over seven days, while smaller tokens such as Zcash’s ZEC and Cosmos’ ATOM have posted gains of as much as 20% in the past week. Historically, when majors lag, the rest of the market struggles to sustain upside momentum.

“The decline of the largest coins is an ominous sign for smaller ones, as it may soon pull them down with it at an accelerated pace,” said Alex Kuptsikevich, chief market analyst at FxPro, in an email.

On-chain analysts at CryptoQuant say the market has entered a stress phase but has not yet seen the kind of heavy loss realization that typically marks a definitive cycle bottom – suggesting the unwind may not be finished.

Adding to the unease, quantum computing has resurfaced in market conversations, with some investors questioning long-term cryptographic risk while developers push back on timelines that place meaningful threats decades away.

Meanwhile, Blockstream CEO Adam Back criticized a proposed BIP-110 update aimed at reducing spam on the network, arguing it could create new reputational risks by changing the rules around what transactions should be allowed, as CoinDesk noted.

Institutional flows are also shifting. Harvard’s endowment cut more than 20% of its bitcoin ETF exposure in the fourth quarter, though it remains the fund’s largest public crypto position.

Outside crypto, Asian equities advanced in thin Lunar New Year trading. The MSCI Asia Pacific Index rose 0.6%, led by gains in Japan, while US futures edged higher after recent AI-related turbulence cooled.

For bitcoin, however, the technical battle remains front and center. Reclaim $70,000 and momentum resets. Fail again, and the market starts pricing a deeper retracement.

Crypto World

CFTC Says Prediction Markets Should Be Federally Regulated

The CFTC’s legal action and statement comes as popular prediction marketplaces like Kalshi and Polymarket face lawsuits from U.S. state gambling regulators.

The U.S. Commodity Futures Trading Commission (CFTC) took a firm stance on prediction market regulation, arguing that the markets should fall under federal, not state, oversight.

On Feb. 17, the CFTC filed a “friend-of-the-court” brief in the Ninth U.S. Circuit Court of Appeals in support of Crypto.com amid its fight with the Nevada Gaming Control Board, according to a video statement from CFTC Chairman Mike Selig.

“The CFTC will no longer sit idly by while overzealous state governments undermine the agency’s exclusive jurisdiction over these markets by seeking to establish statewide prohibitions on these exciting products,” Selig said in a statement.

This move comes as Kalshi, a CFTC-regulated prediction marketplace, faces legal action from the New York Gaming Commission for allegedly operating illegally within the state. The New York action is just one of many lawsuits filed by state regulators, including Nevada’s, against the platform.

The expansion of established sportsbook operators like DraftKings and FanDuel into prediction markets further complicates the landscape.

Kalshi’s co-founder Luana Lopes Lara has criticized the lawsuit against Kalshi, and prediction markets, in general.

“It’s not surprising that entrenched interests are seeding false narratives to discredit prediction markets: this is very similar to what the banks did to discredit the crypto industry (a good reminder not to blindly trust what you read online),” Lopes Lara wrote in a post on X in Nov. 2025.

The CFTC’s involvement highlights the ongoing debate regarding the classification of these markets. The platforms, and now the CFTC itself, argue that prediction market contracts should be classified as derivatives and under the federal oversight of the CFTC, while some state gaming regulators argue that they should be seen as gambling markets and regulated on the state level as such.

This article was generated with the assistance of AI workflows.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business8 hours ago

Business8 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video23 hours ago

Video23 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World22 hours ago

Crypto World22 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

Business40 minutes ago

Business40 minutes agoTesla avoids California suspension after ending ‘autopilot’ marketing