Crypto World

XRP Ledger nears BNB Chain in tokenized RWA rankings

The XRP Ledger has climbed to sixth place among blockchain networks by tokenized real-world asset value, surpassing Solana and approaching BNB Chain, according to the latest RWA league table data.

Summary

- The XRP ledger added $354 million in tokenized assets over the past 30 days.

- It currently ranks behind BNB Chain in total tokenized assets.

- If the current rate of RWA issuance continues, the ledger could challenge BNB Chain’s position among leading tokenization networks.

The ledger added $354 million in tokenized assets over the past 30 days, according to ETHNews. The growth occurred despite downward pressure on XRP’s market price during the period.

The network’s total RWA value, excluding stablecoins and combining distributed and represented assets, now exceeds that of Solana, which holds a slightly lower total in tokenized RWAs, according to the data.

The XRP Ledger currently ranks behind BNB Chain in total tokenized assets. The network would need to add additional tokenized value to overtake BNB Chain and secure fifth position globally, according to the rankings.

The increase in tokenized asset value on the XRP Ledger occurred while the token’s price declined during the broader market downturn. The divergence between price performance and on-chain asset growth indicates infrastructure development on the network, the report stated.

If the current rate of RWA issuance continues, the ledger could challenge BNB Chain’s position among leading tokenization networks, according to the analysis.

Crypto World

DeFi in 2026: From Hype Cycles to Financial Infrastructure

Decentralized finance is no longer in its experimental phase. It’s in its refinement era.

The conversation around DeFi today isn’t about flashy APYs or overnight token pumps. It’s about sustainability, automation, and real-world integration. The market is shifting from speculative excess toward structural resilience — and that shift is defining the latest trend in crypto.

Let’s break down what’s really happening.

The Shakeout: When Weak Protocols Collapse

Every cycle needs a cleansing moment.

The recent collapse of ZeroLend, which saw roughly 98% of its total value locked evaporate, reminded everyone that unsustainable yield models don’t survive market pressure.

TVL crashes are painful, but they serve a purpose. They expose:

-

Fragile lending structures

-

Over-leveraged positions

-

Emission-driven “fake yield.”

-

Governance without proper risk oversight

Capital in DeFi is becoming more selective. Investors are no longer blindly chasing APY. They’re evaluating fundamentals — revenue models, security architecture, liquidity depth, and real use cases.

In many ways, this is a sign of maturity.

The Rise of Real-World Assets (RWAs)

If one sector is dominating serious conversations, it’s real-world asset tokenization.

Treasury bills, private credit, real estate, and bonds are increasingly being brought on-chain. Unlike traditional yield farming, RWAs introduce external cash flows into DeFi ecosystems.

This changes everything.

Instead of circular crypto-native incentives, protocols can generate yield backed by real-world income streams. That’s a massive leap toward financial legitimacy.

Institutional players are paying attention. Firms like Grayscale Investments continue rebalancing crypto exposure as blockchain-based financial infrastructure evolves. While adoption may not always make headlines, integration is steadily progressing behind the scenes.

RWAs represent a bridge between traditional finance and decentralized networks — and that bridge is getting stronger.

AI Meets DeFi: Automation Becomes the Edge

Another defining trend is the integration of artificial intelligence into DeFi operations.

We’re moving from manual yield farming to AI-driven capital allocation.

Today’s DeFi tools increasingly offer:

-

Automated yield optimization

-

Risk-scoring engines

-

Cross-chain arbitrage execution

-

Smart portfolio rebalancing

Instead of users jumping between dashboards and chains, intelligent agents can autonomously execute complex strategies.

The impact is significant:

-

Reduced emotional decision-making

-

More efficient liquidity deployment

-

Lower inefficiencies in fragmented markets

Automation isn’t just convenience — it’s becoming a competitive advantage.

Cross-Chain Liquidity Is Becoming Standard

Liquidity fragmentation once slowed DeFi’s growth. Now interoperability is becoming a default expectation.

Users don’t want to think about which chain offers the best yield. They want seamless access.

Cross-chain bridges, aggregators, and modular infrastructure are making capital more fluid across ecosystems. As a result:

-

Slippage decreases

-

Arbitrage gaps tighten

-

User experience improves

The focus is shifting from individual chain dominance to ecosystem-wide liquidity efficiency.

Despite market volatility and protocol failures, foundational networks remain central to DeFi’s evolution.

Ethereum continues to serve as the backbone of decentralized finance, with Layer 2 scaling solutions, staking upgrades, and institutional integrations strengthening its position.

Infrastructure improvements may not create viral headlines, but they create long-term stability.

And stability is what sustainable finance requires.

The Bigger Shift: DeFi Is Growing Up

The DeFi landscape in 2026 looks very different from the frenzy of 2020–2021.

The market is transitioning:

-

From emissions-based yield to revenue-backed returns

-

From manual trading to AI-managed automation

-

From isolated chains to interconnected ecosystems

-

From speculation-driven hype to infrastructure-driven value

This doesn’t mean volatility disappears. Crypto will always be volatile. But beneath the surface, the architecture is becoming more robust.

The reckless experiments are being filtered out. The protocols with sustainable models are absorbing liquidity. Institutional interest is deepening. Automation is improving efficiency.

DeFi isn’t fading — it’s evolving.

And this phase may be the most important yet.

Because for the first time, decentralized finance is starting to look less like an experiment… and more like the foundation of a parallel financial system.

REQUEST AN ARTICLE

Crypto World

PUMP price nears breakout amid Cashback Coins launch

PUMP price is tightening below a descending trendline as a new cashback model reshapes trader incentives.

Summary

- PUMP is compressing beneath a descending trendline after a recent recovery.

- Pump.fun’s new Cashback Coins shift fee rewards from creators to traders.

- A decisive breakout could trigger expansion, while rejection keeps downside risk in play.

Pump.fun’s native token PUMP was trading at $0.002162 at press time, down 3.2% in the past 24 hours. Over the last seven days, it has moved between $0.001843 and $0.002355, placing the current price close to the upper end of that range.

The token is up 13% on the week, but still down around 15% over the past month. Trading activity has accelerated. Spot volume reached $110 million in the last 24 hours, a 56% increase from the previous day.

Derivatives show a similar pickup in activity. According to CoinGlass data, futures volume climbed 38% to $234 million, while open interest rose 1.08% to $174 million.

Rising volume alongside a slight increase in open interest suggests that new positions are being opened, though leverage growth remains limited.

Cashback Coins introduce new incentive model

The recent compression in price comes as Pump.fun (PUMP) rolls out a structural change to its launch model.

On Feb. 17, the platform announced Cashback Coins, a feature that lets creators choose between traditional Creator Fees or redirecting those fees entirely to traders and holders. The decision must be made before launch, and once a token goes live, it cannot be changed.

Under the Cashback model, market participants, not the deployer, receive all creator fees. The goal is to address criticism that some token deployers collect fees without contributing long-term value.

This change could have an impact on short-term trading behavior. Rewards are tied to trading activity as opposed to passive holding. If volume increases, more fees are generated and redistributed.

That structure may encourage higher turnover and short bursts of speculation. At the same time, it can amplify volatility if traders rotate quickly in and out of positions to maximize rewards.

PUMP price technical analysis

On the daily chart, PUMP is trading below a clear descending trendline drawn from a prior swing high. The pattern shows lower highs, while lows have begun to stabilize near $0.0021. Price is compressing between $0.0021 support and $0.0023 resistance.

Bollinger Bands are tightening, indicating volatility contraction. When ranges narrow this way, expansion usually follows. Direction will depend on which level breaks first.

Momentum has improved but has not flipped bullish. The relative strength index is near 45, after bouncing from lower levels earlier in the month. It remains below 50, meaning buyers have not taken control.

A sustained move above 50 would strengthen upside momentum. To regain traction, bulls must close above the descending trendline and the 20-day moving average, ideally with a strong volume increase.

The immediate resistance lies around $0.0023. A breakout above that level might signal the start of a move toward the most recent high at $0.002355. A decisive decline below $0.0021 would reveal a lower liquidity pocket and shift momentum back toward sellers.

Crypto World

Bitcoin ETFs hold billions after price crash, but resilience masks harsh reality

Bitcoin exchange-traded funds (ETFs) continue to hold billions in assets despite bitcoin’s brutal price crash, but that staying power isn’t necessarily the bullish signal that many have come to believe.

According to one analyst, the resilience stems from market makers and arbitrageurs who trade in and out rather than die-hard long-term holders betting on price appreciation.

Bitcoin’s price peaked above $126,000 in early October and recently crashed to nearly $60,000. Despite the price halving, the 11 spot bitcoin ETFs listed in the U.S. have cumulatively registered just $8.5 billion in net outflows. These funds still hold $85 billion in assets under management, which equates to over 6% of bitcoin’s supply.

Several analysts, including those CoinDesk spoke with at Consensus Hong Kong last week, cited the same data as evidence of bullish positioning.

Markus Thielen, founder of 10x Research, says the resilience comes not just from long-term hodlers, but from market makers and arbitrageurs with hedged, non-directional positions.

“This reflects the structural nature of ETF ownership, which is dominated by market makers and arbitrage-focused hedge funds holding largely hedged positions, as well as long-term institutional investors with low turnover and longer investment horizons,” Thielen said in a note to clients on Wednesday.

Thielen pointed to reports from institutions (called 13F filings) for late 2025. They show that 55% to 75% of BlackRock’s IBIT ETF, which holds $61 billion, is owned by market makers and arbitrage-focused hedge funds who keep their bets hedged or neutral, not truly bullish on bitcoin.

Market makers are entities that create liquidity in an exchange’s order book, facilitating the seamless execution of large buy and sell orders at stable prices. They profit from the bid-ask spread and therefore strive to maintain market-neutral exposure to bypass price volatility risks. Similarly, arbitrage hedge funds take opposing positions in two markets, such as spot ETFs and futures, to profit from the price differential between the two.

Both entities, therefore, do not inject directional pressures (bullish/bearish) into the market.

Thielen added that market makers trimmed exposure by around $1.6 billion to $2.4 billion during the fourth quarter, as bitcoin traded near $88,000, reflecting “declining speculative demand and reduced arbitrage inventory requirements.”

Crypto World

Bridge receives conditional OCC approval for national trust bank charter

Bridge, a stablecoin platform acquired by Stripe in 2024, has received conditional approval from the Office of the Comptroller of the Currency to become a federally chartered national trust bank, the company announced.

Summary

- Stablecoins are digital currencies designed to maintain stable value, typically backed by reserve holdings such as U.S. dollars.

- Bridge stated that the federal charter would create “the regulatory backbone” companies need to deploy stablecoins securely and at scale.

- Ripple, Circle, BitGo, Fidelity Digital Assets, and Paxos reportedly received conditional approvals in December.

The national trust bank charter would enable Bridge to store digital assets for customers, issue stablecoins, and monitor reserve funds backing those digital currencies, according to the company. Stablecoins are digital currencies designed to maintain stable value, typically backed by reserve holdings such as U.S. dollars.

Bridge stated that the federal charter would create “the regulatory backbone” companies need to deploy stablecoins securely and at scale. The charter would allow the platform to serve financial institutions, fintech companies, cryptocurrency firms, and enterprises seeking digital payment options.

Bridge joins several major cryptocurrency companies seeking federal charters from the OCC. Ripple, Circle, BitGo, Fidelity Digital Assets, and Paxos reportedly received conditional approvals in December, according to industry reports. Anchorage Digital Bank remains the only company to have completed the process and secured a national trust bank charter, which it obtained in 2021.

The conditional approval positions Bridge to operate under the Guiding and Establishing National Innovation for U.S. Stablecoins Act, known as the GENIUS Act. The legislation, signed in 2024, establishes a legal framework for stablecoin issuance and oversight in the United States. The law includes provisions for increased transparency, strengthened reserve requirements, and federal regulatory oversight of firms involved in stablecoin issuance and custody.

The OCC’s recent conditional approvals indicate federal regulators are increasingly willing to integrate cryptocurrency companies into the regulated financial system. However, the approvals remain conditional as regulators proceed cautiously amid concerns about potential risks cryptocurrency companies could pose to the financial system.

For Stripe, Bridge’s approval could strengthen the payment processor’s position in digital payments. Stablecoins are emerging as alternatives to traditional cross-border payment systems, offering faster transaction speeds and lower costs, according to industry analysts.

Crypto World

BitMine Stacks 45,759 ETH Amid Crypto Mini-Winter as Tom Lee Eyes Market Bottom

TLDR:

- BitMine acquired 45,759 ETH in one week, bringing total holdings to 4,371,497 ETH worth $8.7 billion.

- Tom Lee compares current crypto sentiment to 2018 and 2022 lows, calling the pullback a buying opportunity.

- BitMine’s staked ETH of 3.04 million tokens generates $176M annually at a 7-day yield of 2.89%.

- MAVAN, BitMine’s proprietary staking validator network, is set to launch in early 2026 with three partners.

Tom Lee’s Bitmine Immersion Technologies (NYSE AMERICAN: BMNR) purchased 45,759 ETH in a single week, pushing total holdings to 4,371,497 tokens.

The move comes as Lee publicly identifies what he calls bottom-like sentiment across crypto markets. Combined with cash and other investments, Bitmine’s total holdings now stand at $9.6 billion, reinforcing its position as the world’s largest Ethereum treasury.

Lee Calls Market Sentiment a Buy Signal

Tom Lee drew a direct comparison between today’s crypto market and the lows of 2018 and 2022. He described current investor mood as carrying the same weight as previous cycle bottoms. Unlike past downturns, however, no major institutional failures have triggered the current weakness.

Lee pointed to a specific turning point, stating that “crypto has remained weak since the ‘price shock’ and massive deleveraging seen on October 10th.”

He noted that 2025 and 2026 have not produced the large-scale debacles seen in prior cycles, such as the FTX collapse or Three Arrows Capital in 2022. The current softness, in his view, is a sentiment-driven correction rather than a structural breakdown.

At Consensus Hong Kong, Lee outlined three long-term growth drivers for Ethereum, covering Wall Street tokenization, AI agent payment infrastructure, and creator-focused Layer 2 standards.

He argued that “Ethereum is well positioned to garner significant share, given its neutrality and 100% uptime and reliability.” These themes dominated panel discussions throughout the conference, reinforcing his conviction.

On the company’s buying strategy, Lee was direct: “We cannot control the price of Ethereum, and the company is acquiring ETH regardless of price trend, as the long-term outlook for Ethereum remains outstanding.”

He added that Bitmine continues to “buy ETH even as crypto moves through this ‘mini-winter,’” framing the pullback as an accumulation window rather than a warning sign.

Staking Machine Running as MAVAN Nears Launch

Beyond accumulation, Bitmine is generating meaningful revenue from its existing ETH stack. Total staked ETH now stands at 3,040,483 tokens, valued at roughly $6.1 billion at current prices. Annualized staking revenues have climbed to $176 million, based on a 7-day yield of 2.89%.

Lee noted that “at scale, when Bitmine’s ETH is fully staked by MAVAN and its staking partners, the ETH staking rewards is $252 million annually.”

The company is currently working with three staking providers as it prepares to deploy MAVAN, its proprietary Made in America Validator Network. The solution is expected to launch in early 2026 as a best-in-class staking infrastructure platform.

Bitmine’s total holdings also include 193 Bitcoin, $670 million in cash, a $200 million stake in Beast Industries, and a $17 million position in Eightco Holdings.

The company ranks 158th among all US-listed stocks by average daily dollar volume, trading approximately $0.9 billion per day. Institutional backers include ARK’s Cathie Wood, Founders Fund, Pantera, Galaxy Digital, and Kraken.

Crypto World

Bitwise, GraniteShares Join Race for Prediction Market-Style ETFs

Bitwise and GraniteShares have moved to put political-event outcomes inside the ETF framework, filing with the U.S. Securities and Exchange Commission to launch six PredictionShares funds on NYSE Arca. The prospectuses describe a lineup built around binary event contracts that settle to $1 if the specified outcome occurs and $0 otherwise. The target scope spans three election cycles: the 2028 presidential contest, the 2026 Senate race, and the 2026 House race. Each fund would invest at least 80% of its net assets in binary-event derivatives traded on exchanges regulated by the Commodity Futures Trading Commission, with the expectation that the market’s implied probabilities drive share prices day to day. The filings emphasize that if the Democratic candidate were to win the 2028 presidential election, the fund would aim to deliver capital appreciation for investors.

The risk, as spelled out in the prospectus, is equally stark: should the Democratic candidate not win the 2028 presidential race, the fund would likely lose substantially all of its value. In effect, the product translates political prognostication into an ETF vehicle, allowing investors to buy and sell exposure to a binary outcome through regulated venues. The envisioned mechanism—contracts that settle at $1 for a successful outcome and $0 otherwise—creates a differentiated price signal that fluctuates with polls, news developments, and evolving sentiment around the election landscape.

The two filings come as Bitwise publicly circulated its six-ETF lineup under the PredictionShares label, while GraniteShares independently submitted a parallel set of six funds with the same structural logic. The broader narrative this week reflects a growing appetite among ETF sponsors to explore the application of prediction-market dynamics within traditional investment products, a theme that has drawn commentary from market observers about the normalization of politically oriented risk assets in mainstream markets.

Market observers have noted that these funds represent a novel fusion of prediction markets and exchange-traded funds. The arrangement would allow investors to select a fund aligned with a specific political outcome, rather than taking a broad bet on a party or policy. Price discovery for each fund would be driven by the market’s probability assessment for the referenced outcome, with share prices moving within a $0–$1 band in response to new information and evolving forecasts. This construct differentiates itself from conventional political bets by anchoring the exposure in an ETF structure and publicly traded shares on a major U.S. exchange.

The move has drawn attention from critics and observers alike. James Seyffart, a Bloomberg ETF analyst, commented that “the financialization and ETF-ization of everything continues,” underscoring how investors and issuers are increasingly packaging complex, event-driven risk into standardized, regulated vehicles. The fact that two separate issuers are pursuing similar six-fund lineups suggests a broader push to test how far prediction-market concepts can be integrated into mainstream financial products. Notably, Roundhill Investments had signaled a nearby path with a comparable six-fund filing focused on the same election outcomes, a reminder that the sector of prediction-market ETFs is far from a one-off experiment.

Market context

Market context: These filings arrive amid growing investor curiosity about how political outcomes can be monetized through regulated products, even as the broader market debates the valuation of event-driven exposures and the regulatory boundaries surrounding binary bets. The rollout aligns with a trend of experimentation within the ETF space, where sponsors seek to diversify risk-bearing strategies beyond traditional equity or fixed income exposures.

Why it matters

For investors, the proposed PredictionShares funds would represent a distinct way to express views on political outcomes, leveraging a market-driven pricing mechanism rather than a single directional bet. Because each fund targets a specific outcome, the price of a share would, in theory, reflect the market’s current odds for that outcome and adjust as polls and news flow shift. The structure’s 80% allocation to binary-event contracts on CFTC-regulated venues provides a path to enforce a standardized, regulated approach to what has historically been a hybrid of prediction markets and speculative trading.

From a market-structure perspective, the filings illustrate how ETF designers are exploring increasingly binary, outcome-based products as part of a broader push to repackage risk. The prospectuses stress that a successful outcome would deliver capital appreciation, while the opposite outcome could wipe out most of the value, highlighting both the potential upside and the material downside risk inherent in this genre of investing. The conversation around these products has intensified since similar proposals emerged earlier in the year from other issuers, signaling a test case for whether regulatory clearances, liquidity, and investor demand can align to support a new class of event-driven ETFs.

Industry observers also point to the regulatory and compliance considerations that such funds would entail, given their reliance on binary settlement mechanics and politically anchored exposure. The SEC and the CFTC would likely scrutinize the contract types, counterparty risk, liquidity, and the potential for market manipulation in a space where polling data and headlines can meaningfully swing valuations in real time. The debate is not merely academic: if these funds reach the market, they could influence how hedge-like exposures tied to political events are priced and traded, potentially widening the spectrum of publicly accessible tools for managing political-risk bets.

What to watch next

- SEC action on Bitwise’s and GraniteShares’ prospectuses for the six PredictionShares ETFs, including potential comments or conditions from regulators.

- Whether NYSE Arca lists the funds and the pace of any initial trading, including liquidity expectations and settlement logistics for binary-event contracts.

- Further filings from other issuers, such as Roundhill, and the degree to which multiple teams compete in offering prediction-market ETFs.

- Regulatory guidance or policy developments regarding binary event contracts and their use inside ETFs, which could influence product design and investor protection measures.

Sources & verification

- Bitwise PredictionShares prospectus filed with the SEC: https://www.sec.gov/Archives/edgar/data/1928561/000121390026017412/ea0277256-01_485apos.htm

- GraniteShares six-fund prospectus filing with the SEC: https://www.sec.gov/Archives/edgar/data/1689873/000149315226007125/form485apos.htm

- Roundhill Investments’ similar event-contracts/prediction-market ETF filing referenced in coverage: https://cointelegraph.com/news/roundhill-investments-event-contracts-prediction-markets-etf-united-states-election

- Related discussion of prediction markets’ role in open-source intelligence and market design: https://cointelegraph.com/opinion/prediction-markets-new-spycraft

Prediction markets move to the ETF stage: six funds, one framework

The filings reveal a structured approach to capturing political-outcome probabilities within six distinct funds, with each fund keyed to a specific outcome across three election cycles. The first pair targets the presidential result in 2028, designating a Democrat or a Republican as the winner; two more funds focus on which party captures control of the Senate in 2026, and the final two on House control. The investment thesis centers on deploying at least 80% of net assets into binary-event derivatives that settle at $1 if the referenced outcome materializes and $0 if it does not. While the concept offers a clear path to capital appreciation should the expected outcome occur, the prospectus makes the flip side explicit: if the anticipated outcome fails to materialize, the portfolio could experience a sharp decline in value, potentially approaching zero for the affected fund.

In practice, investors would see the daily price of each fund move between $0 and $1 as market participants adjust their views in response to polling data, election dynamics, and news flow. This pricing dynamic mirrors the very essence of prediction markets while placing it inside a regulated, exchange-traded wrapper. The framing also allows for diversified exposure: instead of a single bet on a party or a policy, an investor could select a fund aligned with a particular outcome, effectively creating a basket of binary-event bets under a single ticker and governance structure. The filings underscore that such products are not simply novelty investments; they are designed to be traded on regulated venues with defined settlement mechanics and disclosures about risk levels.

Industry voices have framed this development as part of a broader narrative about how traditional finance intersects with prediction-market concepts. The comment from James Seyffart about the ongoing “financialization and ETF-ization” of new risk assets encapsulates a sentiment that regulators and market participants are recalibrating the boundary between political risk and tradable financial instruments. The Roundhill filing referenced alongside Bitwise and GraniteShares signals that multiple teams are testing the appetite for six-fund lineups that cover presidential, Senate, and House outcomes, pointing to a possible wave of similar products if the regulatory path remains navigable and investor demand proves durable.

Crypto World

Gemini executive depart amid cost-cutting push

Cryptocurrency exchange Gemini disclosed plans for a leadership restructuring that will see three senior executives depart as the company narrows its geographic focus and implements cost reductions, according to a regulatory filing released Tuesday.

Summary

- Gemini operates in more than 60 countries, but demand in certain regions proved insufficient to support continued growth.

- The firm plans to execute separation agreements with three executives that may allow them to remain temporarily to assist with transitions.

- The board appointed Chief Accounting Officer Danijela Stojanovic as interim CFO.

Chief Operating Officer Marshall Beard, Chief Financial Officer Dan Chen, and Chief Legal Officer Tyler Meade will leave their positions effective Feb. 17, the company stated in a Form 8-K filing. Gemini plans to execute separation agreements with each executive that may allow them to remain temporarily to assist with transitions, during which they would receive base salary and benefits without additional bonuses or incentive compensation.

Beard also resigned from Gemini’s board of directors on the same date. The filing indicated his departure was not related to disagreements over operations, policies, or practices.

Gemini announced a round of layoffs earlier this month.

The company will not fill the chief operating officer position. Co-founder Cameron Winklevoss will assume many of Beard’s responsibilities, including revenue-related duties, according to the filing. The board appointed Chief Accounting Officer Danijela Stojanovic as interim CFO, while Kate Freedman, currently associate general counsel and corporate secretary, will serve as interim general counsel.

ETF analyst James Seyffart characterized the changes as a “big shakeup” in a post on social media platform X following the filing’s publication.

The leadership changes accompany broader operational restructuring announced earlier this month. Gemini Space Station Inc. will cease operations in the United Kingdom, the European Union, and Australia, the company stated. Gemini also announced workforce reductions of approximately 25% to decrease costs and concentrate on core priorities.

Company management indicated that expansion into multiple countries created operational complexity and elevated expenses. While Gemini operates in more than 60 countries, demand in certain regions proved insufficient to support continued growth, executives stated. Future operations will focus primarily on the U.S, which management identified as the company’s strongest market.

Unaudited financial results for the previous year reflected mixed performance. Monthly transacting users increased approximately 17% year-over-year to roughly 600,000, according to company data. Net revenue is projected between $165 million and $175 million, compared with $141 million in 2024.

Operating costs, however, outpaced revenue growth significantly. The company estimated operating expenses may reach $530 million, with adjusted EBITDA losses of approximately $260 million. Total net losses for the year could approach $600 million, according to the projections.

Market participants responded negatively to the disclosed losses, according to reports.

Crypto World

Wall Street Bets on Prediction Markets With New ETF Wave

Institutional investors are entering prediction markets, following a strategy seen earlier in the crypto space.

Asset managers are filing for prediction-market tied exchange-traded funds as the space continues to gain traction.

Sponsored

Sponsored

Institutional Capital Moves Into Prediction Markets as ETF Race Begins

On February 17, 2026, Bitwise Asset Management submitted a post-effective amendment to register six ETFs under a new brand called “PredictionShares.” The proposed funds, tied to event contracts on the outcome of US elections, would be listed and primarily traded on NYSE Arca.

“PredictionShares will serve as a new Bitwise platform focused on providing exposure to prediction markets. Bitwise’s CIO Matt Hougan says prediction markets are accelerating in both scale and importance, making client exposure an opportunity the firm couldn’t pass up,” Crypto In America host Eleanor Terrett wrote.

The six proposed funds are:

- PredictionShares Democratic President Wins 2028 Election

- PredictionShares Republican President Wins 2028 Election

- PredictionShares Democrats Win Senate 2026 Election

- PredictionShares Republicans Win Senate 2026 Election

- PredictionShares Democrats Win House 2026 Election

- PredictionShares Republicans Win House 2026 Election

Each ETF seeks capital appreciation tied to a specific US election outcome. It follows an 80% investment policy under which it will invest at least 80% of its net assets, plus any borrowings for investment purposes, in derivative instruments whose value is linked to that defined political event.

The funds gain exposure primarily through swap agreements that reference CFTC-regulated event contracts listed on designated contract markets, although they may also invest directly in those event contracts. The event contracts follow a binary payout structure, typically settling at $1 if the specified outcome occurs and at $0 if it does not.

“This makes an investment in the Fund highly risky. An investment in the Fund is not appropriate for investors who do not wish to invest in a highly risky investment product or who do not fully understand the Fund’s investment strategy. Such investors are urged not to purchase Fund Shares,” the filing reads.

Sponsored

Sponsored

Moreover, GraniteShares, an independent ETF issuer, also filed a Form 485APOS on February 17 for six similar funds. These two filings followed shortly after Roundhill made the same move.

Bloomberg Intelligence Senior Research Analyst James Seyffart indicated that more filings are likely to continue.

“The financialization and ETF-ization of everything continues,” he added.

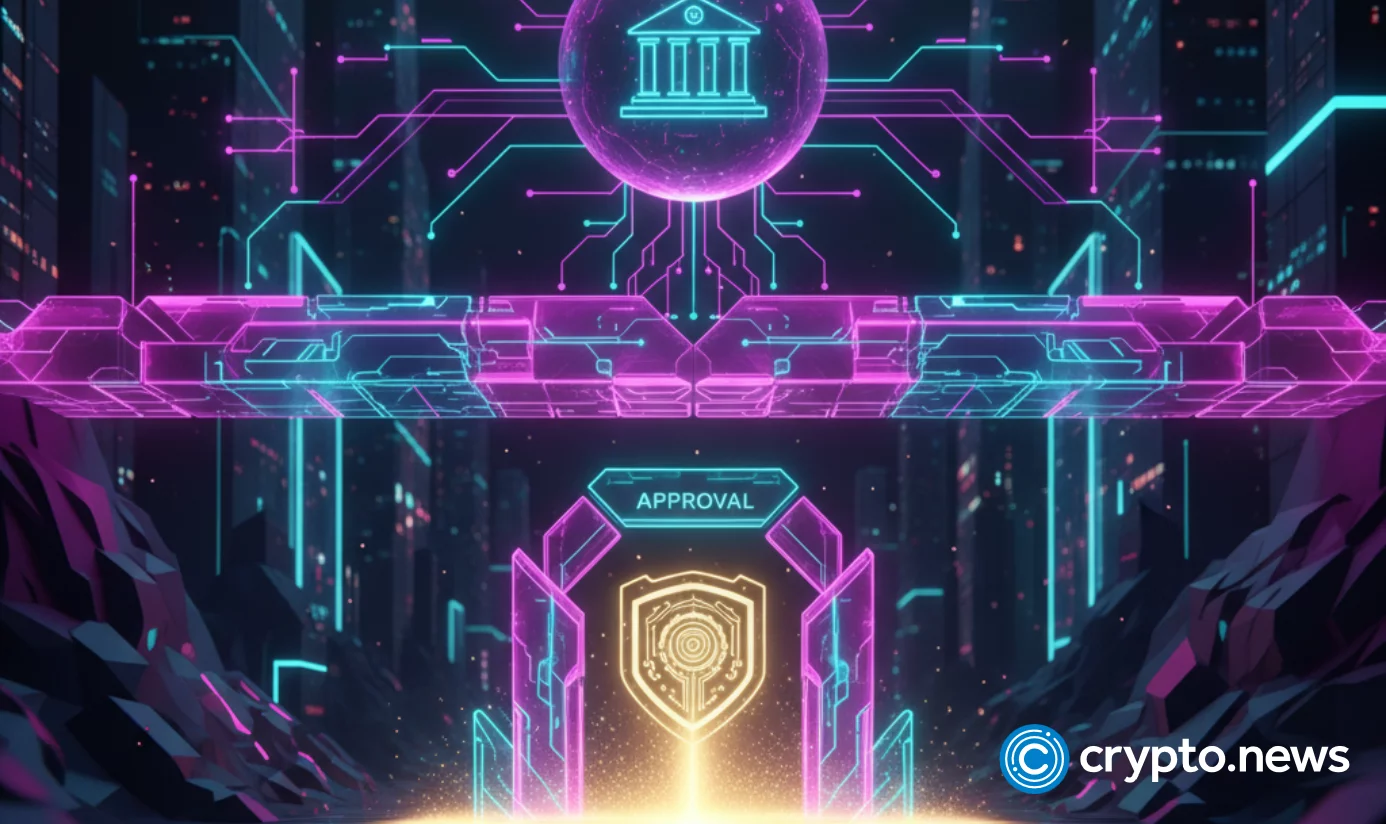

The ETF filings arrive as the prediction market sector posts record-breaking growth. The move mirrors the surge of ETF applications tied to digital assets, when asset managers rushed to capitalize on renewed momentum in the sector following the election of a pro-crypto administration.

While demand for Bitcoin and Ethereum ETFs appears to have slowed, evidenced by significant outflows from the spot products, institutions may be looking to broaden their exposure to the growing prediction market space.

Data from Dune Analytics highlights the sector’s momentum. Monthly trading volume climbed to $15.4 billion in January, setting a new all-time high.

Transaction count also reached a record, surpassing 122 million, while monthly users rose to 830,520. Taken together, these suggest sustained growth across the prediction market sector, alongside increasing product development and institutional interest.

Crypto World

Dragonfly Raises $650M for New Fund to Back DeFi, Prediction Markets and Stablecoins

Dragonfly Capital has announced the closing of its $650 million Fund IV, focusing on stablecoins, decentralized finance, and prediction markets.

Dragonfly Capital, a crypto venture capital firm, has closed its Fund IV at $650 million, to focus on DeFi, stablecoins and prediction markets, despite stagnant prices and a mildly down market.

Haseeb Qureshi, managing partner at Dragonfly Capital, announced in an X post today, Feb. 17, that Fund IV is the firm’s “biggest bet yet that the crypto revolution is still early in its exponential.” Qureshi added:

“If you look at our recent bets — Polymarket, Ethena, Rain, Mesh — the growth speaks for itself. Agentic payments, on-chain privacy, the tokenization of everything — crypto’s surface area is about to explode, and we want to be backing the founders at the center of it.”

Dragonfly Capital’s approach during market downturns is not new. The firm has raised capital during previous challenging periods, such as the 2018 ICO winter and prior to the Luna collapse, Qureshi added.

The firm’s first fund in 2018 closed at roughly $100 million during the ICO downturn, followed by a $225 million Fund II in 2021, and a $650 million Fund III in 2022 — overshooting an initial $500 million target — just before the market’s prolonged downturn.

This article was generated with the assistance of AI workflows.

Crypto World

BlackRock, Coinbase to keep 18% of ETH ETF staking revenue

BlackRock and Coinbase plan to take an 18% share of staking rewards from BlackRock’s proposed Ethereum staking exchange-traded fund, according to an updated regulatory filing.

Summary

- BlackRock and Coinbase will take 18% of ETH ETF staking rewards.

- Between 70% and 95% of the fund’s Ethereum would be staked, with Coinbase serving as custodian and execution agent.

- Supporters see institutional yield access as positive, while critics warn about fees and centralization risks.

The firms disclosed the fee structure in an amended S-1 filing with the U.S. Securities and Exchange Commission on Feb. 17. According to the filing, investors will receive 82% of gross staking rewards, with the fund sponsor and its execution partner receiving 18%.

A sponsor fee that ranges from 0.12% to 0.25% of the investment value will be paid by shareholders each year in addition to the staking fee.

How the staking model will work

Under the proposed structure, most of the fund’s Ethereum (ETH) holdings will be used for staking. The filing says between 70% and 95% of assets may be staked under normal conditions, with the rest kept available for liquidity and redemptions.

Coinbase will act as the prime execution agent and custodian through its institutional services unit. The company may also pass part of its share to third-party validators and infrastructure providers involved in the staking process.

BlackRock has already seeded the trust with $100,000, equal to 4,000 shares priced at $25 each. The firm is also building its Ethereum position ahead of a potential launch.

Based on early 2026 network data, Ethereum staking yields have averaged close to 3% annually. After the 18% cut and other fees, the effective return for investors is expected to be lower, depending on market conditions and network participation.

Market reaction and centralization concerns

The fund is a yield-generating variant of BlackRock’s current Ethereum spot ETF, which has garnered significant institutional interest since its inception. After the success of its Bitcoin (BTC) and Ethereum products, the company has established itself as a significant player in digital asset ETFs over the last two years.

Nasdaq has already applied to list the staked, indicating growing support for regulated crypto yield products in traditional markets.

Some analysts say the structure could appeal to investors seeking exposure to blockchain rewards without managing wallets or validators. Others have questioned whether an 18% share of staking income is too high, especially as competition in the ETF space increases.

Concerns have also been raised about the concentration of influence. In the same week as BlackRock’s filing, Vitalik Buterin warned that growing Wall Street involvement in Ethereum could increase centralization risks over time.

Supporters argue that institutional products help bring liquidity and legitimacy to the market. Critics say they may shift too much control toward large financial firms.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Video2 days ago

Video2 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech1 day ago

Tech1 day agoThe Music Industry Enters Its Less-Is-More Era

-

Business6 hours ago

Business6 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video21 hours ago

Video21 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World20 hours ago

Crypto World20 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat3 days ago

NewsBeat3 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World6 days ago

Crypto World6 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

-

Crypto World4 days ago

Crypto World4 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

![I AM SHAKING!!!! [insane Bitcoin Signal]](https://wordupnews.com/wp-content/uploads/2026/02/1771392411_maxresdefault-80x80.jpg)