Cryptocurrency

XRP Price Could Collapse With Black Monday: Key Pattern Rings Bear Market Alarms for XRP

Published

2 months agoon

By

NewsAdmin

XRP price crashes to $1.61 on Black Monday 2025 as inverse cup and handle pattern prints. At spot rates, XRP is down 45% from 2025 highs and risks plunging some more. Meanwhile, Ripple whales have been selling, worsening the situation now that Donald Trump is implementing reciprocal tariffs.

It’s a tough start to the week for the crypto market. With XRP, Bitcoin, Ethereum, and meme coins facing intense pressure, it’s understandable why investors are anxious. As of April 7, XRP is trading below critical support after weeks of sideways consolidation.

XRP Price Analysis: More Pain for Traders?

On the daily chart, XRP fell to $1.61 earlier today, hitting a new 2025 low as sellers finally broke below February lows. As sellers prepare to press harder, there’s a real risk of prices extending losses and reversing the gains of Q4 2024.

In January, XRP surged to as high as $3.40, cementing its position in the top 10. However, the tide is turning at press time, and the technical candlestick arrangement favors sellers.

(XRPUSDT)

XRP is currently down 45% from January highs. If the sell-off intensifies today, the coin could slip as low as $1.31 in a bearish breakout continuation formation.

This drop may mark the start of another leg down to $0.50, which would be catastrophic for some of the best meme coins to buy.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

XRP/USD Bearish as Inverse Cup and Handle Formation Prints

On TradingView, analysts note that a textbook bearish formation is printing out on the daily chart.

From his analysis, an inverse cup and handle formation is taking shape. This pattern is often seen as a harbinger of sharp price losses and typically forms after a period of sideways consolidation that may indicate distribution.

If prices edge lower in the coming trading days, confirming the losses of April 6 and 7, XRP will likely slide to $1.50 and later $0.50, as mentioned earlier.

Conversely, if buyers step in and reverse the losses of the past two days, the reaction around $2 will shape the short- to medium-term trend.

Critically, the XRP/USD price must rally above the April 6 high of around $2.20 for the uptrend to take shape. In that case, further demand from buyers could drive prices above $3 and later to the 2025 high of $3.40.

Will Ripple Withstand Tariff Shock? XRP Whales Selling

Still, the pace of this recovery will depend on how the broader crypto market and investor community navigate Donald Trump’s tariffs.

On April 2, the president announced sweeping tariffs impacting over 60 countries.

China, India, Taiwan, the European Union, and all other economies will be affected.

In response, these tariff announcements triggered a chain reaction across financial markets. XRP and some of the best cryptos to buy were not spared.

Although Trump and the executive defended these tariffs, claiming they protect American companies, the sell-off in equities and the crypto market paints a different picture.

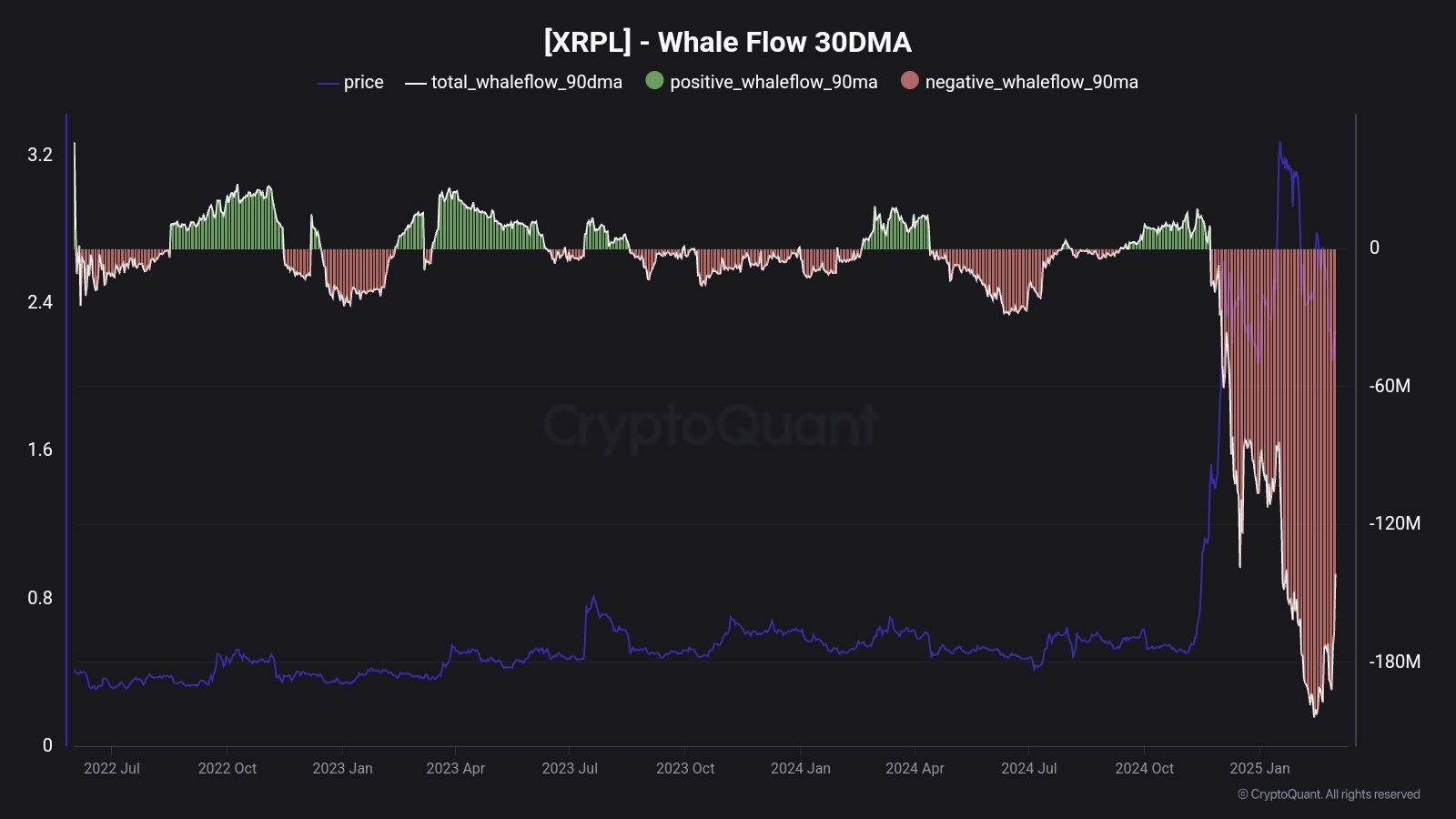

For Ripple and XRP, the situation could worsen now that whales are also offloading, compounding the current stock market storm.

(Source)

Since late 2024, on-chain data show that XRP whales have been aggressively selling.

Considering how vital whales are to crypto valuations, their offloading suggests they anticipate a market downturn in the future, which doesn’t bode well for the situation.

DISCOVER: 10 Best Crypto Presales to Invest in April 2025 – Top Token Presale

XRP Price Collapses On Trump Tariffs, Ripple Whales Selling

- XRP price crashing, drops to $1.61

- XRP price down 45% from 2025 highs as inverse cup and handle pattern prints

- Will Trump tariffs trigger more sell-offs

- Ripple whales have been offloading since late 2024

The post XRP Price Could Collapse With Black Monday: Key Pattern Rings Bear Market Alarms for XRP appeared first on 99Bitcoins.

You may like

Cryptocurrency

Crypto’s optimism isn’t just hype. It’s a structural feature.

Published

7 minutes agoon

May 29, 2025By

NewsAdmin

Opinion by: Oleksandr Lutskevych, Founder and CEO of CEX.io

Bitcoin markets have consistently shown greater emotional resilience than traditional equities during multiple global shocks.

While some on Wall Street found this “impressive” during the “Liberation Day” sell-off on April 2, such optimism isn’t a glitch — it’s a pattern that extends across digital assets.

Let’s look closer at Fear and Greed Index dynamics in crypto and stocks. After Donald Trump announced tariffs on nearly all countries in April, the Stock F&G Index dropped from 19 to 3 — a more than 80% plunge and a three-year low. In contrast, the Crypto F&G Index declined from 44 to 18 — a 59% decrease.

Of course, these indexes aren’t identical. CNN’s Stock F&G Index tracks traditional sentiment through signals like VIX volatility, safe-haven demand and market breadth. The Crypto F&G Index relies on price momentum, volume and social sentiment metrics. Despite different inputs, both aim to measure the same thing: market emotion.

When viewed side by side during macro shocks, the contrast in mood becomes obvious. When macro winds turn cold, stock investors typically panic harder and recover more slowly than crypto investors.

May 2022 offers an illustrative example. On May 4, the US Federal Reserve raised interest rates from 0.5% to 1%, sparking recession fears that spilled into crypto. Then, on May 9 to May 13, LUNA and UST collapsed. Yet the Stock F&G Index fell 82% (to 4), while Crypto F&G dropped 62% (to 8).

Even while crypto was already under pressure and hit harder by LUNA’s collapse, which contributed to several bankruptcies within the industry, crypto remained less terrified than the stock market. Crypto sentiment took longer to rebound, however, due to the established bear market at the time.

Crypto’s inherent optimism is a strength, not a flaw

Some may call crypto’s optimism naive or irrational. In reality, it’s structural.

The volatility native to crypto recalibrated investor expectations. A 20% drawdown in equities is a bear market. In crypto, it could be a healthy correction. The scale and frequency of price swings conditioned crypto enthusiasts to better withstand market shocks.

There’s also a cultural divide. The stock market is built by and for institutions. It’s cautious and slow-moving. Crypto was born from rebellion and raised by retail, which rapidly shifts to new narratives.

Still, crypto’s optimism isn’t immune to erosion. As institutional influence grows and Bitcoin continues to correlate with equities, Wall Street fears are increasingly bleeding into the sector. During the tariff scare, sentiment recovery timelines were nearly identical across stocks and crypto — a possible sign of optimism erosion.

Even so, crypto optimism remains structurally sound.

The shield of crypto optimism

What protects crypto optimism is the presence of two dominant, and very different, groups.

The first — the believers — view crypto as the future. Within this group, Bitcoin (BTC) adopters tend to see it as a store of value and hedge. To them, short-term volatility is just noise, a distraction from the long-term vision. That perspective leads them to become long-term holders, unfazed by daily fluctuations.

Recent: Dogecoin traders predict 180% DOGE price rally if Bitcoin gains continue

Altcoin believers, meanwhile, draw strength from rapid innovation. New protocols, narratives and technologies keep the sector in constant motion. That ability to reinvent — and rebound — reinforces the idea that crypto is an ecosystem defined by momentum, not stagnation.

There is also a second group, which primarily consists of recent arrivals. They see crypto more as a speculative bet. They comprise many short-term holders and tend to be more reactive to news.

When fear spreads, this second group primarily rushes for the exits, as shown by more frequent peaks in Bitcoin’s Binary CDD for short-term holders (STHs) than long-term holders (LTHs). This group is also more susceptible to the erosion of optimism.

If, however, this second group is the minority, as in Bitcoin, where LTHs control over 65% of BTC’s supply, then all these macro-related fears that creep into the space would have only a limited, short-term effect.

Beyond simple belief

The conviction of believers in a bright future is not based on blind faith but has a solid foundation. In Bitcoin’s case, this foundation rests on a firm, committed holder base, a fixed supply, and a clear, predictable monetary philosophy that stands out during periods of economic uncertainty. These aren’t speculative claims — they’re principles that have gained credibility over time.

Actions also backed this optimism. While markets panicked over tariffs in March-April, Bitcoin LTHs accumulated over 300,000 BTC. Liquidity strengthened, with 1% market depth ending Q1 at $500 million, indicating continued confidence and participation from market makers and investors.

Meanwhile, macro metrics such as global liquidity reached new highs. Multiple Bitcoin cycle indicators, including Pi Cycle Top, are far from flashing a top signal, fueling reassurance that there still could be room for upward movement.

These are just a few of the factors fueling crypto optimism, and more will emerge. Because optimism in this space isn’t temporary — it’s embedded. While fear drives headlines, crypto continues operating like a system preparing for something bigger. And so far, history supports that view.

Opinion by: Oleksandr Lutskevych, Founder and CEO of CEX.io.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Published on By Sophon’s utility token, SOPH, fell by 24.97% within 24 hours of its market debut on Binance and several other exchanges, shedding over $80 million from its market capitalisation. The steep decline followed a large-scale airdrop event in which 900 million tokens—9% of SOPH’s total 10 billion supply—were unlocked and distributed to early contributors, farmers, zkSync users, and NFT holders. While airdrops are a common strategy to drive initial interest, they often lead to aggressive profit-taking, especially when token utility is still limited. Binance began SOPH trading at 13:00 UTC on 28 May, shortly after announcing its listing via an X post on 23 May. Other exchanges, including OKX, KuCoin, Upbit, Bitget, and MEXC, also launched trading support on the same day. SOPH initially peaked at $0.11 before tumbling to $0.06 within the same day, recording a 24.97% drop. SOPH’s early volatility is not just a result of the unlocked supply. Binance assigned a “seed tag” to SOPH, categorising it among high-risk tokens prone to volatility. These tags often caution investors about potential price fluctuations, particularly in new projects. In addition, Binance Futures listed SOPH with leverage of up to 75x, creating an environment that incentivised speculative trading and amplified price swings. The trading volume surged by 2,724.8% in the last 24 hours, according to CoinGecko, as early recipients of the airdrop rushed to sell their allocations. This created a large supply overhang that the current market demand failed to absorb, exacerbating the price decline. Sophon is built as a Layer 2 blockchain using Validium technology and is part of ZKsync’s Elastic Chain roadmap. It aims to serve as a decentralised infrastructure for entertainment applications. However, for now, SOPH’s practical utility remains narrow, primarily limited to covering gas fees and contributing to the network’s sequencer decentralisation process. The lack of immediate use cases appears to have contributed to the weak market support during the sell-off. Despite the price drop, on-chain metrics point to rising user engagement. According to DefiLlama, Sophon’s total value locked (TVL) climbed to $20.28 million on launch day, up 14.1% from the previous day. Decentralised exchange (DEX) volumes reached $47.44 million, indicating robust participation in token swapping activities. While speculative activity dominated the launch, the on-chain data shows that interest in the protocol remains strong. The project has raised over $70 million from investors, including Binance Labs, and has positioned itself as a key Layer 2 player within the zkSync ecosystem. Looking ahead, the next supply unlock looms large. Another 20% of SOPH’s total supply, designated as node rewards, will begin unlocking on a weekly basis starting three months from the Token Generation Event. If current market sentiment does not improve or if new utility use cases are not rolled out in time, this influx could trigger further downside pressure. Sophon has indicated that it intends to broaden SOPH’s use cases in the coming months. While no specific dates have been given, the team plans to expand the network’s entertainment applications and decentralised tools. In a recent post, the project team stated that additional products and services would be launched as part of its long-term roadmap. For now, though, the token’s performance is being closely watched by investors, particularly given its sharp debut correction. Airdrops have historically proven to be a double-edged sword—driving early adoption, but often at the cost of price stability. Published on By Michigan has become the latest U.S. state to push digital asset regulations, with four new bills landing in the State Senate to promote BTC mining and ban the looming digital dollar. With House Bill 4510, the Great Lakes State seeks to pave the way for the state treasurer to invest in digital assets. Introduced by Bill Schuette, the Republican State Rep. for the 95th district, the new bill amends the state’s retirement system investment laws to allow investment in digital assets. However, it limits investment to assets that have averaged a market cap of at least $250 billion over the past calendar year. The bill also outlines that the state can only hold digital assets as exchange-traded products issued by registered companies. This stipulation comes at a time when spot ETFs have exploded in the U.S. and now hold over $50 billion in assets. Michigan’s Bureau of Investment, which the state treasurer oversees, held $165 billion by the end of 2024, most of which is from the public retirement systems. Michigan joins dozens of states racing to implement digital asset reserves in response to a similar push at the federal level by President Donald Trump. In February, two State Senators introduced a bill allowing the Michigan state government to establish a BTC reserve. It limited the investment to 10% of the assets, which would be around $17 billion by the latest figures. Michigan bans the digital dollar In the second proposed bill, House Bill 4511, the state seeks to ban the digital dollar, again aligning with Trump’s position against the proposed sovereign digital currency. The bill “prohibits the advocacy or support through certain actions by certain state governmental officers and entities of a central bank digital currency by the United States government.” Introduced by Republican Rep. Bryan Posthumus, the bill mirrors dozens of others across the U.S. that have sought to halt any prospective digital dollar at the state level. The earliest opposition came from Florida, where Gov. Ron DeSantis led anti-CBDC campaigns years before Trump’s election. While several states have advanced bills resisting the digital dollar, the central bank digital currency (CBDC) is unlikely to see the light of day under the Trump presidency. Upon retaking office earlier this year, Trump signed an executive order prohibiting the Fed from launching a CBDC, which he argued “threatens the stability of the financial system.”

Beyond the CBDC, the same bill also prohibits Michigan from banning digital assets or denying licenses to holders. The state must also not prohibit the operation of blockchain nodes or participation in staking.

The other two bills, House Bill 4512 and House Bill 4513, focus on block reward mining. The first will permit the revival of abandoned oil and gas wells to mine BTC, and the second will expand the tax laws to accommodate income from such mining activities. The miners would shoulder the costs of well restoration, with the State’s Supervisor of Wells having jurisdiction over the sector. The block reward mining bills come amid a rise in anti-mining campaigns across the U.S. and beyond by local communities. In dozens of ongoing lawsuits, these communities have accused miners of noise pollution, which they say is pushing them away from their homes. Russia pushes miners to the north amid power shortages Meanwhile, in Russia, the Ministry of Energy plans to push BTC miners to the northern regions as it navigates power shortages in the more densely populated eastern and southern regions. In an interview with state-owned news agency TASS, Deputy Minister Yevgeny Grabchak revealed that the government intends to incentivize miners to relocate to the north. Russia’s north is the least populated region, with harsh weather—especially its severe winters—mostly to blame. However, the region also has the most abundant natural resources, including oil and gas. “[The north] is where we can think about something with miners, put them there and consider the possibility of a network tariff. But this is not a benefit as such, but a different principle of tariff formation,” the minister stated. In particular, the ministry intends to relocate the miners to power grid centers whose capacity was previously used to mine oil. Repurposing unused or excess electricity to mine digital assets is becoming common globally. The U.S., Pakistan, Japan and Germany are among the countries that have announced new initiatives to leverage the surplus capacity to mine BTC. Watch: Finding ways to use CBDC outside of digital currencies title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>

The final 6 ‘Game of Thrones’ episodes might feel like a full season The Worst Mistake for a Flat Stomach How to Increase Hip Mobility (Fix The Root Cause) Good Morning America Full Broadcast — Monday, May 19, 2025 Illinois’ financial crisis could bring the state to a halt OUTRAGEOUS DEADLIFT PR! 930 LBS x 3 AT 275 LBS BODY WEIGHT! How to Deadlift Like a Tren Twin 4 SHOOTING DRILLS THAT WILL FIX YOUR JUMPSHOT #basketballtrainingCryptocurrency

SOPH token drops 24.97% after $900M airdrop, despite strong TVL growth

Market volatility is fuelled by limited utility and high leverage

Investor interest remains high despite short-term dip

Roadmap promises more utility, but outlook remains cautious

Share this article

Categories

Tags

Cryptocurrency

Michigan’s new bills ban CBDC, permit state to invest in ‘crypto’

7 Best Sunrise Alarm Clocks (2025), Tested and Reviewed

Crypto’s optimism isn’t just hype. It’s a structural feature.

State Department to cut or revamp more than 300 offices in largest overhaul since Cold War

Trending

![]()

![]()

![]()

![]()

![]()

![]()