Crypto World

XRP price risks drop to 50 cents, single-print candle theory holds

XRP price remains vulnerable to further downside as unresolved single-print imbalances continue to exert technical pressure toward the $0.50 support zone.

Summary

- Value area low has been lost, confirming bearish continuation

- Single-print imbalance remains unfilled, acting as a downside magnet

- $0.50 is critical support, where a potential macro pivot may form

XRP (XRP) price action has turned decisively bearish following an impulsive move to the downside, with structural weakness continuing to dominate the chart. After losing key value levels, the market has failed to regain bullish control, despite short-lived buying reactions.

From a long-term perspective, XRP appears to be trading within a broader corrective phase, with unfinished price structures remaining exposed below current levels.

One of the most notable technical features influencing the current outlook is the presence of a single-print candle imbalance. This structure, which often acts as a magnet for price, suggests that XRP may need to trade lower to complete unfinished auction activity before any meaningful macro pivot can occur.

XRP price key technical points

- Value area low has been lost, confirming bearish continuation

- Single-print imbalance remains partially unfilled, creating downside magnet

- $0.50 marks the base of the single-print structure, a critical high-timeframe level

XRP’s decline accelerated after the price failed to hold above the value area low, a key indication that buyers were unable to maintain acceptance at higher prices. Once this level was lost, the price fell aggressively, producing a bearish impulse that established a new swing low around $1.11.

Although price has since printed a buying tail, suggesting short-term demand, this reaction has not altered the broader market structure. Lower highs and weak follow-through continue to define price behavior, indicating that any upside moves remain corrective rather than trend-changing. As long as XRP remains below reclaimed value, downside risk stays elevated.

Understanding the single-print candle imbalance

Single-print candles occur when price moves rapidly through a zone without sufficient two-way trade, leaving behind an area of inefficiency. From a market profile and auction theory perspective, these zones are often revisited as price seeks to rebalance and complete unfinished business.

In XRP’s case, a high-timeframe single-print structure has been exposed, with only part of the imbalance filled during the recent decline. The upper portion of the single prints has already been retraced, but the base of the structure remains open. This unfinished area is located near the $0.50 level, creating a strong technical incentive for price to rotate lower.

Historically, markets show a high probability of revisiting these imbalances, particularly when broader structure aligns with bearish momentum, as is currently the case with XRP.

$0.50 emerges as a critical support zone

The $0.50 region is not only the base of the single-print candle but also aligns with a high-timeframe support zone. This convergence increases the importance of this level and makes it a key decision point for the market.

A move toward $0.50 would likely represent a continuation of the current corrective phase rather than a breakdown into uncharted territory. Such moves are often necessary to flush remaining weak hands and reset positioning before a potential macro pivot can form.

However, reaching support does not automatically imply a reversal. The reaction quality at $0.50, including volume expansion, rejection wicks, and structural behavior, will ultimately determine whether XRP can form a durable bottom or continue consolidating at lower levels.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, XRP remains biased toward further downside until the exposed single-print imbalance is fully resolved. The $0.50 level stands out as the most likely target for this rebalancing process and a zone where the market may attempt to establish a macro pivot.

If price reaches this level and shows strong acceptance and demand, it could mark the beginning of a broader base-building phase. Conversely, a weak reaction or continued acceptance below support would suggest prolonged consolidation before any sustained recovery.

For now, XRP remains structurally weak despite a short-term balance, with incomplete auction dynamics favoring a continuation of the lower trend. Traders should closely monitor how price behaves as it approaches the $0.50 region, as this area is likely to define the next major phase of XRP’s market cycle.

Crypto World

Why Is the Crypto Market Up Today?

The total crypto market cap (TOTAL) and Bitcoin (BTC) finally broke free from the bearish curse they had been under for the past 12 days. As BTC neared $70,000, it sparked a rally amongst the altcoins as well, led by XDC Network (XDC).

In the news today:-

Sponsored

Sponsored

The Crypto Market Breaths a Sigh Of Relief

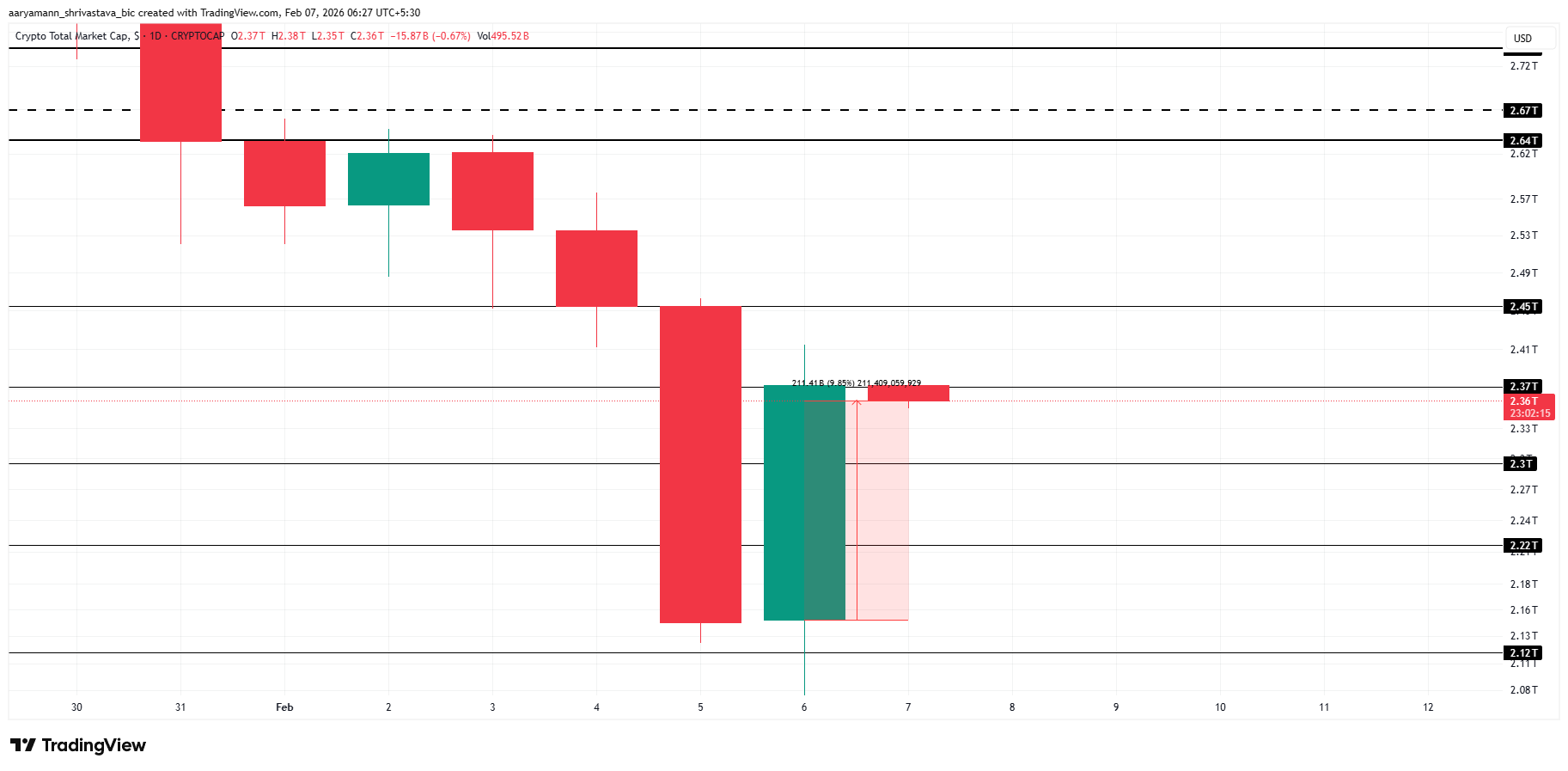

The total crypto market cap rebounded by $211 billion over the past 24 hours, signaling a relief rally after Thursday’s sharp sell-off. The recovery has improved short-term sentiment across digital assets. Closing the week in positive territory could help stabilize markets and support risk appetite through the weekend.

TOTAL is trading near $2.36 trillion at the time of writing, hovering just below the $2.37 trillion resistance. A decisive flip of this level into support would confirm strengthening momentum. Such a move could open the path for a continued advance toward the $2.45 trillion zone.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Downside risk remains if bullish momentum fades. Failure to secure $2.37 trillion in support may trigger renewed selling pressure. Under this scenario, TOTAL could slip below the $2.30 trillion level and fall toward $2.22 trillion, erasing a significant portion of the recent recovery.

Sponsored

Sponsored

Bitcoin Attempts Recovery

Bitcoin is trading near $69,972 at the time of writing as it attempts to reclaim $70,000. This level remains a key psychological threshold for market participants. A successful flip into support would signal renewed buyer confidence and mark the early stages of a broader recovery attempt.

The immediate objective is to secure $70,000 as support and push higher toward $75,000. Achieving this would confirm improving momentum and strengthen bullish structure. If buying pressure persists, Bitcoin could regain traction and set its sights on the $80,000 level in the near term.

Failure to reclaim $70,000 would weaken the recovery narrative. Renewed selling pressure could drag Bitcoin back toward $65,000 or lower. Such a move would invalidate the bullish thesis, reinforce downside risk, and prolong market uncertainty amid fragile investor sentiment.

XDC Network Jumps Sharply

XDC led the altcoin market, surging 23% over the past 24 hours to trade near $0.0370 at the time of writing. The rally reflects renewed buying interest and improving sentiment. Securing this level of support is critical for sustaining momentum and confirming the strength of the current price move.

XDC is now targeting a move toward $0.0413, but a breakout requires clearing the $0.0392 resistance. Rising inflows and sustained investor participation could provide the needed catalyst. A decisive breach would validate bullish continuation and strengthen confidence in XDC’s short-term recovery trajectory.

Downside risk remains if support fails to hold. A loss of $0.0370 could push XDC back toward $0.0345. Breaking below that level would expose price to a deeper pullback near $0.0299, erasing much of the recent recovery and weakening the bullish setup.

Crypto World

Trump-Linked World Liberty Finance Sells 173 WBTC Amid Bitcoin Volatility

TLDR:

- 173 WBTC sold at $67K, totaling $11.75M in USDC during a volatile Bitcoin session.

- Initial trades were fast and decisive, signaling structured exits amid price weakness.

- Bitcoin dipped to low $60Ks but quickly recovered to $70K, showing market absorption.

- WBTC to USDC rotation reflects liquidity preference and defensive risk management strategy.

Trump-linked World Liberty Finance sold 173 WBTC near $67K, moving $11.75M into USDC. The trades were fast and decisive, coinciding with Bitcoin’s dip into the low $60Ks.

Liquidity thinned, stops triggered, but buyers quickly stepped in. Bitcoin rebounded to $70K, showing the market absorbed pressure efficiently. The sale signaled caution, yet strength remained clear.

Timing and Market Mechanics of the WBTC Sale

Trump-linked World Liberty Finance executed 173 WBTC sales on February 5, coinciding with Bitcoin’s decline from the mid-$70Ks to the low-$60Ks. Initially, 40 WBTC were sold for $2.761M USDC, immediately followed by 33 WBTC for $2.276M USDC.

Both trades occurred within a minute. Consequently, the market saw a clear signal of urgency rather than routine rebalancing.

Later, 100 WBTC were sold for $6.711M USDC as Bitcoin accelerated downward. This final trade appeared as a towering spike on the chart, coinciding with a steep price drop.

Therefore, the sequence indicates that the sales were structured and decisive, creating a liquidity event during volatility.

Moreover, moving from WBTC to USDC demonstrates a defensive approach. USDC preserves value while offering flexibility for future actions. Thus, the strategy prioritizes liquidity over exposure.

Market participants noted that sales at the $67K level influenced sentiment. Even if independent, the “Trump-linked” label amplified attention, making the timing appear cautious.

In addition, the total volume, while meaningful, is not existential for Bitcoin liquidity. The $11.75M converted into USDC represents a tactical adjustment rather than a complete exit.

Consequently, the trades reinforced short-term bearish momentum but also created opportunities for buyers. The compressed timing, coupled with large trade sizes, allowed other market players to anticipate liquidity points.

Bitcoin’s Reaction and Market Absorption

Following the WBTC sales, Bitcoin briefly dipped into the low $60Ks on February 6. This drop coincided with the heavy USDC conversions.

As a result, liquidity thinned, stop orders triggered, and weaker traders exited positions. Consequently, the session recorded an emotional low that reflected short-term fear.

However, Bitcoin quickly recovered to $65K and continued a controlled ascent. By evening, the price approached $70K, nearly erasing earlier losses.

Therefore, the market absorbed the $11.75M sell pressure without structural breakdown. This V-shaped rebound indicates strong buying interest.

Furthermore, the transaction demonstrates how tactical exits interact with market depth. Large holders rotated positions, yet equally serious buyers absorbed the coins efficiently.

Consequently, the market interpreted the Trump-linked sales as a liquidity event rather than a persistent sell-off.

As a result, Bitcoin’s quick rebound reinforced confidence in liquidity and market resilience. Finally, the WBTC sale highlights how high-profile players manage risk while maintaining market stability.

Crypto World

Crypto PACs Stack Millions Ahead of Midterms

Political action committees (PACs) representing the interests of the crypto industry have already secured millions of dollars in funding as the US heads toward its midterm elections.

Super PACs are the uber-rich, no-limits, non-disclosure counterparts to crypto PACs. Last year, the industry spent at least $245 million in campaign contributions alone.

The main super PAC funded by the cryptocurrency industry, Fairshake, raised some $133 million in 2025, bringing its total cash on hand up to over $190 million. Venture capital firm a16z contributed an initial $24 million, while Coinbase and Ripple each donated $25 million.

This influx of cash has alarmed activist and election reform groups. Saurav Ghosh, director of the Campaign Legal Center — a legal center concentrated on voting rights, fair districting and campaign finance reform — told Cointelegraph:

“This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry’s deregulatory desires.”

Bipartisan support ensures crypto lobby’s success

The US crypto industry’s main goal is to pass a large framework law, the CLARITY Act, which passed in the House of Representatives this summer and moved on to the Senate. The bill still hasn’t managed to satisfy the crypto industry, particularly Coinbase, nor the ethics and oversight concerns of Senate Democrats.

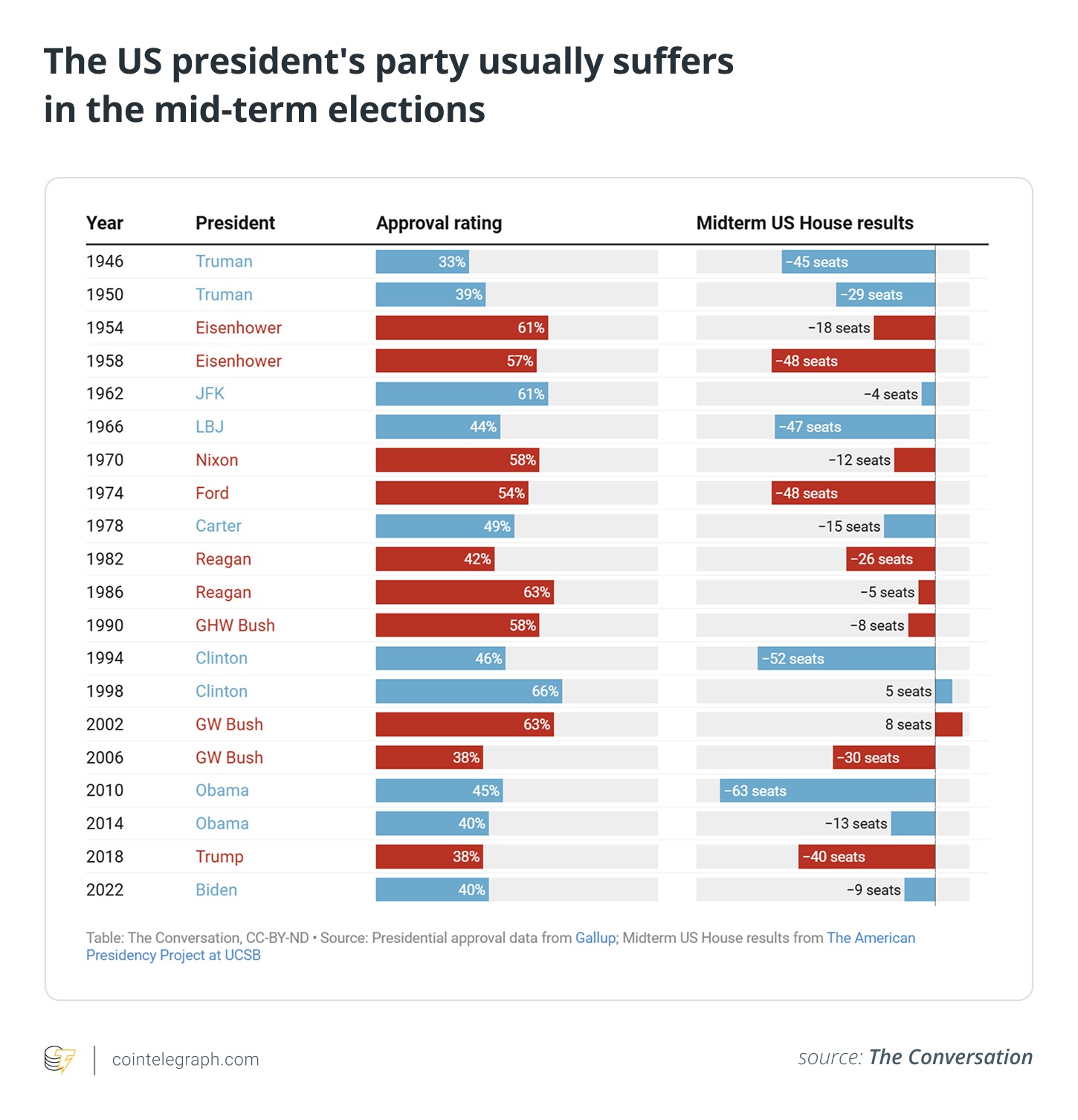

Now, the CLARITY Act is in limbo, and Congress is shifting its attention to the 2026 midterm elections. For nearly 80 years, the president’s party has almost always lost the midterms, the federal elections in the off-year between presidential elections. This is particularly important for the crypto industry, which enjoys more full-throated support among the Republican Party. Take, for example, the roll call for the Senate’s vote on the GENIUS Act: Nearly twice as many Democrats voted against the motion compared to those in support of it.

Some in the crypto space have taken this to mean they need to take a partisan stance. Cameron and Tyler Winklevoss, founders of the crypto exchange Gemini, have poured millions into the conservative PAC Digital Freedom Fund, which aims to boost pro-crypto and pro-Trump candidates.

Others have stressed the need for bipartisan support, warning that backing one party is bound to backfire once the other eventually takes power.

Representative Sam Liccardo, a crypto-friendly Democrat, told Politico in October 2025, “I don’t think anybody in this town would recommend that an industry put their eggs in one party’s basket.”

One major lobby, Fairshake, has shown it’s more than willing to support Democrats, so long as they are sufficiently pro-crypto. The Super PAC actually spent more money in support of Democrats than it did Republicans from 2023 to 2024, according to Open Secrets.

Whether it be among Republicans or Democrats, the crypto industry’s political strategy has changed significantly both in how much and where it spends its dollars.

How did we get here?

Crypto made headlines in 2024 for donating nearly a quarter of a billion dollars to different political campaigns and super PACs — the largest contribution of any single industry.

But this wasn’t crypto’s first step in the political arena. During the crypto bull run of 2020-2021, crypto companies made massive ad buys. Celebrities like Matt Damon were advertising crypto investment platforms. Now-convicted fraudster Sam Bankman-Fried slapped the name of his now-defunct crypto exchange, FTX, onto the home of the Miami Heat basketball team.

At the same time, crypto increased its lobbying efforts in Washington. Major platforms like Coinbase and fintech developers like Ripple padded their budgets as the industry gained visibility.

Coinbase raised spending from $1.5 million in 2020 to $3.9 million in 2021. Ripple more than tripled the amount it spent on lobbying over the same period, spending $330,000 in 2020 and more than $1.1 million in 2021.

One major donor from the crypto space was Bankman-Fried. He made more than $100 million in political campaign contributions in the 2022 midterms. “He leveraged this influence, in turn, to lobby Congress and regulatory agencies to support legislation and regulation he believed would make it easier for FTX to continue to accept customer deposits and grow,” federal prosecutors said in a later indictment.

By Bankman-Fried’s own admission, he supported campaigns on both sides of the aisle, though he found Republicans “far more reasonable” on crypto.

The crypto market crashed soon after. FTX went bust, the Terra stablecoin system collapsed, and the Securities and Exchange Commission (SEC), the US’ main finance regulator under then-Chair Gary Gensler, opened enforcement actions against many crypto companies operating in the US.

Related: SBF always played both sides of the aisle despite new Republican plea

In 2023, the presidential election cycle began. Trump ran against ex-Vice President Kamala Harris. Crypto, for the first time, was on the presidential platform. Trump visited a Bitcoin (BTC) conference and made promises of ending “regulation by enforcement.

Crypto poured money into the race through PACs and super PACs. For the 2024 selections, these were namely:

Fairshake raised a whopping $260 million from 2023 to 2024, at least $92 million of which came from Coinbase. It made $126 million in independent expenditures and transfers to affiliated committees.

Independent expenditures are expenditures “for a communication that expressly advocates the election or defeat of a clearly identified candidate and which is not made in coordination with any candidate or their campaign or political party,” per the FEC.

According to Follow the Crypto, the two other single-issue crypto PACs are affiliated with Fairshake, despite one being liberal and the other conservative. Defend American Jobs made $57 million in independent expenditures, and Protect Progress made $34.5 million over the same 2023-2024 period.

This vast amount of money entering PACs reflects a broader shift in how companies seek political influence.

“Super PACs are increasingly becoming in vogue for special interests who want to make their presence known in Washington,” Michael Beckel, research director of Issue One — a bipartisan political reform organization watching big money in politics — told Cointelegraph.

“Industry-aligned super PACs with huge bank accounts have made a huge splash and helped thwart new regulations on their business interests.”

Just a few years ago, “corporate influence operations focused more on lobbying and direct campaign contributions,” Beckel explained. “Now we’re seeing sector-specific super PACs with massive bank accounts.”

And it’s changing how laws are made in Washington.

Crypto lobby affects policy as Trump seeks to “nationalize” elections

Blockchain bigwigs now regularly visit Washington to meet with lawmakers and advise policymakers on how to regulate the industry.

Issue One vice president of advocacy Alix Fraser said, “The Trump administration is packed with tech industry insiders who have acted in the interest of their own companies — not the American people — to rig policy for their own profit.”

The degree to which the crypto industry is involved in the legislative process is no more apparent than with the market structure bill making its way through the Senate. Work on the bill stalled in mid-January after Coinbase withdrew its support.

The exchange’s CEO, Brian Armstrong, wrote on X:

The main point of contention is a provision that would outlaw one of Coinbase’s products: stablecoin yields for consumers. Banks are pushing to outlaw the practice, saying a flight of deposits from insured lenders could threaten financial stability. The crypto industry and Coinbase argue that the ban stifles innovation and is anti-competitive.

Earlier this week, the White House scheduled a closed-door summit for leaders from the crypto and banking industries to hash out their differences, but according to Reuters, no deal was made.

According to reporter Eleanor Terrett, Senate Democrats said that the talks were “constructive” and were optimistic about the chances of passing a bill. Reporter Sander Lutz said that Senate Minority Leader Chuck Schumer is “desperate” to get the bill finished, as Fairshake alone now has $193 million in its coffers.

“These payments help explain the crypto industry’s success in curtailing efforts to meaningfully regulate their business model, which is consistent with a well-established practice of wealthy corporate special interests using lobbying and political contributions to influence policy decisions,” Ghosh told Cointelegraph.

“This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry’s deregulatory desires.”

Rick Claypool, research director at consumer rights advocacy group Public Citizen, told Cointelegraph that big money from lobbies like crypto pushes out the priorities of most voters from the agenda.

“This feeds cynicism — the sense that our elected officials prioritize the interests of wealthy donors over all other constituents — and erodes faith in our democratic institutions.”

Related: US crypto market structure bill in limbo as industry pulls support

The increased influence of monied interests in Washington comes at a time when election integrity itself is under threat. Trump has recently said Republicans should “nationalize” the midterm elections.

“The Republicans should say, ‘We want to take over. We should take over the voting, the voting in at least many — 15 places … the Republicans ought to nationalize the voting,’” he said.

He added that he will only accept the results if they are “honest,” while claiming that there was widespread voter fraud in many American cities. Election experts have refuted the claims. House Speaker Mike Johnson has admitted that he himself has no evidence of his own claims of voter fraud.

Marc Elias, a partner at Elias Law Group, said that Trump “is not interested in following the Constitution. As we have seen before, he prefers to act by force.”

Crypto is set to increase its influence in Washington as the very elections themselves are at risk of tampering and interference from the highest levels of government.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Cointelegraph Features and Cointelegraph Magazine publish long-form journalism, analysis and narrative reporting produced by Cointelegraph’s in-house editorial team and selected external contributors with subject-matter expertise. All articles are edited and reviewed by Cointelegraph editors in line with our editorial standards. Contributions from external writers are commissioned for their experience, research or perspective and do not reflect the views of Cointelegraph as a company unless explicitly stated. Content published in Features and Magazine does not constitute financial, legal or investment advice. Readers should conduct their own research and consult qualified professionals where appropriate. Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Russia’s Sovcombank Becomes First Russian Bank to Publicly Offer Bitcoin-Backed Lending

TLDR:

- Sovcombank rolled out bitcoin-backed loans for individuals and firms that legally own digital assets in Russia.

- The launch follows an earlier pilot by state-owned Sberbank with a mining company in December.

- Russian miners are seeking liquidity solutions that allow them to retain long-term bitcoin exposure.

- The product aligns with recent regulatory changes legalizing mining and reopening crypto markets.

Sovcombank bitcoin-backed loans signal a gradual shift in Russia’s banking approach to digital assets.

The lender has launched financing options secured by bitcoin, targeting miners and legal crypto holders seeking liquidity without selling their holdings.

Sovcombank expands regulated crypto lending

Sovcombank is the first Russian bank to publicly offer bitcoin-backed loans. The product is available to individuals and corporations that legally own digital assets.

The bank emphasized that bitcoin serves strictly as collateral. Borrowers can therefore access capital while retaining ownership of their holdings.

This approach aligns with growing demand among crypto holders for non-dilutive financing. As a result, banks are reassessing how digital assets fit within lending frameworks.

In online statements, Sovcombank executives described the product as business-focused. Financing is positioned to support expansion rather than speculative activity.

State-owned Sberbank launched a similar offering earlier through a pilot program. That initiative issued a bitcoin-secured loan to mining firm Intelion Data.

However, Sberbank’s product remains limited in scope. Sovcombank’s rollout marks a broader public-facing step in crypto-secured lending.

Regulatory clarity remains uneven across the sector. Still, banks appear more willing to test products tied to digital assets.

Crypto mining became legal in Russia on November 1, 2024. The law allows registered entities to operate without energy restrictions.

Unregistered miners may operate only within strict electricity limits. This framework narrowed participation but improved oversight.

Soon after, authorities imposed a six-year mining ban in ten regions. The decision addressed power grid strain rather than crypto activity itself.

In December 2025, regulators reopened the crypto market to the public. The central bank introduced rules governing participation and compliance.

Sovcombank referenced these developments in public remarks shared online. Executives framed bitcoin-backed lending as compatible with the evolving framework.

Focus on miners, liquidity, and banking services

Russian miners and crypto businesses increasingly seek access to liquidity. Many prefer borrowing against bitcoin rather than selling during volatile market cycles.

Bitcoin-backed loans address this preference directly. They provide working capital while preserving long-term asset exposure.

Sovcombank stated that mining is no longer viewed as a niche activity. Instead, it is treated as an investment class with defined financial metrics.

Executives noted predictable returns and clearer payback periods. These factors support structured lending products tied to mining operations.

Alongside the loan launch, Sovcombank introduced a promotion for miners and hosting providers. The campaign targets registered market participants.

Corporate clients receive free account management and online banking services. Preferential terms for currency control are also included.

Small and medium enterprises benefit from free internal transfers. The limit is set at one million rubles per transaction.

Only new clients listed in the official miners’ registry qualify. This condition reinforces compliance with national regulations.

Sovcombank also confirmed it offers bitcoin-backed loans to corporate clients. Legal entities and sole proprietors may access the product.

The bank outlined broader plans for crypto-sector partnerships. These include miners, data center operators, exchanges, and money changers.

Public statements referenced specialized cash management tools. Project financing and risk management services were also mentioned.

Together, these offerings signal deeper engagement with the crypto economy. Russian banks are gradually integrating digital assets into traditional finance under defined rules.

Crypto World

Crypto crash to end soon? Recovery possible, indicators show

The crypto crash accelerated this week, with Bitcoin price plunging to $60,500, its lowest level since October 2024, and the market capitalization of all coins moving to $2.2 trillion.

Summary

- The crypto crash accelerated this week as most coins tumbled.

- The Fear and Greed Index has fallen to extreme levels.

- Technical analysis suggests that it has become highly oversold.

Why the crypto crash is happening

The ongoing crypto market retreat is influenced by a mix of global economic concerns and investor sentiment. Rising tensions between the U.S. and Iran have added uncertainty, with both sides issuing warnings that any escalation could impact the region and potentially affect oil prices. However, there are no confirmed reports of U.S. military action, and any link between geopolitical fears and crypto price movements is speculative.

Bitcoin and altcoins also dropped as investors rotated out of risk assets and into value ones. A good example of this is the stock market, where the tech-heavy Nasdaq 100 Index has slumped, while value ETFs like the Vanguard Value ETF and the Schwab US Dividend ETF have soared to record highs.

Additionally, the rising crypto ETF outflows and soaring liquidations put more pressure on these assets. Spot Bitcoin (BTC) ETFs shed over $689 million in assets this year and are in their fourth consecutive month in the red. Similarly, Ethereum ETFs have shed over $149 million in assets.

Crypto liquidations have also soared in the past few days. That jumped by over 122% in the last 24 hours to over $2 billion.

On the positive side

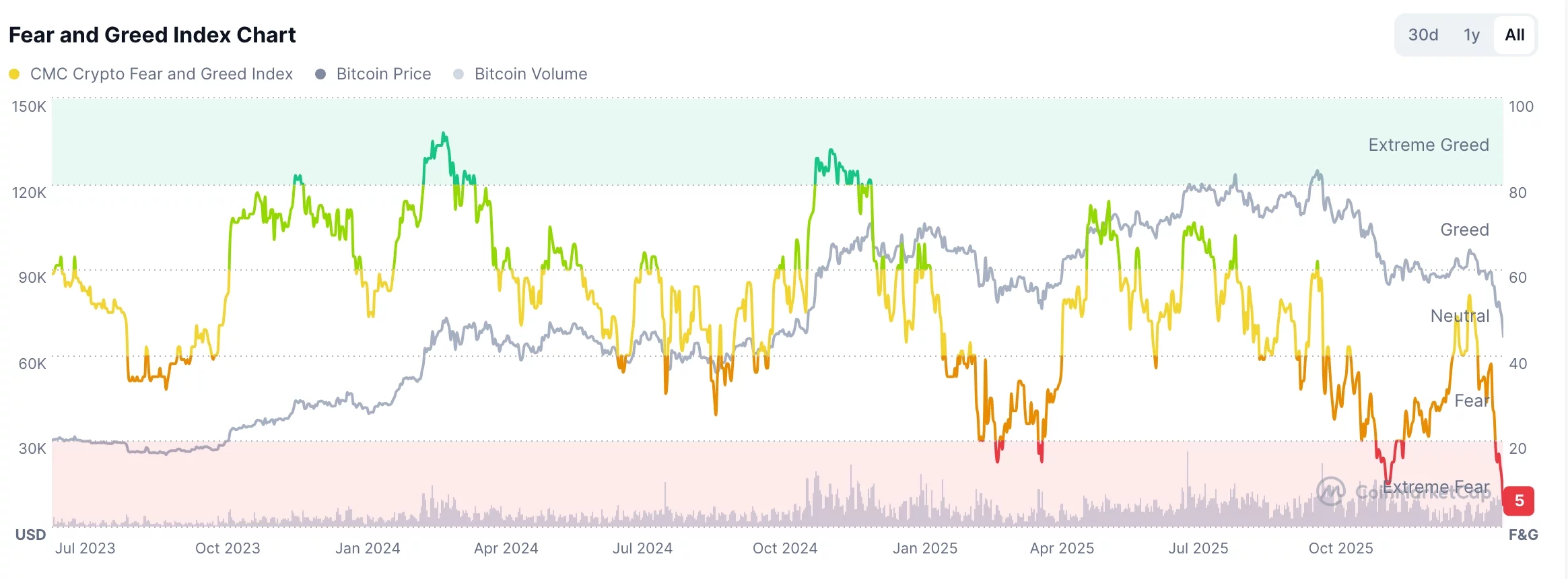

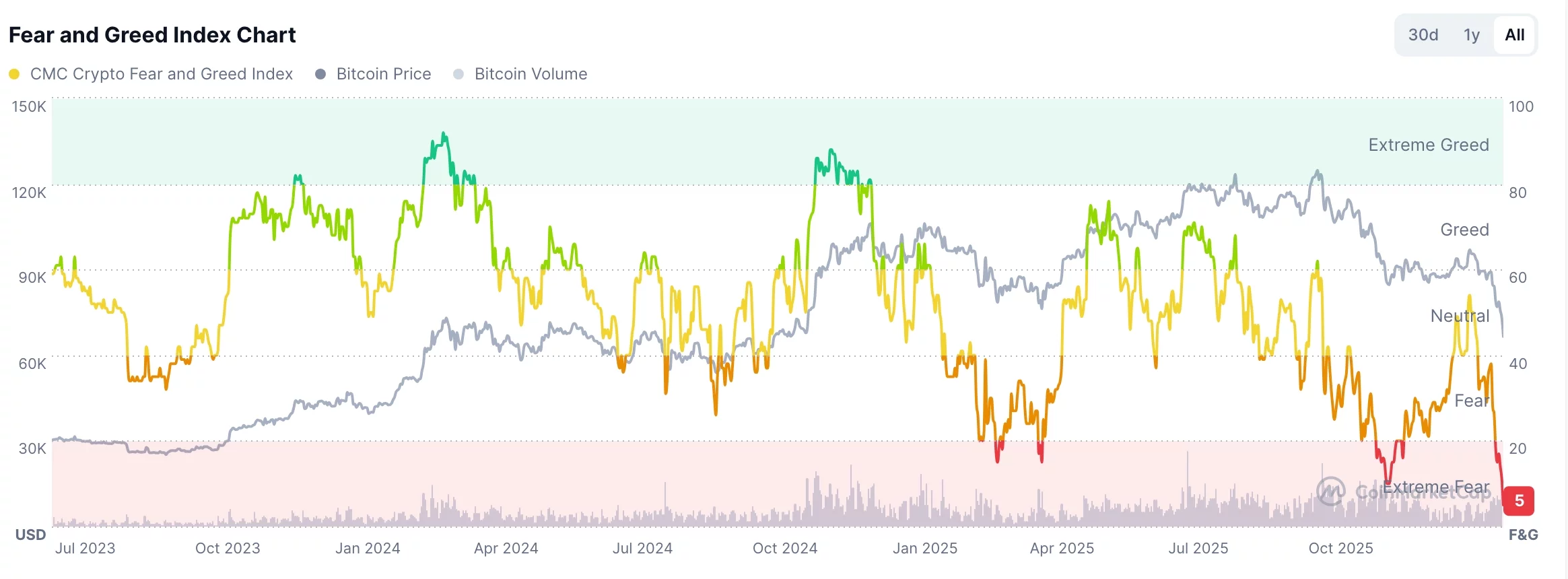

There are some key signs that suggest a crypto recovery is coming soon. First, the Crypto Fear and Index has slipped to 5. That’s the lowest level in years.

In most cases, crypto bull runs normally start when the index moves to the extreme fear zone. Similarly, crypto prices typically drop when they move into the extreme greed zone.

A good example of this is what happened in December, when it moved into the extreme greed zone at 10. Bitcoin and other altcoins rebounded in January, with BTC nearing $100,000. Before that, the index moved to the extreme fear zone in April last year and then rebounded to a record high after Trump changed his tune on tariffs.

Technical analysis also suggests that Bitcoin may rebound soon. For example, Bitcoin’s Relative Strength Index has moved to the oversold level of 27 for the first time since November 2022. Bitcoin has always rebounded whenever it moved to these oversold levels.

At the same time, Bitcoin has fallen to the rising wedge target. As the chart below shows, the widest point of this pattern was ~42%. It has then fallen by over 42% from the breakout point.

Crypto World

Remittix’s 300% bonus goes live

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix 300% bonus sparks buzz on X, Telegram, and Discord, highlighting real product utility over hype.

Summary

- Remittix sparks crypto buzz with an exclusive 300% bonus, backed by 703m+ tokens sold and $28.9m raised.

- Analysts highlight Remittix’s working wallet, strong funding, and growth plan as drivers of this week’s crypto talk.

- Crypto communities react to Remittix’s rare bonus, emphasizing urgency, scarcity, and verified project progress.

This week, crypto users on X, Telegram, and Discord are talking about one thing: the Remittix 300% bonus. While the market as a whole is still slow, this brings in new excitement. Experts have said that this incident is important because it is not just about promises or hype around cryptocurrency; this time, it is about an actual product.

In past cycles, big bonuses were often linked to risky or unfinished projects. Remittix is different because it already has a working wallet, strong funding, and a clear growth plan. That is why many analysts are calling this one of the most talked-about crypto events of the week.

Why this Remittix bonus is getting so much attention

The main reason for the buzz is that a 300% bonus is extremely rare in today’s cryptocurrency market. Even more surprisingly, this bonus is not open to everyone. It is exclusive and requires a special code that can only be gotten through email. The code is not public, and you cannot find it in any online articles.

This setup has piqued the curiosity of many users. It evokes a sense of urgency and scarcity for the bonus offer. Experts have noted that this is why the topic is trending in crypto communities at the moment. Analysts have all agreed that the true reason for the interest in the topic is what Remittix is working on behind the scenes.

Another reason this event is getting attention is Remittix’s strong fundraising performance. The project has sold over 703.7 million tokens, raised more than $28.9 million, and is currently trading at $0.123 per token. Experts say this level of progress shows that many investors are backing the idea even before the full platform launch.

Remittix: A project focused on real use

Remittix is a PayFi project, and this means it focuses on payments, not just trading or speculation. Its goal is to help people use crypto in real life by making it easy to move money across borders. Many crypto users face the same problem. They hold digital assets, but turning them into cash that they can actually spend is slow and costly. Banks charge high fees, and transfers can take days. Remittix is designed to fix this.

For instance, with Remittix, you can send cryptocurrency, and the recipient receives the funds in local currency and is directly deposited into their bank account. This is especially useful for freelancers, remote workers, and those in countries with poor banking systems. What sets Remittix apart is that it has already made progress.

Remittix: Real progress that builds trust

Unlike many crypto projects, Remittix already has a functional product. The wallet is already available on the Apple App Store, so users can use it anytime they want. The Google Play Store version will be available very soon. Another major milestone is the full PayFi platform launch scheduled for February 9, 2026. Experts believe this date is important because it marks the move from early testing into full-scale use.

Here are some of the key features driving interest in Remittix:

- Remittix is fully verified by the CertiK team KYC

- The project ranks #1 on pre-launch tokens

- The platform offers lower fees than traditional remittance services

- It is built for everyday users and not just crypto traders

Conclusion: More than just a bonus event

While the headlines focus on the Remittix 300% bonus, experts say the bigger picture is more important. Remittix already has a live wallet, a clear mission to fix real payment problems, and a confirmed PayFi platform launch on February 9, 2026.

This week’s buzz is not just about free value. It is about a project that combines strong incentives with real-world utility. That combination is rare, and it explains why Remittix has become the crypto event everyone is talking about right now.

For more information, visit the official website, and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

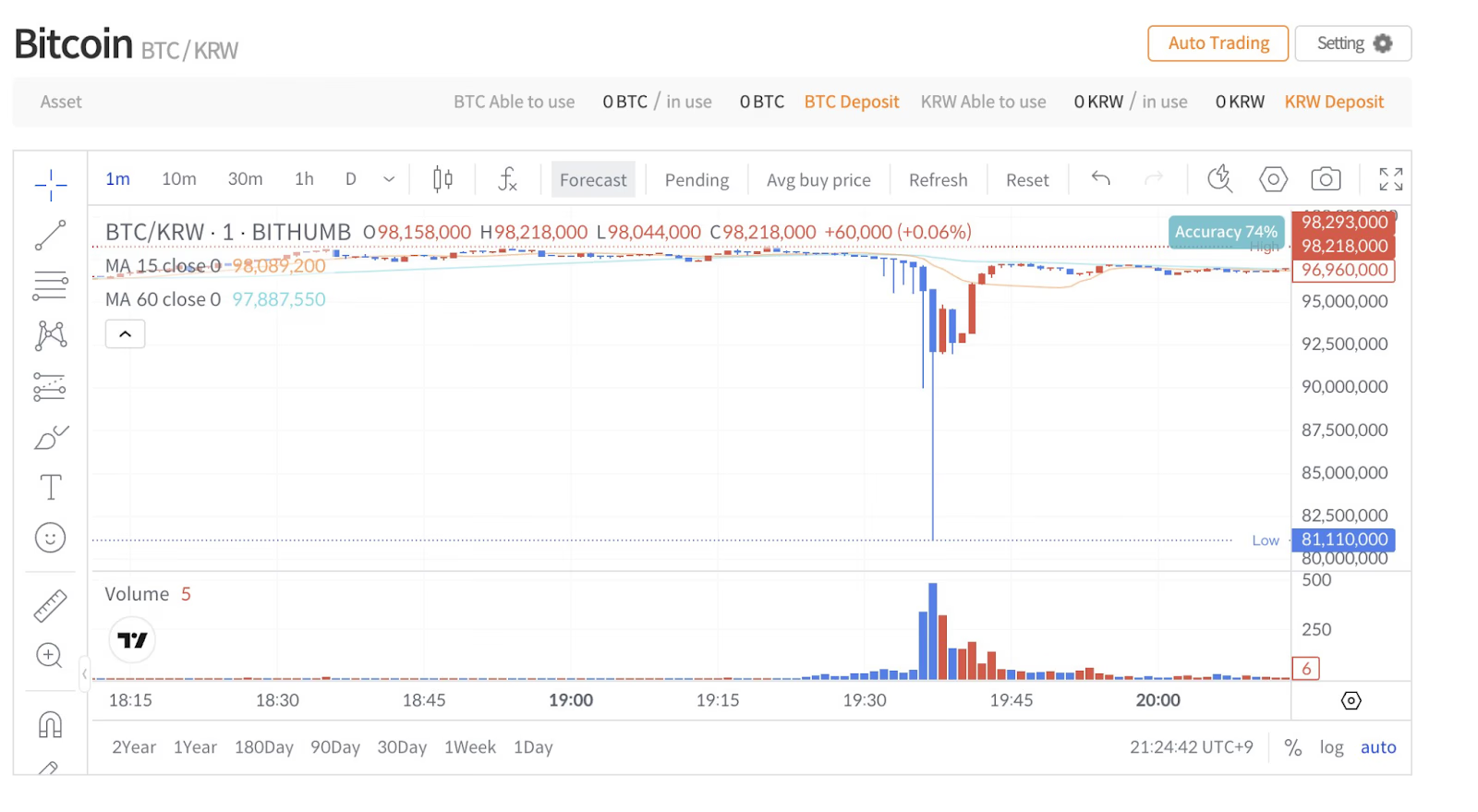

Bithumb Mistakenly Airdrops $30 Billion of Bitcoin

The Korean crypto exchange intended to send 2,000 WON to some users but accidentally sent 2,000 BTC instead.

Bithumb, one of Korea’s leading centralized exchanges (CEX), made a multi-billion dollar mistake overnight when management accidentally sent 2,000 BTC, worth almost $140 million, to more than 200 users instead of 2,000 WON, which is worth less than $1.5.

As users received the BTC, they immediately attempted to sell and offramp funds, briefly sending BTC on Bithumb almost 18% below the market price according to LookOnchain.

The exchange addressed the situation in a notice that read, “During today’s event payment process, an abnormal amount of Bitcoin was paid to some customers. As sales were made on some accounts that received the Bitcoin, the Bitcoin price temporarily fluctuated rapidly. Bithumb immediately recognized abnormal transactions through its internal control system and quickly restricted transactions to related accounts.”

Korean outlet The Chosun Daily broke the news and said that “most” of the 240 users who partook in Bithumb’s Random Box promo event received 2,000 BTC in each of their wallets, and roughly $3 billion was withdrawn from the exchange.

According to the local news outlet, the Financial Services Commission (FSC) and Financial Supervisory Service (FSS) in Korea are actively investigating the incident due to its magnitude.

The exact number of BTC distributed has not been disclosed, but based on information provided by Chosun, the airdrop could have been worth up to $30 billion.

Crypto World

MegaETH Unveils Token Buyback and TGE Plan

The highly anticipated Ethereum Layer 2 blockchain will launch its mainnet on Monday.

MegaETH, the real-time blockchain and Ethereum Layer 2, is launching its mainnet on Feb. 9, but the token generation event (TGE) will be dependent on network performance milestones.

The MegaLabs team has defined three key performance indicators (KPIs), and at least one of these must be met for the TGE to proceed. The chain must either establish a baseline of $500 million in USDM circulating, see 10 “mafia mainnet”- aligned apps deployed with more than 100,000 transactions across at least 25,000 wallets, or host three apps that generate at least $50,000 in daily fees for 30 days.

Once the token is circulating, MegaETH will use priority fees from its proximity markets and yield from its native stablecoin, USDM, for MEGA token buybacks.

In an article, MegaETH co-founder Shuyao Kong said, “The largest issue that’s faced our industry over the past few years was a simple question: why does a token need to exist? Equity has acted as king, with every successful story over the past few years, barring hyperliquid, having some variation of equity.”

The community-focused approach has been well received, but pre-market derivatives still price MEGA at just a $1.3 billion fully diluted valuation, only 40% higher than its initial coin offering (ICO) price in October.

This comes just days after Ethereum cofounder Vitalik Buterin said the current Ethereum Layer 2 landscape “makes no sense” and stated that Layer 2’s must offer something completely unique outside of Ethereum scaling.

Crypto World

Why is crypto down? 6 key factors from Bitwise’s Matt Hougan

Bitcoin has taken a significant hit recently, falling 14% in a single day and 25% over the past week. And this bear market could extend for several months before it fully bottoms, according to Bitwise’s Matt Hougan.

Summary

- Bitcoin’s recent drop is driven by factors like investors preemptively adjusting to the four-year cycle, competition from AI and metals, and a major leveraged liquidation event.

- While the market has fallen 54% from its peak, previous downturns have been more severe, Hougan says.

- Regulatory progress and innovation will drive future growth, Hougan says. Fortune favors patient investors.

Although Bitcoin has shown a brief recovery, trading nearly 50% below its all-time high, investors are left grappling with questions: Why is the market down? Could it fall further? And when will it bottom?

6 key factors

According to Hougan, Bitwise’s chief investment officer, there are several complex reasons behind the current crypto market downturn, but six primary factors stand out.

- The Four-Year Cycle: A major reason for the pullback is that long-term investors have been selling to preemptively adjust for the four-year market cycle, where crypto sees strong bull years followed by inevitable pullbacks. Investors, wary of a repeat of previous cycles, have sold significant portions of their holdings—estimated to be over $100 billion in Bitcoin last year alone.

- Competition from Other Markets: Crypto has enjoyed significant retail interest, but now AI stocks and precious metals are pulling some attention away. “Attention investors,” who flocked to crypto in recent years, are now diverting their capital elsewhere.

- The October 10 Leverage Liquidation: The crypto market also faced the largest leveraged liquidation event in history following an unexpected announcement by former President Donald Trump. This event triggered panic selling in the absence of traditional market liquidity, further depressing prices.

- Concerns Over Federal Reserve Leadership: President Trump’s nomination of Kevin Warsh for Federal Reserve Chair raised concerns, particularly among investors who feared Warsh’s hawkish stance on interest rates, creating unease in broader markets, including crypto.

- Rising Fears of Quantum Computing: There’s a growing anxiety within the crypto community about the potential threat of quantum computing, which could undermine the security of Bitcoin. While many believe it’s a long-term issue, the lack of visible action has led some investors to retreat from the market.

- Macro Risk-Off Sentiment: A broader shift in global markets towards risk-off sentiment has affected Bitcoin. Alongside Bitcoin’s struggles, other assets like gold, silver, and tech stocks have also seen steep declines.

Could crypto fall further?

While the market’s current drawdown of 54% from its peak seems severe, Hougan cautions that it could go lower.

Previous downturns have been much larger—Bitcoin fell 86% in 2014, 84% in 2018, and 77% in 2022.

Historical trends suggest that bear markets typically last 12-13 months, so this current slump might not be over yet. However, given crypto’s maturing nature, a 77% drop seems unlikely, though it remains a possibility.

What could help it recover?

For many seasoned investors, this moment feels similar to past bear markets in 2018 and 2022, which were followed by massive rallies. Investors who bought the dip in those years saw substantial returns—around 2,000% from 2018 and 300% from 2022.

The fundamentals supporting crypto are still in place: a growing demand for digital currencies, increasing regulatory clarity, and innovations like tokenization and stablecoins continue to drive the sector forward.

The timing of the market bottom remains uncertain, but recovery often comes through time and exhaustion. Specific catalysts could accelerate recovery, such as regulatory developments like the Clarity Act, the continued rise of AI-linked crypto projects, or a return to risk-on market sentiment.

For now, Hougan advises patience. While it’s impossible to predict the exact moment the market will turn, the long-term outlook for crypto remains promising for those with the fortitude to weather the storm.

Crypto markets are volatile, and the current downturn could continue in the short term, Hougan adds. However, for investors with a long-term perspective, history suggests that bear markets often precede significant growth.

With key factors like regulatory advancements and growing adoption still in play, he argues that crypto’s future still holds substantial upside, making the current moment a potential buying opportunity for those prepared to wait.

Crypto World

Nancy Guthrie Kidnapping Tied to Bitcoin Ransom?

Nancy Guthrie, an elderly 84-year-old woman, vanished overnight in Arizona, triggering a high-stakes investigation with alleged crypto demands.

She is the mother of popular NBC journalist and TODAY show host Savannah Guthrie. Authorities believe she was likely taken from her home after a violent encounter.

Sponsored

Sponsored

Blood at the Doorstep Turns Missing Case Criminal

Investigators found blood spatter at the entrance of her residence in the Catalina Foothills area near Tucson, Arizona. Forensic testing confirmed the blood belonged to Nancy Guthrie, according to law enforcement.

As a result, what began as a missing-person report has escalated into a suspected kidnapping investigation.

Nancy Guthrie lived a private, low-profile life and was not a public figure. She became nationally known only because of her daughter’s role as a senior anchor on NBC’s Today.

Family members last saw her on the evening of January 31 after dropping her home. She failed to attend church the next morning, raising immediate concern.

Her phone, wallet, car, and medication were all left behind.

The Pima County Sheriff’s Department, with assistance from the FBI, is leading the investigation.

Sponsored

Sponsored

Deputies also discovered that her doorbell camera had been removed or disabled, reinforcing concerns that she did not leave voluntarily.

So far, authorities have named no suspects and confirmed no proof of life.

Bitcoin Ransom Claims Add a Crypto Twist

The case took a darker turn after multiple alleged ransom communications surfaced, some referencing Bitcoin payments.

Sponsored

Sponsored

Media reports describe a purported ransom note demanding “millions of dollars’ worth of Bitcoin”, complete with deadlines and a wallet address.

However, police have not confirmed the authenticity of any ransom demand or verified that it came from whoever took her.

Crucially, investigators stress that no confirmed captor has made direct contact with the family.

Sponsored

Sponsored

Fake Bitcoin Extortion Attempt Clouds the Case

Separately, authorities arrested Derrick Callella, a California man accused of sending fraudulent Bitcoin-related messages to members of the Guthrie family.

Law enforcement says Callella is not connected to the kidnapping and acted independently, highlighting the rise of opportunistic crypto scams during high-profile cases.

Investigation Ongoing, Answers Still Missing

Savannah Guthrie has stepped away from broadcasting duties as the search continues.

For now, investigators say the focus remains on locating Nancy Guthrie and determining who took her, how, and why—with the Bitcoin angle still unverified and under review.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World7 days ago

Crypto World7 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech6 hours ago

Tech6 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports16 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat12 hours ago

NewsBeat12 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World1 day ago

Crypto World1 day agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Tech6 days ago

Tech6 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined