Crypto World

XRP price’s latest bounce lacks follow-through as sellers stay in control

XRP edged higher over the past 24 hours, rising roughly 2% in a modest relief move after last week’s sharp sell-off.

Summary

- XRP price rose about 2% in the past 24 hours, but the move shows little follow-through as momentum and volume indicators continue to favor sellers.

- RSI remains below neutral and on-balance volume is still trending lower, suggesting recent gains are driven by short-term relief rather than sustained buying interest.

- Fibonacci retracement levels point to heavy resistance between $2.05 and $2.30, a zone XRP price would need to reclaim to shift its short-term outlook.

But despite the uptick, the Ripple token’s (XRP) chart indicators suggest the bounce offers little cause for celebration, with sellers still firmly in control of the broader trend.

XRP price holds near $1.45, but broader downtrend remains intact

On the daily chart, XRP remains locked in a clear downtrend, marked by a series of lower highs and lower lows since late January. While price has stabilized near the $1.45 level after briefly dipping toward recent lows, the move appears more like short-term consolidation than the start of a meaningful recovery.

Momentum indicators reinforce that cautious view.

The relative strength index (RSI) is hovering in the mid-30s, well below the neutral 50 mark, indicating bearish momentum remains intact even after the latest bounce. Historically, sustained recoveries tend to coincide with RSI reclaiming neutral territory, something XRP has yet to achieve.

Volume-based indicators also point to continued selling pressure. On-balance volume (OBV) has been trending lower, suggesting that distribution is still outweighing accumulation. This implies that recent green candles may be driven by short covering or temporary relief rather than fresh buying interest.

XRP price faces heavy resistance near $2.05–$2.30 fibonacci zone

From a trend perspective, XRP is trading well below its 20-day simple moving average, currently near $1.68. The downward slope of that moving average underscores the lack of bullish follow-through and signals that rallies are likely to face selling pressure at higher levels.

Fibonacci retracement levels drawn from XRP’s recent swing high to its January low further highlight the challenge for buyers. The $2.05–$2.30 zone, which includes the 0.382, 0.5 and 0.618 retracement levels, represents a dense area of overhead resistance. A sustained move above that range would be needed to shift the short-term outlook more constructively.

Until then, analysts say the latest 2% rise should be viewed in context — as a pause within a broader downtrend rather than a decisive change in direction. With momentum and volume indicators still favoring sellers, XRP’s price action suggests caution remains warranted in the near term.

Crypto World

Xinbi Handled Nearly $18B in Crypto Transactions After Ban: TRM Labs

A Chinese-language crypto guarantee marketplace known as Xinbi processed nearly $18 billion in onchain transaction volume despite platform bans and United States enforcement actions aimed at dismantling similar services, according to a new report from TRM Labs.

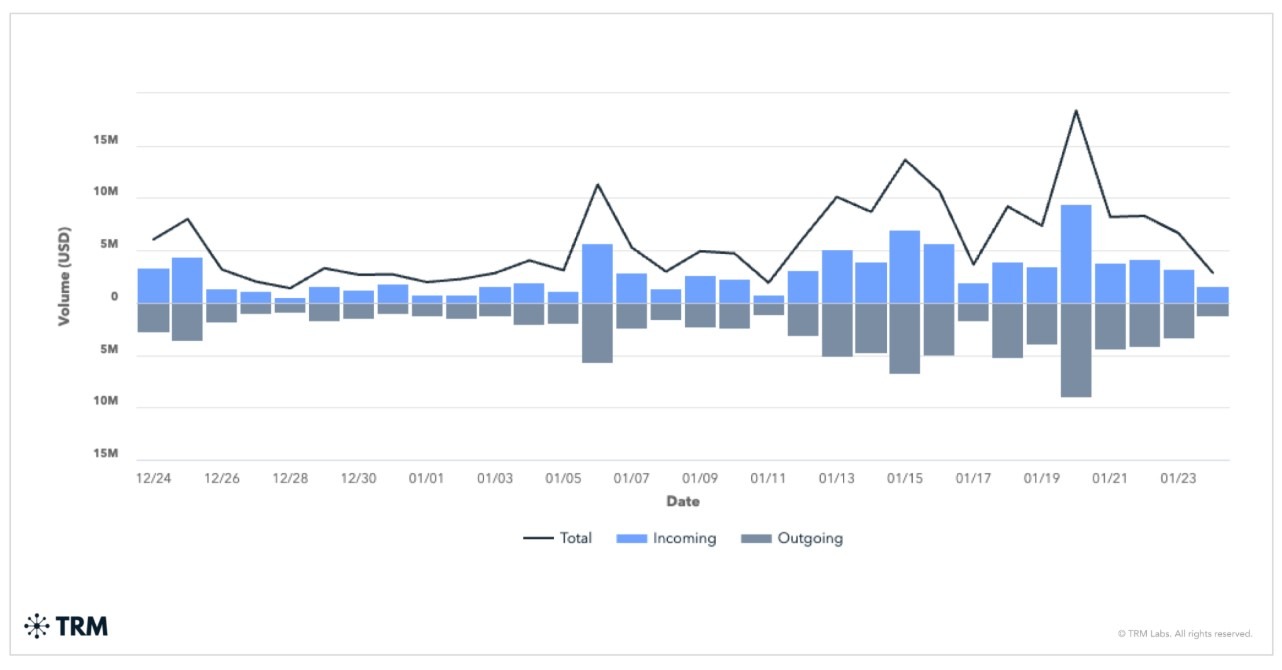

The report said recent crackdowns — reshaped but failed to dismantle — a key layer in crypto-enabled laundering infrastructure. TRM’s analysis showed that Xinbi sustained on-chain activity after Telegram banned clusters of Chinese-language guarantee services in 2025.

The report attributes Xinbi’s resilience to rapid migration to alternative messaging services and the launch of an affiliated wallet, XinbiPay. Onchain data showed wallet activity rebounded in January 2026 as users transitioned to the new setup.

The analytics firm said Xinbi has allegedly played a central role in allegedly laundering proceeds for scam operations and cybercrime syndicates, including pig-butchering fraud schemes.

The $17.9 billion figure reflects gross onchain transaction volume processed by wallets attributed to Xinbi by TRM. This includes inflows, outflows and internal transfers within the platform’s escrow and wallet system.

TRM said the figure does not represent the net proceeds or confirmed illicit gains, and may include internal recycling of funds, which is common to guarantee services.

Alleged illicit guarantee service Xinbi adapts to enforcement

In a statement sent to Cointelegraph, Ari Redbord, global head of policy at TRM Labs, said services like Xinbi are adapting.

“Guarantee services like Xinbi are learning to survive enforcement by fragmenting across platforms and building their own infrastructure,” Redbord said.

“These services sit at the center of the scam economy,” he said, adding that taking them out of the laundering chain exposes entire networks that depend on them.

TRM said Xinbi started promoting alternative channels for coordination as early as mid-2025, laying the groundwork for migration as enforcement pressure intensified.

The analytics firm said the transition accelerated in January, coinciding with additional actions against peer services and arrests tied to laundering networks.

Related: Crypto thieves, scammers plunder $370M in January: CertiK

Xinbi previously flagged over $8 billion in stablecoin flows

Xinbi has been under scrutiny since 2025. In May, blockchain analytics firm Elliptic reported that wallets linked to Xinbi Guarantee had received at least $8.4 billion in stablecoins, tied to money laundering and scam-related activity in Southeast Asia.

The earlier report linked Xinbi to a Chinese-language, Telegram-based marketplace selling money laundering services, stolen data, scam-enabling tools and other illicit offers.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

Crypto Fund Outflows Drop 89% to $187 Million

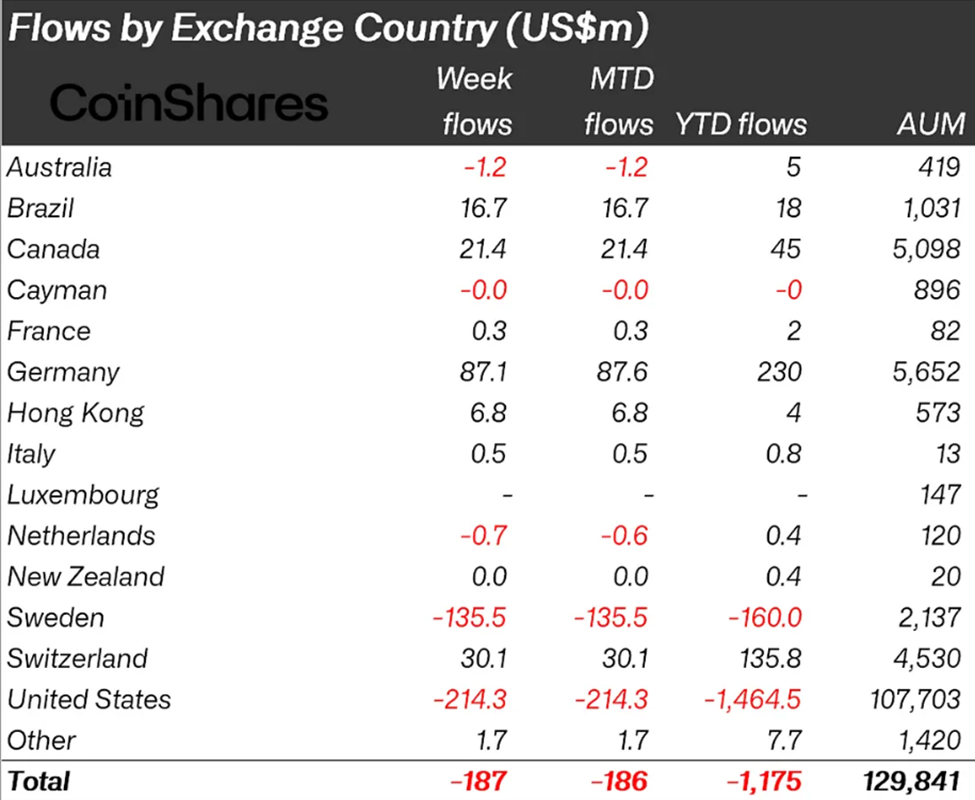

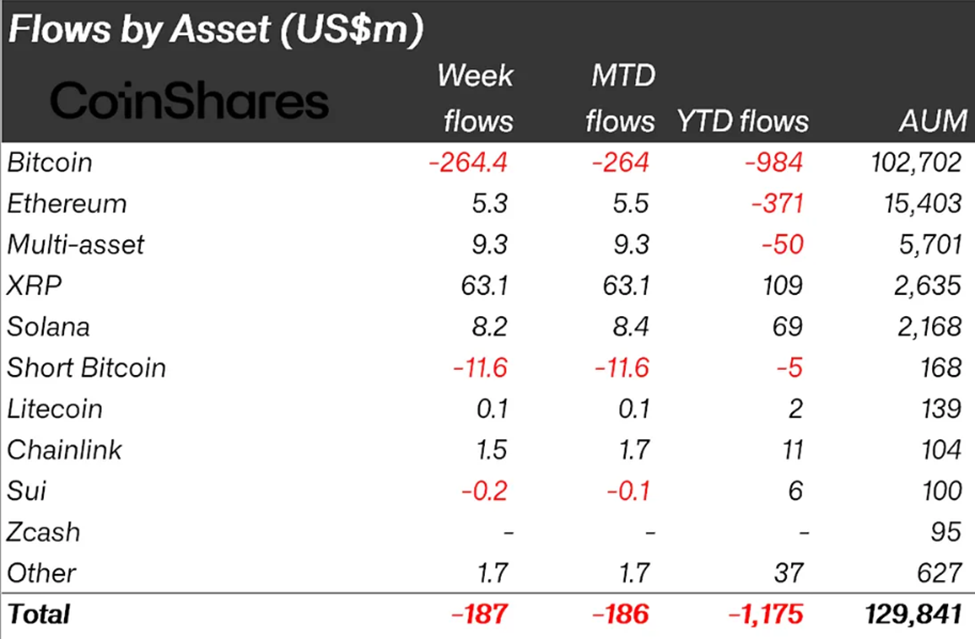

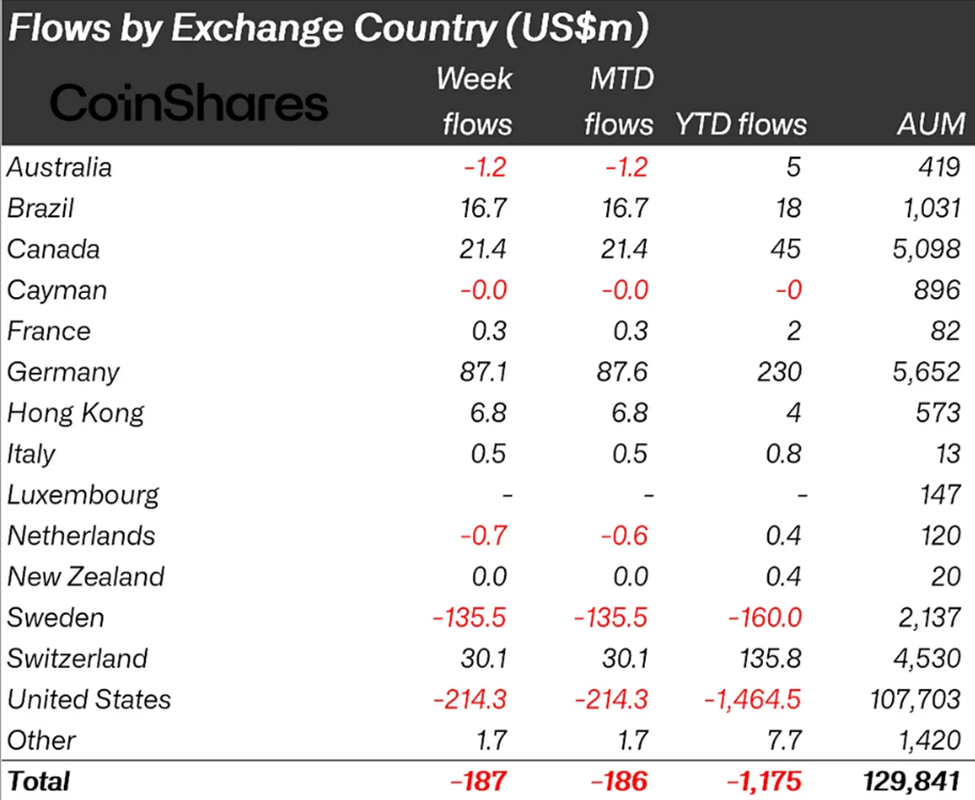

Crypto markets may be showing early signs of stabilization after weeks of intense selling, according to the latest CoinShares report on digital assets.

Investment products saw outflows collapse from over $1.7 billion recorded for two successive weeks to just $187 million last week.

Sponsored

Crypto Outflows Shrink to $187 Million, CoinShares Report Shows

CoinShares’ latest figures show that total assets under management fell to $129.8 billion, the lowest level since March 2025. This reflects the ongoing impact of the recent price slide.

Based on the chart below, regional trends hint at selective confidence, with institutional and region-specific strategies diverging even as global sentiment remains cautious.

Yet while investors were cautious, trading activity remained strong. Crypto exchange-traded products (ETPs) recorded a record $63.1 billion in weekly volume. With this, they surpassed the previous high of $56.4 billion set in October 2025.

Notably, high volumes amid slowing outflows indicate that investors are repositioning rather than abandoning the market, a subtle but important distinction.

Sponsored

Bitcoin experienced $264 million in outflows, highlighting a rotation away from the pioneer crypto toward alternative digital assets.

Among altcoins, XRP, Solana, and Ethereum led inflows, receiving $63.1 million, $8.2 million, and $5.3 million, respectively. XRP, in particular, has emerged as a favorite, attracting $109 million year-to-date.

Crypto Capitulation Shows Signs of Slowing, But Bottom Not Yet Confirmed

Despite continued price pressure, it is worth noting that the sharp drop in outflows is no mean feat, following $1.73 billion in negative flows and $1.7 billion the week before. This sharp contraction in crypto fund flows across successive weeks is being interpreted as a potential inflection point.

Sponsored

According to analysts, such a deceleration often precedes changes in market momentum, suggesting the selling frenzy could be approaching its limit.

“The deceleration in outflows suggests selling pressure is easing, and capital flight may be reaching exhaustion. Historically, this shift often precedes a change in market momentum. Early signs of stabilization are starting to emerge,” stated Andre.

Historically, crypto cycles rarely reverse immediately following peak sell-offs. Instead, the market often experiences a gradual easing of outflows before inflows return, a pattern that seems to be emerging in the current correction.

Therefore, last week’s slowing outflows may be a leading indicator, but should not be misconstrued as a guarantee of recovery.

Sponsored

The broader implication is that the market may be transitioning from panic-driven capitulation to consolidation and selective accumulation.

While Bitcoin continues to see outflows, the inflows into altcoins and regional markets suggest that investors are rotating risk rather than exiting crypto entirely.

Still, caution remains warranted because one week of slower crypto outflows does not signal a confirmed bottom.

Crypto World

Infini Hacker Returns After Exploit, Buys Ether Dip $13M

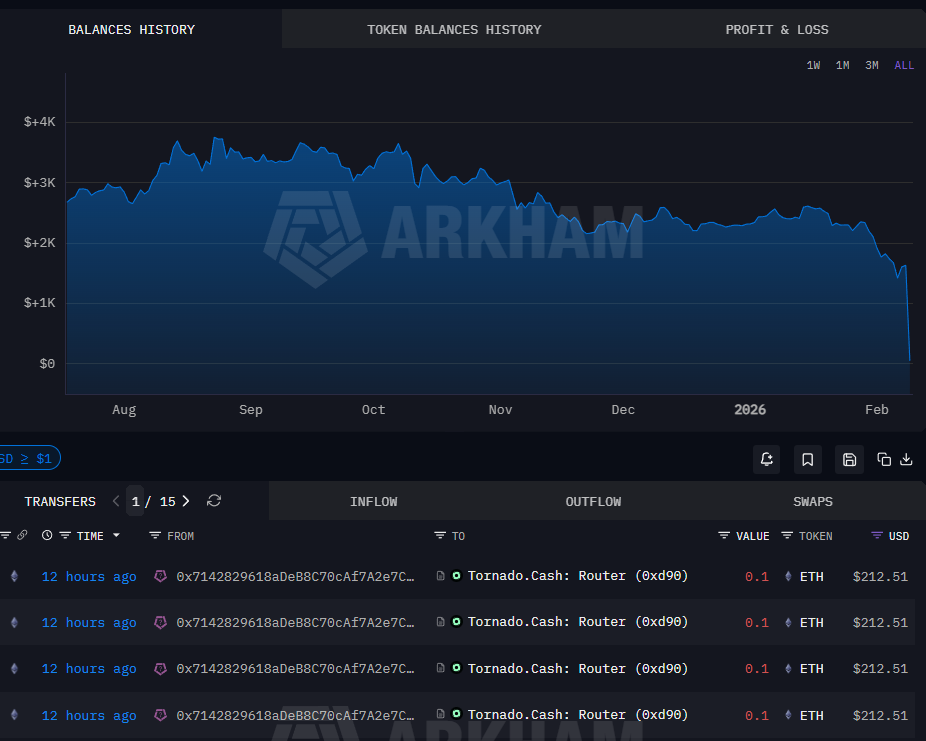

A wallet linked to the $50 million Infini exploit has become active again nearly a year after the breach, snapping up Ether during last week’s market downturn before routing the funds through a crypto mixing service.

The Infini exploiter-labelled wallet address bought $13.3 million worth of Ether (ETH) as the price dropped to $2,109 before sending the funds to crypto mixing protocol Tornado Cash, according to blockchain data platform Arkham.

“He seems very good at buying low and selling high,” blockchain tracking service Lookonchain said in a Monday X post.

The activity marked the wallet’s first known transactions since August 2025, when the same address sold about $7.4 million worth of Ether near $4,202, close to the asset’s yearly high at the time.

Infini exploiter buys ETH dip after massive liquidations

The renewed activity comes against the backdrop of a sharp market selloff. Crypto markets logged their 10th-largest liquidation event on record last week, with roughly $2.56 billion in leveraged positions wiped out, according to data from Coinglass.

Related: Wallet linked to alleged US seizure theft launches memecoin, crashes 97%

Ether’s price briefly sank to $1,811 on Thursday, marking a nine-month low last seen at the beginning of May 2025, TradingView data shows.

The acquisition comes a year after stablecoin payment company Infini lost $50 million in an exploit suspected to have been conducted by a rogue developer who retained administrative privileges after project delivery, Cointelegraph reported in February 2025.

The stolen USDC (USDC) was immediately swapped for Dai (DAI) stablecoins that have no freeze function. The latest transactions show that the attacker is still at large with the $50 million, using it to chase more profits through cryptocurrency trading.

The ETH purchase suggests the exploiter is still actively trading the proceeds of the attack, rather than exiting entirely into stablecoins.

Related: Bitcoin dips to $60K, TRM Labs becomes crypto unicorn: Finance Redefined

Infini launches Hong Kong lawsuit against developer

A month after the exploit, Inifini filed a Hong Kong lawsuit against a developer and several unidentified individuals suspected of involvement in the $50 million breach.

In a March 24 onchain message to the attacker, Infini named developer Chen Shanxuan and three unidentified persons with access to wallets involved in the exploit as defendants in the lawsuit.

The Hong Kong court also sent an injunction order via an onchain message to the attacker’s wallet, including a writ of summons for the defendants.

Infini previously offered 20% of the bounty to the hackers responsible for the attack, upon return of the stolen funds. The protocol claimed it had gathered IP and device information about the exploiters.

Cointelegraph reached out to Infini for comment on progress related to the legal dispute and the recovery of the stolen funds, but had not received a response by publication.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

January’s ‘great decoupling’ flips Bitcoin from buy-the-dip to sell-the-rip: Finestel

January’s “fake rally” ended with Bitcoin losing its $84k floor as smart money sold into ETF euphoria, rebuilt stablecoin war chests, and shifted to defensive accumulation, according to a new monthly report published by Finestel.

Summary

- Finestel says tourists chased “Trump QE” ETF flows as BTC spiked toward $98k, before Fed and Iran shocks sent Bitcoin crashing while gold hit new highs.

- BTC’s close near $77,195 trapped ~1.2m coins at a loss, while ETH broke $2,900 support, saw a 26% January drop, and on-chain realized losses topped $400m per day.

- Pro desks raised stablecoin allocations from ~5% to 28% and now favor a 55% BTC, 35% stables mix, treating $75k–$77k as support and $84k as the line to re-risk.

According to a new monthly report published by Finestel, January’s “great decoupling” was brutal, but it was not blind chaos. It was a month in which retail chased the “digital gold” myth while smart money quietly sold into them and raised cash at the top.

From Trump QE euphoria to Warsh shock

The year opened with what Finestel calls a “fake rally,” as roughly $1.42 billion rushed into U.S. spot Bitcoin ETFs on the back of “Trump QE” hopes and easy-money fantasies. “This was just tourists chasing a trend, not believers,” the report notes, as BTC ripped back toward $90,000 and briefly tested $98,000. Then came the double hit: Kevin Warsh emerging as Fed Chair favorite and rapidly escalating Iran tensions, which flipped the tape from risk-on to full risk-off almost overnight. Gold powered to fresh highs above $5,500 while Bitcoin “acted like a risky tech stock and crashed,” shattering the digital gold story for now.

Broken floors and forced sellers

Technically, the key event was the loss of the long‑defended $84,000 floor in Bitcoin. By month-end, BTC closed near $77,195, effectively trapping about 1.2 million coins at an unrealized loss and turning that supply into heavy overhead resistance. “We are no longer in a ‘buy the dip’ environment; until proven otherwise, we have entered a ‘sell the rip’ structure,” Finestel warns. Ethereum fared worse, ending January down 26% as the ETH/BTC ratio slid to multi‑year lows and the $2,900 support gave way, opening “the door to lower prices around $2,200” despite a $104 million ETH buy from Bitmine that the market simply faded. On‑chain, the reset was violent: short‑term holders were dumping at roughly $400 million in daily realized losses, while Jan. 31 alone saw $2.53 billion in liquidations, 88% from longs.

Smart money’s defensive rotation

Against this backdrop, Finestel’s asset‑manager data show professionals were not caught flat‑footed. “While the broader market chased the $95,000 breakout, professional desks on Finestel were already executing a quiet exit,” the report states. Stablecoin balances that had been run down to 5.2% in early January were methodically rebuilt, climbing to 18.5% as ETF inflows peaked and then to 28.4% by the time the late‑month liquidation cascade hit. “This wasn’t luck; it was a disciplined execution of ‘selling the rip,’” Finestel writes, arguing that January “transferred wealth from weak ETF hands to strong corporate balance sheets.”

Policy tailwinds beneath the pain

Ironically, January’s price carnage arrived as the regulatory backdrop turned more constructive. In Washington, the White House signaled support for a “Bitcoin Strategic Reserve,” indicating it plans to stop dumping seized BTC and instead hold it as a strategic asset. Japan moved to cut crypto investor taxes toward 20%, while South Korea lifted its ban on corporate crypto investing and layered in stronger consumer protections, steps Clifford Chance described as part of a broader “global crypto regulatory maturation” through January. Even privacy assets caught a bid, with softer rhetoric around privacy coins helping tokens like NIGHT “perform better than the rest of the market” despite the broader drawdown.

February: defensive accumulation, not hero trades

With leverage flushed and “tourists” blown out, Finestel’s playbook for February is deliberately dull: “Defensive Accumulation.” Top managers favor keeping roughly 55% in Bitcoin, 35% in cash‑like stablecoins, and a small residual for selective altcoin exposure, treating the $75,000–$77,000 band as the institutional line in the sand and $84,000 as the trigger to re‑risk. “The bottom is a process, not a single moment,” they argue, advising investors to “stay liquid, stay patient, and let the price come to you.”

Meanwhile, spot action reflects that bruised but functioning market. Bitcoin (BTC) trades near $70,746, with a 24‑hour range between roughly $60,256 and $71,604 and about $132.2B in volume. Ethereum (ETH) changes hands close to $2,062, with 24‑hour turnover over $64.1B and intraday prints between roughly $1,756 and $2,085. Solana (SOL) sits around $86, essentially flat on the day after a 35% monthly drawdown and a seven‑day range of roughly $75.76–$104.98 as derivatives activity and open interest grind lower.

Crypto World

BingX doubles down on AI with $300m bet on multi-asset trading edge

Crypto exchange BingX spends $300m on AI tools to turn macro, gold, and crypto volatility into personalized, multi-asset trading decisions.

Summary

In a year when crypto markets trade at macro speed, BingX is betting that the next edge will come from artificial intelligence woven into the plumbing of the exchange, not bolted on as an afterthought. The platform has committed $300 million to AI over the long term, positioning itself as what it calls an “all‑in AI” venue that treats automation as core infrastructure rather than marketing gloss.

BingX’s internal suite runs across multiple models, coordinated by specialized agents mapped to distinct points in the trading process.

Two flagship tools, BingX AI Bingo and BingX AI Master, are designed as decision‑support layers rather than execution engines, with AI Bingo acting as a conversational “trading idea generator” that scans more than 1,000 market pairs and surfaces scenarios, support and resistance levels, and probability forecasts.

“The outcome is an experience that feels less like software and more like a companion who understands you,” BingX product leadership has said of AI Master’s adaptive design, which learns risk tolerance and adjusts recommendations in real time.

This pivot is unfolding just as crypto venues pull in traditional instruments like precious metals and tokenized equity exposure, allowing traders to watch gold, oil, and Bitcoin from a single AI‑powered interface around a major macro release.

UBS has recently raised its gold price target to $6,200 per ounce for March, June and September 2026, while still expecting prices to ease slightly to $5,900 by year‑end, underscoring sustained institutional demand for precious metals even as tokenized versions migrate onto exchange rails. BingX argues that routing these assets through blockchain settlement improves traceability, while AI helps traders read macro‑driven moves across asset classes rather than in isolated order books.

The scale is already non‑trivial: BingX reports more than $2 billion in 24‑hour trading volume in its traditional‑market products alone and says its AI tools have attracted millions of users, with a broader ecosystem now claiming over 40 million accounts globally. As analysts frame AI‑supported, multi‑asset environments as a baseline expectation for 2026, the competitive battlefield is shifting away from raw speed toward interpretation, risk assessment, and personalization. In that contest, BingX’s wager is blunt: the exchanges that win the next decade will be those that turn correlated, cross‑asset noise into usable decisions—secure, simple, and responsive enough to keep pace with markets that no longer sleep.

Broader crypto market reactions

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $70,961, with 24‑hour turnover near $42.3B. Ethereum (ETH) changes hands close to $2,095, on roughly $20.9B in 24‑hour volume. Solana (SOL) trades around $87.6, with about $3.6B in day‑long activity. For BingX and its rivals, those flows are the proving ground for whether AI‑native exchanges can genuinely help traders keep up.coinmarketcap+3

Related coverage: BingX’s rollout of AI Master as a crypto trading “strategist,” a deep dive into the exchange’s AI Bingo and AI Master stack, and the latest UBS upgrade to its 2026 gold price targets as macro demand for safe‑haven assets accelerates.

Crypto World

Here’s how ‘invisible hands’ likely accelerated bitcoin’s crash to $60,000

Bitcoin plunged early this month to nearly $60,000, wiping out large chunks of value across the crypto market and vaporizing some trading funds.

Most observers pinned the slide on macro forces, including the capitulation of spot ETF holders (and potential rumors of funds blowing out their positions). Yet another, quieter force, one that typically keeps trading running smoothly, likely played a major role in crashing the spot price lower.

That force is the market makers, or dealers, who continuously post buy and sell orders in the order book when you trade, keeping liquidity strong so trades happen smoothly without significant delays or price jumps. They are always on the opposite end of investors’ trades and make money from the bid-ask spread, the small gap between the buy price (bid) and the sell price (ask) of an asset, without gambling on whether prices will rise or fall.

They hedge their exposure to price volatility by buying and selling actual assets (such as bitcoin) or related derivatives. And sometimes, these hedging activities end up accelerating the ongoing move.

That’s what happened between Feb. 4 and Feb. 7 as bitcoin fell from $77,000 to nearly $60,000, according to Markus Thielen, founder of 10x Research.

This episode shows bitcoin’s options market increasingly swaying its spot price, mirroring traditional markets where market makers quietly amplify volatility.

According to Thielen, options market makers were “short gamma” between $60,000 and $75,000, meaning they held bags of short (call or put) options at these levels without enough hedges or protective bets. This left them vulnerable to price volatility around these levels.

As bitcoin fell below $75,000, these market makers sold BTC in the spot or futures markets to rebalance their hedges and stay price-neutral, injecting extra selling pressure in the market.

“The presence of approximately $1.5 billion in negative options gamma between $75,000 and $60,000 played a critical role in accelerating Bitcoin’s decline and helps explain why the market rebounded sharply once the final large gamma cluster near $60,000 was triggered and absorbed,” Thielen said in a note to clients Friday.

“Negative gamma means that options dealers, who are typically the counterparties to investors buying options, are forced to hedge in the same direction as the underlying price move. In this case, as Bitcoin declined to the $60,000–$75,000 range, dealers became increasingly short gamma, which required them to sell bitcoin as prices fell to remain hedged,” he explained.

In other words, hedging by market makers established a self-feeding cycle of falling prices, forcing dealers to sell more, which further pushed prices lower.

Note that market makers’ hedging isn’t always bearish. In late 2023, they were similarly short options above $36,000. As Bitcoin’s spot price rose past that level, they bought BTC to rebalance, sparking a rapid rally above $40,000.

Crypto World

Over $278 Million Set to Hit the Market

TLDR

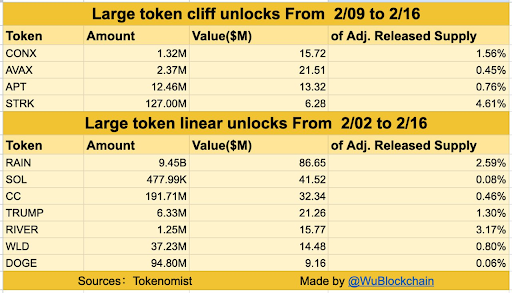

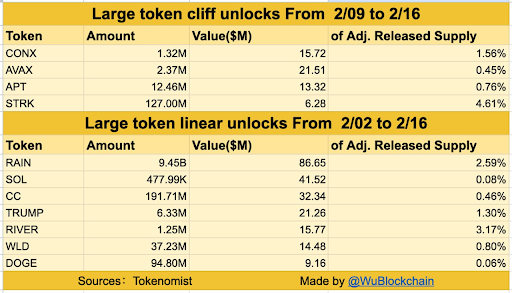

- Cliff token unlocks from CONX, AVAX, APT, and STRK will inject over $56 million into the market this week.

- STRK leads cliff unlock volume with 127 million tokens valued at $6.28 million.

- RAIN dominates linear unlocks, releasing $86.65 million in value, 2.59% of its total supply.

- SOL and CC follow with daily token unlocks valued at $41.52 million and $32.34 million, respectively.

- Combined cliff and linear token unlocks exceed $278 million, impacting short-term liquidity across multiple assets.

This week, the market will brace for token unlocks from February 9 to February 16 across Cliff and Linear token unlocks. These unlocks will introduce over $278 million worth of tokens into circulation, potentially impacting short-term market behavior.

Cliff Token Unlocks Set to Inject Over $56 Million

According to a summary prepared by Wu Blockchain, in the cliff token unlocks category, four major projects will release notable token volumes. CONX will unlock 1.32 million tokens worth $15.72 million, accounting for 1.56% of its adjusted released supply.

AVAX will release 2.37 million tokens, valued at $21.51 million, increasing its supply by 0.45%. APT is scheduled to unlock 12.46 million tokens worth $13.32 million, contributing 0.76% to circulation. STRK will release the largest amount by volume, unlocking 127 million tokens valued at $6.28 million, which equals 4.61% of its supply.

Linear Token Unlocks to Release Over $221 Million

On the other hand, linear token unlocks began today and will continue until February 16. RAIN will unlock 9.45 billion tokens worth $86.65 million, representing 2.59% of its supply. SOL will release 477,990 tokens, valued at $41.52 million, representing only 0.08% of its supply.

CC will unlock 191.71 million tokens valued at $32.34 million, adding 0.46% to circulation. TRUMP will release 6.33 million tokens worth $21.26 million, equal to 1.30% of the supply.

RIVER will inject 1.25 million tokens, worth $15.77 million, into the market, representing 3.17% of the adjusted supply. WLD will release 37.23 million tokens valued at $14.8 million, representing 0.80% of the total supply. DOGE rounds off the list with 94.8 million tokens worth $9.16 million, impacting only 0.06%.

These token unlocks signal an increase in liquid supply for multiple assets. Cliff token unlocks introduce abrupt liquidity events, while linear unlocks apply steady distribution pressure. RAIN, SOL, and AVAX dominate in terms of value, while STRK and RIVER lead in percentage impact.

Crypto World

In a Tokenless Crypto World, These 3 Protocols Would Still Matter

Crypto discussions often default to token price, market cap, and short-term performance. But if tokens are taken out of the equation entirely, what actually remains valuable?

In an interview with BeInCrypto, Ryan Chow, CEO and co-founder of Solv Protocol, said that if tokens stopped mattering tomorrow, priorities would snap back to fundamentals. He also shared 3 crypto protocols he believes would still clearly matter in 2026, even if tokens no longer existed.

Are Token Prices a Reliable Measure of Value in Crypto?

Crypto is often defined by its tokens and volatile price swings. Much of the industry conversation revolves around price speculation.

What top coins will do next, when altcoin season might begin, or which token could be the next 100x winner? These narratives dominate headlines, social media, and market sentiment.

Sponsored

Sponsored

While prices dominate mindshare, what do they actually say about whether a project is actually working, being used, or delivering real value?

Chow mentioned that price can be informative when it’s backed by sustained usage and revenue. However, most of the time, he described it as a “lagging, noisy proxy.”

The real test, he said, is when it’s backed by sustained usage and revenue, and becomes infrastructure that people build on, and institutions can trust, regardless of market charts.

“Token price tells you what the market feels, not whether the system works,” he stated.

According to Chow, price movements often run ahead of fundamentals or diverge from them entirely. Tokens can rally on expectations alone, while protocols that are steadily gaining adoption may see little immediate price reaction.

He added that a project’s real progress is better measured by the strength of its infrastructure, the security of its operations, and its ability to earn trust from institutional participants. Chow explained that if tokens are removed:

“Value then comes down to adoption, usability and security. Metrics like onchain adoption, integration with other protocols, compliance readiness and the ability to scale reliably for institutions are far stronger signals of impact than market cap alone.”

What User and Developer Behavior Looks Like Without Crypto Tokens

But if tokens, and with them trading, were to disappear, would users leave as well? Chow suggested that without the ability to profit from holding or trading tokens, most speculative activity would vanish almost immediately.

This includes momentum trading, airdrop, points farming, mercenary liquidity, and governance.

“What would remain is purely instrumental use: stablecoins for payments and treasury, onchain credit for capital efficiency, and institutions using verifiable rails for issuance and collateral. I am seeing genuine demand in crypto for capabilities, settlement, custody, verification, distribution, and risk-managed yield, not for tokens. This tells us that real utility is what sustains a project beyond price incentives,” he told BeInCrypto.

Sponsored

Sponsored

The executive also stressed that such a theoretical scenario would fundamentally shift developer priorities. According to Chow, token performance has pushed builders to focus on short-term gains rather than long-term infrastructure.

The current structure rewards what is easiest to market, such as new narratives, incentives, points programs, and short-term total value locked (TVL), rather than what is hardest to build: security, risk controls, reliability, and clear unit economics.

“If tokens stopped mattering tomorrow, priorities would snap back to fundamentals. Builders would focus on systems that earn trust, such as verifiable reserves and accounting, execution and management, auditability, uptime, governance, and compliance-ready workflows. You’d see more work on distribution rails across wallets, exchange integrations, settlements, identity, and business models that work on fees,” he remarked.

Lending, Settlement, and Custody as Core Crypto Use Cases

Chow also argued that crypto would continue to exist even in the absence of tokens.

“In a token-agnostic world, crypto survives as paid infrastructure, with revenue tied to measurable work,” he commented.

He pointed to several business models that are already operating sustainably. These include usage-based fees for settlement, execution, minting, and routing, as well as financial primitives such as lending protocols. According to him,

“One of the most proven sustainable revenue models in DeFi is lending protocols. Well-designed lending protocols generate revenue through interest rate spreads and borrower fees, with income scaling based on utilisation and risk management rather than token emissions.”

Chow noted that even during periods of market volatility, demand for leverage, hedging, and liquidity tends to persist, allowing these systems to continue generating revenue.

Sponsored

Sponsored

Chow also highlighted infrastructure designed for institutional use as among the most resilient segments of the industry. Services such as custody, compliance, reporting, and payments are typically paid for in fiat or stablecoins and are adopted to reduce operational and regulatory risk. In weaker market conditions, he said, these services often remain the primary bridge between traditional finance and crypto.

“Another sustainable revenue model is to incorporate transactional infrastructure fees. Blockchains and settlement layers that charge for real activity, such as processing transactions or facilitating cross-chain transfers, generate revenue regardless of the market sentiment, making it sustainable even in the face of speculation, hedging, or arbitrage,” he remarked.

Ultimately, Chow argued that any system capable of reliably solving real-world problems and integrating into enterprise workflows can sustain itself, regardless of token performance or market cycles.

Which Crypto Projects Would Still Matter in 2026 Without Tokens?

The question now becomes which crypto protocols would still clearly matter in 2026 if tokens were removed entirely. Chow told BeInCrypto that the answer lies in identifying projects that have built real economic infrastructure that solves actual problems. He pointed to 3 protocols:

1. Chainlink

First, Chow pointed to Chainlink. He detailed that it would remain essential because it provides critical data infrastructure underpinning much of the crypto ecosystem.

DeFi protocols rely on accurate and secure price feeds to function properly. Without reliable oracles, basic activities such as liquidations, derivatives settlement, and asset pricing become unsafe.

He claimed that Chainlink has emerged as the de facto standard for oracle services, processing billions of dollars in transaction value. Chow emphasized that even without the LINK token, protocols would continue paying for these services in stablecoins or Ethereum (ETH).

Sponsored

Sponsored

“Because the alternative is building inferior oracle systems themselves or facing catastrophic failures from bad data. Institutions and protocols would continue paying for Chainlink’s verifiable, tamper-proof data feeds because the cost of not having them is existential.”

2. Canton Network

Second, Chow highlighted the Canton Network. He argued that its relevance is driven by institutional demand for privacy combined with regulatory compliance.

According to Chow, Canton provides a regulated settlement layer where BTC-backed positions can move without exposing sensitive counterparties or proprietary strategies. The executive revealed that its value is still clear, institutional coordination, and settlement funded by enterprise usage and validator/service fees.

“It would survive because its demand is structural (regulated workflows don’t disappear in bear markets) and its economics are usage-funded (enterprise adoption and validator/service fees), not dependent on speculation,” he suggested.

3. Circle

Third, Chow said Circle would continue to matter in a tokenless crypto space. USDC, he noted, has become foundational infrastructure for crypto payments, treasury management, and cross-border settlement.

For banks and enterprises seeking a reliable and regulated digital dollar, USDC has emerged as a trusted settlement option. Without a native token to manage or distribute, Chow described Circle as essentially a modern financial utility that earns spreads on deposits.

As demand for instant, programmable dollars capable of moving globally around the clock continues to grow, he argued that Circle could potentially thrive in a token-agnostic world by continuing to solve real financial problems.

Overall, Chow’s comments present an alternative framework for assessing value in crypto that places less emphasis on token price and more on usage, infrastructure, and operational reliability.

His views suggest that, in the absence of token-driven incentives, projects with sustained adoption, clear revenue models, and institutional relevance would be better positioned to remain relevant over time.

Crypto World

Ethereum price prediction after Tom Lee’s Bitmine buys 20K ETH worth $41.98M

Tom Lee’s Bitmine has moved closer to its goal of acquiring 5% of the total supply with its latest 20K ETH purchase. But a bearish flag pattern confirmed on the weekly ETH/USDT chart suggests a potential price correction for Ethereum may be imminent.

Summary

- Tom Lee’s Bitmine has acquired 20,000 ETH for $41.98 million.

- Market demand generated from spot Ethereum ETFs remains weak.

- A bearish head and shoulders pattern was confirmed on the weekly chart.

Bitmine, the tech-focused infrastructure company run by renowned market strategist Tom Lee, had acquired another 20,000 ETH worth $41.98 million over the weekend. The move follows its acquisition of over 40,000 ETH in late January, valued at approximately $117 million at that time.

Following Bitmine’s latest purchase, the company’s total reserves now stand at nearly 4.29 million ETH, making it nearly 71% complete with its goal of owning at least 5% of the total circulating supply.

In contrast to the debt-fueled acquisition strategy popularized by Michael Saylor’s Strategy, Bitmine Immersion Technologies (BMNR) maintains a pristine, zero-debt balance sheet bolstered by over $586 million in cash and short-term liquidity.

The company’s most strategic pivot, however, is the transition to active Ethereum staking. By putting its massive ETH treasury to work, Bitmine is positioned to generate over $500 million in annual high-margin revenue, provided staking yields hold above the 2.5% threshold.

When large institutional players like Bitmine continue to gobble up supply, it typically tends to create a supply shock, which helps support price floors in the long run.

However, the overall outlook for Ethereum still remains precarious as a number of bearish catalysts may continue to overshadow any optimism generated by big buys.

First, the Ethereum (ETH) price has remained in a steady downtrend since mid January, dropping over 45% to nearly $1,800 last week. This decline came about as the broader market remained gripped by fear, as macroeconomic and geopolitical volatility combined with massive recurring liquidations continued to keep investor appetite at bay.

Second, spot Ethereum ETFs, which had previously served as a primary bullish driver, have been witnessing back-to-back outflow months since November of last year. These investment products have shed over $2.5 billion in that period alone, and any further outflows could erode retail confidence and often make traders reevaluate their positions.

Third, the total value locked on the Ethereum network has fallen to $57 billion, which is significantly lower than the $98 billion recorded in October of last year. Declining TVL means reduced on-chain utility and could likely sour the sentiment of traders and hence further dampen the recovery.

On the weekly chart, Ethereum price has confirmed a head and shoulders pattern as it fell below a key support level at $2,800 last month. The pattern is formed of three distinct peaks, where the middle peak is the highest, and the two outside peaks are relatively equal in height. It is widely considered one of the most popular bearish reversal patterns in technical analysis.

At press time, the Ethereum price was trading close to $2,000, which is another key psychological support level that could largely dictate market sentiment for weeks to come.

A sharp drop below this crucial floor could trigger a deeper slide toward $1,000, which represents the next major historical support. Prices could even fall as low as $800, a bearish target calculated by subtracting the total height of the head from the point at which the price broke below the neckline of the pattern.

Several technical indicators seem to support this grim prediction. Notably, the MACD lines remain stuck under the zero line and are currently pointing downward, indicating strong selling momentum, while the supertrend indicator has flashed a clear red signal.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

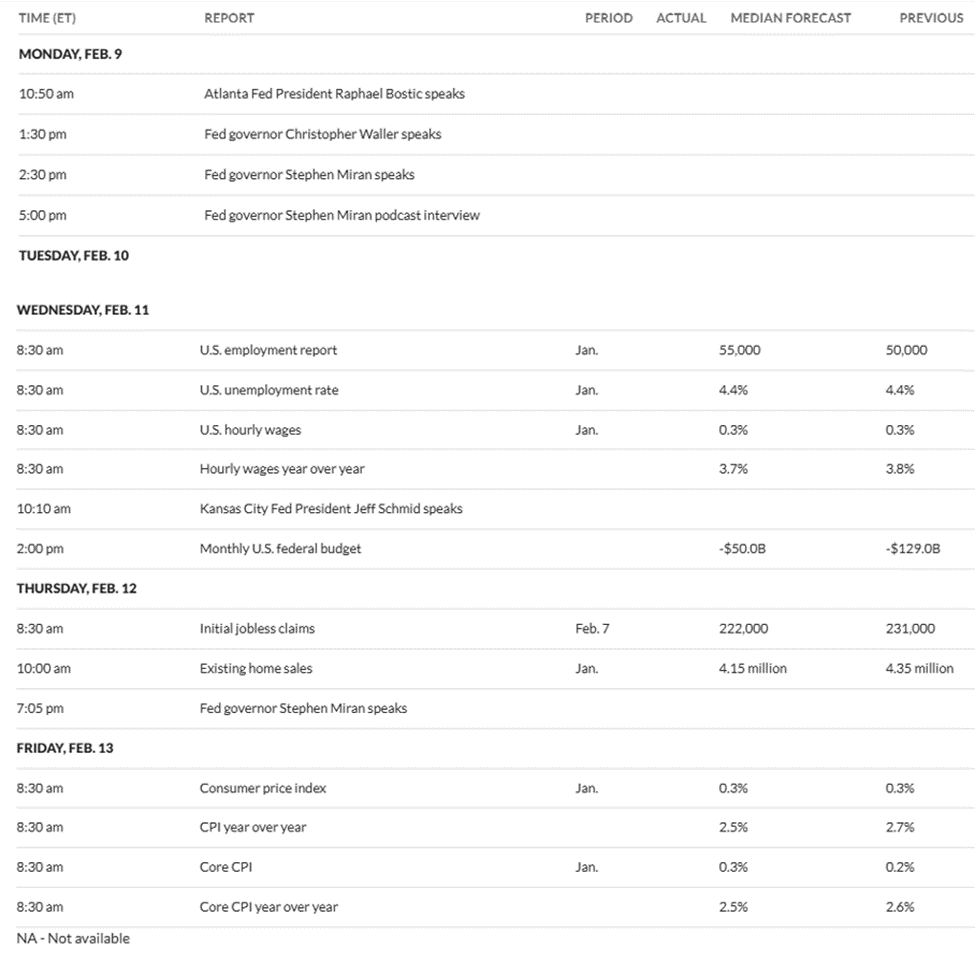

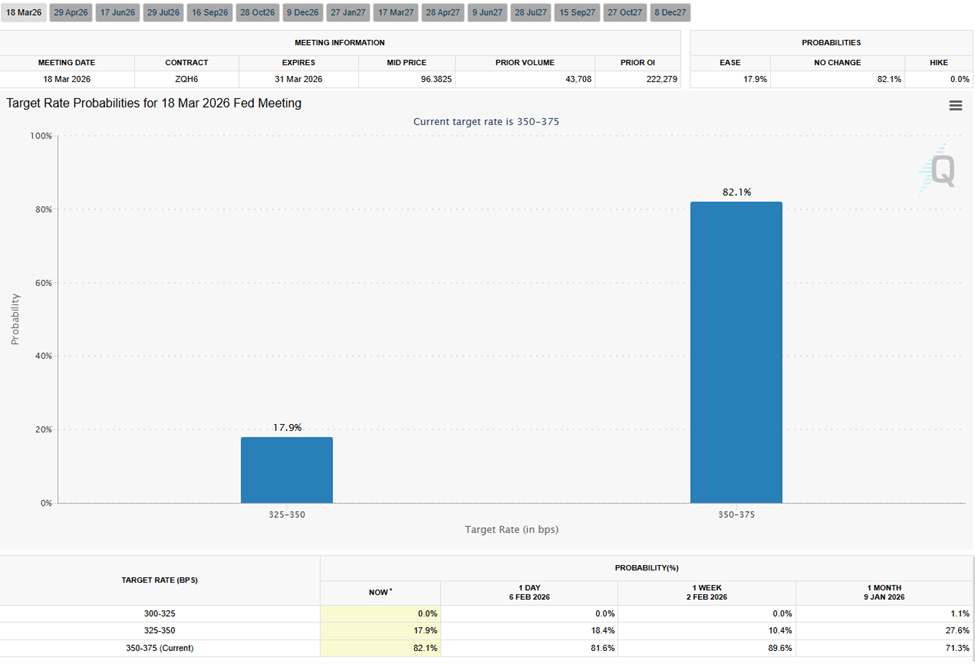

Bitcoin Investors Should Watch These US Economic Signals

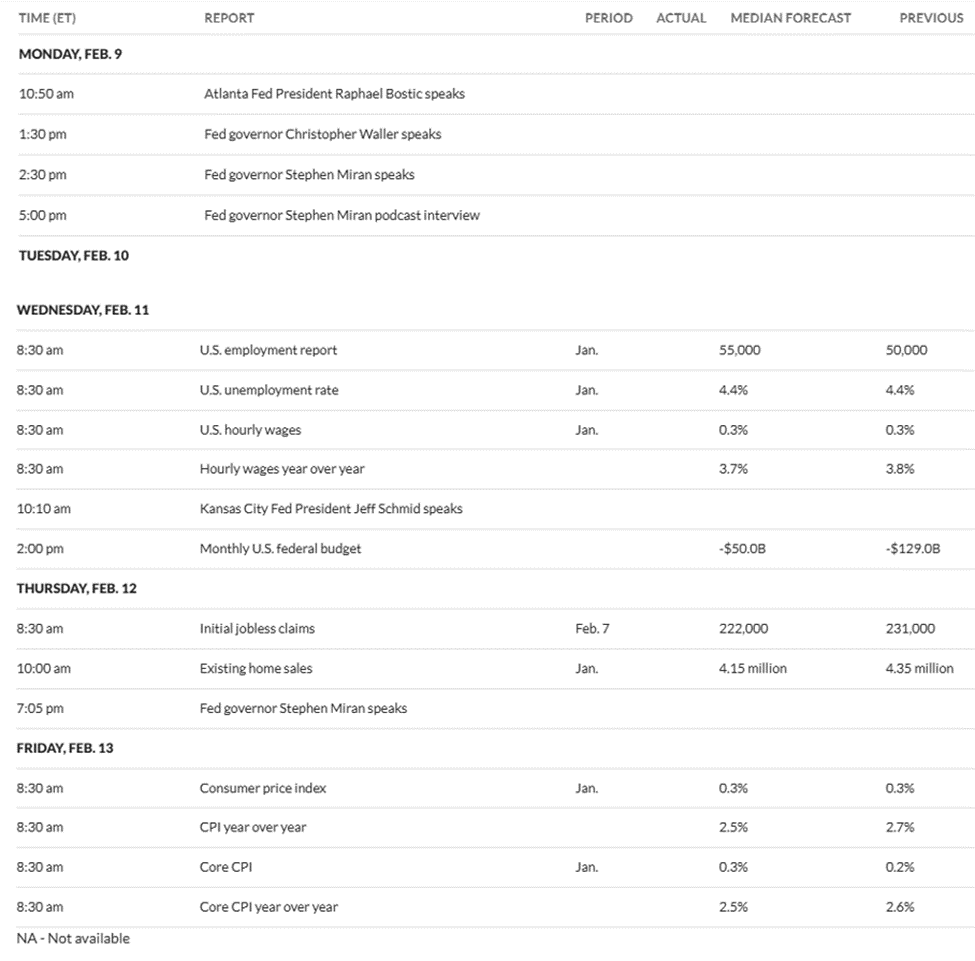

Bitcoin traders are heading into a macro-heavy week, with four US economic events expected to shape sentiment across crypto markets.

With Bitcoin trading in a volatile range and macro narratives dominating market psychology, traders are increasingly treating economic releases as short-term catalysts that can trigger sharp moves in both directions.

Which US Economic Signals Should Bitcoin and Crypto Investors Watch This Week?

A Federal Reserve (Fed) governor’s media appearance, key labor-market data, weekly unemployment claims, and January inflation figures could all influence expectations around interest rates and liquidity—two of the strongest drivers of Bitcoin’s price cycles.

Sponsored

Sponsored

Fed Governor Stephen Miran Interview in Focus

Markets will first look to comments from Federal Reserve Governor Stephen Miran, who is scheduled to appear in a podcast interview on Monday, February 9. Ahead of the 5:00 p.m. ET. appearance, there is already mixed sentiment across the crypto community, especially amid broader market caution.

Some market participants point to Miran’s relatively constructive view on stablecoins, arguing that regulatory clarity and dollar-linked digital assets could indirectly support Bitcoin by strengthening the broader crypto ecosystem and institutional participation.

Others see risk. Speculation that Miran could play a larger role in future Fed leadership has already coincided with bouts of volatility in both precious metals and crypto. This reflects fears that tighter policy could weigh on inflation-hedge narratives.

At the same time, some macro analysts have described Miran as more dovish than many of his peers, citing past arguments in favor of substantial rate cuts to support the labor market.

Any signals in that direction could lift sentiment in risk assets, particularly Bitcoin, which remains highly sensitive to liquidity expectations.

Sponsored

Sponsored

US Employment Report Could Drive “Bad News Is Good News” Narrative

Attention will shift on Wednesday, February 11, to the US employment report, one of the most closely watched indicators of economic health and monetary-policy direction.

Forecasts suggest relatively modest job growth, potentially reaching 55,000 from the previous 50,000. Weaker-than-expected data could paradoxically support Bitcoin. Cooling labor conditions would increase pressure on the Fed to ease policy, potentially improving liquidity conditions for risk assets.

Recent labor-market indicators have already pointed to signs of slowing. Reports of rising layoffs and a slowdown in hiring have strengthened expectations that rate cuts could arrive sooner than previously anticipated.

However, the employment report also carries downside risk. A sharp deterioration in job data could spark broader growth fears, prompting investors to move toward defensive positions. Such an outcome could trigger short-term selloffs in crypto, as seen during previous macro shocks.

Sponsored

Sponsored

Jobless Claims May Reinforce or Challenge the Trend

Thursday’s initial jobless claims release will provide a more immediate snapshot of labor-market conditions. As such, it could reinforce the narrative set by the employment and unemployment reports on Wednesday.

Recent spikes in claims have coincided with risk-off reactions in crypto markets, including liquidation events and rapid price swings. Some traders interpret rising claims as a signal that economic conditions are weakening enough to force monetary easing, a longer-term positive for Bitcoin.

Others warn that in the short term, deteriorating employment data can unsettle markets, especially when liquidity is thin and leverage is elevated.

That dynamic has made jobless-claims releases a growing source of volatility, even though they rarely move markets in isolation.

Sponsored

Sponsored

CPI and Core CPI Seen as the Week’s Decisive Catalyst

The most consequential data point may arrive on Friday, February 13, with the release of January’s Consumer Price Index (CPI) and Core CPI figures.

Inflation data remains the primary driver of Fed policy expectations and, therefore, a key determinant of crypto market sentiment.

Cooler-than-expected readings in recent months have supported risk assets by weakening the “higher for longer” rate narrative.

Another soft inflation print could accelerate expectations for rate cuts in 2026, potentially reinforcing bullish momentum in Bitcoin and strengthening the case for a move toward six-figure price levels over time.

However, sticky or rising inflation would likely have the opposite effect, pushing Treasury yields higher and pressuring speculative assets, including cryptocurrencies.

“If data comes in hot, rates will likely stay higher, and risk assets may struggle. If data cools, rate cut expectations could return, and markets may breathe. This week will tell us what comes next,” remarked analyst Kyle Chasse.

Taken together, the week’s events represent a concentrated test of the macro narratives currently driving Bitcoin: inflation, employment, and the timing of monetary easing.

While long-term adoption trends, such as ETF flows, institutional participation, and stablecoin growth, continue to underpin bullish projections, short-term price action remains closely tied to economic data.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics17 hours ago

Politics17 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat11 hours ago

NewsBeat11 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business16 hours ago

Business16 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports7 hours ago

Sports7 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics19 hours ago

Politics19 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business24 hours ago

Business24 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know