Crypto World

XRP Sees Impressive Recovery Wick With Massive 37% Price Surge: Here’s Why

Ripple’s token has also surpassed BNB in terms of market cap after its sublime surge.

It was just hours ago, less than a day, when we wrote about XRP’s spectacular collapse as the asset plummeted to $1.11 for the first time since before the US presidential elections at the end of 2024.

This meant that it had shed over 50% of its value in a month as it peaked at $2.40 on January 6. Oh, how the landscape in crypto can change in hours sometimes, not even days or weeks.

What happened with XRP’s price since that local low has been nothing short of amazing. There were some signs about a potential rebound, such as the plummeting RSI metric, but even the most vocal XRP bulls were probably surprised by the extent of the rally.

After all, the cross-border token skyrocketed by 37% in about 18 hours – going from the aforementioned low to $1.54 before it faced some resistance and now trades around $1.50. This still represents a 34% surge in less than a day.

Santiment also weighed in on the token’s performance. The analysts acknowledged XRP’s rise in terms of market cap as well, as it now sits above BNB as the fourth-largest crypto asset.

They blamed the massive price pump in the past several hours on the overall network stability and growing activity on the XRP Ledger. Moreover, they showcased a chart indicating that Ripple whales went on an accumulation spree, with almost 1,400 separate $100K+ whale transactions (the highest in four months).

📈 Crypto markets are rebounding, but $XRP‘s price has been on a particularly huge tear. Since bottoming out below $1.15 just under 18 hours ago, the #4 market cap has now recovered to back above $1.50.

😱 Panic sellers should have stopped to notice the massive activity on the… pic.twitter.com/3y0eyGxpo2

— Santiment (@santimentfeed) February 6, 2026

You may also like:

The ETF behavior will also be interesting to compare, but we would need to verify the data at the end of the trading day in the US. Preliminary data on SoSoValue shows a minor net inflow even for yesterday, but there’s no official confirmation as of yet, which is rather surprising.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Coinbase Launches Perpetual Futures Contracts in Europe

Cryptocurrency exchange Coinbase has launched new futures offerings in Europe, expanding its push to give users access to both crypto and traditional market exposure through regulated products.

Coinbase said Monday the contracts are being rolled out to Coinbase Advanced users in 26 European countries, including Germany, France and the Netherlands, through its Markets in Financial Instruments Directive, or MiFID, entity.

The new lineup includes crypto futures tied to assets such as Bitcoin (BTC) and Solana (SOL), along with an equity-index product called the Mag7 + Crypto Equity Index Futures. Coinbase said that contract combines exposure to the so-called Magnificent Seven stocks of Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla, with crypto-linked equities and BlackRock iShares exchange-traded funds tied to BTC and Ether (ETH).

The exchange said it has launched two types of cash-settled futures contracts, including perpetual-style futures with five-year expiries and dated contracts with specific monthly or quarterly expiries. Traders can access up to 10x leverage on select crypto-denominated contracts and equity indices and up to 5x leverage on other products, with fees as low as 0.02% per contract.

ESMA warns crypto perpetual derivatives may fall under CFD rules

The launch comes about two weeks after the European Securities and Markets Authority warned firms that many derivatives marketed as perpetual futures or perpetual contracts are likely to fall under existing national product intervention measures for contracts for difference (CFDs).

In a Feb. 24 statement, ESMA said products that meet the CFD definition are subject to leverage limits, mandatory risk warnings, margin close-out rules, negative balance protection and a ban on monetary and nonmonetary benefits. The regulator also told firms to identify, prevent or manage conflicts of interest tied to those offerings.

Coinbase also announced expanded access to its decentralized exchange (DEX) trading platform to 84 countries on Friday.

Related: Crypto exchanges gain as tokenized commodity market climbs to $7.7B

Coinbase doubles down on “everything exchange” ambitions

Coinbase called the derivatives rollout a “major step” in its ambition to build an “exchange for everything,” where users can trade all major global assets under a single platform.

“As regulatory clarity continues to mature across Europe and globally, we are looking forward to continuing to introduce new and expanded services,” Coinbase said in the announcement.

Other cryptocurrency exchanges that launched regulated perpetual contracts in Europe include One Trading, Kraken, Backpack and Gemini.

Cointelegraph reached out to Coinbase for comment, but had not received a response by publication.

Related: Binance completes $1B Bitcoin conversion for SAFU emergency fund

Magazine: Coinbase and Base: Is crypto just becoming traditional finance 2.0?

Crypto World

Crypto Funding Jumps +50% Year Over Year Despite Fewer Deals

Crypto fundraising, or funding rate, surged +50% to over $25.5Bn in the 12 months ending March 2026 compared to the previous year, despite a -46% drop in total deal volume, according to Messari data.

This divergence signals a stark consolidation of capital into late-stage mega-rounds as VCs retreat from speculative early-stage bets and concentrate on established infrastructure.

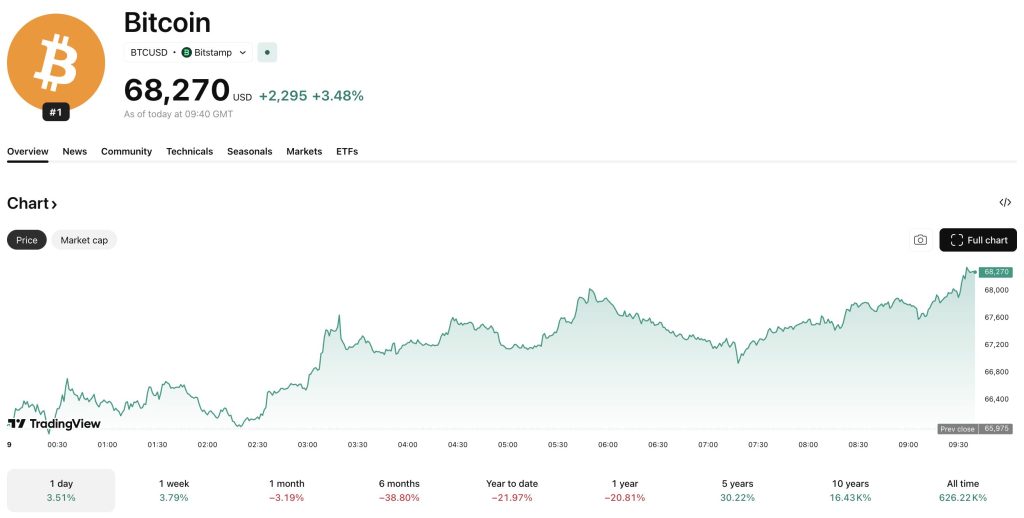

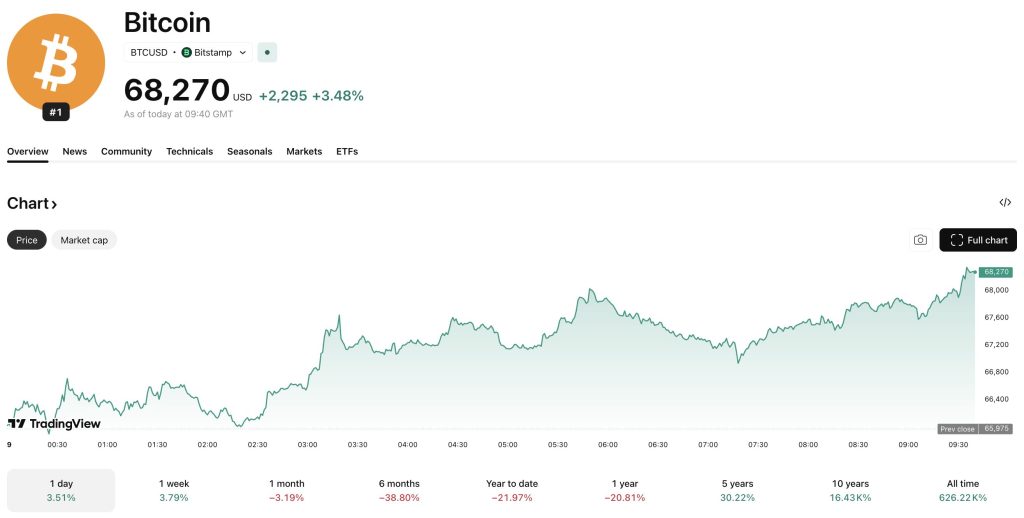

It comes as the total crypto market cap stayed flat overnight, dropping just -0.1% to $2.38 trillion, with the Bitcoin price trading at around $68,200 after a 0.7% move since yesterday.

Record Average Deal Size Marks Strategic Shift

Data from Messari CEO Eric Turner shows that the average crypto deal size swelled to $34M over the last year, up +272% from the prior period.

This comes as the raw count of finalized deals dropped by nearly half. Total funding hit $25.5Bn, but the distribution of that capital has shifted fiercely toward established players rather than seed-stage startups.

The divergence between rising dollar volume and falling deal count indicates a structural maturation. The “spray and pray” tactics common in previous cycles have been replaced by high-conviction bets.

While the headline funding number looks bullish, Turner noted that outside of Dragonfly Capital, few major crypto VCs have closed new funds recently.

DISCOVER: Next Crypto to Explode in 2026

Institutional Concentration and the ‘Flight to Quality’

The heavy skew toward mega-rounds signals that the crypto market structure is beginning to mirror traditional fintech.

Late-stage strategic rounds are now the primary driver of volume. Big investors see value in established networks and infrastructure rather than speculative tokens, evidenced by significant flows into major assets.

Capital concentration is evident in the declining number of active investors, which fell -34.5% to 3,225. This drop likely represents the exit of tourists and crossover funds that dabbled in crypto during the bull market but lacked the conviction to stay through volatility.

If this trend holds, early-stage founders may face a liquidity crunch while Series B and C companies command premium valuations.

February’s data illustrates the trend perfectly. Just three fundraising events contributed 44% of the $795M raised that month. Tether injected $200M into the marketplace Whop, while stablecoin app ARQ secured $70M in a Series B led by Sequoia Capital.

Prediction markets are also attracting significant capital. Novig raised $75M in a round led by Pantera Capital. That sector heat recalls how competitors like Kalshi and Polymarket discuss fundraising at valuations hitting $2Bn. Investors are chasing platforms with clear revenue models and regulatory moats rather than governance tokens with vague utility.

Despite these massive checks, the monthly total of $795M represented a -65.3% drop from the previous 30 days. This volatility in monthly figures further highlights the reliance on a few mega-deals to prop up the aggregate numbers.

Outlook for the 2026 Crypto Funding Landscape: Bullish Times Ahead?

The funding environment suggests the industry is prepping for a wave of public listings. Pantera Capital predicts 2026 will be a breakout year for digital asset IPOs, with companies like Circle and Figure paving the way.

However, broad market conditions remain a factor. Stocks must stabilize against bond market risk for these high valuations to hold in public markets.

Moving forward, expect the line between crypto VCs and traditional finance to blur further. Banks like JPMorgan and heavyweights like Sequoia are taking seats at the table that were once reserved for the crypto-native firms that dominated funding from 2017-2022.

If the “fresh capital” Turner referenced does not enter the ecosystem soon, the innovation pipeline could stall, but for now, the money is following maturity.

EXPLORE: Best Crypto Presales to Buy in 2026

The post Crypto Funding Jumps +50% Year Over Year Despite Fewer Deals appeared first on Cryptonews.

Crypto World

Solana price forecast as bulls fight to keep $80 support intact

- Solana changed hands for around $83 on the morning of March 9, 2026.

- The cryptocurrency could dip to under $75 if bearish sentiment holds.

- SOL price has floundered amid macro headwinds but could see another oversold bounce.

Solana (SOL) trades at around $83 in the early hours of Monday, March 9, 2026, up 1.3% in the past 24 hours.

The altcoin may be showing signs of bucking the trend across stocks as Bitcoin also pulls off the $66,000 low.

However, SOL is down by more than 5% in the past month and could revisit recent lows under $80 amid persistent negative funding rates and as the Iran war decimates risk sentiment.

Solana price: market conditions fuel caution

SOL has faced headwinds alongside Bitcoin and Ethereum since sliding from $250 in September 2025.

An acceleration in losses saw SOL drop to lows of $75 on February 5, 2026, and bulls have struggled to break above $90 since.

The broader macro and geopolitical headwinds have been key downward catalysts year-to-date, with these contributing significantly to the fading memecoin hype that has hit trading volumes hard.

While net inflows into Solana spot ETFs have largely defied the sharp redemptions that hit BTC and ETH products, institutional demand has slowed.

Cumulative SOL ETF assets sit at $958 million.

SoSoValue data shows two consecutive days of outflows last week, with over $8.2 million exiting on Mar 6.

That saw weekly flows cut to about $24 million from over $44 million the previous week.

Technical analysis

Standard Chartered recently cut its 2026 target for SOL to $250, but analysts at the bank forecast a bullish flip to $2,000 by 2030.

Buyers have the long-term forecast in their favour.

However, struggles below $100 suggest bulls have work to do in the short term if macro and geopolitical headwinds continue to batter sentiment.

SOL prices hover in a broader range between $75 and $94, but as broader crypto sentiment weighs on investors amid surging oil prices, the altcoin could flip lower.

Earlier on Monday, oil prices surged to near $120 a barrel amid concerns around the US- Iran war. Prices have since dropped to $100 after reports said the G7 will discuss to release emergency oil reserves.

The RSI and MACD indicators on the daily chart above highlight this possibility.

But could Solana bulls hold $80-$75 as a support zone intact as they eye a bullish reversal?

On-chain data shows funding rates extending in the negative and open interest down to $4.93 billion, down from $8.86 billion in mid-January.

Prolonged negative funding rates have nonetheless preceded an upside flip for the cryptocurrency.

This positions SOL for a likely short-term uptick, with $118-$120 the primary hurdle above the psychological level of $100.

Crypto World

DeXe price hits 3-month high amid 22% rally: What’s next?

- DEXE price is up amid a volume spike and broader crypto resilience.

- Bitcoin, Ethereum, and Solana are all holding onto gains despite the Iran war.

- DeXe has hit the $4.70 mark and could eye an extended rally to $9.00.

DeXe, the governance token for the DeXe Protocol, has surged to its highest level in three months after a robust 22% spike in the past 24 hours.

The DEXE token, which traded among the top gainers early Monday alongside Chilliz, Bittensor, and Pi Network, has surged by more than $112% in the past month to trade at prices last seen in late November 2025.

DeXe price today

DeXe is trading above $4.70 at press time on Monday, March 9, 2026, extending intraday gains to over 22%.

The surge comes after a breakout above $3.71 on Sunday, with today’s uptick aligning with a sharp volume spike.

According to CoinMarketCap, DEXE’s trading volume increased by 190%.

This stood at over $21.3 million at the time of writing, reflecting the high interest in the token.

Momentum comes amid resilience for Bitcoin and top altcoins despite the conflict in the Middle East following the United States and Israel’s attack on Iran.

Despite escalating geopolitical tensions in the Middle East, including recent escalations involving regional powers, the overall digital asset sector has held firm.

Oil prices surging in early trading tanked stock futures, but BTC and ETH held near key levels as institutional inflows continued to pick up.

For DeXe, gains come amid altcoin rotation and renewed optimism around decentralized finance (DeFi) protocols.

DEXE price technical analysis: What’s next?

The near-term outlook for DeXe is mixed after the token broke out from below a key resistance level.

Bulls have pushed prices above key moving averages, including the 50-day and 100-day exponential moving averages (EMAs) near $3.14 and $3.59, respectively.

If buyers continue to position and preserve the short-term uptrend from the swing low of $1.72 to the recent high of $4.70, the next hurdle will be the 200-day EMA.

On the daily chart, the 200-day EMA currently sits at $5.03, hovering as overhead resistance amid the bulls’ quest to turn $4 into support.

Doing this could shift DEXE from trading within a prolonged downtrend into a breakout trend.

Currently, the Moving Average Convergence Divergence (MACD) indicator suggests sustained buying pressure.

However, the Relative Strength Index (RSI) at 76 lingers in the overbought territory.

While bulls could extend gains, they face elevated risks of a temporary pullback amid profit-taking.

A decisive daily close above $4.22 will keep buyers in control.

If prices move lower, failure to hold $4.00 might trigger a retest of the 100-day EMA at $3.59.

Key support levels lie below the moving averages, with $3.24 and $2.10 providing robust demand reload zones.

Crypto World

Peraso (PRSO) Stock Soars Over 100% on Defense Contract Win

TLDR

- Defense contractor InTACT from Israel has chosen Peraso’s 60 GHz millimeter-wave technology to power a military-grade drone Identification Friend or Foe (IFF) system.

- The system enables military personnel on the ground to differentiate between friendly and hostile drones using mutual authentication protocols.

- Peraso’s beamforming transceiver chips provide directional, low-power communications that are difficult to intercept or jam.

- The collaboration between Peraso and InTACT has spanned more than two years, concentrating on tactical drone identification capabilities.

- PRSO shares skyrocketed by as much as 115% during Friday’s trading session and continued climbing over 33% in Monday’s pre-market hours.

Peraso Inc. (PRSO) experienced an extraordinary trading session on Friday. The semiconductor manufacturer based in California witnessed its share price soar by as much as 115% during intraday trading following news that its 60 GHz millimeter-wave technology will be integrated into a military drone identification platform.

The agreement centers around InTACT, a defense contractor headquartered in Israel. InTACT has selected Peraso’s semiconductor technology as the foundation for its Identification Friend or Foe (IFF) drone system — a critical tool that enables armed forces to rapidly determine whether an approaching drone poses a threat or belongs to allied forces.

The collaboration between these two entities has been ongoing for more than 24 months. This latest announcement signals a significant milestone in their relationship, as the technology transitions toward real-world military applications.

PRSO shares jumped over 96% during pre-market hours on Friday before the rally intensified to 115% intraday. The stock settled at a closing gain exceeding 86%. Monday’s pre-market session saw another surge of 33%.

How the Technology Works

Peraso’s 60 GHz beamforming transceiver chips serve as the core hardware for InTACT’s IFF platform. These semiconductors establish a short-distance, highly directional wireless communication link between unmanned aerial vehicles and troops on the ground.

The directional characteristics of the signal are crucial. This design makes the communications extremely difficult to detect or disrupt in contested electronic warfare scenarios — precisely the environments where such systems are needed most.

Through mutual authentication protocols, ground-based units can verify in real time whether an approaching drone is part of friendly operations. In modern combat zones saturated with drone activity, this identification capability provides significant tactical advantages.

CEO Ron Glibbery characterized the technology as “designed to provide a secure, directional communications channel ideally suited for these environments.”

Peraso’s Recent Business Performance

Peraso has shown signs of business momentum leading up to this defense contract announcement. During Q3 of fiscal year 2025 (concluded September 2025), the company reported revenue growth of 45% on a quarter-over-quarter basis, reaching $3.2 million.

This revenue increase was primarily fueled by record-breaking sales from millimeter wave products — the exact product category featured in this defense partnership.

Despite the sequential growth, total revenue for that quarter still declined 16% year-over-year, falling from $3.84 million in the comparable period.

For a micro-cap semiconductor firm, securing a design win in the defense industry can fundamentally alter investor perception of the company’s prospects. Commercial agreements typically don’t carry the same strategic weight as military deployment contracts.

InTACT has not revealed the financial parameters of this partnership. Neither contract value nor revenue forecasts have been made public.

The company has confirmed that its beamforming transceiver technology is ready for production and has been officially selected as the hardware platform for InTACT’s system. A specific timeline for military deployment has not been announced.

As of Monday’s pre-market trading, PRSO was up more than 33% following Friday’s impressive 86% closing gain.

Crypto World

Cardano Called the ‘Most Useless Network in Crypto’ as ADA Down 92% From ATH

The analyst who made that claim also laid out the most important support levels for ADA going forward.

Popular crypto market observer and commentator Ali Martinez took it to X to criticize the popular blockchain network, Cardano, for its failure to deliver on many of its promises.

Given the project’s popularity, many of the comments below the post lashed out at his harsh words, but there were some that agreed with his statements.

Most Useless Blockchain?

In a post titled “The Most Useless Network In The Crypto Market,” Martinez began by indicating that the Cardano DeFi ecosystem has never exceeded the coveted $1 billion mark. He added that it has “historically been only a fraction of what is locked on competing platforms like Ethereum.”

A quick double check on DeFiLlama confirms his words, as the Cardano TVL in DeFi peaked last year at roughly $700 million. However, the value has plummeted to $136 million as of press time. In comparison, the TVL on Ethereum is currently at a whopping $55 billion, down from almost $100 billion reached last year.

Solana’s TVL jumped to over $12 billion in September 2025, but it’s down to $6.6 billion as of now. Martinez also compared Cardano’s TVL with newer chains like SUI, which has already surpassed it with $568 million after peaking at $2.5 billion last year.

“Unlike Ethereum, which has built a dominant position in DeFi, or Solana, which has captured high-speed consumer applications, Cardano still lacks a clear use case that consistently attracts users, developers, and investors,” said Martinez.

He added that Cardano was officially launched nine years ago, but smart contracts were introduced in 2021, which allowed its competitors to “build stronger network effects with more developers, applications, and liquidity.”

He believes Cardano’s research-driven model, which prioritizes academic review and formal verification, slows down product rollouts compared to other blockchains.

You may also like:

As mentioned above, the community was split after his post, with some bringing out Cardano’s liquid staking capabilities, while others agreed to a large extent with his words.

ADA’s Survival

Martinez also explained that blockchains that reach scale early tend to attract more capital and talent as this is a market “driven by adoption and network activity.” This makes it “difficult for slower-growing networks to catch up once competitors establish a lead,” which could be the main reason behind ADA’s struggles.

The token peaked at over $3 in 2021, but it has fallen from grace since then, currently trading 91.7% away from those levels. Even the 2024/2025 bull rally managed to drive it to as high as $1.30, and it now sits at around $0.25.

Martinez weighed in on ADA’s performance as well, suggesting that if it breaks the $0.245 support, it could plunge to the next ones at $0.112 or $0.021, which would represent another 50% to 80% decline.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Oil Cools After Overnight Spike as G7 Eyes Reserve Release

Oil prices pulled back sharply early Monday after reports that Group of Seven (G7) finance ministers planned an emergency call to discuss a coordinated release of strategic crude reserves, giving markets a possible policy response to the war-driven supply shock.

The Financial Times reported that G7 finance ministers planned an emergency call to discuss a possible coordinated release of 300 million to 400 million barrels from strategic oil reserves to calm markets after the war-driven spike in crude prices. The G7 countries consist of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States, with the European Union as a non-enumerated member.

On Hyperliquid, crude oil futures rose nearly 25% to as high as about $117 overnight before falling by around 14.5% to roughly $100 after the G7 reports emerged. The reversal suggested traders were quickly repricing the risk of a coordinated reserve release even as the conflict continued to threaten supply.

Bitcoin rebounds after earlier drop

Bitcoin (BTC) also rebounded after an earlier drop during the oil spike. After falling to about $65,725, CoinGecko data shows BTC climbing as high as $67,992.88 at the time of writing, a gain of roughly 3.45% in a few hours.

CryptoQuant analyst Darkfost said in a market note that higher oil prices and Strait of Hormuz tensions could weigh on risk appetite and complicate the outlook for volatile assets such as Bitcoin.

“Historically, periods when oil prices regain strength often coincide with BTC end-of-cycle phases,” he wrote.

Hyperliquid HIP-3 hits record weekend volume on oil price surge

The episode also underscored how onchain venues can attract demand when traditional markets are closed.

Hyperliquid’s oil-linked contracts had already surged after the initial US-Israeli strike on Iran in late February, with traders turning to decentralized perpetuals for round-the-clock commodity exposure. Hyperliquid data shows that Tradexyz, a trading interface built on Hyperliquid, reached its highest weekend volume of over $610 million on Feb. 28.

Related: Iranian crypto outflows spike 700% after US-Israeli airstrikes

As the conflict escalates, oil prices have continued to rise, and Tradexyz has surpassed its previous weekend record with nearly $720 million in trading volume over the weekend, onchain analytics hub Pine Analytics said in an X post on Monday.

“These two waves of demand in the past month on Tradexyz show the platform is absorbing demand for traditional assets by people who don’t have TradFi access, or at points in time when these exchanges are offline,” Pine wrote.

Magazine: The debate over Bitcoin’s four-year cycle is over: Benjamin Cowen

Crypto World

How Do SEC Regulations for Tokenized Assets Impact RWAs?

AI Summary

- The blog post discusses the regulatory challenges and implications of tokenized securities.

- It highlights the recent regulatory clarity provided by the U.S.

- Securities and Exchange Commission, signaling a turning point for the sector.

- The post emphasizes the importance of a robust compliance strategy and legal framework for real-world asset tokenization.

- It addresses legal challenges, regulatory compliance, custody solutions, and governance mechanisms essential for successful tokenized asset platforms.

For a number of years, the promise of tokenized securities has been hindered by one major obstacle: the issue of regulatory ambiguity. While blockchain technology has continued to develop and advance, the institutions and organizations in the sector have remained hesitant due to the unclear interpretation of securities laws in the context of on-chain transactions. For tokenization platforms, asset issuers, and investors alike, the complex nature of the regulations has hindered the sector, with many projects remaining in the idea phase.

The most recent announcement by the U.S. Securities and Exchange Commission has marked a turning point in the tokenization sector. In providing a level of clarity on the application of existing SEC regulations on tokenized assets, the SEC has started to set boundaries on the legality of blockchain-based securities. For those in the sector looking to leverage blockchain-based securities, this is a positive indication of a more structured and compliant environment in the future.

While the SEC has provided a level of clarity, this does not remove the complexity; it changes it. For businesses, a robust compliance strategy, legal model, and technological model will be required in line with the emerging regulations on real world asset tokenization.

Regulatory Boundaries Clearly Defined

The U.S. Securities and Exchange Commission’s most recent regulatory clarification establishes a critical new framework for understanding blockchain-based financial assets under U.S. securities law. For companies that have been developing tokenized securities for years, operating in such an environment has been filled with uncertainty. Although many believed that tokenized assets would be covered by the existing regulations surrounding how traditional financial instruments are regulated, there was and still is very little clarity around how traditional legal principles apply to the issuance, transfer and/or trading of securities on blockchain.

With the most recent guidance, regulators have confirmed a key concept: digitized securities are subject to the same legal and compliance requirements as traditional financial instruments, regardless of how they are represented — by paper certificates on a centralized ledger, or a distributed ledger. The underlying regulatory expectations continue to be the same.

This clarification helps reduce the previously existing degree of ambiguity related to the SEC regulations for tokenized assets. Companies creating tokenized investment vehicles in an increasing variety of real-world asset types (real estate, private equity, commodities, and debt) will need to re-evaluate their operating structures against the changing actual product-specific regulations regarding tokenized investments.

Key implications include:

- Tokenized securities remain subject to federal securities laws, regardless of whether they are issued on blockchain platforms.

- Platforms facilitating trading or transfers of tokenized securities may need to register as broker-dealers, alternative trading systems (ATS), or exchanges.

- Compliance obligations around investor protection, disclosure, and custody continue to apply to blockchain-based securities structures.

- Firms must design tokenized asset platforms with regulatory oversight integrated from the beginning.

Addressing RWA Tokenization Legal Challenges

Tokenization changes how we see ownership of things but also makes things legally complicated which traditional finance wasn’t built for as it didn’t expect to be dealing with digital assets. When real-world assets are moved onto the blockchain they are not only digital tokens, but they also involve many different systems intersecting, like Property law, Securities law, Smart Contracts and Digital Custody Frameworks.

These overlapping domains create several RWA tokenization legal challenges that businesses must address before launching compliant tokenized asset ecosystems. One major issue lies in ensuring that the legal rights embedded in traditional asset agreements are accurately reflected and enforceable within blockchain-based token structures.

For instance, if a token represents a fractional ownership in a piece of real estate or a private fund, the investor’s rights will still have to be enforceable as per the legal agreements regardless of whether any transactions take place on-chain or off-chain. The blockchain also needs to include provisions in the underlying technology to ensure compliance with laws relating to investor onboarding, asset transfers and the settlement process.

In order to address these legal complexities, it will be necessary for there to be close collaboration by the legal professionals, technology architects and compliance professionals.

Common challenges include:

- Ensuring that token holders possess enforceable legal ownership rights tied to the underlying asset.

- Managing cross-jurisdictional regulatory requirements when tokenized assets are traded internationally.

- Aligning smart contract logic with legal agreements governing asset ownership and investor rights.

- Maintaining compliance with securities registration, disclosure, and custody obligations.

Organizations entering the tokenization space increasingly rely on specialized advisory partners to navigate these complexities and build legally resilient infrastructure.

How This Impacts Institutional RWA Adoption

For many years, institutional investors have realized that there are advantages to using tokenization; these advantages include better liquidity (the ease with which something can be sold or bought), fractional ownership, and a faster time frame when it comes to settling transactions. However, regulatory uncertainty has limited large institutions’ (such as banks or asset managers) ability to adopt tokenization on a large scale.

With its latest guidance, the SEC is providing a more clear understanding of the regulations that govern tokenized assets, which gives institutions more confidence in exploring potential ways to apply tokenization. By providing specific examples of how SEC regulations for tokenized assets will apply to the blockchain ecosystem, the SEC has removed a lot of the ambiguity that has previously kept large institutions from participating.

Regulatory clarity will allow institutional stakeholders to have better structured risk management practices in place. Now that compliance teams can evaluate potential tokenized assets based on clearly defined regulatory guidelines instead of hypothetically interpreting them, many organizations can move past research-based pilot projects to implementing scale and enterprise-level platforms that utilize tokenized assets.

As institutions increasingly explore digital asset strategies, the development of a robust RWA legal framework for blockchain assets becomes essential to ensure operational and regulatory alignment.

Key impacts for institutional adoption include:

- Greater regulatory certainty supporting long-term investment strategies in tokenized markets.

- Increased confidence among institutional investors and financial service providers.

- Accelerated development of regulated tokenized securities platforms.

- Improved integration between traditional financial infrastructure and blockchain networks.

Looking to Launch Compliant tokenized assets in a rapidly evolving regulatory environment? Connect with the Experts!

Building a Compliant RWA Legal Framework for Blockchain Assets

Regulatory frameworks need to be established by the private sector for tokenization to fully grow in the regulatory constraints of financial services. The SEC’s recent guidance implies that compliance must be an integral part of the design of a tokenized platform’s architecture rather than an afterthought and embedded through the entire lifecycle of the token.

A comprehensive RWA legal framework for blockchain assets is the means by which technology can be used to create new financial products while still adhering to existing regulation while providing transparency and protection for investors. Such a framework must be able to create a bridge between traditional means of creating financial documentation and executing them using blockchain technology.

Identifying a comprehensive framework for RWAs built on blockchain technology will require all organizations involved in the development of such a framework to focus on multiple areas of foundational concern, including the structure and function of the asset, onboarding procedures for investors, custody of the asset, and regulatory reporting obligations. Additionally, all participants in the development of tokenized platforms must also establish governance mechanisms that define the roles and responsibilities of the issuers, custodians, exchanges, and service providers.

Structuring tokenized assets in accordance with securities laws and investor protection requirements

A tokenization initiative’s legal structuring can significantly impact whether or not it’s compliant with regulations. This means that when you get a token, it needs to show you have legally enforceable rights to the underlying asset. Examples of the underlying assets could be either equity, debt instruments, real estate, commodities, etc. Proper structuring means that you, as a token holder, would have the same rights, protections and access to disclosures as a traditional investor would have in a conventional securities offering.

In order for an issuer to comply with the SEC regulations for tokenized assets, they need to define how each token relates to ownership, dividends, voting rights and claims to the underlying assets. Legal documentation related to the tokens (such as offering memoranda, shareholder agreements, and asset contracts) need to be consistent with the structure of the tokens created and retained on the blockchain. This will allow for on-chain transactions to reflect the underlying legal rights and obligations of the asset.

Implementing robust compliance protocols for investor identity verification and regulatory reporting

Transaction monitoring and onboarding investors are both essential to remain in compliance with regulations when using tokenized financial ecosystems. In order for a blockchain-based platform to allow eligible users access to trade in tokenized securities markets that must comply with regulatory requirements, all platforms will need to incorporate robust procedures for verifying the identities of their users.

This includes implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, verifying accredited investor status when required, and maintaining ongoing compliance reporting systems. These mechanisms are essential to ensure that tokenized asset platforms operate within the boundaries of SEC regulations for tokenized assets and broader financial oversight requirements.

In addition to the initial verification process, platforms will also need to develop reporting capabilities that are transparent to both regulatory authorities and other interested stakeholders. This can be accomplished through developing automated compliance tools and/or building smart contract logic into the platforms’ tokenization processes to enforce transaction restrictions ensuring that the transfer of tokens follows regulatory limitations and the eligibility of each investor.

Ensuring secure custody solutions for digital asset representations of traditional securities

Custody is a key component of the operational aspects associated with a tokenized asset infrastructure. When a real-world asset is digitized into a token that operates on a blockchain, then the way the token will be stored and protected must comply with security and regulatory standards as applicable to that asset class.

A tokenized security typically will require a regulated custodian that can securely hold the representation of the digital asset while still retaining its legal relationship to the underlying asset. The custodian will also have strong safeguards to prevent the unauthorized transfer of digital assets and from cyber threats and operational risks that could result in the loss of investor’s assets.

Custody frameworks provide for the protection of tokenized assets when they are in trade across decentralized or distributed systems. Institutional investors rely heavily upon the custodial mechanism both to ensure secure custody of the asset and to operate within the broader RWA legal framework for blockchain assets.

Establishing transparent governance mechanisms to manage tokenized asset platforms

The way that governance is structured will dictate how decisions are made, distributed responsibilities are assigned, and how any disputes are settled in the ecosystem of tokenized assets. Without established governance frameworks, a tokenized platform is subject to operational disarray, regulatory uncertainty, and investor unpredictability.

Governance mechanisms will help establish the rights and roles of issuers, custodians, operators of the platform, and compliance officials; as well as define processes for managing upgrades of smart contracts, resolution of investor disputes, and response to regulatory inquiries.

Transparent governance not only strengthens investor trust but also ensures that tokenized platforms maintain accountability within regulated financial environments. As tokenized asset ecosystems expand, governance models must evolve to support scalable operations while maintaining compliance with emerging real world asset tokenization regulation standards.

Strategic Role of an RWA Compliance Consulting Firm

With the ongoing changes in the way regulations are being developed concerning tokenized assets, more companies are starting to realize that they need access to specialized expertise that bridges together innovations in blockchain with financial regulation. Legal teams traditionally have expertise and experience with securities law but often do not have much experience related to the infrastructure and platform involved in blockchain-based systems; on the flip side, technology developers typically use their time developing systems functionality without appropriately considering how those systems relate to regulatory implications.

Utilizing a qualified RWA legal consulting company can assist a business throughout every phase of developing a tokenized asset–starting from the initial legal structuring of the tokenized asset through a comprehensive compliance strategy, through engaging regulators in the regulatory approval process, and finally launching the tokenized asset on the developers’ blockchain platform.

Among the various advisory services that will typically be provided by a RWA Legal Consulting Company are:

- Conducting regulatory risk assessments for tokenized asset projects.

- Structuring tokenized securities offerings to comply with U.S. regulatory requirements.

- Creating governance and compliance frameworks for blockchain-based financial systems.

- Supporting regulatory filings and communicating with regulatory authorities.

By utilizing the services of an RWA legal consulting firm, companies are provided the ability to minimize their legal risks associated with developing and launching tokenized assets and can accelerate innovation in compliance with regulatory requirements for tokenized assets.

What This Means for the Future of On-Chain Assets

The SEC’s latest guidance signals a broader transition in how regulators view blockchain-based financial infrastructure. Rather than treating tokenization as an experimental or fringe concept, regulatory authorities are increasingly integrating it into established financial oversight frameworks.

This shift indicates that tokenization is moving from a niche innovation to a core component of the evolving digital financial system. As SEC regulations for tokenized assets become more defined, market participants will gain the confidence required to develop larger and more sophisticated tokenized asset ecosystems.

Clear regulatory expectations also encourage standardization across platforms, improving interoperability and strengthening investor protection. Over time, this regulatory clarity is expected to accelerate the development of global markets built around compliant real world asset tokenization regulation.

- Expansion of regulated tokenized securities markets.

- Increased institutional investment in tokenized real-world assets.

- Development of standardized legal and technological frameworks for tokenization.

- Stronger collaboration between regulators, financial institutions, and blockchain innovators.

In this evolving regulatory environment, partnering with an experienced RWA legal consulting company becomes critical for organizations seeking to navigate tokenization with confidence. We support enterprises with end-to-end blockchain advisory and compliance-driven strategies to help build secure, regulation-ready tokenized asset ecosystems.

Crypto World

Coinbase Futures Go Live in Europe: Regulated Crypto Derivatives Now Available in 26 Countries

TLDR:

-

- Coinbase has rolled out regulated futures trading across 26 European countries through Coinbase Advanced.

- Traders can access up to 10x leverage on BTC, ETH, and equity index futures contracts on Coinbase.

- Two contract types are available: perpetual-style futures with 5-year expiries and dated contracts.

- Coinbase offers fees as low as 0.02% per contract, making derivatives more accessible in Europe.

Coinbase futures are now available to European traders for the first time. The crypto exchange has rolled out regulated futures contracts across 26 countries in Europe.

Available through Coinbase Advanced, the offering covers Bitcoin, Solana, and equity index products. Germany, France, and the Netherlands are among the eligible markets.

The launch gives European traders access to a regulated alternative to the unregulated platforms many have historically relied on for crypto derivatives.

Two Contract Types With Flexible Leverage Options

Coinbase futures come in two primary forms: perpetual-style contracts and dated contracts. Perpetual-style futures carry five-year expiries and use an hourly funding mechanism.

They are cash-settled once per day to keep prices aligned with underlying assets. Dated contracts, by contrast, expire on specific monthly or quarterly dates.

Dated contracts are marked to market daily using official exchange settlement prices. If held until expiry, these contracts are also cash-settled.

Together, both contract types offer traders flexibility in managing their positions. This dual structure caters to both short-term and longer-term trading strategies.

Traders can access up to 10x leverage on select contracts, including BTC, ETH, and equity indices. Other products carry leverage ranging from 4x to 5x.

Coinbase noted it is “making derivatives trading more accessible with fees as low as 0.02% per contract.” These rates exclude NFA, exchange, and clearing fees.

The product range also covers equity index futures, including the Mag7 + Crypto Equity Index Futures. This moves Coinbase futures beyond crypto and into broader financial markets.

European traders now have access to multi-asset derivatives on a single regulated platform. The exchange has positioned itself as a one-stop shop for multiple asset classes.

How European Traders Can Access and Begin Trading

Eligible Coinbase users can find the new offering under the derivatives tab on Coinbase Advanced. This tab is available on both the web and mobile versions of the platform.

Traders must complete eligibility checks, including assessments of their trading experience. Know-your-customer verification is also required before trading can begin.

Accounts can be funded using EUR or USDC. Once set up, users gain access to the full range of Coinbase futures products.

The process is designed to be straightforward for existing Coinbase Advanced users. New users may need to complete additional onboarding steps before proceeding.

The rollout follows growing regulatory clarity across Europe for crypto derivatives. Coinbase offers these contracts through its MiFID-regulated entity.

In a statement, the company described the launch as “a major step in our push to build an exchange for everything.” It added that it is looking “to expand beyond crypto all within the trusted Coinbase app.”

Coinbase futures represent a step toward the exchange’s goal of becoming a full-service financial platform. The company stated it is “looking forward to continuing to introduce new and expanded services” as regulations mature globally.

European traders now have a regulated, multi-asset derivatives option available to them. Additional product launches are expected as the regulatory landscape continues to develop.

Crypto World

Can $1.35 hold amid massive 400M barrel oil dump?

The crypto markets witnessed a shift today as oil prices underwent one of their most significant intraday reversals in history. Following an initial surge of nearly 30% that saw Brent crude flirting with $120 per barrel due to the escalating conflict in the Middle East and the effective closure of the Strait of Hormuz, the market plunged back toward the $100 mark.

Summary

- Oil prices reversed sharply after reports that G7 nations may release up to 400 million barrels of crude from reserves, easing inflation concerns.

- XRP is consolidating between $1.34 and $1.40 after rejecting the $1.47 local high earlier this month.

- Technical indicators show neutral momentum and steady accumulation, suggesting selling pressure may be fading near the $1.30 support level.

This sudden correction followed an exclusive report from the Financial Times stating that G7 finance ministers, in coordination with the International Energy Agency (IEA), are weighing the largest-ever emergency intervention: a release of up to 400 million barrels of crude oil from strategic reserves.

For the cryptocurrency sector, and specifically for XRP, this cooling of energy-driven inflation fears has provided a much-needed window of stability.

XRP price analysis

The current price action on the XRP/USDT (XRP) 4-hour chart illustrates a period of high-tension consolidation following a significant rejection from the $1.47 local high.

After peaking on March 4th, the asset entered a steady downtrend characterized by a series of lower highs and lower lows. However, a vital defensive effort by bulls is now visible around the $1.34 to $1.35 range, where price has begun to trade sideways in a narrow cluster.

The most immediate support is firmly established at the $1.30 level, which served as a major floor during the late February sell-off.

Conversely, overhead resistance is concentrated at $1.40, a psychological barrier that has repeatedly stifled recovery attempts. If bulls can successfully leverage the current macro stabilization to push back above $1.40, the next significant resistance target lies at the recent swing high of $1.47.

Technical indicators suggest that while the immediate trend is cautious, the selling pressure may be nearing exhaustion. The Money Flow Index (MFI-14) is currently positioned at 44.58, indicating a neutral momentum that has recovered from an oversold dip below 20 seen on March 7th.

This suggests that capital is slowly re-entering the asset at these lower price points.

Additionally, the Accumulation/Distribution line remains relatively flat at 26.1 billion, showing that despite the price drop from $1.47, there hasn’t been a massive exodus of volume, pointing toward “strong hands” holding through the volatility.

For a definitive bullish reversal, traders are looking for a break out of the current tight range, specifically a close above the $1.36 level seen in the most recent candle.

Failure to defend the $1.34 immediate floor could lead to a retest of the $1.30 primary support, while a breakout could pave the way for a run back toward $1.50 if global energy fears continue to subside.

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat7 days ago

NewsBeat7 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports1 day ago

Sports1 day agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business5 days ago

Business5 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World7 days ago

Crypto World7 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business17 hours ago

Business17 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Entertainment2 days ago

Entertainment2 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

NewsBeat7 days ago

NewsBeat7 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World4 days ago

Crypto World4 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment4 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death