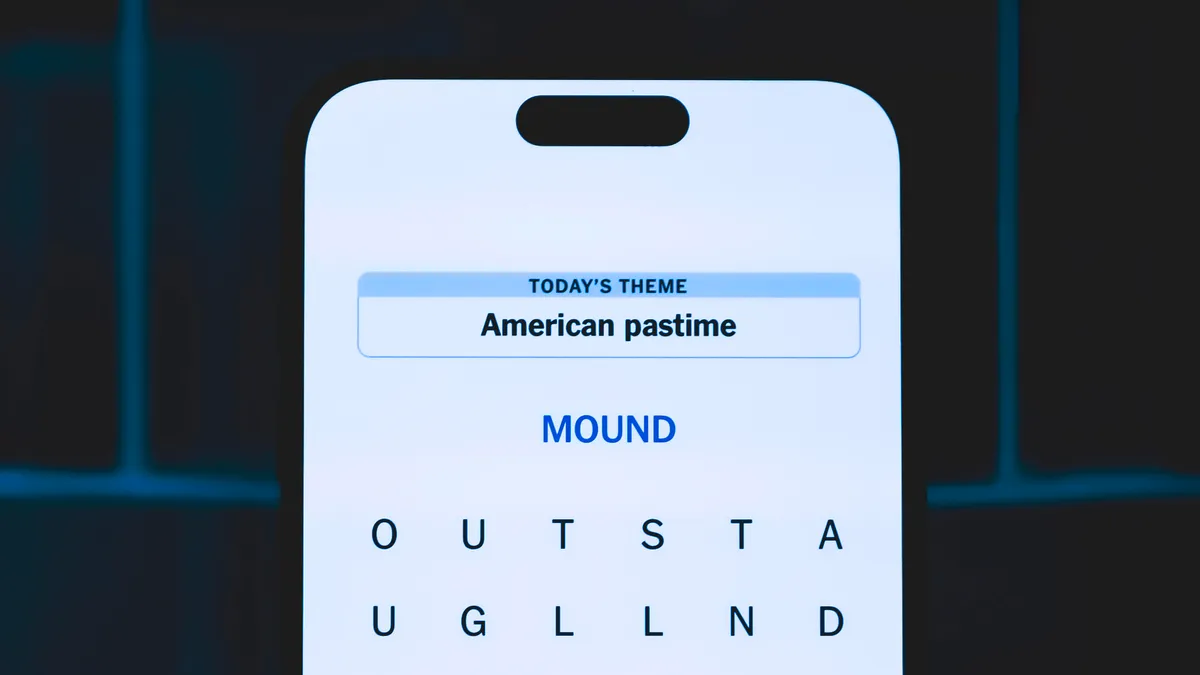

Big Tech capital expenditure for this year is predicted to rise 60pc from $410bn in 2025.

Meta, Google, Amazon and Microsoft are signalling a collective 2026 capital expenditure package of around $650bn, with AI, cloud and data centres as unsurprising high-ticket items. Wary investors, however, seem unhappy, and the Financial Times reported that Amazon, Google and Microsoft are set to lose $900bn in market cap altogether.

Big Tech capital expenditure predictions would mark a rise of 60pc from the $410bn spent in 2025 and 165pc from the $245bn spent the year before.

The four competitors see the race to provide AI compute as “the next winner-take-all or winner-takes-most market”, Gil Luria, an analyst at DA Davidson told Bloomberg. None of the companies are “willing to lose”, he added.

Amazon shares fell by 11pc after the company’s earnings call yesterday (5 February) in which company president and CEO Andy Jassy announced a $200bn capital expenditure (capex) plan for the year, growing more than 50pc since last year.

He reasoned that a 24pc revenue growth in Amazon’s cloud offerings and a 22pc growth in advertising is evidence that the heavy spending is paying off. This year’s spending will be focused on AI, chips, robotics and low-Earth orbit satellites, Jassy said.

Meanwhile, Microsoft announced a $37.5bn quarterly capital expenditure bill on 28 January, just slightly more than analyst estimates. But the company was the worst hit among the four for a while, dropping 18pc since the announcement.

The company had also, for the first time, disclosed the true nature of its close economic relationship with OpenAI. It reported that roughly 45pc of its $625bn expected in future cloud contracts was from the start-up, leading to investor wariness on its over-reliance on one customer.

Google parent Alphabet initially dropped 4pc in share price after it reported its earnings on Wednesday (4 February), but climbed back up to being just below 0.5pc since yesterday. Sales and earnings per share grew by 18pc and 31pc respectively during Q4, beating analyst expectations, while Alphabet’s cloud backlog grew by 55pc quarter-over-quarter to $240bn.

The company announced capex for the year between $175bn and $185bn, doubling expenses to meet customer demand and capitalise on the growth of the company’s AI offerings. Though despite fears of heavy spending, Gemini Enterprise is selling 8m seats and the Gemini App now has more than 750m monthly active users, which, Motley Fool reported, is keeping investors relatively content.

Lastly, Meta has announced its total expenses for 2026 to be in the range $115bn to $135bn. The growth, it said, is driven by an increased investment to support its Meta Superintelligence Labs efforts as well as its core business.

While the stocks rose 10pc after the earnings announcement, the Financial Times reports that it lost those gains after overall investor fear has pushed the tech-heavy Nasdaq down 4pc over the week.

Don’t miss out on the knowledge you need to succeed. Sign up for the Daily Brief, Silicon Republic’s digest of need-to-know sci-tech news.