Crypto World

Rare earth miners jump as Trump is eyeing mineral stockpile

U.S. President Donald Trump delivers remarks before signing an executive order in the Oval Office of the White House on Jan. 30, 2026 in Washington, DC.

Alex Wong | Getty Images

Shares of U.S.-listed rare earth miners jumped Monday after news that President Donald Trump is preparing a sweeping plan to build a strategic stockpile of critical minerals.

The proposal, known as Project Vault, would launch a first-of-its-kind strategic critical minerals stockpile designed for the U.S. private sector, according to a White House official. The plan pairs $1.67 billion in private capital with a $10 billion loan from the U.S. Export-Import Bank, the person said. Trump’s move is aimed at cutting America’s dependence on China for materials essential to electric vehicles, defense systems and advanced technology.

MP Materials, the operator of the Mountain Pass mine in California, surged 6% in early trading Monday. USA Rare Earth and Critical Metals Corp. rallied 13% and 12%, respectively, as investors bet the initiative could accelerate domestic demand and government-backed financing for the sector.

Bloomberg News first reported on the proposal earlier Monday.

USA Rare Earth has already held discussions with Commerce Secretary Howard Lutnick, pitching its domestic mining and magnet assets to the federal government. Those talks would ultimately lead to a proposed deal that could provide the company with about $1.6 billion in funding, subject to certain conditions, and include a U.S. government equity stake.

The moves build on a more direct role Washington has begun taking in the sector. The Department of Defense struck a landmark agreement with MP Materials last summer that included an equity stake, price floor, and long-term agreement to buy a specific amount of rare earth minerals and magnets.

— CNBC’s Spencer Kimball contributed to this report.

Crypto World

Top BSC-Based Prediction Market Opinion Raises $20M

The funding round comes right after the platform had a record month for revenue and trading volume.

Crypto World

XRP price sits at key support, Permissioned DEX vote

XRP price remains in a bear market this week despite some important network news and progress on its permissioned decentralized exchange vote.

Summary

- XRP price has crashed by 57% from its highest level in 2025.

- The vote for the Permissioned DEX is moving on smoothly and is likely to pass.

- Technical analysis suggests that it is hovering at a crucial support level.

The Ripple (XRP) token dropped to a key support level at $1.5463, down 56% from its 2025 high. This retreat has coincided with the broad crypto market crash that has hit Bitcoin and most altcoins.

XRP price has dropped despite some major ecosystem news. For example, the developers announced that Ripple Labs had received an EU-wide electronic money license. This license will make it easy for the company to ink deals with financial services companies in the bloc.

Ripple Labs has received more licenses in the past few months, including a U.S. banking charter and licenses in the UK and Singapore.

Meanwhile, the network activated the XLS-80 vote, which focused on permissioned domains. Most importantly, the Permissioned DEX vote is nearing its threshold.

The two amendments are important because they will enable institutions and other developers to build high-quality, regulatory-compliant decentralized exchanges. These DEX networks are different from other networks because they will include features such as Know Your Customer and Anti-Money Laundering policies.

The team believes that permissioned DEX will have more use cases in corporations. Some of these use cases are in stablecoin and fiat currency swaps, contractor and payroll payouts, cross-border business-to-business payments, and corporate treasuries.

The XRP Ledger network is also doing well in the tokenization industry. Data show that the value of the represented asset in the real-world asset tokenization industry rose by 265% over the last 30 days to over $1.45 billion.

XRP price prediction: Technical analysis

The weekly chart shows that the XRP price has crashed over the past few months and is now hovering at a crucial support level that coincides with the Major S&R Pivot Point of the Murrey Math Lines tool. It has failed to move below this price several times since April last year.

The token has moved below the 50-week Exponential Moving Average and the Supertrend indicator. At the same time, the Relative Strength Index has continued falling and is now hovering near the oversold level.

Therefore, a move below this support will signal further downside, potentially to the key level at $1, about 35% below the current level. The alternative scenario is where it rebounds, potentially to the strong, pivot and reverse level of the Murrey Math Lines tool at $2.34.

Crypto World

Europe’s role in the next wave of tokenisation

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Lukas Enzersdorfer-Konrad on how the EU’s regulatory clarity could allow tokenised markets to scale

- Andy Baehr tells BNB to “suit up”

- Top headlines institutions should pay attention to by Francisco Rodrigues

- “Bitcoin’s drawdowns compress as markets mature” in Chart of the Week

Expert Insights

Europe’s role in the next wave of tokenisation

– By Lukas Enzersdorfer-Konrad, chief executive officer, Bitpanda

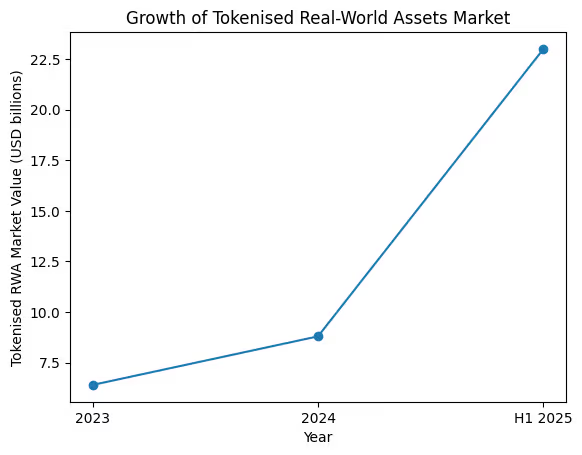

The tokenisation of real-world assets (RWAs) has moved from buzzword to business case. It has become the bedrock of institutional blockchain adoption. In the first half of 2025 alone, the value of tokenised RWAs surged by 260%, reaching $23 billion in on-chain value. Over the past several years, the sector has experienced rapid and sustained growth, enough to shift tokenisation from an experimental concept to a core pillar of digital-asset infrastructure. This signals a structural shift in how financial markets are built and ultimately expanded.

Tokenisation is emerging as the foundation of institutional blockchain adoption with BlackRock, JPMorgan and Goldman Sachs having publicly explored or deployed related initiatives and major institutions validating its potential. Despite this momentum, growth remains constrained. Most assets are still embedded in permissioned systems, segmented by regulatory uncertainty and limited interoperability. Scalable public-network infrastructure remains underdeveloped, slowing the path from institutional pilots to mass-market participation. In short, tokenisation works, but the market rails to support global adoption are still being built.

What’s missing? Regulation, as an enabler. Institutions need clarity before committing to balance sheets and building long-term strategies. Retail investors need transparent rules that protect them without shutting them out. Markets need standards they can trust. Without these elements, liquidity stays shallow, systems stay siloed and innovation struggles to move beyond early adopters.

Europe has undoubtedly emerged as an early leader in this area. With MiCA now in force and the DLT Pilot Regime enabling structured digital-securities experimentation, the region has moved beyond fragmented sandboxes. The European market is the first to implement a unified, continent-wide regulatory framework for tokenised assets. Instead of treating compliance as an obstacle, the region has elevated regulatory clarity into a competitive advantage. It provides the legal, operational and technical certainty that institutions require to innovate with confidence and at scale.

The continent’s regulatory-first approach is already generating tangible momentum. Under MiCA and the EU’s DLT Pilot Regime, banks have begun issuing tokenised bonds on regulated infrastructure, with European issuance exceeding €1.5 billion in 2024 alone. Asset managers are testing on-chain fund structures designed for retail distribution, while fintechs are integrating digital-asset rails directly into licensed platforms. Together, these developments mark a shift from pilot programmes to live deployment, reducing one of the industry’s longest-standing bottlenecks: the ability to build compliant infrastructure from day one.

A new phase: interoperability and market structure

The next frontier of tokenisation will hinge on interoperability and shared standards, areas where Europe’s regulatory clarity could again set the pace. As more institutions bring tokenised products to market, fragmented liquidity pools and proprietary frameworks risk recreating the silos of traditional finance in digital form.

While traditional finance has spent years optimising for speed, the next wave of tokenisation will be shaped by trust in who builds and governs the infrastructure, as well as whether both institutions and retail participants can rely on it. Europe’s clarity around rules and market structure gives it a credible opportunity to define global standards rather than simply follow them.

The EU can reinforce this position by encouraging cross-chain interoperability and common disclosure standards. Establishing shared rules early would allow tokenised markets to scale without repeating the fragmentation that slowed earlier financial innovations.

Headlines of the Week

– By Francisco Rodrigues

President Donald Trump’s surprise nomination of Kevin Warsh to lead the Fed introduced new variables that shook the markets. The precious metals rally saw a violent selloff, while cryptocurrency prices endured a major correction, with major players nevertheless moving to capture value.

Vibe Check

Suit up, BNB

– By Andy Baehr, head of product and research, CoinDesk Indices

Last week’s CoinDesk 20 (CD20) reconstitution brought BNB into the index for the first time. This wasn’t a question of size — BNB has long been one of the largest digital assets by market cap. It was a matter of meeting the liquidity and other requirements that govern CD20 inclusion. For the first time, BNB cleared those hurdles.

The result? One of the largest composition changes since the index launched in January 2024. BNB enters the CD20 with a weight exceeding 15%, making it an immediate heavyweight in the lineup.

From a portfolio construction perspective, this is a meaningful shift. BNB has historically exhibited lower volatility than the broader CD20, which could reduce the index’s overall risk profile. Its correlation with other index constituents has been moderate rather than lockstep (until recently, at least), adding a diversification benefit. The potential outcome: a lower-risk, more diversified index.

Of course, adding a big name means pushing other constituents down the weight ladder, even with the capping mechanisms CD20 employs. The pie charts tell that story clearly — existing holdings get compressed to make room for the new arrival.

As crypto enters what we’ve been calling its “sophomore year” of institutional maturity, the CoinDesk 20 is beginning its own third year of existence. The index evolves alongside the market it’s meant to capture.

Sunday scaries (real or imagined?)

This past weekend felt rough. Bitcoin traded below $75K, billions in liquidations got clocked, and if you’re in crypto, you were probably watching it happen in real time. Whether you count 24/7 market access as a blessing or a curse, it’s simply a fact of life now.

After a few weekends like this one, it starts to feel like a pattern — like crypto absorbs the world’s anxieties while traditional markets sleep. So, we decided to test that feeling against the data.

The scatter plot shows daily returns for the CoinDesk 20, with weekend moves highlighted separately. Yes, there are a few instances of outsized downside moves on Saturdays and Sundays. But there are plenty of quiet weekends too — and plenty of weekday chaos that doesn’t fit the narrative.

It may be memory inflation. Painful weekends stick in our minds more than calm ones. The drama of watching markets move when others aren’t paying attention amplifies the psychological weight. The data suggests that Sunday scaries might be more perception than pattern.

Still, after a weekend like this past one, the feeling is real even if the statistical significance isn’t. We keep on indexin’ through it all — tracking what’s happening, measuring what matters and trying to separate signal from sentiment.

Chart of the Week

Bitcoin’s drawdowns compress as markets mature

Bitcoin’s peak-to-trough drawdowns have steadily compressed over time, moving from -84% in the first epoch (post-1st halving) to a current cycle maximum of -38% as of early 2026. This persistent reduction in “peak pain” suggests a structural shift toward market maturity, as institutional capital and spot ETFs establish a more stable price floor compared to the retail-driven 80%+ crashes of previous eras. Historically, bitcoin has taken approximately 2 to 3 years (roughly 700 to 1,000 days) to fully recover from major cycle bottoms to new highs, though recovery speed has recently increased, with Epoch 3 reclaiming its peak in only 469 days.

Listen. Read. Watch. Engage.

Looking for more? Receive the latest crypto news from coindesk.com and explore our robust Data & Indices offerings by visiting coindesk.com/institutions.

Crypto World

Where Is The Best Place To Turn $500 Into $5,000? Remittix Rewards Presale Investors With 300% Bonus

As investors search for high-upside opportunities in a cautious crypto market, Remittix is drawing serious attention. The PayFi-focused project has already raised over $28.9 million, launched a live wallet and is now offering a limited 300% bonus to presale participants.

With real product traction and tightening supply, Remittix is increasingly viewed as a rare early-stage setup with asymmetric potential.

Why Remittix Is Drawing Capital Right Now

Remittix is not competing on hype. It is competing on usefulness. The project is building a full PayFi ecosystem that allows users to convert crypto into fiat and send funds directly to bank accounts worldwide. No delays. No hidden charges. No complex steps.

This focus on everyday payments is resonating with both retail investors and businesses. Remittix solves that problem directly.

Momentum is already visible. Over 701 million tokens have been sold and the token price has climbed steadily to $0.123. The Remittix Wallet is live on the App Store. This will give users hands-on access to the ecosystem before the core crypto-to-fiat feature launches on February 9th 2026.

Security and credibility also matter in this stage of the market. Remittix has been fully verified by CertiK, with audited smart contracts and a public development roadmap. Exchange exposure is lining up as well, with BitMart confirmed and LBank announced.

These factors explain why many analysts now describe Remittix as a best crypto to buy now for investors seeking real utility rather than narrative-driven speculation. With the presale entering its final stretch, some are already framing RTX as a top crypto under $1 that still offers early-entry dynamics.

The 300% Bonus Is Driving Urgency

The strongest short-term catalyst is the limited 300% bonus, available for just 72 hours. This incentive dramatically increases token allocation for early participants and has accelerated inflows across the presale.

Combined with a referral program that rewards community growth, the structure favors fast movers rather than passive observers.

What presale investors are getting right now

- A time-limited 300% bonus that multiplies initial token allocation

- A 15% referral reward paid in USDT and claimable every 24 hours

- Confirmed centralized exchange listings starting with BitMart

- A live wallet product with crypto-to-fiat functionality launching next

This combination is why some investors believe Remittix offers one of the clearest risk-reward profiles currently available. Turning $500 into $5,000 is never guaranteed. However, bonus mechanics, fixed supply and early-stage pricing significantly shift the math.

At $0.123, RTX still sits firmly in top crypto under $1 territory. With supply tightening and bonuses expiring, many see this window as unusually short. That urgency is also why Remittix keeps appearing in conversations around the best crypto presale opportunities this cycle.

A Long-Term PayFi Thesis With Short-Term Catalysts

Beyond bonuses, Remittix is structured for durability. The project targets the global payments market. This is a market estimated in the tens of trillions annually. That means that even modest adoption translates into sustained demand for the RTX token.

Unlike meme-driven assets, Remittix benefits from usage. Every transfer, every settlement and every business integration reinforces the network. That is why some analysts are already labeling it a best new altcoin candidate with staying power beyond launch.

Upcoming exchange listings are expected to enhance both liquidity and market visibility. The wallet rollout reduces onboarding friction for new users, while the planned February 2026 crypto-to-fiat launch completes the PayFi loop. Together, these milestones are advancing at a rapid pace.

From an investment perspective, this mix of near-term incentives and long-term utility is rare. It is also why Remittix is increasingly compared to earlier breakout projects that combined real-world relevance with early-stage pricing. Some market watchers even position RTX as a next big altcoin 2026 contender if execution continues as planned.

The referral program adds another layer of momentum, encouraging organic growth rather than paid hype. Community-driven expansion has historically supported stronger post-launch price stability.

For investors scanning the market for the best crypto to buy now, Remittix ticks multiple boxes at once. It pairs a best crypto presale structure with tangible delivery, clear timelines and shrinking availability. With the 300% bonus clock running down and tokens moving quickly, the question for many is not whether Remittix will launch, but how much of the early allocation will still be available when the window closes.

That same calculus is why some are already treating RTX as a potential next big altcoin 2026 story in the making, rather than just another short-lived presale.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Is Hyperliquid Losing Ground? On-Chain Data Highlights Rising HFDX Adoption

Some parts of the crypto world think Hyperliquid might be slowing down. That talk comes as new numbers show traders and capital flow shifting toward new DeFi projects like HFDX. On-chain data shows trading patterns and volume trends that hint at real changes in where users spend their time and capital.

Meanwhile crypto prices, news, and expert views shape how people see these projects today. In this piece, we look at Hyperliquid’s recent situation and then contrast it with what HFDX is doing. The goal is to give you a clear snapshot of the current state of play.

Hyperliquid: On-Chain Data, Price Moves and What Experts Say

Hyperliquid’s native token HYPE has had a mixed run lately. Some reports show that HYPE had strong periods of trading and network activity in 2025. At times, its prices climbed after large on-chain liquidity and network upgrades that lowered fees and drew traders to its perpetual markets. On-chain figures show huge trading volumes and growing open interest, which helped push HYPE toward past price highs.

But recent market chatter suggests pressure on the token. Some news points to price slides or sideways trading around current levels, even though earlier in late 2025 it rallied thanks to on-chain liquidity innovations.

Analysts and price prediction models still talk about potential upside for HYPE into future years. Some long-term price outlooks suggest that if adoption and volume remain strong, HYPE could trade significantly higher in the medium term.

Still, not all views are upbeat. Some experts say the market overall remains weak, and the hype around early growth may fade as users look for fresh opportunities. The idea that Hyperliquid is losing ground is tied to how traders react to alternatives and look for new ways to manage capital and risk.

HFDX: On-Chain Futures and Structured Yield Momentum

HFDX is a newer protocol that offers non-custodial perpetual futures trading along with structured yield frameworks based on real protocol revenue. It targets active traders and investors who want precise tools without giving up control of their assets. HFDX runs entirely on-chain, and all actions, whether trades or liquidity participation, happen in smart contracts.

On-chain data shows some traders migrating from legacy decentralized exchanges to HFDX because of its risk-managed liquidity strategies and transparent fee structure. Reports that Bitcoin perpetual traders have been splitting volume between Hyperliquid and HFDX point to a real shift in user priorities. HFDX’s structured approach draws those who want returns tied to actual trading revenue and borrowing fees rather than just speculation.

HFDX’s technical design mixes deep liquidity with risk controls that appeal to DeFi-native users. The liquidity loan note (LLN) strategies let participants put capital into protocol liquidity and receive fixed rates that reflect real activity. This model may attract users seeking a different balance of risk and return.

What HFDX offers:

- On-chain perpetual futures with full user custody

- Trades that clear against shared liquidity pools

- Pricing based on decentralized oracle feeds

- Liquidity Loan Note strategies with fixed terms

- Yield tied to trading fees and borrow costs

- Smart contracts that manage risk rules on-chain

Experts Note A Shifting Landscape

In the short term, Hyperliquid still holds significant on-chain volume and active user counts. Its upgrades and network features helped it achieve strong adoption in earlier phases, and experts continue to discuss its price prospects. Still, recent market signals and trader behavior hints that some of its user base is looking elsewhere.

HFDX’s rise does not mean Hyperliquid is done. It just shows the market is evolving. Traders now split capital, test new products, and choose platforms based on what fits their goals. HFDX’s structured yield options and transparent execution are part of that shift. The next few months will be critical for both protocols as price trends, on-chain metrics, and user choices play out in real time.

Make Your Money Work Smarter And Unlock A Wealth Of Opportunities With HFDX Today!

Website: https://hfdx.xyz/

Telegram: https://t.me/HFDXTrading

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Pudgy Penguins, Known For NFT Toys, Dives Deeper Into Soccer

Join Our Telegram channel to stay up to date on breaking news coverage

Pudgy Penguins, a globally recognized non-fungible token brand known for creating NFT-inspired toys, has expanded into soccer through significant NFT partnerships with two leading football clubs. Pudgy Penguins NFT team, which partnered with Spain’s soccer club CD Castellón last year, has now partnered with England’s Premier League soccer club Manchester City. In this article, we shall explore this expansion journey further.

Pudgy Penguins’ Journey From Toys To Soccer

Over the weekend, the Pudgy Penguins team, via its official X account, confirmed that it has dived deeper into the world of soccer. Launched in July 2021, the Pudgy Penguins is a digital asset incubation studio known for creating Pudgy Penguins, a globally recognized non-fungible token collection featuring a fixed set of 8,888 unique digital penguin characters on the Ethereum blockchain network.

🚨PUDGY PENGUINS PARTNERS WITH MANCHESTER CITY

Pudgy Penguins will release a premium collectibles for 18+ audience and merch line with Manchester City, tapping into the club’s 300M+ global fanbase. pic.twitter.com/B0HtfgNj2q

— Coin Bureau (@coinbureau) January 16, 2026

Pudgy Penguins is also the brainchild behind Lil Pudgy, a non-fungible token series that features a fixed supply of 22,222 smaller NFTs hosted on the Ethereum blockchain network, Pudgy Rod, a companion collection of fishing rod NFTs that were airdropped to original holders in 2021 and are now used as multipliers in the ecosystem and soulbound tokens, a non-transferable tokens such as ‘Opensea x Penguins SBTs’ launched to recognize community engagement, loyalty, and licensing participation.

Pudgy Penguins entered the physical retail space in May 2023 with the release of its first line of toys. Initially launched online through Amazon, the collection sold over 20,000 units in its first 48 hours and generated more than $500,000 USD in sales. This was clear evidence of a strong demand beyond the NFT community. Later that year, the toys were stocked in more than 2,000 Walmart stores across the U.S., and within 12 months of launching, over 1 million plushies had been sold worldwide. These plushies are now available in the United States, Europe, Asia, and Hong Kong.

Pudgy Penguins Dives Deeper Into Soccer

Pudgy Penguins NFT team partnered with the Spanish soccer club CD Castellón in January 2025 to feature their characters on the team’s official jerseys and shorts. As part of the collaboration, an open edition NFT was released, and some holders of that NFT were eligible to be featured in some way related to the partnership. Pudgy Penguins and Lil Pudgys characters appeared directly on CD Castellón’s jerseys.

CD Castellón🇪🇸 x Pudgy Penguins🐧 https://t.co/DgPV0URVMz pic.twitter.com/7jb2Ww8BJ9

— Football Shirt News🌍 (@Footy_ShirtNews) January 24, 2025

In the latest news, the Pudgy Penguins NFT team has announced a “landmark partnership” with English Premier League champions Manchester City to launch a premium co-branded NFT line targeted at an adult audience. This move is considered one of the highest-profile crossovers between a web3-native brand and a global sports giant, aimed at bringing the Pudgy Penguins intellectual property to a massive, mainstream audience. The merchandise drop was scheduled for January 17, 2026.

These ventures are part of the Pudgy Penguins’ broader strategy to evolve beyond their digital origins and toy lines into a mainstream, global intellectual property (IP) through real-world utility and high-profile brand building, bridging the gap between digital assets and traditional markets. This integration will provide tangible ways for NFT holders to feel part of the brand’s journey, reinforcing holder identity and community.

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

XRP Risks Another 23% Drop as Price Slides Below $1.60

XRP (XRP) price dropped below $1.50 over the weekend, its lowest level in over 14 months. Now, a bearish technical setup on the charts suggests that the downtrend may extend throughout February.

Key takeaways:

-

XRP’s bear pennant on the four-hour chart targets $1.22.

-

XRP futures open interest dropped to $2.61 billion, which gives some hope for the bulls.

XRP price chart shows a textbook bear pennant

On Saturday, XRP price fell about 14% from a high of $1.75 to a low of $1.50, losing the $1.60 support level for the first time since November 2024.

The latest drop has put it into the breakdown phase of its bear pennant setup, as shown on the four-hour chart below.

Related: Price predictions 1/30: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

XRP dropped below the pennant’s lower trendline on Tuesday, then rebounded to retest it as support. The price is likely to drop lower if the retest fails and a four-hour candlestick closes below this level at $1.58.

The measured target of the bear pennant, calculated by adding the height of the initial drop to the breakout point, is $1.22, representing a 23% drop from the current price.

XRP’s recovery to $2.40 in January turned out to be a “fakeout” as the price continued to form “price formed a fresh lower lows,” pseudonymous analyst AltCryptoGems said in a recent post on X, adding:

“The downtrend remains intact and we are on the verge of a disastrous collapse in a huge no-support zone.”

Trader and investor Alex Clay said that after breaching the support line of a double bottom pattern at $1.60, the path is now cleared for a drop toward $1 or lower.

As Cointelegraph reported, XRP’s next major support level is near its aggregated realized price at $1.48. If this level is lost, it would put the average holder underwater, a setup that closely matches the 2022 bear phase that ultimately ended in a 50% drawdown toward $0.30.

XRP buyers step back

The 90-day Spot Taker Cumulative Volume Delta (CVD), a metric that tracks whether market orders are driven by buyers or sellers, reveals that buy-orders (taker buy) have been declining sharply since early January.

While demand-side pressure has dominated the order book since November 2025, buy orders have dropped sharply over the last 30 days, according to CryptoQuant.

This indicates waning enthusiasm or exhaustion among XRP investors, signaling reduced bullish momentum and increasing downside risk for the price.

Previous sharp drops in spot CVD have been accompanied by 28%-50% price drawdowns within weeks.

However, in the current downtrend, one hope for the bulls is the declining XRP futures open interest (OI). It has dropped sharply to $2.61 billion on Wednesday, from $4.55 billion on Jan. 6.

When OI declines in combination with falling prices, it indicates a weakening bearish trend or a potential trend reversal.

This could provide some fuel for the bulls to test the important overhead resistance at around $1.85, a level that served as support throughout most of 2025.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

The DAO hacked again, but this time it’s the good guys

Ten years on from the most notorious hack in Ethereum history, The DAO has been exploited once again.

However, this time, far from 2016’s existential crisis, it’s actually good news.

In what a Security Alliance (SEAL) member described as a “long-planned whitehat rescue,” over 50 ether (ETH) were rescued from an insecure contract.

The funds, worth over $100,000 had sat in a vulnerable smart contract for a decade. They currently sit in this recovery address.

Read more: 2025’s biggest crypto hacks: From exchange breaches to DeFi exploits

The 2016 hack of the original DAO saw 3.6 million ETH lost. The sum was worth around $60 million at the time, but would now be valued at close to $8 billion.

Whitehat hackers subsequently sprang into action, racing to reverse engineer the hack and drain the contracts themselves in order to secure funds that blackhats may otherwise have gained.

This bought time until a longer-term solution could be decided on by the community.

The event caused such disruption to the Ethereum community that it collectively took the decision to fork the network, restoring the blockchain to its pre-hack state.

Today’s whitehat rescue was announced by “Giveth,” whose co-founder Griff Green worked on The DAO back in 2016.

It may be surprising that such a high profile codebase, especially from a security standpoint, would still contain an unidentified vulnerability a decade later. But a recent spate of blackhat attacks on older projects show that such hidden weaknesses may be more common than expected.

Read more: Legacy DeFi platforms lose $27M as hacking spree continues into 2026

The rescue mission comes on the back of more good news for the Ethereum security community.

Last week, Green pledged that recovered funds will be returned “to the people who put it there, or if unclaimed, [used] for funding Ethereum Security.”

Any unclaimed funds from today’s rescue will be added to the pot.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Gold Volatility Beats Bitcoin’s Risk Profile

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and brace yourself: markets are moving in ways few expected. One asset is swinging wildly, defying norms, while the other struggles to catch up. Traders and investors are watching closely as volatility reshapes familiar narratives, signaling that nothing is quite as it seems.

Sponsored

Sponsored

Crypto News of the Day: Gold’s Volatility Surges Past Bitcoin Amid Historic Market Swings

Gold has overtaken Bitcoin amid market turbulence. Its recent price swings surpass even Bitcoin’s, highlighting a rare inversion in risk dynamics that few investors expected.

Data shows the 30-day volatility in gold surged to a new peak of 48.68, and stood at 41.04 as of this writing. Notably, this level was not tested since the 2008 financial crisis.

In comparison, Bitcoin’s volatility currently hovers around 39%, despite its reputation as a highly speculative asset.

The surge in gold volatility follows its sharpest plunge in more than a decade, including a single-session drop of nearly 10% from a peak of $5,600 to roughly $4,400 per ounce in Asian trading.

Since Bitcoin’s creation 17 years ago, gold has been more volatile only twice. The most recent was in May 2019 during a flare-up in trade tensions sparked by tariff threats from US President Donald Trump.

The wild swings in gold come amid broader macroeconomic uncertainty. As indicated in a recent US Crypto News publication, renewed fears of geopolitical instability, currency debasement, and questions about the Federal Reserve’s independence drove investors to pile into precious metals.

Sponsored

Sponsored

Gold Rebounds $6 Trillion in Two Days, Leaving Bitcoin Behind

The recovery in gold has been equally dramatic, with XAU prices surging back above $5,000/oz, up 17% in just 48 hours.

During the same period, gold added $4.74 trillion to its market capitalization, while silver gained $1 trillion. This brings the total growth in the precious metals market cap to nearly $6 trillion in two days.

“That’s over 4× Bitcoin’s market cap,” stated analyst Crypto Rover.

Sponsored

Sponsored

The rebound reflects strong accumulation by institutional and high-net-worth investors, with consistent buying on every dip speaking volumes about who’s accumulating the precious metal, regardless of the noise.

“Volatility shouldn’t surprise anyone here—it’s rare for an asset to absorb a hit like last week’s and then move straight back up without a few bumps. Gold remains severely under-owned, and this move has real legs as part of a much larger cycle,” said Otavio in a post.

Even amid volatility, gold has maintained its status as a safe-haven asset, up roughly 66% year-on-year, while Bitcoin remains down more than 20% over the same period.

The contrast mirrors how, in times of macroeconomic stress, traditional precious metals continue to command a premium in investor portfolios, outpacing even high-profile digital assets.

As geopolitical and monetary pressures persist, gold’s newfound volatility is likely to remain in focus, offering both risk and opportunity for traders seeking refuge from broader market swings.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 3 | Pre-Market Overview |

| Strategy (MSTR) | $133.26 | $132.55 (-0.53%) |

| Coinbase (COIN) | $179.66 | $178.89 (-0.43%) |

| Galaxy Digital Holdings (GLXY) | $21.98 | $22.11 (+0.59%) |

| MARA Holdings (MARA) | $9.05 | $8.99 (-0.66%) |

| Riot Platforms (RIOT) | $15.34 | $15.32 (-0.13%) |

| Core Scientific (CORZ) | $17.74 | $17.65 (-0.51%) |

Crypto World

BTC might just be another software name, and that’s bad news

Bitcoin is increasingly behaving like a software stock, with its latest correction unfolding alongside the broader software sell-off.

The relationship between bitcoin and software equities has strengthened notably. On a 30-day rolling basis, bitcoin’s correlation with the iShares Expanded Tech Software ETF, (IGV), stands at a high 0.73, according to ByteTree. The IGV is down around 20% year to date, while bitcoin has fallen 16%.

IGV is heavily weighted toward software and services names such as Microsoft (MSFT), Oracle (ORCL), Salesforce (CRM), Intuit (INTU) and Adobe (ADBE).

While the technology sector appears relatively resilient at the headline level — the Nasdaq 100 (QQQ), is only around 4% below its record high — software stocks have absorbed most of the selling pressure, and bitcoin is increasingly trading in line with this weaker pocket of the market rather than the broader index.

As for why software names are getting hammered, the answer is simple: AI. The rapid progress towards fully functioning artificial general intelligence (AGI) is currently being considered an existential issue for software.

“There can be no doubt that bitcoin has been caught up in the technology selloff,” said ByteTree. “At its heart, bitcoin is an internet stock. Software stocks have been the most recent casualty, and the price of bitcoin has shown similar performance over the past five years, with high correlation.”

ByteTree also notes that the average technology bear market lasts about 14 months. With this current downturn having started in October, this suggests pressure could persist through much of 2026. However, ByteTree notes that a resilient economic backdrop could provide support for bitcoin.

“Bitcoin is just open-source software,” said Van Eck’s Matthew Sigel.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech9 hours ago

Tech9 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World18 hours ago

Crypto World18 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards