Business

The Czech Tennis Phenom Breaking Into the WTA Top 100

At only 20 years old, Sara Bejlek has already established herself as one of the most promising young talents on the WTA Tour. The Czech left-hander, once the world’s No. 4 junior, has transitioned to the professional ranks with impressive speed and maturity. In 2026 she sits inside the top 100 for the first time in her career and is widely regarded as the next big breakout star from the tennis powerhouse nation that produced Petra Kvitová, Karolína Plíšková, Barbora Krejčíková and Markéta Vondroušová.

Here are the 10 essential things every tennis fan should know about Sara Bejlek right now.

1. Record-Setting Junior Career

Bejlek was one of the most dominant juniors of her generation. She reached a career-high junior ranking of No. 4 in the world and won four ITF junior titles, including back-to-back Grade 1 titles in 2021 (Czech Indoor and Czech Open). She made the semifinals of the 2022 Australian Open juniors and the quarterfinals of the French Open juniors the same year. Her junior highlight came at the 2021 US Open juniors, where she reached the final before falling to Robin Montgomery.

She turned pro full-time at 16 and never looked back.

2. Fastest Climb to the WTA Top 200

Bejlek cracked the WTA top 200 for the first time in May 2023 at age 17 after winning three consecutive ITF W60 titles on clay (Prerov, Otočec, Prague). She became the youngest Czech woman to reach that milestone since Karolína Muchová in 2015. By the end of 2024 she was ranked No. 139 and in 2025 she finished the year at No. 92—her first top-100 season.

3. Clay-Court Specialist with Serious Power

Bejlek is a classic clay-court player with heavy topspin groundstrokes, excellent movement, and a dangerous lefty forehand that can flatten out into winners. Her average forehand speed on clay exceeds 78 mph, placing her among the fastest-hitting teenagers on tour. She won 78% of her main-draw ITF matches on clay between 2022 and 2025.

She is particularly dangerous when dictating with her forehand from the baseline and using sharp angles to open the court.

4. Breakthrough 2025 Season: First WTA Quarterfinal & Top-100 Finish

2025 was the breakout year. Bejlek reached her first WTA quarterfinal at the Prague Open in July (lost to Linda Nosková), made the third round of the US Open as a qualifier (defeating former top-20 player Elise Mertens), and finished the season inside the top 100 for the first time. She won two ITF W75 titles and reached the final of an ITF W100, posting a 52–19 win-loss record.

5. First WTA-Level Win Over a Top-20 Player

In the second round of the 2025 US Open, Bejlek defeated world No. 18 Elise Mertens 6–4, 7–5 in a tense three-set battle that lasted 2 hours 18 minutes. It was her first victory over a top-20 opponent and the biggest win of her career at the time. She followed it with a gritty third-round loss to eventual semifinalist Jessica Pegula.

6. Mental Toughness & Clutch Play

Bejlek has already shown championship-level composure in deciding sets. In 2025 she won 14 of her last 17 deciding sets and converted 68% of her break points in matches that went the distance. Coaches and opponents frequently praise her “ice-in-the-veins” mentality on big points.

7. Left-Handed Advantage & Serve Potential

As a lefty, Bejlek creates unique angles with her forehand and serve that right-handers find difficult to read. Her first serve averages 105–108 mph and she has been working intensively on adding kick and slice variety to her second serve. Analysts believe her serve could become a significant weapon once she adds more consistency and placement.

8. Czech Tennis Factory Continues to Produce

Bejlek is the latest product of the Czech tennis development system that has produced more Grand Slam champions per capita than any other nation over the last 15 years. She trains at the Prague Tennis Academy under coach David Škoch (former Davis Cup player) and frequently practices with Karolína Muchová and Linda Nosková. The Czech Republic now has six women ranked inside the top 100 in early 2026 — the most of any country outside the United States.

9. Off-Court Personality & Growing Brand

Bejlek is known for her dry humor, love of heavy metal music (she has Metallica and Slipknot tattoos), and candid interviews. She frequently engages with fans on social media and has built a loyal following in Central Europe. Her signature celebration—a quick double fist-pump followed by a point to the sky—has become recognizable.

She signed endorsement deals with Nike, Babolat, and a Czech energy-drink brand in 2025 and is starting to appear in fashion campaigns in Prague.

10. 2026 Goals: Top 50, First WTA Title & Grand Slam Fourth Round

Entering the 2026 season ranked No. 92, Bejlek is projected by most analysts to finish the year inside the top 50. Her goals are clear: win her first WTA title, reach the fourth round of a Grand Slam, and break into the top 40. With a healthy clay-court swing (she excels in Europe’s spring swing) and continued improvement on hard courts, many believe 2026 could be the year she truly announces herself as a top-30 player.

Business

LIC shares climb 4% after Q3 results. Should you buy, sell, or hold?

The insurer reported a 17% year-on-year (YoY) rise in consolidated net profit at Rs 12,930 crore for the December quarter, compared with Rs 11,008 crore in the year-ago period.

Net premium income stood at Rs 1.26 lakh crore in Q3FY26, up 17% from Rs 1.07 lakh crore in the corresponding period last year. On a sequential basis, profit after tax rose 28% from Rs 10,098 crore reported in Q2FY26, even as net premium income declined marginally by 0.7% quarter-on-quarter.

During the nine months ended December 31, 2025, LIC sold 1,16,63,856 policies in the individual segment, slightly lower than 1,17,10,505 policies sold in the same period last fiscal year, reflecting a decline of 0.40%.

On an Annualised Premium Equivalent (APE) basis, total premium for 9MFY26 stood at Rs 44,007 crore. Of this, Individual Business contributed 62.61% or Rs 27,552 crore, while Group Business accounted for 37.39% or Rs 16,455 crore.

Within Individual Business, Par products made up 63.54% of APE at Rs 17,507 crore, while Non-Par products accounted for 36.46% or Rs 10,045 crore. Individual Non-Par APE increased to Rs 10,045 crore for the nine months ended December 31, 2025, compared with Rs 6,813 crore in the year-ago period, registering a growth of 47.44%.

The Value of New Business (VNB) for the nine-month period rose to Rs 8,288 crore from Rs 6,477 crore a year earlier, marking a growth of 27.96%. Net VNB margin expanded by 170 basis points to 18.8%, compared with 17.1% in the year-ago period.LIC’s solvency ratio improved to 2.19 as on December 31, 2025, from 2.02 a year earlier. Assets under management (AUM) increased to Rs 59,16,680 crore as of December 31, 2025, compared with Rs 54,77,651 crore on December 31, 2024, reflecting a rise of 8.01% YoY.

The overall expense ratio for the nine months ended December 31, 2025 declined by 132 basis points to 11.65%, compared with 12.97% in the corresponding period last year.

Brokerage view

Bernstein maintained a neutral stance on LIC, assigning a Market-Perform rating with a target price of Rs 940.

The brokerage said LIC delivered a strong topline performance in Q3FY26 despite ongoing GST-related pressures, while margins improved on the back of a healthier business mix and favourable yield curve movements.

It noted that new business margins rose to around 21%, aided by a better product mix and yield gains, with the GST impact largely offset through tight cost discipline.

On the strategic front, management indicated that the process for the government’s stake sale is likely to commence soon. Bernstein also expects greater clarity on LIC’s dividend policy following the transition to IFRS accounting standards, a key monitorable for investors.

(Disclaimer: The recommendations, suggestions, views, and opinions given by the experts are their own. These do not represent the views of The Economic Times)

Business

Toyota CEO Sato to step down, to be replaced by CFO Kon

Toyota CEO Sato to step down, to be replaced by CFO Kon

Business

StepStone Group Inc. (STEP) Q3 2026 Earnings Call Transcript

Operator

Good day, and thank you for standing by. Welcome to the Q3 2026 StepStone Group Inc. Earnings Conference Call. [Operator Instructions] Please be advised that today’s conference is being recorded.

I would now like to hand the conference over to your first speaker today, Seth Weiss, Head of Investor Relations. Please go ahead.

Seth Weiss

Managing Director of Corporate Investor Relations

Thank you. Joining me on today’s call are Scott Hart, Chief Executive Officer; Jason Ment, President and Co-Chief Operating Officer; Mike McCabe, Head of Strategy; and David Park, Chief Financial Officer.

During our prepared remarks, we will be referring to a presentation, which is available on our Investor Relations website at shareholders.stepstonegroup.com.

Before we begin, I’d like to remind everyone that this conference call as well as the presentation contains certain forward-looking statements regarding the company’s expected operating and financial performance for future periods.

Forward-looking statements reflect management’s current plans, estimates and expectations and are inherently uncertain and are subject to various risks, uncertainties and assumptions. Actual results for future periods may differ materially from those expressed or implied by these forward-looking statements due to changes in circumstances or a number of risks or other factors that are described in the Risk Factors

Business

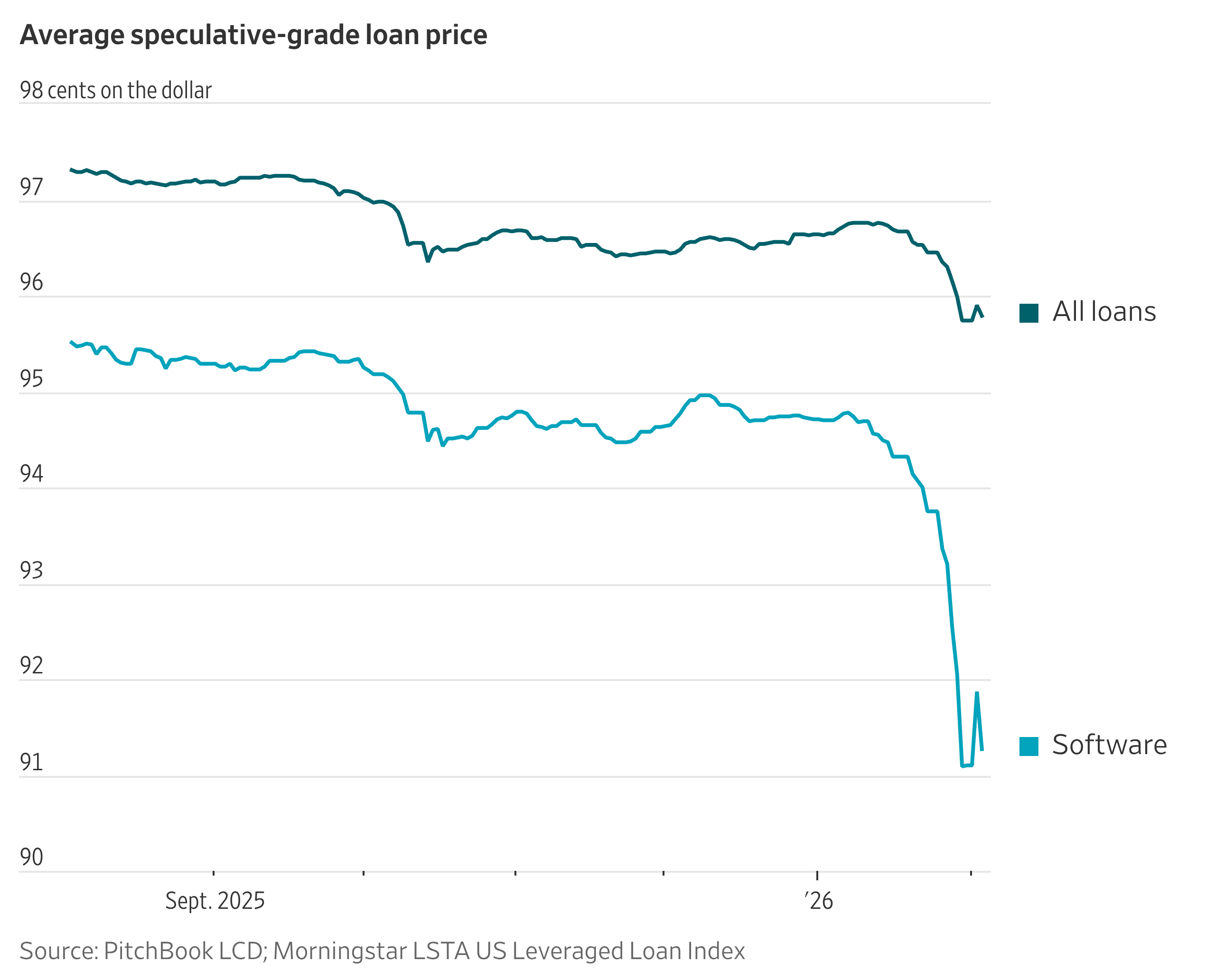

Software Selloff Extends to Loan Market

As of Tuesday, the average price of software company loans was 91.27 cents on the dollar, down from 94.71 cents at the end of last year.

At the end of January, the extra yield, or spread, that investors demand to hold software loans over a benchmark short-term interest rate had jumped to 5.95 percentage points from 4.78 percentage points at the end of December.

Some $25 billion of software loans were trading at distressed levels–below 80 cents on the dollar–at the end of January, up from $11 billion a month earlier. That accounted for nearly a third of all distressed loans.

Business

SiTime Corporation 2025 Q4 – Results – Earnings Call Presentation (NASDAQ:SITM) 2026-02-05

Q4: 2026-02-04 Earnings Summary

EPS of $1.53 beats by $0.32

| Revenue of $113.28M (66.32% Y/Y) beats by $11.38M

Seeking Alpha’s transcripts team is responsible for the development of all of our transcript-related projects. We currently publish thousands of quarterly earnings calls per quarter on our site and are continuing to grow and expand our coverage. The purpose of this profile is to allow us to share with our readers new transcript-related developments. Thanks, SA Transcripts Team

Business

Five Key Challenges for China’s Green Economy in 2026

China’s five-year plan targets carbon peaking by 2030 and neutrality by 2060, but coal dominates energy. Challenges include inefficient renewable energy distribution and costly grid upgrades amid ongoing economic difficulties.

Key Points

- China’s upcoming five-year plan (2026-2030) strives for carbon peaking by 2030 and carbon neutrality by 2060, despite coal constituting over 51% of its energy supply.

- The nation faces significant challenges in renewable energy distribution and costly upgrades to its inefficient grid, which often leads to curtailing excess energy production.

- Investment in energy transport and storage is crucial, as the State Grid Corporation plans to allocate 650 billion yuan to modernize the power network.

China’s ambitious new five-year plan, which spans from 2026 to 2030, aims for significant climate targets: carbon peaking by 2030 and achieving carbon neutrality by 2060. Despite these goals, coal continues to play a dominant role in China’s energy landscape, supplying around 51% of the nation’s electricity as of mid-2025. This reliance on coal presents a persistent challenge for China as it attempts to transition toward a greener economy.

One considerable obstacle in this green transition lies in the inefficiencies of renewable energy distribution. For instance, in regions like Tibet, Xinjiang, and Qinghai, an abundance of solar and wind energy is generated on optimal days. However, the country’s power grid struggles to manage this load effectively. When renewable energy generation surges and threatens to overload the system, grid operators are forced to curtail output, leading to significant amounts of clean energy being wasted. This produced energy often fails to reach key economic centers in eastern China, where demand is significantly higher.

Addressing these distribution challenges requires substantial investments in infrastructure for energy transport and storage. The State Grid Corporation of China plans to allocate approximately 650 billion yuan (about £69 billion) by 2025 to upgrade the nation’s power network, with prospects for future investments thereafter. However, sustaining such capital-intensive projects poses a dilemma, especially as China’s broader economy grapples with the enduring repercussions of the 2021 property crisis.

As China solidifies its commitment to greening its economy, it faces a complex interplay of technological, economic, and infrastructural challenges. Successfully navigating these hurdles will be crucial for the fulfillment of its climate promises and for achieving a sustainable energy paradigm. The dual focus on short-term energy needs and long-term environmental goals exemplifies the difficulty of balancing economic resilience with climate responsibility.

Read the original article : China’s five green economy challenges in 2026

Other People are Reading

Business

India central bank holds policy rate, as expected

India central bank holds policy rate, as expected

Business

American Express launches flexible payment option to ease SME cashflow

American Express has launched a new Flexible Payment Option designed to give UK small businesses greater control over cashflow, allowing eligible cardholders to unlock an instant line of credit directly through their business charge card.

The new feature is available to new Business Platinum and Business Gold Cardmembers and enables them to choose how they repay their monthly statement balance. Cardholders can either pay in full, pay the minimum amount due, or repay any amount in between, with interest applied only to the portion carried forward.

Because the Flexible Payment Option is embedded within the card itself, businesses can manage repayments seamlessly through their online account or the American Express app. Importantly, no interest is charged if the full balance is paid by the statement due date.

Business Cardmembers also continue to benefit from up to 54 calendar days interest-free before payment is required, allowing cash to remain in the business for longer and improving short-term liquidity.

The move comes as cashflow management remains a pressing concern for UK SMEs. Research conducted by American Express last year found that nearly a third of small businesses consider cashflow a key operational priority, while more than a quarter said repayment flexibility is a critical factor when assessing financing options.

Ruchi Sharma, Vice President of UK Commercial at American Express, said the new feature was designed to remove friction at moments when businesses need flexibility most. “We know that cashflow is vital for small businesses, and Flexible Payment Option gives owners immediate access to credit when they need it,” she said. “This means they don’t have to dip into personal savings, take out a separate loan or miss out on growth opportunities when they arise.”

Alongside the new payment flexibility, American Express Business Platinum and Gold Cards continue to operate with no pre-set spending limit. Instead, spending power adjusts dynamically based on a business’s profile, usage patterns and payment history.

Cardmembers can also earn Membership Rewards points on everyday business spending, which can be redeemed against travel, experiences or purchases, offering additional value beyond day-to-day financing.

The launch positions American Express as targeting a growing segment of SMEs seeking flexible, embedded finance solutions that sit alongside existing payment tools, rather than relying on traditional overdrafts or standalone business loans.

Business

Participation of Fortune 500 companies in DEI index falls by 65%: Study

Sen. Eric Schmitt, R-Mo., on Iran’s refusal to give up on its nuclear enrichment dreams and an upcoming Senate judiciary committee hearing on DEI.

The share of Fortune 500 companies that publicly outlined their diversity, equity and inclusion (DEI) commitments fell by nearly two-thirds from a year ago, new research shows.

The Human Rights Campaign Foundation released the latest version of its Corporate Equality Index on Tuesday, which showed a 65% decline in the number of Fortune 500 companies that chose to voluntarily submit their DEI policies for evaluation in the index.

HRC noted that 131 companies in the Fortune 500 chose to participate in the CEI this year, down from 377 in 2025, and the group noted that many of the companies that opted against participating are federal contractors.

“What we’re seeing is the collapse of a corporate social credit system,” Robby Starbuck, host of “The Robby Starbuck Show” and visiting fellow for capital markets at the Heritage Foundation, told FOX Business. “The HRC’s CEI system turned boardrooms into political compliance offices, where companies were pressured to prove their ideological loyalty instead of focusing on their business, customers, employees, and shareholders.”

NIKE’S DIVERSITY INITIATIVES UNDER EEOC SCRUTINY FOR ALLEGED DISCRIMINATION AGAINST WHITE WORKERS

The number of Fortune 500 companies participating in HRC’s Corporate Equality Index fell by nearly two-thirds from last year. (Getty Images)

Starbuck, who emerged as a leading activist in spotlighting corporate DEI policies in recent years, added that the decline in participation in the index shows those policies were out of step with average Americans and that corporate leaders appreciated the risk they posed when shares declined amid DEI controversies.

“While I bask in this victory over a truly despicable, evil ideology, I still have 35% left to eliminate and mark my words, I will,” he added. “It turns out supporting sex changes for kids, racism against Whites via DEI and struggle sessions at work aren’t that popular in the real world!”

CHRISTIAN INVESTORS WITH $4B+ LAUNCH CAMPAIGN TO STRIP ‘WOKE’ AGENDAS FROM MAJOR CORPORATIONS

Conservative activist Robby Starbuck has been an outspoken opponent of corporate DEI policies. (Bess Adler/Bloomberg via Getty Images)

Last year, President Donald Trump signed an executive order to “end illegal DEI discrimination and preferences” while directing federal agencies to take steps to encourage private sector companies to end illicit DEI policies through regulatory actions, investigations, litigation or other means.

HRC president Kelley Robinson said that while it remains illegal to discriminate against LGBTQ+ workers, she noted in the group’s report that “pressure from the federal government has been unprecedented, rolling back protections, publishing executive orders and threatening investigations for diversity and inclusion work.

“It’s in this context that some companies have pulled back from this work,” she added.

NEW ‘ANTI-DEI’ INDEX FUND LAUNCHES TO ONLY INVEST IN COMPANIES THAT HIRE BASED ON MERIT

Activists have encouraged companies to engage on political issues in addition to adopting internal DEI policies. (Alisha Jucevic/Bloomberg via Getty Images)

The HRC noted that among companies that disclosed DEI policies and practices through the CEI in 2025 and 2026, they found the implementation of those policies and practices was sustained or increased with no drop off.

“Companies that communicate clearly and lead with transparency earn trust, retain talent, and strengthen their business. And they’re overwhelmingly backed by their shareholders who have rejected anti-DEI measures by nearly unanimous votes,” Robinson said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“At a moment when fear and confusion are growing, providing clarity and confidence isn’t just good leadership – it’s essential.”

Business

Designing a pattern for growth

Subiaco architecture practice MJA Studio has become a household name in Perth’s multi-residential space.

-

Crypto World7 days ago

Crypto World7 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business12 hours ago

Business12 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat18 hours ago

NewsBeat18 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World12 hours ago

Crypto World12 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”