Crypto World

Israeli Military Bets on Polymarket Trigger Indictments

Israel indicted two citizens for allegedly using classified information to place wagers on the prediction platform Polymarket, according to a statement made by authorities on Thursday.

The news renewed concern that prediction markets make it easier to engage in insider trading for profit.

Sponsored

Sponsored

Israeli Agencies Target Military Insider Betting Case

In a joint statement, the Israeli Defense Ministry, Israel Police, and the Shin Bet said the suspects — an army reservist and a civilian — were arrested on suspicion of placing bets on Polymarket about potential military operations.

“This was allegedly based on classified information to which the reservists were exposed through their military duties,” the statement said.

The announcement comes weeks after Israeli public broadcaster Kan News reported on the matter. The outlet said security agencies had opened an investigation into the suspected misuse of classified information within the defense establishment.

The report alleged that the information was used to place bets on Polymarket, including on the timing of Israel’s opening strike on Iran during the 12-day war in June 2025.

These platforms have seen a surge in wagers on geopolitics, crypto, politics, and sports. Although marketed as alternatives to traditional gambling, their structure closely mirrors conventional betting markets.

Users buy and sell shares tied to real-world outcomes, with prices ranging from $0.01 to $1.00 reflecting the market’s implied probability of each outcome.

Sponsored

Sponsored

Their accessibility, pseudonymity, and ease of use have also prompted concerns about potential insider trading and misconduct.

Are Prediction Markets Exploitable Profit Machines?

Since the start of the year, several incidents have emerged, raising questions about whether individuals with confidential information are using these platforms to generate substantial profits.

In early January, a cluster of newly created Polymarket accounts placed large, precisely timed wagers on contracts predicting Venezuelan strongman Nicolás Maduro would be removed from office.

These wallets netted more than $630,000 in combined profits just hours before reports of his capture broke.

A similar controversy emerged last December. A Polymarket user earned nearly $1 million by placing highly accurate bets on Google’s 2025 Year in Search rankings. The precision prompted speculation about possible insider access.

The wallet achieved an unusually high success rate, correctly predicting nearly all outcomes, including several low-probability results. However, there is no evidence confirming any internal connection.

Together, the incidents have intensified debate over the role of prediction markets. Critics question whether they function as efficient information aggregators or enable the monetization of privileged, non-public information.

Crypto World

Crypto bulls ignore 'extreme fear' to push bitcoin higher

Your day-ahead look for Feb. 12, 2026

Crypto World

Transform Ventures CEO Michael Terpin says bitcoin could see ‘one more point of pain’

The current state of the crypto market is unfolding almost exactly as historical patterns would suggest, according to Michael Terpin, CEO of Transform Ventures

That’s why he was skeptical of recent overly optimistic bottom calls. “When people thought the bottom was going to be at $80,000 and that it would only be a six-week bear market, that seems ridiculous to me,” Terpin said at Consensus Hong Kong 2026 on Thursday.

Predictions that bitcoin would bottom at $60,000 and immediately resume its climb struck him as premature. “That also seems a little too soon.”

While he stopped short of forecasting another year-long drawdown, Terpin believes the market likely faces “one more point of pain” in what he describes as a fragile environment. He suggests bitcoin could revisit levels in the $50,000s or even the $40,000s before a durable bottom is formed.

The halving is central to bitcoin’s design because it cuts the reward miners receive for validating transactions in half roughly every four years, reducing the rate at which new coins are created.

This built-in supply shock reinforces bitcoin’s scarcity, a core part of its value proposition, and has historically preceded major bull markets as reduced new supply meets steady or rising demand.

The halving mechanism slows bitcoin’s inflation rate over time, ultimately capping total supply at 21 million coins and reinforcing its positioning as digital gold.

“We are exactly where we should be,” Terpin argued, pointing to the well-established four-year cycle anchored around Bitcoin’s halving events.

One of the most reliable elements of prior cycles has been the rough timing of the bubble peak and subsequent unwind, he argued.

“The bull market popped in the fourth quarter after the halving,” he notes, adding that the speculative blow-off phase typically lasts between nine and 11 months. “This time it was 11 months.”

Terpin draws a close parallel to the last cycle. “The highs, the bubble popping, were on Nov. 10, 2021,” he says. “The lows were right after FTX declared bankruptcy on Nov. 10, 2022. Exactly a year to the day.”

Read more: Crypto asset manager Bitwise says bitcoin will break its four-year cycle in 2026

Crypto World

Healthcare Still Leads as Job Engine

Job growth varied dramatically by sector last month, though healthcare and social assistance remained stalwart employment engines.

The healthcare sector started off the year strong with the addition of 82,000 jobs in January, after a softer month in December. That’s much higher than the average monthly gains of 33,000 seen in 2025.

The social assistance sector added 42,000 jobs last month. Healthcare and social assistance have been the only consistent industries for job growth for more than a year. Without their gains, the economy would have lost jobs last year. December did show some softening in those areas’ hiring, but that trend dissipated last month.

Crypto World

Here’s Why Bitcoin Analysts Say BTC Market Will Bottom in Q4 2026.

Bitcoin (BTC) sellers resumed their activity on Thursday as the Bitcoin price turned away from its intraday high of $68,300. Analysts said that Bitcoin remained in capitulation, which could push the price lower, potentially reaching a bottom during the last quarter of 2026.

Key takeaways:

-

Multiple onchain indicators suggest Bitcoin is in deep capitulation as downside risks remain.

-

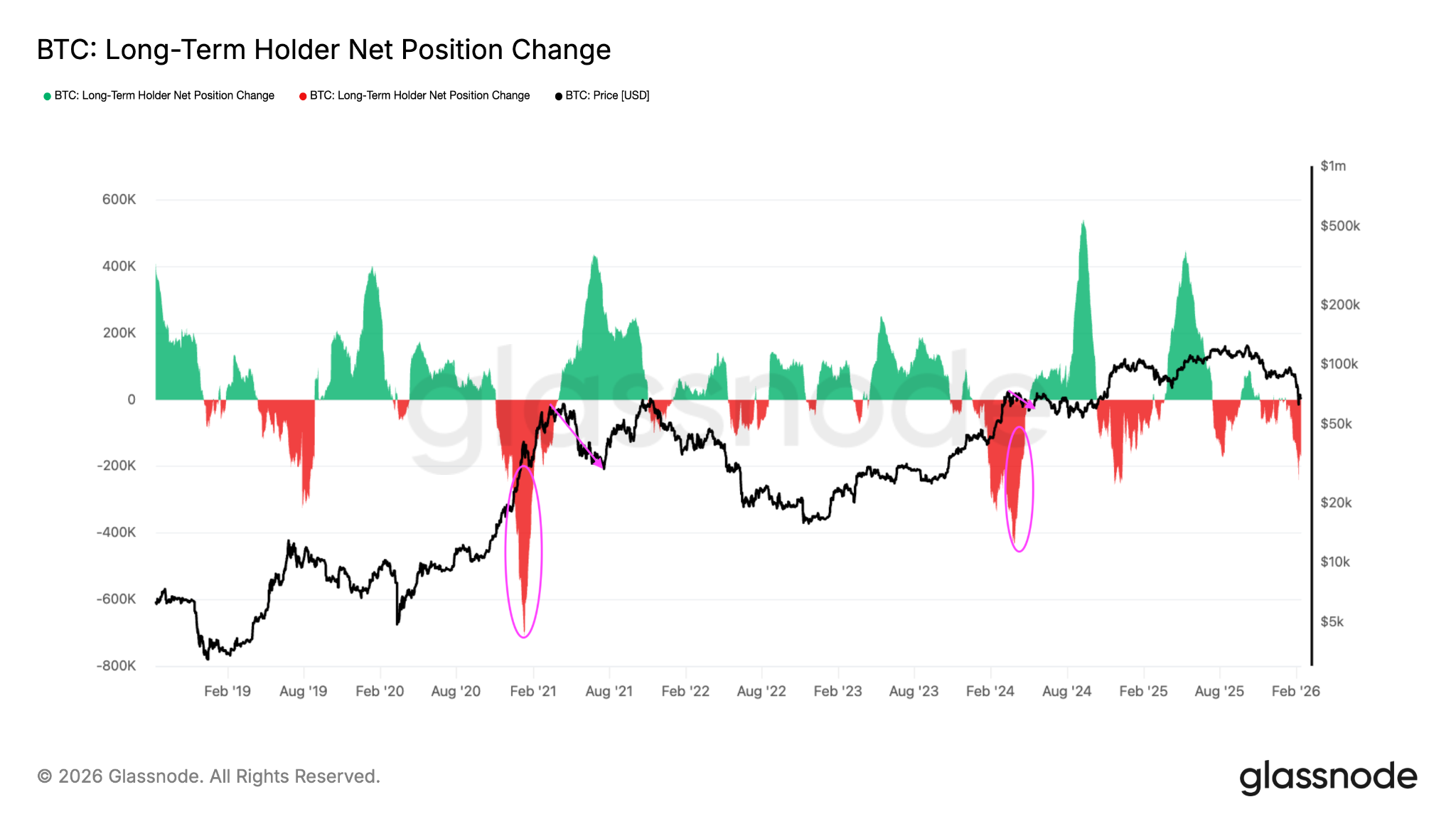

Long-term holder net-position change shows extreme distribution, mirroring past corrections that preceded further downside before bottoms.

-

Analysts forecast BTC price to hit a bottom in Q4/2026 based on various technical and onchain metrics.

Bitcoin’s capitulation persists

Bitcoin’s 46% drawdown from its all-time high of $126,000 has left a significant portion of holders underwater, and data shows they are now reducing their exposure.

Glassnode’s long-term holder (LTH) net-position change shows that Bitcoin held by these investors over 30 days decreased by 245,000 BTC on Feb. 6, marking a cycle-relative extreme in daily distribution. Since then, this investor cohort has been reducing its exposure by an average of 170,000 BTC, as shown in the chart below.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto sentiment hits record low

Similar spikes in LTH net position change appeared during the corrective phases in 2019 and mid-2021, leading to BTC price consolidating before extended downtrends.

CryptoQuant data shows that Bitcoin’s MVRV Adaptive Z-Score (365-Day Window) has fallen to -2.66, reinforcing the intensity of the sell-side pressure.

“The current Z-Score reading of -2.66 proves that Bitcoin remains persistently in the capitulation zone,” CryptoQuant contributor GugaOnChain said in a Thursday Quicktake post, adding:

“The indicator suggests that we are approaching the historical accumulation phase.”

Bitcoin’s Realized Profit/Loss Ratio is about to break below 1, levels that have historically aligned with “broad-based capitulation, where realized losses outpace profit-taking across the market,” Glassnode said.

Analysts say Bitcoin will bottom out toward the end of 2026

According to multiple analyses, Bitcoin could extend its downtrend, possibly reaching as low as $40,000 to $50,000 during the last quarter of the year.

The “final capitulation on $BTC is still ahead,” Crypto analyst Tony Research said in a recent post on X, adding:

“My take is, $BTC will bottom at $40K–50K, most likely forming between mid-September and late November 2026.”

Fellow analyst Titan of Crypto said that previous bear cycles in 2018 and 2022 printed their lows 12 months after the bull market top.

Bitcoin’s current all-time high of over $126,000 was reached on Oct. 2, 2025.

“If this cycle follows the same rhythm, that puts the low around October,” the analyst added.

On-Chain College shared a chart showing that Bitcoin’s Net Realized Loss levels hit extreme levels at $13.6 billion on Feb. 7, levels last seen during the 2022 bear market.

“The 2022 loss peak occurred 5 months before the actual bear market bottom was printed,” the analyst said, suggesting that BTC could form a bottom in July 2026.

As Cointelegraph reported, many analysts expect 2026 to be a bear market year, and various forecasts predict the BTC price dropping to as low as $40,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Apple Stock Tumbles as Censorship Claims, AI Spending Fuel Investor Concerns

TLDR

- Apple stock dropped more than 5% following political controversy and regulatory scrutiny.

- The Federal Trade Commission raised concerns about political bias on Apple News.

- Several institutional investors reduced their exposure to Apple stock amid growing risks.

- Apple’s increasing investments in artificial intelligence are raising concerns about rising costs.

- Despite strong quarterly earnings, investor confidence in Apple has weakened due to regulatory and political challenges.

Apple’s stock suffered a sharp decline after facing new political controversies, investor caution, and concerns about escalating AI investments. Despite a strong performance last week, Apple’s shares dropped more than 5% on Thursday. Regulatory issues and increasing scrutiny over its content platform added to the uncertainty.

Rally Reverses as Political Controversy Erupts

The reversal of Apple’s stock came after the Federal Trade Commission (FTC) raised concerns about political bias on the Apple News platform. FTC Chair Andrew Ferguson urged CEO Tim Cook to investigate claims of censorship, specifically regarding conservative outlets. The allegations suggest that Apple News may be promoting left-wing content while suppressing conservative views.

The FTC’s letter highlighted reports that claimed Apple News was skewed toward liberal sources. Apple, however, has yet to publicly respond to these allegations. This political controversy comes at a time when technology companies are already under close regulatory scrutiny.

Apple Stock Sees Institutional Investor Withdrawals

As political risks grew, institutional investors began reducing their exposure to Apple stock. Reports revealed that NBT Bank reduced its position by 5.3%, while Campbell & Co cut its holdings by over 70%. Other firms, such as Gamco, also lowered their stakes, signaling a shift in sentiment toward Apple’s stock.

These moves reflect a broader rotation out of large tech stocks as investors seek safer investments in the current market climate. The growing regulatory scrutiny, along with political controversies, has made Apple a less attractive option for some institutional investors. This caution comes after a long period of strong performance, during which Apple’s stock price reached new highs.

AI Spending Raises Fresh Concerns

Apple’s growing investment in artificial intelligence (AI) has raised additional concerns for investors. CEO Tim Cook has called AI a “profound opportunity,” but the rising costs associated with AI development are becoming a concern. Apple’s recent acquisition of Israeli startup Q.ai, which focuses on advanced human-computer interaction, highlights the company’s deepening commitment to AI.

Investors are increasingly questioning the high costs involved in AI research and infrastructure. The capital required to compete in the AI sector, especially for specialized chips and data centers, could put pressure on Apple’s profit margins. There are concerns that the commercial viability of certain AI technologies may not justify the hefty investment required in the short term.

Despite these challenges, Apple’s financial performance remains strong. The company’s recent quarterly results showed a 16% increase in revenue, reaching $143.8 billion. The iPhone continues to be a key driver, with record sales of $85.3 billion. However, investors are now focusing on how effectively Apple can manage its increasing AI costs and whether these investments will translate into long-term growth.

In the meantime, Apple continues to benefit from favorable policy changes in India, which support its supply chain strategy. However, these long-term advantages do little to ease investor concerns in the near term, as political scrutiny and AI-related costs dominate the narrative around the company’s future prospects.

Crypto World

March Rate-Cut Odds Fade

The hot January jobs report had traders rethinking bets on multiple interest-rate cuts before July.

Odds of a quarter-point cut at the Federal Reserve’s March policy meeting fell to 6% from 20.1% prior to the report.

Through the June meeting, odds of no cuts surged to 40.4% from 24.8%. Odds of a single quarter-point cut were at 49.4% from 49%, while odds of a half point in cuts or more fell to 10.2% from 26.2%.

Crypto World

Stock Futures Pop After Stronger-Than-Expected January Jobs Report

Stock Futures Pop After Stronger-Than-Expected January Jobs Report

Crypto World

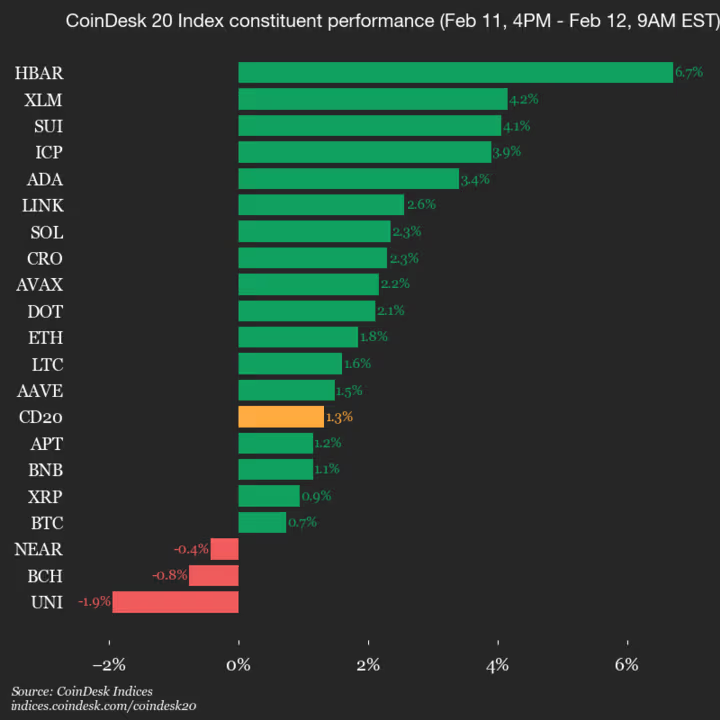

Hedera (HBAR) rises 6.7%, leading index higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1943.37, up 1.3% (+25.4) since 4 p.m. ET on Wednesday.

Seventeen of the 20 assets are trading higher.

Leaders: HBAR (+6.7%) and XLM (+4.2%).

Laggards: UNI (-1.9%) and BCH (-0.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Only 5% of companies see AI boosting bottom line, McKinsey’s Joe Ngai tells Consensus

Nearly every major company in the world is experimenting with artificial intelligence, but almost none are changing meaningfully as a result, McKinsey’s chairman of Greater China, Joe Ngai, told Consensus Hong Kong on Thursday.

Internal surveys show 98% of corporate executives report implementing some form of AI, Ngai said. But when asked how much of that is deployed at scale, “that number drops significantly” to less than 20%, he said. When it comes to measurable profit impact, it’s 5%.

The bottleneck, Ngai argued, isn’t technical capability, it’s organizational design.

Modern corporations, he said, are built on “layers of people, hierarchies, managers and reporting.” In an AI-native world, that structure becomes friction.

Instead of reimagining business models, most firms are layering AI pilots onto legacy processes, seeking approvals, testing small use cases and protecting reporting lines.

“That is actually not where you get the most benefit out of AI,” Ngai said. “The bottleneck of AI implementation is actually people.”

From his vantage point in China, Ngai sees a different approach. Chinese companies have spent a decade digitizing operations around mobile and data. As a result, the “receptance … on agentic and AI is far greater,” with less resistance from labor structures and legacy governance.

Unlike Western discourse, which often centers on frontier models and artificial general intelligence, China’s focus is pragmatic: “There’s a lot less talk about the models … there’s a lot more talk around usage.”

Ngai also highlighted embodied AI, such as robotics, automation and autonomous driving, as a major frontier. Given China’s supply chain scale, he predicts a coming “robot dividend,” arguing the country may soon deploy more robots than humans, offsetting demographic decline and reshaping industrial productivity.

Ngai described 2026 as defined by two opposing forces: geopolitical uncertainty and technological acceleration. CEOs are navigating tariffs and fragmentation on one hand, and AI-driven transformation on the other. Yet corporate earnings remain resilient.

Crypto World

Gate CEO Lin Han says banks have lost the ‘existential’ war against stablecoins

The traditional four-year crypto cycle, long-tethered to bitcoin’s halving events, may be a thing of the past.

Han Lin, founder and CEO of Gate and an early advocate of bitcoin, told CoinDesk on Thursday the digital asset market has matured into a global macroeconomic pillar that now moves in lockstep with U.S. equities and AI-driven technological shifts rather than internal supply shocks.

Lin, who leads the world’s fourth-largest exchange with daily volume exceeding $2 billion, laid out his vision of an industry that has transitioned from an “existential threat” to the foundational infrastructure of traditional finance.

The American Bankers Association (ABA) urged U.S. Congress to ban yield on payment stablecoins and revise open banking rules, framing the changes as necessary for consumer protection and competitive balance. Crypto and fintech critics say the ABA’s agenda would tilt the regulatory playing field toward banks by limiting how wallets, stablecoin issuers and apps can access users and their financial data.

“I don’t believe in the four-year cycle anymore,” Lin said, noting that Gate (formerly Gate.io) is positioning itself for an upward move driven by the convergence of crypto and TradFi. “The market is bigger now. It is more related to the global economy and the U.S. stock market. You cannot see it as isolated.”

Lin’s outlook comes as Gate executed a massive global rebranding, moving to the Gate.com domain and securing high-profile sponsorships with Oracle Red Bull Racing and Inter Milan. The goal, Lin says, is to prepare for a wave of real-world asset (RWA) tokenization that extends far beyond the current stablecoin market.

While stablecoins like USDC and USDT are the “most successful use cases” today, Lin anticipates a rapid migration of stocks, precious metals, and commodities onto the blockchain. Gate is already facilitating this shift, offering users access to traditional assets in a tokenized, 24/7 format.

“We will beat traditional exchanges and banks very soon,” Lin claimed, citing the inherent efficiency of onchain liquidity. He argues that while legacy institutions like the New York Stock Exchange are only now exploring 24/7 trading, crypto-native platforms have already perfected the infrastructure required for a round-the-clock global market.

Lin dismissed the idea that stablecoins are an inherent threat to bank deposits. Instead, he views them as a technological upgrade that banks are increasingly eager to adopt.

“I have talked with some banks; they are no longer eager to go against crypto,” Lin said. “They can use stablecoins to accelerate their own service. We use them as a rail for money transfer.”

Despite the competitive landscape, Lin confirmed that his crypto exchange has no plans to develop its own stablecoin, preferring to remain a neutral venue that integrates existing tokens like Circle’s USDC. This strategy focuses on “building the infrastructure” rather than competing with the assets themselves.

Market resilience and AI tailwinds

Despite a volatile 2025 that saw many retail participants sidelined, Lin remains bullish on the “believers” who continue to accumulate at low points. He points to the 15x growth in crypto-based payments over the last two years as evidence that digital assets are finding “real-world utility” beyond simple speculation.

Lin sees the current AI boom as a “strong support” for crypto. As investors hunt for the next technological frontier, the intersection of AI and blockchain, particularly in lowering the barrier to entry for new users, is expected to drive the next wave of adoption.

“We don’t care about the price alarms,” Lin concluded. “We care about the applications. We are making it lower cost and more efficient. The technology works, and nobody can stop that.”

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video22 hours ago

Video22 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month