Crypto World

Lighter Strikes $920 Million Deal With Circle

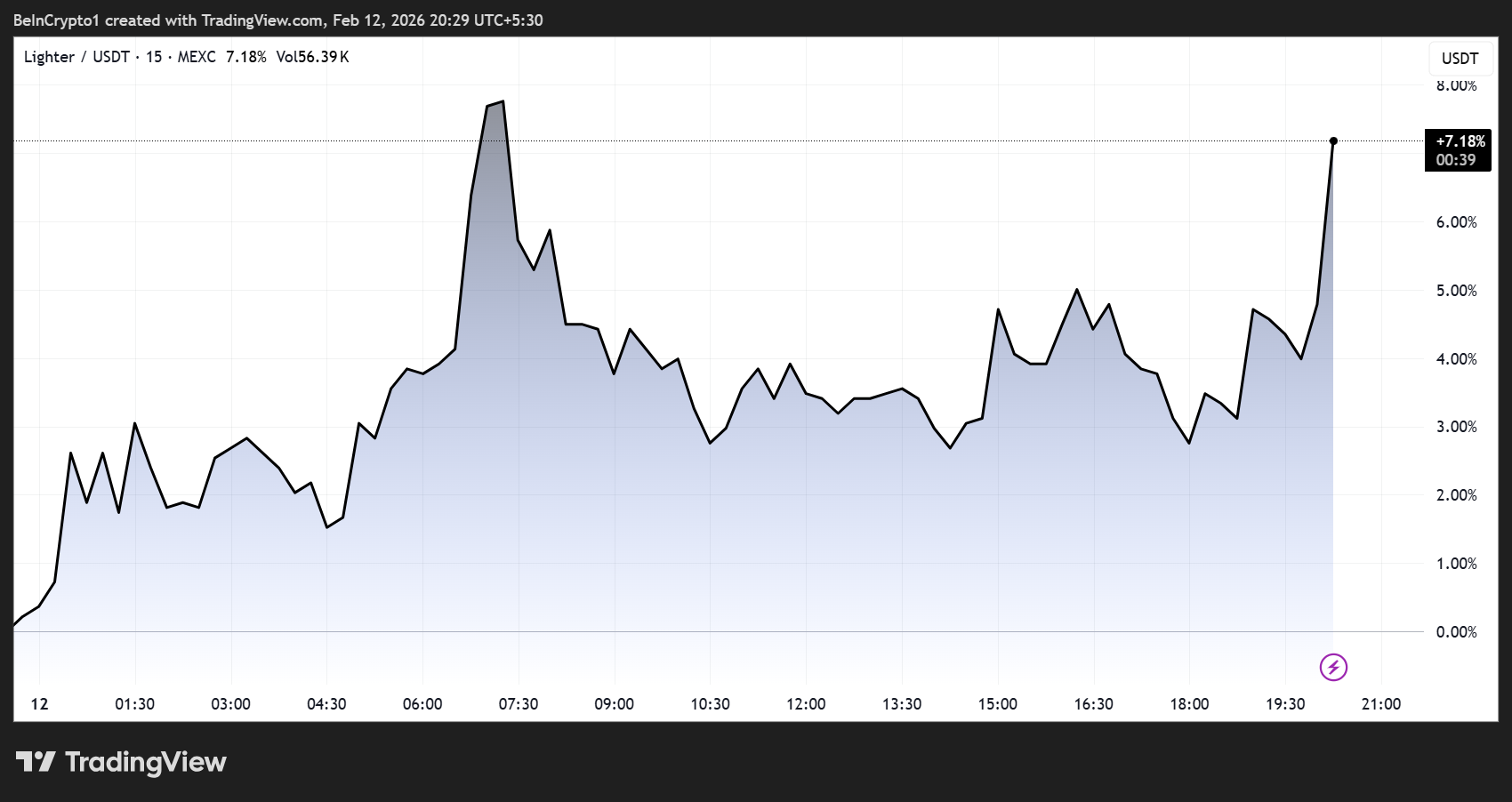

Decentralized perpetuals trading platform Lighter saw its native token LIT surge nearly 10% during the early hours of the US session.

It follows news that it had struck a major revenue-sharing deal with USDC issuer Circle.

Sponsored

Sponsored

Lighter Strikes $920 Million USDC Revenue-Sharing Deal with Circle — A Win for DeFi Traders

LIT, the powering token for the Lighter ecosystem, exploded by nearly 10% on the news, and was trading for $1.46% on the news.

The agreement covers approximately $920 million in USDC deposits on Lighter’s platform, marking a significant milestone for the young DeFi exchange.

Under the partnership, interest income generated from Circle’s USDC reserves will be shared between Circle and Lighter.

This aligns with Circle’s broader revenue-sharing model, which it has previously implemented with leading exchanges such as Coinbase and Bybit.

For Lighter, the deal offers a fast and capital-efficient path to grow its yield engine, fund user incentives, and support platform features such as funding rate rebates and rewards programs.

Sponsored

Sponsored

Unlike some of its competitors, Lighter has opted to lean on USDC rather than launching a proprietary stablecoin.

Hyperliquid, for instance, introduced its native stablecoin USDH in late 2025 after a competitive governance auction. The move diverted billions in deposits and yield away from Circle and other stablecoin issuers.

It allowed Hyperliquid to capture revenue internally and reduce centralization risks, but required significant capital and infrastructure investment.

Lighter Leverages Circle Partnership to Boost Adoption, Liquidity, and LIT Token Sentiment

Lighter’s approach, by contrast, allows the platform to tap directly into Circle’s established reserves while still benefiting from shared yield.

Sponsored

Sponsored

This could accelerate adoption by leveraging Circle’s USDC ecosystem, enabling Lighter to scale more efficiently while delivering value to traders and token holders.

The deal represents a potential win-win scenario:

- Circle benefits by locking in a large volume of USDC on a growing DeFi platform, incentivizing adoption and circulation.

- Lighter gains access to a steady revenue stream, which could enhance platform sustainability, attract more liquidity, and increase user engagement.

Moving forward, interest will be on on-chain USDC flows to Lighter contracts as this could show early signs of the agreement’s impact on liquidity and token sentiment.

Lighter has been gaining traction in the DeFi perpetuals market, with growing trading volumes, loyalty points programs, and community engagement.

Sponsored

Sponsored

Token listings on popular platforms like Robinhood have also contributed to its growing bullish sentiment.

The revenue-sharing announcement is expected to boost confidence, perhaps further than during its LIT token event in December.

Nevertheless, it is impossible to forget past controversies surrounding Lighter, including allegations of secret token sales.

While official details on the exact share split of USDC interest have not yet been disclosed, even a conservative arrangement could provide a meaningful boost to LIT holders.

Crypto investors are advised to monitor announcements from both Lighter and Circle for updates, as revenue-sharing agreements of this scale can change quickly.

Crypto World

Crypto Use in Trafficking Surges, but May Help in Crackdowns

Crypto flows to suspected human trafficking networks increased 85% year over year in 2025, but crypto analytics firm Chainalysis said blockchain transparency could help disrupt the operations.

Chainalysis said in a report on Thursday that the total transaction volume to suspected trafficking networks, largely based in Southeast Asia, reached “hundreds of millions of dollars across identified services.”

It added that the services are “closely aligned” to scam compounds, online casinos, and Chinese-language money-laundering networks, which have recently grown in popularity.

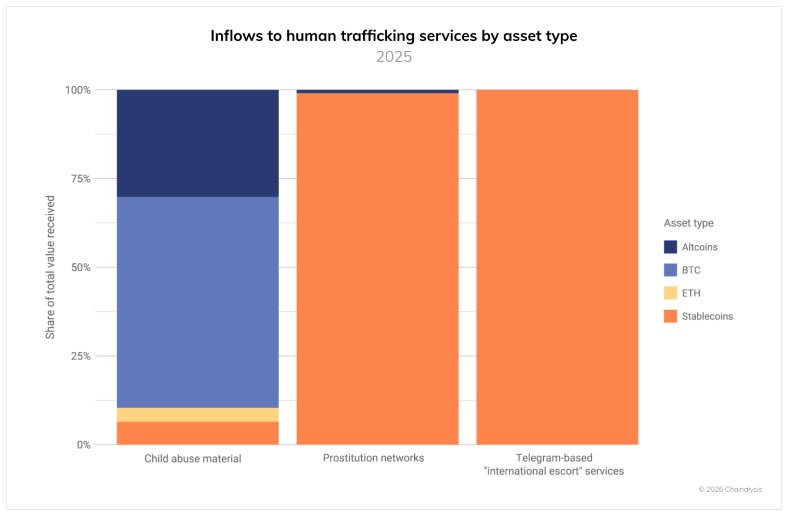

Chainalysis said the crypto-facilitated human trafficking it tracked included Telegram-based services for international escorts, labor placement agents that kidnap and force people to work at scam compounds, prostitution networks, and child sexual abuse material vendors.

Crypto payment methods varied significantly, with international escort services and prostitution networks operating almost exclusively using stablecoins.

Blockchain could help track traffickers

Chainalysis said that the blockchain could help law enforcement detect and disrupt trafficking operations by identifying transaction patterns, monitoring compliance, and targeting strategic chokepoints at exchanges and illicit online marketplaces.

“Unlike cash transactions that leave no trace, the transparency of blockchain technology provides unprecedented visibility into these operations, creating unique opportunities for detection and disruption that would be impossible with traditional payment methods,” it said.

Related: Crypto launderers are turning away from centralized exchanges: Chainalysis

Chainalysis said compliance teams and law enforcement should monitor for large, regular payments to labor placement services, wallet clusters showing activity across multiple categories of illicit services, and regular stablecoin conversion patterns, among others.

Chainalysis said law enforcement scored several wins against traffickers last year, including German authorities taking down a child sexual exploitation platform, which it added was aided by blockchain analysis.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

$3 Billion Options Expiry Looms: Liquidations, Skew, and More

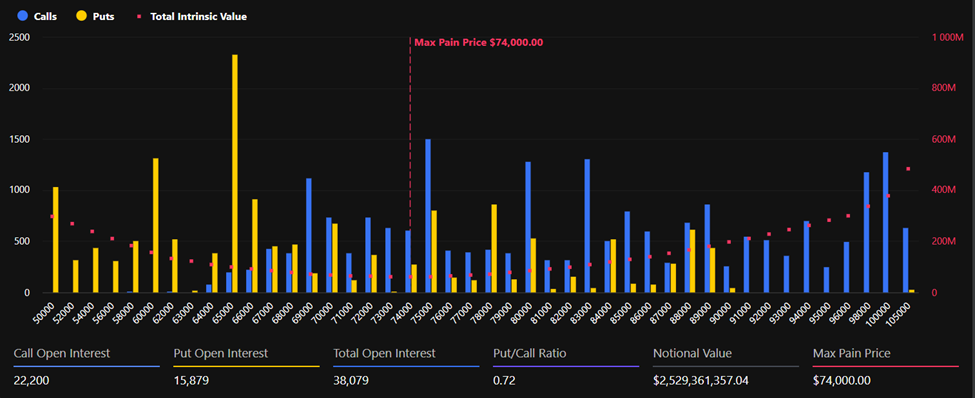

Nearly $3 billion in Bitcoin and Ethereum options expire today at 08:00 UTC on Deribit, placing derivatives markets under intense scrutiny.

Going into today’s options expiry, interest will be on whether the recent price stabilization marks a temporary pause or the beginning of a new directional move.

Sponsored

Sponsored

$3 Billion Bitcoin and Ethereum Options Expiry Tests Market Nerves After Liquidation Shock

As of this writing, Bitcoin was trading at $66,372, with a max pain around $74,000 and total notional open interest exceeding $2.53 billion.

Ethereum, meanwhile, is trading near $1,950, with approximately $425 million in notional open interest and a max-pain level around $2,100.

These figures suggest that a large share of open positions would benefit if prices drifted higher toward max pain levels, but sentiment in the options market remains cautious.

Despite the recent rebound from last week’s sharp sell-off, options metrics suggest traders are still hedging against downside risk.

Analysts at Laevitas noted that Bitcoin’s risk reversals remain heavily skewed toward puts.

Sponsored

Sponsored

“BTC 1-week and 1-month 25-delta RRs have recovered from extreme lows but remain notably negative at approximately −13 and −11 vols, respectively, indicating persistent demand for downside protection,” the derivatives analyst stated.

Risk reversals are widely used to gauge sentiment in derivatives markets. Meanwhile, sustained negative readings typically signal that traders are paying a premium for protective puts, often reflecting fears of further declines.

Liquidations, Put Skew Shock, and a Fragile Shift Toward Calls as Expiry Nears

The current cautious tone follows a dramatic market event in which Bitcoin briefly fell below $70,000, triggering widespread liquidations and extreme derivatives imbalances.

Analysts at Deribit said the move caused one of the most pronounced shifts toward put (sales) demand seen in years.

Sponsored

Sponsored

“BTC broke $70K last week, triggering cascading liquidations, and one of the most extreme put skew moves in years before bouncing back toward the 67K range,” Deribit analysts said.

Such events often leave a lasting psychological impact on markets, with traders remaining defensive even after prices stabilize.

More recently, however, derivatives positioning has begun to shift, with some traders rotating back into call (purchase) options as volatility declines from panic levels. Deribit analysts observed that the market is now at a critical inflection point.

Options expiries of this size can sometimes exert short-term gravitational effects on price, especially when large clusters of open interest are concentrated near specific strike levels.

Sponsored

Sponsored

While short-term positioning has improved, some indicators suggest institutional traders remain skeptical about the medium-term outlook.

Analysts at Greeks.live reported that put options continue to dominate activity in Bitcoin derivatives markets.

“Put options continue to dominate the market, with over $1 billion in BTC put options traded today, accounting for 37% of the total volume. The majority of these are out-of-the-money options priced between $60,000 and $65,000,” the analysts said.

This indicates that institutions have a negative outlook for the medium- to long-term market trajectory. According to the analysts, there is a strong expectation of a bearish trend within the next one to two months

The settlement of today’s options expiry could relieve pressure and stabilize markets. However, it could also be the catalyst for another bout of volatility heading into the weekend.

Crypto World

Crypto Used by Trafficking Networks Surged in 2025, Chainalysis Finds

Chainalysis has released a detailed assessment showing a notable uptick in crypto flows tied to suspected human trafficking networks, with an 85% rise in 2025 and transaction volumes reaching hundreds of millions of dollars across identified services. The report highlights networks largely rooted in Southeast Asia and intertwined with scam compounds, online casinos, and Chinese-language money-laundering rings that have gained momentum as crypto adoption broadens. Notably, the study emphasizes that the choice of asset varies by service, with some operators leaning on stablecoins for cross-border payments. While the numbers are concerning, Chainalysis argues that the transparency of blockchains also creates actionable choke points for enforcement.

Among the opaque channels identified are Telegram-based services that facilitate international escorts, labor-placement schemes that allegedly coerce victims into work at scam compounds, prostitution networks, and vendors distributing material related to child sexual abuse. The research underscores that, in practice, payment methods diverge across illicit networks: international escort services and prostitution networks have shown a pronounced reliance on stablecoins, while other segments employ a broader mix of on- and off-ramp techniques. The report’s granular look at asset-type inflows and wallet behavior aims to give investigators and compliance teams new signals to pursue.

Chainalysis stresses that blockchain’s traceability can be a powerful tool for law enforcement. By identifying transaction patterns, monitoring compliance at exchanges, and pinpointing chokepoints in the ecosystem, authorities can disrupt bad actors in ways that cash or traditional remittance systems cannot. This is particularly relevant as illicit online marketplaces and money-laundering networks continue to adapt to shifting regulatory landscapes and evolving crypto offerings. The report also points readers to related work on the broader crypto-laundering landscape and how on-chain analytics are changing the enforcement playbook.

As a case in point, the firm notes several enforcement successes last year, including German authorities dismantling a child sexual exploitation platform, an operation that Chainalysis said was aided by blockchain analysis. The finding illustrates how coordinated usage of on-chain data can assist in tracing the flow of funds across multiple layers of a criminal network, from on-ramps to marketplaces to end-services. Chainalysis also emphasizes the need for ongoing vigilance by compliance teams and law enforcement to monitor for patterns such as high-frequency transfers to labor-placement entities, wallet clusters that operate across multiple illicit categories, and stablecoin conversion activity that appears routine rather than incidental.

Key takeaways

- 2025 crypto flows to suspected human trafficking networks surged by 85%, with total transaction volume reaching hundreds of millions of dollars across identified services.

- Southeast Asia emerges as a central hub for these networks, which are tied to scam compounds, online casinos, and Chinese-language money-laundering networks.

- Seemingly disparate services—Telegram-based international escorts, labor-placement agents, prostitution networks, and vendors supplying illicit content—rely on a mix of assets, with stablecoins favored for cross-border payments in several cases.

- Blockchain’s transparency is framed as a diagnostic and disruption tool: it can reveal transaction patterns, flag large or anomalous activity, and help block or slow illicit flows at exchanges and at online marketplaces.

- Law enforcement achievements, such as the German takedown of a child exploitation platform aided by blockchain forensics, demonstrate the practical leverage of on-chain analytics in complex investigations.

- The report calls for heightened monitoring by compliance teams—watching for regular, large-payments to labor-placement services, wallet clusters spanning illicit categories, and recurring stablecoin conversions—as part of a broader AML framework.

Market context: The findings sit against a backdrop of growing regulatory interest in on-chain analytics, the expanding use of stablecoins, and ongoing scrutiny of cross-border crypto payments. As governments and financial institutions seek robust AML controls, analytics firms and exchanges are increasingly integrating sophisticated tracing tools to deter illicit finance while balancing user privacy and legitimate use cases. The evolving regulatory environment underscores the value—and the limits—of blockchain transparency in addressing criminal finance without stifling legitimate innovation.

Why it matters

The report illustrates a fundamental tension in the crypto economy: the same technologies that enable rapid, borderless financial activity can also facilitate harm if left unchecked. For users and investors, the message is clear—transparency tools are becoming a standard part of risk assessment, and due diligence now increasingly hinges on on-chain behaviors and counterparties. For builders and product teams, the emphasis on compliance signals a growing demand for wallet- and exchange-level controls, better KYC/AML workflows, and clearer disclosures around illicit-risk indicators.

For policymakers, the analysis reinforces the need for clear guidelines on stablecoins and cross-border settlements, as these instruments appear in multiple illicit-use cases. The data also supports continued investment in cross-agency cooperation and international information sharing, given that many of these networks operate across different jurisdictions and platforms. At a technical level, the findings encourage further development of attribution methodologies that preserve user privacy while enabling lawful investigators to trace criminal flows. In short, the study adds to a growing body of evidence that on-chain data can augment traditional investigative methods, but it must be integrated within a broader, well-governed framework.

For the broader crypto ecosystem, the emphasis on chokepoints and wallet clusters highlights practical avenues for disruption: exchanges can improve real-time monitoring, on-chain analytics can be used to flag risky counterparties, and marketplaces can adopt stricter seller verification and payment-processing controls. The convergence of enforcement and technology is likely to shape how illicit activity is funded and how quickly it can be identified and neutralized, potentially reducing the latency between crime and detection in a space historically challenged by anonymity and speed.

What to watch next

- Follow-up updates from Chainalysis on 2026 data and trend analysis, including any revisions to the 2025 figures.

- Regulatory actions targeting stablecoins and cross-border crypto payments, particularly in Southeast Asia and Europe.

- Adoption of enhanced AML controls by exchanges and online marketplaces in response to on-chain‑driven findings.

- Investigations and public disclosures related to large wallet clusters that span multiple illicit services or jurisdictions.

- Further enforcement actions demonstrated or inspired by blockchain-forensic capabilities, such as high-profile takedowns and asset-tracing successes.

Sources & verification

- Chainalysis blog post: crypto-human-trafficking-2026

- Crypto-launderers turning away from centralized exchanges: Chainalysis coverage

- Blockchain forensics and asset tracking explainer

- Related investigative reporting on enforcement actions and policy context

Blockchain visibility and illicit finance: what the findings imply

Chainalysis’s report underscores how on-chain visibility can illuminate the pathways by which crypto assets are moved to support trafficking and exploitation. By charting flows into labor-placement operations, escort services, and adult services that rely on cross-border payments, investigators can identify recurring patterns that mark a network’s lifecycle—from onboarding to monetization. The emphasis on stablecoins in particular reflects how certain assets are chosen to minimize friction across borders, optimize settlement times, and obscure the origin and destination of funds in less-regulated corridors.

Yet the study also warns against overreliance on any single signal. Illicit actors adapt, and the same tools that reveal patterns can be misapplied if not paired with traditional investigative methods and robust governance. The combination of blockchain analytics with proactive compliance, inter-agency collaboration, and targeted enforcement represents a pragmatic approach to mitigating on-chain risks without dampening legitimate innovation in the crypto economy.

Crypto World

XRP price prediction ahead of January US CPI report today

XRP price is hovering near $1.35 as markets closely watch the January U.S. Consumer Price Index (CPI) report due later today.

Summary

- Markets expect January U.S. CPI to show sticky inflation, with core prices remaining elevated, a result that could delay Federal Reserve rate cuts and pressure crypto assets.

- XRP is trading near $1.35, below its 50-day SMA around $1.84, with the broader trend still bearish on the daily chart.

- Key support sits at $1.30 and $1.20, while resistance stands at $1.40 and the $1.80–$1.85 region; CPI data could determine the next breakout or breakdown.

Economists expect headline inflation to tick slightly higher on a month-over-month basis. Annual inflation is projected to land in the 2.5% range. Core CPI, which strips out food and energy, is also expected to show sticky price pressures.

Goldman sees January CPI +0.24%, bringing the YoY rate to 2.44% — Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 8, 2026

+0.33% core, +2.52% pic.twitter.com/IOycjqoVBm

If CPI comes in hotter than expected, it could reduce the chances of near-term Federal Reserve rate cuts. That would likely strengthen the U.S. dollar and weigh on risk assets, including cryptocurrencies like the Ripple token (XRP).

A softer-than-expected print, however, could boost expectations of monetary easing and trigger a relief rally across crypto markets.

XRP price prediction and key levels

XRP is currently trading around $1.35, down roughly 0.6% on the day, according to the daily price chart.

The chart shows a clear downtrend since early January. XRP failed to hold above the $2.20–$2.30 region and has printed a series of lower highs and lower lows. The price is trading well below the 50-day Simple Moving Average (SMA), which sits near $1.84, signaling continued bearish momentum.

The recent sharp sell-off toward the $1.20 zone was followed by a brief rebound, but upside momentum has faded. Candles are now compressing near the $1.35 level, suggesting indecision ahead of the CPI release.

The Chaikin Money Flow indicator is currently around -0.12, remaining in negative territory. This indicates capital outflows and weak buying pressure, reinforcing the bearish bias.

For the XRP price, immediate support lies near $1.30, followed by the recent swing low around $1.20. A break below $1.20 could open the door toward the psychological $1.00 level.

On the upside, initial resistance sits near $1.40, with stronger resistance at the 50-day SMA around $1.84.

A hotter CPI reading could push XRP below $1.30 and retest $1.20. A softer inflation print may spark a rebound toward $1.40 and potentially $1.60 in the short term.

Crypto World

ETHZilla Shifts Strategy With Tokenized Jet Engine Offering

Crypto treasury company ETHZilla has launched a token offering access to equity in jet engines that the company acquired last month as part of its pivot into tokenized assets.

ETHZilla said on Thursday that the token, called Eurus Aero Token I, was being launched through its new subsidiary, ETHZilla Aerospace, and is backed by two commercial jet engines that are leased to “a leading US air carrier.”

The company has priced each token at $100, with a minimum purchase of 10 tokens. ETHZilla said it’s targeting an 11% return rate based on holding it for the full term of the engine leases that extend into 2028.

ETHZilla was formerly a clinical-stage biotech company called 180 Life Sciences Corp that pivoted to buying and holding Ether (ETH) in July amid a frenzy of new crypto treasury companies at the time.

ETHZilla chairman and CEO McAndrew Rudisill said the project “expands investment access and modernizes fractional asset ownership in markets that have historically been available only to institutional credit and private equity.”

“Offering a token backed by engines leased to one of the largest and most profitable US airlines serves as a strong use case in applying blockchain infrastructure to aviation assets with contracted cash flows and global investment demand,” he added.

ETHZilla shifting away from crypto treasury

Rudisill said in December ETHZilla is moving away from just buying and holding ETH and aims to build a business that brings assets on-chain through tokenization.

Crypto treasury companies experienced significant growth and hype last year, but enthusiasm has since started to cool across the market.

ETHZilla purchased the two jet engines for a combined $12.2 million in January, after selling off some of its ETH stash last year.

As part of its ongoing tokenization push, ETHZilla is also planning to launch tokens for additional asset classes, including home and car loans, according to the company’s announcement.

Some crypto execs have predicted tokenized RWAs will grow significantly in 2026, fueled by adoption in emerging economies facing issues with capital formation and attracting foreign investment.

Over $24 billion in RWA is estimated to be on-chain as of Friday, across more than 846,808 holders, according to RWA.xyz.

Ether stash down from previous high

In a Securities and Exchange Commission filing in September, ETHZilla disclosed it held 102,246 Ether at an average acquisition price of roughly $3,948, which was valued at $443 million at the time.

Related: ‘Horse has left the barn:’ ETHZilla bets big on Ethereum’s stablecoin play

Ether has fallen in step with the rest of the crypto market and has been drifting between $1,872 and $2,130 in the last seven days, according to CoinGecko.

Strategic Ether reserves lists ETHZilla as holding more than 93,000 in Ether, worth over $188 million. However, CoinGecko estimates the company’s stash is closer to 69,802, and is worth about $136 million.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

Morph Integrates USDT0, Unlocking Access to the World’s Largest Stablecoin Liquidity Pool

[PRESS RELEASE – Singapore, Singapore, February 13th, 2026]

Ethereum-based payments settlement network Morph has integrated USDT0, the omnichain Tether liquidity network powered by LayerZero. The move gives Morph, which aims to become the settlement layer for everyday money, direct access to unified USDT liquidity across 18+ blockchains.

For developers building payment apps, merchant tools or even DeFi protocols on Morph, this means they can tap into a massive, ready-made liquidity pool from day one without the headache of managing a dozen different bridged token contracts.

No more bridges. No more wrapped tokens

Traditionally, using USDT on another blockchain requires a bridge. This process locks the original tokens and mints a new, “wrapped” version on the destination chain.

These wrapped variants are not the same asset. They are separate tokens backed by assets held in complex smart contracts, leading to liquidity fragmentation — where the same currency is trapped in isolated pools — and introducing counterparty risk if a bridge fails.

USDT0 proposes a different model. Instead of locking and minting, it uses a burn-and-mint mechanism. To move USDT from Chain A to Chain B, tokens are burned on Chain A and minted directly from Tether’s canonical supply on Chain B.

As a result, USDT0’s Omnichain Fungible Token (OFT) standard creates a single, consistent asset across all supported networks.

What USDT0 enables for builders on Morph

While many L2s compete for general DeFi activity, Morph is engineered for a specific vertical: payments. Its architecture — featuring sub-300ms block times and zero-fee stablecoin transfers — targets merchant settlement, remittances, crypto cards issuance, and treasury management.

For such use cases, deep and frictionless liquidity is non-negotiable. USDT, with a market cap exceeding $185 billion, represents the largest pool of stablecoin liquidity in crypto.

As the USDT0 integration is now live on Morph mainnet, developers on Morph can integrate what is effectively a universal USDT, slashing technical overhead and simplifying cross-chain user experience, which means:

- Payment applications can process cross-border transactions with instant settlement and minimal overhead.

- DeFi protocols can access deeper liquidity without managing multiple stablecoin variants.

- Merchant platforms can accept stablecoin payments with seamless conversion and settlement.

- Financial institutions can execute treasury operations with predictable behavior across chains.

The combination of USDT0’s unified liquidity and Morph’s payment-optimized infrastructure lays a powerful foundation for next-generation financial applications.

We’re excited to work alongside the USDT0 team in advancing the vision of unified, omnichain liquidity that makes stablecoins truly borderless.

Money at the speed of life.

About Morph

Morph is an Ethereum-based, payments-first settlement layer and the native onchain home of BGB, focused on building the foundation for global consumer finance onchain. Morph supports real-world financial activity across payments, savings, identity, and rewards, enabling scalable, onchain settlement for consumer and business use. Guided by the Morph Foundation, the network connects more than 120 million users through the Bitget and Bitget Wallet ecosystems.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRPL Activates XLS-85 Token Escrow Upgrade: XRP Price Impact

The XRP Ledger (XRPL) activated the XLS-85 amendment on February 12, 2026, bringing native escrow to all Trustline-based tokens (IOUs) and Multi-Purpose Tokens (MPTs). This upgrade opens new use cases for secure, programmable asset settlement.

Moreover, the move expands XRPL’s utility, and market watchers suggest the upgrade could pave the way for institutional capital deployment. But will this impact XRP’s price? That is a question that remains to be answered.

Sponsored

XLS-85 Amendment Extends Escrow Functionality Beyond XRP

XLS-0085 expands how escrow works on the network. Until now, XRPL’s native escrow functionality was limited to XRP. With XLS-85, that restriction is removed.

“From stablecoins like RLUSD to Real World Assets, the XRPL now supports secure, conditional, on-chain settlement for all assets,” RippleX stated.

XLS-85 upgrades the existing EscrowCreate, EscrowFinish, and EscrowCancel transaction types. Importantly, token issuers retain control. Tokens must explicitly allow escrow functionality through issuer-level flags. This preserves compliance controls and token governance structures already in place.

This is not just a minor tweak. It shifts XRPL from being a network where only XRP could be escrowed to one where assets gain native time-lock and conditional release functionality.

That opens the door to:

Sponsored

- Token vesting schedules

- Institutional settlement workflows

- Treasury management for issued assets

- Conditional stablecoin payouts

- Structured financial products built directly on XRPL

“Token Escrow (XLS-85) is an upgrade to the #XRP Ledger, which plugs directly into it and makes the DEX institution-ready. The Institutions will begin deploying CAPITAL on #XRPL starting 12 February,” an analyst wrote.

The latest update comes shortly after XRPL activated Permissioned Domains earlier this month to expand institutional use cases.

Sponsored

XRPL’s Token Escrow Upgrade Raises Questions About XRP’s Long-Term Price Impact

It’s worth noting that while the activation of XLS-0085 does not directly increase demand for XRP, it could influence the asset’s long-term price trajectory through broader network effects.

The amendment extends native escrow functionality to Trustline-based tokens and Multi-Purpose Tokens, rather than expanding escrow usage for XRP itself. That means the upgrade does not automatically create additional XRP lockups or immediate supply constraints.

However, the structural implications are more nuanced. If token issuers, including stablecoin providers, RWA platforms, or institutions, adopt XRPL because it now supports native token escrow:

- Token issuance on XRPL could increase

- Transaction volume may rise

- The number of active accounts could expand

- Demand for XRP may grow due to fees and reserve requirements

Sponsored

That increases network usage, and XRP is still the gas and reserve asset of the ledger. Higher utility → potentially higher demand for XRP → possible price appreciation. But this depends entirely on real adoption.

Upgrades like XLS-0085 signal that XRPL is positioning itself as a tokenized finance infrastructure. If markets perceive XRPL as becoming more competitive with Ethereum or other token platforms, sentiment alone can influence price. Crypto markets often price in narrative and positioning, not just usage.

In the short term, price impact may depend more on market sentiment than on immediate usage metrics. Over the longer term, sustained ecosystem growth driven by token-enabled escrow could contribute to stronger network fundamentals, which historically play a role in digital asset valuation.

For now, XRP continues to face challenges along with the broader market. At press time, it was trading at $1.36, down 1.35% over the past day.

Crypto World

UBS Expands BlackRock Bitcoin ETF Stake as Institutional Crypto Interest Grows

TLDR:

- UBS raised its IBIT stake to 548,614 shares valued at $27.2M.

- The position remains small compared with UBS’s $616B reported portfolio.

- Crypto trading tools are being tested for high‑net‑worth clients.

- Online crypto supporters and critics reacted to the disclosure on social media.

UBS expanded its BlackRock Bitcoin ETF holdings to $27.2M, signaling steady institutional interest. The move comes as the bank tests crypto trading for wealthy clients and builds digital asset tools.

Social media users reacted, with supporters calling it adoption and critics noting it is ETF exposure, not direct Bitcoin ownership.

UBS Expands Exposure Through BlackRock’s Bitcoin ETF

UBS increased its holdings in BlackRock’s iShares Bitcoin Trust to 548,614 shares. The position was valued at $27.2 million as of December 31, 2025.

The disclosure appeared in the bank’s January 29, 2026, 13F filing with the U.S. Securities and Exchange Commission.

The position represents a sharp increase from UBS’s previous holdings. However, the allocation remains small compared to its $616 billion 13F portfolio. The structure shows exposure through regulated ETF instruments rather than direct Bitcoin custody.

Market observers noted the move as part of a broader institutional trend. The investment method reflects a preference for compliance, custody protection, and regulated access.

This approach also aligns with existing risk frameworks used by large financial institutions.

Online discussions intensified after crypto commentator Vivek Sen shared the disclosure on X. His post framed the development as a major signal of banking sector participation. The tweet amplified visibility and drove conversation across crypto-focused communities.

The ETF structure provides price exposure without direct asset ownership. This model allows institutions to participate in Bitcoin markets while avoiding on-chain operational risks. It also fits traditional portfolio reporting standards.

Institutional Strategy and Digital Asset Infrastructure Growth

Skeptics online noted that ETF exposure differs from direct Bitcoin ownership. They argued that the structure limits self-custody and blockchain-level participation. Supporters countered that institutional adoption often begins through regulated financial products.

UBS has also been testing crypto trading services for wealthy clients. The bank is building digital asset tools designed for private banking use. These developments show a controlled approach to digital asset integration.

The ETF allocation reflects a gradual strategy rather than a rapid transformation. UBS appears focused on structured exposure rather than speculative positioning. This aligns with long-term wealth management and compliance priorities.

The filing shows how traditional finance institutions are entering crypto markets cautiously. ETF-based exposure offers familiarity, governance standards, and regulatory clarity. This model supports incremental adoption across conservative portfolios.

As more filings emerge, market participants continue tracking institutional movements. ETF flows remain one of the clearest data points for measuring bank-level participation. UBS’s position now places it among visible institutional holders of Bitcoin-linked assets.

The disclosure adds to the growing list of regulated financial entities using ETFs for crypto exposure. The strategy reflects measured integration rather than direct blockchain engagement.

Crypto World

Markets Signal Stress as El Salvador Sticks to Its Bitcoin Playbook

Bitcoin’s (BTC) bear market has weighed heavily on investors across the spectrum. Corporate treasuries, major whales, and even nation-state holders have all felt the pressure.

The cryptocurrency’s slide has slashed the value of El Salvador’s holdings as credit default swaps rise to a five-month high, raising concerns over the country’s IMF program and debt outlook.

Sponsored

El Salvador’s Bitcoin Bet Under Pressure as Portfolio Drops

According to the latest data from El Salvador’s Bitcoin Office, the country’s Bitcoin reserves stand at 7,560 BTC, worth approximately $503.8 million. Bloomberg reported that the portfolio’s value has fallen from around $800 million at Bitcoin’s October 2025 peak, marking a drop of nearly $300 million in just four months.

Bukele, an ardent Bitcoin advocate, has continued purchasing one Bitcoin per day. However, this strategy increases the country’s exposure to market volatility.

In contrast, Bhutan recently sold $22.4 million worth of Bitcoin. The divergent strategies of El Salvador and Bhutan reflect fundamentally different risk philosophies.

Bhutan’s Bitcoin mining operations generated more than $765 million in profit since 2019. However, the 2024 Bitcoin halving significantly increased mining costs, compressing margins and reducing returns. Bhutan now appears to be liquidating part of its holdings, while El Salvador continues to prioritize long-term accumulation.

Nonetheless, the country has also diversified its portfolio. Last month, it spent $50 million to acquire gold as demand for the safe-haven metal rose amid macroeconomic tensions.

IMF Loan Talks Face Strain Over El Salvador’s Bitcoin Policy

El Salvador’s deepening commitment to cryptocurrency has impacted relations with the International Monetary Fund. The government’s continued Bitcoin purchases, combined with delays in implementing pension reforms, have complicated the country’s IMF agreement.

Sponsored

The Fund has expressed concern about Bitcoin’s potential impact on fiscal stability. A disruption to the IMF program would weaken one of the key supports behind El Salvador’s sovereign debt recovery. Over the past three years, the country’s bonds have returned more than 130%, making them one of the standout turnaround stories in emerging markets.

“The IMF may take issue with disbursements potentially being used to add Bitcoin. Bitcoin being down also doesn’t help to ease investors’ concerns,” Christopher Mejia, an EM sovereign analyst at T Rowe Price, told Bloomberg.

The IMF approved a 40-month Extended Fund Facility on February 26, 2025, unlocking about $1.4 billion in total, according to official IMF documentation. The first review ended in June 2025, with $231 million disbursed.

However, the second review has remained on hold since September, following the government’s delay in publishing a pension system analysis. During that period, El Salvador continued to add to its Bitcoin reserves despite repeated warnings from the IMF.

Sponsored

A third review is scheduled for March, with each review tied to additional loan disbursements.

“The continued purchase of Bitcoin, in our view, does create some potential challenges for the IMF reviews. The market would react quite poorly if the anchor provided by the IMF were no longer present.” Jared Lou, who helps manage the William Blair Emerging Markets Debt Fund, said.

Meanwhile, bond markets are signaling rising concern over El Salvador’s fiscal outlook. Credit default swaps have climbed to a five-month high, reflecting increasing investor anxiety about the country’s repayment capacity.

According to data compiled by Bloomberg, El Salvador faces $450 million in bond payments this year, with obligations increasing to nearly $700 million next year.

El Salvador’s Bitcoin policy now sits alongside key fiscal and IMF negotiations. The outcome of upcoming IMF reviews and the country’s bond repayment schedule will play a significant role in shaping investor confidence and the sustainability of its debt trajectory.

Crypto World

DeFi’s Role in a Multi-Chain Financial System

For a while, crypto acted like high school cliques. One chain. One tribe. One ecosystem. But finance doesn’t work that way. Capital moves. Liquidity hunts yield. Users want speed, low fees, and security — not ideology.

Welcome to the multi-chain era.

The Shift From “One Chain to Rule Them All”

Early narratives pushed a single dominant smart contract platform. Then reality happened.

-

Network congestion

-

High gas fees

-

Fragmented liquidity

-

Scalability ceilings

Today, value flows across ecosystems like:

-

Ethereum

-

Solana

-

Avalanche

-

Arbitrum

-

Optimism

Each chain optimizes for something different: decentralization, speed, throughput, cost efficiency, or developer tooling.

No single network can dominate all dimensions at once. And that’s exactly where DeFi becomes critical.

DeFi as the Financial Glue

In a multi-chain world, DeFi acts as infrastructure — not just applications.

It provides:

1. Liquidity Routing

Capital doesn’t stay loyal. It moves toward better yields and incentives. Cross-chain bridges and liquidity layers enable assets to flow between networks, allowing users to deploy capital wherever it’s most productive.

Without DeFi, each chain would be an isolated island. With DeFi, they become connected economic zones.

2. Composability Across Ecosystems

DeFi introduced composability — the “money lego” concept.

In a multi-chain system, this expands further:

-

A lending protocol on one chain

-

A DEX aggregator on another

-

A yield optimizer somewhere else

-

Wrapped or bridged assets, tying them together

This interconnected design turns separate chains into a distributed financial stack.

3. Risk Diversification

Multi-chain finance reduces systemic concentration risk.

If one chain experiences congestion or technical issues, capital can migrate elsewhere. This flexibility strengthens the overall system, similar to global financial markets operating across jurisdictions.

In traditional finance, markets are interconnected but geographically distributed. DeFi mirrors that model digitally.

4. Specialized Financial Zones

Different chains are becoming financial “specialists”:

-

High-speed trading environments

-

Institutional settlement layers

-

NFT ecosystems

-

Experimental governance playgrounds

DeFi protocols adapt to each environment’s strengths.

Instead of forcing every activity onto one blockchain, multi-chain DeFi allows specialization without isolation.

The Rise of Cross-Chain Infrastructure

Multi-chain finance would collapse without secure interoperability.

Key components include:

Security remains the biggest challenge. Bridge exploits have historically drained billions. A resilient multi-chain future depends on robust cryptographic verification and minimized trust assumptions.

This is where innovation is accelerating rapidly.

Governance in a Multi-Chain World

As protocols deploy across multiple ecosystems, governance becomes more complex.

-

Should voting power be unified?

-

Should token emissions vary by chain?

-

How are incentives aligned across environments?

DAOs are evolving from single-chain governance systems into cross-chain coordination networks.

The future isn’t just multi-chain liquidity. It’s multi-chain decision-making.

What This Means for the Future of Finance

A multi-chain financial system resembles a digital federation:

DeFi is not just a product layer — it is the coordination layer.

It ensures that capital efficiency, innovation, and accessibility are not confined to one ecosystem.

And here’s the strong opinion:

The chains themselves may compete.

But DeFi wins either way.

Because wherever value flows, DeFi builds the rails.

Final Thoughts

The future of crypto finance isn’t maximalist — it’s modular. A multi-chain world enables specialization, resilience, and global access. DeFi transforms fragmented networks into an interconnected financial web.

The result? A permissionless, borderless system where capital moves at the speed of code — not paperwork. And that’s not just evolution. That’s financial infrastructure getting an upgrade.

REQUEST AN ARTICLE

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month