Crypto World

HIVE BUZZ Signs $30M AI Cloud Deals, Expanding Tier-III Data Centers

Editor’s note: As the AI compute era intensifies, the industry is reassessing how and where powerful workloads are hosted. Hive Digital’s BUZZ platform illustrates a practical path: repurposing mining-era campuses into scalable, energy-conscious AI data hubs. By converting existing sites and deploying high-density GPUs, Hive aims to deliver reliable AI capacity more quickly and with renewable energy at the core. This press release highlights a milestone in that transition, underscoring the resilience of regional digital infrastructure and the role of private-sector investment in accelerating AI readiness across North America, Europe, and Latin America.

Key points

- BUZZ signs about $30 million in AI cloud contracts, accelerating expansion of Tier-III data centers globally.

- Converting mining facilities into AI-ready infrastructure across Canada, Sweden, Paraguay, and beyond.

- First deployments include a 2,000-GPU Sweden liquid-cooled facility and a 7.2 MW Toronto site, with Bell and Dell partnerships.

- Conversions are up to 75% faster than traditional builds and powered by 100% renewable energy.

Why this matters

The milestone illustrates a shift toward scalable, energy-efficient high-performance computing capacity as demand for AI compute rises. Hive’s dual‑engine model leverages existing land and facilities to accelerate AI deployments while maintaining renewable energy use. By converting Tier‑I mining sites into Tier‑III AI data centers, Hive aims to strengthen sovereign AI capabilities and regional digital infrastructure across Canada, Sweden, Paraguay, and Latin America. Investors will watch how execution aligns with contracted demand and expansion plans.

What to watch next

- Canada West deployment of the initial 504-GPU phase online by the quarter ending March 31, 2026.

- Projected ARR growth for BUZZ’s AI cloud platform as deployments scale.

- Expansion into Latin America and continued sovereign AI partnerships.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

HIVE’s BUZZ Signs $30 Million in AI Cloud Contracts, Accelerating Global HPC Tier-III Data Center Expansion

San Antonio, Texas, February 13, 2026 — BUZZ High Performance Computing (“BUZZ”), the Canadian Tier-III high-performance computing (“HPC”) data center platform of HIVE Digital Technologies Ltd. (“HIVE” or the “Company”) (TSX.V: HIVE) (Nasdaq: HIVE) (FSE: YO0) (BVC: HIVECO), today announced a major step forward in its AI cloud strategy, signing customer agreements representing approximately $30 million in total contract value over two-year fixed terms, subject to performance obligations and deployment milestones (all amounts in US dollars, unless otherwise indicated).

Building on four years of experience operating GPU infrastructure, BUZZ is accelerating its expansion as HIVE’s AI engine, complementing the Company’s established Tier‑I hashrate services provider and reinforcing its position as a twin-engine leader in next-generation digital infrastructure.

The new contracts underpin the initial phase of BUZZ’s AI-optimized GPU deployment at its Canada West location in Manitoba, with compute capacity expected to come online during the quarter ending March 31, 2026. The first phase consists of 504 liquid-cooled Dell server-based GPUs, purpose-built for high-performance AI and HPC workloads.

Based on executed contracts, current pricing, and deployment schedules, management expects this initial phase to generate approximately $15 million in annual recurring revenue (“ARR”) to BUZZ’s cloud business once fully operational. Upon full deployment, management expects total annualized revenue attributable to HIVE’s HPC segment, driven by BUZZ, to grow from approximately $20 million currently to roughly $35 million, reflecting strong contracted demand for BUZZ’s AI cloud platform. These projections are subject to capital expenditures, operating costs, customer utilization levels, and other risk factors described herein, and actual results may vary.

To support this growth, the Company expects to incur capital expenditures related to GPU acquisition, supporting electrical and cooling infrastructure, and working capital requirements. Operating expenses are expected to include power, hosting, maintenance, staffing, and network costs. BUZZ continues to expand capacity at its Canada West site in alignment with executed customer agreements.

Management Commentary

Frank Holmes, Executive Chairman of HIVE, commented: “We are entering 2026 with strong momentum in our HPC and GPU cloud business. HIVE has built a track record as one of the longest-standing publicly traded crypto Tier‑I data center operators, performing through multiple market cycles while protecting cash flow and balance sheet strength. Now, with BUZZ, we are leveraging that foundation to build a high-growth AI cloud platform spanning Canada, Sweden, and Paraguay.”

Tier-I data centers for hashrate services typically require approximately $1 million per megawatt of infrastructure https://www.jbs.cam.ac.uk/wp-content/uploads/2025/04/2025-04-cambridge-digital-mining-industry-report.pdf, whereas Tier-III facilities supporting advanced GPU clusters can require materially higher capital intensity due to premium GPU hardware, redundant power architecture, and advanced cooling systems. Industry benchmarks suggest that constructing and equipping a comparable fully self-funded Tier-III facility with similar GPU capacity could require approximately $70 million in capital expenditures, depending on site conditions, financing structure, vendor pricing, and market dynamics.

Through vendor financing arrangements for GPUs and strategic Tier-III data center partnerships, we are scaling efficiently while reducing upfront capital intensity compared to a fully self-funded build. Where HIVE owns land and buildings and operates its Tier-I facilities, we are pursuing selective Tier-III conversions and colocation strategies for HPC. This showcases our vertically integrated model and diversified revenue streams from both HPC co-location and GPU AI cloud services, reinforcing HIVE’s dual-engine strategy of hashrate services and high-performance computing.”

Aydin Kilic, President and Chief Executive Officer of HIVE, added: “Our vision is to scale our HPC GPU AI cloud business toward approximately $140 million in ARR over the next year, subject to market conditions and successful infrastructure deployment. As we execute, this growth will be supported by continued investment in infrastructure and operations. In our previous earnings webcast, we outlined a target deployment of 2,000 AI-optimized GPUs at our Canada West facility this year. The initial 504-GPU deployment is already backed by executed customer agreements representing approximately $30 million in total contract value over two years, subject to performance obligations and deployment milestones.”

This is just the beginning. Demand for long-term access to high-performance, power-efficient AI compute continues to expand globally, and we are excited to further scale our GPU cloud business throughout 2026.”

Craig Tavares, President and Chief Operating Officer of BUZZ HPC, commented: “Canada requires more sovereign AI compute capacity, both to serve domestic workloads and to support global AI companies from a secure Canadian base. With Dell and Bell Canada as key partners, we are scaling GPU capacity with the infrastructure, connectivity, and resiliency needed to compete on a global stage.”

BUZZ was recently recognized by SemiAnalysis for having one of the fastest data center networks globally and earned a Bronze rating in their ClusterMAX report, validating our technical architecture and execution capabilities.

Launching this cluster in Canada West marks a significant milestone. It expands BUZZ’s national footprint and advances our vision of coast-to-coast AI infrastructure, with commercial‑grade clusters operating at scale to serve both sovereign workloads and international demand. Under HIVE’s dual-engine model, BUZZ is positioned to be a powerful growth catalyst as we accelerate into the global AI supercycle.”

About HIVE Digital Technologies Ltd.

Founded in 2017, HIVE Digital Technologies Ltd. is the first publicly listed company to mine digital assets powered by green energy. Today, HIVE builds and operates next-generation Tier‑I and Tier‑III data centers across Canada, Sweden, and Paraguay, serving both Bitcoin and high-performance computing clients. HIVE’s twin-turbo engine infrastructure-driven by hashrate services and GPU-accelerated AI computing-delivers scalable, environmentally responsible solutions for the digital economy.

For more information, visit http://hivedigitaltech.com, or connect with us on:

X: https://x.com/HIVEDigitalTech

YouTube: https://www.youtube.com/@HIVEDigitalTech

Instagram: https://www.instagram.com/hivedigitaltechnologies/

LinkedIn: https://linkedin.com/company/hiveblockchain

On Behalf of HIVE Digital Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information, please contact:

Nathan Fast, Director of Marketing and Branding

Frank Holmes, Executive Chairman

Aydin Kilic, President & CEO

Tel: (604) 664-1078

Forward-Looking Information

Forward-looking information in this news release is based on current expectations, assumptions, and/or beliefs that are subject to risks and uncertainties. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law. Details of factors that could cause actual results to differ materially from those described in such forward-looking information are included in the Company’s filings with securities regulators.

Crypto World

All Social Benefits Can Be Distributed Onchain, Says Compliance Exec

Blockchain technology is increasingly being viewed as a practical backbone for distributing social benefits, though regulatory guardrails remain a central challenge for governments testing on-chain tools. In the Marshall Islands, guidance from Guidepost Solutions on regulatory compliance and sanctions framework accompanies the rollout of a tokenized debt instrument known as USDM1, issued by the state and backed 1:1 by short-term U.S. Treasuries. Separately, the country launched a Universal Basic Income (UBI) program in November 2025, delivering quarterly payments directly to citizens via a mobile wallet. As proponents point out, digital delivery can accelerate provisioning and provide auditable trails for expenditures, but the path to widescale adoption is entangled with anti-money laundering (AML) and know-your-customer (KYC) requirements that regulators say are non-negotiable.

Key takeaways

- Tokenized government debt is expanding, with asset-backed bonds that settle rapidly and offer fractional ownership gaining traction in pilots and policy discussions.

- The Marshall Islands’ UBI program, distributed through a digital wallet since November 2025, exemplifies how on-chain tools can reach citizens directly, pending robust AML/KYC controls.

- Regulators view AML and sanctions compliance as the largest risk in issuing on-chain bonds to the public, underscoring the need for rigorous oversight in tokenized finance.

- Data show a sharp rise in tokenized U.S. Treasuries, illustrating growing demand for programmable settlement and auditable fund flows in public debt markets.

- Analysts forecast meaningful growth for the tokenized bond market, with projections pointing to hundreds of billions of dollars by decade’s end, contingent on regulatory clarity.

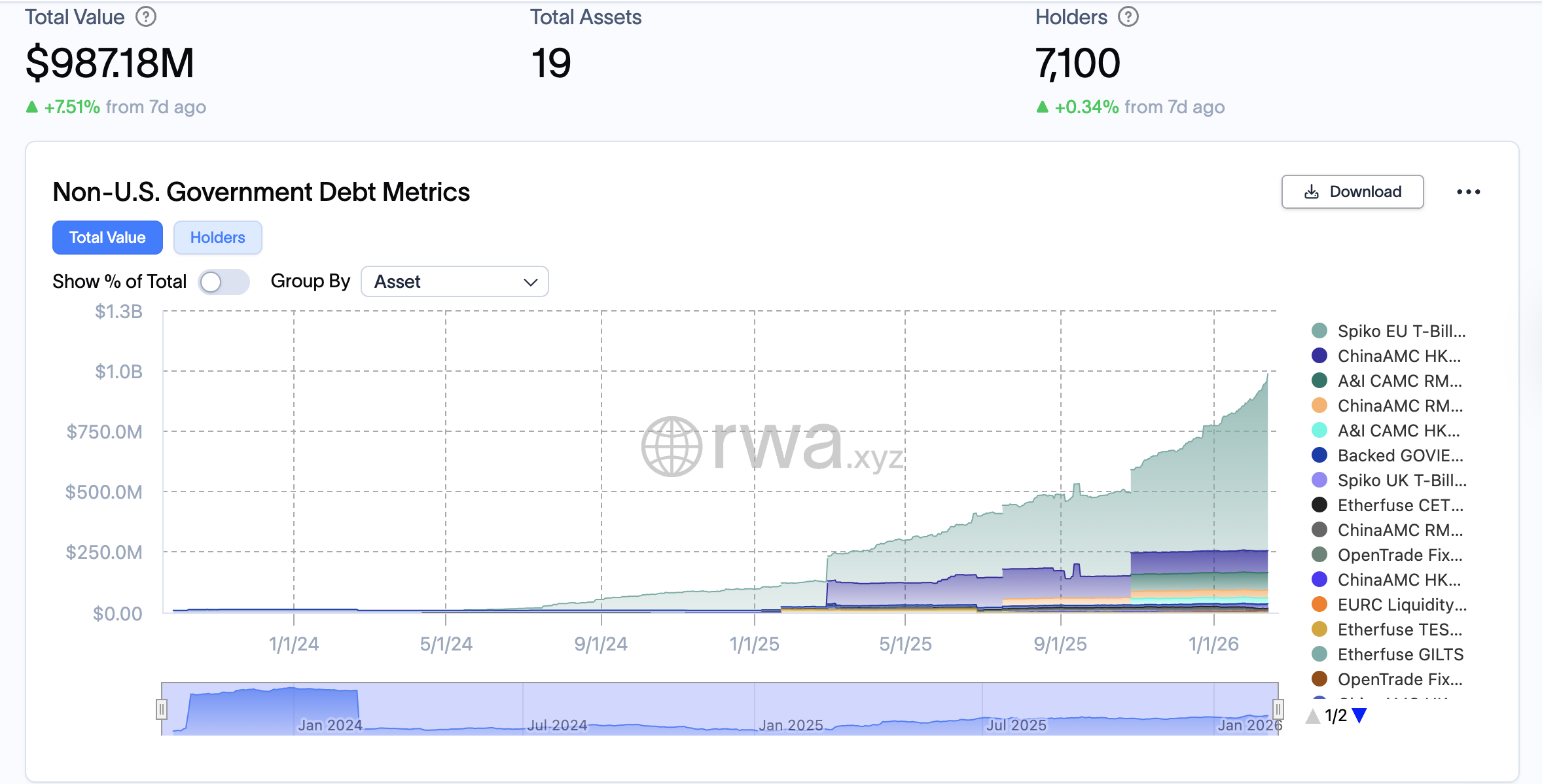

Market context: The push toward tokenized government debt and on-chain social benefits sits amid a broader push to modernize public finance and expand financial inclusion. Jurisdictions are piloting tokenized instruments to cut settlement times and reduce transaction costs, while also grappling with the necessary compliance architecture. The United Kingdom has taken a parallel step, with HSBC appointed for a tokenized gilt pilot, signaling cross-border interest in the model. Data from Token Terminal indicate the tokenized U.S. Treasury market has grown more than 50-fold since 2024, highlighting the rapid shift toward on-chain finance in a $X trillion debt ecosystem. Analysts, including Lamine Brahimi, co-founder of Taurus SA, project the tokenized bond market could surge to around $300 billion by 2030, a forecast that reflects both demand for digital liquidity tools and the continuing need for robust governance.

Why it matters

The Marshall Islands’ approach illustrates how tokenization can reshape public finance and social programs alike. By backing a debt instrument 1:1 with short-term U.S. Treasuries and tying it to a regulatory framework shaped by a risk-focused compliance firm, the government aims to attract legitimate investment while maintaining guardrails against misuse. The on-chain UBI experiment is a practical testbed for direct-to-citizen distributions, where quarterly payments flow through a digital wallet rather than traditional channels. The potential benefits—faster disbursement, traceable expenditure lines, and a more inclusive financial system—could extend beyond the Marshall Islands, offering a blueprint for other nations seeking to streamline welfare programs and debt issuance through programmable money.

However, the regulatory reality remains central. AML requirements and sanctions screening are highlighted by experts as the most significant obstacles to broad adoption. Governments issuing tokenized bonds must collect know-your-customer information to ensure funds reach the intended beneficiaries, while also ensuring that sanctions regimes are not breached through on-chain channels. The tension between innovation and compliance is not unique to the Marshall Islands; it is echoed in wider discussions about tokenization of public assets and the need for robust, interoperable standards that can scale across borders without compromising security or oversight.

From an investor and builder perspective, the narrative is equally nuanced. Tokenization promises near-instant settlement and fractional ownership, expanding access to assets that were previously illiquid or inaccessible to ordinary individuals. The growth in the tokenized debt market, as tracked by data platforms like Token Terminal, is often cited as evidence that digital-native debt instruments can coexist with traditional markets while offering new forms of liquidity and programmability. Yet the same data underline that progress hinges on a stable policy environment—one that defines privacy, censorship-resistance, anti-fraud controls, and cross-border enforcement mechanisms. The broader ecosystem’s trajectory will be shaped by how quickly regulators can translate principles into scalable, enforceable rules without stifling innovation.

In parallel, pilots such as the UK gilt initiative and other tokenization efforts illustrate that government-sponsored projects are moving from theory toward real-world applications. The combination of digital governance with financial instrumentation could unlock new funding channels and enable more responsive social programs, provided that the operational and legal frameworks keep pace with technological capability. This synthesis—technological potential matched with disciplined compliance—will determine whether tokenized debt and on-chain welfare tools become enduring components of public finance or remain transient experiments.

What to watch next

- Progress and results from the Marshall Islands’ UBI wallet rollout and any regulatory updates on AML/KYC standards for on-chain benefits.

- Monitoring the UK’s tokenized gilt pilot and any published findings on feasibility, costs, and investor interest.

- Updates to tokenized debt instrument frameworks and sanctions regimes as more governments explore issuance and distribution through blockchain rails.

- New data releases from Token Terminal and other analytics firms tracking growth in tokenized government debt and on-chain settlements.

- Prominent forecasts, such as Taurus SA’s projection of a $300 billion tokenized bond market by 2030, and any revisions based on policy or market developments.

Sources & verification

- Guidance from Guidepost Solutions to the Marshall Islands government on regulatory compliance and sanctions for USDM1 tokenized debt instruments (tokenized debt instrument reference).

- Marshall Islands’ Universal Basic Income program launch in November 2025 via a digital wallet (UBI program reference).

- Analysis and data on the tokenized U.S. Treasuries market growth since 2024 from Token Terminal (growth reference).

- Forecast by Lamine Brahimi, co-founder of Taurus SA, that tokenized bonds could reach $300 billion by 2030 (market forecast reference).

- On-chain debt instrument and tokenized government debt discussions and related policy pilots, including RWA.XYZ and UK gilt pilot context (verification references).

Tokenized debt, digital governance, and the path to inclusive finance

The effort to tokenize government debt and deliver social benefits on-chain sits at the intersection of efficiency, transparency, and risk management. The Marshall Islands’ USDM1 project showcases how a regulatory framework can be crafted to support tokenized debt while maintaining strong sanctions and AML controls. The accompanying UBI initiative demonstrates a pragmatic use case for digital wallets as a means of distributing welfare benefits with auditable spending trails, potentially reducing delays and leakage that can accompany traditional channels. In parallel, the broader market signals—rapid growth in tokenized U.S. Treasuries, governance pilots in the UK, and ambitious market projections—underscore growing institutional and public interest in tokenization as a means to reimagine public finance and social programs. Yet the narrative remains contingent on a reliable compliance scaffold: one that balances innovation with rigorous risk management to safeguard funds and protect citizens. As policymakers, technologists, and financial actors navigate this evolving terrain, the defining question will be whether these on-chain instruments can deliver measurable benefits at scale without compromising the integrity of the financial system.

Crypto World

Onchain Public Benefits are the Future but Challenges Remain, CEO Says

Blockchain technology is an effective medium for administering social benefit programs, but key compliance challenges remain, according to Julie Myers Wood, CEO of compliance and monitoring consulting firm Guidepost Solutions.

Guidepost Solutions advised the Republic of the Marshall Islands’ government on a regulatory compliance and sanctions framework for its USDM1 bond, a tokenized debt instrument issued by the government, backed 1:1 by short-term US Treasuries.

The Marshall Islands government launched a Universal Basic Income (UBI) program in November 2025 that distributes quarterly benefits to citizens directly through a mobile wallet. Wood told Cointelegraph:

“Any benefit that is currently being distributed through analog means should be explored for a digital delivery option for several reasons. Digital delivery speeds up the process and can provide an auditable trail for provisioning and expenditures.”

Several governments are exploring tokenized debt instruments and administering social benefit programs onchain to eliminate settlement delays and costly transaction fees inherent in traditional finance by disintermediating the issuing and clearing process.

Related: UK government appoints HSBC for tokenized bond pilot

Regulatory compliance and sanctions challenges remain as the tokenized bond market grows

The cost reduction and near-instant settlement times for tokenized bonds and other onchain instruments democratize access to the financial system for individuals who lack access to traditional banking infrastructure.

However, anti-money laundering (AML) requirements and sanctions compliance are two of the biggest regulatory risks for governments issuing onchain bonds to the public, Wood told Cointelegraph.

Governments issuing tokenized bonds must also collect know-your-customer (KYC) information to ensure that funds are directed to the proper recipients, she added.

The tokenized US Treasury market grew by over 50x since 2024, according to data from crypto analysis platform Token Terminal.

The tokenized bond market could surge to $300 billion, according to a forecast from Lamine Brahimi, co-founder of Taurus SA, an enterprise-focused digital asset services company.

Reduced settlement times, transaction costs and asset fractionalization, which allows individuals to purchase fractions of a financial asset, all expand investor access to the global financial system, Brahimi told Cointelegraph.

Magazine: Will Robinhood’s tokenized stocks REALLY take over the world? Pros and cons

Crypto World

ZKP Stage 2 Presale Auction Ends in 5 Days! Buyers Rush Ahead of Supply Drops, as Monero and Cardano Track Trends

The digital asset landscape is shifting, and finding the best crypto to buy right now requires looking beyond the household names. While established players like Monero continue to offer privacy-centric utility, and analysts weigh in on the long-term Cardano price prediction, a new contender is rewriting the rules of entry. Zero Knowledge Proof (ZKP) is currently capturing the market’s attention with its unique Initial Coin Auction (ICA), a system designed for pure transparency.

As the Monero price USD faces typical market volatility, ZKP is moving through its final days of Stage 2. With the transition to Stage 3 occurring in just 5 days, the window to participate in the current 190-million daily token distribution is closing. Investors are pivoting toward ZKP’s deflationary burn mechanics and fair-launch protocol, seeking the stability and growth potential that traditional presales often lack.

Tracking Volatility and Demand for Monero Price USD

Privacy remains a core focus within the blockchain sector, making the Monero price USD a key metric for those tracking anonymity-centric assets. Recent market data indicate that Monero has faced notable volatility, including a sharp decline of over 50% from its January high of nearly $800. This correction has seen the Monero price USD stabilize around the $340 to $370 range as of February 2026.

Regulatory pressure continues to influence its market standing, with the asset facing approximately 73 exchange delistings over the past year due to tightening global compliance standards. While technical indicators like the RSI currently show oversold conditions, consistent selling pressure from long-term holders has impacted liquidity. Monero remains a specialized utility for private transactions, though it operates under persistent structural headwinds and shifting regulatory frameworks.

Analyzing the Future Through Cardano Price Prediction

Cardano continues to maintain its position as a major cryptocurrency by market capitalization, currently valued at approximately $9.22 billion. When analysts evaluate a long-term Cardano price prediction, they frequently focus on the protocol’s peer-reviewed development phases, such as the Voltaire era for on-chain governance. Technical data from February 2026 shows the asset trading near $0.26, supported by over 1.3 million active staking wallets that contribute to network decentralization.

Recent milestones include the launch of regulated ADA futures on the CME Group marketplace, marking a step in institutional integration. While a conservative Cardano price prediction often accounts for its methodical scaling approach, the network has reached 17,000 smart contract deployments, reflecting the steady development of its underlying technical infrastructure over time.

ZKP’s Stage 2 Presale Auction Enters Final Countdown

While many market participants wait on external price swings, Zero Knowledge Proof (ZKP) is introducing the first Initial Coin Auction (ICA), a radical shift toward true decentralization. This is precisely why it is being highlighted as the best crypto to buy right now. Unlike traditional models where prices are set behind closed doors, the ZKP price is determined by real-time market demand through a transparent, 24-hour on-chain process.

The urgency has reached a fever pitch as ZKP’s presale auction enter final days of Stage 2. This represents the absolute last window to access the largest remaining daily distribution of 190 million tokens. In just 5 days, the protocol triggers a structural supply cliff, transitioning to Stage 3 where the daily allocation is slashed by 10 million tokens to a 180-million limit.

This aggressive reduction continues across every subsequent stage of the 450-day timeline, meaning the available daily supply is rapidly evaporating. Furthermore, any unallocated tokens are burned permanently at the end of each day, ensuring that every 24-hour cycle is a final opportunity to participate at the current stage’s specific supply level.

To maintain total integrity, ZKP utilizes an “Anti-Whale” protocol, capping daily contributions at $50,000 per wallet. This prevents large players from dominating the auction, ensuring that the best crypto to buy right now remains accessible on equal terms. With no gas wars, no insider advantages, and a daily supply that drops by 10 million tokens in less than a week, the window to secure a position before the Stage 3 reduction is closing fast.

In Summary

In a market defined by choice, the path forward depends on specific objectives. While monitoring the Monero price USD remains vital for privacy-focused utility, and tracking the long-term Cardano price prediction is essential for patient, research-oriented holders, the shift toward transparent infrastructure is undeniable. ZKP stands out as the best crypto to buy right now, offering a fair-launch model that established projects simply cannot replicate.

With Stage 2 and its 190-million daily ceiling ending in just 5 days, the opportunity to secure tokens at this level is vanishing. As the supply cliff approaches and unallocated tokens burn daily, the window for maximum allocation is rapidly closing. The transition to Stage 3 marks a permanent tightening of the ecosystem, positioning ZKP as a high-momentum choice for those observing the shrinking supply.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Presale: https://buy.zkp.com/

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Sui executives say institutional demand has never been higher

Institutional interest in crypto is accelerating even as markets fluctuate, according to Sui executives at Consensus Hong Kong 2026.

Stephen Mackintosh, chief investment officer of Sui Group Holdings, called 2025 a “landmark year for institutional adoption,” pointing to the boom in digital asset treasury (DAT) vehicles and the success of spot bitcoin ETFs.

“Post the Genius Act, we’ve seen so much more institutional demand and awareness for what the promise of crypto could deliver,” he said, particularly around tokenization and stablecoins.

While sentiment has fluctuated, Mackintosh argued the structural shift is clear. “The market, despite all of the sentiment being low, has never been greater,” he said, citing record options volumes and the entrance of major firms such as Citadel and Jane Street into crypto markets. He described a long-term trend in which “the biggest institutions in finance in the world” are investing in infrastructure and talent to capture market share.

Mysten Labs CEO Evan Cheng framed the next phase as convergence rather than competition between traditional finance and decentralized finance. In his view, TradFi products often operate on “T+1 or T+whatever,” while DeFi is “T+0”—a “strictly better product” in settlement terms.

The convergence, he suggested, will emerge through tokenization. “You acquire [an asset] and immediately you can collateralize and borrow against it,” Cheng said, enabling DeFi strategies layered on traditional exposure.

On whether ETFs compete with DeFi, Cheng said products will evolve. Institutional on-ramps may begin conservatively but could incorporate yield or other on-chain mechanics over time.

Both executives emphasized infrastructure as Sui’s differentiator. Mackintosh described Sui as “a differentiated proposition” built by former Facebook engineers behind Libra, offering low latency and high throughput suited for emerging use cases such as “agentic commerce”, the intersection of AI and onchain transactions.

Crypto World

Coinbase Swings to $667M Q4 Loss as Crypto Portfolio Markdowns Bite

Coinbase posted a $667 million Q4 2025 loss after crypto markdowns hit its holdings even though it registered record trading growth.

Coinbase reported a $667 million net loss for the fourth quarter of 2025, its first quarter in the red since 2023.

The loss, which was largely driven by non-cash write-downs on the company’s crypto holdings and strategic investments, landed far below analyst expectations and reversed a $1.3 billion profit from the same period last year.

Record Growth Metrics Masked by Portfolio Pain

Coinbase’s shareholder letter, published after market close, painted two divergent pictures of its 2025 performance. On the operational side, the company logged all-time highs in total trading volume ($5.2 trillion, up 156% year-over-year), crypto trading market share (6.4%, double the year before), and subscription revenue.

In the letter, the crypto firm stated that paid Coinbase One subscribers have nearly hit 1 million and that it now has 12 products generating over $100 million in annualized revenue.

However, fourth-quarter financials told a different story, with total revenue falling 21.6% year-over-year to $1.78 billion and missing consensus estimates of about $1.83 billion. Additionally, transaction revenue, the company’s core fee business, dropped 36% from Q4 2024 to $983 million. Adjusted earnings per share of $0.66 also came in below analyst forecasts, which ranged from $0.86 to $0.96, according to market commentator MartyParty.

Per Coinbase’s report, the primary culprit behind the GAAP loss was a $718 million unrealized markdown on the exchange’s crypto investment portfolio, as Bitcoin (BTC) and other tokens declined in Q4.

The company also recorded a $395 million loss on strategic investments, including its stake in Circle, the issuer of USDC, which dropped approximately 40% quarter-over-quarter. Ultimately, Coinbase ended the year with $11.3 billion in cash and cash equivalents.

You may also like:

Market Share Gains Face New Competitive Pressure

Recent data suggests Coinbase is facing rising competition, with analytics firm Artemis reporting that decentralized derivatives platform Hyperliquid processed $2.6 trillion in trading volume, nearly double Coinbase’s $1.4 trillion in the same period. Artemis also reported a sharp divergence in market performance this year, with Hyperliquid’s token up 31.7% while Coinbase shares were down 27% over the same stretch.

The company’s mixed quarter follows a busy 2025, where it joined the S&P 500, secured approval to operate across the European Union under MiCA rules, and completed major acquisitions, including Deribit. It also benefited from a legal win when the U.S. Securities and Exchange Commission (SEC) dropped a lawsuit against the firm.

Not all commentary has been positive, though, as shown by security researcher Taylor Monahan’s argument that user protection on Coinbase is still lagging, citing more than $350 million in preventable losses during 2025.

Nonetheless, the exchange has maintained that its strategy focuses on diversification beyond spot trading. It said it is building an “Everything Exchange” that includes derivatives, equities, and prediction markets, and it recently partnered with Kalshi to support event-based contracts. Whether that broader model offsets swings in crypto prices will become clearer in the coming quarters.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Elon Musk’s X to launch crypto and stock trading in ‘couple weeks’

Elon Musk’s social media platform X is set to soon let users trade stocks and cryptocurrencies directly from their timelines as the company pushes deeper into financial services.

The upcoming features, described by the company’s head of product, Nikita Bier, will include “Smart Cashtags.” These will allow users to interact with ticker symbols in posts and execute trades from the app.

The announcement comes as the company prepares to launch an external beta of X Money, its in-house payments system. Musk said the tool is already live in internal testing and will be available to a limited group of users within one to two months.

The idea is to make X a one-stop platform where users can message, post, send money and invest, a version of Musk’s “everything app” vision.

He’s compared the rollout of financial tools like X Money to adding banking services inside the app, saying users could eventually manage most of their daily digital activity without leaving the platform.

Elon Musk’s companies have been involved with crypto in the past. His electric car maker Tesla owns 11,509 bitcoin on its balance sheet, down from an initial investment of 42,300 made in early 2021. SpaceX currently controls around 8,285 BTC.

Over the years Musk has also shown support for the meme-inspired cryptocurrency dogecoin. In 2022, he said SpaceX would accept DOGE for some merchanside, echoing an earlier move from Tesla. Earlier this month, Musk said he may put DOGE “on the moon.”

Crypto World

Best Crypto to Buy Right Now: Why BlockDAG, Solana, BNB, and Cardano Could Shift the Market

In 2026, the digital asset market has matured into a high-stakes arena where architectural precision determines long-term survival. While the era of speculative “moonshots” has faded, the demand for protocols that can handle massive transactional loads without sacrificing decentralization is at an all-time high.

Major assets like Binance Coin and Solana continue to anchor portfolios with their massive liquidity, and Cardano remains a benchmark for peer-reviewed security. However, the narrative is rapidly shifting toward BlockDAG, which has recently transitioned to a live Mainnet environment. For those identifying the best crypto to buy right now, the convergence of proven legacy power and fresh, scalable infrastructure offers a clear roadmap for the current cycle.

1. BlockDAG: Final Call for $0.00025 Entry Before Feb 16 Listings

BlockDAG has moved beyond the development phase to become a fully operational powerhouse in the Layer 1 space. With its Mainnet now live, the network has transitioned into active block production, signaling the true beginning of the Genesis era. For anyone scanning the market for the best crypto to buy right now, the data behind BlockDAG (BDAG) is compelling.

The project has already raised a staggering $452M through its presale batches, and the Token Generation Event (TGE) rails are now active, meaning BDAG is being issued directly on the BlockDAG Mainnet. Minting is complete, and the vesting contracts are running, with the claim function for the initial airdrop set to go live shortly.

The current window represents the final private sale allotment, offering a fixed price of $0.00025 for only the next 3 days. This is a rare structural opportunity, as the coin is confirmed for launch on over 20 global exchanges on February 16 with a target listing price of $0.05. This pricing gap implies a 200x potential at launch.

Unlike many early-stage projects, this final allocation carries zero vesting, ensuring that 100% of the coins are delivered to user wallets on launch day. Furthermore, participants in this round gain the advantage of trading up to 9 hours before the public markets open, allowing them to position themselves ahead of the initial volatility and front-run launch liquidity.

Securing the $0.00025 final allocation is the definitive move before the February 16 launch. With the Mainnet live, this is the last window to front-run global markets and 200x potential.

2. Solana: Testing Recovery Near the $80 Support

Solana is currently hovering around the $80 level, showing tentative signs of recovery after recent market fluctuations. As a high-throughput layer‑1 blockchain, Solana supports a broad spectrum of DeFi, NFT, gaming, and payment applications, leveraging fast transaction speeds and minimal fees. Its utility is particularly strong for developers needing quick finality without high operational costs.

Active staking and network participation help secure the network while incentivizing holders, keeping developer engagement robust. While Solana occasionally faces network congestion and performance challenges, these are typical trade-offs for high-speed chains. For investors assessing the best crypto to buy right now, Solana remains relevant due to its resilient ecosystem and adoption, even as it navigates price recovery and market volatility.

3. Binance Coin: Exchange Utility and BNB Smart Chain

Binance Coin is the native token of the Binance ecosystem, used for transaction fees, participation in launchpad events, and as gas on the BNB Smart Chain. It is currently trading around the mid‑$600s, following recent market fluctuations. The network records millions of active daily users, supporting a variety of decentralized applications and DeFi protocols.

BNB has a circulating supply of approximately 136.36 million, with periodic token burns reducing supply over time. Technical data indicate resistance near $620, while derivatives markets show a balanced long-to-short ratio. For those considering the best crypto to buy right now, BNB provides a practical case study in exchange and network utility, reflecting consistent usage rather than speculative activity.

4. Cardano: CME Futures Launch Amid Institutional Consolidation

Cardano is currently trading in the $0.26 – $0.27 range, reflecting moderate volatility. The network uses a proof-of-stake consensus and emphasizes formal verification and research-driven development. Recently, Cardano futures were introduced on the CME Group, offering institutions a regulated way to participate and adding structure to market activity.

At the same time, the ecosystem is gradually expanding into DeFi, including the integration of USDCx via LayerZero. While price movement remains relatively conservative compared to newer high-throughput networks, its capped supply and predictable issuance schedule provide consistent tokenomics. For those evaluating the best crypto to buy right now, ADA illustrates steady adoption and measured network development, prioritizing security and protocol reliability over rapid growth.

Why BlockDAG Tops the 2026 Rankings

The February 2026 market presents a clear contrast between established utility and high-velocity growth. While Solana, Binance Coin, and Cardano remain functional pillars of the industry, they are currently navigating phases of technical resistance and institutional consolidation. For buyers identifying the best crypto to buy right now, these assets offer reliability but lack the explosive multiplier potential found in a Tier-1 launch.

BlockDAG stands apart because its Mainnet is now live, providing a high-throughput ecosystem paired with a final $0.00025 private allocation. With the February 16 exchange debut approaching and a $0.05 target price, the window to secure a 200x edge is closing fast. This is the definitive moment to act before the fixed-price era ends and global market FOMO takes over.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

How modern blockchain teams ship products 10x faster

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Building blockchain projects in web3 no longer demands months of Solidity coding or six-figure budgets, as production-ready code cuts DeFi costs 90% and slashes timelines from months to days.

Summary

- Web3.Market lets web3 project founders buy production-ready smart contracts, cutting blockchain development costs by 90%.

- Blockchain code marketplaces compress months of Solidity work into days, reducing audit and deployment costs.

- Curated dApp templates and tools on Web3.Market offer secure, ready-to-launch projects beyond GitHub’s open code.

The calculus of blockchain development has fundamentally shifted. Five years ago, launching a web3 project meant assembling a team of Solidity developers, spending months writing smart contracts from scratch, and budgeting six figures before a single line of code touched mainnet.

That approach still works for protocols building genuinely novel mechanisms. But for the 80% of blockchain projects implementing proven patterns — token launches, staking platforms, DEX deployments, NFT marketplaces — custom development increasingly represents misallocated capital and time.

The numbers tell the story. According to industry data, experienced Solidity developers command $150 to $300 per hour. A production-ready DeFi application typically reaches $100,000 to $300,000 in total development costs. Smart contract audits alone range from $10,000 for simple contracts to over $100,000 for complex protocols. And these figures assume everything goes right the first time.

The alternative — acquiring production-ready code from specialized marketplaces — compresses timelines from months to days while reducing costs by 90% or more.

What changed: The rise of blockchain code marketplaces

Software marketplaces are not new. WordPress themes migrated from scattered downloads to organized platforms like ThemeForest. Mobile app templates followed a similar consolidation. The same pattern has emerged in blockchain development.

Web3.Market represents this category, operating as a specialized platform where developers and founders acquire complete blockchain project source code rather than building from scratch. The platform combines a curated marketplace of production-ready smart contracts and dApp templates with a directory of 84 developer tools across 18 categories — from RPC providers like Alchemy and Infura to security frameworks like OpenZeppelin and Slither.

The distinction from open-source repositories matters. GitHub offers abundant smart contract code, but quality varies enormously. Maintenance status, test coverage, and security review are often unclear. Commercial marketplaces apply curation; each listing includes documentation, deployment instructions, and license terms clarifying modification and commercial use rights.

The technical stack: What production-ready actually means

A smart contract that compiles is not the same as a smart contract ready for mainnet deployment with user funds. The gap between these two states explains why marketplace products command premium prices over raw open-source code.

Production-ready blockchain code typically includes:

Security Considerations: Reentrancy guards, integer overflow protection, access control patterns, and emergency pause functionality. These aren’t features — they’re table stakes for any contract handling value. The Smart Contract Weakness Classification Registry documents over 37 vulnerability categories that production contracts must address.

Gas Optimization: Inefficient code translates directly to higher user costs. Production implementations minimize storage operations, batch transactions where possible, and implement efficient data structures.

Upgrade Patterns: Whether using proxy contracts or modular architecture, production systems account for the inevitability of bugs and evolving requirements.

Integration Points: Wallet connection libraries, oracle integration for price feeds, and event emission patterns for frontend synchronization.

Documentation: Setup guides, configuration options, deployment scripts for multiple networks, and verification instructions for block explorers.

This infrastructure development represents the unglamorous work that separates a hackathon project from a mainnet deployment.

The hybrid approach: Where build vs buy gets interesting

The choice between building and buying rarely presents as binary. The most efficient blockchain teams treat it as a portfolio decision — buying commodity functionality while reserving custom development for genuine differentiation.

Consider a team launching a DeFi protocol. The token contract, staking mechanism, and presale infrastructure follow well-established patterns documented in standards like ERC-20 and ERC-721. Custom development here adds cost without differentiation. The novel economic mechanism at the protocol’s core — that warrants custom work.

This hybrid approach accomplishes several things simultaneously:

Capital Efficiency: Development budget concentrates on features that matter competitively. A staking contract purchased for $200 versus $30,000 in custom development frees $29,800 for the unique protocol logic, marketing, or audit expenses.

Timeline Compression: Standard components deploy in hours rather than weeks. Teams reach market testing faster, gathering real user feedback while competitors remain in development.

Reduced Security Surface: Battle-tested code that has already undergone security review presents lower risk than freshly written contracts. The most dangerous code is code nobody has examined.

Focus Allocation: Engineering time is directed toward problems that benefit from original thinking rather than re-implementing patterns available elsewhere.

The developer tools layer

Beyond marketplace listings, modern blockchain development depends on an infrastructure stack that has matured significantly. The fragmentation that once characterized web3 tooling — where developers spent significant time simply identifying which tools existed — has consolidated into clearer categories.

Node Infrastructure: Rather than operating blockchain nodes directly, most application developers rely on RPC providers. QuickNode, Alchemy, and Infura handle the infrastructure complexity while exposing standard interfaces.

Development Frameworks: The tooling landscape has consolidated around Hardhat and Foundry. Hardhat dominates in JavaScript/TypeScript environments with its extensive plugin ecosystem. Foundry, built in Rust, offers faster compilation and native fuzzing support — the direction most new projects have adopted.

Security Analysis: Production workflows incorporate static analysis tools like Slither and Mythril as automated checks before human review. These catch common vulnerabilities — reentrancy patterns, access control issues, integer handling—before code reaches auditors.

Indexing and Data: Raw blockchain data remains difficult to query directly. The Graph provides decentralized indexing, while services like Moralis offer managed approaches for teams prioritizing speed over decentralization.

Directories that catalog these tools — like Web3.Market’s Developer Hub with 84 tools across 18 categories — reduce the discovery overhead that historically slowed web3 development.

Security: The constant that doesn’t change

Regardless of whether code originates from custom development or marketplace acquisition, security requirements remain identical. Any smart contract managing user funds requires a systematic review.

The layered approach that has emerged as the industry standard:

Automated Scanning: AI-powered audit tools and static analyzers run against every code change. These catch low-hanging vulnerabilities — common patterns that automated tools recognize reliably. Platforms now offer free smart contract audit tools that scan Solidity files against 100+ vulnerability patterns in under two minutes.

Manual Review: Automated tools miss business logic flaws and economic vulnerabilities. Human auditors examine how contracts interact, what incentives they create, and how they might be exploited in ways that compile correctly but behave unexpectedly.

Ongoing Monitoring: Post-deployment, production contracts require transaction monitoring for anomalous patterns. Bug bounty programs through platforms like Immunefi provide ongoing security coverage.

The cost profile differs between custom and acquired code. Custom development requires full audit scope. Marketplace code that has previously undergone review may require only delta audits examining modifications and integration points—reducing both cost and timeline.

What this means for different stakeholders

For Founders and CEOs: The build vs buy decision affects runway directly. Custom development of commodity functionality represents opportunity cost — capital and time that could be deployed toward market validation, user acquisition, or the technical innovation that actually differentiates the project.

For CTOs and Technical Leaders: The question becomes which components warrant original engineering. Novel mechanisms, proprietary algorithms, and competitive differentiators justify custom work. Standard infrastructure — token contracts, authentication, basic DeFi primitives — can often be acquired.

For Developers: The landscape offers leverage. Rather than rebuilding proven patterns, development time can focus on problems that benefit from creative solutions. Marketplace code provides reference implementations and learning resources alongside deployable components.

The trajectory

The pattern blockchain development follows mirrors other software markets. As infrastructure matures and patterns standardize, custom development concentrates at the innovation frontier while commodity functionality commoditizes.

This benefits the ecosystem broadly. Lower barriers to entry mean more experimentation. Faster iteration cycles mean faster learning. Reduced capital requirements mean more diverse participation.

The projects succeeding in 2026 are not necessarily those with the largest development budgets. They are those that deploy resources strategically — building where building matters, buying where buying makes sense, and shipping while competitors remain in development.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Virginia advances crypto kiosk licensing and scam safeguards

Virginia’s crypto ATM regulation bill passed both state chambers and now awaits the governor’s signature.

Summary

- Virginia approves crypto kiosk rules with licensing and limits.

- New users face 48-hour hold to prevent scam-related losses.

- Bill targets fraud as kiosks often mistaken for bank ATMs.

The legislation creates statewide licensing requirements, consumer protections, and transaction limits while prohibiting operators from marketing kiosks as ATMs or using ATM-related language.

Delegate Michelle Maldonado, the bill’s sponsor, cited scam cases across Virginia including a Southwest Virginia victim who lost $15,000 and incidents in Fairfax County.

Scams account for approximately 7% of the crypto kiosk industry’s business. This has prompted lawmakers to establish guardrails before the problem expands.

“The thing about crypto is that once it goes into the exchange, which is in the blockchain environment, there’s no way to trace it. There’s no way to get it back,” Maldonado stated.

Crypto bill implements 48-hour fraud prevention hold

The legislation requires kiosks to register with the state, pay licensing fees, and cap consumer transaction fees.

Operators must implement daily and monthly transaction limits along with ID verification for all transactions. A 48-hour hold applies to new users, allowing funds to be returned if fraud is suspected.

Clear warning notices must appear on all kiosks alerting users to scam risks. The registration system will track operators while refund mechanisms must be available for recoverable portions of funds sent through the machines.

Maldonado explained that crypto kiosks confuse consumers who mistake them for traditional ATMs. “They look like ATMs. They’re shaped like ATMs. But instead of taking money out, you’re sort of putting money in to purchase crypto that goes into a broader exchange,” the delegate said.

AARP Virginia backs protections as scammers target older adults

AARP Virginia called the changes urgently needed as scammers increasingly use unregulated kiosks to target state residents, particularly older adults.

The organization noted seniors face heightened vulnerability to schemes involving fake debts, legal threats, and romantic manipulation.

Maldonado called the bill proactive rather than reactive regulation. “That doesn’t mean that there’s no problem. It means that it’s in the beginning. And so this is the time to put the guardrails and the safeguards in place so that 7% doesn’t grow,” she said.

The bill now requires Governor approval to become law. If signed, Virginia would join states implementing crypto kiosk oversight as the machines proliferate across the country.

Crypto World

ETH Needs to Reclaim This Key Level to Flip the Script

Ethereum’s recent price action reflects a market transitioning from impulsive selling into a potential short-term stabilisation phase. After a sharp decline toward the $1,750 demand zone, ETH has reacted with a moderate rebound, yet is expected to continue fluctuating in the short term.

Ethereum Price Analysis: The Daily Chart

On the daily chart, ETH continues to trade inside its descending channel, with lower highs and lower lows still intact. The recent impulsive drop pushed the price sharply into the $1.8K demand area, where buyers reacted and triggered a rebound toward the $2.1K region.

However, the asset remains below the 0.5 Fibonacci level at $2.4K and well under the 0.618 level at $2.5K, confirming that the current move is corrective rather than a confirmed trend reversal.

The $2.7K range, aligned with the 0.702–0.786 retracement levels, stands as a major supply zone and would be the key resistance area if a stronger recovery unfolds. As long as ETH remains below $2.5K, the broader structure favours sellers, while the $1.7K level remains the critical support to hold.

ETH/USDT 4-Hour Chart

On the 4-hour chart, the price action has formed a short-term contracting structure after the sharp bounce from $1.7K. The market is currently fluctuating between the ascending short-term support trendline and the descending local resistance trendline, compressing near the $2.1K area. A successful break above $2.1K could open the path toward $2.5K, which is the next key resistance.

Conversely, losing the $2K intraday support would likely expose the $1.8K zone again. For now, ETH appears to be in a short-term consolidation phase between $1.8K and $2.1K following the recent volatility spike.

Sentiment Analysis

The Ethereum Spot Average Order Size chart shows a notable increase in green dots during the recent decline toward the $1.8K region. These green clusters indicate large whale-sized spot orders entering the market as prices traded at low levels. This behaviour suggests potential accumulation by bigger players during the panic-driven sell-off.

While this does not immediately signal a trend reversal, the concentration of whale activity near $1.8K strengthens this zone as a structurally important demand area. If accumulation continues and price stabilises above $2K, the probability of a broader recovery toward higher resistance levels will gradually increase.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World16 hours ago

Crypto World16 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?