Crypto World

Solana Active Addresses Soar as More Merchants Accept Bitcoin

January delivered a mix of on-chain momentum and macro headwinds, spotlighting how activity on major networks can surge even as prices wobble. In particular, Solana and Ethereum posted notable milestones, while Bitcoin miners in the United States faced weather-driven disruption. Beyond network metrics, the month also underscored the growing role of crypto in everyday commerce as PayPal highlighted rising merchant adoption. The month’s narrative wove together rapid token launches, upgrade-driven efficiency gains, and geopolitical jitters that reverberated through risk assets, leaving investors weighing the pace of innovation against real-world constraints.

Key takeaways

- Solana (CRYPTO: SOL) saw a 115% jump in active daily addresses by Jan. 28, regularly surpassing 5 million, driven by renewed memecoin minting and an ecosystem push around token launches.

- Ethereum (CRYPTO: ETH) activity surged 25% in January after a December milestone where the network surpassed several major Layer 2s in daily active addresses, aided by upgrades that boosted throughput and lowered costs.

- Network fees on Ethereum remained low on average, dipping to under $0.01 on Jan. 29 as capacity improvements took effect.

- Bitcoin (CRYPTO: BTC) faced price volatility, briefly pushing toward $100,000 mid-month before retreating to around $87,000 amid geopolitical headlines centered on Greenland and broader risk-off sentiment.

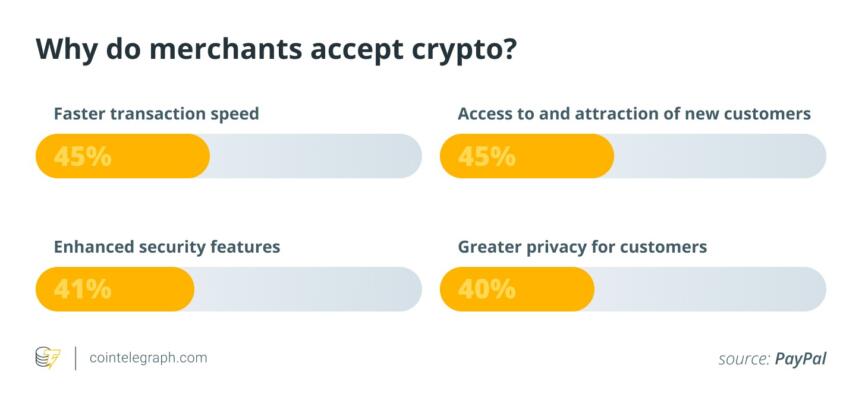

- Merchant adoption of crypto payments continued to expand in the US, with four in ten merchants reporting acceptance, and 84% predicting crypto payments will become mainstream within five years, per a PayPal (EXCHANGE: PYPL) January report.

Tickers mentioned: $BTC

Price impact: Negative. Bitcoin moved from a monthly high near $97k to about $87k amid geopolitical headlines and shifting risk sentiment.

Market context: The month illustrated how on-chain activity can accelerate even as macro headlines and policy signals shape risk appetite, with Ethereum’s upgrade cycle contributing to lower fees and Solana’s launch-driven activity underscoring a healthy, if episodic, ecosystem dynamic.

Why it matters

The January dynamics underscore a recurring theme in crypto markets: on-chain activity can accelerate even in periods of price uncertainty when infrastructure improvements, developer activity, and user demand coalesce. Solana’s surge in active addresses signals continued trust in its ability to support rapid token launches and decentralized applications, particularly as launch platforms like Bags compute the economics of new tokens and liquidity taps into a broader user base. The 115% rise in daily active addresses by late January, anchored by data from Nansen, points to a cohort of participants returning to activity after a quieter stretch, and it hints at a cyclical pattern of experimentation and completion within Solana’s ecosystem.

Ethereum’s resilience, evident in a 25% rise in daily active addresses in January, reinforces the narrative of a network maturing beyond episodic speculation. After overtaking some notable Layer 2s in December, Ethereum’s continued usage reflects a combination of broader dApp engagement and ongoing optimizations—essentials for a network contemplating sustained scalability. The drop in average transaction fees to sub-cent ranges around the end of January illustrates how upgrade-driven capacity expansions can alter user experience, lowering the cost barrier to routine usage and potentially widening the audience for on-chain services. This dynamic matters for builders seeking predictable costs and users seeking reliable, fast transactions.

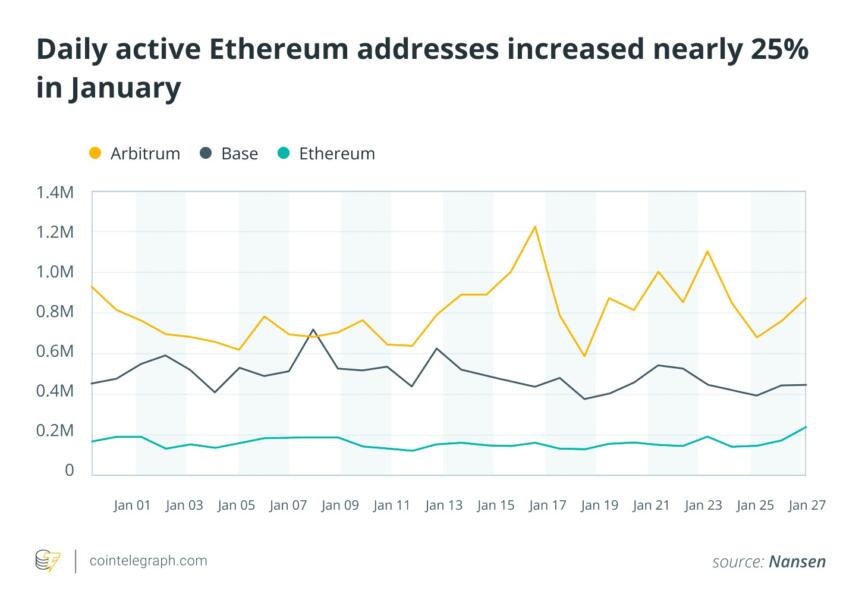

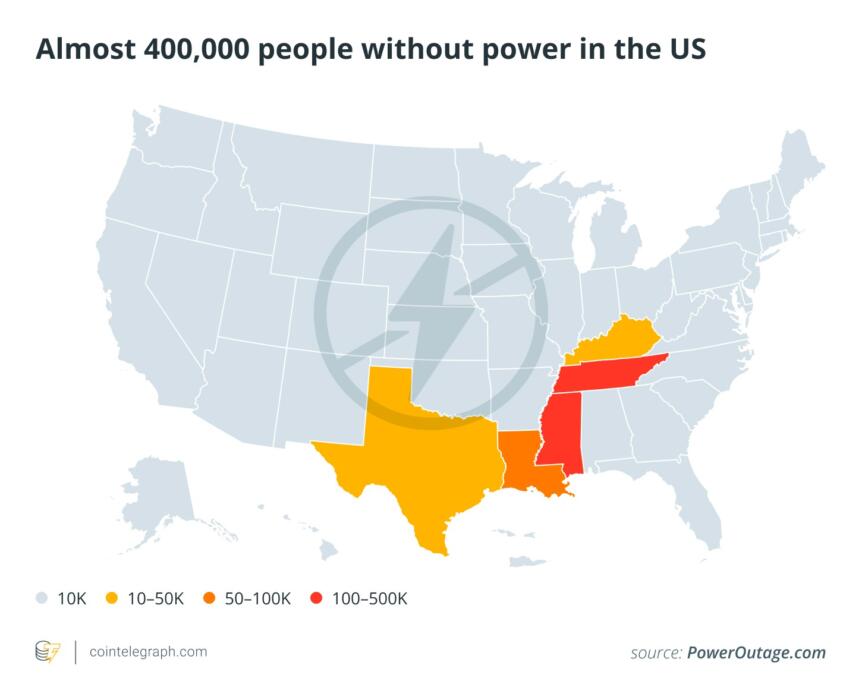

On the funding, infrastructure, and governance side, the month’s events remind market participants that energy and risk management remain acute for miners, especially in climates where grid stability is tested. The storm-induced curtailment scenario in the United States—where seven mining operations faced potential reductions—highlights the sector’s reliance on demand-response programs and the delicate balance between profitability and grid reliability. As Matthew Sigel, head of digital assets research at VanEck, noted, these facilities can act as flexible loads, a capability that could prove valuable during periods of grid stress. The broader takeaway is that mining economics are increasingly intertwined with energy policy and regional weather events, not solely with Bitcoin price movements.

Beyond network activity and mining resilience, the integration of crypto into everyday commerce continued to gain traction. PayPal’s January report showing that roughly 40% of US merchants accept crypto marks a meaningful expansion from niche adoption to a broader business reality. With 84% of merchants surveyed expecting crypto payments to become mainstream within five years, the trend points to a persistent demand-side readiness among consumers and a growing willingness among merchants to accommodate digital assets in checkout flows. The combination of merchant adoption alongside on-chain efficiency gains strengthens the case for crypto as a viable complement to traditional payments, even as headline risk and regulatory chatter persist.

The January price narrative was tempered by geopolitics. Bitcoin’s mid-month push toward the $100,000 level gave way to a retreat as Trump-era tensions and Greenland-related headlines created risk-off dynamics across markets. Analysts argued that cryptocurrencies did not provide a safe haven during a broad market sell-off triggered by policy rhetoric and cross-border tensions. While the macro environment remains uncertain, the month’s on-chain signals suggest that user activity and infrastructure improvements could sustain longer-term momentum, even if short-term price action remains fragile in response to external shocks.

What to watch next

- Solana ecosystem activity: Track the pace and quality of token launches on Bags and any shifts in memecoin issuance that could drive activity into February.

- Ethereum upgrade cadence: Monitor further network efficiency gains, blob sizes, and gas-price dynamics as core developers push toward finalization milestones and the walkaway test concept gains broader attention.

- Mining and energy dynamics: Watch potential curtailments or reliefs as winter weather patterns evolve, and assess how demand-response programs influence miner economics and network security.

- Crypto payments adoption: Follow PayPal’s ongoing reporting on merchant uptake and consumer usage to gauge how mainstream adoption is progressing and what that means for on-chain settlement velocity.

- Geopolitical and regulatory signals: Remain attentive to developments that could impact risk sentiment, capital flows, and the willingness of institutions to engage with crypto markets during periods of geopolitical tension.

Sources & verification

- Nansen data on Solana’s active daily addresses, with figures peaking above 5 million by late January.

- DeFiLlama metrics showing Bags platform fee activity and the token-launching landscape on Solana, including the comparison with Pump.fun.

- Etherscan gas tracker figures indicating January 29 average Ethereum fees below $0.01.

- Vitalik Buterin’s public remarks on Ethereum’s “walkaway test” and the idea that the network should function without constant developer intervention.

- VanEck commentary by Matthew Sigel on how mining operations can operate as flexible loads to support grid stability during stress periods.

- PayPal’s January report on crypto payment adoption, noting the share of US merchants accepting crypto and the sentiment around mainstream adoption in five years.

- Geopolitical developments around Greenland and related market responses that influenced risk-on assets such as Bitcoin.

Market reaction and key details

Solana (CRYPTO: SOL) posted a striking gain in on-chain activity in January as the ecosystem gathered momentum around token launches and integrations. By Jan. 28, total active daily addresses on the Solana network exceeded five million, marking a roughly 115% jump from the start of the month. The surge aligned with a renewed minting cycle on the Bags launchpad, a Solana-based platform that has become a hub for new tokens, and with the broader appetite for fast, low-fee transactions. The momentum was amplified by a parallel development: the release of Claude Cowork, an AI agent from Anthropic intended to help manage tasks, which developers leveraged to accelerate token-related experiments. The resulting activity helped lift network usage into new territory even as the broader market navigated a volatile January.

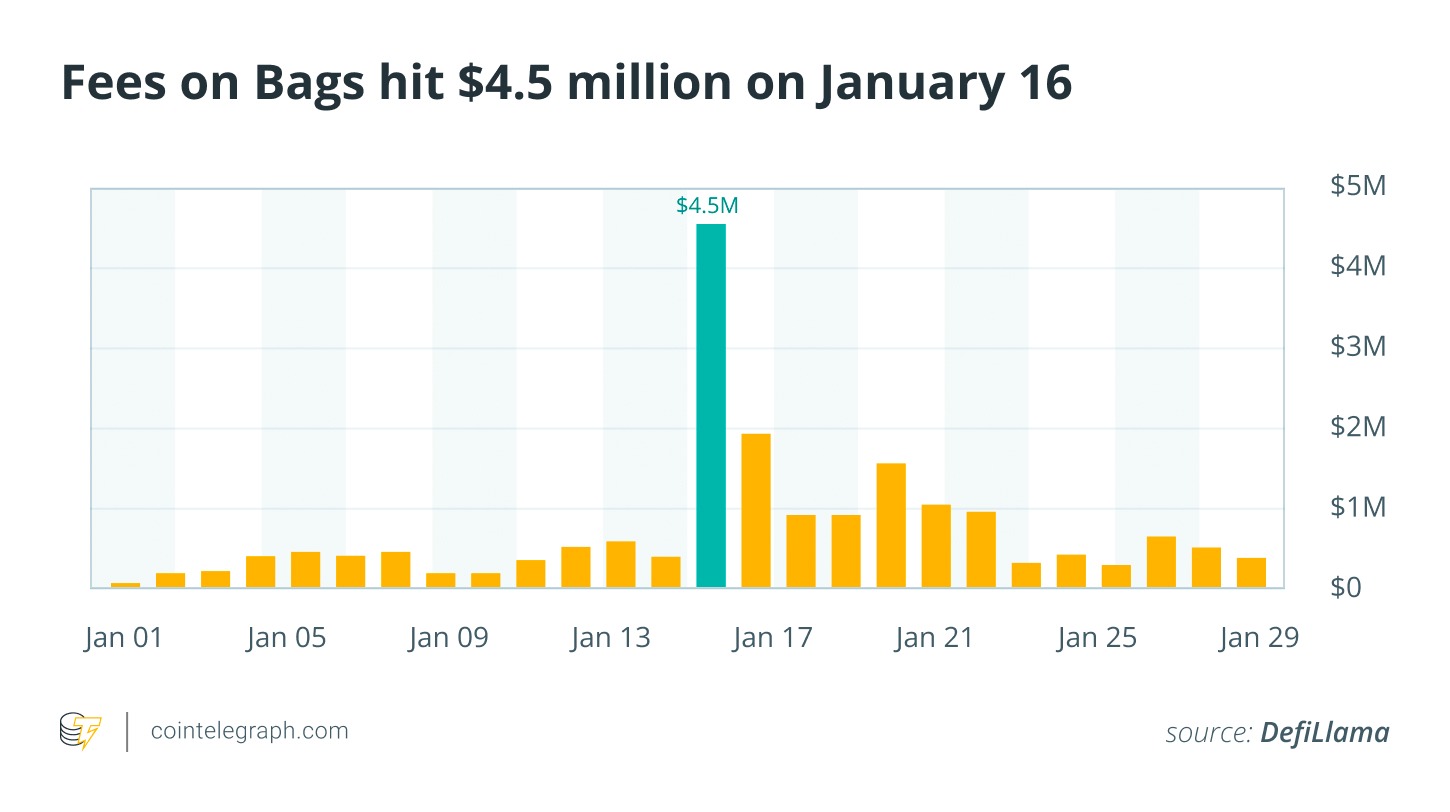

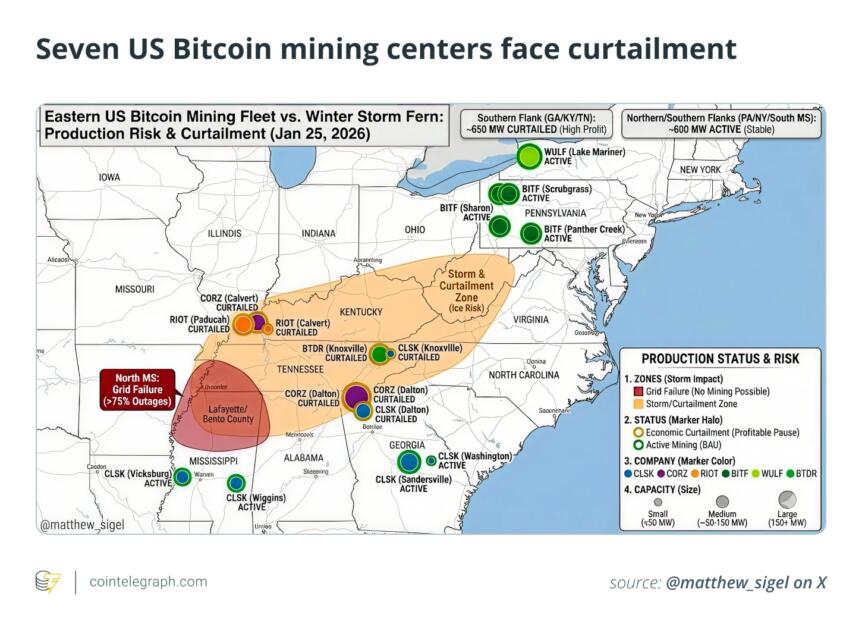

Following this spike, fees on the Bags ecosystem reached about $4.5 million on Jan. 16, highlighting how surges in launch activity can temporarily elevate on-chain costs. By contrast, the broader Solana ecosystem had experienced days with substantially lower fees in late 2024 and 2025, underscoring how launch-driven demand can create short-lived headwinds for users and developers participating in token drops. The number of tokens that “graduated” from Bags continued to outpace other Solana launch venues, indicating Bags’ growing role as a go-to path for new projects seeking initial liquidity and community engagement.

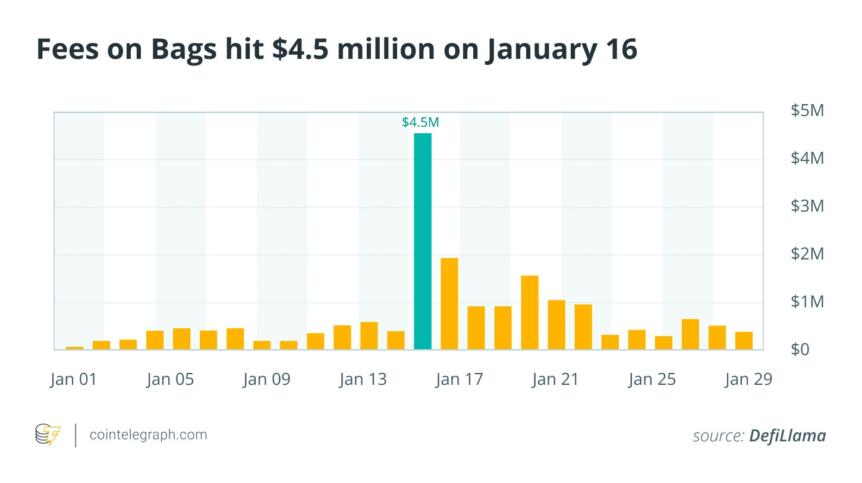

On Ethereum (CRYPTO: ETH), activity mirrored a maturation trajectory that has been evident since late 2023. After Ethereum overtook several prominent Layer 2 networks in daily active addresses in December, January’s metrics showed a further 25% uptick in on-chain activity. Upgrades implemented through the month improved blob sizes and reduced transaction costs, with average fees dipping below $0.01 on Jan. 29, according to on-chain trackers. The upgrades were framed by the ecosystem as foundational work toward a more scalable and accessible platform, enabling more users to transact without the friction that previously constrained adoption.

That momentum occurred in the context of Vitalik Buterin’s call for a “walkaway test”—a benchmark for Ethereum to function sustainably without developers actively guiding the chain. The thrust behind the comment was to emphasize that a resilient network should continue to meet users’ needs even in the absence of ongoing, hands-on governance. In tandem with this vision, Ethereum’s upgrades were designed to improve efficiency and lower costs for end users, reinforcing the idea that long-term usability is central to network health.

Meanwhile, Bitcoin faced a different set of headwinds in January. A winter storm disrupted power grids across the Southeast and South Central United States, prompting seven mining operations to consider curtailment. Data cited by Matthew Sigel of VanEck indicated that major players—Riot Platforms, Core Scientific, CleanSpark, and Bitdeer—maintained the ability to reduce grid demand through demand-response programs, a mechanism that can help stabilize power costs for operators while preserving grid reliability. The storm’s impact extended beyond energy, with travel disruptions, outages, and a humanitarian toll in several states as conditions worsened. The price narrative reflected this mood, with Bitcoin briefly testing near $100,000 earlier in the month before retreating toward $87,000 as turbulence persisted.

Beyond price action, crypto payments continued to gain traction in the broader economy. PayPal, a major payments processor, reported that four in ten US merchants now accept crypto, signaling increasing practical acceptance of digital assets in everyday commerce. The same report highlighted that crypto payments can offer faster settlement and enhanced privacy, factors that could drive further merchant experimentation in 2026. PayPal (EXCHANGE: PYPL) executives noted that crypto payments are moving beyond experimentation into everyday commerce, with 84% of merchants anticipating crypto’s mainstream status within five years.

The month’s mixed signals—robust on-chain activity on Solana and Ethereum against price swings driven by geopolitics and weather—underscore a market still in the process of reconciling technology-driven momentum with macro risk. The Greenland headlines, which briefly suggested potential policy pivots and security considerations, reminded markets that crypto assets remain sensitive to global political developments. Analysts argued that while cryptocurrencies don’t always act as a hedge in the face of geopolitical stress, their growing integration into real-world use cases—from token launches to payments—could help sustain longer-term interest even when price action turns choppy.

https://platform.twitter.com/widgets.js

Crypto World

Euro Stablecoin Boom Will Be Driven by RWA Tokenization, Not Payments: S& P Global

EUR-pegged stablecoins are set to grow 800x-1,600x by 2030, S&P projects.

Crypto World

Crypto VC Funding Doubled in 2025 as RWA Tokenization Took the Lead

Cointelegraph Research provides a data-driven report on crypto VCs, highlighting capital flows, sector rotation and changes in investor behavior.

Cointelegraph Research’s latest report provides an outlook on the state of fundraising in the crypto market and the key VC trends of 2025. VC investments in Web3 startups doubled in 2025 from the year before, driven by institutional interest, particularly in the RWA sector, which raised more than $2.5 billion. There has also been a distinct increase in mergers and acquisitions (M&A) and other large-scale corporate financing arrangements.

Download the free report to discover important industry highlights

The state of crypto venture capital (VC) in 2026

In 2025, venture capital investment in crypto startups exceeded $8 billion in every quarter for the first time since 2022. Total funding in 2025 reached more than $34 billion, double the $17 billion recorded in 2024. Nevertheless, 2025 can still be considered a risk-off year, as investors favored bonds and safe-haven assets, such as precious metals, which posted exceptional performance that year, amid geopolitical uncertainty and elevated interest rates.

The reduced risk appetite of venture capital also changed perceptions of business models in crypto. In 2025, fund managers prioritized sustainable revenue models, organic user metrics and strong product market fit instead of projects with early traction and limited revenue visibility. This shift was corroborated by the move from pre-seed and seed rounds toward later financing stages. Seed-stage financing declined by 18%, while Series B funding increased by 90%. This indicates deeper investor involvement in projects and a stronger focus on ecosystem development rather than early-stage experimentation.

Download the full report to explore which startups and niches attracted most attention from VCs

The trending narrative: Real-world assets (RWA)

RWA tokenization has shifted from a narrative into a budding sector over the past three years. According to RWA.xyz data, tokenized real-world assets have surpassed a capitalization of $38 billion, up 744% from $4.5 billion in 2022. RWAs have emerged as one of the fastest-growing segments in the crypto market, second only to stablecoins. Despite this growth, the crypto RWA sector remains small relative to $156 trillion in fixed-income and $146 trillion global equities markets. This suggests substantial room for further expansion.

From the investment side, the first signs of this shift are present in the progression of annual funding figures. In 2025, VC funding for RWA tokenization projects exceeded $2.5 billion.

Download the full Cointelegraph Research report to explore deeper insights into the RWA sector

Fading narrative for Ethereum layer 2s and modular infrastructure projects

While overall VC interest in the crypto market increased throughout the year, certain narratives showed clear signs of decline. In 2022, Ethereum layer 2 projects raised more than $1.2 billion, followed by $387 million in 2023 and $587 million in 2024. In 2025, funding reached a low of $162 million, representing a 72%decline from 2024.

This was likely caused by the rapid proliferation of layer-2 blockchains, which has led to an increasingly saturated landscape and a decline in VC appetite for this technology. As the number of L2 chains quickly increased above 50, the demand for blockspace was saturated.

See which crypto sectors are losing VC interest in the latest report by Cointelegraph Research

We would like to thank Canton Foundation, CryptoRank, DWF Labs, Everest Ventures Group, Mercuryo, and RWA.xyz for contributing data, insights, and opinions to this report.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. This article is for general information purposes and is not intended to be and should not be taken as, legal, tax, investment, financial, or other advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Nvidia (NVDA) Shares Fall to a Year-to-Date Low

As the Nvidia (NVDA) share price chart shows, the stock fell below $177 during yesterday’s session, marking its lowest level since the start of 2026.

Negative market sentiment is largely driven by uncertainty surrounding supplies to China. According to the Financial Times, Nvidia’s sales of H200 chips to China are still awaiting final approval from US authorities.

Yesterday’s statement from AMD, noting that the scale of its own shipments to China remains uncertain, reinforced these concerns and added further pressure to Nvidia shares. Previously, NVDA had been supported by expectations that deliveries of H200 chips to Chinese partners would begin in early 2026.

In addition, some media reports suggest that the stock is facing extra pressure from news of delayed investment in OpenAI, which is reportedly exploring alternative suppliers.

Technical Analysis of the Nvidia (NVDA) Chart

On 23 December, when analysing NVDA price action, we:

→ reaffirmed the long-term ascending channel, which remains intact;

→ suggested that bulls might attempt to break out of the corrective pattern (shown in red) in order to reach the channel median.

As expected (indicated by the black arrow), the price reached this target. However, January’s price behaviour offers little evidence that the uptrend has resumed with renewed strength.

Moreover, the red arrows highlight several bearish signals:

→ the median acted as clear resistance;

→ the 30 January peak (the highest level since the start of the year) formed with a long upper shadow, resulting in a false break of the previous high — a classic “bull trap”.

While bearish momentum appears to be in control, it is worth noting that:

→ the break below the 20 January low could also prove to be false;

→ the lower boundary of the channel, which has acted as key support for many months, is nearby.

Taking all of this into account, it is reasonable to assume that NVDA may find a period of consolidation in the lower quarter of the channel. A potential catalyst for the next major move could be the company’s earnings release scheduled for 25 February.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

ProShares introduces first CoinDesk 20 Crypto ETF under ticker KRYP

ProShares unveiled the first U.S.-listed exchange-traded fund (ETF) designed to target the performance of the CoinDesk 20 Index, expanding options for investors seeking broad exposure to crypto markets.

The CoinDesk 20 Crypto ETF (KRYP) is the first ETF tied to the benchmark of 20 of the largest and most liquid digital assets, ProShares said in a Wednesday email.

The index is market-capitalization weighted, subject to caps, and rebalanced quarterly, aiming to provide diversified exposure while limiting concentration in any single cryptocurrency.

“As the cryptocurrency market has matured, investors have increasingly looked beyond single-asset exposure,” CEO Michael Sapir said in a statement, describing KRYP as a way to access the broader asset class through one ticker.

The CoinDesk 20 selects assets from the top 250 by market cap, applying liquidity and exchange-listing requirements, while excluding stablecoins, memecoins, privacy tokens and various wrapped or pegged assets.

ProShares already offers one of the largest suites of crypto-linked funds in the U.S., with 13 ETFs and additional mutual fund products.

Crypto World

DeepSnitch AI Holders Capitulate to Join Digitap ($TAP) Presale: Best Crypto to Buy

Market behavior during drawdowns often forces a hard reset. Tools that help traders react faster lose relevance when volatility compresses opportunity, and liquidity dries up. This is why attention is moving away from analytics-heavy platforms toward structures that preserve value and generate utility regardless of market direction.

For DeepSnitch AI holders, the current environment has created a clear inflection point. Capital is rotating out of signal-based products and into fixed-entry opportunities with real usage and cash-flow logic.

That rotation explains why Digitap ($TAP) is seen as the best crypto to buy now, positioned as a defensive crypto presale built for recessionary conditions. As risk appetite contracts, the conversation around altcoins to buy favors platforms that move money, not just data.

Why DeepSnitch AI Holders Should Move to Digitap

DeepSnitch AI was built to solve information asymmetry. Its AI-driven agents monitor wallets, contracts, liquidity shifts, and sentiment across multiple chains, delivering alerts designed to improve trading outcomes. In active markets, that value proposition resonates. In slow, risk-off conditions, actionable signals become scarce, and analytics lose leverage as capital prioritizes preservation over precision.

The platform’s reliance on constant market activity creates a dependency on volatility. When fewer trades occur and narratives stall, demand for premium alerts softens. Token utility becomes concentrated around access rather than economic throughput, leaving holders exposed to sentiment cycles rather than structural demand.

Digitap operates from a different foundation. Instead of optimizing decision-making within the market, it serves as infrastructure for price discovery outside the market. Payments, settlements, conversions, and storage continue regardless of volatility. That distinction matters when trading edges compress and capital seeks stability over timing.

For holders exiting signal-based exposure, Digitap represents a pivot from observation to utility. It facilitates day-to-day financial operations, creating demand that does not rely on speculation. This independence is why capital migration is accelerating.

How Digitap Works and What It Actually Is

Digitap is the world’s first omni-bank, designed to unify crypto and traditional finance within a single platform. It allows users to quickly exchange crypto for fiat and fiat for crypto, bridging on-chain assets with real-world banking rails through a live, downloadable app.

At the core of the ecosystem sits the $TAP token, built around fixed supply and utility-driven demand. Total supply is capped at 2 billion tokens, with no inflation, no buy or sell tax, and no hidden minting mechanisms. Circulating supply is engineered to move in one direction only: downward, as buyback and burn activity removes tokens from the market.

$TAP is woven directly into platform functionality. The token powers staking programs, unlocks fee discounts, enables governance participation, and grants access to premium account tiers. $TAP functions as the economic engine of the ecosystem.

Demand for $TAP is tied to usage of the platform itself, not to market sentiment or trading frequency. As the app scales, token utility scales alongside it.

Crypto Presale Structure, Fees, and Real Usage

Digitap’s relevance increases in recessionary conditions, where fees and friction compound financial stress. Traditional remittance channels often charge more than 6% per transfer. Digitap compresses cross-border costs to under 1%, keeping more value in circulation and reducing erosion during periods of economic pressure.

The platform also serves freelancers and remote earners who receive income in crypto. Funds can be converted to cash and routed toward rent, utilities, or daily expenses without navigating multiple applications or intermediaries. This turns crypto into spendable income rather than dormant capital.

Privacy and flexibility are embedded through a tiered KYC structure. No-KYC wallet options coexist with higher-limit accounts, allowing different levels of access without forcing a single compliance model. Offshore banking partnerships further reduce geographic concentration risk.

The current crypto presale price stands at $0.0467, with the next stage set at $0.0478 and a defined listing price of $0.14. This staged structure introduces predictability at a time when most assets lack clear valuation anchors. Nearly $5 million has been raised, with more than 213 million tokens sold.

Why $TAP Is the Best Altcoin to Buy Now

The market is no longer rewarding speed or signal density. It is rewarding resilience. Platforms that generate economic value outside price speculation are gaining ground as liquidity remains constrained and volatility fails to translate into opportunity.

Digitap fits this environment precisely. It replaces high-frequency decision-making with structural utility, positioning itself as a financial layer that functions regardless of market direction. That is why it continues to surface in discussions around the best crypto to buy now.

Compared to analytics-driven tokens, $TAP benefits from real usage cycles tied to payments, remittances, and income conversion. This creates persistent demand and separates it from assets dependent on trader sentiment.

As capital rotates out of reactive tools and into foundational infrastructure, Digitap’s presale structure amplifies its appeal. With fixed pricing, growing adoption, and clear economic logic, $TAP defines what a crypto to buy now looks like in defensive conditions.

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Top AI Crypto Wallet Development Companies in 2026 for Serious Businesses

Investors with enterprise ambitions need more than marketing slides and checklists. They need clarity about which Web3 crypto wallet providers can deliver secure, compliant, and future-proof infrastructure that supports scalable revenue models. In 2026, the winning wallet partners combine hardened cryptography, account abstraction for superior UX, and production-grade AI that meaningfully reduces operational risk and customer friction. This article is written for well-informed investors evaluating strategic bets in web3 infrastructure. It focuses on technical differentiators, observable production capabilities, and the commercial trade-offs that matter when moving from proof of concept to live financial rails. Read on for a concise technical framework, the top vendor shortlist, a head-to-head feature comparison, and a rigorous 10-question crypto wallet development company evaluation.

Why 2026 Is a Defining Year for AI-Smart Crypto Wallets?

The market dynamics making 2026 pivotal are technical, regulatory, and behavioral. On the technical side, account abstraction and smart account primitives have matured into usable production tooling, enabling programmable wallets that solve long-standing UX and recovery problems. This shift changes how cryptocurrency wallet solutions are built and consumed because it decouples signature management from the user experience and enables sponsored gas, batched operations, and policy-driven approvals. At the same time, multi-party computation and threshold signature schemes are moving from academic proofs into operational custody solutions, offering enterprises key-management alternatives that reduce single-point risk and regulatory exposure.

AI is no longer an experimental add-on. Leading teams embed machine learning for real-time anomaly detection, risk scoring, and personalized usage assistance, which materially lowers fraud losses and onboarding friction. Finally, enterprise demand is rising as financial institutions and high-net-worth services adopt tokenized assets and require wallets that can integrate with existing KYC, treasury, and audit systems. The intersection of account abstraction, MPC-class key management, and production AI is why investors should re-evaluate wallet vendors in 2026 with technical scrutiny.

Top 7 AI Cryptocurrency Wallet Development Companies of 2026

1. Antier Solutions

Antier has evolved into a platform-first provider for enterprise crypto wallets that fuse production AI, multi-model custody, and broad chain interoperability. Their white-label AI smart crypto wallet product emphasizes intelligent transaction processing, behavioral recovery flows, and predictive risk analytics designed for high-compliance environments. Antier presents architecture and runbook artifacts aimed at enterprise buyers, showing an operational approach to MPC and hybrid custody and clear support for multi-chain EVM ecosystems. For investors, Antier’s strength is not only in delivery speed but also in a repeatable architecture that embeds AI into the signing and policy layers so that fraud detection, onboarding automation, and recovery are measurable features rather than add-ons. This makes Antier the most compelling partner for institutional-grade wallet infrastructure.

2. Oodles Blockchain

Oodles brings a decade of blockchain engineering to mobile crypto wallet development projects with a service model built for custom enterprise implementations. Their wallet practice focuses on cross-platform wallets, DeFi integrations, and NFT support, and they have published explorations of AI in wallet monitoring and personalized insights. Oodles is strongest where deep integration with enterprise systems is required, including payment rails and legacy back ends. For investors, this firm is a reliable engineering house capable of producing robust non-custodial and custodial wallets quickly; their AI positioning is currently oriented toward transaction monitoring and fee optimization rather than embedded MPC. Use Oodles when you need platform engineering and rapid, audit-ready delivery for multi-chain wallets.

- Real-time transaction monitoring with rule-based AI alerting.

- Fee optimization suggestions driven by transaction pattern analysis.

- Personalized in-wallet recommendations using market and user signals.

- Integration patterns for embedding AI outputs into enterprise reporting.

Choose Wallet Infrastructure That Scales With Demand

3. PixelPlex

PixelPlex positions itself at the intersection of blockchain and intelligent assistants, offering wallets that act as “co-pilots” for users. Their public material highlights proactive scam detection, predictive insights for asset management, and an emphasis on UX that reduces human error in transactions. This renowned crypto wallet provider has experience scaling projects and building wallet layers that integrate with exchanges, DeFi rails, and custodial services. From an investor standpoint, PixelPlex is attractive where productized AI features, such as proactive scam alerts and contextual recommendations, are required alongside professional-grade engineering and proven delivery for consumer and institutional clients. Expect a strong UX and AI pairing, but validate custody model specifics for enterprise risk tolerance.

- Client-side assistive AI that reduces user error and improves retention.

- Proactive scam detection leveraging behavioral and network signals.

- Predictive portfolio insights that feed in-wallet recommendations.

- Plug-and-play AI modules for rapid feature integration.

4. BlocktechBrew

BlocktechBrew is a pragmatic wallet developer focused on white-label blockchain wallet apps with a strong emphasis on security and time to market. Their offering is oriented toward entrepreneurs and enterprises seeking complete wallet stacks, browser extensions, and mobile clients. BlocktechBrew’s AI footprint is currently focused on analytics and automated security checks that are integrated into the development lifecycle. For investors, the company represents a cost-effective engineering partner able to deliver MVPs and iterate rapidly; their strength is execution velocity rather than platformized AI governance. For portfolio companies that need fast, secure shipping of wallet products with AI-powered monitoring, BlocktechBrew is a sensible operational choice.

- Automated security and integrity checks during development and CI.

- Transaction analytics modules for post-deployment monitoring.

- White-label AI hooks for swapping in enterprise models.

- Lightweight fraud detection pipelines for early production stages.

5. BlockchainX

BlockchainX markets end-to-end Web3 cryptocurrency wallet solutions and white-label products aimed at businesses that need rapid deployment and rebranding. Their products emphasize multi-asset support and customization for local regulatory environments. BlockchainX is best for enterprises that want a full productized wallet stack with roadmap acceleration rather than heavy R&D in cryptographic custody. Their AI claims are more conservative and typically implemented as analytics and reporting layers to aid compliance and support teams. Investors should view BlockchainX as a commercial, modular provider suitable for scaling standard wallet features quickly across geographies.

- Compliance and reporting dashboards powered by analytics.

- Customer support augmentation via AI-summarized event logs.

- Automated KYC/AML signal enrichment feeding the wallet audit trail.

- Configurable AI alerts for operational monitoring.

6. Rapid Innovation

Rapid Innovation focuses on secure blockchain wallet development with an emphasis on UX, authentication, and integrations for web and mobile. Their public material highlights features such as multi-factor authentication, QR flows, and session controls. Rapid Innovation complements AI with applied analytics and automation that strengthen onboarding and reduce support costs. For investors, Rapid Innovation is a reliable engineering partner when robust authentication and solid engineering practices are primary goals and when you prefer to integrate third-party or bespoke AI services. Verify their custody posture and ask for AI performance metrics during diligence.

- AI-assisted onboarding flows to reduce drop-offs.

- Analytics-driven session and fraud detection.

- Modular AI connectors for third-party risk engines.

- Emphasis on secure authentication with AI-backed anomaly detection.

How Does Antier Stand Out From Other Vendors?

In 2026, market leaders will be defined by products users actually adopt, not those that are merely deployed. We build with that outcome in mind.

You must have heard Investors asking often, what does a company they hire bring them that others do not? Well, Antier has all the answers to it. Below is the curated list of capabilities that Antier holds rather than marketing claims.

| Feature area | Antier | Typical other vendors |

|---|---|---|

| AI-powered transaction analytics | Productionized predictive analysis & UX personalization. Public docs reference AI-native wallet modules. | Most vendors offer fraud detection or analytics, but many present these as integrations or roadmaps. |

| Key management options | Multi-model: seedless experiences, MPC and hybrid custody options, enterprise recovery flows. | Predominantly, seed phrase, multisig, HSM options. Few demonstrate integrated MPC in public collateral. |

| Multi-chain support | Claims broad EVM coverage and chain integrations; designed for cross-chain wallet UX. | Many vendors support multiple chains but often with narrower out-of-the-box integrations. |

| Account abstraction readiness | Focus on smart-wallet flows and sponsored transactions | Many provide ERC-4337 support as part of engineering engagements, but adoption varies. |

| Enterprise compliance & audit support | Emphasizes enterprise controls, audit readiness and recoverability | Most firms offer integration support; investors should request SOC2 and third-party audit evidence |

| Turnkey vs custom | Balance of white-label products and custom integrations | Several vendors focus primarily on white-label or custom, based on business needs |

It is always suggested that you partner with an experienced team of blockchain experts who are adept at crafting impactful and successful customized cryptocurrency wallet solutions.

How to Evaluate a Wallet Development Company in 10 Questions?

For investors doing diligence, these 10 technical and operational questions reveal whether a crypto wallet service provider is enterprise-grade or merely marketing-first.

- What is your key management model in production, and can you provide architecture diagrams and a failure mode analysis?

- Do you offer MPC or TSS-based signing? If so, provide a public audit or third-party review.

- How do you support account abstraction and ERC-4337 user operations? Provide sample UserOperation flows and bundler integration details.

- How is AI used in the stack, and what are measurable production outcomes for fraud reduction or onboarding improvements?

- Which chains and L2s are supported natively, and what is the process to integrate new chains?

- Provide SOC2 type II, ISO, or third-party audit evidence and recent penetration test results.

- What are your SLAs for transaction throughput, incident response, and key compromise scenarios?

- How is regulatory compliance built in, specifically AML tooling, on-chain metadata retention, and explainability for AI decisions?

- What is the upgrade and migration path for wallet contracts and key-management components?

- Provide client references where you implemented a production wallet with live volumes, and share anonymized KPIs.

Use these answers to rank vendors against the architecture and risk appetite of the target business.

Final Verdict: Choosing Antier for Serious Business Impact

For institutional investors and enterprise product owners, architecture and operational proof trump feature lists. Prioritize crypto wallet development companies that can demonstrate production MPC or hardened custody, an ERC-4337 smart account strategy, and measurable AI outcomes for fraud and UX.

Antier, as positioned in public product material, claims mature AI wallet modules, multi-chain coverage, and enterprise controls; these are the traits investors should seek and verify.

Our experience building and advising regulated web3 projects shows the following pattern. Projects succeed when businesses choose partners who deliver three things: a security-first signing model, programmable accounts for frictionless UX, and an AI stack that is auditable and measurable. Legal and compliance expertise is critical during architecture and vendor selection because custody, AML, and data residency requirements directly influence design choices. We help institutional teams navigate these trade-offs by validating cryptographic proofs, confirming audit evidence, and shaping deployment plans that map to local regulatory regimes. If you are evaluating strategic investments into blockchain wallet development infrastructure, focus your diligence on architecture diagrams, third-party audits, and production AI performance. Those artifacts distinguish long-term infrastructure from short-term launches.

Let’s move from intent to execution. Talk to our experts to understand where and how to begin.

Frequently Asked Questions

01. Why is 2026 considered a pivotal year for AI-smart crypto wallets?

2026 is pivotal due to advancements in account abstraction, smart account primitives, and the integration of AI for real-time anomaly detection and risk scoring, which enhance user experience and reduce operational risks in cryptocurrency wallet solutions.

02. What are the key technical differentiators investors should consider when evaluating crypto wallet providers?

Investors should focus on hardened cryptography, account abstraction for improved user experience, production-grade AI capabilities, and the ability to integrate with existing KYC, treasury, and audit systems.

03. What does the article provide for investors looking to evaluate crypto wallet development companies?

The article offers a concise technical framework, a shortlist of top vendors, a head-to-head feature comparison, and a rigorous 10-question evaluation guide for assessing crypto wallet development companies.

Crypto World

Canaccord slashes price target as stock tumbles to multi-year low

With crypto winter clearly having set in, bulls are now left looking for signs that the bearishness has become so embedded that a bottom might form.

One case in point might be a note from Canaccord’s Joseph Vafi on Wednesday, slashing his price target on Strategy (MSTR) by a whopping 61% to $185 from $474.

Vafi, who lifted his outlook on Strategy as recently as November (to that $474 level), still maintains a buy rating on the stock, and his new $185 target suggests about 40% upside from last night’s close of $133.

Strategy is now down 15% year-to-date, 62% year-over-year, and 72% from its record high in November 2024.

Bitcoin, said Vafi, is in the midst of an “identity crisis,” still fitting the profile of a long-term store of value but increasingly trading like a risk asset. That tension came into focus during October’s crypto flash crash, when forced liquidations accelerated selling.

Though frequently cast as “digital gold,” bitcoin has failed to keep pace with the recent surge in precious metals, he continued. As gold has climbed on geopolitical tensions and macro uncertainty, bitcoin has lagged, underscoring its ongoing dependence on liquidity and risk appetite rather than safe-haven demand.

Strategy is built to weather volatility, the report said. The company holds more than $44 billion in bitcoin against roughly $8 billion in convertible debt, including a $1 billion tranche puttable in 2027 that remains in the money. Preferred dividends are manageable through modest share issuance, even with MSTR’s market cap no longer commanding much of a premium to the value of its BTC holdings.

Quarterly results are coming this week, but they have become largely immaterial given Strategy’s near-complete dependence on BTC, Vafi continued. A sizable unrealized loss tied to bitcoin’s fourth-quarter selloff is expected.

Vafi’s new $185 target assumes a 20% rebound in bitcoin prices and a recovery in the company’s mNAV to about 1.25x.

Read more: ETF that feasts on carnage in bitcoin-holder Strategy hits record high

Crypto World

Bitcoin Price Falls to a New Low

As the BTC/USD chart shows, prices dropped below $74,000 yesterday. This marks the lowest level since November 2024, when the cryptocurrency was rallying on news of Trump’s election victory.

At the same time, sentiment indicators are signalling “extreme fear” across the market. This was reinforced by the break below the key April 2025 low near $74,450.

The media has been circulating increasingly alarming headlines:

→ Michael Burry, well known for his bearish calls, has suggested that a drop below the $70k level could create problems for the largest coin holder, MicroStrategy (MSTR);

→ Matt Hougan, Chief Investment Officer at Bitwise, warns that the market may be heading for a “full-blown” crypto winter rather than a simple correction.

Technical Analysis of the BTC/USD Chart

The price continues to move further away from the support level whose break we highlighted on 30 January.

At the same time, the market appears extremely oversold:

→ the price has fallen below the lower boundary of the previously drawn descending red channel;

→ the RSI indicator is forming bullish divergences.

Under these conditions, it is reasonable to assume that the market may be setting up for a technical rebound. This scenario looks particularly plausible given the scale of long position liquidations — around $2.5 billion were wiped out on 31 January alone.

If a recovery does unfold, a key test of bullish intent will be the psychological $80k area, where bears previously held clear control while breaking below the lower boundary of the descending channel.

FXOpen offers the world’s most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service (additional fees may apply). Open your trading account now or learn more about crypto CFD trading with FXOpen.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Survey Shows Crypto Investors Favor Infrastructure Over DeFi

A survey of senior crypto investors and executives suggests capital priorities are shifting away from decentralized finance (DeFi) and toward core infrastructure, as decision-makers focus on liquidity constraints and market plumbing.

The findings come from a new report published by the digital asset conference CfC St. Moritz, based on responses from 242 attendees of its invitation-only event in January. Respondents included institutional investors, founders, C-suite executives, regulators and family office representatives.

According to the survey, 85% of respondents selected infrastructure as their top funding priority, ahead of DeFi, compliance, cybersecurity and user experience.

While expectations for revenue growth and innovation remain broadly positive, respondents flagged liquidity shortages as the industry’s most pressing risk. The results suggest that investor interest remains, but capital deployment is becoming more selective.

Infrastructure takes priority as liquidity concerns persist

Respondents pointed to market depth and settlement capacity as key bottlenecks preventing larger pools of institutional capital from entering crypto markets.

About 84% of respondents described the macroeconomic backdrop as better than neutral for crypto growth, though many said existing market infrastructure remains insufficient for large-scale capitalization.

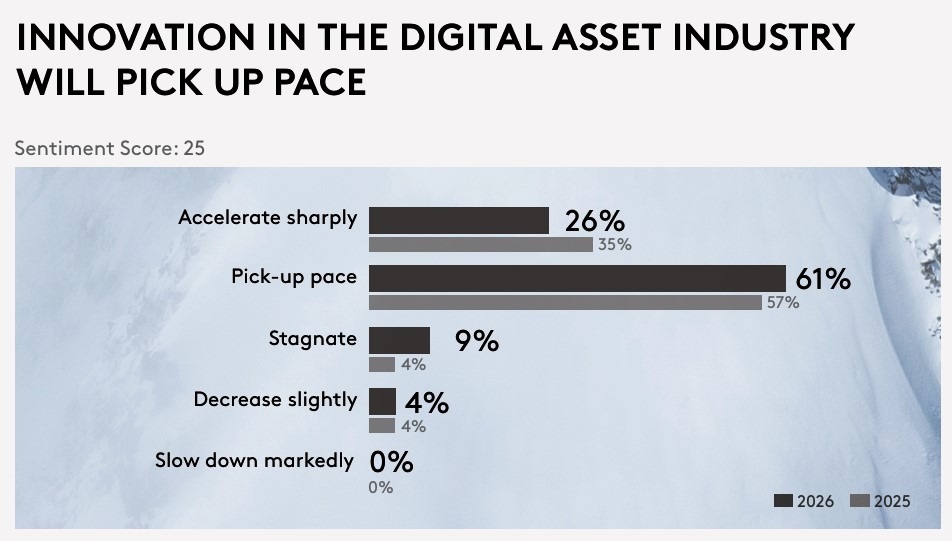

The survey also showed a change in innovation expectations. While a majority expects innovation to accelerate in 2026, fewer respondents anticipate a sharp increase compared to last year, suggesting a shift away from more speculative expectations toward execution-focused development.

This shift aligns with broader industry trends, including a focus on custody, clearing, stablecoin infrastructure and tokenization frameworks rather than consumer-facing applications.

Related: CoreWeave shows how crypto-era infrastructure quietly became AI’s backbone

US sentiment improves as IPO expectations cool

The survey found a sharp improvement in perceptions of the US regulatory environment, with respondents ranking the country as the second-most favorable jurisdiction for digital assets, behind the United Arab Emirates.

CfC St. Moritz attributed the shift to stablecoin legislation and clearer rules for banks and regulated market participants.

At the same time, expectations for crypto initial public offerings cooled after what respondents described as a record year in 2025. While most still expect listings to continue, fewer expressed high confidence, citing valuation resets and liquidity constraints.

Magazine: Crypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye

Crypto World

Bitcoin Traders Eye 200-Week Trendlines for a BTC Price Bottom

Bitcoin (BTC) traders see its ultimate support trendline coming into play as part of a new macro BTC price bottom.

Key points:

-

Bitcoin is nearing a long-term trendline retest for the first time since late 2023.

-

Weekly moving averages are on the radar as a BTC price safety net should the market fall again.

-

Market outlooks place emphasis on trader resilience despite a 40% drawdown.

BTC 200-week trend line “should be the bottom”

The latest analysis increasingly expects Bitcoin to test its 200-week exponential moving average (EMA) at $68,400.

After four straight red monthly candles, BTC price is fielding fresh downside targets, which include sub-$50,000 levels.

Despite dropping to its lowest levels since late 2024 this week, BTC/USD may be rescued by classic support trend lines in the end.

“We’re currently trading at Strategy’s cost basis & are close [to] the April lows at $74.4k. If we break below, the next key level is $70k which is just above the previous ATH of $69k,” Nic Puckrin, CEO of crypto education resource Coin Bureau, wrote in an X post Wednesday.

“Breaking below that means we head to a bear market low target. The area to watch here $55.7k – $58.2k. That’s just between the average realised price of all coins & the 200w MA. That should be the bottom.”

Puckrin referenced the 200-week simple moving average (SMA), which forms a $10,000-wide support band with the EMA equivalent, data from TradingView shows.

Trader Altcoin Sherpa, meanwhile, said that it would “make sense” for the price to drop to at least the 200-week EMA.

on 1 hand it makes sense for $BTC to tap the 200W EMA, an indicator that hasn’t been touched since 2023. This would be around 68k.

On the other, this is still an interesting level as the 2025 low.

Either way, the bottom is closer than we think imo pic.twitter.com/93DO4s4qlu

— Altcoin Sherpa (@AltcoinSherpa) February 4, 2026

“Every time Bitcoin has lost 100W EMA, it has retested the 200W EMA,” trader BitBull continued on the topic.

“Right now, 200W EMA is at $68,000 and this will most likely be retested. Once the retest happens, you could start accumulating for the long-term.”

Bitcoin investors resist full capitulation

Other market synopses are also offering hope to panicking BTC investors.

Related: BTC price heads back to 2021: Five things to know in Bitcoin this week

Fresh analysis released Tuesday by Matt Hougan, chief investment officer of crypto asset manager Bitwise, predicted that the current “crypto winter” would soon be over.

“Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while,” he argued, noting that the average “winter” lasted around 14 months.

Cointelegraph further reported on strong conviction among Bitcoin derivatives traders after enduring a drawdown of more than 40%.

The US spot Bitcoin exchange-traded funds (ETFs) have seen net outflows of $3.2 billion since mid-January — just 3% of their total assets under management.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech7 hours ago

Tech7 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World16 hours ago

Crypto World16 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards