Business

Mortgage Broker, Real Estate Agent, and Insurance Professional

Mohit Seth is a seasoned finance expert and the founder of MAAK Finance Ltd., a mortgage practice known for its clear, client-focused advice.

Based in Canada, Mohit works as a Mortgage Broker, Real Estate Agent, and Insurance Professional, offering a well-rounded perspective on property financing and financial protection.

Originally from Lucknow, India, Mohit earned a Master’s in Mathematics before moving to Delhi to complete a Master’s in Finance. These academic foundations gave him a sharp, analytical approach to decision-making. He began his career at ICICI Bank, where he rose quickly through the ranks. He later moved to Canada and joined TD Canada Trust, where he worked as a Small Business Advisor, earning top-performer honours across the Prairie region.

In 2014, Mohit shifted to mortgage brokering, and by 2022 he launched his own independent firm. His work spans residential and commercial mortgages, and he often helps first-time buyers, property investors, and small business owners find smart, long-term solutions. His knowledge of banking, real estate, and insurance allows him to offer end-to-end advice, tailored to individual needs.

Clients trust Mohit Seth for his calm, methodical approach and his commitment to explaining things clearly. “There’s no such thing as a bad question,” he often says.

Outside of work, he enjoys reading about markets, staying active, and spending time with family. Mohit is also a quiet supporter of community causes and financial education.

Q&A:

What led you into the world of finance?

I’ve always enjoyed problem-solving. I studied mathematics first—it taught me how to approach things logically. Later, I added a Master’s degree in finance to better understand how the world works in real terms. That mix of theory and application was a good fit for banking. I started with ICICI Bank in India and worked my way up.

What were those early years in banking like?

Fast-paced. ICICI taught me a lot. I began as a Loans Manager and eventually became a Cluster Manager. I handled credit, risk, and client relationships across branches. It was very hands-on. I remember once helping a small business owner restructure his loan when his inventory was hit by flooding. It wasn’t just about numbers—it was about listening, finding options, and helping someone stay afloat.

When did you move to Canada?

In 2009. I wanted to broaden my horizons. I joined TD Canada Trust and worked as a Financial Advisor, then a Small Business Advisor. That gave me a chance to understand a whole new market. I learned quickly that trust matters here even more. Clients wanted transparency and someone who could break things down simply.

What did you enjoy most about working with clients directly?

Seeing them succeed. Especially first-time homebuyers or small business owners. When I was at TD, I was lucky to be ranked among the top 20 investment consultants in the Prairie Region. But it was always the client calls later—when someone moved into their new place or expanded their business—that meant the most.

What made you shift into mortgages and self-employment?

By 2014, I wanted to offer more than what the banks allowed. At Mortgage Alliance, and now independently with MAAK Finance, I can source options from across lenders. I’m not tied to one product. That lets me focus on solutions that actually fit the person sitting across from me. A good mortgage isn’t about the rate alone—it’s about the right structure for the life someone’s building.

What does a typical client interaction look like for you now?

First, I listen. I ask a lot of questions. People often come in thinking they know what they need. But sometimes they’re reacting to what a friend said or something they saw online. My job is to get a full picture—income, goals, comfort level—and then build from there.

You’re also licensed in real estate and insurance. Why wear so many hats?

Because life doesn’t happen in silos. Someone buying a home usually needs financing. They might also need mortgage protection or life insurance. Sometimes they’re also selling a property or investing in another. Being able to offer support across all of that makes the process smoother for them—and more complete.

What’s changed in the industry since you started?

Access to information. Clients do a lot of research now, which is great. But it also means more confusion. There are online calculators that aren’t accurate, outdated advice, and one-size-fits-all ideas being treated like rules. My role has shifted toward helping people interpret and apply what actually matters to their case.

What’s something people often overlook when it comes to financing?

Preparation. I always tell clients to review their credit reports, organise documents, and understand their affordability range before falling in love with a home. It saves disappointment. Also, people forget that lending rules vary across lenders—even slightly—so working with someone who understands the full landscape can make a big difference.

What’s a recent professional moment you’re proud of?

Helping a family navigate a complex refinance during a tough time. They were between jobs, had growing children, and needed flexibility. We found a structure that gave them breathing room. Later, they told me it helped them avoid selling the house. That kind of impact sticks with you.

Outside of work, what keeps you grounded?

Reading. I like finance books and global economic trends. I also walk a lot—it clears my head. And spending time with my family. My children help me see things simply again. That’s helpful in this line of work.

You’ve received multiple awards over the years—how do you define success now?

Consistency. Not every deal is big. But if you show up, communicate clearly, and deliver on your word, people remember. Many of my clients have come through referrals or returned after years. That kind of trust is earned day by day.

What advice would you give to someone entering this industry?

Keep learning. Stay humble. And never assume two clients are the same—even if their numbers are. This is a people-first business.

Final Thoughts

Mohit Seth’s approach is built on substance. With over a decade of banking experience, deep academic training, and a multi-licensed practice, he brings both range and rigour to every client interaction. As finance evolves, so does he—always listening, always learning, and always focused on what matters most to the people he serves.

Business

Form 144 TFS FINANCIAL CORPORATION For: 4 February

Form 144 TFS FINANCIAL CORPORATION For: 4 February

Business

Perdaman progresses 50MW solar farm near Karratha

A Perdaman-backed solar farm looks set to become the foundation tenant of a traditional owner-backed green energy park near Karratha.

Business

Vacant Perth lot earmarked for office, dwellings in $10m plan

A vacant strip of land in Northbridge has been earmarked for an eight-storey office and apartment building.

Skypacts Property Resources has submitted a $10 million plan to build a mixed-use development on 441 William Street.

The 508-square metre lot, currently an unoccupied infill site, sits next to the Perth Mosque and is bound by William Street and Brisbane Place.

According to Skypacts’ application filed with the City of Vincent, the proposed development comprises offices and associated parking from the first to the fourth floor, and nine apartments across the upper levels.

Lateral Planning, on behalf of Skypacts, said the project would be a high-quality development on an underutilised infill site.

“Overall, the proposed development will not detract from the amenity of the area rather, it will significantly enhance it,” the application said.

“It represents a positive, forward-looking contribution to the locality, by supporting strategic planning goals, and promoting sustainable urban growth.”

RP data shows Skypacts bought the site for about $2.5 million in 2022.

Skypacts Property Resources is owned by Kian Kiong Lee and has a registered address in Nedlands, according to an Australian Securities and Investments Commission document.

About 600 metres away, another vacant Northbridge lot was flagged for development.

A 480-square metre site at 195 Beaufort Street, next to the Ellington Jazz Club, has been vacant for about 20 years.

In May 2024, a development assessment panel approved a $2.4 million proposal to build a four-storey apartment and retail project on the site.

However, the site, with the attached development application approval, was recently listed on the market.

Business

Ford and Geely in talks for manufacturing, technology partnership, sources say

Ford and Geely in talks for manufacturing, technology partnership, sources say

Business

Analysis: Fiscal realities rein in US’s aggressive Nordic ambitions

ANALYSIS: The negative response of financial markets dissuaded the US president from pursuing his designs on Greenland.

Business

Pinterest sacks engineers for tracking layoffs

The social media platform announced last week that it was laying off around 15% of its workforce.

Business

Brokerages May Start Charging ETF Issuers Distribution Fees, Says J.P. Morgan

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

Business

Analysis-Ultra-low bond spread unity still out of reach for euro area

Analysis-Ultra-low bond spread unity still out of reach for euro area

Business

Opinion: Net downside in fishing bans

OPINION: The state government may have hooked itself with what looked like an easy political decision.

Business

Airbnb: Hotel Expansion Is Promising, But The Valuation Leaves Little Room For Error

Airbnb: Hotel Expansion Is Promising, But The Valuation Leaves Little Room For Error

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat23 hours ago

NewsBeat23 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World8 hours ago

Crypto World8 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

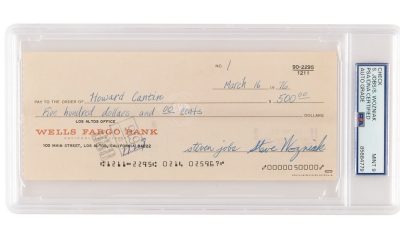

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined