Business

Nearly two dozen more prisoners freed in Venezuela, legal rights group says

Business

Asia Dominates Global Digital Hardware Trade with Key Electronic Components

Nearly 80% of the world’s information and communications technology goods now originate from Asia, according to new trade data released by the United Nations Conference on Trade and Development (UNCTAD), underscoring the region’s overwhelming dominance in the backbone of the digital economy.

Key takeaways

- Asia produces nearly 80% of global ICT goods exports, with electronic components like chips and sensors driving growth while consumer electronics stagnate.

- Europe dominates ICT services exports with 57% market share, while Africa and Latin America combined account for just 2.5% of the $1.2 trillion global market.

- Developing countries risk permanent marginalization in digital trade without urgent investment in broadband infrastructure, digital skills, and supportive trade policies.

The findings, published on January 29, reveal that ICT products ranging from semiconductors to smartphones accounted for more than 12% of total global merchandise exports in 2024. This translates to over one dollar in every eight earned from international trade in goods coming from digital-enabling hardware.

Electronic Components Fuel Unprecedented Growth

The surge in digital trade has been primarily driven by electronic components, including microchips, circuit boards, and sensors, the invisible infrastructure powering everything from cloud computing and electric vehicles to renewable energy systems. Trade in these components has surged dramatically over the past 15 years, even as consumer electronics and other ICT products have stagnated.

“Electronic components are the invisible backbone of the digital economy,” UNCTAD stated in its analysis, emphasizing that countries capable of producing these components secure not only skilled jobs but also technology spillovers and more resilient export revenues.

The Digital Divide Deepens

While Asia’s manufacturing prowess continues to expand, the data exposes a stark global imbalance. Many developing economies remain confined to lower-value components or assembly operations, limiting their ability to capitalize on digital and energy transitions.

The disparity is even more pronounced in ICT services. Europe commanded 57% of the $1.2 trillion global ICT services export market in 2024, with Asia and Oceania capturing 33%. North America held 8%, while Africa, Latin America, and the Caribbean combined accounted for a mere 2.5%, less than $30 billion.

Digital Delivery Reshapes Trade Landscape

Trade in digitally deliverable products, services that can be transmitted remotely over computer networks, including telecommunications, consulting, healthcare, education, and digital media, grew 10% in 2024, reaching 56% of all global services exports.

Developed economies dominated this sector, exporting approximately $3.8 trillion worth of digitally deliverable products compared to $1.2 trillion from developing nations.

“Digital delivery eliminates the need for physical proximity between service suppliers and consumers, lowering traditional barriers to services trade,” UNCTAD noted. However, this advantage comes with a caveat: dependence on digital connectivity and skills creates new obstacles for countries with weaker digital infrastructure.

A Call for Strategic Investment

UNCTAD’s analysis warns that without targeted investment in broadband infrastructure, digital skills development, data governance frameworks, and supportive trade policies, many developing countries risk being permanently sidelined as digital trade deepens.

“The imbalances between developed and developing countries highlight persistent gaps in digital capacity,” the report emphasized. “Countries that fail to invest in their digital ecosystems risk remaining marginal players in one of the fastest-growing segments of global trade.”

As technological change accelerates and global trade undergoes structural transformation, the data reveals not just economic statistics but deeper stories about opportunity, inequality, and the shifting geography of economic power in the digital age.UNCTAD’s analysis issues a critical warning: without targeted investment in broadband infrastructure, digital skills development, data governance frameworks, and supportive trade policies, many developing countries risk permanent marginalization in an increasingly digital global economy. The report emphasizes persistent gaps in digital capacity, urging countries to invest in their digital ecosystems to avoid being sidelined from one of the fastest-growing segments of global trade.

Other People are Reading

Business

U.S. Oil Outlook: WTI In Focus With US-Iran Talks Cancelled

U.S. Oil Outlook: WTI In Focus With US-Iran Talks Cancelled

Business

Paul Weiss law firm Chairman Brad Karp resigns after Epstein emails released

Paul Weiss law firm Chairman Brad Karp resigns after Epstein emails released

Business

Australia says attempted bombing of national day protest was act of terror

Australia says attempted bombing of national day protest was act of terror

Business

Corporate DEI index sees 65% drop in participation from Fortune 500

People hold flags outside the US Supreme Court on December 4, 2024 in Washington, DC, during oral argument on whether states can ban certain gender transition medical treatments for young people.

Roberto Schmidt | AFP | Getty Images

New research from the LGBTQ+ group Human Rights Campaign showed a drastic drop in Fortune 500 companies willing to publicly disclose their diversity, equity and inclusion practices.

The HRC’s 2026 Corporate Equality Index saw a 65% drop in participation this year, falling from 377 Fortune 500 companies in 2025 to just 131 companies in 2026. HRC noted many of the companies that dropped out hold federal contracts.

“Our research shows the strength and the strain of this moment on LGBTQ+ workers, consumers and the companies that count on us,” HRC President Kelley Robinson said in a statement.

Of the 1,450 companies that participated, 534 earned a score of 100, representing nearly 6 million U.S. employees, according to HRC.

HRC’s index launched in 2002 and rates companies based on their social responsibility and equity in the workplace.

Over the past two years, the anti-DEI movement, championed by the White House, began to reframe the index, making it a conservative target.

The Corporate Equality Index has increasingly seen more companies exiting its orbit, beginning with Tractor Supply and including big names like Walmart, Ford and Lowe’s. Walmart, the largest U.S. retailer and grocer, said it had conversations with conservative activist Robby Starbuck, who has publicly advocated for a shift away from DEI, before the company pulled out.

It was a significant change from years prior, when companies like Ford and Walmart issued public statements supporting DEI and touting their achievements in their workplaces.

Business

Strong Thai Baht Influences 90% of Travelers’ Decisions

The Tourism Council of Thailand (TCT) conducted a “Tourism Business Confidence Index” survey in Q4 2025, involving 302 foreign tourists in Bangkok and Chonburi. The survey revealed that while overall safety concerns were moderate, specific issues like scams were highly problematic, and the strength of the Thai baht significantly influenced 90% of visitors’ travel decisions.

Key Points

- The strength of the baht significantly influences 90% of travel decisions, while end-of-year promotions impact 78%. Key development priorities include sustainable management (28%) and promoting local events (26%).

- Awareness about secondary-city tourism is moderate with 72% familiar, but interest varies: 36% want to visit, 51% are unsure, and 13% lack interest. Nearly half have visited, while 49% express interest in visiting.

- Tourists rated satisfaction highly in safety (4.12) and friendliness (4.01). Average spend per person in Q4 2025 was 51,286 baht for a 10.66-night stay, with European tourists spending the most (76,624 baht).

Key Visitor Concerns and Safety: Foreign tourists generally expressed moderate concern about travel safety, with average scores ranging from 2.96 to 3.34. However, certain areas generated higher anxiety:

- Top 5 Concerns:

- Tourist-targeted scams/fraud (e.g., taxi, tour company scams) – highest concern (score 3.44).

- Communication barriers with locals or emergency services (score 3.37).

- Quality of emergency medical services (score 3.31).

- Being exploited or asked for bribes by officials (score 3.31).

- Pollution (e.g., PM2.5 or haze) (score 3.21).

Bangkok Travel and Public Transport: Tourists expressed strong agreement that electric rail fares in Bangkok are too expensive (score 3.70). The main issues were repeated entry fees when switching lines (68%) and high single-trip fares for short distances (21%). A significant majority (over 71%) indicated they would purchase a reasonably priced Tourist Pass offering unlimited rides.

- Desired Improvements for the Rail System:

- English signage and information.

- Better value for money and fare levels.

- Improved connections and transfer links to other transport systems.

Awareness and Interest in Secondary City Tourism

A survey on secondary-city tourism revealed that the majority of respondents (72%) have a moderate awareness of this travel niche. Although 36% expressed a desire to visit secondary cities, 51% remained uncertain, indicating a need for increased outreach. Among the respondents, half had previously visited these cities, while another half expressed interest in doing so, illustrating a significant opportunity for tourism in these areas. Despite low levels of disinterest (only 2%), it’s clear that a large portion of potential visitors is still weighing their options.

Visitor Experiences and Spending Patterns

Tourists reported high satisfaction in their experiences in secondary cities, with a feeling of safety scoring the highest at 4.12 out of 5. Factors like friendliness towards foreigners and overall accommodation quality also received favorable ratings.

The average spending per trip in Q4 2025 peaked at 51,286 baht with European tourists reporting the highest expenditure. Independent travelers tended to spend more and stay longer than those opting for tour packages. Currency fluctuations and tourism promotions significantly influenced travel decisions for many respondents, highlighting the importance of cost-effectiveness in their choices.

Development Priorities and Influencing Factors

Respondents prioritized sustainable environmental management (28%) as the most critical factor for future development in secondary cities, followed closely by promoting local activities and improving transport services. Tourism promotions like the Amazing Thailand Countdown were credited with influencing travel decisions for 78% of participants. This underscores the importance of timely events in driving tourism momentum. The findings indicate that while there’s significant potential in secondary city tourism, effective marketing and supportive infrastructure will be essential for attracting and retaining visitors.

Other People are Reading

Business

Dow Jones And U.S. Index Outlook: Rebalancing Continues As Tech Dives

Dow Jones And U.S. Index Outlook: Rebalancing Continues As Tech Dives

Business

Grey Owl Capital Management Q4 2025 Client Letter

Donny DBM/iStock via Getty Images

Expansion create opportunity. – Anonymous

Dear Client,

The Grey Owl All-Season Strategy’s objectives are to minimize drawdowns, outperform short-term bonds by several hundred basis points each year (i.e., beat “cash”), and participate meaningfully in risk-on rallies. For the full year 2025, GOAS returned +11.4% and met each of these objectives.

We are particularly pleased with the strategy’s 2025 performance given how the year began. While the popular “Magnificent 7 (MAGS)” group of stocks declined roughly -30% from its December 17, 2024 peak to the April 8, 2025 low 1 , the Grey Owl All-Season (GOAS) portfolio was down less than -3% at its worst point in early April. The rebound that followed was rapid, and the year ultimately proved strong for most risk assets. GOAS managed risk during the drawdown and then repositioned to participate as conditions turned risk-on.

A few specifics below on the present environment and our current positioning, but first a more detailed review of the performance of the “primary” asset classes. 2

For the full year 2025, gold gained +63.7%, global equities rose +22.4%, U.S. equities followed closely at +17.7%, commodities increased 5.9%, and long-dated U.S. Treasury bonds returned +4.3%.

During the fourth quarter of 2025, precious metals continued to shine, with gold up another +11.5%. U.S. equities gained +2.7%, while global equities performed slightly better at +3.3%. Commodities were essentially flat, up +0.4%, and long-dated U.S. Treasury bonds declined -1.0%. Over this period, GOAS delivered a respectable +2.4% return.

As 2026 gets underway, a more dramatic shift may be developing. In 2025, technology and growth outperformed the broader market (i.e., the Nasdaq beat the S&P 500, finishing up +20.8%), while small-capitalization stocks lagged, ending the year up +12.7%. 3 That dynamic has changed meaningfully during the first three weeks of 2026.

As of the close on January 23, 2026, the “Magnificent 7” group was down -3.6% from its October 29, 2025, high and -0.5% year-to-date. In contrast, small-capitalization equities and commodities are significantly outperforming, up +7.6% and +7.4% year-to-date, respectively. GOAS is aligned with these prevailing conditions and is up +5.3% through January 23, 2026.

In short, our diversified, risk-managed approach delivered solid double-digit returns in 2025 while avoiding major drawdowns during early-year volatility. Today, we are positioned for meaningful economic growth in the U.S. and much of the rest of the world. We believe conditions now favor cyclical outperformance and a broadening of equity participation. That means overweight exposure to commodities and smaller-capitalization equities. As the charts below indicate, this phase may only persist through the first half of 2026. For now, that is the prevailing condition regardless of how long it lasts. We are prepared to adjust as conditions evolve.

Economic Growth

Hedgeye’s real GDP projection model shows a reacceleration in growth gaining significant momentum in the first quarter and continuing through much of the second quarter. As growth has accelerated, cyclical equities and commodities have outperformed. While this acceleration continues, we expect risk assets to continue performing well.

Figure 1 – GDP Projections

Economic growth is accelerating, which historically supports risk assets—particularly cyclical equities and commodities.

Inflation

Inflation expectations have been decelerating for several quarters, as evidenced by the five-year breakeven spread—often referred to as “the market’s” inflation forecast.

Figure 2 -5-Year Breakeven

Hedgelye’s CPI model corroborates this trend, projecting continued disinflation through the second quarter of 2026, followed by only a modest seven-basis-point increase in the third quarter. Combined with accelerating growth, this backdrop is favorable for risk-taking.

Figure 3 – Inflation Projections

A key driver of lower inflation has been the price of oil—one of the few major commodities not yet firmly in a bull market.

Figure 4 -US Crude Oil Spot

WTI). The chart shows a candlestick price history from 2018 to 2026. A red trendline is drawn across the chart, showing a general downward trend. The current price is $61.025 as of 06/30/19. The y-axis represents price in USD from 10.000 to 130.000. The x-axis shows time from 2018 to 2026. The chart includes technical indicators and a volume bar at the bottom.” width=”640″ height=”446″ loading=”lazy” srcset=”https://static.seekingalpha.com/uploads/2026/2/4/542689-1770260573389652_origin.jpg?io=w640 640w,https://static.seekingalpha.com/uploads/2026/2/4/542689-1770260573389652_origin.jpg?io=w480 480w,https://static.seekingalpha.com/uploads/2026/2/4/542689-1770260573389652_origin.jpg?io=w320 320w,https://static.seekingalpha.com/uploads/2026/2/4/542689-1770260573389652_origin.jpg?io=w240 240w” sizes=”(max-width: 767px) calc(100vw – 36px), (max-width: 1023px) calc(100vw – 180px), 552px”>

Inflation pressures remain contained, creating a favorable backdrop for risk-assets.

Broadening US Equity Market

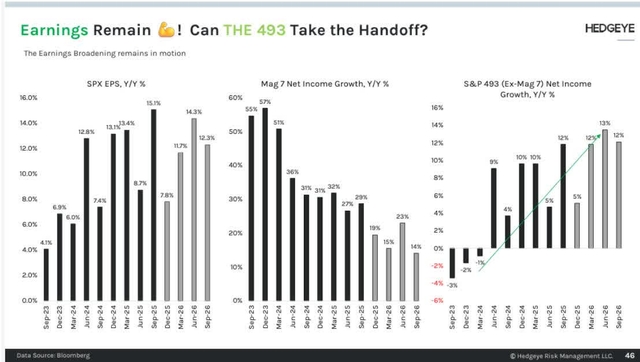

While the broader macro environment—accelerating real growth alongside disinflation—is critical to the rally’s expansion, sector-level dynamics are also playing an important role. Mega-capitalization technology companies are now facing more difficult year-over-year comparisons, as cycle-peak artificial-intelligence capital expenditures may be behind us, pressuring both revenue growth and margins.

The opposite is true for much of the rest of the market, particularly smaller-capitalization and cyclical businesses. With easier comparisons to last year, both revenues and margins are improving.

Hedgeye data show that while S&P 500 earnings are expected to continue growing, a greater share of that growth is coming from the “other 493” stocks.

Figure 5 – Earnings Projections

Market leadership is expanding beyond mega-cap technology, increasing opportunity across smaller and more cyclical companies.

Market Signals

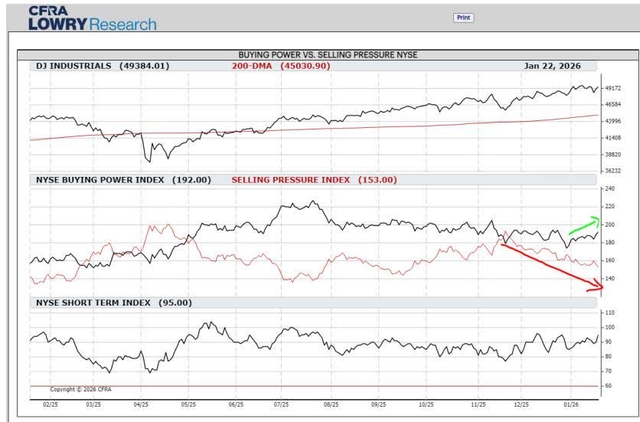

Last quarter we wrote:

Market internals also point to change beneath the surface. While large-cap indices hit new highs in the third quarter, participation was narrow—signs of enthusiasm were limited. In October, that pattern began to broaden as Buying Power improved and Selling Pressure eased. With Buying Power still stronger overall, we do not see a shift toward a risk-off environment. Instead, the data suggest equity markets are transitioning as investors respond to—and anticipate—changes in growth and inflation, opening the door for new leadership among sectors and styles.

That improvement and broadening has continued. Selling Pressure is receding, and Buying Power shows further signs of strengthening.

Figure 6

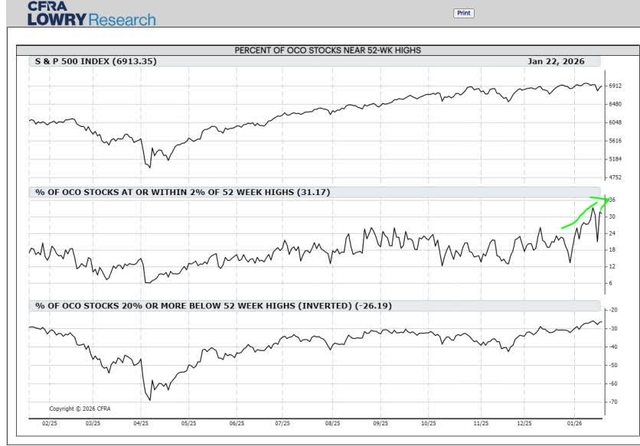

More granular market data look even better. Lowry’s writes:

While many investors and the financial media are focused on the cap-weighted price indexes, the Lowry Analysis is predominantly centered on the full market on an equal weighted basis, which is dominated by smaller stocks. The reason for this is simple: the greater the number of stocks participating in a market advance and displaying promising Demand trends, the more difficult it is for sellers to take control of the market. While such features do not make the market impervious to pullbacks, recent evidence continues to mount in favor of a broad and durable advance. Still, we would like to see these improvements reflected in our longer-term measures of market health to solidify our conviction in the bulls further.

In their most recent weekly report, Lowry’s emphasized the dramatic increase in the percentage of stocks within 2% of their 52-week highs.

Figure 7

Explaining the chart, Lowry’s wrote:

One method to view how many stocks are carrying the performance load within the market is our measure of Demand intensity, or the Percent of OCO1 Stocks At or Within 2% of 52-Week Highs. This is one of the more sensitive indicators in our suite, and on January 15, it reached a one-year high of 33.36%. While this was an impressive development, the indicator moving above its multi-month range is perhaps even more important. It essentially reflects a change in character within demand intensity from good to great, as the OCO Index is dominated by smaller stocks. The more stocks that reach new highs, the stronger the market’s constitution ultimately becomes.

Market internals support the case for a broader, more durable advance.

Current Positioning

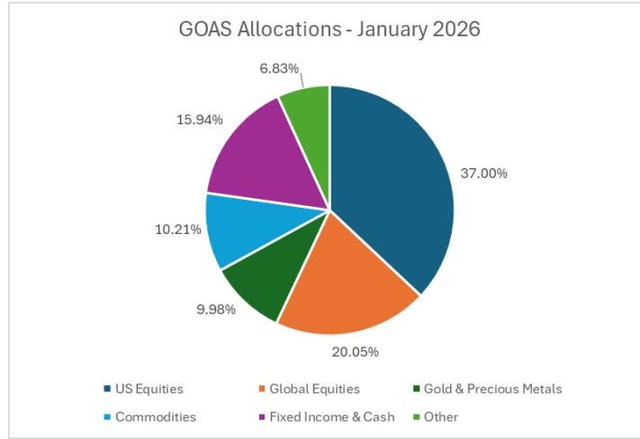

Our current portfolio remains balanced within an all-season framework but is more aggressive than when we last reported in October 2025. Since last quarter, we have increased exposure to U.S. small-capitalization equities, expanded global equity exposure—particularly in emerging markets—and added to precious metals and commodities. Fixed income and cash allocations declined from 28% to 16%.

Figure 8 – GOAS Allocation

This positioning maintains meaningful protection against inflation or market stress while remaining tilted toward growth. This balance—rooted in our all-season philosophy and adjusted for present conditions—reflects our core belief: don’t try to predict the future; position with prevailing conditions while diversifying to enable success across many possible futures.

The portfolio remains balanced but is intentionally tilted toward growth.

As always, if you have any thoughts regarding the above ideas or your specific portfolio that you would like to discuss, please feel free to call us at 1-888-GREY-OWL.

Sincerely,

Grey Owl Capital Management

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Business

Alphabet, Google’s Parent Company, Exceeds US$400 Billion in Annual Revenue for the First Time

Alphabet, Google’s parent company, had a great 2025, to say the least.

The company has announced that, for the first time, it exceeded US$400 billion in annual revenue.

Alphabet Exceeds Expectations

According to a report by 9to5Google, Alphabet also shared its Q4 2025 earnings, announcing that it earned US$113.8 billion in revenue.

This figure is an 18% increase from the US$96.5 billion in revenue recorded in Q4 2024.

An operating income of US$35.93 billion, and a net income of US$34.46 billion has also been reported for Q4 2025.

In his remarks during the 2025 Q4 earnings call, Google and Alphabet CEO Sundar Pichai highlighted major milestones:

- Search continued to accelerate with revenues growing 17%

- YouTube’s annual revenues surpassed $60 billion across ads and subscriptions

- Cloud significantly accelerated with revenues growing 48%, now on an annual run rate of over $70 billion

- Backlog grew by 55% quarter over quarter to $240 billion, representing a wide breadth of customers, driven by demand for AI products.

- 325 million paid subscriptions across consumer services, with strong adoption for Google One and YouTube Premium

- Gemini App now has over 750 million monthly active users

AI Drives Revenue for Alphabet

According to Pichai, “Overall, we’re seeing our AI investments and infrastructure drive revenue and growth across the board.”

Pichai likewise provided an update on Alphabet’s progress with its AI developments.

The Alphabet CEO highlighted how AI has been integrated across the company’s different products and services. He provided a variety of examples, including the introduction of AI features to Gmail and the launch of Personal Intelligence in AI Mode in Search and the Gemini app.

Aside from these, Pichai highlighted how Search saw more usage in Q4 and the integration of Gemini 3 directly to AI Mode.

“We’ve also made the Search experience more cohesive, ensuring the transition from an AI Overview to a conversation in AI Mode is completely seamless,” he said. “These new experiences are proving to be more helpful and are driving greater usage.”

Business

Trump administration cancels $1.5 billion in blue-state federal grants

Check out what’s clicking on FoxBusiness.com.

The Trump administration’s budget office told FOX Business Wednesday that it is canceling $1.5 billion in blue-state grants, citing concerns about how funds are being managed in California, Colorado, Illinois and Minnesota.

The Office of Management and Budget (OMB) said it will target projects at the Department of Transportation (DOT) and the Centers for Disease Control and Prevention (CDC), cutting $943 million and $602 million, respectively.

An OMB spokesperson told the New York Post that the states were being targeted due to “waste and mismanagement” of taxpayer funds.

The announcement follows OMB launching a sweeping review of federal funding for several Democratic-led states in January, which required states to submit detailed receipts proving no funds were being mishandled, CBS News reported.

TRUMP’S ENERGY DEPARTMENT AXES BIDEN-ERA PROJECTS, SAVING TAXPAYERS $7.56B

The Office of Management and Budget is planning to cancel over $1 billion in grants from the Department of Transportation (DOT) and the Centers for Disease Control and Prevention (CDC). (Stephen Goin / Fox News)

The initiative reflects a shift in fiscal policy toward “America First” priorities by withholding funds from states that maintain sanctuary policies or projects the administration deems wasteful.

Concerns cited include tax support for illegal immigrants, green initiatives and alleged fraud in certain states, such as the $250 million COVID-era scam in Minnesota uncovered in the “Feeding Our Future” case.

Several DOT and CDC programs in blue states could be affected by the funding cuts, including equity-focused infrastructure projects and public health initiatives the OMB previously criticized as “social engineering” rather than legitimate public health efforts.

“The use of Federal resources to advance Marxist equity, transgenderism, and Green New Deal social engineering policies is a waste of taxpayer dollars that does not improve the day-to-day lives of those we serve,” the OMB previously said in 2025.

TREASURY SECRETARY ANNOUNCES CASH REWARDS FOR MINNESOTA FRAUD WHISTLEBLOWERS

The Trump administration’s budget office is canceling $1.5 billion in funding for DOT and CDC projects in four blue states over funding misuse concerns. (Al Drago/Bloomberg via Getty Images / Getty Images)

In January, Trump halted more than $10 billion in federal childcare and social services funding to four states, as well as New York, over concerns that some benefits had been fraudulently funneled to noncitizens, the Post reported.

In California, San Francisco was slated to receive $15 million to expand its electric vehicle charging network, with a focus on “disadvantaged communities that are marginalized by underinvestment and overburdened by pollution,” city officials said in 2025.

Similarly, the California Reducing Disparities Project, an equity-focused public health program serving marginalized communities, including racial minorities and LGBTQ+ populations, was awarded $60 million over six years.

Chicago has drawn scrutiny for its initiatives focused on diversity, equity and inclusion.

The Biden-era Red Line Extension and the Red and Purple Modernization Programs, which together total approximately $2.1 billion, were paused in 2025 pending a review of “race-based contracting” practices.

DEMS’ DHS SHUTDOWN THREAT WOULD HIT FEMA, TSA WHILE IMMIGRATION FUNDING REMAINS INTACT

CDC research may be subject to potential cuts. (Nathan Posner/Anadolu Agency via Getty Images / Getty Images)

Additionally, funding for CDC research on sexually transmitted diseases affecting “adolescents and young adults, gay, bisexual, and other men who have sex with men” may be subject to potential cuts. The project, which listed Chicago as a recipient, was in line to receive $7 million, The Post reported.

In October 2025, the Trump administration labeled federal funding for various climate and renewable energy initiatives as a “Green New Scam” and subsequently terminated or paused $7 billion in grants, with Colorado among the primarily affected states, according to local media CPR News.

CLICK HERE TO DOWNLOAD THE FOX NEWS APP

The Trump administration may expand grant cancellations in the future amid concerns about systemic failures in sanctuary city leadership, which surfaced prominently following Minnesota’s fraud schemes.

The governors of California, Colorado, Illinois and Minnesota did not immediately respond to FOX Business’ request for comment.

Fox News Digital’s Greg Norman contributed to this report.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech20 hours ago

Tech20 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards