Business

Sphere Arena’s Success Is Sweet for CEO James Dolan

Business

Real Estate Giant CoStar Group Is Under Activist Pressure. Insiders Are Buying Stock.

Real Estate Giant CoStar Group Is Under Activist Pressure. Insiders Are Buying Stock.

Business

US stocks fell, GIFT Nifty down nearly 300 points and oil nears $100. How will stock market react on Monday?

The negative cues follow a sharp selloff on Wall Street on Friday, where all three major US indexes closed lower amid rising geopolitical tensions in the Middle East and concerns about the health of the American economy.

The Dow Jones fell nearly 1%, posting its steepest weekly decline since April 2025. The S&P 500 dropped 1.3%, while the Nasdaq Composite slid 1.6%. US markets were unsettled by a disappointing US payrolls report that raised fresh concerns about a cooling labour market at a time when rising energy prices threaten to revive inflation pressures.

The bigger shock, however, came from oil markets.

Crude prices jumped sharply after the United States and Israel carried out military strikes on Iran, escalating the conflict in the region and raising fears of prolonged disruptions to global energy supplies. Shipping through the Strait of Hormuz, a key route for global oil trade, was halted amid the tensions.

US crude futures surged more than 12% to above $90 per barrel on Friday, while Brent crude climbed about 8.5% to around $92. Analysts warn that prices could climb further if the conflict intensifies, with some forecasts pointing to oil potentially moving toward the $100 per barrel mark or higher.

Higher oil prices pose a direct risk to India’s markets and economy, given the country’s heavy dependence on imported crude. Rising energy costs tend to push up inflation, widen the current account deficit and pressure corporate margins across several sectors.The global risk-off mood had already weighed heavily on Indian equities last week.

Benchmark indices, Sensex and Nifty, fell nearly 3% each during the week, marking their biggest weekly drop in more than a year. The selling was widespread, with 41 of the 50 Nifty stocks ending the week in the red, highlighting the broad-based pressure across sectors.

Financial stocks were among the biggest losers as investors reduced exposure to risk assets amid rising geopolitical uncertainty.

The market’s weakness was also reflected in trading patterns through the week. Out of four sessions, the market declined on three sessions and managed to close higher only once, underscoring the cautious sentiment among investors.

Foreign institutional investors selling and a weakening rupee added to the pressure.

Although the market attempted a brief recovery on Thursday, supported by bargain hunting and slightly improved global cues, the rebound was short-lived. Selling resumed in the final trading session as crude prices surged further and global uncertainty intensified.

Technical indicators now suggest that the market is entering a period of heightened volatility.

Pravesh Gour, senior technical analyst at Swastika Investmart, said the Nifty is currently holding an important support level but remains vulnerable to further declines. “Nifty is taking support near 24,300 but remains highly volatile. On the upside, the 24,900-25,000 range is likely to act as an immediate supply zone where selling pressure could emerge if the index attempts a recovery,” Gour said.

He added that a decisive break below the 24,300 level could trigger further downside. “If the index slips below 24,300, the next important support comes near 23,800, which traders will closely monitor,” he said.

Banking stocks may also remain under pressure. According to Gour, the Bank Nifty is currently trading below its 100-day moving average but finding support near the 200-day average. The index faces immediate resistance near the 59,000-59,500 zone, while a break below 57,500 could extend the decline toward 56,700.

Looking ahead, analysts say the direction of equities will largely depend on three key factors: developments in the Middle East conflict, movements in crude oil prices, and foreign investor flows.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

Ahead of Market: 10 things that will decide stock market action on Monday

Here’s how analysts read the market pulse:

“While geopolitical tensions remain a near‑term overhang, selective value‑buying opportunities are expected to emerge, offering long‑term investors attractive entry points,” said Vinod Nair, Head of Research, Geojit Investments.

European Markets

European stocks slipped on Friday as the US-Iran war drove fresh concerns about oil supplies, prompting traders to rethink their expectations for central bank rate cuts. Europe’s STOXX 600 index dipped 0.15% in choppy trading, undoing an earlier rise of almost 0.5% as oil prices appeared to stabilise.

Tech View

The broader structure remains weak, and any pullback is likely to attract selling pressure. Momentum indicators and oscillators remain in sell mode on both the daily and weekly charts. Meanwhile, India VIX surged another 11% to close near the 20 level. Any further rise in volatility could intensify the downside risks.

Most active stocks in terms of turnover

Mazagon Dock (Rs 3,155 crore), ICICI Bank (Rs 3,013), HDFC Bank (Rs 2,970 crore), RIL (Rs 2,729 crore), LT Foods (Rs 2,436 crore), SBI (Rs 2,345 crore) and Commercial Engineering (Rs 2,207 crore) were among the most active stocks on BSE in value terms. Higher activity in a counter in value terms can help identify the counters with the highest trading turnovers in the day.

Most active stocks in volume terms

Vodafone Idea (Traded shares: 45,08,40,141), Commercial Engineering (Traded shares: 7,59,37,223), Ircon International (Traded shares: 6,71,15,792), Suzlon Energy (Traded shares: 6,30,58,597), YES Bank (Traded shares: 6,15,93,487), LT Foods (Traded shares: 5,63,52,435) and Reliance Power (Traded shares: 5,06,62,050) were among the most actively traded stocks in volume terms on BSE.

Stocks showing buying interest

Commercial Engineering, Kirloskar Bros, Ircon International, Radico Khaitan, United Breweries, Bharat Dynamics and Aegis Vopak were among the stocks that witnessed strong buying interest from market participants.

52 Week high

Among the ones that hit their 52-week highs were MRPL, Data Patterns, Kirloskar Oil, ABB Power, BEL and Astra Poly Tech.

Stocks seeing selling pressure

Among the names which witnessed significant selling pressure were LT Foods, Tejas Networks, Vedant Fashions, Godrej Properties, Mahanagar Gas, Ashok Leyland and Suven Pharma.

Sentiment meter favours bears

Out of the 4,374 stocks that traded on the BSE on Friday, March 6, 1,812 stocks witnessed advances, 2,396 saw declines, while 166 stocks remained unchanged.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times.)

Business

‘Silver tsunami’ of retiring owners threatens US small businesses: expert

‘The Big Money Show’ panel discusses the boom in entrepreneurship and the role of AI.

A looming “silver tsunami” of retiring baby boomer business owners could dramatically reshape America’s small-business landscape.

Nearly half of U.S. small-business owners are 55 or older, yet just 54% have a succession plan in place — setting the stage for a potential retirement shock that could leave many companies vulnerable over the next decade, according to Forbes.

The stakes are high. Small businesses employ more than 62 million Americans and account for roughly 43% of U.S. GDP, according to the U.S. Small Business Administration.

If a significant share of those businesses close instead of transitioning to new leadership, communities nationwide could feel the effects, American Operator Founder William Fry told FOX Business.

PAYCHECKS KEEP RISING FOR AMERICAN WORKERS, PROVIDING BOOST TO HOUSEHOLD BUDGETS

A “silver tsunami” of retiring baby boomer business owners could dramatically reshape America’s small-business landscape. (iStock / iStock)

“They’re huge creators of wealth, and in my opinion, they’re the most pure version of the American Dream — you come to this country, and you can build a better life for yourself,” Fry told FOX Business.

Many owners have spent decades building their businesses on relationships and reputation, making succession decisions deeply personal.

After 12 years growing a painting company in Jackson, Wyoming, husband-and-wife team Erik and Kassie Hansen began considering their next chapter at Greenway Painting — whether to sell the business or step away entirely.

By 2024, 90% of the company’s revenue came from commercial clients, and 85% came from repeat customers, a testament to the loyalty they had cultivated.

“All of our clients are very important,” Erik Hansen told FOX Business. “Especially in a small town, they are like friends or family when you work with them for years and years. You want to make sure they get well taken care of. That’s important.”

SELF-DEFENSE COMPANY FINDS MAJOR BENEFITS AFTER MOVING MANUFACTURING FROM OVERSEAS TO US

Erik and Kassie Hansen stand together in Jackson, Wyo. The husband-and-wife team own Greenway Painting. (American Operator)

Companies like American Operator aim to bridge the succession gap by pairing retiring owners with operators ready to take the reins.

In Greenway’s case, that operator was Anthony Douglas, a former U.S. Air Force Combat Controller who previously founded and scaled his own painting company in Tucson, Arizona.

“One of the reasons why I was attracted to Greenway Painting was that it was a relational business,” Douglas told FOX Business. “Greenway was pretty successful without having any advertising or marketing.”

In October 2025, Douglas became CEO and a day-one equity partner, acquiring a 10% stake with a structured path toward majority ownership over time.

Anthony Douglas sits in a vehicle in Jackson, Wyo. Douglas said he was drawn to Greenway Painting’s relationship-driven model and strong reputation. (American Operator)

He relocated to Jackson from Tucson to lead the company, focusing on preserving customer trust while gradually putting his own stamp on operations.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

For companies like American Operator, the coming wave of retirements also represents an opportunity to preserve local businesses that form the backbone of the American economy.

“To open this opportunity to all that answer the call of ownership, and to let everyday Americans share in the upside, we are working towards building America’s small business stock,” its website states. “Our goal is a public offering that allows millions of Americans to have a stake in the American Dream.”

Business

Taylor Swift’s Wedding Plans Heat Up Amid Fan Speculation and New Album Buzz in March 2026

As spring approaches in 2026, pop superstar Taylor Swift continues to command global attention, with recent reports centering on her upcoming wedding to Kansas City Chiefs tight end Travis Kelce, ongoing promotion of her latest album and lingering fan theories about future music and tours.

Multiple entertainment outlets reported March 1 that Swift and Kelce have finalized a wedding date of June 13, 2026. The couple, who began dating in the summer of 2023 and announced their engagement privately in late 2025, reportedly selected the mid-June Saturday for what sources describe as a large but intimate ceremony. Details remain closely guarded, but insiders suggest heightened security measures described as “military-level precise” to ensure privacy amid intense public interest.

The wedding planning comes after Swift’s record-breaking Eras Tour concluded in 2024, followed by the release of her 12th studio album, “The Life of a Showgirl,” in October 2025. The upbeat project has generated mixed but widespread discussion, with Swift addressing criticism in recent interviews by noting that any conversation—positive or negative—ultimately benefits her visibility and career.

In a wide-ranging appearance on the “New Heights” podcast hosted by Kelce and his brother Jason, Swift discussed the album’s creation and shared playful moments, including reading a romantic letter Kelce wrote her during the tour’s final stretch. The Disney+ docuseries “The End of an Era,” which chronicled the tour’s closing nights, featured the note and other personal insights, delighting fans with behind-the-scenes glimpses into the couple’s relationship.

Friendships remain a prominent theme in Swift’s orbit. On March 4, Selena Gomez shared details of a handmade gift Swift created for her 30th birthday—a stunning painting on cloth that Gomez called one of the “best” she’s ever seen and the “sweetest” present received. Gomez has also confirmed that several Swift songs, including an unreleased track, draw inspiration from their long-standing friendship. The revelation sparked excitement among fans speculating about potential future collaborations or a long-rumored “family” themed song.

Swift’s personal life intersected with sports headlines when Kelce’s casual chat with Kai Trump drew reactions from self-described Swifties, including influencer Bronwin Aurora. Meanwhile, Kelce faces retirement decisions with the Chiefs, with friends expressing confidence in his next move. Swift was absent from Super Bowl LX in February 2026, where Kelce attended pre-game events and the game itself without her, marking a departure from her visible support during previous seasons.

Professionally, Swift continues promoting “The Life of a Showgirl.” She shared a makeup-free behind-the-scenes video for the “Opalite” music video, featuring producer Shellback and ’90s-inspired aesthetics starring actor Domhnall Gleeson. Swift later revealed Easter eggs in the clip, fueling fan decoding sessions typical of her releases.

Speculation persists about 2026 projects. While Swift has not confirmed a new tour, sources indicate “ideas percolating” for a potential “Life of a Showgirl” run, building on her positive Eras Tour experience. The 20th anniversary of her self-titled debut album in October 2026 has prompted predictions of special releases, possibly including vault tracks from “Reputation” or a reimagined edition. Fans also watch for hints of a 13th studio album, with some theorizing ties to personal milestones like her wedding.

In legal and business news, Swift successfully resolved a trademark dispute in February when a bedding company withdrew its “Swift Home” application after her appeal to the U.S. Patent Office. The move underscored her ongoing efforts to protect her brand.

Philanthropy and cultural impact remain strong. Swift sent a message to 2026 Olympics athletes, particularly women’s figure skating team members, and was linked to Team USA initiatives. A defaced mural in her honor sparked backlash over environmental concerns related to tour emissions, though the artist expressed devastation.

Older headlines linger, including resolved plots against her concerts and fake ticket scams, but Swift’s focus appears forward-looking. As June approaches, anticipation builds for what could be one of the year’s most talked-about events.

Swift’s influence extends beyond music. Her fashion choices, like a $13,000 designer outfit worn on a recent New York City date with Kelce, and rare public outings continue to trend. Even non-music moments, such as her playful “wood” lyric reference on a podcast, generate laughs and headlines.

With the wedding date set and album promotion rolling, Taylor Swift’s 2026 story blends romance, creativity and enduring stardom. Fans and observers alike await the next chapter in what remains one of entertainment’s most captivating narratives.

Business

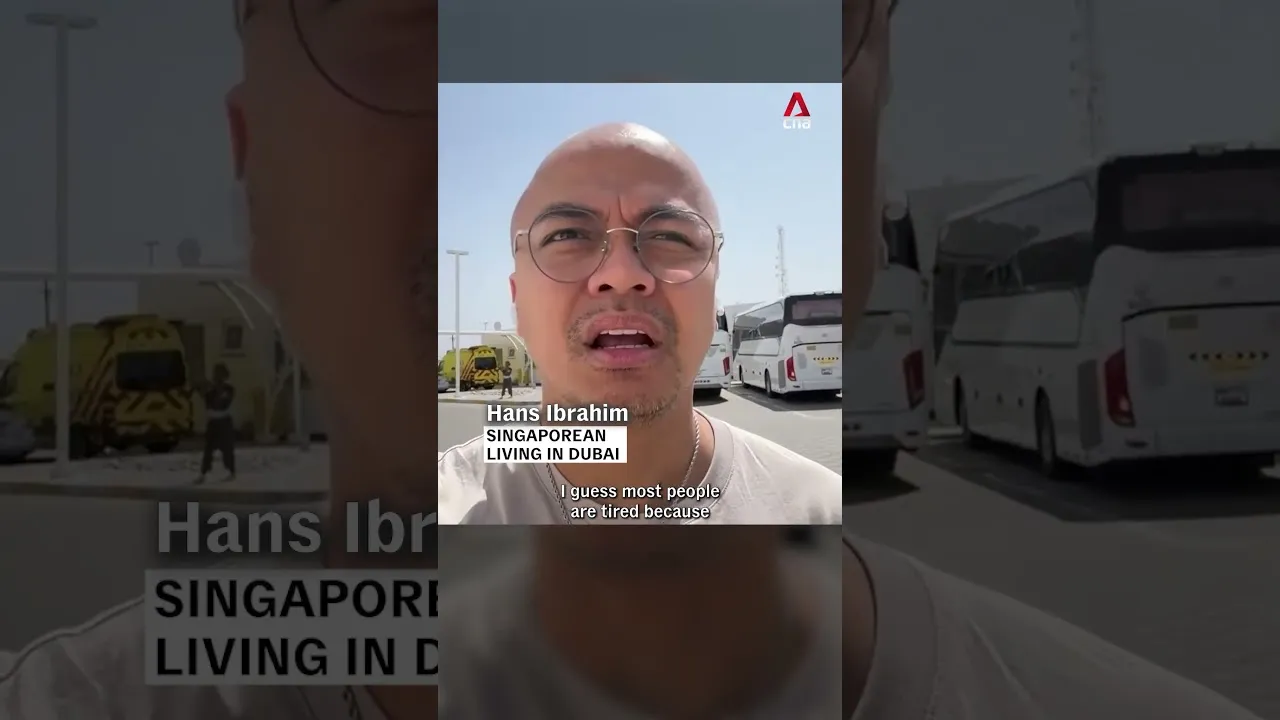

Singaporeans embark on an overland journey from Dubai to Muscat to catch their flight home

Singaporeans leaving Dubai amid the Middle East crisis began their journey with a bus ride to Muscat, Oman, to catch the country’s first repatriation flight from the region, arriving at Changi on March 7. They shared their experiences of the transit and the challenges faced during this evacuation.

Briefing and Routine

The event started with a briefing, where about 80 people gathered, including couples, singles, older family members like uncles and aunts, mostly Singaporeans living in Dubai. The atmosphere was calm and organized, with refreshments provided on the bus. Participants appeared tired but prepared, as they were asked to arrive early at 6:30 a.m. after a light breakfast and a short briefing, everyone seemed to be ready for the day ahead.

Observations and Environment

The group noted that since the initial attack, the key areas affected in Dubai included landmarks such as Dubai Marina, Downtown Dubai, and the Burj Khalifa. Despite the unsettling circumstances, the weather was beautiful, and the overall atmosphere remained calm. The event’s organization was efficient, starting from the hotel to the transportation, which contributed to a sense of order amid uncertainty.

Personal Feelings and Safety

The individual expressed a sense of reassurance, feeling that the situation was under control due to the well-organized arrangements. While the times are unsettling and unprecedented for most, the experience so far has been smooth and professional. The general sentiment reflected confidence in the safety measures and the preparation involved in managing the events, providing a reassuring perspective during a tense period.

Other People are Reading

Business

Explainer-Who might succeed in Iran’s theocratic system of power?

Explainer-Who might succeed in Iran’s theocratic system of power?

Business

(VIDEO) iPhone 17 Pro Max vs iPhone 17e: Which One Is Better?

Apple’s flagship iPhone 17 Pro Max, released last September, now shares the spotlight with the newly unveiled iPhone 17e, a $599 budget model that brings many modern features to a lower price point while highlighting the stark contrasts in the company’s 2026 smartphone lineup.

The iPhone 17e, announced March 2 and set for release March 11, arrives as Apple’s most affordable current-generation device, starting at $599 for 256GB storage — double the base capacity of its predecessor, the iPhone 16e, at the same price. Preorders opened March 4, with the device available in black, white and a new soft pink finish.

In comparison, the iPhone 17 Pro Max starts at $1,199 for 256GB, positioning it as the premium large-screen option with top-tier performance, camera capabilities and battery life. The gap of $600 underscores Apple’s strategy of offering tiered choices: the entry-level 17e for cost-conscious buyers seeking solid everyday use, and the Pro Max for power users demanding the best hardware.

The iPhone 17e retains a familiar 6.1-inch Super Retina XDR OLED display with a notch for the TrueDepth camera system, rather than the Dynamic Island found on higher models. It features Ceramic Shield 2 front glass for 3x better scratch resistance than previous generations, an aluminum frame and IP68 dust and water resistance. The display runs at 60Hz without ProMotion adaptive refresh rates or Always-On capability.

Powering the 17e is Apple’s A19 chip with a 6-core CPU (2 performance, 4 efficiency cores) and a 4-core GPU, paired with 8GB of RAM. This setup delivers strong performance for daily tasks, gaming and Apple Intelligence features, though the GPU has one fewer core than the A19 in the standard iPhone 17. It includes Apple’s latest C1X cellular modem for faster connectivity, up to 2x improvement over the prior C1 in the 16e.

Camera-wise, the 17e sports a single 48MP Fusion main sensor that enables optical-quality 2x telephoto shots and captures 4K Dolby Vision video. It supports next-generation portraits and advanced computational photography like Photonic Engine, Deep Fusion and Smart HDR 5. The 12MP front camera handles selfies and video calls with features like Retina Flash.

Battery life benefits from efficient power management, though exact capacity remains around 4,000 mAh in estimates. New this year is MagSafe support for faster wireless charging and a vast accessory ecosystem, along with Qi2 compatibility — a significant upgrade from the 16e.

Satellite features, including Emergency SOS, Roadside Assistance, Messages and Find My via satellite, ensure connectivity in remote areas.

The iPhone 17 Pro Max, by contrast, targets enthusiasts with a larger 6.9-inch Super Retina XDR display featuring ProMotion up to 120Hz, Always-On display, peak brightness of 3,000 nits and Ceramic Shield 2 on both front and back for enhanced durability.

It runs on the more powerful A19 Pro chip with a superior GPU, 12GB of RAM and advanced thermal design including vapor chamber cooling for sustained performance during intensive tasks like video editing or gaming. Storage options extend to 2TB.

The Pro Max’s camera system stands out with three 48MP Fusion lenses: main, ultrawide and a new telephoto offering extended optical zoom (up to 8x equivalent in some configurations), macro capabilities and professional-grade video recording. It excels in low-light performance, computational photography and versatility.

Battery capacity approaches 5,088 mAh in reports, delivering what Apple calls the best life ever in an iPhone, aided by efficiency gains in iOS 26.

Design differences include a titanium frame on the Pro Max for premium feel and lighter weight relative to size, versus the aluminum on the 17e. The Pro Max measures roughly 6.43 x 3.07 x 0.34 inches and weighs 233 grams, while the 17e is more compact at about 5.78 x 2.82 x 0.31 inches and 169 grams.

Both run iOS 26 with full Apple Intelligence support, ensuring long-term software updates, privacy features and ecosystem integration.

Analysts see the 17e as a smart evolution for Apple’s budget segment. By adding MagSafe, doubling base storage and upgrading to the A19 chip without raising the price, it narrows the gap to mid-tier models like the $799 iPhone 17. Early reviews praise its value for users prioritizing battery, camera basics and modern connectivity over pro-level extras.

The Pro Max remains the choice for creators, photographers and those wanting maximum screen real estate and performance. Its larger form factor suits media consumption, multitasking and extended use.

As preorders ramp up for the 17e, Apple positions it as “feature stacked, value packed,” appealing to first-time iPhone buyers or those upgrading from older devices. The Pro Max continues to dominate premium sales, driven by its unmatched hardware.

The release highlights Apple’s segmented approach in 2026: accessible entry points like the 17e alongside flagship powerhouses, giving consumers clear trade-offs between price and capability in a competitive smartphone market.

Business

5 big analyst AI moves: Buy Samsung pullback, Nvidia back as top chip pick

5 big analyst AI moves: Buy Samsung pullback, Nvidia back as top chip pick

Business

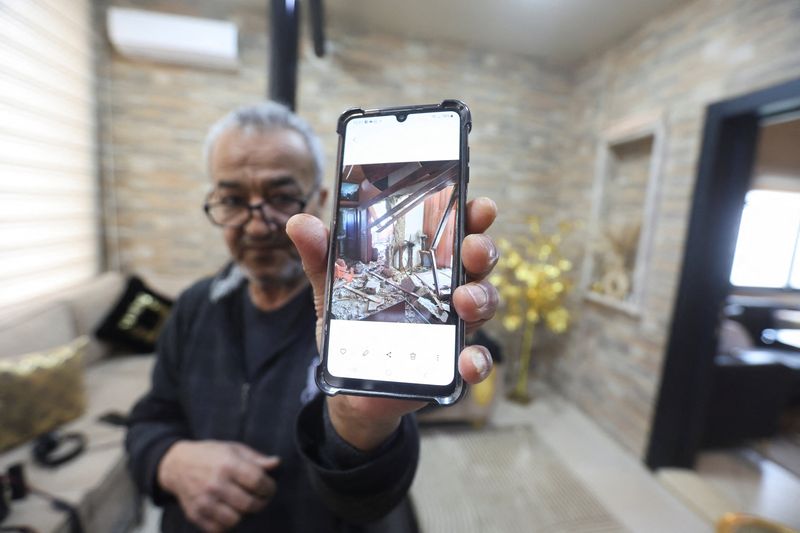

Lebanese man flees hometown, months after repairing home damaged in last war

Lebanese man flees hometown, months after repairing home damaged in last war

-

Politics5 days ago

Politics5 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business2 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion2 days ago

Fashion2 days agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech3 days ago

Tech3 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment6 days ago

Entertainment6 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports3 days ago

Sports3 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Sports14 hours ago

Sports14 hours agoThree share 2-shot lead entering final round in Hong Kong

-

Fashion7 days ago

Fashion7 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video6 days ago

Video6 days agoHow to Build Finance Dashboards With AI in Minutes

-

Sports5 hours ago

Sports5 hours agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown

-

NewsBeat3 days ago

NewsBeat3 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Tech6 days ago

Tech6 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Video6 days ago

Video6 days agoLPP + Financial Maths + Numerical Applications | One Shot | Applied Maths | Target Board Exams 2026

-

NewsBeat6 days ago

NewsBeat6 days agoHandcuffed presenter Jonathan Ross’ sweet admission about marriage to wife of 38 years

-

Sports5 days ago

Sports5 days agoJack Grealish posts new injury update as Man City star enters crucial period