Crypto World

BlackRock Joins DeFi as Institutional Crypto Push Accelerates

BlackRock has taken a formal step into decentralized finance by listing its tokenized U.S. Treasury fund on Uniswap, signaling a measured pivot toward on-chain trading of real-world assets. The USD Institutional Digital Liquidity Fund (BUIDL) is being tokenized with the help of Securitize and will be tradable on a public decentralized exchange, a first for the asset manager in DeFi. This collaboration sits within a broader backdrop of continued institutional exploration of crypto rails even as traditional markets wrestle with ETF flows and shifting sentiment. In parallel, Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) posted modest weekly gains of about 2.5% but failed to clear key psychological levels, pressured by a pattern of ETF inflows and subsequent outflows that underscored the fragility of near-term upside in a risk-off environment.

Bitcoin ETFs started the week with some inflows but quickly surrendered ground, registering net outflows of $276 million on Wednesday and $410 million on Thursday, according to data from market trackers. Ether ETFs displayed a similar pattern, with two light days of inflows followed by $129 million and $113 million of outflows on the same two days. The net effect was a market that, while buoyed by a perceived liquidity boost from tokenized assets, remained sensitive to shifting flows and investor appetite for risk-sensitive exposure. The weekly price action did not decisively break above crucial levels, leaving traders weighing the significance of macro liquidity versus on-chain adoption momentum.

Against this backdrop, BlackRock’s move into DeFi stands out as a milestone for institutional participation. The BUIDL fund is described as a tokenized version of a money-market approach to Treasuries, issued across multiple blockchains, including Ethereum, Solana, BNB Chain, Aptos and Avalanche. The asset manager’s public-facing rationale centers on providing transparent, on-chain access to highly liquid, U.S. Treasury–backed instruments for institutions that favor self-custody and programmable settlement. The collaboration is being driven by Securitize, a tokenization platform that previously partnered with BlackRock on the BUIDL launch, and the Uniswap deployment aligns with the exchange’s mission to expand institutional liquidity into DeFi.

Initial trading is described as selective, with eligibility limited to certain institutional investors and market makers before broader access is opened. The official rollout underscores a broader trend: institutions are increasingly testing the on-chain infrastructure that underpins tokenized real-world assets as counterparties seek improved settlement speed, on-chain custody options, and transparent governance. In the wake of this development, industry observers noted that BlackRock’s involvement could set a precedent for other asset managers exploring tokenized securities and on-chain liquidity solutions.

The BUIDL fund is reported to hold more than $2.18 billion in total assets, according to RWA.xyz, and its cross-chain issuance has brought it to multiple networks, including Ethereum, Solana, BNB Chain, Aptos and Avalanche. That breadth matters because it signals an on-ramp for real-world assets to traverse different ecosystems—potentially expanding liquidity across layers and enabling more nuanced risk and yield profiles for institutional participants. In December, BUIDL reached a milestone of surpassing $100 million in cumulative distributions from its Treasury holdings, reflecting the ongoing interest in tokenized treasury income streams and the potential for on-chain yield to complement traditional fixed-income exposure.

Beyond the specific instrument, the broader DeFi landscape remains mired in a tension between innovation and regulatory scrutiny. In a separate development this week, a New York federal court dismissed a Bancor-affiliated patent suit against Uniswap, ruling that the asserted patents described abstract ideas related to calculating on-chain exchange rates and did not meet the standards for patent eligibility. While the dismissal was without prejudice, the ruling represented a procedural win for Uniswap and illustrated the ongoing IP and legal risk environment that surrounds major DeFi protocols. The court’s decision does not end the dispute, but it does provide a window for Uniswap to continue operating while the case can be refined in future filings.

On the crypto market’s more tactical front, Binance completed the conversion of $1 billion in Bitcoin into its SAFU emergency fund, adding another tranche of BTC to its reserve. The exchange disclosed that the SAFU wallet now holds 15,000 Bitcoin, valued at just over $1 billion, acquired at an average cost basis of about $67,000 per coin. Binance had announced the move earlier in the month, stating it would rebalance the fund if volatility pushed its value below a defined threshold. The decision to anchor the SAFU reserve in Bitcoin reinforces the ongoing narrative of BTC as a long-term store of value within the ecosystem’s risk-management framework.

Meanwhile, voices within the blockchain community continued to draw lines around what constitutes “real” DeFi. Ethereum co-founder Vitalik Buterin argued that DeFi’s true value lies in rethinking risk allocation and governance, rather than chasing yield on centralized assets. He cautioned that yield-centric strategies tied to fiat-backed stablecoins can obscure issuer risk and counterparty exposure, a reminder that the sector’s risk dynamics remain a central theme as institutions seek scalable, on-chain alternatives to traditional finance.

The broader DeFi market activity remained resilient in its own right, with data from Cointelegraph Markets Pro and TradingView showing a majority of the top 100 cryptocurrencies finishing the week in the green. Among standout performers, the Pippin (CRYPTO: PIPPIN) token surged as the week’s top gainer in the broader ranks, followed by the Humanity Protocol (CRYPTO: H), which posted notable gains. The week’s digest also highlighted continuing interest around tokenized assets and on-chain credit vehicles, even as volatility persisted and risk sentiment remained tepid.

In short, a week marked by a landmark institutional move into DeFi coexisted with ongoing market frictions—ETF outflows, macro caution and a series of regulatory and IP questions that continue to shape the pace and scope of blockchain-enabled finance. The juxtaposition underscores a sector attempting to bridge the gap between traditional liquidity channels and the new, programmable infrastructure driving tokenized real-world assets across multiple chains.

Hayden Adams

https://platform.twitter.com/widgets.js

Why it matters

The listing of BlackRock’s BUIDL on Uniswap marks a watershed for institutional access to tokenized real-world assets. It demonstrates a willingness among large asset managers to experiment with DeFi infrastructure not merely as a speculative overlay but as a potential avenue for compliant, on-chain trading of regulated securities. If the model proves scalable and cost-efficient, more traditional asset managers could follow, accelerating the normalization of tokenized fixed income within institutional portfolios and potentially expanding liquidity pools for tokenized securities on public exchanges.

From a market dynamics perspective, the week’s ETF flow patterns reaffirm that short-term price action remains highly sensitive to inflows and outflows. While BTC and ETH posted modest gains, the absence of a sustained breakout suggests that the macro backdrop—comprising liquidity conditions, risk appetite, and regulatory signals—continues to constrain upside despite positive structural developments in DeFi adoption. The Bancor-Uniswap ruling also underscores that the legal framework governing DeFi protocols remains unsettled, with patent arguments still in flux and ongoing debates about what constitutes innovation versus abstract idea protection.

For on-chain participants and developers, the Binances SAFU move reinforces the idea that reserve designs are evolving under pressure to balance security, liquidity, and risk management. The repeated emphasis on Bitcoin as a reserve asset signals confidence in BTC as a durable anchor for risk-averse users and institutions seeking transparent, auditable reserves in a rapidly changing landscape. In parallel, Vitalik Buterin’s call for a clearer definition of DeFi’s core value proposition keeps attention on risk-sharing mechanisms and the governance of on-chain ecosystems, moving the debate beyond yield optimization toward sustainable, systemic risk management.

What to watch next

- Broader rollout of BUIDL to additional institutional clients and potential cross-chain expansions in the coming weeks.

- Further tokenization of real-world assets and the adoption trajectory of Securitize’s platform across more issuers.

- Resolution or further filings in remaining IP and patent matters related to DeFi protocols, shaping protocol-level risk profiles.

- Continued monitoring of ETF and on-chain liquidity flows to gauge whether institutional demand for tokenized assets translates into sustained price action.

- Regulatory signals and macro liquidity shifts that could either reinforce or dampen the case for tokenized fixed income and DeFi-enabled settlement rails.

Sources & verification

- Uniswap-Labs and Securitize collaboration to unlock liquidity options for BlackRock’s BUIDL — Business Wire

- BlackRock’s BUIDL tokenization milestone and Uniswap collaboration — Fortune

- Bitcoin ETF and Ether ETF flow data — Farside Investors

- BUIDL asset data and cross-chain issuance — RWA.xyz

- Bear-market inflection point discussion and Kaiko Research notes

Crypto World

HBAR price rises after Hedera and FedEx partnership, but risks remain

HBAR price has bounced back in the past few days as the crypto market rebound continued and after Hedera reached a key partnership with FedEx, a top player in the delivery and logistics industry.

Summary

- HBAR price has rebounded to a crucial resistance level this year.

- Hedera inked a major partnership with FedEx, a top global company.

- Technical analysis suggests that the token may resume the downtrend.

Hedera (HBAR) token jumped to a high of $0.1038, up sharply from this month’s low of $0.0735. It remains much lower than $0.3045, its highest level in 2025.

HBAR price has rebounded primarily because of the ongoing crypto market rally. Bitcoin and most altcoins rebounded after the recent US consumer inflation report raised the possibility that the Fed will deliver more cuts.

The token also jumped after Hedera reached a deal with FedEx, a top global multinational. FedEx became the latest major company to enter the governance council, joining other companies like Tata Communications, LG, Mondelez, Google, Hitachi, and Deutsche Telekom.

FedEx aims to help advance a trusted digital infrastructure that can support the lifecycle of global shipments and make supply chains smarter for everyone involved. In a statement, Vishal Talwar said:

“As supply chains become increasingly digital-native, trusted data must be shared and verified across many parties without increasing risk or centralizing control.”

Still, the HBAR price faces some major risks that may hit its performance. One of them is that demand for the Canary HBAR ETF has dried in the past few months. It has not had any inflow since February 9 of this year. Its inflows stands at about $6 million this year, bringing the cumulative inflow to $90 million.

Also, the ecosystem growth has stalled, with the total value locked in its DeFi ecosystem falling to just $39 million. The stablecoin market cap has dropped to $68 million, a tiny amount in an industry with billions of dollars.

HBAR price technical analysis

The daily timeframe chart shows that the HBAR price has rebounded in the past few days. It has rallied from a low of $0.07360 to the current $0.1037.

The coin has retested the key resistance at $0.1037, its lowest level in October and December last year. That is a sign that the coin has formed a break-and-retest pattern.

The coin has also found resistance at the 50-day moving average. Therefore, there is a likelihood that the token will resume the downtrend, potentially to the year-to-date low of $0.073.

Crypto World

UNI Token Tests Critical $2.80 Support After 93% Crash: Analyst Eyes 1,500% Rally Potential

TLDR:

- UNI has declined 93% from all-time highs and currently tests multi-year channel support at $2.80 level.

- Historical patterns show UNI delivered 2,400% gains in 2020 and 400% rally in 2023 from similar support zones.

- Analyst targets range from $14 to $45, representing potential 3x to 8x returns if current support holds firm.

- Uniswap V4 development and DeFi narrative momentum provide fundamental catalysts for projected 1,500% rally.

UNI, the native token of decentralized exchange Uniswap, currently trades at $3.63 after dropping 93% from its all-time high.

The token is testing a multi-year descending channel support that has remained intact since 2022. This high-timeframe structure represents a potential cycle-level accumulation zone.

Market analysts are monitoring whether this support holds as the token approaches critical demand levels.

Multi-Year Channel Support Shows Historical Significance

The descending channel support has proven reliable during previous market cycles. UNI delivered a 2,400% rally in 2020 from October lows when similar support structures formed. The token repeated this pattern in 2023 with a 400% increase from support levels.

Technical indicators show the token trading below the $6 support zone. However, the $2.80 demand zone continues to attract buying interest. This level represents a major macro support that would invalidate below this threshold.

Crypto analyst Patel shared his technical outlook on the token’s structure. According to his analysis, the current positioning suggests smart money accumulation at high-timeframe support levels. The extended base formation historically precedes substantial upward movements in cryptocurrency markets.

The token’s correction from all-time highs places it in what traders call a maximum pain zone. This region often marks periods where retail investors capitulate while institutional participants accumulate positions. The 93.68% decline matches the severity of previous bear market bottoms for major DeFi tokens.

Price Targets Align With DeFi Sector Recovery

Patel’s analysis projects three potential targets if the support structure holds: $14, $26, and $45. These levels represent 3x to 8x returns from current prices. The projections assume the multi-year channel support remains valid through 2026.

The potential for a 1,500% rally stems from historical precedent and cycle analysis. Previous instances where UNI tested similar structures resulted in exponential gains. The asymmetric risk-reward profile becomes attractive when the token trades near established support zones.

Uniswap V4 development adds a fundamental catalyst to the technical setup. The protocol upgrade introduces new features that could drive increased trading volume and fee generation.

DeFi narratives are gaining momentum as the broader cryptocurrency market recovers from the bear cycle.

Market participants watch whether the $2.80 level holds during potential retests. A breakdown below this zone would challenge the bullish thesis and require reassessment of accumulation strategies. Conversely, a successful defense of support could trigger the next leg higher.

The longer consolidation period at these levels typically builds energy for eventual breakouts. Time spent building a base correlates with the magnitude of subsequent rallies in cryptocurrency markets. The current structure mirrors formations that preceded major bull runs in previous cycles.

Crypto World

PEPE Memecoin Whales Accumulate Trillions as Technical Breakout Signals Bullish Reversal

TLDR:

- Whales have reportedly purchased trillions of PEPE tokens as the memecoin trades below $0.01 per token.

- Technical analysts confirm breakout from multi-week downtrend with strong volume supporting bullish momentum.

- PEPE burned 7 trillion tokens from circulation, representing a significant deflationary supply reduction event.

- Community sentiment shows 30% mindshare focused on PEPE’s potential to rival Dogecoin and Shiba Inu dominance.

PEPE token has captured renewed market attention following reports of massive whale purchases and a confirmed technical breakout from a prolonged downtrend.

The memecoin currently trades below $0.01 while social sentiment metrics show surging community interest. Recent on-chain activity reveals whales have acquired trillions of tokens as discussions about PEPE’s potential to rival established memecoins gain traction across crypto platforms.

Whale Activity and Rising Community Sentiment Drive Market Interest

Large-scale investors have reportedly purchased substantial quantities of PEPE tokens in recent trading sessions. This accumulation pattern suggests institutional and high-net-worth participants are positioning for potential upside movement.

The buying activity comes as the token maintains its sub-cent valuation, creating what some market observers view as an attractive entry point.

Data from LunarCrush indicates PEPE commands significant mindshare among cryptocurrency communities. According to the analytics platform, 30% of conversations focus on the token’s cultural relevance and market position.

Community members are drawing comparisons between PEPE and established projects like Dogecoin and Shiba Inu. These discussions explore whether the token could emerge as a leading memecoin in the current market cycle.

Another 25% of tracked conversations center on investment opportunities at current price levels. Crypto influencer Jake Gagain and others have publicly advocated for continuous accumulation.

The “free money” narrative has gained momentum among retail traders monitoring the token’s price action. However, memecoin investments carry substantial risk due to their speculative nature and high volatility.

Market participants are also debating PEPE’s long-term viability within the competitive memecoin sector. The token’s community-driven nature and meme culture foundation provide both strengths and challenges.

Meanwhile, social media activity continues to amplify as traders share technical analysis and price predictions across multiple platforms.

Technical Breakout Coincides with Major Token Burn Event

Technical analyst WhaleFactor reported a confirmed breakout from a weeks-long downtrend resistance line. The breach occurred with what traders describe as a “massive impulse candle” showing strong buying pressure.

This price movement suggests a potential shift in market structure after an extended consolidation period.

Volume analysis reveals a solid support base has formed at lower price levels. The volume shelf indicates sufficient liquidity absorption during the recent decline.

Traders now view the breakout zone as a critical area for potential retests. The path of least resistance appears tilted toward higher prices based on current technical conditions.

Fibonacci retracement levels have been mapped by analysts tracking the price action. The first major target sits at the 0.618 Fibonacci level.

Technical traders recommend waiting for potential pullbacks rather than chasing immediate price spikes. This approach aims to secure better risk-reward ratios on new positions.

Separately, PEPE underwent a significant token burn removing 7 trillion tokens from circulation. The burn mechanism represents 20% of current community discussions according to LunarCrush data.

Supply reduction events often serve as bullish catalysts in cryptocurrency markets. The updated total supply figures reflect this deflationary action.

Crypto World

Institutions Could Fire Bitcoin Devs Over Quantum Fears

Rising concerns about quantum threats to Bitcoin have captured the attention of institutions and veteran investors. In a recent appearance on the Bits and Bips podcast, venture capitalist Nic Carter warned that large holders might grow impatient with developers if action on quantum-resistant cryptography stalls, potentially triggering governance shifts. He argued that a slow pace could prompt major players to replace core contributors with new teams more willing to push forward a solution. The debate centers on risk management, control, and the pace of change at a time when the network remains one of the largest, publicly verifiable assets in the world.

BlackRock, the world’s largest asset manager, is reported to hold around 761,801 BTC, valued at roughly $50.15 billion at publication, accounting for about 3.62% of the circulating supply. The sheer scale of institutional exposure highlights why the question of security upgrades and governance is no longer purely academic. Carter’s provocative framing asks what happens if a consent-based, volunteer-driven development model cannot keep up with the demands of major participants. “If you’re BlackRock and you have billions of dollars of client assets in this thing and its problems aren’t being addressed, what choice do you have?” he asked during the discussion.

That framing has sparked a broader debate within the industry about whether Bitcoin (CRYPTO: BTC) is approaching a tipping point where governance dynamics could shift under institutional pressure. The discussion comes amid a wider conversation about the timing and feasibility of upgrading the network’s cryptographic foundations to resist quantum attacks, a threat some researchers say could become material within the next decade, while others contend the risk is overstated or manageable with incremental steps.

Key takeaways

- Institutional stakeholders are explicitly weighing governance and development tempo in response to potential quantum threats to Bitcoin’s security model.

- A number of prominent investors and commentators see the risk as real enough to spur calls for faster action or even new development leadership if progress stalls.

- One of the largest holders, BlackRock, adds a practical layer of pressure, given the scale of capital that could influence upgrade decisions and strategy for the Bitcoin network.

- The industry remains divided: some argue the threat is existential and immediate, while others say the concern is theoretical and can be mitigated through measured research and gradual hardening.

- Proposals and discussions around quantum-resistant cryptography are entering mainstream crypto discourse, with researchers pointing to tangible, albeit gradual, paths forward.

Tickers mentioned: $BTC

Market context: The conversation around quantum risk sits alongside ongoing debates about protocol upgrades, risk management by institutional holders, and the role of governance in a decentralized-but-institutionally-influenced ecosystem. As markets monitor liquidity, macro cues, and regulatory signals, the quantum-resilience question adds a new layer to how investors assess Bitcoin’s security posture and future upgrade trajectories.

Why it matters

The potential for quantum computing to undermine current cryptographic protections touches every layer of Bitcoin—from wallets and transaction verification to the very assumptions underpinning its security model. If the network’s cryptography were shown to be vulnerable, large institutions with significant BTC exposure could demand faster progress toward quantum-resistant schemes, or even push for changes in who controls core development. That possibility — sometimes described as a “corporate takeover” of the upgrade process — would represent a shift in how decentralized networks interact with centralized capital markets and risk managers. Proponents of swifter action argue that delaying a secure upgrade could amplify systemic risk, while skeptics caution against hasty changes that might fracture consensus or introduce new vulnerabilities.

A number of voices in the industry have weighed in on the urgency and feasibility of addressing quantum threats. Austin Campbell, founder of Zero Knowledge Consulting, echoed concerns that if a structural problem exists and large players maintain a long view, they will eventually demand reform or louder participation from the governance and development community. In parallel, other industry figures emphasize a more measured approach, warning against overreaction and highlighting the resilience of Bitcoin’s current security margin. Carter’s assertions that a rapid, market-driven shift could occur if developers don’t move quickly enough contrast with more conservative analyses that quantify the actual exposure and the practical timelines for cryptanalytic breakthroughs.

On the other side of the debate, proponents of the status quo point to long-term research cycles, the complexity of hard-fork upgrades, and the importance of broad consensus across a decentralized ecosystem. They note that a handful of publicized vulnerabilities do not automatically translate into imminent risk and that the path to quantum resilience will likely involve multiple layers of defense, from protocol changes to key management practices and architectural diversification. Notably, researchers at CoinShares and others have sought to quantify risk by examining the number of BTC addresses with vulnerable keys and the distribution of assets among holders, offering a more nuanced picture than headlines alone. This spectrum of views helps explain why the conversation remains contentious rather than resolved.

The market backdrop adds further texture to the debate. Bitcoin’s price action has been volatile in recent weeks, trading near the $70,000 mark at the time of reporting after a period of drawdown. This macro context — combined with an evolving risk appetite among institutional buyers — can influence how quickly stakeholders push for any technical changes. If the quantum risk becomes perceived as a credible, near-term threat, capital flows could shift toward safer hedges or more robust security architectures, potentially affecting liquidity, volatility, and the calculus around new product structures that rely on Bitcoin’s security model.

The tension between urgency and caution also reflects the broader governance challenge that applies to many decentralized networks: when and how to upgrade cryptography in a way that preserves security while maintaining broad participation and network integrity. The debate is not purely academic; it implicates who steers development, how funding is allocated, and what kinds of governance tests are acceptable for a system that prizes decentralization as a foundational principle. As institutions increasingly intersect with Bitcoin’s technical frontier, the next steps—whether they involve formal proposals, research milestones, or new collaboration mechanisms—will be watched closely by miners, custodians, and everyday holders alike.

What to watch next

- Progress updates on quantum-resistant cryptography proposals within Bitcoin development discussions and any related roadmap milestones.

- Public statements or filings from major institutions referenced in discussions, including BlackRock’s involvement or commentary on Bitcoin governance and security upgrades.

- Any new research quantifying quantum risk, particularly metrics around vulnerable keys and potential attack surfaces in exposed wallets.

- Emerging viewpoints from prominent figures in the space who advocate for faster or slower adoption of quantum-resilience measures and their rationale.

Sources & verification

- BlackRock’s BTC holdings and value reference on iShares Bitcoin Trust page.

- CoinShares research outlining the quantum vulnerability landscape for Bitcoin and the count of vulnerable addresses.

- Bitcoin price data and 30-day performance cited by CoinMarketCap.

- Remarks from Nic Carter on the Bits and Bips podcast and related discussion threads on X (Twitter).

Quantum risk, governance and the future of Bitcoin

Bitcoin (CRYPTO: BTC) sits at the center of a fraught debate about how quickly the network should respond to the looming threat of quantum computing. In the Bits and Bips discussion, Nic Carter framed a scenario where institutions with billions of dollars at stake could lose patience with a dev community perceived as dragging its feet on a critical upgrade. He warned that the gatekeepers of capital might push for a reconfiguration of development leadership, arguing that “the corporate takeover” could become a practical reality if cryptographic progress remains slow. The assertion is provocative, but it highlights a real tension: the need to balance rapid risk mitigation with the safeguards that come from broad, consensus-driven protocol evolution.

BlackRock’s reported stake in BTC amplifies the significance of this tension. With around 761,801 BTC behind a $50.15 billion position, the firm’s exposure underscores why governance and upgrade decisions in Bitcoin become questions with market-wide consequences. The argument that institutions might actively influence the upgrade path rests not on ideological appeal but on the leverage that comes from asset ownership and the perceived security of client funds. Carter’s question—what choice do institutions have when problems aren’t being addressed—frames this as a practical policy question as much as a technological one.

Yet the Bitcoin ecosystem remains far from a monolithic front. Other voices argue that large holders are primarily passive investors rather than active governance agents, suggesting that the path of protocol evolution will continue to hinge on a combination of developer consensus, open research, and gradual, tested improvements. Austin Campbell and other observers point to a need for vocal stakeholders to participate in technical discussions, ensuring that any shift toward quantum resilience reflects a broad spectrum of interests rather than a single corporate logic. On the other hand, researchers and market observers have presented data suggesting that the immediate threat may be more manageable than headline risk implies, reinforcing the idea that any upgrade will be incremental and guarded by multiple layers of security review.

As the market digests these perspectives, the next few quarters are likely to feature intensified dialogue around cryptographic resilience, governance mechanisms, and the practicalities of deploying quantum-resistant technologies without destabilizing the network. The discussion also reflects a broader trend: institutions increasingly seeking a measurable, verifiable security posture when engaging with crypto assets, and developers striving to preserve decentralization while addressing evolving risk models. The interplay between capital influence and technical progress will continue to shape how Bitcoin navigates this complex risk landscape—an evolution that could redefine how the network balances security, governance, and growth in a dynamic market environment.

Crypto World

here’s why Pepe Coin, Zcash, Morpho, and Dogecoin are rising

A crypto market rally is going on today, February 15, as investors buy the recent dip after the encouraging US consumer inflation report.

Summary

- The crypto market rally restarted today, with Bitcoin and most altcoins rising by double digits.

- This rally ignited after the recent US inflation report, which showed that prices retreated in January.

- The rally is also happening as the Crypto Fear and Greed Index remains in the extreme fear zone.

Bitcoin (BTC) price jumped to $70,000, while the market capitalization of all coins soared to over $2.4 trillion. Pepe Coin (PEPE) jumped by over 30% in the last 24 hours, while Zcash (ZEC), Dogecoin, and Bonk were up by over 10% in the same period.

Most of these tokens have soared by over 50% from their lowest levels this year. Other top gainers were coins like Shiba Inu, Jupiter, Morpho, and Pippin.

Crypto market rally triggered by US inflation report

The ongoing crypto market rally is happening because of last Friday’s macro report, which showed that the headline consumer inflation continued falling in January. This report showed that the headline Consumer Price Index dropped to 2.4% in January from 3% a few months ago. It is slowly moving towards the 2% target..

Another report showed that the labor market is making strides despite some notable layoffs announced this year. The unemployment rate dropped to 4.3% as the economy created over 130k jobs during the month.

These numbers mean that the Federal Reserve will likely cut interest rates more time than expected this month. While Fed officials have hinted at one interest rate cut this year, most analysts expect that the bank will deliver more cuts than that.

The crypto market rally is also happening as the futures open interest continues rising. Data compiled by CoinGlass shows that the futures open interest rose by nearly 2% to $100 billion, a sign that investors are adding more leverage to their positions.

Crypto Fear and Greed Index has rebounded

Additionally, the rally is happening because of the ongoing performance of the Crypto Fear and Greed Index, which has remained in the extreme fear zone in the past few weeks. It has jumped from the extreme fear zone of 8 to the current 13.

Historically, crypto bull runs normally start whenever the Fear and Greed Index falls to the extreme fear zone. A good example of this is what happened earlier this year when Bitcoin and other cryptocurrencies rallied.

Still, there is a need for caution as this rebound may be a dead-cat bounce, a situation where financial assets in a freefall rebound briefly and then resumes the downtrend trend.

Crypto World

Why Heavy Crypto Selling Often Signals Institutional Accumulation, Not Weakness

TLDR:

- Institutional buyers require substantial sellers to build large positions without excessive slippage.

- Historical market bottoms form during heavy selling as ownership transfers to strong hands.

- Low-volume rallies without seller absorption often prove fragile and fail quickly under pressure.

- What traders interpret as resistance zones frequently represents patient institutional accumulation.

Large sellers appearing in cryptocurrency markets often trigger concern among traders who view heavy supply as resistance.

However, market structure suggests a different reality. Technical analyst Aksel Kibar argues that significant selling pressure enables institutional accumulation rather than preventing price appreciation.

This counterintuitive framework challenges conventional wisdom about market dynamics. Understanding how major buyers require substantial sellers to build positions reveals why apparent resistance zones can precede strong rallies.

Institutional Accumulation Requires a Substantial Supply

Markets function as auctions where every transaction needs both willing buyers and sellers. Many traders expect prices to rise simply because demand exists.

Yet without an available supply, meaningful position building becomes impossible. Pension funds seeking portfolio allocations and hedge funds scaling convictions cannot execute strategies in thin markets.

Price gaps upward when liquidity disappears, but this creates poor entry conditions rather than sustainable trends. Slippage increases dramatically as large orders chase a limited supply.

The result leaves institutions with smaller positions at worse average prices. This friction prevents rather than facilitates strategic deployment.

When institutional sellers provide liquidity, conditions change entirely. Buyers gain time and stability to accumulate quietly. Volume increases as ownership transfers from short-term holders to long-term participants.

Technical analyst Aksel Kibar explains this dynamic: markets cannot move higher sustainably unless strong hands enter, and strong hands require someone willing to sell size.

The process traders interpret as price suppression often represents patient accumulation. What appears as capping actually allows sophisticated positioning.

Retail participants see resistance, while institutions see opportunity. This disconnect between perception and reality shapes market outcomes.

Historical Patterns Show Strength Building Under Pressure

Major market bottoms frequently form while large sellers remain active. Weak holders panic, and forced liquidations create supply.

Institutions step in to absorb available positions during these periods. Volume rises not from weakness but from ownership changing hands.

This absorption phase makes the price appear stuck under heavy supply. However, structural strength builds beneath visible action.

Markets consolidate as distribution meets accumulation. The visible seller provides necessary liquidity for invisible buyers.

Rallies beginning without this process often prove fragile. Low-volume moves lack genuine ownership transfer. These liquidity-driven advances look strong initially but fail quickly. Sustainable bull trends require high volume, willing sellers, and patient buyers working together.

Strong hands differ from traders by prioritizing size, stability, and time over quick moves. Large sellers provide all three elements simultaneously.

Without them, entry becomes inefficient and volatility increases. Markets that eliminate sellers before major rallies never allow proper institutional positioning. The presence of committed supply paradoxically enables rather than prevents subsequent appreciation.

Crypto World

Bitcoin Devs’ Inaction on Quantum Will Frustrate Institutions: VC

Major Bitcoin-holding institutions may eventually lose patience with Bitcoin developers for not addressing quantum computing concerns quickly enough, according to venture capitalist Nic Carter.

“I think the big institutions that now exist in Bitcoin, they will get fed up, and they will fire the devs and put in new devs,” Carter said during the Bits and Bips podcast episode published on Thursday.

“I think the devs will continue to do nothing,” Carter said.

“If you’re BlackRock and you have billions of dollars of client assets in this thing and its problems aren’t being addressed, what choice do you have?” he said.

“Corporate takeover” is a possibility, says Carter

BlackRock, the world’s largest asset manager, holds around 761,801 Bitcoin (BTC), valued at roughly $50.15 billion as of publication. That amounts to around 3.62% of Bitcoin’s total supply.

Carter warned that if Bitcoin developers don’t move quickly to implement quantum-resistant cryptography, it will lead to “a corporate takeover,” arguing that it will be “a successful one.”

Zero Knowledge Consulting founder Austin Campbell echoed a similar sentiment. “If there is a structural problem here, and they have a large view, eventually they are going to be required to speak up,” Campbell said.

Carter has been vocal recently about the threat that quantum computing poses to Bitcoin. He said on Jan. 21 that Bitcoin’s “mysterious” price underperformance is “due to quantum” and is “the only story that matters this year.”

Bitcoin is trading at $70,281 at the time of publication, down 26.25% over the past 30 days, according to CoinMarketCap.

However, not everyone agrees that institutions would attempt to influence the network. Lumida Wealth Management founder Ram Ahluwahlia said that major institutions in Bitcoin are “passive” investors. “They are not activists,” he said.

Industry split over urgency of Bitcoin quantum risk

It comes as the broader industry continues to debate how imminent the threat to Bitcoin really is.

Related: Bitcoin passes $69K on slower US CPI print, but Fed rate-cut odds stay low

Capriole Investments founder Charles Edwards views quantum computing as a potential “existential threat” to Bitcoin, arguing that an upgrade is needed now to strengthen network security.

Meanwhile, CoinShares Bitcoin research lead Christopher Bendiksen argued in a post on Friday that just 10,230 Bitcoin of 1.63 million Bitcoin sit in wallet addresses with publicly visible cryptographic keys that are vulnerable to a quantum computing attack.

Some Bitcoiners, such as Strategy executive chairman Michael Saylor and Blockstream CEO Adam Back, believe quantum threats are overblown and will not disrupt the network for decades.

Magazine: Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets

Crypto World

Top reasons why the Pi Network price has surged by 50%

Pi Network price has staged a strong recovery this month, moving up by 50% from its lowest level this year, making it one of the best-performing cryptocurrencies in the industry.

Summary

- Pi Network price has gone parabolic in the past few days.

- The token’s rally has coincided with the broader crypto market rally.

- Pi Coin’s rally has coincided with the broad crypto market rally.

Pi Coin (PI) token rose to a high of $0.1945, its highest level since January 20th. It has risen in the last four consecutive days, outperforming other cryptocurrencies like Bitcoin and Ethereum.

Pi Network token jumped as investors waited for key upgrades, which will start today, February 15. More upgrades will continue in the coming weeks or months as the developers work towards increasing its decentralization. The upgrades are part of its movement from version 19 to 22 of the Stellar network.

Pi Network price has also jumped as investors anticipate the upcoming first-year anniversary of its mainnet launch, which happened on February 20th last year.

Additionally, data shows that the coin’s demand has jumped in the past few days. Data compiled by CoinMarketCap shows that the 24-hour volume jumped to over $52 million, much higher than the recent daily average of below $10 million.

Most importantly, there are signs that the network will receive a big listing later this year. For example, Kraken, a top American exchange, has hinted that it will launch it soon. It has added it on its roadmap page, raising the possibility of a listing.

Kraken will become the first major exchange that has listed the token since its mainnet launch last year. It will make it available to other American investors as the company has millions of customers.

Pi Coin price is also doing well because of the ongoing crypto market rally, which started on Friday after the US released the latest consumer inflation report. The report revealed that the headline CPI fell to 2.4% in January and is slowly moving towards the 2% target.

Pi Network price technical analysis

The daily timeframe chart shows that the Pi Network price bottomed at $0.1300 this month and has rebounded in the past few days. It has rebounded to a high of $0.1965, its highest level since January 19.

The token has jumped above the key resistance level at $0.1522, its lowest level on October 10 last year. It formed a double-bottom pattern at that level. It also rebounded after becoming oversold.

The coin has now formed a three white soldiers pattern, which is made up of three consecutive bullish candles. It has moved above the 50-day Exponential Moving Average, a sign that bulls are in control.

Therefore, the most likely scenario is where the token continues rising as bulls target the key resistance level at $0.2166, its highest swing in December last year. A move above that level will point to more gains, potentially to the psychological level at $0.2500.

The risk, however, that the ongoing rebound could be a dead-cat bounce, where an asset in a freefall rebounds and then resumes the downtrend.

Crypto World

Vitalik Buterin Proposes Hedging-Based Transformation for Prediction Markets

TLDR:

- Buterin warns prediction markets prioritize short-term betting over meaningful information discovery value

- Current platforms rely on naive traders with poor judgment, creating incentives for exploitative practices

- Hedging applications allow users to reduce risk exposure without extracting value from uninformed participants

- Personalized AI-driven prediction market baskets could replace traditional stablecoins and fiat currencies

Prediction markets face a critical juncture as Ethereum co-founder Vitalik Buterin expresses growing concerns about their current trajectory.

The platforms have achieved commercial success with substantial trading volumes. However, they increasingly focus on short-term cryptocurrency bets and sports wagering.

Buterin argues this shift toward immediate gratification undermines the technology’s potential for societal benefit. The current model prioritizes revenue over meaningful information discovery.

Buterin recently outlined an alternative vision centered on hedging applications that could reshape decentralized finance.

Current Market Dynamics and Sustainability Concerns

Prediction markets currently operate with two primary participant types. Smart traders provide market intelligence and generate profits through informed positions.

The counterparty must inevitably absorb losses to maintain market function. This structure creates fundamental questions about long-term viability.

Buterin identifies three categories of loss-absorbing participants in his analysis. Naive traders bet on incorrect outcomes based on flawed reasoning.

Information buyers fund automated market makers to extract valuable data. Hedgers accept negative expected value to reduce overall risk exposure.

The present ecosystem relies heavily on naive traders with poor judgment. Buterin acknowledges no inherent moral failing in this dynamic.

Nevertheless, he warns this dependency creates perverse incentives for platform operators. Companies feel pressure to attract and retain traders with weak analytical skills.

This approach pushes platforms toward what Buterin describes as activities with short-term appeal but lacking meaningful value. Teams justify these choices as survival tactics during challenging market conditions.

The business model rewards cultivating communities that embrace poor decision-making. Market participants chase dopamine-driven activities rather than meaningful information discovery.

Hedging Applications and Decentralized Stability Solutions

Buterin proposes hedging as a sustainable alternative for prediction market growth. The concept extends beyond traditional insurance into personalized risk management.

A biotech shareholder could bet against favorable political outcomes to balance portfolio exposure. This strategy reduces volatility without requiring zero-sum extraction from uninformed traders.

The most ambitious application targets stablecoin architecture itself. Current stablecoins depend on fiat-backed reserves that compromise decentralization principles.

Users seek price stability to meet future financial obligations. Different individuals face varying expense profiles across goods and services.

Buterin envisions eliminating traditional currency through prediction markets on diverse spending categories. Users would hold personalized baskets of market shares representing their expected expenses.

Local artificial intelligence systems would analyze individual spending patterns. The technology would recommend appropriate hedging positions for each user’s circumstances.

This framework requires markets denominated in productive assets like interest-bearing instruments or wrapped equities. Non-yielding currencies carry excessive opportunity costs that negate hedging benefits.

Both market sides achieve satisfaction when participants pursue genuine risk management. In his message, Buterin urges the industry to “build the next generation of finance, not corposlop.” Sophisticated capital flows naturally toward sustainable economic structures rather than exploitative models.

Crypto World

Ethereum Whales Seem Confused, Where Is Price Heading?

Ethereum price remains under pressure after a recent decline that stalled recovery momentum. ETH trades at $2,087 and has reclaimed the $2,000 level, but is failing to build sustained upside.

The challenge facing Ethereum is not just resistance levels, but indecision among key holder cohorts.

Sponsored

Sponsored

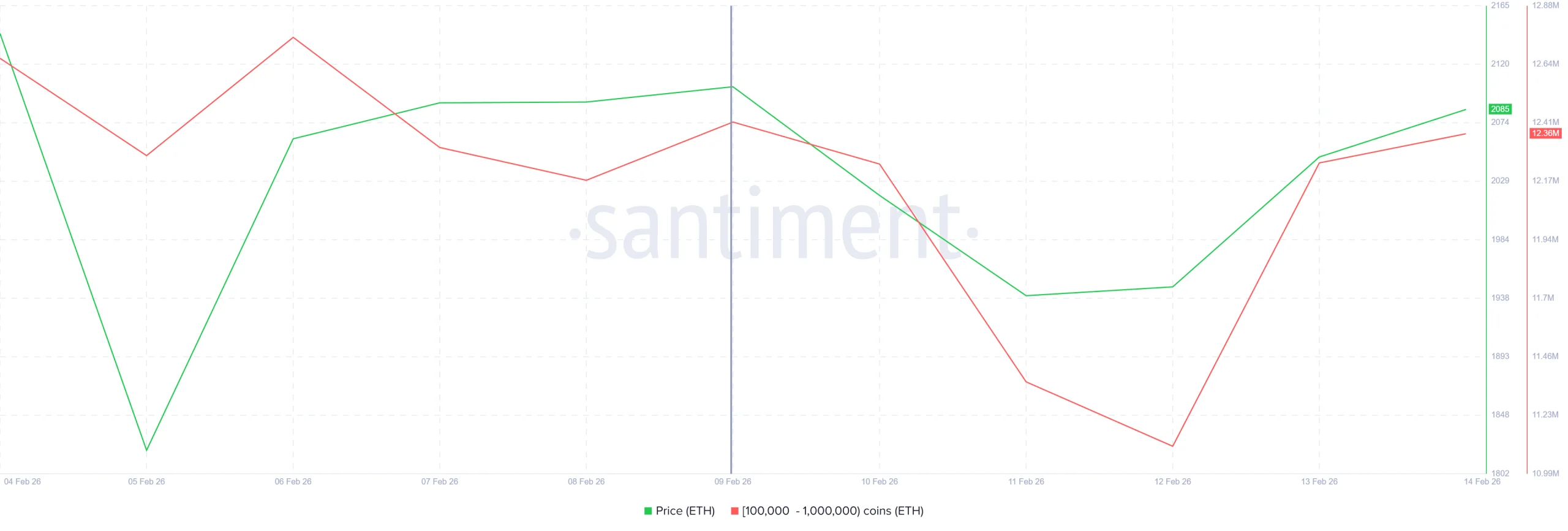

Ethereum Whales Sell… Then Buy Again

Whales and long-term holders represent two of the most influential cohorts in any cryptocurrency market. In Ethereum’s case, both groups are sending mixed signals. This lack of alignment is contributing to prolonged sideways price action.

Addresses holding between 100,000 and 1 million ETH sold approximately 1.3 million ETH between February 9 and February 12. That selling equates to roughly $2.7 billion in value. However, the same cohort purchased 1.25 million ETH within the following 48 hours.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The rapid reversal represented nearly $2.6 billion in buying during the same week. Such large-scale back-and-forth activity creates liquidity without directional bias. As a result, the Ethereum price remains range-bound rather than trending decisively upward or downward.

Sponsored

Sponsored

Ethereum LTHs Accumulated… But They Are Now Selling

The HODLer net position change metric reinforces this indecision. This indicator tracks movements of long-term holder balances. Since late December 2025, long-term holders had been steadily accumulating ETH.

At the beginning of February, that trend shifted. Long-term holders reduced buying activity and began modest distribution. While the selling pressure has not been aggressive, it signals growing uncertainty among investors, typically associated with strong conviction.

Mixed whale activity, combined with cautious long-term holders, limits bullish momentum. Without sustained accumulation from these cohorts, the Ethereum price faces difficulty breaking above major resistance levels.

ETH Price Is Stuck Around $2,000

Ethereum trades at $2,087 and has successfully reclaimed the $2,000 threshold. The next major resistance sits at $2,241. A move toward that level requires a clear bullish bias from dominant holder groups.

Given the current absence of decisive accumulation, consolidation remains the most probable scenario. Ethereum may continue hovering near $2,000 while defending the $1,902 support level. Sideways momentum could persist until directional conviction emerges.

If whales and long-term holders shift back toward accumulation, Ethereum could break above $2,241. A sustained rally may extend toward $2,395 and potentially test $2,500. Clearing $2,500 would invalidate the bearish thesis and confirm a stronger recovery trend.

-

Politics7 days ago

Politics7 days agoWhy Israel is blocking foreign journalists from entering

-

Business7 days ago

Business7 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech4 days ago

Tech4 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports6 days ago

Sports6 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Tech4 hours ago

Tech4 hours agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video2 days ago

Video2 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics7 days ago

Politics7 days agoThe Health Dangers Of Browning Your Food

-

Business7 days ago

Business7 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business6 days ago

Business6 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

NewsBeat6 days ago

NewsBeat6 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World1 day ago

Crypto World1 day agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World5 days ago

Crypto World5 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World5 days ago

Crypto World5 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video3 days ago

Video3 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle