Crypto World

Coinbase Launches Crypto Wallets for AI Agents

Coinbase has unveiled a wallet infrastructure designed to let AI agents spend, earn, and trade crypto autonomously. The feature, dubbed Agentic Wallets, builds on the AgentKit framework introduced in November 2024 and aims to push agents from answering questions to taking concrete actions in the market. The system enables developers to embed wallets into agents, enabling tasks such as monitoring DeFi positions, rebalancing portfolios, paying for compute and API access, and participating in creator economies. Core to this rollout is x402, Coinbase’s payments protocol built for autonomous AI use cases, which has reportedly processed 50 million transactions to date.

Agentic Wallets are designed to operate across networks, including the Ethereum layer-2 network Base, where agents can manage positions and execute strategies wherever opportunities exist. The approach envisions a future where agents autonomously optimize yields, rebalance liquidity, and deploy capital without requiring explicit, real-time approvals, provided permissions and controls are preconfigured by users. This marks a shift from AI assistants that merely advise to agents that act, according to Coinbase engineers Erik Reppel and Josh Nickerson in a Wednesday post announcing the development.

“The next generation of agents won’t just advise — they’ll act,” Reppel and Nickerson wrote, detailing plans for agents to perform a range of functions from monitoring yields across protocols to executing trades on Base and managing liquidity positions around the clock. They described a scenario in which an agent detects a more favorable opportunity at 3 a.m., rebalances automatically, and does so without explicit approval because user permissions and safety controls are already in place.

AI agents now operable on the Bitcoin Lightning Network

Beyond Ethereum’s Base, Lightning Labs—the team behind Bitcoin’s Layer-2 Lightning Network—rolled out a new toolset enabling AI agents to transact on Lightning through the L402 protocol standard. The update also allows AI agents to run a Lightning node and manage a Lightning wallet containing native Bitcoin (BTC) without accessing private keys. This development broadens the scope for autonomous financial activity on Bitcoin’s network, providing a parallel pathway for agents to engage with programmable money at the base layer’s second tier.

The push toward agent-enabled wallets comes alongside broader industry activity. Crypto.com CEO Kris Marszalek announced ai.com, a platform intended to let users create personal AI agents to perform everyday tasks on their behalf. The capability ranges from managing emails and scheduling meetings to canceling subscriptions, shopping tasks, and even trip planning. Marszalek described a spectrum of tasks that AI agents could handle, illustrating how these tools might eventually operate as your digital proxy across daily routines.

Why crypto leaders are embracing agentic AI

Industry executives have long warned that AI could redefine how value is exchanged online. In late January, Circle CEO Jeremy Allaire suggested billions of AI agents could transact with crypto and stablecoins for everyday payments within three to five years. Former Binance CEO Changpeng Zhao has echoed a similar sentiment, arguing that a native currency for AI agents is likely to be crypto, capable of supporting tasks from purchasing event tickets to paying restaurant bills. These public statements reflect a shared belief that programmable money and autonomous agents will converge to enable more fluid, real-time financial interactions.

At a higher level, the convergence of AI with decentralized finance and payments ecosystems is driving experimentation around agent autonomy. Google’s recent Universal Commerce Protocol, announced in January, is designed to power agentic commerce by enabling agents to initiate transfers on a user’s behalf, with Google Pay acting as the default payment handler for USD-denominated transactions. The protocol signals a broader push in the tech sector to enable AI-driven commerce that can operate across apps, devices, and payment rails without constant human oversight.

“Build agents that monitor yields across protocols, execute trades on Base and manage liquidity positions 24/7. Your agent detects a better yield opportunity at 3am? It rebalances automatically, no approval needed because you’ve already set permissions and controls.”

As these capabilities mature, momentum in the space is likely to hinge on two dimensions: the robustness of autonomous decision-making and the security of permissioning and governance models. Agentic Wallets must balance the convenience of automated actions with safeguards to prevent unintended risk exposure. The ongoing conversations around risk controls and regulatory alignment will shape how broadly such wallets are adopted by retail and institutional users alike.

Market context

The emergence of autonomous wallets sits within a broader cycle of increased on-chain programmability and the maturation of smart contract-enabled finance. As liquidity provision, yield optimization, and creator economy participation become more automation-friendly, the appetite for self-operating agents grows among developers and institutions alike. The convergence of AI tooling with established networks like Base and the Lightning Network underscores a dual-track approach: one path leverages scalable, smart-contract-enabled ecosystems, while the other emphasizes fast, low-friction payments on Bitcoin’s secondary layer. Regulatory clarity and ETF-related flows in traditional markets are likely to influence how aggressively capital participates in these early-stage, automation-centric use cases.

Why it matters

Agentic Wallets represent a tangible step toward programmable money that can autonomously allocate capital, monitor risk, and adjust exposure across multiple protocols. If successful, the approach could reduce the overhead of manual trading and portfolio management, enabling more people to experiment with sophisticated strategies without in-depth technical know-how. The ability to manage DeFi positions and pay for compute or data access autonomously also has implications for developers building AI-powered financial tools, potentially accelerating product development cycles and new business models in the crypto space.

The integration with Bitcoin’s Lightning Network adds a separate layer of significance. By enabling AI agents to transact via L402 on Lightning and hold a Lightning-compatible wallet, the ecosystem expands the set of on-chain and off-chain rails that can be orchestrated by autonomous programs. This broadens practical use cases for AI agents—from micro-payments to cross-network arbitrage—while testing the limits of permissioned automation and the user controls that balance safety with convenience. Taken together, these developments suggest a future in which agents operate across multiple rails with varying latency, fees, and settlement characteristics.

For users and builders, the key takeaway is a shift in how wallets are used and who controls them. Agentic Wallets place agency in the hands of AI-enabled programs, but with computerized governance that requires explicit permissions ahead of time. The risk-management framework around such permissions will be critical to its sustainable adoption, particularly as public enthusiasm for automation intersects with concerns about security and misuse. The coming months are likely to reveal the first generation of real-world deployments and decision-making heuristics that will define the role of agents in everyday crypto activity.

What to watch next

- Expansion of Agentic Wallets beyond Base to other Ethereum layer-2s and compatible networks, including any developer updates from Coinbase.

- Tracking adoption and volume on the x402 payments protocol, including any reported milestones beyond the 50 million transactions already noted.

- Broader deployment of AI agents on Bitcoin via the Lightning Network using L402, and the integration of wallets with Lightning node operations.

- Progress and practical traction for ai.com by Crypto.com, including user adoption metrics and featured autonomous tasks.

- Further details on Google’s Universal Commerce Protocol and collaboration milestones that enable agent-initiated transfers and payments in real-world settings.

Sources & verification

- Coinbase: Introducing AgentKit — developer-facing overview and the roadmap for embedding wallets into autonomous agents.

- Coinbase Developer Platform status updates on AgentKit and Agentic Wallets deployment.

- Lightning Labs: L402 protocol standard enabling AI agents to transact on Lightning and manage Lightning-enabled wallets.

- Crypto.com: ai.com platform launch and its scope for personal AI agents performing daily tasks.

- Google: Universal Commerce Protocol and Agent Payment Protocol 2 for agent-enabled transfers in commerce.

Key figures and next steps

Coinbase’s public framing of Agentic Wallets as a step toward “agents that act” follows a broader wave of AI-powered automation across crypto layers. The combination of AgentKit, x402, and multi-network reach—spanning Base and the Lightning Network—provides a multi-faceted testbed for autonomous financial activity. Investors and builders will be watching for evidence of sustainable user authorization models, transparent risk controls, and clear metrics around automated yield optimization and liquidity management. As the ecosystem experiments with agent-based transactions, market participants will assess whether these autonomous wallets can reliably operate without compromising security or user intent.

Crypto World

Berachain (BERA) is up 75%: here’s why the altcoin is rising

- Berachain’s strategic shift toward revenue-driven apps boosted long-term confidence.

- The successful mainnet launch and smooth token unlock have helped ease BERA’s selling pressure.

- Berachain’s token price needs to stay above $0.8318 for the bullish momentum to hold.

Berachain’s native token, BERA, posted a sharp 75% rally in 24 hours, drawing renewed attention from traders and long-term crypto investors alike.

The move comes after a prolonged period of weakness that pushed the token close to its all-time lows earlier this year, coinciding with the broader crypto market’s plunge.

This sudden reversal has not been driven solely by hype, but by a combination of structural, strategic, and market-specific developments that have shifted sentiment around the project.

Below is a breakdown of the key reasons behind BERA’s strong rebound and what it could mean going forward.

Strategic shift toward revenue-generating applications

One of the most important catalysts behind BERA’s rally is Berachain’s strategic pivot toward supporting applications that generate real, sustainable revenue.

In its end-of-year report, Berachain stated that it has moved away from heavy reliance on token incentives and emissions that often attract short-term liquidity but create long-term sell pressure.

Instead, the focus is now on encouraging builders to create businesses that generate fees, activity, and organic demand for the token.

This shift has resonated with the market because it addresses one of the biggest criticisms of many layer-1 projects, which is the lack of durable economic value.

By prioritising sustainable use cases, Berachain has improved investor confidence in the long-term utility of BERA.

This narrative change has helped reframe BERA from a speculative asset into a token with a clearer economic role within its ecosystem.

Token unlock passed without heavy selling pressure

BERA also benefited from a token unlock event that did not result in the aggressive selling many had anticipated.

According to data from Tokenomist, Berachain, on February 6, unlocked tokens worth around $24 million.

Token unlocks often lead to sharp declines as early holders rush to realise profits.

In this case, the market absorbed the additional supply relatively smoothly.

The lack of panic selling surprised traders and reinforced the idea that weaker hands had already exited during the long downtrend.

This dynamic contributed to a relief rally, as short sellers were forced to reconsider their positions.

As selling pressure failed to materialise, upward momentum accelerated.

Berachain mainnet launch

Berachain’s mainnet launch on February 6 marked a critical milestone for the project and laid the foundation for long-term ecosystem growth.

The launch was accompanied by a large airdrop that distributed a meaningful portion of the token supply to early users and contributors.

This helped decentralise token ownership and encouraged active participation across the network.

By rewarding testnet users and liquidity providers, Berachain strengthened its community and increased on-chain engagement.

The mainnet launch also made it easier for users to interact with the network through familiar wallet infrastructure.

Together, these developments increased visibility and usage, supporting the recent recovery in price.

BERA price forecast

From a technical perspective, the most important support level sits at $0.8318, which needs to hold to maintain the current bullish structure.

As long as BERA remains above this zone, buyers are likely to stay in control.

On the upside, the first major resistance level is located at $1.51, where profit-taking pressure could emerge.

A clean break and sustained move above $1.51 would open the door for a rally toward the next resistance at $1.86.

If bullish momentum continues and market conditions remain favourable, analysts say that the third resistance level to watch is around $2.19.

Failure to hold above the key support, however, could invalidate the bullish outlook and return BERA to consolidation.

But for now, the combination of improved fundamentals and constructive technical levels suggests that traders will remain closely focused on how price behaves around these zones.

Crypto World

Bitmine’s Tom Lee says bottom may be near

BitMine executive Tom Lee discussed Ethereum’s price outlook at Consensus, saying past downturns have always ended in sharp, “V-shaped” recoveries.

Summary

- BitMine executive Tom Lee says Ethereum is likely nearing a bottom, noting that ETH has recovered from every major 50%+ drawdown since 2018.

- Lee points to a potential “undercut” near $1,890 as a technical signal that the current sell-off could be close to exhaustion.

- Ethereum is trading near $1,900 support, with momentum indicators suggesting selling pressure is easing, though key resistance remains overhead.

Ethereum has always rebounded after major drops, says Tom Lee

Lee pointed out that Ethereum (ETH) has fallen more than 50% eight times since 2018, and in every case ETH recovered quickly after hitting a low. He suggested that the current decline is behaving similarly to prior drops and that the market may be close to a bottom.

The Bitmine exec referenced analysis from market timer Tom DeMarc, who believes a revisit to about $1,890, an “undercut” level, would signal a perfected bottom.

“If you’ve already seen the decline, you should be thinking about opportunities here instead of selling,” Lee said, showing his confidence that ETH will rebound again.

Lee emphasized that nothing fundamental has changed about Ethereum’s long-term trajectory despite the recent drop. He believes the current decline should also find a floor soon and transition into an uptrend.

While Lee did not provide exact timing, his comments reflect a bullish long-term view rooted in historical price behavior and technical undercut levels, offering some optimism to investors navigating near-term volatility.

Ethereum price action hovers near $1,900 support

Ethereum’s price has been trading near the $1,900–$2,000 range recently amid broader crypto volatility. At press time, ETH was trading around $1,965, fluctuating in a tight range over the past 24 hours and reflecting cautious sentiment among traders.

The daily chart shows ETH well below its 50-day simple moving average, which is currently positioned near $2,800 and acting as firm overhead resistance. This gap highlights how extended the recent sell-off has been.

The Relative Strength Index (RSI) has rebounded from deeply oversold territory. While RSI remains below the 50 mark, the recovery indicates selling momentum is slowing rather than accelerating.

Price action over recent sessions points to short-term base formation around the $1,850–$1,900 range. This zone has acted as support, with buyers stepping in to defend repeated dips. A decisive break below $1,850 would weaken the near-term structure and open the door toward the next support near $1,750.

On the upside, initial resistance sits near $2,000, a psychological level that has capped recent rebound attempts. Beyond that, stronger resistance emerges around $2,100–$2,150.

Crypto World

OKX Ventures backs STBL in partnership with Hamilton Lane and Securitize

OKX Ventures, the venture capital arm of the global cryptocurrency exchange, has made a strategic investment in STBL, a next-generation stablecoin and yield infrastructure provider.

STBL, co-founded by Reeve Collins, who also co-founded Tether, and tokenization pioneer Avtar Sehra, also announced a partnership with Hamilton Lane (HLNE), an alternative-investment management firm, and Securitize, a regulated digital securities issuance firm whose clients include BlackRock (BLK).

The plan is to develop a stablecoin backed by real-world assets (RWA) on OKX’s Ethereum-compatible layer-2 blockchain X Layer, the companies said on Wednesday.

The endeavor features a feeder fund to Hamilton Lane’s Senior Credit Opportunities Fund (SCOPE), issued and tokenized via Securitize, according to a press release.

“RWA markets are entering a new phase, where tokenization must deliver real utility, not just representation,” said Sehra, who is also CEO of the company. “STBL provides a purpose-built architecture for RWA-backed stablecoins combined with compliant yield management.”

The collaboration shows how tokenization brings utility to assets when it’s paired with regulated issuance and programmable settlement, said Securitize CEO Carlos Domingo.

“By embedding institutional private credit directly into onchain money flows, we’re turning tokenized assets into functional building blocks: assets that can be settled, composed and used across financial applications, not just held,” Domingo said.

Crypto World

Ripple CEO Garlinghouse Reassures XRP Community Amid Market Struggles

Ripple’s CEO, Brad Garlinghouse, recently addressed the ongoing turbulence in the cryptocurrency market, emphasizing XRP’s importance to the company’s future. During his appearance on X Spaces, Garlinghouse reassured the community that XRP remains central to Ripple’s operations. Despite the market’s struggles, Ripple is focused on long-term goals that center around the utility and liquidity of XRP and the XRP Ledger.

XRP is the “North Star” for Ripple ✨

@BradGarlinghouse highlights how Ripple Payments, Ripple Prime, & Ripple Treasury all drive utility & liquidity around $XRP. pic.twitter.com/g9xlCPpToy

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) February 11, 2026

Garlinghouse explained that XRP continues to be the company’s guiding principle, described as its “North Star.” He pointed out that Ripple’s various products, including Ripple Payments, Ripple Prime, and Ripple Treasury, all aim to increase XRP’s utility. The goal, he noted, is to build trust around XRP, which remains the “heartbeat” of Ripple’s financial infrastructure.

Ripple’s focus on XRP is evident in the company’s aggressive strategies. These efforts include expanding its services in traditional finance while working to build cross-sector solutions for both crypto and traditional financial systems. This strategy aligns with Garlinghouse’s belief that XRP plays a crucial role in shaping the future of financial systems globally.

Ripple Takes an Offensive Approach Amid Market Drawdown

Garlinghouse acknowledged the recent market downturn, which he described as a “bloodbath.” Despite the setback, he suggested that the current conditions could offer an opportunity for investors to enter the market. His view echoes the sentiment that periods of fear can present valuable buying chances for those willing to take risks.

He noted that, while the crypto market is facing significant challenges, XRP has remained resilient. Since November 2024, XRP has been one of the top performers in the market, contrasting with Bitcoin’s relatively flat performance. This positive outlook highlights the coin’s strength and Ripple’s commitment to its long-term vision despite market fluctuations.

Ripple’s Focus on Expansion and Strategic Acquisitions

After years of navigating regulatory challenges, Ripple is now focusing on aggressive acquisitions to accelerate its growth. Garlinghouse described this shift as a crucial move to position Ripple for future success. The company is working hard to recover time lost due to past delays and to maintain its momentum in 2026.

Ripple’s acquisition strategy aims to expand its reach beyond the cryptocurrency community and into traditional finance. By blending both sectors, the company aims to bridge gaps and create solutions that benefit both crypto and conventional financial institutions. This dual focus positions Ripple for broader success as the company prepares to make an even stronger impact in 2026.

Ripple’s approach, according to Garlinghouse, will allow the company to forge new paths in the crypto space while securing XRP’s dominance in the global financial ecosystem. With its aggressive acquisition strategy and renewed focus, Ripple is set to continue pushing forward into 2026, determined to shape the future of finance.

Crypto World

Wallet in Telegram Launches Cross Chain Deposits in Self Custodial TON Wallet

[PRESS RELEASE – Ile Du Port, Seychelles, February 11th, 2026]

Over 100 million users can now fund their TON Wallet using crypto from the most popular blockchains – no additional bridges, swaps or manual conversions required.

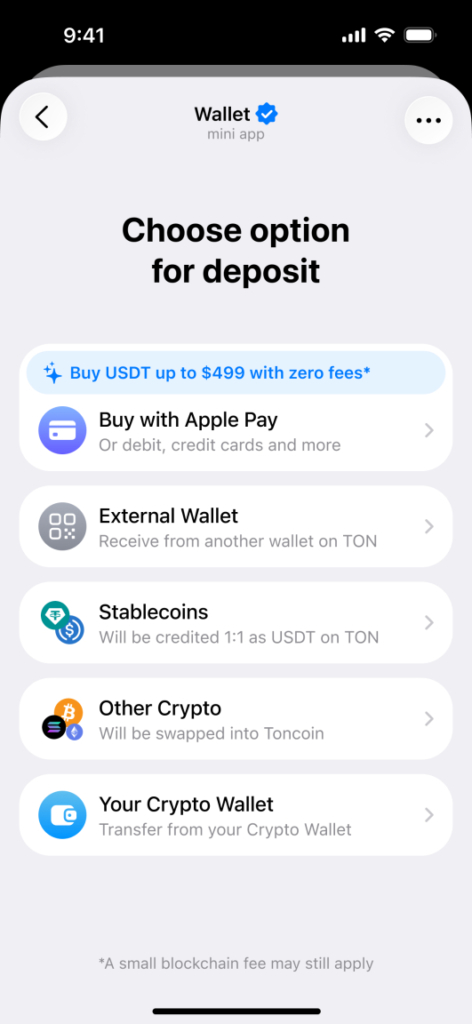

Wallet in Telegram today announced the launch of cross-chain deposits in its self-custodial TON Wallet, enabling users to fund their wallets with crypto from the most popular blockchains. Powered by MoonPay, the integration manages cross-chain transfers behind the scenes, ensuring a smooth deposit experience in TON Wallet.

With this launch, more than 100 million users can transfer their stablecoins from other chains to TON without friction or losing value. TON Wallet users can now deposit USDC or USDT from Ethereum, Solana, TRON, BSC, Polygon, Arbitrum, and Base – converted at a 1:1 rate to USDT (TON) – directly in Wallet in Telegram. This removes the need to already hold TON-native assets, opening the ecosystem to users across the broader crypto landscape. As part of the integration, users will soon be able to withdraw USDT on TON to USDT or USDC on popular blockchains with a fee and deposit BTC, ETH, and SOL, which are automatically converted into Toncoin.

This Launch Introduces the Following Functionality

- Stablecoin deposits from leading blockchains, allowing users to deposit USDC or USDT with automatic 1:1 conversion into USDT (TON)

- Stablecoin withdrawals from USDT (TON) to USDT or USDC on other major blockchains, processed at a 1:1 rate, subject to applicable network and service fees. Will be available soon.

- Crypto deposits from BTC, ETH, and SOL, which are automatically converted into Toncoin upon arrival in TON Wallet

Removing Barriers to Web3 Adoption on Telegram

Funding a self-custodial wallet has traditionally been a complex, multi-step process. Through its collaboration with MoonPay, Wallet in Telegram removes this friction by introducing a single, seamless deposit flow that works across blockchains and assets. As a result, cross-chain transfers are now as simple as custodial ones, significantly streamlining onboarding into TON Ecosystem – while preserving value by minimizing unnecessary conversion losses and fees.

“One of the biggest challenges in crypto adoption is the first step – getting users funded and ready to participate. Until now, using TON Wallet meant already having assets on TON, which created unnecessary friction and limited access to the broader ecosystem. Now, we’re removing that barrier entirely. Users can bring their funds directly into TON Wallet from other networks, without unnecessary conversions, exchanges or lock-ins,” said Andrew Rogozov, Founder and CEO of The Open Platform and Wallet in Telegram. “Our goal is simple: make entering, and exiting, TON ecosystem as seamless as using a custodial wallet, while preserving the freedom and control of self-custody.”

Powered by MoonPay Deposits and built on MoonPay’s infrastructure, the solution supports the end-to-end flow, from deposit detection to final asset delivery, and is integrated natively into partner environments

“Users shouldn’t have to buy new assets or navigate complex steps just to fund an account,” said Ivan Soto-Wright, CEO of MoonPay. “We simplify the process by letting people use the crypto they already have while we handle the technicalities behind the scenes, making it easier to move value across the ecosystem and access a broader range of applications.”

Funding a TON Wallet now takes just a few steps

- The Deposit section includes two options: Stablecoins (for 1:1 stablecoin deposits) and Other Crypto (for converting BTC, ETH, or SOL to TON).

- After selecting the token and the originating network, a deposit address is generated automatically.

- The deposit address can be copied or accessed via QR code.

- This address is entered on the withdrawal page of the external wallet or exchange.

- The transfer amount must meet the minimum deposit requirement.

- Once the details are verified, the transfer is confirmed on the sending platform.

Funds arrive in the user’s selected asset, fully compatible with TON ecosystem and Telegram’s growing network of decentralized applications.

Built for Scale, Native to Telegram

The new deposit experience is available exclusively in the self-custodial TON Wallet, part of Wallet in Telegram’s dual-wallet setup, and is fully integrated into the Telegram interface. By abstracting away cross-chain complexity, Wallet in Telegram makes it easier for users to participate in DeFi, gaming, payments, and on-chain apps – without needing deep crypto expertise.

This launch marks a major step toward making Telegram the most accessible Web3 gateway in the world, combining mass-market distribution with self-custody and open blockchain infrastructure.

About Wallet in Telegram

Wallet in Telegram is a digital asset solution natively embedded into Telegram’s interface. Backed by The Open Platform, Wallet in Telegram has gained 150M+ registered users to date and continues to grow. The company offers a dual-wallet experience with Crypto Wallet (a multi-chain wallet for trading and sending crypto to contacts) and TON Wallet (a self-custodial wallet with access to TON ecosystem of apps and TON-based digital assets).

About MoonPay

Founded in 2019, MoonPay is a global financial technology company that helps businesses and consumers move value across fiat and digital assets. MoonPay has more than 30 million customers across 180 countries and supports more than 500 enterprise customers spanning crypto and fintech.

Through a single integration, MoonPay powers on- and off-ramps, trading, crypto payments, and stablecoin infrastructure, connecting traditional payment rails with blockchains. MoonPay maintains a broad regulatory footprint, including a New York BitLicense, a New York Limited Purpose Trust Charter, and money transmitter licenses across the United States, as well as MiCA authorization in the EU.

MoonPay is how the world moves value.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Extreme Fear Returns to Crypto: What Investors Should Know

The Crypto Fear & Greed Index fell to 5 on Thursday, signaling a sharp deterioration in market sentiment as digital asset prices continue to slide.

The decline reflects intensifying panic among investors, with risk appetite eroding amid broader global market uncertainty.

Sponsored

Sponsored

Crypto Sentiment Sinks Deeper Into “Extreme Fear”

The Crypto Fear & Greed Index measures the overall emotional state of the cryptocurrency market on a scale from 0 to 100. Readings between 0 and 24 indicate Extreme Fear, 25 to 49 signal Fear, 50 represents Neutral conditions, 51 to 74 reflect Greed, and 75 to 100 denote Extreme Greed.

At 5, the index places the market firmly in Extreme Fear territory. The latest drop comes amid a steady decline in sentiment over recent weeks.

A month ago, the index stood at 26, already within the Fear range. It slid to 12 a week earlier and registered 11 just a day before reaching its current low. The rapid deterioration highlights how quickly confidence has unraveled as prices weakened.

The collapse in crypto sentiment coincides with a broader surge in global economic anxiety, as evidenced by the World Uncertainty Index. The index tracks how frequently the term “uncertainty” appears in Economist Intelligence Unit country reports.

It covers more than 140 countries and provides a quarterly, cross-country indicator widely used in macroeconomic research and global risk analysis.

In the third quarter of 2025, the World Uncertainty Index surged to an all-time high above 100,000. In the fourth quarter, it was recorded at 94,947.

Sponsored

Sponsored

Those levels are roughly double the peaks observed during previous major crises, including the COVID-19 pandemic, Brexit, and the Eurozone debt crisis.

“Rising geopolitical tensions, volatile markets, and policy uncertainty are driving the spike, as investors struggle to price in what comes next,” Coin Bureau wrote.

The elevated reading signals heightened anxiety across global markets as investors grapple with unpredictable economic and political conditions. Against this backdrop, the crypto market’s plunge into Extreme Fear reflects not only falling prices but also a broader retreat from risk assets worldwide.

Crypto Market Cap Falls 22% in 2026 as Bitcoin and Ethereum Extend Losses

The collapse in sentiment comes as the broader crypto market continues to move downwards. In 2026, total market capitalization has fallen by more than 22%, reversing the optimism that defined the start of the year.

Sponsored

Sponsored

Bitcoin, which began January on a stronger footing, ended the month down by more than 10%. It has dropped another 14.6% so far in February.

Ethereum has also fallen 33.8% year to date. The sustained drawdown has weighed on market activity.

Analysts Weigh Crypto Market’s Next Move

Amid these bear market conditions, the community remains uncertain about what comes next. Analyst Kyle Chassé pointed to historical precedents, noting that similarly depressed readings in the Crypto Fear & Greed Index were seen in 2018, March 2020, and in the aftermath of the FTX collapse in 2022.

Sponsored

Sponsored

“Every time, it marked a massive opportunity window. No, it doesn’t guarantee the bottom. But historically, peak fear is where asymmetry lives,” he said.

Other analysts argue the current downturn could represent a shakeout phase before a potential breakout. Still, it remains unclear when, or if, a broader crypto market recovery will follow.

Ray Youssef, CEO of NoOnes, has forecasted that Bitcoin could trade sideways until summer 2026. He noted that the exact location of the Bitcoin bottom remains unclear and that current dynamics increasingly suggest the market has entered a protracted reassessment of risk.

Youssef pointed to several structural factors, including US political and monetary cycles, persistent inflation constraints, weakened retail capital flows, and cautious institutional demand following heavy losses.

“As a result, we are unlikely to see a V-shaped reversal before the summer of 2026. More likely, we will see regular rebounds, triggered by short-covering and short squeezes,” he told BeInCrypto.

According to Youssef, such rebounds could be strong, ranging between 20% and 30%, and potentially prolonged. However, he warned they may ultimately prove to be bull traps.

He stated that crypto traditionally remains in a long accumulation phase within a single range before the start of a true bull market.

Crypto World

DAO Development for Regulated Stablecoin Ecosystems

Over the past five years, DAOs promised borderless governance, permissionless finance, and community-driven growth. Today, a new reality is reshaping this vision. Regulation is no longer operating in the background. It is now directly influencing how DAOs design their governance, manage treasuries, and build trust with investors and institutions. At the same time, stablecoins have become the primary settlement layer for Web3 economies. For founders, investors, and governance leaders, this shift raises critical questions. How do you remain decentralized while meeting compliance expectations? How do you protect treasury assets from regulatory risk? How do you design governance systems that institutions can trust? This blog answers those questions.

Inside, you will learn how regulation is transforming DAO architecture, why traditional governance models are losing credibility, and how modern DAO development is evolving into a scalable, institution-ready framework. If you are building, investing in, or advising a DAO, this guide will help you make informed decisions for long-term growth in regulated stablecoin ecosystems.

How Stablecoin Regulation Is Reshaping DAO Architecture

Governments worldwide are implementing formal rules for stablecoin issuance, custody, and settlement, fundamentally reshaping how DAOs operate in regulated financial environments and accelerating the demand for advanced DAO development frameworks. In the United States, authorities are enforcing reserve audits and issuer licensing, while the European Union is advancing MiCA compliance frameworks. Across Asia, regulators are strengthening payment-token supervision models, and Middle Eastern jurisdictions are establishing dedicated digital asset oversight authorities.

As regulated stablecoins become the dominant settlement layer, DAOs integrating them are now expected to meet higher operational standards, including full treasury transparency, automated KYC and AML compliance layers, real-time transaction monitoring systems, and clearly defined governance accountability norms. As a result, traditional anonymous treasury and token-based voting models are becoming structurally weak and increasingly incompatible with institutional and regulatory expectations.

What Changes Inside a DAO?

Modern DAO architecture is shifting toward:

- Segmented treasury wallets

- Role-based governance permissions

- Regulated payment rails

- Smart-contract compliance logic

- Hybrid on-chain/off-chain reporting

This transformation is being led by specialized DAO development company providers that understand both blockchain engineering and regulatory frameworks.

Prepare your DAO for regulation-driven stablecoin ecosystems today

Why Traditional DAO Governance Models Are Breaking

As regulatory expectations reshape DAO infrastructure and treasury operations, governance frameworks are now being examined more closely, pushing projects to rely on advanced DAO development services for compliance-ready design. Structures that once worked in loosely regulated environments are increasingly proving inadequate in a modern, compliance-driven ecosystem.

1. Token Voting Limits

Token-based governance is facing growing structural limitations as DAOs scale and attract regulatory attention. Three major challenges now define voting systems: capital concentration, low participation rates, and regulatory scrutiny.

In many DAOs, less than five percent of token holders control more than eighty percent of voting power. Regulators increasingly view this imbalance as centralized influence presented as decentralization, weakening institutional trust.

2. Treasury Risk Levels

As DAOs accumulate large reserves in regulated stablecoins, treasury operations are becoming more vulnerable to compliance and jurisdictional risks.

Key exposure points include account freezes, regulatory investigations, jurisdictional conflicts, and dependency on traditional banking relationships. These risks remain fragmented and largely unmanaged without professional DAO platform development.

3. Governance Standards

Modern governance systems are expected to function with the same transparency and accountability as financial institutions.

Future-ready DAOs must demonstrate clear decision traceability, financial accountability, conflict resolution mechanisms, and legal clarity across jurisdictions. Governance is no longer defined by voting alone. It is now measured by institutional credibility and operational discipline.

The New Compliance-Ready Stablecoin-Based DAO Operating Model

The Rise of “Regulated-Native” Stablecoin DAOs

As regulated stablecoins become the foundation of on-chain payments and treasury management, next-generation DAOs are being designed from day one to operate within compliant financial ecosystems.

These modern governance frameworks are built to support:

- Stablecoin licensing alignment

- Multisig compliance approval flows

- Automated reporting dashboards

- Smart-contract risk monitoring

- Legal wrapper integration

Implementing these systems at scale requires professional DAO development services rather than fragmented, do-it-yourself governance frameworks.

Core Layers of a Future-Ready DAO

| Layer | Function |

|---|---|

| Governance | Role-based voting and accountability |

| Treasury | Segmented regulated wallets |

| Compliance | Automated AML and KYC systems |

| Reporting | Real-time audit dashboards |

| Operations | Smart workflow management |

This modular architecture allows stablecoin-powered DAOs to scale across jurisdictions while minimizing regulatory friction and operational risk.

Why Investors Are Repositioning Around Regulated DAOs

As governance models mature and compliance becomes a defining success factor, the way capital evaluates decentralized organizations is undergoing a fundamental shift. What once attracted speculative funding now demands structural credibility, financial transparency, and regulatory preparedness.

Capital Is Moving Toward Compliance-Ready Projects

Institutional and venture capital are no longer chasing hype-driven DAO experiments. Instead, serious investors are reallocating funds toward projects that demonstrate regulatory awareness, financial discipline, and long-term governance stability, often backed by professional DAO development services that ensure regulatory and technical alignment from day one.

Today, capital is increasingly flowing into DAOs that operate within structured ecosystems, including:

- RWA-backed governance networks

- Stablecoin-powered payment infrastructures

- Regulation-aligned DeFi protocols

- Institutional-grade treasury platforms

These projects signal operational maturity, a key factor in modern investment decisions.

How Investors Evaluate DAOs in 2026?

Investor due diligence has evolved beyond token metrics and community size. Leading funds now assess DAOs using governance, compliance, and sustainability indicators such as:

- Legal survivability across jurisdictions

- Governance resilience under regulatory pressure

- Exposure to stablecoin issuer risk

- Ability to adapt to changing compliance frameworks

These factors determine whether a DAO can scale responsibly in global markets.

The New Institutional Due Diligence Checklist

Before allocating capital, most professional investors now require evidence of:

- Verified treasury compliance

- Assessed stablecoin counterparty risk

- Documented governance audit trails

- Mapped jurisdictional exposure

- Automated financial reporting systems

DAOs that fail to meet these benchmarks are increasingly excluded from institutional portfolios, regardless of their technical innovation.

Build compliant DAO platforms without sacrificing decentralization.

How Founders Should Rebuild DAO Strategy in 2026

Step 1: Redesign Governance Architecture

Founders must move beyond token-only voting toward:

- Weighted governance systems

- Committee-based approvals

- Regulatory oversight nodes

- Emergency intervention layers

Step 2: Professionalize Treasury Operations

Treasury must function like a fintech institution:

- Regulated custody

- Multi-jurisdiction banking

- Stablecoin diversification

- Risk hedging

Step 3: Implement Compliance Automation

Manual compliance does not scale.

Modern DAOs use:

- On-chain identity modules

- Smart AML triggers

- Reporting oracles

- Audit automation

Step 4: Choose the Right DAO Development Partner

Not every blockchain agency understands regulatory engineering.

Working with experienced providers in DAO infrastructure ensures:

- Long-term scalability

- Legal adaptability

- Institutional readiness

Conclusion: The Next Decade Belongs to Compliance-Native DAOs

The future of DAOs belongs to projects that combine decentralization with regulatory readiness. As stablecoins become the backbone of Web3 finance, governance models, treasury systems, and reporting structures must evolve to meet institutional and legal expectations. For founders, investors, and compliance leaders, this is no longer a theoretical shift. It is a strategic decision point.

Working with professional DAO development company ensures your DAO is built for scalability, transparency, and long-term resilience in regulated ecosystems. This is where Antier plays a critical role. With deep expertise in governance engineering and compliance-focused infrastructure, we help DAOs transition from experimental frameworks to enterprise-ready platforms.

Frequently Asked Questions

01. How is regulation impacting the governance of DAOs?

Regulation is directly influencing how DAOs design their governance, manage treasuries, and build trust with investors and institutions, leading to higher operational standards and transparency requirements.

02. What are the key changes in modern DAO architecture?

Modern DAO architecture is evolving to include segmented treasury wallets, role-based governance permissions, regulated payment rails, and smart-contract compliance to meet regulatory expectations.

03. Why are traditional governance models losing credibility in the context of DAOs?

Traditional anonymous treasury and token-based voting models are becoming structurally weak and increasingly incompatible with institutional and regulatory expectations, prompting a shift toward more transparent and accountable governance systems.

Crypto World

Trump-linked WLFI’s Zak Folkman teases forex platform at Consensus Hong Kong

, the Trump-family-linked crypto project, will soon launch a foreign exchange platform called World Swap, its co-founder, Zak Folkman, said on stage at Consensus Hong Kong.

The forex teaser adds to a growing list of products orbiting the project’s USD1 stablecoin as the project positions itself as a full-stack financial ecosystem, with further announcements expected at a Mar-a-Lago event later this month.

Speaking on stage, Folkman said the company’s goal is to abstract away much of the complexity associated with crypto wallets and cross-border transfers, allowing users to send and receive digital dollars in a manner similar to popular payment apps.

He framed the planned foreign exchange service as a direct challenge to traditional remittance providers that often charge fees ranging from 2% to 10% per transaction.

The company’s broader strategy centers on USD1, a dollar-pegged stablecoin that Folkman said is backed by cash and cash equivalents.

Folkman also highlighted the launch of World Liberty Markets, a lending platform that has attracted hundreds of millions of dollars in deposits within weeks of going live, and partnerships with decentralized finance protocols to increase the token’s utility.

In late January, Crypto Twitter users had spotted AMG Software Solutions LLC, a Puerto Rico-based company that owns WLFI’s intellectual property, had registered trademarks related to World Swap.

Crypto World

Short-Term Bitcoin Holders in Pain as Bear Market Deepens

Losses are mounting up for short-term holders of Bitcoin as the asset dumps below $70,000 again.

“Short-term holders keep suffering as this correction drags on,” said CryptoQuant analyst ‘Darkfost’ on Wednesday.

The short-term holder cost basis is around $94,200, and with BTC back at around $67,000, the price gap has now reached 28%, they said.

“So we can roughly estimate an average unrealized loss of about 28% for STHs, if we simplify things.”

Not a Correction, But Bear Market

The analyst noted that Bitcoin’s price has been trading below the STH cost basis for four months, “marking their longest period of stress so far.”

They added that it was unusual for this cycle and “suggests that the current correction is increasingly resembling a bear market.” During the two previous bear markets, this situation lasted for a little over a year, the analyst cautioned.

Short term holders keep suffering as this correction drags on.

📊 With an STH cost basis of around $94,200 and BTC at $68,000, the price gap has now reached 28%.

So we can roughly estimate an average unrealized loss of about 28% for STHs, if we simplify things.

But that is not… pic.twitter.com/MnLcbAgHCx

— Darkfost (@Darkfost_Coc) February 11, 2026

A “lack of fresh capital” is reinforcing bear conditions, confirmed CryptoQuant on Wednesday, with analysts stating that new investor inflows have flipped negative.

“The sell-off is not being absorbed by fresh capital. In bull markets, drawdowns attract accelerating capital. In early bear markets, weakness triggers withdrawal.”

Analyst ‘Daan Trades Crypto’ said that after holding the .382 Fibonacci retracement temporarily, the price eventually fell through and broke the pattern it had held this cycle.

You may also like:

“The .618 Fibonacci retracement level has historically always been another important one to watch during larger drawdowns,” he added. This level is currently around $57,800 and could be the next support zone.

Bitfinex analysts were a little more positive, observing that Bitcoin long-term holder supply has turned up after months of distribution, and is now back near 14.3 million BTC.

“If this buildup continues, it supports the view that this is a mid-cycle reset, not a final top,” they said.

Bitcoin long term holder supply has turned up after months of distribution, now back near 14.3M BTC.

In past cycles fresh highs in LTH supply led $BTC by roughly 3–4 months.

If this build up continues, it supports the view that this is a mid cycle reset, not a final top. pic.twitter.com/EJ0Q87vp7d

— Bitfinex (@bitfinex) February 11, 2026

Bitcoin Falls to $66,000

Short term holder loses are even worse with Bitcoin’s collapse back to just under $66,000 in late trading on Wednesday. The asset was trading at $67,200 on Thursday morning in Asia, but the path of least resistance remains down.

Ether failed to hold above the psychological $2,000 level and crashed back to $1,950 on Wednesday, failing to reclaim it at the time of writing. ETH is now trading at March 2025 lows, but it has yet to dip as low as the April 2025 crash.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BlockFills halts deposits and withdrawals amid market stress

Crypto trading firm BlockFills has temporarily suspended client deposits and withdrawals, citing recent market and financial conditions.

Summary

- BlockFills has temporarily suspended client deposits and withdrawals, citing challenging market and financial conditions, while allowing trading to continue.

- The halt was implemented last week as Bitcoin experienced sharp volatility, sliding from the low $70,000s to the mid-$60,000s before rebounding.

- The firm says it is working with investors and clients to restore liquidity and will provide updates as the situation develops.

The decision was disclosed in a post shared by the company on X and was described as a protective measure for both clients and the firm.

According to BlockFills, the suspension was implemented last week. While deposits and withdrawals are paused, clients have still been able to trade on the platform. This includes opening and closing positions in spot markets, derivatives trading, and select other situations, the firm said in its statement.

The company did not specify how long the restrictions will remain in place, but emphasized that trading functionality has been maintained to allow clients to manage existing exposure.

Bitcoin price swings during suspension week

The announcement comes amid notable volatility in the broader crypto market. Bitcoin (BTC), the largest cryptocurrency by market value, experienced sharp price swings last week.

BTC slid from a range near the low $70,000s to a weekly low around the mid-$60,000s before rebounding toward $67,000 at press time.

BlockFills said the move was taken to safeguard liquidity during a period of heightened uncertainty.

“Management has been working hand in hand with investors and clients to bring this issue to a swift resolution and to restore liquidity to the platform,” BlockFills said.

In its statement, BlockFills stressed its commitment to transparency. The firm said it has remained in active dialogue with clients, including hosting information sessions and giving customers the opportunity to ask questions directly to senior management.

Updates will continue to be shared as developments occur, according to the company.

The news, shared via the BlockFills X account, comes at a time of increased scrutiny around liquidity management across crypto trading firms, as market volatility continues to test operational resilience.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports7 hours ago

Sports7 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World8 hours ago

Crypto World8 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video4 hours ago

Video4 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month