Crypto World

Crypto PAC Fairshake leaps into first midterm Senate race with $5 million in Alabama

Crypto’s $193 million campaign-finance force, the Fairshake political action committee, is launching into congressional midterm season with a massive $5 million injection into the Republican primary campaign of Barry Moore, a U.S. congressman now running for Senate.

One of Fairshake’s affiliates, Defend American Jobs, is committing that spending to support Moore, even though the general election remains almost nine months away. That marks one of the group’s first major forays into what promises to be a high-stakes, high-spending election season.”We are proud to stand with Barry Moore, a leader who will fight for economic growth and make America the crypto capital,” Fairshake said in a Tuesday statement.

Fairshake had also recently devoted funds to Representative French Hill, the chairman of the House Financial Services Committee who has led the charge on crypto legislation in the U.S., according to a representative of the PAC. Hill and his allies already managed to get a crypto market structure bill through the House of Representatives last year and are now awaiting a matching effort in the U.S. Senate.

Such crypto legislation is the central purpose of Fairshake’s giving — promoting pro-crypto candidates ready to pass friendly bills and opposing those who stand against such legislation.

As with all the super PAC’s giving, the money for Moore will be through “independent expenditures” under federal election law, meaning the cash can buy ads for the candidate, but they can’t deal directly with the campaign. Fairshake-backed ads in the 2024 election didn’t mention crypto at all, and this broadcast ad for Moore intends to feature the candidate’s endorsement from President Donald Trump.

Moore has served five years in the House, and he’s now campaigning to replace Senator Tommy Tuberville, a Republican who is aiming for the governor’s mansion this year. The Alabama congressman has so far served in the House’s Agriculture Committee, where crypto legislation was on the agenda last year.

“Crypto is not a fad,” Moore wrote in a December post on social media site X. “It is part of our future. It is part of Alabama’s future.”

Moore is one of five Republican candidates who announced their participation in that primary. Early polling has so far seen Moore generally in second place behind state Attorney General Steve Marshall. Both have “A” crypto ratings from Stand With Crypto, a group that reviews the digital assets views of political figures.

Read More: Industry’s PAC Keeps Seeking to Add Allies as Congress Hashes Out Crypto Legislation

Crypto World

Saylor pushes “1.4% forever” Bitcoin play to Middle East wealth funds

Michael Saylor pitches a 1.4% credit‑funded balance‑sheet formula to Middle East capital, aiming to turn corporates into perpetual Bitcoin accumulators in a fragile market.

Summary

- Saylor claims selling credit equal to 1.4% of capital assets can both fund stock dividends and grow a company’s Bitcoin stack indefinitely.

- He frames Bitcoin as “digital capital” and “digital gold,” arguing Bitcoin‑backed credit can deliver two to four times traditional fixed‑income yields.

- The pitch hits as Bitcoin trades near $70,345 and major alts like ETH, SOL, and XRP reflect a macro‑sensitive, drawdown‑scarred risk environment.

Michael Saylor has found a way to turn balance‑sheet engineering into a perpetual Bitcoin (BTC) accumulator’s charter — and he is not whispering it, he is broadcasting it to the Middle East.

Saylor’s “1.4% forever” math

Speaking live on Middle Eastern television, Strategy’s executive chairman Michael Saylor distilled his pitch into a single, aggressive sentence: “If we sell credit instruments equal to 1.4% of our capital assets, we can pay the dividends funded in Bitcoin and we can increase the amount of BTC we have forever.”

The logic is brutally simple: monetize a thin slice of the asset base via credit, recycle that into yield‑bearing Bitcoin exposure, and feed shareholders both cash flow and upside without, in his view, diluting the core capital stack. KuCoin’s summary of the framework put it starkly: selling 1.4% of capital assets as credit “could allow the company to boost Bitcoin holdings permanently” while still supporting stock dividends.

This approach extends a strategy he outlined at the Bitcoin MENA conference, where he told regional sovereign funds in the Middle East that “Bitcoin is digital capital, or digital gold, and digital credit builds on it by stripping out volatility to generate yield.”

Macro risk, meet corporate leverage

Saylor’s formula lands in a market where Bitcoin itself has turned into the cleanest proxy for global risk appetite. At press time, Bitcoin (BTC) trades around $70,345, with a 24‑hour range between roughly $68,428 and $71,852 on about $59.3B in volume. Ethereum (ETH) changes hands near $2,012, with 24‑hour trading volume close to $28.7B and intraday prints between about $1,999 and $2,140. Solana (SOL) sits around $86, with roughly $3.9B traded over the last day as it grinds through a 2025–26 drawdown. XRP (XRP) hovers near $1.44, down about 1% over the last 24 hours as on‑chain data flags a “stop‑loss phase” after months of distribution.crypto+8

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $70,345, with a 24‑hour high near $71,852 and a low near $68,428, on roughly $59.3B in dollar volumes. Ethereum (ETH) changes hands close to $2,012, with about $28.7B in 24‑hour turnover and spot quotes clustered in the $2,000–$2,100 band on major exchanges earlier this week. Solana trades around $86, up modestly over the last 24 hours, with nearly $3.9B in volume.crypto+5

Middle Eastern capital in the crosshairs

Saylor has been explicit about his target audience. In Abu Dhabi, he claimed to have met “every Middle East sovereign wealth fund” to pitch Bitcoin‑backed credit as a superior fixed‑income replacement, promising “two to four times” traditional yields while using corporate structures like Strategy as leverage amplifiers.

The sales pitch collides with a more fragile tape. Bitcoin has slipped below $70,000 amid what one analyst called an “unpumpable” market, with selling pressure overwhelming inflows after a 45% drawdown from the 2025 peak. Whether Saylor’s 1.4% rule becomes a template or a cautionary tale will be decided not in televised sound bites, but in the next macro stress test.

Crypto World

Why Is LayerZero (ZRO) Token Up Today?

LayerZero’s native token, ZRO, has bucked the broader market downturn, posting double-digit gains to reach a four-month high.

The rally follows the LayerZero’s unveiling of a new blockchain, backed by Citadel Securities and ARK Invest. Both firms made strategic investments through ZRO purchases.

Sponsored

Sponsored

Institutional Backing Fuels ZRO Rally While Crypto Market Slides

BeInCrypto Markets data shows the crypto market extended its decline today, following yesterday’s $19 billion in losses. Over the past 24 hours, total market capitalization has fallen by more than 2%, reflecting continued risk-off sentiment across major digital assets.

Despite the broader pullback, select altcoins have managed to post outsized gains, with ZRO being one of them. During early Asian trading hours, the token climbed to an intraday high of $2.42 on Binance.

This level was last seen in early October 2025. At the time of writing, ZRO was trading at $2.27, up nearly 22% over the past day.

The token secured the third spot among the top 300 daily gainers on CoinGecko. Trading activity has also accelerated significantly. Over the past 24 hours, the token recorded $491 million in volume, marking a 410.60% increase.

What Is LayerZero’s New Blockchain?

The rally followed LayerZero Labs’ announcement of Zero. It is a new blockchain network designed to address scalability constraints that have historically limited decentralized systems.

Sponsored

Sponsored

According to the company, Zero introduces a heterogeneous architecture. It separates transaction execution from verification using zero-knowledge proofs, eliminating the “replication requirement.”

LayerZero claims the network can scale to up to 2 million transactions per second per zone, with transaction costs as low as $0.000001. The blockchain is scheduled to launch in fall 2026.

“Zero’s architecture moves the industry’s roadmap forward by at least a decade. We believe we can actually bring the entire global economy on-chain with this technology. Our mission is to build permissionless infrastructure for a better world – this is the beginning of that world,” Bryan Pellegrino, CEO of LayerZero Labs, stated.

As part of the rollout, Citadel Securities is collaborating with LayerZero to evaluate potential applications in trading, clearing, and settlement workflows. The firm also made a strategic investment in ZRO.

ARK Invest is likewise becoming a shareholder in LayerZero and has purchased ZRO. Cathie Wood, ARK’s founder and CEO, will join the project’s advisory board.

“ZRO is the token of the network, and LayerZero will provide interoperability between Zones and across the 165+ blockchains it connects,” the announcement read.

Beyond these investments, LayerZero said it is working with The Depository Trust & Clearing Corporation to explore enhancements to tokenized securities infrastructure, including scalability improvements for its DTC Tokenization Service.

Intercontinental Exchange, parent company of the New York Stock Exchange, is examining potential applications related to 24/7 markets and tokenized collateral integration. Google Cloud is also partnering with LayerZero to explore infrastructure enabling AI agents to conduct micropayments autonomously.

Meanwhile, the development closely follows Tether’s strategic investment in LayerZero Labs through Tether Investments. Thus, the combination of strategic capital and institutional collaboration appears to have fueled investor interest in ZRO, even as the broader crypto market continues to face selling pressure.

Crypto World

Hong Kong working to allow perpetual contracts, chief regulator says

HONG KONG — Financial regulators in Hong Kong are going to unveil a framework for trading platforms to offer perpetual contracts, the head of the region’s Securities and Futures Commission said Wednesday.

Brokers in Hong Kong will soon be able to provide financing to clients backed by bitcoin and ether and platforms will be able to offer market-making through independent units, said Julia Leung, the CEO of Hong Kong’s SFC at CoinDesk’s Consensus Hong Kong conference.

While the SFC plans to share more details later, the moves are part of the regulator’s broader push to let regulated firms offer more products and services, Leung said, following on its 2025 roadmap which included an effort to develop the local crypto market.

The SFC has already published the conclusions from its consultation on custody and related issues, but these new initiatives are focused on continuing to develop these markets in Hong Kong, including with novel products like perpetual futures contracts.

“We will be publicizing a high-level framework for platforms to be offering perpetual contracts,” she said.

These products will only be available for institutional investors, not retail clients, at this time, she said, and the framework will focus on risks. Platforms seeking to offer these products will need to be able to manage those risks, “and it also has to be very fair to the customers.”

On the other initiatives, Leung said that the SFC will start sharing further details soon.

“We will allow brokers to provide financing to clients with strong … credit profiles, and the collateral will be backed by both securities as well as virtual assets,” she said. “Because virtual assets … many of them are very volatile, so we’ll start with two that will be eligible as collateral, bitcoin and ether.”

Platforms looking to engage in market-making will need to make sure they have strong conflict-of-interest rules and independent market-making units, she said.

Crypto World

Vitalik Buterin Explores Ethereum’s Future Role in AI and AGI Integration

Vitalik Buterin, co-founder of Ethereum, reignited conversations about the potential intersection of Ethereum and artificial intelligence (AI). In a recent post on X, Buterin revisited his past thoughts on how the Ethereum network could contribute to the development of AI and artificial general intelligence (AGI). His comments underscore his ongoing commitment to long-term technological objectives, highlighting Ethereum’s broader potential beyond decentralized finance.

Two years ago, I wrote this post on the possible areas that I see for ethereum + AI intersections: https://t.co/ds9mLnrJWm

This is a topic that many people are excited about, but where I always worry that we think about the two from completely separate philosophical… pic.twitter.com/pQq5kazT61

— vitalik.eth (@VitalikButerin) February 9, 2026

Buterin sees Ethereum as a foundational layer not only for blockchain transactions but also for enhancing AI systems. He envisions Ethereum supporting more open, transparent, and censorship-resistant AI technologies. Through Ethereum’s decentralized infrastructure, Buterin believes AI could develop in a way that aligns with human progress, rather than accelerating unchecked technological growth.

Ethereum as the Economic Layer for AI Transactions

Buterin suggests that Ethereum could play a pivotal role as an economic coordination layer for AI-to-AI transactions. Autonomous AI agents, operating independently, could use Ethereum to interact, negotiate, and exchange value seamlessly. In this model, Ethereum would serve as a neutral and reliable settlement layer, facilitating trust in transactions within machine-driven economies.

This vision of Ethereum goes beyond supporting financial markets. Buterin highlights Ethereum’s potential to create a decentralized environment where AI systems can autonomously interact efficiently and securely. By providing a transparent and immutable ledger, Ethereum could support an ecosystem where AI agents transact with each other in a trustless manner, all within the bounds of decentralized principles.

AI-Assisted On-Chain Verification and Trust

Buterin also emphasizes the importance of on-chain verification, with Ethereum providing the trust framework for various operations. He imagines a future where AI could assist in auditing smart contracts, verifying data, and improving decentralized governance systems. With Ethereum at the core, this verification process would be transparent, efficient, and immutable, strengthening the security and reliability of the entire system.

This idea aligns with Buterin’s vision of building a decentralized infrastructure that could sustain long-term technological development. He points out that AI could improve market efficiency, ensuring that decentralized systems function with higher levels of trust and accuracy. The integration of AI in Ethereum’s blockchain could bring about a new era of AI systems that are more accountable and reliable, further embedding Ethereum into the future of computing technology.

A Vision Beyond Market Cycles

Buterin’s recent tweet serves as a reminder to the crypto community that Ethereum’s development isn’t only about short-term trends or market movements. While many in the crypto industry remain focused on speculative developments, Buterin’s call for long-term thinking encourages broader innovation. His remarks suggest that Ethereum’s real potential lies in its ability to shape the next generation of computing infrastructure, not just in financial applications.

By revisiting ideas from nearly two years ago, Buterin aims to inspire developers and researchers to look at Ethereum’s broader potential. Ethereum’s decentralized architecture could serve as the foundation for future breakthroughs in AI and AGI development. Buterin’s comments, though not offering a clear roadmap, are a signal to think bigger and consider how Ethereum can be integrated into the next wave of technological advancements.

Crypto World

Robinhood Chain Testnet Goes Live on Arbitrum

Robinhood has launched a public testnet for Robinhood Chain, its new Ethereum layer‑2 network built using Arbitrum technology that aims to bring tokenized real‑world and digital assets onchain.

According to a release shared with Cointelegraph, the testnet, which is now live for developers, offers network access points, documentation at docs.chain.robinhood.com, compatibility with standard Ethereum development tools and early integrations from infrastructure partners.

Robinhood says the chain is designed for “financial‑grade” use cases, including 24/7 trading, seamless bridging, self‑custody, and decentralized products such as tokenized asset platforms, lending markets, and perpetual futures exchanges.

A mainnet launch is planned for later this year, with testnet-only assets such as stock‑style tokens and tighter integration with Robinhood Wallet among the features expected in the coming months.

Johann Kerbrat, senior vice president and GM of Crypto and International at Robinhood, said in the release that the testnet for Robinhood Chain laid the groundwork for “an ecosystem that will define the future of tokenized real-world assets,” and enable builders to tap into decentralized finance (DeFi) liquidity within the Ethereum ecosystem.

Related: Coinbase adds stock trading, prediction markets in ‘everything app’ push

Robinhood’s tokenization push

The launch marks a deeper shift by Robinhood from simply offering crypto trading to operating its own onchain infrastructure, following its decision to tokenize nearly 500 United States stocks and exchange‑traded funds (ETFs) on Arbitrum as part of a broader real‑world asset strategy.

Robinhood Chain also mirrors a broader trend in which exchanges try to control both the user‑facing interface and the underlying onchain rails.

Coinbase, for example, runs a regulated trading platform while also building out its Base L2, and announcing the start of its rollout of tokenized equities in Dec. 2025.

Kraken is pursuing a similar end‑to‑end play, operating a global crypto exchange while developing Ink, its own Optimism‑based L2 network, alongside xStocks tokenized equities.

Mixed track record

Robinhood has faced regulatory and public criticism over system outages during periods of market stress and its reliance on payment for order flow in equities, where market-making firms pay brokers to route customer orders to them in exchange for rebates.

Robinhood CEO Vlad Tenev said in January that tokenized stocks could help prevent trading freezes, thanks to the real-time settlement properties of blockchain technology.

Crypto World

Kaspersky Shares Practical AI Safety Tips for Children on Safer Internet Day

Editor’s note: On Safer Internet Day, cybersecurity firm Kaspersky addresses a growing concern for families navigating the rapid adoption of AI by Generation Alpha. As children increasingly use AI-powered tools for learning, entertainment, and everyday questions, the company outlines practical guidance for parents on how to frame AI as a helpful tool without overlooking its risks. The focus is on education, supervision, and the responsible use of digital assistants, rather than restriction alone. The guidance reflects broader questions around digital literacy, data privacy, and online safety that are becoming central as AI tools enter daily life at an early age.

Key points

- Parents are encouraged to explain what AI tools are and are not, emphasizing their limitations and potential inaccuracies.

- Children should be taught to verify AI-generated information and avoid using it for sensitive topics without adult input.

- Built-in safety settings and content filters on devices and platforms are highlighted as a first layer of protection.

- Verifying the authenticity of AI-powered apps and limiting permissions is presented as essential to reducing privacy risks.

- Ongoing dialogue between parents and children is positioned as key to safe and informed AI use.

Why this matters

As AI tools become embedded in everyday digital experiences, early exposure is shaping how the next generation learns, searches for information, and interacts online. For parents, this raises new challenges around trust, privacy, and digital wellbeing. For the broader tech ecosystem, it underscores the importance of responsible design, clear safeguards, and digital literacy as AI adoption expands beyond adults. Guidance like this reflects how cybersecurity and education are becoming tightly linked as AI use moves into younger age groups.

What to watch next

- How AI platforms continue to develop and communicate child safety and parental control features.

- Adoption of digital literacy practices by families and schools as AI use grows.

- Ongoing discussion around data privacy and age-appropriate AI access.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Born between 2010 and 2025, Gen Alpha aren’t just growing up with technology – they’re actively living it. These digital natives are already wielding smartphones, tablets, and AI-powered tools with the confidence of seasoned users, navigating everything from gaming and social media to online learning platforms with remarkable ease. But the question that concerns parents and security experts is whether we are giving our kids too powerful technology, too soon. On Safer Internet Day, Kaspersky security experts are sharing practical tips to help parents turn AI from a potential threat into a trusted ally for the younger generation.

The first line of defence is building AI awareness

Children already discovered that ChatGPT, DeepSeek and other neural networks can answer questions faster than you can find the right answer in Google, and Alexa can play music without pressing a single button.

So, the only solution is to become children’s AI support. Begin by explaining that these digital assistants aren’t friends, pets, or even real people. They’re sophisticated tools that can be helpful, but also potentially misleading, biased, or simply wrong. Then teach them to cross-check information with multiple sources, just like they’d verify facts in a school project.

When discussing AI with children, emphasize that they should never fully trust AI answers, especially for sensitive topics like health, mental wellbeing, or safety concerns. Always encourage them to verify information and never share personal details or documents with AI systems.

Enabling safely filters

Most AI platforms and smart devices come with built-in safety features that are often overlooked or misunderstood. Spend some time to check the privacy settings and content filters and, if possible, tailor them to match your family’s values and your child’s maturity level. This is a basic protection against inappropriate content, privacy breaches, and potentially harmful interactions.

However, not all services and platforms provide an opportunity to set up content filters and fully control children’s online activity. To create safer digital environment for your children consider using parental control tools like Kaspersky Safe Kids. It allows parents to not only to hide inappropriate content and prevent specific apps and websites from being opened, but also helps balance children’s time spent online with screen time management.

Checking the AI-powered app’s authenticity

In a world where AI apps are popping up faster than you can say “chatbot,” verifying app authenticity is essential. Only download apps from official stores and inform your children about the importance of not installing anything from unfamiliar sources. Look up the company behind the app and check whether they have a website and legitimate business presence. Teach your kids to limit their apps’ permissions and do not give access to data unless it’s necessary for the apps to work.

Staying involved and informed

A basic understanding of the range of problems your child is willing to entrust to AI is already significant. By asking simple questions like “What did you ask AI today? Did it give you the right answer?” you’ll be teaching your children to openly discuss with you the use of AI and problems they might face. When they mention using ChatGPT for homework, ask them to show you what they’ve learned. When they talk about their favourite voice assistant, ask about the topics they like to discuss and funny particularities they noted.

“When you actively participate in your child’s AI journey, you transform from a concerned parent into a trusted guide. They’ll seek your input because they know you’re interested in their digital experiences, not just trying to control them. But while allowing children some AI freedom, you must always remain vigilant about their online safety and healthy growth,” comments Andrey Sidenko, Cyber Literacy Projects Lead at Kaspersky.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure, and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com

Crypto World

Uniswap wins CPAMM patent lawsuit against Bancor

Uniswap has won a patent infringement lawsuit filed by organizations connected to Bancor, marking a major legal victory for the decentralized exchange and the wider decentralized finance sector.

Summary

- Uniswap won a patent infringement lawsuit filed by Bancor-linked entities in a U.S. federal court.

- The case focused on the constant product market maker formula used in decentralized trading.

- The ruling supports open-source development and limits patent claims over core DeFi tools.

On Feb. 11, Uniswap founder Hayden Adams said on X that his legal team had informed him of the court’s decision in Uniswap’s favor. The case had challenged the technology that powers automated token trading on the platform.

Many people in the crypto world paid close attention to the lawsuit because it brought up a bigger issue. It questioned whether simple trading formulas used in DeFi can actually be protected by patents.

Lawsuit focused on AMM technology

The legal fight started in May 2025. Bprotocol Foundation and LocalCoin Ltd., both connected to Bancor, filed a lawsuit in a federal court in New York. They claimed that Uniswap Labs and the Uniswap Foundation used a trading method that was covered by a patent granted back in 2017.

The patent covered the constant product automated market maker model, commonly known for the formula x*y=k. This system is used to price tokens in liquidity pools and has become a foundation of many decentralized exchanges.

Bancor argued that Uniswap (UNI) had relied on this patented method since launching in 2018 without permission. The plaintiffs sought financial damages for several years of alleged unauthorized use.

Uniswap strongly rejected the claims from the start. The company said its code had always been open-source and publicly available. It also argued that the patent attempted to claim ownership over basic mathematical principles applied to blockchain systems.

Several industry groups supported Uniswap’s position. Organizations such as the DeFi Education Fund and the Solana Institute filed statements backing the exchange and warning against using patents to restrict open innovation.

Impact on DeFi and open-source development

According to people familiar with the case, the court found that the allegations did not meet the legal standard required for patent infringement, especially given the open nature of Uniswap’s software.

Legal experts say the ruling sends a strong message to the market. Core financial mechanisms that rely on simple formulas may be difficult to protect through patents when they are openly shared and widely adopted.

Many developers see this outcome as a strong moment for open finance. It sends a message that the basic tools behind DeFi cannot easily be restricted or put behind paywalls through patents.

Uniswap users and its partners can also breathe a little easier. The uncertainty surrounding the case had raised concerns about possible setbacks. If the court had ruled differently, it might have slowed down new features and partnerships across the wider ecosystem.

So far, there has been no word of an appeal. For now, the matter seems to be settled at the district court stage.

Crypto World

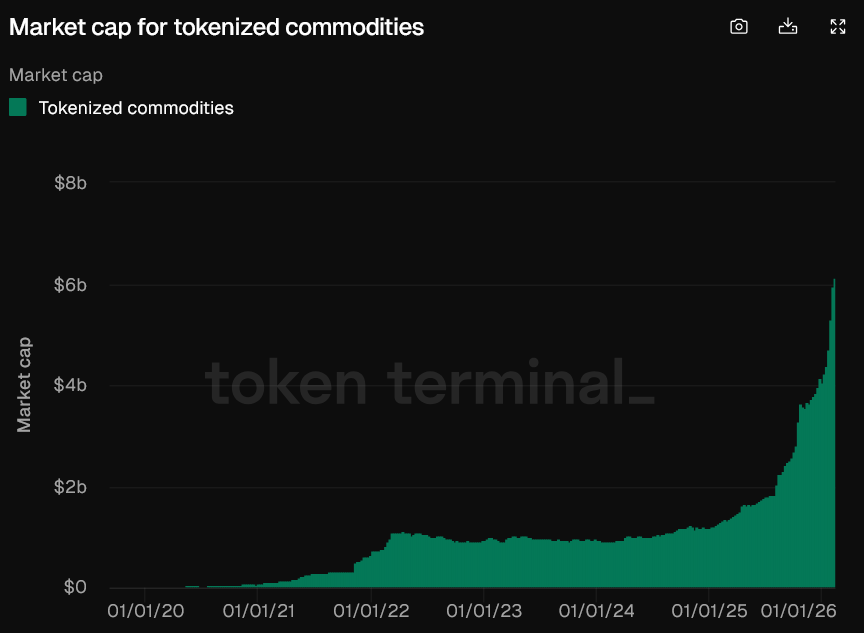

Tokenized Commodities Blows Past $6B on Gold Adoption

The tokenized commodities market has risen 53% in less than six weeks to over $6.1 billion, making it the fastest-growing vertical in the real-world asset tokenization market as more gold moves onchain.

The tokenized commodities market was valued at just over $4 billion at the start of the year, meaning around $2 billion has been added to the market’s value since Jan. 1, according to data from crypto analytics platform Token Terminal.

Data shows the tokenized commodities market is dominated by gold products.

Stablecoin issuer Tether’s gold-backed token, Tether Gold (XAUt), has been the biggest contributor to the rise, with its market cap increasing 51.6% in the past month to $3.6 billion, while the Paxos-listed PAX Gold (PAXG) has increased 33.2% to $2.3 billion over the same timeframe.

Tokenized commodities have now risen 360% year-on-year, with the increase since the start of 2026 outpacing growth in the tokenized stocks and tokenized funds markets at 42% and 3.6%, respectively.

It also puts the tokenized commodities market at just over one-third the size of the $17.2 billion tokenized funds market. It’s also much larger than tokenized stocks, which are valued at $538 million.

Tether expanded its tokenized commodities strategy on Thursday by acquiring a $150 million stake in precious metals platform Gold.com, in an effort to broaden access to tokenized gold.

Tether said its XAUt token would be integrated into Gold.com’s platform and that it is exploring options to allow customers to purchase physical gold with USDt (USDT) stablecoin.

Gold picks up the pace as Bitcoin stuck below $70,000

The rise in tokenized gold comes as gold’s spot price rallied more than 80% over the past year to set a new all-time high of $5,600 on Jan. 29.

A minor pullback saw gold retrace to the $4,700 mark earlier this month, but it has since risen back up to $5,050 at the time of writing.

Related: Do Super Bowl ads predict a bubble? Dot-coms, crypto and now AI

Meanwhile, Bitcoin (BTC) and the crypto market have been in a slump since Oct. 10, when a crypto market crash triggered $19 billion in liquidations.

Bitcoin fell 52.4% from its early October high of $126,080 to about $60,000 on Friday but has since rebounded to $69,050, CoinGecko data shows.

Bitcoin’s fall amid a rise in traditional safe-haven assets has led some industry commentators, like Strike CEO Jack Mallers, to speculate that Bitcoin is still treated like a software stock despite having hard money characteristics.

Crypto asset manager Grayscale similarly said Bitcoin’s long-standing narrative as “digital gold” has been put to the test, stating that its recent price action increasingly resembles that of a high-risk growth asset rather than a traditional safe-haven.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

XRP Holders Realize Major Losses as Price Decline Triggers Panic Selling

Since August 2025, XRP holders have increasingly spent their coins, adding to the selling pressure that has flipped the asset’s on-chain profitability negative.

The past six months have been primarily depressing for XRP, the native cryptocurrency of the Ripple Network. Now, the asset appears to be flashing a capitulation signal as holders realize major losses amid panic selling.

Data from Glassnode shows that on-chain profitability for the digital asset has flipped negative, with the Spent Output Profit Ratio (SOPR) falling from 1.16 on July 25, 2025, to 0.96 currently. Analysts say the current setup mirrors that seen during the September 2021 to May 2022 period, when the SOPR for XRP fell into the <1 range. A prolonged consolidation followed the plunge, leading to stabilization.

XRP Holders Realize Huge Losses

Since August 2025, the price of XRP has been in a steady decline, recovering only briefly before resuming its descent. By late October, the price had dropped 27% from $3.5 in mid-July to $2.4. As the asset lost its value, long-term holders who had accumulated before November 2024 increased their spending by 580% from $38 million per day to $260 million per day.

The numbers remained steady into early November, highlighting a distribution into weakness, not strength. Analysts noted that the spending spree was unlike past profit-realization waves that aligned with rallies. There was a clear signal that experienced traders were exiting their positions, adding pressure to the price of XRP.

By mid-November, the share of XRP supply in profit had plummeted to 58.5%, the lowest since November 2024, when the asset was worth $0.53. Even though XRP traded around $2.15 at the time, four times higher than the November 2024 price, more than 41% of the coin’s supply was sitting in losses. It was an indication that the market was top-heavy, structurally fragile, and dominated by late buyers.

Capitulation Signal or Structural Failure?

As the bears would have it, the price of XRP fell below $2 in mid-November, and the 30-day estimated market average (30D-EMA) of daily realized losses surged to $75 million. Since the beginning of the year, investors have realized between $500 million and $1.2 billion in losses per week each time XRP has retested $2. $2 is now a major psychological zone for XRP holders.

At the time of writing, XRP was trading at $1.40, having lost its aggregate holder cost basis, which explains the panic selling. Such moves have raised questions about whether the XRP market is in a capitulation or experiencing a structural failure. Experts insist the former is the case because fundamentals are stronger now, unlike 2022, when regulatory clarity did not exist.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Stripe taps Base for AI agent x402 payment protocol

Stripe has launched a new payment system designed for artificial intelligence agents, allowing them to pay for digital services automatically using cryptocurrency.

Summary

- Stripe launched x402 payments to enable AI agents to make automated USDC transactions on Base.

- The system supports fast, low-cost micropayments for APIs, data, and compute services.

- The move shows the growing convergence between AI, fintech, and blockchain infrastructure.

Stripe product manager Jeff Weinstein revealed the feature on Feb. 11 and it is currently in preview. The update adds support for Base, an Ethereum-based blockchain network, for the x402 payment protocol.

Through this system, AI agents can quickly and easily make small payments using USD Coin (USDC) stablecoins. Developers can charge agents for services like data access, processing power, and API calls using Stripe’s built-in tools, eliminating the need for manual billing or traditional subscriptions.

Built for machine-to-machine payments

Weinstein said current payment systems are designed mainly for humans and are not well-suited for automated software. AI agents, he noted, need fast, low-cost, and always-available payment rails that can work without human supervision.

Under the new system, businesses create a standard Stripe Payment Intent. Stripe assigns a one-of-a-kind wallet address to every transaction. When the AI agent sends funds to that address, the payment can be monitored in real time through the Stripe dashboard, via webhooks, or by using the API.

Once the transaction is confirmed, the funds are deposited into the merchant’s Stripe balance, just like any standard payment. Stripe’s current infrastructure also manages tax reporting, refunds, and compliance tools.

The system relies on x402, an open protocol that revives the old HTTP “402 Payment Required” status code. When an agent tries to access a paid service, it receives a payment request. After sending USDC on Base, access is automatically granted.

Because Base offers fast settlement and low fees, payments can be completed in a matter of seconds. This makes the setup suitable for frequent, low-value transactions, such as paying per request or per minute of usage.

Stripe has also released an open-source command-line tool called “purl,” along with sample code in Python and Node.js, to help developers test machine payments.

Expanding the agent economy

The launch reflects Stripe’s growing focus on what it calls the “agent economy,” where software programs operate independently and manage their own finances. These agents are expected to buy data, computing resources, and digital services without human approval.

The company said more protocols, currencies, and blockchain networks will be added in the future. For now, support is focused on USDC on Base, which provides stability and predictable pricing.

Industry observers see the move as another sign that AI, fintech, and crypto are becoming more closely connected. Instead of relying on monthly plans or prepaid credits, services can now be priced per action, per second, or per request.

-

Tech7 days ago

Tech7 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat1 day ago

NewsBeat1 day agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports4 days ago

Sports4 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Tech2 hours ago

Tech2 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Sports2 days ago

Sports2 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Sports5 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business3 days ago

Business3 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

Crypto World13 hours ago

Crypto World13 hours agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World22 hours ago

Crypto World22 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat2 days ago

NewsBeat2 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports1 day ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World21 hours ago

Crypto World21 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?