Crypto World

Dreamcash Partners with Tether to Launch USDT0-Collateralized Perpetual Markets

TLDR:

- Tether invests in Dreamcash to expand USDT0-collateralized perpetual markets globally.

- Ten equity and commodity markets, including TSLA/USDT and GOLD/USDT, are now live.

- USDT0 allows seamless transfers from centralized exchanges to Dreamcash wallets.

- Dreamcash launches $200K weekly incentive program to encourage USDT trading adoption.

Dreamcash has received a strategic investment from Tether to expand USDT-quoted RWA perpetual markets on Hyperliquid.

Through its operating entity, Supreme Liquid Labs, Dreamcash launched the first USDT0-collateralized HIP-3 perpetual markets. Ten markets, including USA500/USDT, TSLA/USDT, and NVDA/USDT, are now live.

The initiative allows millions of retail traders to access equity and commodity perpetuals directly using USDT without changing their preferred trading setup.

Tether Invests to Enable USDT0 Markets

Dreamcash confirmed the investment via its official channel, noting Tether’s role in supporting broader retail access.

“This investment from Tether validates what we’ve been building; a trading experience that meets retail users where they are,” said Marco van den Heuvel, emphasizing the strategic importance for retail traders.

The first HIP-3 markets collateralized with USDT0 leverage LayerZero’s OFT standard. Since January 2025, USDT0 has processed over $50 billion in transfers across 15 networks, offering fast cross-chain liquidity.

USDT0 maintains a 1:1 peg with USDT through a lock-and-mint system. Traders can move funds seamlessly from centralized exchanges to non-custodial wallets in Dreamcash, preserving stablecoin exposure.

The investment underlines a shared goal of making on-chain trading accessible to retail users holding USDT.

Dreamcash noted that millions of traders who already use USDT for margin trading can now participate in Hyperliquid markets without converting their assets.

Equity and Commodity Perpetuals Live on Dreamcash

Dreamcash now offers equity and commodity perpetuals, including TSLA/USDT, NVDA/USDT, MSFT/USDT, GOOGL/USDT, AMZN/USDT, META/USDT, HOOD/USDT, INTC/USDT, GOLD/USDT, and SILVER/USDT.

Liquidity for these markets is provided by Selini Capital. According to the announcement, the collaboration ensures tight spreads, consistent fills, and reliable execution quality for retail traders.

To encourage adoption, Dreamcash will introduce a $200,000 weekly incentive program for CASH markets using USDT. Traders will earn rewards proportional to their share of total USDT trading volume during the initial launch period.

Marco van den Heuvel explained the practical benefits of the launch: “With USA500, TSLA, NVDA, and many others now live, traders can finally access equity perpetuals using the stablecoin they already hold, removing a barrier that has kept mainstream traders on centralized platforms.”

The USDT0-collateralized markets position Dreamcash as a bridge for millions of traders to enter Hyperliquid’s onchain ecosystem.

By combining a mobile-first interface with institutional-grade liquidity, Dreamcash delivers accessible and seamless trading for global retail participants.

Crypto World

On Saint Valentine’s Day, Kaspersky warns against gift card scams

Editor’s note: Valentine’s Day is a peak time for digital gifting, but gift cards and online offers also attract scammers. This editorial highlights how fraudsters exploit popular gift options and what consumers can do to stay safe. Ahead of the day, the following press release from Kaspersky outlines current scams, risk signals and practical tips to protect yourself and your loved ones from gift-card related fraud. The aim is to provide clear, actionable context for readers navigating a surge in digital gifting and phishing activity.

Key points

- 80% of respondents consider digital gifts such as gift cards, subscriptions, or gaming credits.

- Scammers forge fake stores and verification portals to steal gift card value.

- Always verify websites, check URLs, and use official brand sites to check balances.

- A fake site mimicking major marketplaces can deploy malware or backdoors; if a deal seems too good to be true, beware.

- Kaspersky Premium offers AI-powered anti-phishing and protection against fraudulent shops.

Why this matters

Valentine’s Day shopping for digital gifts has surged, expanding opportunities for fraud. By understanding common tricks and using trusted sources, readers can reduce the risk of gift-card fraud and protect personal data during peak gift seasons.

What to watch next

- Expect more gift-card related scams around holidays.

- Watch for fake gift card sites mimicking retailers and deceptive verification portals.

- Phishing attempts through fraudulent marketplaces and links may rise; use protection with phishing detection.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

On Saint Valentine’s Day Kaspersky warns against gift card scams

13 February 2026

Looking for a gift for your soulmate on February 14th and think that a gift card would be a nice option? Just remember that when digital trends rapidly rise in popularity with customers, they are also gaining traction with scammers looking to use them as bait. With Saint Valentine’s Day approaching Kaspersky has identified several phishing and malicious campaigns targeting gift card owners and those who’re looking for a digital present for their loved ones. To help stay safe, the security experts at Kaspersky have also shared practical advice on how not to be tricked.

A “check‑your‑balance” that drains your gift card

Kaspersky’s latest survey* shows that 80% of respondents consider giving digital presents such as subscriptions, gaming credits or gift cards. Scammers are actively exploiting this trend capitalizing on well-known brands, creating fake online stores and even crafting fake verification portals designed specifically to steal gift card value.

Kaspersky’s phishing detection identified deceptive platforms offering victims a “secure” system to check their gift cards validity, status or balance. Targeting those who recently received a gift card, phishers steal the card’s identification data and get an opportunity to activate the certificate before the user themselves.

To stay protected from such scams, Kaspersky recommends double‑checking that a website is real. Look carefully at the web address, any links you’re asked to click, and spot any odd pictures or designs that might hint the site is fake. The safest way to confirm a gift card’s balance is to go straight to the brand’s official website – don’t follow any other links. To prevent clicking on malicious link use a security solution such as Kaspersky Premium with a strong AI-powered anti-phishing component.

Is it a gift card for you or for cybercriminals?

As gift shoppers flood online marketplaces with flash sales and limited-time deals, cybercriminals are watching closely, ready to strike when users are most vulnerable.

Kaspersky experts detected a fake website that mimics Amazon, one of the most famous marketplaces, offering $200 gift card. With this tempting offer, scammers encourage customers to press a “Get your Amazon gift card” button. However, when the user clicks it, they get an MSI installer with a backdoor that cybercriminals use to remotely control the victim’s device.

This fraudulent scheme highlights the importance of complex cybersecurity protection, showing that clicking on a wrong link may result in not only money and data loss, but also device infection or loss of control over it. When a fake site copies the original store’s look exactly, it’s hard to tell which one is real and which is a scam.

Kaspersky Premium protects users from fraudulent online stores through advanced detection technology that analyzes website characteristics and URLs to identify suspicious patterns. For its excellent performance in AV-Comparatives Fake Shops Detection certification in 2025 Kaspersky Premium was awarded an “Approved” certificate, making it the right choice for confident online shopping.

“As Valentine’s Day approaches, cybercriminals may increase their efforts to exploit the emotional vulnerability and romantic spirit that define this holiday. They’re creating fake gift card websites, spoofing popular retailers, and launching phishing campaigns that prey on your desire to make your loved ones happy. The best defense is to stick to well-known retailers, check URLs carefully, apply a security solution with advanced phishing detection and remember that if a deal seems too good to be true, it probably is,” comments Anton Yatsenko, Lead Web Content Analyst at Kaspersky.

* The study was conducted by Kaspersky’s market research center in November 2025. 3000 respondents from 15 countries (Argentina, Chile, China, Germany, India, Indonesia, Italy, Malaysia, Mexico, Saudi Arabia, South Africa, Spain, Turkey, UK, United Arab Emirates) took part in the survey.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure, and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.

Crypto World

Bitcoin set for monetary slingshot rebound

ProCap Financial chairman Anthony Pompliano predicted Bitcoin will benefit from a “monetary slingshot” as the Federal Reserve prints money to combat deflation.

Summary

- Pompliano sees Bitcoin gaining after deflation triggers money printing.

- BTC drop to $70K tests long-term debasement thesis for holders.

- Gold leads now, but Bitcoin may win in post-deflation phase.

Speaking on FOX Business, Pompliano said Bitcoin’s value proposition remains intact long-term, but investors must hold through periods when deflation masks currency debasement effects.

Bitcoin (BTC) fell 50% from its $126,000 all-time high to around $70,000 as deflation replaced inflation as the primary economic concern.

Pompliano framed this as a test for Bitcoin holders: “Can you hold an asset when there is not high inflation in your face on a day to day basis? Can you still believe in what Bitcoin’s value proposition is, which is it’s a finite supply asset.”

The analyst urged investors who “liked it at one hundred twenty six thousand, you should love it at seventy thousand.”

Monetary slingshot will devalue currency as deflation fades

Pompliano shared a scenario where money printing to fight deflation will eventually devalue the currency once the economy exits the deflationary period.

“We’re going to print a bunch of money to try to deal with deflation. And all of a sudden, as we come out of that thing, now we’re going to see that the currency has been devalued and Bitcoin becomes more valuable than ever,” he explained.

The timing creates a challenge for Bitcoin investors. Deflation suppresses immediate price action while the Fed implements policies that will benefit Bitcoin long-term.

“If they print money, Bitcoin is going higher over the long run,” Pompliano stated.

Real-time inflation data shows prices declining across categories. Rent has fallen 32 consecutive months while food and gas prices trend downward.

Artificial intelligence replaces jobs faster than expected, adding deflationary pressure. The U.S. economy faces pressure from three forces: tariffs, AI, and robotics, all pushing prices lower.

Bitcoin sold off as deflation overtook inflation concerns

Bitcoin rallied during summer 2025 on tariff-related inflation fears. Google searches for currency debasement spiked last month, benefiting gold and silver.

Bitcoin failed to participate in the rally as deflation replaced inflation as the dominant narrative.

“People were talking about, is inflation coming because of the tariffs? As soon as all of a sudden we realized it’s not coming. Well, do you need to put a ton of your money into Bitcoin if deflation is the bigger risk? And so I think that’s where you see the cooling off of Bitcoin,” Pompliano said.

Gold outperformed through central bank buying rather than retail debasement trades. Foreign central banks move away from all fiat currencies but “are not ready to buy Bitcoin.”

Crypto World

Figure Technology Data Breach Exposes Personal Customer Details

Figure Technology, a Nasdaq-listed blockchain-based lending firm, confirmed a data breach after attackers used social engineering to compromise an employee. A spokesperson cited by TechCrunch on February 13, 2026, said investigators found a limited set of files had been accessed and that the firm had begun notifying those affected and offering free credit monitoring. The disclosure comes amid continued scrutiny of security practices in crypto‑enabled financial services, where the value of open networks is matched by the risk of exposed personal data when staff can be manipulated into providing access.

Key takeaways

- Unauthorized access resulted from social engineering targeting an individual employee, yielding a limited quantity of files.

- Leaked material includes customers’ full names, home addresses, dates of birth and phone numbers, which could enable identity fraud or phishing attempts.

- The ShinyHunters group claimed responsibility on its dark‑web site, citing the data exfiltration after a ransom declined by the company and publishing roughly 2.5 gigabytes of data.

- Approximately 2.5 gigabytes of data were published by the attackers as part of the leak.

- Figure Technology announced it began notifying affected customers and offering free credit monitoring; the company had recently listed on the Nasdaq and launched the OPEN platform in January 2026.

- OPEN, short for On‑Chain Public Equity Network, enables issuing real shares on Provenance’s blockchain and allows direct lending of pledged shares, bypassing traditional brokers for certain activities.

Market context: This incident sits within a broader pattern of security episodes affecting crypto lenders and open‑finance platforms. While overall phishing losses in 2025 declined to about $83.85 million across Ethereum Virtual Machine chains, that trend does not imply phishing has ended; attackers adapt to market conditions and target staff or supply chains. The lull followed a mid‑2025 rally in the market, notably amid Ethereum’s strong rally in 2025, but risks remain high for users of on‑chain finance protocols.

Why it matters

For investors, the breach underscores the intertwined risks facing fintechs and crypto lending platforms that rely on open networks and real‑time settlement. The exposure of personal data heightens the potential for identity fraud and phishing campaigns aimed at Figure’s customers, complicating risk management for the company and its users.

For builders and platform operators, the incident highlights the ongoing need for robust authentication, staff training against social engineering, and zero‑trust architectures that limit data access even after a single employee is compromised. The January 2026 OPEN launch signals Figure’s ambition to reimagine the capital‑markets stack by enabling real shares on a blockchain, but the breach shows that security controls must keep pace with product innovation to sustain user trust.

From a market perspective, security incidents like this can influence sentiment around on‑chain equity solutions and related fintech services, especially as regulators scrutinize data privacy and the standards governing tokenized assets and cross‑border lending.

What to watch next

- Figure’s forthcoming disclosures on the scale of the breach, including the number of affected individuals and the exact data types exposed.

- Any regulatory notices or investigations stemming from the incident and their implications for data privacy in blockchain‑driven lending.

- Adoption metrics or governance updates tied to OPEN and its integration with the Provenance blockchain.

- Additional data releases or countermeasures from threat actors and any indications of ransom activity or negotiations.

- Figure’s assurances regarding the integrity of its services and remediation steps across its lending and custody workflows.

Sources & verification

- TechCrunch: Figure confirms data breach, with details on the social‑engineering vector and notification efforts (Feb 13, 2026). https://techcrunch.com/2026/02/13/fintech-lending-giant-figure-confirms-data-breach/

- ShinyHunters’ dark‑web leak page claiming 2.5 GB of Figure data published after the ransom note rejection.

- Figure IPO and valuation details reported by Cointelegraph at the time of the September listing and the IPO price of $25 per share that raised about $787.5 million.

- OPEN launch coverage and its description as a platform for issuing real shares on a blockchain and enabling peer‑to‑peer lending of pledged shares, per Cointelegraph reporting.

- Crypto phishing losses context and the decline in 2025, with data from Scam Sniffer and related Cointelegraph analyses on wallet drains and security trends.

Figure breach tests security of blockchain lending and OPEN platform

Figure Technology, a blockchain‑driven lending firm that trades on the Nasdaq, faced a data breach the company described as the result of social engineering aimed at an employee. A spokesperson cited by TechCrunch on February 13, 2026, said investigators found a limited set of files had been accessed and that the firm had begun notifying those affected and offering free credit monitoring. The disclosure comes amid continued scrutiny of security practices in crypto‑enabled financial services, where the value of open networks is matched by the risk of exposed personal data when staff can be manipulated into providing access.

The attackers’ method was not a broad, automated intrusion, but a targeted manipulation of an individual inside Figure’s organization. This distinction matters because it frames the breach not as a systems‑wide hack into a platform but as a social‑engineering incident that created a path to internal files. The information set exposed in some samples reviewed by TechCrunch included personally identifiable details such as full names, home addresses, dates of birth and phone numbers. The potential impact is twofold: identity theft and phishing campaigns that impersonate Figure or its affiliates, complicating the company’s remediation efforts and potentially eroding client trust.

In the wake of the breach, the security ecosystem around Figure has drawn attention to a dark‑web claim of responsibility by a known group. ShinyHunters asserted on its leak site that the operation was successful after the company refused to meet ransom demands and published roughly 2.5 gigabytes of data purportedly taken from Figure’s systems. The veracity and scope of the data remain under investigation, but the assertion underscores the ongoing danger of data exfiltration as a tactic in post‑breach pressure campaigns.

Figure Technology had gone public the previous September, selling shares at $25 each and raising about $787.5 million, with a reported initial valuation in the multi‑billion range. The company has since been pushing an expansion of its business model through new ventures like the On‑Chain Public Equity Network (OPEN), launched in January 2026 on its Provenance blockchain. OPEN is designed to let companies issue real shares and permit investors to lend or pledge those shares directly to one another, sidestepping traditional brokers, custodians, or exchanges. The move signals Figure’s attempt to fuse tokenized, on‑chain equity with a lending marketplace, aiming to create liquidity channels that are not tethered to centralized intermediaries.

As the breach unfolded, the industry watched for how aggressively Figure would respond: how quickly affected customers would be notified, what data would be offered for protection, and what steps the company would take to harden its systems. The incident also emphasizes the broader reality that security incidents in active crypto and fintech ecosystems can influence investor confidence in newly launched products and platforms that aim to shift how assets are issued and transferred on‑chain. While the OPEN platform promises a more direct and less intermediary‑dependent path for equity transactions, the breach invites closer scrutiny of Figure’s internal controls, access governance, and privacy protections for both retail and institutional users.

The incident is part of a larger narrative in which the crypto security landscape continues to evolve. Researchers have noted that phishing and wallet‑draining incidents surged in the past and then contracted in 2025, even as market cycles reignite risk appetites. The data view from Scam Sniffer shows a dramatic year‑over‑year decline in phishing losses and victims across Ethereum Virtual Machine chains, but security incidents remain a persistent threat, especially when attackers exploit human factors and cross‑system dependencies. The breach at Figure highlights that even as markets and technologies mature, operators must remain vigilant against social engineering and insider threats that can expose customer data and undermine trust in innovative financial services.

https://platform.twitter.com/widgets.js

Crypto World

Meme Coins Rebound as Santiment Signals Capitulation

Meme coin market capitalization reached $34.5 billion with a 3.5% gain over 24 hours, according to CoinGecko data.

Summary

- Meme coin market cap climbs to $34.5B with modest gains.

- Santiment calls “meme era dead” sentiment a capitulation sign.

- DOGE leads sector while Pump.fun posts strongest rebound.

Trading volume hit $2.89 billion as major tokens posted modest recoveries, with Pump.fun leading gains at 9.3% and Shiba Inu climbing 5.7% during the period.

Santiment identified a “nostalgia” narrative forming around meme coins as traders treat the sector as “permanently dead.”

The sentiment analytics platform called this collective acceptance of the “end of the meme era” a classic capitulation signal.

“When the crowd completely writes off a sector, it is often the contrarian time to start paying attention again,” Santiment reported.

Dogecoin leads market cap at $16.3 billion

Dogecoin (DOGE) holds $16.29 billion in market capitalization, accounting for 47% of the total meme coin sector. The token traded at $0.09659 with 4.3% gains over 24 hours.

Shiba Inu (SHIB) ranks second with $3.74 billion in market capitalization at a price of $0.006343. The token posted 5.7% gains over 24 hours and 1.1% over seven days.

MemeCore holds third position at $2.37 billion market capitalization but posted the weakest performance among top tokens. The coin traded at $1.36, down 4.5% over 24 hours and 18.9% over seven days.

Pepe (PEPE) maintains $1.59 billion in market capitalization at $0.003792 per token. The frog-themed coin gained 3.1% over 24 hours but declined 2.5% over seven days.

Pump.fun posts strongest 24-hour gains at 9.3%

Pump.fun recorded the sector’s strongest 24-hour performance with 9.3% gains to reach $0.0021. The token holds $1.24 billion in market capitalization with seven-day gains of 1.3%.

The overall meme sector shows mixed signals. While 24-hour performance appears positive with market cap climbing 3.4%, seven-day charts reveal most tokens remain under pressure.

Only Shiba Inu and Pump.fun posted positive weekly gains among the five largest meme coins tracked.

Santiment’s capitulation signal comes from widespread trader pessimism declaring the meme coin era finished.

Crypto World

Best Altcoin to Watch Now as Bitcoin (BTC) Is Down Almost 50% From ATH

As Bitcoin (BTC) struggles to regain its former highs and crypto prices today remain under pressure, investors are looking for altcoins that can outperform during market consolidation. One project capturing attention is Mutuum Finance (MUTM), a next-generation DeFi platform currently in its Phase 7 presale. With its innovative design, rewarding mechanisms, and growing ecosystem, MUTM is positioning itself as a promising alternative for both new and seasoned crypto investors.

Entry Price Advantage

Currently valued at $0.04, the MUTM token has surged an impressive 4x from its initial $0.01 price. So far, $20.52 million has been raised, and the holder count sits at around 18,980. In each presale phase, the price of the MUTM token has increased by nearly 20%, making it one of the best crypto options for early investors.

In fact, investing now while using crypto or cards could be particularly advantageous, as the potential launch price of $0.06 is still ahead. This means investors today could potentially enjoy growth of around 50%. For example if someone invests $2,000 today, at the anticipated launch price the total value holding will reach $3,000. With a current entry price of $0.04, MUTM presents an excellent opportunity to start accumulating before launch.

Mutuum Finance (MUTM) Launched on Ethereum (ETH) Testnet

A key reason for MUTM’s rising prominence is the recent launch of its V1 protocol on Ethereum (ETH)’s Sepolia testnet. This environment allows users to interact with fully functional smart contracts without using the real assets in a risk-free setting, creating confidence ahead of the mainnet release. During this phase, participants can explore features such as lending, liquidity pools, mtTokens representing lender shares, debt tokens for borrowers, and a liquidator bot ensuring system solvency.

Launching V1 protocol on the testnet gives the community early access to experience the protocol before the mainnet release. This phased deployment enhances transparency, encourages early engagement, and allows the development team to collect practical feedback for optimization. As more users interact with the testnet, confidence in the ecosystem is expected to grow, supporting long-term interest and demand for the MUTM token making it one of the top altcoin options to buy now.

Looking ahead, the team will introduce peer-to-peer (P2P) lending, enabling users to negotiate loans directly without intermediaries. This feature will drive more platform activity, generating additional fees and increasing organic demand for MUTM. By giving investors early exposure to its protocol, Mutuum Finance (MUTM) is cultivating trust and a committed community — essential ingredients for sustainable growth in the DeFi arena.

Alongside lending, analysts say Mutuum Finance (MUTM) is planning to launch its own stablecoin. Designed to stay near $1, it will only be minted against crypto collateral and burned upon loan repayment or liquidation. This structure ensures value preservation and liquidity circulation, which will reinforce MUTM’s utility and support consistent borrowing and lending activity. Stablecoins have historically anchored thriving DeFi ecosystems, and this implementation could further accelerate MUTM adoption hence increase its value to somewhere $0.5 to $1 within a year.

Buy-and-Distribute Model Creates Sustained Demand

Another compelling factor that makes MUTM the best altcoin to watch is its buy-and-distribute model. Revenue generated from lending and borrowing will be used to repurchase MUTM tokens from the open market. These tokens are then distributed to mtToken stakers as rewards, incentivizing active participation and reinforcing long-term MUTM demand.

This mechanism ensures that the platform’s growth directly benefits its community. The more users interact with Mutuum Finance (MUTM), the more revenue is generated, fueling further buybacks and rewards.

With Bitcoin (BTC) under pressure, Mutuum Finance (MUTM) offers investors a compelling alternative. Its carefully designed ecosystem, presale incentives, and sustainable tokenomics make MUTM one of the best altcoins to watch now. As the platform moves closer to mainnet, MUTM is likely to capture further attention, making this phase of the presale an attractive window for potential gains.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Elon Musk’s X (Twitter) Is Launching Crypto Trading Features

Social media platform X, formerly known as Twitter, is set to integrate stock and cryptocurrency trading directly into user feeds.

This move marks a significant escalation in Elon Musk’s bid to transform the platform into a dominant player in financial technology.

On February 14, Nikita Bier, X’s head of product, said the new functionality will allow users to execute trades immediately after discovering an asset on their timeline.

Sponsored

Sponsored

The feature centers on “Smart Cashtags,” an evolution of the platform’s existing indexing system. Currently, users prefix ticker symbols with dollar signs—such as $BTC for Bitcoin—to create clickable links.

Under the new system, tapping these symbols will display live price charts and related posts, and offer direct trading options.

This development is the company’s latest move to reduce friction when switching between social media and brokerage applications. By bridging these functions, the update potentially accelerates how quickly retail investors can act on information

The integration is a cornerstone of Musk’s broader strategy to evolve X into an “everything app.” Notably, he has championed this concept since acquiring the company in 2022.

The vision mirrors the utility of Asian “super apps” that combine messaging, social networking, and payments.

Over the past years, X has ramped up efforts to build a financial ecosystem. The firm has laid the groundwork for peer-to-peer transfers, daily consumer payments, and now, active investing.

However, the intersection of social media hype and financial speculation poses moderation challenges.

Bier noted that while the company intends for cryptocurrency to proliferate on the platform, it remains cautious regarding user experience.

He warned that applications that create incentives for spam, raiding, or harassment will not be supported. According to him, such behavior “meaningfully degrades the experience for millions of people.”

So, as X transitions from a town square to a trading floor, the company faces the dual challenge of competing with established brokerage firms while navigating the regulatory complexities inherent in facilitating financial transactions for a global user base.

Crypto World

Sui Blockchain Secures Institutional Backing as Grayscale Files ETF with Coinbase Custody

TLDR:

- Grayscale’s S-1 amendment for Sui ETF with Coinbase custody brings institutional capital access channels.

- zkLogin technology eliminates seed phrases by enabling Google, Face ID, and phone authentication methods.

- Object-centric architecture processes transactions simultaneously, maintaining sub-cent fees during peak usage.

- Move programming language prevents asset duplication and deletion, eliminating common smart contract exploits.

The Sui blockchain has entered a new phase of development in February 2026 as institutional finance shows increased interest in the platform.

Grayscale recently amended its S-1 filing for a Sui exchange-traded fund, naming Coinbase as custodian. This development marks a shift from retail-driven speculation toward institutional infrastructure adoption.

The move signals growing recognition of Sui’s technical capabilities and regulatory compliance standards within traditional finance circles.

Institutional Capital Opens New Access Channels

The Grayscale ETF filing represents more than a routine regulatory submission. Exchange-traded funds transform digital tokens into recognized financial instruments accessible to pension funds and retirement accounts.

These institutional investors can now gain exposure without managing wallets or private keys directly. Coinbase’s role as custodian addresses security and compliance requirements that traditional finance demands.

Bitcoin ETFs previously demonstrated how institutional access drives capital inflows at scale. However, Bitcoin had already matured before ETF approval.

Sui remains in earlier development stages, meaning institutional capital entering now carries greater relative impact. Fixed supply dynamics combined with increasing demand create favorable conditions for long-term growth.

The institutional validation extends beyond price speculation. Regulatory recognition attracts enterprise developers and commercial applications.

Projects building on blockchains with clear compliance pathways face fewer legal uncertainties. This regulatory clarity reduces friction for businesses considering blockchain integration.

Capital markets now view Sui as legitimate infrastructure rather than experimental technology. The shift reflects broader industry maturation as crypto moves from speculative trading toward functional utility.

Traditional finance involvement brings stability and resources that support long-term ecosystem development.

Technical Architecture Removes Adoption Barriers

Sui addresses two critical obstacles that have prevented mainstream adoption. The platform eliminates seed phrase requirements through zkLogin technology developed by partners, including Human.tech’s Wallet-as-a-Protocol and Ika.

Users authenticate with Google accounts, Face ID, or phone numbers while maintaining full asset control. Zero-knowledge authentication verifies identity without exposing private keys to third parties.

This onboarding simplification removes the most intimidating aspect of cryptocurrency usage. Traditional wallet setup requires writing down twelve-word phrases and understanding address systems.

Sui reduces this process to familiar login methods users already trust. The technology breakthrough makes blockchain accessible without requiring technical education.

The underlying architecture also delivers performance improvements. Sui employs an object-centric model where assets exist as independent objects rather than account balances.

Tokens, NFTs, and smart contracts process simultaneously instead of sequentially. This parallel execution prevents network congestion even during high-demand periods.

Transaction fees remain under one cent with finality achieved in approximately 400 milliseconds. The Mysticeti consensus upgrade further reduced latency.

Move programming language adds security advantages by treating assets as resources that cannot be copied or accidentally deleted.

This design eliminates common exploit categories, including reentrancy attacks. The combination of usability and technical performance positions Sui for practical application deployment across finance and gaming sectors.

Crypto World

Figure Technology Data Breach Exposes Customer Personal Information

Figure Technology, a blockchain-based lending firm, was reportedly hit by a data breach after attackers manipulated an employee in a social-engineering scheme.

The incident allowed hackers to obtain “a limited number of files,” a company spokesperson told TechCrunch. The company said it has begun notifying affected parties and is offering free credit-monitoring services to anyone who receives a breach notice.

Details about the scope of the incident, including how many users were affected or when the intrusion was detected, were not disclosed publicly. Cointelegraph reached out to Figure for comment, but had not received a response by publication

The hacking collective ShinyHunters claimed responsibility on its dark-web leak site, alleging the company declined to pay a ransom. The group published roughly 2.5 gigabytes of data said to have been taken from Figure’s systems.

Related: ‘Hundreds’ of EVM wallets drained in mysterious attack: ZachXBT

Leaked Figure data includes names, addresses

TechCrunch reported that it reviewed samples of the leaked material, which included customers’ full names, home addresses, dates of birth and phone numbers. This information could be used for identity fraud and phishing attempts.

As Cointelegraph reported, crypto phishing attacks linked to wallet drainers dropped sharply in 2025, with total losses falling to $83.85 million, an 83% decline from nearly $494 million in 2024, according to Web3 security firm Scam Sniffer. The number of victims also fell to about 106,000, down 68% year over year across Ethereum Virtual Machine chains.

Researchers said the drop does not mean phishing has disappeared. Losses closely tracked market activity, rising during periods of heavy onchain trading and easing when markets cooled. The third quarter of 2025, during Ethereum’s strongest rally, recorded the highest losses at $31 million, with monthly totals ranging from $2.04 million in December to $12.17 million in August.

Related: Crypto hack counts fall, but supply chain attacks reshape threat landscape

Figure Technology goes public

Figure Technology went public in September last year, listing on the Nasdaq Stock Exchange. The fintech firm, known for its blockchain-based lending, priced its initial public offering (IPO) at $25 per share, raising $787.5 million and achieving an initial valuation of approximately $5.3 billion to $7.6 billion.

Last month, Figure Technology launched the On-Chain Public Equity Network (OPEN), a platform on its Provenance blockchain that lets companies issue real shares and allows investors to lend or pledge those shares directly to one another without traditional brokers, custodians or exchanges.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

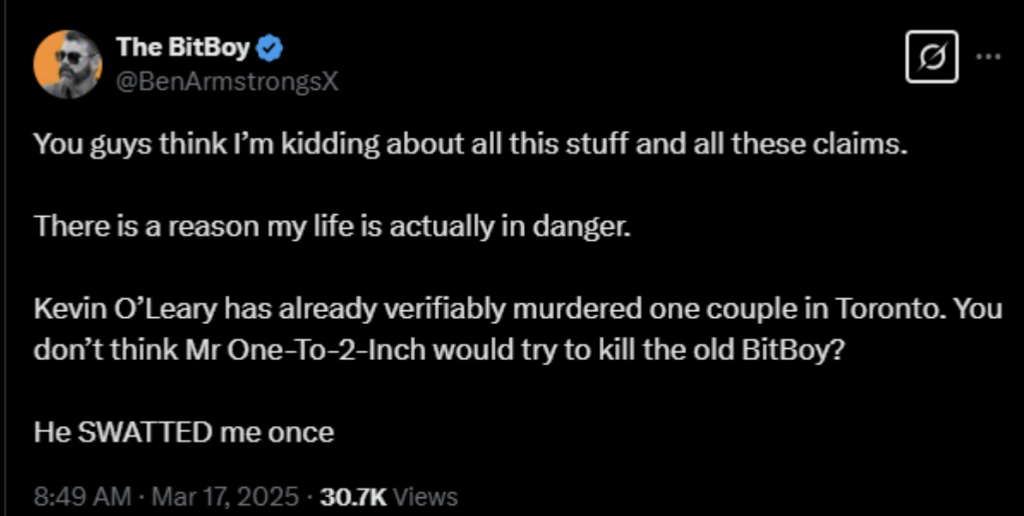

Kevin O’Leary Wins $2.8 Million Defamation Judgment Against BitBoy Crypto

Kevin O’Leary just walked away with a $2.8 million courtroom win. The Shark Tank investor secured a default judgment against former crypto influencer Ben Armstrong, better known as BitBoy Crypto.

The funny thing? Armstrong did not even properly defend himself. A federal judge in Florida stepped in and awarded heavy punitive damages after claims surfaced that Armstrong publicly called O’Leary a “murderer.”

- Judge Beth Bloom awarded O’Leary $2 million in punitive damages plus $750,000 for emotional distress.

- The court rejected Armstrong’s attempt to blame the default on mental health struggles and incarceration.

- Armstrong previously taunted O’Leary online, posting his personal phone number and alleging a cover-up regarding a 2019 boat crash.

The Feud Behind Kevin O’Leary Lawsuit

This whole fight traces back to a tragic 2019 boat crash involving O’Leary’s wife, Linda, where two people lost their lives. She was fully acquitted in 2021. Case closed.

Years later, Armstrong went online and ignored that outcome completely. He posted claims saying O’Leary and his wife “murdered a couple and covered it up.” Then it escalated. He shared O’Leary’s private phone number and urged followers to call him, throwing out lines like he was a “rabid dog” going after him.

At one point, Armstrong even mocked critics by asking, “What are you gonna do, sue me?”

Turns out, that is exactly what happened. And on March 26, 2025, he got his answer in court.

Breaking Down the $2.8 Million Judgment

The ruling included $78,000 for reputational damage and $750,000 for emotional distress.

O’Leary even pointed to increased security measures and changes to studio access because of fears tied to Armstrong’s online following.

Then came the real blow. An extra $2 million in punitive damages, meant to send a message. Armstrong had already defaulted after failing to respond to the lawsuit in 2025. He later tried to undo that default in early 2026, arguing incarceration and mental health struggles kept him from defending himself.

The court did not buy it.

This judgment adds to what has already been a brutal stretch for Armstrong, who was pushed out of the HIT Network and is now staring at serious financial fallout.

The post Kevin O’Leary Wins $2.8 Million Defamation Judgment Against BitBoy Crypto appeared first on Cryptonews.

Crypto World

Massive 500% PI Surge Forecast as Pi Network Leadership Sends Key Message

The PI token is among the notable gainers in the past 24 hours and has risen far above its recent all-time low.

Despite growing criticism and controversy surrounding the project, many Pioneers continue to publicly praise and support the Pi Network Core Team and the ecosystem they have built.

The underlying asset has finally shown notable signs of recovery, prompting a prominent analyst to hint at buying PI and making bold price predictions.

“Adding Some PI”

Captain Faibik, a renowned cryptocurrency analyst with well over 100,000 followers on X, made a rare call on Pi Network’s native token. In a recent tweet, Faibik outlined their 500% surge expectation for PI after explaining that they had added some of the token for the midterm.

Adding Some $PI for the Midterm..!!

Expecting +500% Bullish Rally..🔜#Crypto #PI #PIUSDT pic.twitter.com/LQppQBAblo

— Captain Faibik 🐺 (@CryptoFaibik) February 14, 2026

PI has performed rather well in the past day, jumping by 10% to over $0.16. This means the asset is now 23% higher than its all-time low of $0.1312, set on February 11. Despite this daily increase, PI remains deep in the red on almost all other scales, down nearly 95% from its all-time low recorded last February.

If Captain Faibik’s 500% surge prediction is to come true, the token could be on its way to $1. However, that seems unlikely at the moment, given the overall market environment and PI’s inability to stage a longer, more profound recovery.

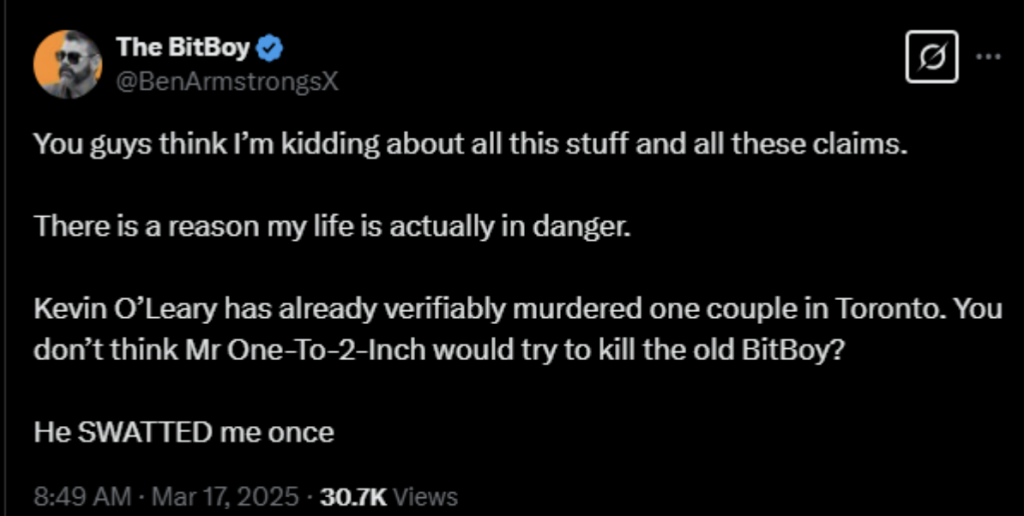

There’s a big elephant in the Pi Network room for the next few weeks. The token unlock schedule from PiScan indicates that, on average, more than 7.2 million PI will be released daily over the next month, but the number will frequently exceed 13.5 million by February 25. The unlocks will ease in March, though.

You may also like:

These large unlocking events are viewed as bearish, as they can increase immediate selling pressure from investors who have been waiting for their tokens for a long time.

Co-Founder Speaks Out

Pi Network’s Core Team has faced significant scrutiny over the past several weeks. However, this didn’t stop them from announcing a new series of upgrades with a February 15 deadline for Mainnet nodes.

One of the project’s co-founders, Dr. Nocolas Kokkalis, also issued the same reminder to his over 120,000 followers on X, claiming that the PI nodes are the “4th role in the PI ecosystem.” He urged users to run the PI node on their laptop or desktop to validate transactions, strengthen network security, and support global consensus and trust.

🚀 Pi Nodes — The 4th Role in the Pi Ecosystem 🌐

💻 Run Pi Node on your laptop or desktop and help power decentralization:

✅ Validate transactions on a distributed ledger

🔐 Strengthen network security

🌍 Support global consensus & trust

⚡ Every node makes the network stronger… pic.twitter.com/jrxy0IKSyM— Dr. Nicolas Kokkalis (@drnicolas_) February 14, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

-

Politics6 days ago

Politics6 days agoWhy Israel is blocking foreign journalists from entering

-

Business6 days ago

Business6 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat5 days ago

NewsBeat5 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business6 days ago

Business6 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech3 days ago

Tech3 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat6 days ago

NewsBeat6 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports5 days ago

Sports5 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Video1 day ago

Video1 day agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Politics6 days ago

Politics6 days agoThe Health Dangers Of Browning Your Food

-

Business6 days ago

Business6 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-400x240.jpg)

![Heathrow has said passenger numbers were 60% lower in November than before the coronavirus pandemic and there were “high cancellations” among business travellers concerned about being trapped overseas for Christmas as Omicron spreads. The UK’s largest airport said the government’s travel restrictions had dealt a fresh blow to travel confidence and predicted it was likely to take several years for passenger numbers to return to pre-pandemic levels. This week ministers said passengers arriving in the UK would have to take a pre-departure Covid test, as well as a post-flight test, because of fears about the spread of the new variant. “[The] high level of cancellations by business travellers concerned about being trapped overseas because of pre-departure testing shows the potential harm to the economy of travel restrictions,” the airport said in an update. Heathrow said the drop in traveller confidence owing to the new travel restrictions had negated the benefit of reopening the all-important corridor to North America for business and holiday travel last month. Eleven African countries have been added to the government’s red list, requiring travellers to quarantine before reuniting with families. “By allowing Brits to isolate at home, ministers can make sure they are reunited with their loved ones this Christmas,” said John Holland-Kaye, the chief executive of Heathrow. “It would send a strong signal that restrictions on travel will be removed as soon as safely possible to give passengers the confidence to book for 2022, opening up thousands of new jobs for local people at Heathrow. Let’s reunite families for Christmas.” Heathrow said that if the government could safely signal that restrictions would be lifted soon, then employers at Heathrow would have the confidence to hire thousands of staff in anticipation of a boost in business next summer. The airport is expecting a slow start to 2022, finishing next year with about 45 million passengers – just over half of pre-pandemic levels. This week Tui, Europe’s largest package holiday operator, said it expected bookings for next summer to bounce back to 2019 levels. However, Heathrow said on Friday not to expect the aviation industry to recover for several years. “We do not expect that international travel will recover to 2019 levels until at least all travel restrictions (including testing) are removed from all the markets that we serve, at both ends of the route, and there is no risk of new restrictions, such as quarantine, being imposed,” the airport said.](https://wordupnews.com/wp-content/uploads/2026/02/shutterstock_1100012546-scaled-80x80.jpg) Business5 days ago

Business5 days agoWeight-loss jabs threaten Greggs’ growth, analysts warn

-

Crypto World3 days ago

Crypto World3 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World4 days ago

Crypto World4 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World12 hours ago

Crypto World12 hours agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 days ago

Video2 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

NewsBeat5 days ago

NewsBeat5 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports5 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 days ago

Crypto World4 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?