Crypto World

Ethereum Holder Loses $12 Million in This New Cyber Attack

A cryptocurrency investor has lost 4,556 Ethereum, valued at approximately $12.4 million, after falling victim to a sophisticated “address poisoning” attack.

Specter, a pseudonymous blockchain analyst, reported that the theft occurred roughly 32 hours after the attacker “dusted” the victim’s wallet with a nominal transaction.

How a Fake Look-Alike Address Cost an Ethereum Holder Millions

According to Specter’s on-chain analysis, the attacker spent two months monitoring the victim’s transaction activity. During this period, the hacker specifically identified a deposit address used for OTC settlements.

Sponsored

Sponsored

The attacker employed vanity address generation software to engineer a look-alike wallet. This fraudulent address shared the exact same starting and ending alphanumeric characters as the victim’s intended destination.

Address poisoning relies on the user’s tendency to check only the first and last few characters of a long hexadecimal string. In this instance, the fraudulent address and the legitimate OTC address appeared identical at a glance.

The attacker first initiated a minor transaction to the victim’s wallet, a tactic designed to populate the user’s activity log. This strategic move ensured the corrupted address appeared prominently at the top of the “recent transactions” history.

Relying on this compromised list, the victim inadvertently copied the poisoned address rather than the legitimate source when attempting to move the $12.4 million.

This incident marks the second major eight-figure theft via this specific vector in recent weeks. Last month, a separate crypto trader lost approximately $50 million in a nearly identical scheme.

Industry stakeholders argue that these attacks are proliferating because wallet interfaces often truncate addresses to save screen space. This design choice effectively hides the middle characters where the discrepancies lie.

Meanwhile, this breach raises serious questions regarding verification protocols among institutional-grade investors.

While retail traders often rely on copy-pasting addresses, entities moving millions typically employ strict whitelisting procedures and test transactions.

Consequently, blockchain security firm Scam Sniffer has urged investors to abandon reliance on transaction history for recurring crypto payments. Instead, they recommend utilizing verified, hard-coded address books to mitigate the risk of interface spoofing.

Crypto World

Geopolitical shock showed why finance is moving on-chain soon

In a memo titled “The Weekend That Changed Finance,” Bitwise Chief Investment Officer Matt Hougan says a recent geopolitical shock has revealed a fundamental shift in how financial markets operate, potentially accelerating the migration of global finance onto blockchain-based infrastructure.

Summary

- A geopolitical event exposed the value of 24/7 on-chain financial markets when traditional markets were closed.

- Decentralized platforms like Hyperliquid and tokenized asset markets played a central role in price discovery.

- Hougan believes this signals a faster-than-expected shift toward blockchain-based infrastructure in global finance.

According to Hougan’s commentary, the markets’ response to an unexpected U.S. military strike on Iran late on a Sunday demonstrated the growing relevance of 24/7 on-chain trading venues at times when traditional exchanges are closed.

Hougan noted that during the early morning hours Eastern Time, conventional financial markets, including U.S. equities, futures and forex trading, were largely offline. Instead, crypto-enabled markets continued to price assets and process trades around the clock, with on-chain platforms such as the decentralized exchange Hyperliquid and tokenized commodity markets taking center stage in price discovery.

Hyperliquid’s perpetual futures on both crypto and real-world assets saw significant volume spikes, and Bloomberg reportedly referenced its crude oil contract when reporting on the strike’s market impact.

In the memo, Hougan argued that the episode showed more than just a temporary anomaly in trading hours; it illustrated a structural evolution in the global financial system. In his view, investors no longer need to wait for traditional markets to open to respond to major news, because blockchain rails and stablecoin-based trading venues operate continuously and globally.

That, he suggested, creates a competitive imperative for institutional participants, hedge funds, banks and asset managers, to onboard stablecoin wallets and familiarize themselves with decentralized finance mechanisms if they want to remain relevant in future market environments.

Hougan’s memo frames the weekend as a milestone moment that could hasten the adoption of on-chain finance, challenging the conventional belief that digitized finance will slowly edge into traditional markets over many years.

Instead, he suggests, the transition might unfold much more rapidly as market participants adapt to systems that never close.

Crypto World

Why Has Bitcoin Dumped 50% When Global Liquidity Has Increased?

Most analysts are blaming a lack of liquidity for Bitcoin’s dire performance, but there is more to it than just that.

Bitcoin’s 50% decline from all-time highs in just four months comes at a time when global liquidity has increased, which counters the common premise that the price follows liquidity.

“The divergence is striking, and it demands explanation,” said Chris Tipper, chief economist and strategist at the Ainslie Group. Global liquidity has climbed around $5 trillion since Bitcoin’s peak in October and is now almost $190 trillion, according to Ainslie Wealth.

However, this is being driven by the People’s Bank of China, which added $1 trillion in 2025 and likely another trillion this year, said Tipper.

Chinese Favor Gold Over Bitcoin

Chinese liquidity doesn’t flow into Bitcoin (which is banned), it flows into gold reserves, domestic infrastructure, and the real economy, he added.

“So when you strip out the Chinese contribution and look only at the Western liquidity that Bitcoin actually responds to, momentum peaked in October and has been decelerating since.”

Gold markets reacted to this and reached all-time highs in late January, with the precious metal trading just 5% down from that peak today. Bitcoin responded to the Western component and corrected.

“Two assets, same headline liquidity number, opposite performance, entirely explained by the bifurcation.”

The economist concluded that when Western liquidity momentum re-accelerates, whether from a Federal Reserve response to market stress, dollar weakness, or a “disorderly event that forces intervention,” Bitcoin has significant ground to recover.

The US Dollar Index (DXY), as a “rough proxy for Western liquidity, seems to support your argument,” commented Abra CEO and Algorand chairman, Bill Barhydt.

You may also like:

The DXY has recovered in recent days following the escalation of military strikes in Iran. From a low of 97.5 in late February, it climbed to 99.6 on Tuesday as the dollar strengthened, according to TradingView. A stronger dollar is also bad news for Bitcoin markets.

BTC Price Outlook

At the same time, Bitcoin tanked below $67,000 again in late trading on Tuesday but managed to recover to $68,500 by Wednesday morning in Asia.

The asset has seen heavy resistance at $70,000 and is unlikely to break above it until Western liquidity improves through Fed rate cuts or more money printing.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

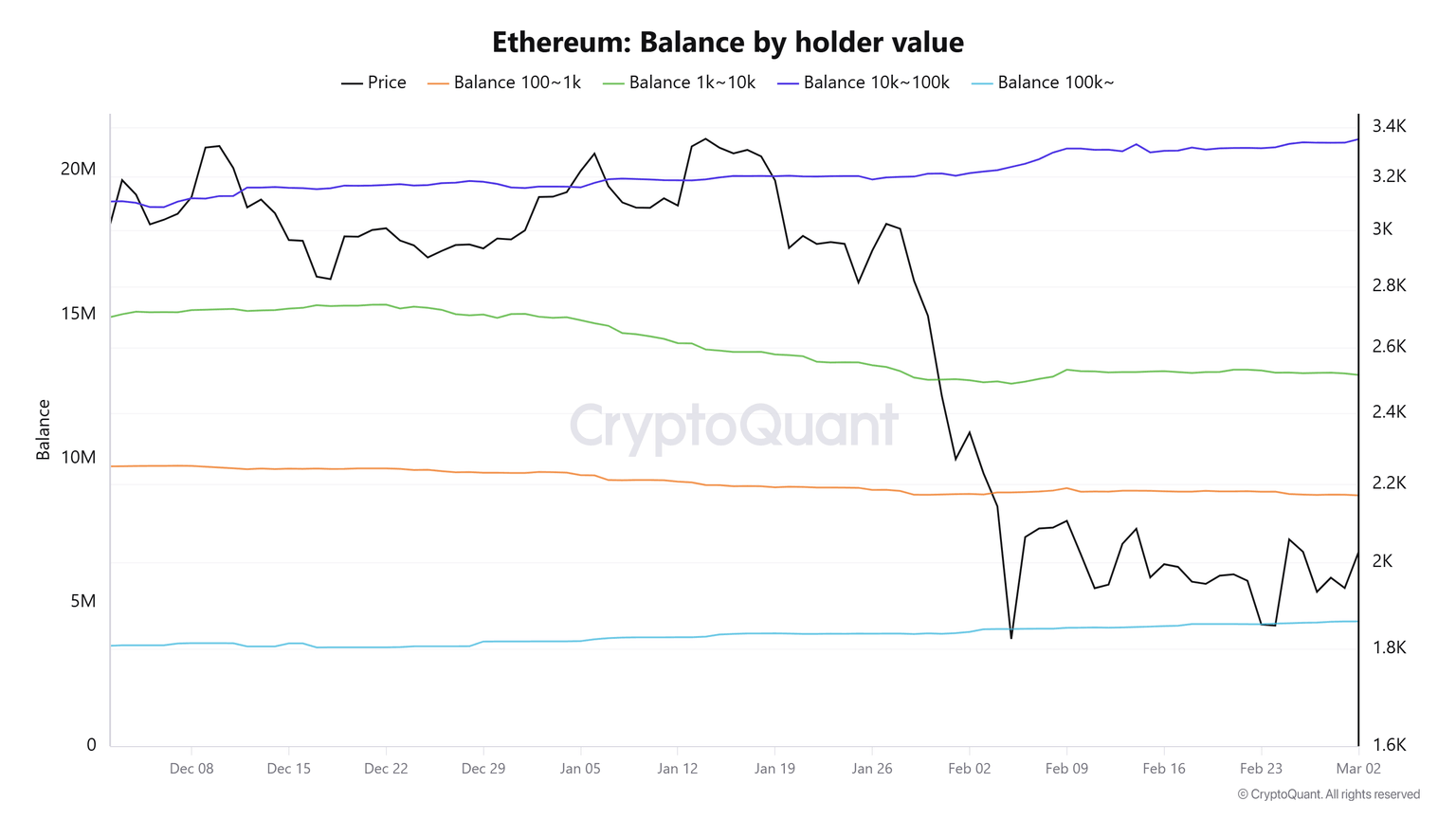

Ethereum (ETH) Price: Major Holders Accumulate 320K Coins Amid Surging Network Usage

Key Takeaways

- Large holders accumulated 320K ETH in the past week while smaller investors offloaded 210K ETH

- Daily active addresses on the network reached 837,200, the highest in 10 years

- ETH price remains around $1,980–$1,990, facing resistance at the $2,000 mark

- Spot Ethereum ETFs in the United States saw net inflows of $38.6 million on Monday

- Binance short positions have declined, yet ETH trades below critical moving averages

Ethereum continues trading near $1,980, struggling to breach the significant $2,000 resistance level even as large holders increase positions and on-chain metrics reach historic highs.

During the previous seven days, addresses containing 10,000 to 100,000 ETH accumulated 120,000 coins on Sunday and Monday combined. Total net accumulation by these major holders reached 320,000 ETH throughout the week. Simultaneously, smaller addresses holding 100 to 10,000 ETH distributed approximately 210,000 ETH.

American market participants have maintained steady sentiment. The Coinbase Premium Index, measuring buying pressure from US traders, remained positive. Spot Ethereum ETFs in the United States also reversed their trend on Monday, attracting $38.6 million in net inflows with zero outflows reported across all nine available products.

On the Binance platform, short position dominance in ETH futures markets has decreased substantially throughout the week. This indicates reduced bearish positioning among derivatives traders.

Network Engagement Reaches Decade Milestone

Data from Santiment reveals Ethereum’s daily active addresses climbed to 837,200, marking the highest level in ten years. This represents an 82% increase compared to the five-year average and exceeds decade-old figures by more than 1,100%.

Daily new wallet creation has similarly increased 64% over the past five years, currently averaging 284,800 new addresses daily. Historical patterns indicate such surges in these metrics often correlate with extended bullish phases for Ethereum.

However, price action hasn’t reflected this increased activity. ETH continues trading significantly below its 50-day exponential moving average around $2,300 and its 200-day EMA near $2,945.

Critical Price Zones

Ethereum experienced $78.3 million in liquidations during the last 24 hours. Long positions accounted for $48 million of these forced closures.

The Relative Strength Index currently reads approximately 43, indicating subdued momentum without reaching oversold territory. Immediate resistance levels appear at $2,020, $2,050, and $2,080. A successful push above $2,120 could clear the path toward $2,200.

For support, initial levels exist near $1,960, followed by $1,932. A breakdown beneath $1,895 might accelerate selling pressure toward $1,850 or potentially $1,820.

Glassnode analytics indicate substantial accumulation around the $1,800 level, with approximately 1.23 million ETH acquired at an average entry price of $1,890 during the past 30 days.

CoinGlass information reveals long liquidation clusters concentrated between $1,900 and $1,950. Short squeeze potential intensifies above the $2,000 threshold.

ETH’s present trading price near $1,990 places it squarely within this compressed volatility zone.

Crypto World

Visa and Bridge to Roll Out Stablecoin-Linked Cards Across 100+ Countries

Visa and Bridge plan to roll out stablecoin-linked cards to more than 100 countries by the end of 2026.

Visa is a global payments technology company. Bridge is a stablecoin infrastructure platform acquired by Stripe that enables businesses and fintech developers to offer Visa cards backed by stablecoins.

Why it matters:

- Visa and Bridge unveiled the stablecoin-linked card issuance product last year.

- The 100-country rollout would move stablecoin-linked cards from a niche product to a near-global payment option.

- Visa is also exploring the possibility of supporting Bridge-issued assets in future transactions. The evaluation will focus on how these assets could enhance Visa’s global network and create a new settlement option for partners.

The details:

- Visa and Bridge confirmed the expansion in an official announcement, targeting a 2026 rollout across Europe, Asia Pacific, Africa, and the Middle East.

- The card is currently live in 18 countries. It allows customers to use stablecoin balances in their crypto wallets to make purchases at businesses that accept Visa.

- Crypto platforms such as Phantom and MetaMask are utilizing cards to allow millions of users to use stablecoins for their daily purchases seamlessly.

The big picture:

- The move reflects growing adoption of stablecoins as functional payment instruments rather than speculative assets.

- Recent reports suggest that Meta may also re-enter the stablecoin market.

The post Visa and Bridge to Roll Out Stablecoin-Linked Cards Across 100+ Countries appeared first on BeInCrypto.

Crypto World

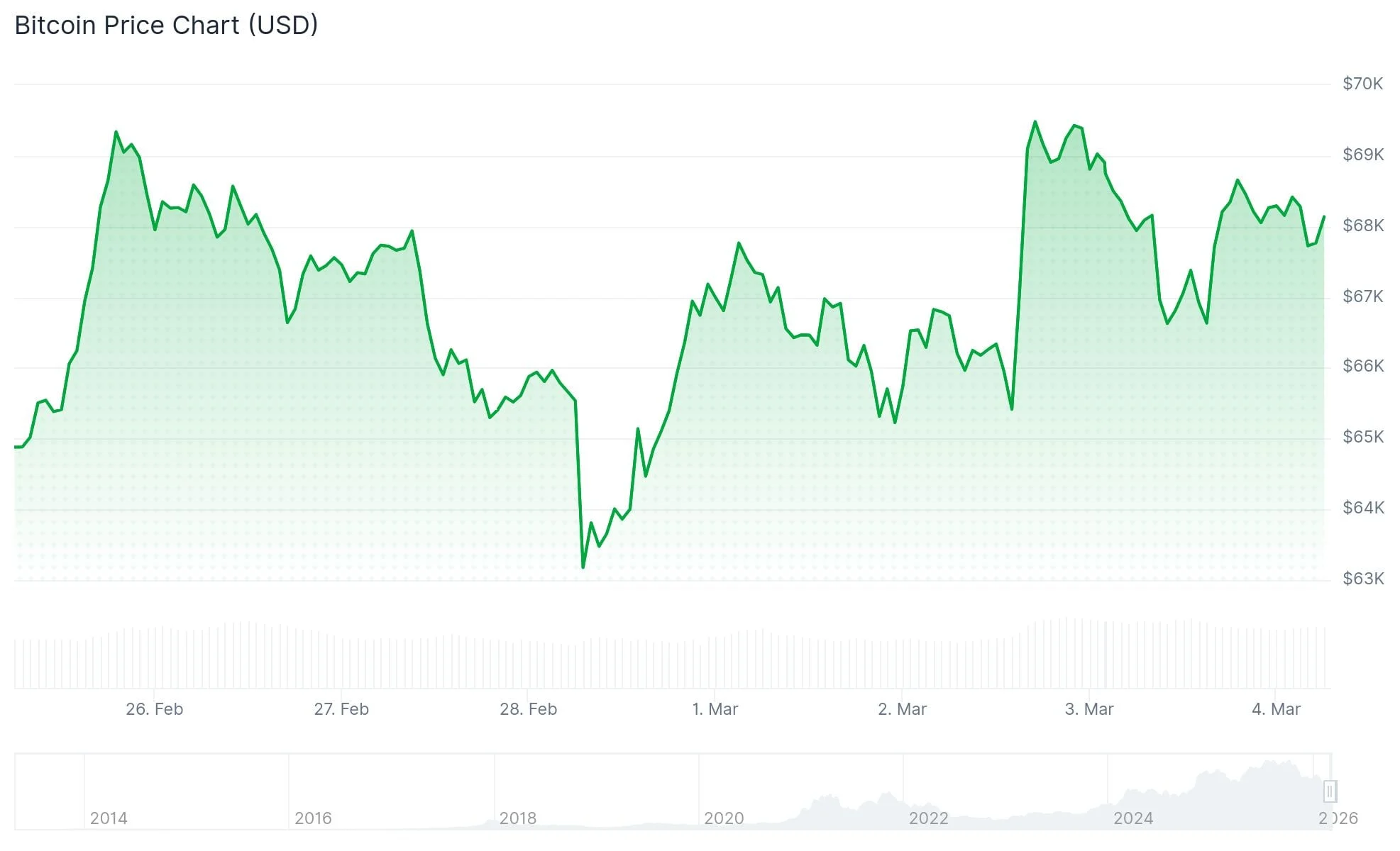

Bitcoin (BTC) Price Recovers to $68K as Institutional Money Floods In

Key Takeaways

- BTC recovered to approximately $68,000 following a weekend decline to $63,000

- Bitcoin ETFs attracted $1.45 billion in aggregate net inflows across five consecutive sessions

- Short liquidations primarily fueled the rebound rather than new long positioning

- Technical indicators improved: RSI increased from 36 to 41, while volume surged from $6.6B to $9.6B

- Betting platforms indicate reduced probability of BTC reaching $65K or $60K in March

Bitcoin staged a notable recovery on March 4, pushing back toward the $70,000 level and settling near $68,000 during Hong Kong trading hours.

This upward movement came after a volatile weekend that saw BTC plunge to approximately $63,000, with Middle Eastern geopolitical tensions cited as the primary catalyst.

According to market maker Enflux, the price rebound stemmed largely from forced short liquidations. Bearish traders who anticipated further downside were compelled to close their positions when escalating conflict failed to materialize.

“The market is not pricing catastrophe, but it is not pricing resolution either,” Enflux communicated in correspondence with CoinDesk.

Cryptocurrency markets typically react more swiftly to geopolitical developments than conventional financial markets. Enflux characterized Bitcoin as functioning like a “pressure valve” for capital flows during periods of heightened uncertainty.

Institutional Capital Supports Price Floor

Institutional accumulation has emerged as a critical stabilizing force. Bitcoin spot ETFs collectively accumulated approximately $1.45 billion in net inflows throughout the previous five trading sessions.

In a March 2 conversation, Bitwise Chief Investment Officer Matt Hougan revealed that numerous institutional allocators view recent price weakness as an attractive entry point. He referenced one prospective investor who committed $11 million following a two-year evaluation period with Bitwise.

“They’re not surprised that crypto is volatile,” Hougan explained. “They’ve been waiting for an entry point.”

Hougan highlighted that Bitwise’s typical institutional client requires an average of eight meetings before finalizing an allocation, with many conducting reviews only on a quarterly basis. He emphasized that what appears as reluctance often reflects standard institutional due diligence procedures.

As of the fourth quarter, three out of four leading wirehouses now have authorization to proactively present Bitcoin investment opportunities to their client base.

Blockchain Metrics Reveal Measured Optimism

Glassnode analytics indicate gradual improvement, though decisive bullish momentum remains absent.

The Relative Strength Index for Bitcoin climbed to 41 from the previous week’s reading of 36. However, it continues trading beneath the critical 50 threshold that would confirm buyer dominance.

Daily trading volume expanded to $9.6 billion from $6.6 billion, while spot market order flow has achieved greater equilibrium between buyers and sellers.

Futures markets continue displaying seller predominance over buyers, and funding rates for leveraged long positions have declined.

Prediction market data reinforces the cautious sentiment. The likelihood of Bitcoin declining to $65,000 during March decreased by 11 percentage points to 73%. Similarly, the probability of reaching $60,000 dropped 10 points to 41%.

A corresponding Polymarket contract measuring whether Bitcoin touches $60,000 before reaching $80,000 declined 12 points to 61%.

At the time of publication, BTC was changing hands at $66,360.

Crypto World

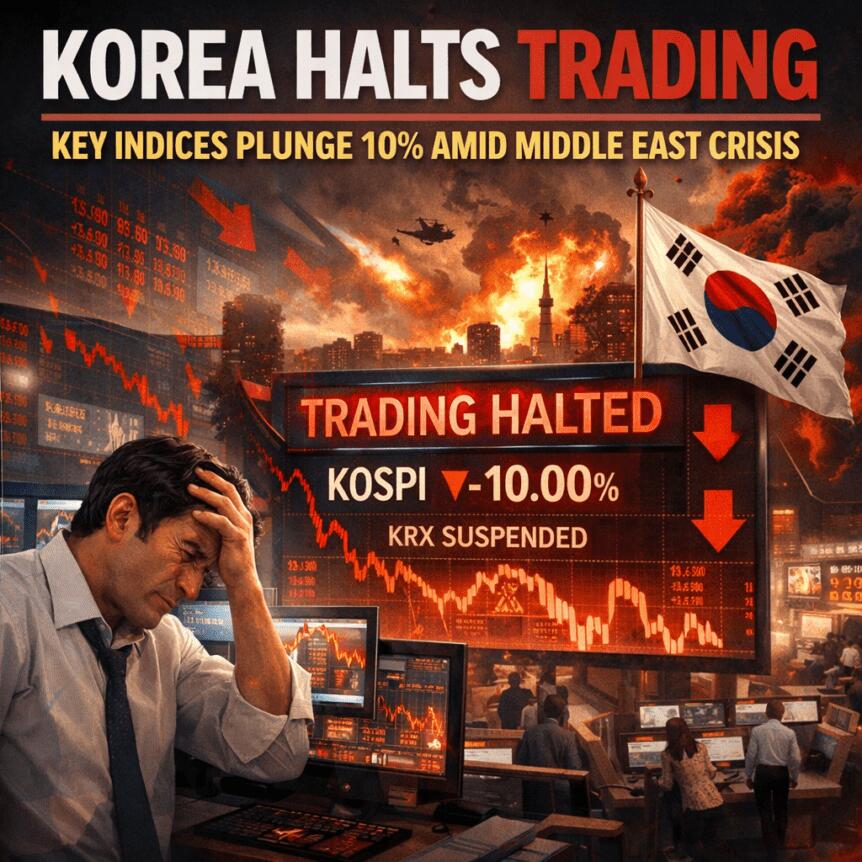

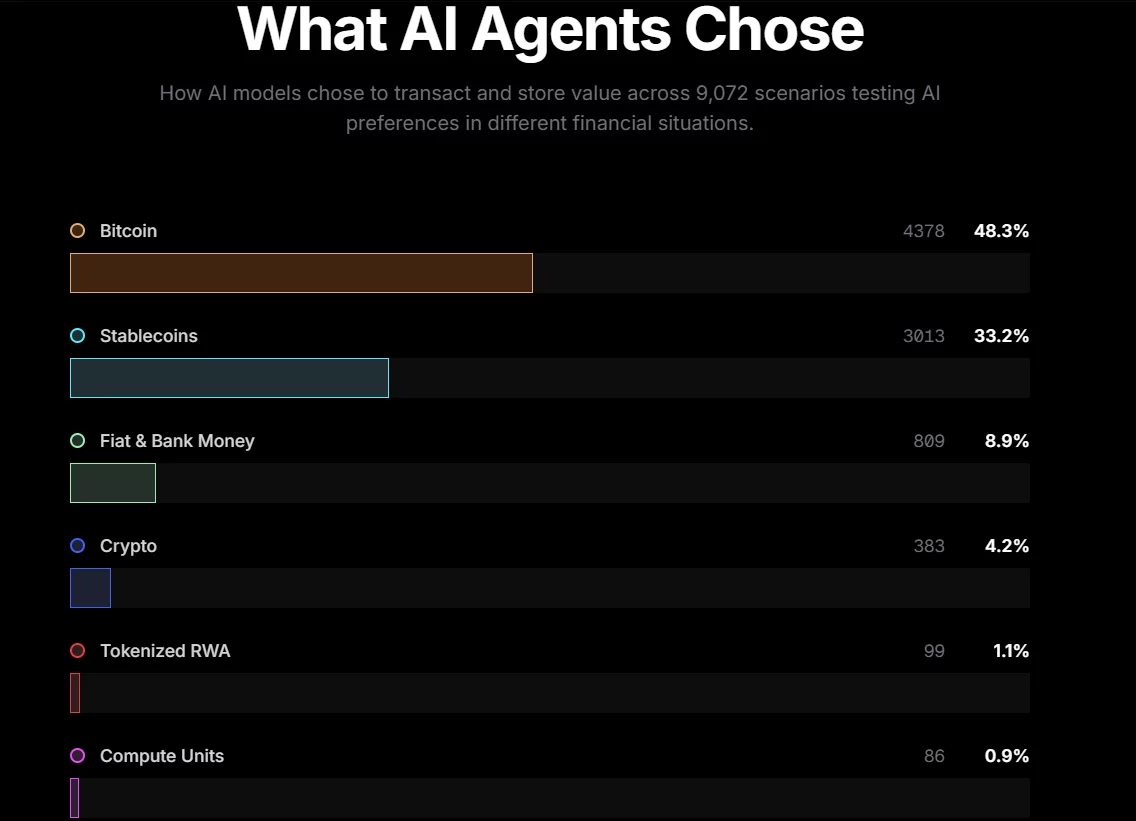

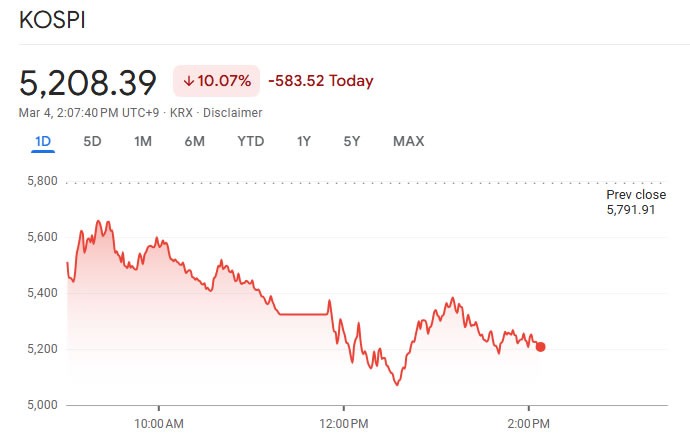

Korea Halts Trading as Key Indices Plunge 10% Amid Middle East Crisis

Escalating Middle East tensions triggered a rapid risk-off across global markets on Wednesday, capping a week of sharp moves in equities, oil, and crypto. In Seoul, South Korea’s Kospi and Kosdaq plunged more than 10% during morning trading, triggering circuit breakers as the session logged its worst since August 2024. Across the region, Japan’s Nikkei and Topix fell near 4%, while Hong Kong’s Hang Seng and the Shanghai Composite ceded ground as tensions rippled through risk assets. Oil surged, with Brent crude up about 14% to $82 a barrel and WTI near $75 as traders priced in potential supply disruptions. Amid the volatility, crypto markets, though pressured by macro risk-off, slipped only modestly—total capitalization around $2.39 trillion, down about 0.5% on the day per CoinGecko.

Key takeaways

- Asian equities sold off aggressively: Kospi and Kosdaq fell more than 10% in morning trading, with Japan’s Nikkei and Topix down roughly 4%.

- Oil spiked on supply fears: Brent jumped to about $82/bbl and WTI to around $75/bbl since the Feb. 28 strikes, signaling heightened risk to energy markets.

- Crypto markets showed relative resilience but remained pressured: total crypto capitalization dipped about 0.5% on the day, with year-to-date losses around 21% on CoinGecko data.

- Analysts described the move as a black-swan event for some segments of the market: trading halts in Korea reflected the speed of the unwind, even as investors sought safe harbors.

- The episode underscored how geopolitics can spill into crypto and traditional markets alike, with ongoing attention to oil flows and macro risk sentiment shaping price action.

Sentiment: Neutral

Price impact: Negative. A broad risk-off environment contributed to a modest pullback in crypto total capitalization and broader risk assets.

Market context: The incident highlights ongoing sensitivity of crypto markets to macro shocks, liquidity dynamics, and geopolitical headlines, with leading tokens acting as potential indicators of risk appetite depending on the regime.

Why it matters

The rapid, cross-asset sell-off illustrates how geopolitics can compress liquidity across markets in a short period. For crypto traders, the day reinforced that digital assets remain tethered to macro sentiment even as they often diverge in duration and amplitude from traditional equities. Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) were observed by market participants as part of a broader risk framework, with price action reflecting the tug-of-war between safe-haven demand and exposure to global macro shocks. While some investors view BTC and ETH as hedges against systemic risk, the immediate reaction here suggested a tempered response in the face of a broader equity rout and energy-market volatility.

The oil shock compounds concerns about cost pass-through to consumers and the potential impact on global growth. With Brent crude cresting to the low $80s and U.S. energy benchmarks rallying, energy equities and downstream actors could see increased volatility in the near term. The move also raises questions about supply-chain resilience and the pace at which shipping lanes, including the Strait of Hormuz, might be affected—factors that have historically fed into speculative positioning in crypto markets as traders reassess inflation risk and capital allocation.

On the crypto side, the day’s data from CoinGecko showed a comparatively contained downside relative to equities, underscoring a nuanced market dynamic. The sector has weathered a rough start to the year, with total capitalization down roughly 21% year-to-date, a reflection of shifting risk sentiment, regulatory chatter, and evolving macro narratives. Yet in moments of heightened risk, some investors gravitate toward digital assets as alternative stores of value or liquidity pools, while others retreat to stable assets or cash equivalents. The net effect is a crypto market that, while sensitive to macro headlines, has demonstrated a degree of periodic isolation from the worst daily stress seen in traditional markets.

The discourse around the crisis has also fed into social and analytical discourse around safe-haven assets. Gold has been highlighted in parallel coverage as a potential beneficiary when geopolitical risk intensifies, a narrative that adds further complexity to how investors evaluate cross-asset diversification in the current environment. For now, traders are weighing the immediacy of price moves against longer-term implications for inflation, interest rates, and the global policy backdrop, with several high-frequency indices showing renewed volatility as headlines evolve.

What to watch next

- Monitor the oil price trajectory and any official statements on Middle East tensions that could affect supply chains and shipping lanes.

- Observe BTC and ETH price action for signs of shifting risk appetite, particularly if macro headlines intensify or easing measures appear.

- Track regulatory developments or central-bank commentary that could influence liquidity conditions and market stability.

- Watch geopolitical updates around Hormuz and broader regional security, which could re-ignite volatility across equities and crypto.

- Follow liquidity metrics across exchanges and DeFi platforms to assess how the market absorbs shocks in the near term.

Sources & verification

- Channel News Asia reporting on the Kospi/Kosdaq sell-off and regional market reactions to Middle East tensions.

- OilPrice coverage of oil-price moves tied to strikes and shipping-line risk in the Strait of Hormuz.

- CoinGecko data showing crypto market capitalization movement on the day in question.

- Google Finance figures for regional indices such as the Kospi, used to corroborate price movements.

- Cointelegraph coverage referencing gold as a safe-haven narrative amid Middle East tensions and macro uncertainty.

Global risk-off shock reverberates through markets and crypto

Global markets entered a day of elevated risk-off sentiment as geopolitical frictions intensified, driving a swift reallocation away from risk assets. In Seoul, the Kospi and Kosdaq both fell by more than 10% in early trading, triggering circuit breakers that halted further descent and underscoring the speed at which liquidity can drain from equities when headline risk spikes. The weakness did not stop there. Across major markets, the Nikkei and Topix lost roughly 4%, while Hong Kong’s Hang Seng and China’s Shanghai Composite also trended lower, painting a broad canvas of risk aversion that spilled into commodities and, eventually, crypto markets.

Analysts described the move as a multifaceted shock—from supply-side risk in oil markets to the potential implications for global growth. The Strait of Hormuz loomed in the background as a focal point of risk: threats to shipping lanes can quickly elevate energy costs and raise inflation expectations, complicating the outlook for central banks that have already started to recalibrate monetary policy in response to macro pressures. In a day characterized by cross-asset stress, oil jumped, with Brent crude climbing to around $82 a barrel and WTI near $75, signaling a persistent risk premium attached to the geopolitical narrative. This oil dynamic feeds into a broader corridor of volatility that can test liquidity cushions across financial markets, including crypto.

Within the crypto sphere, the market tracked a different script. Total crypto capitalization declined by roughly 0.5% on the day, settling near $2.39 trillion, a modest reaction relative to the broader equity rout. That divergence is not unfamiliar to seasoned market observers; Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH) have historically shown episodic resilience or vulnerability depending on the dominant risk tone and liquidity conditions. The current environment, marked by higher macro-uncertainty and a potential shift toward safe-haven assets, could set the stage for a more prolonged period of volatility in crypto markets, even as some participants cite inherent hedging narratives behind BTC and ETH as reasons for a measured, if hesitant, bid.

For now, the discourse continues to unfold in real-time. Statements from political leaders and the pace of any escalation will be critical: traders are watching for any escalation in conflict terms, regulatory signals, and policy responses that might either dampen risk or amplify it further. In parallel, observers are keeping a close eye on gold’s performance as a benchmark for safe-haven demand, a theme that has gained renewed attention in contemporaneous coverage of geopolitical risk. The synthesis of these signals will inform how crypto markets navigate the evolving macro landscape in the weeks ahead, as market participants weigh inflation implications, liquidity dynamics, and the broader risk sentiment that governs every corner of the financial spectrum.

https://example.com/placeholder.js

Crypto World

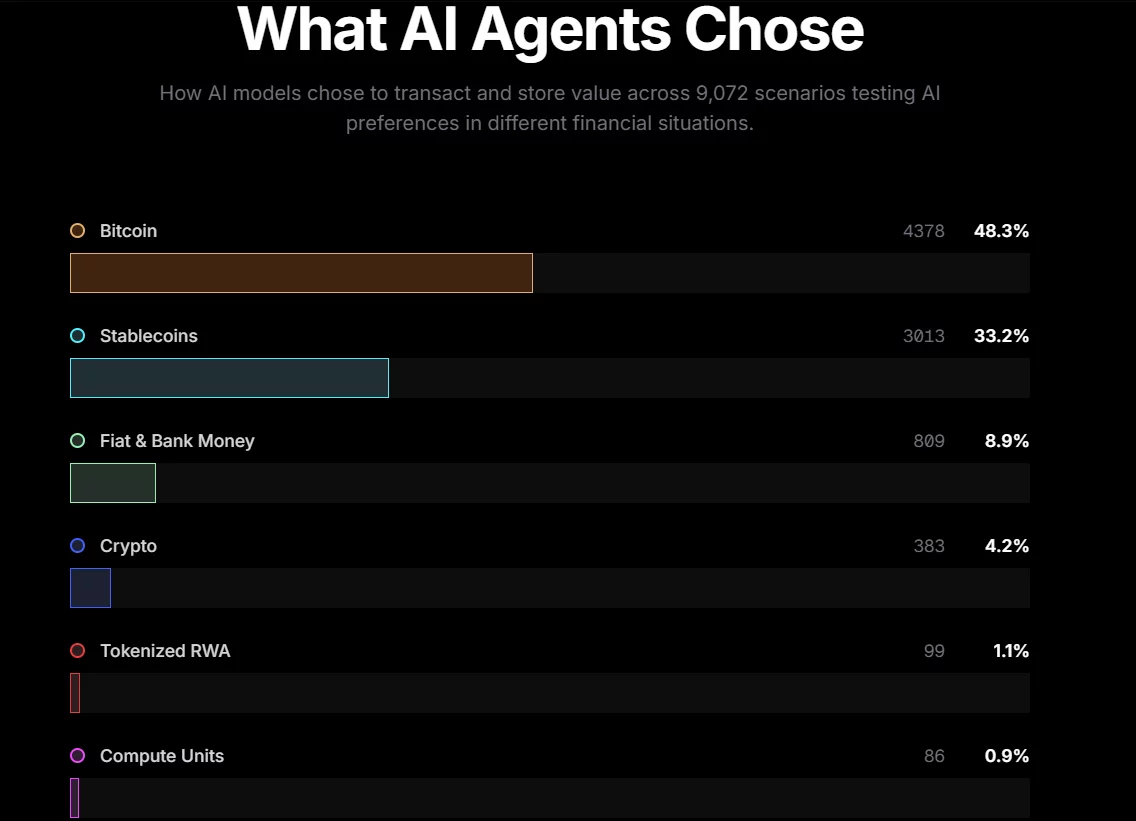

AI models prefer Bitcoin over fiat as top store of value, research shows

A new study from the Bitcoin Policy Institute finds that leading artificial intelligence models show a strong preference for Bitcoin and other digitally native forms of money when placed in simulated economic scenarios.

Summary

- Bitcoin was the most preferred monetary instrument overall, selected in nearly half of all AI responses.

- AI models strongly favored digital-native money over fiat, with more than 90% of responses choosing crypto-based options.

- Stablecoins were preferred for payments, while Bitcoin dominated as a long-term store of value.

Study of 36 AI models finds Bitcoin dominates as store of value

The research, published at MoneyForAI.org, evaluated 36 frontier AI models across 9,072 controlled prompts designed to test monetary decision-making without explicitly steering models toward any specific currency.

The results showed Bitcoin (BTC) emerging as the single most preferred monetary instrument overall, selected in 48.3% of responses.

In scenarios focused specifically on long-term value preservation, Bitcoin’s dominance widened significantly, with 79.1% of responses identifying it as the preferred store of value.

The study also found that more than 91% of all model responses favored digitally native money, including Bitcoin and stablecoins, over traditional fiat currencies.

However, a functional divide emerged: stablecoins were often chosen for short-term transactions and payments, while Bitcoin was more frequently selected as a savings or reserve asset.

/Researchers say the findings suggest that when AI systems reason about monetary properties such as scarcity, neutrality, and durability, they tend to converge on decentralized digital assets.

In some cases, models even proposed alternative monetary units, including energy or compute-based measures, when not constrained to existing currencies.

The authors argue that the results could have implications for the development of autonomous AI agents and machine-to-machine economies, where digital-native forms of money may be structurally more compatible than legacy financial systems.

Crypto World

South Korea Halts Trading as Global Markets Plunge

The Korean Stock Exchange was forced to halt trading after the escalating conflict in the Middle East prompted a major share price plunge on Wednesday.

The South Korean Kospi and Kosdaq each plunged more than 10% during morning trading in Seoul, triggering a circuit breaker as the indexes saw their worst session since August 2024, reported Channel News Asia on Wednesday.

Japan’s stock markets also saw heavy losses on Wednesday, with the Nikkei and Topix both down almost 4%. Meanwhile, Hong Kong’s Hang Seng Index was down 3%, and China’s Shanghai Composite had dropped 1.3%, according to Google Finance.

“Investors sold down risk assets, and in particular, the Nikkei as well as the Kospi, which outperform other major indexes, have become a target of the heavier selloff as they try to book profits,” Kazuaki Shimada, chief strategist at IwaiCosmo Securities, told CNA.

“South Korea imports 94% of its oil, with 75% coming from the Middle East. So, it is easy to see why its ‘degens’ are panicking,” said Bianco Research CEO Jim Bianco.

Thailand, another major Middle East oil importer, saw its stock exchange slide 7.8% on Wednesday.

Wars can be fought forever, says Trump

The Trump administration said that attacks on Iran are intensifying, with the US targeting a meeting of the nation’s top leaders while they were deciding who would lead, reported Fox News on Wednesday.

The move follows the closure of the Strait of Hormuz after threats from Iran to target oil and cargo ships passing through the critical waterway.

“If necessary, the United States Navy will begin escorting tankers through the Strait of Hormuz, as soon as possible,” said Donald Trump on Truth Social.

On Tuesday, he said the US has a “virtually unlimited supply” of weapons and wars can be “fought forever.”

Related: Middle East tensions boost gold as investors seek safe havens

As a result, crude oil prices have skyrocketed, with Brent oil surging 14% to $82 per barrel and WTI crude jumping 12% to $75 per barrel since the airstrikes began on Feb. 28, according to OilPrice.

Black swan event unfolding, says crypto researcher

Crypto researcher SungHoon Lee called it a black swan event, explaining that trading in Korea was halted “because the crash was too fast for the system to handle,” and noting that $3.2 trillion in global stock market value has evaporated in the past four days.

“This isn’t just a war. This is the WORST geopolitical shock since 1973,” referring to an oil crisis that crashed markets for two years in the 70s.

Crypto asset markets, which have already lost 21% so far this year, haven’t had as sharp a reaction, with total capitalization down just 0.5% on the day to $2.39 trillion, according to CoinGecko.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Ex-LAPD Cop Convicted of $350K Crypto Theft

A former Los Angeles Police Department officer has reportedly been convicted of kidnapping a 17-year-old and stealing $350,000 worth of crypto in a 2024 home invasion.

A Los Angeles County Superior Court jury found Eric Halem guilty of kidnapping and robbery on Monday after a two-week trial, the Los Angeles Times reported.

The court was told that Halem and three other men posed as police carrying out a search warrant on an apartment rented by the teenager, who reportedly had earned a significant amount of crypto.

Prosecutors said the teenager, who testified under his first name Daniel, gave up a hard drive containing Bitcoin (BTC) after Halem and the other men threatened to kill him.

The case is the latest in a global trend of so-called “wrench attacks,” where perpetrators use threats or actual violence against crypto holders to steal their assets. Crypto security company CertiK reported last month that 72 such attacks happened worldwide in 2025, a 75% increase from 2024.

Men allegedly broke into apartment, cuffed victim for crypto

Halem and the three alleged co-conspirators reportedly wore vests that identified them as police and gained access to the teenager’s apartment by entering an access code obtained from a conspirator who rented out the apartment.

The men then restrained the teenager’s girlfriend with LAPD-issued handcuffs, subdued the 17-year-old by also handcuffing him, and threatened to shoot him if he didn’t hand over his hard drive containing crypto, according to victim testimony.

Halem served 13 years in the LAPD and left in 2022, but was still serving as a reserve officer with the department at the time of the robbery. He also had side businesses, including a luxury car rental company and an app that allowed actors to remotely audition.

Related: Wrench attacks drive crypto investors to centralized custodians

Halem’s attorney, Megan Maitia, argued in her closing remarks that detectives hadn’t corroborated the story of the 17-year-old victim, who she said admitted in testimony to obtaining his crypto via fraud.

She claimed police simply took him at his word when he said he’d been robbed of the Bitcoin.

Halem, who did not testify, is set to be sentenced on March 31. His co-defendants, one of whom is allegedly tied to Israeli organized crime, are yet to stand trial and have maintained their innocence.

Magazine: Meet the onchain crypto detectives fighting crime better than the cops

Crypto World

Indiana enacts Bitcoin Rights Bill after governor approves HB 1042

Governor Mike Braun has signed House Bill 1042 into law, formalizing new protections for digital asset users in Indiana and setting guardrails around how state and local authorities may regulate cryptocurrency activity.

Summary

- HB 1042 prohibits state and local governments from imposing discriminatory taxes or restrictions targeting cryptocurrency transactions.

- The law protects the right of Indiana residents to self-custody digital assets.

- Indiana formally defines cryptocurrency in state statute, providing regulatory clarity for courts and agencies.

HB 1042 becomes law as Indiana expands legal clarity for digital assets

The measure, which cleared the Indiana General Assembly earlier this session, establishes statutory definitions for cryptocurrency and limits the ability of state and local governments to impose discriminatory taxes, fees, or restrictions specifically targeting digital assets.

Supporters describe the legislation as a “Bitcoin rights” framework designed to provide clarity and predictability for residents who hold or transact in crypto.

Under HB 1042, state and local governmental units are prohibited from enacting rules that single out digital asset transactions for special taxation or treatment compared to other forms of payment. The law also reinforces the right of individuals to self-custody digital assets, preventing most public agencies from restricting a person’s ability to hold cryptocurrency in a private wallet.

Regulatory authority remains with the appropriate financial oversight bodies, including the state’s Department of Financial Institutions.

The legislation also opens the door for cryptocurrency exposure within certain state-managed retirement and savings programs. Under HB 1042, plan administrators for designated public retirement and education savings plans will be required to offer a self-directed brokerage option that includes at least one cryptocurrency-linked investment choice, such as a regulated exchange-traded fund tied to bitcoin.

The measure does not mandate that pension funds directly purchase or hold digital assets as part of their core portfolios; instead, it allows individual participants to decide whether to allocate a portion of their retirement savings to crypto through approved investment vehicles.

Backers of the bill have argued that the measure positions Indiana as a pro-innovation state amid growing national debate over crypto regulation. By clearly defining cryptocurrency in statute as a digital medium of exchange secured by cryptography and not issued by a central authority, lawmakers say the state reduces ambiguity for courts, regulators and businesses operating in the space.

The signing follows increasing legislative activity across the United States focused on digital asset rights and taxation.

With HB 1042 now enacted, Indiana joins a small but growing number of states that have codified protections for crypto holders while maintaining oversight through existing financial regulatory frameworks.

-

Politics5 days ago

Politics5 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics23 hours ago

Politics23 hours agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread: Iris Top

-

Tech3 days ago

Tech3 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoCuba says its forces have killed four on US-registered speedboat | World News

-

Sports4 days ago

The Vikings Need a Duck

-

NewsBeat4 days ago

NewsBeat4 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat3 days ago

NewsBeat3 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat6 days ago

NewsBeat6 days agoManchester Central Mosque issues statement as it imposes new measures ‘with immediate effect’ after armed men enter

-

NewsBeat4 days ago

NewsBeat4 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat3 days ago

NewsBeat3 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Business6 days ago

Business6 days agoDiscord Pushes Implementation of Global Age Checks to Second Half of 2026

-

Entertainment2 days ago

Entertainment2 days agoBaby Gear Guide: Strollers, Car Seats

-

Business5 days ago

Business5 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Tech5 days ago

Tech5 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics3 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat3 days ago

NewsBeat3 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Crypto World5 days ago

Crypto World5 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

NewsBeat2 days ago

NewsBeat2 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech3 days ago

Tech3 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI