Crypto World

Ethereum Price Rebounds 23%, But $1,000 Risk Still Looms

Ethereum price hit its projected breakdown target near $1,800 in early February. It even slipped to $1,740 before bouncing. Since then, ETH has rebounded almost 23%, giving traders hope that the worst may be over.

But price rebounds inside downtrends often look strong at first. The real question is whether this bounce is supported by strong buyers. Right now, charts, on-chain data, and technical metrics suggest that support remains weak. Several warning signs still point to downside risk.

The ETH Price Breakdown Worked, But the Rebound Lacks Real Strength

On February 5, Ethereum completed a major breakdown pattern on the daily chart, as predicted by BeInCrypto analysts. This pattern usually signals that sellers are taking control. The projected target was near $1,800. Ethereum price followed that path and dropped to $1,740 on February 6.

Sponsored

Sponsored

After hitting this zone, ETH rebounded about 23%. At first glance, this looks like strong dip buying as the February 6 price candle saw a large lower wick. But momentum tells a different story.

Between February 2 and February 8, the price made lower highs. At the same time, the Relative Strength Index (RSI), which tracks short-term momentum, moved higher.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This creates a hidden bearish divergence, where momentum improves but price fails to follow.

In simple terms, price is struggling to rise, even though short-term momentum looks better. That usually means sellers are still active in the background. So while the breakdown target was reached, the rebound does not yet show deep conviction.

This weak follow-through sets the stage for the next risk.

Short-Term Bounce Is Slipping Into Another Bearish Setup

Because the rebound lacks strong follow-through, the next thing to watch is the structure of the move. On the 12-hour chart, Ethereum is forming a bearish pole and flag.

First, the price dropped sharply. Then it rebounded inside a rising channel. This is a classic continuation pattern in downtrends.

Sponsored

Sponsored

It often leads to another leg lower as volume confirms the risk. On-Balance Volume, which tracks real buying and selling activity, is staying weak. It is not rising aggressively, like the price. This means fewer real buyers are supporting the rebound. Additionally, the OBV metric itself is close to breaking down its own ascending trendline. If volume breaks down, this flag structure could fail.

That would open the door to deeper losses, around 50% from the lower trendline levels. To understand whether buyers, who led the 23% rebound, can prevent that, we need to look on-chain.

Are Short-Term Traders Buying As Long-Term Holders Sell?

On-chain data shows that the recent rebound is being driven mainly by short-term traders, not long-term investors.

A key metric here is short-term Holder NUPL, which measures whether recent buyers are sitting in profit or loss.

In early February, as Ethereum dropped to $1,740, short-term holder NUPL fell to around -0.72, placing it firmly in the capitulation zone. This reflected heavy unrealized losses among recent buyers.

During the 23% rebound, however, NUPL recovered to about -0.47. That is an improvement of roughly 35% from the bottom. While it remains negative, the speed of this recovery shows that many short-term traders rushed in to buy the dip.

Sponsored

Sponsored

This pattern closely resembles past failed bottom formations.

On March 10, 2025, NUPL also rebounded to around -0.45 while ETH traded near $1,865. At that time, many traders believed a bottom had formed. A more durable bottom only appeared on April 8, 2025, when NUPL dropped close to -0.80, roughly 75% deeper than the March level. That phase marked true seller exhaustion and preceded a sustained recovery. The price was around $1,470 at the time.

Today’s structure looks much closer to March 2025 than April 2025. Losses have eased too early, suggesting that panic has not fully cleared. At the same time, long-term holders remain cautious.

The 30-day rolling Hodler Net Position Change, which tracks investors holding ETH for more than 155 days, remains negative. On February 4, outflows stood near -10,681 ETH. By February 8, they had widened to around -19,399 ETH.

This represents an increase in net selling of roughly 82% in just four days. This signals weak conviction at current levels. So the rebound is being driven mainly by short-term traders chasing a bounce, while long-term investors continue reducing exposure.

Sponsored

Sponsored

Key Ethereum Price Levels Show Why the $1,000 Risk Is Still Alive

All technical and on-chain signals now point to a weak structure. Ethereum must reclaim key resistance to stay safe. The first resistance is near $2,150.

Holding above this would ease short-term pressure. The major invalidation level is $2,780.

Only above this would the bearish structure truly break. On the downside, risk remains heavy.

Key support levels are:

- $1,990: short-term support

- $1,750: Fibonacci support

- $1,510: major retracement zone (close to the April 8, 2025 bottom)

- $1,000: bear flag projection

A daily close below $1,990 would weaken the rebound. Losing $1,750 would expose the $1,500 ETH price zone. If the bearish flag fully breaks, the projected move points toward $1,000.

That would mean a drop of nearly 50% from current levels. Right now, Ethereum is still below major resistance.

Volume is weak. Long-term holders are selling. And Short-term traders dominate activity. Until these conditions change, the risk of a much deeper Ethereum price move remains real.

Crypto World

HTX Launches USDe Minting and Redemption Service

TLDR

- HTX launches USDe minting and redemption service, offering an efficient platform for global users with enhanced features.

- The new minting and redemption service eliminates the need for OTC liquidity, simplifying the process for users.

- HTX introduces a daily rewards program for USDe holders, paid weekly, increasing capital efficiency and incentivizing participation.

- Users can now access USDe with unlimited minting and redemption capabilities and uniform transaction costs.

- HTX’s new campaigns, including APY boosts and trading competitions, encourage increased engagement with the USDe ecosystem.

HTX has launched its new USDe minting and redemption service, enhancing its platform with a daily rewards program for USDe holders. This service follows the recent listing of USDe and promises to provide a more efficient experience for HTX’s global user base.

USDe Minting and Redemption Now Available on HTX

According to the press release, the HTX minting and redemption process for USDe utilizes Ethena Labs’ smart contracts. The service eliminates the need for spot order books or OTC liquidity, simplifying the minting and redemption process.

This new feature provides benefits, including unlimited scale for minting and redemption and uniform transaction costs. With this integration, HTX users can smoothly enter or exit USDe positions, avoiding liquidity issues often seen in secondary markets.

The addition of USDe to HTX’s platform strengthens its position in both the DeFi and CeFi ecosystems. As HTX strives for innovation, these features enable users to manage their exposure to USDe with improved efficiency and transparency.

Daily Rewards and Additional Campaigns for USDe Holders

Alongside minting and redemption, HTX introduces a daily rewards program for users holding USDe in their spot accounts. Rewards will be paid weekly, allowing users to earn passive returns while maintaining dollar-denominated exposure.

The initiative enhances capital efficiency, offering an attractive incentive to hold USDe on the platform. HTX users can also participate in several campaigns, such as the upcoming APY boost for USDe in HTX Earn. This will provide subscribers with an annual percentage yield of up to 15%.

In addition, users can compete in a trading competition to share a 10,000 USDe prize pool. These initiatives aim to increase engagement with the USDe ecosystem and incentivize users to participate in HTX’s offerings.

Crypto World

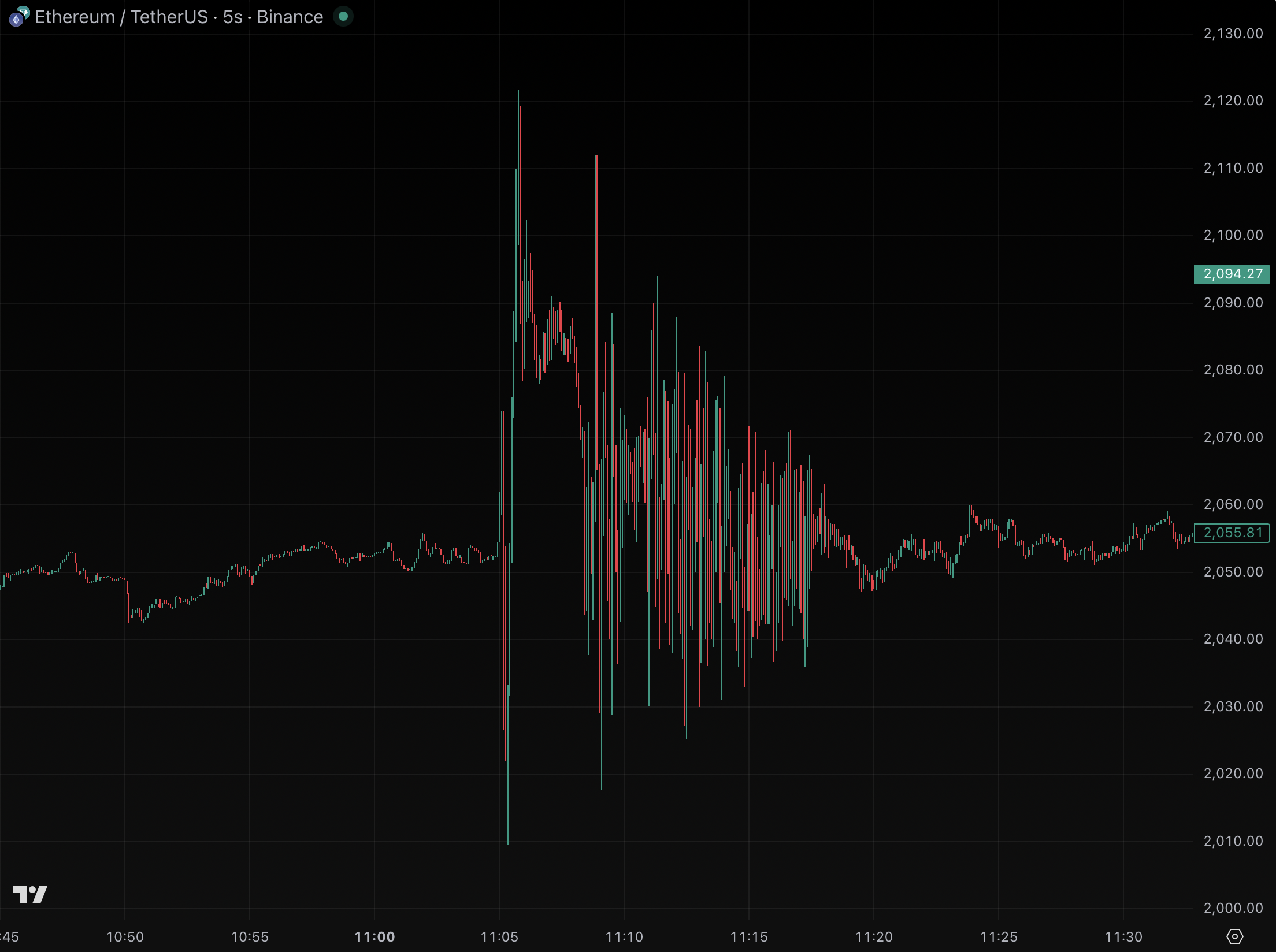

Binance critics revive trading allegations against CZ after ETH whipsaw

Amid ongoing backlash over its role in October 10’s liquidations and a bizarre chart of transactions from Saturday, critics of Binance are questioning founder Changpeng Zhao (CZ) over his repeated claims that he’s not an active crypto trader.

Sharing reminders about CZ’s ownership of market-makers Merit Peak Limited and Sigma Chain (which have both traded on Binance) critics decried a tether (USDT)-denominated ether (ETH) chart from Binance’s exchange on Saturday, alleging that CZ somehow was involved.

However, one of the most repeated assurances from CZ is that he is not an active crypto trader.

Indeed, in countless interviews, he tells a story of his brief attempt at active trading about a decade ago, concluding that he was entirely unskilled at that endeavor.

’I don’t trade at all’

For years, CZ has claimed, he’s not been an active crypto trader. Although he makes infrequent, long-term purchases, he reiterates that he’s “not a trader. I buy and hold.”

CZ worked at Bloomberg and built high-frequency trading platforms for stockbrokers, so he had plenty of experience with active traders before his career at crypto businesses Blockchain.info, OKCoin, and Binance.

According to CZ’s version of his biography, he wanted to become a trader during the early years of his crypto career, didn’t succeed, and instead decided to focus on building Binance.

Rather than trade along the way, he’s focused on long-term investments: bitcoin (BTC), the Binance Coin (BNB) he founded, and most of all, equity in Binance itself.

“I don’t trade at all, I just hold bitcoins,” CZ said in a representative interview. “I hold BNB, and I don’t do daytrading.”

Read more: Lawsuits are piling up against Binance over Oct. 10

CZ doesn’t need to trade to make billions from Binance

Bloomberg analysts agree that CZ’s long-held equity in Binance, for what it’s worth, accounts for the vast majority of his estimated $50 billion net worth.

Even without any digital asset holdings, CZ could easily be worth tens of billions of dollars simply as the founding shareholder of his profitable company.

However, critics on social media have recently become skeptical of CZ, alleging or insinuating that he’s concerned with manipulating Binance trading pairs.

A highly suspicious whipsaw in ETH renewed their anger.

Just because trades occur on Binance, however, doesn’t mean that CZ or Binance are participating in those markets beyond its customary commissions for matching third-party orders.

Wintermute CEO Evgeny Gaevoy called Saturday’s trading action “a market-maker bot blowing up to the tune of tens of millions,” defending his own market-making company from an accusation about scamming on Binance, for example.

For his part, CZ barely acknowledged the social media controversy. He summarized it as another example of FUD and posted recaps of his snowboarding trip, instead.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Remittix tops crypto altcoin charts worldwide as exchanges get set to list mega token Remittix

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Remittix is climbing global altcoin charts as rising demand for payment-focused crypto and a wave of upcoming exchange listings put the token firmly in the spotlight.

Summary

- Remittix has sold over 703.7 million tokens, raised more than $28.9 million, and continues to gain traction through strong sales, user engagement, and a 300% bonus incentive.

- Confirmed listings on BitMart and LBANK, with more exchanges preparing to onboard the token, are expanding Remittix’s global reach and liquidity.

- A live wallet, upcoming PayFi platform launch on February 9, 2026, and CertiK verification are reinforcing Remittix’s position as one of the most closely watched altcoins of 2026.

The crypto market is paying attention as Remittix climbs altcoin rankings across trading platforms and chart trackers. The interest in payment tokens has been on the increase with the growing demand for real utility in the blockchain world. Although other tokens fluctuate and experience volatility, Remittix has been successful in terms of sales and user engagement.

The project’s momentum has intensified as multiple exchanges prepare to list Remittix, giving the token broader access globally. Remittix isn’t just moving in the charts; it is becoming one of the most talked-about tokens in the crypto market.

How Remittix is rising in market attention

Remittix’s recent performance shows an increase in investor interest and adoption of the token. Remittix has sold more than 703.7 million out of the 750 million tokens available for sale at $0.123 and has raised more than $28.9 million, with the aim of reaching the milestone of raising approximately $30 million.

The project’s 300% bonus, available via email activation, has also driven new buyers, increasing liquidity and attention.

Beyond sales figures, Remittix has seen real product engagement. Its crypto wallet is live on the Apple App Store, with the Google Play release in progress. This wallet allows users to securely store, send, and manage assets ahead of the official platform launch on 9 February 2026, when the full PayFi services will go live.

Some crypto analytics platforms have reported a climb in social mentions and ranking metrics tied to altcoin performance. This uptick in attention signals that Remittix is gaining traction among traders and investors looking at projects with both utility and growing demand.

Listing momentum is boosting Remittix exposure

Exchange listings are playing a key role in Remittix’s rising profile. BitMart and LBANK have already confirmed listings for Remittix, giving traders on those platforms direct access to trade and hold the token. These listings help expand liquidity and provide a broader market reach for users seeking exposure to Remittix as one of the fastest growing crypto in 2026.

Preparations are underway for additional top-tier exchange listings that will open Remittix to even larger trading communities once the next funding milestone is hit. Market watchers note that broad exchange access often correlates with higher volume visibility and ranking improvements on altcoin charts.

Security and credibility support this expansion. Remittix is fully audited and verified by CertiK, holding a #1 ranking on CertiK Skynet with an 80.09 Grade A score from over 24,000 community ratings, which strengthens confidence among traders and long-term holders.

Also, a 15% USDT referral program rewards engagement and helps broaden the user base. All of this activity, strong sales, listing momentum, live wallet adoption, and incentives, contribute to why Remittix attracts attention from both traders and long-term supporters.

Key drivers behind Remittix demand:

- Tackling the $19 trillion global payments market with real-world solutions

- Seamless crypto-to-bank transfers across 30+ countries

- Utility-focused token supported by genuine transaction activity

- Deflationary tokenomics designed for long-term growth

- Broad market appeal extending beyond traditional crypto users

Why Remittix continues to attract interest

Remittix’s growth in visibility is rooted in both its incentives and product rollout. Positioned at the intersection of crypto, payments, and global remittance, a $19 trillion market, Remittix aims to be the go-to crypto-to-fiat payment hub for merchants, users, and businesses worldwide.

With the 9 February 2026 platform launch approaching, Remittix is moving from early momentum to real utility deployment. As more exchanges prepare to list the token and user engagement grows, Remittix stands as a clear example of how practical adoption and visibility can combine to lift a token’s presence across global charts.

To learn more about Remittix, visit the website and socials.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

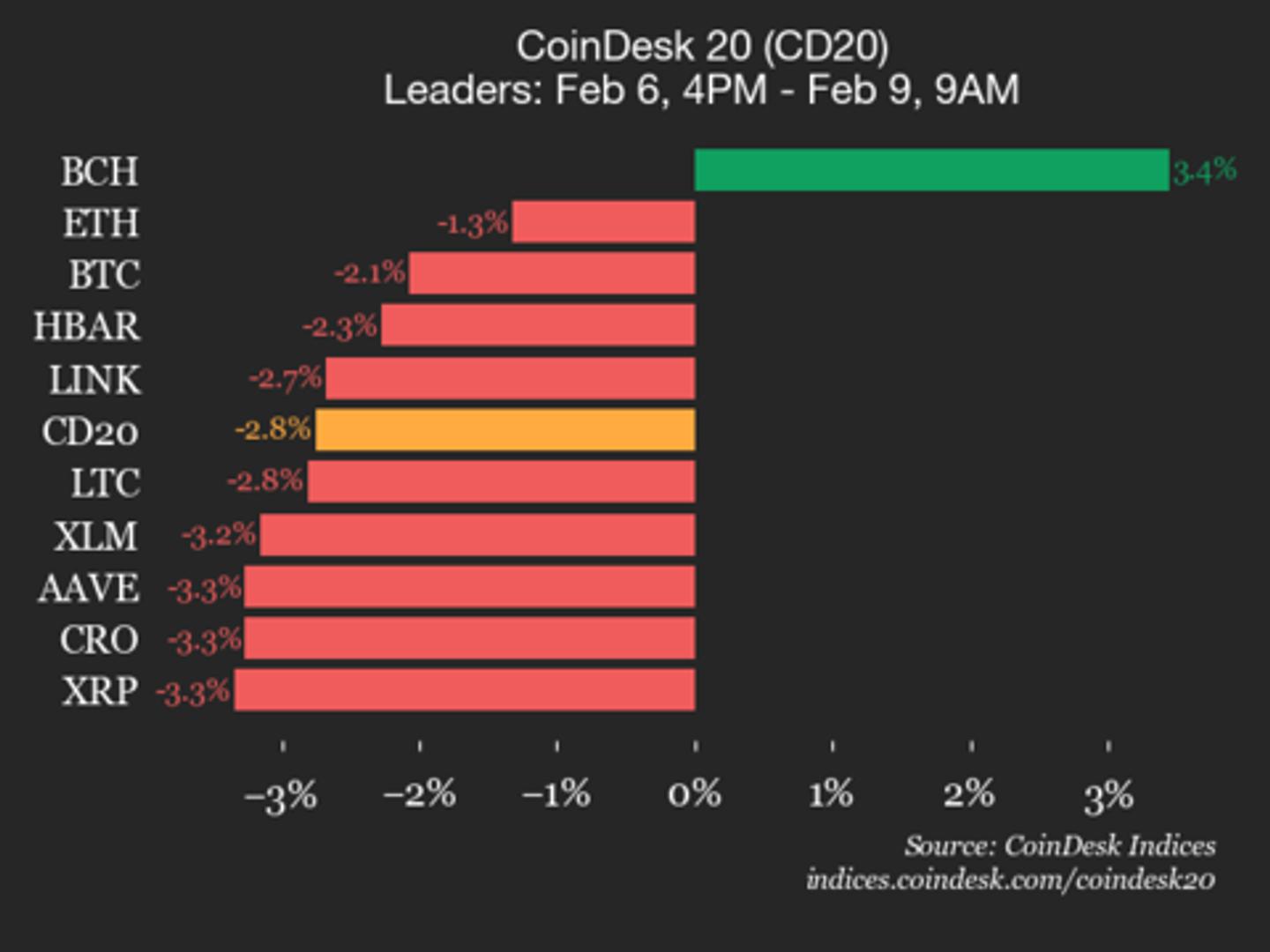

CoinDesk 20 performance update: Bitcoin Cash (BCH) is only gainer, up 3.4%

Aptos (APT) declined 9.4% and NEAR Protocol (NEAR) fell 8%, leading index lower.

Crypto World

Solana price near key $75 support as RSI oversold signals potential bounce

- Solana (SOL) currently trades near $83 after a nearly 39% monthly drop.

- Weekly and daily RSI signal the token is oversold, hinting at a possible short bounce.

- The key support around $75 is critical to prevent further decline.

Solana (SOL) has been under intense pressure in recent weeks.

The altcoin currently trades around $83, down nearly 39% over the past month.

This decline comes amid broader weakness in the crypto market and low retail engagement.

Technical analysis shows that SOL’s weekly Relative Strength Index (RSI) is deeply oversold.

Some are suggesting that the token may have reached a “final dip,” referencing a long-term structural support around the $75 level, and eyes are now on whether this support can hold.

Solana price technical analysis

From a technical standpoint, Solana’s trading volume remains high, with over $3.9 billion exchanging in the past 24 hours.

But despite this high activity, the token is trading well below key moving averages.

The 50-day and 200-day averages now act as the immediate resistance levels and remain out of reach for now.

Short-term momentum indicators, including the MACD histogram, have flattened, reflecting waning bearish momentum.

In addition, on the daily and weekly charts, RSI remains near historic lows, indicating extreme oversold conditions.

This combination suggests potential for a short-term relief bounce, though trend reversal is not guaranteed.

Market sentiment shows a muted retail engagement

Retail interest in Solana remains muted, with recent reports showing low futures open interest, signalling that traders are reducing exposure.

Derivatives funding rates are also negative, suggesting bias toward short positions.

Solana ETFs have also recorded outflows, reinforcing weak institutional participation.

Analysts note that these factors add to the bearish pressure on the token.

Still, technical indicators hint at a potential stabilisation near critical support zones, with the $75 level having been repeatedly cited as key support in recent forecasts.

Breaking below this threshold could open the door to further downside, possibly toward $67 or even $51 in extreme scenarios.

On the upside, recovery faces resistance around $111 and $138, which would need to be breached to shift the market sentiment positively.

Long-term Solana market analysis

Long-term forecasts for Solana remain mixed.

Some analysts foresee recovery toward the mid-$100s if support holds and broader market conditions improve.

Bullish projections even extend toward $250, though these are contingent on sustained buying pressure and macro-level stability.

For now, the focus remains on short-term price stability.

Investors and traders should keep a close eye on the $75 support, viewing it as a potential floor for consolidation.

SOL’s trajectory will likely depend on a combination of market sentiment, institutional flows, and technical momentum.

As it stands, Solana is navigating a critical juncture where its next move could define the tone for the coming months.

Crypto World

Phemex introduces 24/7 TradFi futures trading with 0-Fee Carnival, creating an all-in-one trading hub

- Phemex, a user-first crypto exchange, announced the launch of Phemex TradFi, a new futures trading offering.

- Futures linked to commodities, foreign exchange, and global indices will be introduced in subsequent phases.

- Phemex TradFi is designed for traders seeking simplicity and continuity across markets.

Apia, Samoa, February 9, 2025 — Phemex, a user-first crypto exchange, announced the launch of Phemex TradFi, a new futures trading offering that allows users to access traditional financial assets, including stocks and precious metals, on a 24/7 basis.

Futures linked to commodities, foreign exchange, and global indices will be introduced in subsequent phases.

The launch marks Phemex’s entry into multi-market derivatives, enabling traders to manage exposure to both crypto and traditional assets within a single, USDT-settled futures framework.

To support early adoption, Phemex is introducing a 0-Fee TradFi Futures Carnival, offering three months of zero trading fees, starting from February 6, on stock futures alongside a $100,000 incentive pool aimed at structured and risk-aware participation, and a first-trade protection mechanism that reimburses eligible users with trading bonus if their initial TradFi futures trade results in a loss.

Unlike spot markets that are constrained by exchange hours, TradFi futures continue price discovery outside standard trading sessions.

By bringing this derivative structure into a crypto-native environment, Phemex allows users to respond to global macro events as they unfold, whether during nights, weekends, or market closures—without switching platforms or settlement systems.

Phemex TradFi is designed for traders seeking simplicity and continuity across markets.

Users can trade crypto and traditional futures side by side, benefit from transparent maker-taker pricing rather than spread-based execution, and apply strategy-driven tools to manage risk more systematically.

Copy trading support for TradFi futures is also planned, extending Phemex’s strategy trading ecosystem into traditional markets.

“As markets become more connected and operate beyond fixed sessions, platforms need to evolve with them” commented Federico Variola, CEO of Phemex.

“Our goal with Phemex TradFi is not to replicate traditional markets, but to rethink how they are accessed — bringing continuous availability, unified settlement, and risk-aware tools into a single trading environment that reflects how traders actually operate today.”

The introduction of TradFi futures signals Phemex’s evolution from a crypto-native exchange into a broader derivatives platform built for always-on global markets.

As additional asset classes roll out, Phemex aims to offer traders a more integrated, resilient, and forward-looking way to navigate both digital and traditional finance.

About Phemex

Founded in 2019, Phemex is a user-first crypto exchange trusted by over 10 million traders worldwide. The platform offers spot and derivatives trading, copy trading, and wealth management products designed to prioritize user experience, transparency, and innovation.

With a forward-thinking approach and a commitment to user empowerment, Phemex delivers reliable tools, inclusive access, and evolving opportunities for traders at every level to grow and succeed.

For media inquiries, please contact: [email protected]

For more information, please visit: https://phemex.com/

Media contact Oyku Yavuz PR Lead [email protected]

This article is authored by a third party, and CoinJournal does not endorse or take responsibility for its content, accuracy, quality, advertisements, products, or materials. Readers should independently research and exercise due diligence before making decisions related to the mentioned company.

Crypto World

Mother of Olympics TV host kidnapped for bitcoin ransom

Nancy Guthrie, the 84 year-old mother of Today host Savannah Guthrie, was kidnapped from her rural Tuscon, Arizona home on February 1. While law enforcement has refused to confirm or deny whether two ransom notes sent to TMZ, KOLD, and KGUN were real, the media is operating under the assumption that they are.

The notes included two deadlines — one that passed without any updates and another that TMZ states has “an element of ‘or else’” — and demanded $6 million worth of bitcoin (BTC).

Media outlets haven’t clarified if the abductors are demanding a specific amount of BTC or a specific amount valued in dollars. If they’re demanding a specific number of BTC, the recent fall in the price could actually suggest that more than $6 million worth of the cryptocurrency was originally demanded.

As of today, $6 million would equate to roughly 85 BTC, on February 1, it would be 75-76 BTC.

Savannah Guthrie has hosted NBC’s coverage of three recent Olympic games, however, she’s understandably unable to host this year.

During the opening ceremony, three hosts acknowledged her difficult situation and wished her well.

A hoax and a second note

In a confusing set of circumstances, a man from California sent the Guthries a fake ransom demand shortly before the likely real kidnappers, who had originally stated they wouldn’t contact any media or the family in the first note, sent a second ransom note.

A local reporter at KOLD spoke to CNN and stated that the note was shorter than the first and seemed to be an attempt to provide some sort of proof they still had Guthrie in their possession.

Reporters have suggested that the emailed ransom demands are extremely secure and unlikely to be traced.

Read more: Crypto execs hiring private security after high-profile kidnappings, report

Sloppy or brilliant?

It is difficult to establish whether the Guthrie abductors are brilliant, investigators have been sloppy, or some combination of the two.

Surprises have included that there has reportedly been no footage obtained of either the perpetrators or the vehicle(s) in which they escaped, no suggestion that a so-called “proof-of-life” has been shared with the family, and that the abductors used BTC instead of a coin that is easier to shield, such as Monero or Zcash.

It’s unknown if the kidnappers have demanded the BTC be sent to a single wallet address or want it broken up, or if they believe they know an exchange or mixer that would reliably accept the BTC and not be easily traced.

Damning for law enforcement is the fact that they have combed through the crime scene in Tuscon at least three times and have yet to come up with any leads or new information to share with the public.

A deadline and an introduction

It’s still unclear which timezone the 5:00pm deadline refers to or what threat is being levelled. The Guthries have sent out a distressing, public video in which they speak directly to the kidnappers.

“We received your message and we understand. We beg you now to return our mother to us so that we can celebrate with her. This is the only way that we will have peace. This is very valuable to us and we will pay.”

While there’s little doubt that this horrifying crime has had a profound effect on the Guthrie family, Savannah Guthrie’s co-workers at Today, and others close to her, it’s also becoming more clear that entirely new demographics of the US population are about to be introduced to one of the absolute darkest sides to crypto.

The Today show averages almost 3 million viewers a day, with those who regularly tune in skewing older.

This means that an ongoing and growing global problem — that crypto is enabling kidnappers and extortionists to set up scam call centers or abduct the mother of a wealthy celebrity — will begin to finally worry older Americans.

Perhaps a new issue for the “Crypto President.”

Not surprising, but shocking

Anyone who’s been following crypto for the past several years has heard about pig butchering.

The scam works by luring victims, usually from developing nations like China and Thailand, to vast scam call center campuses almost always located in Cambodia, Laos, or Myanmar.

Once the victim arrives, they’re imprisoned in apartment blocks and offices where they’re forced to cold text and call Westerners and romance them in a long con to get crypto.

Read more: Bitcoin torture suspects granted bail in Manhattan court

An underreported, but important, element of the pig butchering scam is that victims are often able to contact family members to demand a ransom for their eventual release.

While an outsized ransom, such as the $6 million in BTC being demanded by the Nancy Guthrie kidnappers, is never asked for, the numbers are still high enough as to be out of reach for an average Chinese or Thai family.

This leads to victims languishing in the compounds for months or years at a time, but also leads pig butcherers to a secondary, less profitable source of income: kidnapping.

In this sense, perhaps the Guthrie kidnapping, while equal parts disturbing, terrible, and disheartening, is an important spotlight on what is now becoming a problem for everyone: cryptocurrency providing kidnappers a new, innovative way to actually get away with it.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

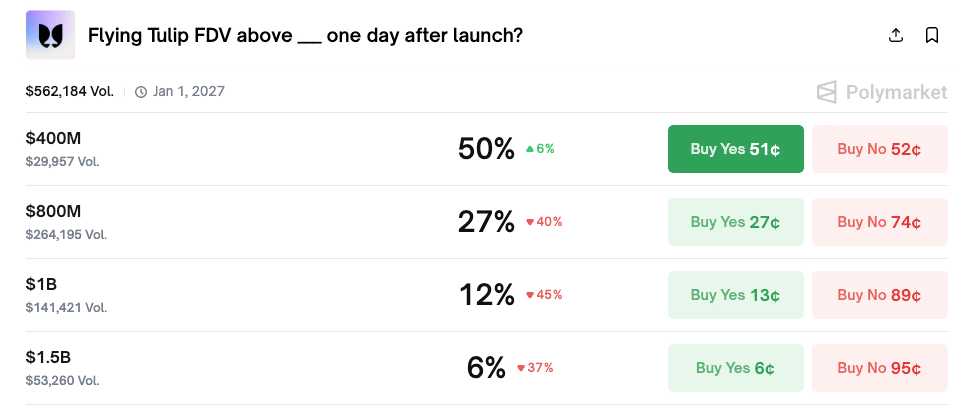

Andre Cronje’s Flying Tulip Gears Up for Public Sale

The DeFi application is set to launch its public sale on Feb 16, with the token live on Feb 23.

The DeFi super application space is facing headwinds following the Infinex token generation event (TGE) in January, but despite the adverse market conditions, Yearn Finance founder Andre Cronje is launching Flying Tulip’s (FT) public sale next week.

Flying Tulip confirmed the sale date on Saturday, and prediction markets are giving the platform a 50-50 chance of trading above a $400 million fully diluted valuation (FDV), albeit on low volumes.

For comparison, Infinex’s INX token is trading at a $121 million FDV, leaving ICO participants at a 60% loss from its $300 million ICO valuation.

Flying Tulip looks to fill a similar niche as Infinex, offering users a single platform that allows them to leverage some of DeFi’s most popular applications, including perpetual derivatives trading, spot trading, and lending.

However, Cronje has highlighted that the “Flying Tulip FDV is not standard FDV.” In a traditional model, FDV equates to the total supply multiplied by the token price, whereas the FT token includes an underlying put option, making it “closer to a NAV valuation than FDV.”

The protocol raised $200 million from the likes of Brevan Howard and DWF Labs in September, followed by a $25 million raise at a $1 billion valuation in January, $55 million via Impossible Finance, and $10 million via CoinList last week.

Flying Tulip is the YearnFi founder’s latest DeFi endeavor after Fantom, the Layer-1 blockchain that rebranded as Sonic. While Sonic started out hot, the token has struggled over the last year and is down 96% from its launch price, trading at a $160 million FDV.

Crypto World

Bitcoin Miner Activity Hits Highest Level Since 2024 with 90K BTC Sent to Binance

Rising miner deposits to Binance signal near-term supply pressure despite whale accumulation during the dip.

Bitcoin miners have sent more than 90,000 BTC to Binance since early February, pushing miner exchange inflows to their highest level since 2024, according to on-chain data shared by Arab Chain.

The rise in deposits comes during a period of heavy price swings and stressed investor sentiment, adding to short-term sell-side pressure even as other large holders moved in the opposite direction.

Miner Selling Rises as Volatility Shakes the Market

Data cited by Arab Chain shows miner activity picking up immediately after the start of February, with one day alone recording deposits of over 24,000 BTC to Binance. Such transfers often reflect miners converting part of their holdings to cover operating costs or lock in profits during volatile conditions, making these flows a gauge of potential sell-side supply.

The timing is notable, as Bitcoin experienced a steep correction last week that briefly pushed prices below $60,000 for the first time since October 2024, extending a drawdown of more than 50% from the last all-time high, according to analysis posted by Darkfost.

During that window, nearly 241,000 BTC flowed into exchanges across the market, with Binance seeing especially heavy activity from short-term holders. Darkfost described these flows as consistent with capitulation, particularly among investors reacting to rapid losses.

Retail behavior also shifted, with Darkfost noting that holders with less than 1 BTC, often referred to as “shrimps,” heavily increased transfers to Binance after the sell-off. On February 5, their daily inflows topped 1,000 BTC, far above the monthly average of around 365 BTC. However, that spike eased as prices stabilized, suggesting selling pressure from this group faded once Bitcoin recovered above $70,000.

Whales Accumulate as Price Steadies Near $70,000

While miners and smaller holders sent coins to exchanges, large holders took the opposite approach. Analyst CW8900 reported on February 8 that whales accumulated aggressively during the drop, with nearly 67,000 BTC moving into long-term accumulator addresses in a single day, the largest such inflow of this cycle.

You may also like:

Price action since then reflects that tug-of-war, with Bitcoin now trading at just over $70,000 per CoinGecko, a figure that is up about 1% on the day but still down nearly 8% over the past week and more than 22% in the last 30 days. The rebound followed a sharp fall from the mid-$80,000 range, part of a broader slide that erased gains made after the U.S. election and dragged major altcoins down by double digits.

Sentiment remains fragile, a state highlighted by the Bitcoin Fear and Greed Index, which fell to its lowest reading since 2019, even after prices bounced from the lows. As things stand, elevated miner inflows point to ongoing supply hitting the market, while whale accumulation and reduced retail selling suggest that selling pressure is no longer one-sided, with BTC attempting to hold above $70,000.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BTC miner sold more than half of its holdings

Bitcoin miner Cango (CANG) completed the sale 4,451 BTC over the weekend, raising roughly $305 million in USDT as it looks to reduce leverage and reposition its business around artificial intelligence infrastructure.

The company said it raised $305 million from the sale, suggesting an average sale price of about $68,524 per coin, or not far above multi-year low prices for bitcoin.

Shares are little-changed in Monday trading, but are lower by 83% on a year-over-year basis.

The company’s bitcoin sales were “based on a comprehensive assessment of current market conditions,” the firm said, as it plans to shift into AI computing infrastructure. Cango plans to deploy modular GPU units across its global network of over 40 sites to serve small and mid-sized businesses needing on-demand AI inference capacity, it said.

The company used the proceeds of its BTC sale to pay down a bitcoin-collateralized loan, bolstering its balance sheet. The company still holds 3,645 BTC worth more than $250 million, according to data from BitcoinTreasuries.

“In response to recent market conditions, we have made a treasury adjustment to strengthen balance sheet and reduce financial leverage, which provides increased capacity to fund our strategic expansion into AI compute infrastructure,” the company wrote in a letter to shareholders.

Its move into the AI sector comes as it faces what it framed as a gap between rising compute demand and existing grid capacity. Cango wrote that it’s well positioned to take advantage of that gap.

Cango is not alone. A growing group of bitcoin miners is scaling back exposure to pure mining and redirecting capital and infrastructure toward AI data centers and high-performance computing.

Bitfarms (BITF) has said it plans to exit crypto mining entirely by around 2027, and famously declared it’s no longer a bitcoin company as it shifts to high-performance computing and AI workloads.

Analysts at KBW have warned that the industry’s pivot toward AI workloads is compelling, but that the path to monetization is fraught with execution risks. That led to a downgrade not only on Bitfarms but also in Bitdeer (BTDR) and Hive Digital (HIVE).

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat22 hours ago

NewsBeat22 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat7 days ago

NewsBeat7 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports17 hours ago

Sports17 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

NewsBeat1 hour ago

NewsBeat1 hour agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat12 hours ago

NewsBeat12 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report