Crypto World

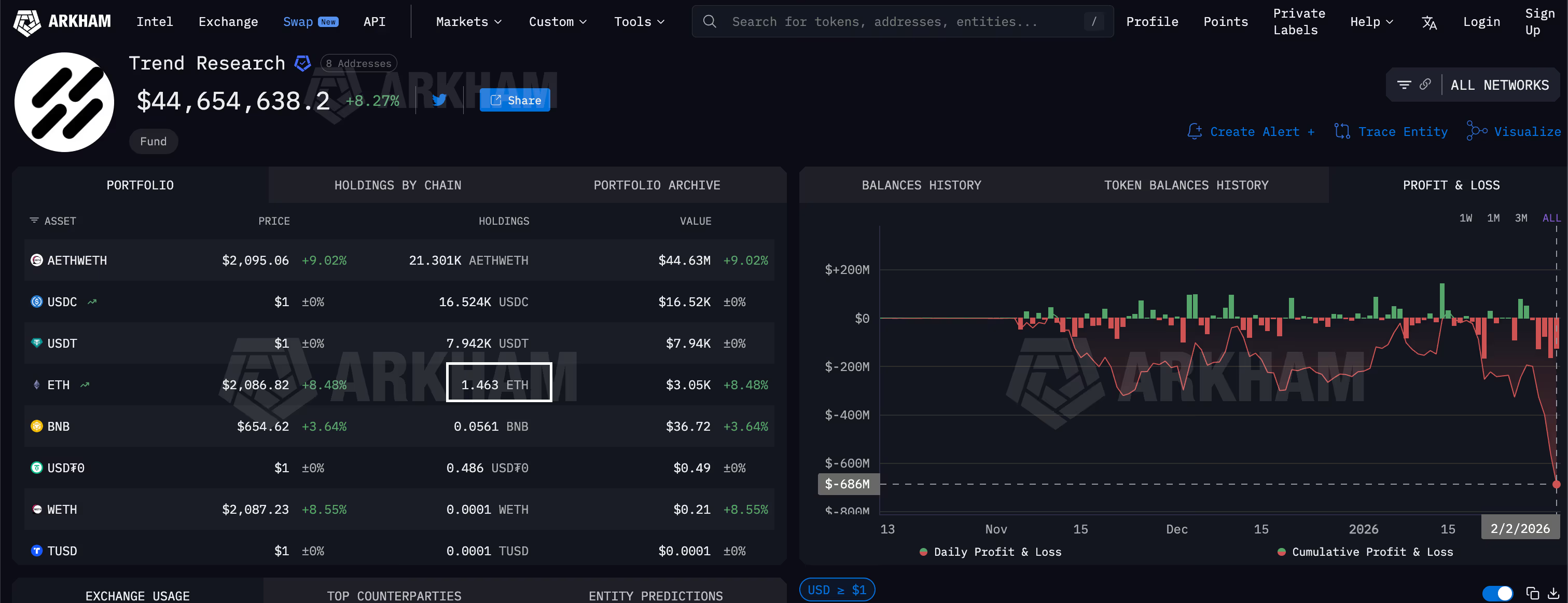

Ether’s crash leaves $686 million gaping hole in trading firm’s book

An ether bull was caught leaning hard into the upside this week as the cryptocurrency tanked, turning the whale bet into a multi-million dollar horror story.

That bull is Trend Research, a trading firm headed by Liquid Capital founder Jack Yi. The firm spent recent months building a bullish (long) bet worth $2 billion on ether by borrowing stablecoins from DeFi giant Aave, which were reportedly collateralized by ether.

The position blew up this week, leaving the firm with a $686 million loss, according to Arkham.

The blow up underscores the crypto market’s unchanged reality: Volatility can still make or break traders in a single week. It also shows how traders keep chasing risky leveraged loop plays – borrowing stablecoins against ETH collateral – despite these bets exploding spectacularly every downtrend.

How it went down

The team was convinced of ether’s long-term potential and expected a quick rebound from its October drop below $4,000.

But that never materialized – ether kept sliding, endangering their “looped ether” long position. As prices fell, the stablecoin collateral backing the leveraged bet shrank, while the fixed debt loomed large in classic leveraged fashion.

The final blow came this month as ether started falling rapidly with bitcoin and on Feb. 4 prices tanked to $1,750, the weakest level since April 2025. Trend Research responded by liquidating over 300,000 ether, according to data source Bubble Maps.

“Trend Research started sending large amounts of ETH to Binance to repay debt on AAVE In total, this cluster moved 332k ETH worth $700M to Binance over 5 days,” Bubble Maps said on X. The firm now holds just 1.463 ETH.

Jack Yi described these sales as a risk-control measure.

“As multi-heads in this round, we remain optimistic about the performance of the new bull market: ETH reaching over $10,000, BTC exceeding $200,000 USD. We’re just making some adjustments to control risk, with no change in our expectations for the future mega bull market,” Yi said in a post on X.

He added that now is the best time to buy tokens, calling volatility as the biggest feature of the crypto circle. “Historically, countless bulls have been shaken off by this volatility, but often what follows is a doubled rebound,” he noted.

Crypto World

EU Moves to Ban Russia’s Digital Ruble and Crypto Services in New Sanctions

Key insights

- EU blocks Russia’s digital ruble and crypto services to close alternative payment channels.

- Over 40 shadow fleet tankers targeted to enforce oil price cap and energy restrictions.

- Banks, third-country suppliers, and military contractors face expanded financial sanctions.

Why is the EU now targeting crypto and the digital ruble?

The European Union has unveiled its proposed 20th sanctions package against Russia, expanding restrictions beyond traditional finance into digital assets. The measures aim to weaken Moscow’s ability to fund its war in Ukraine by blocking new financial channels that emerged after earlier banking sanctions.

🚨 EUROPE JUST PUT CRYPTO ON THE SANCTIONS MAP

On February 6, 2026, Ursula von der Leyen announced the EU’s 20th sanctions package — and this time the focus widens to crypto assets, firms trading them, and platforms enabling those trades.

Why this matters:

The goal is simple:… pic.twitter.com/nuVfDbR7sX— Naeem Aslam (@NaeemAslam23) February 6, 2026

Announced by EU foreign policy chief Kaja Kallas, the plan bans the use of Russia’s central bank digital currency (CBDC) — the digital ruble — inside the bloc. It also prohibits European businesses and institutions from interacting with Russian crypto-asset service providers.

Wars end when one side runs out of money.

Cutting cash flows to Moscow is essential to stop the fighting.More banks supplying the Kremlin will face transaction bans, in Russian and in third countries. All will be cut off from SWIFT.

We will also ban Russia’s central bank…

— Kaja Kallas (@kajakallas) February 6, 2026

As Russia faced growing limits on international banking access, it increasingly turned to alternative settlement tools, including cryptocurrencies and the digital ruble, to facilitate trade and cross-border payments. The EU now intends to close what officials see as a financial workaround.

The package further proposes removing additional Russian and affiliated banks from the SWIFT messaging network and placing full transaction bans on institutions accused of providing liquidity to the Kremlin.

Could these measures actually disrupt war financing?

EU officials believe so. By cutting both traditional and digital payment rails, the bloc aims to make financing military operations significantly more costly.

The sanctions also target companies in third-party countries suspected of helping Russia obtain electronics and industrial components for weapons production. About 40 firms linked to military supply chains would face full sanctions.

New export restrictions will apply to essential industrial materials, including chemicals, rubber products, metalworking tools, and laboratory equipment — all items that can support defense manufacturing.

What about Russia’s oil trade and the “shadow fleet”?

The EU is also tightening enforcement of energy sanctions. More than 40 oil tankers believed to be part of Russia’s so-called shadow fleet — aging vessels used to sell oil above the G7 price cap — would be blacklisted.

These ships would lose access to EU ports and maritime services. The proposal also bans maintenance services for Russian LNG tankers and icebreakers.

Additionally, the bloc plans to activate its Anti-Circumvention Tool against countries suspected of acting as trade transit hubs. Companies providing insurance or technical services to sanctioned Russian oil shipments could face heavy penalties.

The sanctions list will also expand to include individuals linked to war crimes, propaganda operations, and the deportation of Ukrainian children.

Crypto World

Bitcoin Caught Between CME Gaps and New Macro Lows: Analysis

Bitcoin (BTC) failed to hold $69,000 as the weekend began amid predictions of fresh macro lows next.

Key points:

-

Bitcoin faces a lack of acceptance above $69,000, while traders see new lows to come.

-

Analysis says that the rebound into the weekend was nothing more than a “relief rally.”

-

Two CME futures gaps provide potential targets for BTC price upside.

BTC price bottom “not in,” analysis warns

Data from TradingView showed BTC price action dropping more than $4,000 versus the daily open.

With the old 2021 all-time high increasingly turning to resistance, already wary traders were in no mood for relief.

“TLDR: The $BTC bottom, is not in. My priority right now is capital preservation,” Keith Alan, cofounder of trading resource Material Indicators, warned X followers the day prior.

“If you’re thinking, ‘We’re so back,’ we’re not. There is literally no evidence of that yet.”

Alan described the 2021 $69,000 highs as “important” within what he called the ongoing “relief rally.”

“$60k was a gift yesterday, but there’s a high probability that lower is likely before the Bull Market returns,” he continued.

Zooming out, trader and analyst Rekt Capital also had reason to believe that the worst of the bearish BTC price move was not over.

“Whenever Bitcoin peaks in its Bull Market in Q4 of the Post-Halving year… It tends to produce a multi-month Relief Rally from the Macro Triangle Base before breaking down from the Triangle to transition into Bearish Acceleration,” he wrote on X, comparing BTC/USD with the 2022 bear market.

“This is the 4th consecutive cycle that this historical tendency has continued. And history suggests there’s more downside to come.”

Bitcoin bulls bet on CME gap fills

Saturday’s retracement, meanwhile, left a new potential “gap” in CME Group’s Bitcoin futures market.

Related: Bitcoin beats FTX, COVID-19 crash with record dive below 200-day trend line

A classic short-term price magnet, the gap joined another left at $84,000, and both were now of interest to traders eyeing a broader market relief move.

Will we see this #Bitcoin CME Gap filled next week?

$84,215 🎯 pic.twitter.com/ZHaKynuR3F

— Elja (@Eljaboom) February 7, 2026

“Today: correction day. Tomorrow: back up again towards the CME gap. Next week: continuation to $75k+,” crypto trader, analyst and entrepreneur Michaël van de Poppe forecast.

Samson Mow, CEO of Bitcoin adoption company JAN3, included the higher CME gap as one of two questions that “every financial analyst should be asking themselves.”

The other topic revolved around the ability of large-scale corporate buyers to add BTC to their treasuries at current 15-month lows.

“I believe the answers are not for long and very soon,” he concluded.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

CFTC Quietly Corrects Stablecoin Guidance for US Banks

The US Commodity Futures Trading Commission (CFTC) expanded its digital asset collateral framework on February 6.

This update explicitly authorizes futures commission merchants (FCMs) to accept stablecoins issued by national trust banks as margin.

Sponsored

Sponsored

Bank-Issued Stablecoins Enter US Derivatives Margin

The revision, detailed in Staff Letter 25-40, serves as a critical course correction to guidance issued in December.

That earlier framework had inadvertently created a two-tiered system by restricting eligible payment stablecoins to those issued by state-regulated money transmitters or trust companies.

The oversight effectively sidelined federally chartered national trust banks from participating in the burgeoning market for tokenized derivatives collateral.

Consequently, their previous exclusion from the eligible collateral list was an unintentional error that required immediate rectification.

In light of this, this update confirms that stablecoins issued by national trust banks now have parity with assets from state-regulated issuers, such as Circle and Paxos.

CFTC Chairman Mike Selig characterized the revision as a strategic step toward cementing American dominance in the digital asset sector.

Sponsored

Sponsored

“With the enactment of the GENIUS Act and the CFTC’s new eligible collateral framework, America is the global leader in stablecoin innovation,” Selig said in a statement Friday.

The update is critical for the clearing industry, which has struggled to integrate digital assets into traditional settlement workflows.

Salman Banei, general counsel of Plume Network, noted the operational significance of the fix, saying:

“With this, GENIUS Act compliant stablecoins can be used as the payment leg for institutional derivatives settlement.”

The commission stated that it would not recommend enforcement action against FCMs that accept newly qualified assets. However, this leniency is conditional on their adherence to the enhanced reporting protocols outlined in the no-action letter.

Meanwhile, this latest move is part of a broader pilot program launched by the commission last year.

Under this initiative, FCMs are temporarily permitted to utilize Bitcoin, Ethereum, and qualified stablecoins as collateral for derivatives trading.

However, the CFTC emphasized that this relief comes with stringent oversight.

Participating FCMs must file frequent reports detailing their digital asset holdings and must immediately disclose any significant operational failures, disruptions, or cybersecurity incidents.

This reporting mechanism effectively places the industry in a regulatory sandbox, where the operational resilience demonstrated during this trial period will determine the long-term viability of crypto-collateral.

Crypto World

Ethereum Reclaims $2K Level, Bitcoin Recovery Halted at $72K: Weekend Watch

Meanwhile, XRP and SOL are among the top performers today, with notable increases following the latest market crash.

Bitcoin’s price volatility only intensified at the end of the business week as the asset dumped to a multi-month low before it staged an impressive five-digit recovery that was stopped at $72,000.

Most altcoins are well in the green on a daily scale, but the weekly charts are still painful. Nevertheless, many have bounced off the multi-year lows they posted yesterday.

BTC Stopped at $72K

There’s no valid way to sugarcoat what happened in the crypto markets in the past week or so. Just last Saturday, the primary digital asset dumped from $84,000 to under $76,000 in what’s usually a highly uneventful day. Although that was a painful crash on its own, it wasn’t the end of BTC’s struggles.

The asset dipped once again to under $74,000 at the beginning of the business week, but the actual calamity took place on Thursday and culminated on Friday morning.

At the time, BTC plummeted by approximately $17,000 in just over 24 hours from $77,000 to $60,000, which became its lowest price tag since before the US elections in late 2024. After liquidating thousands of traders for billions of dollars, the move south was finally exhausted, and bitcoin actually went on the offensive on Friday evening.

The peak came at almost $72,000, which was tapped on a couple of occasions, but BTC couldn’t break through it. Just the opposite, it was stopped and driven south to $68,000, where it currently sits.

Its market capitalization is down to $1.360 trillion on CG, while its dominance over the alts has slipped to 56.6%.

Alts Try to Rebound

Ethereum was among the poorest performers during the overall crash, dumping from more than $3,000 to under $2,700 in just over a week. It has bounced since then to $2,010 as of press time. SOL, BCH, XMR are also well in the green, followed by XRP, TRX, DOGE, and ADA.

In contrast, the recent high-flyer HYPE has dropped by almost 5% daily and now sits below $33. PUMP and WLFI are also in the red from the larger caps.

The total crypto market cap has recovered over $100 billion since its multi-year bottom on Friday morning and is up to $2.4 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Strategy says BTC would need to fall to $8K to strain debt

Strategy has told investors that Bitcoin would have to collapse to around $8,000 before its crypto holdings no longer cover the company’s net debt, even as paper losses continue to deepen.

Summary

- Strategy holds more than 713,000 BTC acquired at an average of $76,052.

- Management says debt coverage fails only near $8,000.

- Current Bitcoin prices place holdings about $10B below cost.

The Michael Saylor-led firm made the disclosure in investor materials released alongside its fourth-quarter results on Feb. 5.

At the time of the filing, Strategy said its Bitcoin (BTC) holdings were worth $59.7 billion at a reference price of $84,000, about 10 times compared with net debt of about $6 billion.

With Bitcoin now trading near $63,800, the value of those holdings has fallen to roughly $45.4 billion, as per Saylor Tracker data, down about $10 billion from the company’s average purchase cost.

Debt coverage and balance sheet position

Strategy said its Bitcoin would fail to cover net debt only in what it described as an “extreme scenario” involving a drop to $8,000, a level last seen in early 2020. The company added that its Bitcoin is unencumbered and not pledged as collateral, which limits the risk of forced selling even during sharp market declines.

As of Feb. 1, 2026, Strategy held 713,502 BTC, acquired at a total cost of $54.26 billion, or $76,052 per coin. The firm also reported a 22.8% Bitcoin yield for fiscal year 2025, reflecting gains from capital raising and reinvestment strategies.

During 2025, Strategy raised $25.3 billion in capital, making it the largest U.S. equity issuer for a second straight year. It also completed five preferred stock offerings, raising $5.5 billion, and expanded its digital credit program, STRC, to $3.4 billion.

“We raised $25.3 billion of capital in 2025 to advance our Bitcoin treasury strategy,” said president and CEO Phong Le. “In 2026, we remain focused on expanding STRC to generate amplification and drive growth in Bitcoin Per Share.”

Chief financial officer Andrew Kang said the company’s capital structure is stronger than in previous cycles, citing its $2.25 billion reserve fund, which covers more than two years of dividend and interest payments.

Michael Saylor described Strategy’s balance sheet as a “digital fortress,” built around its Bitcoin holdings and digital credit platform.

Losses, valuation, and sector-wide pressure

Strategy’s confidence in its debt coverage comes as losses linked to Bitcoin volatility continue to weigh on financial results.

Due to unrealized losses on digital assets under fair value accounting, the company reported an operating loss of $17.4 billion for the fourth quarter of 2025. Common shareholders incurred a net loss of $12.6 billion, or $42.93 per diluted share.

With Bitcoin trading in the low $60,000 range, Strategy’s holdings are now valued at about $45.4 billion, well below their $54.26 billion acquisition cost. Since late 2025, as prices fell and selling pressure mounted on cryptocurrency markets, that gap has grown.

At the moment, the company’s diluted multiple to net asset value, or mNAV, is about 0.85x. mNAV measures how the market values a firm’s equity relative to the net value of its assets, mainly its Bitcoin holdings, after accounting for debt. A ratio below 1 means the stock is trading at a discount to the underlying asset value.

Pressure is also building across the wider crypto treasury sector. Data from Artemis shows that unrealized losses among crypto accumulation firms have surpassed $25 billion. None of those firms has generated profits that exceed acquisition costs.

Some analysts view Strategy’s $8,000 threshold as a theoretical floor rather than a realistic risk. Others note that prolonged weakness below $60,000 could test investor confidence, raise re-financing costs, and limit the company’s ability to raise new capital on favorable terms.

Crypto World

Vietnam Draft Rules Set Sights on 0.1% Tax on Crypto Transfers

Vietnam is moving to formalize how crypto transactions are taxed and regulated, signaling a push toward a tightly controlled but economically significant digital asset market. A draft circular circulated by the Ministry of Finance would impose a 0.1% personal income tax on the value of each crypto transfer executed through licensed service providers, aligning digital asset activity with the country’s securities trading framework. While transfers and trading would be VAT-exempt, the plan taxes turnover, applying the levy to investors regardless of residency. For institutions, crypto-related income would be taxed at 20% corporate rate, calculated after deducting purchase costs and related expenses. The measures also set a high bar for exchanges, including a 10 trillion dong charter capital threshold and a 49% foreign-ownership cap, reflecting a cautious approach to market infrastructure.

The draft circular, released for public consultation, also formalizes a definition of crypto assets as digital assets issued, stored or transferred using cryptographic or similar technologies. It arrives as Vietnam accelerates a broader, five-year pilot program for a regulated crypto-asset market that began in September 2025. By October 2025, officials indicated no companies had applied to participate in the pilot, underscoring barriers related to capital requirements and eligibility criteria. Separately, authorities have begun opening licensing windows for digital asset trading platforms, signaling that the regulatory framework could start to take shape in early 2026.

As the policy discussion unfolds, Vietnam’s approach appears to be balancing tax revenue opportunities with stringent oversight of who can operate and how financial flows are monitored. The Ministry of Finance’s draft circulates alongside ongoing regulatory experiments and a push to bring crypto activity into formal channels, while the broader ecosystem weighs the implications for retail investors, institutions, and technology providers. The Hanoi Times highlighted the 0.1% PIT as the centerpiece of the tax framework, noting that the tax would be levied on transfers through licensed providers and would mirror the existing stock-trading levy in form and function. The article also points to a clear distinction between value-added tax treatment and turnover taxes, a nuance that could influence how exchanges structure their operations and how tax authorities monitor cross-border activity.

Vietnam formally defines crypto assets

In what appears to be a step toward regulatory clarity, authorities described crypto assets as digital instruments that rely on cryptographic or analogous technologies to issue, store and verify transfers. This definitional move is a precursor to stricter licensing criteria and more predictable tax treatment, which in turn could attract legitimate players while screening out speculative, non-compliant activity. The proposed regime sets a higher capital bar for exchanges than many industries require for traditional banks, signaling an intent to ensure resilience and risk controls in markets that are closely linked to global capital flows.

Under the proposed rules, operators seeking to run a digital asset exchange would need substantial capital, with charter requirements set at 10 trillion dong (about $408 million at current exchange rates). Foreign ownership would be allowed but capped at 49% of an exchange’s equity, limiting influence from outside the country while still enabling international participation. Such thresholds underscore the government’s preference for domestic guardianship of critical financial infrastructure, even as it permits foreign-backed ventures to participate under strict caps and regulatory oversight.

The broader regulatory arc has been visible since Vietnam launched a five-year crypto market pilot in September 2025, a landmark shift intended to test how a regulated ecosystem could coexist with a growing domestic economy. By early October, authorities acknowledged that no companies had yet submitted applications to join the pilot, a reflection of the substantial entry hurdles and careful qualification criteria in play. This admission came alongside reports that the pilot’s scope would eventually be complemented by formal licensing for trading platforms, a move that would bring crypto activity under formal government supervision and pave the way for standardized reporting and consumer protections.

Vietnam opens licensing for crypto exchanges

In the lag time between policy signals and practical rollout, Vietnam began accepting applications for exchange licenses, marking a tangible step toward operationalizing a regulated crypto market. The State Securities Commission of Vietnam (SSC) stated that applications would be accepted starting January 20, 2026, framing the licensing process as a deliberate, multi-year effort to bring crypto activities into a formal regulatory framework. The liquidity and risk-management requirements implied by the licensing window are designed to channel legitimate market participants into a controlled environment, potentially reducing fraud and improving transparency for investors and policymakers alike.

Key takeaways

- The Ministry of Finance’s draft circular would impose a 0.1% personal income tax on the value of each crypto transfer conducted through licensed providers, aligning crypto transfers with the country’s stock-trading levy.

- Crypto transfers and trading would be exempt from value-added tax, while turnover-based taxation would apply to investors regardless of residency status.

- Institutional investors earning income from crypto transfers would face a 20% corporate income tax on profits after deducting costs and expenses.

- Exchanges would face a high capital requirement of 10 trillion dong (roughly $408 million) and foreign ownership would be limited to 49% of equity.

- A formal definition of crypto assets would anchor regulatory rules, helping separate compliant activity from informal or illicit use cases.

- The country has launched a five-year pilot for a regulated crypto market (Sept 2025) with licensing for exchanges anticipated to begin in 2026, although initial participation had not materialized by Oct 2025.

Market context: The policy comes as many jurisdictions reassess how to regulate crypto markets, balancing tax revenue with consumer protection and financial stability. Vietnam’s approach leans toward rigorous control, reflecting a global trend toward centralized oversight while still signaling potential for regulated participation by international players under strict conditions.

Why it matters

The package signals a deliberate attempt to integrate crypto activity into the formal economy, with taxes and licensing acting as primary levers to enhance oversight. For retail investors, the PIT on transfers through licensed providers creates a clear tax path that will influence trading behavior and cost considerations. Institutions face a defined tax regime and a high bar for market entry, potentially filtering participants to those willing to navigate substantial capital prerequisites and regulatory compliance obligations.

From a market infrastructure perspective, the 10 trillion dong charter capital threshold and 49% foreign-ownership cap set a high ceiling for domestic exchanges, aiming to safeguard the financial system while still inviting foreign expertise. The definitional clarity around crypto assets helps align Vietnamese rules with broader financial standards, reducing ambiguity for developers, exchanges, and custodians seeking to establish local operations. Observers will watch how this framework interacts with ongoing pilot programs and whether the regulatory appetite broadens to accommodate more players over time.

For policymakers, the balance between revenue collection, investor protection, and market growth is delicate. Vietnam’s approach suggests a patient, data-driven trajectory: tax structures that incentivize compliance, capital requirements that deter low-capital risk, and licensing that creates an auditable, auditable market foundation. If successful, the model could influence neighboring economies contemplating similar regulated pathways for digital assets, especially in a region where adoption is uneven and regulatory certainty remains a key obstacle for institutional participation.

What to watch next

- January 20, 2026: Applications open for digital asset exchange licenses, establishing a formal entry point for market participants.

- Public responses to the draft circular: Feedback from domestic and international stakeholders could shape final text and practical implementation.

- Details on how PIT and corporate tax will be administered across different crypto products and services, including calculation methodologies and reporting requirements.

- Progress of the five-year pilot: uptake, participant eligibility, and any regulatory adjustments arising from early pilot findings.

- Any updates to foreign ownership rules or capital thresholds as exchanges begin building their local presence under clarified regulatory conditions.

Sources & verification

- Draft circular on crypto taxation and licensing circulated by Vietnam’s Ministry of Finance for public consultation.

- The Hanoi Times report outlining the 0.1% personal income tax on crypto transfers through licensed providers.

- Five-year crypto market pilot launched in September 2025, with a status update stating no applicants as of October 6, 2025.

- State Securities Commission of Vietnam (SSC) statement on the licensing window for digital asset exchanges and the January 20, 2026 start date.

- Coverage of Vietnam opening licensing for crypto exchanges and related regulatory developments referenced in contemporaneous reporting.

Crypto World

Pump.fun Boosts Cross-Chain Trading Terminal With Vyper Deal

Meme coin launchpad Pump.fun has announced the acquisition of trading terminal Vyper, a move aimed at expanding its cross-chain trading capabilities.

Summary

- Pump.fun has acquired Vyper to expand its cross-chain trading terminal, with a focus on improving EVM and Base support.

- Vyper’s team and technology will be integrated into Pump.fun’s Terminal, while the standalone Vyper product will be phased out.

- The deal highlights Pump.fun’s push to evolve from a meme-coin launchpad into a broader trading and infrastructure platform.

The deal was confirmed on February 5, 2026, though financial terms were not publicly disclosed. Vyper’s team and technology will now join Pump.fun’s broader product suite as part of this strategic expansion.

Pump.fun integrates Vyper into its Terminal

Pump.fun is a Solana-originated meme coin launchpad and token creation platform that has grown into one of the most active crypto applications. Since its launch in early 2024, it has allowed users to create and trade tokens without technical expertise and has played a major role in the surge of memecoin activity on Solana.

Under the acquisition plan, Vyper’s infrastructure will be integrated into Pump.fun’s Terminal platform, while the standalone Vyper product will be phased out. The Terminal, previously built after Pump.fun acquired another trading terminal product called Padre, aims to serve as a multi-chain trading hub focused on fast execution and broad market support.

In a post announcing the integration, the Terminal team stated: “EVM support is a core focus for Terminal. With Vyper’s infrastructure & talent, expect trading on EVM (including Base) to massively improve.”

Pump.fun co-founder Alon Cohen also commented on the deal via social media. He framed the acquisition as part of a broader growth strategy, writing that “despite market conditions, we’re expanding our team rapidly and aggressively,” and highlighted the importance of building “super rapid and efficient cross-chain trading infrastructure.”

For Pump.fun, adding Vyper’s technical expertise strengthens its Terminal offering and helps accelerate its reach into EVM-compatible networks like Base and others. This is crucial for broad cross-chain liquidity and execution quality. For Vyper, integration into a larger ecosystem offers a clearer path for product evolution than remaining a standalone service.

Crypto World

Gold Holds Below $5,000 as Volatility Remains High, Exchange Operator CME Hikes Margins

Gold prices remained below $5,000 as volatility remains high following last week’s historic rout, with exchange operator CME Group raising margin requirements for precious metals once again.

Futures in New York ticked 0.1% higher at $4,891.10 a troy ounce and are headed for a weekly gain of 3%. Meanwhile, silver fell 4.1% to $73.56 an ounce, on track for a weekly decline of more than 6%.

“Until volatility subsides and price discovery improves, gold, and especially silver is likely to trade violently in both directions,” said Ole Hansen from Saxo Bank.

Crypto World

Hyperliquid price holds bullish structure despite $337M unlock

Hyperliquid price has stayed resilient above key support levels despite a $340 million token unlock and wider crypto market weakness.

Summary

- HYPE continues to trade above its breakout zone near $32–$33, keeping its bullish structure intact.

- Strong volume and limited sell-off suggest the recent unlock was largely priced in.

- A fresh Coinbase listing adds near-term visibility as momentum stays constructive.

Despite a decline in the overall cryptocurrency market, Hyperliquid is up 2.9% on the day, trading at $34.80 at the time of writing. Most top-100 tokens posted losses, yet HYPE continued to attract buyers, maintaining a strong multi-week run.

The token is up 20% over the past seven days, 25% over the past month, and 36% year-over-year. Over the last week, Hyperliquid (HYPE) has traded between $28.23 and $37.84, showing wide but controlled price movement. Trading activity has surged alongside price, with daily volume jumping 65% to $1.31 billion.

Derivatives data support this trend. As per CoinGlass data, futures volume rose 33% to $5.43 billion, while open interest increased 2.3% to $1.59 billion. Rising price alongside growing open interest points to fresh positioning rather than short covering.

Token unlock pressure meets structural demand

On Feb. 6, roughly 9.92 million HYPE tokens were unlocked, roughly 2.8% of the circulating supply. At current prices, that equals about $340 million. The market absorbed the supply without experiencing major price fluctuations despite the large number of tokens entering circulation.

According to Tokenomist data, approximately 395 million HYPE, or 40% of the entire supply, have already been made available. The majority of these tokens were reserved for distribution to the community, early ecosystem incentives, and core contributors.

In a significant change, Hyperliquid also cut the number of team-related unlocks by 90%, resulting in a February allocation of about 140,000 HYPE, or about $4.5 million, instead of 1.2 million tokens. Monthly unlocks of around 9.9 million HYPE are expected through late 2027, though reduced team allocations could continue.

To offset supply pressure, the protocol uses an Assistance Fund that converts about 97% of trading fees into HYPE buybacks. Hyperliquid just posted a record $29 billion in 24-hour trading volume, generating close to $6 million in fees that feed directly into this mechanism.

Another tailwind came on Feb. 5, when Coinbase announced spot trading for HYPE/USD. Trading went live the same day, marking HYPE’s first appearance on a major U.S. exchange.

While HYPE had already been listed on Kraken and Gemini, Coinbase’s reach is often seen as more impactful, especially since it attracts U.S.-based institutional traders.

Hyperliquid price technical analysis

Technically, Hyperliquid’s bullish structure is still present. Price continues to hold above the former range high around $32–33, a level that has flipped into support. This area has now absorbed both market-wide weakness and the recent unlock.

Buyers are taking advantage of pullbacks, as shown by a distinct sequence of higher lows. Since the breakout, the 20-day moving average has served as dynamic support, and the price is still above it.

Bollinger Bands tightened following the initial rally, suggesting consolidation as opposed to distribution. The relative strength index is above 60, indicating that although momentum has slowed, buyers are still in charge of the trend.

Downside follow-through after the unlock has been limited. Price hasn’t slipped back into the prior range, and recent red candles are small. This behavior suggests that much of the supply was priced in ahead of time.

If HYPE continues to hold above the $32–33 zone, the setup favors continuation toward the $38–40 area, especially if exchange-driven demand persists. Although the current structure still favors buyers, a clean daily close below that support would weaken the setup and pave the way for a deeper pullback.

Crypto World

Dollar Trades Steady After Shrugging Off Weak Jobs Data

The dollar was trading steady after reaching a two-week high on Thursday as investors shrug off weak U.S. jobs data.

U.S. job openings fell to the lowest level in more than five years in December, the Labor Department said Thursday. However, the focus is on upcoming nonfarm payrolls data, which will be published Wednesday after being delayed due to the recent partial government shutdown.

Moreover, President Trump’s nomination of Kevin Warsh as Federal Reserve chair has lifted the dollar as markets bet that he will take a restrictive policy stance and uphold central bank independence. Markets are not fully pricing in another interest-rate cut until June, LSEG data show.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech3 days ago

Tech3 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics5 days ago

Politics5 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports7 days ago

Sports7 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World7 days ago

Crypto World7 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Tech16 hours ago

Tech16 hours agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports8 hours ago

Sports8 hours agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Crypto World5 days ago

Crypto World5 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports1 day ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat22 hours ago

NewsBeat22 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business2 days ago

Business2 days agoQuiz enters administration for third time

-

NewsBeat4 days ago

NewsBeat4 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat5 days ago

NewsBeat5 days agoGAME to close all standalone stores in the UK after it enters administration

-

Sports5 days ago

Sports5 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat9 hours ago

NewsBeat9 hours agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World4 days ago

Crypto World4 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat4 days ago

NewsBeat4 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World2 days ago

Crypto World2 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World2 days ago

Crypto World2 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation