Crypto World

ETHZilla Launches Aviation Token Backed By Jet Engines

The new token offers investors exposure to lease payments generated by two jet engines.

ETHZilla Corporation (Nasdaq: ETHZ) on Thursday, Feb. 12 launched Eurus Aero Token I, a tokenized asset backed by two commercial jet engines currently in use by a U.S. air carrier.

The tokens — which are issued on Ethereum Layer 2 networks and distributed through the Liquidityio platform — give investors exposure to lease payments generated by the engines. ETHZilla said it acquired the engines for about $12.2 million. Meanwhile, tokens are priced at $100 each, with a minimum purchase of 10 tokens.

The company said in a press release viewed by The Defiant that the investment targets annual returns of about 11% over the life of the leases, which run through 2027 and 2028.

The launch comes as interest in tokenized real-world assets (RWAs) continues to grow across both crypto and traditional finance. Data from RWAxyz shows that distributed asset value rose to $23.87 billion, up nearly 11% over the past 30 days.

The value of underlying RWAs represented on-chain also increased more than 8% during the same period to $21.41 billion. Meanwhile, the number of asset holders jumped to 835,179, a 34% month-over-month increase.

ETHZilla CEO McAndrew Rudisill told The Defiant that the company’s mission is to “democratize access to institutional-grade investments” by giving investors direct exposure to RWAs that have historically been out of reach.

Rudisill explained that jet engine leasing has traditionally been accessible only to large institutions and private investment funds. However, by using tokenization technology, the asset can be accessed by smaller players – though the offering is limited to accredited investors.

“ETHZilla was able to design a financial instrument that is structured around defined lease terms, creating a uniquely transparent, income-oriented alternative to traditional private aerospace leasing structures,” he said.

Lease payments are collected each month and paid out to token holders, the release explained. The engines are not financed with debt, and ETHZilla said it does not plan to use borrowing to boost returns for this product.

While ETHZilla is contractually restricted from naming the specific air carrier, a person familiar with the matter confirmed to The Defiant that it is “one of the largest and most profitable airlines.”

Looking Ahead

Looking ahead, Rudisill said ETHZilla recently acquired a portfolio of manufactured and modular home loans, which it plans to tokenize next.

“Manufactured home loans represent an approximately $14 billion market, and are a high-yield, high-quality asset class historically accessible only to a handful of private lenders,” he said. “Not only will tokenizing these assets open this market up to a broader range of investors, we also believe that facilitating financing breadth for manufactured homes could contribute to adding housing supply and alleviate an ongoing national shortage.”

Further down the line, ETHZilla is exploring auto loans, commercial real estate, and other asset classes as potential tokenized income products, Rudisill added.

ETHZilla Corporation, formerly 180 Life Sciences, rebranded in August 2025 to focus on building an Ethereum-based treasury and developing decentralized finance (DeFi) strategies. The company currently holds 69,802 ETH, valued at about $148.4 million, according to CoinGecko.

ETHZ is currently trading at $3.40, up about 5% today following the news.

Crypto World

Is A Short Squeeze Near?

Bitcoin (BTC) formed a new weekly low at $65,500 on Thursday, as the price has continued to trend lower over the past four days. Derivatives data also indicate that traders are heavily positioned to the downside.

Analysts said that this setup may lead to a sharp move higher that forces sellers to close their positions, even as other indicators hint that the move may not be straightforward.

Key takeaways:

-

The seven-day average funding rate for Bitcoin has turned strongly negative for the first time since March 2023 and November 2022.

-

Bitcoin liquidity and stablecoin flow data show renewed capital outflows, reducing the odds of a sustained squeeze.

Bitcoin funding stays red as short positions rise

Bitcoin’s daily funding rate has remained in deep red territory since the beginning of February, marking its most negative period since May 2023. The seven-day simple moving average (SMA) has flipped negative for the first time in nearly a year.

The funding rate is a periodic payment between the traders in futures markets. When it is negative, the short sellers pay long traders, signaling that the bearish positions are crowded, and vice versa.

Crypto analyst Leo Ruga said the current “red funding rate for days” signals that the bearish or short trade may be getting overcrowded. Ruga added:

“This is the kind of negative funding that typically appears during bottoming phases. Not because shorts are wrong, but because extended negative funding often marks exhaustion of selling pressure.”

Similarly, market analyst Pelin Ay highlighted that the funding rate recently dropped near -0.02 last Friday, with sharp negative spikes. Ay added that when sharp price declines coincide with negative funding, it can set the stage for a short squeeze, particularly if $58,000 holds as the local support.

Related: Bitcoin must close week at $68.3K to avoid ‘bearish acceleration:’ Analyst

The last time Bitcoin’s daily funding rate stayed deeply negative for 10 to 20 days after a bullish phase was in May 2021 and January 2022. In May 2021, BTC corrected for nearly two months before breaking out to new highs. In January 2022, the negative stretch preceded a broader bearish cycle. Thus, extended negative funding has not consistently produced an immediate reversal in the past

Onchain data supports a cautious view. Bitcoin researcher analyst Axel Adler Jr. noted that the SSR oscillator, which measures Bitcoin’s strength relative to stablecoins, has mostly stayed in negative territory since August 2025.

A brief move into positive territory in mid-January (+0.057) coincided with a rally above $95,000, but the oscillator has since dropped to -0.15 as the price pulled back toward $67,000.

Stablecoin flows tell a similar story. The 30-day change in USDt (USDT) market cap turned positive in early January (+$1.4 billion), but it has since reversed to -$2.87 billion, signaling a period of capital outflows.

Until liquidity trends and the SSR oscillator turn sustainably positive, Adler Jr. said that the BTC market remains in a “risk-off” phase.

Related: Binance completes $1B Bitcoin conversion for SAFU emergency fund

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

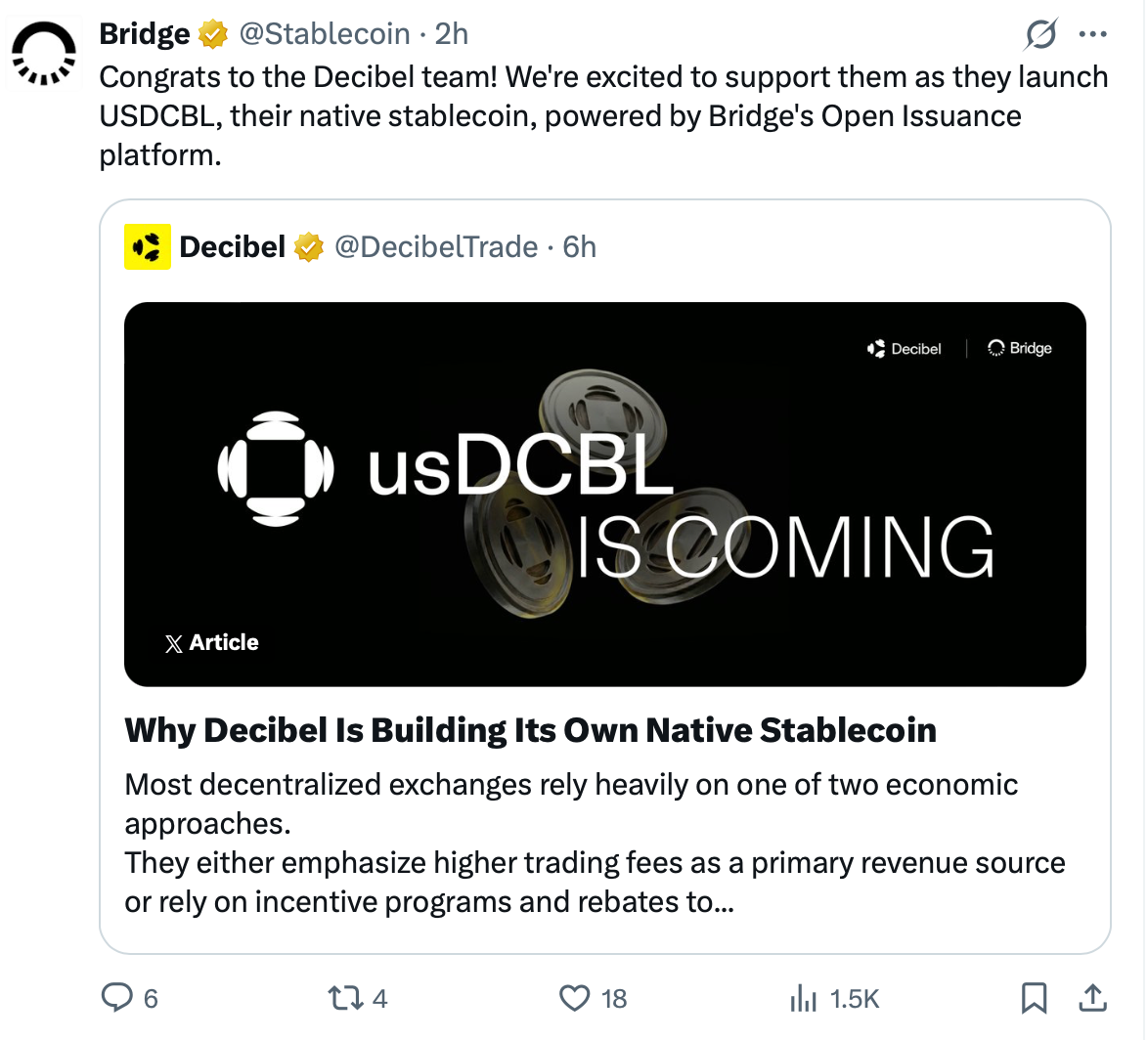

Aptos-Based Decibel to Launch USDCBL Stablecoin via Stripe-owned Bridge

The Decibel Foundation said it will introduce a protocol-native stablecoin, USDCBL, issued by Bridge, ahead of the February mainnet launch of its Aptos-based decentralized derivatives exchange.

According to an announcement shared with Cointelegraph on Thursday, the US dollar-denominated token will serve as collateral for onchain perpetual futures trading, allowing the platform to internalize reserve-related economics rather than rely on third-party stablecoin issuers.

Decibel, incubated by Aptos Labs, plans to launch later this month with a fully onchain perpetual futures venue using a single cross-margin account. The exchange said its December testnet attracted more than 650,000 unique accounts and exceeded 1 million daily trades, though those figures have not been independently verified.

At launch, users will deposit USDC (USDC) and convert it into USDCBL as part of the onboarding process. USDCBL will be issued through Bridge’s Open Issuance platform, which enables projects to create regulated, fully collateralized stablecoins with integrated on- and off-ramps. Bridge was acquired by Stripe in late 2025.

According to an X post on Thursday from Decibel, the foundation said USDCBL reserves will be backed by a mix of cash and short-term US Treasurys, with yield generated from those assets retained within the protocol.

It added that capturing reserve income could reduce reliance on trading fees or incentive programs as primary revenue sources, allowing value to be reinvested into protocol development and ecosystem initiatives.

“This is not about launching another stablecoin,” the foundation wrote, describing USDCBL as core exchange infrastructure rather than a standalone retail token.

Related: US credit union regulator proposes stablecoin licensing path

Rise of ecosystem-native stablecoins across crypto and banking

The shift toward ecosystem-aligned dollar tokens spans both crypto and traditional finance, as platform operators increasingly issue stablecoins tailored for use within their own networks rather than relying solely on external issuers.

The closest comparison to Decibel may be Hyperliquid, a decentralized perpetual futures exchange that launched its native stablecoin, USDH, in September after a fierce bidding war for issuance rights.

The dollar-pegged token is minted on the platform’s Ethereum-compatible execution layer, HyperEVM, and is designed to serve as collateral across the exchange while reducing reliance on external issuers.

The trend extends beyond crypto-native platforms. In November, JPMorgan Chase introduced JPM Coin for institutional settlement on its blockchain infrastructure, representing tokenized US dollar deposits held at the bank.

The deposit token was piloted on Coinbase’s Base network, giving institutional clients access to 24/7 blockchain-based transfers. Unlike publicly circulating stablecoins, JPM Coin is permissioned and available only to the bank’s institutional clients.

Fintech platforms have also participated. PayPal launched PYUSD in 2023 as a dollar-backed stablecoin embedded directly into its payments system, giving the company greater control over settlement flows within its own network.

In 2025, the company introduced a 3.7% annual rewards program for US users holding PYUSD in PayPal or Venmo wallets, further embedding the stablecoin into its consumer payments ecosystem.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

Crypto Use in Trafficking Surges, but May Help in Crackdowns

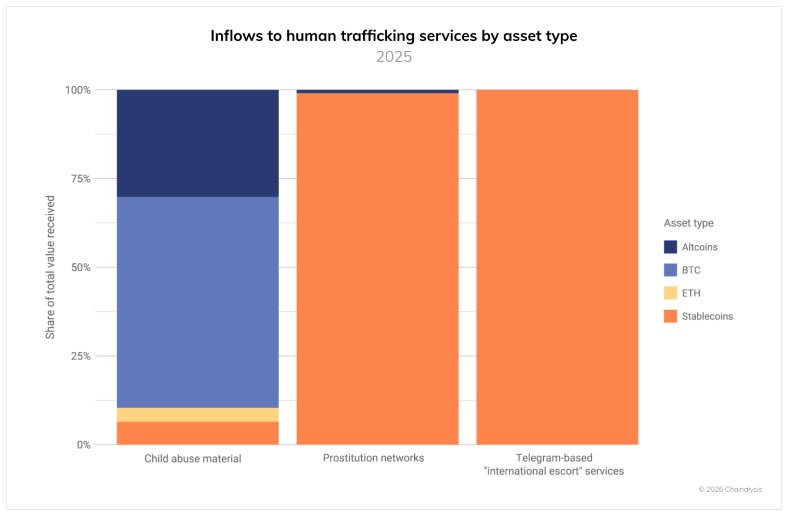

Crypto flows to suspected human trafficking networks increased 85% year over year in 2025, but crypto analytics firm Chainalysis said blockchain transparency could help disrupt the operations.

Chainalysis said in a report on Thursday that the total transaction volume to suspected trafficking networks, largely based in Southeast Asia, reached “hundreds of millions of dollars across identified services.”

It added that the services are “closely aligned” to scam compounds, online casinos, and Chinese-language money-laundering networks, which have recently grown in popularity.

Chainalysis said the crypto-facilitated human trafficking it tracked included Telegram-based services for international escorts, labor placement agents that kidnap and force people to work at scam compounds, prostitution networks, and child sexual abuse material vendors.

Crypto payment methods varied significantly, with international escort services and prostitution networks operating almost exclusively using stablecoins.

Blockchain could help track traffickers

Chainalysis said that the blockchain could help law enforcement detect and disrupt trafficking operations by identifying transaction patterns, monitoring compliance, and targeting strategic chokepoints at exchanges and illicit online marketplaces.

“Unlike cash transactions that leave no trace, the transparency of blockchain technology provides unprecedented visibility into these operations, creating unique opportunities for detection and disruption that would be impossible with traditional payment methods,” it said.

Related: Crypto launderers are turning away from centralized exchanges: Chainalysis

Chainalysis said compliance teams and law enforcement should monitor for large, regular payments to labor placement services, wallet clusters showing activity across multiple categories of illicit services, and regular stablecoin conversion patterns, among others.

Chainalysis said law enforcement scored several wins against traffickers last year, including German authorities taking down a child sexual exploitation platform, which it added was aided by blockchain analysis.

Magazine: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

$3 Billion Options Expiry Looms: Liquidations, Skew, and More

Nearly $3 billion in Bitcoin and Ethereum options expire today at 08:00 UTC on Deribit, placing derivatives markets under intense scrutiny.

Going into today’s options expiry, interest will be on whether the recent price stabilization marks a temporary pause or the beginning of a new directional move.

Sponsored

Sponsored

$3 Billion Bitcoin and Ethereum Options Expiry Tests Market Nerves After Liquidation Shock

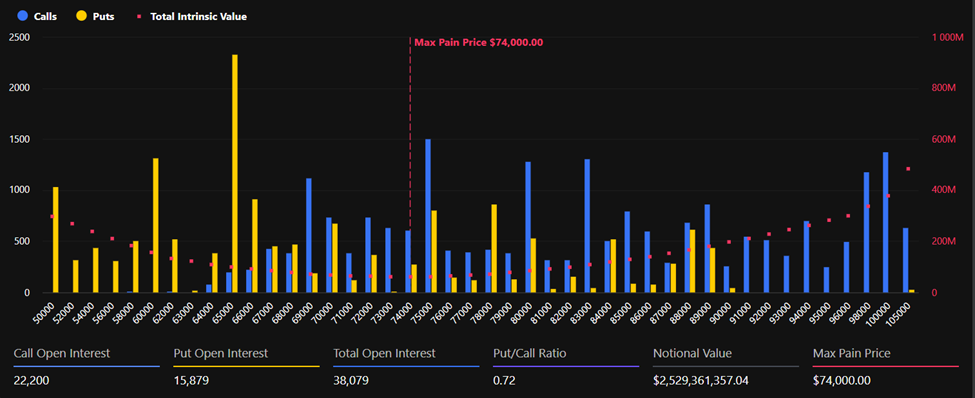

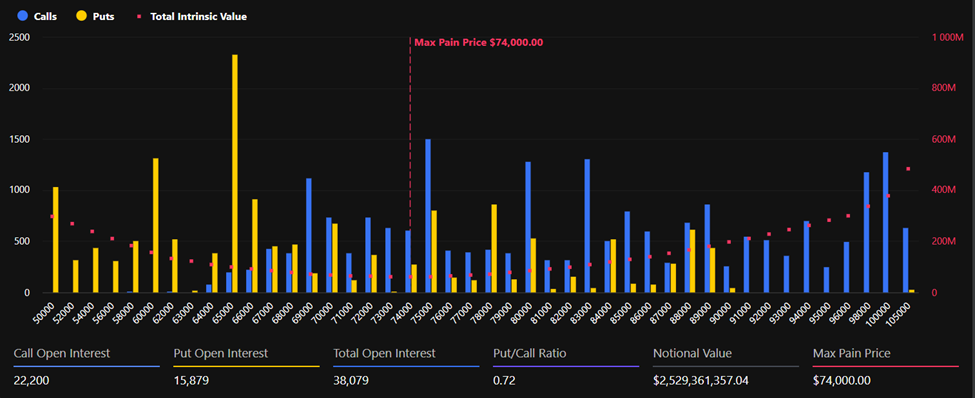

As of this writing, Bitcoin was trading at $66,372, with a max pain around $74,000 and total notional open interest exceeding $2.53 billion.

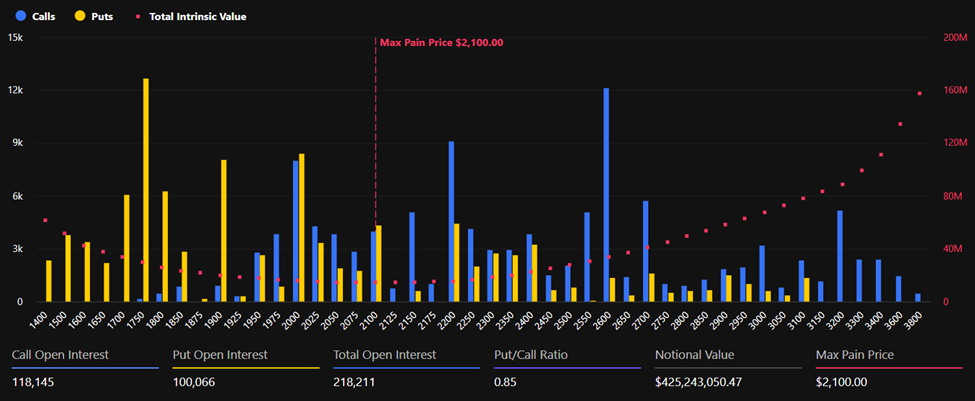

Ethereum, meanwhile, is trading near $1,950, with approximately $425 million in notional open interest and a max-pain level around $2,100.

These figures suggest that a large share of open positions would benefit if prices drifted higher toward max pain levels, but sentiment in the options market remains cautious.

Despite the recent rebound from last week’s sharp sell-off, options metrics suggest traders are still hedging against downside risk.

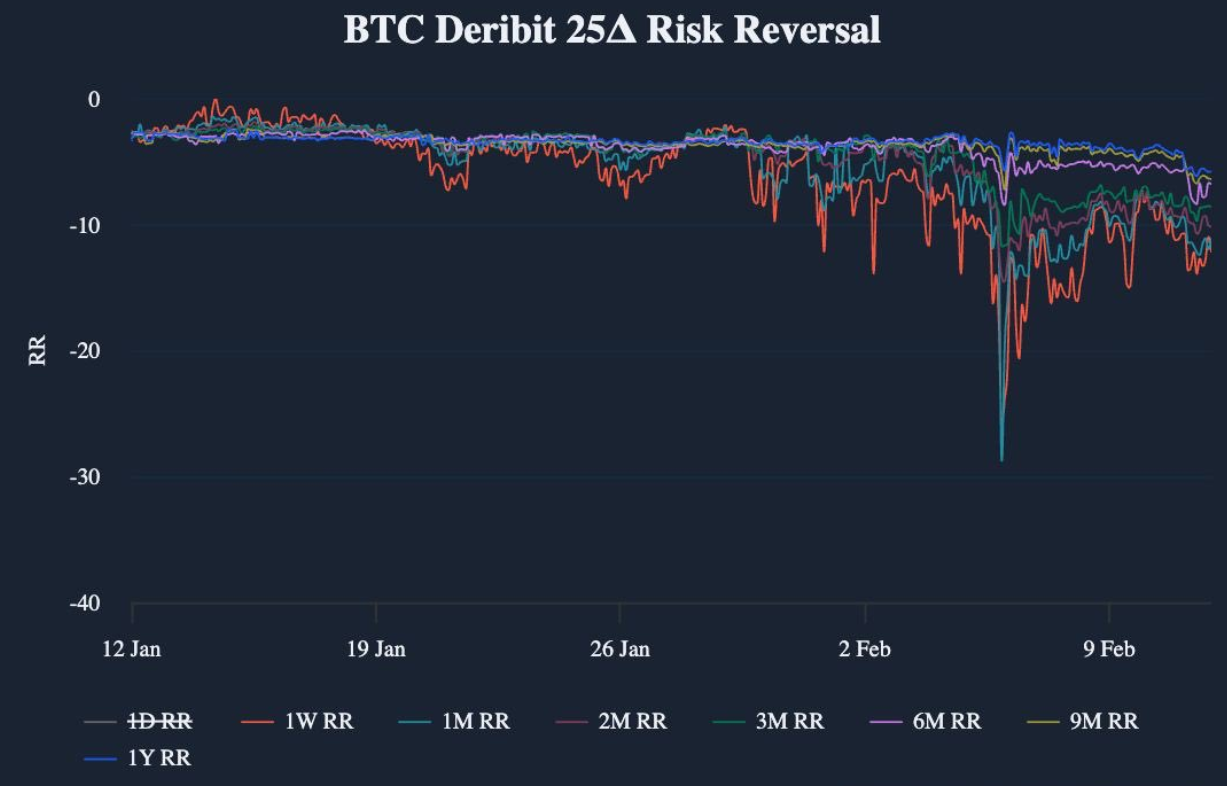

Analysts at Laevitas noted that Bitcoin’s risk reversals remain heavily skewed toward puts.

Sponsored

Sponsored

“BTC 1-week and 1-month 25-delta RRs have recovered from extreme lows but remain notably negative at approximately −13 and −11 vols, respectively, indicating persistent demand for downside protection,” the derivatives analyst stated.

Risk reversals are widely used to gauge sentiment in derivatives markets. Meanwhile, sustained negative readings typically signal that traders are paying a premium for protective puts, often reflecting fears of further declines.

Liquidations, Put Skew Shock, and a Fragile Shift Toward Calls as Expiry Nears

The current cautious tone follows a dramatic market event in which Bitcoin briefly fell below $70,000, triggering widespread liquidations and extreme derivatives imbalances.

Analysts at Deribit said the move caused one of the most pronounced shifts toward put (sales) demand seen in years.

Sponsored

Sponsored

“BTC broke $70K last week, triggering cascading liquidations, and one of the most extreme put skew moves in years before bouncing back toward the 67K range,” Deribit analysts said.

Such events often leave a lasting psychological impact on markets, with traders remaining defensive even after prices stabilize.

More recently, however, derivatives positioning has begun to shift, with some traders rotating back into call (purchase) options as volatility declines from panic levels. Deribit analysts observed that the market is now at a critical inflection point.

Options expiries of this size can sometimes exert short-term gravitational effects on price, especially when large clusters of open interest are concentrated near specific strike levels.

Sponsored

Sponsored

While short-term positioning has improved, some indicators suggest institutional traders remain skeptical about the medium-term outlook.

Analysts at Greeks.live reported that put options continue to dominate activity in Bitcoin derivatives markets.

“Put options continue to dominate the market, with over $1 billion in BTC put options traded today, accounting for 37% of the total volume. The majority of these are out-of-the-money options priced between $60,000 and $65,000,” the analysts said.

This indicates that institutions have a negative outlook for the medium- to long-term market trajectory. According to the analysts, there is a strong expectation of a bearish trend within the next one to two months

The settlement of today’s options expiry could relieve pressure and stabilize markets. However, it could also be the catalyst for another bout of volatility heading into the weekend.

Crypto World

Crypto Used by Trafficking Networks Surged in 2025, Chainalysis Finds

Chainalysis has released a detailed assessment showing a notable uptick in crypto flows tied to suspected human trafficking networks, with an 85% rise in 2025 and transaction volumes reaching hundreds of millions of dollars across identified services. The report highlights networks largely rooted in Southeast Asia and intertwined with scam compounds, online casinos, and Chinese-language money-laundering rings that have gained momentum as crypto adoption broadens. Notably, the study emphasizes that the choice of asset varies by service, with some operators leaning on stablecoins for cross-border payments. While the numbers are concerning, Chainalysis argues that the transparency of blockchains also creates actionable choke points for enforcement.

Among the opaque channels identified are Telegram-based services that facilitate international escorts, labor-placement schemes that allegedly coerce victims into work at scam compounds, prostitution networks, and vendors distributing material related to child sexual abuse. The research underscores that, in practice, payment methods diverge across illicit networks: international escort services and prostitution networks have shown a pronounced reliance on stablecoins, while other segments employ a broader mix of on- and off-ramp techniques. The report’s granular look at asset-type inflows and wallet behavior aims to give investigators and compliance teams new signals to pursue.

Chainalysis stresses that blockchain’s traceability can be a powerful tool for law enforcement. By identifying transaction patterns, monitoring compliance at exchanges, and pinpointing chokepoints in the ecosystem, authorities can disrupt bad actors in ways that cash or traditional remittance systems cannot. This is particularly relevant as illicit online marketplaces and money-laundering networks continue to adapt to shifting regulatory landscapes and evolving crypto offerings. The report also points readers to related work on the broader crypto-laundering landscape and how on-chain analytics are changing the enforcement playbook.

As a case in point, the firm notes several enforcement successes last year, including German authorities dismantling a child sexual exploitation platform, an operation that Chainalysis said was aided by blockchain analysis. The finding illustrates how coordinated usage of on-chain data can assist in tracing the flow of funds across multiple layers of a criminal network, from on-ramps to marketplaces to end-services. Chainalysis also emphasizes the need for ongoing vigilance by compliance teams and law enforcement to monitor for patterns such as high-frequency transfers to labor-placement entities, wallet clusters that operate across multiple illicit categories, and stablecoin conversion activity that appears routine rather than incidental.

Key takeaways

- 2025 crypto flows to suspected human trafficking networks surged by 85%, with total transaction volume reaching hundreds of millions of dollars across identified services.

- Southeast Asia emerges as a central hub for these networks, which are tied to scam compounds, online casinos, and Chinese-language money-laundering networks.

- Seemingly disparate services—Telegram-based international escorts, labor-placement agents, prostitution networks, and vendors supplying illicit content—rely on a mix of assets, with stablecoins favored for cross-border payments in several cases.

- Blockchain’s transparency is framed as a diagnostic and disruption tool: it can reveal transaction patterns, flag large or anomalous activity, and help block or slow illicit flows at exchanges and at online marketplaces.

- Law enforcement achievements, such as the German takedown of a child exploitation platform aided by blockchain forensics, demonstrate the practical leverage of on-chain analytics in complex investigations.

- The report calls for heightened monitoring by compliance teams—watching for regular, large-payments to labor-placement services, wallet clusters spanning illicit categories, and recurring stablecoin conversions—as part of a broader AML framework.

Market context: The findings sit against a backdrop of growing regulatory interest in on-chain analytics, the expanding use of stablecoins, and ongoing scrutiny of cross-border crypto payments. As governments and financial institutions seek robust AML controls, analytics firms and exchanges are increasingly integrating sophisticated tracing tools to deter illicit finance while balancing user privacy and legitimate use cases. The evolving regulatory environment underscores the value—and the limits—of blockchain transparency in addressing criminal finance without stifling legitimate innovation.

Why it matters

The report illustrates a fundamental tension in the crypto economy: the same technologies that enable rapid, borderless financial activity can also facilitate harm if left unchecked. For users and investors, the message is clear—transparency tools are becoming a standard part of risk assessment, and due diligence now increasingly hinges on on-chain behaviors and counterparties. For builders and product teams, the emphasis on compliance signals a growing demand for wallet- and exchange-level controls, better KYC/AML workflows, and clearer disclosures around illicit-risk indicators.

For policymakers, the analysis reinforces the need for clear guidelines on stablecoins and cross-border settlements, as these instruments appear in multiple illicit-use cases. The data also supports continued investment in cross-agency cooperation and international information sharing, given that many of these networks operate across different jurisdictions and platforms. At a technical level, the findings encourage further development of attribution methodologies that preserve user privacy while enabling lawful investigators to trace criminal flows. In short, the study adds to a growing body of evidence that on-chain data can augment traditional investigative methods, but it must be integrated within a broader, well-governed framework.

For the broader crypto ecosystem, the emphasis on chokepoints and wallet clusters highlights practical avenues for disruption: exchanges can improve real-time monitoring, on-chain analytics can be used to flag risky counterparties, and marketplaces can adopt stricter seller verification and payment-processing controls. The convergence of enforcement and technology is likely to shape how illicit activity is funded and how quickly it can be identified and neutralized, potentially reducing the latency between crime and detection in a space historically challenged by anonymity and speed.

What to watch next

- Follow-up updates from Chainalysis on 2026 data and trend analysis, including any revisions to the 2025 figures.

- Regulatory actions targeting stablecoins and cross-border crypto payments, particularly in Southeast Asia and Europe.

- Adoption of enhanced AML controls by exchanges and online marketplaces in response to on-chain‑driven findings.

- Investigations and public disclosures related to large wallet clusters that span multiple illicit services or jurisdictions.

- Further enforcement actions demonstrated or inspired by blockchain-forensic capabilities, such as high-profile takedowns and asset-tracing successes.

Sources & verification

- Chainalysis blog post: crypto-human-trafficking-2026

- Crypto-launderers turning away from centralized exchanges: Chainalysis coverage

- Blockchain forensics and asset tracking explainer

- Related investigative reporting on enforcement actions and policy context

Blockchain visibility and illicit finance: what the findings imply

Chainalysis’s report underscores how on-chain visibility can illuminate the pathways by which crypto assets are moved to support trafficking and exploitation. By charting flows into labor-placement operations, escort services, and adult services that rely on cross-border payments, investigators can identify recurring patterns that mark a network’s lifecycle—from onboarding to monetization. The emphasis on stablecoins in particular reflects how certain assets are chosen to minimize friction across borders, optimize settlement times, and obscure the origin and destination of funds in less-regulated corridors.

Yet the study also warns against overreliance on any single signal. Illicit actors adapt, and the same tools that reveal patterns can be misapplied if not paired with traditional investigative methods and robust governance. The combination of blockchain analytics with proactive compliance, inter-agency collaboration, and targeted enforcement represents a pragmatic approach to mitigating on-chain risks without dampening legitimate innovation in the crypto economy.

Crypto World

XRP price prediction ahead of January US CPI report today

XRP price is hovering near $1.35 as markets closely watch the January U.S. Consumer Price Index (CPI) report due later today.

Summary

- Markets expect January U.S. CPI to show sticky inflation, with core prices remaining elevated, a result that could delay Federal Reserve rate cuts and pressure crypto assets.

- XRP is trading near $1.35, below its 50-day SMA around $1.84, with the broader trend still bearish on the daily chart.

- Key support sits at $1.30 and $1.20, while resistance stands at $1.40 and the $1.80–$1.85 region; CPI data could determine the next breakout or breakdown.

Economists expect headline inflation to tick slightly higher on a month-over-month basis. Annual inflation is projected to land in the 2.5% range. Core CPI, which strips out food and energy, is also expected to show sticky price pressures.

Goldman sees January CPI +0.24%, bringing the YoY rate to 2.44% — Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 8, 2026

+0.33% core, +2.52% pic.twitter.com/IOycjqoVBm

If CPI comes in hotter than expected, it could reduce the chances of near-term Federal Reserve rate cuts. That would likely strengthen the U.S. dollar and weigh on risk assets, including cryptocurrencies like the Ripple token (XRP).

A softer-than-expected print, however, could boost expectations of monetary easing and trigger a relief rally across crypto markets.

XRP price prediction and key levels

XRP is currently trading around $1.35, down roughly 0.6% on the day, according to the daily price chart.

The chart shows a clear downtrend since early January. XRP failed to hold above the $2.20–$2.30 region and has printed a series of lower highs and lower lows. The price is trading well below the 50-day Simple Moving Average (SMA), which sits near $1.84, signaling continued bearish momentum.

The recent sharp sell-off toward the $1.20 zone was followed by a brief rebound, but upside momentum has faded. Candles are now compressing near the $1.35 level, suggesting indecision ahead of the CPI release.

The Chaikin Money Flow indicator is currently around -0.12, remaining in negative territory. This indicates capital outflows and weak buying pressure, reinforcing the bearish bias.

For the XRP price, immediate support lies near $1.30, followed by the recent swing low around $1.20. A break below $1.20 could open the door toward the psychological $1.00 level.

On the upside, initial resistance sits near $1.40, with stronger resistance at the 50-day SMA around $1.84.

A hotter CPI reading could push XRP below $1.30 and retest $1.20. A softer inflation print may spark a rebound toward $1.40 and potentially $1.60 in the short term.

Crypto World

ETHZilla Shifts Strategy With Tokenized Jet Engine Offering

Crypto treasury company ETHZilla has launched a token offering access to equity in jet engines that the company acquired last month as part of its pivot into tokenized assets.

ETHZilla said on Thursday that the token, called Eurus Aero Token I, was being launched through its new subsidiary, ETHZilla Aerospace, and is backed by two commercial jet engines that are leased to “a leading US air carrier.”

The company has priced each token at $100, with a minimum purchase of 10 tokens. ETHZilla said it’s targeting an 11% return rate based on holding it for the full term of the engine leases that extend into 2028.

ETHZilla was formerly a clinical-stage biotech company called 180 Life Sciences Corp that pivoted to buying and holding Ether (ETH) in July amid a frenzy of new crypto treasury companies at the time.

ETHZilla chairman and CEO McAndrew Rudisill said the project “expands investment access and modernizes fractional asset ownership in markets that have historically been available only to institutional credit and private equity.”

“Offering a token backed by engines leased to one of the largest and most profitable US airlines serves as a strong use case in applying blockchain infrastructure to aviation assets with contracted cash flows and global investment demand,” he added.

ETHZilla shifting away from crypto treasury

Rudisill said in December ETHZilla is moving away from just buying and holding ETH and aims to build a business that brings assets on-chain through tokenization.

Crypto treasury companies experienced significant growth and hype last year, but enthusiasm has since started to cool across the market.

ETHZilla purchased the two jet engines for a combined $12.2 million in January, after selling off some of its ETH stash last year.

As part of its ongoing tokenization push, ETHZilla is also planning to launch tokens for additional asset classes, including home and car loans, according to the company’s announcement.

Some crypto execs have predicted tokenized RWAs will grow significantly in 2026, fueled by adoption in emerging economies facing issues with capital formation and attracting foreign investment.

Over $24 billion in RWA is estimated to be on-chain as of Friday, across more than 846,808 holders, according to RWA.xyz.

Ether stash down from previous high

In a Securities and Exchange Commission filing in September, ETHZilla disclosed it held 102,246 Ether at an average acquisition price of roughly $3,948, which was valued at $443 million at the time.

Related: ‘Horse has left the barn:’ ETHZilla bets big on Ethereum’s stablecoin play

Ether has fallen in step with the rest of the crypto market and has been drifting between $1,872 and $2,130 in the last seven days, according to CoinGecko.

Strategic Ether reserves lists ETHZilla as holding more than 93,000 in Ether, worth over $188 million. However, CoinGecko estimates the company’s stash is closer to 69,802, and is worth about $136 million.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

Morph Integrates USDT0, Unlocking Access to the World’s Largest Stablecoin Liquidity Pool

[PRESS RELEASE – Singapore, Singapore, February 13th, 2026]

Ethereum-based payments settlement network Morph has integrated USDT0, the omnichain Tether liquidity network powered by LayerZero. The move gives Morph, which aims to become the settlement layer for everyday money, direct access to unified USDT liquidity across 18+ blockchains.

For developers building payment apps, merchant tools or even DeFi protocols on Morph, this means they can tap into a massive, ready-made liquidity pool from day one without the headache of managing a dozen different bridged token contracts.

No more bridges. No more wrapped tokens

Traditionally, using USDT on another blockchain requires a bridge. This process locks the original tokens and mints a new, “wrapped” version on the destination chain.

These wrapped variants are not the same asset. They are separate tokens backed by assets held in complex smart contracts, leading to liquidity fragmentation — where the same currency is trapped in isolated pools — and introducing counterparty risk if a bridge fails.

USDT0 proposes a different model. Instead of locking and minting, it uses a burn-and-mint mechanism. To move USDT from Chain A to Chain B, tokens are burned on Chain A and minted directly from Tether’s canonical supply on Chain B.

As a result, USDT0’s Omnichain Fungible Token (OFT) standard creates a single, consistent asset across all supported networks.

What USDT0 enables for builders on Morph

While many L2s compete for general DeFi activity, Morph is engineered for a specific vertical: payments. Its architecture — featuring sub-300ms block times and zero-fee stablecoin transfers — targets merchant settlement, remittances, crypto cards issuance, and treasury management.

For such use cases, deep and frictionless liquidity is non-negotiable. USDT, with a market cap exceeding $185 billion, represents the largest pool of stablecoin liquidity in crypto.

As the USDT0 integration is now live on Morph mainnet, developers on Morph can integrate what is effectively a universal USDT, slashing technical overhead and simplifying cross-chain user experience, which means:

- Payment applications can process cross-border transactions with instant settlement and minimal overhead.

- DeFi protocols can access deeper liquidity without managing multiple stablecoin variants.

- Merchant platforms can accept stablecoin payments with seamless conversion and settlement.

- Financial institutions can execute treasury operations with predictable behavior across chains.

The combination of USDT0’s unified liquidity and Morph’s payment-optimized infrastructure lays a powerful foundation for next-generation financial applications.

We’re excited to work alongside the USDT0 team in advancing the vision of unified, omnichain liquidity that makes stablecoins truly borderless.

Money at the speed of life.

About Morph

Morph is an Ethereum-based, payments-first settlement layer and the native onchain home of BGB, focused on building the foundation for global consumer finance onchain. Morph supports real-world financial activity across payments, savings, identity, and rewards, enabling scalable, onchain settlement for consumer and business use. Guided by the Morph Foundation, the network connects more than 120 million users through the Bitget and Bitget Wallet ecosystems.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRPL Activates XLS-85 Token Escrow Upgrade: XRP Price Impact

The XRP Ledger (XRPL) activated the XLS-85 amendment on February 12, 2026, bringing native escrow to all Trustline-based tokens (IOUs) and Multi-Purpose Tokens (MPTs). This upgrade opens new use cases for secure, programmable asset settlement.

Moreover, the move expands XRPL’s utility, and market watchers suggest the upgrade could pave the way for institutional capital deployment. But will this impact XRP’s price? That is a question that remains to be answered.

Sponsored

XLS-85 Amendment Extends Escrow Functionality Beyond XRP

XLS-0085 expands how escrow works on the network. Until now, XRPL’s native escrow functionality was limited to XRP. With XLS-85, that restriction is removed.

“From stablecoins like RLUSD to Real World Assets, the XRPL now supports secure, conditional, on-chain settlement for all assets,” RippleX stated.

XLS-85 upgrades the existing EscrowCreate, EscrowFinish, and EscrowCancel transaction types. Importantly, token issuers retain control. Tokens must explicitly allow escrow functionality through issuer-level flags. This preserves compliance controls and token governance structures already in place.

This is not just a minor tweak. It shifts XRPL from being a network where only XRP could be escrowed to one where assets gain native time-lock and conditional release functionality.

That opens the door to:

Sponsored

- Token vesting schedules

- Institutional settlement workflows

- Treasury management for issued assets

- Conditional stablecoin payouts

- Structured financial products built directly on XRPL

“Token Escrow (XLS-85) is an upgrade to the #XRP Ledger, which plugs directly into it and makes the DEX institution-ready. The Institutions will begin deploying CAPITAL on #XRPL starting 12 February,” an analyst wrote.

The latest update comes shortly after XRPL activated Permissioned Domains earlier this month to expand institutional use cases.

Sponsored

XRPL’s Token Escrow Upgrade Raises Questions About XRP’s Long-Term Price Impact

It’s worth noting that while the activation of XLS-0085 does not directly increase demand for XRP, it could influence the asset’s long-term price trajectory through broader network effects.

The amendment extends native escrow functionality to Trustline-based tokens and Multi-Purpose Tokens, rather than expanding escrow usage for XRP itself. That means the upgrade does not automatically create additional XRP lockups or immediate supply constraints.

However, the structural implications are more nuanced. If token issuers, including stablecoin providers, RWA platforms, or institutions, adopt XRPL because it now supports native token escrow:

- Token issuance on XRPL could increase

- Transaction volume may rise

- The number of active accounts could expand

- Demand for XRP may grow due to fees and reserve requirements

Sponsored

That increases network usage, and XRP is still the gas and reserve asset of the ledger. Higher utility → potentially higher demand for XRP → possible price appreciation. But this depends entirely on real adoption.

Upgrades like XLS-0085 signal that XRPL is positioning itself as a tokenized finance infrastructure. If markets perceive XRPL as becoming more competitive with Ethereum or other token platforms, sentiment alone can influence price. Crypto markets often price in narrative and positioning, not just usage.

In the short term, price impact may depend more on market sentiment than on immediate usage metrics. Over the longer term, sustained ecosystem growth driven by token-enabled escrow could contribute to stronger network fundamentals, which historically play a role in digital asset valuation.

For now, XRP continues to face challenges along with the broader market. At press time, it was trading at $1.36, down 1.35% over the past day.

Crypto World

UBS Expands BlackRock Bitcoin ETF Stake as Institutional Crypto Interest Grows

TLDR:

- UBS raised its IBIT stake to 548,614 shares valued at $27.2M.

- The position remains small compared with UBS’s $616B reported portfolio.

- Crypto trading tools are being tested for high‑net‑worth clients.

- Online crypto supporters and critics reacted to the disclosure on social media.

UBS expanded its BlackRock Bitcoin ETF holdings to $27.2M, signaling steady institutional interest. The move comes as the bank tests crypto trading for wealthy clients and builds digital asset tools.

Social media users reacted, with supporters calling it adoption and critics noting it is ETF exposure, not direct Bitcoin ownership.

UBS Expands Exposure Through BlackRock’s Bitcoin ETF

UBS increased its holdings in BlackRock’s iShares Bitcoin Trust to 548,614 shares. The position was valued at $27.2 million as of December 31, 2025.

The disclosure appeared in the bank’s January 29, 2026, 13F filing with the U.S. Securities and Exchange Commission.

The position represents a sharp increase from UBS’s previous holdings. However, the allocation remains small compared to its $616 billion 13F portfolio. The structure shows exposure through regulated ETF instruments rather than direct Bitcoin custody.

Market observers noted the move as part of a broader institutional trend. The investment method reflects a preference for compliance, custody protection, and regulated access.

This approach also aligns with existing risk frameworks used by large financial institutions.

Online discussions intensified after crypto commentator Vivek Sen shared the disclosure on X. His post framed the development as a major signal of banking sector participation. The tweet amplified visibility and drove conversation across crypto-focused communities.

The ETF structure provides price exposure without direct asset ownership. This model allows institutions to participate in Bitcoin markets while avoiding on-chain operational risks. It also fits traditional portfolio reporting standards.

Institutional Strategy and Digital Asset Infrastructure Growth

Skeptics online noted that ETF exposure differs from direct Bitcoin ownership. They argued that the structure limits self-custody and blockchain-level participation. Supporters countered that institutional adoption often begins through regulated financial products.

UBS has also been testing crypto trading services for wealthy clients. The bank is building digital asset tools designed for private banking use. These developments show a controlled approach to digital asset integration.

The ETF allocation reflects a gradual strategy rather than a rapid transformation. UBS appears focused on structured exposure rather than speculative positioning. This aligns with long-term wealth management and compliance priorities.

The filing shows how traditional finance institutions are entering crypto markets cautiously. ETF-based exposure offers familiarity, governance standards, and regulatory clarity. This model supports incremental adoption across conservative portfolios.

As more filings emerge, market participants continue tracking institutional movements. ETF flows remain one of the clearest data points for measuring bank-level participation. UBS’s position now places it among visible institutional holders of Bitcoin-linked assets.

The disclosure adds to the growing list of regulated financial entities using ETFs for crypto exposure. The strategy reflects measured integration rather than direct blockchain engagement.

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month