Crypto World

Fiserv Launches US Dollar Settlement Platform for Digital Asset Companies

Fiserv, a major US payments and financial technology provider, has launched a new cash settlement platform for digital asset companies, a move that could strengthen fiat infrastructure for crypto players and improve access to liquidity.

On Thursday, Fiserv announced the debut of INDX, a real-time cash settlement system that operates 24 hours a day, 365 days a year. The platform allows digital asset companies to move US dollars instantly using a single custodial account, potentially improving how exchanges, trading desks and other crypto businesses manage fiat balances.

INDX will be made available to more than 1,100 insured financial institutions participating in the Fiserv Deposit Network. The account structure provides up to $25 million in Federal Deposit Insurance Corporation (FDIC) coverage, according to the company.

The launch is notable because many digital asset companies still rely on traditional banking rails that operate only during business hours or on onchain token transfers to move dollar value. By enabling round-the-clock US dollar settlement within the banking system, INDX offers functionality similar to blockchain-based settlement while remaining offchain.

Fiserv is one of the largest payments and financial services technology providers globally, offering core banking, merchant acquiring and transaction processing services. The company generated more than $21 billion in revenue in fiscal 2025.

Fiserv has also expanded its footprint in digital assets. As Cointelegraph reported in October, the company is involved in North Dakota’s state-backed stablecoin initiative, where it is providing payments and settlement infrastructure to support the project’s rollout.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

TradFi and digital assets continue to converge

INDX is the latest example of an established financial institution building infrastructure for the digital asset sector. For institutional clients, the platform offers a more familiar banking framework while introducing faster, always-on cash management capabilities.

The system could also position Fiserv ahead of legacy banking partners that still depend on batch-based processing for US dollar transfers. For crypto infrastructure providers, including exchanges, trading desks, stablecoin issuers and custodians, reliable, real-time dollar liquidity can provide a meaningful operational advantage.

The Milwaukee, Wisconsin company in December completed the acquisition of Stone Castle Cash Management, which provides banks liquidity, in a move widely seen as bolstering its FIUSD stablecoin, launched in June 2025

Beyond settlement speed, stablecoins are increasingly being viewed by traditional financial institutions as liquidity infrastructure. Always-on digital dollars can facilitate collateral movement, treasury operations and cross-border payments with fewer intermediaries and less settlement friction.

While INDX stands out for combining traditional bank settlement with continuous-dollar availability tailored to digital-asset companies, other companies have also prioritized real-time settlement.

For example, Sygnum operates a round-the-clock multi-asset network that enables instant settlement across fiat currencies, stablecoins and other digital assets for institutional clients.

Similarly, Fireblocks supports real-time settlement infrastructure for stablecoins and digital asset transfers, helping institutions streamline liquidity management.

Related: How TradFi banks are advancing new stablecoin models

Crypto World

Apple Stock Tumbles as Censorship Claims, AI Spending Fuel Investor Concerns

TLDR

- Apple stock dropped more than 5% following political controversy and regulatory scrutiny.

- The Federal Trade Commission raised concerns about political bias on Apple News.

- Several institutional investors reduced their exposure to Apple stock amid growing risks.

- Apple’s increasing investments in artificial intelligence are raising concerns about rising costs.

- Despite strong quarterly earnings, investor confidence in Apple has weakened due to regulatory and political challenges.

Apple’s stock suffered a sharp decline after facing new political controversies, investor caution, and concerns about escalating AI investments. Despite a strong performance last week, Apple’s shares dropped more than 5% on Thursday. Regulatory issues and increasing scrutiny over its content platform added to the uncertainty.

Rally Reverses as Political Controversy Erupts

The reversal of Apple’s stock came after the Federal Trade Commission (FTC) raised concerns about political bias on the Apple News platform. FTC Chair Andrew Ferguson urged CEO Tim Cook to investigate claims of censorship, specifically regarding conservative outlets. The allegations suggest that Apple News may be promoting left-wing content while suppressing conservative views.

The FTC’s letter highlighted reports that claimed Apple News was skewed toward liberal sources. Apple, however, has yet to publicly respond to these allegations. This political controversy comes at a time when technology companies are already under close regulatory scrutiny.

Apple Stock Sees Institutional Investor Withdrawals

As political risks grew, institutional investors began reducing their exposure to Apple stock. Reports revealed that NBT Bank reduced its position by 5.3%, while Campbell & Co cut its holdings by over 70%. Other firms, such as Gamco, also lowered their stakes, signaling a shift in sentiment toward Apple’s stock.

These moves reflect a broader rotation out of large tech stocks as investors seek safer investments in the current market climate. The growing regulatory scrutiny, along with political controversies, has made Apple a less attractive option for some institutional investors. This caution comes after a long period of strong performance, during which Apple’s stock price reached new highs.

AI Spending Raises Fresh Concerns

Apple’s growing investment in artificial intelligence (AI) has raised additional concerns for investors. CEO Tim Cook has called AI a “profound opportunity,” but the rising costs associated with AI development are becoming a concern. Apple’s recent acquisition of Israeli startup Q.ai, which focuses on advanced human-computer interaction, highlights the company’s deepening commitment to AI.

Investors are increasingly questioning the high costs involved in AI research and infrastructure. The capital required to compete in the AI sector, especially for specialized chips and data centers, could put pressure on Apple’s profit margins. There are concerns that the commercial viability of certain AI technologies may not justify the hefty investment required in the short term.

Despite these challenges, Apple’s financial performance remains strong. The company’s recent quarterly results showed a 16% increase in revenue, reaching $143.8 billion. The iPhone continues to be a key driver, with record sales of $85.3 billion. However, investors are now focusing on how effectively Apple can manage its increasing AI costs and whether these investments will translate into long-term growth.

In the meantime, Apple continues to benefit from favorable policy changes in India, which support its supply chain strategy. However, these long-term advantages do little to ease investor concerns in the near term, as political scrutiny and AI-related costs dominate the narrative around the company’s future prospects.

Crypto World

March Rate-Cut Odds Fade

The hot January jobs report had traders rethinking bets on multiple interest-rate cuts before July.

Odds of a quarter-point cut at the Federal Reserve’s March policy meeting fell to 6% from 20.1% prior to the report.

Through the June meeting, odds of no cuts surged to 40.4% from 24.8%. Odds of a single quarter-point cut were at 49.4% from 49%, while odds of a half point in cuts or more fell to 10.2% from 26.2%.

Crypto World

Stock Futures Pop After Stronger-Than-Expected January Jobs Report

Stock Futures Pop After Stronger-Than-Expected January Jobs Report

Crypto World

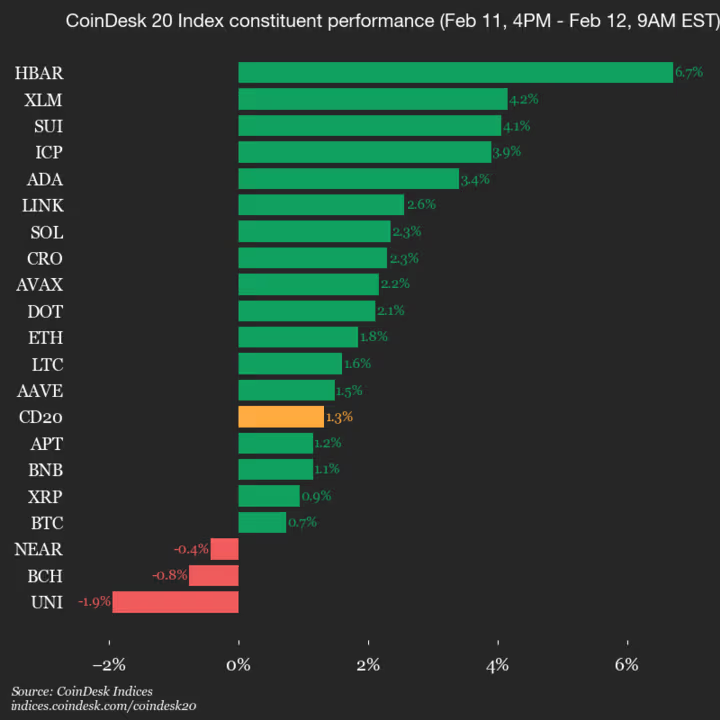

Hedera (HBAR) rises 6.7%, leading index higher

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 1943.37, up 1.3% (+25.4) since 4 p.m. ET on Wednesday.

Seventeen of the 20 assets are trading higher.

Leaders: HBAR (+6.7%) and XLM (+4.2%).

Laggards: UNI (-1.9%) and BCH (-0.8%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

Crypto World

Only 5% of companies see AI boosting bottom line, McKinsey’s Joe Ngai tells Consensus

Nearly every major company in the world is experimenting with artificial intelligence, but almost none are changing meaningfully as a result, McKinsey’s chairman of Greater China, Joe Ngai, told Consensus Hong Kong on Thursday.

Internal surveys show 98% of corporate executives report implementing some form of AI, Ngai said. But when asked how much of that is deployed at scale, “that number drops significantly” to less than 20%, he said. When it comes to measurable profit impact, it’s 5%.

The bottleneck, Ngai argued, isn’t technical capability, it’s organizational design.

Modern corporations, he said, are built on “layers of people, hierarchies, managers and reporting.” In an AI-native world, that structure becomes friction.

Instead of reimagining business models, most firms are layering AI pilots onto legacy processes, seeking approvals, testing small use cases and protecting reporting lines.

“That is actually not where you get the most benefit out of AI,” Ngai said. “The bottleneck of AI implementation is actually people.”

From his vantage point in China, Ngai sees a different approach. Chinese companies have spent a decade digitizing operations around mobile and data. As a result, the “receptance … on agentic and AI is far greater,” with less resistance from labor structures and legacy governance.

Unlike Western discourse, which often centers on frontier models and artificial general intelligence, China’s focus is pragmatic: “There’s a lot less talk about the models … there’s a lot more talk around usage.”

Ngai also highlighted embodied AI, such as robotics, automation and autonomous driving, as a major frontier. Given China’s supply chain scale, he predicts a coming “robot dividend,” arguing the country may soon deploy more robots than humans, offsetting demographic decline and reshaping industrial productivity.

Ngai described 2026 as defined by two opposing forces: geopolitical uncertainty and technological acceleration. CEOs are navigating tariffs and fragmentation on one hand, and AI-driven transformation on the other. Yet corporate earnings remain resilient.

Crypto World

Gate CEO Lin Han says banks have lost the ‘existential’ war against stablecoins

The traditional four-year crypto cycle, long-tethered to bitcoin’s halving events, may be a thing of the past.

Han Lin, founder and CEO of Gate and an early advocate of bitcoin, told CoinDesk on Thursday the digital asset market has matured into a global macroeconomic pillar that now moves in lockstep with U.S. equities and AI-driven technological shifts rather than internal supply shocks.

Lin, who leads the world’s fourth-largest exchange with daily volume exceeding $2 billion, laid out his vision of an industry that has transitioned from an “existential threat” to the foundational infrastructure of traditional finance.

The American Bankers Association (ABA) urged U.S. Congress to ban yield on payment stablecoins and revise open banking rules, framing the changes as necessary for consumer protection and competitive balance. Crypto and fintech critics say the ABA’s agenda would tilt the regulatory playing field toward banks by limiting how wallets, stablecoin issuers and apps can access users and their financial data.

“I don’t believe in the four-year cycle anymore,” Lin said, noting that Gate (formerly Gate.io) is positioning itself for an upward move driven by the convergence of crypto and TradFi. “The market is bigger now. It is more related to the global economy and the U.S. stock market. You cannot see it as isolated.”

Lin’s outlook comes as Gate executed a massive global rebranding, moving to the Gate.com domain and securing high-profile sponsorships with Oracle Red Bull Racing and Inter Milan. The goal, Lin says, is to prepare for a wave of real-world asset (RWA) tokenization that extends far beyond the current stablecoin market.

While stablecoins like USDC and USDT are the “most successful use cases” today, Lin anticipates a rapid migration of stocks, precious metals, and commodities onto the blockchain. Gate is already facilitating this shift, offering users access to traditional assets in a tokenized, 24/7 format.

“We will beat traditional exchanges and banks very soon,” Lin claimed, citing the inherent efficiency of onchain liquidity. He argues that while legacy institutions like the New York Stock Exchange are only now exploring 24/7 trading, crypto-native platforms have already perfected the infrastructure required for a round-the-clock global market.

Lin dismissed the idea that stablecoins are an inherent threat to bank deposits. Instead, he views them as a technological upgrade that banks are increasingly eager to adopt.

“I have talked with some banks; they are no longer eager to go against crypto,” Lin said. “They can use stablecoins to accelerate their own service. We use them as a rail for money transfer.”

Despite the competitive landscape, Lin confirmed that his crypto exchange has no plans to develop its own stablecoin, preferring to remain a neutral venue that integrates existing tokens like Circle’s USDC. This strategy focuses on “building the infrastructure” rather than competing with the assets themselves.

Market resilience and AI tailwinds

Despite a volatile 2025 that saw many retail participants sidelined, Lin remains bullish on the “believers” who continue to accumulate at low points. He points to the 15x growth in crypto-based payments over the last two years as evidence that digital assets are finding “real-world utility” beyond simple speculation.

Lin sees the current AI boom as a “strong support” for crypto. As investors hunt for the next technological frontier, the intersection of AI and blockchain, particularly in lowering the barrier to entry for new users, is expected to drive the next wave of adoption.

“We don’t care about the price alarms,” Lin concluded. “We care about the applications. We are making it lower cost and more efficient. The technology works, and nobody can stop that.”

Crypto World

Bitcoin price could bottom at $65K before major relief rally

Bitcoin price is approaching a critical $65,000 support zone where Fibonacci and channel confluence suggest a potential local bottom may form before a strong relief rally unfolds.

Summary

- Rising channel support and 0.618 Fibonacci converge near the $64,400–$65,000 zone

- Local downtrend likely persists until stronger support is tested

- Bullish volume at support could spark a relief rally toward channel resistance

Bitcoin (BTC) price action remains corrective in the near term, with the market continuing to rotate lower within a broader rising channel. After failing to hold the channel midpoint, BTC has slipped into a weaker internal trend, putting downward pressure on the price as sellers remain in control.

Despite this weakness, the broader structure does not yet signal a macro breakdown. Instead, current conditions suggest Bitcoin may be nearing a high-probability support zone where a temporary bottom could form.

This type of environment often precedes internal rotations within an uptrend, where price revisits deeper support before attempting a recovery. The focus now shifts to whether Bitcoin can find demand near the lower boundary of its rising channel.

Bitcoin price key technical points

- Rising channel structure remains intact, despite the loss of mid-channel support

- 0.618 Fibonacci retracement aligns with channel support near the $64,400–$65,000 zone

- Bullish volume at support is required, to confirm a relief rally and trend continuation

Bitcoin has been trading within a rising channel that has guided price action over recent months. The recent loss of the channel midpoint marked an important shift in short-term momentum, indicating that buyers were unable to maintain control at higher value levels. Once this internal support failed, price began rotating lower toward the stronger structural support at the channel low.

This type of movement is common in trending markets. Rather than immediately reversing, price often seeks deeper liquidity and stronger technical confluence before stabilizing. The current downtrend on lower timeframes reflects this internal rotation rather than a full trend reversal.

Importantly, this move lower has occurred without aggressive expansion in bearish volume, suggesting controlled selling rather than panic-driven capitulation.

$65,000 support zone comes into focus

The next major technical level sits near the $64,400–$65,000 region. This zone represents a strong confluence of technical factors, including the 0.618 Fibonacci retracement of the broader move and the lower boundary of the rising channel. When Fibonacci retracements align with structural channel support, they often act as high-probability reaction zones.

A move into this area would complete the current internal rotation within the channel. As long as price holds this support on a closing basis, the broader bullish structure remains intact. This makes the $65,000 region a key area where buyers may step in to defend trend continuation.

‘No Man’s Land’ consolidation likely before support test

At present, Bitcoin is trading between major support and resistance levels, an area often described as “no man’s land.” In these zones, price action tends to be choppy, with limited follow-through in either direction. Consolidation in this region is typical as the market prepares for its next decisive move.

As long as BTC remains below reclaimed resistance and above major support, further ranging and slow drift lower remain likely. This environment often frustrates both bulls and bears, but it is a necessary phase before larger rotations unfold.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Bitcoin appears to be nearing the latter stages of its current corrective rotation. While short-term downside risk remains, the $64,400–$65,000 region stands out as a potential bottoming zone.

For a meaningful relief rally to begin, Bitcoin will need to show a clear reaction at its support level. This includes strong bullish volume, rejection wicks, and acceptance back above short-term value levels.

If these conditions are met, price could rotate back toward the upper boundary of the rising channel, with the $75,000 region acting as the next major resistance target.

Crypto World

Pakistan’s Bilal Bin Saqib says crypto is a necessity, not a luxury

Pakistan didn’t just wake up one morning and decide that it loves crypto, said the chairman of the country’s Virtual Assets Regulatory Authority (PVARA).

The country was in the unusual position of having one of the largest crypto markets on the planet, but no guardrails at all, PVARA chairman Bilal Bin Saqib told Consensus Hong Kong 2026 on Thursday.

“In 2025, Pakistan did realize that we have approximately 40 million of its citizens who are already trading digital assets with zero rules, zero protection, and zero benefit flowing back to the state,” Bin Saqib said via virtual link. “The market existed, but the regulations didn’t. So essentially, we tried to move from a gray market into a governed market.”

In fact, Pakistan boasts the third largest crypto market by retail activity, ahead of places like Germany and Japan, Bin Saqib said. This is because Pakistan isn’t just an emerging economy, it’s also a young country in terms of demographics. Some 70% of the 250 million population are under the age of 30.

“We are one of the most tech savvy youth populations on the planet,” the PVARA chairman said. “We have over 100 million unbanked citizens, people who have no saving tools, no investment tools, no way to break out of their economic class. And hence why crypto and blockchain are not a luxury for Pakistan. It’s a ladder for the masses.”

Pakistan’s bitcoin strategic reserve and national mining plans

One area of interest for the crypto industry was Bin Saqib’s announcement last year at Bitcoin Las Vegas that Pakistan was planning to establish a strategic bitcoin BTC $68,087.00 reserve and support bitcoin mining.

Bin Saqib pointed out it wasn’t just “an announcement,” but added that “when you are dealing with something as strategic as the Bitcoin reserve or the national energy allocation, speed without structure can be dangerous.”

As for the reserve, “the first step is we’ve identified the digital assets that are held by the state, moving them into a formal state controlled custody framework, and that establishes transparency, accountability and the standards. It’s not about speculation; it’s about treating digital assets as sovereign wealth,” Bin Saqib said.

On the mining side, he said: “We’ve identified the sites where we have surplus electricity, and now we are assessing the economics and the impacts, and at the same time, we are also engaging with global miners and also AI compute operators.”

The project is about following a “responsible partnership model,” Bin Saqib said, because this is not just a stand alone crypto experiment.

“It’s part of a broader strategy around energy optimization, compute capacity and our national digital infrastructure. Because Bitcoin mining and AI data centers are the two mechanisms for converting unused energy into productive capacity for our country.”

Crypto World

Sharplink Executives Promote Ether as Productive Asset Amid Price Drops

TLDR

- Sharplink executives Joe Lubin and Joseph Chalom emphasize the importance of ether as a productive financial asset.

- Despite market volatility, Sharplink continues to treat ether as a long-term investment to generate consistent returns.

- Sharplink’s strategy contrasts with traditional ETFs by focusing on permanent capital and staking ether for yield.

- Chalom highlights Ethereum’s growing role in global finance through stablecoins and tokenization.

- Lubin compares the evolution of blockchain to the early internet era, predicting that every company will soon be a blockchain company.

As Ether prices face sharp fluctuations, Sharplink Gaming continues to defend its strategy of treating Ether as a productive asset. The company’s approach revolves around utilizing ether not just as an investment but as a means to generate consistent financial returns. Sharplink’s executives, Joe Lubin and Joseph Chalom, have emphasized the long-term value of decentralized finance (DeFi) solutions during a panel discussion at Consensus Hong Kong 2026.

Sharplink’s Commitment to Ether as a Long-Term Asset

Sharplink Gaming’s executives have expressed strong confidence in the potential of Ether (ETH) as a valuable asset. Chalom pointed out that, despite the market’s volatility, the broader outlook for Ethereum has never been stronger.

“The actual macro tailwinds for Ethereum have never been better in its 10-and-a-half-year history,” he stated.

He referred to the growing adoption of stablecoins and the rise of tokenization as key factors behind the blockchain’s expanding role in global finance. Chalom also highlighted a comment by BlackRock’s Larry Fink, noting that $14 trillion of assets are expected to be tokenized, with over 65% of this occurring on Ethereum.

Sharplink’s approach contrasts with the passive investment strategy of traditional crypto exchange-traded funds (ETFs). Instead of relying on daily liquidity, the company focuses on deploying permanent capital into ether.

According to Lubin, the yield generated through ether staking is a key aspect of their strategy.

“Ether would be a much better asset… because it is a productive asset. It yields. It has a risk-free rate,” Lubin said.

Sharplink’s decision to stake nearly all of its ether holdings has allowed the company to accumulate consistent returns.

Evolving DeFi Strategies for Institutional Investors

Sharplink’s strategy also emphasizes the importance of “good institutional DeFi,” according to Chalom. The company focuses on long-term locked capital, aiming for stable, risk-adjusted returns rather than high-risk, high-reward ventures typical of venture capital (VC) investments.

“We’re not looking for convex VC 10x outcomes, we’re looking for the best risk-adjusted yield for our investors,” Chalom explained. This method, according to Chalom, helps improve the DeFi ecosystem by setting higher standards for institutional engagement.

In their view, the institutional adoption of DeFi will increase over time as firms seek more stable, productive assets on their balance sheets. Lubin compared the evolution of blockchain to the early days of the internet. He noted that while companies once existed solely as internet companies, soon every firm will be a blockchain company. According to Lubin, the future will see more corporations holding tokens on their balance sheets and using sophisticated onchain treasury tools.

Crypto World

Argentina Congress Blocks Right To Take Salary In Crypto

Argentine fintech groups had welcomed the possibility that, for the first time, workers could deposit their salaries into virtual wallets. However, lawmakers removed the provision, a move widely seen as favoring traditional banking interests.

During negotiations to secure broader support for the bill, President Javier Milei’s party agreed to exclude the article, despite polls indicating that a large majority of Argentines prefer the freedom to choose where their salaries are deposited.

Sponsored

Distrust In Banks Drives Wallet Adoption

Argentine law today stipulates that workers must deposit their salaries into traditional bank accounts. Despite that law, digital wallet adoption in Argentina has soared over the past few decades.

In part, that growth reflects limited access to banking. A 2022 Central Bank survey found that only 47% of Argentines had a bank account, a gap largely driven by longstanding distrust of traditional systems.

Decades of financial instability, including the 2001 “corralito” deposit freeze, persistent inflation, and repeated restrictions on access to funds, have eroded public trust in banks and accelerated a shift toward cash and dollar-denominated savings.

In response, fintech-run digital wallets, operated by non-bank payment service providers, have expanded access to financial services across Argentina.

Sponsored

Platforms such as Mercado Pago, Modo, Ualá, and Lemon now rank among the most widely used. Many users without access to traditional bank accounts rely on these apps as their first point of entry into the formal digital financial system.

That’s why fintech leaders welcomed a provision that would have allowed Argentines to deposit their salaries directly into virtual wallets. However, the article was cut out of the proposed labor reform before it was even debated in Congress.

“The exclusion of Article 35 from the labor reform eliminated the possibility for Argentinians to freely choose where to receive their salary. In practice, the obligation to channel salaries through traditional banks was maintained, following strong pressure from the sector,” Maximiliano Raimondi, CFO of Lemon told BeInCrypto. “Governing involves negotiation, but it’s paradoxical that in a context where economic freedom is a central tenet, there has been a setback on a point that expanded a concrete freedom.”

That setback followed an intense lobbying effort by Argentina’s banking sector, which moved quickly to block the proposal.

Sponsored

Political Trade Off Favors Banks

Banking associations sent letters to key senators this week outlining their objections to allowing salary deposits into digital wallets.

They argued that digital wallets lack adequate regulation, pose potential systemic risks, and could deepen financial exclusion.

“They do not have a regulatory, prudential or supervisory framework equivalent to that of banks and their approval would generate legal, financial, asset and systemic risks that would directly affect workers and the functioning of the financial system,” said Banco Provincia, a leading Argentine bank, in a statement.

Sponsored

Fintech organizations pushed back, arguing that these claims were false.

“All Payment Service Providers (PSPs) are regulated and supervised by the Central Bank of Argentina (BCRA)… digital wallets were the gateway to financial services for millions of people who were able to open a virtual account easily and free of charge, and access better financial solutions,” Lemon said in a statement.

A recent study by consulting firm Isonomía also found that 9 out of 10 Argentines wanted the option to choose where to deposit their salaries. The tendency was even stronger among independent workers and those who work in the informal sector. The report also revealed that 75% of Argentines already use digital wallets daily.

Ultimately, the banking sector prevailed before the bill reached a Senate vote. According to reports, the government removed the provision to avoid straining relations with banks and to improve the bill’s chances of securing final approval.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video22 hours ago

Video22 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’