Crypto World

How to launch your crypto exchange software in Georgia in 2026?

Bybit and Bitget, both amongst 10 crypto exchange software by global trading volume, entered Eastern Europe with Georgian Virtual Asset Service Provider registration in 2025. That wasn’t random but strategic.

Since then, Bybit has treated Georgia as a launchpad, not a checkbox jurisdiction. The rollouts have been deliberate and aggressive:

- Bybit Georgia with one-click crypto purchases

- A crypto card launch in January 2026, bridging spending and trading

- Upcoming neobank features, including IBAN accounts expected in February

This is not how cryptocurrency exchanges behave in unstable and speculative markets. This behavior reflects predictable regulations, workable banking access, and long-run expansion economics make sense.

Georgia fits that profile.

If you’re any of those planning your cryptocurrency exchange development for launch in Georgia:

- Entrepreneurs building long-term exchange businesses

- Stock exchanges evaluating crypto and tokenized assets

- Brokerage firms expanding into digital markets

- Fintechs launching regulated trading infrastructure

This guide is for you.

Why is Georgia Quietly Becoming a Crypto Exchange Software Base?

Until 2023, cryptocurrency exchanges in Georgia operated in a grey, lightly supervised environment, but not anymore.

-

- The National Bank of Georgia (NBG) now regulates crypto under a defined VASP framework.

- Exchanges register instead of negotiating regulatory uncertainty.

- AML and KYC are enforced proportionally, aligned with FATF guidance.

- Entry and compliance costs remain far lower than in the EU, UK, or US.

To date, Georgia is officially legally clear for operators and investable for institutions that can’t touch unregulated markets.

-

Small Population, Outsized Impact

With over 3.7 million people, Georgia ranks among the top three countries in the 2025 Chainanalysis Global Crypto Adoption Index (population-adjusted). And even more important than ownership is Georgian behavior, as testified by various recent research.

-

- Eastern Europe remains underbanked but crypto-active.

- Retail traders actively move between spot trading, wallets, and DeFi protocols

- On-chain usage remains strong relative to population size.

- Regular use of crypto beyond speculation

- Users are comfortable with self-custody, stablecoins, and cross-platform movement.

This creates a real user base that understands trading mechanics, adopts new financial tools quickly, and does not require heavy education to onboard. All of this also reduces friction at the launch of the crypto exchange software.

-

Favorable For Operators & Traders

Georgia’s crypto appeal is not driven by retail hype but operational hype.

-

- 0% capital gains tax for individual crypto holders

- VAT exemption on crypto transactions

- Crypto exchanges can scale operations without an early tax drag. They don’t pay tax when they earn profit or reinvest it, but when they pay dividends, 5% tax applies.

- Affordable licensing and entity setup

- No political or regulatory hostility toward crypto businesses

For exchange founders, this directly impacts:

-

- User acquisition efficiency

-

- Market maker participation

-

- High-frequency and professional trading activity

-

- Long-term retention of active users

It also creates a clear path for stock exchanges and brokerages to introduce regulated crypto trading, tokenized assets, and hybrid digital markets.

-

Remittances and Stablecoin Effect

One of the strongest drivers of crypto usage in Georgia is remittances.

-

- Georgia receives over $2 billion annually in cross-border remittances.

- Major remittance corridors for Georgia include the US, Russia, and Turkey.

- Traditional remittance fees often range between 7-10%.

Stablecoins, primarily USDT and USDC, offer a cheaper and faster alternative to traditional remittance systems, and users in Georgia already understand fiat-pegged crypto assets. Those seeking a cryptocurrency exchange software development company must build with those who can implement fiat on/off ramps along with P2P rails within crypto exchanges.

-

Mining Legacy and Infrastructure Advantage

For years, Georgia was an active mining hub due to low energy costs and early openness to crypto operations. While large-scale mining has since normalized globally, its impact on local adoption patterns remains.

-

- Georgia’s crypto adoption did not begin with trading apps. It began with infrastructure. In markets without a mining or infrastructure phase, crypto usually enters as a price chart, meme, or quick-profit instrument. In Georgia, crypto entered earlier as hardware, energy economics, wallets, custody, long-term holding, and not as a speculative instrument. That changes user psychology.

- Mining-heavy ecosystems produce wallet-native users and not just app-only users who are comfortable with private keys and custody. They have a higher tolerance for advanced products such as derivatives, tokenized assets, on-chain settlement mechanisms, etc. So, it ultimately lowers onboarding friction and education costs for those planning advanced cryptocurrency exchange development.

For cryptocurrency exchange software operators planning an initial launch, Georgia becomes a launchpad that enables:

-

- Liquidity bootstrapping with high-intent users

- Active, stablecoin-heavy order books

- Early adoption of new products such as derivatives, tokenized assets, yield products, etc.

Georgia vs “Popular” Crypto Jurisdictions

| Jurisdiction | Regulatory Clarity | Tax Burden | Cost to Launch | Institutional Viability |

|---|---|---|---|---|

| EU (MiCA) | High | High | Very High | Strong, slow |

| USA | Fragmented | High | Very High | Legally risky |

| UAE | High | Medium | High | Strong |

| Offshore hubs | Low | Low | Low | Weak |

| Georgia | High | Low | Low | Strong |

Regulatory Framework for Crypto Exchange Software in Georgia

Georgia’s crypto regulation doesn’t live in assumptions or interpretations but is driven by processes, filings, and enforcement. This section breaks down how the Georgian crypto exchange registration regime works in practice.

1. Who Regulates Crypto Exchange Software in Georgia?

As stated above, crypto exchange operators in Georgia have been regulated by the National Bank of Georgia (NBG) under the Law on the Registration of VASP since July 1, 2023. The Georgian Lari remains the only legal currency. However, crypto trading, custody and exchange operations are explicitly regulated under the VASP framework.

The National Bank of Georgia (NBG) does not operate like a product gatekeeper. It does not:

- Approve or reject individual tokens

- Certify each trading pair

- Review every new crypto product before launch

Instead, it regulates the cryptocurrency exchange software operator, not each asset. It only evaluates whether a VASP:

- Has proper AML/KYC controls

- Can monitor and report suspicious activity

- Has governance, risk, and operational controls in place

- Can prevent market abuse, fraud, and illicit finance

Once a VASP is registered, the responsibility for what it lists lies with the exchange, not with NBG, provided it stays within the regulatory boundaries.

2. Who Must Register as a VASP?

Any entity providing crypto-related financial services from or within Georgia must register as a VASP with the NBG.

This includes, but is not limited to:

- Centralized crypto exchanges: Platforms facilitating spot, derivatives, or margin trading

- Custodial wallet providers: Services holding private keys or assets on behalf of users

- Crypto/fiat service providers: Fiat on-ramps, off-ramps, and settlement platforms

- OTC desks and brokerage-style platforms: Particularly relevant for institutions, high-net-worth clients, and mining firms

For stock exchanges and brokerages planning cryptocurrency exchange development, this means operations cannot be treated as a side or unregulated activity. If digital assets are offered, VASP registration becomes mandatory.

3. VASP Registration Requirements

Georgia’s VASP registration is documentation-driven and process-oriented.

A. Corporate Structure & Disclosures

Crypto exchange software applicants must submit:

- Legal entity details (Georgian incorporation or registered branch)

- Ownership structure and ultimate beneficial owners (UBOs)

- Business model description (products, markets, target users)

- Operational flow of funds and assets

B. AML / KYC Systems

VASP applicants applying for their wallet or crypto exchange development projects must demonstrate:

- Risk-based customer onboarding procedures

- Identity verification aligned with FATF guidance

- Transaction monitoring systems

- Suspicious activity reporting workflows

- Sanctions screening and record retention

Georgia does not allow anonymous or privacy-focused assets that prevent traceability. Exchanges must be able to explain how illicit activity is detected and mitigated.

C. “Fit and Proper” Management Checks

Key personnel among crypto exchange software operators are assessed for:

- Professional competence

- Relevant financial or compliance experience

- Clean legal and regulatory history

This applies to directors, senior management, and compliance officers

D. Reporting & Ongoing Obligations

Registered VASPs are required to:

- Maintain transaction and customer records

- Submit periodic activity and volume reports

- Cooperate with regulatory inspections

- Notify the NBG of material changes (ownership, services, governance)

Non-compliance can result in financial penalties, operational suspension, and deregistration as a VASP

E. Costs Associated With Georgian Cryptocurrency Exchange Software Registration

The State registration fee is approximately 1,500 GEL, and there are no excessive capital lock-up requirements. This keeps Georgia accessible for:

- Startups with serious intent

- Regional exchanges

- Stock exchanges that are testing digital asset markets

- Fintechs expanding into crypto trading

Step-by-Step: How to Launch a Crypto Exchange Software in Georgia in 2026

1. Define the Business Model & Jurisdictional Structuring

Before the incorporation of their crypto exchange software or licensing, founders must lock in three decisions:

- Target users (retail, institutional, remittance, regional)

- Asset focus (crypto-only, stablecoins, tokenized assets)

- Operating footprint (Georgia-only vs regional hub)

Those planning their crypto exchange development must learn that Georgia works best when treated as a safe gateway into Eastern Europe and a regulated operating base, and not as a domestic market or loophole jurisdiction.

Also, when you’re deciding on cryptocurrency exchange software models, you must not clone any existing random exchange. The best way is to pick models that regulators and banking environments support.

Top Cryptocurrency Exchange Software Development Models For Launch in Georgia Include:

A. Centralized Exchanges: Best suited for crypto exchange software development projects building fiat on/off ramps, compliance-heavy trading environments, or those targeting institutional and professional traders.

Why this works in Georgia:

- Georgian banks are most compatible with custodial structures.

- Easier alignment with AML and reporting expectations under the National Bank of Georgia.

- Market makers prefer centralized custody and execution predictability.

For stock exchanges or brokerages entering crypto, a centralized exchange development model is quite low-friction.

B. Hybrid Custody Exchange: Hybrid custody crypto exchange development combines centralized order books and matching engines with self-custodial as well as centralized wallets.

Why this fits Georgia well:

- Compliance remains centralized and auditable

- Custody models can evolve gradually

- Supports future expansion into tokenized assets

Georgian stock exchanges and financial institutions extending existing infrastructures without abandoning established governance models can leverage such models.

C. Niche Exchanges: Those planning a domestic cryptocurrency exchange software development must not build retail-focussed platforms but can go for focused niches including:

- Stablecoin-focused remittance exchanges (USDT/USDC corridors)

- Mining-community and professional trading

- Regional liquidity hubs serving Eastern Europe and CIS markets

2. Entity Setup in Georgia and VASP registration

Once the cryptocurrency exchange software model is finalized, it’s time to:

- Incorporate a Georgian legal entity or register a branch

- Define ownership and beneficial controllers

- Appoint directors and compliance officers aligned with VASP requirements

A cryptocurrency exchange software development company can help structure an entity based on:

- The exchange model selected above

- Future product scope (derivatives, tokenized assets, custody)

After setting up the entity, all crypto exchange software must register as VASPs.

3. Crypto Exchange Software Development

Collaborate with your cryptocurrency exchange software development company to bring these essential components together and weave them with compliance and security.

- High-performance matching engine and order management

- Wallet and custody infrastructure (hot/cold segregation)

- User accounts, balances, and permissions

- Admin and compliance dashboards

- APIs for liquidity providers and market makers

Now, since businesses need to build for the Georgian market, they need to devise the right fiat and banking settlement strategy to establish a workable fiat on/off ramp. They must have clear custodial structures, transparent fund flow documentation, and strong AML alignment for compliance with Georgian banks.

Also, cryptocurrency exchange software development won’t work in 2026 and beyond until it aligns with top Georgian digital asset trends. Modern platforms are expected to support:

- Tokenized asset readiness, including tokenized stocks, bonds, and commodities, with clear separation between primary issuance workflows and secondary market trading, ownership traceability, transfer controls, and secondary-market structures suitable for institutional participation rather than unrestricted retail issuance.

- Stablecoin-centric market design, where USDT and USDC function as core base pairs, enabling fiat-light settlement flows, efficient cross-border remittance use cases, and treasury, margin, and liquidity management denominated primarily in stablecoins.

- Embedded, institutional-grade compliance technology, covering real-time transaction monitoring, on-chain analytics and risk scoring, automated regulatory and activity reporting, and rule-based alerts with full audit trails to meet ongoing supervision expectations under the NBG.

4. Security and Liquidity:

Strong cryptocurrency exchange development liquidity directly impacts regulator confidence, banking relationships, and institutional adoption. So, crypto trading platforms must implement the following security essentials:

- Hot and cold wallet segregation

- Key management and access controls

- Custody auditability

- Incident response procedures

Also, for initiating trading instantly, crypto exchange software solutions need to plan liquidity mechanisms that align with the exchange model, target users, and asset scope. Georgia-based cryptocurrency exchanges typically rely on:

- Professional market makers

- Liquidity aggregation APIs

- Stablecoin-denominated order books

- OTC partnerships for large trades

5. Go-live, Audits & Scaling

Before the public launch, operators must collaborate with a cryptocurrency exchange software development company to:

- Conduct internal and third-party audits

- Test compliance reporting workflows

- Validate banking and settlement flows

Post-launch, they can scale on the following:

- Regional expansion

- New asset classes

- Tokenized markets

- Institutional partnerships

Final Takeaway

Georgia’s VASP regime is designed to filter out anonymous operators, compliance-averse exchanges and regulatory arbitrage plays. It also supports predictable licensing timelines, banking relationships, institutional participation, and expansion into tokenized assets and regulated crypto products.

If you’re serious about launching a regulated crypto exchange in Georgia, Antier offers custom and compliance-ready white label cryptocurrency exchange infrastructure that regulators approve and that users trust.

Share your project requirements today!

Crypto World

Where Is The Best Place To Turn $500 Into $5,000? Remittix Rewards Presale Investors With 300% Bonus

As investors search for high-upside opportunities in a cautious crypto market, Remittix is drawing serious attention. The PayFi-focused project has already raised over $28.9 million, launched a live wallet and is now offering a limited 300% bonus to presale participants.

With real product traction and tightening supply, Remittix is increasingly viewed as a rare early-stage setup with asymmetric potential.

Why Remittix Is Drawing Capital Right Now

Remittix is not competing on hype. It is competing on usefulness. The project is building a full PayFi ecosystem that allows users to convert crypto into fiat and send funds directly to bank accounts worldwide. No delays. No hidden charges. No complex steps.

This focus on everyday payments is resonating with both retail investors and businesses. Remittix solves that problem directly.

Momentum is already visible. Over 701 million tokens have been sold and the token price has climbed steadily to $0.123. The Remittix Wallet is live on the App Store. This will give users hands-on access to the ecosystem before the core crypto-to-fiat feature launches on February 9th 2026.

Security and credibility also matter in this stage of the market. Remittix has been fully verified by CertiK, with audited smart contracts and a public development roadmap. Exchange exposure is lining up as well, with BitMart confirmed and LBank announced.

These factors explain why many analysts now describe Remittix as a best crypto to buy now for investors seeking real utility rather than narrative-driven speculation. With the presale entering its final stretch, some are already framing RTX as a top crypto under $1 that still offers early-entry dynamics.

The 300% Bonus Is Driving Urgency

The strongest short-term catalyst is the limited 300% bonus, available for just 72 hours. This incentive dramatically increases token allocation for early participants and has accelerated inflows across the presale.

Combined with a referral program that rewards community growth, the structure favors fast movers rather than passive observers.

What presale investors are getting right now

- A time-limited 300% bonus that multiplies initial token allocation

- A 15% referral reward paid in USDT and claimable every 24 hours

- Confirmed centralized exchange listings starting with BitMart

- A live wallet product with crypto-to-fiat functionality launching next

This combination is why some investors believe Remittix offers one of the clearest risk-reward profiles currently available. Turning $500 into $5,000 is never guaranteed. However, bonus mechanics, fixed supply and early-stage pricing significantly shift the math.

At $0.123, RTX still sits firmly in top crypto under $1 territory. With supply tightening and bonuses expiring, many see this window as unusually short. That urgency is also why Remittix keeps appearing in conversations around the best crypto presale opportunities this cycle.

A Long-Term PayFi Thesis With Short-Term Catalysts

Beyond bonuses, Remittix is structured for durability. The project targets the global payments market. This is a market estimated in the tens of trillions annually. That means that even modest adoption translates into sustained demand for the RTX token.

Unlike meme-driven assets, Remittix benefits from usage. Every transfer, every settlement and every business integration reinforces the network. That is why some analysts are already labeling it a best new altcoin candidate with staying power beyond launch.

Upcoming exchange listings are expected to enhance both liquidity and market visibility. The wallet rollout reduces onboarding friction for new users, while the planned February 2026 crypto-to-fiat launch completes the PayFi loop. Together, these milestones are advancing at a rapid pace.

From an investment perspective, this mix of near-term incentives and long-term utility is rare. It is also why Remittix is increasingly compared to earlier breakout projects that combined real-world relevance with early-stage pricing. Some market watchers even position RTX as a next big altcoin 2026 contender if execution continues as planned.

The referral program adds another layer of momentum, encouraging organic growth rather than paid hype. Community-driven expansion has historically supported stronger post-launch price stability.

For investors scanning the market for the best crypto to buy now, Remittix ticks multiple boxes at once. It pairs a best crypto presale structure with tangible delivery, clear timelines and shrinking availability. With the 300% bonus clock running down and tokens moving quickly, the question for many is not whether Remittix will launch, but how much of the early allocation will still be available when the window closes.

That same calculus is why some are already treating RTX as a potential next big altcoin 2026 story in the making, rather than just another short-lived presale.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Is Hyperliquid Losing Ground? On-Chain Data Highlights Rising HFDX Adoption

Some parts of the crypto world think Hyperliquid might be slowing down. That talk comes as new numbers show traders and capital flow shifting toward new DeFi projects like HFDX. On-chain data shows trading patterns and volume trends that hint at real changes in where users spend their time and capital.

Meanwhile crypto prices, news, and expert views shape how people see these projects today. In this piece, we look at Hyperliquid’s recent situation and then contrast it with what HFDX is doing. The goal is to give you a clear snapshot of the current state of play.

Hyperliquid: On-Chain Data, Price Moves and What Experts Say

Hyperliquid’s native token HYPE has had a mixed run lately. Some reports show that HYPE had strong periods of trading and network activity in 2025. At times, its prices climbed after large on-chain liquidity and network upgrades that lowered fees and drew traders to its perpetual markets. On-chain figures show huge trading volumes and growing open interest, which helped push HYPE toward past price highs.

But recent market chatter suggests pressure on the token. Some news points to price slides or sideways trading around current levels, even though earlier in late 2025 it rallied thanks to on-chain liquidity innovations.

Analysts and price prediction models still talk about potential upside for HYPE into future years. Some long-term price outlooks suggest that if adoption and volume remain strong, HYPE could trade significantly higher in the medium term.

Still, not all views are upbeat. Some experts say the market overall remains weak, and the hype around early growth may fade as users look for fresh opportunities. The idea that Hyperliquid is losing ground is tied to how traders react to alternatives and look for new ways to manage capital and risk.

HFDX: On-Chain Futures and Structured Yield Momentum

HFDX is a newer protocol that offers non-custodial perpetual futures trading along with structured yield frameworks based on real protocol revenue. It targets active traders and investors who want precise tools without giving up control of their assets. HFDX runs entirely on-chain, and all actions, whether trades or liquidity participation, happen in smart contracts.

On-chain data shows some traders migrating from legacy decentralized exchanges to HFDX because of its risk-managed liquidity strategies and transparent fee structure. Reports that Bitcoin perpetual traders have been splitting volume between Hyperliquid and HFDX point to a real shift in user priorities. HFDX’s structured approach draws those who want returns tied to actual trading revenue and borrowing fees rather than just speculation.

HFDX’s technical design mixes deep liquidity with risk controls that appeal to DeFi-native users. The liquidity loan note (LLN) strategies let participants put capital into protocol liquidity and receive fixed rates that reflect real activity. This model may attract users seeking a different balance of risk and return.

What HFDX offers:

- On-chain perpetual futures with full user custody

- Trades that clear against shared liquidity pools

- Pricing based on decentralized oracle feeds

- Liquidity Loan Note strategies with fixed terms

- Yield tied to trading fees and borrow costs

- Smart contracts that manage risk rules on-chain

Experts Note A Shifting Landscape

In the short term, Hyperliquid still holds significant on-chain volume and active user counts. Its upgrades and network features helped it achieve strong adoption in earlier phases, and experts continue to discuss its price prospects. Still, recent market signals and trader behavior hints that some of its user base is looking elsewhere.

HFDX’s rise does not mean Hyperliquid is done. It just shows the market is evolving. Traders now split capital, test new products, and choose platforms based on what fits their goals. HFDX’s structured yield options and transparent execution are part of that shift. The next few months will be critical for both protocols as price trends, on-chain metrics, and user choices play out in real time.

Make Your Money Work Smarter And Unlock A Wealth Of Opportunities With HFDX Today!

Website: https://hfdx.xyz/

Telegram: https://t.me/HFDXTrading

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Pudgy Penguins, Known For NFT Toys, Dives Deeper Into Soccer

Join Our Telegram channel to stay up to date on breaking news coverage

Pudgy Penguins, a globally recognized non-fungible token brand known for creating NFT-inspired toys, has expanded into soccer through significant NFT partnerships with two leading football clubs. Pudgy Penguins NFT team, which partnered with Spain’s soccer club CD Castellón last year, has now partnered with England’s Premier League soccer club Manchester City. In this article, we shall explore this expansion journey further.

Pudgy Penguins’ Journey From Toys To Soccer

Over the weekend, the Pudgy Penguins team, via its official X account, confirmed that it has dived deeper into the world of soccer. Launched in July 2021, the Pudgy Penguins is a digital asset incubation studio known for creating Pudgy Penguins, a globally recognized non-fungible token collection featuring a fixed set of 8,888 unique digital penguin characters on the Ethereum blockchain network.

🚨PUDGY PENGUINS PARTNERS WITH MANCHESTER CITY

Pudgy Penguins will release a premium collectibles for 18+ audience and merch line with Manchester City, tapping into the club’s 300M+ global fanbase. pic.twitter.com/B0HtfgNj2q

— Coin Bureau (@coinbureau) January 16, 2026

Pudgy Penguins is also the brainchild behind Lil Pudgy, a non-fungible token series that features a fixed supply of 22,222 smaller NFTs hosted on the Ethereum blockchain network, Pudgy Rod, a companion collection of fishing rod NFTs that were airdropped to original holders in 2021 and are now used as multipliers in the ecosystem and soulbound tokens, a non-transferable tokens such as ‘Opensea x Penguins SBTs’ launched to recognize community engagement, loyalty, and licensing participation.

Pudgy Penguins entered the physical retail space in May 2023 with the release of its first line of toys. Initially launched online through Amazon, the collection sold over 20,000 units in its first 48 hours and generated more than $500,000 USD in sales. This was clear evidence of a strong demand beyond the NFT community. Later that year, the toys were stocked in more than 2,000 Walmart stores across the U.S., and within 12 months of launching, over 1 million plushies had been sold worldwide. These plushies are now available in the United States, Europe, Asia, and Hong Kong.

Pudgy Penguins Dives Deeper Into Soccer

Pudgy Penguins NFT team partnered with the Spanish soccer club CD Castellón in January 2025 to feature their characters on the team’s official jerseys and shorts. As part of the collaboration, an open edition NFT was released, and some holders of that NFT were eligible to be featured in some way related to the partnership. Pudgy Penguins and Lil Pudgys characters appeared directly on CD Castellón’s jerseys.

CD Castellón🇪🇸 x Pudgy Penguins🐧 https://t.co/DgPV0URVMz pic.twitter.com/7jb2Ww8BJ9

— Football Shirt News🌍 (@Footy_ShirtNews) January 24, 2025

In the latest news, the Pudgy Penguins NFT team has announced a “landmark partnership” with English Premier League champions Manchester City to launch a premium co-branded NFT line targeted at an adult audience. This move is considered one of the highest-profile crossovers between a web3-native brand and a global sports giant, aimed at bringing the Pudgy Penguins intellectual property to a massive, mainstream audience. The merchandise drop was scheduled for January 17, 2026.

These ventures are part of the Pudgy Penguins’ broader strategy to evolve beyond their digital origins and toy lines into a mainstream, global intellectual property (IP) through real-world utility and high-profile brand building, bridging the gap between digital assets and traditional markets. This integration will provide tangible ways for NFT holders to feel part of the brand’s journey, reinforcing holder identity and community.

Related NFT News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

XRP Risks Another 23% Drop as Price Slides Below $1.60

XRP (XRP) price dropped below $1.50 over the weekend, its lowest level in over 14 months. Now, a bearish technical setup on the charts suggests that the downtrend may extend throughout February.

Key takeaways:

-

XRP’s bear pennant on the four-hour chart targets $1.22.

-

XRP futures open interest dropped to $2.61 billion, which gives some hope for the bulls.

XRP price chart shows a textbook bear pennant

On Saturday, XRP price fell about 14% from a high of $1.75 to a low of $1.50, losing the $1.60 support level for the first time since November 2024.

The latest drop has put it into the breakdown phase of its bear pennant setup, as shown on the four-hour chart below.

Related: Price predictions 1/30: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, XMR

XRP dropped below the pennant’s lower trendline on Tuesday, then rebounded to retest it as support. The price is likely to drop lower if the retest fails and a four-hour candlestick closes below this level at $1.58.

The measured target of the bear pennant, calculated by adding the height of the initial drop to the breakout point, is $1.22, representing a 23% drop from the current price.

XRP’s recovery to $2.40 in January turned out to be a “fakeout” as the price continued to form “price formed a fresh lower lows,” pseudonymous analyst AltCryptoGems said in a recent post on X, adding:

“The downtrend remains intact and we are on the verge of a disastrous collapse in a huge no-support zone.”

Trader and investor Alex Clay said that after breaching the support line of a double bottom pattern at $1.60, the path is now cleared for a drop toward $1 or lower.

As Cointelegraph reported, XRP’s next major support level is near its aggregated realized price at $1.48. If this level is lost, it would put the average holder underwater, a setup that closely matches the 2022 bear phase that ultimately ended in a 50% drawdown toward $0.30.

XRP buyers step back

The 90-day Spot Taker Cumulative Volume Delta (CVD), a metric that tracks whether market orders are driven by buyers or sellers, reveals that buy-orders (taker buy) have been declining sharply since early January.

While demand-side pressure has dominated the order book since November 2025, buy orders have dropped sharply over the last 30 days, according to CryptoQuant.

This indicates waning enthusiasm or exhaustion among XRP investors, signaling reduced bullish momentum and increasing downside risk for the price.

Previous sharp drops in spot CVD have been accompanied by 28%-50% price drawdowns within weeks.

However, in the current downtrend, one hope for the bulls is the declining XRP futures open interest (OI). It has dropped sharply to $2.61 billion on Wednesday, from $4.55 billion on Jan. 6.

When OI declines in combination with falling prices, it indicates a weakening bearish trend or a potential trend reversal.

This could provide some fuel for the bulls to test the important overhead resistance at around $1.85, a level that served as support throughout most of 2025.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

The DAO hacked again, but this time it’s the good guys

Ten years on from the most notorious hack in Ethereum history, The DAO has been exploited once again.

However, this time, far from 2016’s existential crisis, it’s actually good news.

In what a Security Alliance (SEAL) member described as a “long-planned whitehat rescue,” over 50 ether (ETH) were rescued from an insecure contract.

The funds, worth over $100,000 had sat in a vulnerable smart contract for a decade. They currently sit in this recovery address.

Read more: 2025’s biggest crypto hacks: From exchange breaches to DeFi exploits

The 2016 hack of the original DAO saw 3.6 million ETH lost. The sum was worth around $60 million at the time, but would now be valued at close to $8 billion.

Whitehat hackers subsequently sprang into action, racing to reverse engineer the hack and drain the contracts themselves in order to secure funds that blackhats may otherwise have gained.

This bought time until a longer-term solution could be decided on by the community.

The event caused such disruption to the Ethereum community that it collectively took the decision to fork the network, restoring the blockchain to its pre-hack state.

Today’s whitehat rescue was announced by “Giveth,” whose co-founder Griff Green worked on The DAO back in 2016.

It may be surprising that such a high profile codebase, especially from a security standpoint, would still contain an unidentified vulnerability a decade later. But a recent spate of blackhat attacks on older projects show that such hidden weaknesses may be more common than expected.

Read more: Legacy DeFi platforms lose $27M as hacking spree continues into 2026

The rescue mission comes on the back of more good news for the Ethereum security community.

Last week, Green pledged that recovered funds will be returned “to the people who put it there, or if unclaimed, [used] for funding Ethereum Security.”

Any unclaimed funds from today’s rescue will be added to the pot.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Gold Volatility Beats Bitcoin’s Risk Profile

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and brace yourself: markets are moving in ways few expected. One asset is swinging wildly, defying norms, while the other struggles to catch up. Traders and investors are watching closely as volatility reshapes familiar narratives, signaling that nothing is quite as it seems.

Sponsored

Sponsored

Crypto News of the Day: Gold’s Volatility Surges Past Bitcoin Amid Historic Market Swings

Gold has overtaken Bitcoin amid market turbulence. Its recent price swings surpass even Bitcoin’s, highlighting a rare inversion in risk dynamics that few investors expected.

Data shows the 30-day volatility in gold surged to a new peak of 48.68, and stood at 41.04 as of this writing. Notably, this level was not tested since the 2008 financial crisis.

In comparison, Bitcoin’s volatility currently hovers around 39%, despite its reputation as a highly speculative asset.

The surge in gold volatility follows its sharpest plunge in more than a decade, including a single-session drop of nearly 10% from a peak of $5,600 to roughly $4,400 per ounce in Asian trading.

Since Bitcoin’s creation 17 years ago, gold has been more volatile only twice. The most recent was in May 2019 during a flare-up in trade tensions sparked by tariff threats from US President Donald Trump.

The wild swings in gold come amid broader macroeconomic uncertainty. As indicated in a recent US Crypto News publication, renewed fears of geopolitical instability, currency debasement, and questions about the Federal Reserve’s independence drove investors to pile into precious metals.

Sponsored

Sponsored

Gold Rebounds $6 Trillion in Two Days, Leaving Bitcoin Behind

The recovery in gold has been equally dramatic, with XAU prices surging back above $5,000/oz, up 17% in just 48 hours.

During the same period, gold added $4.74 trillion to its market capitalization, while silver gained $1 trillion. This brings the total growth in the precious metals market cap to nearly $6 trillion in two days.

“That’s over 4× Bitcoin’s market cap,” stated analyst Crypto Rover.

Sponsored

Sponsored

The rebound reflects strong accumulation by institutional and high-net-worth investors, with consistent buying on every dip speaking volumes about who’s accumulating the precious metal, regardless of the noise.

“Volatility shouldn’t surprise anyone here—it’s rare for an asset to absorb a hit like last week’s and then move straight back up without a few bumps. Gold remains severely under-owned, and this move has real legs as part of a much larger cycle,” said Otavio in a post.

Even amid volatility, gold has maintained its status as a safe-haven asset, up roughly 66% year-on-year, while Bitcoin remains down more than 20% over the same period.

The contrast mirrors how, in times of macroeconomic stress, traditional precious metals continue to command a premium in investor portfolios, outpacing even high-profile digital assets.

As geopolitical and monetary pressures persist, gold’s newfound volatility is likely to remain in focus, offering both risk and opportunity for traders seeking refuge from broader market swings.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 3 | Pre-Market Overview |

| Strategy (MSTR) | $133.26 | $132.55 (-0.53%) |

| Coinbase (COIN) | $179.66 | $178.89 (-0.43%) |

| Galaxy Digital Holdings (GLXY) | $21.98 | $22.11 (+0.59%) |

| MARA Holdings (MARA) | $9.05 | $8.99 (-0.66%) |

| Riot Platforms (RIOT) | $15.34 | $15.32 (-0.13%) |

| Core Scientific (CORZ) | $17.74 | $17.65 (-0.51%) |

Crypto World

BTC might just be another software name, and that’s bad news

Bitcoin is increasingly behaving like a software stock, with its latest correction unfolding alongside the broader software sell-off.

The relationship between bitcoin and software equities has strengthened notably. On a 30-day rolling basis, bitcoin’s correlation with the iShares Expanded Tech Software ETF, (IGV), stands at a high 0.73, according to ByteTree. The IGV is down around 20% year to date, while bitcoin has fallen 16%.

IGV is heavily weighted toward software and services names such as Microsoft (MSFT), Oracle (ORCL), Salesforce (CRM), Intuit (INTU) and Adobe (ADBE).

While the technology sector appears relatively resilient at the headline level — the Nasdaq 100 (QQQ), is only around 4% below its record high — software stocks have absorbed most of the selling pressure, and bitcoin is increasingly trading in line with this weaker pocket of the market rather than the broader index.

As for why software names are getting hammered, the answer is simple: AI. The rapid progress towards fully functioning artificial general intelligence (AGI) is currently being considered an existential issue for software.

“There can be no doubt that bitcoin has been caught up in the technology selloff,” said ByteTree. “At its heart, bitcoin is an internet stock. Software stocks have been the most recent casualty, and the price of bitcoin has shown similar performance over the past five years, with high correlation.”

ByteTree also notes that the average technology bear market lasts about 14 months. With this current downturn having started in October, this suggests pressure could persist through much of 2026. However, ByteTree notes that a resilient economic backdrop could provide support for bitcoin.

“Bitcoin is just open-source software,” said Van Eck’s Matthew Sigel.

Crypto World

DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER): What Early-Stage Project Reigns Supreme in 2026?

President Donald Trump is expected to sign the bill approved by the US House of Representatives, which will reopen the government after a recent partial shutdown.

While the political tailwinds could push some liquidity into the choppy market, many traders are actually exploring presale opportunities.

The biggest debate pits three projects against each other: DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

Although all entries are the epitome of quality, DeepSnitch AI takes the cake with its upside potential and mass appeal that places it on a path to 100x gains post-launch.

The government may be opening soon

On February 3, the US House of Representatives approved a bill that will largely end a four-day partial government shutdown, voting 217–214 to pass the roughly $1.2 trillion funding package already cleared by the Senate.

The measure funds most government operations through September 30, with some Democratic support despite opposition from many in the party over immigration enforcement provisions included in the bill.

US President Donald Trump is expected to sign the legislation without any changes, which will swiftly reopen affected sectors.

The brief shutdown, which only partially disrupted government functions, was far shorter than the 43-day shutdown in 2025. The quick resolution avoids prolonged disruption, but it’s expected that the immigration-related funding fights will resume shortly

Meanwhile, retail traders are trying to decide on DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

What’s the best presale in Q1?

1. DeepSnitch AI: Is DSNT a mass-adoption coin?

Early-stage sales are back in the limelight as majors keep printing lows. Case in point, DeepSnitch AI raised $1.47M fast, and its $0.03830 price attracted buyers who are eyeing 100x with reasonable investments.

The reason for this conviction is the utility. DeepSnitch AI is powered by five AI agents that help users spot breakout opportunities while dodging common traps like rugs, honeypots, and liquidity issues. The workflow is dead simple: paste any contract address into the LLM-style interface for an instant audit and clear risk assessment.

While that’s certainly a godsend for the retail trader, the ability to predict social sentiment shifts and incoming FUD is another trick that DeepSnitch AI brings to the table that strengthens the mass adoption narrative.

When comparing DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER), many traders highlight DSNT’s broader mass-adoption potential thanks to its retail-first focus and practical daily utility.

Many traders are debating the merits of AI analytics vs payment-focused crypto, but DeepSnitch AI’s approach is certainly more original than most of the popular DeFi projects.

2. LivLive: Is LivLive too niche?

The DeepSnitch AI vs LivLive comparison is common among investors hunting fresh Q1 opportunities. However, the two projects couldn’t be more different.

LivLive is all about the concept of augmented reality, which lets users tokenize daily actions, blending lifestyle posting with blockchain rewards. Users earn LIVE tokens and XP by completing quests, check-ins, business reviews, social challenges, streaks, and AR interactions.

The level of gamification is high, meaning that LivLive could have viral potential (think Pokémon GO meets blockchain impact).

The LIVE presale price sits at $0.02. While the project certainly has a place in your portfolio (especially if you’re sold on the concept, many argue that DeepSnitch AI’s utility for day-to-day trading offers more durable long-term growth and staying power.

3. Bitcoin Hyper: Could Bitcoin L2 outpace the competition?

DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER) debate is tough to call simply because all the projects ooze quality.

Take Bitcoin Hyper as an example. The project delivers genuine innovation with its Bitcoin-native Layer 2 built on the Solana Virtual Machine. This allows it to provide ultra-fast off-chain transactions while opening Bitcoin’s massive ecosystem to Solana dApps.

The Bitcoin Hyper valuation remains speculative at this stage, but the fundamentals are compelling. At the current presale price of $0.013675, HYPER offers an accessible entry point with a solid narrative. While it may not have the day-to-day appeal of DeepSnitch AI or the social angle of LivLive, Bitcoin Hyper still has a strong draw, especially for those looking for quality tech.

Final words: Take your pick

As ICOs attract serious attention, traders are split between DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

While personal taste certainly plays a role in deciding your own personal “winner”, DeepSnitch AI may have the most compelling narrative. Look at it this way: DeepSnitch AI combines mass appeal, real AI utility for everyday traders, explosive upside potential, and a bullish trajectory with $1.47M in the bank.

Moreover, you can get an unreal amount of value by jumping in right now. The largest code, DSNTVIP300, delivers 300% on $30K+ ($90K worth of DSNT tokens), which basically seems like printing money.

Reserve your spot in the DeepSnitch AI presale today and follow the latest community buzz on X or Telegram.

FAQs

1. Which is the best presale? DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER)?

DeepSnitch AI ($DSNT) leads as the next crypto to explode, with $1.47M raised at $0.03830, five AI agents for real-time risk detection and sentiment prediction, plus strong mass-adoption potential and widespread 100x forecasts.

2. What makes DeepSnitch AI stand out in the DSNT vs LIVE vs HYPER comparison?

DeepSnitch AI offers practical daily utility and mass appeal potential that could elevate it above its key competitors.

3. How does the US government reopening impact the market?

The US House passed a $1.2T funding bill to end a partial shutdown, with President Trump expected to sign it quickly. The resolution boosts overall sentiment and liquidity.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

BTC under pressure as U.S. tech sector stumbles

Bitcoin fell back below $74,000 in the early innings of the U.S. session, with the bounce from Tuesday’s lows quickly fading away as weakness in tech stocks weighed on crypto.

The Nasdaq 100 was 1% lower following the previous day’s 1.5% decline. The software sector continued its tumble, with the thematic iShares Expanded Tech-Software ETF (IGV) declining another 4%, now down 17% in a little over a week, amid fears that AI will be severely disruptive.

Crypto miners, increasingly tied to the buildout of AI infrastructure, mirrored the slide, with Cipher Mining (CIFR), IREN, and Hut 8 (HUT) falling by more than 10%. The declines stemmed from chipmaker AMD, which fell 14% after its 2026 outlook missed analysts’ expectations.

Gold was also caught in the selling, with the yellow metal quickly reversing an overnight surge to $5,113 per ounce and sliding back below $5,000.

U.S. economic data is mixed

The ISM Services PMI for January held steady at 53.8, matching December’s revised reading and beating expectations by a hair, pointing to continued expansion in the services sector.

However, private job growth slowed sharply, with just 22,000 jobs added according to an ADP report, well below forecasts for 48,000 and December’s already weak 37,000. The government’s January job report would normally have been released this Friday, but the short government shutdown has delayed it until next week.

“Manufacturing has lost jobs every month since March 2024 (Main Street recession) but this month professional and business services and large employers joined the weakness,” said Lekker Capital CIO Quinn Thompson, who believes markets are underestimating the amount of Fed stimulus that may be coming in 2026.

Crypto World

Bitcoin Dips to $95K as Crypto Funds See Record Inflows

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped 3% in the last 24 hours to trade at $93,324, as crypto investment products continue to attract strong interest from investors with record inflows.

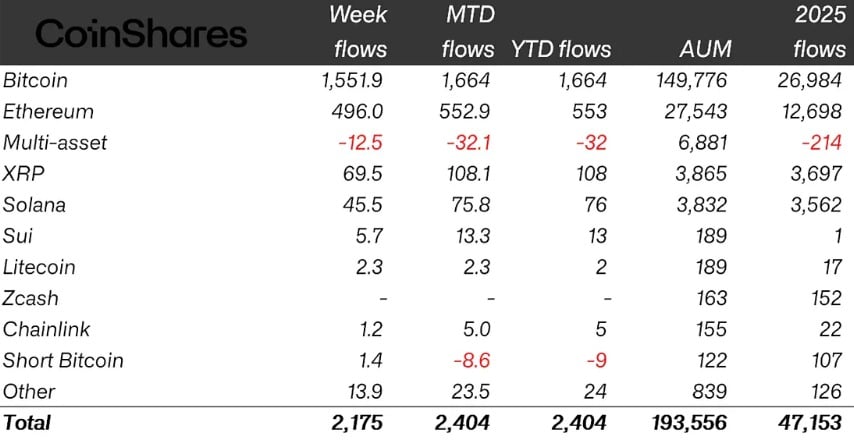

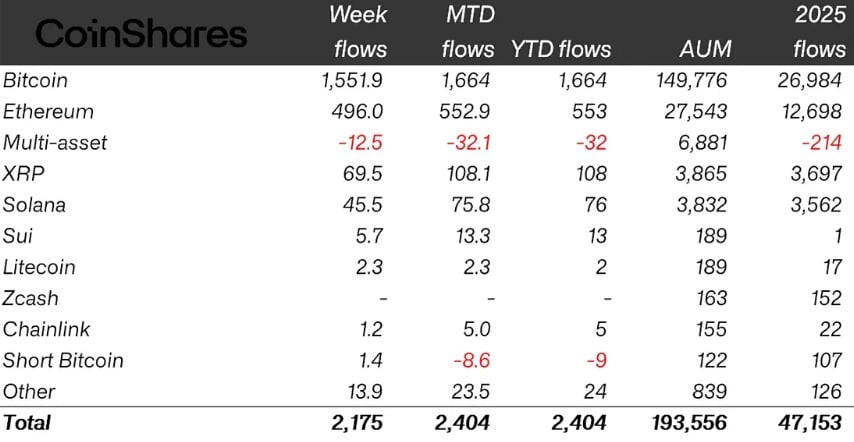

Last week, crypto funds saw inflows of $2.17 billion, the highest in 2026 so far and the largest weekly gain since October, according to European asset manager CoinShares. Most of the money entered the market earlier in the week, but Friday recorded $378 million in outflows due to geopolitical tensions in Greenland and fresh concerns over tariffs.

James Butterfill, CoinShares’ head of research, also noted that sentiment was affected by expectations that Kevin Hassett, a leading contender for US Fed Chair, would likely remain in his current position. Bitcoin dominated last week’s fund inflows, pulling in $1.55 billion, which represented over 70% of the total.

Ether followed with $496 million, while XRP and Solana attracted $70 million and $46 million, respectively. Smaller altcoins such as Sui and Hedera recorded minor inflows of $5.7 million and $2.6 million. Despite proposals under the US Senate’s CLARITY Act that could limit stablecoin yields, Ether and Solana funds held up well.

Among fund types, multi-asset and short Bitcoin products were the only categories to see outflows, totaling $32 million and $8.6 million. On the issuer side, BlackRock’s iShares ETFs led the market with $1.3 billion in inflows, followed by Grayscale Investments at $257 million and Fidelity Investments at $229 million.

Geographically, the US accounted for the majority of inflows at $2 billion, while Sweden and Brazil saw small outflows of $4.3 million and $1 million, respectively. With these gains, total assets under management in crypto funds surpassed $193 billion for the first time since early November, showing renewed investor confidence.

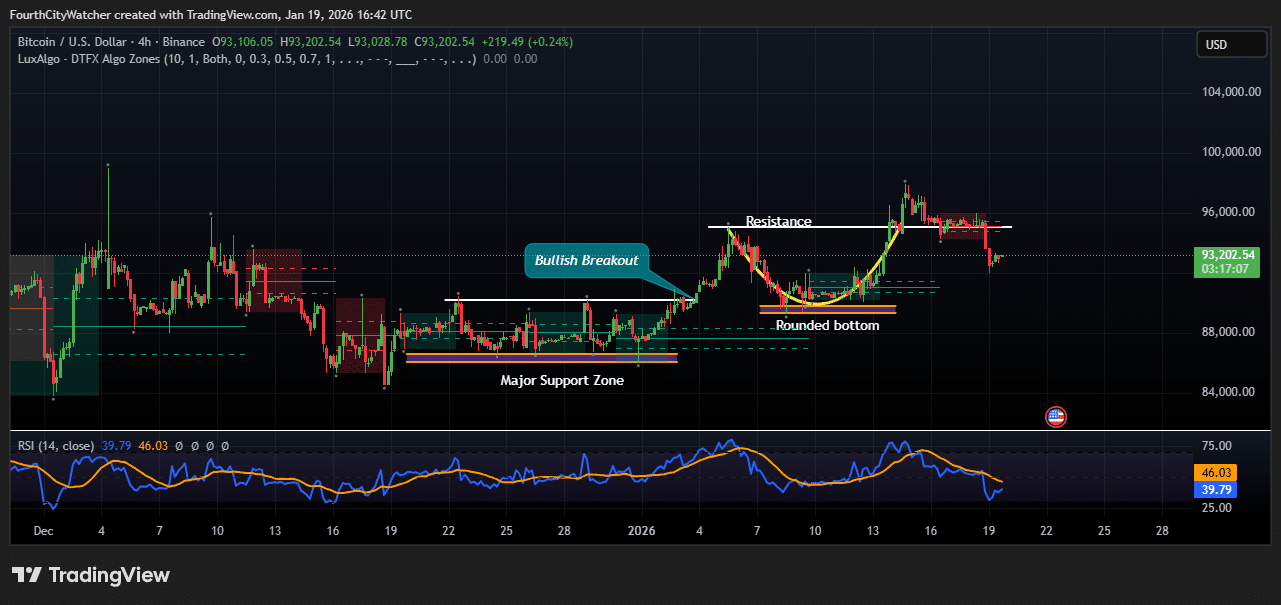

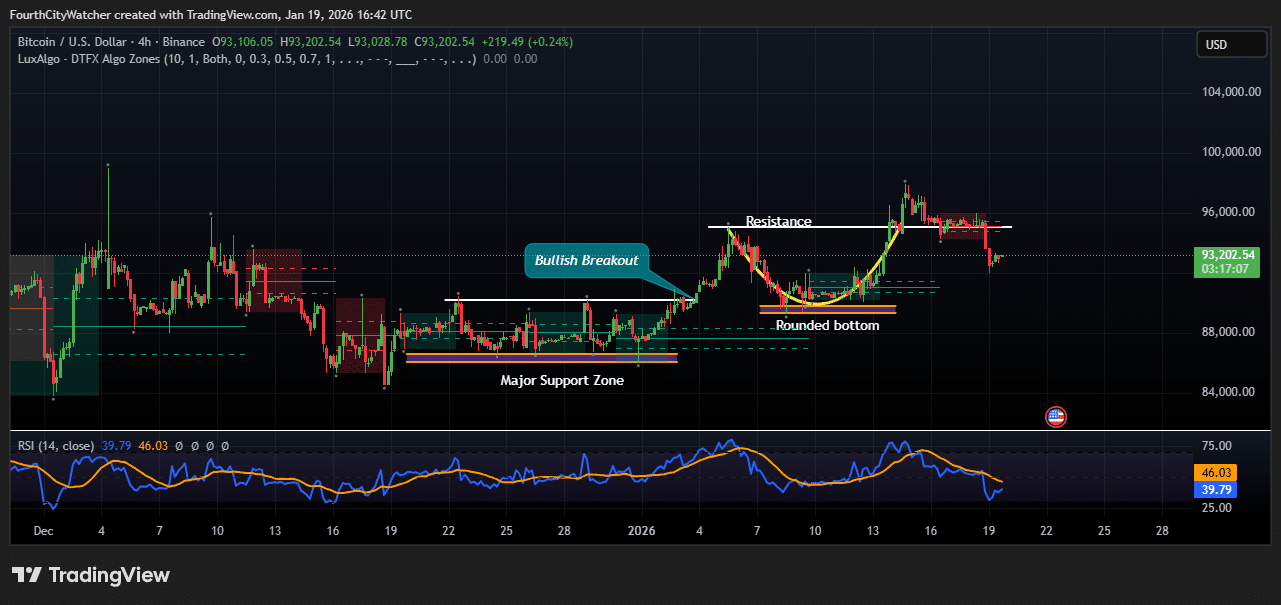

The Bitcoin price 4-hour chart shows a series of bullish developments, though recent price action indicates some short-term consolidation. Price recently rebounded from a major support zone around $87,500–$88,500, which had previously acted as a strong accumulation area. This level has successfully absorbed selling pressure multiple times in the past, providing a solid foundation for higher moves.

Following this support, Bitcoin formed a rounded bottom pattern between January 6 and January 12, signaling a shift from bearish to bullish sentiment. The rounded bottom reflects a gradual loss of selling momentum, allowing buyers to regain control.

A bullish breakout occurred after the rounded bottom, pushing the price above prior resistance levels around $91,000. This breakout was accompanied by strong upward momentum, with the price briefly testing the $96,000 region. The breakout confirms that buyers were willing to step in decisively after the consolidation, signaling potential continuation of the short-term uptrend.

Currently, the price has pulled back slightly after hitting the $96,000 resistance area. The minor retracement appears healthy, as it allows buyers to enter at lower levels without threatening the overall bullish structure. The relative strength index (RSI), currently around 39.8, shows that Bitcoin is not yet oversold, indicating room for further upside once buyers re-enter. The 46-level on the RSI also indicates previous resistance in momentum, now acting as a potential pivot point.

The chart shows a well-defined support and resistance structure, with price respecting the $88,000–$91,000 range before attempting higher levels. The rounded bottom and bullish breakout highlight a transition from accumulation to renewed upward momentum. Traders may watch for a retest of $91,000–$92,000 as a key support level, while the $96,000 area remains a near-term resistance barrier.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech9 hours ago

Tech9 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World18 hours ago

Crypto World18 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards