Crypto World

New Crypto Casino With 275% Welcome & 75 Free Spins!

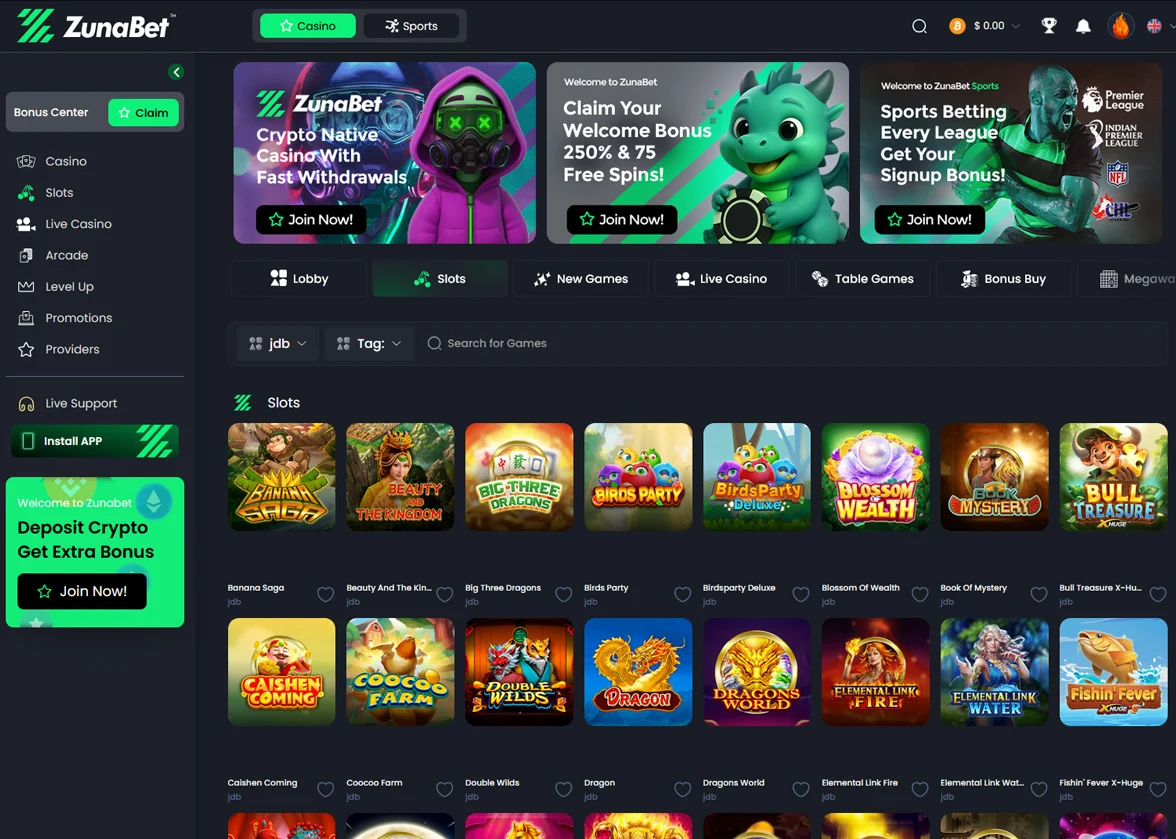

ZunaBet is a new crypto casino and sportsbook that launched in 2026. The platform combines traditional casino gaming with cryptocurrency payments and modern features. With over 11,000 games and a full sports betting section, it aims to serve players looking for a crypto-friendly gambling destination.

Here’s our full review!

Quick Verdict: ZunaBet is a crypto casino offering over 11,000 games from 63 providers, extensive sports betting options across traditional and eSports, and a generous welcome package of 250% up to $5000 with 75 free spins,

Quick Facts

| Category | Information |

|---|---|

| Launch Year | 2026 |

| License | Government of Anjouan, License No. ALSI-202510047-FI2 |

| Operator | Strathvale Group Ltd., Belize |

| Number of Games | 11,294+ |

| Game Providers | 63 providers |

| Cryptocurrencies | 20+ including BTC, ETH, USDT, SOL |

| Sports Betting | Traditional sports and eSports |

| Welcome Bonus | 250% up to $5000 + 75 Free Spins |

| Loyalty Program | Dragon Evolution System with 6 tiers |

| Mobile Access | Responsive design plus downloadable apps |

| Customer Support | Email at support@zunabet.com |

| Supported Languages | English, Italian, Spanish, French, German, Indian |

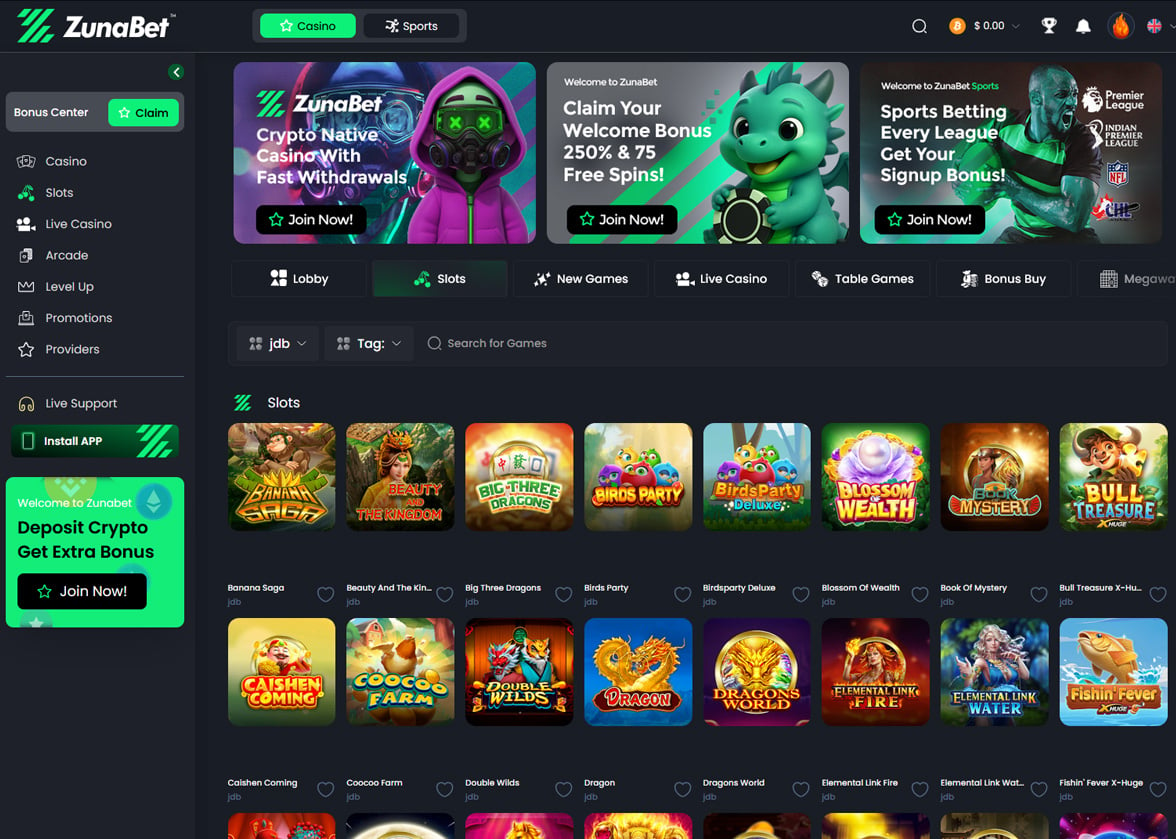

Casino Games

ZunaBet hosts an impressive collection of 11,294 casino games. This extensive library comes from 63 different software providers, giving players access to a wide variety of gaming styles and themes. The selection covers all major casino game categories that players expect from a modern online casino.

The slot game section makes up the majority of the casino’s offerings. Players can find everything from classic three-reel slots to modern video slots with complex bonus features. The games come with different volatility levels and return-to-player percentages to suit different playing styles.

Table game fans have access to multiple versions of blackjack, roulette, baccarat, and poker. These games range from standard versions to variants with special rules or side bets. The variety ensures that both casual players and experienced table game enthusiasts can find options that match their preferences.

Live dealer games bring the casino floor experience to your screen. The platform includes live versions of popular table games where real dealers run the games in real-time. Players can interact with dealers and other players through chat functions while placing their bets.

The game providers list reads like a who’s who of the online casino industry. Pragmatic Play and Hacksaw Gaming feature prominently, offering their popular slot titles. Playtech contributes both slots and table games to the collection. Evolution Gaming powers the live dealer section with their industry-leading live casino products.

Other major providers include BGaming, Booming Games, Endorphina, Evoplay, Ezugi, Habanero, and Yggdrasil. Each provider brings their own unique style and game mechanics to the platform. This diversity means players can explore different themes, features, and gameplay styles without leaving the site.

The casino doesn’t require downloads to play games. All titles run directly in web browsers using HTML5 technology. This means players can access games from any device with an internet connection and a modern browser.

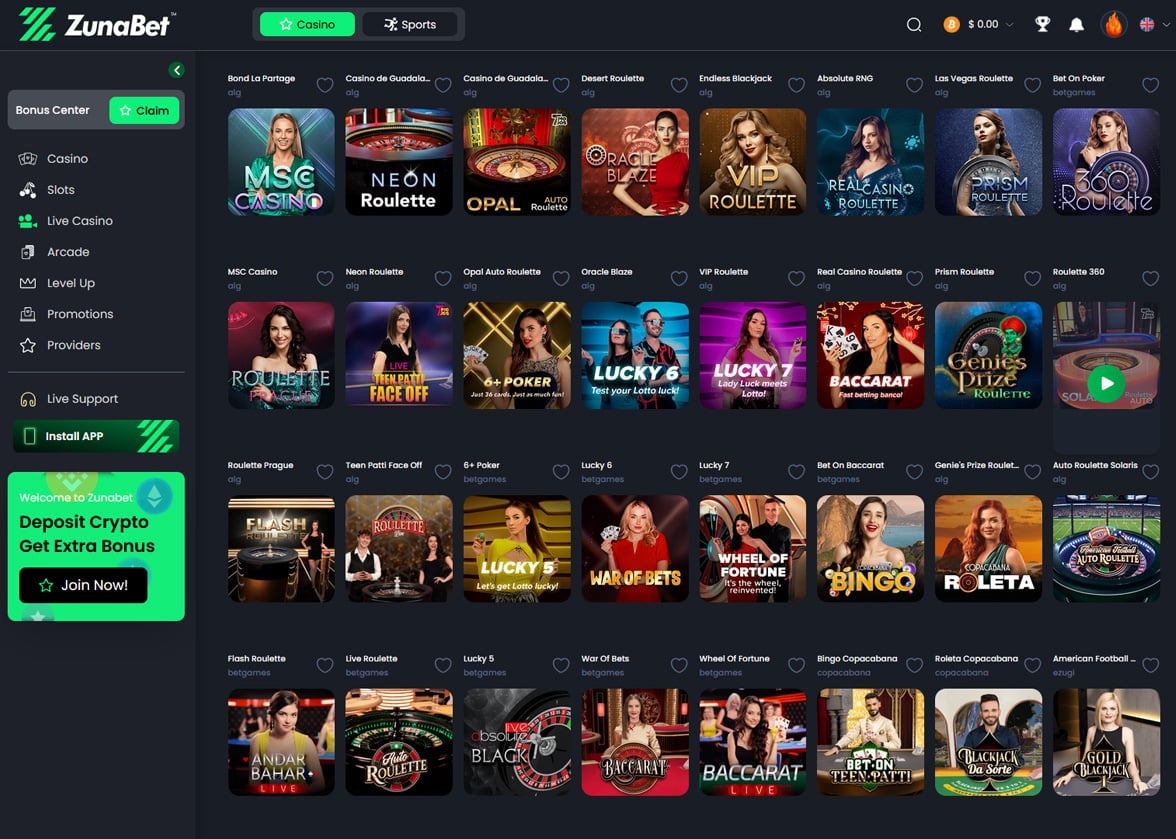

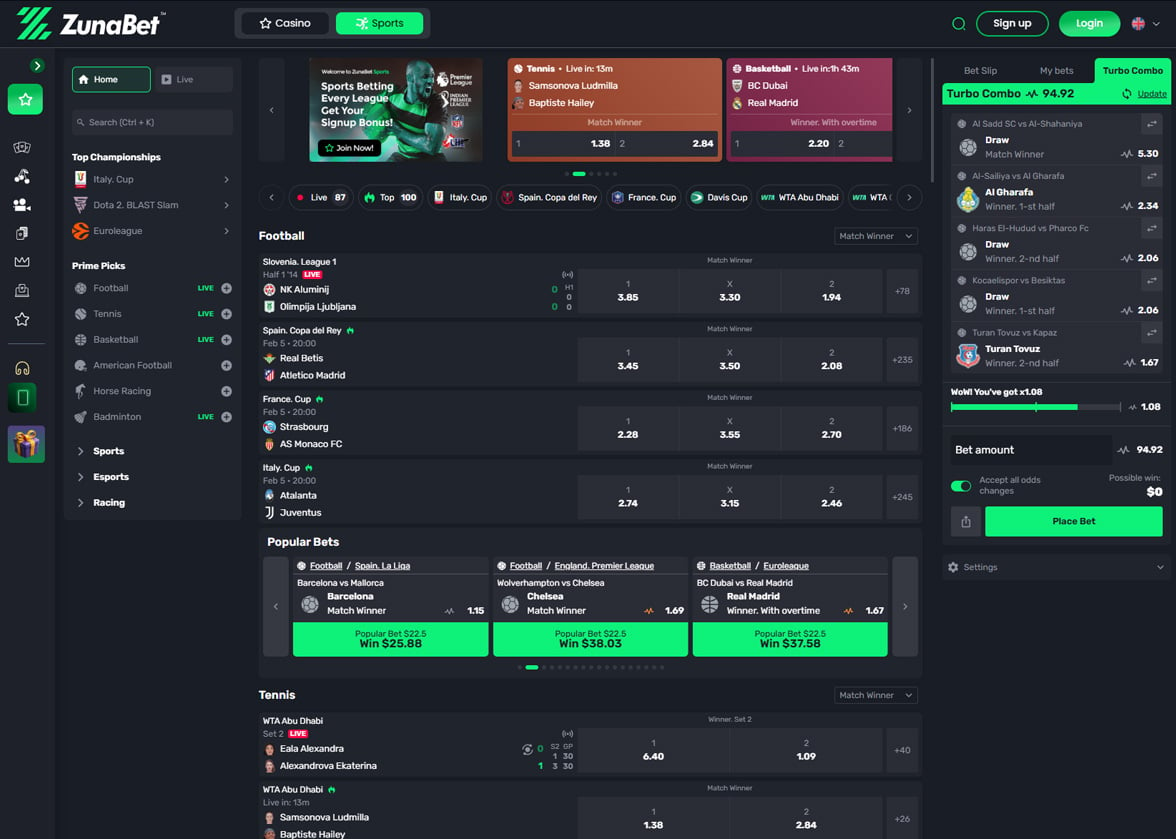

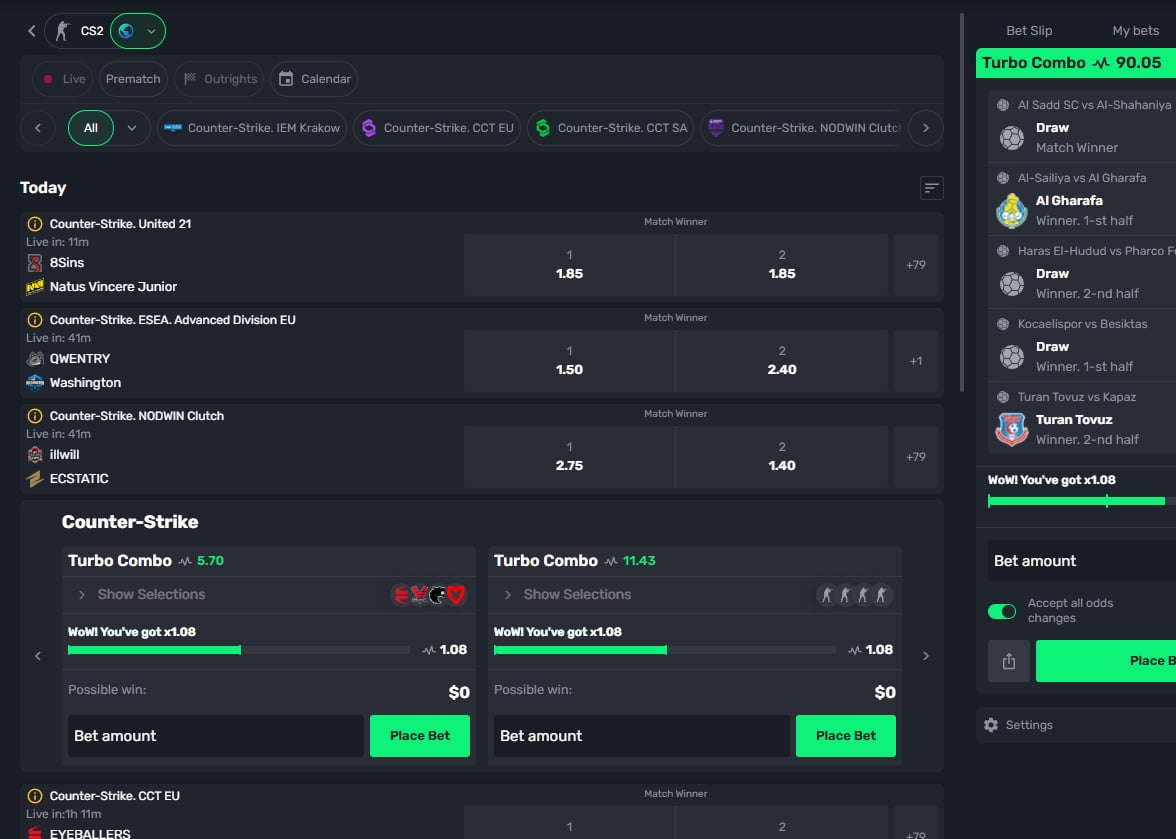

Sports Betting

The sportsbook at ZunaBet covers a comprehensive range of sporting events. Traditional sports betting includes football, which features leagues and matches from around the world. Bettors can place wagers on major European leagues, international tournaments, and regional competitions.

Tennis betting includes ATP, WTA, and Grand Slam events. The platform offers markets on match winners, set betting, and game handicaps. Basketball coverage includes both NBA action and international leagues, with 3×3 basketball also available for betting.

Ice hockey fans can bet on NHL games and international competitions. Baseball betting focuses primarily on MLB, with markets on game winners, run lines, and totals. Volleyball and beach volleyball provide options for fans of court sports.

Rugby betting covers both rugby union and rugby league competitions. The platform includes markets on Six Nations, Rugby Championship, and club competitions. Other traditional sports include badminton, table tennis, handball, Australian football, and futsal.

Water polo, snooker, and darts provide options for fans of these sports. Combat sports coverage includes boxing and MMA, with betting available on major promotions. The platform also added Power Slap, reflecting its commitment to covering emerging combat sports.

Cricket betting serves fans in countries where the sport is popular. Chess betting offers a unique option for those interested in wagering on intellectual competitions. Bowls, cycling, Formula 1, lacrosse, and golf round out the traditional sports offerings.

eSports coverage includes all major competitive gaming titles. Counter-Strike betting covers tournaments from around the world. Dota 2 and League of Legends, two of the biggest eSports titles, have dedicated betting markets. The platform includes major tournaments like The International and the League of Legends World Championship.

Other Products

The loyalty program stands out as a unique product. Built around a dragon theme, it gamifies the player experience. New members choose an elemental egg when joining. This egg evolves as players wager, eventually hatching into a personalized Zuna Dragon.

The dragon mascot, named Zuno, serves as the casino’s brand ambassador. According to the casino’s lore, Zuno is a dragon who grew up in the ZunaBet vaults surrounded by casino games. The character adds personality to the platform and features in promotional materials.

Players can install dedicated apps for iOS, Android, Windows, and MacOS. These apps provide quick access to the casino without opening a web browser. The apps mirror the functionality of the website, giving players a seamless experience across devices.

The platform includes social elements through its community features. Players can interact through the VIP club, which becomes available at higher loyalty tiers. Random promotions add an element of surprise to the player experience.

A wheel spin feature gives players additional chances to win prizes. This becomes a double wheel spin at certain loyalty levels. These extra features create more engagement opportunities beyond standard casino games and sports betting.

Welcome Bonuses

ZunaBet offers a substantial welcome package for new players. The promotion is structured across three deposits, giving new members multiple opportunities to claim bonus funds and free spins. The total potential value reaches $5000 in bonus money plus 75 free spins.

- The first deposit triggers a 100% match bonus up to $2000. This means if a player deposits $2000, they receive an additional $2000 in bonus funds. The first deposit also includes 25 free spins that can be used on selected slot games.

- The second deposit comes with a 50% match bonus up to $1500. A player depositing $1500 would receive $750 in bonus funds. This deposit also awards 25 free spins, bringing the total to 50 free spins across the first two deposits.

- The third deposit provides a 100% match bonus up to $1500. Combined with another 25 free spins, this completes the welcome package. When fully claimed across all three deposits, players receive the maximum $5000 in bonuses plus 75 free spins total.

The casino markets this as a “250% Match bonus up to $5000 + 75 FS” for new players. This calculation adds together the percentages from all three deposit bonuses. The structure encourages players to make multiple deposits to unlock the full value.

Free spins awarded as part of the welcome package apply to specific slot games. The casino determines which games are eligible for free spin use. Players should check the promotion terms to see which slots are included.

How to Signup

Creating an account at ZunaBet follows a straightforward process:

- Visit the ZunaBet website at zunabet.com

- Click the registration or sign-up button, typically located in the top right corner of the homepage

- Enter your email address and create a secure password for your account

- Choose your preferred cryptocurrency for deposits and withdrawals

- Select your elemental egg, which starts your journey in the dragon loyalty program

- Agree to the casino’s terms and conditions and confirm you meet the minimum age requirements

- Complete any verification steps required, which may include email confirmation

- Make your first deposit using one of the supported cryptocurrencies

- Claim your welcome bonus if you want to participate in the promotion

- Start playing games or placing sports bets

The registration process takes only a few minutes. The casino uses email verification to confirm account ownership. Once your email is verified and your first deposit is made, you can access the full range of games and betting options.

Regular Promotions and Loyalty Program

The loyalty program at ZunaBet uses a tiered system with six levels. Each level offers increasing rewards and benefits. Players progress through levels based on their total wagering volume. The system tracks all bets placed on casino games and sports betting to calculate advancement.

- The first tier is Squire, which is the starting level for all new players. Squire members receive 1% rakeback on their bets. This level requires no minimum wagering and provides no free spins. However, it grants access to random promotions and the double wheel spin feature.

- Warden is the second tier, requiring $1,000 in total wagers. The rakeback increases to 2% at this level. Warden members receive 20 free spins as a tier reward. All the benefits from Squire continue, including random promotions and wheel spin access.

- Champion tier requires $5,000 in total wagering. Rakeback jumps to 4% for Champion members. The tier awards 50 free spins. Players maintain access to all previous benefits while enjoying the improved rakeback rate.

- Divine tier becomes available at $20,000 in total wagers. Members receive 5% rakeback and 150 free spins. The increased rakeback means players get more value returned on every bet they place, whether in the casino or on sports.

- Knight tier is for serious players with $200,000 in total wagering. The rakeback rate reaches 10%, providing substantial returns on play volume. Knight members receive 400 free spins. Access to VIP club benefits becomes more valuable at this level.

- Ultimate tier represents the highest achievement in the loyalty program. It requires $1,000,000 in total wagering. Ultimate members enjoy 20% rakeback, the maximum rate available. The tier awards 1,000 free spins. These players receive the best treatment available at the casino.

Rakeback is a valuable benefit that returns a percentage of all wagers to players. Unlike traditional bonuses, rakeback typically has fewer restrictions. Players receive rakeback regularly based on their betting activity, providing a steady stream of value.

The free spins awarded at each tier can be used on selected slot games. These spins provide opportunities to try new games or play favorites without risking additional funds. Free spins from tier advancement are separate from promotional free spins.

Random promotions add an element of surprise to the loyalty program. The casino runs special offers that vary based on seasons, events, or promotional calendars. These might include deposit bonuses, free spin packages, or tournament entries.

The double wheel spin feature gives players two chances instead of one when using the wheel feature. This doubles the potential for winning prizes from the wheel, which may include bonus funds, free spins, or other rewards.

VIP club access becomes more meaningful at higher tiers. VIP members may receive personalized customer service, faster withdrawal processing, and exclusive bonus offers. The casino tailors VIP benefits to reward its most loyal players.

The dragon evolution theme ties the loyalty program together. Your chosen egg evolves as you progress through tiers. The visual representation of your dragon growing provides a fun way to track loyalty progress. Each tier brings your dragon closer to its ultimate form.

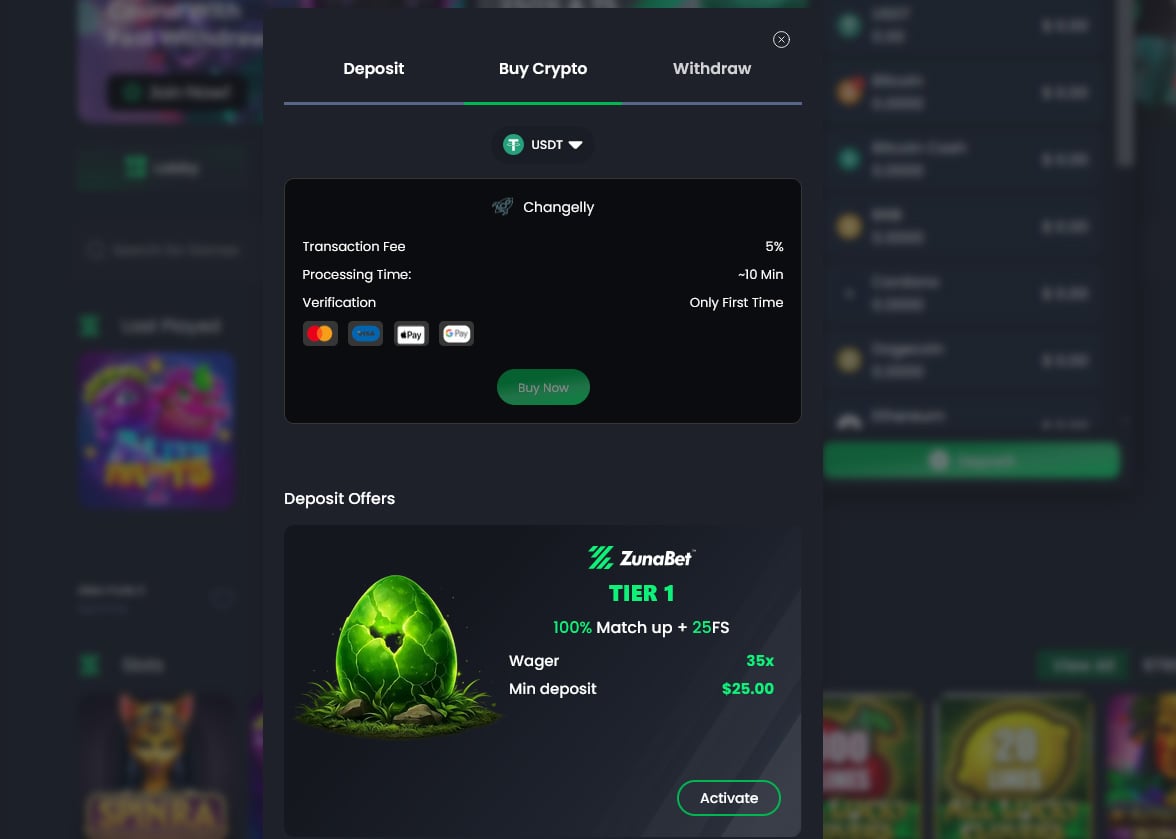

Payment Methods

ZunaBet operates as a cryptocurrency casino, accepting 20 different digital currencies for deposits and withdrawals. The platform’s crypto-first approach means all transactions use blockchain technology. This provides fast processing times and lower fees compared to traditional banking methods.

The supported cryptocurrencies include:

- Bitcoin (BTC) – The original cryptocurrency remains the most popular option

- Ethereum (ETH) – The second-largest cryptocurrency by market cap

- Binance Coin (BNB) using the BSC network

- Ripple (XRP) – Known for fast transaction speeds

- Tron (TRX) – Popular for low transaction fees

- Bitcoin Cash (BCH) – A Bitcoin fork with larger block sizes

- Litecoin (LTC) – Often called the silver to Bitcoin’s gold

- Dogecoin (DOGE) – Originally a meme coin, now widely accepted

- Cardano (ADA) using the Cardano network

- Solana (SOL) – Known for high-speed transactions

- Toncoin (TON) – The blockchain associated with Telegram

- Polygon (POL) – A scaling solution for Ethereum

The casino also accepts multiple stablecoins pegged to the US dollar. These include USDC on Ethereum, Polygon, and Solana networks. USDT (Tether) is available on Ethereum, Polygon, TON, Tron (TRC20), and Solana networks. Stablecoins provide price stability while maintaining the benefits of cryptocurrency transactions.

Players select their preferred cryptocurrency during account registration. Deposits require sending the chosen cryptocurrency to the wallet address provided by the casino. The platform generates unique deposit addresses for each player to ensure funds reach the correct account.

Cryptocurrency deposits typically process within minutes, depending on blockchain confirmation times. Bitcoin transactions may take longer during periods of network congestion. Faster blockchains like Solana and Tron often complete deposits in seconds.

Withdrawals follow a similar process. Players request a withdrawal to their personal cryptocurrency wallet. The casino processes the request and sends funds to the provided wallet address. Blockchain transactions provide transparency, allowing players to track their transfers.

The casino plans to introduce fiat currency payment options during 2026. This expansion will allow players to deposit using traditional currencies through methods like credit cards, bank transfers, or e-wallets. The addition of fiat options will make the casino accessible to a broader audience.

Is it Legit?

ZunaBet operates under a gambling license from the Government of the Autonomous Island of Anjouan, Union of Comoros. The license number is ALSI-202510047-FI2. This license authorizes the casino to offer games of chance and wagering to players in permitted jurisdictions.

The casino is owned and operated by Strathvale Group Ltd., a company registered in Belize. The registration number is 000050881, and the registered address is San Victor Street, Orange Walk Town, Belize. This information is publicly available and can be verified.

The Anjouan license allows the casino to operate legally within its regulatory framework. The Government of Anjouan regulates online gambling operators under its jurisdiction. Licensed casinos must meet certain standards to maintain their authorization.

The casino states it has passed all regulatory compliance requirements. This includes verification of gaming systems, fairness of games, and proper business practices. Licensed operators undergo review processes to ensure they meet licensing standards.

The team behind ZunaBet brings over 20 years of combined experience in online casino operations. This experience suggests the operators understand the industry and how to run a gambling platform. Experienced operators are more likely to maintain professional standards.

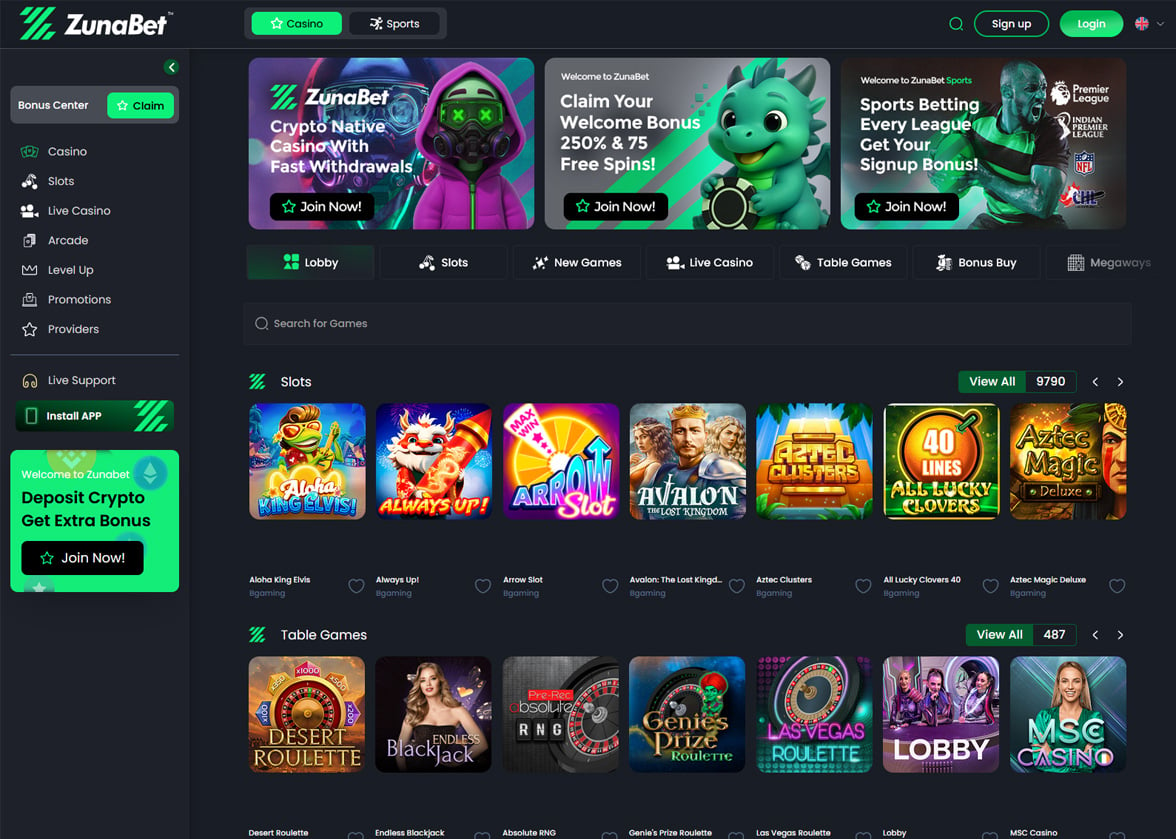

Design & Usability

ZunaBet features a modern design with a dark color scheme. The black background creates a sleek appearance that reduces eye strain during extended gaming sessions. Green accents throughout the interface tie into the casino’s brand colors and logo design.

The dark theme has become popular among online casinos and gaming platforms. It provides a contemporary look that appeals to modern players. The green highlights stand out against the dark background, making important buttons and features easy to locate.

The layout follows current web design principles with clear navigation menus. The homepage showcases featured games, popular slots, and current promotions. Players can quickly access different sections without searching through complicated menus.

The casino organizes games into categories for easy browsing. Players can filter by game type, provider, or popularity. A search function allows finding specific titles quickly. This organization helps players navigate the large game library of over 11,000 titles.

The sports betting section maintains the same design aesthetic. The sportsbook interface shows available events and markets clearly. Live betting features are accessible, with real-time odds updates displayed prominently.

Visual elements throughout the site reflect the dragon theme. The Zuno mascot appears in various places, adding personality to the platform. The dragon imagery creates a cohesive brand experience that makes ZunaBet memorable.

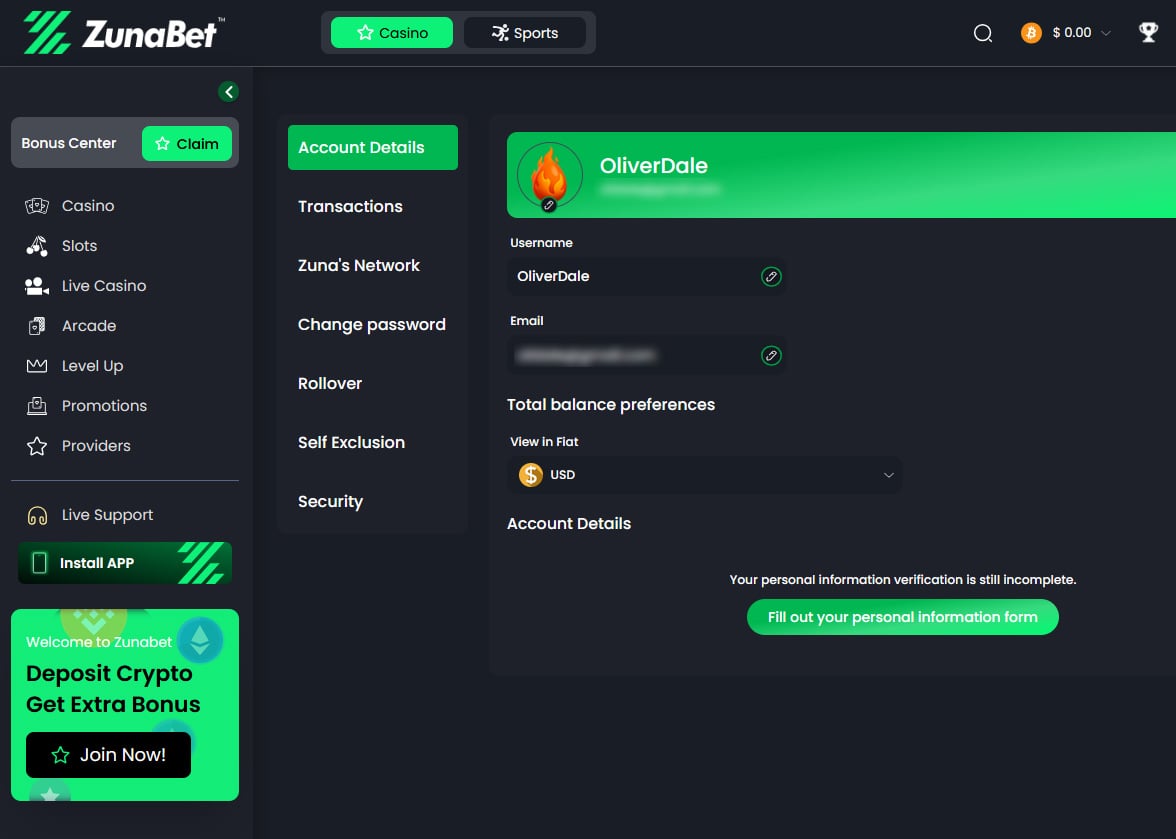

Members Area

The members area serves as the hub for account management. After logging in, players access their dashboard showing account balance, recent activity, and available bonuses. The dashboard provides an overview of account status at a glance.

Account settings allow players to update personal information and preferences. This includes email address, password changes, and communication preferences. Players can manage how they receive notifications from the casino.

The loyalty program status displays prominently in the members area. Players can see their current tier, progress toward the next level, and available rewards. The dragon evolution visual shows how close the dragon is to its next stage.

Transaction history is accessible through the members area. Players can review all deposits and withdrawals with dates, amounts, and transaction IDs. This transparency helps players track their gambling activity and verify transactions on blockchains.

Mobile Offering

ZunaBet provides full mobile access through multiple channels. The website uses responsive design that adapts to different screen sizes. Players can access the casino through mobile web browsers on smartphones and tablets without any loss of functionality.

The responsive design ensures games display properly on smaller screens. Touch controls work smoothly for navigation and gameplay. The mobile web version includes all features available on desktop, from casino games to sports betting.

Dedicated mobile apps are available for multiple operating systems. iOS users can install the app on iPhones and iPads. Android users have an app optimized for Android devices. The availability of native apps improves performance and convenience.

Windows and MacOS apps extend mobile access to laptops and desktop computers. These apps provide quick access without opening a web browser. Installing the app creates a shortcut that launches directly to the casino.

The apps mirror the website’s functionality completely. Players have access to the full game library, sportsbook, and account features. There’s no compromise in available features between web and app access.

Mobile gameplay performs well across games. Slots are optimized for touch controls with easy tap-to-spin functions. Table games work smoothly with touch-based betting interfaces. Live dealer games stream in good quality on mobile devices.

Customer Support

ZunaBet provides customer support through email at support@zunabet.com and also the live chat area of the website. Players can contact the support team with questions, issues, or feedback. Email support allows for detailed explanations of problems and provides a written record of communications.

The support team assists with account issues including login problems, password resets, and verification questions. They can help troubleshoot technical issues if players experience problems with games or the website.

Deposit and withdrawal inquiries are handled through customer support. If transactions are delayed or players have questions about cryptocurrency transfers, the support team can investigate. They can provide updates on pending withdrawals or verify deposit confirmations.

Bonus-related questions are common support inquiries. The team can explain wagering requirements, bonus terms, and eligibility for promotions. They can verify bonus crediting and help resolve issues if bonuses don’t appear correctly.

Game-specific issues can be reported to customer support. If a game malfunctions or a round doesn’t complete properly, the team can investigate. They can review game logs to determine what happened during a disputed session.

Conclusion

ZunaBet enters the online casino market with a strong offering. The platform combines over 11,000 games from 63 providers with comprehensive sports betting coverage. The cryptocurrency focus provides fast transactions and lower fees for players comfortable with digital currencies.

The welcome bonus package offers good value with up to $5000 in bonuses plus 75 free spins across three deposits. The structure encourages new players to make multiple deposits to unlock the full value. This compares favorably with welcome offers at other crypto casinos.

The dragon-themed loyalty program adds a unique element to the player experience. The six-tier system with increasing rakeback rates rewards regular players. The gamification aspect makes progress feel more engaging than standard VIP programs.

The game selection is impressive in both quantity and variety. Having 63 providers ensures diverse gaming options from established names and innovative newcomers. Players will find popular titles alongside games they might not encounter at other casinos.

Sports betting coverage is thorough across traditional sports and eSports. The inclusion of lesser-known sports and extensive eSports options broadens the appeal. Live betting functionality allows action on events as they happen.

The modern design with dark theme and green accents creates a contemporary feel. The platform performs well with responsive design across devices. Mobile apps for multiple operating systems provide convenient access for players on the go.

For players seeking a crypto casino with extensive games, solid sports betting, and rewarding loyalty benefits, ZunaBet delivers. The platform provides entertainment value with enough variety to keep regular players engaged. The combination of features positions it well in the competitive crypto casino space.

FAQs

What cryptocurrencies does ZunaBet accept?

ZunaBet accepts over 20 cryptocurrencies including Bitcoin, Ethereum, Litecoin, Dogecoin, Solana, Cardano, and multiple stablecoins like USDT and USDC on various networks. The platform also accepts BNB, XRP, TRX, BCH, ADA, TON, and POL.

How does the loyalty program work?

The loyalty program has six tiers from Squire to Ultimate. Players progress through tiers based on total wagering volume. Each tier offers increased rakeback percentages from 1% to 20%, free spins, and access to random promotions and VIP benefits. Your dragon evolves as you advance through tiers.

What is the welcome bonus at ZunaBet?

New players receive a welcome package worth up to $5000 plus 75 free spins across three deposits. The first deposit gets 100% up to $2000 plus 25 free spins, the second deposit gets 50% up to $1500 plus 25 free spins, and the third deposit gets 100% up to $1500 plus 25 free spins.

Can I play on my mobile device?

Yes, ZunaBet is fully mobile-compatible with responsive web design that works on any mobile browser. The casino also offers downloadable apps for iOS, Android, Windows, and MacOS devices for convenient access.

How many games are available at ZunaBet?

ZunaBet offers over 11,294 games from 63 different software providers. The library includes slots, table games, live dealer games, and various specialty games. Major providers include Pragmatic Play, Hacksaw Gaming, Evolution Gaming, and many others.

Zunabet

Pros

- Massive game library with over 11,000 titles from 63 providers

- Generous welcome bonus package

- Unique dragon-themed loyalty program

- Extensive cryptocurrency support

- Comprehensive sports betting

Cons

- Currently crypto-only payments

- New casino without established track

Crypto World

MYX Finance (MYX) Plunges 40% Daily, Bitcoin (BTC) Stalls at $67K: Market Watch

MYX is the most volatile token today, while PIPPIN has surged by 13%.

Bitcoin’s underwhelming price movements continue as the asset has failed to stage a notable recovery from its dip below $66,000 yesterday and now sits just a grand higher.

Some altcoins have posted more impressive gains over the past day, including HYPE and HBAR, both of which have gained around 5%.

BTC Stalls at $67K

The primary cryptocurrency has been in a knockdown state for weeks. Ever since it was rejected at $90,000 on January 28, the predominant force in the market has been the bears. The culmination of a week-long correction took place last Friday when they drove the asset to its lowest position in well over a year at $60,000.

After such a calamity in which bitcoin lost $30,000 in less than ten days, the bulls finally intervened and staged a quick and impressive rebound to $72,000. BTC tried to take down that level on a couple of occasions by Monday, but it was ultimately stopped.

The latest correction occurred yesterday when bitcoin slipped below $66,000 again. Although it bounced to $68,000 almost immediately, it couldn’t continue higher and now trades around $67,000 once more after a 5% weekly decline.

Its market cap struggles at $1.340 trillion on CG, while its dominance over the alts has dropped further to 56.6%.

MYX Plunges

Most larger-cap alts are slightly in the green on a daily scale. However, ETH continues to trade well below $2,000, and XRP is beneath $1.40. Only BNB has defended its territory and sits above $600 from the top 5 alts. HYPE and HBAR are today’s top gainers from this cohort of altcoins, posting 5% gains to $30 and $0.093, respectively.

PIPPIN continues to chart notable gains, surging 11% daily and a whopping 190% weekly to almost $0.50. ASTER and VET follow suit. In contrast, MYX has dumped by nearly 40% daily to under $3.3.

The total crypto market cap has remained below $2.4 trillion on CG, even though it has increased slightly ($2o billion or so) since yesterday.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Smart investors are positioning in SolStaking

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A sharp $90 billion crypto market selloff is prompting renewed attention on structured staking models designed to maintain capital efficiency during volatility.

Summary

- Bitcoin fell below $66,000, Ethereum approached $1,900, and altcoins dropped up to 7%, pushing sentiment into “Extreme Fear” territory.

- Rather than relying solely on price recovery, some investors are exploring staking and cloud-based models aimed at generating yield during downturns.

- SolStaking combines blockchain-based settlement with diversified real-world asset exposure and a defined compliance framework to support more stable participation in turbulent cycles.

In just a few hours, nearly $90 billion evaporated from the crypto market.

Bitcoin dropped sharply below $66,000. Ethereum slid toward $1,900. Altcoins fell 4%–7%. The Fear & Greed Index plunged into “Extreme Fear.”

This wasn’t just volatility. It was a reminder.

In high-risk cycles, assets without structure bleed the fastest.

And that’s exactly why capital is shifting toward structured participation models like SolStaking.

Volatility isn’t the problem. Passive exposure is.

When markets crash:

- Leverage accelerates liquidations

- Fear drives irrational exits

- Capital becomes reactive instead of strategic

Simply holding assets without a yield structure means users’ portfolios depend entirely on price recovery. That’s speculation.

Structured staking participation is strategy.

What is SolStaking?

SolStaking is a structured digital asset platform designed to help crypto holders maintain capital efficiency during volatile cycles.

Instead of relying purely on price appreciation, SolStaking allows users to participate in automated staking and cloud mining models supported by both blockchain infrastructure and diversified real-world asset operations (RWA).

The goal is simple: Keep assets working — even when markets aren’t.

Security and compliance infrastructure

In times of instability, security matters more than yield.

SolStaking operates with a clearly defined compliance and risk framework:

- U.S.-registered operating entity: Sol Investments, LLC

- Asset segregation: User staking assets are kept strictly separate from platform operating funds

- Independent audits: Periodic audits conducted by PwC

- Custody insurance: Coverage provided by Lloyd’s of London

- Enterprise-grade security: Multi-layer encryption, system isolation, and 24×7 risk monitoring

This structure is designed for long-term operational stability, not short-term hype.

Real-world asset support structure

Unlike purely speculative staking models, SolStaking integrates diversified real-world operational assets, including:

- AI data center infrastructure

- Sovereign and investment-grade bonds

- Physical gold and commodity exposure

- Industrial metal inventory

- Logistics and cold-chain infrastructure

- Agriculture and clean energy projects

These assets operate off-chain, generating structured revenue streams that are reflected through automated on-chain contract execution.

The result? Even during heavy market corrections, the operational structure continues functioning.

Contract participation

SolStaking offers various staking and cloud mining contract models tailored to different asset types and time horizons.

Users can participate using assets such as BTC, ETH, SOL, USDT, and others. Contracts are executed automatically by the system, with daily settlement mechanisms and transparent tracking.

For full details regarding available contract plans, participation terms, and performance structures, users are encouraged to visit the official website for the most up-to-date information.

Why this matters in a bear market

Bear markets don’t destroy capital overnight. They drain it slowly, through inactivity, poor structure, and emotional decision-making.

The difference isn’t who predicts the bottom. It’s who builds a structure that continues operating through volatility. When others are waiting for price recovery, structured participants are maintaining capital efficiency.

Final thought

Crypto will always be volatile. But how people position their assets during volatility is a choice.

People can wait for the next rally. Or they can structure their assets to operate through the storm.

SolStaking is built for high-volatility markets. To learn more, visit the official website.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Digital assets exchange-traded product landscape: past, present and future

In today’s newsletter, Joshua De Vos, head of research at CoinDesk, summarizes their latest crypto ETF report covering U.S. adoption, the speed at which it’s happening and asset concentration.

In Keep Reading, we link to the U.S. and Global ETF reports for those who want to do a deeper dive.

Digital assets exchange-traded product landscape: past, present and future

Crypto for Advisors – February – Digital Asset ETPs

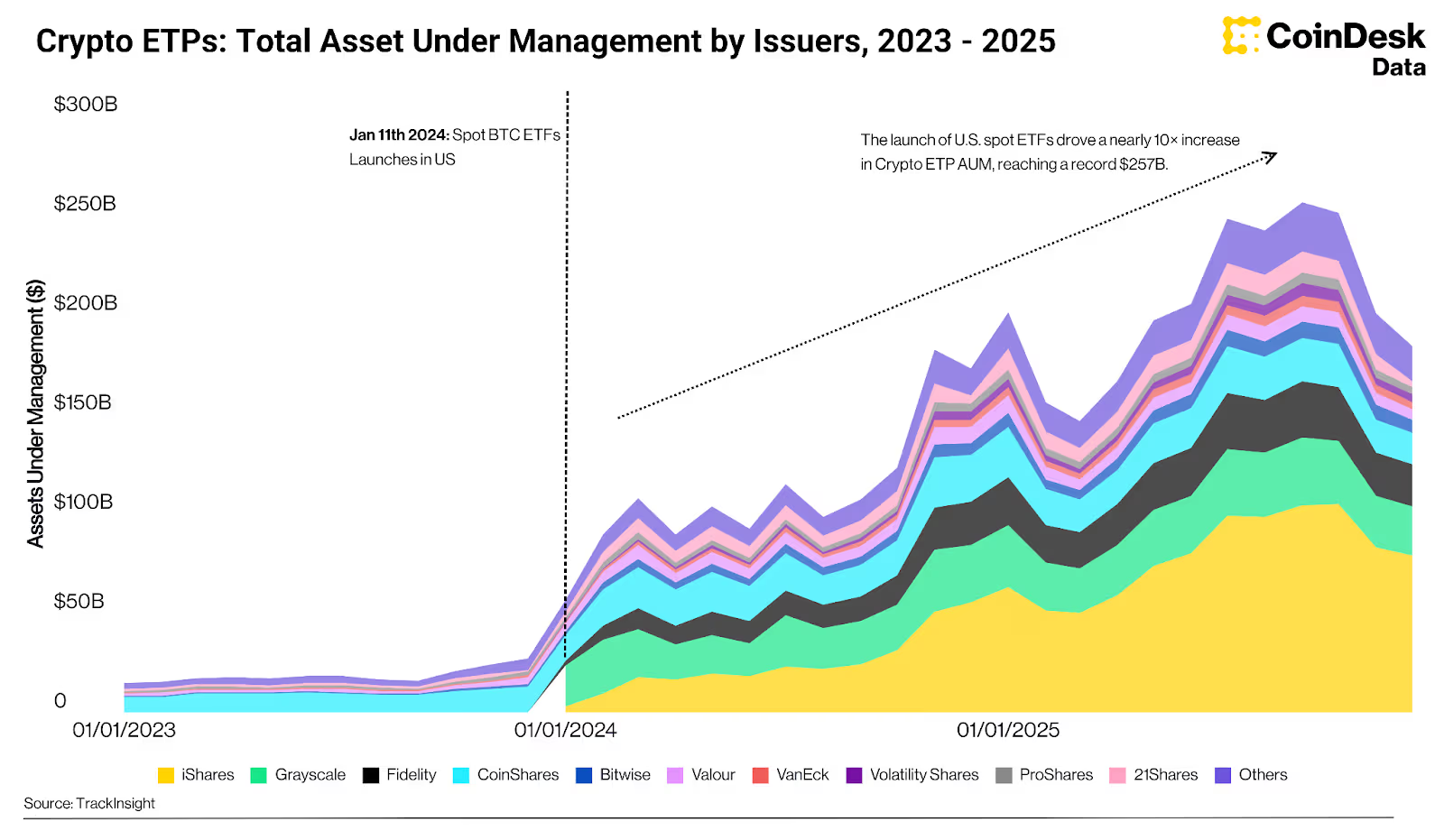

Digital asset Exchange-Traded Products (ETPs) are now one of the clearest signals of how quickly crypto is being integrated into traditional portfolio infrastructure. As presented in CoinDesk’s latest research report, the market has moved beyond the early phase of fragmented access and into a period where regulated wrappers and exchange-traded fund (ETF) distribution are materially shaping how capital enters the asset class.

The state of crypto ETP adoption

As of the end of 2025, crypto ETP assets under management (AUM) reached $184 billion. The United States remains the center of gravity, accounting for approximately $145 billion, or close to 80% of global assets AUM. ETFs dominate the product landscape, representing 84.6% of crypto structured products by assets. The market is also heavily skewed toward simple exposure. Around 94.1% of crypto ETPs employ a delta-one strategy, and 96.1% are passively managed.

The growth in AUM has been driven primarily by the launch of U.S. spot bitcoin ETFs in January 2024. The step-change was immediate. The launch cycle pushed crypto ETP assets sharply higher and created a product category that now sits inside the same ETF allocation frameworks used across equities, fixed income and commodities.

The pace of adoption has also been unusually fast when compared to earlier ETF cycles. U.S. bitcoin ETFs reached $100 billion in assets in just 11 months, while U.S. gold ETFs took nearly 16 years to surpass the same milestone. By early 2025, bitcoin ETFs had matched 91% of the top 10 U.S. gold ETFs by AUM, before gold’s subsequent rally widened the gap. This is less a statement about relative value and more a statement about how quickly bitcoin has been absorbed into institutional distribution channels once the wrapper became available.

Scale and concentration

Within the crypto ETP market, exposure remains heavily concentrated. Bitcoin-based products account for $144 billion in AUM, representing 78.2% of total AUM. Ether-based products have reached $26.5 billion, indicating that institutional demand is gradually broadening beyond bitcoin. Outside of those two assets, exposure remains limited. Solana- and XRP-linked products manage $3.8 billion and $3.0 billion respectively, while multi-cryptocurrency ETPs represent 0.62% of total AUM, or $2.16 billion.

The pipeline broadens

This hierarchy is consistent with how ETF markets typically develop. Institutions tend to begin with the most liquid assets, in the most established structures, before expanding into broader exposure as markets deepen and benchmarks standardise. That dynamic is now beginning to appear in the crypto ETP pipeline. As of end-2025, more than 125 digital asset ETP filings were pending, with bitcoin continuing to lead the filing landscape, followed by XRP and Solana as the most active single-asset categories.

The other notable development is the growing momentum behind basket products. Multi-cryptocurrency ETPs remain a small segment by AUM, but they represent the second most active category by number of pending filings. This matters because basket products tend to become more relevant as markets mature, correlations evolve and concentration risk becomes more apparent. Indices such as the CoinDesk 5 and CoinDesk 20 are increasingly being used as reference points for ETPs, structured notes and derivatives, reflecting the market’s gradual shift toward diversified exposure.

Advisor access

The expansion of crypto ETPs has also occurred before broad adoption across major advisory platforms. Many large advisors remain in evaluation or early allocation phases, suggesting current AUM reflects initial positioning rather than full participation. That is beginning to change, with firms such as Vanguard only recently expanding client access to crypto ETFs.

Looking ahead, the scale of the global ETF market provides context for how large the category could become. Global ETF and ETP assets are projected to grow to roughly $30 trillion by 2030. Within that framework, even modest allocation decisions have the potential to translate into a materially larger crypto ETP market over time.

This summary was created based on CoinDesk Research’s latest report; Digital Assets ETP Landscape: Past, Present and Future.

– Joshua De Vos, research team lead, CoinDesk

Keep Reading

Read the full global and U.S. ETF reports here:

Crypto World

Flipster FZE Secures In-Principle Approval from VARA, Reinforcing Commitment to Regulated Crypto Access

[PRESS RELEASE – Dubai, UAE, February 12th, 2026]

Flipster, a global cryptocurrency trading platform, has received in-principle approval from Dubai’s Virtual Assets Regulatory Authority (VARA) under Flipster FZE. The approval is a key milestone in Flipster’s expansion into the Middle East and reinforces its focus on building safe, compliant access to digital assets in regulated markets.

The in-principle approval allows Flipster FZE to progress toward offering regulated virtual asset services under VARA’s framework, with spot trading as the initial offering. It reflects Flipster’s long-term strategy to operate within established regulatory frameworks in key global markets.

“This milestone is a meaningful vote of confidence in our long-term commitment to the region,” said Benjamin Grolimund, General Manager at Flipster FZE. “The Middle East has become a blueprint for how digital assets should be regulated and adopted. VARA’s clear framework enables innovation while prioritizing trust and security — and we’re committed to building trading solutions that meet the highest standards globally.”

Flipster’s regulatory progress is matched by its continued enhancement of its compliance infrastructure. The platform’s partnership with Chainalysis enhances its capabilities in transaction monitoring and risk management — supporting Flipster’s readiness to meet VARA’s regulatory standards and operate with greater accountability and oversight.

Flipster first announced its entry into the Middle East in May 2025, with the appointment of Benjamin Grolimund, a seasoned fintech executive with prior leadership roles at Rain and Bloomberg. The UAE’s regulatory clarity and maturing digital asset ecosystem continue to position it as a strategic base for Flipster’s global growth plans.

About Flipster FZE

Flipster FZE is a regulated digital asset exchange planning to offer spot trading across leading cryptocurrencies. The platform is engineered for dependable execution, transparent pricing, and a streamlined user experience.

With a strong emphasis on compliance and security, Flipster provides users with a trusted venue to access digital asset markets with confidence.

Users can learn more at flipster.io or follow X.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum price nears oversold zone as ETH staking metric hits key milestone

Ethereum price remained in a bear market as the crypto market continued to weaken ahead of the U.S. consumer inflation report.

Summary

- Ethereum price has moved into a bear market after falling by 60% from its all-time high.

- The Relative Strength Index is approaching the oversold level.

- Ethereum’s staking ratio has jumped to a record high of 30%.

Ethereum (ETH) dropped to $1,985, down by 60% from its highest level in August last year. This is the token’s fourth consecutive week in the red, a move that has shed billions of dollars in value.

Ethereum’s price retreated as demand for its ETFs and futures open interest declined. Data compiled by SoSoValue shows that spot ETH ETFs shed over $129 million in assets on Wednesday, bringing the monthly outflow to over $224 million. It is the fourth consecutive month of outflows, with the cumulative net inflows being $11.75 billion.

More data show that Ethereum’s futures open interest has continued to fall over the past few months. Its open interest dropped to $23 billion, down sharply from last year’s high of over $70 billion. Falling open interest is a sign that investor demand has waned.

However, there are signs that more Ethereum is being moved today to staking pools. Data show that Ethereum staking recently crossed 30% of the total supply for the first time.

More data show that the staking queue has continued soaring in the past few months. There are now over 4 million ETH tokens in the queue waiting to be staked, with less than 25,000 waiting to exit.

Ethereum price prediction: Technical analysis

The weekly timeframe chart shows that the ETH price has been in a strong downward trend in the past few months, moving from $4,950 in August to the current $1,988.

It has crashed below the crucial support level at $2,112, its lowest level in August 2024.

On the positive side, the coin has formed an inverted head-and-shoulders pattern, a common bullish reversal sign in technical analysis.

Also, the Average Directional Index has dropped from 33 in July last year to 21 now, a sign that the downtrend is losing momentum.

Most notably, the Relative Strength Index is nearing the oversold level of 30, its lowest level since April last year. Ethereum has often rebounded whenever the RSI has moved into the oversold zone.

Therefore, as Tom Lee noted, there are signs that Ethereum is about to bottom. If this happens, the next level to watch will be the psychological $2,500 level.

Crypto World

BlackRock’s BUIDL Fund Hits Uniswap as UNI Jumped 40%

UNI surged 40% in minutes after Uniswap enabled trading for BlackRock’s tokenized BUIDL fund via UniswapX integration.

Uniswap’s UNI token jumped about 40% within half an hour, after Uniswap Labs announced that BlackRock’s tokenized money market fund BUIDL can now trade through its protocol.

The move links one of the world’s largest asset managers with a decentralized exchange, drawing attention from traders and institutional watchers alike.

BlackRock Fund Trading Goes Live on Uniswap Rails

In a February 11 press release, Uniswap Labs said it partnered with Securitize to make BlackRock’s USD Institutional Digital Liquidity Fund available for trading via UniswapX, its request-for-quote trading system.

The company stated that investors can swap BUIDL with approved counterparties at any time using smart contracts for settlement.

Hayden Adams, CEO of Uniswap Labs, said the integration aims to make markets cheaper and faster, while Securitize CEO Carlos Domingo said it brings traditional financial standards to blockchain-based trading.

BlackRock’s global head of digital assets, Robert Mitchnick, called the launch “a notable step” for tokenized funds interacting with decentralized finance systems. The asset manager also confirmed it has made an investment within the Uniswap ecosystem, though it did not disclose the amount or whether it bought UNI tokens.

Market reaction followed quickly, with UNI rising by more than 40% in about 30 minutes to touch $4.57 after the announcement and news of BlackRock’s involvement spread across trading desks.

You may also like:

As of the latest CoinGecko data, the excitement around the token seems to have petered down somewhat, with UNI now trading near $3.40, which is still up about 5% over 24 hours.

Despite the short-term jump, the token is still down about 9% over seven days and more than 35% in the past month, showing that the spike came after a longer decline.

Tokenized Assets Keep Drawing Major Finance Firms

The integration builds on a wider trend of institutions putting financial products on public blockchains. Earlier in the year, the official Ethereum account on X noted that 35 major firms, including BlackRock, JPMorgan, and Fidelity, have launched services tied to the network. Those projects range from tokenized stocks and funds to stablecoins and deposit tokens.

Securitize, which manages more than $4 billion in assets, has worked with asset managers such as Apollo, KKR, and BNY to tokenize funds. By linking its compliance-focused platform with Uniswap’s trading system, the companies are testing a structure where regulated investors can access blockchain liquidity while remaining within whitelisted environments.

UNI’s recent price swings show how closely traders track institutional activity tied to decentralized finance.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tom Lee Says Ethereum Has Never Failed This Pattern and Expects Another V-Shaped Recovery

BitMine bought roughly $83 million in ETH this week, even as Ethereum struggles to reclaim $2,000-mark.

Ethereum has remained volatile since October, while the sell-off intensified over the last month. Fundstrat head of research Tom Lee said investor frustration around the leading altcoin’s recent weakness overlooks a long and consistent historical pattern of sharp declines followed by equally rapid recoveries.

In fact, he believes that the bottom is near.

Ethereum Near the Bottom?

While speaking at a conference in Hong Kong this week, Lee said that since 2018, Ethereum has experienced drops of more than 50% on eight different drawdowns, including a steep 64% fall between January and March last year. In every one of those instances, ETH formed a “V-shaped bottom,” recovering fully and doing so at roughly the same pace as its decline. From his perspective, this track record indicates that the current drawdown does not represent any change in Ethereum’s outlook, and he expects another V-shaped bottom to emerge following the latest sell-off.

Lee also cited BitMine market analyst Tom DeMark’s assessment, who believes Ethereum may need to revisit the $1,890 level to form a “perfected bottom.” Lee added that, based on BitMine’s assessment, ETH appears to be very close to such a bottom, as he drew parallels to previous downturns in late 2018, late 2022, and April 2025.

While Lee refrained from pinpointing the exact low, he argued that the magnitude of the decline itself is more important, and that investors should be thinking in terms of opportunity rather than offloading their stash.

“If you have already seen a decline, you should be thinking about opportunities here instead of selling.”

BitMine Is Buying

His comments came as Ether prices fell to $1,760 on February 6, as it approached the 2025 low of almost $1,400. So far, ETH has continued to struggle to reclaim the $2,000 level after a more than 36% drop over the past 30 days. As weakness in the market continues, BitMine, the ETH-focused treasury firm chaired by Lee, purchased roughly $83 million worth of ETH this week.

It executed two large buys of 20,000 ETH each via institutional platforms BitGo and FalconX, even as its existing holdings remained significantly underwater.

You may also like:

Meanwhile, the drawdown has already led to large-scale portfolio adjustments. For instance, Trend Research, a trading firm led by Liquid Capital founder Jack Yi, fully exited its Ethereum positions and closed what was once Asia’s largest ETH long. The firm had built roughly $2.1 billion in leveraged ETH exposure but ultimately realized losses of about $869 million after unwinding its positions despite Yi reiterating a bullish long-term outlook just days earlier.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Standard Chartered sees bitcoin (BTC) sliding to $50,000, ether (ETH) to $1,400 before recovery

Investment bank Standard Chartered lowered its short-term and full-year price forecasts for major cryptocurrencies, citing continued downside risk as exchange-traded fund (ETF) outflows and a challenging macro backdrop pressure the market.

The bank now expects bitcoin to fall to around $50,000 in the coming months, with ether potentially bottoming near $1,400.

The world’s largest cryptocurrency was trading around $67,900 at publication time. Ether, the second-largest, was trading around $1,980.

Geoff Kendrick, Standard Chartered’s head of digital assets research, said the selloff in recent weeks could extend as ETF investors, many sitting on losses, are more likely to reduce exposure than “buy the dip.”

Once prices establish a bottom, Kendrick said, he expects a recovery through the rest of 2026. The analyst reduced his year-end target for bitcoin to $100,000 from $150,000, ether to $4,000 from $7,500, solana to $135 from $250, BNB Chain to $1,050 from $1,755 and to $18 from $100.

The crypto market has weakened sharply in early 2026, with major assets like bitcoin sliding significantly from late-2025 highs and the total market cap down sharply over recent weeks. Bitcoin has dropped almost 23% since the start of the year.

The downturn has been marked by heightened volatility, large liquidations of leveraged positions and broad risk-off sentiment, which has seen crypto correlate more closely with weakening equity markets.

Macro pressures such as concerns about global growth and interest-rate outlooks have pushed investors toward traditional havens like gold, while stalled regulatory clarity, particularly in the U.S., and liquidity strains at some institutions have weighed on confidence. Combined, these forces have led to reduced trading revenues for crypto-exposed firms and bearish sentiment across many tokens.

Holdings of bitcoin ETFs have declined by nearly 100,000 BTC from their October 2025 peak, according to Kendrick. The average ETF purchase price is around $90,000, leaving many investors with unrealized losses of roughly 25%.

Macro conditions are also weighing on sentiment. Kendrick noted that while U.S. economic data show signs of softening, markets expect no interest-rate cuts before Kevin Warsh’s first Federal Open Market Committee meeting as Federal Reserve chair in mid-June, limiting near-term support for risk assets.

Despite the expected capitulation, the bank said the current drawdown is less severe than previous cycles. At its worst point in early February, bitcoin was down about 50% from its October 2025 all-time high, and roughly half of supply remained in profit, declines that are sharp but not as extreme as in prior downturns.

Crucially, this cycle has not seen the collapse of major crypto platforms, unlike 2022’s failures of Terra/Luna and FTX. Kendrick said that suggests the asset class is maturing and more resilient.

The analyst left his longer-term projections unchanged, maintaining end-2030 targets of $500,000 for bitcoin and $40,000 for ether, arguing that usage trends and structural drivers remain intact.

The analyst previously reduced his bullish bitcoin forecasts in December.

Read more: Standard Chartered Throws in the Towel on Bullish Bitcoin Forecast

Crypto World

BYDFi Joins Solana Accelerate APAC at Consensus Hong Kong

VICTORIA, Seychelles, February 12, 2026 — Global crypto trading platform BYDFi participated as a sponsor of Solana Accelerate APAC at Consensus Hong Kong 2026, held alongside Consensus Hong Kong at the Hong Kong Convention and Exhibition Centre. The combined gathering brought founders, institutions, policymakers, and builders together, highlighting Hong Kong’s role as a leading regional hub and a key meeting point for Web3 and blockchain innovation.

BYDFi at Solana Accelerate APAC in Hong Kong

Solana Accelerate APAC convened the Solana community and broader crypto ecosystem around the future of internet capital markets and onchain innovation, set against the backdrop of a global financial center known for clear frameworks and active market participation. BYDFi’s participation marked a first deeper step into Solana-focused programming and community dialogue. Discussions also reflected ongoing market focus on crypto regulation Hong Kong and crypto licensing Hong Kong.

During the event, the BYDFi team was on site to meet attendees, share product context, and distribute limited merchandise, including Newcastle United co-branded items as part of BYDFi’s ongoing brand collaboration with the club. The booth saw strong foot traffic throughout the day.

What BYDFi Is Sharing in Hong Kong

BYDFi used the event to share how a CEX + DEX dual-engine approach can support clearer participation across venues and workflows, particularly for users who want both centralized liquidity and onchain discovery in one connected experience. MoonX, BYDFi’s onchain trading engine, supports Solana and is designed to help users track and navigate fast moving onchain markets with a workflow built for speed, signal clarity, and execution efficiency.

In parallel, BYDFi highlighted reliability foundations that support long term trust in volatile markets, with an emphasis on operational safeguards and service responsiveness. These include over 1:1 Proof of Reserves with periodic public reporting, an 800 BTC Protection Fund, and 24/7 multilingual customer support with timely responses across official channels, including social media.

Why This Matters for BYDFi and the Solana Ecosystem

Solana Accelerate APAC brought ecosystem builders and market infrastructure discussions into the same orbit. BYDFi’s participation centered on two goals: listening closely to Solana-native users and teams, and exploring deeper collaboration opportunities that can strengthen product coverage, user experience, and market access as the crypto market continues to mature.

Michael, Co-Founder and CEO of BYDFi, said: Solana Accelerate APAC creates the right setting for practical conversations between builders, market participants, and policymakers. BYDFi joined to learn, connect, and contribute in a way that holds up over time. Reliability is built through consistent infrastructure, clear safeguards, and responsive support, and BYDFi will continue strengthening all three as engagement across the Solana ecosystem deepens.

About BYDFi

Founded in 2020, BYDFi now serves over 1 million users across 190+ countries and regions. BYDFi is Newcastle United’s Exclusive Official Crypto Exchange Partner. Recognized by Forbes as one of the Best Crypto Exchanges In Canada For 2026, BYDFi offers intuitive, low-fee trading across Spot and Perpetual Contracts to Copy Trading, and Automated Crypto Trading Bots, empowering both new and experienced traders to navigate digital assets with confidence.

BYDFi is dedicated to delivering a world-class crypto trading experience for every user.

BUIDL Your Dream Finance.

Twitter( X ) | LinkedIn | Telegram | YouTube | TikTok | How to Buy on BYDFi

Crypto World

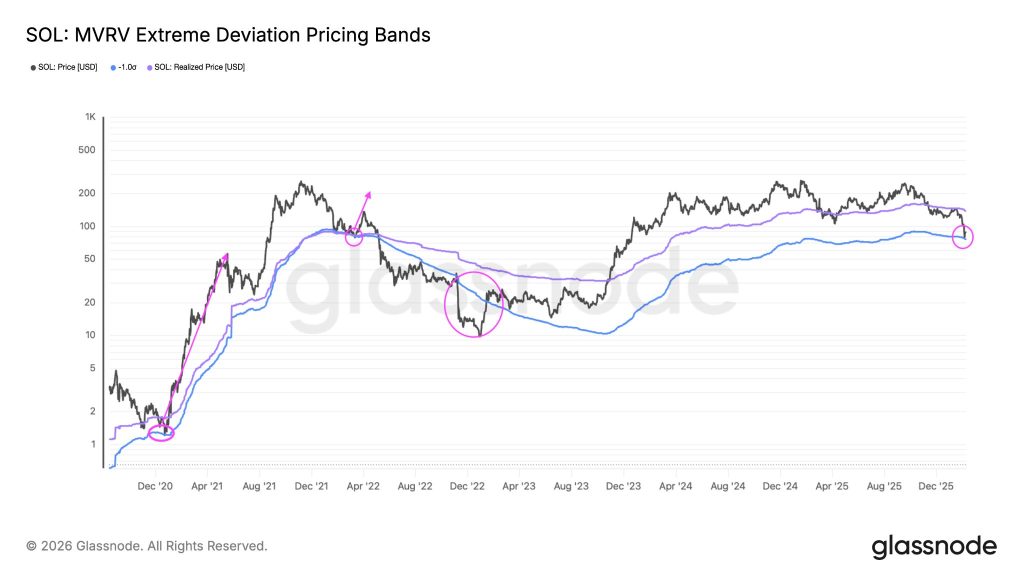

Solana Price Prediction: SOL Faces $42 Target as Head-and-Shoulders Pattern Emerges

The price of Solana (SOL) is teetering on the edge of a major technical breakdown today.

After plummeting 42% over the last 30 days and testing two-year lows, analysts warn that a massive head-and-shoulders pattern on the monthly chart signals a potential freefall.

If support fails, there might be no further support until the price hits $30.

Solana is currently stuck in a “make-or-break” juncture.

Sitting at approximately $82, the token has erased billions in market value, reflecting a staggering 72% loss from its ATH of $293 in January 2025. While typical market corrections are expected, this downward spiral has validated a classic head-and-shoulders bearish structure across its chart from April 2025 to February 2026.

For traders assessing the damage, whether SOL is one of the best cryptos to buy now might depend on whether key support levels can hold against this macro pressure.

Solana Price Prediction: Does the Head-and-Shoulders Pattern Indicate Imminent Collapse?

Is the bottom in, or is the pain just starting? The charts paint a grim picture.

Pseudonymous X crypto analyst “Shitpoastin” highlighted that a massive head-and-shoulders (H&S) pattern has formed on the monthly chart. This specific setup is notorious in technical analysis for signaling prolonged downturns.

Analyst Bitcoinsensus confirmed a breakdown from this macro structure, projecting a downside target as low as $50 per SOL.

Other market watchers are even more bearish. Analyst Alex Clay flagged an aggressive target of $42, a level that aligns with a long-watched demand zone from previous cycles. This represents a potential further downside of nearly 50% from current levels.

However, it is not all doom and gloom. Solana’s MVRV extreme deviation bands suggest a potential floor at $75. Historically, SOL has staged rallies, like the 87% bounce in March 2022, after testing these lower boundaries.

Discover: Best crypto to buy for portfolio diversification

What Traders Should Watch Next

If you are holding SOL, the $75 level is your line in the sand.

A decisive daily close below this support could trigger the secondary phase of the correction, mirroring the catastrophic drops seen during the 2022 crashes. This would likely open the floodgates toward the $30 to $42 range mentioned by analysts.

Despite the price carnage, Solana’s network activity remains high, with fee revenue nearly doubling Ethereum’s recently.

Divergences between price and fundamentals often create opportunities to buy the best crypto, but only for traders who wait for confirmation.

Watch for a reclaim of $100 to invalidate the bearish thesis. Until then, the head-and-shoulders pattern dictates caution.

Discover: The best meme coins on Solana today

The post Solana Price Prediction: SOL Faces $42 Target as Head-and-Shoulders Pattern Emerges appeared first on Cryptonews.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports15 hours ago

Sports15 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World17 hours ago

Crypto World17 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video12 hours ago

Video12 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

₿ (@Shitpoastin)

₿ (@Shitpoastin)

See you there

See you there