Crypto World

Ondo Integrates Chainlink Price Feeds for Tokenized US stocks on Ethereum

Ondo Finance said its Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling price feeds for tokenized US stocks including SPYon, QQQon and TSLAon to go live on Ethereum.

According to a post from Ondo on Wednesday, the feeds are now being used on Euler, where users can post the tokenized equities as collateral to borrow stablecoins.

The integration provides onchain pricing data for the tokenized assets, allowing decentralized finance (DeFi) protocols to set collateral parameters and manage liquidations based on reference prices tied to the underlying equities. The feeds incorporate corporate actions such as dividends, enabling applications to reference updated equity values.

Initial support covers SPYon (which represents the SPDR S&P 500 ETF), QQQon (representing the Invesco QQQ ETF) and TSLAon (Tesla stock), with additional tokenized stocks and exchange-traded funds (ETFs) expected to be added as oracle coverage and protocol integrations are expanded.

According to the announcement, risk parameters for the new lending markets, including collateral factors and liquidation thresholds, are being set and monitored by Sentora.

Ondo said the move addresses a prior limitation for tokenized equities, which had largely been held for price exposure but were not widely accepted as collateral in DeFi. By pairing exchange-linked liquidity with onchain price feeds, the companies aim to enable broader use of tokenized stocks in lending and other structured products.

The announcement follows an October 2025 partnership between Ondo Finance and Chainlink, a blockchain oracle network launched in 2017, that designated Chainlink as the primary data provider for Ondo’s tokenized stocks and ETFs.

Related: Wemade taps Chainlink for Korean won stablecoin infrastructure

Race to tokenize US equities

As US regulators continue to refine the legal framework for tokenized securities, legacy financial institutions and crypto platforms are accelerating efforts to put equities on blockchain infrastructure.

In September, Nasdaq filed for a rule change with US Securities and Exchange Commission (SEC) that would enable it to list and trade tokenized versions of publicly traded stocks, potentially allowing blockchain-based representations of listed shares to trade within its regulated exchange framework.

On Dec. 11, the same day it clarifyied how broker-dealers may custody tokenized securities under existing rules, the SEC issued a no-action letter allowing a Depository Trust & Clearing Corporation subsidiary to launch a tokenization service for securities already held in DTC custody.

On Jan. 19, the New York Stock Exchange and its parent company, Intercontinental Exchange, said they are developing a blockchain-based platform for trading tokenized stocks and ETFs with 24/7 trading and near-instant settlement, pending regulatory approval.

On the crypto side, more than 60 tokenized US stocks launched in June across exchanges Kraken and Bybit. The product, developed by Backed Finance under its xStocks brand, provides blockchain-based exposure to blue-chip companies, though it is not yet available to US customers.

Meanwhile, fintech Robinhood, which introduced tokenized versions of nearly 500 US stocks for EU users in October, has launched a public testnet for Robinhood Chain, an Ethereum layer-2 network built on Arbitrum.

On Wednesday, the company said the network is designed to support tokenized real-world and digital assets, including 24/7 trading, self-custody and onchain lending and derivatives applications.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Bitcoin $60K Retest Possible Due To Growing Liquidity Gap

Bitcoin (BTC) price fell to $65,800 on Wednesday, slipping back below key intraday trend lines and raising concerns that last week’s drop to $60,000 may not have been the final bottom. Now, analysts say the possibility of another drop to the yearly low ($59,800) is increasing due to a growing liquidity gap between $66,000 and $60,000.

Key takeaways:

-

Bitcoin has formed a series of lower highs after repeated rejections near the $70,000–$72,000 resistance zone.

-

The relative strength index (RSI) is trending toward oversold levels as the price trades below key moving averages.

-

The liquidation heatmap indicated an absence of liquidity up to $60,500, keeping the risk of a downside price move open.

Failure to hold $70,000 weakens Bitcoin’s short-term prospects

Bitcoin’s one-hour chart shows multiple failed attempts to hold above $70,000. Each rejection has led to lower price highs and steady selling pressure.

BTC’s price briefly pushed into intraday highs of $69,800 before reversing sharply during the New York session on Wednesday, forming a classic swing failure pattern. The move trapped breakout longs and accelerated downside momentum.

BTC also traded below both the 50-period and 100-period exponential moving averages, confirming short-term bearish control. The RSI remained below 50, indicating limited buying pressure.

A 15-minute order block sits near the $60,800–$61,000 region, an area where strong buying pressure previously stepped in after BTC printed a yearly bottom at $59,800. This region remains a liquidity target if $64,000 fails to hold.

Related: When will Bitcoin start a new bull cycle toward $150K? Look for these signs

Heatmap data shows $60,000 is a liquidity magnet

Bitcoin’s liquidity heatmaps reveal stacked orders above $72,000, but it also highlights a “liquidity void” from $66,000 to $60,500. This “liquidity void” may act as a magnet, as price tends to move quickly through low-liquidity areas to tap concentrated stop clusters below.

Despite more visible liquidity being higher, the downside remains open as a final stack of leveraged longs worth over $350 million is still positioned near $60,500.

Bitcoin trader Husky said Bitcoin is slipping below the anchored volume-weighted average price (VWAP) drawn from last week’s lows at $59,800, a level that is acting as a short-term fair value.

With the overall market structure starting to weaken, a lack of a swift recovery above $68,000 increases the risk of further downside toward lower support levels near $65,000. For now, Bitcoin is expected to trade within a broad $60,000 to $72,000 range, according to the trader.

Likewise, market analyst EliZ noted that BTC is consolidating near $66,500 inside a descending channel. A break below this level may send the price toward the $63,400–$64,600 support zone, increasing the odds of a revisit to $60,000.

Related: Bitcoin reacts to major US jobs data beat as Fed rate pause odds near 95%

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Intercontinental Exchange Unveils Polymarket Signals Tool to Enhance Trader Insights

Intercontinental Exchange (ICE) has launched the Polymarket Signals and Sentiment Tool, integrating prediction market data into its services to provide traders with enhanced market insights.

Intercontinental Exchange (ICE) has announced the launch of the Polymarket Signals and Sentiment Tool, a service designed to provide real-time and historical prediction market data to traders. This tool aims to enhance market insights by offering crowd-sourced probability assessments through ICE’s infrastructure.

The tool is specifically targeted at professional and institutional traders. By delivering normalized data feeds from Polymarket’s prediction markets, it allows traders to consume crowd-sourced probability assessments as market signals. These signals provide implied probabilities on real-world outcomes that are not typically captured by traditional financial instruments. The service is designed to complement existing market, pricing, and sentiment inputs within institutional workflows.

Prediction markets have been gaining traction in financial services for their ability to forecast and gauge public sentiment. The prediction market industry itself has experienced notable growth, with a weekly volume of $6.2 billion as of January 2026.

This article was generated with the assistance of AI workflows.

Crypto World

Ethereum Leaders Propose New System to Protect AI Privacy

Ethereum Foundation AI lead Davide Crapis and Ethereum co-founder Vitalik Buterin have proposed a way to use zero-knowledge proofs and other methods to ensure that a user’s interactions with large language models are private, while preventing spam and abuse.

API calls occur every time a user sends a message to a software application, such as an AI chatbot. Crapis and Buterin said in a blog post on Wednesday that a core challenge for both users and providers is privacy, security, and efficiency.

“We need a system where a user can deposit funds once and make thousands of API calls anonymously, securely, and efficiently,” they said.

“The provider must be guaranteed payment and protection against spam, while the user must be guaranteed that their requests cannot be linked to their identity or to each other,” they added.

With the use of AI chatbots rising, data leaks from LLMs have become a growing concern. Chatbots often handle highly sensitive data, and linking usage to identities can create significant privacy, legal, and security risks. Usage logs can even be used in court proceedings.

Crapis and Buterin’s solution for users and providers

Crapis and Buterin said providers currently are forced to choose between two “suboptimal paths,” identity-based access with users forced to hand over sensitive information like an email or credit card, which creates privacy risks, or per-request on-chain payments, which are slow, costly, and traceable.

The duo proposes a system where users deposit funds into a smart contract and then make API calls without revealing their identity or linking requests, leveraging zero-knowledge proofs and rate-limit nullifiers for payments and anti-spam enforcement.

“A user deposits 100 USDC into a smart contract and makes 500 queries to a hosted LLM. The provider receives 500 valid, paid requests but cannot link them to the same depositor, or to each other, while the user’s prompts remain unlinkable to the user identity,” Crapis and Buterin said.

“The model enforces solvency by requiring the user to prove that their cumulative spending—represented by their current ticket index—remains strictly within the bounds of their initial deposit and their verified refund history.”

Cheating the system could slash your deposit

To deter scammers, illegal content generation, jailbreaking attempts, and other terms-of-service violations, Crapis and Buterin propose a dual-staking system.

Related: Vitalik draws line between ‘real DeFi’ and centralized yield stablecoins

If a user is caught trying to double-spend, their deposit can be claimed by anyone, including the server. However, users violating the terms of service will have their deposit sent to a burn address and the slashing event is recorded on-chain.

“For example, a user might submit a prompt asking the model to generate instructions for building a weapon or to help them bypass security controls – requests that would violate many providers’ usage policies,” Crapis and Buterin said.

“While the user’s identity remains hidden, the community can audit the rate at which the Server burns stakes and the posted evidence for these burns.”

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

Stellar Expands Asia Push With TopNod Wallet Integration

The Stellar Development Foundation (SDF) announced at Consensus Hong Kong that TopNod, a non-custodial wallet, will integrate with the Stellar network. The move is part of SDF’s broader push into Asia — a region where it faces stiff competition from Solana, TON, and XRP in the payments and tokenization markets.

TopNod’s wallet uses key sharding and Trusted Execution Environment (TEE) technology to eliminate the need for seed phrases. The platform focuses on tokenized real-world assets (RWAs) and stablecoins rather than speculative tokens, though it remains a relatively young project with limited brand recognition outside Web3 circles.

Sponsored

Sponsored

SDF Bets on Emerging Markets

In an exclusive interview with BeInCrypto, Stellar CBO Raja Chakravorti called Asia Pacific “a critical growth driver” and said SDF plans to build out anchor networks in Indonesia, the Philippines, and Vietnam over the coming year.

“We brought employees in the region focused on Singapore first, but we’ve really been focusing on expanding rapidly,” Chakravorti said, adding that more APAC financial institution partnerships would be announced over the next two quarters — though he declined to share specifics.

SDF has also partnered with MarketNode, a Singapore-based tokenization platform, and said it is in discussions with financial institutions about tokenizing money market funds in the region.

The ambition is clear, but execution remains the question. Stellar’s on-chain RWA value crossed $1 billion over the past year, and its DeFi TVL tripled. Yet XLM has fallen roughly 71% from its 2025 high of $0.52, underperforming both Bitcoin and Ethereum. Daily transaction volumes have held steady, but average transaction values have dropped, suggesting that core payment use cases persist while speculative and high-value capital flows have dried up.

2026: The Distribution Problem

Chakravorti acknowledged that tokenization alone is no longer the differentiator.

Sponsored

Sponsored

“Last year was really about proving that tokenized products can be built at scale. This next year is really going to be about focusing on finding the right distribution outcomes for these assets,” he told BeInCrypto.

This is arguably Stellar’s biggest challenge. Franklin Templeton’s tokenized money market fund remains the network’s flagship RWA product, and US Bank recently announced a stablecoin partnership. But competing chains are moving fast — Solana and Polygon are both founding members of the same Blockchain Payments Consortium (BPC) as Stellar, and networks like Ethereum and Avalanche continue to attract institutional tokenization projects.

Privacy vs. Compliance

Stellar’s recent X-Ray upgrade (Protocol 25) introduced native zero-knowledge cryptography. Chakravorti framed this as an institutional necessity rather than a privacy-maximalist play.

“Privacy elements may encompass send, receive, who is the holder — but importantly, these have to be auditable,” he said. “The privacy may look slightly different depending on who you’re talking to.”

Whether this configurable approach satisfies both regulators and privacy-conscious users in Asia’s diverse regulatory landscape remains to be seen.

What’s Next

SDF confirmed its annual Meridian conference will move to Abu Dhabi in October 2026. The TopNod integration is expected to go live across the Philippines, Singapore, Japan, and other Asian markets, though no specific timeline has been provided.

For Stellar, the formula is familiar: strong infrastructure, growing institutional interest, and a clear narrative. The missing piece — as Chakravorti himself admitted — is distribution at scale.

Crypto World

US Fines Paxful $4M for Funds Linked to Trafficking and Fraud

In a high‑profile enforcement action, Paxful, the peer‑to‑peer crypto exchange, was ordered to pay $4 million after admitting it knowingly profited from criminals who used its platform due to lax anti‑money laundering controls. The Department of Justice outlined that Paxful pleaded guilty in December to conspiring to promote illegal prostitution and knowingly transmitting funds derived from crime, in violation of federal AML requirements. The government also detailed that, between January 2017 and September 2019, Paxful facilitated more than 26 million trades valued at nearly $3 billion, earning about $29.7 million in revenue while turning a blind eye to illicit activity. The case centers on how a platform marketed itself as a lenient, low‑information exchange while neglecting core safeguards. The DOJ’s filing underscores that Paxful’s business model depended on attracting criminal users by downplaying compliance obligations.

The Justice Department highlighted that Paxful had agreed the appropriate criminal penalty would be $112.5 million, but prosecutors determined the company could not pay more than $4 million. The settlement reflects a broader push by federal authorities to curb crypto platforms that fail to implement or enforce anti‑money laundering measures, particularly when they facilitate illegal activities such as fraud, extortion, prostitution, and trafficking. The department said Paxful profited from moving money for criminals it attracted with the promise of minimal compliance, a dynamic prosecutors described as corrosive to legitimate finance and to users seeking lawful services.

The case traces to Paxful’s ambitious growth period from 2017 through 2019, when the platform reportedly handled tens of millions of trades and generated substantial revenue despite warnings from investigators about AML gaps. Prosecutors maintained that Paxful’s marketing messaging, which emphasized a lack of required customer information, paired with policies it knew were not implemented or enforced, created a permissive environment for illicit actors. The backers of the case say this approach allowed criminal actors to route funds through Paxful more readily than through regulated channels.

The Justice Department’s description of Paxful’s operational ethos is complemented by a notable cross‑industry connection: the crypto platform had ties to Backpage and a similar site during a period spanning 2015 to 2022, a relationship the government says contributed to Paxful’s profits, estimated at about $2.7 million. While Backpage’s platform was shut down due to illegal activities, the Paxful alliance is cited as a concrete example of how illicit networks exploited crypto rails to monetize wrongdoing. The department noted that Paxful’s founders publicly boasted about the “Backpage Effect,” portraying the collaboration as a catalyst for growth, a claim the government used to illustrate a deliberate strategy of enabling criminal transactions.

The case also sheds light on Paxful’s eventual exit from the market. The exchange halted operations in November, and its October closure‑announcement post—later archived—depicted the decision as a response to “the lasting impact of historic misconduct by former co‑founders Ray Youssef and Artur Schaback prior to 2023, combined with unsustainable operational costs from extensive compliance remediation efforts.” Youssef publicly countered the timing of the closure, suggesting the firm should have closed when he left the company. Meanwhile, Schaback, Paxful’s former chief technology officer, pleaded guilty in July 2024 to conspiring to fail to maintain an effective AML program and awaits sentencing, with a California judge moving his hearing from January to May to accommodate ongoing cooperation with authorities. The DOJ’s account makes clear that a broader reckoning—beyond Paxful’s leadership—extends into the company’s users, employees, and the broader crypto ecosystem.

As authorities pursued the case, officials emphasized that the Paxful matter is not an isolated incident but part of a wider effort to tighten regulatory expectations on crypto marketplaces. The department pointed to the need for robust know‑your‑customer checks, comprehensive AML compliance programs, and proactive monitoring of suspicious activity to deter illicit uses of digital assets. The implications extend to other platforms that operate in the same space, signaling that permissive, low‑oversight models will attract intensified scrutiny from federal law enforcement and regulators.

Key takeaways

- Paxful received a $4 million criminal penalty after pleading guilty to conspiracy related to illegal activities and AML violations, with prosecutors noting a potential maximum penalty of $112.5 million.

- From 2017 through 2019, Paxful facilitated more than 26 million trades valued at nearly $3 billion and amassed around $29.7 million in revenue, according to DOJ filings.

- The DOJ characterizes Paxful as profiting from enabling criminals by downplaying AML controls and failing to comply with applicable money‑laundering laws.

- Prosecutors linked Paxful to illicit revenue streams via partnerships with Backpage and similar platforms, describing profits of about $2.7 million tied to those connections.

- The company shut down operations in November, citing historic misconduct by former co‑founders and the costs of compliance remediation, with ongoing legal actions surrounding Schaback’s case and the broader investigation.

- The case illustrates how enforcement agencies are escalating scrutiny of crypto marketplaces that permit lax due‑diligence and high‑risk activity, reinforcing expectations for AML programs across the sector.

Sentiment: Bearish

Market context: The Paxful action aligns with a broader tightening of crypto‑AML standards as regulators seek to normalize compliance expectations across peer‑to‑peer platforms, exchanges, and other digital asset services, influencing liquidity, risk sentiment, and enforcement tempo across the industry.

Why it matters

The DOJ’s settlement with Paxful underscores a pivotal moment for the crypto‑platform landscape. For users, it signals that providers must demonstrate verifiable diligence in their AML programs or face tangible penalties and reputational damage. For operators, the case reinforces the need to align platform design, user onboarding, and transaction monitoring with established legal requirements rather than relying on marketing narratives about anonymity or minimal information. The development also matters for builders and policymakers. It highlights the costs of lax controls and the potential for illicit activity to undermine trust in decentralized finance ecosystems, prompting crypto firms to invest more heavily in compliance technology, real‑time surveillance, and robust governance frameworks.

From an investor perspective, enforcement actions like this can influence risk pricing and funding cycles for crypto platforms, particularly those with international user bases or complex payment rails. The Paxful narrative—centered on public statements by founders, internal policy gaps, and late‑stage remediation—serves as a cautionary tale about the fragility of business models that rely on permissive compliance postures. In a market where users increasingly demand transparency and regulatory alignment, the case emphasizes why credible AML programs are not merely a legal checkbox but a core driver of platform reliability and long‑term viability.

What to watch next

- Schaback’s sentencing timing remains fluid, with a May hearing continuing to unfold as prosecutors incorporate ongoing cooperation into the government’s recommendation.

- Any additional actions or disclosures related to Paxful’s former leadership could emerge as part of related investigations and settlements.

- Regulators may intensify scrutiny of other P2P exchanges and non‑custodial marketplaces to assess AML controls, monitoring capabilities, and enforcement readiness.

- Broader market reactions might reflect shifting risk sentiment as platforms adjust compliance investments and governance standards in response to high‑profile enforcement cases.

Sources & verification

- U.S. Department of Justice press release: Virtual Asset Trading Platform sentenced for violating Travel Act and other federal crimes (link provided in the DOJ filing).

- DOJ Criminal Division official X/Twitter post confirming the case details and sentencing status.

- Paxful closure announcement (archived): Paxful closure announcement, noting misconduct and remediation costs.

- Statements and coverage surrounding Ray Youssef’s response to Paxful’s closure and Artur Schaback’s guilty plea.

- Related reporting on Paxful’s alleged “Backpage Effect” and the platform’s historical collaborations cited by prosecutors.

What the story changes

The Paxful case illustrates how enforcement actions tied to AML controls can reshape the operations and viability of crypto platforms that rely on rapid growth and minimal compliance. By tying significant penalties to proven misconduct and highlighting explicit links to illicit activities, authorities are sending a clear signal: robust, transparent AML programs are foundational, not optional. As the industry evolves, platforms may need to reassess their onboarding, transaction screening, and governance practices to withstand heightened regulatory scrutiny and to restore or preserve user trust in a landscape that continues to balance innovation with accountability.

Crypto World

Crypto Lender BlockFills Paused Withdrawals Amid Market Fall

Institution-focused crypto lending platform BlockFills announced it halted customer deposits and withdrawals last week as Bitcoin and the broader crypto market continued to tumble.

The suspension, which remains in effect, was intended to protect clients and restore liquidity on the platform, BlockFills said in an X post on Wednesday.

Last week’s market tumble saw Bitcoin fall another 24% from $78,995 to $60,000.

Blockfills said the withdrawal and deposit halt came “in light of recent market and financial conditions.”

“Management has been working hand in hand with investors and clients to bring this issue to a swift resolution and to restore liquidity to the platform,” BlockFills said.

“Clients have been able to continue trading with BlockFills for the purpose of opening and closing positions in spot and derivatives* trading and select other circumstances,” BlockFills added.

The halt potentially impacts about 2,000 institutional clients, including asset managers and hedge funds, which contributed to more than $60 billion in trading volume on the platform in 2025.

The crypto liquidity and lending platform serves only investors with crypto holdings of $10 million or more.

BlockFills was founded by CEO Nick Hammer and President Gordon Wallace in 2017 and is backed by the likes of Susquehanna Private Equity Investments and CME Group.

Bitcoin is down 46% from its October high

Bitcoin’s price began to fall on Oct. 10 after a social media post on tariffs by US President Donald Trump sent shockwaves through the crypto markets, contributing to nearly $20 billion worth of positions being liquidated.

It fell further in the months following, hitting a year-to-date low of $60,008 on Feb. 5.

Related: Crypto super PAC to spend $5M on Barry Moore’s Senate bid: Report

Bitcoin has since rebounded to $67,575, but is still 46.6% off its all-time high of $126,080 set on Oct. 6.

BlockFills’ withdrawal halt marks the first suspension among major crypto platforms as a result of market conditions.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Elon Musk Announces X Money Limited Beta Launch Within Months

X Money, an upcoming payments system that forms part of Elon Musk’s “everything app” plans, is scheduled to come out as a “limited beta” in the next two months before launching to X users worldwide.

Musk gave the new timeline at his AI company’s “All Hands” presentation on Wednesday, during which he said that X Money was already live “in closed beta within the company.”

“This is intended to be the place where all money is. The central source of all monetary transactions,” he said, calling it a “game changer.”

Payments part of X’s “everything app”

The move is framed as a key upcoming feature to make X more essential, tied with its “everything app” vision, with payments a core driver of daily engagement.

Musk noted that the platform has 1 billion installed users but said its average monthly users were around 600 million.

X Money, rumored to be launched last year, is expected to integrate directly into the X platform, which aims to become a single place for social networking, messaging, content, and financial services, similar to WeChat in China.

“As we give people more reasons to use the X app, whether it’s for communications, or for Grok, or for X Money […] we want it to be such that if you wanted to, you could live your life on the X app,” said Musk.

Elon Musk has been pushing for payments on X since shortly after acquiring Twitter in 2022. The idea ties back to his early career in 1999, when he co-founded X.com, an online bank that merged with Confinity to become PayPal, which was later acquired by eBay.

Crypto integration remains a mystery. Musk has previously shared enthusiasm for Dogecoin (DOGE), but the initial focus is likely to be fiat since the company has partnered with Visa. According to the Blockchain Council, it will support crypto in the future.

Related: Musk’s xAI seeks crypto expert to train AI on market analysis

xAI expands Macrohard data center

Musk also highlighted the company’s AI growth, stating that xAI can “deploy more AI compute faster than anyone else.”

The tech billionaire showcased the firm’s “Macroharder” AI data center in Memphis, Tennessee — an expansion of the existing plant that adds 220,000 more graphics processing units.

“All this will be training the [AI] models that you experience. It’s absolutely fundamental to have large-scale training compute in order to get the best models,” he said.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

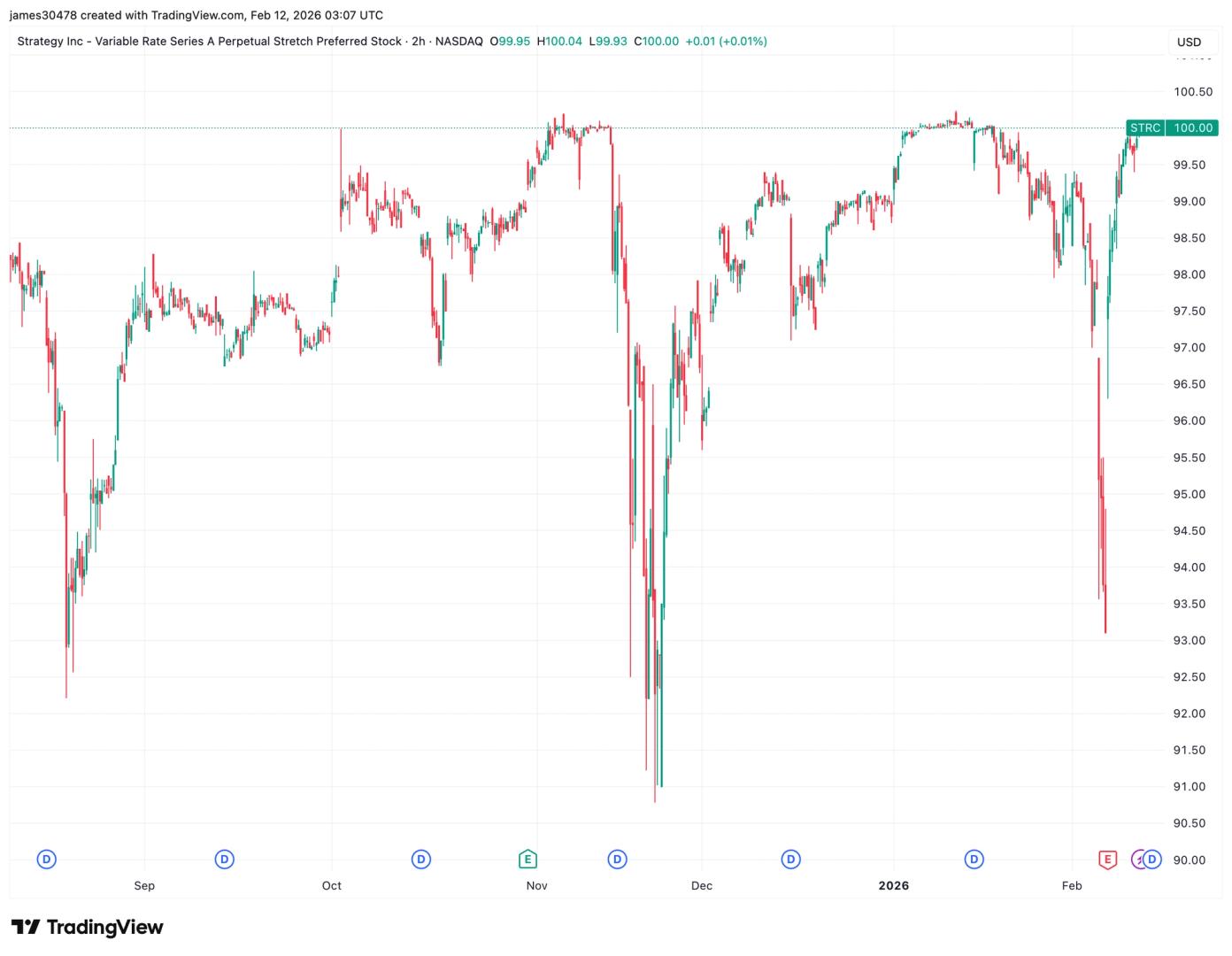

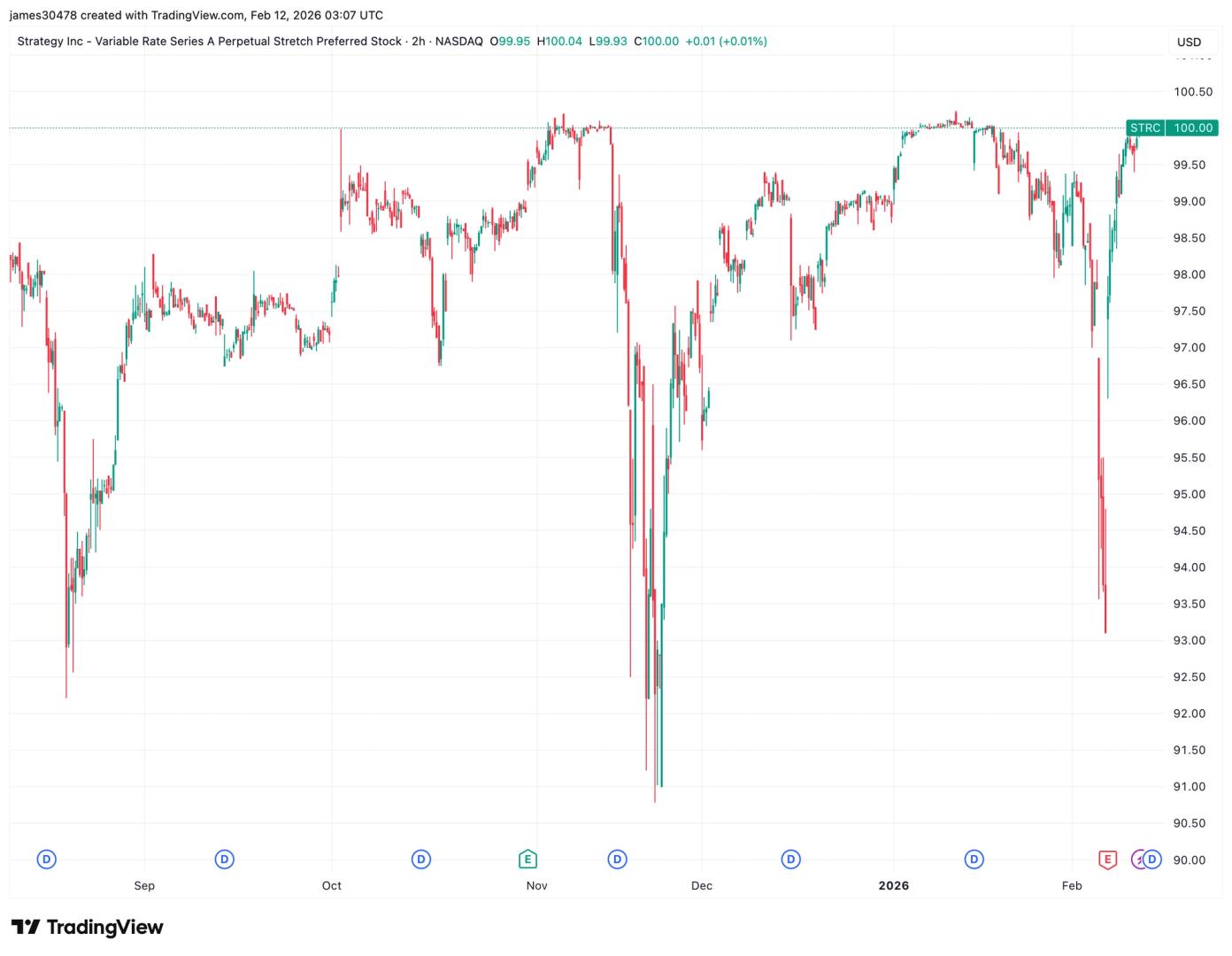

MSTR’s STRC returns to $100 par, poised to unlock more BTC accumulation

Stretch (STRC), the perpetual preferred equity issued by Strategy (MSTR) the world’s largest corporate bitcoin holder reclaimed its $100 par value during Wednesday’s U.S. session for the first time since mid-January.

STRC trading at or above par enables the company to resume at-the-market (ATM) offerings to fund further bitcoin acquisitions. STRC last hit the $100 level on Jan. 16 when bitcoin hovered near $97,000; however, as the largest cryptocurrency by market capitalization retreated to as low as $60,000 by on Feb. 5, STRC dipped to a low of $93 before its recent rebound.

Positioned as a short-duration, high-yield credit instrument, STRC currently offers an 11.25% annual dividend distributed monthly. To mitigate volatility and incentivize trading near par, Strategy resets this rate monthly, recently hiking it to the current 11.25% yield.

MSTR common stock faced pressure, sliding 5% on Wednesday to close at $126, as bitcoin hovers around $67,500.

Crypto World

Juspay Expands in the Middle East with New DIFC Headquarters

Editor’s note: Juspay has announced its expansion into the Middle East with the launch of its regional headquarters in Dubai International Financial Centre. The move is aimed at supporting enterprise merchants, banks, and financial institutions as digital commerce accelerates across the GCC. By establishing a local presence, the company plans to deepen partnerships and address growing payment complexity linked to multiple currencies, regulations, and local payment methods. The DIFC base signals a long-term commitment to building regulated, enterprise-grade payment infrastructure in the region, at a time when cross-border commerce and scalable financial rails are becoming critical for large businesses operating across global markets.

Key points

- Juspay opens its Middle East regional headquarters in DIFC to support enterprise payment demand.

- The expansion targets merchants and banks facing complex, multi-currency and multi-regulatory environments.

- The company will offer its payments orchestration and infrastructure solutions locally.

- Juspay plans to work closely with regional banks, acquirers, and ecosystem partners.

Why this matters

The Middle East is seeing rapid growth in digital commerce, putting pressure on payment systems to scale reliably across borders and regulatory frameworks. Juspay’s entry into DIFC reflects rising demand for enterprise-grade payment infrastructure that can handle volume, compliance, and localization at once. For large merchants and financial institutions, access to proven orchestration and real-time payments technology can improve authorization rates, reduce operational friction, and support expansion across GCC and global markets. For the region, it reinforces Dubai’s role as a hub for fintech infrastructure.

What to watch next

- Growth of Juspay’s regional team in business development, engineering, and partnerships.

- New collaborations with Middle East banks, acquirers, and payment networks.

- Adoption of Juspay’s platform by regional enterprise merchants.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Dubai, February 10th, 2026 – Juspay a global leader in payment infrastructure solutions for enterprises and banks, today announced its expansion into the Middle East with the opening of its regional headquarters in Dubai International Financial Centre (DIFC). This move marks an important step in Juspay’s international expansion, deepening its focus on serving enterprise merchants, banks, and financial institutions in the Middle East. The DIFC headquarters will support closer engagement with existing partners as enterprise payment demand continues to scale.

With digital commerce accelerating in the GCC region, rapidly scaling enterprises in sectors such as airlines, hospitality, e-commerce, and financial services face increasing complexity driven by multiple regional currencies, evolving regulations, and diverse local payment methods.

To address this complexity, Juspay’s payments orchestration platform provides a unified & reliable payments stack, helping organizations optimize authorisation rates and costs, simplify compliance and scale seamlessly across GCC and global markets with institutional-grade reliability.

Establishing operations in DIFC highlights Juspay’s long-term commitment to the Middle East, with a focus on building , regulated, and enterprise-grade payments infrastructure in the region. As a leading global financial hub, DIFC provides a strong regulatory environment, robust infrastructure, and access to high quality talent. Juspay plans to leverage this and work closely with regional banks, acquirers, networks, and ecosystem partners to deliver scalable and reliable payment solutions tailored for enterprises operating across global markets.

Commenting on the expansion, Sheetal Lalwani, Co-founder & COO of Juspay, said: “Juspay has been building foundational payments infrastructure for large-scale, mission-critical commerce globally for over a decade. We are excited to bring these learnings to the Middle East and partner with merchants, banks, networks, and the broader ecosystem to build secure, scalable payments infrastructure that supports the region’s rapidly evolving digital economy.”

Salmaan Jaffery, Chief Business Development Officer at DIFC Authority said: “We are pleased to welcome Juspay to the Middle East, Africa and South Asia’s most significant fintech and financial services ecosystem. As a global leader in payment infrastructure, Juspay’s presence strengthens our growing digital economy, reinforces DIFC’s role as a catalyst for financial innovation and cements Dubai’s position as a top four global FinTech hub.”

With more than a decade of experience in scaling payment infrastructure, Juspay powers 500+ enterprise merchants and banks globally including Agoda, Amazon, Flipkart, Google, HSBC, IndiGo, Swiggy, Urban Company, Zepto & more. It offers a comprehensive suite of payment solutions that spans full-stack payment orchestration, authentication, tokenisation, reconciliation, fraud solutions and more. The company also provides end-to-end, white-label payment gateway and real-time payments infrastructure tailored for banks. Together these capabilities enable merchants and banks to deliver seamless, reliable and scalable payment experiences to the end-consumers.

Speaking about Juspay’s regional focus, Nakul Kothari, head of Middle East & APAC said, “By establishing our presence in the Middle East with DIFC, we continue our mission of building innovative payment solutions rooted in deep local market understanding. The region holds tremendous potential, and we are investing in long-term partnerships with merchants and banks to help them build future-ready payment stacks that can scale across markets.”

This expansion reflects Juspay’s long-term vision of enabling open, interoperable, and accessible payments worldwide. With a team of over 1,500 payment experts solving payment complexities across Asia-Pacific, Latin America, Europe, UK, and North America, Juspay is strategically positioned to reshape the Middle Eastern payments landscape. The company plans to grow its regional team, specifically targeting growth in business development, solution engineering, and partnerships.

About Juspay

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 300 million daily transactions, exceeding an annualized total payment volume (TPV) of $1 trillion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1500+ payment experts operating across San Francisco, Dublin, São Paulo, Dubai, and Singapore.

Juspay offers a comprehensive product suite for merchants that includes open-source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end-to-end reconciliation, unified payment analytics & more. The company’s offerings also include end-to-end white label payment gateway solutions & real-time payments infrastructure for banks.These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

To learn more about Juspay, visit: www.juspay.io

About Dubai International Financial Centre

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa, and South Asia (MEASA), which comprises 77 countries with an approximate population of 3.7bn and an estimated GDP of USD 10.5trn. With a 20-year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast-growing markets with the economies of Asia, Europe, and the Americas through Dubai. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of 46,000 professionals working across over 6,900 active registered companies – making up the largest and most diverse pool of industry talent in the region.Comprising a variety of world-renowned retail and dining venues, a dynamic art and culture scene, residential apartments, hotels, and public spaces, DIFC continues to be one of Dubai’s most sought-after business and lifestyle destinations.For further information, please visit our website: difc.ae

Crypto World

Charles Hoskinson confirms deal to onboard LayerZero on Cardano

Input Output CEO and founder Charles Hoskinson announced a deal to get LayerZero ported over to the Cardano blockchain during a keynote speech at Consensus Hong Kong on Thursday.

LayerZero is a blockchain aimed at powering institutional-grade markets that received investment from Citadel Securities on Wednesday.

The announcement comes alongside the rollout of Midnight’s mainnet, which was also revealed on Thursday morning.

Hoskinson, who was comically wearing a McDonalds uniform in a nod to the recent market downturn said: “The industry is not healthy. S*** is getting real. Twitter is a nuclear dumpster fire. Sentiment is at an all time low.”

But he insisted it was a micro downturn, and “the macro remains bullish.”

“And to prove it, I’m excited to announce our partnership with LayerZero,” he said. “We’re bringing USDCx to Cardano with a launch date set, complete with broad wallet and exchange support. This means stablecoins with true privacy and immutability, powered by zero-knowledge tech. It’s institutional-grade, and it’s happening now — alongside Midnight’s mainnet rollout. Get ready, folks. This changes everything.”

UPDATE (Feb. 12, 2026, 02:21 UTC): Adds additional information and commentary from Charles Hoskinson.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports4 hours ago

Sports4 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World5 hours ago

Crypto World5 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’