Crypto World

Polymarket & Kalshi Give Free Groceries During Prediction Market Boom

Two leading prediction-market platforms, Kalshi and Polymarket, are leaning into experiential marketing as they vie for dominance in a fast-growing segment of the financial landscape. Kalshi staged a $50 grocery giveaway for more than 1,000 Manhattan residents on Tuesday, drawing lines that stretched for blocks and highlighting the power of real-world perks to convert interest into signups. In tandem, Polymarket announced plans to open a free grocery store, a venture branded as “The Polymarket,” slated to launch next week with a pledge of $1 million to Food Bank for NYC to assist food access across all five boroughs. The dual promotions illustrate how prediction-market platforms are blending commerce, charity, and media partnerships to expand reach beyond digital trading floors.

Thousands have already picked up their free Kalshi groceries!

We are being told we’ve already inspired other companies to keep up the initiative!

2 more hours to get yours

Westside Market | 84 3rd Ave. NYC pic.twitter.com/8R11OGODLu

— Kalshi (@Kalshi) February 3, 2026

Kalshi’s giveaway took place at the Westside Market on 84 3rd Ave in Manhattan, a venue chosen to maximize visibility among urban shoppers already accustomed to the grocery aisles of daily life. The event ran between 12 pm and 3 pm local time, and footage circulating on social media shows long lines that extended for several blocks. The guest list for the promotion tallied 1,795 names, a figure described by Kalshi as an indicator of robust interest in markets that sit at the intersection of public participation and financial speculation. The company’s broader strategy in 2025 included generating $263.5 million in fee revenue, illustrating how these platforms monetize crowdsourced insights through prediction activity and related services.

“Free groceries. Free markets. Built for the people who power New York.”

Meanwhile, Polymarket revealed a parallel push to inject the experience of its markets into real-world settings. The company said it had signed a lease to open what it brands as “New York’s first free grocery store,” aiming to launch the venture next Thursday at 12 pm local time. In support of the initiative, Polymarket donated $1 million to the Food Bank for NYC to bolster food access across all five boroughs. The timing aligns with a broader push by both platforms to integrate traditional media strategies with their online ecosystems, including public-facing campaigns and high-visibility advertising components that are increasingly difficult to distinguish from mainstream marketing.

The Polymarket initiative was not the only signal of a broader marketing tilt. Kalshi has engaged in media partnerships, including collaborations with CNN and CNBC during 2023 and 2024 cycles, while Polymarket has pursued collaborations with Dow Jones in early 2024. These alliances reflect a trend in which prediction-market operators seek to normalize and accelerate participation through mainstream outlets, a move that can affect liquidity and user acquisition in a space that sees daily volume in the hundreds of millions.

Kalshi gives out free groceries to thousands of New Yorkers https://t.co/62BO68KbuZ pic.twitter.com/rBnSAqWdBg

— Historic Vids (@historyinmemes) February 3, 2026

Across the industry, trading volumes in prediction markets have surged in recent months, with daily activity measured well above $400 million. The scale underscores the sector’s momentum as traditional finance intersects with decentralized and on-chain thinking. Kalshi’s and Polymarket’s growth has been underscored by their valuations; both platforms have drawn multibillion-dollar assessments following significant funding rounds and strategic integrations. The volume growth is notable because it coincides with a broader reaggregation of liquidity around derivative-style contracts tied to current events, sports outcomes, and macro developments—areas where prediction markets have garnered increasing interest from both retail and institutional participants.

Those market dynamics intersect with regulatory and competitive considerations. Industry observers note that prediction-market advertising faced a high-profile challenge during major U.S. sports broadcasts, specifically with the Super Bowl slated for Feb. 8, when advertising restrictions were cited as a constraint for such platforms. In the meantime, the promotional efforts by Kalshi and Polymarket reflect a broader appetite to test new distribution channels and community-building models, particularly in major markets like New York City where both platforms are headquartered.

Kalshi has distributed free groceries to thousands in NYC as part of a broader push to democratize markets

— Historic Vids (@historyinmemes) February 3, 2026

Both Kalshi and Polymarket are rooted in New York City, a jurisdiction that remains central to the industry’s branding and strategy. The city’s status as a financial hub, housing the New York Stock Exchange and the Nasdaq, provides a backdrop that could help attract mainstream attention to prediction markets as legitimate tools for forecasting and civic participation. The partnerships with traditional media outlets, coupled with on-the-ground promotions, illustrate how the space is attempting to bridge online activity with tangible, real-world experiences.

Market context

Market context: The prediction-market segment continues to exhibit rapid growth in liquidity and engagement, even as it navigates a complex regulatory and advertising environment. The combination of large-donor events, high-profile media partnerships, and city-focused promotions indicates a push to normalize and scale these platforms beyond niche online communities, while still relying on event-driven incentives to drive signups and participation.

Why it matters

For users, these promotions may lower the friction to engage with prediction markets and explore how markets price events in real time. For investors and builders, the initiatives reveal the potential for user acquisition through experiential programs and philanthropy, while also highlighting the importance of disciplined risk management and regulatory awareness as volumes rise. The campaigns also reflect a broader trend of blending consumer experiences with financial instruments, a development that could shape how new entrants think about distribution, trust-building, and community governance in prediction ecosystems.

From a market structure perspective, the convergence of media partnerships, real-world store concepts, and online trading desks could influence liquidity flows, contract design, and the range of outcomes that platforms offer. The emphasis on partnerships with established media brands and charity groups may help broaden the audience beyond traditional traders, a factor that could influence the valuation trajectories and strategic priorities of these operators in the coming quarters.

What to watch next

- Launch date and details for “The Polymarket” free grocery store, including its location, hours, and product offerings, scheduled for next Thursday at 12 pm local time.

- Results and turnout from Kalshi’s Westside Market promotion, including any follow-on campaigns or additional free-grocery events.

- Regulatory and advertising developments around prediction markets ahead of major events such as the next Super Bowl.

- Any new media partnerships or cross-promotional campaigns as the platforms seek to sustain growth in NYC and beyond.

Sources & verification

- Kalshi’s Westside Market grocery giveaway details, including the event timing and location (Westside Market, 84 3rd Ave, Manhattan).

- Guest-list figures and attendance reporting for Kalshi’s promo (1,795 sign-ups; media estimates of “thousands”).

- Polymarket’s lease announcement for a new NYC grocery store and the $1 million donation to Food Bank for NYC.

- The Polymarket post on X announcing the store launch and related updates.

- Industry context on prediction-market volumes and Kalshi’s 2025 fee revenue ($263.5 million) and “multibillion-dollar valuations.”

- Partnerships with Dow Jones (Polymarket) and CNN/CNBC (Kalshi) and broader media activity.

- Advertising restrictions related to the Super Bowl affecting prediction-market promotions.

- DefiLlama’s reporting on daily prediction-market trading volumes (above $400 million).

Grocery promos illuminate the race to shape prediction markets

The rivalry between Kalshi and Polymarket is less about a single product and more about a narrative that blends user engagement, real-world impact, and media visibility. Kalshi’s promotional event at the Westside Market in Manhattan demonstrates a direct approach to converting curiosity into participation, with a tangible payoff in the form of free groceries and a high turnout. The associated social-media chatter—evidence of a pipeline from online engagement to offline foot traffic—suggests the campaign achieved its core objective: to broaden awareness and recruit a broader audience into a space that has, to date, been dominated by digital activity and a relatively narrow subset of enthusiasts.

Polymarket’s response—a move to open a free grocery store—extends the promotional strategy into a durable, long-form engagement. By tying the store to a charitable effort with a reported $1 million donation to Food Bank for NYC, the company frames its market ecosystem as an instrument for social good while simultaneously creating a venue for real-world interaction with its trademark “free markets” concept. The lease agreement and the store’s planned launch time—12 pm local time on a Thursday—edge the project closer to a conventional retail rollout, albeit anchored by a prediction-market frame that invites visitors to consider probabilities in everyday decisions.

From a market-structure perspective, these promotional pushes are set against a backdrop of surging liquidity. Daily volumes in prediction markets exceed $400 million, a level that signals growing appetite for event-driven contracts and crowd-sourced forecasting. Kalshi’s reported 2025 fee revenue of $263.5 million, coupled with “multibillion-dollar valuations,” underscores the financial scale that these platforms have achieved in a relatively short period. While the revenue and valuation figures reflect fundraising and partnerships rather than pure trading profits, they point to a vibrant ecosystem in which media tie-ins, sponsorships, and philanthropic commitments intersect with product development and user acquisition strategies.

The campaigns also reflect a broader regulatory and reputational environment. The industry has faced scrutiny around advertising during major events, including proposals to limit promotional activity around the Super Bowl. As Kalshi and Polymarket expand their footprint, they will likely navigate this landscape by emphasizing transparency, compliance, and partnerships with established brands. The NYC focus of both initiatives spotlights the importance of local markets in building a scalable national or international footprint for prediction markets, an approach that echoes the way traditional financial markets have grown through regional hubs connected by digital platforms.

//platform.twitter.com/widgets.js

Crypto World

BTC might just be another software name, and that’s bad news

Bitcoin is increasingly behaving like a software stock, with its latest correction unfolding alongside the broader software sell-off.

The relationship between bitcoin and software equities has strengthened notably. On a 30-day rolling basis, bitcoin’s correlation with the iShares Expanded Tech Software ETF, (IGV), stands at a high 0.73, according to ByteTree. The IGV is down around 20% year to date, while bitcoin has fallen 16%.

IGV is heavily weighted toward software and services names such as Microsoft (MSFT), Oracle (ORCL), Salesforce (CRM), Intuit (INTU) and Adobe (ADBE).

While the technology sector appears relatively resilient at the headline level — the Nasdaq 100 (QQQ), is only around 4% below its record high — software stocks have absorbed most of the selling pressure, and bitcoin is increasingly trading in line with this weaker pocket of the market rather than the broader index.

As for why software names are getting hammered, the answer is simple: AI. The rapid progress towards fully functioning artificial general intelligence (AGI) is currently being considered an existential issue for software.

“There can be no doubt that bitcoin has been caught up in the technology selloff,” said ByteTree. “At its heart, bitcoin is an internet stock. Software stocks have been the most recent casualty, and the price of bitcoin has shown similar performance over the past five years, with high correlation.”

ByteTree also notes that the average technology bear market lasts about 14 months. With this current downturn having started in October, this suggests pressure could persist through much of 2026. However, ByteTree notes that a resilient economic backdrop could provide support for bitcoin.

“Bitcoin is just open-source software,” said Van Eck’s Matthew Sigel.

Crypto World

DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER): What Early-Stage Project Reigns Supreme in 2026?

President Donald Trump is expected to sign the bill approved by the US House of Representatives, which will reopen the government after a recent partial shutdown.

While the political tailwinds could push some liquidity into the choppy market, many traders are actually exploring presale opportunities.

The biggest debate pits three projects against each other: DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

Although all entries are the epitome of quality, DeepSnitch AI takes the cake with its upside potential and mass appeal that places it on a path to 100x gains post-launch.

The government may be opening soon

On February 3, the US House of Representatives approved a bill that will largely end a four-day partial government shutdown, voting 217–214 to pass the roughly $1.2 trillion funding package already cleared by the Senate.

The measure funds most government operations through September 30, with some Democratic support despite opposition from many in the party over immigration enforcement provisions included in the bill.

US President Donald Trump is expected to sign the legislation without any changes, which will swiftly reopen affected sectors.

The brief shutdown, which only partially disrupted government functions, was far shorter than the 43-day shutdown in 2025. The quick resolution avoids prolonged disruption, but it’s expected that the immigration-related funding fights will resume shortly

Meanwhile, retail traders are trying to decide on DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

What’s the best presale in Q1?

1. DeepSnitch AI: Is DSNT a mass-adoption coin?

Early-stage sales are back in the limelight as majors keep printing lows. Case in point, DeepSnitch AI raised $1.47M fast, and its $0.03830 price attracted buyers who are eyeing 100x with reasonable investments.

The reason for this conviction is the utility. DeepSnitch AI is powered by five AI agents that help users spot breakout opportunities while dodging common traps like rugs, honeypots, and liquidity issues. The workflow is dead simple: paste any contract address into the LLM-style interface for an instant audit and clear risk assessment.

While that’s certainly a godsend for the retail trader, the ability to predict social sentiment shifts and incoming FUD is another trick that DeepSnitch AI brings to the table that strengthens the mass adoption narrative.

When comparing DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER), many traders highlight DSNT’s broader mass-adoption potential thanks to its retail-first focus and practical daily utility.

Many traders are debating the merits of AI analytics vs payment-focused crypto, but DeepSnitch AI’s approach is certainly more original than most of the popular DeFi projects.

2. LivLive: Is LivLive too niche?

The DeepSnitch AI vs LivLive comparison is common among investors hunting fresh Q1 opportunities. However, the two projects couldn’t be more different.

LivLive is all about the concept of augmented reality, which lets users tokenize daily actions, blending lifestyle posting with blockchain rewards. Users earn LIVE tokens and XP by completing quests, check-ins, business reviews, social challenges, streaks, and AR interactions.

The level of gamification is high, meaning that LivLive could have viral potential (think Pokémon GO meets blockchain impact).

The LIVE presale price sits at $0.02. While the project certainly has a place in your portfolio (especially if you’re sold on the concept, many argue that DeepSnitch AI’s utility for day-to-day trading offers more durable long-term growth and staying power.

3. Bitcoin Hyper: Could Bitcoin L2 outpace the competition?

DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER) debate is tough to call simply because all the projects ooze quality.

Take Bitcoin Hyper as an example. The project delivers genuine innovation with its Bitcoin-native Layer 2 built on the Solana Virtual Machine. This allows it to provide ultra-fast off-chain transactions while opening Bitcoin’s massive ecosystem to Solana dApps.

The Bitcoin Hyper valuation remains speculative at this stage, but the fundamentals are compelling. At the current presale price of $0.013675, HYPER offers an accessible entry point with a solid narrative. While it may not have the day-to-day appeal of DeepSnitch AI or the social angle of LivLive, Bitcoin Hyper still has a strong draw, especially for those looking for quality tech.

Final words: Take your pick

As ICOs attract serious attention, traders are split between DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER).

While personal taste certainly plays a role in deciding your own personal “winner”, DeepSnitch AI may have the most compelling narrative. Look at it this way: DeepSnitch AI combines mass appeal, real AI utility for everyday traders, explosive upside potential, and a bullish trajectory with $1.47M in the bank.

Moreover, you can get an unreal amount of value by jumping in right now. The largest code, DSNTVIP300, delivers 300% on $30K+ ($90K worth of DSNT tokens), which basically seems like printing money.

Reserve your spot in the DeepSnitch AI presale today and follow the latest community buzz on X or Telegram.

FAQs

1. Which is the best presale? DeepSnitch AI ($DSNT) vs LivLive ($LIVE) vs Bitcoin Hyper ($HYPER)?

DeepSnitch AI ($DSNT) leads as the next crypto to explode, with $1.47M raised at $0.03830, five AI agents for real-time risk detection and sentiment prediction, plus strong mass-adoption potential and widespread 100x forecasts.

2. What makes DeepSnitch AI stand out in the DSNT vs LIVE vs HYPER comparison?

DeepSnitch AI offers practical daily utility and mass appeal potential that could elevate it above its key competitors.

3. How does the US government reopening impact the market?

The US House passed a $1.2T funding bill to end a partial shutdown, with President Trump expected to sign it quickly. The resolution boosts overall sentiment and liquidity.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

BTC under pressure as U.S. tech sector stumbles

Bitcoin fell back below $74,000 in the early innings of the U.S. session, with the bounce from Tuesday’s lows quickly fading away as weakness in tech stocks weighed on crypto.

The Nasdaq 100 was 1% lower following the previous day’s 1.5% decline. The software sector continued its tumble, with the thematic iShares Expanded Tech-Software ETF (IGV) declining another 4%, now down 17% in a little over a week, amid fears that AI will be severely disruptive.

Crypto miners, increasingly tied to the buildout of AI infrastructure, mirrored the slide, with Cipher Mining (CIFR), IREN, and Hut 8 (HUT) falling by more than 10%. The declines stemmed from chipmaker AMD, which fell 14% after its 2026 outlook missed analysts’ expectations.

Gold was also caught in the selling, with the yellow metal quickly reversing an overnight surge to $5,113 per ounce and sliding back below $5,000.

U.S. economic data is mixed

The ISM Services PMI for January held steady at 53.8, matching December’s revised reading and beating expectations by a hair, pointing to continued expansion in the services sector.

However, private job growth slowed sharply, with just 22,000 jobs added according to an ADP report, well below forecasts for 48,000 and December’s already weak 37,000. The government’s January job report would normally have been released this Friday, but the short government shutdown has delayed it until next week.

“Manufacturing has lost jobs every month since March 2024 (Main Street recession) but this month professional and business services and large employers joined the weakness,” said Lekker Capital CIO Quinn Thompson, who believes markets are underestimating the amount of Fed stimulus that may be coming in 2026.

Crypto World

Bitcoin Dips to $95K as Crypto Funds See Record Inflows

Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has dropped 3% in the last 24 hours to trade at $93,324, as crypto investment products continue to attract strong interest from investors with record inflows.

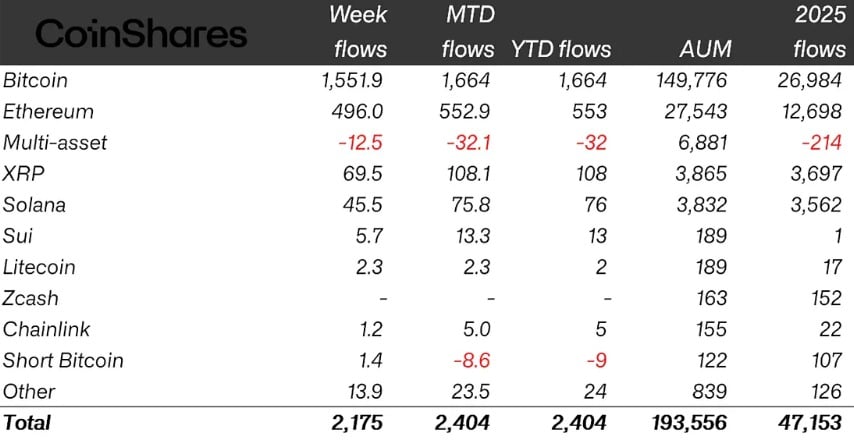

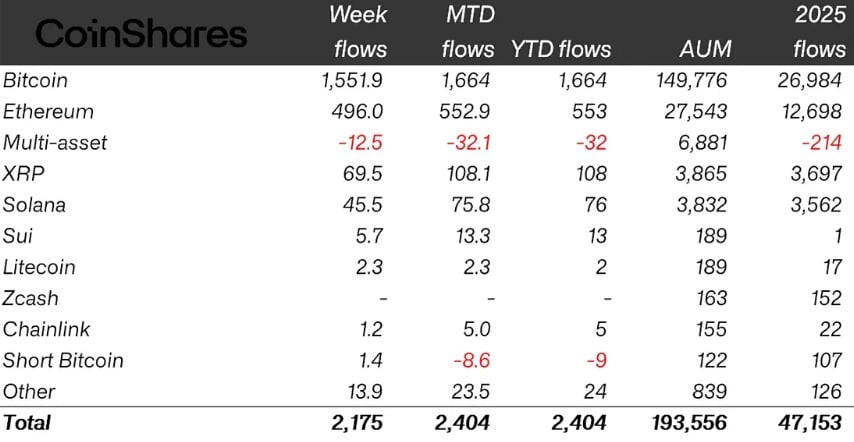

Last week, crypto funds saw inflows of $2.17 billion, the highest in 2026 so far and the largest weekly gain since October, according to European asset manager CoinShares. Most of the money entered the market earlier in the week, but Friday recorded $378 million in outflows due to geopolitical tensions in Greenland and fresh concerns over tariffs.

James Butterfill, CoinShares’ head of research, also noted that sentiment was affected by expectations that Kevin Hassett, a leading contender for US Fed Chair, would likely remain in his current position. Bitcoin dominated last week’s fund inflows, pulling in $1.55 billion, which represented over 70% of the total.

Ether followed with $496 million, while XRP and Solana attracted $70 million and $46 million, respectively. Smaller altcoins such as Sui and Hedera recorded minor inflows of $5.7 million and $2.6 million. Despite proposals under the US Senate’s CLARITY Act that could limit stablecoin yields, Ether and Solana funds held up well.

Among fund types, multi-asset and short Bitcoin products were the only categories to see outflows, totaling $32 million and $8.6 million. On the issuer side, BlackRock’s iShares ETFs led the market with $1.3 billion in inflows, followed by Grayscale Investments at $257 million and Fidelity Investments at $229 million.

Geographically, the US accounted for the majority of inflows at $2 billion, while Sweden and Brazil saw small outflows of $4.3 million and $1 million, respectively. With these gains, total assets under management in crypto funds surpassed $193 billion for the first time since early November, showing renewed investor confidence.

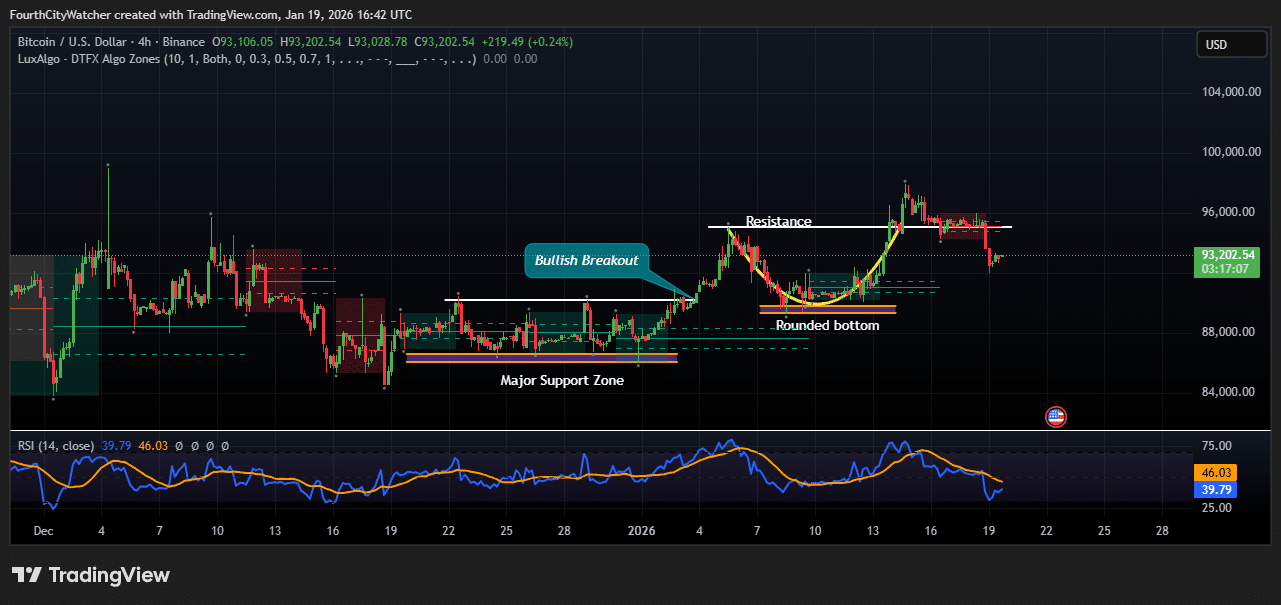

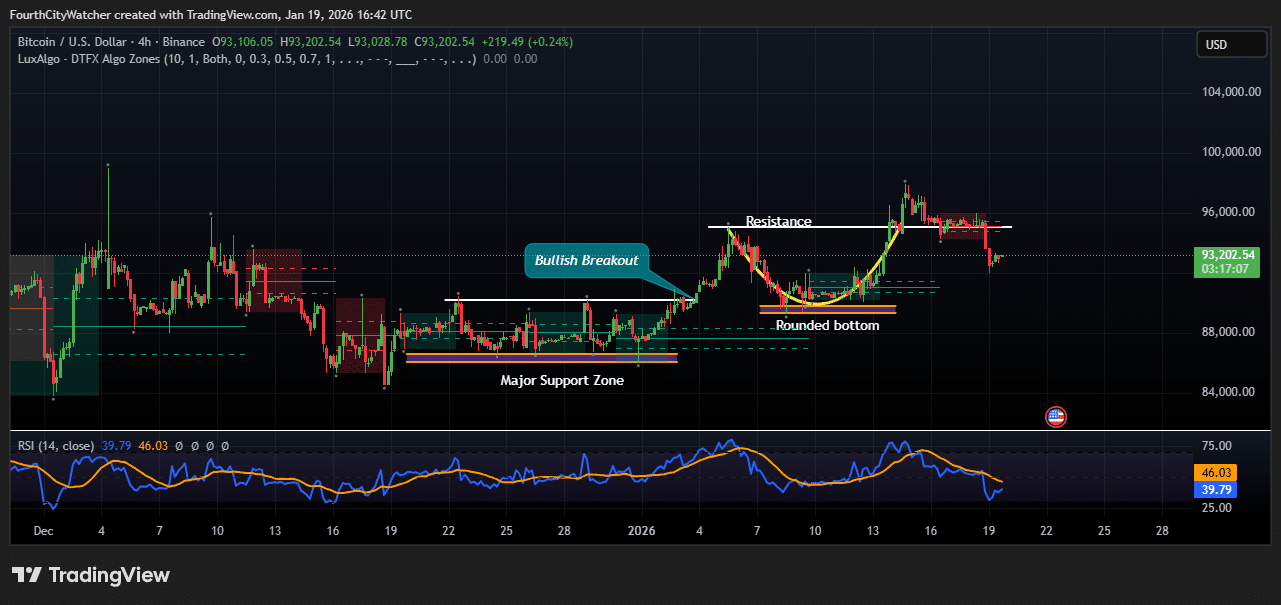

The Bitcoin price 4-hour chart shows a series of bullish developments, though recent price action indicates some short-term consolidation. Price recently rebounded from a major support zone around $87,500–$88,500, which had previously acted as a strong accumulation area. This level has successfully absorbed selling pressure multiple times in the past, providing a solid foundation for higher moves.

Following this support, Bitcoin formed a rounded bottom pattern between January 6 and January 12, signaling a shift from bearish to bullish sentiment. The rounded bottom reflects a gradual loss of selling momentum, allowing buyers to regain control.

A bullish breakout occurred after the rounded bottom, pushing the price above prior resistance levels around $91,000. This breakout was accompanied by strong upward momentum, with the price briefly testing the $96,000 region. The breakout confirms that buyers were willing to step in decisively after the consolidation, signaling potential continuation of the short-term uptrend.

Currently, the price has pulled back slightly after hitting the $96,000 resistance area. The minor retracement appears healthy, as it allows buyers to enter at lower levels without threatening the overall bullish structure. The relative strength index (RSI), currently around 39.8, shows that Bitcoin is not yet oversold, indicating room for further upside once buyers re-enter. The 46-level on the RSI also indicates previous resistance in momentum, now acting as a potential pivot point.

The chart shows a well-defined support and resistance structure, with price respecting the $88,000–$91,000 range before attempting higher levels. The rounded bottom and bullish breakout highlight a transition from accumulation to renewed upward momentum. Traders may watch for a retest of $91,000–$92,000 as a key support level, while the $96,000 area remains a near-term resistance barrier.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Bitcoin-native USDT protocol joins CTDG Dev Hub

Bitcoin has long served a simple purpose: storing and transferring value. The blockchain’s inherent limitations in scalability and programmability prevented use cases like high-frequency payments and smart contracts.

Launched in 2018, the layer-2 solution Lightning Network introduced noticeable improvements in scalability. It takes some of the burden offchain by creating side channels between the sender and receiver.

The model settles transactions faster, with lower fees. Rendering Bitcoin feasible for daily use, the solution spurred the development of many payment apps on the blockchain.

Programmability also arrived in Bitcoin through secondary protocols, such as RGB, an open-source solution designed to expand Bitcoin’s capabilities. The protocol enables the creation of smart contracts and other digital assets on Bitcoin through private, offchain transactions.

RGB powers decentralized applications (DApps) and tokenization, and allows digital assets other than Bitcoin (BTC) to exist on top of the original blockchain.

Bitcoin-native USDT transactions

CTDG Dev Hub, a collaborative platform for blockchain developers working on protocol ideas, has added Utexo as a new participant. The project examines how stablecoin transfers could be represented natively on Bitcoin by combining the Lightning Network’s payment channels with RGB’s client-side asset model. By focusing on interoperability between Bitcoin’s scaling and asset layers, Utexo aligns with DevHub’s goal of supporting experimental infrastructure research and practical developer-driven use cases.

Before the introduction of native solutions, the prevailing practice for using USDT on Bitcoin was utilizing methods like wrapping and bridging, which add intermediaries to the process and increase security risks.

Utexo moves USDT on Bitcoin-native rails instead by combining Lightning’s payment flow with RGB’s asset transfer model. Through RGB, USDT is issued and transferred under a client-side validation model, which keeps most of the transaction details off Bitcoin’s base layer.

Meanwhile, the Lightning Network enables fast and low-cost execution. Bitcoin’s layer-1 only serves as the security anchor that ultimately settles transactions and prevents double-spending.

That combination is meant to avoid the extra trust assumptions that come with wrapping and bridging while still keeping the experience fast. In other words, speed comes from Lightning, asset logic comes from RGB and the security stays tied to Bitcoin.

In Utexo’s design, separating execution from base-layer congestion can make cost behavior less sensitive to Bitcoin’s mempool conditions, since most activity occurs off-chain and Bitcoin is used only for final settlement. This structural decoupling is one reason some implementations aim for more stable cost behavior as throughput grows.

Utilizing the Lightning Network or RGB normally requires a good amount of manual labor. Users have to set up and run a Lightning node, open and manage channels, ensure liquidity, handle routing failures and monitor payment status.

On the RGB side, they also need to manage issuance and transfers, exchange the data needed for client-side validation and keep track of state so balances remain accurate.

The project brings these steps into a single integration flow available via an SDK and REST API. It exposes programmatic access to Lightning execution, routing and failure handling, as well as RGB asset issuance, transfers and state transitions, enabling interaction with both layers through one interface.

Bitcoin developers gain a hub

Cointelegraph has been taking an active role in blockchain governance and development through its initiative, Cointelegraph Decentralization Guardians.

As part of the CTDG ecosystem, CTDG Dev Hub serves as a developer-focused hub alongside CTDG’s validator operations and educational initiatives. The hub offers an open, global public space for developers and other members of the blockchain community to exchange ideas, develop solutions, and submit proposals.

Through its participation in CTDG Dev Hub, Utexo becomes part of a shared development environment where its approach can be reviewed and discussed by other contributors. The Dev Hub serves as a coordination point for developers and community members exploring infrastructure and tooling for Bitcoin-based applications.

Crypto World

Indian investors have matured, buying BTC in shift from speculative tokens

Indian crypto investors have shed the speculative itch and are buying the dip in bitcoin price like seasoned pros, Mumbai-based CoinDCX exchange told CoinDesk.

“Indian investors are maturing. They’re no longer driven purely by sentiment or headlines; instead, they’re focused on fundamentals and the long-term potential of the asset class,” CoinDCX’s CEO Sumit Gupta said in an email.

“We’re seeing it in their behavior: regular bitcoin systematic investment plans (SIPs), deliberate market orders, and thoughtfully placed limit orders,” he added, naming ether , solana and XRP as other favorites.

The latest trend contrasts with the frenzied trading in 2021 when newbies chasing 100x pumps dabbled with clones and other smaller tokens.

“It’s clear that participation is becoming more strategic and measured, rather than reactive. Increasingly, investors are looking at Bitcoin for portfolio diversification and long-term wealth creation,” Gupta said.

Bitcoin’s price has dropped to $75,000 after having hit a high of over $126,000 in October. The broader market has followed suit, with altcoins registering bigger losses. Coincidentally, the Indian national rupee (INR) has depreciated against the U.S. dollar in recent weeks, hitting a record low of 92 per USD.

Yet trading volumes have picked up on the exchange, rising from about $269 million in December to roughly $309 million in January, he said, adding that the activity has been more balanced. “We see profit-taking from short-term traders who bought near recent lows, but at the same time, steady accumulation from long-term investors who view these levels as an opportunity,” he noted.

India, the world’s fastest-growing major economy, maintains a cautious, regulatory-focused stance on digital assets, treating them as taxable Virtual Digital Assets (VDA) rather than legal tender. The annual budget announced over the weekend maintained a 30% tax on crypto gains, with no loss set-offs, and a 1% transaction tax deducted at source.

Regulations issued by the Financial Intelligence Unit also mandate strict KYC requirements, including regular and accurate reporting of user transactions by exchanges. These measures are aimed at bolstering compliance and countering money laundering and terrorist financing.

“The Union Budget 2026 proposes strengthening compliance for crypto platforms over lapses in transaction disclosures, aiming to curb tax evasion in virtual digital assets,” Gupta said.

We remain fully committed to working with policymakers to support the development of a safe, innovative, and globally competitive VDA ecosystem, as the regulatory landscape continues to evolve.

Crypto World

NYSE Develops Blockchain Platform for Tokenized Stock Trading

Join Our Telegram channel to stay up to date on breaking news coverage

The New York Stock Exchange (NYSE) is developing a new blockchain-based platform that will allow trading of tokenized stocks and exchange-traded funds (ETFs) with 24/7 access and near-instant settlement.

The initiative is part of a broader effort by NYSE and its parent company, Intercontinental Exchange (ICE), to modernize market infrastructure and meet growing global demand for US equities. According to the announcement, the new platform will combine ICE’s existing Pillar trading engine with blockchain-powered post-trade systems.

It will support multiple blockchains for custody and settlement, allowing trades to be funded and settled in real time using stablecoins instead of the current one-day (T+1) settlement cycle used in US equity markets. The platform is subject to regulatory approval and is expected to support a new NYSE trading venue specifically designed for tokenized securities.

🇺🇸 BREAKING: NYSE plans to launch 24/7 trading for tokenized stocks & ETFs on blockchain.

The platform will support instant settlement, fractional ownership, and stablecoin-based funding — bringing TradFi and crypto closer than ever.

This move could enable global,… pic.twitter.com/fbMcO89HUf

— Mayank Dudeja || SPYONGEMS (@imcryptofreak) January 19, 2026

Tokenized stocks are digital representations of traditional company shares issued on a blockchain. They give investors exposure to stock prices while offering key benefits such as 24/7 trading, faster settlement, and fractional ownership. These features are seen as especially attractive to global investors who cannot easily trade during standard US market hours.

NYSE and ICE Push Toward 24/7, Fully On-Chain Markets

The move aligns with NYSE’s broader push to extend trading hours. In October 2024, the exchange announced plans to seek approval from the US Securities and Exchange Commission (SEC) to extend weekday trading to 22 hours. Nasdaq has also revealed plans to introduce 24-hour weekday trading, highlighting a wider industry shift toward always-on markets.

ICE described the tokenized securities platform as a core part of its digital strategy. This includes building on-chain clearing infrastructure, supporting 24/7 trading, and potentially integrating tokenized collateral. ICE is also working with major banks such as BNY and Citibank to support tokenized deposits, helping market participants manage liquidity outside traditional banking hours.

NYSE Group President Lynn Martin said the exchange aims to lead the industry toward fully on-chain solutions while maintaining strong regulatory standards. ICE executives described the initiative as a pivotal step toward creating onchain infrastructure for trading, settlement, custody, and capital formation in the next era of global finance.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Euro Stablecoin Boom Will Be Driven by RWA Tokenization, Not Payments: S& P Global

EUR-pegged stablecoins are set to grow 800x-1,600x by 2030, S&P projects.

Crypto World

Crypto VC Funding Doubled in 2025 as RWA Tokenization Took the Lead

Cointelegraph Research provides a data-driven report on crypto VCs, highlighting capital flows, sector rotation and changes in investor behavior.

Cointelegraph Research’s latest report provides an outlook on the state of fundraising in the crypto market and the key VC trends of 2025. VC investments in Web3 startups doubled in 2025 from the year before, driven by institutional interest, particularly in the RWA sector, which raised more than $2.5 billion. There has also been a distinct increase in mergers and acquisitions (M&A) and other large-scale corporate financing arrangements.

Download the free report to discover important industry highlights

The state of crypto venture capital (VC) in 2026

In 2025, venture capital investment in crypto startups exceeded $8 billion in every quarter for the first time since 2022. Total funding in 2025 reached more than $34 billion, double the $17 billion recorded in 2024. Nevertheless, 2025 can still be considered a risk-off year, as investors favored bonds and safe-haven assets, such as precious metals, which posted exceptional performance that year, amid geopolitical uncertainty and elevated interest rates.

The reduced risk appetite of venture capital also changed perceptions of business models in crypto. In 2025, fund managers prioritized sustainable revenue models, organic user metrics and strong product market fit instead of projects with early traction and limited revenue visibility. This shift was corroborated by the move from pre-seed and seed rounds toward later financing stages. Seed-stage financing declined by 18%, while Series B funding increased by 90%. This indicates deeper investor involvement in projects and a stronger focus on ecosystem development rather than early-stage experimentation.

Download the full report to explore which startups and niches attracted most attention from VCs

The trending narrative: Real-world assets (RWA)

RWA tokenization has shifted from a narrative into a budding sector over the past three years. According to RWA.xyz data, tokenized real-world assets have surpassed a capitalization of $38 billion, up 744% from $4.5 billion in 2022. RWAs have emerged as one of the fastest-growing segments in the crypto market, second only to stablecoins. Despite this growth, the crypto RWA sector remains small relative to $156 trillion in fixed-income and $146 trillion global equities markets. This suggests substantial room for further expansion.

From the investment side, the first signs of this shift are present in the progression of annual funding figures. In 2025, VC funding for RWA tokenization projects exceeded $2.5 billion.

Download the full Cointelegraph Research report to explore deeper insights into the RWA sector

Fading narrative for Ethereum layer 2s and modular infrastructure projects

While overall VC interest in the crypto market increased throughout the year, certain narratives showed clear signs of decline. In 2022, Ethereum layer 2 projects raised more than $1.2 billion, followed by $387 million in 2023 and $587 million in 2024. In 2025, funding reached a low of $162 million, representing a 72%decline from 2024.

This was likely caused by the rapid proliferation of layer-2 blockchains, which has led to an increasingly saturated landscape and a decline in VC appetite for this technology. As the number of L2 chains quickly increased above 50, the demand for blockspace was saturated.

See which crypto sectors are losing VC interest in the latest report by Cointelegraph Research

We would like to thank Canton Foundation, CryptoRank, DWF Labs, Everest Ventures Group, Mercuryo, and RWA.xyz for contributing data, insights, and opinions to this report.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. This article is for general information purposes and is not intended to be and should not be taken as, legal, tax, investment, financial, or other advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph. Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Nvidia (NVDA) Shares Fall to a Year-to-Date Low

As the Nvidia (NVDA) share price chart shows, the stock fell below $177 during yesterday’s session, marking its lowest level since the start of 2026.

Negative market sentiment is largely driven by uncertainty surrounding supplies to China. According to the Financial Times, Nvidia’s sales of H200 chips to China are still awaiting final approval from US authorities.

Yesterday’s statement from AMD, noting that the scale of its own shipments to China remains uncertain, reinforced these concerns and added further pressure to Nvidia shares. Previously, NVDA had been supported by expectations that deliveries of H200 chips to Chinese partners would begin in early 2026.

In addition, some media reports suggest that the stock is facing extra pressure from news of delayed investment in OpenAI, which is reportedly exploring alternative suppliers.

Technical Analysis of the Nvidia (NVDA) Chart

On 23 December, when analysing NVDA price action, we:

→ reaffirmed the long-term ascending channel, which remains intact;

→ suggested that bulls might attempt to break out of the corrective pattern (shown in red) in order to reach the channel median.

As expected (indicated by the black arrow), the price reached this target. However, January’s price behaviour offers little evidence that the uptrend has resumed with renewed strength.

Moreover, the red arrows highlight several bearish signals:

→ the median acted as clear resistance;

→ the 30 January peak (the highest level since the start of the year) formed with a long upper shadow, resulting in a false break of the previous high — a classic “bull trap”.

While bearish momentum appears to be in control, it is worth noting that:

→ the break below the 20 January low could also prove to be false;

→ the lower boundary of the channel, which has acted as key support for many months, is nearby.

Taking all of this into account, it is reasonable to assume that NVDA may find a period of consolidation in the lower quarter of the channel. A potential catalyst for the next major move could be the company’s earnings release scheduled for 25 February.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech8 hours ago

Tech8 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World17 hours ago

Crypto World17 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards