Crypto World

SEC, CFTC relaunch Project Crypto to align U.S. digital asset oversight

Crypto regulators push Congress for urgent market structure laws as SEC and CFTC relaunch Project Crypto to coordinate on‑chain oversight and close gaps.

Summary

- SEC Chair Atkins and CFTC Chair Selig relaunch Project Crypto to align oversight of on‑chain trading, clearing, settlement, and custody.

- The chairs urge Congress to pass the CLARITY Act and broader crypto market structure bills using a “minimum‑effective‑dose” regulatory approach.

- The plan aims to harmonize definitions, reduce duplicative registrations, and keep innovation in the U.S. amid rising global competition.

Securities and Exchange Commission Chair Paul S. Atkins called on Congress to pass crypto market structure legislation immediately as federal regulators announced a coordinated approach to digital asset oversight.

Commodity Futures Trading Commission Chair Michael S. Selig joined the SEC to relaunch Project Crypto on Jan. 29, 2026, according to statements from both agencies. The joint initiative aims to align SEC and CFTC oversight as digital asset markets increasingly operate on blockchain networks.

The announcement comes as lawmakers debate bipartisan crypto bills addressing market structure. Atkins and Selig stated in their joint statement that regulatory clarity requires both legislative action and coordinated implementation by federal agencies.

Project Crypto was described as a program designed to prepare U.S. markets for digital asset trading and settlement. The regulators stated that crypto markets have moved “on-chain,” requiring agencies to modernize oversight frameworks and surveillance capabilities.

The initiative seeks to establish coordinated regulation across agencies, according to the statement. The chairs argued that unclear rules and enforcement-focused approaches have constrained innovation and limited investor opportunities, calling for clear regulatory frameworks and consistent enforcement.

Selig and Atkins proposed that regulators should sequence new requirements rather than impose multiple obligations simultaneously, creating pathways for compliant market participants. The statement outlined a “minimum-effective-dose” regulatory approach, with rules focused on material risks and grounded in statutory authority.

The chairs noted that fragmented oversight creates regulatory gaps in on-chain markets, where trading, clearing, settlement, and custody functions are often integrated. Jurisdictional divisions between agencies produce duplicative requirements that reduce efficiency and regulatory clarity, according to the statement.

Project Crypto aims to eliminate regulatory conflicts by aligning definitions across agencies, coordinating oversight responsibilities, and enabling data sharing between regulators. The goal is to prevent firms from facing duplicative registrations for similar products, the statement said.

SEC seeks to attract global digita;l asset activity

The chairs warned that global jurisdictions are competing to attract digital asset activity, with some implementing lighter regulatory frameworks while others impose restrictions that may slow market development. They argued that overly restrictive regulation could drive innovation to other jurisdictions.

Atkins urged Congress to pass the CLARITY Act and broader market structure legislation, calling legislative action urgent. He also expressed support for expanding retirement account access to crypto assets. Both chairs stated that legislative action must be accompanied by coordinated implementation plans to provide regulatory clarity.

The statement emphasized that regulators should adapt rules to new technology rather than applying legacy frameworks, focusing on material risks. Registration, disclosure, custody, clearing, and surveillance were identified as near-term priority areas.

The initiative places pressure on Congress to establish statutory frameworks for digital asset markets, with the chairs indicating that coordinated regulatory implementation would follow legislative progress.

Crypto World

NFT Marketplace Collapse: Nifty Gateway, Foundation Lead Wave of Major Platform Shutdowns

TLDR:

- NFT trading volumes collapsed from $2.9 billion in 2021 to just $23.8 million by early 2025 quarterly data.

- Major platforms including Nifty Gateway, Foundation, and MakersPlace announced closures within days in January 2026.

- Centralized storage systems left 27% of top NFT collections vulnerable to permanent loss after server shutdowns.

- OpenSea recaptured 67% of Ethereum NFT volume by expanding into fungible tokens as competitors exited the market.

The digital art marketplace landscape has undergone a dramatic transformation as prominent NFT platforms cease operations.

Trading volumes collapsed from $2.9 billion in 2021 to $23.8 million by early 2025, representing a 93 percent decline.

Gemini’s Nifty Gateway, Foundation, and multiple other platforms announced closures or ownership transfers within days of each other in January 2026, marking the effective end of the venture-backed NFT marketplace ecosystem.

Wave of Platform Closures Reshapes Digital Art Infrastructure

Nifty Gateway announced its shutdown on January 24, 2026, with approximately 650,000 NFTs requiring withdrawal before the April 23 deadline.

Community outcry initially extended the original February 23 closure date. Three days later, Foundation’s creator transferred ownership to BlackDove, a digital art streaming company. The platform had generated $230 million in primary sales during its operational period.

MakersPlace shut down in January 2025 after facilitating the landmark $69.3 million Beeple sale through Christie’s in 2021.

Content manager Brady Evan Walker announced that “ongoing market challenges and funding difficulties have made it impossible to sustain operations while fulfilling our mission.”

KnownOrigin, acquired by eBay in 2022, wound down operations in July 2024. Async Art closed in October 2023 despite raising $2 million in seed funding.

Active traders declined from 529,101 in 2022 to 19,575 by 2025, according to DappRadar. Average art NFT prices fell from $2,044 in 2021 to $475 in 2023.

CEO Conlan Rios reflected that when Async Art launched, “the NFT world was smaller and simpler” with “a genuine sense of altruism all around.”

Christie’s eliminated its digital art department in September 2025 after none of its 11 auctions exceeded $400,000 in sales.

Technical Infrastructure Exposes Centralization Vulnerabilities

A 2024 Pinata analysis revealed that 27 percent of top NFT collections stored metadata on centralized servers. The report noted that some NFTs “simply no longer exist” as their “smart contracts point to metadata that is no longer accessible from the original centralized servers.”

Sam Spratt commented on Twitter that Nifty Gateway’s closure represented “a pure loss” and expressed “gratitude for what was given” before the platform’s ending.

XCOPY’s early work demonstrates the fragility of NFT storage systems. The London-based artist described how Ascribe “fell into the cryptoart platform graveyard” after the service closed.

“Death Wannabe,” released on July 17, 2018, had ten editions but only three remain accessible. Seven editions are locked in the original RareArt Labs contract while “Disaster Suit” survives in four editions but lost its metadata entirely.

Nifty Gateway responded to criticism by announcing metadata migration to Arweave for newer NFTs. Artist Bryan Brinkman acknowledged that “many of us knew the risks of minting on there” but noted the platform “still clung to too many centralized choices” despite contract improvements.

Collector G4SP4RD warned that collections from artists like Beeple and Spratt could become “broken with no possibility of recovery” if servers shut down.

OpenSea recaptured 67 percent of Ethereum NFT volume by late 2025 after expanding into fungible tokens. CEO Devin Finzer tweeted that the platform crossed $2.6 billion in trading volume with “over 90 percent from token trading.”

SuperRare announced on Twitter it was “not going anywhere” and continued operating. Art Basel Miami Beach launched Zero 10 in December, selling 65 percent of digital art works by mid-afternoon on opening day.

Crypto World

Michael Saylor Hints at Strategy’s Next Bitcoin Purchase

Join Our Telegram channel to stay up to date on breaking news coverage

Michael Saylor has hinted that Strategy will soon make another Bitcoin purchase, pushing its holdings beyond 3% of Bitcoin’s total supply.

Saylor posted “Bigger Orange” on X, a phrase he has used in the past before announcing new Bitcoin buys. Strategy currently holds about 687,410 Bitcoin, which equals roughly 3% of Bitcoin’s maximum supply of 21 million coins. The company has made more than 94 Bitcoin purchases since 2020, with an average buying price of around $75,000 per Bitcoin.

Last week alone, Strategy bought 13,627 BTC for about $1.25 billion, using a mix of debt, equity, and cash. With Bitcoin trading close to $95,000, Strategy’s unrealized gains have grown significantly. This large exposure has made the company one of the biggest corporate Bitcoin holders in the world, strengthening its image as a long-term Bitcoin-focused firm.

₿igger Orange. pic.twitter.com/HI47hMCnui

— Michael Saylor (@saylor) January 18, 2026

Strategy’s Bitcoin Bet Strengthens as MSTR Lags Holdings

However, Strategy’s stock price has not fully reflected its growing Bitcoin holdings yet. According to TradingView data, MSTR shares rose about 4% in the past week and are up over 12% year-to-date. The stock was trading near $174 at the time of reporting. Over the last five years, MSTR has gained more than 180%, showing strong long-term performance.

Investor confidence also improved after MSCI decided not to change its index rules, removing uncertainty around Strategy’s market position. Many investors now see MSTR as a leveraged proxy for Bitcoin, meaning the stock often moves more sharply when Bitcoin rises or when Strategy announces new purchases.

Meanwhile, short-term Bitcoin market sentiment remains cautious. Analyst Ted Pillows noted tightening liquidity and heavy trading interest between $96,000 and $98,000. These price levels often attract strong activity and can slow price movement or trigger volatility.

Despite caution among retail traders, institutional Bitcoin futures activity is increasing, suggesting larger players are still positioning for future moves. Overall, corporate accumulation remains strong, but short-term Bitcoin price action may stay volatile.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Tether Pulls Back on $20B Fundraising Plans After Investor Pushback (Report)

Tether has scaled back fundraising talks to about $5B after investors pushed back on a proposed $500B valuation.

Tether has reportedly scaled back its planned multibillion-dollar fundraising target after facing resistance from investors.

According to a report from the Financial Times on February 4, advisers for the stablecoin issuer are now examining the possibility of raising at least $5 billion, down from the $15 billion to $20 billion figure circulated during early talks in 2025.

Lower Target Follows Valuation Concerns

The original range, first reported by Bloomberg in September 2025, was linked to a valuation of roughly $500 billion, placing Tether among the world’s most valuable private companies. However, the number has reportedly proven difficult to justify for several prospective investors.

In comments cited by the FT, Paolo Ardoino, Tether’s chief executive, said the higher figure was never a firm target. According to the executive, the amount discussed was only the maximum the company would consider selling. “If we were selling zero, we would be very happy as well,” Ardoino said, noting that the firm is profitable and does not urgently need external capital.

Tether is the issuer of USDT, the world’s largest dollar-pegged stablecoin, with about $185 billion in circulation. The company has generated strong earnings from returns on reserves backing USDT, mainly U.S. Treasuries. Ardoino said Tether made around $10 billion in profit last year, a figure that has featured prominently in valuation discussions.

Despite that profitability, some investors have taken a cautious stance, with the FT reporting that concerns centered on how the $500 billion valuation was calculated and whether it reflects realistic growth expectations in the current market environment.

Nonetheless, fundraising talks are still in the early stages, and no decision has been made on the size or timing of any raise.

You may also like:

Profitability, Reserves, and Lingering Skepticism

Tether’s capital plans have come against a backdrop of mixed sentiment around the stablecoin issuer. The firm has expanded beyond cash-like reserves in recent years, building large positions in Bitcoin and gold. Earlier in the year, Ardoino confirmed that the company bought about $779 million worth of Bitcoin in the fourth quarter of 2025, lifting its holdings to more than 96,000 BTC.

At the same time, scrutiny around transparency has not faded, especially considering that S&P Global Ratings assigned USDT its lowest score on the agency’s stablecoin stability scale in November 2025, citing gaps in disclosure and a higher share of assets such as Bitcoin, gold, and secured loans. Ardoino publicly criticized the rating, arguing that traditional frameworks fail to capture Tether’s business model.

The reduced fundraising target suggests Tether is adjusting to market feedback rather than pressing ahead with an aggressive valuation. Whether the company proceeds with a smaller raise or pauses altogether will likely depend on investor appetite and broader conditions in crypto markets over the coming months.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto’s Point of No Return: Institutions are Finally Here, with Brett Tejpaul

In this episode, Brett Tejpaul, head of Coinbase Institutional, sits down with Camila Russo to explain why institutional adoption accelerated last year.

Crypto World

IREN favors AI cloud in high-stakes break from Bitcoin roots

IREN Ltd., once known for mining Bitcoin, is undergoing a dramatic reinvention as an AI infrastructure provider—a transformation that will face a critical test when the company reports second-quarter earnings on Thursday.

Summary

- IREN has pivoted from Bitcoin mining to AI cloud infrastructure, repurposing its energy sites into data centers and securing a $9.7 billion partnership with Microsoft to support next-generation compute.

- Shares have sold off sharply ahead of Q2 earnings as investors focus on dilution risk.

- The upcoming earnings report has investors concerned over whether funding roughly 140,000 GPUs by year-end could require equity issuance.

Formerly Iris Energy, IREN has shifted away from crypto mining and into what it calls a “Neocloud” model, repurposing its stranded-energy Bitcoin sites into large-scale data centers designed to support artificial intelligence workloads.

A $9.7 billion partnership with Microsoft helped position IREN as a potential player in the race to supply next-generation compute capacity.

The ambition has not come cheap

Ahead of earnings, IREN shares have tumbled, falling nearly 19% intraday on Wednesday and down about 28% over the past five days, as investors worry that funding the company’s GPU-heavy cloud expansion could require dilutive equity issuance.

After a 314% rally over the past year, the pullback underscores growing skepticism about whether IREN can scale its AI cloud business without eroding shareholder value.

The upcoming earnings report represents a clear break from the company’s Bitcoin mining past, shifting attention to cloud execution, financing discipline, and competition with established players like Amazon and Oracle—making it a critical test of the company’s pivot.

IREN isn’t alone

Other companies have attempted comparable transformations—some successfully, others less so:

- Core Scientific – Transitioned from pure Bitcoin mining to offering high-performance computing and AI colocation services after emerging from bankruptcy, leveraging existing infrastructure to attract AI customers.

- Hut 8 – Expanded beyond crypto mining into HPC and data center services, pitching its energy assets as ideal for AI workloads.

- Northern Data – Repositioned itself as a European AI and cloud infrastructure provider, shifting investor focus from Bitcoin exposure to GPU-based compute capacity.

- Nvidia (earlier era) – While not a crypto miner, Nvidia successfully pivoted from gaming-focused GPUs to becoming the backbone of AI compute, showing how infrastructure players can redefine their identity through demand shifts.

- IBM – Moved from legacy hardware to cloud and AI services over the past decade, using partnerships and hybrid infrastructure to reinvent its growth narrative.

IREN now joins this list at a moment when AI infrastructure demand is booming—but capital markets patience is thinning. Whether it becomes a case study in smart reinvention or costly overreach may hinge on what it delivers this earnings season.

Crypto World

$2.9B Bitcoin ETF Outflow, Bearish Futures Data Project More BTC Downside

Key takeaways:

-

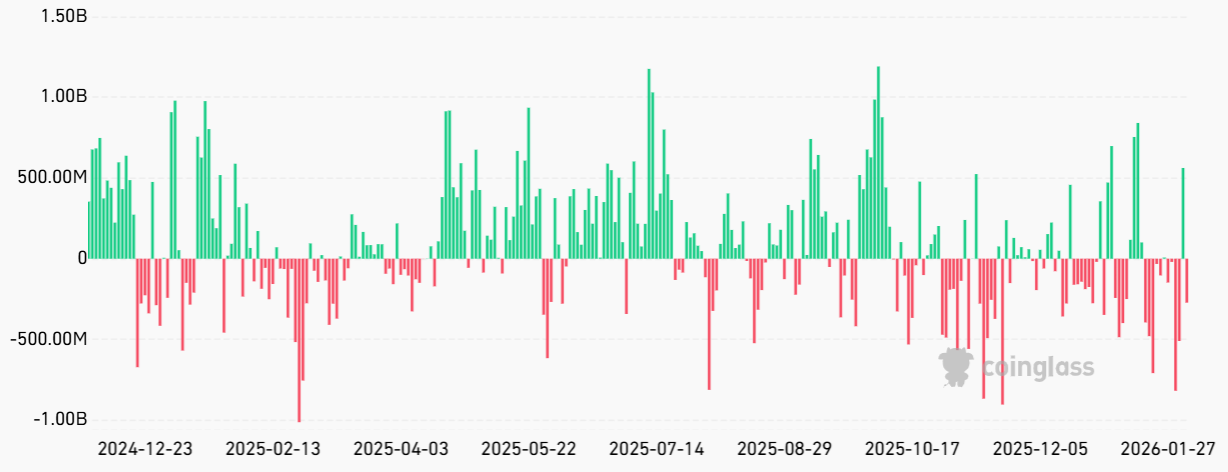

Heavy outflows from Bitcoin exchange-traded funds and massive liquidations show that the market is purging highly leveraged buyers.

-

Bitcoin options metrics reveal that pro traders are hedging for further price drops amid a tech stock sell-off.

Bitcoin (BTC) slid below $73,000 on Wednesday after briefly retesting the $79,500 level on Tuesday. This downturn mirrored a decline in the tech-heavy Nasdaq Index, driven by a weak sales outlook from chipmaker AMD (AMD US) and disappointing United States employment data.

Traders now fear further Bitcoin price pressure as spot exchange-traded funds (ETFs) recorded over $2.9 billion in outflows across twelve trading days.

The average $243 million daily net outflow from the US-listed Bitcoin ETFs since Jan. 16 nearly coincides with Bitcoin’s rejection at $98,000 on Jan. 14. The subsequent 26% correction over three weeks triggered $3.25 billion in liquidations for leveraged long BTC futures. Unless buyers deposited additional margin, any leverage exceeding 4x has already been wiped out.

Some market participants blamed the recent crash on the lingering aftermath of the $19 billion liquidation on Oct. 10, 2025. That incident was reportedly triggered by a performance glitch in database queries at Binance exchange, resulting in delayed transfers and incorrect data feeds. The exchange admitted fault and disbursed over $283 million in compensation to affected users.

According to Haseeb Qureshi, managing partner at Dragonfly, huge liquidations at Binance “could not get filled, but liquidation engines keep firing regardless. This caused market makers to get wiped out, and they were unable to pick up the pieces.” Qureshi added that the October 2025 crash did not permanently “break the market,” but noted that market makers “will need time to recover.”

The analysis suggests that cryptocurrency exchanges’ liquidation mechanisms “are not designed to be self-stabilizing the way that TradFi mechanisms are (circuit breakers, etc.)” and instead focus solely on minimizing insolvency risks. Qureshi notes that cryptocurrencies are a “long series” of “bad things” happening, but historically, the market eventually recovers.

BTC options skew signals traders doubt $72,100 bottom

To determine if professional traders flipped bearish after the crash, one should assess BTC options markets. During periods of stress, demand for put (sell) instruments surges, pushing the delta skew metric above the 6% neutral threshold. Excess demand for downside protection typically signals a lack of confidence from bulls.

The BTC options delta skew reached 13% on Wednesday, a clear indication that professional traders are not convinced Bitcoin’s price has found a bottom at $72,100. This skepticism stems partly from fears that the tech sector could suffer from increased competition as Google (GOOG US) and AMD roll out proprietary artificial intelligence chips.

Related: Bitcoin open interest falls by $55B in 30 days–What’s next for BTC price?

Another source of discomfort for Bitcoin holders involves two unrelated and unfounded rumors. First, a $9 billion Bitcoin sale by a Galaxy Digital customer in 2025 was previously attributed to quantum computing risks. However, Alex Thorn, Galaxy’s head of research, denied those rumors in an X post on Tuesday.

The second speculation involves Binance’s solvency, which gained traction after the exchange faced technical issues that temporarily halted withdrawals on Tuesday. Current onchain metrics suggest that Bitcoin deposits at Binance remain relatively stable.

Given the current uncertainty in macroeconomic trends, many traders have opted to exit cryptocurrency markets. This shift makes it difficult to predict whether Bitcoin spot ETF outflows will continue to apply downward pressure on the price.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

CME Group Weighs Issuing Proprietary Token for Collateral and Margin

Chicago-based derivatives exchange CME Group is weighing the launch of its own digital token as it explores how tokenized assets could be used as collateral across financial markets, according to comments from CEO Terry Duffy.

Speaking on a company earnings call, Duffy said CME is reviewing different forms of margin, including tokenized cash and a CME-issued token that could operate on a decentralized network. He said:

Not only are we looking at tokenized cash […] we’re looking at different initiatives with our own coin that we could potentially put on a decentralized network for other of our industry participants to use.

He added that collateral issued by a “systemically important financial institution” may offer greater comfort to market participants than tokens issued by a “third or fourth-tier bank trying to issue a token for margin.”

Duffy’s reference to tokenized cash points to a collaboration with Google announced in March, in which CME Group and Google Cloud said they had begun piloting blockchain-based infrastructure for wholesale payments and asset tokenization using Google Cloud’s Universal Ledger.

The potential CME-issued token would be a separate initiative, and the exchange did not specify how it would function.

CME Group is a derivatives exchange that operates futures and options markets across rates, equities, commodities and cryptocurrencies.

In January, CME said it plans to expand its regulated crypto offerings by listing futures contracts tied to Cardano (ADA), Chainlink (LINK) and Stellar (XLM). Separately, it agreed with Nasdaq to unify its crypto index offerings under the Nasdaq-CME Crypto Index.

The exchange also recently said it plans to introduce 24/7 trading for cryptocurrency futures and options beginning in early 2026, pending regulatory approval.

Related: CME launches Bitcoin volatility index as institutional crypto trading matures

Banks expand stablecoin and payment token efforts amid regulatory debate

While CME Group did not announce specific details about its potential proprietary token, Duffy’s comments place the derivatives exchange alongside a broader push by traditional financial institutions, particularly banks, to explore blockchain-based tokens for payments and settlement.

In July, Bank of America said it was exploring stablecoins to modernize its payments infrastructure, with CEO Brian Moynihan describing them as a potential transactional tool for moving US dollar and euro-denominated funds through the bank’s global payment systems.

JPMorgan rolled out JPM Coin in November, issuing a blockchain-based token that represents US dollar deposits held at the bank. The token is available to institutional clients and can be used to move funds on Base, a blockchain developed by Coinbase, enabling onchain payments and settlement.

Fidelity Investments said it soon plans to launch a US dollar–backed stablecoin called the Fidelity Digital Dollar (FIDD), extending its digital-asset push after receiving conditional approval to operate a national trust bank.

Still, as US banks move ahead with stablecoin and token initiatives, they are simultaneously pushing back against yield-bearing stablecoins, fueling an active policy clash with the crypto industry under the CLARITY Act, which is being debated in Congress.

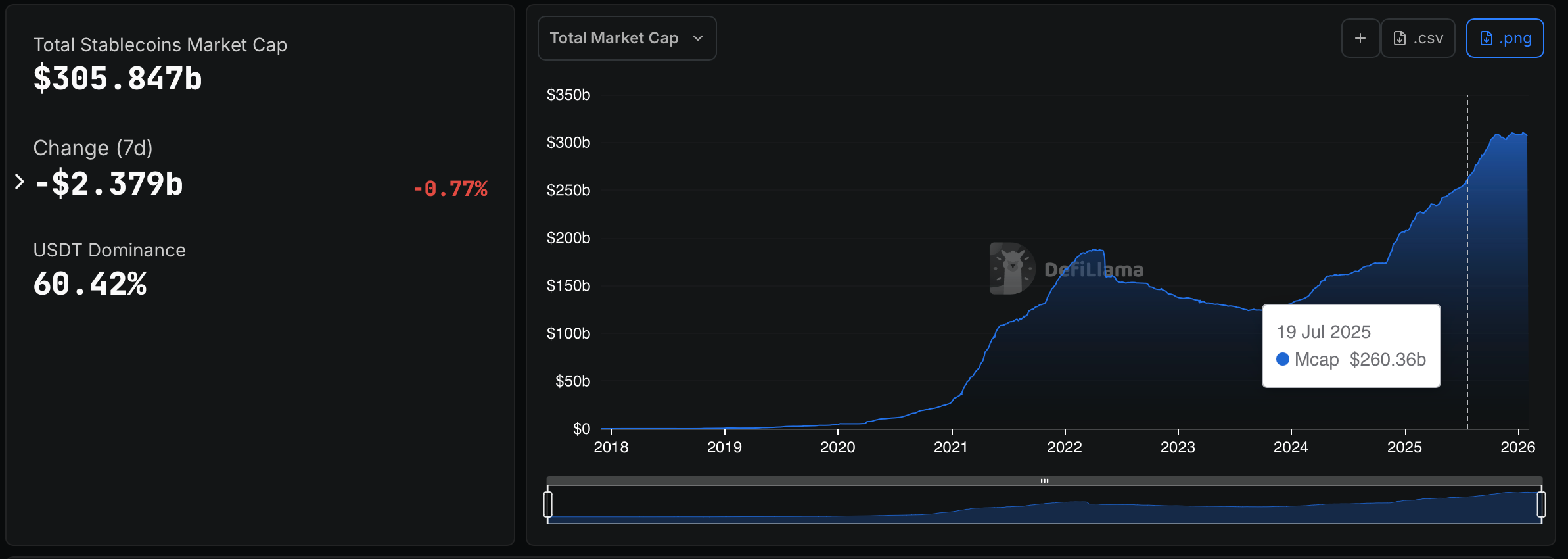

Since the passage of the GENIUS Act in July 2025, the stablecoin market has grown considerably. It has a market capitalization of around $305.8 billion, up from around $260 billion when the law was passed, according to DefiLlama data.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Bitcoin Drops $4,000 As EU-US Trade War Wipes $110B

Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price fell almost $4,000 as Europe hinted at retaliatory measures against US President Donald Trump, who threatened new trade tariffs unless negotiations could begin over Greenland.

The BTC drop came as the trade war also wiped out about $110 billion, sending BTC down by over 2.5% to a market capitalization of $3.22 trillion.

Bitcoin prices dumped 2.5% in the last 24 hours, dropping to below $92,000. BTC is now trading at $92,440 as of 1:16 a.m. EST, according to a Coinbase chart on TradingView.

EU–US Trade War Shakes the Crypto Market

As a result of the crypto market wiping over $110 billion in the last 24 hours, around $787 million in long positions were liquidated in the last day, bringing the total 24-hour liquidations to over $870 million, according to Coinglass data. Over $223 million was BTC-related long positions.

The drop comes after US President Donald Trump revived global fears of trade tariffs by imposing duties on several major European nations over Greenland.

Trump had earlier threatened to impose up to 25% tariffs on several European countries, stating that the duties would remain in place until a deal to sell Greenland to the United States was reached.

🇺🇸🇬🇱 Trump threatens new tariffs on countries opposed to Greenland takeover.

Starting on February 1, 2026, 10% tariffs would be imposed on the following countries, rising to 25% on June 1, 2026:

🇩🇰 Denmark

🇳🇴 Norway

🇸🇪 Sweden

🇫🇷 France

🇩🇪 Germany

🇬🇧 UK

🇫🇮 Finland

🇳🇱 The… pic.twitter.com/ZbCAT3iB3A— Mario Nawfal (@MarioNawfal) January 17, 2026

However, European nations have continuously rejected Trump’s demand for the Danish territory, with France also seen preparing retaliatory economic measures against Washington.

Trump has repeatedly demanded that Greenland be ceded to the U.S., claiming that the island is of great importance to U.S. national security.

Following the refusal to sell Greenland, Trump said that Denmark has been unable to stave off a Russian threat from Greenland.

“NATO has been telling Denmark, for 20 years, that ‘you have to get the Russian threat away from Greenland…’ Denmark has been unable to do anything about it,” Trump said. “Now it is time, and it will be done.”

“NATO has been telling Denmark, for 20 years, that “you have to get the Russian threat away from Greenland.” Unfortunately, Denmark has been unable to do anything about it. Now it is time, and it will be done!!!” – President Donald J. Trump pic.twitter.com/ZyFh9OsNsn

— The White House (@WhiteHouse) January 19, 2026

Gold futures soared to record highs of $4,680 per ounce as markets reacted to the resumption of the US-EU trade war, according to Google Finance. Silver futures also skyrocketed above $93 per ounce for the first time in history.

Bitcoin Price Pull Backs As Selling Pressure Intensifies

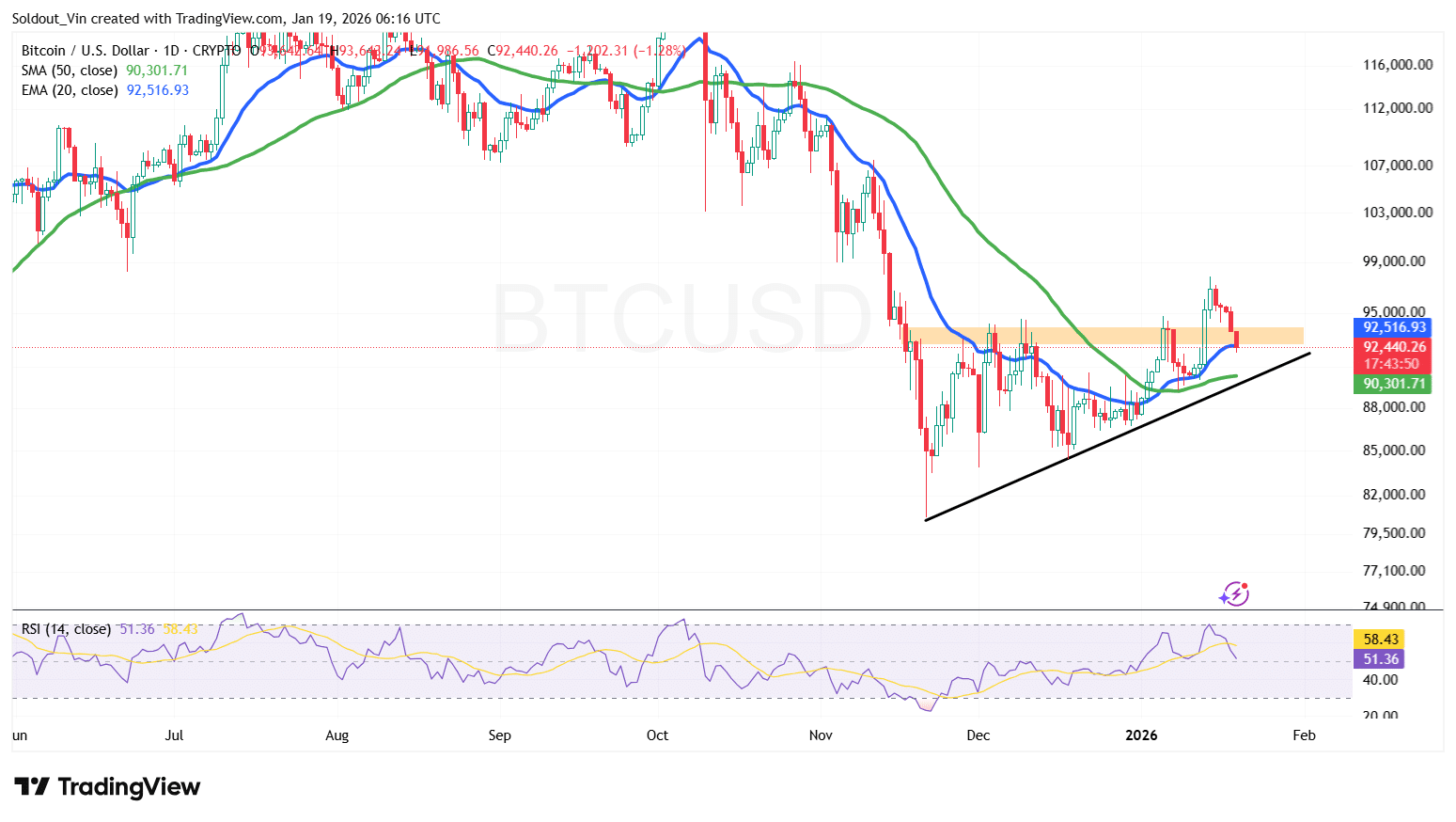

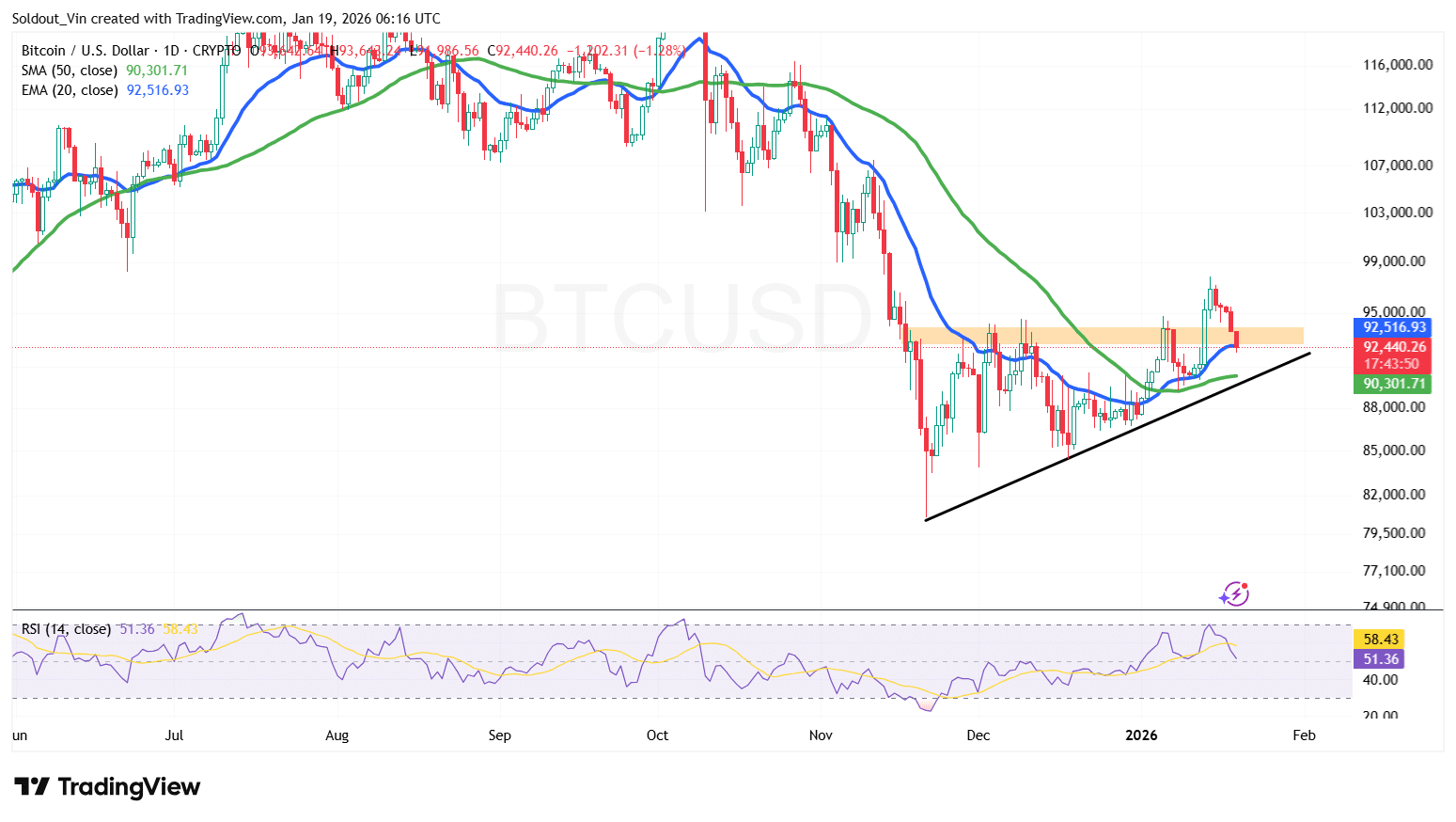

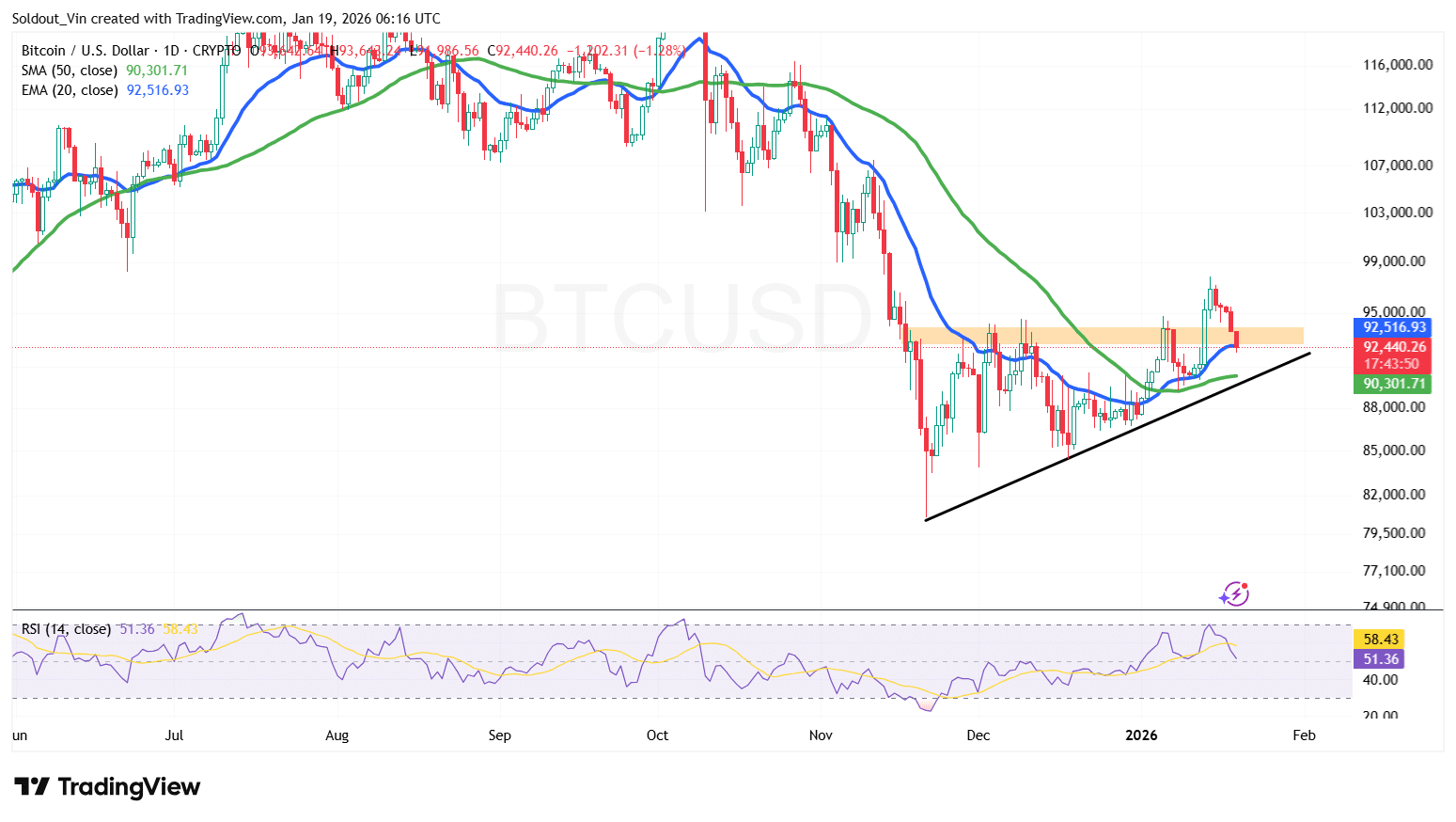

After breaking above the ascending triangle and rallying to over $97,000, the BTC price has since faced selling pressure at this resistance level.

This has resulted in the Bitcoin price dropping back into the triangle, now trading around the upper boundary of the pattern and the 20-day Exponential Moving Average (EMA).

To add to the bearish pressure, the Relative Strength has dropped from around 68 to 51.36 and is still plunging, indicating sustained selling pressure in the Bitcoin market.

BTC Price Outlook: Is The Drop A Warning Sign?

As a result of the trade war, the cryptocurrency market, especially Bitcoin, is experiencing a sustained drop as traders run to safe-haven assets.

According to the BTC/USD Chart analysis, the Bitcoin price is still trading above the 50-day Simple Moving Average (SMA), which is providing strong short-term support at $90,301.

With trade threats looming as BTC tries to hold above $90,000 over the last two weeks, Bitcoin could yet drop further. If Bitcoin’s price continues to drop and breaches the 50-day SMA, the asset risks a drop to the lower boundary around $89,000.

However, institutional buying could be a positive factor in holding the price above this support. Michael Saylor has hinted that Strategy will soon make another BTC purchase, as it pushes to hold over 3% of the asset’s total supply.

Saylor posted “Bigger Orange” on X, a phrase he has used before announcing new Bitcoin buys.

₿igger Orange. pic.twitter.com/HI47hMCnui

— Michael Saylor (@saylor) January 18, 2026

After buying 13,627 BTC last week, Strategy now holds 687,410 BTC acquired for $51.8 billion at $75,353 per Bitcoin.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

MetaMask Integrates Ondo Finance for Tokenized US Stocks and ETF Trading

TLDR:

- MetaMask users can now trade 200+ tokenized US stocks and ETFs directly through their wallet interface.

- Trading operates 24/5 from Sunday 8:05 PM ET to Friday 7:59 PM ET with continuous token transfer capability.

- Integration uses USDC on Ethereum mainnet through MetaMask Swaps to acquire Ondo Global Markets tokens.

- Service excludes major regions including US, UK, Canada, China, and European Economic Area jurisdictions.

MetaMask has partnered with Ondo Finance to introduce tokenized US stocks, ETFs, and commodities directly within its self-custodial wallet.

Eligible users in supported non-US jurisdictions can now access over 200 tokenized securities, including major stocks and ETFs, without traditional brokerage accounts.

The integration went live on February 3, 2026, marking a shift in digital asset management infrastructure.

Bringing Traditional Securities to Self-Custodial Wallets

The collaboration between MetaMask and Ondo Global Markets represents a notable development in blockchain-based financial services.

Users can now purchase, hold, and trade tokenized versions of popular US securities such as Tesla, NVIDIA, Apple, Microsoft, and Amazon. The offering also includes commodity-tracking ETFs like SLV for silver, IAU for gold, and QQQ.

This integration was announced at the Ondo Global Summit in Fort Worth, Texas. The launch comes as tokenized real-world assets have grown to exceed $22 billion globally.

MetaMask users can access these securities through the MetaMask Swaps feature, using USDC on Ethereum mainnet to acquire Ondo Global Markets tokens.

Joe Lubin, Founder and CEO of Consensys, addressed the limitations of existing market infrastructure. “Access to US markets still runs through legacy rails. Brokerage accounts, fragmented apps, and rigid trading windows haven’t meaningfully evolved,” Lubin said.

He added that bringing Ondo’s tokenized US stocks and ETFs directly into MetaMask demonstrates an improved model where people can move between crypto and traditional assets without intermediaries.

The move extends MetaMask’s functionality beyond cryptocurrency management into broader financial markets. For Ondo Finance, the integration expands distribution through one of the most widely adopted self-custodial wallets worldwide.

Ian De Bode, President at Ondo Finance, explained that MetaMask serves as the platform where millions already manage on-chain assets, and the integration introduces an entirely new asset class into that familiar experience.

Extended Trading Hours and Portfolio Management Features

MetaMask’s implementation of Ondo Global Markets tokens offers trading availability 24 hours daily, five days weekly.

Trading operates from Sunday 8:05 PM ET through Friday 7:59 PM ET. Token transfers remain available continuously, operating on a 24/7 basis throughout the week.

The GM tokens function as blockchain-based assets designed to track underlying securities’ market values. Users conduct transactions subject to applicable terms and fees.

De Bode noted that the integration offers users access to tokenized US stocks and ETFs with pricing that reflects traditional brokerage markets, bringing the economics of platforms like Robinhood into a self-custodial, on-chain wallet.

The platform launches with access to more than 200 tokenized US stocks and ETFs on Ethereum mainnet. Users can manage these tokenized securities alongside cryptocurrency holdings within a single multichain account.

The integration maintains the MetaMask app experience without requiring external platforms or applications.

Portfolio management occurs entirely within the MetaMask Mobile interface for eligible users. The service is available today in supported jurisdictions outside the United States.

However, numerous regions face exclusions, including the European Economic Area, United Kingdom, Canada, China, Singapore, and various other territories.

The restrictions apply to users in Afghanistan, Algeria, Belarus, and multiple additional countries spanning different continents.

Crypto World

TRM Labs Reaches $1 Billion Valuation With $70 Million Series C Funding Round

TLDR:

- TRM Labs secured $70 million in Series C funding led by Blockchain Capital and Goldman Sachs investors.

- The blockchain analytics firm now serves 40% private sector clients as tokenization adoption accelerates rapidly.

- FBI and IRS rely on TRM Labs technology to investigate thousands of cryptocurrency-related criminal cases annually.

- Company reports 500% increase in AI-enabled crypto scams, positioning itself for continued market expansion.

TRM Labs secured $70 million in Series C funding, reaching a $1 billion valuation. The blockchain analytics firm attracted investment from Blockchain Capital, Goldman Sachs, Bessemer, Brevan Howard, Thoma Bravo, and Citi Ventures.

The San Francisco-based company now joins the ranks of crypto unicorns. Its growth reflects increasing demand for blockchain intelligence across government and private sectors.

Law Enforcement Partnership Drives Market Position

TRM Labs carved its niche by supporting global law enforcement agencies in cryptocurrency investigations. The company emerged in 2018 when founders Esteban Castaño and Rahul Raina recognized the need for blockchain intelligence.

Their strategy focused on tracking multiple cryptocurrencies beyond Bitcoin, differentiating them from competitor Chainalysis.

Castaño explained their early thinking: “Then we asked ourselves, ‘What’s the second order consequence? The world would need intelligence to make sense of that data to ultimately manage risk.’”

Jarod Koopman, soon-to-be chief of criminal investigation at the IRS, confirmed the agency’s decade-long reliance on blockchain analytics.

“Without third-party tools, it would be infinitely more time-consuming and inefficient,” Koopman told Fortune. The IRS began using TRM Labs shortly after launch to diversify its analytical tools.

Koopman noted the strategy prevented putting “all of our eggs in one basket,” especially as criminals expanded beyond Bitcoin.

The FBI’s New York field office processes thousands of crypto cases annually, up from just a handful in 2015. Assistant Director James Barnacle highlighted TRM’s role following the October 7 Hamas attacks in Israel.

“The partnership between the FBI and the private sector is critical for us to be successful,” Barnacle stated. He emphasized that there’s nothing the FBI can accomplish entirely on its own in crypto investigations.

The company employs former government investigators, including Chris Janczewski, who led operations against child exploitation sites. This expertise strengthened TRM’s credibility with law enforcement agencies worldwide.

However, close ties with governmental agencies created friction within the crypto community. Many industry participants objected to TRM’s involvement in Hamas wallet tracking reports.

Castaño defended the company’s mission, arguing that “bringing security to digital assets is very much aligned with the crypto industry.”

Private Sector Expansion Signals Future Growth

TRM Labs reports that 40% of its customer base now operates in the private sector. This segment continues expanding as financial institutions explore tokenized assets.

The company’s revenue grew approximately 50% annually over the past four years. Blockchain Capital’s Spencer Bogart described TRM as “one of those things that becomes absolutely table stakes for anybody that’s going to be touching something in the space.”

The firm’s analytics tools serve compliance professionals and financial organizations entering blockchain technology. Wall Street’s embrace of tokenization creates new opportunities for TRM’s intelligence platform.

Ari Redbord, global head of policy, highlighted emerging threats: “We’ve seen a 500% increase in AI-enabled use in scams and fraud. This is a civilization-level threat, and we’re building the company for that moment.”

TRM published reports documenting widespread use of Tether stablecoin on Tron blockchain by cybercriminals. The company later partnered with Tether and Tron to combat illicit activity.

Critics questioned the decision, but Redbord maintained the partnership serves the core mission. “You don’t stop bad actors working only with the most regulatory-compliant places where there’s no illicit activity,” he explained.

Artificial intelligence presents both challenges and opportunities for blockchain analytics. Castaño emphasized the technology’s necessity in modern investigations.

“If you’re operating in a world where there’s trillions of transactions, how in the world do you find the needle in the haystack without using AI?” he questioned. With 350 employees, TRM continues building capabilities to address emerging threats in digital finance.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech15 hours ago

Tech15 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World24 hours ago

Crypto World24 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards