Crypto World

Sharplink Executives Promote Ether as Productive Asset Amid Price Drops

TLDR

- Sharplink executives Joe Lubin and Joseph Chalom emphasize the importance of ether as a productive financial asset.

- Despite market volatility, Sharplink continues to treat ether as a long-term investment to generate consistent returns.

- Sharplink’s strategy contrasts with traditional ETFs by focusing on permanent capital and staking ether for yield.

- Chalom highlights Ethereum’s growing role in global finance through stablecoins and tokenization.

- Lubin compares the evolution of blockchain to the early internet era, predicting that every company will soon be a blockchain company.

As Ether prices face sharp fluctuations, Sharplink Gaming continues to defend its strategy of treating Ether as a productive asset. The company’s approach revolves around utilizing ether not just as an investment but as a means to generate consistent financial returns. Sharplink’s executives, Joe Lubin and Joseph Chalom, have emphasized the long-term value of decentralized finance (DeFi) solutions during a panel discussion at Consensus Hong Kong 2026.

Sharplink’s Commitment to Ether as a Long-Term Asset

Sharplink Gaming’s executives have expressed strong confidence in the potential of Ether (ETH) as a valuable asset. Chalom pointed out that, despite the market’s volatility, the broader outlook for Ethereum has never been stronger.

“The actual macro tailwinds for Ethereum have never been better in its 10-and-a-half-year history,” he stated.

He referred to the growing adoption of stablecoins and the rise of tokenization as key factors behind the blockchain’s expanding role in global finance. Chalom also highlighted a comment by BlackRock’s Larry Fink, noting that $14 trillion of assets are expected to be tokenized, with over 65% of this occurring on Ethereum.

Sharplink’s approach contrasts with the passive investment strategy of traditional crypto exchange-traded funds (ETFs). Instead of relying on daily liquidity, the company focuses on deploying permanent capital into ether.

According to Lubin, the yield generated through ether staking is a key aspect of their strategy.

“Ether would be a much better asset… because it is a productive asset. It yields. It has a risk-free rate,” Lubin said.

Sharplink’s decision to stake nearly all of its ether holdings has allowed the company to accumulate consistent returns.

Evolving DeFi Strategies for Institutional Investors

Sharplink’s strategy also emphasizes the importance of “good institutional DeFi,” according to Chalom. The company focuses on long-term locked capital, aiming for stable, risk-adjusted returns rather than high-risk, high-reward ventures typical of venture capital (VC) investments.

“We’re not looking for convex VC 10x outcomes, we’re looking for the best risk-adjusted yield for our investors,” Chalom explained. This method, according to Chalom, helps improve the DeFi ecosystem by setting higher standards for institutional engagement.

In their view, the institutional adoption of DeFi will increase over time as firms seek more stable, productive assets on their balance sheets. Lubin compared the evolution of blockchain to the early days of the internet. He noted that while companies once existed solely as internet companies, soon every firm will be a blockchain company. According to Lubin, the future will see more corporations holding tokens on their balance sheets and using sophisticated onchain treasury tools.

Crypto World

U.S. Federal Reserve urges new rules for crypto derivatives

Federal Reserve researchers have proposed treating cryptocurrencies as a separate asset class for derivatives margin rules, citing their unique risks and high volatility.

Summary

- Fed researchers suggest creating a dedicated crypto risk category in derivatives markets.

- The proposal separates stablecoins and floating cryptocurrencies for better risk modeling.

- The move aims to improve margin accuracy and reduce under-collateralization in OTC trades.

U.S. central bank researchers are calling for cryptocurrencies to be treated as a separate asset class in derivatives markets, arguing that digital assets carry risks that do not fit neatly into existing financial categories.

In a paper updated on Feb. 12, analysts examined how crypto-related risks are handled in over-the-counter derivatives. The study, titled “Initial Margin for Crypto Currencies Risks in Uncleared Markets,” focuses on how margin requirements are calculated under the framework used by the International Swaps and Derivatives Association.

Why crypto needs its own category

The researchers argue that the behavior of cryptocurrencies differs greatly from that of traditional assets like stocks, commodities, and foreign exchange. Market stress tends to show up more abruptly, prices move more quickly, and swings are bigger. These features make it harder to measure risk using existing models.

Because of this, the paper suggests creating a separate crypto risk class within the current margin system. The proposal suggests sorting digital assets into two broad categories.

The first would include pegged cryptocurrencies, such as stablecoins designed to mirror the value of traditional currencies. The second would cover floating cryptocurrencies, whose prices are determined entirely by market supply and demand.

This distinction is intended to acknowledge the different levels of risk involved. Stablecoins tend to fluctuate less, while unpegged tokens can swing sharply and without warning. According to the authors, applying the same margin framework to both groups can result in misjudged risk and poorly calibrated requirements.

The study also advises relying on long-term market data, including periods of severe financial stress, when assigning risk weights. While this mirrors established industry methods, it tailors them more closely to the specific behavior of crypto markets.

What this could mean for markets

If market participants adopt the proposal, margin requirements for crypto derivatives could become both stricter and more accurately aligned with underlying risk. In practical terms, traders and institutions might have to commit additional collateral, particularly for contracts linked to highly volatile assets.

Backers argue that this approach would lower the chances of under-collateralization, a situation in which trading losses exceed the margin posted. In stressed markets, that problem can spread quickly and threaten financial stability. A clearer framework could help limit those risks.

At the same time, the paper stresses that it is not a formal regulation. It represents research and analysis by Fed staff, not an official rule or policy decision. Any real changes would need to come through industry adoption or future regulatory action.

Still, the timing is notable. As crypto markets grow and become more connected to traditional finance, regulators and institutions are paying closer attention to risk management. More banks, funds, and trading firms are now involved in digital assets, making standardized rules more important.

By recognizing crypto as its own category, the researchers signal that digital assets have reached a level of maturity that demands tailored oversight. While the proposal does not change the rules today, it adds momentum to ongoing efforts to bring a clearer structure to crypto derivatives markets.

Crypto World

Zcash Draws Institutional Backing Amid Privacy Narrative and Technical Upgrades

TLDR:

-

Zcash secured backing from Vitalik Buterin and Winklevoss twins who deployed $50M and lab donations.

-

Project Tachyon uses recursive zero-knowledge proofs to enable thousands of shielded transactions per second.

-

The shielded pool reached 5,030,093 ZEC representing 30% of total supply at all-time high adoption levels.

-

ZEC trades at $220-250 after 69% correction from $758 peak as community debates critical governance proposals.

Zcash continues to attract institutional attention as privacy becomes a focal narrative in cryptocurrency markets. The digital asset recently received backing from Vitalik Buterin and the Winklevoss twins.

ZEC trades between $220-250 after a 69% correction from its November 2025 peak of $758. The shielded pool reached an all-time high of 5,030,093 ZEC, representing 30% of total supply.

Community governance proposals including Project Tachyon are under consideration as the network evaluates technical upgrades.

Institutional Validation and Strategic Backing

Vitalik Buterin made his second donation to Shielded Labs on February 6, 2026, specifically supporting the Crosslink upgrade.

The Ethereum co-founder stated that Zcash remains one of the most honorable crypto projects with a steadfast focus on privacy.

Shielded Labs’ Crosslink work aims to enhance security while reducing the security budget for long-term sustainability.

The Winklevoss twins restructured Cypherpunk Technologies, formerly Leap Therapeutics, into the first Digital Asset Treasury focused exclusively on Zcash.

They deployed $50 million to acquire ZEC and donated 3,221 ZEC valued at $1.2 million to Shielded Labs. Tyler Winklevoss emphasized that privacy remains crucial for a free and open society.

Grayscale maintains its Zcash Trust (ZCSH) as the only institutional product offering pure ZEC exposure. The trust has operated through multiple market cycles.

These institutional moves validate Zcash’s position in the privacy sector as regulatory scrutiny on transparent blockchains intensifies.

Technical Upgrades and Project Tachyon

Project Tachyon represents a complete architectural redesign of how privacy scales on the network. Sean Bowe, the cryptographer behind Halo and Sapling, leads this effort to solve fundamental bottlenecks in privacy coin adoption. Current systems require wallets to scan every transaction on the blockchain to identify relevant ones.

Tachyon uses Proof-Carrying Data and recursive zero-knowledge proofs to flip this model entirely. Wallets maintain their own cryptographic proof of solvency instead of scanning all network transactions.

The system enables oblivious synchronization where wallets sync in seconds rather than hours. This approach allows Zcash to scale to thousands of shielded transactions per second.

The upgrade targets mainnet deployment within a year. Benchmarks demonstrate the cryptographic primitives work as designed. Community funding supports the development effort.

The technology aims to enable planetary-scale encrypted money that works for billions of users with mobile-first accessibility.

Governance Decisions and Community Sentiment

The Zcash Coinholder Protocol Feature Sentiment Poll addresses 11 questions shaping the network’s future direction.

Key proposals include Project Tachyon, Network Sustainability Mechanism fee removal, Zcash Shielded Assets, and Consensus Accounts. The community actively debates each proposal through established governance channels.

The Network Sustainability Mechanism proposes burning 60% of transaction fees to address long-term security funding.

ZIP 233, ZIP 234, and ZIP 235 introduce infrastructure to remove funds from circulation and smooth issuance curves. The mechanism extends the security budget timeline while maintaining the 21 million ZEC cap.

Zcash Shielded Assets would enable custom token issuance within the Orchard shielded pool. QEDIT developed ZIP 226 and ZIP 227 for the technical implementation.

However, some community members express concerns about protocol complexity and regulatory exposure. The governance process ensures thorough community review before implementation.

Market Conditions and Price Outlook

ZEC currently trades at $220-250 after declining from $758. The recent drop swept the October 17, 2025 low of $187, creating a potential liquidity grab.

Support zones exist at $220-250, $180-200, and $120. Resistance levels appear at $300-310, $380-420, and $540-560.

The Electric Coin Company development team resigned in January 2026 due to commercialization disagreements. The Zcash Foundation, Shielded Labs, and community contributors continue development work. This transition reduces reliance on a single organization for protocol advancement.

Dubai’s Financial Services Authority banned privacy coins from DIFC-regulated venues in January 2026. However, the SEC closed its investigation into the Zcash Foundation in late 2025 without action.

Zcash’s optional transparency through view keys and transparent addresses provides regulatory flexibility compared to fully anonymous alternatives.

Crypto World

Israel Arrests Two Over Polymarket Trades on Iran Strikes

Israeli authorities have arrested and indicted two people for allegedly using secret information to place bets on the predictions market Polymarket related to Israel striking Iran.

In a joint statement on Thursday, Israel’s Defense Ministry, its internal security service Shin Bet, and police said a military reservist and a civilian were arrested after an investigation found that the reservist obtained classified information to place the bets.

The prosecutor’s office will pursue criminal charges for security-related offenses, bribery, and obstruction of justice. Authorities said the reservist was working for Shin Bet.

Prediction markets have seen major insider trading scandals this year after a Polymarket user won a bet that Nicolás Maduro would be ousted as Venezuelan president hours before he was captured by US forces, profiting around $400,000.

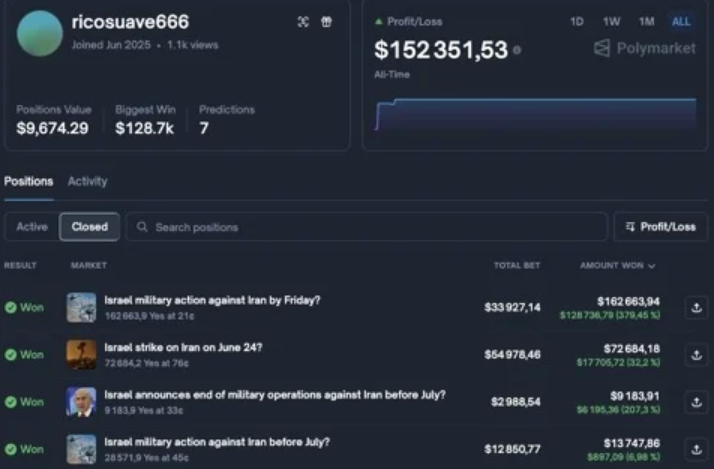

The Israeli state-owned news outlet Kan reported last month that the Polymarket user “ricosuave666” placed several bets related to Israel’s military operations in Iran in June 2025, but it’s unknown if those arrested are behind the account.

The account had reportedly wagered tens of thousands of dollars and had profited over $152,300, betting on markets such as “Israel strike on Iran on June 24” and “Israel military action against Iran by Friday,” with the latter of the two bets winning them over $128,700.

Related: Crypto PACs secure massive war chests ahead of US midterms

Prediction markets lead to real security risks when misused

Lawmakers worldwide have raised concerns that insider knowledge could be exploited in prediction markets, undermining market integrity and eroding public trust.

Israel’s Ministry of Defense said bets based on secret information pose a “real security risk for Israel Defense Forces activity and national activity,” adding that Israel’s military, security and police units will continue to pursue action against anyone who uses classified information illegally.

A lawyer representing the reservist told Bloomberg that the indictment is “flawed,” while noting that the charge of harm to national security has been dropped.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Transak announces integration with Ethereum Layer 2 MegaETH

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Transak has completed its integration with MegaETH, enabling users to purchase ETH directly on the high-speed Layer 2 network using standard fiat payment methods.

Transak, the web3 payments infrastructure provider, announced its full integration with MegaETH, a real-time Ethereum Layer 2.

According to the firms, with this integration, over 10 million users globally can purchase ETH natively on MegaETH in seconds using everyday payment methods, including credit and debit cards, Apple Pay, Google Pay, SEPA, etc. And, there will be no need for bridging, centralized exchange accounts, or prior crypto holdings.

Jack Bushell, Director of Sales at Transak, states that this integration is about removing friction at the exact moment users want to get started. He adds that MegaETH has built Ethereum performance that finally matches real-world expectations, and that with Transak, users can jump straight into that experience using the payment methods they already trust: no setup, no complexity, no detours.

As per both companies, Transak’s direct fiat on-ramp eliminates these barriers, opening MegaETH’s high-frequency use cases, such as real-time DeFi trading, on-chain gaming, AI agents, streaming payments, and micro-transactions, to mainstream audiences.

The integration arrives just days after MegaETH opened its Frontier mainnet to builders and ahead of the upcoming “OMEGA” phase that will welcome the broader public. Transak also confirmed that popular stablecoins will be added in the near future, further strengthening liquidity for DeFi and payments on the chain.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin Open Interest at 2024 Lows: Is TradFi Abandoning BTC?

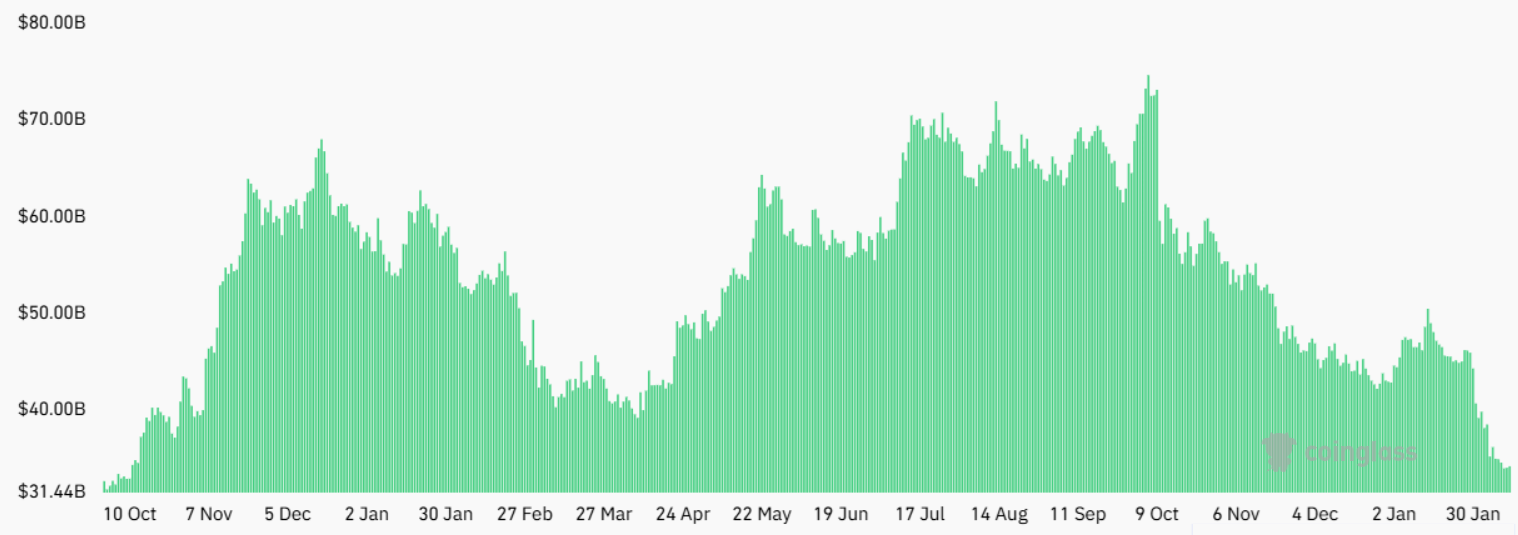

Bitcoin has struggled to stay above the $72,000 mark over the past week, as traders weigh whether a renewed institutional bid is at hand or merely a temporary pause in a broader risk-off cycle. While price action remains choppy, a dramatic shift sits in the derivatives market: aggregate open interest on Bitcoin futures fell to $34 billion in USD terms—the lowest level in months and the steepest decline since November 2024. Yet when measured in BTC, open interest sits around 502,450 BTC, suggesting that the appetite for leverage hasn’t collapsed and that the unwind is not uniform across asset denominations. Over the past two weeks, forced liquidations totaled about $5.2 billion, underscoring the fragility of long bets in a mood of caution and uncertainty.

Key takeaways

- BTC futures open interest dropped to $34 billion, a 28% decline from 30 days earlier; BTC-denominated open interest remains roughly flat at BTC 502,450, implying ongoing leverage demand despite lower USD exposure.

- Bearish leverage signals surfaced as risk appetite cooled: forced liquidations of roughly $5.2 billion in the last two weeks point to sustained volatility and risk management pressure.

- Weak US job data fed concerns about the macro backdrop: the US Labor Department reported 181,000 jobs added in 2025, a number seen as soft against expectations, while gold reclaimed the $5,000 level and equities sit near highs, complicating the narrative for Bitcoin.

- Bitcoin options markets flashed caution: the 30-day delta skew for BTC jumped to about 22%, with put options trading at a premium, signaling a clear tilt toward downside hedging among professional traders.

- On the demand side, Bitcoin ETFs continued to trade thousands of BTC daily, with roughly $5.4 billion of average daily volume across US-listed funds, underscoring that institutional interest remains visible even amid uncertainty.

Bitcoin (BTC) has faced repeated hesitations around the $72,000 level as investors await clearer catalysts from the macro environment. The sheer contrast between price stability in select risk assets—gold rebounding past the $5,000 threshold and the S&P 500 hovering near record territory—and the weakness seen in BTC’s derivatives environment has intensified questions about whether Bitcoin is decoupling from traditional markets or simply pausing before the next leg of a broader risk-off cycle. The immediate concern is whether weak job data will push the Federal Reserve toward earlier or more aggressive easing, which would, in turn, influence capital flows across risk assets, including cryptocurrencies.

The data on open interest paints a nuanced picture. While USD-denominated OI has slid, the BTC-denominated measure suggests that market participants still seek leverage, albeit with tighter risk controls. Some traders attribute part of the USD OI decline to liquidations that amplified through the market in recent weeks, highlighting a landscape where risk management tools are actively trimming exposure. The tension between a calmer price backdrop and a more defensive sentiment in the derivatives space underscores the complexity of the current setup for Bitcoin.

In the background, the labor market remains a critical flashpoint. The US Labor Department’s latest weekly data indicated softer payroll growth, with an uptick in initial claims not far from pandemic-era levels of uncertainty. While the White House has argued that immigration policy has reduced the number of job openings the economy needs to fill, the broader narrative remains that slower growth could push the Fed toward rate cuts sooner than anticipated. This potential for looser financial conditions could, in theory, be supportive for risk assets, including Bitcoin, but the actual market reaction has been restrained and uneven across sectors.

From a historical perspective, the market’s sensitivity to macro indicators is not new for Bitcoin. The 52% drawdown seen in March 2020 occurred amid a broad global shock to economic activity and a surge in uncertainty, and the subsequent policy response helped restore liquidity and drive a notable risk-on phase. Today’s environment—where equities have held near highs while volatility remains elevated—presents a similar but more nuanced backdrop. If growth risks intensify and the Fed signals an accommodative stance ahead of expectations, the cost of capital for both companies and consumers could ease, potentially raising the odds of a renewed appetite for riskier assets, including BTC. The current mix suggests that traders are weighing both macro signals and on-chain indicators as they look for directional clarity.

The options market paints a more conservative picture than equity traders might prefer. The BTC options delta skew at Deribit climbed to approximately 22% on Thursday, indicating that put options are trading at a premium. Historically, a skew in that range signals a protective stance among market participants and a greater reluctance to embrace upside risk without sufficient hedges. By contrast, the lack of a clear appetite for bullish leverage reinforces the sense that the market remains vulnerable to negative catalysts, even as some investors watch for reasons to re-engage with long positions.

Another critical data point is the appetite for exchange-traded products tied to Bitcoin. Despite the volatility signals from the futures market, US-listed Bitcoin ETFs have maintained solid daily volumes, averaging around $5.4 billion. This level of activity suggests that institutional demand has not dried up, even if price action and the structure of the futures market reflect a more cautious stance. The divergence between robust ETF trading and weaker leverage indicators highlights the complexity of the current market regime and the difficulty of predicting the next major inflection point for Bitcoin.

In sum, the market’s current stance combines a cautious, risk-off tilt with ongoing, albeit selective, institutional participation. The near-term trajectory of Bitcoin will likely hinge on evolving macro data—particularly the pace of payroll growth and inflation trends—and how effectively the Fed communicates its policy path. Traders who expect a rapid reacceleration in risk appetite may face headwinds if macro data disappoints further, while any shift toward clearer economic strength or dovish policy cues could catalyze a re-pricing in both equities and crypto.

Why it matters

The divergence between price performance and leverage demand is a meaningful signal for market participants. If Bitcoin can sustain a movement higher with steady or improving leverage demand, it could point to renewed institutional confidence and a potential re-rating of BTC as a risk-on asset, especially if macro conditions align with looser financial conditions. Conversely, persistent weakness in the labor market and a cautious options market could keep downside risk elevated, making downside hedges a persistent theme for professional traders. For developers and ecosystem participants, the current climate emphasizes the need for robust risk management tools, clearer on-chain signals, and improved liquidity infrastructure to withstand a more volatile macro backdrop.

For traders and investors, the key takeaway is to monitor the interaction between macro signals and market microstructure. The presence of solid ETF trading volumes indicates that institutions remain engaged, even as futures markets signal caution. This dynamic could lengthen the time needed for a decisive breakout, suggesting a period of range-bound activity with sharp snaps if new data or policy developments shift sentiment abruptly.

What to watch next

- Upcoming US payroll data releases and inflation metrics that could alter rate-hike expectations and liquidity dynamics.

- Comments from Federal Reserve officials or changes in policy guidance that might signal a shift in monetary conditions.

- Changes in BTC futures open interest and funding rates across major platforms, to assess whether leverage appetite is re-emerging or remaining subdued.

- Bitcoin ETF flow developments and any notable shifts in daily volumes that could indicate persistent institutional involvement.

- Derivatives metrics, including delta skew and implied volatility, to detect evolving risk sentiment among professional traders.

Sources & verification

- Open interest and price data for BTC futures from CoinGlass.

- BTC annualized funding rate data from Laevitas.ch.

- Deribit 30-day options delta skew (via Laevitas) showing a 22% premium to puts.

- US job data from the US Labor Department; payroll figures referenced in the article.

- US policy and immigration-related labor discussions as reported by BBC.

Bitcoin leverage signals and macro cues

Bitcoin (CRYPTO: BTC) has faced a careful balance between resilience in some sectors of the market and caution in others. The latest readings show a split:USD-denominated open interest has retreated, while BTC-denominated exposure remains comparatively steady, underscoring ongoing demand for leverage even as risk sentiment throughout broader markets has cooled. The pullback in futures open interest comes amid a backdrop of soft payroll data and a policy backdrop that could tilt toward looser financial conditions if growth falters. In this environment, the direction for Bitcoin will hinge on whether macro developments translate into clearer catalysts for risk-taking or a renewed risk-off impulse that drives profits to the sidelines. The dynamic illustrates why traders are paying close attention to how traditional markets behave in response to economic data, and why the crypto market remains highly sensitive to liquidity and risk sentiment changes.

Market participants should note that ETF volumes remain a meaningful barometer of institutional involvement. While futures markets may show caution, the sustained level of average daily trading in Bitcoin-linked ETFs points to a persistent base of liquidity and a willingness among large players to maintain exposure. This dichotomy—between derivatives signals and ETFs activity—helps explain why Bitcoin’s near-term path remains uncertain, with potential for both pullbacks and selective strength depending on how macro data evolves and how policy expectations shift in response.

Crypto World

Federal Reserve Paper Proposes New Risk Weighting Model for Crypto

New analysis published Wednesday by the Federal Reserve proposes that crypto be categorized as a distinct asset class for initial margin requirements used in “uncleared” derivatives markets, including over-the-counter trades and other transactions that do not pass through a centralized clearinghouse.

The working paper said that is because crypto is more volatile than traditional asset classes and does not fit into the risk categories outlined in the Standardized Initial Margin Model (SIMM) that classifies asset classes.

These include interest rates, equities, foreign exchange and commodities, according to authors Anna Amirdjanova, David Lynch and Anni Zheng.

The trio propose a distinct risk weighting for “floating” cryptocurrencies, including Bitcoin (BTC), Binance (BNB), Ether (ETH), Cardano (ADA), Dogecoin (DOGE), XRP (XRP), and “pegged” cryptos like stablecoins.

A benchmark index equally divided between floating digital assets and pegged stablecoins could also be used as a proxy for crypto market volatility and behavior, they said.

The performance and behavior of the benchmark index could then be used as an input to more accurately model “calibrated” risk weights for crypto, according to the authors.

Initial margin requirements are critical for derivatives markets, where traders must post collateral to ensure against counterparty default when opening a position. Crypto’s higher volatility means traders must post more collateral as a buffer against liquidation.

The working paper proposal reflects the maturation of crypto as an asset class and how Federal authorities in the United States are prepping regulatory frameworks to accommodate the growing sector.

Related: Hong Kong greenlights crypto margin financing and perpetual trading

Fed clears the way for banks to engage with crypto

In December, the central bank reversed its previous guidance, first issued in 2023, which limited US banks’ engagement with cryptocurrencies.

“Uninsured and insured banks supervised by the Board will be subject to the same limitations on activities, including novel banking activities, such as crypto-asset-related activities,” the Fed’s 2023 guidance said.

The Federal Reserve also proposed the idea of giving crypto companies access to “skinny” master accounts, bank accounts that have direct access to the central banking system but have fewer privileges than full master accounts.

Magazine: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Magazine

Crypto World

Aave Labs proposes sending all revenue to Aave DAO

Aave Labs has floated a new plan that could send all product revenue to the Aave community.

Summary

- Aave Labs proposed sending 100% of product revenue to Aave DAO.

- The plan covers fees from Aave v3, v4, aave.com, and future products.

- In return, Labs is seeking funding from the DAO to support operations.

Aave Labs has unveiled a new governance proposal that could reshape how revenue flows within the Aave ecosystem. In a non-binding “temperature check” posted on Feb. 12, the company asked the community whether it would support sending all product-related revenue directly to the DAO.

The proposal, titled “Aave Will Win,” suggests that income from Aave-branded products should be re-directed to the protocol’s governing body, Aave DAO, rather than remaining with the development team.

A plan to redirect revenue to the DAO

Under the proposal, Aave Labs wants 100% of revenue from its products to flow into the DAO treasury. This includes swap fees from Aave v3 and the upcoming v4, earnings from the official aave.com interface, and income from future ventures such as the Aave Card and possible ETF-related products.

If approved, this structure would place token holders at the center of value creation. Supporters say it could reduce concerns about “value leakage,” where parts of the ecosystem generate income without benefiting the DAO.

The plan also includes creating a new foundation to hold Aave’s trademarks and intellectual property. This entity would manage the brand on behalf of the community, rather than leaving those assets under company control.

At the same time, Aave Labs is asking for long-term financial support from the DAO. The proposal requests $25 million in stablecoins, 75,000 Aave (AAVE) tokens, and additional grants tied to specific products.

A more open budget system would allocate these funds to operations, marketing, and development. Aave founder Stani Kulechov said the framework is designed to establish a “token-first” relationship between the DAO and its primary developer.

Community reaction and open questions

Aave community’s response to the proposal has been mixed. Since protocol success directly benefits AAVE holders, some token holders view it as a significant step toward greater alignment. They argue that the model’s value returns are more obvious and that it resembles a shareholder structure in traditional finance.

Some are more cautious. Critics question whether Aave Labs is actually giving up economic power and point to the size of the funding request. Marc Zeller and other commentators have raised concerns that the upfront payments could offset much of the revenue being redirected.

The dispute comes after months of conflict over control and ownership. After Aave Labs re-directed interface fees away from the DAO in late 2025, they faced major criticism. Following that incident, token holders attempted in vain to take over the company’s intellectual property.

Since that time, Aave Labs has scaled back several side projects and refocused on core lending products. The “Aave Will Win” proposal appears to be part of that reset.

The framework is still only a preliminary signal check for the time being. It would proceed to the official voting stages if there is substantial community support. Future governance decisions and the DAO’s ability to effectively manage a multibillion-dollar brand will determine whether the model proves sustainable.

Crypto World

Coinbase posts $670M Q4 loss as it expands beyond trading

Coinbase reported a quarterly loss as it expanded into derivatives, stablecoins, and new markets to reduce reliance on spot crypto trading.

Summary

- Coinbase diversified its business through futures, global expansion, and new financial products.

- Market volatility and lower trading activity weighed on short-term performance.

- Management remains focused on long-term stability and revenue balance.

Coinbase Global, Inc. reported a net loss of $670 million in the fourth quarter of 2025, despite posting record operational metrics for the full year, according to its earnings report released on Feb. 12.

The company said its Q4 results were in line with internal expectations, even as weaker crypto market conditions in late 2025 weighed on transaction revenue and profitability.

Strong growth, weaker bottom line

In its shareholder letter, Coinbase highlighted major gains in trading activity and product adoption throughout 2025. While its crypto market share doubled to 6.4%, the total trading volume reached $5.2 trillion, up 156% year-over-year.

Revenue from subscriptions and services also reached a record $2.8 billion, indicating rising demand for non-trading products such as stablecoins, staking, and custody services. Paid Coinbase One subscribers climbed to nearly one million, tripling over the past three years.

“We drove all-time highs across our products,” said chief executive officer Brian Armstrong. “The Everything Exchange is working, and we’re well-positioned for 2026.”

Chief financial officer Alesia Haas added that the company met or exceeded its revenue and expense targets throughout the year, extending what she described as a multi-year track record of operational discipline.

However, softer market conditions in the final months of 2025 reduced trading activity and lowered asset prices, putting pressure on Coinbase’s core transaction business. According to GAAP accounting standards, these elements played a part in the quarterly net loss.

Expanding beyond spot trading

As part of its “Everything Exchange” strategy, which aims to bring various asset classes onto a single platform, Coinbase continued to grow beyond spot trading in 2025.

The company introduced 24/7 U.S. perpetual-style futures, expanded its global reach by acquiring Deribit, and launched new products like stock trading and prediction markets. At the same time, stablecoin and institutional services were further developed.

These efforts are meant to reduce dependence on traditional crypto trading and make revenue less sensitive to price swings. As a result, average USD Coin (USDC) balances on the platform climbed to $17.8 billion, while customer-held assets tripled over three years. In 2025, more than 12% of the world’s crypto was stored on Coinbase.

After the earnings report was released, Coinbase shares fell about 8% as the wider digital asset market weakened. Analysts pointed to ongoing volatility and uncertain trading volumes as major short-term risks.

Even so, the company ended 2025 with a solid financial position, holding $11.3 billion in cash and equivalents. It also bought back $1.7 billion worth of shares during the year. Early 2026 has shown signs of recovery, with about $420 million in transaction revenue recorded by early February.

Crypto World

Bitcoin Posts $2.3B Loss In Historic Capitulation Event

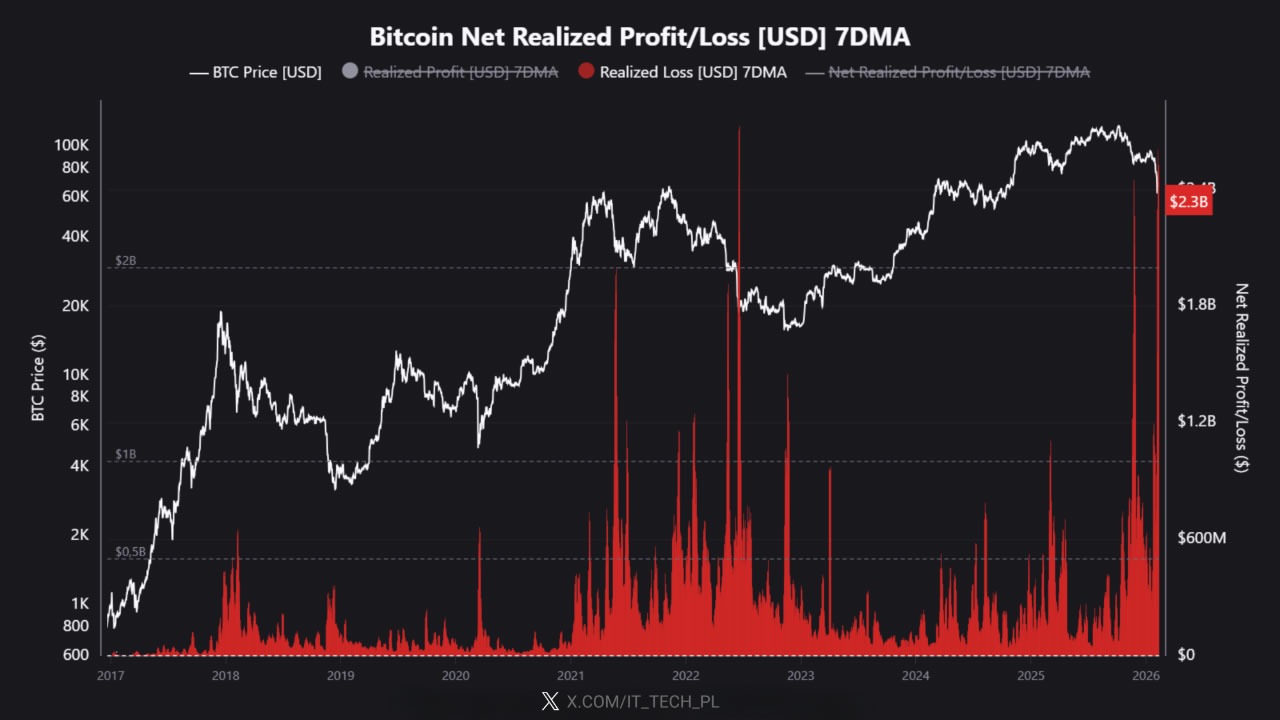

Bitcoin has posted $2.3 billion in realized losses in what an analyst says is one of the largest capitulation events in history, rivaling its crash in 2021.

Bitcoin’s (BTC) seven-day average realized net losses hit $2.3 billion, analyst IT Tech said in a note on CryptoQuant on Thursday, which it called “one of the largest capitulation events in BTC history, rivaling the 2021 crash, 2022 Luna/FTX collapse, and mid-2024 correction.”

“This puts us in the top 3-5 loss events ever recorded,” IT Tech added. “Only a handful of moments in Bitcoin’s history have seen this level of capitulation.”

Bitcoin has dropped nearly 50% from its all-time high of over $126,000 in October to trade around $66,600, having climbed from a low of of $60,000 on Feb. 6.

Deep and slow bleed-out could follow

IT Tech said that previously, “extreme loss spikes like this triggered rebounds,” and noted that Bitcoin had briefly rallied above $70,000 on Tuesday, but added, “this could still be the beginning of a deep and slow bleed-out. Relief rallies happen even in prolonged bear markets.”

Related: Crypto’s ‘age of speculation’ may be ending: Galaxy’s Novogratz

CryptoQuant posted to X on Thursday that $55,000 marks Bitcoin’s realized price, which is “historically tied to bear market bottoms.”

“Past cycles saw BTC trade 24% to 30% below this level before stabilizing,” it stated. “When BTC reaches this area, it usually moves sideways before recovering.”

More time to reach the bottom

Nick Ruck, the director of LVRG Research, told Cointelegraph that the recent capitulation event “reflects intense short-term holder panic and washout amid broader macro pressures and a shift into bear market territory.”

“While this level of oversold conditions historically precedes recovery phases, reaching the full bottom may still require additional time and signals from metrics like sustained institutional buying or miner stabilization,” he added.

Ruck targeted potential support emerging in the $40,000 to $60,000 range, “depending on evolving market dynamics,” a figure in line with predictions from other analysts.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Is The Bull Market Over?

Key takeaways:

-

BTC open interest falls to $34 billion, but stable BTC-denominated volume suggests leverage demand remains unchanged.

-

Weak US jobs data and Bitcoin options skew indicate a bearish shift, even as gold and stocks show relative strength.

Bitcoin (BTC) price has struggled to sustain levels above $72,000 for the past week, leading investors to question whether institutional demand has evaporated. The aggregate Bitcoin futures open interest plummeted to its lowest level since November 2024, fueling fears of a retest of the $60,000 support as uncertainty grows.

The aggregate BTC futures open interest hit $34 billion on Thursday, a 28% drop from 30 days prior. However, when measured in Bitcoin terms, the metric remains virtually flat at BTC 502,450, suggesting that demand for leverage has not actually decreased. Part of this decline is also attributable to forced liquidations, which totaled $5.2 billion over the past two weeks.

Weak bullish leverage demand confirms BTC’s worrisome market decoupling

Investors are increasingly frustrated by the lack of a clear catalyst for Bitcoin’s 28% decline over the last month, especially as gold reclaimed the $5,000 psychological level and the S&P 500 traded just 1% below its all-time high. Some analysts argue that this risk-aversion stems from emerging signs of weakness in the US labor market.

The US Labor Department revealed on Wednesday that the US economy added only 181,000 jobs in 2025, a figure weaker than previously reported. However, the White House has downplayed these concerns. According to the BBC, officials argue that the slowdown in population growth as a result of its immigration policies has reduced the number of working positions the US needs to create.

Bitcoin’s record 52% crash on March 13, 2020, occurred during the peak of the COVID-19 pandemic fears, which anticipated a surge in jobless claims. If economic growth is currently at risk, odds are the US Federal Reserve will cut interest rates sooner than anticipated. This reduces the cost of capital for companies and eases financing conditions for consumers, explaining the stock market strength seen in 2026.

The lack of confidence in Bitcoin is evident through the weak demand for bullish leveraged positions, making the decoupling from traditional markets even more worrisome.

The annualized funding rate on Bitcoin futures held below the neutral 12% threshold for the past four months, signaling fear. Thus, even as the indicator recovered from the negative levels of the prior week, bears continue to have the upper hand. Professional traders remain unwilling to take downside price risk exposure, according to Bitcoin options markets.

Related: Is this crypto winter different? Key observers reevaluate Bitcoin

The BTC options delta skew at Deribit surged to 22% on Thursday as put (sell) instruments traded at a premium. Under normal circumstances, the indicator should range between -6% and +6%, reflecting balanced upside and downside risk aversion. This skew metric last flipped bullish in May 2025 after Bitcoin reclaimed the $93,000 level following a retest of $75,000.

While derivatives metrics reflect weakness, the $5.4 billion average daily trading volume in US-listed Bitcoin exchange-traded funds (ETFs) contradicts speculation of fading institutional demand. Although it is impossible to predict what will cause buyers to display strength, Bitcoin’s recovery likely depends on improved visibility into the US job market conditions.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month