Crypto World

Tech IPO hype drowned out by prospect of $1 trillion in debt sales

Magnificent 7 tech stocks on display at the Nasdaq.

Adam Jeffery | CNBC

While the prospect of a SpaceX initial public offering and the hopeful listings from OpenAI and Anthropic have juiced IPO excitement on Wall Street, the current action in tech capital markets has nothing to do with equity. Rather, it’s all about debt.

Tech’s four hyperscalers — Alphabet, Amazon, Meta and Microsoft — are collectively projected to shell out close to $700 billion this year on capital expenditures and finance leases to fuel their artificial intelligence buildouts, responding to what they call historic levels of demand for computing resources.

To finance those investments, industry giants may have to dip into some of the cash they’ve built up in recent years. But they’re also looking to raise mounds of debt, adding to concerns about an AI bubble and fears about a market contagion if cash-burning startups like OpenAI and Anthropic hit a growth wall and pull back on their infrastructure spending.

In a report late last month, UBS estimated that after tech and AI-related debt issuance across the globe more than doubled to $710 billion last year, that number could soar to $990 billion in 2026. Morgan Stanley foresees a $1.5 trillion financing gap for the AI buildout that will likely be filled in large part by credit as companies can no longer self-fund their capex.

Chris White, CEO of data and research firm BondCliQ, says the corporate debt market has experienced a “monumental” increase in size, amounting to “massive supply now in the debt markets.”

The biggest corporate debt sales this year have come from Oracle and Alphabet.

Oracle said in early February that it planned to raise $45 billion to $50 billion this year to build additional AI capacity. It quickly sold $25 billion of dollars worth of debt in the high-grade market. Alphabet followed this week, upping the size of a bond offering to over $30 billion, after holding a prior $25 billion debt sale in November.

Other companies are letting investors know that they could come knocking.

Amazon filed a mixed shelf registration last week, disclosing that it may seek to raise a combination of debt and equity. On Meta’s earnings call, CFO Susan Li said the company will look for opportunities to supplement its cash flow “with prudent amounts of cost-efficient external financing, which may lead us to eventually maintain a positive net debt balance.”

And as Tesla bolsters its infrastructure, the electric vehicle maker may look to outside funding, “whether it’s through more debt or other means,” CFO Vaibhav Taneja said following fourth-quarter earnings.

With some of the world’s most valuable companies adding to their debt loads by the tens of billions, Wall Street firms are plenty busy as they await movement on the IPO front. There haven’t been any IPO filings from notable U.S. tech companies this year, and the attention is focused on what Elon Musk will do with SpaceX after he merged the rocket maker with AI startup xAI last week, forming a company that he says is worth $1.25 trillion.

Reports have suggested SpaceX will aim to go public in mid-2026, while investor Ross Gerber, CEO of Gerber Kawasaki, told CNBC he doesn’t think Musk will take SpaceX public as a standalone entity, and will instead merge it with Tesla.

As for OpenAI and Anthropic — competing AI labs that are both valued in the hundreds of billions of dollars — reports have surfaced about eventual plans for public debuts, but no timelines have been set. Goldman Sachs analysts said in a recent note that they expect 120 IPOs this year, raising $160 billion, up from 61 deals last year.

‘Not that appetizing’

Class V Group’s Lise Buyer, who advises pre-IPO companies, isn’t seeing bustling activity within tech. The volatility in the public markets, particularly around software and its AI-related vulnerabilities, along with geopolitical concerns and soft employment numbers are some of the factors keeping venture-backed startups on the sidelines, she said.

“It’s not that appetizing out there right now,” Buyer said in an interview. “Things are better than they’ve been the last three years, but an overabundance of IPOs is unlikely to be a problem this year.”

That’s unwelcome news for venture capitalists, who have been waiting for an IPO resurgence since the market shut down in 2022 as inflation soared and interest rates rose. Certain venture firms, hedge funds and strategic investors have generated handsome profits from large acquisitions, including those disguised as acquihires and licensing deals, but startup investors historically need a healthy IPO market to keep their limited partners happy and willing to write additional checks.

There were 31 tech IPOs in the U.S. last year, more than the three years prior combined, though far below the 121 deals completed in 2021, according to data compiled by University of Florida finance professor Jay Ritter, who has long tracked the IPO market.

Greg Abbott, governor of Texas, left, and Sundar Pichai, chief executive officer of Alphabet Inc., during a media event at the Google Midlothian Data Center in Midlothian, Texas, US, on Friday, Nov. 14, 2025.

Jonathan Johnson | Bloomberg | Getty Images

Alphabet has shown that the debt market is extremely receptive to its fundraising efforts, for now at least. The bonds have varying maturity dates, with the first debt coming due in three years. Yields are narrowly higher than for the 3-year Treasury, meaning investors aren’t getting rewarded for risk.

In its U.S. bond sale, Alphabet priced its 2029 notes at a 3.7% yield and its 2031 notes at 4.1%.

John Lloyd, global head of multi-sector credit at Janus Henderson Investors, said spreads are historically tight across the investment grade landscape, which makes it a tough investment.

“We’re not worried about ratings downgrades, not worried about fundamentals of the companies,” Lloyd said. But in looking at potential for returns, Lloyd said he prefers higher-yield debt from some of the so-called neoclouds and the converted bitcoin miners that are now focused on AI.

After raising $20 billion in debt in the U.S., Alphabet immediately turned to Europe for roughly $11 billion of additional capital. A credit analyst told CNBC that Alphabet’s success overseas could convince other hyperscalers to follow, as it shows demand goes well beyond Wall Street.

Concentration risk?

With so much debt coming from a small number of companies, corporate bond indexes are faced with a similar issue as stock benchmarks: too much tech.

Roughly one-third of the S&P 500’s value now comes from tech’s trillion-dollar club, which includes Nvidia and the hyperscalers. Lloyd said tech is now about 9% of investment grade corporate debt indexes, and he sees that number reaching the mid to high teens.

Dave Harrison Smith, chief investment officer at Bailard, described that level of concentration as an “opportunity and a risk.”

“These are tremendously profitable cash flow generative businesses that have a great deal of flexibility to invest that cash flow,” said Smith, whose firm invests in equities and fixed income. “But the way we’re looking at it increasingly is the sheer amount of investment and capital that is being required is quite simply eye-popping.”

That’s not the only concern for the debt market.

White of BondCliQ says that with such a vast supply of debt hitting the market from the top tech companies, investors are going to demand stronger yields from everyone else. Increased supply leads to lower bond prices, and when bond prices fall, yields rise.

Alphabet’s sale was reportedly five times oversubscribed, but “if you supply this much paper into the marketplace, eventually demand is going to wane,” White said.

For borrowers, that means a higher cost of capital, which results in a hit to profits. The companies to look out for, White said, are those that have to come back to the market in the next couple years, when interest rates for corporate bonds are likely to be higher.

“It will cause much, much higher corporate debt financing across the board,” White said, specifying increased costs for companies like automakers and banks. “That’s a big problem down the line because it means higher debt servicing costs.”

— CNBC’s Seema Mody and Jennifer Elias contributed to this report.

Crypto World

Binance Completes $1B SAFU Fund Shift to Bitcoin

Binance converts $1 billion SAFU fund fully into Bitcoin, buying 4,545 BTC to finish its reserve overhaul.

Binance announced on Thursday that it has finished converting its $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin, purchasing a final tranche of 4,545 BTC and bringing total holdings to 15,000 BTC.

The exchange’s decision to shift its emergency insurance reserve into BTC rather than a dollar-pegged asset reversed its position from April 2024 and placed roughly $1 billion of user protection funds directly into the cryptocurrency with the largest market cap.

Conversion Completed Within 30-Day Window

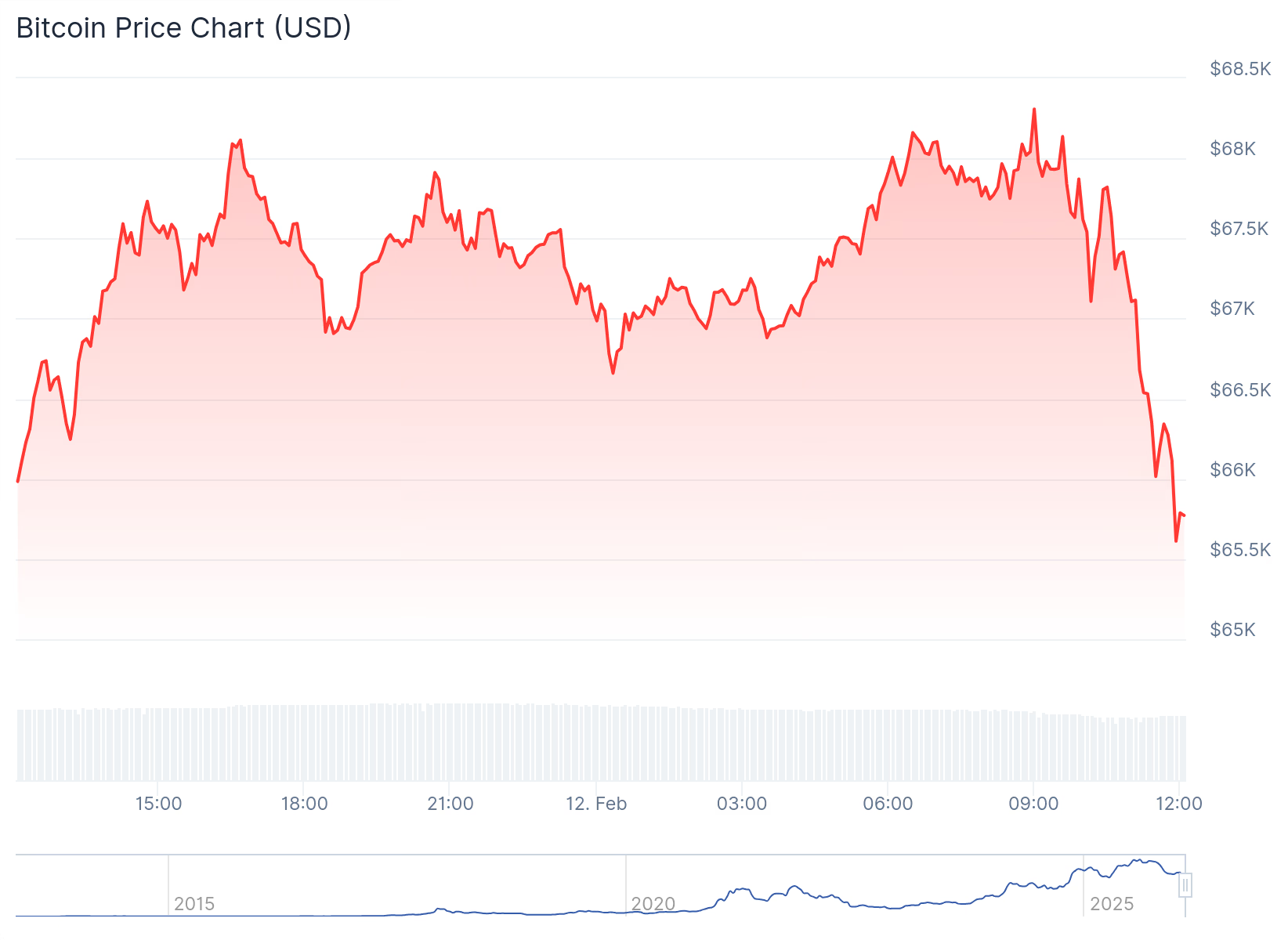

Binance executed the rebalancing in several separate purchases between February 2 and February 12, according to on-chain data monitored by Lookonchain. The final transaction of 4,545 BTC, valued at $304.5 million, brought the total worth of the holding to just over $1 billion based on Bitcoin’s current price around $67,000.

The exchange first announced the conversion plan on January 30, saying the process would conclude within 30 days. However, the completion fell nearly halfway through that window, with the SAFU wallet address, which Binance made public, now holding 15,000 BTC.

The Secure Asset Fund for Users was created in 2018 as an insurance pool to cover user losses in extreme events such as exchange hacks. In April 2024, Binance converted the fund entirely into USDC, describing the move at the time as a stability measure. The completion now marks a full reversal of that approach.

Binance said it views Bitcoin as “the premier long-term reserve asset” and framed the decision as aligning SAFU with that position. The firm also stated it will rebalance the fund if its value falls below $800 million due to price declines.

Market Context

Back when the move was announced, it drew immediate comment from market observers, with crypto commentator Garrett describing the conversion on X as “a direct capital injection into the market” and “what responsible builders do.”

You may also like:

The announcement arrived as CryptoQuant data showed Binance accounted for roughly 41% of spot trading volume among the top 10 exchanges in 2025. The exchange also maintains similarly high shares in Bitcoin perpetual futures and stablecoin reserves.

Meanwhile, at the market, the OG cryptocurrency was trading around the $67,300 level at the time of this writing, up slightly by about 0.5% in the last 24 hours, but in the red over seven days after suffering a nearly 5% dip per CoinGecko data.

The situation is the same across longer timeframes, with BTC shedding just under 24% of its value over the past fortnight and nearly 30% in the last month to keep its price more than 46% below its all-time high above $126,000 reached in October 2025.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Key Senate Democrat wants U.S. crypto bill to move, and SEC chief reveals danger of defeat

One way or another, the U.S. crypto industry is likely to receive official policy that defines which digital assets get what treatment from which federal agencies. The problem: It might not last.

Securities and Exchange Commission Chairman Paul Atkins is focused on reversing the “head in the sand” approach he accuses his predecessors of having on crypto policy, and he’s ready to issue rules that give the industry the regulatory clarity it craves. The catch, though, is that such rules won’t be locked down and can be erased by the same kind of commission vote that puts them in place. They won’t be backed by a targeted law that makes them unassailable by future administrations.

“We need a firm grounding in statute so we can’t have any backsliding in the future,” Atkins told the Senate Banking Committee in Thursday testimony. No matter how enthusiastic he is in giving the industry innovation-friendly rules, they’re not “future-proof.”

But the legislation in the U.S. Senate that would govern such things is floundering. Crypto executives and bankers haven’t been able to reach a compromise on one of the sticking points in stablecoin rewards programs. And Democratic lawmakers haven’t been offered answers to a number of their core concerns, including the full staffing of regulatory commissions and the danger of conflicts of interest when senior government officials have deep business ties to crypto (most obviously, in their view, President Donald Trump).

Senator Mark Warner, one of the leading Democratic negotiators on the Digital Asset Market Clarity Act, which still needs a hearing in the banking panel, said there’s still a big, bipartisan group working hard on the bill.

“We want to get this done,” he said, signalling that Democrats haven’t yet abandoned the talks. “It’s got to be done safely.”

His primary concern is decentralized finance (DeFi) and preventing bad actors from using it for illicit purposes. Warner’s views on this have, at times, shaken the industry and been seen as a threat to the future existence of DeFi projects. But the latest talks over the bill’s treatment of illicit finance haven’t yet settled on an approach.

“We’ve got to make sure that we don’t set up a regime that allows bad actors or carves out enforcement,” Warner said.

A Republican lawmaker, Senator Bernie Moreno, commiserated with the SEC chairman, saying, “Congress has failed miserably to give you laws.”

Atkins reiterated that his agency has “pretty broad authority” to write rules now that put crypto businesses on a clear regulatory foundation, as he’s been trying to execute with his “Project Crypto” agenda. But, he said, the rules would need to have legislation “undergird” them.

“We do need, I believe, a good law coming out of Congress,” Atkins said.

Read More: The big U.S. crypto bill is on the move. Here is what it means for everyday users

So far, a similar version of the Clarity Act already passed the House of Representatives last year. And just last month, another version cleared the Senate Agriculture Committee in a party-line vote. However, when it comes time for the full Senate to vote on a final market structure bill, the industry will need at least seven Democrats like Warner on board — and potentially more, if the Republicans aren’t unanimous.

While Senate Banking Committee Chairman Tim Scott sounded a hopeful note on Thursday about the Clarity Act, even industry leaders such as Coinbase CEO Brian Armstrong have shown a willingness to pull support if the policy doesn’t look right. And Treasury Secretary Scott Bessent called out crypto-industry “nihilists” who are ready to stand in the way, saying they should move to El Salvador if they don’t want vigorous regulation.

The girding that Atkins needs for the SEC’s pending rules remains uncertain, though the White House has directed negotiators to find common ground before the month is out. The clock is ticking, as House Financial Services Committee Chairman French Hill put it.

Read More: SEC’s Paul Atkins grilled on crypto enforcement pull-back, including with Justin Sun, Tron

Crypto World

Ethereum Price Struggles Below $2,000 Despite Entering Buy Zone

Ethereum price remains under pressure after a sharp decline that unsettled investors across the crypto market.

Although Ethereum appears to be entering a historically favorable accumulation zone, on-chain indicators reveal mixed conviction among different holder cohorts.

Sponsored

Sponsored

Ethereum Is In a Prime Accumulation Range

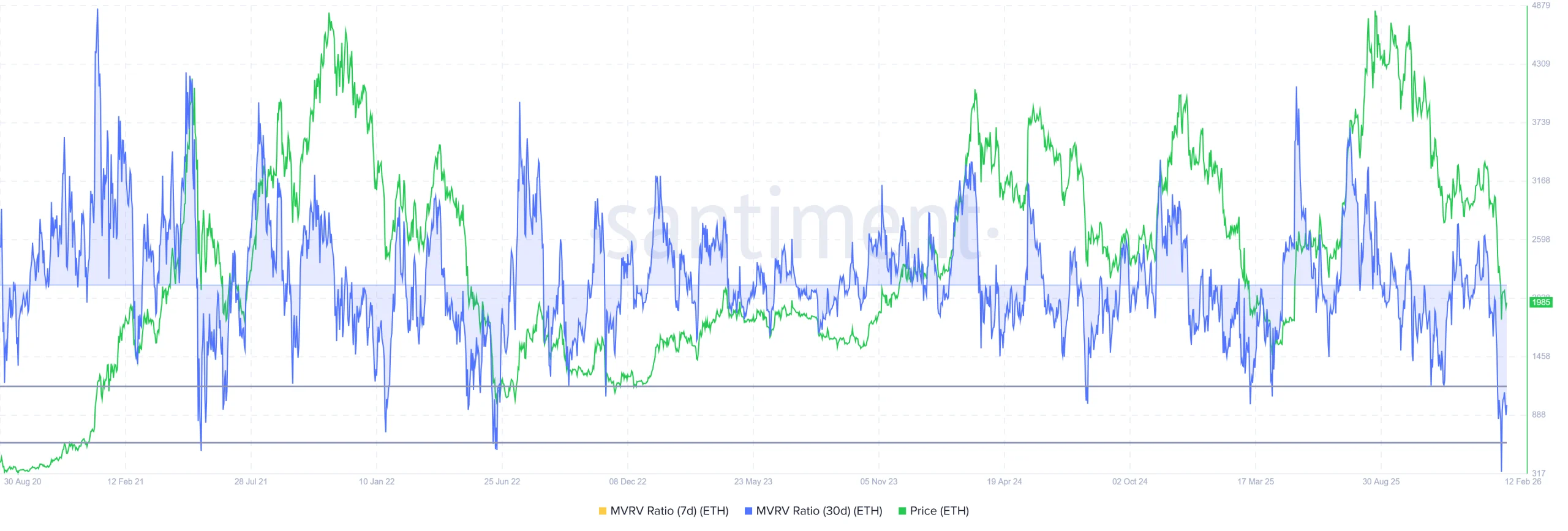

Ethereum’s Market Value to Realized Value, or MVRV, ratio indicates that ETH has entered what analysts describe as an “opportunity zone.” This range lies between negative 18% and negative 28%. Historically, when MVRV falls into this band, selling pressure approaches exhaustion.

Previous entries into this zone often preceded price reversals. Investors typically accumulate when unrealized losses deepen. Such behavior can stabilize the Ethereum price and initiate recovery phases. However, historical probability does not guarantee immediate upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Current macro conditions complicate the outlook. Liquidity constraints and cautious sentiment may delay accumulation. While MVRV suggests undervaluation relative to realized cost basis, broader market weakness could suppress momentum and extend consolidation before any meaningful rebound begins.

Ethereum Holders Are Leaning Differently

Short-term holders are regaining influence over Ethereum price action. The MVRV Long/Short Difference measures profitability between long-term and short-term holders. Deeply negative readings signal greater profitability among short-term holders compared to long-term investors.

Sponsored

Sponsored

Toward the end of January, the metric suggested profitability was shifting away from short-term traders. That trend hinted at an improving structure. However, the recent decline reversed that dynamic, restoring short-term holder profits. These investors typically sell quickly, increasing vulnerability to renewed downside pressure.

The HODLer net position change metric reveals another shift. Long-term holders previously exhibited steady accumulation. In recent days, the buying pressure has transitioned into distribution, reflecting reduced confidence among strategic investors.

Long-term holder selling adds structural risk. These participants often provide foundational support during downturns. Without renewed accumulation from this cohort, the Ethereum price may struggle to absorb supply. Current data shows limited evidence of strong counterbalancing demand.

ETH Price May Look At Consolidation

Ethereum price trades at $1,983 and remains above the $1,811 support level. Despite this stability, the altcoin recently marked a nine-month low at $1,743. Maintaining $1,811 is critical to prevent deeper technical deterioration.

Given ongoing selling from both short-term and long-term holders, recovery may face resistance near $2,238. Continued weakness could keep ETH trading closer to support rather than challenging overhead barriers. A confirmed breakdown below $1,811 may expose Ethereum to $1,571.

Alternatively, reduced selling from short-term holders could ease pressure. If long-term holders resume accumulation, Ethereum may attempt a stronger rebound. A decisive move above $2,238, followed by a rally past $2,509, would invalidate the bearish thesis and improve the medium-term outlook.

Crypto World

What is Zero Knowledge Proof (ZKP)? A $100M Self-Funded Layer-1 Powering Private AI and Driving Massive Growth

In recent years, millions of traders and crypto users have experienced what it feels like when personal data gets exposed. Exchange leaks, identity verification breaches, wallet tracking, and analytics tools have made privacy a growing concern in digital finance. Many blockchain networks record everything publicly, making transactions transparent but not always private. For users who value security, that model no longer feels enough.

This is where Zero Knowledge Proof (ZKP) enters the conversation. ZKP is a Layer-1 blockchain built around one clear principle: prove computation is correct without revealing the underlying data. Instead of exposing sensitive information, it validates results while protecting privacy. In a market where trust is often tested, Zero Knowledge Proof (ZKP) is gaining attention as the top crypto to buy today for those seeking a more secure blockchain foundation.

What is Zero Knowledge Proof (ZKP)?

Zero Knowledge Proof (ZKP) is a Layer-1 blockchain built to validate computation without revealing the underlying data. In simple terms, the network allows a result to be proven correct while keeping sensitive inputs private. This approach is central to zero-knowledge cryptography and is the foundation of the entire ZKP ecosystem.

The project was developed with a strong commitment to readiness. Before launching its presale, the team invested $100 million of self-funded capital into building the blockchain architecture, proof systems, and supporting infrastructure. This build-first model reduces risk and signals long-term focus.

Core features include:

- A privacy-focused Layer-1 blockchain

- Zero-knowledge validation of computation

- Architecture designed for secure AI workloads

- Integration with real hardware through Proof Pods

For newcomers exploring options in today’s market, ZKP stands apart because it already operates with infrastructure in place. This foundation strengthens its case as the top crypto buy today, especially for those looking beyond early hype and into practical execution.

Live Presale Auction: Stage 2 Momentum Builds

Zero Knowledge Proof (ZKP) is currently in a structured crypto presale auction that distributes coins in progressive stages. The presale has already raised $1.85 million, showing early traction. At present, Stage 2 is closing in 6 days, marking a critical point in the auction cycle.

Market observers and analysts have noted the pace of participation. Some experts project that if momentum continues, the ZKP presale auction could reach $1.7 billion, highlighting expectations around the project’s scale.

Below is the current auction snapshot:

| Category | Details |

| Current Stage | STAGE 2 : ROUND 4 |

| Total Raised | $1.85M |

| Yesterday’s Closing Price | $0.00007 USD |

| Auction Day | 77 / 450 |

The auction model allows price discovery across stages rather than through a fixed-price sale. This structured progression creates measurable entry points and encourages sustained participation. For those searching for the top crypto buy today, the combination of raised capital, staged structure, and projected growth gives ZKP a strong position within the current presale market.

Proof Pods: A Working Product Backed by $17M

Proof Pods represent the tangible layer of the Zero Knowledge Proof (ZKP) ecosystem. These physical devices are designed to generate verifiable computation for the network. Instead of relying solely on digital staking models, ZKP connects blockchain incentives to measurable hardware performance.

The project allocated $17 million specifically for Proof Pods creation, covering development, production, and logistics. This investment demonstrates that Proof Pods are not conceptual but operational components of the network’s design.

Key benefits of Proof Pods include:

- Real hardware participation in blockchain validation

- Generation of cryptographic proofs

- Decentralized distribution of computing power

- Accessibility for non-technical users

Proof Pods strengthen decentralization while tying network rewards to real activity. For presale participants, this working product provides tangible backing to the blockchain’s function.

When evaluating the top crypto buy today, projects with operational hardware and capital commitment often stand out. ZKP’s integration of Proof Pods shows that it is building a functioning ecosystem rather than relying purely on token demand.

Final Say

Zero Knowledge Proof (ZKP) combines three critical elements rarely seen together in early-stage blockchain projects: a fully developed Layer-1 architecture, a structured live presale auction, and a working hardware product in Proof Pods. With a $100 million self-funded development, $17 million allocated to hardware, and a presale that has already raised $1.85 million, ZKP demonstrates preparation and execution before scaling further.

As Stage 2 closes in 6 days and experts project the presale could reach $1.7 billion, the project continues to build measurable momentum. The staged auction structure provides transparency, while Proof Pods anchor the network in real-world computation.

For newcomers seeking the top crypto buy today, Zero Knowledge Proof (ZKP) presents a strong combination of privacy technology, financial commitment, and live participation mechanics. Rather than promising future development, ZKP enters the market with infrastructure already built and an ecosystem actively expanding.

Explore ZKP:

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor

Retail traders are dumping Bitcoin in panic mode right now. Fear is everywhere. The Fear and Greed Index is stuck at 12. That is extreme.

However, perpetual futures volume is actually spiking. That kind of divergence does not show up for no reason.

The market has wiped out nearly $800 billion in a month. Brutal. But the real question is this. Is smart money quietly positioning before the next major move.

Because when fear is loud and volume rises at the same time, something is about to break.

Key Takeaways

- JPMorgan maintains a bullish 2026 outlook despite the total market cap falling from $3.1T to $2.3T.

- The Crypto Fear & Greed Index is pinned at 12 (“Extreme Fear”), levels historically associated with bottom formation.

- Bitcoin is trading at $67,610, significantly below its estimated production cost of $77,000.

- Whale activity in perpetual markets suggests complex institutional hedging is dominant over spot selling.

Is This Institutional Hedging or Strategic Accumulation?

So let’s pause for a second.

Who is buying when the market feels this terrified? Bitcoin price is around $67,610 and Ether near $1,950, both down heavily this month.

Spot charts look rough and retail is clearly panicking. Yet, Perpetual futures volume is climbing fast, which usually signals sophisticated players stepping in with structured positions, not emotional longs.

This isn’t what speculative euphoria looks like. When retail piles in, funding spikes positive. Instead, BTC funding is nearly flat and ETH funding is negative.

There are only two real explanations here: institutional hedging… or strategic positioning ahead of a larger move.

Will Bitcoin Price $50K Floor Hold?

The charts look terrible right now, no doubt about it. However, fundamentals wise it might leaning bullish good long term.

JPMorgan estimates Bitcoin’s production cost sits around $77,000. BTC is trading well below that.

Historically, when price drops under production cost, it does not stay there long. Miners either shut off machines or pressure builds for a rebound.

Still, the downside risk is not gone. Chief equity strategist John Blank warned Bitcoin could slide to $40,000 within 6 to 8 months.

That would be a full blown capitulation scenario. All Traders are now locked on $60,000 as the key support to watchout for.

The post The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor appeared first on Cryptonews.

Crypto World

Stacks price retests $0.28: can STX go higher?

- Stacks price surged by 5% to test resistance near $0.28.

- Gains follow Bitcoin’s uptick to $67,500.

- STX could still dip to recent lows if the Bitcoin price falls to new lows.

Stacks’ STX token edged higher on the day as Bitcoin held above the $67,500 level following a roughly 2% intraday move.

Despite the modest gain, the Bitcoin layer-2 network’s native token continues to trade in volatile conditions, reflecting uncertainty across the broader cryptocurrency market.

A sustained pickup in momentum could lift STX toward levels last seen in May 2025.

However, ongoing market turbulence and expectations of further downside risk for Bitcoin suggest Stacks may remain under pressure.

Analysts point to $0.24 as a key support level that bulls will need to defend to prevent a deeper pullback.

Stacks price today

STX posted modest daily gains on February 12, 2026, trading around $0.27 at the time of writing with a 5% uptick.

But buyers are hovering at these levels after hitting resistance around $.028, a level reached after STX recovered from Feb.5, 2026, lows of $0.22.

Despite weekly losses having moderated to 2%, Stacks remains more than 32% down in the monthly time frame.

Meanwhile, gains on the day have also come amid reduced buyer interest, with daily trading volume down 6% to $13.2 million.

Notably, prices remain within the range that offers support at $0.24, with bulls revisiting the level on three occasions year-to-date.

Stacks price prediction

Stacks is among the top Bitcoin DeFi protocols looking to leverage a layer-2 network to enable smart contracts and yield opportunities directly on Bitcoin’s security.

The project has gained traction as the digital asset investment space broadens.

One of its landmark moves is the recent integration with Fireblocks, which could potentially expose over 2,400 institutional clients to STX for native Bitcoin DeFi participation.

“Bitcoiners want to earn yield without sacrificing security. They want their yield to be denominated in Bitcoin and ideally, with as few additional trust assumptions as possible,” the firms stated in their announcement.

Clients will be able to tap into Bitcoin-denominated rewards, BTC-yielding vaults, and BTC-backed loans.

This institutional gateway could significantly boost STX adoption, especially if Bitcoin prices spike.

Bulls could eye the $0.56-$0.60 range or higher, with the altcoin having reached highs of $1.05 in May 2025.

The technical picture supports this short-term outlook and targets.

On the daily chart, the Relative Strength Index (RSI) hovers at 34, but signals bullish divergence.

Charts also show the Moving Average Convergence Divergence (MACD) indicator pointing to a bullish crossover.

If Bitcoin faces intensified selling pressure, Stacks’ upside potential could suffer.

In this case, STX may find support in the $0.23-$0.20 area.

Crypto World

Optimism Taps Succinct to Enable Instant Withdrawals

The zero-knowledge validity proofs will become canonical across the OP stack.

Ethereum Layer 2 Optimism is partnering with Succinct as its first zero-knowledge (ZK) proving provider, in order to provide instant and real-time withdrawals from the L2, according to an announcement shared exclusively with The Defiant.

The move makes Succinct Optimism’s first official ZK partner, and by leveraging Succinct’s proof system, users can off-ramp capital from Optimism to any other chain in a timely fashion, as opposed to the bridge’s traditional, multi-day wait time.

By accelerating the bridge time from Optimism, large on-chain operators such as market makers or treasuries, can move capital quickly without having to rely on a third party bridging solution.

In addition to its withdrawal time upgrade, Optimism is also working towards a larger ZK proof infrastructure launch on the chain, which will allow teams building across the OP Stack to upgrade to ZK validity proofs “seamlessly” per a release shared with The Defiant.

Karl Floersch, the co-founder of Optimism commented on the news:

“Succinct offers one of the most trusted proof systems in the industry, securing billions of dollars in TVL. We’re excited to bring validity proofs to the Superchain as we focus on fast, cost-effective scaling for Optimism and our partners in 2026 and beyond.”

“We’re honored to partner with Optimism to bring ZK to the Superchain, starting with OP Mainnet. As rollups consolidate around ZK, Succinct is building the proving infrastructure the ecosystem can rely on,” said Uma Roy, CEO and co-founder of Succinct.

The news comes shortly after Optimism unveiled OP Enterprise — a new chain deployment suite for enterprise clients who are looking to build their own native blockchains.

Crypto World

Bitcoin Plunges Under $66,000 as Crypto Sentiment Index Hits Historic Low

Total market cap is holding steady today, even as sentiment sinks to the weakest level on record.

Crypto markets took a tumble Thursday morning, Feb. 12, pushing Bitcoin below $66,000 and Ethereum below $2,000, as investor sentiment deteriorated to unprecedented lows.

Total crypto market capitalization is flat over the past 24 hours around $2.33 trillion, while large-cap assets are mixed today. At press time, Bitcoin (BTC) is trading at $65,747 at press time, down marginally on the day and bringing 7-day losses to about 5%.

Ethereum (ETH) fell to $1,910 this morning, little changed over the past 24 hours and down 4% on the week.

While BNB gained nearly 2% on the day, it’s still down almost 10% over the past week. Solana (SOL) slipped 0.6% in the past 24 hours, and is down 8% on the week.

Among the top-10 crypto assets, XRP and Figure Heloc (FIGR_HELOC) stood out on the weekly timeframe, both up about 4%.

Unprecedented Extreme Fear

Market sentiment, however, continues to lag price action. The Crypto Fear & Greed Index fell today to a reading of 5, its lowest level on record, pushing sentiment deeper into “extreme fear” territory than during any previous bear market.

Glassnode analysts said in an X post today that the disconnect between prices and sentiment reflects a market under sustained stress rather than a clear capitulation event.

The analysts pointed out that the 30-day simple moving average of net flows for both BTC and ETH spot ETFs has remained negative for most of the past 90 days, showing “no sign of renewed demand.”

They added in a separate research report that liquidity remains thin, with traders maintaining defensive positioning. Without renewed spot demand or improvement in risk appetite, glassnode warned that price action is likely to remain driven by short-term positioning.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, earlier today, Aster (ASTER) climbed more than 7% after the decentralized exchange confirmed that the mainnet launch of Aster Chain is scheduled for March. Hyperliquid’s HYPE token also rose about 7%, extending its recent rebound.

On the downside, Uniswap (UNI) led losses among large-caps, down 11.6%, erasing all of its gains from Wednesday’s rally that followed news of a strategic investment by BlackRock.

According to CoinGlass data, over 120,000 traders were liquidated over the past 24 hours, with total liquidations reaching $285 million. Bitcoin accounted for roughly $118 million of that total, followed by Ethereum at about $65 million.

ETFs and Macro Conditions

On Wednesday, Feb. 11, spot Bitcoin ETFs reversed their inflow streak, posting over $276 million in net outflows on the day. Spot Ethereum ETFs also recorded net outflows of more than $129 million, according to data from SoSoValue.

In macro markets, U.S. Treasury yields moved lower today as investors assessed fresh labor data and looked ahead to Friday’s consumer price index report. The 10-year yield slipped to 4.158%, while the 30-year fell to 4.782%, CNBC reported.

Per a report published today from the U.S. Labor Department, initial jobless claims came in at 227,000 for the week ended Feb. 7, slightly above expectations but lower than the prior week, the report notes, adding that investors continue to digest January’s nonfarm payrolls report, which showed a decline in the unemployment rate to 4.3%.

Crypto World

XRP price shows bottoming signs as RLUSD hits key milestone

XRP’s price has retreated for six consecutive weeks, in line with the broader market’s performance.

Summary

- XRP price has retreated and moved into a bear market in the past few months.

- Ripple USD’s stablecoin supply has jumped to over $1.5 billion for the first time ever.

- The coin has become oversold and formed a falling wedge chart pattern.

Ripple (XRP) token was trading at $1.3915 on Thursday, down by 62% from its all-time high of $3.6590. Technical indicators suggest the coin may be about to rebound as demand for the Ripple USD (RLUSD) stablecoin rises.

Ripple USD supply is rising

There are signs that demand for the RLUSD stablecoin is growing, a trend that may accelerate after Binance completes its integration on the XRP Ledger. The integration enabled users to deposit and withdraw the token on the largest crypto exchange in the industry.

Data compiled by Artemis shows that the supply of RLUSD in circulation jumped to over $1.5 billion for the first time ever. $1.1 billion of these tokens are in Ethereum, while the rest is in the XRP Ledger.

In a statement on Thursday, Jack McDonald, the Senior Vice President at Ripple Labs, hinted that the stablecoin will overtake “traditional dollar, Venmo, PayPal, and others.” He pointed to the rising institutional demand for the coin, especially as the developers gears to launch the Permissioned DEX platform.

Artemis data show that RLUSD’s usage continues to grow. It handled over 480,000 transactions in the last 30 days, while the adjusted transaction volume soared to close to $4.9 billion. Most of the volume was in decentralized finance, followed by blockchains and centralized exchanges.

Meanwhile, XRP price may benefit from the ongoing ETF inflows. Data compiled by SoSoValue show that spot XRP ETFs have added over $48 million this month so far, more than Bitcoin and Ethereum, which have shed substantial assets in the past few months.

XRP price prediction: Technical analysis

The weekly timeframe chart shows that the XRP price has pulled back in the past few months as the crypto market crash accelerated.

The Relative Strength Index has moved to the oversold level of 30, its lowest level since August 2022. It is common for a coin to rebound after moving to the oversold level.

XRP has also formed a large falling wedge pattern, consisting of two descending, converging trendlines that are nearing the confluence point.

Therefore, the coin will likely rebound in the coming weeks, potentially reaching the key psychological level of $2.0, which is 45% above the current level.

Crypto World

BTC remains under pressure amid slumping stock market

Bitcoin has fallen back to the low end of its recent trading range during late-morning U.S. trading hours on Thursday as the tech-heavy Nasdaq tumbles 1.6%.

Trading at $65,700, bitcoin is now lower by 1.5% over the past 24 hours, while ether , just above $1,900, is down more than 2%.

The bitcoin price action — uncorrelated with the Nasdaq when that index is headed higher, but perfectly correlated when it heads lower — has become all too familiar for the crypto sector. And the failure to hold any sort of sustained bounce from last week’s panicky plunge has bulls seemingly in full capitulation mode.

Alternative’s well-followed Crypto Fear & Greed Index today fell to just 5, a level of “extreme fear” exceeding even what was seen during the multiple collapses of the 2022 crypto winter and the 2020 Covid crash.

Also raising eyebrows is longtime bull Geoff Kendrick from Standard Chartered, slashing his 2026 price targets for bitcoin, ether, solana, BNB and AVAX, while warning bitcoin could dip to as low as $50,000.

Crypto stocks lose ground

Coinbase (COIN) and Robinhood (HOOD) are among the largest losers on Thursday, each down more than 8%. Coinbase reports fourth-quarter results after the bell, but Robinhood’s fourth-quarter report earlier this week confirmed that the crypto bear market had taken a large bite out of trading revenues in the final three months of 2025 — and that was before the price action got really bad to begin 2026.

Other large decliners today include Strategy (MSTR), down 4.2%, Circle Financial (CRCL), down 4.3%, and Hut 8 (HUT), down 6.6%.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports18 hours ago

Sports18 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World19 hours ago

Crypto World19 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video14 hours ago

Video14 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’