Crypto World

US Winter Storm Slows Bitcoin Miner Production, Data Shows

New data paints a clearer picture of how January’s US winter storm disrupted US Bitcoin (CRYPTO: BTC) mining operations, revealing a sharp downturn in daily production across publicly traded operators. The storm underscored the sector’s tether to energy-market dynamics, as grid stress, snow, ice and subfreezing temperatures prompted strategic curtailments. CryptoQuant data, shared by head of research Julio Moreno, shows a stark shift: production that had hovered around 70–90 BTC per day in the weeks prior to the event slid to roughly 30–40 BTC per day at the peak disruption. As conditions improved, production gradually recovered, suggesting the downturn was largely temporary and voluntary. The episode highlights how weather events can translate into meaningful operational and financial pressures for mining firms.

Key takeaways

- Daily production among publicly traded miners fell from the pre-storm range of about 70–90 BTC to roughly 30–40 BTC at the height of the disruption, according to CryptoQuant data.

- The decline appears to reflect temporary, voluntary curtailments tied to grid stress and adverse weather, with signs of recovery as conditions improved.

- The miners tracked by CryptoQuant include Core Scientific (CORZ), Bitfarms (BITF), CleanSpark (CLSK), MARA Holdings (MARA), Iris Energy (IREN) and Canaan (CAN); major US operators cited include Core Scientific, CleanSpark, Marathon (MARA), Riot Platforms (RIOT), TeraWulf (TWLF) and Cipher Mining (CIF).

- The episode compounds a difficult operating environment for miners, where thinning margins, rising energy costs and a shift toward AI/HPC revenue streams are shaping strategic decisions.

- Ultimately, the disruption illustrates mining’s sensitivity to energy-market conditions and weather-driven grid constraints, with potential implications for hashrate and equity valuations in the sector.

Tickers mentioned: $CORZ, $BITF, $CLSK, $MARA, $IREN, $CAN, $RIOT, $TWLF, $CIF

Market context: The January event occurs against a backdrop of volatile energy markets, fluctuating Bitcoin prices and ongoing questions about miners’ profitability. As operators balance demand-response capabilities with the need to maintain cash flow, the sector remains exposed to weather, grid reliability and regulatory signals that could influence energy pricing and access to power.

Why it matters

For investors, the storm underscores the fragility of mining operations to weather-related outages and energy-price swings, even as the sector showcases a potential for grid services through load management. The episode comes amid a broader context of a marginal-tight environment where post-halving revenue pressures and elevated energy costs have compresssed margins for many operators.

For builders and operators, the episode reinforces the importance of diversification in energy arrangements and revenue streams. A growing emphasis on AI and high-performance computing as alternative or supplementary revenue avenues could alter capex allocation, site selection and technology decisions as miners seek resilience against cyclical downturns and weather shocks.

For the broader crypto market, the incident serves as a reminder that mining activity remains a visible proxy for regional energy liquidity and industrial energy demand. Shifts in hashrate, even temporary ones, can influence market sentiment, capital flows and the perceived health of the sector as it contends with macro volatility and evolving energy policies.

What to watch next

- February–March production data from CryptoQuant to determine whether output returns to pre-storm levels.

- Any updates from miners on curtailment policies, grid-demand programs or changes in energy contracts.

- Has rate and stock movements for major miners such as RIOT, MARA and CAN as weather patterns and price cycles unfold.

- Regulatory or policy developments affecting energy pricing, demand-side management or crypto mining in key jurisdictions.

- Signals around 2026 profitability, consolidation and the adoption of AI/HPC strategies as alternative revenue streams settle into corporate plans.

Sources & verification

- CryptoQuant daily production data cited by Julio Moreno showing a drop to roughly 30–40 BTC per day during peak disruption.

- Cointelegraph reporting on how the storm coincided with a decline in US Bitcoin hashrate and a rally in mining stocks.

- Cointelegraph article on Bitcoin hashrate temporarily dropping during the winter storm, providing contextual benchmarks.

- Cointelegraph coverage referencing Canaan’s role in the mining hardware ecosystem and its implications for operations.

- Cointelegraph analyses discussing 2026 outlooks for mining profitability, AI integration and sector consolidation.

Winter storm tests US Bitcoin miners: production dips and resilience

New data paints a clearer picture of how January’s winter storm disrupted US Bitcoin miners, revealing a sharp downturn in daily production across publicly traded operators. Bitcoin (CRYPTO: BTC) mining has long been tied to energy markets, and the storm underscored that linkage as grid stress and frigid weather forced curtailments. CryptoQuant data, cited by Julio Moreno, shows a marked shift: before the storm, daily production hovered around 70–90 BTC per day; at the peak disruption, output contracted to roughly 30–40 BTC per day. That contraction aligns with the broad electricity scarcity and grid constraints that characterize severe winter events in the United States.

The subsequent recovery, as temperatures rose and conditions improved, suggests the declines were largely temporary and voluntary—an adjustment miners can modulate in response to grid signals and energy price movements. The pattern also reflects the operational realities of a sector that has already absorbed higher energy costs and tightening margins over the past year. While one might interpret the drop as a sign of fragility, industry participants emphasize that many miners retain the ability to modulate power use to stabilize the grid and minimize waste during peak demand periods.

Publicly traded miners tracked by CryptoQuant include Core Scientific (CORZ), Bitfarms (BITF), CleanSpark (CLSK), MARA Holdings (MARA), Iris Energy (IREN) and Canaan (CAN). The broader US footprint includes operators such as Core Scientific, CleanSpark, Marathon, Riot Platforms (RIOT), TeraWulf (TWLF) and Cipher Mining (CIF), illustrating how widespread the storm’s effects were across the sector. These names reflect a landscape where facilities in varied climates and energy regimes faced similar pressure points, from subfreezing temperatures to grid stress and the associated risk premiums on energy procurement.

Earlier reporting noted that the storm coincided with a retreat in US hashrate and a rally in mining equities, a juxtaposition that highlighted the market’s sensitivity to the balance of risk and recovery potential. The latest production data adds granularity to that narrative, illustrating that much of the disruption came from voluntary curtailment choices rather than solely from weather-induced downtime. Some facilities reported grid constraints or penalties during peak cold snaps, while others were able to resume operations quickly as conditions eased, signaling a degree of operational resilience within the industry even as it faced an unusually intense weather event.

The disruption occurs amid a broader operating environment that has already tested miners’ margins. Since the post-halving period, miners have contended with lower Bitcoin prices, fluctuating network hashrate and rising energy costs—factors that compress profitability and alter investment calculus. In parallel, industry observers have pointed to a potential pivot toward AI and high-performance computing as a new revenue engine, a shift that could influence capex, siting decisions and long-term competitive dynamics. As 2026 approaches, many players are weighing how to balance traditional mining with these tech-forward opportunities while navigating ongoing energy-market volatility and regulatory developments.

To gauge the full impact of the storm, analysts will monitor shifting hashrate trends and the pace at which miners re-expand operations as grid conditions stabilize. A broader takeaway is that the mining sector remains highly sensitive to external shocks—weather extremes, energy-pricing fluctuations and policy shifts can reverberate through production metrics, stock valuations and strategic planning for the next cycle. Investors and operators alike will be watching closely for how the industry recalibrates in the wake of January’s disruption, and whether the lessons lead to deeper resilience through diversification and efficiency gains.

Crypto World

Payments Protocol by Coinbase, Shopify Processes Just $1.2M USDC Since June: growthepie

The partnership between Shopify, Coinbase and Stripe allows Shopify merchants to accept USDC payments settled on Base.

Crypto World

U.S. regulator declares do-over on prediction markets, throwing out Biden era ‘frolic’

The U.S. government is formally reversing its previous stance on banning certain activities at prediction market firms such as Kalshi and Polymarket, with U.S. Commodity Futures Trading Commission Chairman Mike Selig moving Wednesday to withdraw a proposed event-contracts rule from 2024 and scrapping an earlier advisory he said confused the industry.

In 2024, the derivatives regulator proposed a rule that would have banned contracts based on the outcome of political events, legally equating them with illicit contracts on war, terrorism and assassination and calling them “contrary to the public interest.” That rule never advanced to a final stage before President Donald Trump returned to the White House and appointed new CFTC leadership. The CFTC had allowed prediction markets based on political events to launch after losing a court fight over Kalshi’s intended offering that same year.

The recently confirmed chairman of the agency, Selig, has now cleared the decks of that and a minor advisory issued in September on certain contract markets.

“The 2024 event contracts proposal reflected the prior administration’s frolic into merit regulation with an outright prohibition on political contracts ahead of the 2024 presidential election,” Selig said in a statement. “The Commission is withdrawing that proposal and will advance a new rulemaking grounded in a rational and coherent interpretation of the Commodity Exchange Act that promotes responsible innovation in our derivatives markets in line with Congressional intent.”

Selig’s action is unsurprising, following closely on the heels of his remarks last week that signaled it was coming. He said he’d “directed CFTC staff to move forward with drafting an event contracts rulemaking.”

The Trump administration’s embrace of the prediction markets has paved the way for increased interest from companies seeking to throw their hat into the sector, such as Coinbase, or the tangential pursuit of similar products from Cboe.

The September advisory Selig pulled back had been meant to caution platforms about litigation concerns, he said, but it had “inadvertently created confusion and uncertainty for our market participants.”

The CFTC is expected to become a central voice in digital assets oversight, in which the prediction markets have had an overlapping interest. Selig is working on a number of new initiatives, and the Congress is negotiating its crypto market structure bill that — among many other points — is meant to establish the CFTC as the rightful watchdog of crypto spot markets that don’t involve securities.

Read More: U.S. SEC, CFTC chiefs push united front on paving the way for crypto

Crypto World

Kyle Samani steps away from Multicoin Capital

Kyle Samani, co-founder of crypto investment firm Multicoin Capital, is stepping down from his role as managing director, he announced Wednesday in a post on X.

“It’s a bittersweet moment for me because my time at Multicoin has been some of the most meaningful and rewarding of my life,” Samani wrote. “After nearly a decade in crypto, I’m more confident than ever that crypto is going to fundamentally rewire the circuitry of finance.”

Samani said he’s taking time off and “exploring other areas of technology,” but made clear he’s not walking away from crypto entirely. “While I’ll be stepping away professionally from the industry, I will continue to make personal investments in the space,” he wrote.

He also pointed to the potential impact of U.S. crypto legislation in development, particularly the Clarity Act, a bill designed to provide legal definitions for crypto assets. “I believe the Clarity Act will unlock a tidal wave of new entrants and spur adoption unlike anything we’ve seen,” he wrote.

Samani did not say what his next role would be or when he might return to the industry. As of now, Multicoin has not named a replacement. Co-managing partners Tushar Jain and Brian Smith are currently running the firm’s day-to-day operations.

Founded in 2017, Multicoin quickly gained visibility for backing projects like Solana and before they became widely known. It operates across both venture capital and liquid token markets, setting it apart from traditional VC firms.

Samani says he will remain as chairman at Solana treasury company Forward Industries (FWDI) and is requesting in-kind redemption in FWDI shares and warrants from the Multicoin Master Fund, rather than cash.

Crypto World

Bitwise Leader Makes Shocking Claim on Crypto Winter and Bear Market

Matt Hougan, Chief Investment Officer (CIO) at Bitwise Asset Management, said the market is experiencing a crypto winter.

According to his analysis, the crypto winter began in January 2025, but heavy institutional inflows “papered over that truth,” masking the depth of the downturn. The key question now is, how long will the winter last?

Sponsored

Sponsored

Market Weakness Signals an Ongoing Crypto Winter

In a recent market commentary, Hougan rejected the idea that recent price weakness represents a temporary pullback. Instead, he described the current environment as a “full-blown crypto winter,” pointing to steep drawdowns across major assets.

He highlighted that Bitcoin (BTC) is now trading about 39% from its October 2025 all-time high. Meanwhile, Ethereum (ETH) has fallen roughly 53%. Many altcoins have declined far more.

“This is not a ‘bull market correction’ or ‘a dip.’ It is a full-bore, 2022-like, Leonardo-DiCaprio-in-The-Revenant-style crypto winter—set into motion by factors ranging from excess leverage to widespread profit-taking by OGs,” Hougan noted.

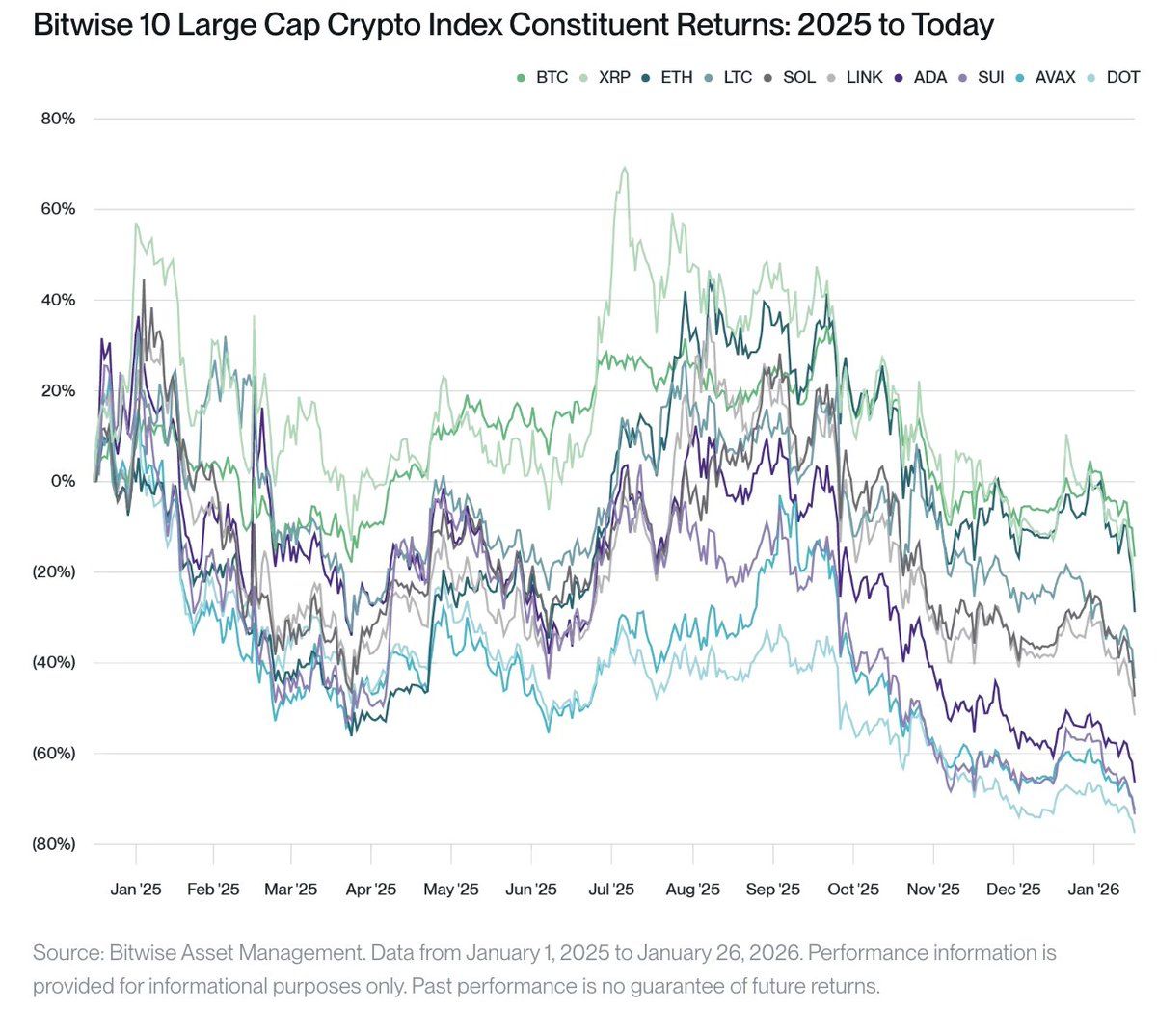

Institutional demand, he said, played a key role in masking the downturn. Using data from the Bitwise 10 Large Cap Crypto Index, Hougan highlighted a clear divide.

Assets with strong institutional support, such as Bitcoin, Ethereum, and XRP (XRP), have posted relatively modest declines since January 2025. Tokens that gained ETF access in 2025, like Solana (SOL), Chainlink (LINK), and Litecoin (LTC), suffered deeper losses.

Nonetheless, assets without any institutional exposure fell between roughly 60% and 75%. According to him,

“The thing that separates the three groups is basically whether or not institutions had the ability to invest in them.”

Sponsored

Sponsored

During this period, exchange-traded funds (ETFs) and Digital Asset Treasuries (DAT) accumulated more than 744,000 Bitcoin, worth an estimated $75 billion. Hougan argued that without this level of institutional support, Bitcoin’s losses would likely have been far greater.

“Retail crypto has been in a brutal winter since January 2025. Institutions just papered over that truth for certain assets for a while,” the executive remarked.

Hougan also addressed a question many market participants have raised: why do crypto prices continue to fall despite positive developments such as increased institutional adoption, regulatory progress, and broader acceptance by Wall Street?

His answer was straightforward. In the depths of a crypto winter, good news typically has little immediate impact on prices.

“Those of you who followed crypto during past winters—either 2018 or 2022—will remember that good news doesn’t matter in the depths of winter. Crypto winters don’t end in excitement; they end in exhaustion,” he added.

However, he suggested that while positive developments are often ignored during bear markets, they do not disappear. Instead, they accumulate as what he described as “potential energy,” which can fuel a recovery once sentiment improves.

Sponsored

Sponsored

Hougan pointed to several factors that could help lift market sentiment, including stronger economic growth that triggers a risk-on rally, a positive surprise related to the Clarity Act, signs of sovereign adoption of Bitcoin, or simply the passage of time.

Looking at historical cycles, Hougan said crypto winters typically last around 13 months. If the current winter indeed began in January 2025, then it’s possible that the end may be near.

He stressed that the prevailing mood of despair and malaise often characterizes the final phase of a crypto winter and stressed that nothing fundamental about crypto has changed during the current pullback.

“I think we’re going to come roaring back sooner rather than later. Heck, it’s been winter since January 2025. Spring is surely coming soon,” Hougan claimed.

Sponsored

Sponsored

When Did Crypto Bear Market Start: Debating the Timeline

Though Hougan traces the bear market’s start to January 2025, not all analysts concur. Julio Moreno, Head of Research at CryptoQuant, acknowledged differences in asset performance due to institutional exposure but disputed the timeline.

“I disagree with the winter starting in January 2025. Bitcoin prices remained in a long-term upward trend throughout 2025, and reached a new ATH in October. The fact that we did not have a blow-off top or closed the year positive doesn’t mean we were in a bear market in 2025. The Bitcoin bear market started on November 2025, as suggested by on-chain and market data,” he posted.

The start date matters. Historically, crypto winters last about 13 months. If the downturn began in January 2025, a spring recovery could be near. If Moreno is right and the market peaked in November 2025, the bear phase would continue.

“The timing has implications for when it will end. My current expectation is Q3 2026,” Moreno wrote.

Whether recovery comes early in 2026, as Hougan predicts, or is pushed to Q3 under Moreno’s timeline, remains to be seen. What is clear, however, is that the market is deep in a downturn.

History suggests these phases do not end with a single catalyst but rather over time. If past cycles are any guide, the groundwork for the next recovery may be forming beneath the surface.

Crypto World

Bitcoin Miners are Facing a Profit Crisis as Economics Tighten

Bitcoin mining crossed a historic threshold in late 2025. According to a recent report from GoMining, the network entered the zetahash era, surpassing 1 zetahash per second of computing power.

But while hashrate surged to record levels, miner profitability moved in the opposite direction. The result is a mining industry that is larger, more industrialized — and more exposed to price risk than at any point this cycle.

Sponsored

Sponsored

Hashrate Reaches Record Highs as Mining Scales Up

The report shows Bitcoin’s network sustained over 1 ZH/s on a seven-day average, marking a structural shift rather than a temporary spike.

This growth reflects aggressive hardware upgrades, new data centers, and expanding industrial operations. Mining is no longer dominated by marginal players. It now resembles energy infrastructure.

As a result, competition for block rewards has intensified sharply.

Revenue Per Miner Falls Despite Network Growth

While hashrate expanded, revenue per unit of compute fell into one of its tightest ranges on record.

The report highlights that miner earnings increasingly depend on Bitcoin’s price and difficulty alone. Other buffers have faded, including transaction fee spikes and the higher block subsidies that once softened margin pressure

This compression means miners now operate with thinner margins, even as they deploy more capital and power.

According to GoMining, the impact was visible in the mempool. For the first time since April 2023, the Bitcoin mempool fully cleared multiple times in 2025.

Sponsored

Sponsored

It means the Bitcoin network was so quiet that transactions cleared immediately, even at the lowest possible fees.

As a result, miners earned almost nothing from fees and had to rely almost entirely on Bitcoin’s price and block subsidy for revenue.

Transaction Fees Offer Little Relief After the Halving

Post-halving dynamics worsened the pressure.

With the block subsidy reduced to 3.125 BTC, transaction fees failed to offset lost revenue. The report notes that fees made up less than 1% of total block rewards for most of 2025.

As a result, miner economics became directly exposed to Bitcoin price swings, with fewer internal stabilizers.

Sponsored

Sponsored

Hashprice Hits Lows as Margins Stay Under Pressure

The squeeze showed up clearly in hashprice — the daily revenue earned per unit of hashrate.

According to the report, hashprice fell to an all-time low near $35 per PH per day in November and remained weak into year-end. It finished the quarter near $38, well below historical averages.

This left little room for operational error.

Shutdown Prices Turn Price Levels Into Economic Triggers

These findings align closely with recent data on miner shutdown prices.

Sponsored

Sponsored

At current difficulty and electricity costs near $0.08 per kWh, widely used S21-series miners approach breakeven between $69,000 and $74,000 per BTC. Below that range, many operations stop generating operational profit.

More efficient, high-end machines remain viable at much lower prices. But mid-tier miners face immediate pressure.

Why This Matters for Bitcoin Price Now

This does not create a price floor. Markets can trade below mining breakeven.

However, it creates a behavioral threshold. If Bitcoin stays below key shutdown levels, weaker miners may sell reserves, shut down equipment, or reduce exposure.

In a market already strained by tight liquidity, those actions can amplify volatility.

Bitcoin mining is stronger and more industrial than ever. But that scale comes with sensitivity. As hashrate grows and fees fade, price matters more, not less, for miner stability.

That makes levels like $70,000 economically meaningful — not because charts say so, but because the network’s cost structure does.

Crypto World

NFT Marketplace Collapse: Nifty Gateway, Foundation Lead Wave of Major Platform Shutdowns

TLDR:

- NFT trading volumes collapsed from $2.9 billion in 2021 to just $23.8 million by early 2025 quarterly data.

- Major platforms including Nifty Gateway, Foundation, and MakersPlace announced closures within days in January 2026.

- Centralized storage systems left 27% of top NFT collections vulnerable to permanent loss after server shutdowns.

- OpenSea recaptured 67% of Ethereum NFT volume by expanding into fungible tokens as competitors exited the market.

The digital art marketplace landscape has undergone a dramatic transformation as prominent NFT platforms cease operations.

Trading volumes collapsed from $2.9 billion in 2021 to $23.8 million by early 2025, representing a 93 percent decline.

Gemini’s Nifty Gateway, Foundation, and multiple other platforms announced closures or ownership transfers within days of each other in January 2026, marking the effective end of the venture-backed NFT marketplace ecosystem.

Wave of Platform Closures Reshapes Digital Art Infrastructure

Nifty Gateway announced its shutdown on January 24, 2026, with approximately 650,000 NFTs requiring withdrawal before the April 23 deadline.

Community outcry initially extended the original February 23 closure date. Three days later, Foundation’s creator transferred ownership to BlackDove, a digital art streaming company. The platform had generated $230 million in primary sales during its operational period.

MakersPlace shut down in January 2025 after facilitating the landmark $69.3 million Beeple sale through Christie’s in 2021.

Content manager Brady Evan Walker announced that “ongoing market challenges and funding difficulties have made it impossible to sustain operations while fulfilling our mission.”

KnownOrigin, acquired by eBay in 2022, wound down operations in July 2024. Async Art closed in October 2023 despite raising $2 million in seed funding.

Active traders declined from 529,101 in 2022 to 19,575 by 2025, according to DappRadar. Average art NFT prices fell from $2,044 in 2021 to $475 in 2023.

CEO Conlan Rios reflected that when Async Art launched, “the NFT world was smaller and simpler” with “a genuine sense of altruism all around.”

Christie’s eliminated its digital art department in September 2025 after none of its 11 auctions exceeded $400,000 in sales.

Technical Infrastructure Exposes Centralization Vulnerabilities

A 2024 Pinata analysis revealed that 27 percent of top NFT collections stored metadata on centralized servers. The report noted that some NFTs “simply no longer exist” as their “smart contracts point to metadata that is no longer accessible from the original centralized servers.”

Sam Spratt commented on Twitter that Nifty Gateway’s closure represented “a pure loss” and expressed “gratitude for what was given” before the platform’s ending.

XCOPY’s early work demonstrates the fragility of NFT storage systems. The London-based artist described how Ascribe “fell into the cryptoart platform graveyard” after the service closed.

“Death Wannabe,” released on July 17, 2018, had ten editions but only three remain accessible. Seven editions are locked in the original RareArt Labs contract while “Disaster Suit” survives in four editions but lost its metadata entirely.

Nifty Gateway responded to criticism by announcing metadata migration to Arweave for newer NFTs. Artist Bryan Brinkman acknowledged that “many of us knew the risks of minting on there” but noted the platform “still clung to too many centralized choices” despite contract improvements.

Collector G4SP4RD warned that collections from artists like Beeple and Spratt could become “broken with no possibility of recovery” if servers shut down.

OpenSea recaptured 67 percent of Ethereum NFT volume by late 2025 after expanding into fungible tokens. CEO Devin Finzer tweeted that the platform crossed $2.6 billion in trading volume with “over 90 percent from token trading.”

SuperRare announced on Twitter it was “not going anywhere” and continued operating. Art Basel Miami Beach launched Zero 10 in December, selling 65 percent of digital art works by mid-afternoon on opening day.

Crypto World

Michael Saylor Hints at Strategy’s Next Bitcoin Purchase

Join Our Telegram channel to stay up to date on breaking news coverage

Michael Saylor has hinted that Strategy will soon make another Bitcoin purchase, pushing its holdings beyond 3% of Bitcoin’s total supply.

Saylor posted “Bigger Orange” on X, a phrase he has used in the past before announcing new Bitcoin buys. Strategy currently holds about 687,410 Bitcoin, which equals roughly 3% of Bitcoin’s maximum supply of 21 million coins. The company has made more than 94 Bitcoin purchases since 2020, with an average buying price of around $75,000 per Bitcoin.

Last week alone, Strategy bought 13,627 BTC for about $1.25 billion, using a mix of debt, equity, and cash. With Bitcoin trading close to $95,000, Strategy’s unrealized gains have grown significantly. This large exposure has made the company one of the biggest corporate Bitcoin holders in the world, strengthening its image as a long-term Bitcoin-focused firm.

₿igger Orange. pic.twitter.com/HI47hMCnui

— Michael Saylor (@saylor) January 18, 2026

Strategy’s Bitcoin Bet Strengthens as MSTR Lags Holdings

However, Strategy’s stock price has not fully reflected its growing Bitcoin holdings yet. According to TradingView data, MSTR shares rose about 4% in the past week and are up over 12% year-to-date. The stock was trading near $174 at the time of reporting. Over the last five years, MSTR has gained more than 180%, showing strong long-term performance.

Investor confidence also improved after MSCI decided not to change its index rules, removing uncertainty around Strategy’s market position. Many investors now see MSTR as a leveraged proxy for Bitcoin, meaning the stock often moves more sharply when Bitcoin rises or when Strategy announces new purchases.

Meanwhile, short-term Bitcoin market sentiment remains cautious. Analyst Ted Pillows noted tightening liquidity and heavy trading interest between $96,000 and $98,000. These price levels often attract strong activity and can slow price movement or trigger volatility.

Despite caution among retail traders, institutional Bitcoin futures activity is increasing, suggesting larger players are still positioning for future moves. Overall, corporate accumulation remains strong, but short-term Bitcoin price action may stay volatile.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Tether Pulls Back on $20B Fundraising Plans After Investor Pushback (Report)

Tether has scaled back fundraising talks to about $5B after investors pushed back on a proposed $500B valuation.

Tether has reportedly scaled back its planned multibillion-dollar fundraising target after facing resistance from investors.

According to a report from the Financial Times on February 4, advisers for the stablecoin issuer are now examining the possibility of raising at least $5 billion, down from the $15 billion to $20 billion figure circulated during early talks in 2025.

Lower Target Follows Valuation Concerns

The original range, first reported by Bloomberg in September 2025, was linked to a valuation of roughly $500 billion, placing Tether among the world’s most valuable private companies. However, the number has reportedly proven difficult to justify for several prospective investors.

In comments cited by the FT, Paolo Ardoino, Tether’s chief executive, said the higher figure was never a firm target. According to the executive, the amount discussed was only the maximum the company would consider selling. “If we were selling zero, we would be very happy as well,” Ardoino said, noting that the firm is profitable and does not urgently need external capital.

Tether is the issuer of USDT, the world’s largest dollar-pegged stablecoin, with about $185 billion in circulation. The company has generated strong earnings from returns on reserves backing USDT, mainly U.S. Treasuries. Ardoino said Tether made around $10 billion in profit last year, a figure that has featured prominently in valuation discussions.

Despite that profitability, some investors have taken a cautious stance, with the FT reporting that concerns centered on how the $500 billion valuation was calculated and whether it reflects realistic growth expectations in the current market environment.

Nonetheless, fundraising talks are still in the early stages, and no decision has been made on the size or timing of any raise.

You may also like:

Profitability, Reserves, and Lingering Skepticism

Tether’s capital plans have come against a backdrop of mixed sentiment around the stablecoin issuer. The firm has expanded beyond cash-like reserves in recent years, building large positions in Bitcoin and gold. Earlier in the year, Ardoino confirmed that the company bought about $779 million worth of Bitcoin in the fourth quarter of 2025, lifting its holdings to more than 96,000 BTC.

At the same time, scrutiny around transparency has not faded, especially considering that S&P Global Ratings assigned USDT its lowest score on the agency’s stablecoin stability scale in November 2025, citing gaps in disclosure and a higher share of assets such as Bitcoin, gold, and secured loans. Ardoino publicly criticized the rating, arguing that traditional frameworks fail to capture Tether’s business model.

The reduced fundraising target suggests Tether is adjusting to market feedback rather than pressing ahead with an aggressive valuation. Whether the company proceeds with a smaller raise or pauses altogether will likely depend on investor appetite and broader conditions in crypto markets over the coming months.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Crypto’s Point of No Return: Institutions are Finally Here, with Brett Tejpaul

In this episode, Brett Tejpaul, head of Coinbase Institutional, sits down with Camila Russo to explain why institutional adoption accelerated last year.

Crypto World

IREN favors AI cloud in high-stakes break from Bitcoin roots

IREN Ltd., once known for mining Bitcoin, is undergoing a dramatic reinvention as an AI infrastructure provider—a transformation that will face a critical test when the company reports second-quarter earnings on Thursday.

Summary

- IREN has pivoted from Bitcoin mining to AI cloud infrastructure, repurposing its energy sites into data centers and securing a $9.7 billion partnership with Microsoft to support next-generation compute.

- Shares have sold off sharply ahead of Q2 earnings as investors focus on dilution risk.

- The upcoming earnings report has investors concerned over whether funding roughly 140,000 GPUs by year-end could require equity issuance.

Formerly Iris Energy, IREN has shifted away from crypto mining and into what it calls a “Neocloud” model, repurposing its stranded-energy Bitcoin sites into large-scale data centers designed to support artificial intelligence workloads.

A $9.7 billion partnership with Microsoft helped position IREN as a potential player in the race to supply next-generation compute capacity.

The ambition has not come cheap

Ahead of earnings, IREN shares have tumbled, falling nearly 19% intraday on Wednesday and down about 28% over the past five days, as investors worry that funding the company’s GPU-heavy cloud expansion could require dilutive equity issuance.

After a 314% rally over the past year, the pullback underscores growing skepticism about whether IREN can scale its AI cloud business without eroding shareholder value.

The upcoming earnings report represents a clear break from the company’s Bitcoin mining past, shifting attention to cloud execution, financing discipline, and competition with established players like Amazon and Oracle—making it a critical test of the company’s pivot.

IREN isn’t alone

Other companies have attempted comparable transformations—some successfully, others less so:

- Core Scientific – Transitioned from pure Bitcoin mining to offering high-performance computing and AI colocation services after emerging from bankruptcy, leveraging existing infrastructure to attract AI customers.

- Hut 8 – Expanded beyond crypto mining into HPC and data center services, pitching its energy assets as ideal for AI workloads.

- Northern Data – Repositioned itself as a European AI and cloud infrastructure provider, shifting investor focus from Bitcoin exposure to GPU-based compute capacity.

- Nvidia (earlier era) – While not a crypto miner, Nvidia successfully pivoted from gaming-focused GPUs to becoming the backbone of AI compute, showing how infrastructure players can redefine their identity through demand shifts.

- IBM – Moved from legacy hardware to cloud and AI services over the past decade, using partnerships and hybrid infrastructure to reinvent its growth narrative.

IREN now joins this list at a moment when AI infrastructure demand is booming—but capital markets patience is thinning. Whether it becomes a case study in smart reinvention or costly overreach may hinge on what it delivers this earnings season.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech15 hours ago

Tech15 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World1 day ago

Crypto World1 day agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards