Crypto World

Trims Bitcoin, buys into Ether ETF

Harvard Management Company (HMC), the investment arm of Harvard University’s endowment, reduced its stake in a major Bitcoin exchange-traded fund (ETF) by roughly 21 %.

Summary

- Harvard Management Company cut its Bitcoin ETF holdings by approximately 21%, trimming around 1.5 million shares of the iShares Bitcoin Trust (IBIT), according to its latest SEC 13F filing.

- Despite the reduction, Bitcoin remains one of the endowment’s largest publicly disclosed positions, valued at roughly $265 million at the end of Q4 2025.

- The filing also shows a new $86.8 million position in the iShares Ethereum Trust (ETHA), marking Harvard’s first disclosed allocation to an Ether-linked ETF.

Harvard rotates into ETH as Bitcoin ETF holdings shrink 21%

Simultaneously, HMC established a new multimillion-dollar position in an Ethereum (ETH) ETF, according to a quarterly 13F filing with the U.S. Securities and Exchange Commission.

The filing, which discloses Harvard’s U.S.-listed equity holdings as of December 31, 2025, shows that the endowment cut close to 1.5 million shares of the iShares Bitcoin Trust (IBIT) compared with the previous quarter.

Despite this reduction, Bitcoin (BTC) remains HMC’s largest publicly disclosed holding with a reported market value of approximately $265.8 million at year-end.

In a notable strategic move, Harvard initiated a new position in the iShares Ethereum Trust (ETHA) acquiring about 3.87 million shares valued at an estimated $86.8 million during the same period. This represents the university’s first publicly disclosed allocation into an Ether-linked ETF.

While the filing primarily highlights the adjustment in digital-asset ETFs, it also shows broader shifts in HMC’s publicly reported equity holdings, including both increases and reductions across major tech and industrial names. However, the crypto positions, even after trimming, remain among the most significant individual line items disclosed.

Crypto World

Revival to $80K or Brutal Crash Below $30K?

“Are you actually prepared for the longest bear market in history,” one analyst asked.

Bitcoin bears have been in control lately, with the asset trading well below last year’s peak levels.

The question now is whether BTC can stage a decisive comeback or if a new painful pullback is on the way.

The Bullish Scenario

The primary cryptocurrency started the month on the wrong foot, with the correction intensifying on February 6 when it plummeted to around $60K, the lowest point since October 2024. In the following days, it reclaimed some lost ground and currently trades at approximately $68,200 (per CoinGecko’s data).

One person touching upon the most recent price dynamics of BTC is the popular analyst Ali Martinez. He assumed that the asset appears to have formed an “Adam & Eve” pattern, in which a break above $71,500 could trigger an additional pump to $79,000.

The bullish setup consists of two bottoms: a sharp drop (Adam) followed by a rounder one (Eve). Some traders see it as a sign that selling pressure is fading and that the price may post a substantial short-term revival.

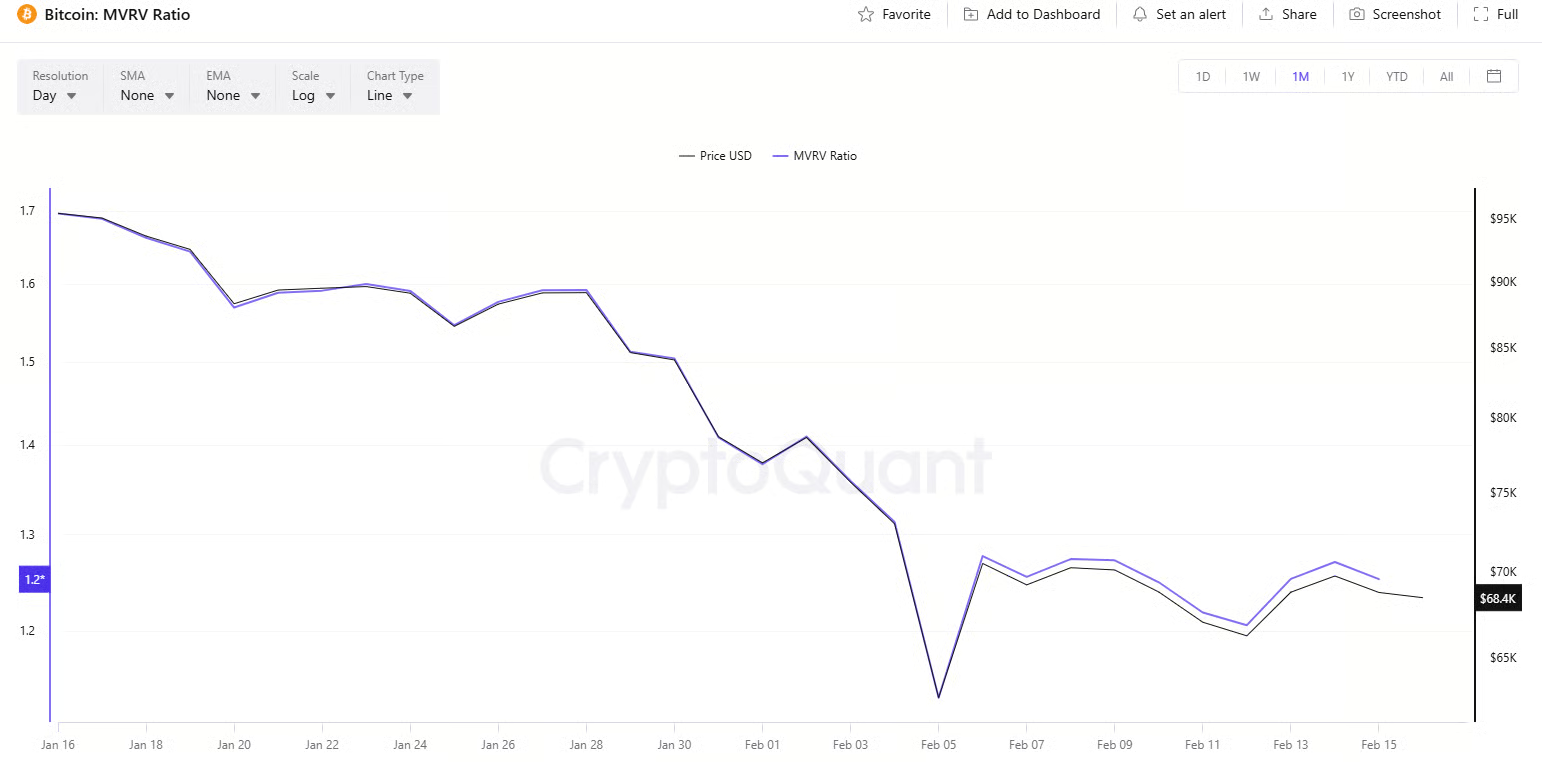

Bitcoin’s Market Value to Realized Value (MVRV) supports the bullish outlook. The index compares the current value of all BTC to the price people initially paid to acquire their holdings. High ratios mean that investors are sitting on big profits and could increase selling pressure, whereas low readings might be interpreted as the end of the bear market.

Over the past few weeks, the MVRV has been steadily declining and now sits near 1.25. According to CryptoQuant, ratios above 3.7 indicate a price top, while values under 1 hint that the bottom could have been reached.

You may also like:

Bitcoin’s Relative Strength Index (RSI) is also worth observing. The technical analysis tool measures the speed and magnitude of recent price changes and provides traders with indications of potential reversal points. It ranges from 0 to 100, with values below 30 seen as buying opportunities and suggesting that BTC may be oversold. On the contrary, ratios above 70 are generally considered a warning of a possible pullback. The RSI has fallen to 28 on a weekly scale.

The Bear Phase Is Just Starting?

Other analysts, including Chiefy, believe another painful decline is the more likely option for BTC in the short term. The X user argued that the asset might be on the verge of a major dump to $29,000 as early as this week and added:

“The final Bull Trap of 2026 is over, and according to this chart, the next crash has already started. Are you actually prepared for the longest bear market in history?”

Meanwhile, BTC balances on centralized exchanges have been climbing in recent weeks. Although this development doesn’t guarantee further downside, it could be interpreted as a bearish sign because it means the number of coins that can be offloaded at any time is increasing.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Tokenized RWAs Rise 13% as Crypto Market Loses $1T

Demand for tokenized real-world assets (RWAs) continued to grow over the past month, even as broader cryptocurrency markets faced heavy selling pressure, underscoring the sector’s resilience and growing institutional footprint.

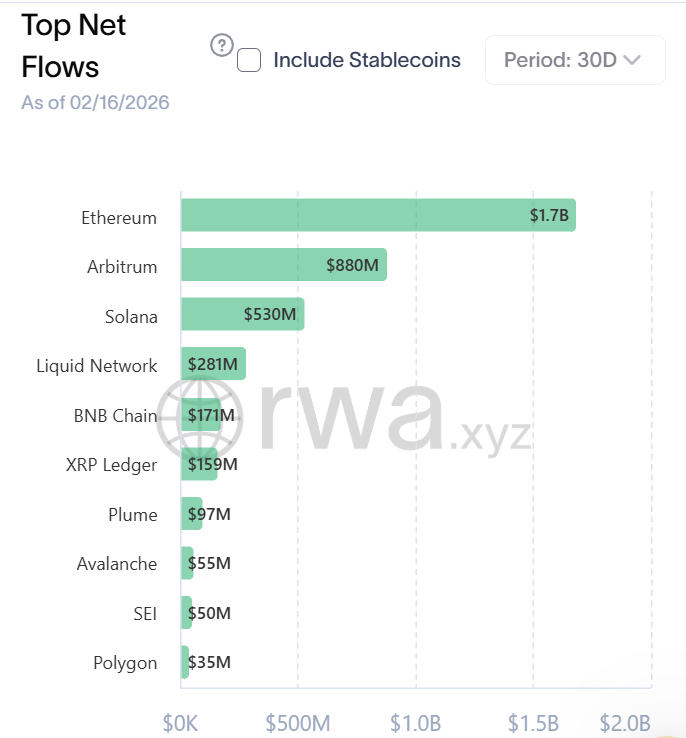

The total value of onchain RWAs increased 13.5% over the past 30 days, according to data from RWA.xyz. The increase reflects both higher asset issuance, meaning more tokenized securities brought onto public blockchains, and growth in the number of unique wallet addresses holding these assets, signaling expanding participation.

As of Feb. 16, all major blockchain networks tracked by RWA.xyz recorded increases in tokenized asset value, led by Ethereum, with roughly $1.7 billion in net growth, followed by Arbitrum at $880 million and Solana at $530 million. The figures refer to the increase in total onchain value of tokenized assets issued or circulating on those networks.

Tokenized US Treasurys and government debt remain the largest RWA category, with more than $10 billion in outstanding onchain products. Flows into these instruments continued during the period, while tokenized stocks and exchange-traded products also posted gains.

Related: Tokenized gold accounts for 25% of RWA net growth in 2025 after 177% market-cap rise

A sharp contrast with the broader crypto market

Steady demand for tokenized RWAs points to deeper institutional participation, as asset managers increasingly use public blockchains to issue and settle tokenized versions of traditional financial products.

Tokenized money market funds, for example, are evolving beyond simple yield vehicles and are beginning to serve as collateral in certain trading and lending markets. Major institutions, including BlackRock, JPMorgan and Goldman Sachs, have become active participants in the space.

BlackRock last week made its first formal move into decentralized finance, bringing its USD Institutional Digital Liquidity Fund (BUIDL) tokenized US Treasury fund to Uniswap.

The growth also stands in contrast to the broader cryptocurrency market, which has shed roughly $1 trillion in market value over the past month, highlighting the relative stability of yield-bearing tokenized assets.

Derivatives markets have been a key source of stress, with a large-scale deleveraging event in October triggering broader weakness across digital assets. Conditions have yet to fully recover, and sentiment remains fragile even as equities continue trading near record highs.

Related: TradFi giant Fiserv builds real-time dollar rails for crypto companies

Crypto World

2026 is crypto’s integration year, Silicon Valley Bank says

Last year restored crypto’s institutional footing. This year, according to Silicon Valley Bank (SVB), is when it becomes more integrated into the financial system.

Regulatory clarity improved in 2025, institutional engagement accelerated and capital markets reopened. Now the focus is shifting from price cycles to infrastructure as digital assets become more deeply embedded into payments, custody, treasury management and capital markets.

“Regardless of how tangible or visible, all the forces shaping crypto today share a common thread: Crypto is moving from expectations to production. Pilot programs are scaling and capital is consolidating,” Anthony Vassallo, senior vice president of crypto at SVB, told CoinDesk in an interview.

The bank, which maintains more than 500 relationships with crypto companies and venture firms investing in the sector, says institutional capital, consolidation, stablecoins, tokenization and AI are converging to reshape how money moves.

After its 2023 collapse, SVB was bought by North Carolina–based First Citizens Bank and now operates within a top-20 U.S. bank with $230 billion in assets. In 2025, it added 2,100 clients and ended the year with $108 billion in total client funds and $44 billion in loans.

Fewer experiments, more conviction

“The suits and ties have arrived,” according to the bank’s 2026 outlook report.

Venture funding in U.S. crypto companies rose 44% last year to $7.9 billion, according to PitchBook data cited by SVB. While the deal count fell, median check sizes climbed to $5 million as investors concentrated capital into stronger teams. Seed valuations jumped 70% from 2023 levels.

The bank warns that demand for institutional-grade crypto companies could outstrip the number of investable firms.

“In 2026, conditions are ripe for continued growth in VC investment in crypto. As institutional adoption accelerates, driving larger venture capital checks, we expect continued capital concentration in fewer companies with investors prioritizing higher-quality projects and follow-ons into proven teams,” Vassallo said.

“For end users, the result will be a more seamless experience across everyday financial interactions, from sending cross-border payments to managing an investment portfolio.”

Corporate balance sheets are reinforcing the shift. At least 172 public companies held bitcoin in the third quarter of 2025, up 40% from the second, collectively controlling roughly 5% of circulating supply, according to data referenced by SVB.

A new class of digital asset treasury companies, firms that treat crypto accumulation as a core strategy, has emerged. The bank expects consolidation as standards tighten and volatility tests business models.

Meanwhile, traditional banks are moving deeper into the sector. JPMorgan, the largest U.S. bank by assets, plans to accept bitcoin and ether as collateral, Bloomberg reported last year. SoFi Technologies offers direct digital asset trading. U.S. Bank provides custody through NYDIG. SVB expects more institutions to roll out lending, custody and settlement products as compliance guardrails solidify.

M&A and the race to full-stack crypto

Why build when you can buy?

More than 140 venture capital-backed crypto companies were acquired in the four quarters ending in September, a 59% year-over-year jump, according to the bank’s analysis of PitchBook data. Coinbase’s $2.9 billion acquisition of Deribit and Kraken’s $1.5 billion purchase of NinjaTrader underscored the scale.

The trend extends to banking charters. In 2025, 18 companies applied for charters from the Office of the Comptroller of the Currency (OCC), most of them blockchain-enabled firms. The OCC granted conditional approval to digital-asset-focused trust banks including custody provider BitGo (BTGO), Circle Internet (CRCL), the company behind the second-largest stablecoin, trading platform Fidelity Digital Assets, stablecoin issuer Paxos and payments network Ripple.

For SVB, that marks a turning point: stablecoin and custody infrastructure moving inside the federal banking perimeter. The bank expects traditional financial institutions to accelerate dealmaking rather than risk being disrupted by vertically integrated crypto-native rivals.

“We expect M&A to set a record again in 2026. As digital asset capabilities

become table stakes for financial services, companies will focus on acquisition strategies instead of building products from scratch,” Vassallo says.

“To meet market demands ranging from stablecoin capabilities to full-stack crypto banks, exchanges, custodians, infrastructure providers and brokerages will consolidate into multiproduct companies,” he said.

Stablecoins become the ‘internet’s dollar’

Stablecoins, SVB said, are evolving from trading tools into digital cash.

With near-instant settlement and lower transaction costs than interbank transfer system ACH or card networks, dollar-backed tokens are attractive for treasury operations, cross-border payments and business-to-business settlement.

Regulatory clarity is accelerating adoption. The U.S. GENIUS Act, passed in July, established federal standards for stablecoin issuance, including 1:1 reserve backing and monthly disclosures. Similar frameworks are in place in the EU, U.K., Singapore and the UAE.

Beginning in 2027, only permitted entities such as banks or approved nonbanks will be allowed to issue compliant stablecoins in the U.S. SVB expects issuers to spend 2026 aligning products with federal oversight.

Banks are already experimenting. Société Générale introduced a euro stablecoin. JPMorgan expanded JPM Coin to public blockchains. A group including PNC, Citi and Wells Fargo is exploring a joint token initiative.

Venture dollars are following. Investment in stablecoin-focused companies surged to more than $1.5 billion in 2025, up from less than $50 million in 2019, according to SVB.

In 2026, the bank expects tokenized dollars to move into core enterprise systems, embedded in treasury workflows, collateral management and programmable payments.

Tokenization and AI

Real-world asset tokenization is scaling. Onchain representations of cash, Treasuries and money-market instruments exceeded $36 billion in 2025, according to data cited by the bank.

Funds from BlackRock (BLK) and Franklin Templeton have amassed hundreds of millions in assets, settling flows directly onchain. ETF issuers and asset managers are testing blockchain-based wrappers to reduce transfer costs and enable intraday settlement. Robinhood (HOOD) now has tokenized stock exposure for European users and plans U.S. expansion.

SVB sees private and public markets converging on shared settlement rails, with tokenization expanding beyond Treasuries into private markets and consumer-facing applications.

Then there’s the convergence with AI. In 2025, 40 cents of every venture dollar invested in crypto went to companies also building AI products, up from 18 cents the year prior, according to SVB’s analysis. Startups are building agent-to-agent commerce protocols, and major blockchains are integrating AI into wallets.

Autonomous agents capable of transacting in stablecoins could enable machines to negotiate and settle payments without human intervention. Blockchain-based provenance and verification tools are being developed to address AI’s trust deficit.

The consumer impact may be subtle. SVB predicts that next year’s breakout apps won’t brand themselves as crypto. They will look like fintech products, with stablecoin settlement, tokenized assets and AI agents operating quietly in the background.

From expectation to infrastructure

Silicon Valley Bank’s overarching message is to treat crypto as infrastructure.

Pilot programs are scaling. Capital is concentrating. Banks are entering. Regulators are defining the perimeter. Blockchain technology is poised to underpin treasury operations, collateral flows, cross-border payments and parts of capital markets.

Volatility will remain, and headlines will continue to move prices. But the deeper narrative, the bank argues, is about the plumbing.

“In 2025, momentum in onchain representations of cash, treasuries and money market instruments carried real-world assets into the financial mainstream,” Vassallo said. “This year, cryptocurrency will be treated as infrastructure.”

Read more: R3 bets on Solana to bring institutional yield onchain

Crypto World

Crypto mining can help energy volatility, Paradigm responds to policy onslaught

Policymakers across North America are worrying about what the energy usage of crypto, artificial intelligence and other data centers might mean for the affordability of regular customers, but crypto investment firm Paradigm argues that the government should leave bitcoin mining operations out of it.

Mining bitcoin does take a tremendous amount of electricity. But the business model only works when that energy is particularly cheap — such as when it’s provided by off-peak renewable sources — and can be given back at the times when it’s most needed by the public, according to a report produced by Paradigm, which has miner Genesis Digital Assets in its investment portfolio.

The report, viewed by CoinDesk, disputes widely shared claims about bitcoin mining’s energy use and waste issues by citing data that the sector actually uses about 0.23% of global energy and emits about 0.08% of the carbon. And the miners have to operate under a “break even price” per megawatt hour of electricity to enable profits.

“This means that by its very nature, Bitcoin mining counter-balances the bulk of the average community’s energy consumption, bringing equilibrium to the grid — not strain,” according to the report compiled by Justin Slaughter, vice president for regulatory affairs at Paradigm, and Veronica Irwin. “It is, in a word, bringing balance to our energy force.”

Federal and state policy efforts are beginning to pile up that would seek to restrict data centers and digital mining operations, which could arguably fit under the “data center” definition in U.S. law. On Thursday, U.S. Senators Richard Blumenthal, a Connecticut Democrat, and Josh Hawley, a Missouri Republican, introduced a bill to stop data centers from pushing up electricity costs for consumers, though the legislative text doesn’t explicitly mention bitcoin or crypto. New York state lawmakers have similarly been pursuing a data-center moratorium.

“Artificial intelligence (AI) and cryptomining are fueling a rising demand for energy driven by massive, energy-intensive data centers,” several Democratic U.S. senators wrote in a November letter to the chief of the Federal Energy Regulatory Commission that asked for “immediate action” to protect consumers.

In Canada, British Columbia said in October it planned to halt new crypto mining operations from its energy grid.

The Paradigm report countered, “Bitcoin miners who use energy that would otherwise go to waste, or who participate in state-led programs to give energy control agencies more control over the grid, should be rewarded for their good behavior.”

Crypto World

Harvard Endowment Reduces Stake in Bitcoin ETF, Adds Ether Exposure

The Harvard Management Company, which manages the eponymous university’s endowment, has reduced its stake in BlackRock’s spot Bitcoin exchange-traded fund and opened a new position in the asset management company’s Ether ETF.

In a Friday filing with the US Securities and Exchange Commission, Harvard’s endowment reported that it had reduced its position in the BlackRock iShares Bitcoin (BTC) Trust ETF to $265.8 million as of Dec. 31 from $442.9 million in Q3 2025. The investments marked the company offloading more than 3 million shares of the ETF, to 5.4 million in Q4 from 6.8 million in Q3.

In addition to the 21% reduction in its Bitcoin position, the Harvard Management Company reported a new investment with exposure to Ether (ETH). According to the SEC filing, the endowment purchased more than 3.8 million shares of BlackRock’s iShares Ethereum Trust, valued at about $87 million as of Dec. 31.

The portfolio managers’ decisions occurred during a period of significant price volatility for Bitcoin and other cryptocurrencies. The price of BTC dropped to less than $90,000 by January 2026 from more than $120,000 at the beginning of July 2025, while Ether dropped to under $3,000 from more than $4,000 in the same period.

Related: Security expert Bruce Schneier ‘guarantees’ governments are bulk spying with AI

As of June 30, 2025, Harvard reported that its endowment stood at $56.9 billion, making its investments in the BlackRock crypto ETFs 0.62% of the total assets under management. The company similarly increased its position in Google’s parent Alphabet by almost $100 million, while reducing its stake in Amazon by about $80 million in Q4 2025.

AI hedge fund backed by “top university endowments”

Harvard’s moves come as Numerai, an AI hedge fund, reported in November that it had raised $30 million in a funding round led by “top university endowments,” which the AI hedge fund described as “the smartest, most long-term allocators in the world,” without identifying specific endowments. However, the announcement pushed the price of its native NMR token up by more than 40%.

Magazine: IronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye

Crypto World

BlockFills Freezes Withdrawals as Bitcoin Slides, Raising Counterparty Risk Concerns

Chicago-based institutional trading firm BlockFills has halted client withdrawals and deposits, locking traders out of their funds just as market volatility begins to spike.

The freeze, reported by community members and active traders, comes amid a broader liquidity crunch that is punishing leveraged positions across the board.

Halting operations during a downturn isn’t just an inconvenience; it is a massive red flag for counterparty risk.

When an execution venue goes dark while red candles are printing, it usually signals that the plumbing behind the scenes is clogging up.

Key Takeaways

- BlockFills has reportedly frozen client withdrawals and deposits without immediate explanation.

- The firm was averaging over $100 million in daily trading volume as of mid-2025.

- Founders include veterans from Deutsche Bank and Credit Suisse, highlighting risks even in “institutional-grade” platforms.

BlockFill’s Institutional Pedigree is Under Pressure

This isn’t some anonymous offshore exchange run by code hobbyists. BlockFills was purpose-built by heavyweights from the traditional finance (“TradFi”) world to bring adult supervision to crypto.

The leadership team includes former executives from Deutsche Bank and Citadel, who pivoted to crypto to bridge the gap between centralized TradFi structures and fragmented crypto liquidity. They pitched themselves as the safe, compliant option for proprietary trading firms.

But pedigree doesn’t immunize you from market mechanics. The halt coincides with a brutal rejection in price action.

As Bitcoin slides following reports on US labor market revisions, liquidity providers are facing severe stress tests.

Traders rely on these platforms for 24/7 access to credit and collateral management. When that access cuts off suddenly, it implies the firm is trying to stop a run on assets or manage a credit blow-up internally.

Is the Fallen Price of Bitcoin Causing a Liquidity Crunch at BlockFill?

Why now? The market structure is thinning out. We are seeing significant capital flight, with Bitcoin ETF outflows hitting $410M as BTC slips below $66k.

When institutions pull back, ECNs (Electronic Communication Networks) like BlockFills often face imbalances. If their liquidity providers pull quotes (i.e. stop offering buy or sell prices), or margin calls start cascading, the safest move for the venue is often to freeze the pipes. That protects the house, but it leaves clients exposed to the elements.

This follows a rough quarter for trading venues globally. Even giants are feeling the pinch, with Coinbase reporting a $667M loss amid the market downturn. However, there is a massive difference between reporting a loss and freezing client assets.

Discover:

What Happens Next?

Silence is expensive in this industry. Traders are already drawing parallels to the 2022 credit contagion, where “temporary” halts often turned into permanent restructuring.

BlockFill users are now keeping vigil for an official statement regarding solvency. Is this a technical glitch, or a liquidity crisis? If the latter, it challenges the narrative that institutional infrastructure has solved crypto’s counterparty risk problem.

(Source – BTCUSD, TradingView)

Analysts are watching support levels closely. While CryptoQuant suggests the ultimate Bitcoin bear market bottom could be $55,000, blocked funds can’t buy the dip.

Ultimately though, for BlockFills clients, the price of Bitcoin matters less right now than the status of their withdrawal button.

The post BlockFills Freezes Withdrawals as Bitcoin Slides, Raising Counterparty Risk Concerns appeared first on Cryptonews.

Crypto World

Hong Kong regulator approves first crypto company license since June last year

Hong Kong’s Securities and Futures Commission (SFC) granted a crypto license to Victory Fintech (VDX), an affiliate entity of publicly listed financial services firm Victory Securities (8540).

Victory won permission to operate a digital asset trading platform on Friday, according to the SFC’s registry of licensed crypto firms, the first addition since June 17 last year.

Hong Kong introduced its current regime for the regulation of companies providing crypto services in 2023, with Hashkey Exchange and OSL Digital Securities the first two parties to receive approval.

There are now 12 approved platforms on the registry, including New York Stock Exchange-listed Bullish (BLSH), which is also the parent company of CoinDesk.

The regime has earned a reputation for being one of the strictest among major financial jurisdictions. Prominent exchanges OKX and Bybit both withdrew their applications for licensing in May 2024.

Crypto World

How South Korea Is Using AI to Detect Crypto Market Manipulation

Key takeaways

-

South Korea is transitioning crypto market surveillance to AI-driven systems, in which algorithms automatically detect suspicious trading activity, replacing manual processes.

-

The new detection model employs a sliding-window grid search technique, scanning overlapping time segments to spot abnormal patterns such as unusual volume surges.

-

Through 2026, the Financial Supervisory Service plans to enhance AI capabilities with tools to detect coordinated trading account networks and trace manipulation funding sources.

-

Regulators are exploring proactive intervention measures, such as temporary transaction or payment suspensions, to freeze suspicious activity early and prevent the withdrawal of illicit gains.

South Korea is advancing its cryptocurrency market oversight by shifting to AI-driven surveillance. Algorithms now perform the initial detection of suspicious activities instead of relying solely on human investigators.

As crypto trading grows faster, more decentralized and increasingly difficult to monitor manually, regulators are leveraging artificial intelligence to identify irregularities and anomalies more quickly.

Central to this evolution is the Financial Supervisory Service’s (FSS) enhanced Virtual Assets Intelligence System for Trading Analysis (VISTA). This upgrade reflects the recognition that traditional, manual, case-by-case probes can no longer keep pace with today’s dynamic digital asset markets.

This article explains how South Korea’s financial regulators are using upgraded AI systems to automatically detect crypto market manipulation, improve surveillance, analyze trading patterns and plan advanced tools. It also explores faster intervention and alignment of crypto oversight with broader financial markets.

Why South Korea is enhancing its crypto monitoring tools

Crypto markets produce massive volumes of data across exchanges, tokens and timelines. Manipulative tactics such as pump-and-dump schemes, wash trading or spoofing often create sudden bursts that are difficult to detect. Manually identifying suspicious periods in crypto activity has become increasingly challenging at the current market scale. As interconnected trading patterns grow more intricate, automated systems are designed to continuously scan and flag potential issues.

This automation aligns with Korea’s broader effort to strengthen oversight of digital markets, particularly as crypto has become more deeply integrated with retail investors and the overall financial system.

What VISTA does and how the recent upgrade improves it

VISTA serves as the FSS’s primary platform for examining unfair trading in digital assets. In its earlier version, analysts had to specify suspected manipulation time frames before running analyses, which restricted the detection range.

The recent upgrade adds an automated detection algorithm that can independently pinpoint potential manipulation periods without manual input. The system now searches the entire data set, enabling investigators to review suspicious intervals that might otherwise go unnoticed.

According to the regulator, the system successfully identified all known manipulation periods in internal tests using completed investigation cases. It also flagged additional intervals that had been difficult to detect using traditional methods.

Did you know? Some crypto exchanges process more individual trades in a single hour than traditional stock exchanges handle in an entire trading day, making continuous automated surveillance essential for regulators seeking to monitor real-time risks.

How the automated detection operates

Applying a sliding-window grid search approach, the algorithm divides trading data into overlapping time segments of varying durations. It then assesses these segments for anomalies.

The model scans every possible sub-period, identifying patterns associated with manipulation without requiring investigators to determine where misconduct may have occurred. Examples of such patterns include sharp price spikes followed by rapid reversals or unusual volume surges.

Rather than supplanting human oversight, the model prioritizes high-risk segments, enabling teams to focus on critical windows instead of manually reviewing the entire data set.

Did you know? In crypto markets, price manipulation can sometimes occur in windows lasting less than five minutes, a time frame too short for most human-led monitoring systems to catch reliably.

Upcoming AI enhancements through 2026

The FSS has secured funding for phased AI improvements through 2026. Key planned features include:

-

Tools designed to identify networks of coordinated trading accounts: These systems aim to detect clusters of accounts acting in sync, a common feature of organized manipulation schemes.

-

Large-scale analysis of trading-related text across thousands of crypto assets: By examining abnormal promotional activity or narrative spikes alongside market data, regulators hope to better understand how attention shocks and price movements interact.

-

Tracing the origin of funds used in manipulation: Linking suspicious trades to funding sources could strengthen enforcement cases and reduce the ability of bad actors to obscure their tracks.

Did you know? Early market surveillance algorithms in traditional finance were originally designed to detect insider trading in equities, not crypto. Many of today’s tools are adaptations of models built decades ago for stock exchanges.

Shift toward proactive intervention in South Korea

South Korea’s AI surveillance push seeks quicker responses. The Financial Services Commission is considering a payment suspension mechanism that could temporarily block transactions linked to suspected manipulation.

This approach aims to prevent gains from being withdrawn or laundered early. While not yet finalized, it suggests a shift by regulators from reactive to preventive enforcement.

Preemptive actions raise important governance questions around thresholds, oversight and the risk of false positives, issues regulators will need to address carefully.

This crypto-focused initiative parallels efforts in conventional capital markets. The Korea Exchange is implementing an AI-based monitoring system to identify stock manipulation earlier. The idea is to create a unified approach across asset classes, combining trading data, behavioral cues and automated risk assessment.

Strengths and limitations of AI surveillance

AI-based systems are adept at spotting repetitive, pattern-driven misconduct such as wash trading or coordinated price spikes. They enhance consistency by flagging suspicious behavior even when it occurs in small or short-lived windows.

For exchanges, AI-driven oversight raises expectations around data quality and monitoring capabilities. It also increases cooperation with regulators. With AI models, surveillance becomes continuous rather than episodic.

Traders and issuers should expect greater scrutiny of subtle manipulative patterns that previously evaded attention. While detection begins algorithmically, real-world penalties remain significant.

But automated surveillance has certain limitations. Cross-venue manipulation, off-platform coordination and subtle narrative engineering remain difficult to detect. AI models also require regular evaluation to avoid bias, drift or the flagging of legitimate activity.

AI tools support, not replace, human investigators.

Shaping of a new enforcement framework

South Korea’s strategy involves AI models built around continuous monitoring, automated prioritization and swifter action. As these systems evolve, balancing efficiency with transparency, due process and accountability will be key.

The implementation of these models will shape not only Korea’s crypto markets but also how other jurisdictions approach regulating digital assets in an era of algorithmic trading and mass participation.

Cointelegraph maintains full editorial independence. The selection, commissioning and publication of Features and Magazine content are not influenced by advertisers, partners or commercial relationships.

Crypto World

Dogecoin erases weekend gains: here are the key levels to watch

- Dogecoin (DOGE) has turned bearish after breaking the $0.107 pivot on strong volume.

- Broader risk-off sentiment is driving heavier selling in Dogecoin.

- The $0.10 support level will likely decide the next major move.

Dogecoin has given back its recent weekend gains, reminding traders how quickly sentiment can shift in a fragile market environment.

The meme-inspired cryptocurrency has slipped sharply, with sellers stepping in aggressively after a short-lived rebound failed to hold.

At the time of writing, Dogecoin was trading near $0.102, reflecting a steep daily decline that has erased much of the gains made on Saturday and Sunday.

Short-term technical structure turns bearish

From a technical perspective, the recent sell-off marked an important shift in Dogecoin’s short-term structure.

The price has broken decisively below its 7-day simple moving average, signalling that short-term buyers had lost control.

At the same time, Dogecoin has slipped under a key daily pivot level around $0.107, a zone that had previously acted as near-term support.

This breakdown has been accompanied by elevated trading volume, which confirmed that the move lower was driven by conviction rather than thin liquidity.

Momentum indicators add weight to the bearish case, with the Relative Strength Index hovering in the mid-40s rather than oversold territory.

This positioning suggests that while Dogecoin has already fallen sharply, there is still room for additional downside if selling pressure persists.

Taken together, these signals point to a market where rallies are being sold into rather than extended.

For the bearish structure to be invalidated, Dogecoin would need to reclaim the $0.107 area on a daily closing basis.

Until that happens, the technical bias remains tilted toward the downside.

Market pressure and sector rotation add to DOGE’s weakness

Beyond individual chart patterns, broader market dynamics have also played a role in Dogecoin’s retreat.

There has been no clear Dogecoin-specific catalyst driving the move, which reinforces the idea that macro positioning is the dominant force.

Capital has been rotating away from riskier altcoins, as reflected in weakening indicators of altcoin market strength.

As a result, Dogecoin’s losses have outpaced those of Bitcoin, underscoring its vulnerability during risk-off phases.

This relative underperformance suggests that traders are prioritising capital preservation over speculative exposure.

As liquidity thins and confidence wanes, assets like Dogecoin often experience sharper drawdowns.

That backdrop makes technical support levels even more important, as they often determine whether selling accelerates or stabilises.

Key Dogecoin price levels that could shape the next move

Looking ahead, the most important level on traders’ radar is the psychological $0.10 support zone.

This area represents a critical test of demand, as buyers have previously shown interest near this price.

If Dogecoin finds strong volume support around $0.10, the market could shift into a consolidation phase.

Such a scenario would likely see the price oscillate between $0.10 and the former pivot near $0.107 as traders reassess direction.

However, a clear break and close below $0.10 would open the door to deeper losses.

In that case, the next notable support sits closer to the $0.095 region, where buyers may attempt another defence.

According to Justcryptopays on CoinMarketCap, Dogecoin is also trading within a descending diagonal structure on lower time frames.

Recent price action shows rejection near $0.115, reinforcing the importance of the downward-sloping trendline.

As long as the price remains below this trendline, downside pressure is likely to persist.

A decisive breakout above the descending trendline would be an early signal that momentum is shifting back toward the bulls.

Until such a breakout occurs, rallies are likely to face resistance rather than follow-through.

Crypto World

Guardrail Launches Proactive Security Model for Stablecoins

New York, USA, 16th February 2026, Chainwire

[PRESS RELEASE – New York, USA, February 16th, 2026]

Rain, fresh off $250M Series C, deploys unified detection-to-response framework to further protect stablecoin payments

Guardrail, a real-time blockchain security platform backed by Coinbase Ventures and Haun Ventures, has launched an integrated security model that connects continuous runtime detection directly to managed incident response. The model addresses the attack cycle at the crucial step between vulnerability exposure and live attacks.

Rain, the global stablecoin payments platform for enterprises, neobanks, and platforms, recently deployed this unified security framework within its smart contracts and wallets used for settlement with Visa, further improving security for millions of purchases in over 150 countries.

Stablecoin transaction volumes crossed $27.6 trillion in 2024, surpassing Visa and Mastercard combined. As traditional finance accelerates its move onchain, the security challenges and unique risks it poses are widening the gap.

The blockchain industry lost over $3.4 billion to theft in 2025. More than 90% of exploits targeted code where security audits and a comprehensive review were completed. The pattern is consistent: audits examine code during development, but attacks take place in production environments through compromised keys, operational failures, and runtime exploits that static code review cannot anticipate and prevent.

Why Post-Deployment Security Matters for Stablecoins

Stablecoin infrastructure operates differently from typical DeFi protocols. When software events translate directly into payment outcomes across 150+ countries, a configuration error or a malicious transaction pattern can cause immediate user harm, with limited options for reversal.

Each application of stablecoin technology by geography, financial application, underlying assets, and wallet infrastructure brings incredible potential while simultaneously growing security risk possibility for unique attack vectors. Industry data shows that off-chain incidents compromised keys, phishing, and operational failures now represent the majority of funds lost, underscoring the need for security extending the attacking surface to: onchain activity, offchain integrations, API dependencies, and user-facing entry points.

“As Web3 matures, risk management and proactive security measures that leading institutions have built into traditional products need to be offered when transacting with stablecoins, like their fiat counterparts. Unifying risk discovery, real-time detection and managed automated response is the gold standard we’re excited to be shaping for our industry,” said Samridh Saluja, CEO of Guardrail.

How the Framework Operates

Guardrail’s platform evaluates transactions and state changes in real time using configurable detection modules. These identify conditions beyond standard vulnerability signatures, economic anomalies, permission violations, oracle deviations, and abnormal approval patterns with sub-second detection across 30+ chains.

When an incident is flagged, alerts route directly into managed response workflows developed in collaboration with Cantina, a Web3 security firm. Response operates through 24/7 triage, pre-built playbooks across technical and governance tracks, and escalation paths with defined ownership. Evidence is captured throughout proactively, resulting in an informed security posture.

Institutional-Grade Security for Onchain Finance

As stablecoins move into enterprise payments and institutional custody, security expectations shift. Partners evaluating onchain infrastructure ask direct questions: Who owns containment? How is authority structured? What evidence trail exists? How does the system perform at 3am on a Saturday?

Rain’s security model with Guardrail and Cantina answers these questions universally. Runtime signals feed governed incident workflows. Escalations route to named owners. Containment follows documented playbooks. Evidence trails support both internal review and partner diligence.

“Our enterprise partners rely on Rain to protect real-world payment flows totaling billions of dollars annually. Integrating Guardrail’s real-time monitoring and Cantina’s managed response capabilities enhances our ability to detect anomalies early and act decisively,” said Charles Yoo-Naut, CTO and Co-founder of Rain. “This is an important addition to the broader set of onchain security partners we rely on to safeguard our ecosystem.”

The integrated detection and response model is a template for protocols operating stablecoin infrastructure, custody flows, enterprise payments, and onchain financial products.

About Guardrail

Guardrail is a real-time blockchain security platform with sub-second detection across 24+ chains. Backed by Coinbase Ventures and Haun Ventures, the platform uses AI-powered anomaly detection and configurable security modules to identify exploits before funds are drained, with automated response capabilities including contract pausing and circuit breakers. Guardrail currently protects over $20+ billion in TVL across thousands of contracts for protocols including Euler, EigenLayer, BadgerDAO, and Bluefin.

Website: https://www.guardrail.ai

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video2 hours ago

Video2 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery